Freelance Invoice Template South Africa for Simple and Professional Billing

For independent professionals, managing financial transactions efficiently is essential to maintaining a successful business. One of the key components of this process is ensuring that all requests for payment are clear, professional, and easy for clients to understand. Properly designed billing forms not only help avoid confusion but also foster trust and streamline the payment process.

In this guide, we will explore the essentials of crafting well-organized and legally compliant billing statements. From understanding the necessary details to including the correct payment terms, you’ll learn how to create documents that enhance your reputation and ensure timely compensation for your work.

Having a properly structured payment request can make a significant difference in how smoothly you get paid. With the right approach, you can save time, reduce administrative errors, and even help clients feel more confident in their transactions with you.

Why Billing Statements Matter in South Africa

For individuals working independently, having a structured and professional approach to requesting payment is essential. Clear and accurate documentation not only ensures that compensation is received on time but also strengthens the relationship with clients by promoting transparency and trust. In countries like South Africa, where businesses are increasingly turning to independent professionals, creating effective payment requests is vital for maintaining financial order and protecting both parties involved.

Building Trust and Professionalism

One of the main reasons for using well-organized documents for payments is the establishment of trust. Clients are more likely to value your work and pay promptly when they see a clear and professional billing statement. A lack of structure can make even simple transactions appear disorganized, potentially leading to confusion or delays. By maintaining high standards in how you request payment, you communicate your professionalism and commitment to providing quality work.

Legal and Tax Compliance

Another crucial aspect of using payment requests is ensuring compliance with local tax laws. In South Africa, for example, professionals need to adhere to tax regulations, including VAT and other business taxes. Well-crafted payment documents help maintain accurate records, making it easier to file taxes correctly and avoid penalties. They also offer protection should there be any disputes about the terms or amounts agreed upon.

| Key Reasons for Using Professional Billing Documents | Impact on Business |

|---|---|

| Establishes Clear Payment Terms | Minimizes confusion and payment delays |

| Ensures Tax Compliance | Helps with accurate record-keeping and tax filings |

| Enhances Professional Image | Builds trust and attracts more clients |

| Reduces Administrative Work | Streamlines payment tracking and management |

Understanding the Basics of Billing for Independent Professionals

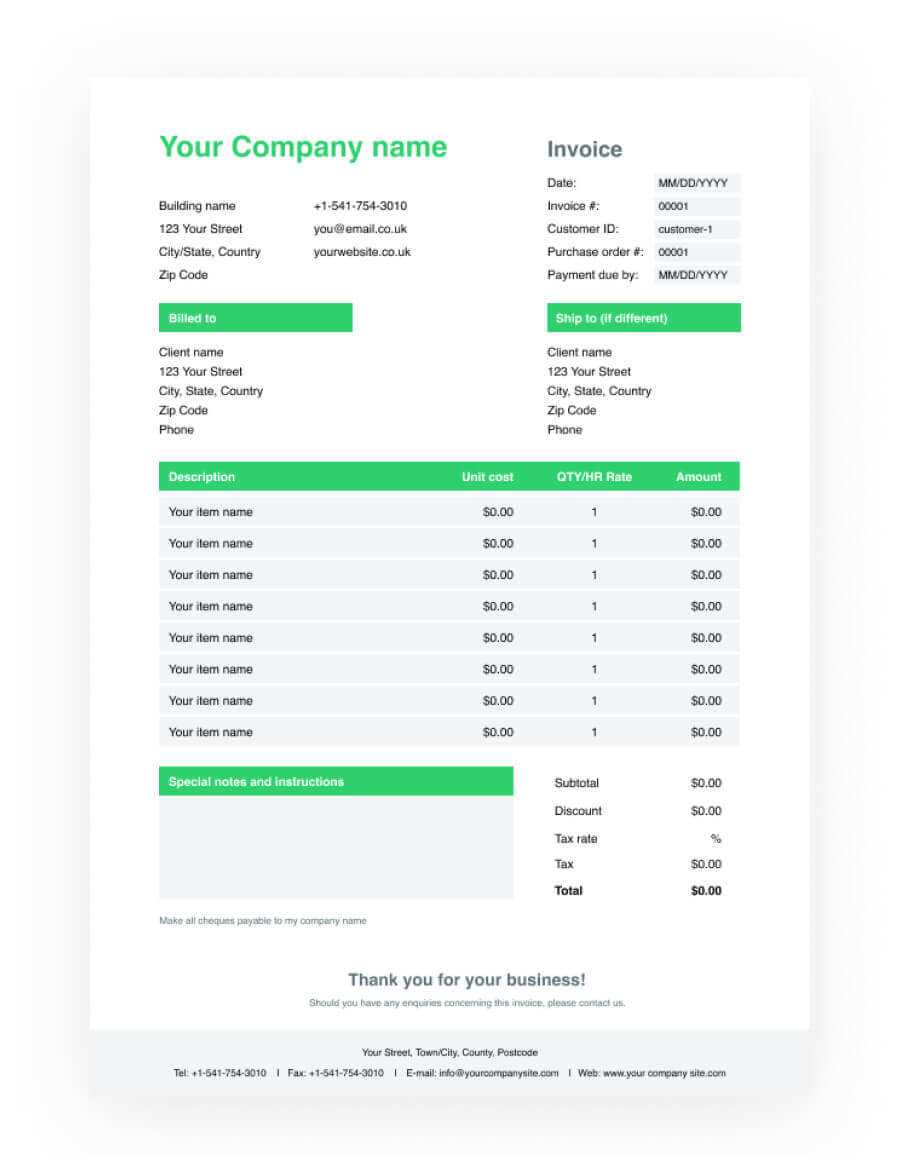

When working as an independent contractor, one of the most important aspects of managing your business is how you request payment for your services. Whether you’re working with local clients or international partners, having a clear, detailed document that outlines the terms of payment ensures that both parties are on the same page. A well-structured payment request not only improves your professionalism but also ensures that you get compensated for your work in a timely manner.

Key Components of a Payment Request

At its core, a payment request should contain specific details that clearly communicate the work completed, the agreed-upon amount, and the payment terms. Some of the most essential elements include:

- Client Information: Your client’s full name, business name, and contact details.

- Details of Work Completed: A clear description of the services provided, including the dates and any relevant project milestones.

- Payment Amount: The agreed-upon fee for the services rendered, along with any taxes or additional charges.

- Payment Ter

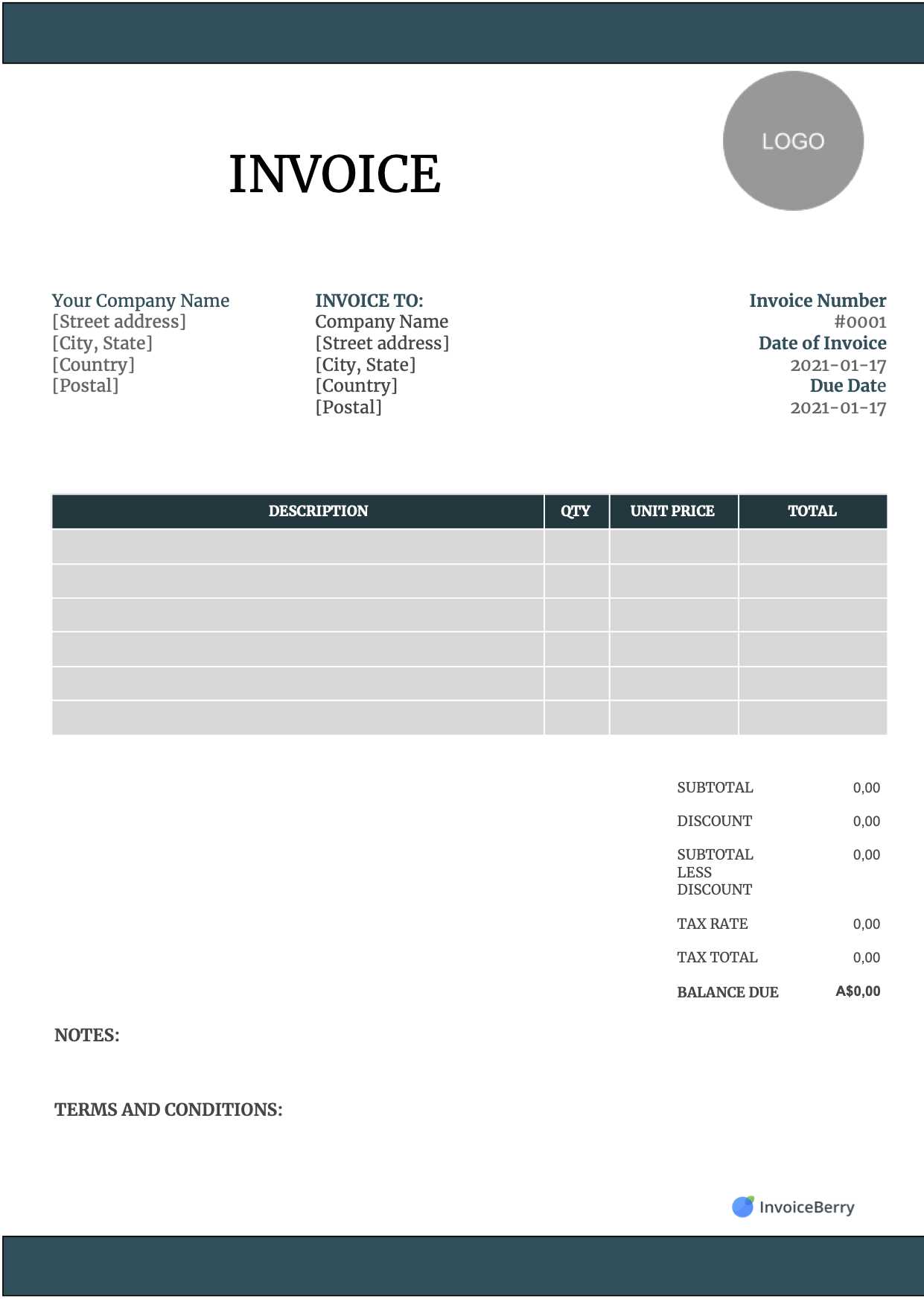

How to Create a Professional Billing Document

Creating a professional payment request is essential for independent professionals looking to maintain credibility and ensure timely compensation. A well-crafted billing document not only provides clarity for both you and your client but also demonstrates a high level of professionalism. To make sure your document meets these standards, it’s important to include the necessary details, use a clean and organized layout, and ensure it aligns with any legal requirements.

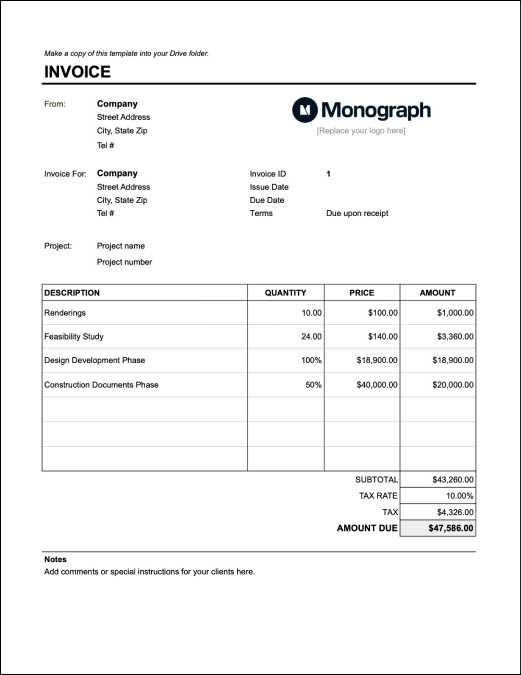

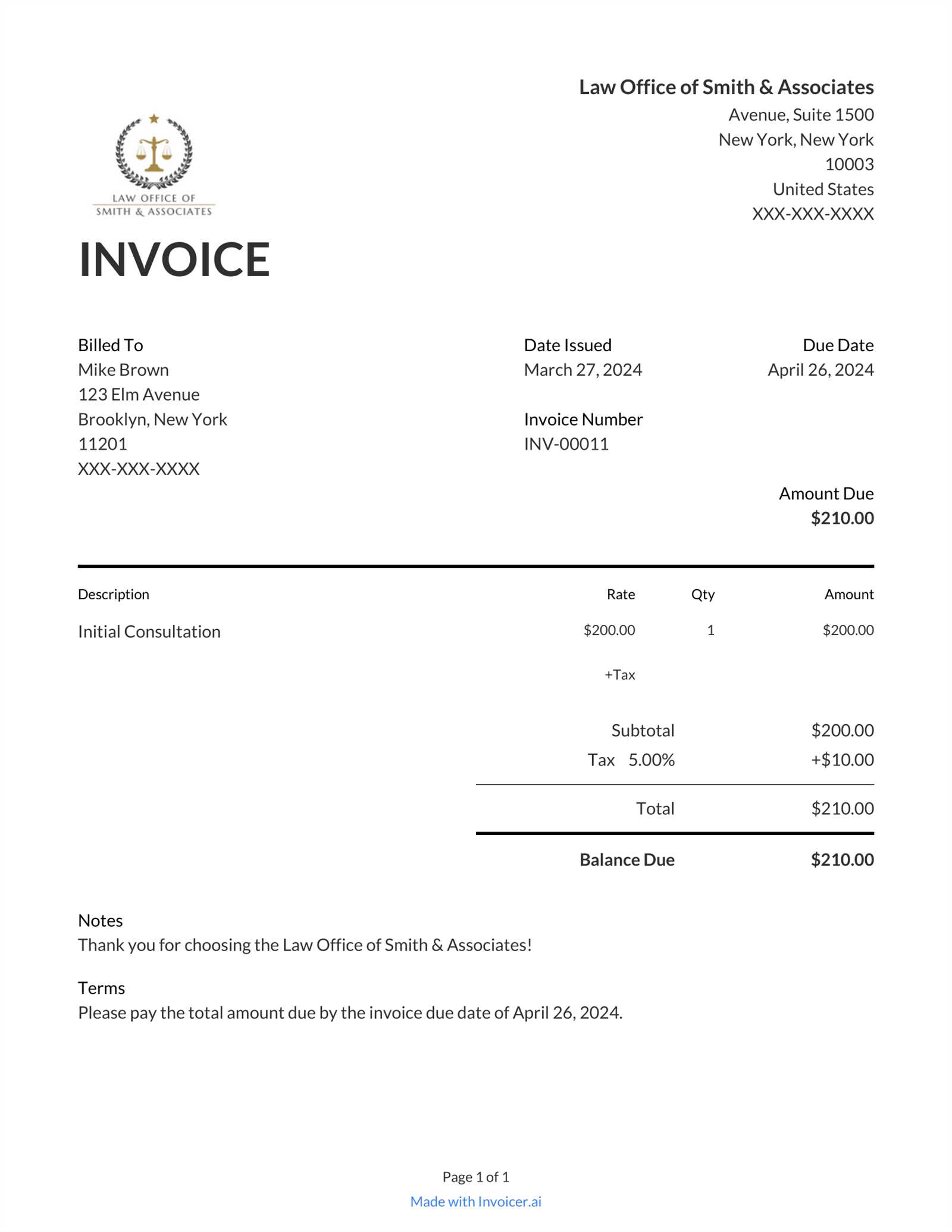

Essential Elements to Include

To create a comprehensive and professional document, make sure to include the following key components:

- Your Information: Your name, business name (if applicable), and contact details (email, phone number, address).

- Client’s Information: The client’s name or business name, address, and contact information.

- Description of Services: Clearly outline the work completed, including dates, hours worked (if applicable), and specific services provided.

- Amount Due: Specify the total payment due, including any taxes, fees, or discounts applied.

- Payment Terms: Indicate when payment is due, the methods of payment accepted, and any penalties for late payments.

- Invoice Number: A unique reference number to help both parties track the transaction.

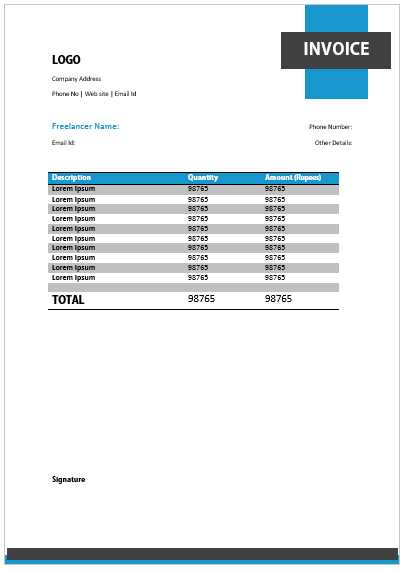

Design and Layout Tips

The appearance of your billing document is just as important as the content. A well-designed, clean document will leave a positive impression on your client. Here are a few design tips to follow:

- Keep it Simple: Use a professional font, such as Arial or Times New Roman, and avoid using too many colors or graphics that could distract from the essential information.

- Organize Information Clearly: Use headings, bullet points, and tables to present information in a structured way.

- Make It Legible: Ensure that the text is large enough to read easily and that there is adequate spacing between sections for clarity.

Incorporating these elements into your payment document will not only make it easier for your client to understand the details but also enhance your credibility and profe

Key Elements of a Professional Billing Document

When requesting payment for services rendered, it is crucial to ensure that the document is clear, detailed, and comprehensive. A well-structured billing document serves as both a formal request for payment and a record of the transaction for both you and your client. By including all the necessary information, you can help prevent misunderstandings and ensure a smooth financial process.

Essential Information to Include

Every billing document should contain specific details to avoid confusion and provide clarity. Here are the key elements that must be included:

- Your Contact Information: This includes your name, business name (if applicable), and contact details, such as email and phone number. It is essential for your client to know how to reach you for any questions or concerns.

- Client’s Contact Information: Include the name or business name of your client, along with their address and any relevant contact details. This ensures that both parties have the correct information.

- Work Description: Clearly outline the services or work completed. Include specific tasks, the time period over which they were completed, and any other relevant details, such as hourly rates or project milestones.

- Amount Due: State the agreed-upon amount for the work completed, along with any applicable taxes, fees, or additional charges. Make sure the total is clearly visible and broken down where necessary.

- Payment Terms: Clearly mention the due date for payment, any accepted payment methods (bank transfer, PayPal, etc.), and any penalties or fees for late payments.

- Unique Reference Number: Each request should have a unique reference number for easy tracking and identification of the transaction. This helps both you and your client manage records and ensures the payment is processed correctly.

Additional Considerations

In addition to these core elements, you may also choose to include other relevant details, such as a brief payment history or notes on future services. It’s also important to maintain a professional tone and layout. Using a clean, easy-to-read format makes the document more accessible and less likely to be overlooked.

Best Payment Request Documents for Independent Professionals

For independent workers, having the right tools to manage financial transactions is crucial for ensuring a smooth payment process. The right document layout not only helps in clearly communicating the details of the work completed but also ensures professionalism and efficiency. There are various formats available, and choosing one that suits your needs can simplify the administrative side of your business and help you get paid on time.

Features to Look for in a Payment Request

When selecting the best payment request format for your business, consider the following features:

- Customizability: Choose a layout that allows you to tailor details like your contact information, payment terms, and services offered. Customizability ensures the document accurately reflects your branding and specific needs.

- Clarity: A well-organized structure with clear headings, bullet points, and a clean design makes it easier for your client to understand the details at a glance. The less confusion, the faster the payment.

- Legal Compliance: Ensure that the format meets local regulations, including tax information, such as VAT or other applicable business taxes. This helps avoid legal issues and simplifies your tax filing process.

- Ease of Use: Opt for a format that is easy to fill out and update, whether it’s a Word document, Excel sheet, or an online generator. The easier it is to complete, the more time you can focus on your work.

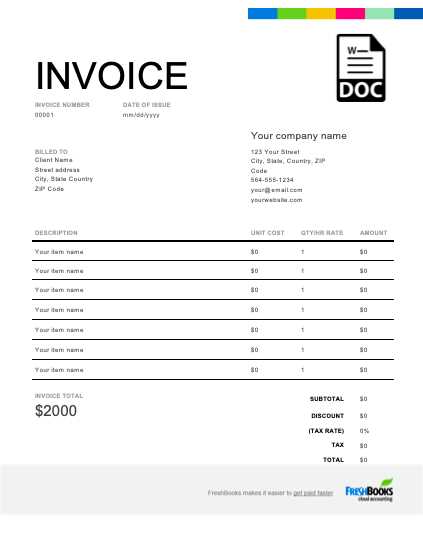

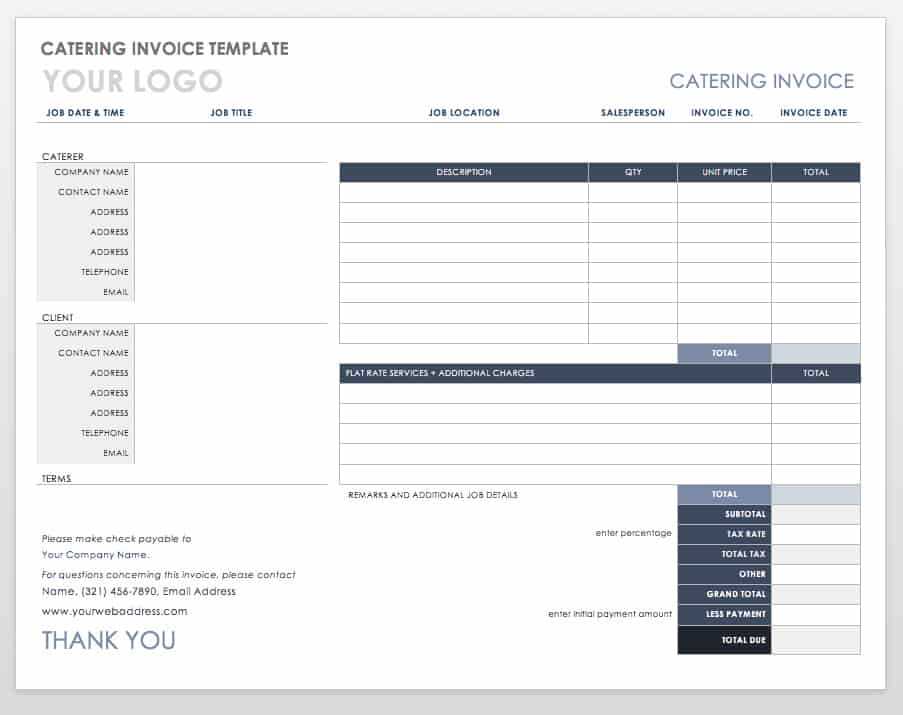

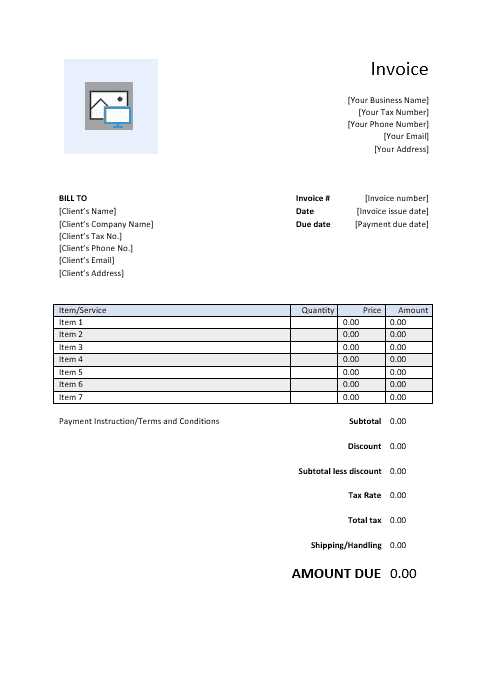

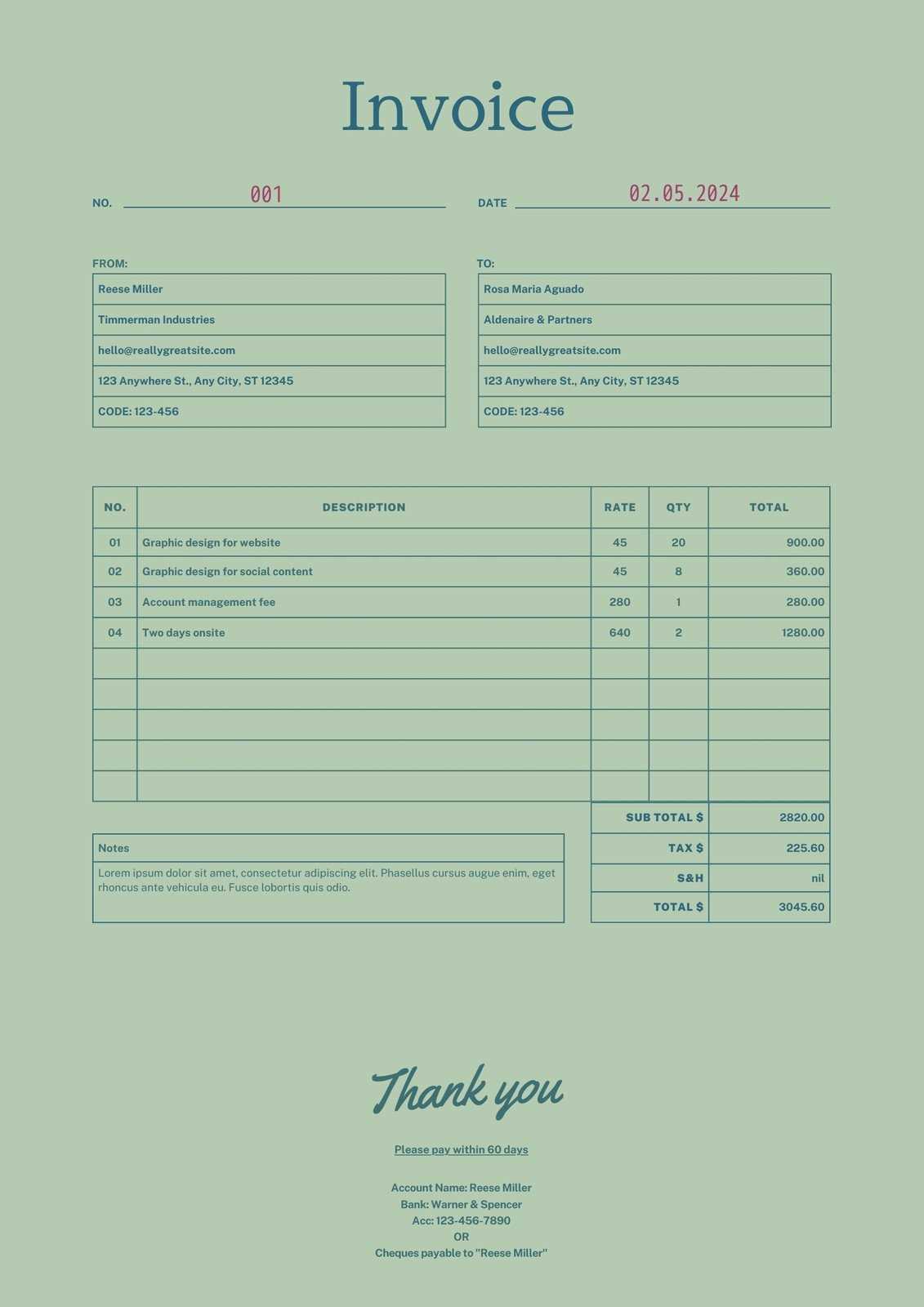

Popular Formats for Independent Professionals

Several formats have become popular due to their ease of use and comprehensive features. These include:

- Online Invoice Generators: These platforms allow you to create and send professional payment requests directly from the website. They often come with customizable fields, templates for different industries, and automatic tax calculations.

- Spreadsheet Templates: A common option for many independent workers, spreadsheet formats like Excel or Google Sheets allow you to track payments and expenses in one place. They also offer flexibility in terms of design and customization.

- Word Document Formats: These are more traditional, allowing for greater control over formatting. Many offer pre-designed layouts, which can be adjusted according to your business’s needs.

Choosing the Right Billing Format for Your Business

Selecting the appropriate document layout for requesting payments is a critical decision for independent professionals. The format you choose impacts not only the clarity of the transaction but also how efficient the overall process will be. A well-designed payment request makes it easier for clients to understand the terms, reducing the likelihood of disputes and delays. In addition, the right format can save you time and help you stay organized in your financial record-keeping.

Factors to Consider When Choosing a Format

When deciding on a payment request format, there are several key factors to keep in mind to ensure it aligns with your business needs:

- Client Preferences: Some clients may prefer certain formats, such as PDF or Word documents, while others may prefer online platforms for ease of use. Understanding their preferences can help ensure smooth communication.

- Complexity of Your Services: If your services involve multiple tasks, long-term projects, or varying rates, choose a format that can accommodate detailed descriptions and multiple line items.

- Ease of Use: Opt for a layout that is simple to complete and doesn’t require significant time or effort. A format that is easy to update and modify will save you time, especially when working with repeat clients.

- Legal Compliance: Ensure the format allows you to include essential legal and tax information, such as VAT numbers or other required details based on local regulations. This ensures your business remains compliant with tax laws.

Popular Formats for Different Business Types

The most suitable format for your payment requests can depend on your business type and the specific nature of your services. Below are some of the most commonly used formats:

- Online Payment Platforms: Many professionals use online tools that allow you to create and send payment requests directly from the platform. These options often come with the added benefit of automated tax calculations and integration with accounting software.

- Spreadsheets: For those who prefer a customizable option, spreadsheet formats such as Excel or Google Sheets can be a good choice. These formats allow you to track payments, apply taxes, and customize the layout based on the complexity of your services.

- Word Processors: Word document formats offer more flexibility in terms of layout design. These are useful if you want a high level of customization, but they can be time-consuming to manage compared to more automated solutions.

Ch

Common Mistakes to Avoid in Payment Requests

When requesting payment for your work, it’s essential to get the details right. Even small errors in your documents can lead to misunderstandings, delayed payments, and unnecessary stress. By being aware of common mistakes, you can ensure that your payment requests are clear, professional, and effective. Below are some of the most frequent errors that can hinder a smooth payment process and how to avoid them.

1. Missing or Incorrect Client Information

One of the most common mistakes is not including or incorrectly listing the client’s details. A missing or incorrect name, address, or contact information can lead to confusion or delayed payments. Always double-check that all client information is accurate before sending the request. This ensures that the document reaches the right person and helps avoid any miscommunication.

2. Lack of Clear Payment Terms

Another frequent mistake is failing to clearly state the payment terms. Whether it’s the due date, late fees, or accepted payment methods, these details should be explicitly mentioned. Ambiguous terms can cause confusion, resulting in delayed payments or disputes. Be specific about when you expect the payment, how you expect to receive it, and any penalties for late settlement. Clear terms help ensure both parties understand what is expected.

3. Overcomplicating the Document

While it may be tempting to make your document visually impressive, overcomplicating the layout can make it harder for clients to find key information. Keep your payment request simple and well-organized. Use headings, bullet points, and tables to break down the details and ensure that the important parts–such as the amount due and payment terms–are easy to locate. Simplicity is key to ensuring your document is both professional and functional.

4. Failing to Include a Unique Reference Number

Not including a unique reference number can make it difficult to track payments, especially if you have multiple clients or ongoing projects. A reference number serves as a point of identification for both you and the client, helping to prevent confusion if there are questions about the payment. It also helps keep your records organized and reduces the risk of errors in the payment process.

5. Forgetting to Acc

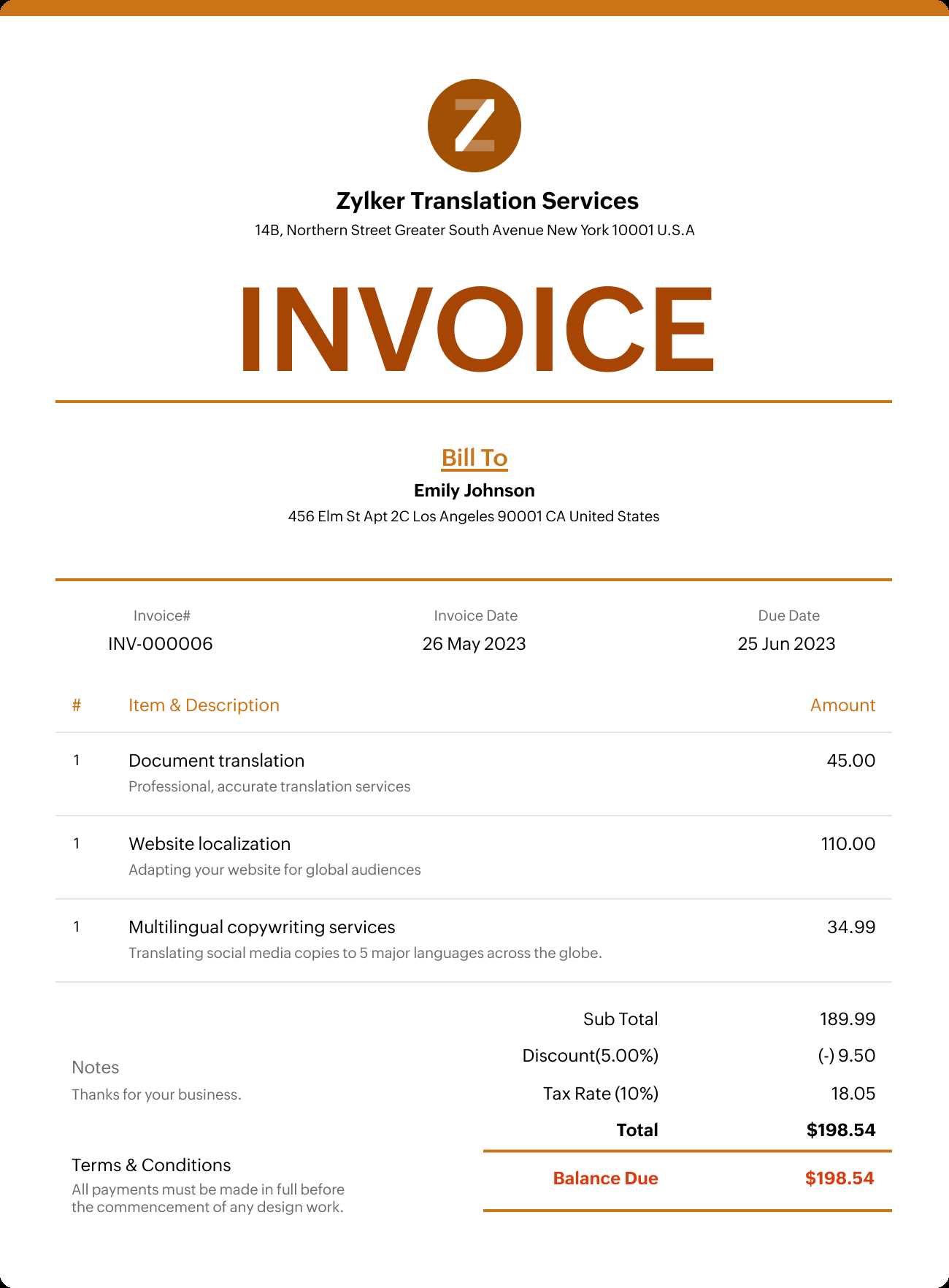

How to Calculate Tax on Your Payment Requests

When requesting payment for services rendered, it’s important to account for any taxes that may apply to the transaction. Calculating taxes correctly ensures that you comply with local regulations, prevents any financial discrepancies, and keeps your business operations transparent. Whether you’re charging VAT or any other applicable tax, it’s essential to include these calculations clearly in your payment request to avoid confusion or issues with your clients.

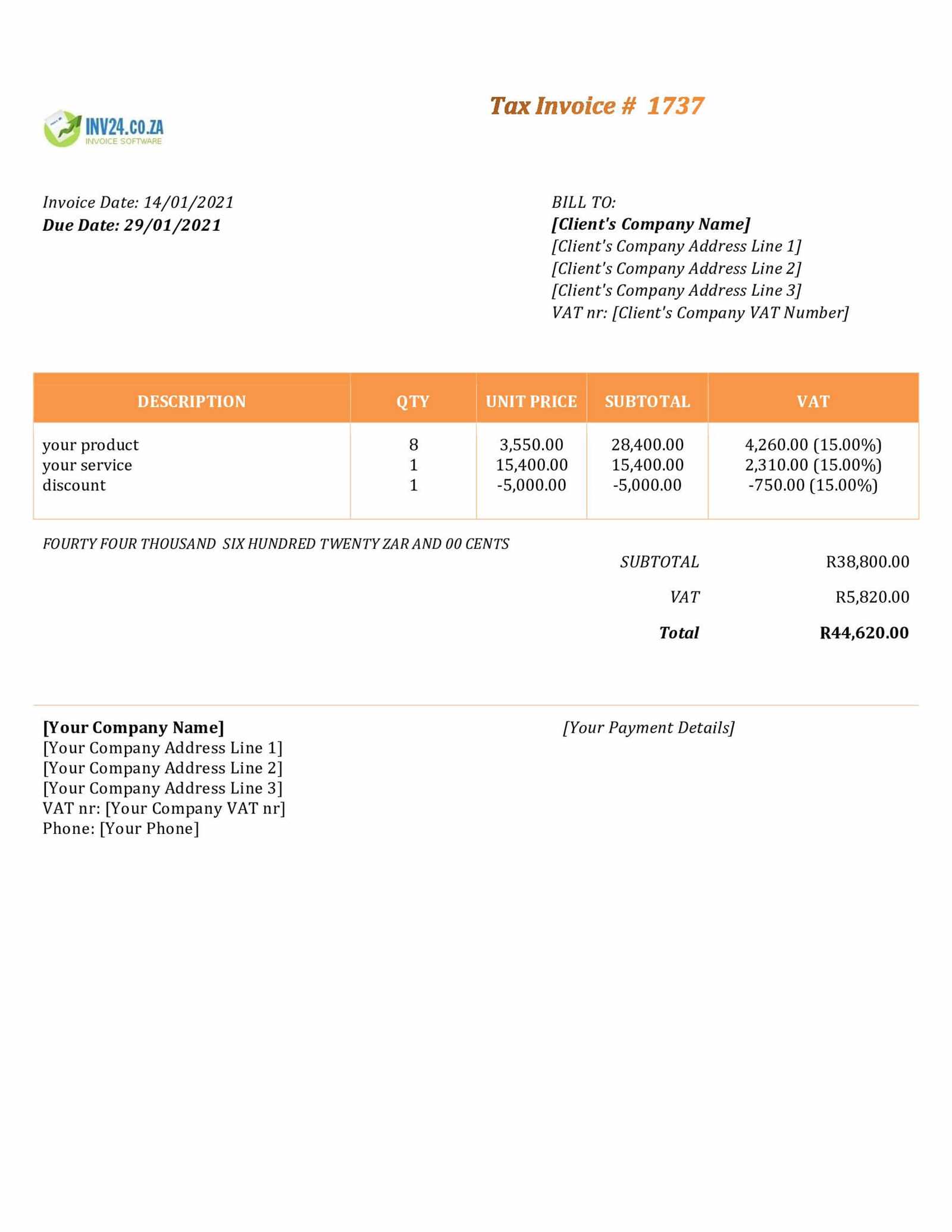

Understanding the Tax Rate

The first step in calculating tax is to determine the applicable tax rate. Different services may be subject to different rates, and this can vary depending on your location and the nature of the service provided. For example, in many regions, VAT (Value Added Tax) is commonly charged on most goods and services. Ensure that you know the correct tax rate for the services you’re providing to your clients.

Once you know the tax rate, you can calculate the amount due by multiplying the base price of the services by the tax rate percentage. Here’s a simple formula:

Step Calculation Example 1. Calculate the base amount Base amount = Service price $500 2. Multiply by the tax rate Tax amount = Base amount × Tax rate $500 × 15% = $75 3. Add the tax to the total Total amount due = Base amount + Tax amount $500 + $75 = $575 Including Tax in Your Payment Request

Once you have calculated the tax amount, it should be clearly presented in your payment request document. The total amount due should include the base amount plus the tax amo

Setting Payment Terms for South African Clients

Clearly defining payment terms is essential for maintaining healthy business relationships and ensuring timely compensation. Whether you’re working on short-term projects or long-term collaborations, having a solid agreement on when and how payments are made can prevent misunderstandings and delays. In South Africa, as in many other places, there are specific expectations and best practices for setting payment terms that both protect you as a professional and make the process clear for your clients.

Standard Payment Timeframes

One of the most important aspects of payment terms is determining the timeframe within which clients should pay. Typical payment periods range from 7 to 30 days, with 30 days being the most common standard for many industries. However, depending on the nature of your work, you may wish to set shorter or longer periods. Be sure to communicate your preferred payment terms clearly and include them in your agreement. If you are uncertain about the standard practices for your industry, research what others are doing or ask your client about their preferences.

Accepted Payment Methods and Late Fees

In South Africa, businesses generally accept various payment methods, including bank transfers, credit cards, and mobile payment services such as SnapScan or Zapper. It’s essential to specify which payment methods you accept and provide the necessary details, such as bank account numbers or digital payment links, in your request. Additionally, including terms for late payments can help protect your cash flow. You can choose to charge a fixed late fee or a percentage of the outstanding amount, which can incentivize timely payments and avoid delays.

Clearly stating these terms not only improves your chances of being paid on time but also fosters transparency and professionalism. By establishing clear and fair payment expectations, you create a more efficient and positive working environment for both you and your clients.

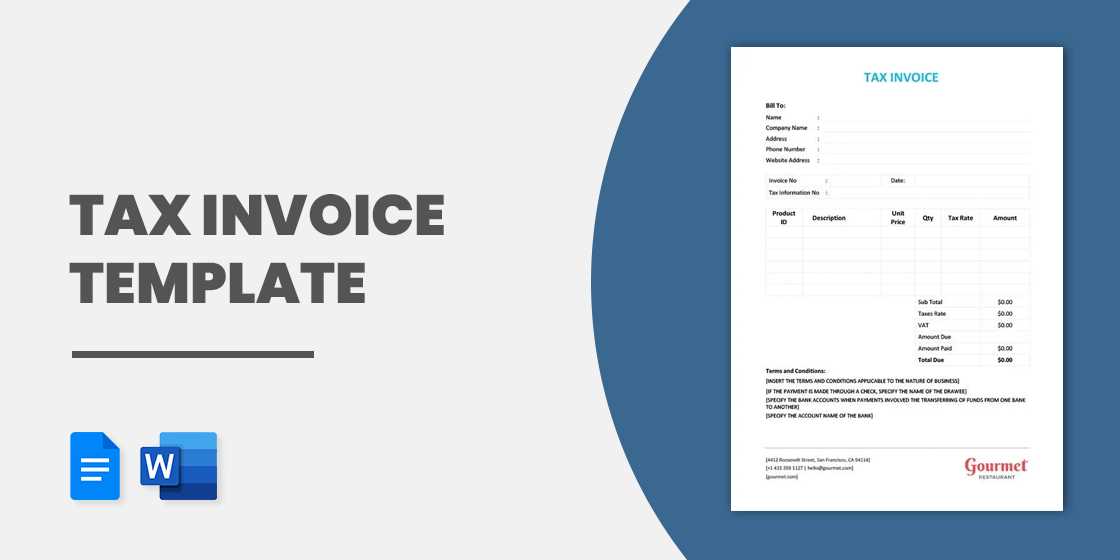

Understanding VAT for Independent Professionals in South Africa

For independent professionals operating in South Africa, understanding Value Added Tax (VAT) is crucial for ensuring compliance with tax laws and maintaining financial transparency. VAT is a consumption tax that is added to goods and services at each stage of the production or distribution process. As a service provider, you may be required to charge VAT on the services you offer, depending on your earnings and business structure. Knowing how VAT works will help you manage your taxes properly and avoid legal issues.

Who Needs to Register for VAT?

In South Africa, any business whose turnover exceeds a specific threshold is required to register for VAT. As of the most recent guidelines, this threshold is R1 million in annual turnover. If your business exceeds this amount, you must register for VAT with the South African Revenue Service (SARS). If you’re below the threshold, you can still voluntarily register if you want to claim back VAT on business expenses.

- Compulsory Registration: If your earnings exceed R1 million per year, registration is mandatory.

- Voluntary Registration: You can register voluntarily if your earnings are less than R1 million but you want to reclaim VAT on purchases.

- Exemptions: Certain services may be exempt from VAT, so it’s important to confirm whether your specific services are subject to VAT.

How VAT Works for Independent Service Providers

If you are VAT-registered, you will charge VAT on your services at the applicable rate, which is currently 15%. You must then submit VAT returns to SARS periodically (usually every two months) to report the VAT you’ve charged and the VAT you’ve paid on business expenses. The difference between the VAT you’ve charged and the VAT you’ve paid determines whether you owe SARS money or are due a refund.

- Output Tax: This is the VAT you charge to clients for your services. It is added to your fee when you send a payment request.

- Input Tax: This is the VAT you pay on goods and services used for your business. You can claim this back on your VAT return.

Including VAT in Your Payment Requests

As an independent professional, it’s essential to clearly state the VAT charged on your services. Make sure to include the VAT amount separately in your payment request, so your client knows exactly how much tax they are paying. You should also include your VAT registration number on the document. This transparency ensures your clients underst

How to Handle Late Payments Effectively

Late payments are an unfortunate reality for many independent professionals, but they don’t have to be a constant source of stress. Knowing how to handle overdue payments efficiently is key to maintaining cash flow and sustaining positive relationships with clients. Whether you’re dealing with a one-time delay or a recurring issue, it’s important to approach the situation in a professional and systematic manner. By setting clear expectations and taking the right steps when payments are delayed, you can resolve issues quickly and maintain financial stability.

1. Set Clear Payment Terms from the Start

Preventing late payments begins with setting clear and explicit payment terms at the outset of the project. Always communicate your payment expectations, including deadlines, late fees, and accepted payment methods, before beginning any work. By putting these terms in writing, you help clients understand their obligations and create a reference point in case of delays.

- Specify payment due dates: Make sure both parties agree on a clear deadline for payment.

- Include late fees: Outline the additional charges that will apply if payments are delayed.

- Clarify payment methods: Indicate the ways clients can pay, whether through bank transfer, credit card, or digital payment platforms.

2. Follow Up Promptly and Professionally

If a payment is overdue, don’t hesitate to follow up with a polite reminder. Often, clients simply forget, and a gentle nudge is all that’s needed to get things back on track. A courteous but firm reminder, sent a few days after the due date, can be effective in resolving the issue without creating tension. If the client continues to delay, be sure to follow up more assertively, but always maintain professionalism.

Be consistent and professional when sending reminders, keeping communication clear and polite. A well-worded email or phone call can often resolve the situation without the

Customizing Documents to Suit Your Brand

When it comes to requesting payment for your services, the way you present your documents can have a significant impact on how clients perceive your professionalism and attention to detail. Customizing your payment requests to reflect your unique brand identity not only makes your documents stand out but also helps reinforce your brand image. From your logo to your color scheme and fonts, every element can contribute to building a cohesive and memorable brand presence.

1. Include Your Branding Elements

Your logo and business name are the foundation of your brand identity. Ensure that these elements are prominently displayed on your documents, ideally at the top of the page, where they’re immediately noticeable. This creates a sense of consistency across all communications and strengthens your professional image. Choose a font style and color scheme that aligns with your brand’s visual identity to give your payment requests a polished and cohesive look.

- Logo: Position your logo at the top of the page to establish your brand immediately.

- Color scheme: Use colors that align with your brand’s palette for a unified appearance.

- Typography: Choose fonts that reflect the tone and style of your brand while ensuring readability.

2. Personalize the Document’s Language

Incorporating your brand’s voice into the language of your payment requests can make the communication feel more personalized and consistent with the rest of your client interactions. If your brand is friendly and approachable, use warm, welcoming language. On the other hand, if your brand is more formal and corporate, keep the tone professional and clear. Tailoring your language will create a stronger connection with your client and reinforce your brand’s values.

- Casual or formal tone: Match your language style to your brand’s personality.

- Clear instructions: Ensure your payment terms and other details are easy to understand.

- Friendly reminders: If applicable, use polite, encouraging language

Why You Should Automate Your Billing Process

Managing the financial side of your business can be time-consuming, especially when it comes to creating and sending payment requests. Manually tracking each transaction, ensuring accuracy, and following up on overdue payments can take valuable time away from the actual work you do. Automating the billing process can streamline these tasks, reduce human error, and save you time, allowing you to focus on what matters most–growing your business and serving your clients. By embracing automation, you can also improve the efficiency and professionalism of your operations.

1. Save Time and Effort

One of the primary reasons to automate your billing is to free up time. Rather than creating each document from scratch or tracking payments manually, automation allows you to generate accurate requests at the click of a button. You can even set recurring payments for ongoing projects, which means less administrative work for you and less chance of overlooking important details.

- Save time: Create and send payment requests with just a few clicks.

- Reduce human error: Automated systems ensure consistency and accuracy in your records.

- Recurring billing: Set up automated billing for ongoing services to reduce manual follow-ups.

2. Improve Accuracy and Consistency

Manual calculations or errors when inputting information can lead to mistakes in your payment requests, which can lead to confusion or delays. Automation ensures that the details are consistently accurate, with no need for re-checking figures or formatting. Once your details are set up–such as rates, taxes, and payment terms–the system will handle the rest, ensuring every document is consistent with your expectations and the client’s agreement.

Manual Process Automated Process Manual calculations and tracking Automatic calculation of amounts, taxes, and totals Risk of human error in details Accurate, consistent information every time Time spent on manual follow-ups Automated reminders and notifications 3. Enhance Professionalism and Client Experience

Automating your billing system can also improve the overall experience for your clients. With automatic emails, timely payment requests, and easy-to-read breakdowns of services rendered, you offer a seamless experience that reflects well on your business. Clients will appreciate the convenience of having all their details neatly organized and easily accessible, improving trust and satisfaction.

- Timely reminders: Automated payment requests ensure that clients receive prompt reminders without delays.

- Consistent

Legal Requirements for Payment Requests in South Africa

When running a business and issuing payment requests, it’s essential to ensure that your documents comply with local laws. In South Africa, there are specific legal requirements that must be met to ensure your payment requests are valid and enforceable. These requirements help protect both businesses and clients by ensuring transparency and accountability in financial transactions. Whether you’re providing services or selling goods, understanding these regulations is crucial to maintaining professionalism and avoiding legal issues.

1. Business Information

Every official document requesting payment should clearly display your business details. This includes your legal business name, registration number, and physical or postal address. If applicable, include your VAT (Value-Added Tax) registration number as well. This transparency helps ensure that your payment requests are legitimate and provides a clear point of contact for clients if any issues arise.

- Business name: Ensure your registered business name is clearly visible.

- Registration number: Include your official business registration number.

- Contact information: Provide your business address and any relevant contact details.

2. Tax Information and Compliance

If your business is VAT-registered, it is important to include the applicable tax details on your payment request. This includes specifying the VAT amount and showing the correct percentage of VAT on taxable goods or services. Failing to adhere to tax regulations can result in fines or legal complications. Make sure to stay up to date on any changes to VAT rates or tax laws to remain compliant.

- VAT number: Include your VAT registration number if applicable.

- VAT rate: Clearly state the VAT rate applied to taxable goods or services.

- Tax breakdown: Show the tax amount and total amounts before and after VAT is applied.

3. Payment Terms and Conditions

To avoid disputes, it is essential to outline clear payment terms. These terms should specify the payment due date, any late fees for overdue payments, and the method of payment. Including this information helps set clear expectations and ensures that both you and the client are on the same page regarding finan

How to Track and Manage Your Billing Requests

Effectively managing and tracking payment requests is an essential part of running a business. Proper organization ensures that you are paid on time and can easily monitor outstanding payments. By setting up an efficient system to track and manage these documents, you reduce the risk of missing deadlines or overlooking unpaid amounts. Additionally, having a clear record of all transactions helps maintain transparency with clients and provides essential data for tax reporting and financial planning.

1. Organize Your Documents

One of the first steps in managing your payment requests is to keep them organized. Whether you are using digital or physical files, ensure that each document is categorized properly. Use folders or labels to sort documents by client, date, or project. For digital files, consider cloud storage options or accounting software to keep your documents secure and easily accessible. A well-organized system helps you quickly find the details you need when following up with clients or reviewing your finances.

- File categorization: Organize documents by client, date, or project for easy reference.

- Digital storage: Use cloud-based tools or accounting software to store and track records.

- Physical files: If using paper records, keep them in clearly labeled folders and boxes.

2. Use Software for Tracking Payments

Automated tools and accounting software are highly effective for tracking payments. These tools allow you to set up reminders, send automatic follow-ups, and keep a real-time record of paid and outstanding amounts. They also make it easy to generate reports and maintain up-to-date records of your financial transactions. Some software options even allow you to integrate payment gateways, making the entire process seamless for both you and your clients.

- Automated reminders: Set up reminders to alert you when payments are due or overdue.

- Tracking payments: Easily mark which requests have been paid and which are still pending.

- Reports: Use built-in reporting tools to monitor your income and outstanding balances.

3. Establish Clear Payment

How to Ensure Timely Payments from Clients

Ensuring that your clients pay on time is a crucial aspect of maintaining healthy cash flow and managing your business effectively. Delayed payments can disrupt your operations, lead to financial strain, and create unnecessary stress. To prevent these issues, it’s important to establish clear expectations and implement strategies that encourage clients to pay promptly. By fostering transparent communication and using well-defined procedures, you can improve the chances of getting paid on time.

1. Set Clear Payment Terms from the Start

One of the most effective ways to ensure timely payments is to establish clear payment terms before any work begins. These terms should specify due dates, late fees, and the payment methods you accept. Make sure that your clients understand these terms upfront, and include them in any contract or agreement you sign. This reduces the chances of confusion and sets clear expectations for both parties.

- Due dates: Clearly state when payments are expected, such as “30 days from the date of service.”

- Late fees: Outline any penalties for overdue payments, such as an additional percentage or flat fee for each week a payment is delayed.

- Payment methods: Specify the acceptable payment options, whether it’s bank transfer, online payment systems, or checks.

2. Send Professional and Timely Payment Requests

Sending a professional payment request promptly after completing work is key to ensuring that your clients remember to pay on time. Make sure your request is clear and easy to understand, with all relevant details included, such as the payment amount, due date, and payment instructions. The sooner you send the payment request, the sooner your client can process it.

- Prompt delivery: Send your payment requests as soon as the job is completed or within the agreed ti