Creating a Custom Invoice Template in FreshBooks for Your Business

For any business, presenting professional and clearly structured payment documents is crucial. Customizing these documents to reflect your brand, tone, and specific needs can help build trust with your clients and streamline your administrative processes. Tailoring these essential tools goes beyond simply filling out the required fields; it’s about creating a seamless experience for both you and your customers.

By adjusting various elements, you can ensure that each document not only meets your business requirements but also enhances your company’s image. From adding your company logo to modifying payment terms and design, the flexibility available allows you to create exactly what you need. Personalization can improve client relations, promote a professional image, and even reduce payment errors.

In this guide, we will explore how to adjust these billing documents to suit your style and business demands, making them as efficient and effective as possible. Whether you are a freelancer, a small business owner, or part of a larger enterprise, the ability to design tailored invoices is an important step towards professionalism.

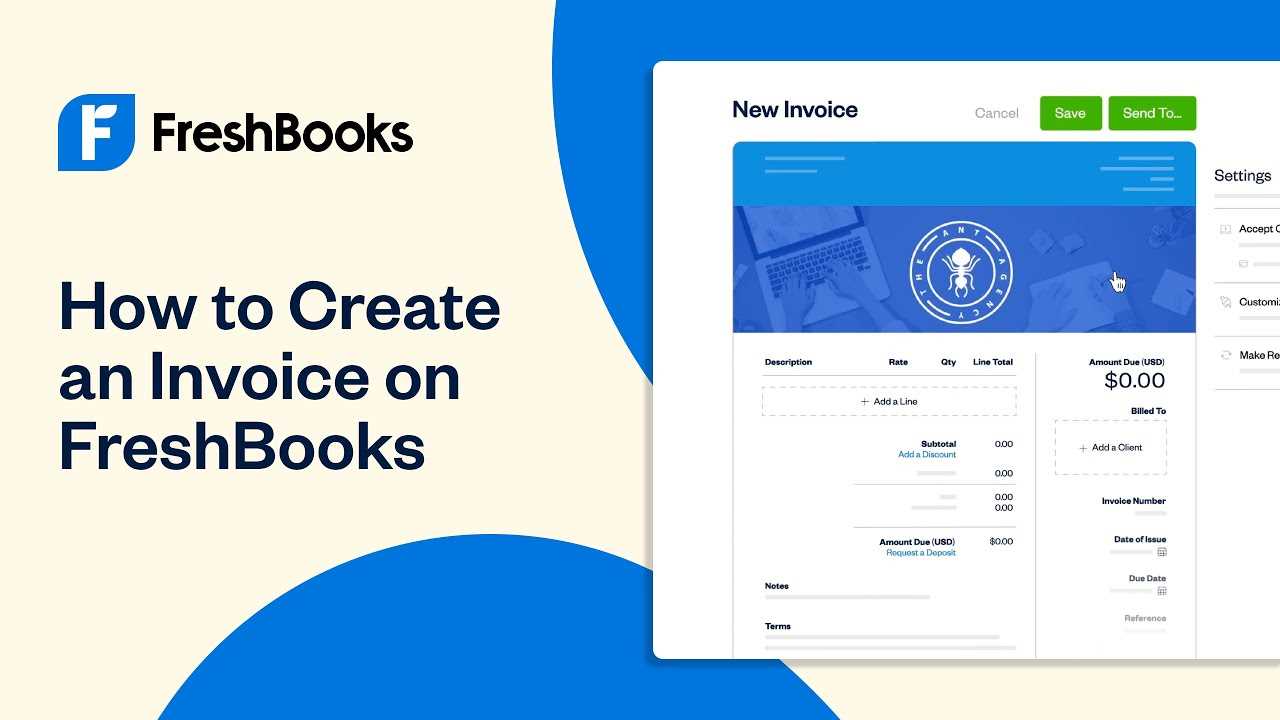

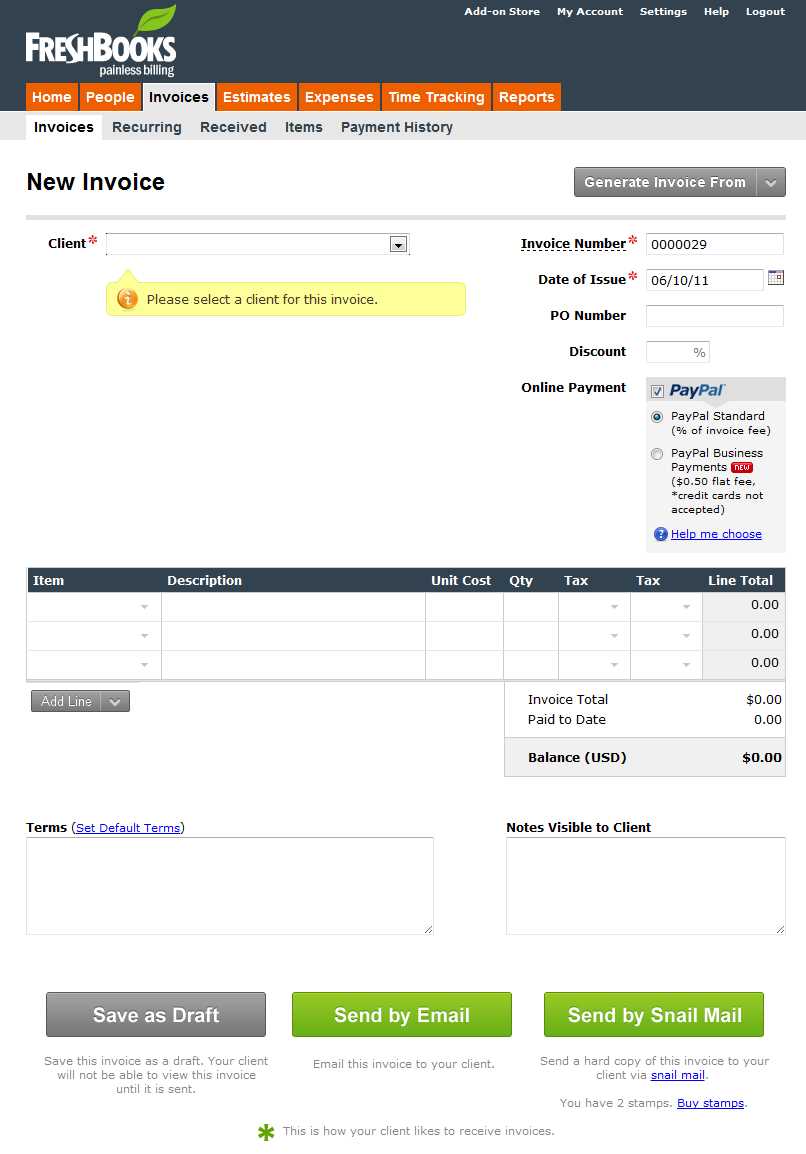

How to Create a Custom Billing Document

Creating a personalized billing document is an essential step in ensuring that your clients receive clear and professional statements. By taking control over the design and structure, you can tailor each document to reflect your brand while including all the necessary details for smooth transactions. This process is straightforward and allows you to adjust every aspect, from appearance to specific fields, according to your business needs.

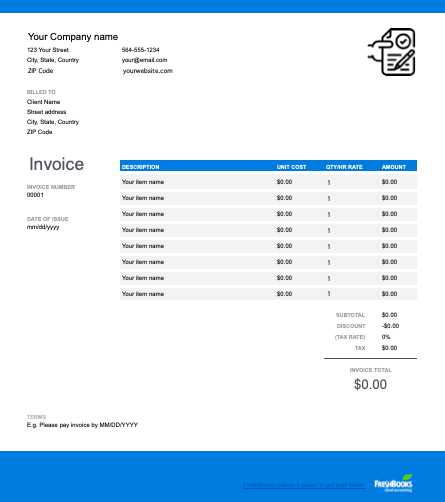

To begin, log into your account and navigate to the section dedicated to managing your payment documents. Here, you’ll find a variety of settings that let you modify different elements such as the layout, fonts, and color schemes. Personalizing these aspects not only enhances the visual appeal but also makes the document more aligned with your business identity.

Next, you’ll want to customize the fields to suit your specific requirements. This can include adding your company logo, adjusting the payment terms, and setting the due date format. You also have the option to adjust the information sections such as item descriptions, quantities, and prices. With these changes, each document will be ready to send with the most relevant and up-to-date information for your clients.

Understanding FreshBooks Invoice Features

When managing your business’s billing system, it’s important to understand the full range of features available for generating payment documents. These tools not only allow you to create detailed records but also provide flexibility to adapt them to your needs. The core functionalities offer a wide range of options that make it easy to design, manage, and track payments efficiently.

Document Layout and Design Options

One of the primary features includes a variety of design options to help you format your documents effectively. You can select from different layouts and adjust the arrangement of key elements such as client information, item descriptions, and total amounts. Visual customization helps maintain consistency with your brand, ensuring a professional look every time you send out a document.

Payment Tracking and Status Monitoring

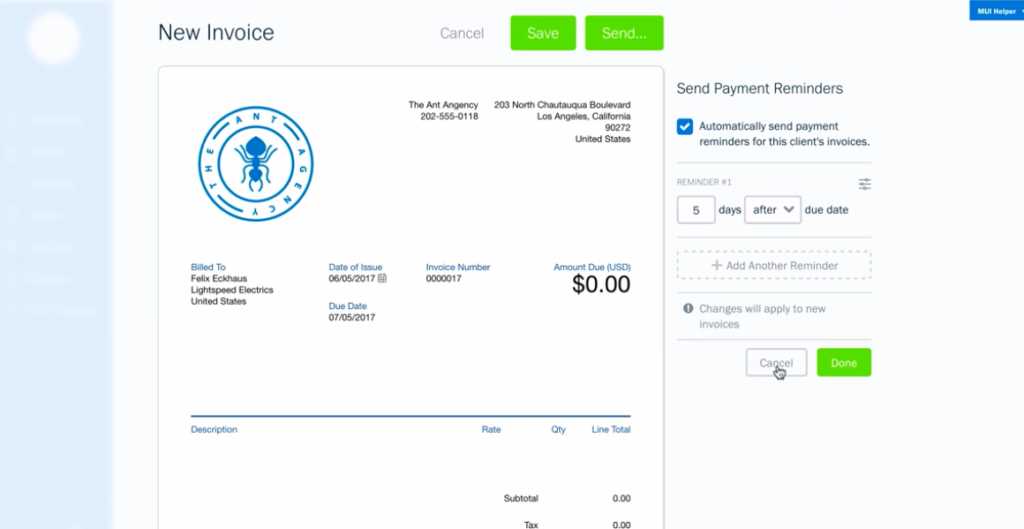

Another powerful feature is the ability to track the status of each payment document. You can easily monitor whether a document has been viewed, paid, or is still pending. This makes it simpler to follow up on overdue payments and stay organized with your financial records. Automation features also send reminders to clients, ensuring timely payments without additional manual effort.

Why Customize Your Billing Documents

Personalizing your billing statements goes beyond mere aesthetics; it helps align your payment requests with your business identity and client expectations. By tailoring these essential documents, you can create a more professional and cohesive experience that resonates with your brand values and strengthens your reputation. This process ensures that every detail, from the design to the information included, reflects your company’s standards.

One major benefit is the ability to include branding elements such as your company logo, colors, and fonts. This creates consistency across all communication with clients, reinforcing your business identity. Tailoring the content also ensures that clients see exactly what they need, reducing confusion and increasing the likelihood of timely payments. With clear terms, payment instructions, and a polished look, your business appears more credible and trustworthy.

Another advantage is the flexibility to adjust each document based on specific client needs or transaction types. Whether you are working with a new customer, offering discounts, or including specific payment terms, having control over the structure allows you to better address the unique aspects of each deal. Personalization ultimately enhances customer satisfaction and promotes smoother, more efficient financial transactions.

Step-by-Step Guide to Document Personalization

Personalizing your billing documents is a straightforward process that allows you to tailor every aspect to meet your specific business needs. By following a few simple steps, you can ensure that each statement reflects your brand, includes all necessary information, and presents a professional image to your clients. This guide will walk you through the process of adjusting the layout, content, and design of your documents.

Start by accessing the section where you manage your financial documents. Here, you’ll find the option to modify or create a new document. Once you’re in the editing section, you can begin by adjusting the overall layout. This includes selecting the arrangement of key elements such as the client’s name, services provided, and payment terms. Make sure to choose a structure that is both functional and easy for your clients to understand.

Next, you can enhance the document’s appearance by adding your logo, changing the font style, or selecting a color scheme that matches your brand identity. This helps ensure consistency across all communication materials. Afterward, personalize the content fields–such as descriptions, pricing, and quantities–to suit each transaction or customer. Finally, save your personalized design as a new template for future use.

Choosing the Right Invoice Template for Your Business

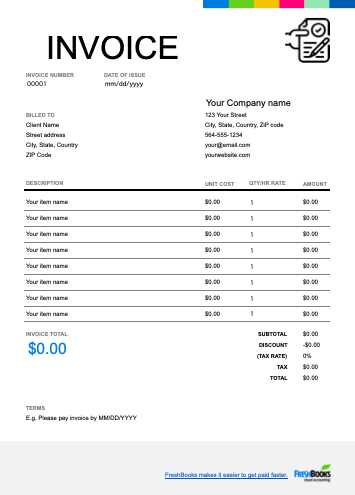

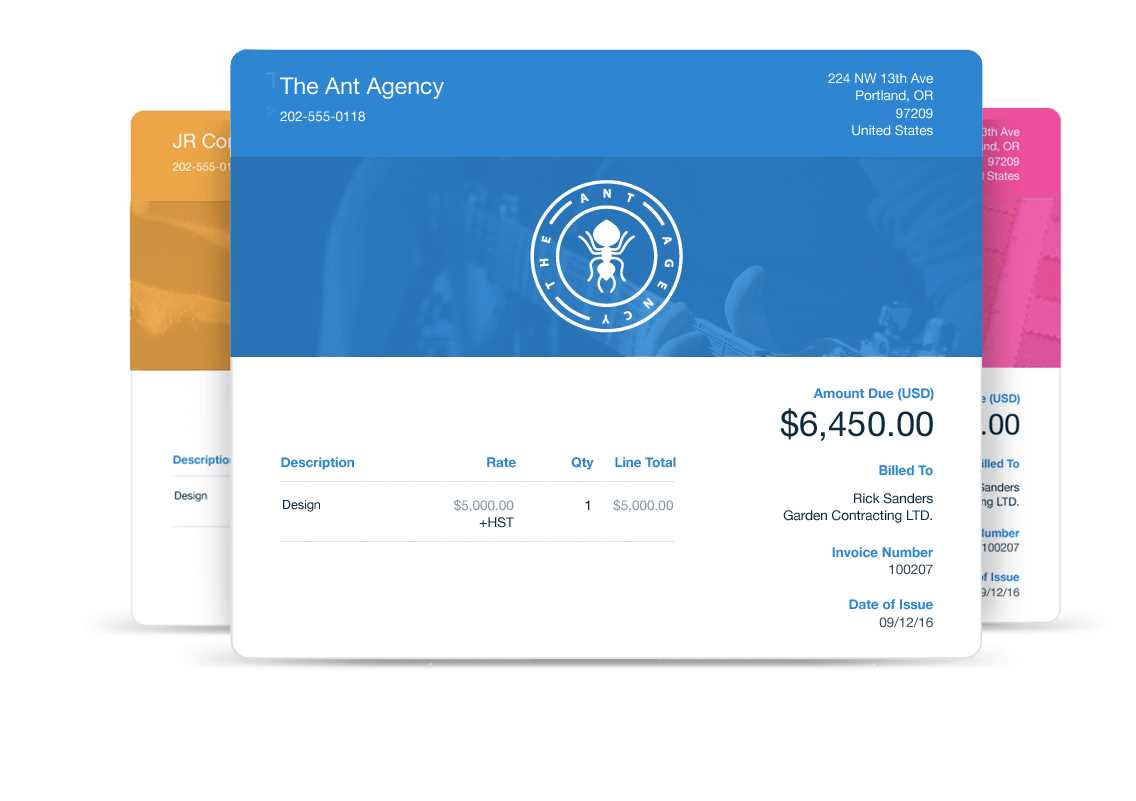

Selecting the right format for your billing documents is crucial for maintaining professionalism and ensuring clarity in transactions. A well-designed structure can help convey important information efficiently and avoid confusion between you and your clients. It’s important to choose a design that aligns with your business’s identity while providing all necessary details in a clear, readable manner.

When considering the best layout, think about the type of services or products you offer, your brand image, and the expectations of your clients. For example, if you work with high-end clients, a sleek and polished design might be most appropriate, while a more casual business may benefit from a simpler, straightforward format. Make sure the chosen format reflects your company’s values and the level of professionalism you want to communicate.

Additionally, ease of use is key. The structure should allow for quick input of key details, such as the client’s information, transaction date, and the agreed-upon amount. Overly complex designs can lead to errors, while overly simplistic ones may lack critical information. The ideal structure strikes a balance between being visually appealing and functionally efficient.

Lastly, consider how well the design will work with your record-keeping and payment processing systems. Choose a format that makes it easy to track payments, generate reports, and integrate with other tools you may use. Flexibility is important, as your business may evolve over time, requiring adjustments to your billing approach.

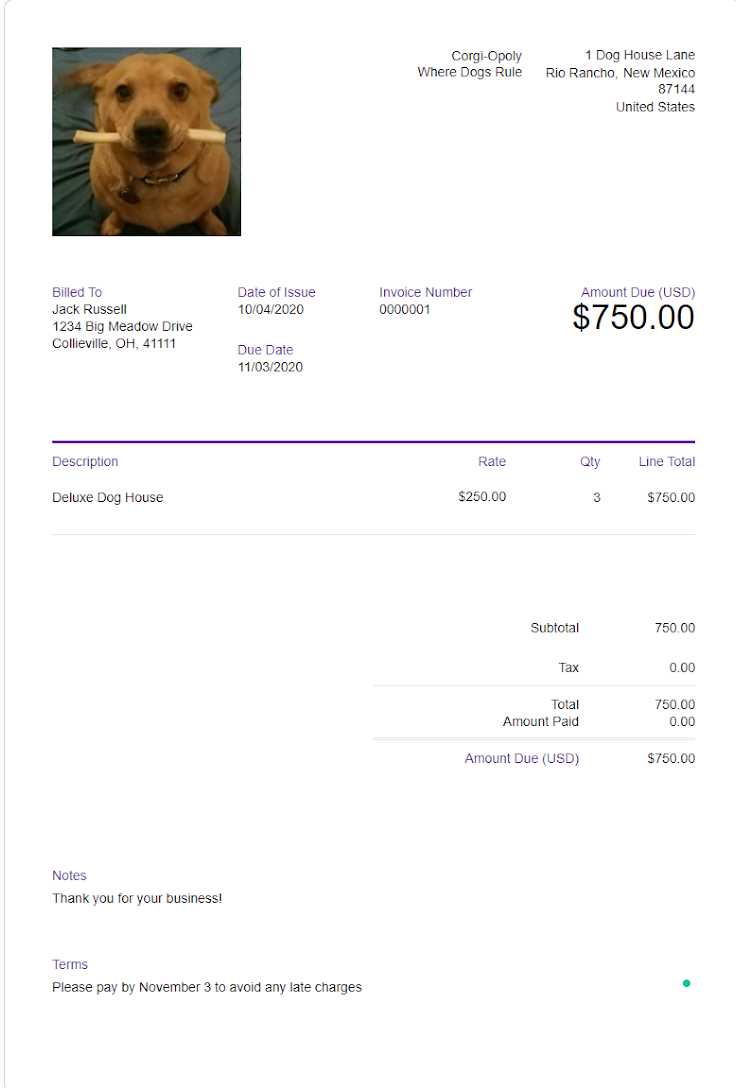

Adding Your Logo to FreshBooks Invoices

Incorporating your company’s logo into your billing documents helps establish brand identity and professionalism. A recognizable logo ensures your documents reflect your business, making them stand out and fostering trust with clients. By personalizing the layout, you convey a sense of attention to detail and care in every transaction.

Why It Matters

Your logo is a visual representation of your brand, and placing it on your financial documents creates a cohesive and polished look. It reminds clients of your business’s identity and strengthens your brand presence. This is particularly important for small businesses or freelancers who may not have a physical storefront but still need to leave a lasting impression.

How to Add Your Logo

To include your company’s logo in the billing document, simply upload a high-quality image file to the platform’s settings. The process is usually straightforward, involving a few clicks to select and upload the file. Make sure the logo is clear and fits well within the document layout, without overpowering the essential details like the payment amount and client information. Choosing the right file format (PNG or JPEG) and appropriate size ensures a crisp, professional appearance.

Once added, your logo will appear consistently across all documents, reinforcing your brand’s image with every transaction. Whether you use a minimalistic design or a more detailed logo, the key is to maintain a balance between aesthetics and readability. In the long run, it’s an easy and effective way to elevate your brand’s perception in your client’s eyes.

Adjusting Invoice Layout and Design

The layout and design of your billing documents are essential in making them both functional and visually appealing. A well-organized structure ensures that all necessary details are easy to find, while an attractive design helps your business stand out. By adjusting these elements, you can create a more streamlined and professional presentation for your clients, making the transaction process clearer and more efficient.

Key Elements to Consider

When modifying the structure and design of your billing documents, several factors should be kept in mind:

- Information Hierarchy: The most important details, such as the total amount due, payment terms, and due date, should be easily visible at a glance.

- Spacing and Alignment: Proper spacing between sections and aligning text correctly ensures clarity and avoids a cluttered look.

- Font Selection: Choose legible, professional fonts that maintain readability while enhancing the overall aesthetic.

- Brand Consistency: Incorporating brand colors and elements reinforces your company’s identity and creates a cohesive look across all documents.

How to Make Adjustments

To modify the layout, simply access the design settings within your platform. You can typically drag and drop sections, change text placement, or resize fields according to your preferences. The goal is to ensure that the design enhances functionality without compromising the ease of use. Here are some helpful tips:

- Start by adjusting the header section–this is where your logo and business details should be prominently displayed.

- Consider customizing the line items, making sure each section (e.g., descriptions, quantities, prices) is well-organized and clear.

- Test different font sizes and spacing to ensure a balanced, professional appearance.

- Review the document on both desktop and mobile to ensure it looks good across devices.

By taking these steps, you can create a document layout that is not only functional but also reflects your brand’s professionalism, making every interaction with your clients more polished and efficient.

How to Personalize Invoice Fields

Personalizing the fields in your billing documents allows you to tailor each element to your business’s unique needs. By adjusting the available fields, you can ensure that all the necessary information is included, formatted properly, and aligned with your brand’s identity. Customizing these sections makes the entire document more relevant and easier to understand for your clients, while also providing greater flexibility in how you present your services.

Whether it’s adding a personal touch to the payment terms, including additional notes, or incorporating specific tax information, altering the standard fields can significantly enhance the clarity and professionalism of your documents. With the right adjustments, you can create a more seamless experience for both you and your clients.

Key Fields to Personalize

Here are some fields you may consider personalizing for a more customized experience:

- Client Information: Include the client’s name, contact details, and billing address to ensure all records are accurate.

- Service or Product Description: Tailor this section to highlight specific services or products provided, with the option to add detailed descriptions.

- Payment Terms: Adjust payment terms to reflect your business’s preferences, such as “due upon receipt” or specifying late fees.

- Tax Information: Include any necessary tax rates, exemptions, or other details specific to your location or industry.

- Notes or Instructions: This field can be used for special instructions or additional comments, allowing for more personalized communication.

Steps to Modify Fields

Making changes to the fields typically involves navigating to your document’s settings and selecting the areas you want to adjust. Once there, you can either add new fields, edit existing ones, or rearrange their order to suit your needs. Here are the general steps:

- Access your document’s settings or editor interface.

- Select the fields you want to modify or add, such as client name, date, or description.

- Customize the labels, add any required data, and adjust the layout to ensure everything is clear and easy to read.

- Preview your changes

Setting Up Payment Terms and Due Dates

Defining clear payment terms and due dates is essential for managing your cash flow and ensuring timely payments from clients. By specifying when payments are expected and under what conditions, you set expectations upfront, reducing misunderstandings and delays. Customizing these details allows you to align your billing practices with your business’s needs while maintaining a professional and transparent relationship with your clients.

Why Payment Terms Matter

Payment terms establish the framework for financial transactions, indicating when and how clients should settle their bills. Clear terms can help prevent late payments and ensure your business receives payments on time, which is crucial for maintaining a steady cash flow. Additionally, well-defined terms help reinforce the professionalism of your business and contribute to a smoother working relationship with clients.

How to Set Payment Terms

Setting up payment terms involves determining when payments are due and whether any discounts or late fees apply. Here are some common options:

- Net 30: Payment is due 30 days after the date of the document.

- Due on Receipt: Payment is due immediately upon receiving the document.

- Net 15: Payment is due 15 days after the date of the document.

- Late Fee: Add a percentage or flat fee for payments made after the due date.

- Early Payment Discount: Offer a discount for clients who pay ahead of the due date, such as a 2% discount for payments made within 10 days.

Establishing Due Dates

Setting a clear due date is just as important as defining payment terms. A specific due date helps eliminate ambiguity and ensures clients know when to settle their accounts. The due date should be realistic for both you and your client. You may also want to consider the following factors when choosing a due date:

- Payment Cycle: Align the due date with your client’s preferred payment schedule or cycle, especially for repeat customers.

- Project Timeline: Consider when the work was completed or when the product was delivered to ensure the due date is re

Customizing Currency and Tax Options

Adjusting the currency and tax settings in your billing documents is essential for businesses operating internationally or in regions with specific tax laws. By personalizing these elements, you ensure that the amounts are calculated correctly and reflect the legal requirements and preferences of your clients. Customizing currency and tax options helps maintain clarity and accuracy in financial transactions, which in turn supports smoother business operations and builds trust with your clients.

Managing Currency Preferences

If your business deals with international clients, it’s important to choose the appropriate currency for each transaction. Different currencies can be displayed, and the exchange rate can be adjusted as necessary. You can specify which currency to use for each document, ensuring the amounts are presented correctly according to the client’s location and payment preferences.

- Choose the Correct Currency: Select the currency that best matches your client’s country or preferred method of payment.

- Set Default Currency: If your business operates in a specific country, setting a default currency can save time and reduce errors.

- Exchange Rate Adjustments: If you need to use a different currency, you may need to adjust the exchange rate based on current market values.

Configuring Tax Settings

Setting up tax options correctly ensures compliance with local tax regulations and avoids issues with undercharging or overcharging clients. Different regions have different rules regarding sales tax, value-added tax (VAT), or other applicable taxes, and customizing these settings allows you to apply the correct rates to each transaction.

- Specify Tax Rates: Set tax rates for the region where your services or products are provided, ensuring that they reflect local laws and requirements.

- Tax Categories: App

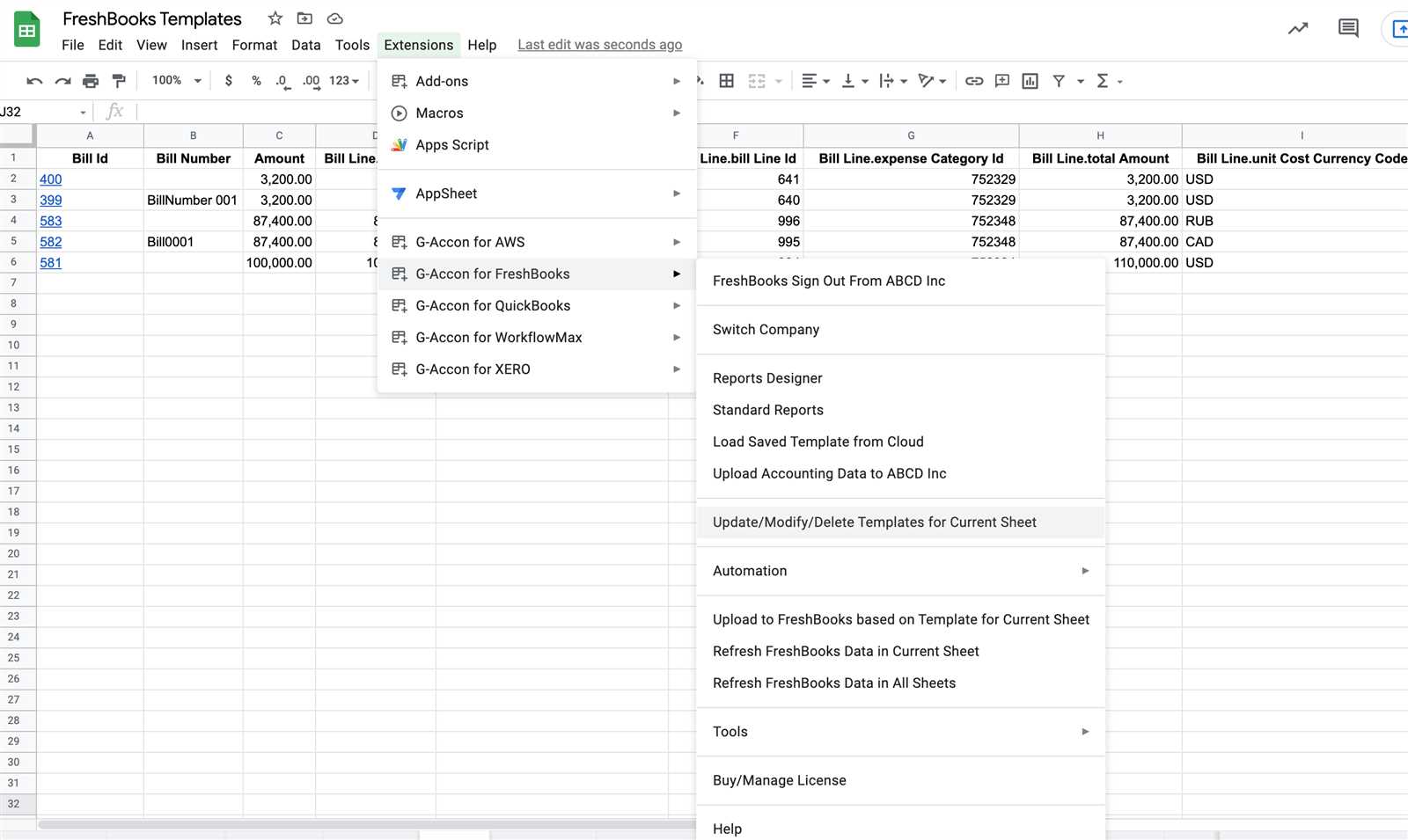

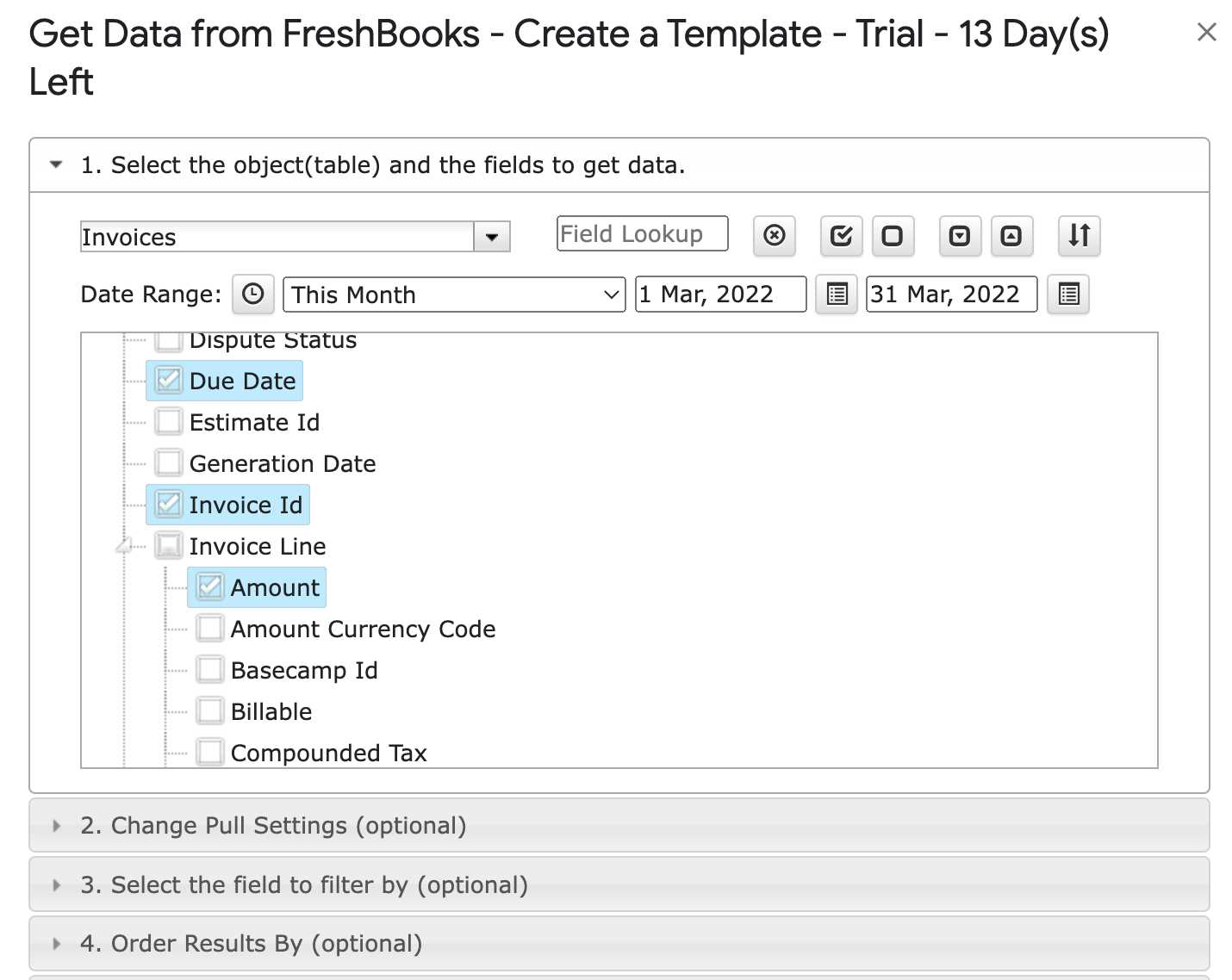

Saving and Managing Custom Templates

Once you’ve designed the ideal layout for your billing documents, it’s important to save and organize these formats for future use. Efficient management of your document designs ensures that you can quickly generate professional documents without having to recreate them each time. By saving different versions or styles, you can easily switch between them based on specific client needs or types of transactions.

Saving Your Design

After customizing the layout and adjusting various elements, it’s essential to save your work properly to avoid starting from scratch in the future. Most platforms allow you to save your layout as a reusable file that can be accessed anytime. Here are a few tips for saving your design:

- Use Clear Naming Conventions: Give each saved version a meaningful name (e.g., “Standard Client Design” or “Product Sale Invoice”) so you can quickly identify it later.

- Save Multiple Versions: You might need different layouts for different types of clients or services. Saving multiple versions allows flexibility without losing your preferred format.

- Backup Your Work: Ensure you have backups of your layouts in case of any technical issues, either by exporting them or saving them on external storage.

Managing Your Saved Designs

Efficiently managing your saved formats is just as important as saving them in the first place. Organizing your designs allows for quick access and easy updates. Here are some ways to keep things organized:

- Organize by Categories: Create categories for different types of documents, such as “Invoices,” “Estimates,” or “Receipts,” to keep everything organized.

- Update When Needed: Regularly review and update your saved formats to reflect any changes in branding, tax rates, or payment terms.

- Keep a Default Version: Set a default design for everyday use, so you don’t have to manually select a layout every time.

By taking the time to properly save and manage your designs, you can streamline your workflow and maintain consistency in your business documents. Efficient doc

How to Preview and Test Your Invoice

Before finalizing and sending your billing documents to clients, it’s crucial to preview and test them to ensure everything appears as expected. This step helps identify any errors in formatting, missing information, or discrepancies that could affect the professionalism and clarity of the document. By reviewing your design before use, you ensure that all the details are accurate and that the document will look great when received by your client.

Previewing Your Document

Most platforms provide a preview function that allows you to see how the document will appear to your client before finalizing it. Here’s how to effectively preview your billing format:

- Check Layout and Design: Ensure that all elements, such as logos, text, and fields, are aligned correctly and look well-organized. Make sure the document is visually appealing and easy to read.

- Verify Information: Double-check that all client details, amounts, dates, and other important data are correct. Ensure that no fields are missing or incorrectly formatted.

- Mobile View: Preview the document on both desktop and mobile devices to ensure it is responsive and looks good on different screen sizes.

Testing for Accuracy

Once the preview looks good, it’s time to test the document’s functionality. This step ensures that any calculations, taxes, or discounts are applied correctly. Here’s how to run a test:

- Enter Sample Data: Fill in sample client information and transaction details to simulate a real billing situation. This will allow you to spot any issues with the layout or calculations.

- Test Payment Calculations: Check that all amounts, taxes, and discounts are calculated correctly and that totals are accurate.

- Review Payment Terms: Make sure that the payment terms and due date are displayed clearly and match what you have set.

By thoroughly previewing and testing your document, you can ensure that it’s both visually appealing and functionally accurate. Taking the time to review your design and test for any potential issues will prevent mistakes and enhance your p

Sending Custom Invoices to Clients

Once you’ve created your billing document, the next step is to send it to your clients in a way that’s both professional and efficient. Properly sending the document not only ensures it reaches the client but also helps establish a smooth payment process. It’s important to use the right method of delivery and follow up when necessary to keep the payment cycle on track.

Choosing the Best Delivery Method

Selecting the right method to send your document depends on your client’s preferences and your business practices. Here are the most common ways to deliver billing documents:

- Email: The most common and efficient way to send a billing document. Attach the document as a PDF to ensure it looks professional and is easy to download and view.

- Postal Mail: For clients who prefer hard copies or when dealing with international clients, mailing a physical copy may be necessary. Be sure to include a return envelope for ease of payment.

- Online Platforms: If you use an online payment or project management system, you may be able to send your document directly through the platform, streamlining the process for both you and your client.

Best Practices for Sending

To ensure your client receives the document in a timely and professional manner, consider the following best practices:

- Double-Check the Recipient’s Contact Information: Always confirm the accuracy of the client’s email address or postal address to avoid delivery issues.

- Include a Clear Subject Line: In the case of email, ensure the subject line clearly states the purpose of the message (e.g., “Invoice for Services Rendered – [Your Company Name]”).

- Provide Payment Instructions: Include detailed instructions on how the client can make the payment, whether via bank transfer, credit card, or another method.

- Set a Friendly Tone: In the body of the email or cover letter, maintain a polite and professional tone. Thank the client for their business and briefly mention the due date for payment.

By following these steps, you make the process of sending your billing documents as smooth as possible, reducing the likelihood of errors and ensuring your client understands their obligations. Effective communication through proper delivery can enhance client relationships and ensure timely payments.

Tracking Invoice Status in FreshBooks

Monitoring the progress of your billing process is crucial for maintaining cash flow and ensuring timely payments. By tracking the status of each transaction, you can stay on top of what has been paid, what is overdue, and what still needs attention. With a well-structured system, you can streamline follow-ups and make informed decisions regarding your business’s financial health.

How to Monitor Payment Progress

Most platforms offer a clear way to view the status of your financial requests. Typically, statuses will include labels such as “Sent”, “Viewed”, “Paid”, or “Past Due”. These indicators help you quickly determine whether a client has received your request and if they’ve taken the necessary action. Staying informed allows you to address any delays or issues proactively.

Automated Alerts and Notifications

Modern systems provide automatic alerts to notify you when a payment has been processed, or if an item is nearing its due date. These notifications can be delivered via email or within the platform, allowing you to act promptly and reduce administrative work. Automation makes it easier to track and manage multiple transactions without constant manual oversight.

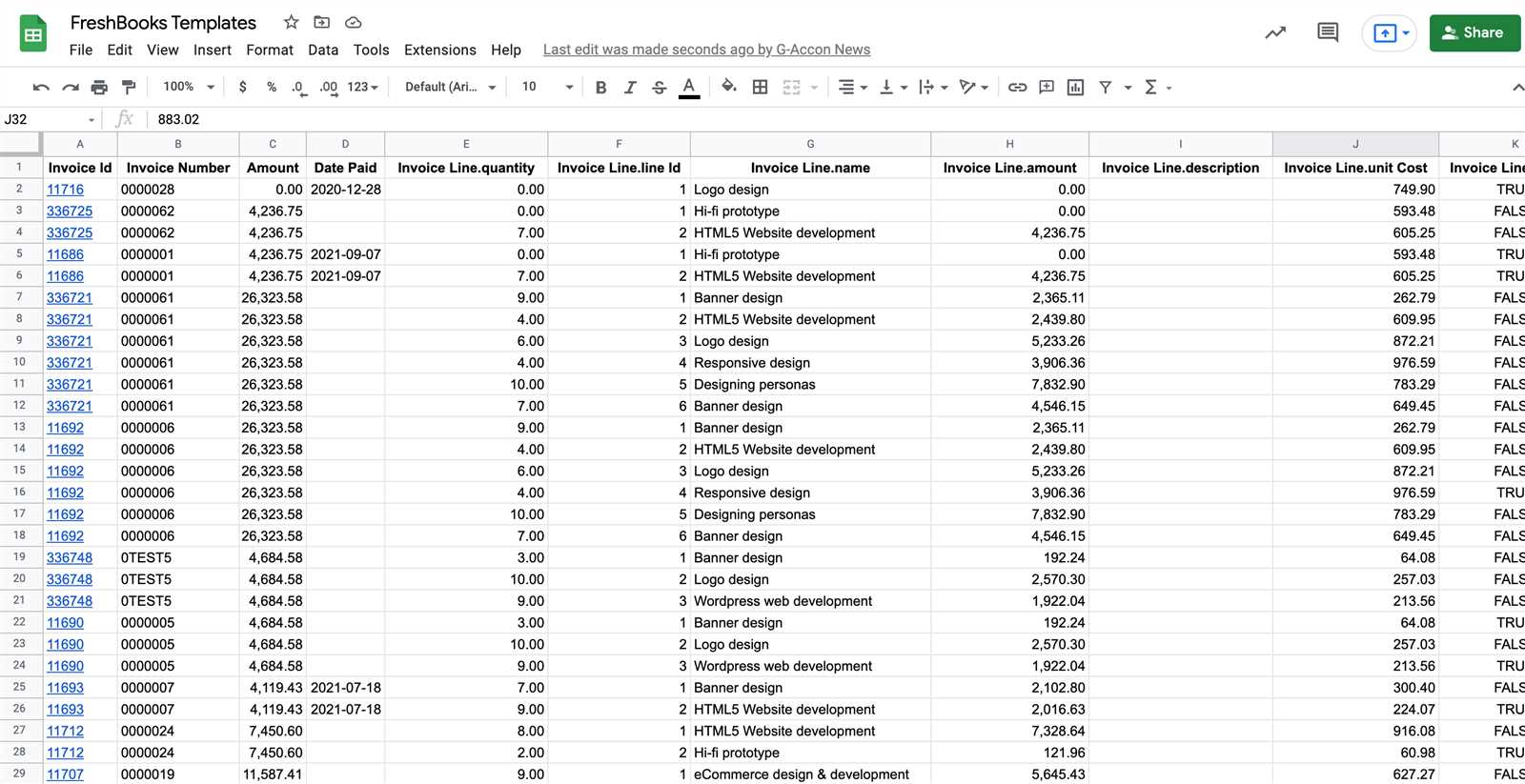

Integrating Custom Invoices with FreshBooks Reports

Efficient financial management requires seamless connectivity between various business functions. By linking your billing documents with detailed reports, you can gain valuable insights into your revenue streams, track outstanding amounts, and identify trends. Integrating payment requests into your reporting system allows for a streamlined approach to financial analysis and decision-making.

Enhancing Financial Insight with Detailed Reports

When your requests for payment are linked to comprehensive reports, it becomes easier to track performance over time. Detailed reports provide a snapshot of your business’s financial health, including income, expenses, and client payment history. This integration ensures that all financial activities are captured in one place, making it simpler to assess the success of your operations and forecast future earnings.

Automation for Streamlined Tracking

Automated syncing between your billing records and reports helps maintain accuracy while saving time. With each completed transaction automatically reflected in your reports, you reduce the chances of human error and streamline the reconciliation process. This setup allows you to focus on growing your business, knowing that all financial data is being accurately tracked and reflected in real-time.

By connecting your billing processes to reporting tools, you ensure a smooth flow of financial information that supports better planning and decision-making.

Best Practices for Professional Invoices

Creating well-organized and clear billing documents is essential for maintaining professional relationships with clients and ensuring timely payments. A polished and accurate request for payment reflects your business’s credibility and helps reduce misunderstandings. By following key guidelines, you can ensure that your billing process is efficient and leaves a positive impression on your clients.

Maintain Clear and Concise Information

It’s important to include all necessary details in a straightforward manner. Ensure that each request includes the client’s name, contact information, itemized list of services or products, the total amount due, and payment terms. Clarity reduces confusion and minimizes the chances of disputes or delayed payments.

Incorporate Professional Design Elements

The design of your payment documents plays a significant role in presenting your business as organized and reliable. Use clean, easy-to-read fonts, clear headings, and consistent layout throughout the document. A well-structured document shows attention to detail and enhances your company’s image.

Set Clear Payment Terms and Deadlines

Specify when the payment is due, what payment methods are accepted, and any late fees or penalties that may apply. Clear payment terms provide both you and the client with a mutual understanding of expectations. Setting deadlines ensures timely payments and avoids unnecessary follow-ups.

Tracking Invoice Status in FreshBooks

Monitoring the progress of your billing process is crucial for maintaining cash flow and ensuring timely payments. By tracking the status of each transaction, you can stay on top of what has been paid, what is overdue, and what still needs attention. With a well-structured system, you can streamline follow-ups and make informed decisions regarding your business’s financial health.

How to Monitor Payment Progress

Most platforms offer a clear way to view the status of your financial requests. Typically, statuses will include labels such as “Sent”, “Viewed”, “Paid”, or “Past Due”. These indicators help you quickly determine whether a client has received your request and if they’ve taken the necessary action. Staying informed allows you to address any delays or issues proactively.

Automated Alerts and Notifications

Modern systems provide automatic alerts to notify you when a payment has been processed, or if an item is nearing its due date. These notifications can be delivered via email or within the platform, allowing you to act promptly and reduce administrative work. Automation makes it easier to track and manage multiple transactions without constant manual oversight.