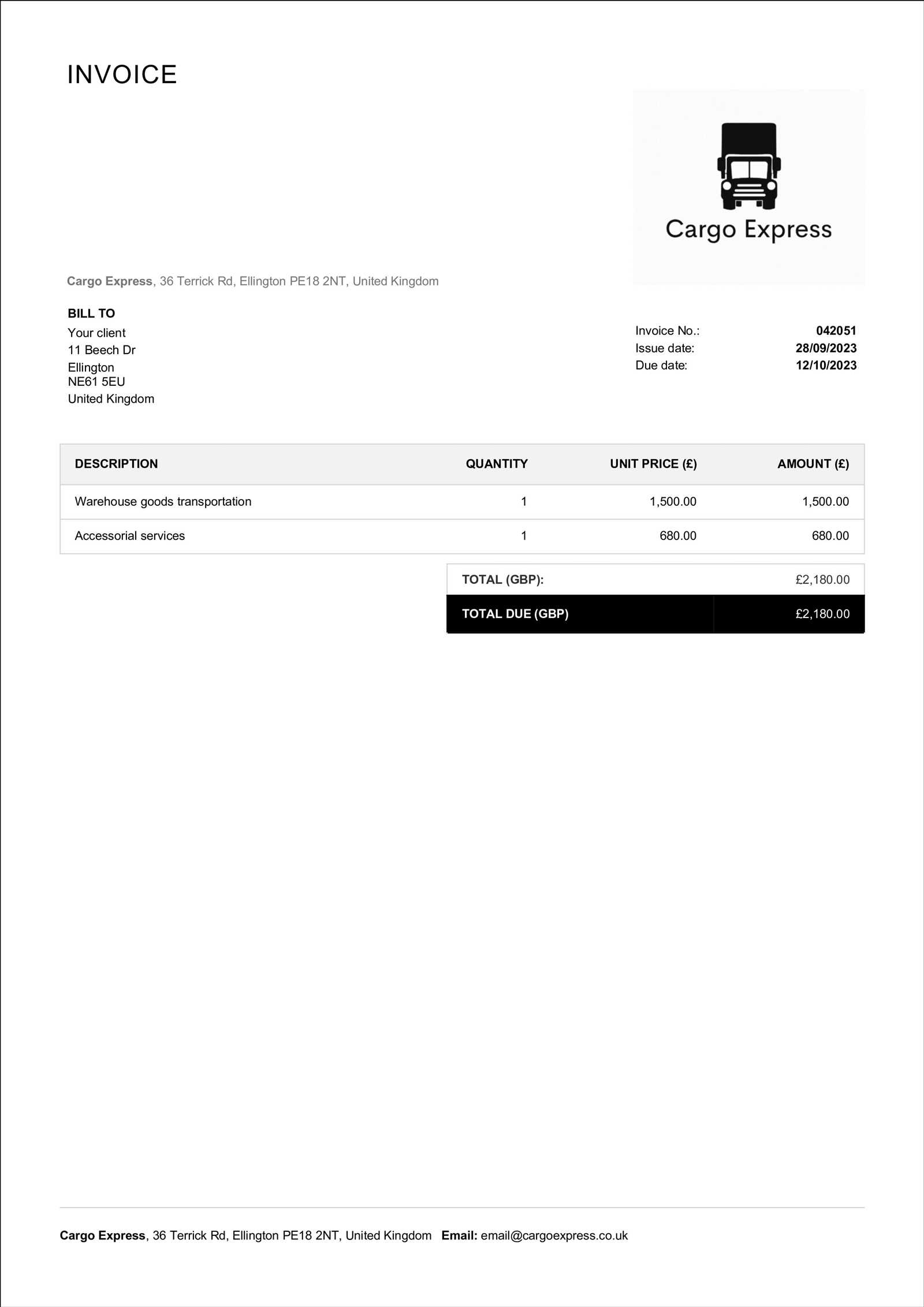

Free Transportation Invoice Template for Easy Billing and Accurate Payments

St

Understanding Billing Documents for Freight Services

In the logistics and delivery industry, having a structured way to document and communicate charges is essential for maintaining smooth business operations. These records serve as a formal request for payment, detailing the costs associated with moving goods from one location to another. By using a standardized approach, businesses can ensure clarity and consistency when handling financial transactions with clients and partners.

Clear documentation is key to avoiding misunderstandings. A well-organized form not only outlines the charges but also specifies essential information such as the type of service, distance covered, and any additional fees. This helps both the service provider and the client review and agree on the financial terms, reducing disputes and improving payment cycles.

Additionally, the right format can streamline administrative work, allowing companies to quickly generate and send out these records while maintaining a professional appearance. With a standardized approach, businesses can focus on their core operations while ensuring that all financial interactions are properly documented and easy to process.

Why Use a Standardized Billing Document?

When managing payments for logistics services, consistency and accuracy are crucial. Using a pre-designed format to generate financial records allows businesses to maintain professionalism and avoid errors. This approach ensures that all necessary details are included, reducing the chances of misunderstandings or missed information between service providers and clients.

Time-saving efficiency is another major advantage of adopting a standardized approach. Instead of manually creating each document from scratch, companies can quickly fill in specific details, saving valuable time and effort. This streamlined process is especially helpful for businesses handling large volumes of shipments and clients.

Moreover, using a well-organized structure helps businesses stay compliant with industry standards and legal requirements. By following a set format, you ensure that all essential elements–such as delivery terms, payment methods, and service charges–are clearly outlined, making it easier for both parties to review and process the document.

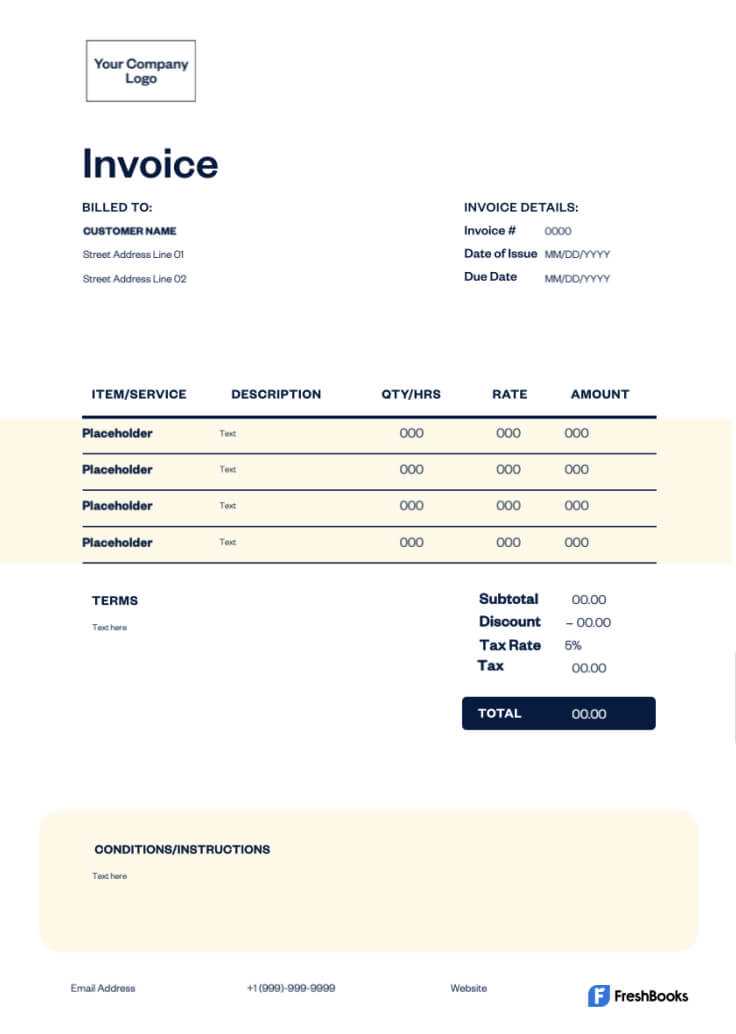

Key Features of a Good Document Layout

A well-designed billing document should be both comprehensive and easy to navigate. It should capture all necessary information in a clear and structured manner, ensuring that the details are easy to understand for both the service provider and the client. A strong document layout not only reduces errors but also speeds up the payment process, promoting smooth business transactions.

Essential Elements to Include

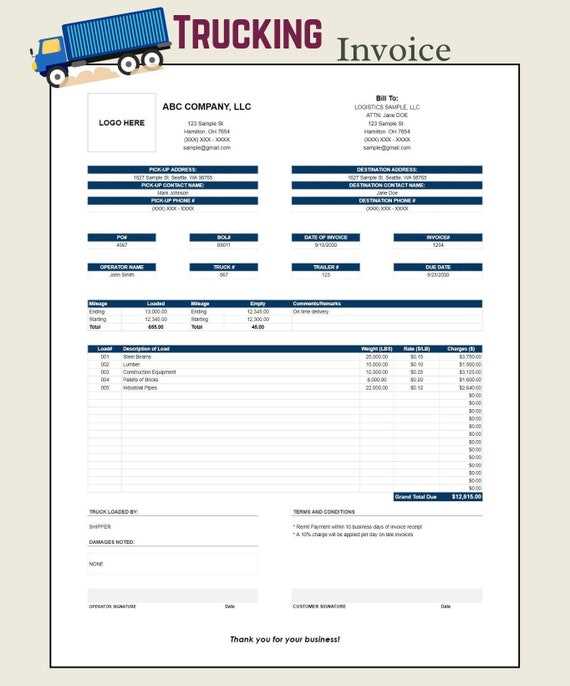

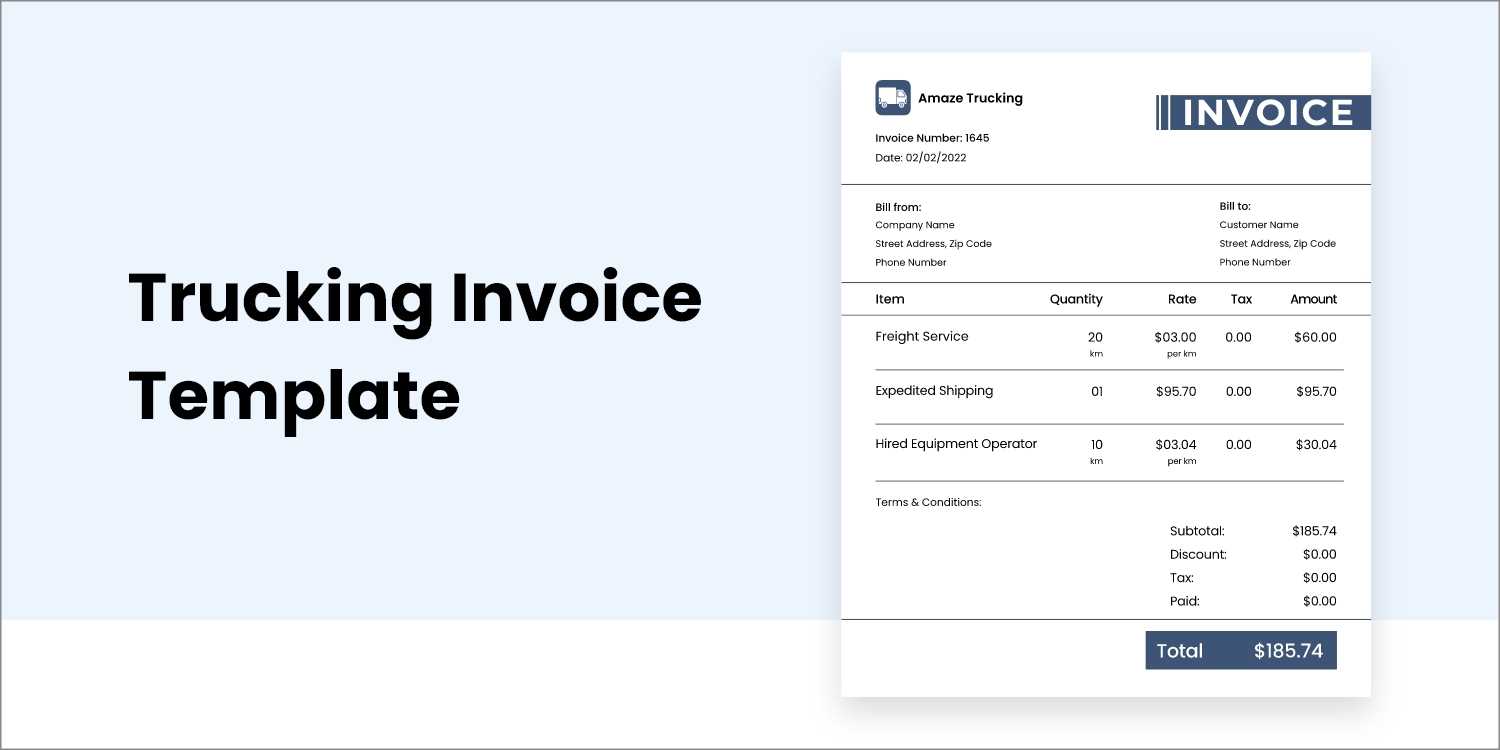

A good structure should include certain key components to ensure that all relevant information is conveyed effectively. These elements typically include client details, service descriptions, payment terms, and additional charges. Below is a table illustrating the core components of an effective billing record:

| Component | Description |

|---|---|

| Client Information | Full name, address, and contact details of the recipient. |

| Service Description | A detailed breakdown of services provided, including type and scope. |

| Dates | Start and end dates of service or delivery period. |

| Payment Terms | Agreed-upon payment methods, due dates, and penalties for late payment. |

| Total Amount | Summation of all costs including base fees and additional charges. |

Additional Features to Consider

Aside from the basic components, a well-organized document layout might also include elements like custom branding (logos, colors), an itemized cost breakdown, and automatic calculation fields. These features can enhance the visual appeal and functionality of the document, further improving both efficiency and professionalism.

How to Customize Your Billing Document

Personalizing your financial records for logistics services ensures that the final document matches your company’s specific needs and branding. Customization allows you to adjust fields, layout, and design, so the document is not only functional but also reflects your business identity. With the right modifications, you can create a streamlined and professional-looking record that enhances both clarity and efficiency.

Start with the basics–the most important details should always be present, such as client information, service descriptions, and payment terms. However, you can tailor these elements to suit your operations, adding or removing sections as necessary. For instance, if you typically work with international clients, you may want to include a currency converter or space for customs charges.

Once the essential content is in place, you can focus on visual customization. Branding elements such as your company logo, color scheme, and font choices can be incorporated to align the document with your business’s identity. This helps maintain a consistent, professional image across all client interactions.

Essential Information on Billing Records

For a billing document to be effective, it must include all necessary details to ensure transparency and prevent confusion. Each record should provide a clear account of the services provided, the associated costs, and the terms of payment. This helps both the service provider and client to have a mutual understanding of the transaction and avoid any disputes or delays.

Key details that should always be included are the recipient’s name and address, the scope of services rendered, the service dates, and the total amount due. Additionally, it’s important to specify the agreed-upon payment terms, such as due dates, accepted payment methods, and any penalties for late payments.

Additional information, such as tracking numbers, reference codes, or shipment specifics, can further clarify the document. By ensuring all relevant details are captured in a well-organized format, businesses can maintain professionalism and streamline payment processing.

Common Mistakes in Billing Documents

While creating billing records for logistics services, it’s easy to overlook small details that can cause significant issues down the line. Errors in these documents can lead to confusion, delayed payments, or even disputes with clients. Understanding the most common mistakes can help businesses avoid these pitfalls and ensure their records are accurate and professional.

Frequent Errors to Avoid

There are several key mistakes that businesses often make when preparing financial documents. These can range from missing details to incorrect calculations, all of which can create unnecessary complications. Below is a table outlining some of the most frequent issues and how to avoid them:

| Error | Consequence | How to Avoid |

|---|---|---|

| Omitting Client Information | Unclear billing process and potential payment delays. | Always ensure the recipient’s full contact details are included. |

| Incorrect Service Descriptions | Confusion over what services were provided, leading to disputes. | Be specific and detailed in describing each service or charge. |

| Missing Payment Terms | Ambiguity around due dates, payment methods, and penalties. | Clearly state due dates, acceptable payment methods, and late fees. |

| Calculation Errors | Overcharging or undercharging, leading to mistrust. | Double-check all calculations and consider using automated fields. |

| Lack of Reference Numbers | Difficulty in tracking payments or resolving issues. | Always include a unique reference number for each transaction. |

How to Minimize Mistakes

The key to minimizing errors in financial documents is attention to detail. Using a well-st

Benefits of Digital Billing Documents

Switching to digital formats for financial records brings numerous advantages, especially in terms of efficiency, accuracy, and accessibility. By adopting electronic solutions, businesses can streamline their billing process, reduce administrative burdens, and enhance overall productivity. The ability to create, store, and send records digitally offers a level of convenience that paper-based systems simply cannot match.

Time savings is one of the most immediate benefits of using digital documents. Rather than manually preparing each record or dealing with physical paperwork, companies can quickly generate professional, error-free forms with minimal effort. This not only speeds up the process but also reduces the chances of human error, leading to fewer disputes and faster payments.

Cost reduction is another significant advantage. With digital records, there’s no need for printing, postage, or physical storage space, which can add up over time. By going paperless, businesses can lower operational costs and invest more resources into other areas of growth.

Moreover, digital solutions provide better organization and accessibility. These documents can be stored securely in the cloud, allowing easy retrieval at any time from anywhere. This is especially valuable for companies handling multiple clients and transactions, as it makes tracking and managing records much simpler.

How to Track Payments with Billing Records

Tracking payments is a critical part of managing financial transactions in any business. With a well-organized system, businesses can ensure that all charges are paid on time, and outstanding balances are easily identified. Using a clear and consistent method for monitoring payments helps to maintain healthy cash flow and avoid issues with clients.

To effectively track payments, it’s important to include specific payment-related details in the billing record, such as the due date, payment status, and any partial payments received. By documenting these elements, businesses can stay on top of outstanding amounts and follow up on overdue balances. Below is a table showing the key payment tracking components:

| Component | Description | Tracking Method |

|---|---|---|

| Due Date | The date by which payment must be made. | Monitor through a calendar or automated reminder system. |

| Amount Due | The total amount to be paid for the services rendered. | Verify against the record’s total calculation. |

| Payment Status | Indicates whether the payment is completed, pending, or overdue. | Update the status upon payment receipt or as it progresses. |

| Partial Payments | Any payments made before the total balance is cleared. | Track the remaining balance and update regularly. |

| Transaction Reference | A unique number to identify the payment. | Record and link payments with specific transaction numbers. |

By maintaining accurate and up-to-date records, businesses can easily track outstanding payments, identify trends, and take proactive steps to ensure

Tips for Efficient Billing Management

Managing financial records effectively is crucial for maintaining smooth operations and ensuring timely payments. By implementing the right practices and tools, businesses can streamline the entire process, reduce errors, and enhance cash flow. Efficiency in handling these records not only saves time but also minimizes the risk of disputes and missed payments.

Best Practices for Streamlining Records

To optimize your billing process, it’s essential to adopt methods that improve organization and accuracy. A few key practices can make a significant difference in how quickly and effectively you manage these records. Below is a table outlining tips for efficient management:

| Practice | Benefit | Implementation |

|---|---|---|

| Automate Record Creation | Saves time and reduces human error. | Use accounting software that generates records based on pre-set parameters. |

| Maintain a Centralized System | Improves access and reduces chances of misplaced documents. | Store all records in a cloud-based system that can be accessed anywhere. |

| Set Payment Reminders | Helps reduce overdue payments and stay on top of collection. | Implement automated reminders for both clients and yourself. |

| Review for Accuracy | Prevents errors that can lead to disputes or delays. | Regularly double-check entries, particularly calculations and client details. |

| Use Standardized Formats | Enhances consistency and professionalism. | Create a uniform structure for all records to follow, ensuring no key details are missed. |

Digital Tools to Simplify Management

Leveraging digital tools can significantly improve the efficiency of your billing process. From automated document creation to online payment tracking, technology provides various solutions that reduce the manual workload. Using software that integrates billing with accounting can help streamline operations and provide real-time insights into cash flow.

Integrating Billing Records with Accounting Software

Integrating financial documents with accounting software can greatly enhance the efficiency and accuracy of your business operations. By connecting billing records directly to your accounting system, you can automate data entry, streamline the reconciliation process, and gain better insights into your company’s financial health. This integration ensures that every transaction is properly documented, reducing the risk of errors and providing real-time updates on payments and outstanding balances.

Using automated tools also saves significant time, as it eliminates the need for manual data transfer between systems. The connection between billing and accounting platforms provides seamless synchronization of all financial information, from payments received to outstanding amounts. Below is a table outlining the key advantages of integrating billing systems with accounting software:

| Benefit | Description | Example Tools |

|---|---|---|

| Automation of Data Entry | Reduces human error and saves time by syncing financial data automatically. | QuickBooks, Xero, FreshBooks |

| Real-Time Financial Tracking | Offers up-to-date insights into payments and outstanding balances. | Zoho Books, Wave, Sage |

| Improved Cash Flow Management | Helps track payments more effectively and identify overdue balances quickly. | QuickBooks, NetSuite, FreeAgent |

| Ease of Tax Preparation | Simplifies tax reporting by consolidating financial data into one platform. | Xero, Intuit TurboTax, TaxSlayer |

| Customizable Reporting | Allows you to generate reports specific to your business needs, such as income statements or payment histories. | Zoho Books, QuickBooks, FreshBooks |

By integrating your billing records with accounting software, you can streamline your financial management

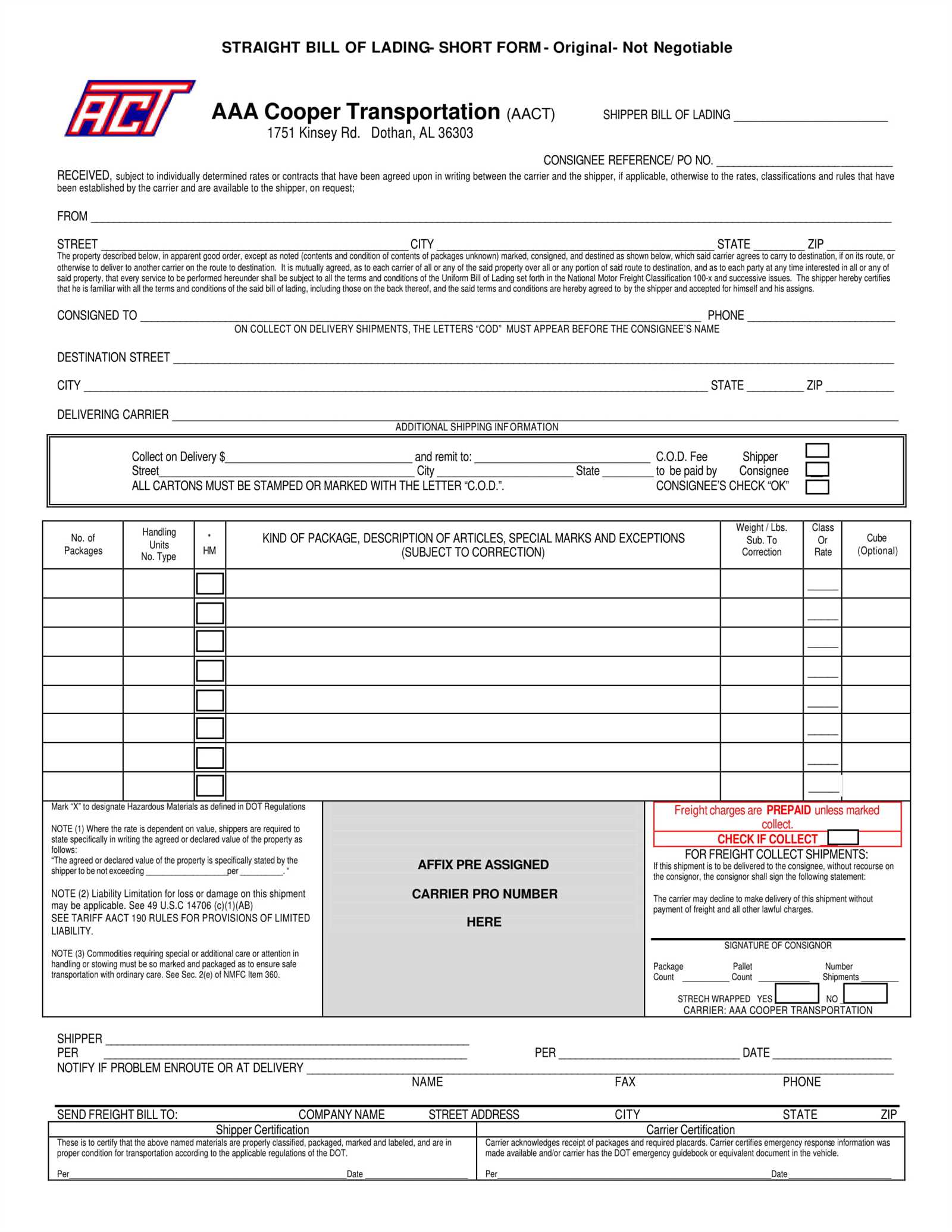

Creating a Document for International Shipping

When dealing with international shipments, having a standardized record to track charges and terms is essential. A well-structured document not only helps ensure smooth financial transactions but also simplifies the communication of details between businesses and clients across borders. Including the correct information tailored to international shipping ensures that both parties understand the full scope of the service and any associated fees or requirements.

Key Elements for International Shipping Records

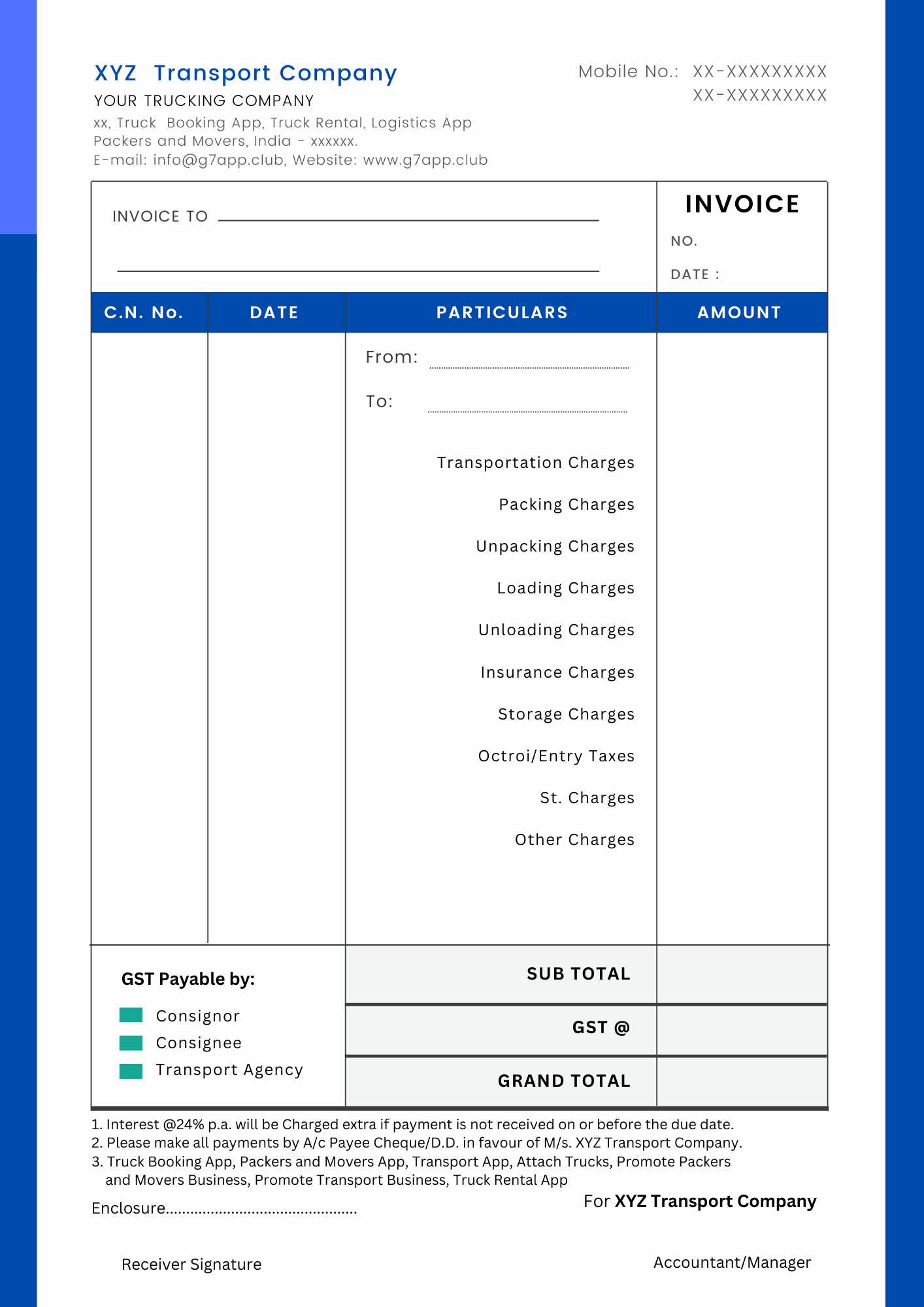

Creating a record for international shipments requires attention to specific details that may differ from domestic transactions. These include information like customs duties, tariffs, and international payment terms. Below is a table outlining the essential components to include in a global shipping document:

| Component | Description |

|---|---|

| Recipient Information | Include full name, shipping address, and contact details, including country-specific codes. |

| Shipping Terms | Specify Incoterms, such as FOB or CIF, which define who is responsible for shipping costs and risk. |

| Customs Declarations | Clearly list the customs duties, tariffs, and codes, ensuring compliance with international regulations. |

| Currency and Payment Terms | Indicate the currency used for the transaction and any international payment options or methods. |

| Tracking Information | Provide shipment tracking numbers and logistics partner details to monitor the delivery process. |

Additional Considerations for Global Transactions

When creating a record for international shipping, it’s important to ensure that the document aligns with the legal and financial practices of both the sender’s and recipient’s countries. This might include specific language or translation requirements, as well as country-specific taxes and import/export restrictions. By paying close attention to these details, businesses can reduce the likelihood of delays or disputes and facilitate smoother international trade.

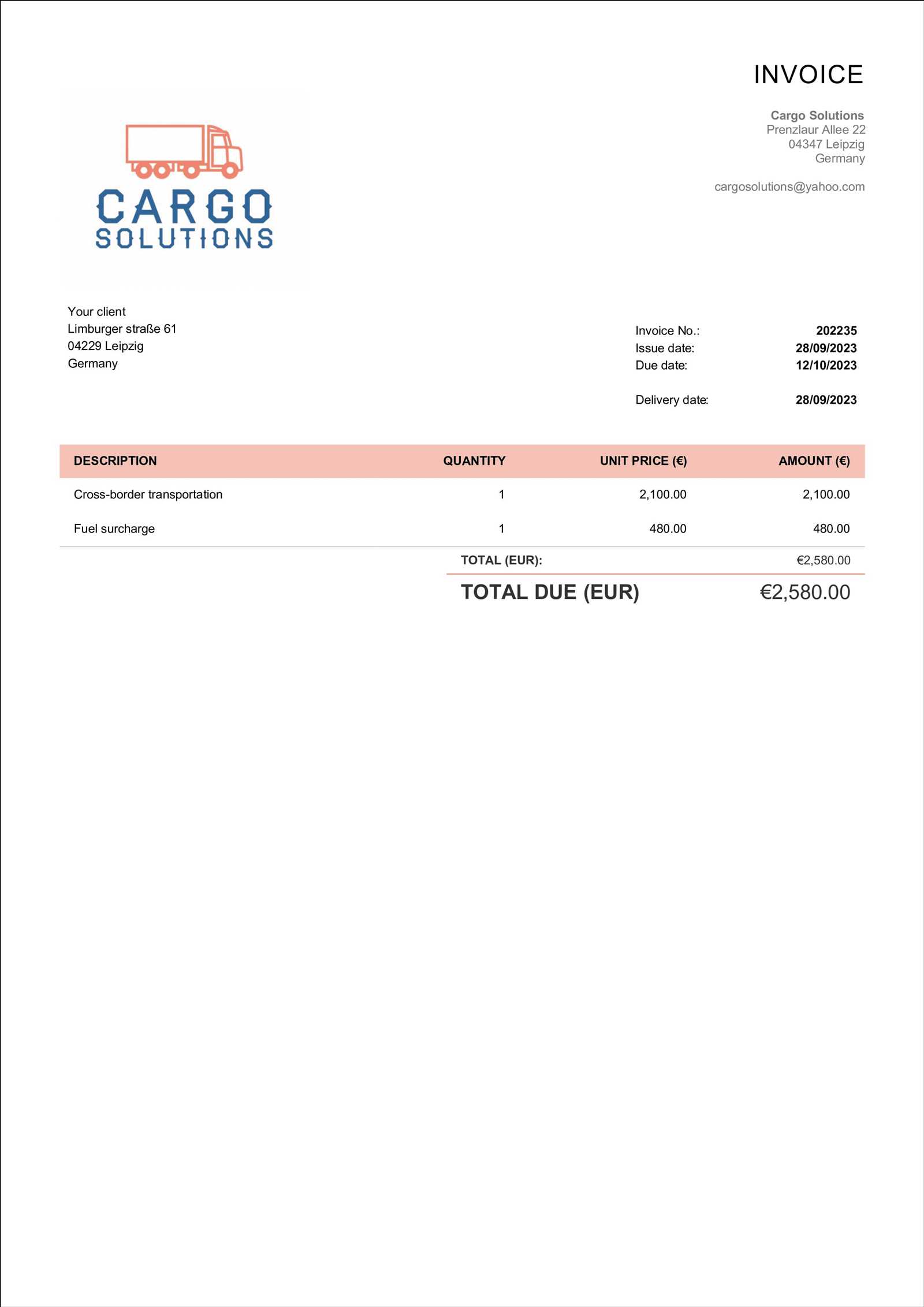

How to Handle Multiple Shipment Charges

When managing multiple shipments, it’s essential to accurately track and allocate the charges associated with each delivery. Whether you’re dealing with a single client receiving several consignments or one large shipment broken into smaller deliveries, ensuring that each cost is clearly outlined and calculated is key to maintaining transparency and smooth financial transactions. This process can seem complex, but by breaking it down and organizing each element, you can easily manage various charges while keeping everything in order.

Steps to Manage Multiple Shipment Costs

Handling multiple shipment charges requires a systematic approach. Here’s a guide to help you stay organized and ensure accuracy:

- Identify Each Shipment – Ensure that every shipment is clearly identified with a unique reference number or tracking code. This helps separate each delivery and its respective charges.

- Break Down the Costs – For each shipment, list out the individual charges, such as delivery fees, customs duties, insurance, and packaging costs. This helps prevent any confusion or missed charges.

- Consolidate or Separate Charges – If multiple deliveries are sent to the same client, you can either combine the charges into one overall amount or keep them separate, depending on the agreement with your client. This approach provides clarity on what exactly is being paid for.

- Use a Structured Format – Use a consistent layout that clearly distinguishes between different shipments and their respective charges. A breakdown of each shipment, followed by a total summary, is often easiest for clients to understand.

Tools to Assist in Tracking Multiple Shipments

Utilizing digital tools and accounting systems can streamline the process of managing multiple shipment charges. Here are some methods to consider:

- Automated Billing Software – Many modern tools automatically track shipments, calculate costs, and generate detailed reports. This can save time and reduce human error.

- Spreadsheets – If you prefer a manual approach, organizing shipment charges in a spreadsheet with separate columns for each charge and shipment reference number is a simple and

Legal Considerations for Shipping Billing Records

When managing financial records related to shipping services, it’s essential to ensure compliance with local, national, and international laws. Properly handling these records not only avoids legal disputes but also ensures that all transactions are transparent and fair for both parties involved. Understanding the legal requirements for documentation, such as taxes, contractual obligations, and dispute resolution, can help businesses maintain credibility and avoid costly mistakes.

Essential Legal Elements in Billing Records

There are several key legal considerations that must be addressed when creating and managing billing records for shipping services:

- Accuracy of Details – Every record must accurately reflect the terms of the agreement between the parties, including services rendered, costs, and payment terms. Any errors in billing can lead to legal complications or disputes.

- Clear Payment Terms – It’s critical to specify payment deadlines, late fees, and payment methods. If these terms are not clearly defined, it can result in misunderstandings and potential legal issues if payments are delayed.

- Tax Compliance – Make sure that all applicable taxes, such as VAT or sales tax, are correctly applied based on the jurisdiction. Failing to include taxes can lead to penalties or fines from tax authorities.

- Dispute Resolution Clauses – Include a clause that outlines how disputes will be resolved, whether through arbitration, mediation, or litigation. This protects both parties in case of any disagreements.

International Legal Considerations

When conducting business across borders, additional legal considerations come into play. For international shipments, you must also ensure that:

- Customs Declarations – Be sure to include the correct customs information and ensure that the appropriate duties and tariffs are accounted for. Incorrect or missing customs details can cause delays or legal issues with import/export authorities.

- International Payment Regulations – Depending on the countries involved, different payment methods, currencies, and legal regulations might apply. Ensure compliance with international finance laws to prevent disputes related to currency exchange or payment processing.

- Compliance with Incoterms – If the transaction involves Incoterms (International Commercial Terms), it’s essential to clearly state which Incoterms are applied in the contract to avoid confusion over shipping costs and responsibilities.

By taking these legal considerations into account, businesses can p

How to Save Time with Billing Automation

Automating the creation and management of billing records can significantly reduce the time spent on manual tasks, streamline processes, and minimize errors. By leveraging automated systems, businesses can ensure that all necessary details are correctly entered, calculations are accurate, and documents are sent out on time–without having to manually input the same information repeatedly. Automation frees up valuable time for employees to focus on other essential tasks while maintaining accuracy and consistency across all transactions.

Key Benefits of Automating Billing Processes

Automation offers numerous advantages that make managing financial records more efficient. Below are the key benefits of automating the billing process:

Benefit Description Reduced Manual Data Entry Automation eliminates the need for repetitive data input, reducing human error and saving time on administrative tasks. Faster Document Generation Automated systems can generate records instantly based on pre-set templates, speeding up the process of creating and sending documents. Improved Accuracy Automation ensures that the correct information is always used, reducing the chances of mistakes like incorrect calculations or missing details. Seamless Integration Automated systems can be integrated with accounting software, making it easier to track payments and manage financial records in real time. Consistency Automating the billing process ensures that all documents follow a standardized format, improving professionalism and consistency across all records. Tools for Automating Billing Tasks

There are various tools available that can help automate the creation and management of billing records. Here are some commonly used software options:

- QuickBooks – A popular accounting software that offers invoicing features, automatic payment tracking, and

Best Practices for Billing in Logistics

In the logistics industry, ensuring timely and accurate billing is crucial for maintaining healthy cash flow and strong relationships with clients. Proper documentation and clear communication of costs are essential to avoid misunderstandings and disputes. By following best practices in managing financial records, businesses can streamline the billing process, reduce errors, and ensure transparency with clients.

To optimize billing practices in logistics, it’s important to focus on key areas such as consistency, accuracy, and clear communication. This involves having a standardized approach to charge calculation, clearly defined payment terms, and a system to track payments and discrepancies. By implementing these practices, logistics companies can improve their financial operations and enhance their clients’ satisfaction.

Key Best Practices for Efficient Billing

Here are some best practices that can help optimize billing processes in logistics:

- Clear Breakdown of Charges – Provide a detailed list of all charges, including shipping costs, handling fees, customs duties, and insurance. This transparency helps avoid disputes and ensures that both parties are on the same page.

- Standardized Formats – Use consistent formats for all billing records to reduce confusion and make the process more efficient. Standardization helps ensure that all required information is included and reduces the chance of errors.

- Timely Billing – Send out billing records promptly after service completion. Delayed billing can disrupt cash flow and cause payment delays, which may impact business operations.

- Accurate Documentation – Always ensure that all the information in your records, such as delivery dates, services rendered, and payment terms, is accurate. Incorrect details can lead to payment delays and disputes.

- Clear Payment Terms – Clearly state payment terms, including deadlines, penalties for late payments, and accepted payment methods. This helps set clear expectations and prevents misunderstandings.

Using Technology to Improve Billing Accuracy

Leveraging modern tools and technology can help businesses improve the efficiency and accuracy of their billing processes. Here are a few ways technology can be integrated into logistics billing:

- Automated Billing Systems – Use software that automatically generates and sends billing records. This reduces manual input errors and ensures that clients receive their records on time.

- Integrated Accounting Software – Integrate your billing system with accounting software to track payments and outstanding balances. This provides real-time financial updates and streamlines the reconciliation process.

- Cloud-Based Solutions – Cloud-based platforms allow you to access and manage billing records from anywhere, providing flexibility and enabling quick updates as needed.

By adopting these best practices, logistics companies can improve their billing accuracy, reduce adm

How to Improve Payment Collection

Efficiently collecting payments is crucial for maintaining steady cash flow and ensuring the financial stability of your business. Late or missed payments can lead to cash flow problems, administrative burdens, and strained customer relationships. Improving your payment collection process requires adopting strategies that streamline communication, offer clear payment terms, and incentivize timely payments. By creating a proactive system, businesses can minimize overdue balances and improve their overall revenue cycle.

One key to success in improving payment collection is to set clear expectations from the start. This involves establishing defined terms for payment deadlines, fees, and acceptable payment methods. Additionally, leveraging technology and automation can enhance the process, reducing delays and administrative workload. By actively managing payment collection, businesses can reduce the risk of non-payment and improve their financial outcomes.

Strategies for Better Payment Collection

Here are some effective strategies for improving the payment collection process:

- Clear Payment Terms – Always define payment deadlines, methods, and any applicable penalties for late payments in your agreements. Clear communication of these terms helps avoid confusion and sets the tone for timely payment.

- Early Reminders – Send reminders ahead of the due date to ensure that clients are aware of upcoming payments. Automated emails or notifications can be set to remind clients a few days before the due date to avoid late payments.

- Flexible Payment Methods – Offer multiple payment options to make it easier for clients to pay. Options such as credit cards, bank transfers, online payment portals, or even installment plans may encourage quicker payment and improve collection rates.

- Follow-Up Procedures – Have a consistent follow-up process in place for overdue payments. Timely and polite reminders can encourage clients to act quickly. Consider using automated tools to send follow-up emails or SMS messages.

- Discounts for Early Payments – Provide incentives, such as a small discount, for early payment. Offering a discount for prompt payment can motivate clients to settle their accounts quickly.

Leveraging Technology for Efficient Payment Collection

Technology can greatly enhance the payment collection process. By integrating automation and digital tools, businesses can streamline tasks that would otherwise require significant manual effort:

- Automated Payment Reminders – Set up automatic reminders that notify clients of due dates and overdue payments. These systems can be configured to send messages via email or SMS at specific intervals.

- Online Payment Platforms – Use platforms that allow clients to make payments quickly and easily online. By offering a seamless and secure payment gateway, you reduce barriers for clients a

Using Templates for Accurate Tax Calculation

Accurate tax calculation is essential for ensuring compliance with local, state, and international regulations. When managing billing for services, one of the most challenging aspects is determining the correct tax amounts, especially when multiple rates or exemptions apply. By using predefined formats for financial records, businesses can simplify the process, reduce errors, and ensure that all tax details are correctly calculated and applied in line with the latest tax laws.

Incorporating automated systems and standardized formats can help businesses avoid the complexities of tax calculation. These systems allow for the seamless inclusion of applicable tax rates, deductions, and exemptions based on the service or goods provided. With the right tools in place, businesses can enhance accuracy and reduce the risk of errors that could lead to tax penalties.

Benefits of Using Predefined Formats for Tax Calculation

Here are some key advantages of utilizing predefined billing formats for tax calculations:

Benefit Description Accuracy Predefined formats ensure that all tax rates and rules are applied correctly, reducing the risk of mistakes in the calculation process. Time-Saving Automating tax calculations through pre-set formulas saves time by eliminating manual work and the need for constant recalculation. Consistency Standardizing the calculation process ensures that every record is consistent, helping to maintain uniformity across different transactions and periods. Compliance Using accurate templates ensures that all tax laws are followed, helping businesses stay compliant with both local and international tax requirements. Key Features to Include in Tax Calculation Templates

When creating or choosing a predefined format for tax calculations, be sure to include these important features:

- Multiple Tax Rates

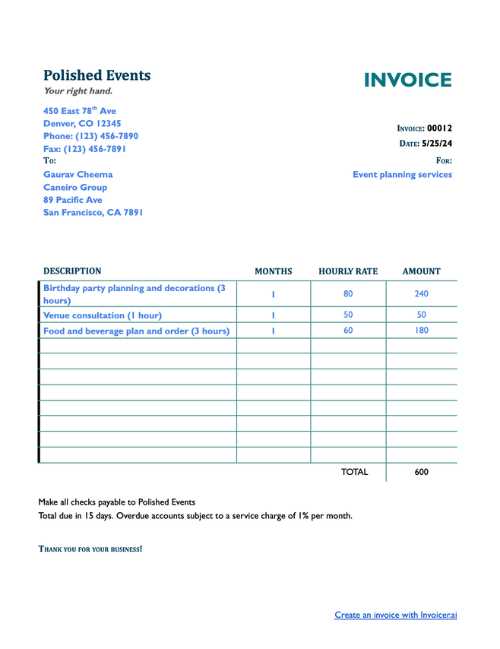

Free and Paid Billing Resource Options

When managing financial records, businesses often need ready-to-use forms to ensure accuracy and consistency in their transactions. Whether you’re just starting or looking to upgrade your existing system, there are numerous resources available for both free and paid options. These resources can help streamline your billing process, reduce errors, and save time on administrative tasks. The key is to find a solution that aligns with your business needs and budget.

Free resources are a great option for small businesses or startups with a limited budget. However, for larger organizations or those requiring more advanced features, paid options may be more suitable. Below, we’ll explore some of the best resources available, both free and paid, to help you improve your financial documentation process.

Free Billing Resource Options

If you’re looking to get started without a financial investment, there are many free resources available to help you create professional and accurate billing records:

- Google Docs – Google Docs offers free templates for generating billing records that can be customized to your needs. The documents can be accessed from anywhere and easily shared with clients.

- Microsoft Word – Microsoft provides basic templates for billing forms. They are easily editable and can be used for a variety of billing needs, with no additional cost if you already have access to the software.

- Invoice Generator Websites – Websites like Invoice Simple and PayPal offer free online tools that allow you to generate billing records quickly and easily, and they can be downloaded or sent directly to clients.

- Excel Templates – Many free Excel templates are available that include built-in formulas to help calculate totals and taxes automatically. These are great for those who need basic but effective forms.

Paid Billing Resource Options

For those who require more advanced features, including automation, branding, and integrations with other business systems, paid resources offer a wider range of functionality:

- QuickBooks – QuickBooks offers a comprehensive suite of tools for businesses, including custom billing record templates, payment tracking, and tax calculation features. It also integrates with accounting systems and helps you manage finances efficiently.

- FreshBooks – FreshBooks is a cloud-based service that provides customizable billing forms, automatic reminders, and integrations with other software. It’s ideal for businesses that need to streamline their payment collection and reporting processes.

- Zoho Invoice – Zoho offers a paid plan with extensive features for creating, managing, and tracking billing records. It includes automated payment reminders and can integrate with various payment platforms.

- Wave – Wave is a free option with an optional paid plan that allows businesses to access advanced features such as invoice automat

- Multiple Tax Rates