Complete Guide to Using Invoice Landscape Template for Professional Billing

In today’s business world, having a well-structured document for financial transactions is crucial for maintaining professionalism and clarity. A visually appealing layout not only ensures that the details are easy to follow but also adds a level of credibility to your services. Whether you are a freelancer, a small business owner, or a large enterprise, the way you present payment information can leave a lasting impression on clients.

Optimizing your billing format is essential to streamline the process, reduce errors, and enhance communication. A clean, organized approach helps both you and your clients quickly understand the financial details without unnecessary confusion. By focusing on clear structure, intuitive design, and relevant content, businesses can improve their financial transactions and strengthen their brand identity.

With the right approach, you can design a document that suits your specific needs, regardless of industry. From straightforward formats to more creative layouts, there are many options to explore. This guide will walk you through the key components and benefits of creating an effective billing format that works for you and your clients.

Invoice Landscape Template Overview

When it comes to designing billing documents, choosing the right format is crucial for clarity and efficiency. A well-designed layout can make the payment process smoother for both the business and the client. The horizontal orientation offers a wider space for organizing essential details, making it easier to present information in a structured, clear manner.

This type of format allows for more flexibility in terms of design elements and the arrangement of content. With more room available, you can include everything necessary–from itemized lists to payment terms–without overcrowding the page. The result is a document that looks professional and communicates all the relevant information effectively.

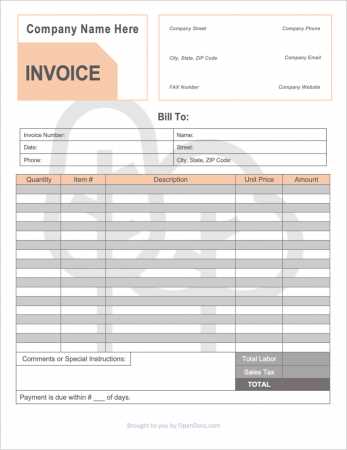

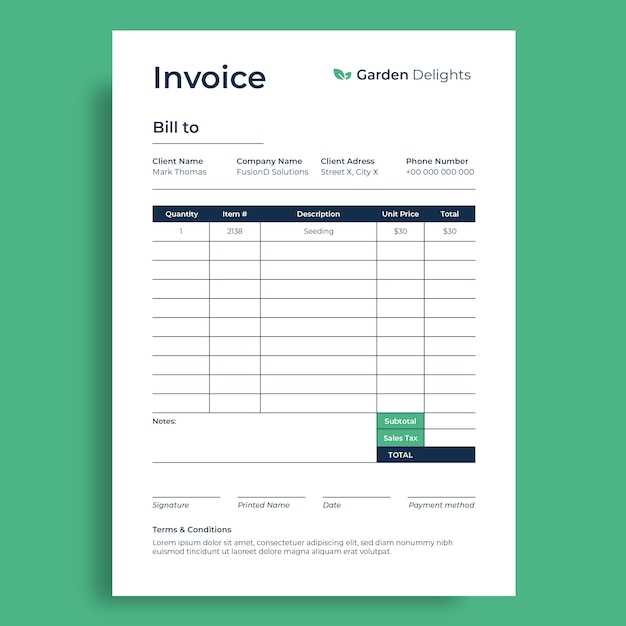

Below is an example of how the key components are typically arranged in this format:

| Section | Description |

|---|---|

| Header | Includes the company logo, contact details, and document title. |

| Client Information | Displays the client’s name, address, and contact information. |

| Itemized List | Shows products or services provided with pricing and quantities. |

| Payment Details | Specifies payment terms, due date, and accepted methods. |

| Footer | Contains additional notes, tax information, or legal disclaimers. |

This format provides a streamlined way to present all necessary details without overwhelming the reader, making it an ideal choice for professional and business communications.

Why Choose a Landscape Layout

Choosing the right page orientation for your financial documents is essential for improving readability and presentation. A horizontal format offers several advantages that can significantly enhance both the design and usability of your paperwork. By utilizing this layout, you can make your document more accessible and organized, improving the overall client experience.

Here are some key reasons why the horizontal layout is often preferred:

- Increased Space for Information: The wider format allows more room for itemized lists, additional notes, and payment details without feeling cramped.

- Better Organization: A horizontal arrangement helps to clearly separate sections and makes it easier to align columns, creating a cleaner look.

- Professional Appearance: The design appears more polished and can help your business stand out with its well-organized, easy-to-read structure.

- Enhanced Flexibility: This layout accommodates various fonts, logos, and other branding elements, making it easier to incorporate unique features.

Overall, this orientation can improve both the efficiency of document creation and the clarity of communication between businesses and clients. By utilizing a wider format, companies can ensure that their financial paperwork meets both functional and aesthetic standards.

Benefits of Using Invoice Templates

Utilizing pre-designed formats for financial documentation offers numerous advantages that can simplify the billing process and improve overall efficiency. By relying on a ready-made structure, businesses can save valuable time, reduce errors, and ensure consistency in their communications. These formats are especially useful for maintaining professionalism and accuracy in all transactions.

Some key benefits include:

- Time Efficiency: With a structured format, you can quickly create professional documents without needing to start from scratch every time.

- Consistency: Using a standardized design ensures that all documents have a uniform look and feel, reinforcing your brand identity.

- Minimized Errors: By following a proven layout, you can reduce the likelihood of missing important details, such as payment terms or client information.

- Customization: Pre-designed formats can often be easily adjusted to fit your specific needs, allowing you to add personal touches or branding elements.

- Professionalism: A polished and well-organized design enhances your business’s image, showing clients that you are serious and reliable.

Overall, using pre-structured formats makes managing your financial communications more efficient and professional, freeing up time for other important business activities.

Key Features of Landscape Invoice Design

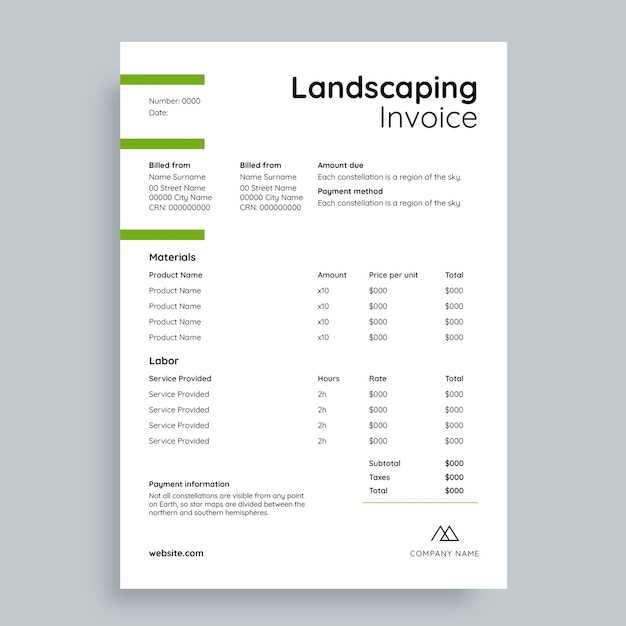

When designing a financial document, the layout plays a significant role in enhancing both its functionality and appearance. The horizontal orientation offers several advantages, providing ample space to organize key information in a way that is both user-friendly and visually appealing. Key features of this design ensure that all the necessary details are easy to read and understand, helping businesses communicate effectively with clients.

Some important characteristics of this layout include:

- Wide Content Space: The broader format allows for clearer separation of sections, such as client details, itemized lists, and payment terms, making the document easier to read.

- Improved Itemization: The horizontal layout provides more room for displaying multiple items or services, ensuring that each entry has sufficient space for descriptions and prices.

- Better Visual Alignment: With more horizontal space, it is easier to align elements such as numbers, text, and logos, giving the document a professional, organized look.

- Clear Section Division: The format allows for effective use of columns and rows, clearly distinguishing each part of the document, which enhances overall readability.

- Enhanced Branding Opportunities: The extra space enables the inclusion of logos, color schemes, and other brand elements, creating a cohesive and personalized design.

By utilizing these features, businesses can create a well-structured document that not only conveys the necessary details but also presents them in an easy-to-understand, visually appealing manner.

How to Customize Your Invoice Template

Customizing your financial document allows you to tailor it to your specific needs and brand identity. By adjusting the design, layout, and content, you can create a professional appearance that aligns with your business’s style and enhances client communication. This flexibility ensures that your documents are both functional and reflective of your company’s image.

Here are some key steps to customize your document:

- Choose the Right Layout: Select a format that best suits the type of information you need to include, ensuring that everything is organized and easy to read.

- Incorporate Your Branding: Add your company logo, colors, and fonts to make the document uniquely yours and consistent with your other materials.

- Adjust the Content Structure: Depending on your business needs, rearrange sections like client details, payment terms, and itemized lists for better clarity and flow.

- Set Clear Payment Terms: Make sure payment instructions and due dates are prominent, so clients know exactly what is expected of them.

- Include Additional Information: Add space for any extra details, such as discounts, taxes, or notes, that might be important for your specific transaction.

- Ensure Compatibility: Make sure your customized design works across different devices and platforms, providing a seamless experience for both you and your clients.

By following these steps, you can create a fully customized document that not only meets your practical needs but also strengthens your business’s professional image.

Free Invoice Templates vs Paid Versions

When it comes to creating financial documents, businesses often face the decision of whether to use free or paid formats. Each option has its own set of advantages and limitations. While free options may be more accessible, paid versions typically offer advanced features and customization. Understanding the key differences between these choices can help you make the best decision based on your needs and budget.

Advantages of Free Formats

Free formats are widely available and easy to use, making them an appealing option for small businesses or freelancers just starting out. These designs provide basic functionality and can be downloaded or used directly from online platforms without incurring any costs.

Advantages of Paid Versions

Paid options, on the other hand, offer a higher level of customization, professional design, and additional features. These formats are often more polished and come with customer support, updates, and advanced features that help businesses streamline their financial processes.

| Feature | Free Versions | Paid Versions |

|---|---|---|

| Customization Options | Limited | Extensive |

| Design Quality | Basic | Professional |

| Customer Support | No Support | Available Support |

| Advanced Features | None | Available (e.g., tax calculations, automated reminders) |

| Cost | Free | Paid (Subscription or One-Time Fee) |

Ultimately, the choice between free and paid versions depends on your business’s specific needs. If you’re just starting and need a simple solution, a free option may suffice. However, as your business grows and your requirements become more complex, investing in a paid version can offer significant benefits in terms of design, functionality, and support.

Best Software for Creating Invoices

Creating professional and well-structured financial documents requires the right tools. There are a variety of software options available that can help streamline the process, offering both ease of use and advanced features. Whether you’re a freelancer, a small business owner, or part of a larger organization, the right program can make a significant difference in terms of efficiency and accuracy.

Here are some of the top software choices for designing and managing your financial paperwork:

- QuickBooks: A comprehensive accounting tool with built-in features for generating and customizing professional-looking documents. It offers templates, tracking options, and integrates with various payment systems.

- FreshBooks: Popular for its user-friendly interface and customizable designs, FreshBooks offers automated billing, time tracking, and expense management, making it ideal for freelancers and small businesses.

- Zoho Books: A great option for businesses looking for a complete accounting solution. Zoho Books allows users to create customized financial documents with features like multi-currency support and automated workflows.

- Wave: A free accounting platform that allows users to easily create and send professional-looking documents. It includes invoicing, payment tracking, and financial reporting features.

- Microsoft Word/Excel: While not specialized for accounting, both Word and Excel provide ample customization options for creating custom layouts. These tools are perfect for businesses that need a simple, no-fuss solution.

Choosing the right software depends on your specific business needs. For those requiring basic functionality, free platforms like Wave may be sufficient. For more robust features, QuickBooks or FreshBooks might be better suited, offering integrations and automation to save time and enhance accuracy.

Choosing the Right Font and Layout

When designing a financial document, the choice of font and layout plays a crucial role in ensuring clarity and readability. The right combination of typography and arrangement not only enhances the overall appearance but also makes it easier for clients to quickly grasp important details. A clean, professional layout paired with legible fonts helps communicate your message effectively and reinforces the credibility of your business.

Font Selection: Opting for the right typeface is essential for readability. A sans-serif font, such as Arial or Helvetica, is often recommended for its clean and modern look. These fonts are easy to read both on screen and in print. Avoid overly decorative or complex fonts that may distract from the document’s content. Additionally, using no more than two or three different fonts ensures that your document remains organized and visually appealing.

Layout Considerations: A clear and organized structure is key to presenting information in an accessible way. Divide the document into distinct sections such as client details, item descriptions, and payment instructions. Use whitespace effectively to avoid overcrowding and to create a clean flow. Aligning text and numbers into neatly organized columns helps ensure that all details are easy to find. Prioritize consistency by maintaining the same spacing and alignment throughout the entire document.

By carefully selecting fonts and maintaining a thoughtful layout, you can create a professional, easy-to-read document that strengthens your brand and makes a positive impression on clients.

Integrating Logo and Branding Elements

Incorporating your company’s logo and other branding elements into your financial documents is an important step in creating a cohesive and professional image. These elements help reinforce your brand’s identity and make your documents easily recognizable to clients. A well-integrated logo, color scheme, and font choices not only enhance the overall look but also communicate consistency and trustworthiness.

Logo Placement

Your logo should be prominently displayed to ensure it’s the first thing clients notice. The most common placement is at the top of the page, either centered or aligned to the left, depending on your overall design. Make sure the logo is high-resolution and properly scaled so that it remains clear and professional, even when printed or viewed on different devices.

Using Colors and Fonts

Incorporating your brand’s color palette can add visual appeal and reinforce your identity. Be mindful of color choices–while bold colors can draw attention, using too many can overwhelm the reader. Stick to a few key brand colors for headers, borders, and accents. Similarly, the fonts you choose should match your brand’s style. Opt for simple, clean fonts that complement your logo, ensuring that the text remains readable while maintaining a cohesive visual identity.

By thoughtfully integrating your logo and other branding elements, you not only enhance the aesthetic appeal of your documents but also establish a stronger, more professional presence with your clients.

Common Mistakes to Avoid with Invoices

Creating professional financial documents is essential for maintaining a smooth business operation. However, even small errors in these documents can lead to confusion, payment delays, or misunderstandings with clients. Being aware of common mistakes and taking steps to avoid them can help ensure that your paperwork is clear, accurate, and effective in managing your transactions.

Errors to Watch For

Some common pitfalls include missing details, inconsistent formatting, or unclear payment terms. These issues may not only affect the client’s experience but could also result in unnecessary delays or disputes. Here are a few examples:

| Mistake | Impact | How to Avoid |

|---|---|---|

| Missing Client Information | Delays in payment and potential confusion | Double-check contact details before finalizing the document |

| Unclear Payment Terms | Clients may not know when or how to pay | Clearly state the payment due date and accepted methods |

| Inconsistent Formatting | Unprofessional appearance and confusion for the client | Use consistent font styles, sizes, and alignment |

| Incorrect Calculation of Amounts | Potential disputes over payment amounts | Verify all numbers and calculations before sending |

| Lack of Legal Information | Legal issues or difficulties in case of disputes | Include all required tax details, terms, and conditions |

Best Practices to Ensure Accuracy

By following best practices, such as reviewing the document carefully before sending, using clear and consistent formats, and always including essential details, you can avoid these common mistakes. This not only ensures smooth transactions but also maintains professionalism and trust in your business operations.

How to Organize Invoice Information Effectively

Proper organization of financial documents is crucial for ensuring that all relevant details are easy to locate and understand. A well-structured layout not only makes the document more professional but also enhances the client’s experience, helping them process payments without confusion. By following a logical flow, you can ensure that each section is clear, concise, and easily accessible.

Here are some tips for effectively organizing the key information in your document:

- Prioritize Key Sections: Start with the most important information, such as your company’s details and the client’s information, at the top of the page. This ensures that both parties can quickly identify who is involved.

- Use Clear Headings and Subheadings: Break down the document into logical sections with clear headings like “Services Provided,” “Payment Terms,” and “Total Amount Due.” This helps the reader navigate the document with ease.

- Group Similar Information Together: Keep related items or services in the same section. For example, list all products or services provided under one heading, followed by a separate section for additional charges or discounts.

- Utilize Tables for Itemization: Use tables to clearly display itemized lists, prices, quantities, and totals. This makes the document look neat and prevents any important information from being overlooked.

- Provide a Summary: At the bottom of the document, include a concise summary of the total amount due, payment due date, and any relevant payment instructions. This ensures that all payment-related information is easy to find.

By organizing the document with these strategies, you create a more professional and user-friendly experience for your clients, helping ensure time

Tips for Ensuring Invoice Clarity

Clarity in financial documents is essential to avoid misunderstandings and ensure that clients can quickly process their payments. A well-organized and clearly written document helps prevent confusion, reduces the risk of errors, and streamlines the payment process. By following a few simple guidelines, you can make sure that all the necessary information is easy to read and understand.

Here are some practical tips to enhance clarity in your financial documents:

- Use Simple, Direct Language: Avoid jargon or overly complex terms. Keep the wording clear and to the point so clients can easily understand what is being charged and why.

- Be Specific with Dates: Clearly state payment due dates and the date the document was issued. This helps avoid any confusion regarding when payment is expected.

- List Charges with Details: Break down the charges in a simple, easy-to-understand format. Include descriptions, quantities, and prices for each item or service provided.

- Highlight Important Information: Use bold text or different font sizes to make key details like the total amount due or payment instructions stand out.

Additionally, here’s a table of common mistakes to avoid when creating your financial documents:

| Common Mistake | Impact | How to Avoid |

|---|---|---|

| Unclear Payment Instructions | Confusion over how and when to pay | Clearly state accepted payment methods and due dates |

| Missing Item Descriptions | Uncertainty about the charges | Include clear, detailed descriptions for each charge |

| Unorganized Layout | Difficulty finding important details | Use clear headings, sections, and tables to organize content |

| Ambiguous Terms | Potential disputes | Clearly define any terms, such as discounts or taxes |

By focusing on clear language, detailed descriptions, and a well-structured layout, you can avoid misunderstandings and make the payment process more efficient for both you and your clients.

How to Add Tax and Payment Details

Including accurate tax information and clear payment details is crucial to avoid confusion and ensure smooth financial transactions. Tax amounts should be specified according to local regulations, and payment instructions should be clear and easy to follow. Properly presenting these details not only helps your clients but also ensures compliance with financial practices.

Adding Tax Information

When adding tax information to your document, it’s important to be precise. This can include sales tax, value-added tax (VAT), or other relevant charges, depending on your region and the nature of the transaction. Always specify the tax rate and calculate the exact amount being added to the total. For clarity, display the tax as a separate line item with its own description, such as “Sales Tax” or “VAT.” This way, your client can easily identify the amount being charged and understand how it was calculated.

Including Payment Instructions

Providing clear payment instructions is essential to ensuring timely payments. Be specific about the due date, acceptable payment methods, and any late payment fees or discounts for early payment. Common payment methods include bank transfers, credit card payments, or online platforms like PayPal. If you’re offering multiple options, make sure each is clearly listed, and provide any necessary details, such as account numbers or online payment links. Additionally, if applicable, mention any payment terms, such as whether a deposit is required upfront or if payment is due in full upon receipt.

By properly adding tax and payment details, you create a transparent and professional document that fosters trust and reduces the likelihood of misunderstandings.

Responsive Design for Different Devices

In today’s digital world, it’s essential that your financial documents are optimized for various devices. Whether your clients are viewing your documents on a desktop, tablet, or mobile phone, ensuring that your design adapts to different screen sizes enhances readability and user experience. A responsive design ensures that all elements of your document–such as text, images, and tables–remain clear and properly aligned across all platforms.

To achieve responsiveness, consider the following tips:

- Flexible Layout: Use fluid grids that adjust to different screen sizes. This allows the content to scale accordingly, ensuring that the document looks professional on any device.

- Mobile-Friendly Fonts: Choose fonts that remain legible on smaller screens. Avoid overly small font sizes and use scalable text that doesn’t compromise readability when zoomed in.

- Optimized Images: Images and logos should be resized or replaced with smaller versions for mobile devices to avoid slow loading times or misalignment.

- Test Across Devices: Always preview your design on various devices to ensure that it maintains a clean and functional appearance on all screen sizes.

By adopting a responsive design, you ensure that your financial documents look great on any device, improving client interaction and professionalism. A well-optimized document helps foster trust and makes it easier for clients to engage with the content, no matter where they are or what device they’re using.

Invoice Templates for Different Industries

Every industry has unique needs when it comes to structuring financial documents. Whether you’re working in construction, consulting, retail, or any other field, customizing your financial documents to fit the requirements of your business sector can help streamline processes and enhance professionalism. Tailoring these documents ensures that all necessary details are clearly communicated and understood by clients, reducing errors and confusion.

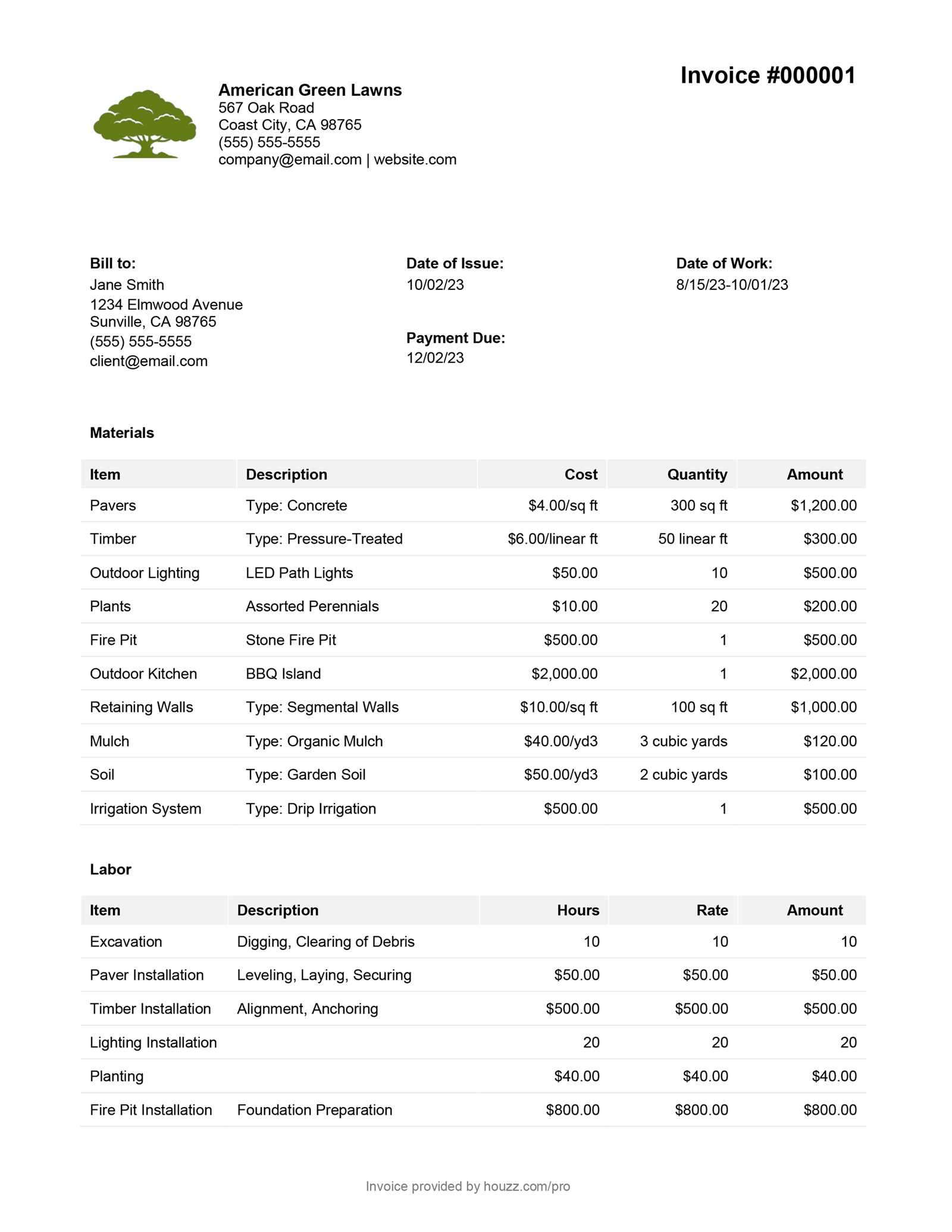

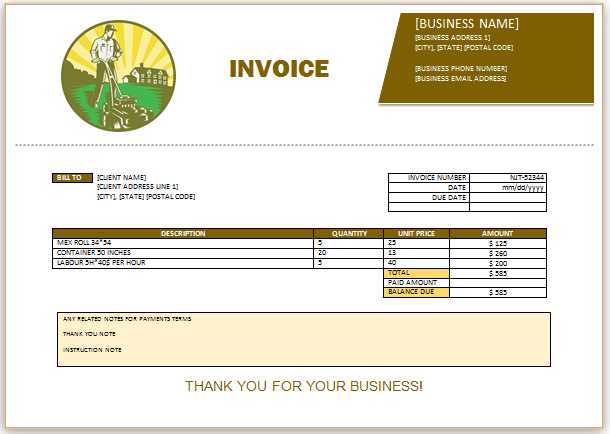

Templates for Service-Based Industries

Service-based businesses, such as consulting, design, and marketing firms, typically need to include detailed descriptions of the services provided. These documents often break down hours worked, project milestones, or consulting fees, so clarity is key. The format should be straightforward, allowing for a detailed list of services with corresponding rates. Additionally, payment terms and due dates should be clearly stated to ensure smooth transactions.

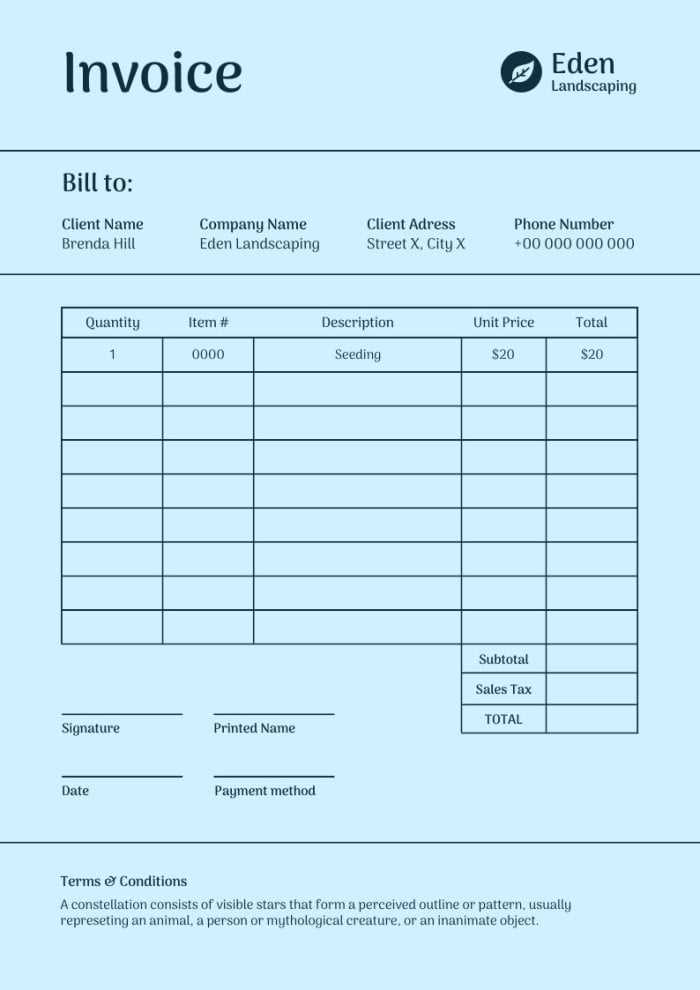

Templates for Product-Based Industries

In product-based industries, such as retail or manufacturing, the document usually needs to itemize products sold, quantities, unit prices, and any applicable discounts. These documents often include shipping or handling fees, as well as any applicable taxes. To ensure accuracy, clear tables and itemized lists are essential for clients to quickly review what they are being charged for, ensuring transparency and reducing the chance of disputes.

By customizing your financial documents to the specific needs of your industry, you create a more efficient, professional, and user-friendly experience for both your business and your clients.

How to Save and Export Your Template

Once you’ve designed your financial document, it’s important to save and export it in a way that allows for easy reuse and distribution. By saving the document in the right format, you ensure that it can be accessed, modified, and shared without any issues. Different file formats provide different advantages, so understanding how to save and export your design effectively will help you maintain flexibility and professionalism.

Choosing the Right File Format

The most commonly used file formats for financial documents include PDF, Excel, and Word. Each format serves a specific purpose:

- PDF: A PDF is ideal for sharing finalized documents that you don’t want to be edited. It preserves the layout and formatting across devices, ensuring the document looks the same for everyone.

- Excel: If you need to make calculations or track data over time, Excel is a great choice. It allows you to manipulate numbers easily and use formulas, while also being compatible with other spreadsheet software.

- Word: Word files are useful for editable documents where text changes may be frequent. They offer flexibility for ongoing revisions, though formatting can shift depending on the device used.

Saving and Exporting Steps

To save your document, simply go to the “File” menu in your chosen design or editing software and select “Save As.” From there, you can choose the location and format in which you want to save your file. Once saved, exporting it is just as simple. In most software programs, the “Export” option is found under the “File” menu, allowing you to choose the format that best suits your needs, whether for digital distribution or printing.

By following these steps, you can ensure that your financial documents are stored securely, ready for sharing or editing as needed, without compromising on quality or accessibility.

Legal Considerations in Invoice Design

When creating financial documents for your business, it’s essential to ensure they comply with relevant legal requirements. Properly structuring your document not only makes it easier for clients to understand but also ensures that it meets the standards set by local laws and regulations. Legal compliance in financial documents helps protect both your business and your clients, minimizing the risk of disputes and legal issues.

Here are some key legal considerations to keep in mind when designing your document:

- Required Information: Depending on your location, certain information must be included in the document, such as your business name, address, contact details, and tax identification number. Ensure that these elements are clearly visible and easy to find.

- Payment Terms: Clearly state the payment terms, including the due date and any late fees or penalties for overdue payments. This helps set expectations and provides a legal basis for taking action if payments are not made on time.

- Taxes and Charges: Make sure all applicable taxes, such as sales tax or VAT, are accurately calculated and clearly indicated. Failure to properly itemize taxes can lead to compliance issues or disputes with clients or tax authorities.

- Clear Itemization: When listing products or services, provide clear descriptions and itemized prices. This transparency helps avoid misunderstandings and ensures that clients are fully aware of what they are being charged for.

- Disclaimers: Include any necessary disclaimers regarding returns, refunds, or service agreements. This can help protect your business in the event of a dispute or disagreement over the terms of the transaction.

By adhering to these legal guidelines, you not only ensure that your financial documents are legally sound but also foster trust and transparency with your clients.

Best Practices for Invoice Design Updates

Regularly updating your financial documents ensures that they remain professional, accurate, and aligned with your business goals. As your business evolves, it’s essential to adapt your designs to reflect any changes in branding, tax regulations, or business practices. Regular updates not only help maintain a modern and consistent appearance but also contribute to a more efficient workflow and smoother client interactions.

1. Keep It Consistent with Branding

Whenever you update your design, make sure that it aligns with your brand identity. Use consistent colors, fonts, and logos that reflect your company’s style. A strong brand presence in your financial documents reinforces professionalism and trust, helping clients recognize your business at a glance. Remember, any design updates should be applied consistently across all communication materials to maintain coherence in your brand image.

2. Ensure Accuracy with Legal and Tax Information

As tax regulations and legal requirements change, it’s important to adjust your documents accordingly. Always ensure that the necessary legal information–such as tax identification numbers, payment terms, and required disclaimers–are up to date. This will help protect your business from potential legal issues and ensure that your clients receive the correct information, reducing the risk of misunderstandings.

By adopting these best practices, you not only keep your financial documents relevant but also demonstrate attention to detail and a commitment to maintaining strong business relationships. Regular design updates ensure that your documents are effective, visually appealing, and legally compliant.