Furniture Store Invoice Template for Easy Billing and Customization

Managing transactions efficiently is essential for the smooth operation of any business. A streamlined system for documenting sales and payments not only enhances professionalism but also helps maintain financial accuracy. Having a well-structured billing document is a fundamental tool for tracking purchases, providing clarity to customers, and ensuring transparency in business dealings.

For businesses in the home furnishings sector, utilizing a customizable and easy-to-use invoicing system can save time and reduce errors. These records serve as crucial references for both sellers and buyers, making it easier to resolve any potential issues and maintain organized financial records. By adapting these documents to meet specific needs, businesses can offer a more personalized and effective service while ensuring all necessary information is captured.

Whether you are a small business owner or managing a larger operation, using the right billing solution can improve workflow, enhance customer relations, and simplify the payment process. In the following sections, we’ll explore how to create, customize, and implement an efficient system to meet your unique requirements.

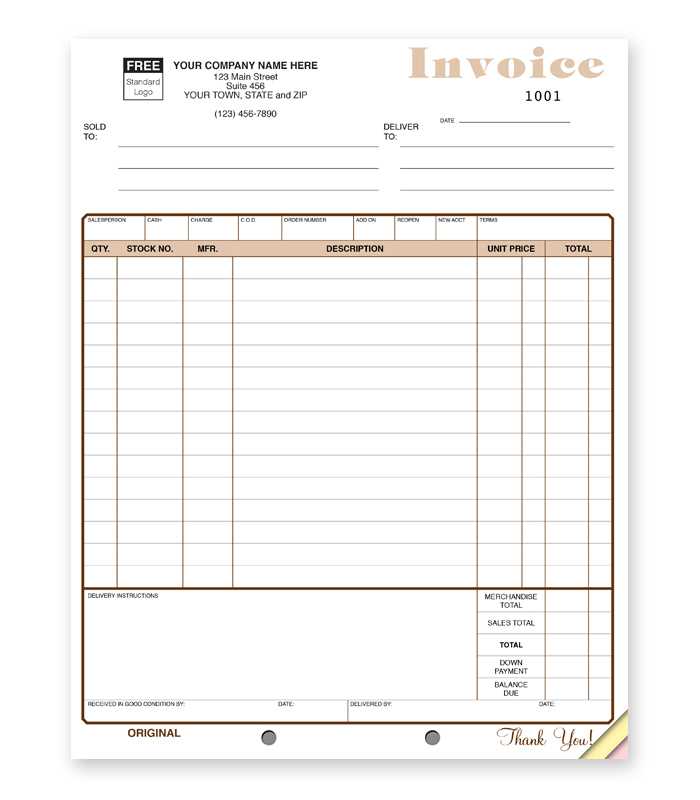

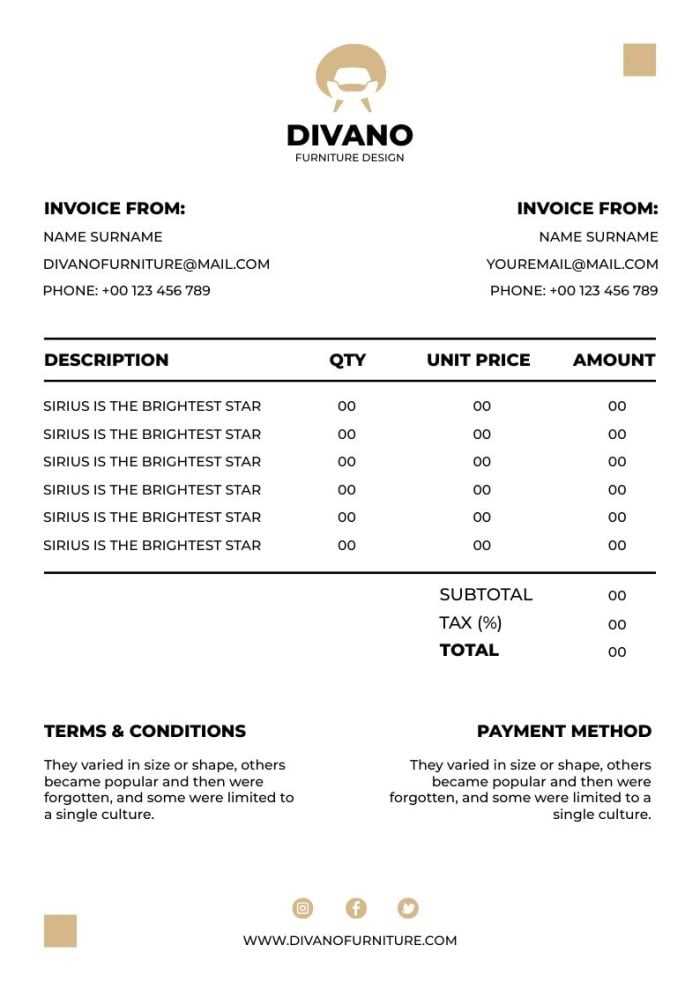

Furniture Store Invoice Template Overview

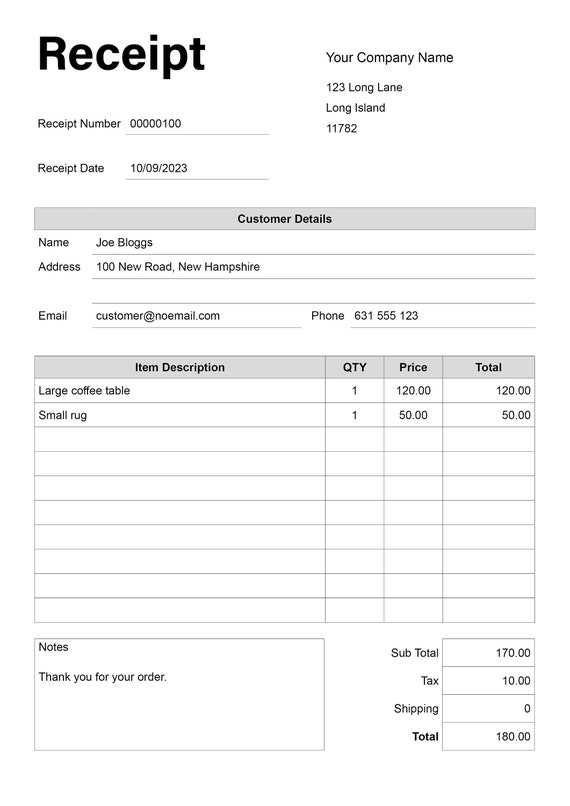

Having a well-designed billing document is an essential part of any business dealing with product sales. This document serves as both a receipt and a record, detailing the transaction between a seller and a buyer. It ensures that both parties have a clear understanding of the products purchased, their prices, and the terms of payment. A comprehensive and customizable billing document is vital for maintaining accurate financial records and fostering professionalism in business dealings.

Key Features of a Billing Document

An effective document for sales should contain several important elements to ensure it is clear and informative. These features include:

- Seller Information: The business name, address, and contact details.

- Buyer Information: The customer’s name, address, and contact details.

- Product List: A detailed description of the items purchased, including quantities and unit prices.

- Subtotal and Taxes: The total before tax and any applicable taxes or discounts.

- Payment Terms: Information on due dates, payment methods, and any late fees.

- Unique Identifier: A reference number or code for tracking the transaction.

Why Customization Matters

Each business has unique needs, and being able to adjust the layout and details of a sales document is crucial. Customization allows businesses to add branding elements, include specific payment instructions, and modify the layout to suit their operations. For example, adjusting the design to reflect the company’s branding helps maintain a professional image, while flexible fields for discounts, taxes, and shipping can ensure that the document meets any legal or customer-specific requirements.

By using a versatile and customizable document, businesses can streamline their operations, improve customer service, and keep detailed records of all transactions.

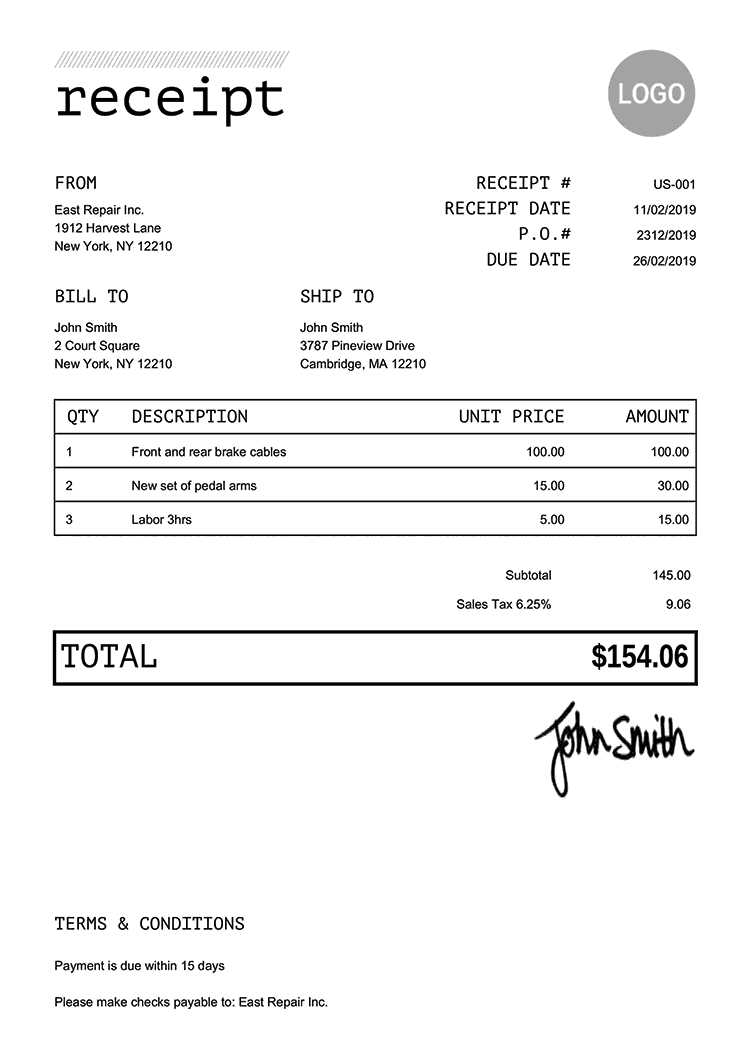

How to Create an Invoice for Furniture Sales

Creating a clear and accurate sales document is essential for tracking transactions and maintaining financial order in any business. This document serves as proof of a transaction, detailing the products purchased, their prices, and the payment terms. Crafting an effective and professional document is crucial for both customer satisfaction and internal record-keeping. In this section, we will walk through the steps of generating a document tailored to your sales needs.

Step-by-Step Process for Creating a Sales Document

Follow these simple steps to create a clear and concise record for each transaction:

- Start with Contact Details: Begin by listing your business name, address, phone number, and email. Then, include your customer’s contact details to establish clear communication channels.

- Include a Unique Identifier: Assign a reference number to each transaction to easily track it for future reference or inquiries.

- List the Products: Provide a detailed description of the items sold, including quantity, unit price, and any additional features that might be relevant. Ensure that each item is listed clearly and accurately.

- Calculate the Subtotal: Sum up the cost of the items purchased before any applicable taxes, fees, or discounts.

- Apply Taxes and Discounts: Clearly outline any taxes or discounts that apply to the sale. Make sure to calculate them accurately and state the final amounts.

- Outline Payment Terms: Specify the payment methods accepted, the due date, and any late payment penalties that may apply.

- Finalize with the Total Amount: Include the total amount due after taxes and discounts, ensuring clarity for both you and your customer.

Important Tips for Accuracy and Clarity

Ensure that your sales document is easy to read and free from errors. Double-check product descriptions and prices to avoid confusion. Use simple language to explain the payment terms and any conditions related to returns or warranties. Including clear headings, itemized lists, and a total amount at the bottom makes it easier for your customer to understand the document and proceed with payment promptly.

By following these steps, you’ll create a professional and organized document that enhances the customer experience and supports smooth financial operations for your business.

Benefits of Using Invoice Templates in Furniture Business

Utilizing ready-made documents for managing sales and payments can greatly streamline administrative tasks. These documents not only save time but also improve the accuracy and consistency of business operations. By relying on a standardized format, companies can ensure that every transaction is documented in a professional manner, reducing the risk of errors and misunderstandings.

One of the primary advantages of using these structured records is the ability to maintain clarity. Customers receive a detailed and easy-to-read summary of their purchases, which helps build trust and enhances the overall customer experience. At the same time, businesses benefit from having a uniform approach to handling financial data, making it easier to track revenue, taxes, and outstanding payments.

Time and Efficiency Gains

By using a pre-designed format, businesses can quickly generate accurate documents without starting from scratch each time. This efficiency allows staff to focus on other critical areas of the business, improving overall productivity. Additionally, these tools can be easily customized to meet specific needs, such as including branding elements or adjusting for local tax regulations, ensuring that each document is tailored while still saving time.

Consistency and Professionalism

Consistency in documentation is vital for maintaining a professional image. When all transactions are recorded using the same clear, organized structure, customers can immediately recognize the professionalism of the business. Furthermore, consistency helps reduce confusion for both customers and employees, making it easier to process payments and resolve any disputes that may arise.

Ultimately, using pre-designed sales records leads to better organization, improved customer relations, and smoother financial operations. The benefits are clear: time savings, reduced errors, and enhanced professionalism are key factors that can help businesses grow and operate more efficiently.

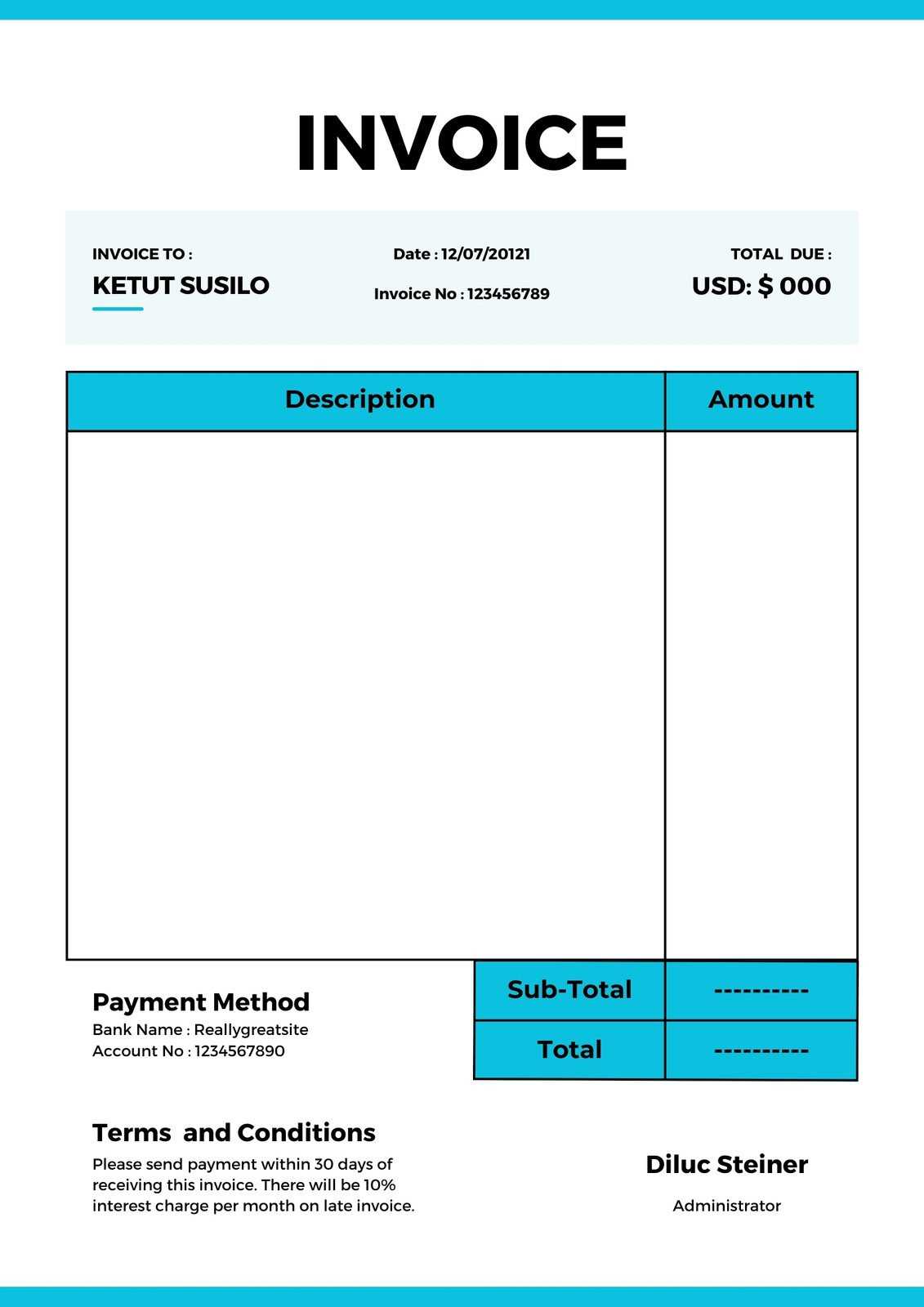

Customizing Your Sales Document

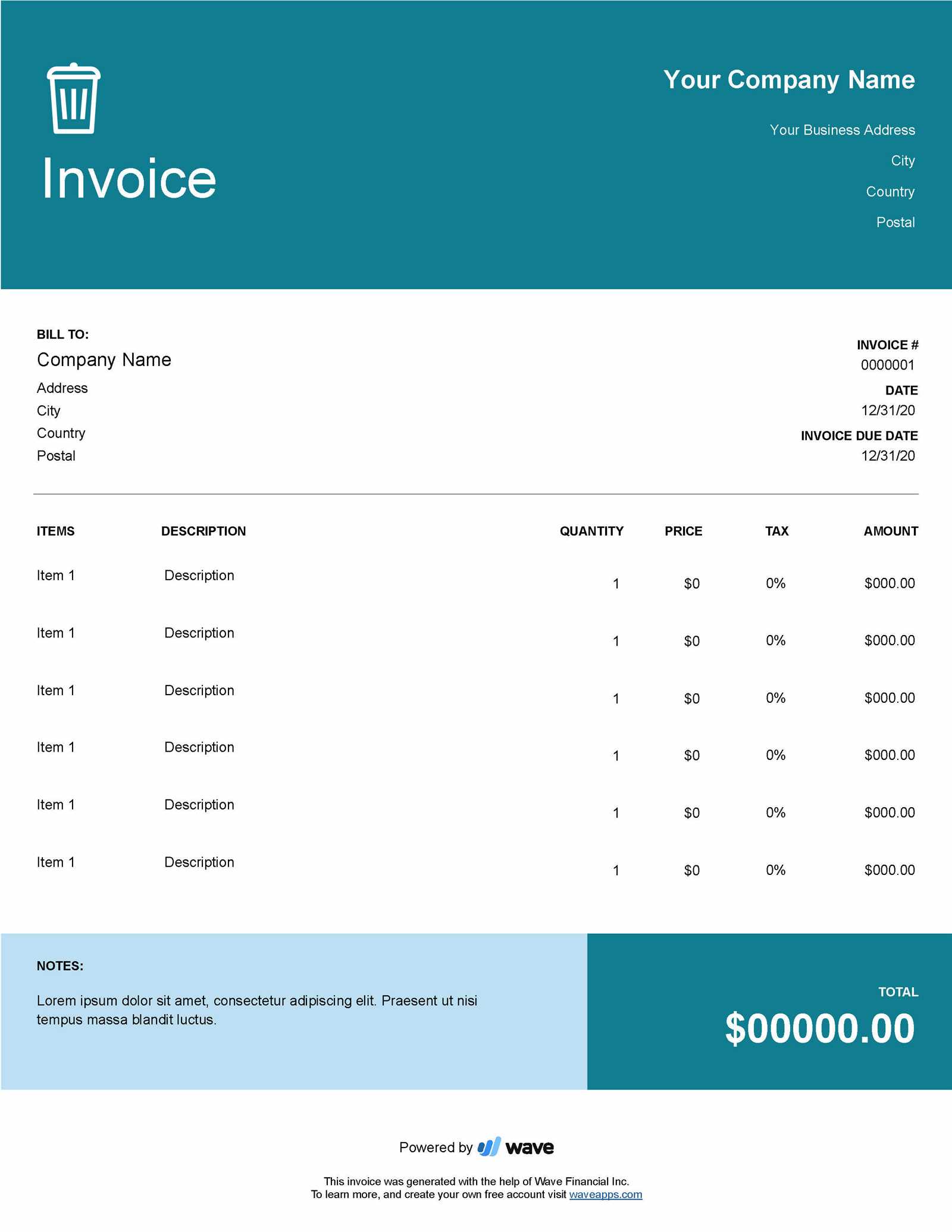

Tailoring your sales records to fit your business needs is a crucial step in ensuring both professionalism and efficiency. By adjusting the layout and content of these documents, you can better reflect your brand identity and meet specific operational requirements. Customizing these records allows you to add important details, include branding elements, and make the document more user-friendly for both your customers and staff.

Personalizing the Design and Layout

The layout of your sales document should align with your brand and business practices. Customization allows you to adjust fonts, colors, and logos, creating a professional and cohesive appearance. Here are a few key elements you can personalize:

| Element | Customization Options |

|---|---|

| Header | Include your logo, business name, and contact details |

| Product List | Add columns for additional product features, such as dimensions or material types |

| Footer | Include payment terms, your website, or social media links |

Adding Specific Business Details

In addition to design adjustments, you may need to incorporate specific business details that are relevant to your operations. For example, including fields for tracking sales commissions, special discounts, or return policies can be very helpful. Customizing these aspects ensures that the document meets all legal requirements and provides your customers with clear, necessary information.

By carefully personalizing your records, you not only ensure consistency in your communication but also enhance your overall branding, customer experience, and operational efficiency.

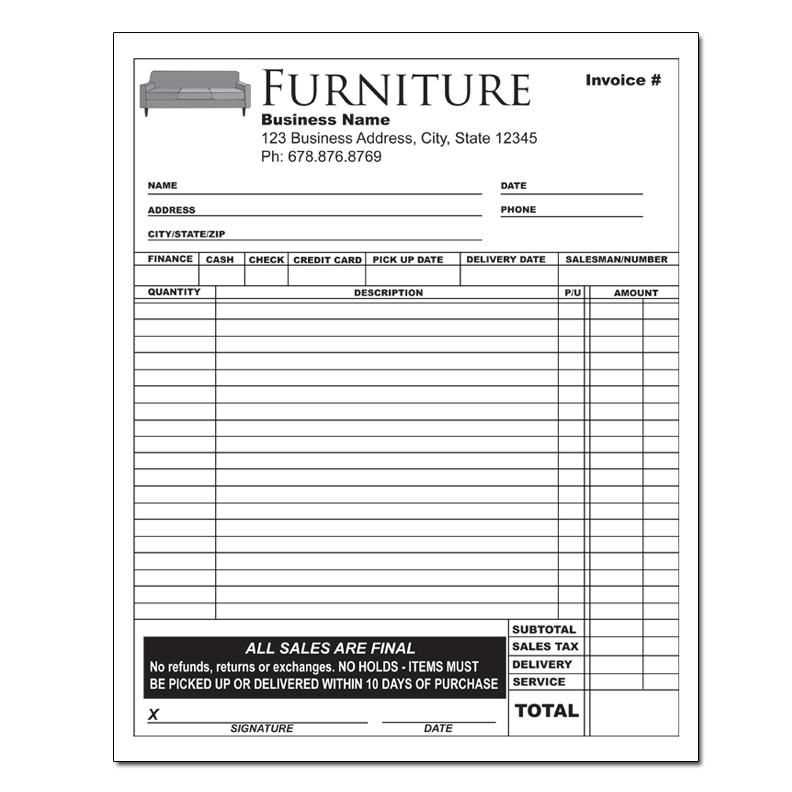

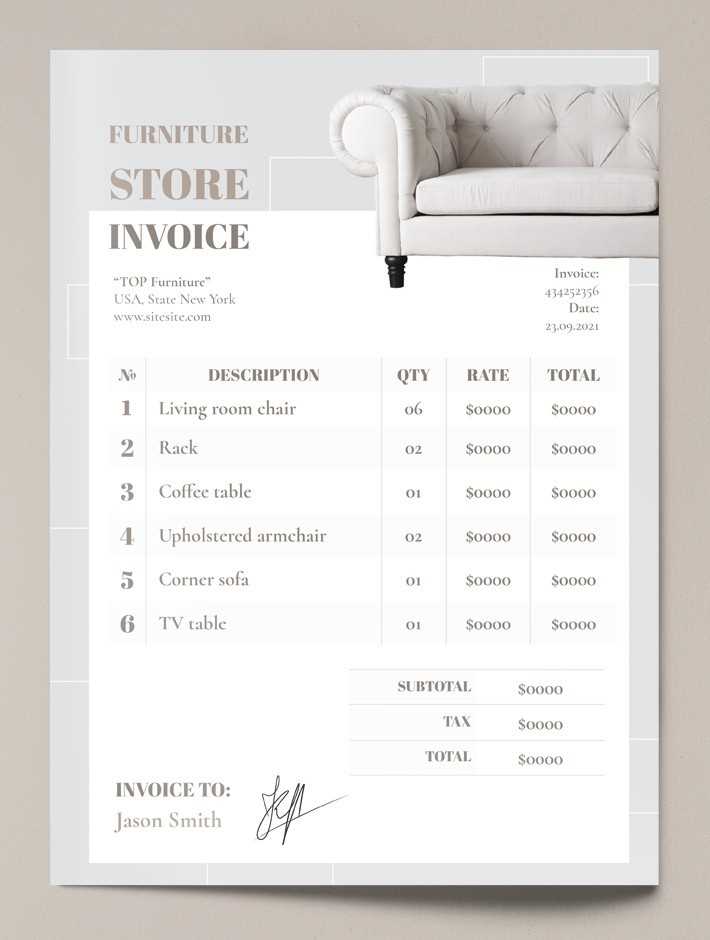

Key Elements of a Furniture Store Invoice

When documenting a transaction, it’s essential to include several critical components that ensure clarity and proper accounting. These elements help both the seller and the buyer keep track of the details of the purchase, facilitating smooth communication and reducing the chances of disputes. Understanding what information should be included ensures all relevant facts are captured correctly.

Here are the fundamental elements that should be present in any sales record:

- Identification Details: This includes the names and contact information of both the seller and the buyer, ensuring that both parties can be easily identified.

- Transaction Date: Clearly stating the date on which the exchange occurred is essential for tracking purchases and managing inventories.

- Unique Reference Number: Each document should have a unique identifier to avoid confusion with other records, aiding in organization and retrieval.

- List of Items: A detailed description of the goods sold, including quantity, model, material, and any other distinguishing features.

- Pricing Information: Each item should have a clear price, and the total cost should be accurately calculated, including taxes, delivery fees, and discounts.

- Payment Terms: Clearly define how and when the payment is expected, whether it’s upfront, in installments, or with other conditions.

- Return Policy: Including information on returns or exchanges helps prevent misunderstandings in case the buyer is unsatisfied with the purchase.

- Signature/Approval: A space for both parties to sign, confirming their agreement with the terms outlined in the document.

These components form the backbone of any transaction record, ensuring that all details are covered for both administrative and legal purposes.

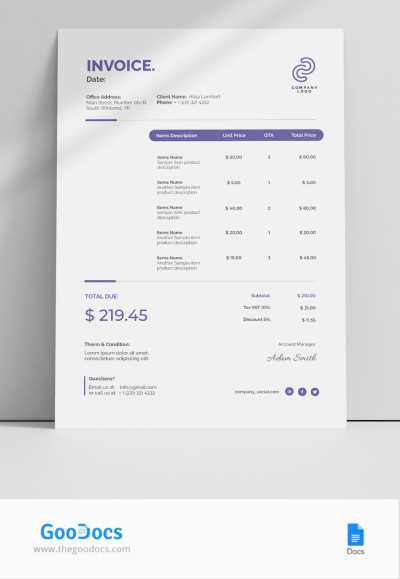

Tips for Designing Professional Invoices

Creating clear and well-structured documents is essential for maintaining professionalism in business transactions. A properly designed record not only enhances credibility but also helps avoid misunderstandings between buyers and sellers. By paying attention to layout, clarity, and detail, you can ensure that all the necessary information is conveyed effectively.

1. Keep the Layout Simple and Clear

The design of your document should prioritize readability and ease of understanding. A cluttered layout can confuse recipients, so it’s important to keep things clean and organized. Use a simple, consistent font and make sure there is enough white space around key information to separate sections clearly.

2. Include Essential Information

Make sure your document includes all the relevant details. An incomplete record can lead to disputes or confusion, so always double-check for accuracy. Below is an example of the basic sections that should be included:

| Section | Details |

|---|---|

| Contact Information | Name, address, phone number, and email of both parties |

| Transaction Date | Date of purchase |

| Item Details | Clear description of the products, quantities, and pricing |

| Total Amount | Final price, including any taxes and shipping fees |

| Payment Terms | Specify how and when the payment is to be made |

By making sure all these points are included, you ensure your document is professional and clear. It helps customers understand exactly what they are paying for and reduces the likelihood of confusion later on.

Choosing the Right Format for Your Invoices

Selecting the right format for documenting transactions is crucial for maintaining professionalism and ensuring smooth communication between buyers and sellers. The format you choose can impact how easily the information is understood, how quickly the payment process is completed, and how well the document integrates into your business operations. There are various options available, and each has its advantages depending on your business needs.

Here are some factors to consider when deciding on the best format:

- Digital vs. Paper: Digital records are easy to store, access, and share, while paper versions might still be necessary for certain industries or customers who prefer traditional methods. Decide which format best suits your workflow and customer preferences.

- Customization: Choose a format that allows flexibility in design. You may want a professional-looking document that reflects your brand, with room for your logo, business name, and other unique elements.

- Automation: If you handle a large number of transactions, it may be beneficial to use automated software that generates records based on input data. This can save time and reduce the risk of errors.

- Compatibility: Ensure that your chosen format is easily compatible with other software you use, such as accounting or inventory management tools. This will help streamline your processes and make tracking transactions more efficient.

By considering these factors, you can select the most effective format for your needs, enhancing the efficiency of your business operations and improving the customer experience.

How to Automate Billing Processes

Automating billing is a powerful way to streamline financial operations, reduce manual errors, and ensure timely transactions. By integrating automation tools into your workflow, you can save time, increase accuracy, and provide better service to your clients. Automation helps generate and send records automatically based on pre-set rules, allowing for a more efficient business process.

1. Choose the Right Software

The first step to automating your billing is selecting the right software. There are many platforms available that can generate detailed records with minimal input. Look for a solution that suits your business size, integrates easily with your current systems, and offers customization options to tailor documents to your needs.

- Cloud-based systems: These are accessible from anywhere and allow for real-time updates.

- Customization options: Ensure the software allows you to add logos, custom fields, and personalized details.

- Integration: Look for a system that works seamlessly with your accounting and inventory management software.

2. Set Up Automated Triggers

Once you’ve selected the appropriate software, the next step is setting up automated triggers. This involves configuring the software to automatically generate records based on specific actions, such as when a transaction is completed or when a product is delivered.

- Order completion: Set the system to create a document automatically once an order is finalized.

- Recurring billing: For subscription-based services or regular deliveries, configure automatic generation of records at specified intervals.

- Payment reminders: Automate follow-ups to remind clients of outstanding payments on specific due dates.

By automating these steps, you can ensure accuracy, speed, and consistency in your transaction records, all while freeing up time for more important tasks.

Why Accurate Invoices Matter in Furniture Sales

In any retail transaction, clear and precise documentation is essential for maintaining trust, ensuring legal compliance, and providing transparency. When dealing with high-value goods, such as home furnishings, the importance of accuracy in records cannot be overstated. Miscommunication or errors in billing can lead to misunderstandings, delayed payments, and potential damage to business relationships.

1. Legal and Financial Accuracy

Accurate records are crucial for both legal and financial reasons. A mistake in the pricing, quantity, or terms of a sale can lead to disputes or even legal action. Correctly documenting every detail ensures that both the buyer and the seller are protected in case of any future disagreements. Furthermore, precise records are necessary for tax reporting, accounting, and auditing purposes.

2. Customer Trust and Satisfaction

For any business, customer satisfaction is key. When a buyer receives a clear and correct statement, it instills confidence in the transaction. Inaccurate details, such as incorrect pricing or missing items, can lead to frustration and damage a brand’s reputation. Providing accurate records consistently helps build trust and encourages repeat business.

By prioritizing accuracy in all sales documentation, businesses can foster stronger relationships with clients, minimize risks, and streamline their operations.

Tracking Payments with Sales Documentation

Efficient tracking of payments is an essential aspect of managing any business, especially when dealing with multiple transactions. Having a reliable system in place ensures that both parties–buyer and seller–are on the same page regarding payment status. By incorporating well-structured records, businesses can easily monitor due amounts, received payments, and any outstanding balances, thereby reducing the chances of errors and misunderstandings.

1. Record Payment Details Clearly

Accurate payment tracking begins with clear and precise documentation. Each transaction should outline essential information, such as the payment method, date, and any amounts due or paid. For instance, specifying whether the amount was paid in full, partially, or is still pending helps create a transparent record for both the business and the client.

- Payment Method: Indicate whether the payment was made via credit card, bank transfer, check, or another method.

- Amount Paid: Clearly list the amount received and any remaining balance.

- Due Date: Make sure to highlight when the payment is expected, reducing the likelihood of late payments.

2. Use Automated Tools for Tracking

To further streamline the payment process, businesses can use automated tools to track payments in real-time. Many accounting and record-keeping systems allow for automatic updates as payments are processed. This reduces the need for manual entry and ensures that your records are up to date at all times.

- Automatic Payment Alerts: Set up notifications to remind clients of upcoming or overdue payments.

- Real-time Updates: Utilize software that updates the payment status automatically when a transaction is processed.

- Reports and Analytics: Generate detailed reports to review payment history and identify any outstanding balances.

By implementing clear, accurate, and automated payment tracking, businesses can improve cash flow management, reduce errors, and maintain better relationships with their customers.

Invoice Templates for Retailers on a Budget

For small businesses looking to streamline their financial documentation without breaking the bank, using a cost-effective solution for generating transaction records is crucial. There are many affordable options available that provide professional-looking results without the need for expensive software or outsourcing. Simple, easy-to-use systems can help ensure that all necessary details are captured and organized properly, allowing businesses to maintain accuracy and professionalism without heavy costs.

Here are a few budget-friendly options for generating detailed records:

| Option | Description | Pros |

|---|---|---|

| Free Online Tools | Websites that offer free, customizable forms for creating transaction documents. | Cost-free, easy to use, quick setup. |

| Excel or Google Sheets | Create custom spreadsheets with formulas to calculate totals, taxes, and discounts. | Highly customizable, free, familiar software. |

| Pre-made Templates | Downloadable document forms that are ready to use, with fields for essential details. | Simple and fast, no learning curve, customizable. |

| Accounting Software with Free Plans | Cloud-based platforms offering free versions with basic invoicing features. | Professional features, cloud access, integration with other tools. |

By choosing the right tool that aligns with your business size and needs, you can easily create functional and professional transaction records while staying within budget.

Integrating Billing Forms with Accounting Software

Efficiently managing financial records becomes significantly easier when your transaction documentation is integrated with accounting systems. By connecting your sales documentation with your financial software, you can automate various processes such as tax calculations, payment tracking, and revenue reporting. This integration reduces manual data entry, minimizes errors, and saves time, allowing you to focus more on running your business.

Here are some benefits and steps to integrate your forms with accounting software:

| Benefit | Description |

|---|---|

| Automation of Data Entry | Automatically populate transaction records from your sales documents, reducing manual input and the risk of mistakes. |

| Real-time Updates | With integration, all financial records are updated in real time, making your accounting up to date and ensuring you always have accurate data. |

| Efficient Payment Tracking | Track payments and outstanding balances directly within the software, without needing to cross-check multiple systems. |

| Seamless Reporting | Generate financial reports with ease, as all data is consolidated in one place, helping you monitor cash flow and assess profitability. |

To integrate your forms with accounting software, ensure that your chosen tool supports this feature. Many modern accounting platforms offer seamless integration with popular document generation systems, allowing you to streamline your workflow and improve efficiency.

Legal Requirements for Sales Documentation

When documenting sales transactions, it is crucial to comply with legal standards to ensure that your business operates smoothly and is protected from potential disputes. These legal requirements are designed to ensure transparency, proper tax reporting, and consumer protection. By including all necessary information in your records, you can avoid issues with audits, refunds, or claims while also building trust with your customers.

Here are the key legal requirements that must be included in any sales documentation:

- Seller’s Information: Include your business name, address, and contact details. This allows the customer to easily reach you if necessary and helps establish the legitimacy of the transaction.

- Customer’s Information: In many cases, it is also important to record the name and address of the buyer, especially for high-value transactions or custom orders. This can be crucial for legal compliance and customer service purposes.

- Date of Transaction: Clearly state the date when the sale took place. This helps with tax calculations, returns, and record-keeping.

- Unique Reference Number: Each document should have a distinct identifier (e.g., order number, reference code). This ensures that both parties can easily track the transaction in case of questions or disputes.

- Detailed Description of Goods: A clear list of the products or services sold, including quantities, sizes, and any specifications, is necessary for both the customer and business to verify the transaction.

- Pricing Information: Provide a breakdown of the price for each item, any applicable taxes, discounts, and the total amount due. This is vital for tax reporting and prevents confusion over pricing.

- Payment Terms: Indicate the agreed-upon payment method (e.g., cash, credit, installments) and any related terms, such as due dates or late payment fees.

- Tax Information: If applicable, include the tax rate and amount, ensuring compliance with local tax laws. Some regions require specific tax details to be shown on documentation.

- Return Policy: Outline the terms for returns or exchanges, as required by consumer protection laws. This helps to manage customer expectations and minimize legal issues.

By adhering to these legal standards, you ensure that your transactions are properly documented, transparent, and in compliance with regulatory requirements. This reduces the risk of legal complications and improves the professionalism of y

Common Mistakes to Avoid in Furniture Invoicing

When managing sales transactions, errors in documenting purchases can lead to confusion, delays, or disputes. Even small mistakes can have a big impact on both the customer experience and the business’s financial processes. Below are some of the most common errors to avoid when preparing detailed records of customer purchases, ensuring smoother operations and better communication.

Incomplete or Incorrect Item Descriptions

One of the most frequent issues is failing to provide clear and accurate descriptions of the products purchased. When details like dimensions, material type, color, or model number are omitted or listed incorrectly, it can create misunderstandings. Customers may not get exactly what they expected, or the seller may encounter issues when fulfilling the order. Always ensure that every item is properly described with all the relevant details, leaving no room for ambiguity.

Neglecting to Include Payment Terms and Conditions

Another common mistake is leaving out essential payment terms, such as due dates, late fees, or available discounts. These details should be stated clearly to avoid future conflicts. Failing to specify whether the transaction is on credit, requires immediate payment, or allows for installment plans can lead to confusion regarding financial obligations. Ensure all terms are unambiguous to maintain trust and minimize the risk of delayed payments.

Consistency in pricing is another important factor. Make sure that all prices are up to date and reflect any promotional discounts, taxes, or additional charges that might apply. Double-check the calculations to avoid errors that could cause discrepancies or dissatisfaction later on.

Where to Find Free Furniture Invoice Templates

For businesses looking to streamline the billing process, there are several sources available online that offer free resources for creating accurate and professional documentation. These tools help ensure that all transactions are well-organized, and they come with customizable features to fit various needs. Whether you’re a small business owner or a freelancer, finding the right resources can save time and reduce errors.

Online Platforms Offering Free Resources

There are numerous websites where you can access no-cost documents tailored to your needs. Below is a list of popular platforms that offer these resources:

| Website | Key Features |

|---|---|

| Template.net | Variety of customizable options, easy-to-use interface, downloadable in multiple formats |

| Invoiced | Simple templates for quick use, no registration required, free basic options |

| Canva | Visually appealing designs, drag-and-drop customization, free access with limited premium features |

| Zoho | Free plan with essential features, integration with accounting tools, customizable fields |

| Microsoft Office Templates | Pre-built designs within Word and Excel, downloadable directly, easily editable |

These resources allow users to download or create tailored documentation, often with options for easy editing to suit various business models and customer interactions. Most platforms offer both free and premium versions, so you can start with the no-cost options and upgrade as needed.