Free Billing Invoice Templates for Quick and Professional Invoicing

Managing financial transactions and ensuring timely payments is a crucial task for any business. To facilitate this process, many professionals and entrepreneurs rely on ready-made solutions that simplify the creation of essential documents. These solutions not only help save time but also provide a professional appearance, enhancing trust between clients and service providers.

Instead of spending valuable hours designing payment documents from scratch, using pre-designed options can ensure accuracy and consistency in your financial communications. Whether you’re a freelancer, small business owner, or large company, these resources can be customized to fit your specific needs, making the entire process more efficient.

In this guide, we will explore how to effectively use these tools to streamline your documentation process, reduce errors, and maintain a smooth workflow. By the end, you’ll have a clear understanding of how to quickly generate professional-looking paperwork with minimal effort.

Free Billing Invoice Templates for Your Business

Running a business involves countless tasks, and ensuring that financial transactions are documented properly is essential for maintaining smooth operations. One of the easiest ways to stay organized and present a professional image to clients is by using pre-designed solutions that help generate accurate payment requests. These resources save time and effort, allowing you to focus more on growing your business.

For businesses of all sizes, having access to these ready-made resources is invaluable. They not only help streamline the process of creating payment requests but also ensure that the necessary details are included every time. With customizable options available, it’s easy to tailor the documents to meet your specific needs, keeping everything consistent across your financial records.

Here’s a quick look at how using these tools can benefit your business:

| Benefit | Description |

|---|---|

| Time-saving | Quickly generate professional documents without starting from scratch. |

| Consistency | Ensure that all payment requests follow the same format, improving organization. |

| Customization | Tailor the content and design to reflect your business branding and requirements. |

| Professionalism | Enhance your business image with polished, well-organized documents. |

| Accuracy | Reduce the risk of missing important details or making errors in financial communications. |

By utilizing these tools, you can focus more on providing great service and less on the paperwork, while maintaining a level of professionalism that clients will appreciate. Whether you’re managing a startup or running an established business, these resources are a valuable asset

Why Use Free Billing Invoice Templates

Creating payment documentation can be time-consuming, especially for business owners managing multiple clients and transactions. Relying on pre-made solutions designed for this purpose can simplify the entire process, ensuring that the necessary details are consistently included while saving valuable time. These resources allow you to generate accurate and professional documents with minimal effort.

Efficiency and Time-Saving

One of the main advantages of using ready-made solutions is the efficiency they offer. Instead of creating a document from scratch every time you need to send a payment request, you can use a pre-designed structure that only requires a few customizations. This significantly reduces the time spent on administrative tasks, allowing you to focus on more important aspects of running your business.

Professional Appearance and Consistency

Maintaining a consistent and professional appearance in your financial communications is crucial for building trust with clients. These resources provide a polished look that enhances your business’s credibility. Since the layout and content are standardized, you can ensure that every document you send out adheres to the same high standards, giving your business a professional edge.

Customization is another important benefit. These tools are flexible enough to be tailored to fit your brand’s specific needs, whether it’s adjusting the layout, adding your company logo, or modifying the text. By using a structured format, you can easily present all necessary details without forgetting important elements.

By integrating such tools into your workflow, you not only save time but also streamline your financial documentation, making it both efficient and professional. Whether you’re just starting out or managing a growing business, these resources are an invaluable asset to any financial process.

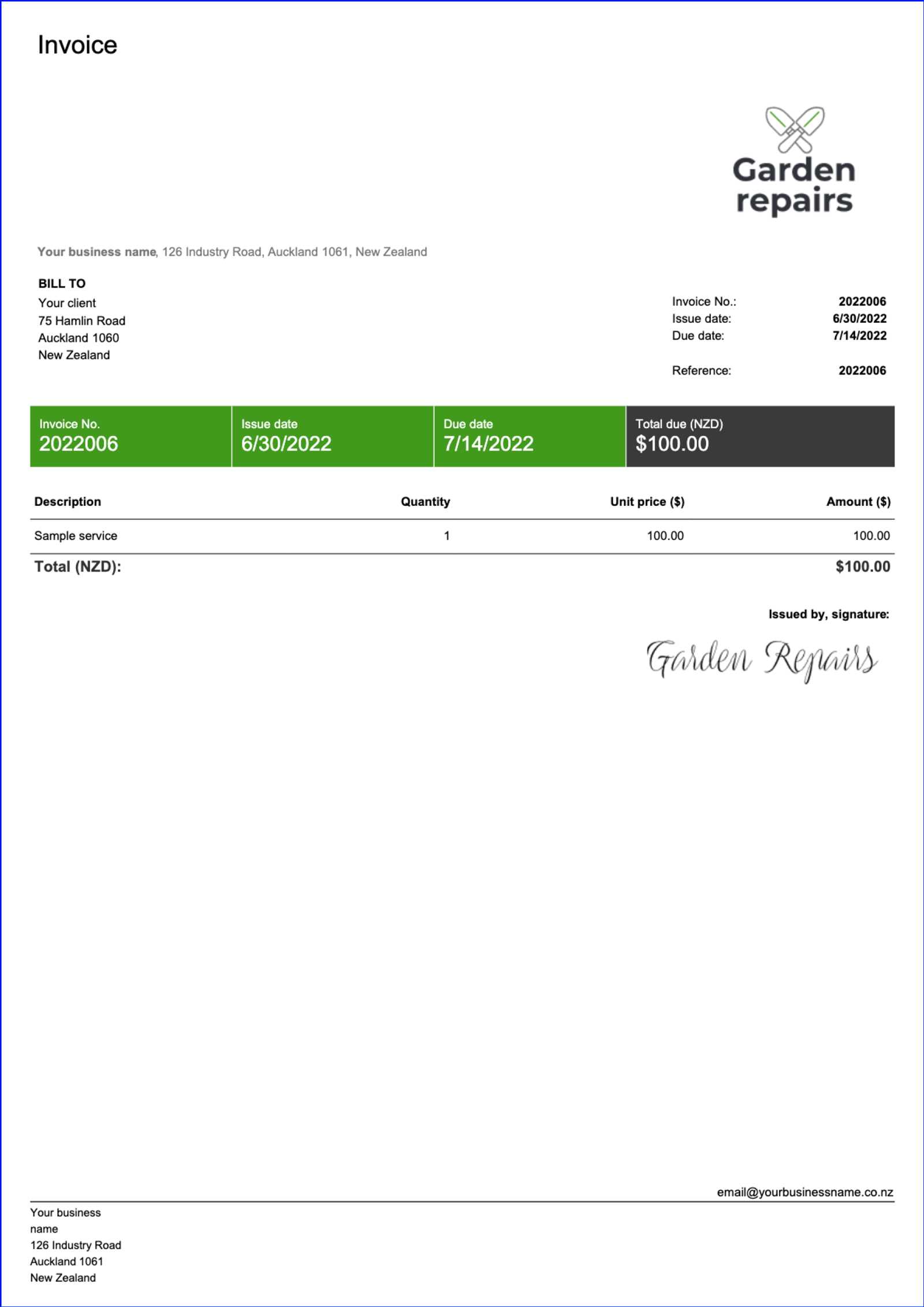

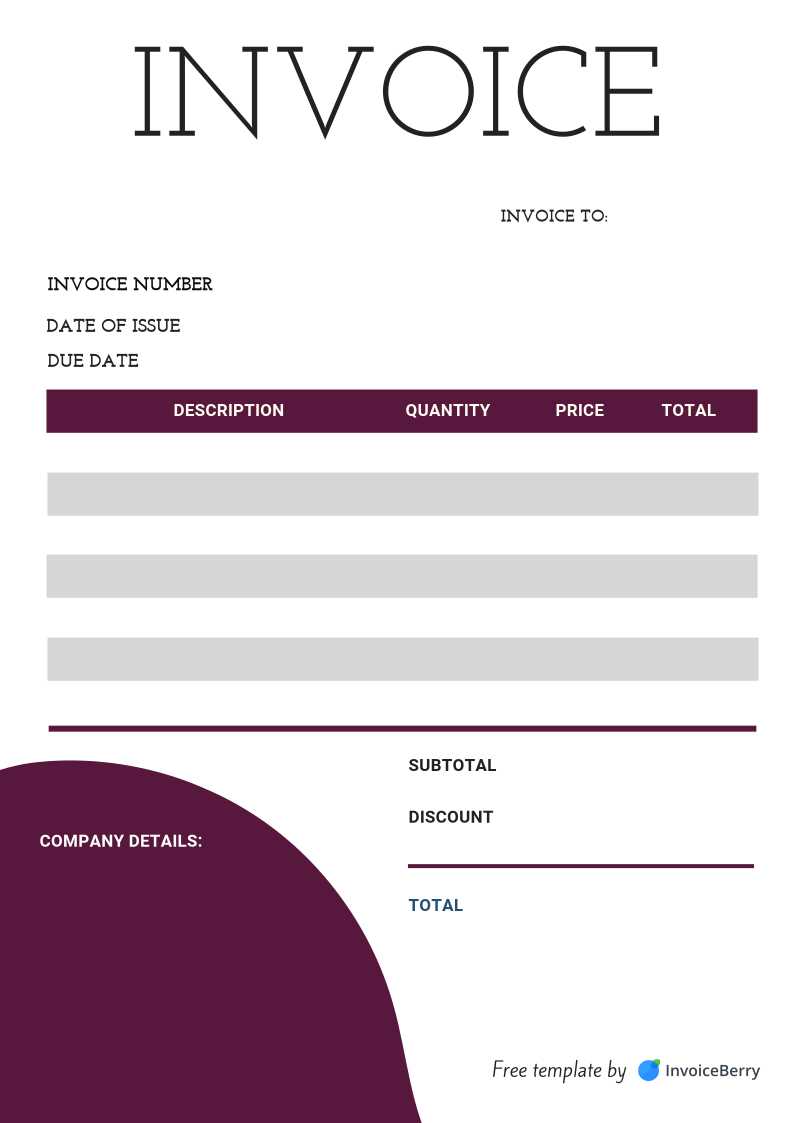

Benefits of Customizable Invoice Templates

Using pre-designed payment request documents that can be easily customized offers numerous advantages. These tools allow businesses to adjust various elements to suit their specific needs, ensuring that each document aligns with their brand identity and the particular requirements of each transaction. Customization not only enhances professionalism but also streamlines the entire process, making it faster and more accurate.

Flexibility in Design and Content

One of the primary benefits of these adaptable tools is the ability to modify both design and content. You can tailor the layout to fit your company’s branding, change fonts, colors, or logos, and even adjust the placement of specific fields. This level of flexibility ensures that every document is unique to your business while maintaining the key elements needed for clarity and functionality.

Improved Accuracy and Consistency

Customizable documents ensure that you can include all necessary details in a structured and consistent way. By having a set format, you reduce the risk of missing crucial information such as payment terms or item descriptions, which can sometimes be overlooked in manually created documents. This leads to more accurate financial records and fewer errors in the long run.

| Benefit | Description |

|---|---|

| Tailored for Your Brand | Adjust colors, fonts, and logos to match your company’s visual identity. |

| Consistency | Maintain a uniform layout across all documents, ensuring professionalism in every transaction. |

| Ease of Use | Quickly update information for each new client or project without starting from scratch. |

| Improved Accuracy | Eliminate the risk of missing important details by using a predefined structure. |

By incorporating customizable solutions into your workflow, you not only streamline your operations but also enhance the overall experience for your clients. These adaptable resources help maintain a high level of professionalism while providing the flexibility you need to accommodate different business needs.

How to Choose the Right Invoice Template

Selecting the appropriate document format for payment requests is crucial for ensuring clarity, professionalism, and accuracy. With so many options available, it’s important to consider several factors before making a decision. The right choice will not only make your financial transactions smoother but also enhance your brand image. Below are some key elements to help you choose the ideal solution for your needs.

Consider Your Business Needs

The first step in selecting the right document structure is to assess your business requirements. Different industries and business models may require distinct formats and elements. Think about the following:

- What type of services or products do you offer?

- Do you need to list itemized services or just a summary of charges?

- Are you working with clients in different countries requiring specific tax information?

Look for Easy Customization Options

One of the greatest advantages of using these ready-made solutions is the ability to adjust them to your specific preferences. When selecting a format, ensure it provides sufficient flexibility for the following:

- Adding or removing sections (e.g., discounts, taxes, payment terms).

- Customizing design elements like colors, fonts, and logos to match your branding.

- Changing the layout to suit your needs (e.g., adding a larger space for notes or references).

Ensure Professional Layout and Structure

The format you choose should reflect your business’s level of professionalism. A clean, well-organized document conveys trustworthiness and reliability. Look for a structure that includes:

- Clear headings and sections to organize essential information (e.g., client details, payment terms, description of services).

- A straightforward, easy-to-read design with well-spaced sections.

- A place for both your business details and the client’s information for easy reference.

Check for Compatibility with Your Software

If you use specific accounting or financial management software, it’s important that the format you choose integrates easily with your system. This compatibility can help streamline the p

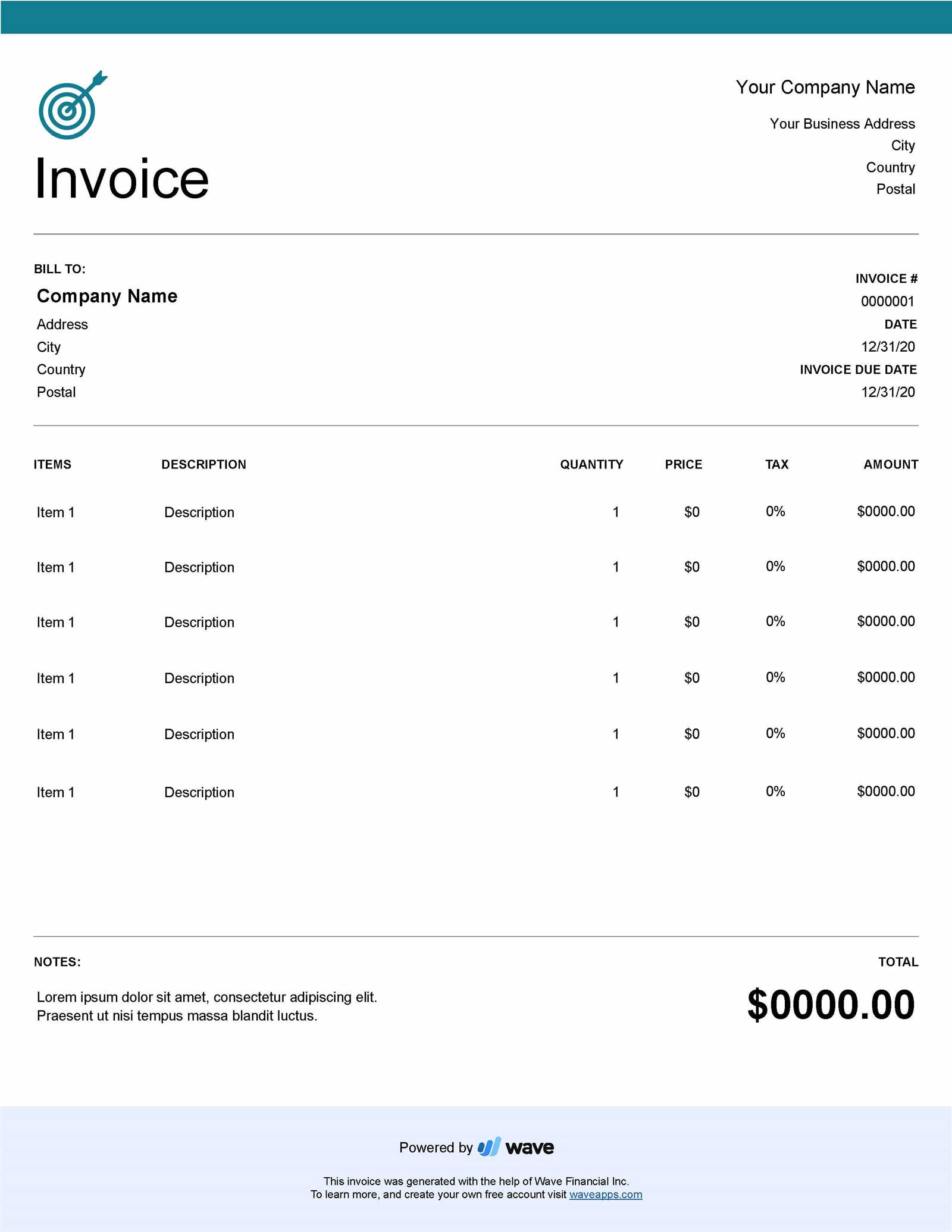

Top Features of Effective Invoice Templates

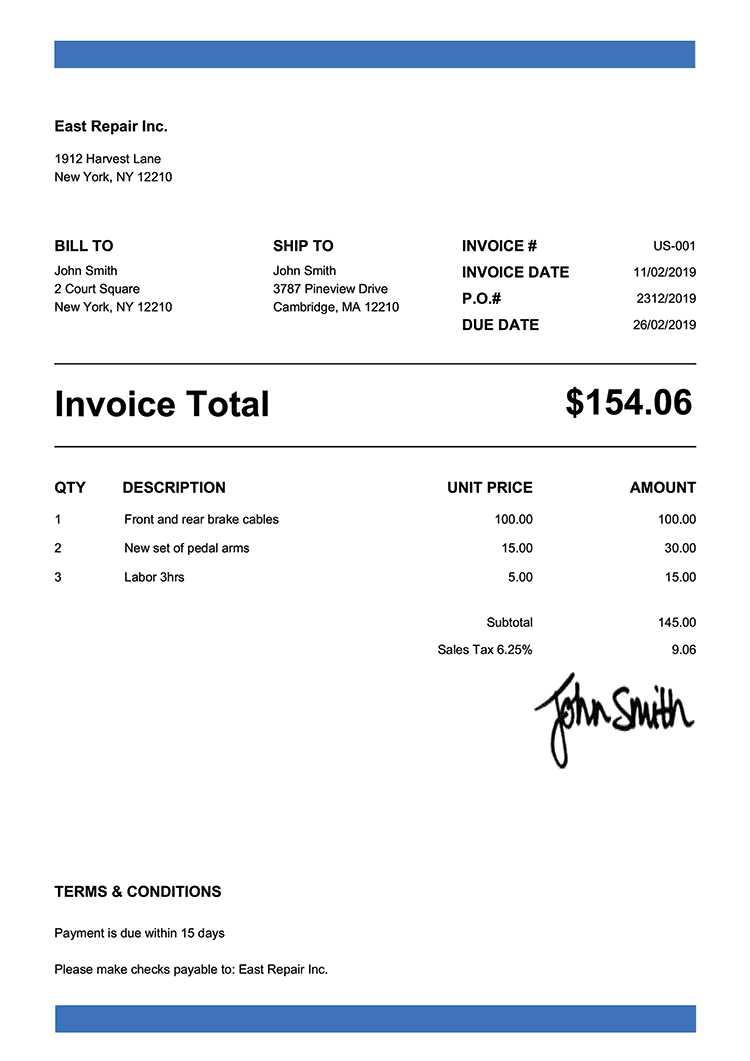

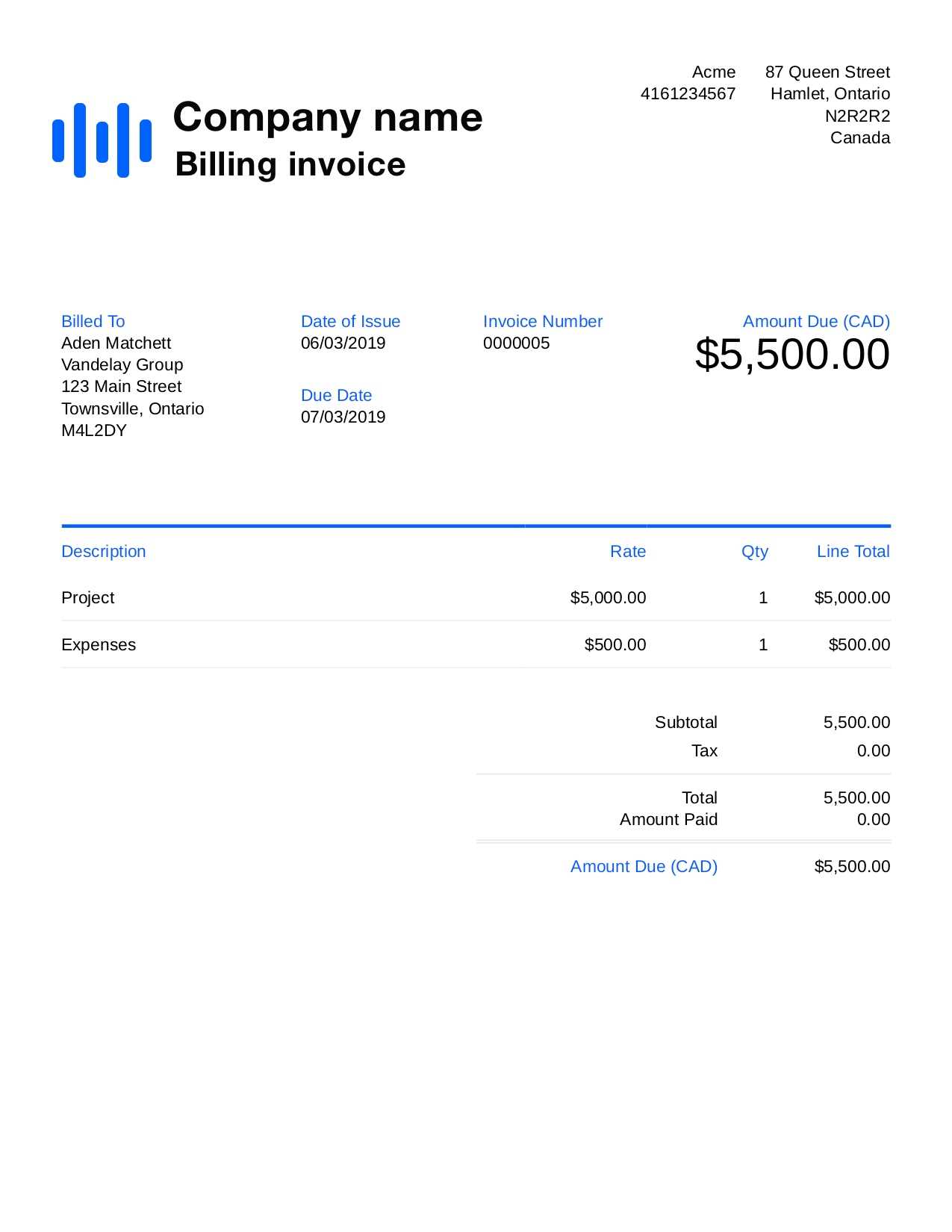

When choosing a document format for financial transactions, certain features make a solution more efficient, professional, and easy to use. A well-structured payment request not only ensures that all the necessary information is presented clearly but also helps maintain consistency across all business communications. The following elements are essential in creating effective and functional documents.

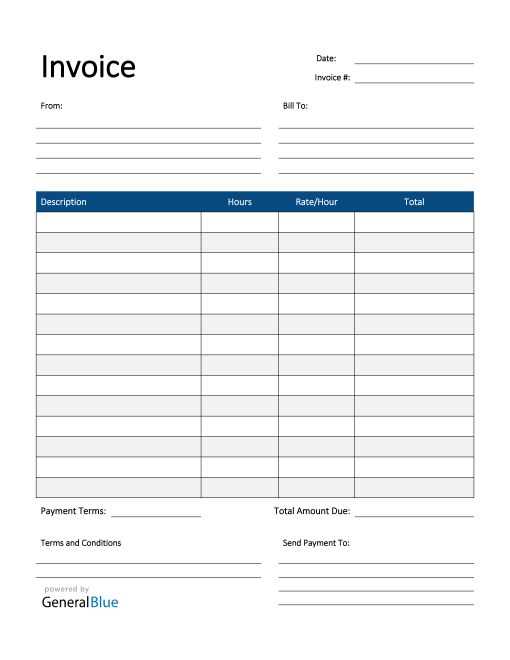

Clear and Organized Layout

The layout of a payment document plays a significant role in how easily the recipient can understand the information. Key elements should be well-organized, with clearly defined sections for each part of the transaction. A good format includes:

- Separate areas for contact information, payment terms, and itemized services or goods.

- Distinct headings to guide the reader through the document.

- Appropriate spacing to prevent the document from feeling cluttered or difficult to navigate.

Customizable Fields

Every business has unique requirements, which is why customization is a crucial feature. The best documents allow for easy adjustments to suit specific needs. Look for options that provide:

- The ability to add or remove fields (e.g., discounts, taxes, additional notes).

- Flexible spaces to modify descriptions and quantities according to the service or product being offered.

- Customization of payment terms, due dates, or preferred methods of payment.

Professional Design

The appearance of a document plays a key role in reflecting your brand and professionalism. An effective format should allow for branding adjustments, such as:

- Customizable logos, colors, and fonts that align with your business identity.

- A visually clean, polished design that helps build trust and credibility with clients.

- Consistent formatting, ensuring that every document reflects the same standard of professionalism.

Easy-to-Fill Structure

One of the most valuable aspects of a good document format is its ease of use. The structure should make it quick and straightforward to input all required information without confusion. Key features of an easy-

Easy Steps to Customize Your Invoice

Customizing your payment request documents can help you tailor them to your specific business needs, while ensuring they reflect your unique brand identity. With a few simple steps, you can personalize the format to make it more effective and professional. Below are easy-to-follow guidelines to modify and adapt your document for every transaction.

Step 1: Choose the Right Format

The first step in customization is selecting the correct structure for your needs. Choose a pre-designed option that aligns with the type of service or product you offer. Make sure the format includes all necessary fields, such as the client’s details, description of services, payment terms, and due dates. A well-organized layout is essential for clarity and ease of use.

Step 2: Personalize the Design

To make your documents reflect your business identity, adjust the design elements. This includes:

- Logo: Add your company’s logo at the top for brand recognition.

- Colors: Modify the color scheme to match your brand’s colors.

- Fonts: Choose readable, professional fonts that are consistent with your brand style.

These small changes will help enhance the document’s appearance, making it look polished and professional.

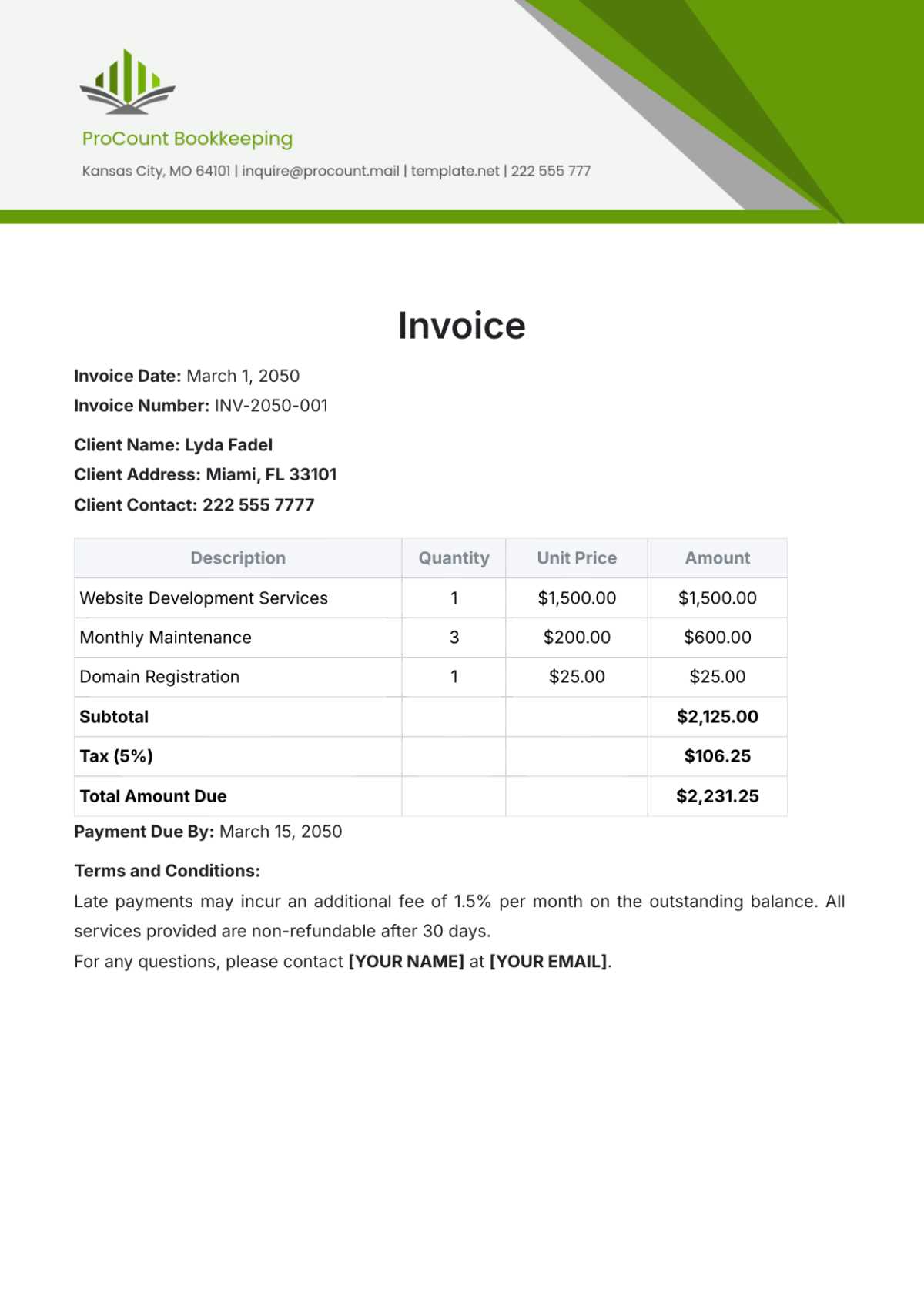

Step 3: Customize the Content

Next, customize the content of the document to reflect the specific details of each transaction. This includes:

- Itemized Descriptions: Provide a clear breakdown of the products or services being charged, including quantities and unit prices.

- Payment Terms: Specify due dates, accepted payment methods, and any early payment discounts or late fees.

- Additional Notes: Include any special instructions or details for the client, such as shipping information or project milestones.

Step 4: Double-Check for Accuracy

Before finalizing your document, it’s essential to review all details for accuracy. Ensure that:

- The client’s name and contact details are correct.

- All charges, including taxes and discounts, are properly calculated.

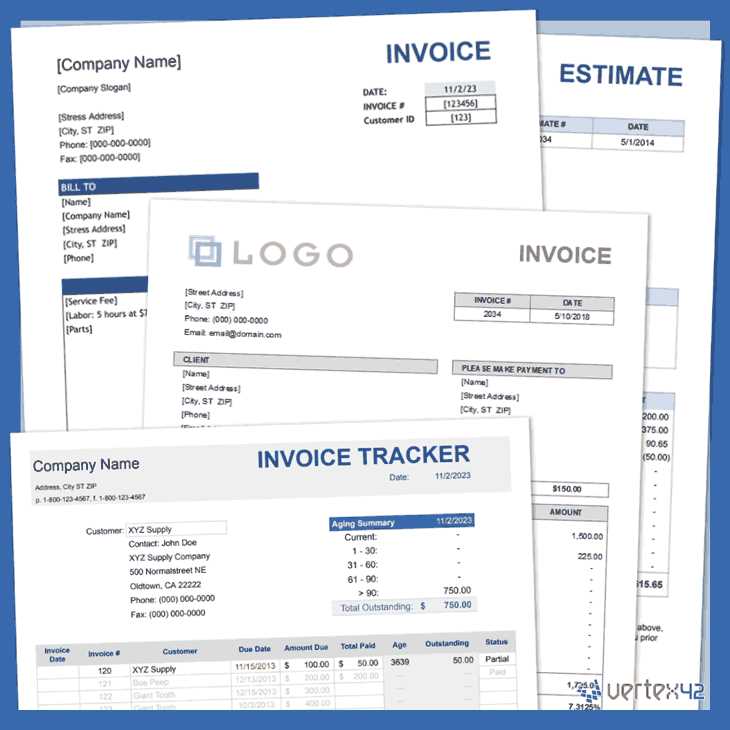

- Canva: Known for its user-friendly interface, Canva offers numerous customizable designs that you can personalize with your branding and transaction details.

- Google Docs: Google Docs provides basic formats that are easily editable and can be shared or stored in the cloud for convenience.

- Microsoft Office Templates: A wide range of professionally designed formats are available through Microsoft Word, all of which can be customized and saved in various file types.

- FreshBooks: Offers several simple yet effective options for businesses of all sizes, including a handy online generator for creating and sending payment requests directly.

- QuickBooks: Provides customizable formats with features that integrate directly into its accounting software for seamless financial management.

- Zoho: A comprehensive platform offering templates tailored to various industries, as well as customizable fields to suit your specific business needs.

- Template.net: A large collection of document options, including payment request forms, all of which can be downloaded and edited as needed.

- Envato Elements: Offers a selection of high-quality business templates, including those for financial documentation, available with a free trial or under free access plans.

- HubSpot: Provides a wide range of customizable business forms, including payment documentation, to help streamline financial processes.

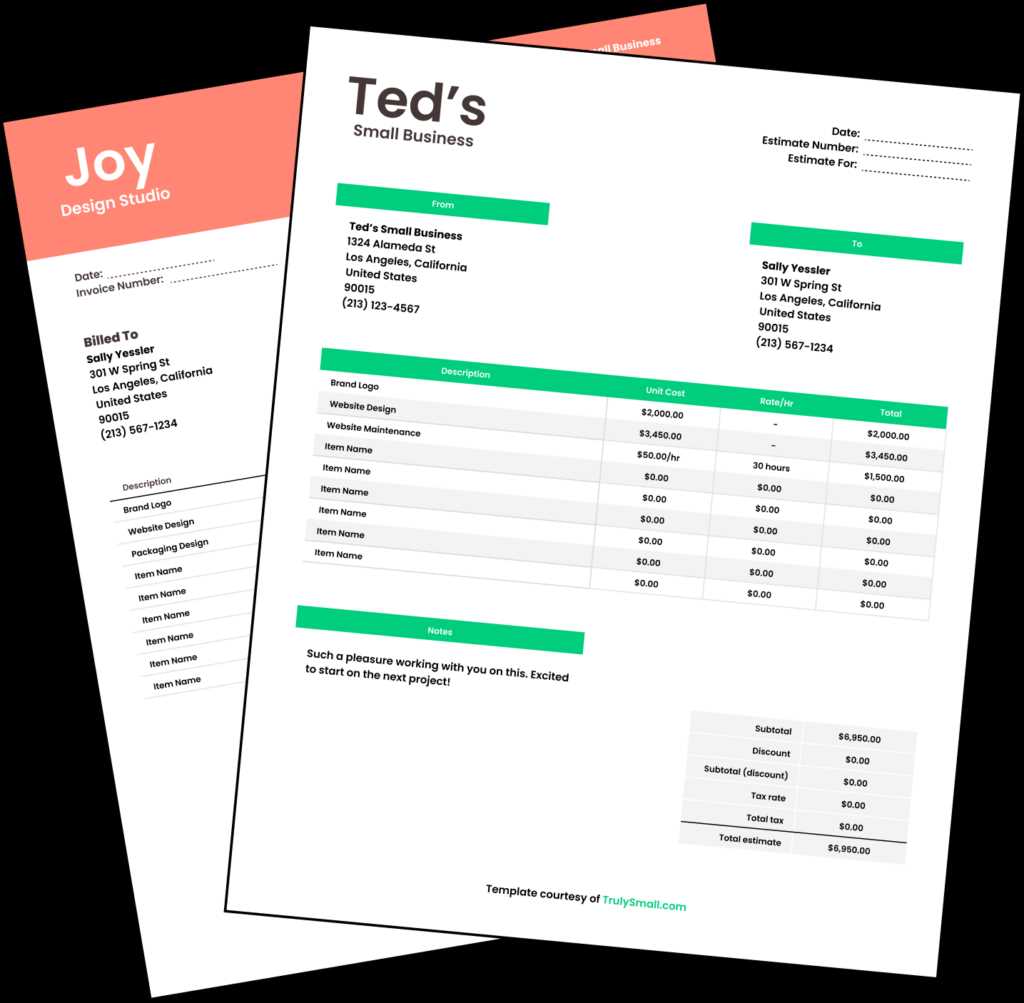

Using Invoice Templates for Small Businesses

For small businesses, managing financial transactions efficiently is crucial to ensuring smooth operations and maintaining good client relationships. One of the best ways to simplify this process is by using ready-made document formats that can be easily customized. These resources help small business owners create professional payment requests without having to invest time in designing them from scratch. By utilizing pre-designed options, you can focus more on growing your business while ensuring your financial records are accurate and consistent.

Streamlining Your Payment Process

With limited time and resources, small businesses need to prioritize tasks that drive growth. By using a pre-designed solution for payment requests, you can automate and streamline the process of documenting financial transactions. This ensures you spend less time on administrative duties and more time on expanding your customer base and improving your products or services.

Professional Appearance for Every Transaction

For any business, especially small ones, maintaining a professional appearance is key to building trust with clients. Customizable formats allow small businesses to create documents that reflect their brand identity. Whether it’s adding a logo, adjusting colors, or tailoring the design, these resources help businesses present themselves in a polished and trustworthy manner with every transaction.

Time and Cost Efficiency

Small business owners often wear many hats, managing everything from operations to marketing. Using these solutions can save time and effort that would otherwise be spent on designing and formatting payment requests. Since these formats are free and easy to access, they also provide a cost-effective way to ensure you have the necessary tools for managing your finances.

Consistency and Accuracy

Keeping financial records consistent and accurate is critical, especially for small businesses that may not have an extensive accounting department. Ready-made formats provide a consistent structure that ensures all the necessary details are included every time. This reduces the risk of errors or omissions, helping to maintain clarity and prevent confusion with clients.

Customization to Fit Your Business Needs

While pre-designed formats provide a solid foundation, they also allow for flexibility. You can tailor the content and layout to meet your specific business needs, whether you’re dealing with one-time services or recurring payments. This adaptability helps ensure that every document aligns with your unique requirements, from payment terms to itemized charges.

By leveragin

Common Mistakes in Invoice Creation

Creating payment documents may seem like a straightforward task, but there are several common errors that can lead to confusion, delays, or even disputes with clients. These mistakes can affect cash flow and tarnish your professional image. Being aware of these pitfalls can help ensure that your financial documentation is accurate, clear, and efficient.

1. Missing Key Information

One of the most frequent mistakes in creating financial documents is failing to include all the necessary details. Omitting critical information such as payment terms, due dates, or itemized services can lead to misunderstandings and delayed payments. Always ensure the following details are clearly stated:

- Client information: Full name, address, and contact details.

- Service/product descriptions: A clear breakdown of what is being charged.

- Payment details: Payment methods, due dates, and any applicable discounts or late fees.

2. Incorrect or Inconsistent Calculations

Another common error is inaccurate calculations. This includes miscalculating totals, taxes, or discounts. Small businesses are especially vulnerable to these mistakes when creating payment documents manually. To avoid errors:

- Double-check all math: Ensure that the sum of individual items, taxes, and total charges are correct.

- Use built-in calculators: Many accounting software and document platforms provide automatic calculations, which can help minimize human error.

- Include clear tax breakdowns: Ensure that the tax rates are correct and that they are shown clearly.

3. Lack of Consistency

Consistency across your payment documents is vital for creating a professional image. Using different formats, fonts, or layouts for each document can make your business appear disorganized. It’s important to maintain a uniform style in all your financial communications. This includes:

- Design consistency: Use the same font style, size, and color scheme for all documents.

- Layout: Ensure the structure of the document is the same every time, with the same sections in the same order.

By avoiding these common mistakes, you can create payment documents that are accurate, professional, and easy for your clients to

How to Ensure Accurate Billing with Templates

Accuracy in financial documentation is essential for maintaining smooth business operations and positive client relationships. Using pre-designed documents can significantly reduce the likelihood of errors, ensuring that all details are captured correctly. However, simply using a pre-made format is not enough. To achieve precise results, it’s important to follow best practices when creating and managing your payment records.

1. Use Structured and Standardized Formats

Choosing a consistent and organized document structure is the first step towards ensuring accuracy. Well-structured forms automatically guide you through including all the necessary details. To ensure precision:

- Use a consistent format: Stick to a specific structure for all your transactions, ensuring uniformity in every document.

- Pre-set fields: Choose formats that include clearly labeled sections for each type of information, such as client details, service descriptions, and payment terms.

- Clearly defined sections: Ensure that the document is divided into easily identifiable sections to avoid confusion when filling in details.

2. Double-Check All Financial Information

One of the most common mistakes in financial documents is miscalculating amounts, taxes, or discounts. To avoid errors:

- Verify totals: Always double-check the calculation of item prices, taxes, and any additional charges.

- Use built-in calculations: Many platforms offer automatic calculation functions that minimize the risk of human error. Utilize these whenever possible.

- Ensure tax and discount accuracy: Confirm that tax rates and discount percentages are correctly applied and clearly stated.

3. Customize the Document to Fit Each Transaction

While standardized formats are helpful, every transaction may have unique requirements. Make sure to tailor each document to fit the specific service or product being provided. Key customization tips include:

- Itemized descriptions: Provide clear and accurate descriptions of the goods or services provided, along with quantities and unit prices.

- Appropriate paym

Free Invoice Templates for Different Industries

Businesses across various sectors often have unique needs when it comes to documenting financial transactions. Whether you’re in creative services, retail, or construction, the right document format can help ensure accuracy and professionalism in every transaction. Tailoring these documents to fit industry-specific requirements can save time and minimize errors, allowing you to focus on what truly matters: growing your business.

1. Creative and Freelance Services

For freelancers and creative professionals, clear and detailed payment documentation is key to maintaining client trust and ensuring timely payments. The document should reflect the nature of the services provided, with specific itemizations of each task or deliverable. Key elements to include:

- Project milestones: Break down the work completed into phases with corresponding charges.

- Hourly or fixed rates: Specify the method of charging (per hour, per project, etc.).

- Licensing or usage rights: If applicable, clearly state the scope of usage for any creative work provided.

2. Retail and E-commerce Businesses

For retail or online stores, payment documents need to detail the products sold, quantities, and prices. Clear product descriptions and accurate inventory tracking are essential. Some important aspects to include are:

- Product descriptions: A clear breakdown of each item purchased with its corresponding price and quantity.

- Shipping details: Include shipping charges, expected delivery times, and tracking numbers if applicable.

- Discounts or promotional offers: Clearly outline any discounts applied to the total order.

3. Consulting and Professional Services

Consultants and service providers often work with clients on long-term projects or provide ongoing advisory services. For these types of businesses, payment documentation needs to reflect both the hours worked and the services rendered. Key sections include:

-

Integrating Invoice Templates with Accounting Software

Integrating pre-designed payment request documents with accounting software can significantly streamline your business’s financial management. This integration not only saves time but also ensures that all records are accurate and consistent. By linking these documents with accounting tools, you can automate many aspects of your financial processes, from generating payment requests to tracking payments and updating financial records. This integration enhances efficiency, reduces human error, and allows for smoother operations across your business.

Many modern accounting platforms offer built-in solutions for customizing and sending payment requests, allowing businesses to input all necessary details directly into the system. These systems often provide seamless connections with existing business tools, such as customer relationship management (CRM) software, payment processors, and inventory management systems. This creates a unified process that ensures every transaction is recorded and reconciled automatically.

Additionally, using accounting software to manage payment requests helps track outstanding balances, payment histories, and client information in one place, making it easier to manage your cash flow. With templates integrated into these systems, businesses can quickly generate professional and accurate documents, minimizing the risk of mistakes while improving the overall efficiency of the financial workflow.

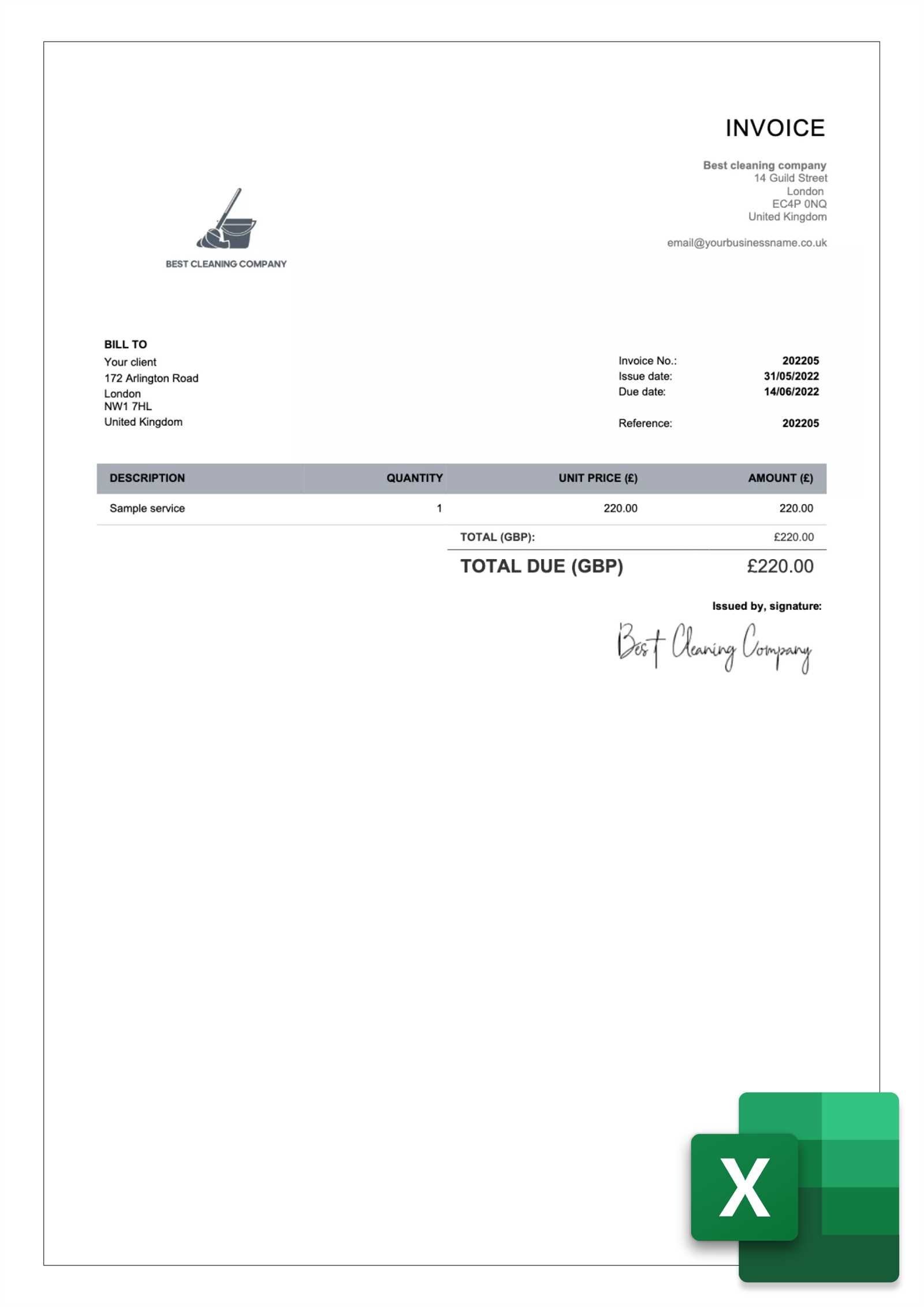

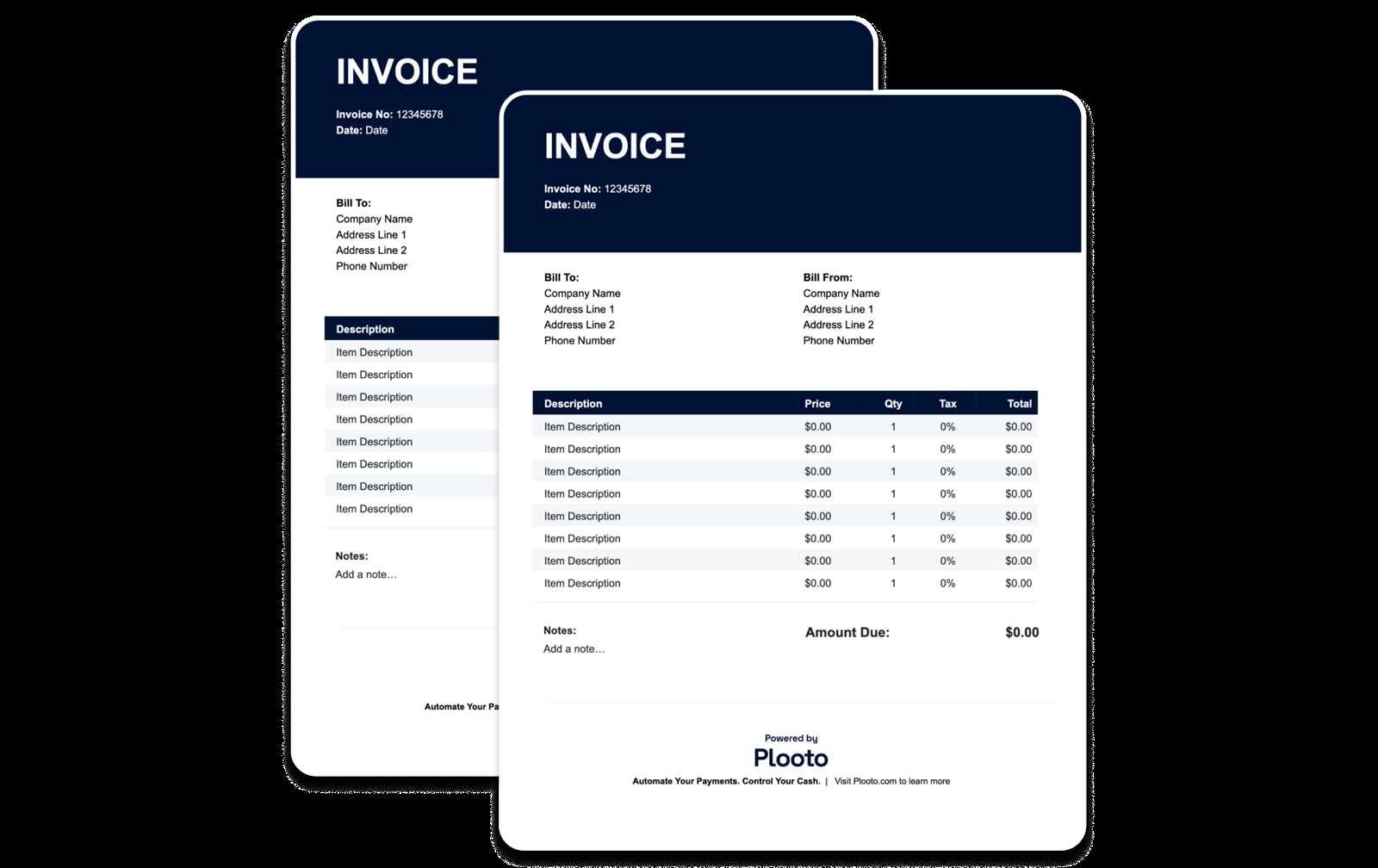

Printable vs Digital Invoice Templates

When it comes to creating payment request documents, businesses must decide whether to use physical, printed formats or digital versions. Each approach has its advantages and potential drawbacks depending on the nature of the business and the preferences of clients. Understanding the differences between the two can help you choose the right option for your operations.

Printable Formats

Printable payment request documents are physical copies that are typically filled out manually and sent via mail or handed over in person. These can be beneficial in industries where physical documentation is preferred or required. Here are some reasons why printable documents might be the right choice:

- Formal presentation: Physical documents can provide a sense of formality and professionalism that some clients may prefer.

- Client preference: Some clients or industries may still rely on hard copies for their records or to meet regulatory requirements.

- Easy to archive: Hard copies can be easily filed and stored for future reference, offering a tangible backup to digital records.

Digital Formats

Digital payment request documents are electronic versions that can be created, sent, and stored entirely online. This approach is becoming increasingly popular due to its convenience and cost-effectiveness. Here are some reasons why digital versions may be a better fit for modern businesses:

- Speed: Sending a digital document can be done almost instantly, allowing faster processing and quicker payments.

- Environmentally friendly: Digital formats eliminate the need for paper, reducing waste and the carbon footprint associated with printing and mailing physical copies.

- Easy tracking and organization: Digital documents can be easily stored, searched, and organized in accounting software or cloud storage for better access and management.

- Automated features: Many digital systems can automatically calculate totals, taxes, and discounts, reducing the risk of human error.

Which Option is Best?

The decision to use printable or digital documents depends largely on your business type and your clients’ preferences. For small businesses or industries that require quick transactions and paperless records, digital solutions are typically more efficient. However, for businesses in more traditional sectors or those dealing with clients who prefer physical paperwork, printable formats may still be a viable option.

In many cases, a hybrid approach that uses both methods may offer the best balance. Pr

Best Practices for Sending Invoices

Sending clear, accurate, and timely payment requests is a critical aspect of managing your business’s cash flow. It ensures that you get paid promptly and helps maintain professional relationships with clients. To achieve these goals, it’s important to follow best practices that streamline the process and minimize the chances of errors or delays.

1. Ensure Clarity and Accuracy

Before sending any payment request, ensure that all the details are correct and easy to understand. This reduces the chances of confusion and prevents the need for follow-ups. Key aspects to check include:

- Complete and correct information: Double-check client names, addresses, and contact details to avoid miscommunication.

- Clear itemization: List each product or service provided with corresponding quantities, rates, and totals.

- Accurate payment terms: Specify due dates, late fees, and accepted payment methods to avoid confusion later.

2. Send Invoices Promptly

Sending payment documents in a timely manner is crucial for ensuring prompt payment. Ideally, invoices should be sent as soon as the service or product has been delivered. Sending them promptly helps set clear expectations and maintains a steady cash flow. Consider the following:

- Timing: Send payment requests immediately after the job is completed or the product is shipped to avoid delays in payment.

- Automation: Use accounting software to automate the invoicing process for quicker and more consistent document delivery.

3. Use Professional Formatting

Sending a well-formatted, professional-looking payment document helps to establish credibility and assures clients that your business operates in a polished and organized manner. P

Best Practices for Sending Invoices

Sending clear, accurate, and timely payment requests is a critical aspect of managing your business’s cash flow. It ensures that you get paid promptly and helps maintain professional relationships with clients. To achieve these goals, it’s important to follow best practices that streamline the process and minimize the chances of errors or delays.

1. Ensure Clarity and Accuracy

Before sending any payment request, ensure that all the details are correct and easy to understand. This reduces the chances of confusion and prevents the need for follow-ups. Key aspects to check include:

- Complete and correct information: Double-check client names, addresses, and contact details to avoid miscommunication.

- Clear itemization: List each product or service provided with corresponding quantities, rates, and totals.

- Accurate payment terms: Specify due dates, late fees, and accepted payment methods to avoid confusion later.

2. Send Invoices Promptly

Sending payment documents in a timely manner is crucial for ensuring prompt payment. Ideally, invoices should be sent as soon as the service or product has been delivered. Sending them promptly helps set clear expectations and maintains a steady cash flow. Consider the following:

- Timing: Send payment requests immediately after the job is completed or the product is shipped to avoid delays in payment.

- Automation: Use accounting software to automate the invoicing process for quicker and more consistent document delivery.

3. Use Professional Formatting

Sending a well-formatted, professional-looking payment document helps to establish credibility and assures clients that your business operates in a polished and organized manner. Pay attention to the following points:

- Consistent design: Use a uniform design for all documents to maintain consistency and professionalism.

- Readable layout: Ensure the document is clean and easy to navigate, with sections clearly labeled and totals highlighted.

- Company branding: Include your company logo, business name, and contact information to give the document a personal touch.

4. Offer Multiple Payment Methods

To make it as easy as possible for clients to settle their bills, provide several payment options. This helps avoid delays that may occur if a client is unable to use a preferred method. Some options to consider include:

- Bank transfers: Include your bank account details for clients who prefer direct deposits.

- Credit/debit card payments: Offer an online payment portal for those who prefer paying with cards.

- Digital wallets: Accept payment through popular platforms such as PayPal, Venmo, or others.

5. Follow Up on Unpaid Requests

Sometimes clients may forget or delay payment. Following up on overdue payments is an important part of maintaining healthy cash flow. Consider the following when sending reminders:

- Send a polite reminder: Contact clients shortly after the due date has passed, reminding them of the outstanding balance.

- Offer assistance: Ask if there were any issues with the payment process and offer solutions if needed.

- Implement late fees: If your payment terms allow for late fees, ensure that they are clearly outlined in your documents and that they are applied fairly when necessary.

6. Keep Records Organized

Finally, maintaining an organized record of all sent payment documents is crucial for both your internal record-keeping and future references. Track every transaction, including:

- Payment status: Monitor whether invoices have been paid or are still pending.

- Communication history: Keep a record of follow-up emails and conversations related to payments.

- Document backups: Store your payment requests digitally or in the cloud to ensure they are safe and easily accessible for future reference.

By following these best practices, you can streamline your payment processes, improve your cash flow, and build stronger relationships with your clients. Being proactive and professional in your approach will lead to timely payments and greater business success.

Free Invoice Templates for Freelancers

As a freelancer, managing your finances and ensuring timely payments from clients is crucial for maintaining steady cash flow. One of the most important tools in this process is a well-organized document that outlines the services provided and the amount owed. Using pre-made documents specifically designed for independent contractors can save you time and ensure that every transaction is recorded professionally.

There are many customizable options available that cater to the unique needs of freelancers in different fields, from creative work to consulting. These documents help you maintain a consistent and professional image while clearly communicating payment terms to clients. Here are some key features freelancers should consider when selecting a suitable document format:

1. Clear Breakdown of Services

Whether you’re a graphic designer, writer, or developer, it’s essential to provide a detailed list of services delivered. Key aspects to include are:

- Task descriptions: Specify each service or project phase with corresponding rates.

- Quantity of hours worked or products delivered: Include the number of hours, pages, or units delivered, depending on your pricing structure.

- Itemized costs: Break down the total amount into individual line items for full transparency.

2. Payment Terms and Deadlines

For clear expectations, it’s important to outline your payment terms. This avoids misunderstandings and helps clients know when and how to pay. Make sure to include:

- Due date: Specify when payment is due after the document is sent.

- Accepted payment methods: Indicate the different ways clients can make payments (e.g., bank transfer, credit card, PayPal).

- Late fees: If applicable, include penalties for late payments to encourage timely settlements.

3. Branding and Personalization

As an independent professional, branding yourself is important. A customizable document allows you to incorporate your business logo, brand colors, and contact details. Personalization adds a professional touch and reinforces your identity. You should include:

- Your logo: Position it prominently at the top for easy recognition.

- Your business name and contact info: Ensure clients can quickly reach you if needed.

- Optional note: Include a personal thank you note or special message for clients, which can stre

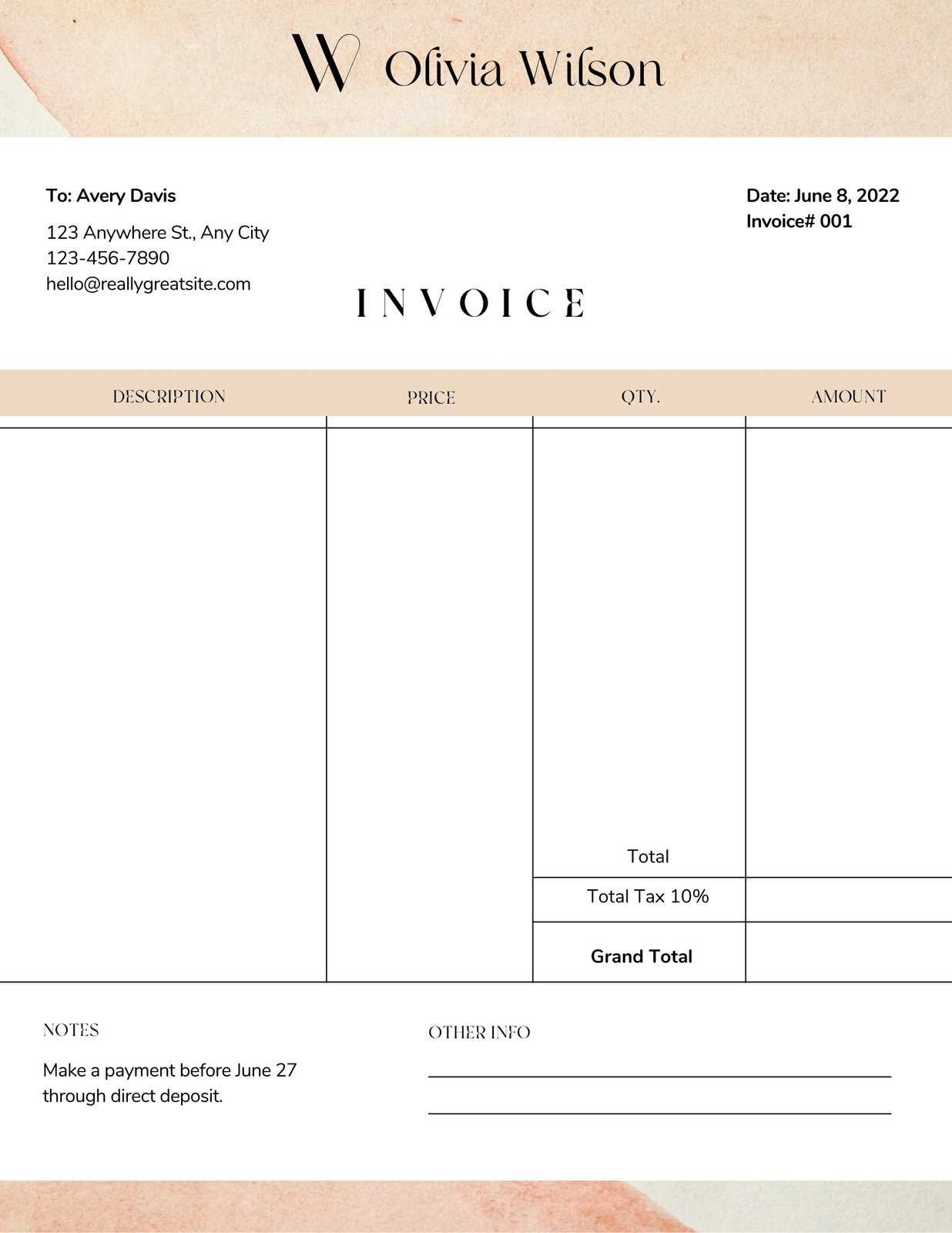

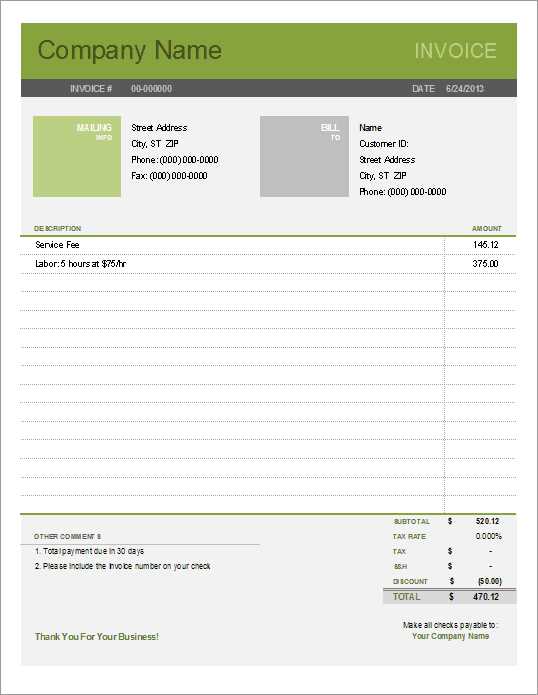

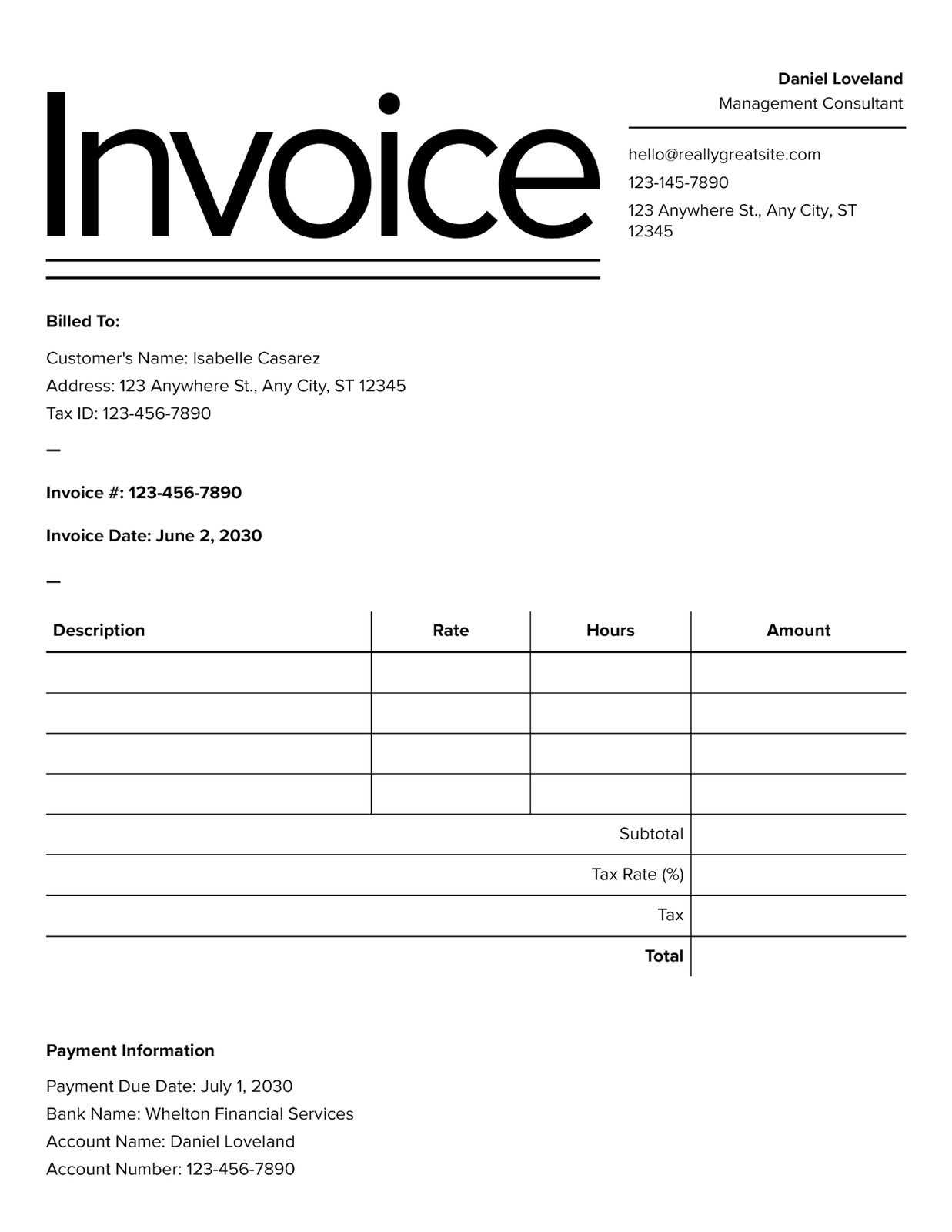

Creating a Professional Look with Invoice Templates

Presenting a polished and professional image to clients is essential for any business, and one of the most effective ways to do this is through the appearance of your payment documents. A well-designed document not only reflects your business’s professionalism but also fosters trust and confidence in your clients. Whether you’re a freelancer, small business owner, or part of a larger organization, creating a professional look can make a significant impact on your business relationships.

1. Clean and Organized Layout

A cluttered or confusing payment document can lead to misunderstandings and delays in payments. Keeping the layout clean and easy to navigate is key. Some tips to achieve this are:

- Clear sections: Use distinct headings for each part of the document, such as client details, service descriptions, and payment terms, to make it easy to follow.

- Whitespace: Don’t overcrowd the document with information. Adequate spacing between sections and lines will enhance readability.

- Consistent font: Use a simple, professional font (like Arial or Times New Roman) that is easy to read and consistent throughout the document.

2. Branding and Personalization

Including your business logo, contact information, and brand colors can help make your document stand out and reinforce your company’s identity. Here are some ways to incorporate branding into your payment requests:

- Logo placement: Position your logo at the top of the document for instant recognition.

- Business details: Include your company name, address, and contact information in the header or footer.

- Brand colors: Subtly incorporate your brand colors into headings, borders, or section backgrounds to give the document a cohesive look.

By using these design principles, you can create a professional-looking document that not only conveys the necessary information but also strengthens your brand identity and builds trust with your clients.

Why Templates Save You Time and Effort

Creating payment documents from scratch every time can be time-consuming and error-prone. Instead of starting with a blank page, using pre-designed documents that are easy to modify can significantly streamline the process. These ready-made formats offer structure, consistency, and the ability to quickly input specific details, allowing you to focus on the work that matters most.

1. Consistent Structure

One of the key advantages of using pre-built formats is that they provide a consistent structure, which saves you from having to reinvent the wheel with each transaction. Here’s how this consistency helps:

- Predefined sections: The document is already organized into necessary sections (such as client information, services rendered, and payment terms), ensuring nothing is missed.

- Uniform layout: By using the same layout every time, you eliminate confusion and reduce the risk of errors.

- Professional appearance: Consistency helps maintain a polished and professional image with each document you send to your clients.

2. Time-Efficiency

Pre-designed formats also save you significant time, allowing you to focus on your core business activities. Rather than starting each document from scratch, you can simply input relevant details such as:

- Client information: Quickly fill in contact details and payment terms without needing to create new headings or sections.

- Service descriptions: Select or add specific services provided with just a few clicks, reducing the need for repetitive typing.

- Automatic calculations: Many formats come with built-in calculation functions for totals, taxes, and discounts, saving you from manual math.

Using a pre-made structure not only helps speed up the process but also minimizes human error, leading to fewer corrections and less back-and-forth with clients.

Where to Find Free Invoice Templates Online

When looking to streamline your financial documentation process, there are numerous online resources where you can access pre-designed formats that can be customized to suit your business needs. These platforms offer a range of options, from basic models to more complex designs, all available for download at no cost. Below are some of the best places to find reliable solutions for your payment requests.

1. Online Document Platforms

Several websites specialize in providing a variety of pre-made business documents, including payment request formats. These platforms offer easy-to-use solutions that can be customized to meet your specific requirements. Some popular options include:

2. Accounting and Business Websites

Many financial and accounting websites provide downloadable models as part of their service offerings. These resources are often designed by professionals to ensure they meet industry standards. Popular websites include:

3. Template Marketplaces

In addition to specialized document platforms, many online marketplaces also offer free options for business forms. These templates are often available in multiple formats, making them compatible with most software. Some well-known marketplaces are:

4. Business Blogs and Online Communities

Many blogs and online communities dedicated to entrepreneurship and small business management share free resources, including downloadable documents. These resources are often designed by industry experts and are perfect for small business owners looking for easy solutions. Examples include: