How to Use an Invoice Statement Template for Efficient Billing

Efficient financial management is crucial for any business. One of the key aspects of managing transactions is having a clear and professional way to request payment. A well-structured document that outlines services provided, amounts due, and payment terms can save time, reduce errors, and enhance your professional image. Using a standardized document for this purpose can help ensure accuracy and consistency in every transaction.

Whether you’re a freelancer, small business owner, or part of a larger enterprise, having a reliable system to request payments is essential. Customizable tools are available to help create such documents quickly, ensuring they meet your specific needs. These tools allow you to include all the necessary details while maintaining a clean, professional layout.

In this guide, we’ll explore how to effectively use such tools to streamline your payment requests. From understanding the essential components to selecting the right format, we will cover everything you need to know to make your financial processes more efficient and organized.

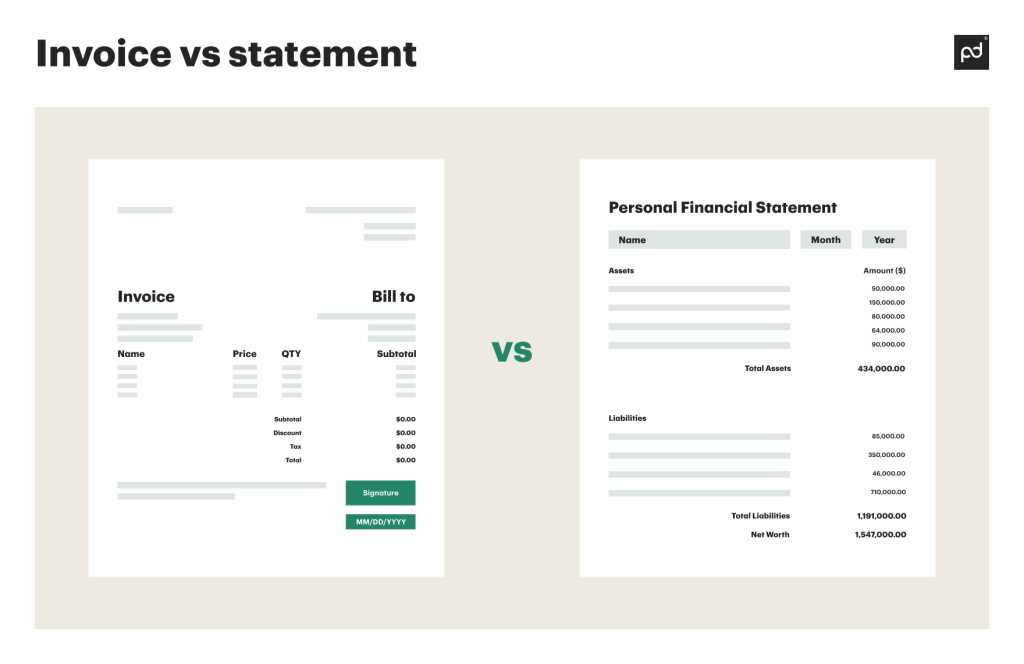

What is an Invoice Statement Template

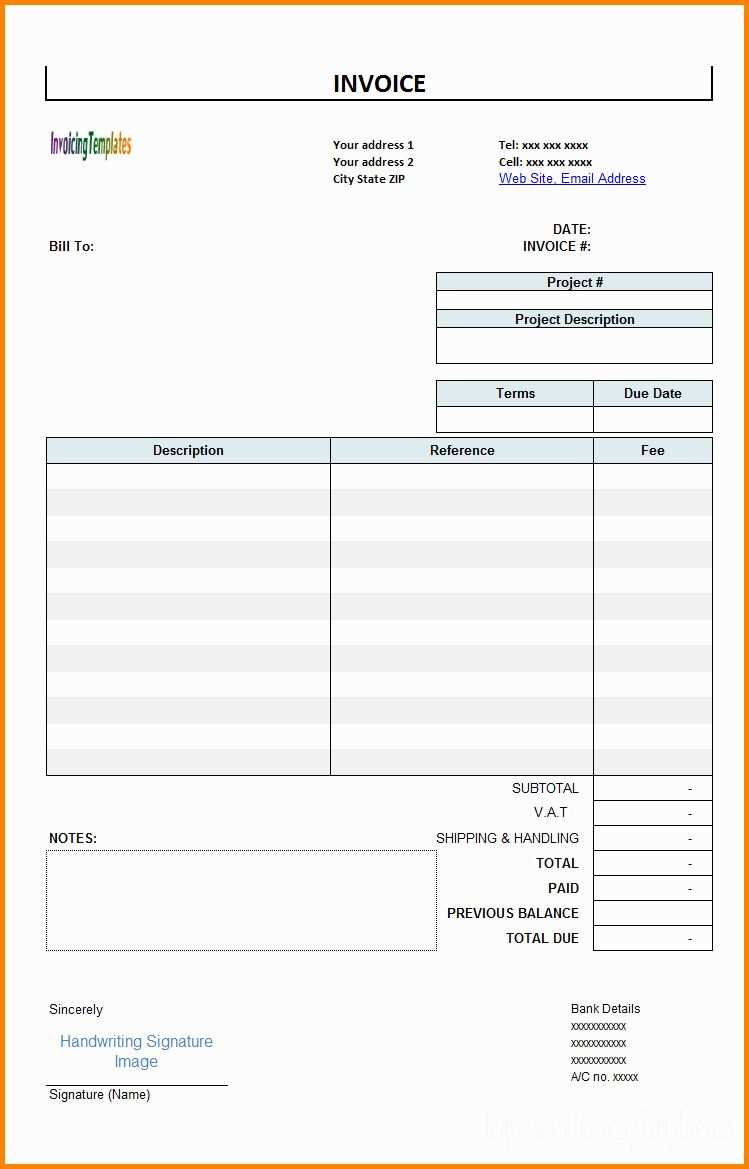

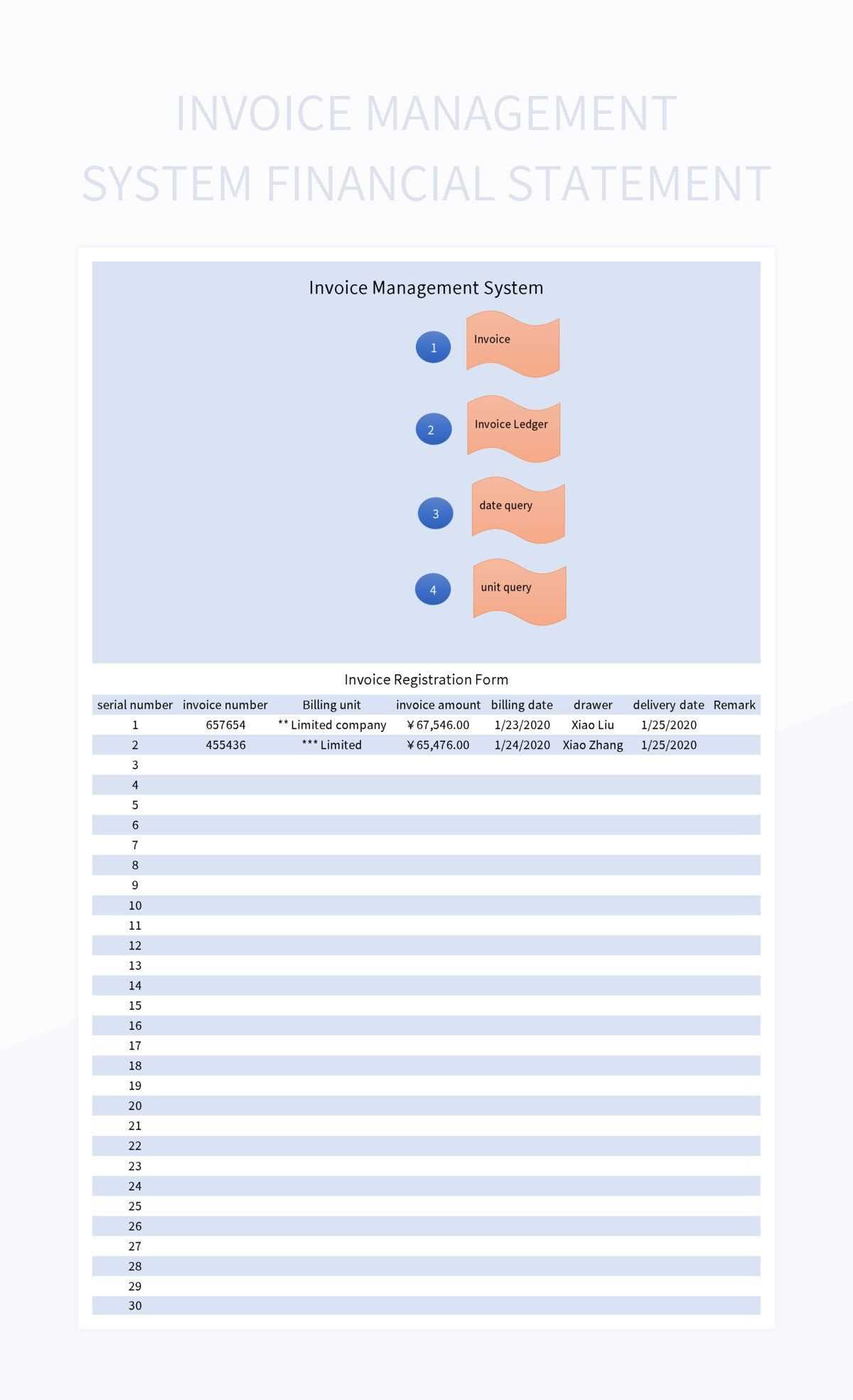

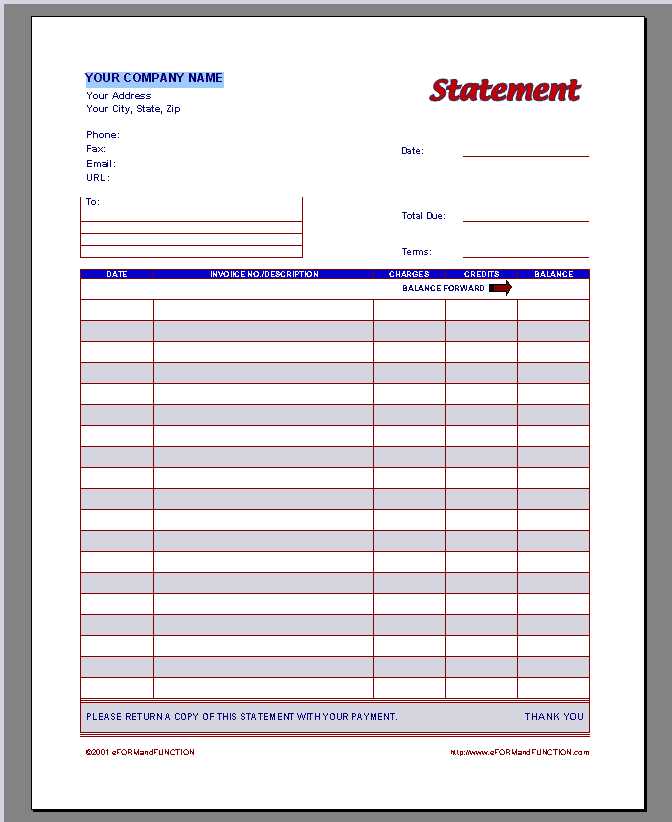

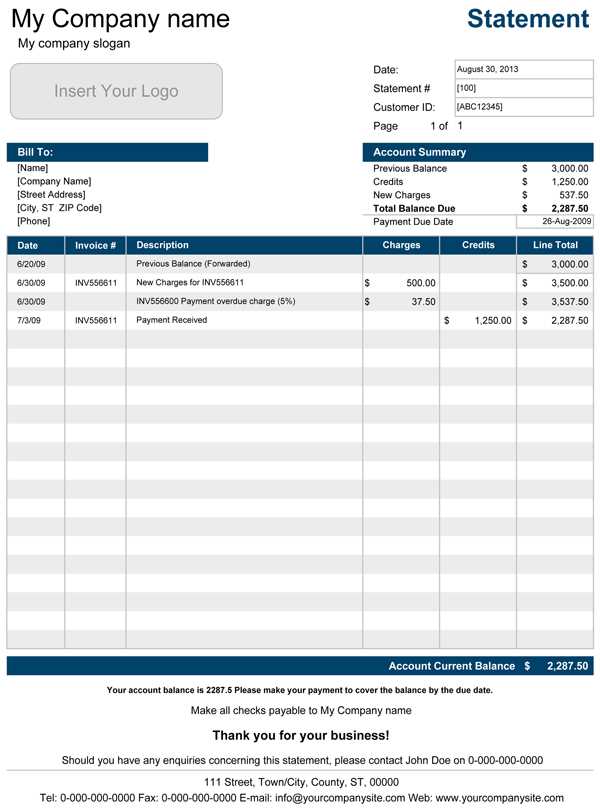

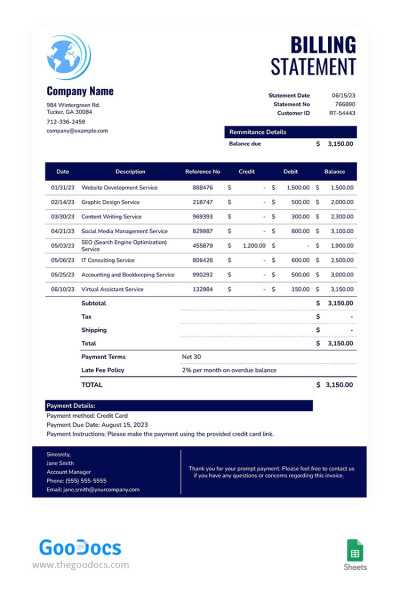

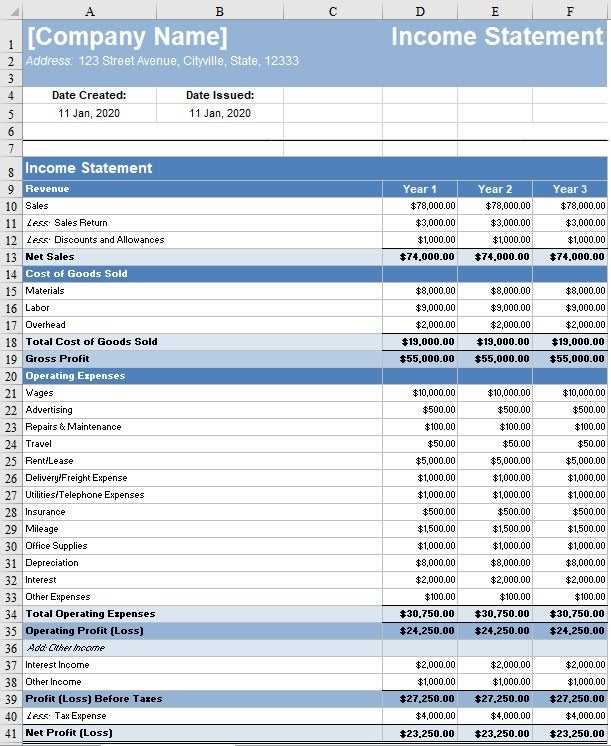

In any business, managing payments and tracking financial transactions is essential. One of the most effective ways to keep things organized is by using a pre-designed document that outlines the details of services provided, payment amounts, and deadlines. These ready-to-use documents can be customized to fit various business needs, helping professionals maintain a consistent and efficient process for billing their clients or customers.

Key Features of a Payment Request Document

Such a document typically includes several important sections that ensure all necessary information is clearly communicated. Below are the key elements often found in these types of documents:

| Feature | Description |

|---|---|

| Client Details | Information about the customer, including their name, address, and contact details. |

| Services Rendered | A detailed list of products or services provided, including quantities and descriptions. |

| Payment Amount | The total amount due, broken down by individual items or services, as well as taxes and discounts. |

| Due Date | The date by which the payment must be made to avoid penalties or late fees. |

| Payment Instructions | Methods of payment accepted and specific details on how the transaction should be completed. |

Why Use a Structured Payment Request Document

By utilizing a pre-designed document, businesses can simplify their financial workflow, reduce human error, and ensure that all clients receive consistent, professional communication regarding their payments. These documents serve not only as a formal request for payment but also as a legal record that can be referred to if an

Benefits of Using Invoice Templates

Utilizing pre-designed documents for requesting payments offers numerous advantages that can simplify and streamline financial processes. By relying on standardized formats, businesses can avoid mistakes, save time, and maintain a professional image. These tools provide an efficient way to manage transactions, ensuring clarity and consistency in every communication with clients.

Time Efficiency and Consistency

One of the main advantages of using these pre-built formats is the time saved in creating each document. Instead of designing a new payment request from scratch, businesses can simply fill in the necessary details. This not only reduces the time spent on each task but also ensures that the document remains consistent across all clients and transactions.

Enhanced Professionalism and Accuracy

These documents are structured in a way that highlights all critical information clearly, ensuring that clients can easily understand the terms and amounts involved. The professional presentation helps build trust and credibility, which is crucial for maintaining long-term business relationships. Additionally, using such tools reduces the risk of errors, such as missing payment terms or incorrect amounts.

| Benefit | Description | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Saving | Quickly fill in details without needing to design each document from scratch. | ||||||||||||||||||||

| Consistency | Maintain a uniform format across all requests, reducing confusion for clients. | ||||||||||||||||||||

| Professional Appearance | Improve your business image with polished and well-structured documents. | ||||||||||||||||||||

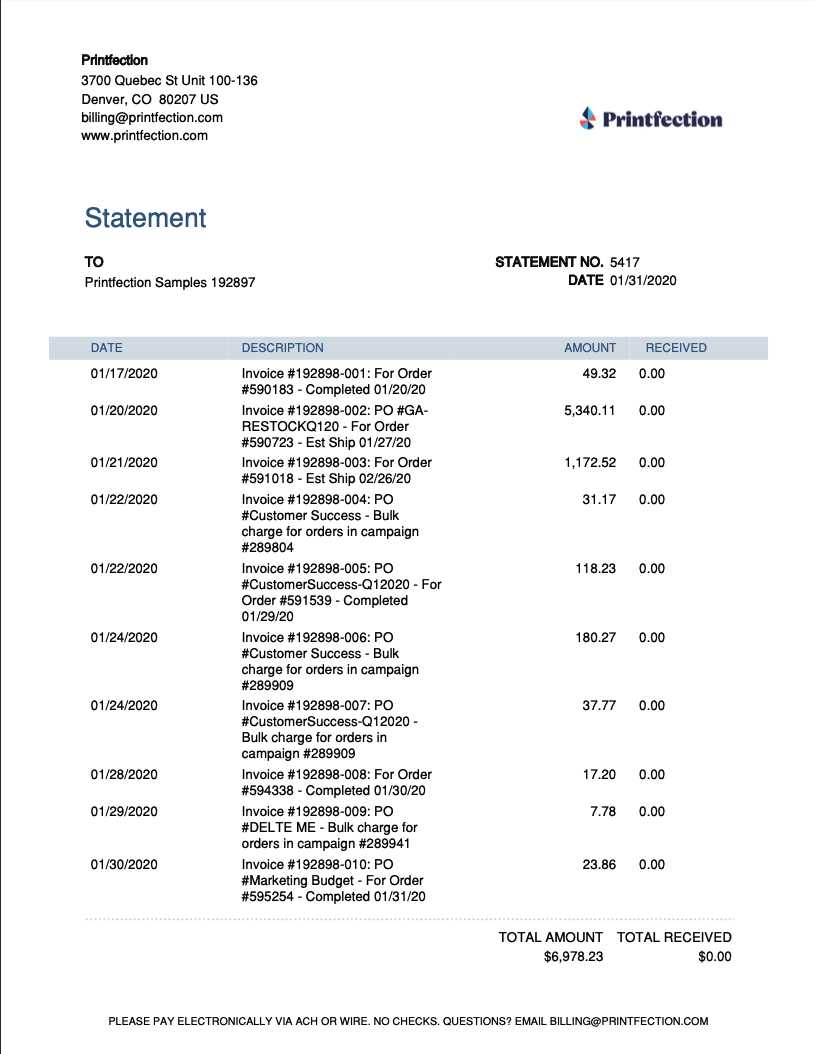

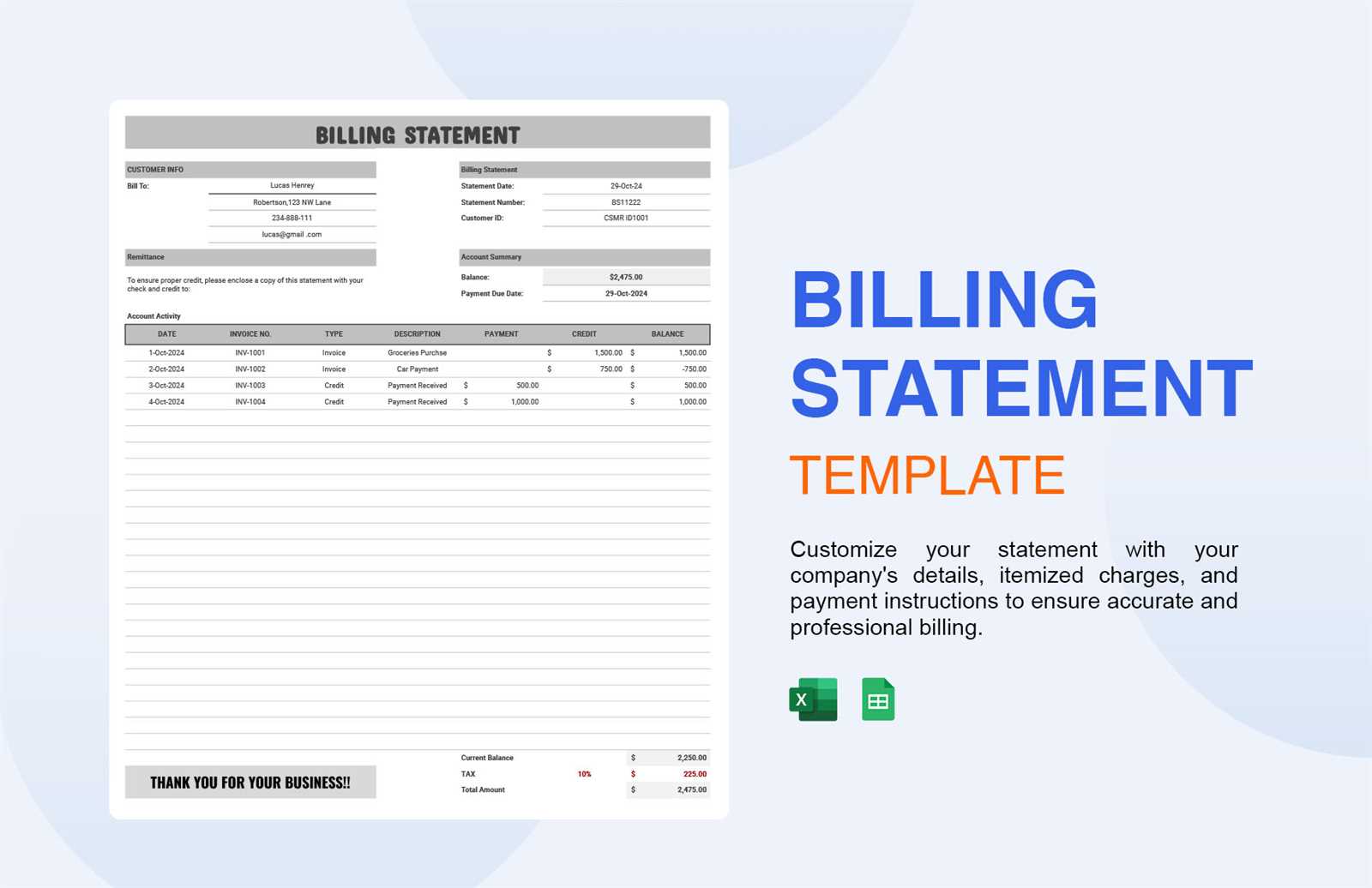

| Section | Details to Include | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Information | Customer name, address, and contact details. | ||||||||||||

| Product/Service Description | Details of the products or services delivered, including quantities, unit prices, and descriptions. | ||||||||||||

| Payment Amount | The total amount due, including any applicable taxes or discounts. | ||||||||||||

| Payment Terms | The

Essential Elements of an Invoice Statement

When creating a document to request payment for services or goods, it is important to ensure it contains all the necessary details for clarity and smooth processing. The structure of this document plays a crucial role in maintaining professionalism and minimizing confusion. Key components should be included to make sure that both the issuer and recipient can easily understand the financial transaction being outlined. Here are the most important aspects to consider when crafting such a document:

By including these core components, the document will serve as a comprehensive, clear, and professional request for payment, helping to avoid misunderstandings and ensuring timely processing. Choosing the Right Invoice Template for Your BusinessSelecting the right document format to request payment is crucial for streamlining financial operations and ensuring a smooth relationship with clients. The right choice can reflect your professionalism, enhance communication, and simplify the accounting process. It is important to consider various factors such as the nature of your business, the type of transactions, and the preferences of your clients when choosing the most suitable option. Here are a few key factors to consider when selecting the most effective format for your business needs:

|