Windshield Repair Invoice Template for Efficient Billing and Professional Service

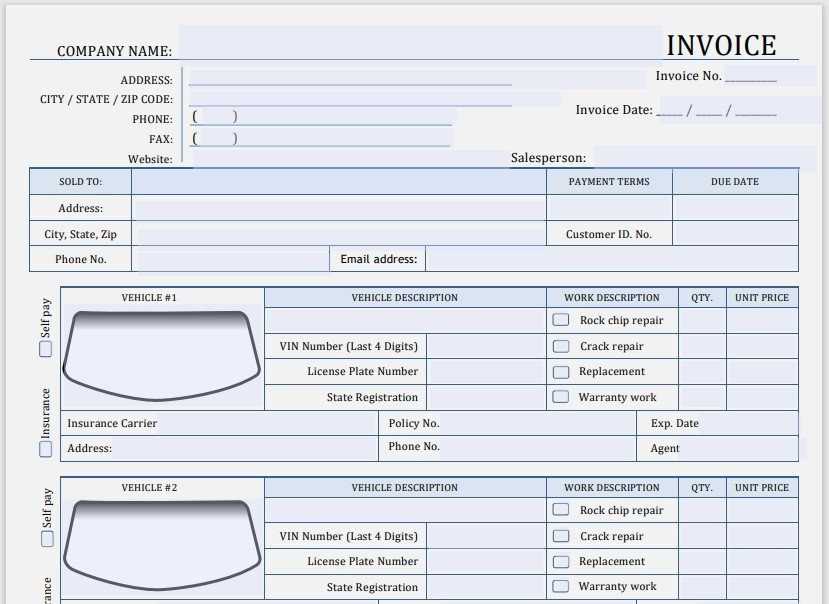

Running a business that provides vehicle glass restoration and maintenance requires not only skilled technicians but also efficient administrative processes. One of the most crucial aspects of maintaining professionalism and ensuring smooth operations is having a streamlined system for documenting and charging for services rendered. Proper documentation ensures clarity, minimizes errors, and helps both the service provider and the customer stay on the same page regarding costs and expectations.

For businesses offering vehicle glass services, creating a clear, consistent, and professional record of each transaction is essential. The right tool can simplify the billing process, save time, and reduce the risk of mistakes that could lead to confusion or disputes. Whether you’re a small shop or part of a larger network, using a standardized method for generating payment requests is a smart way to maintain a high level of customer service while also keeping your financial records organized.

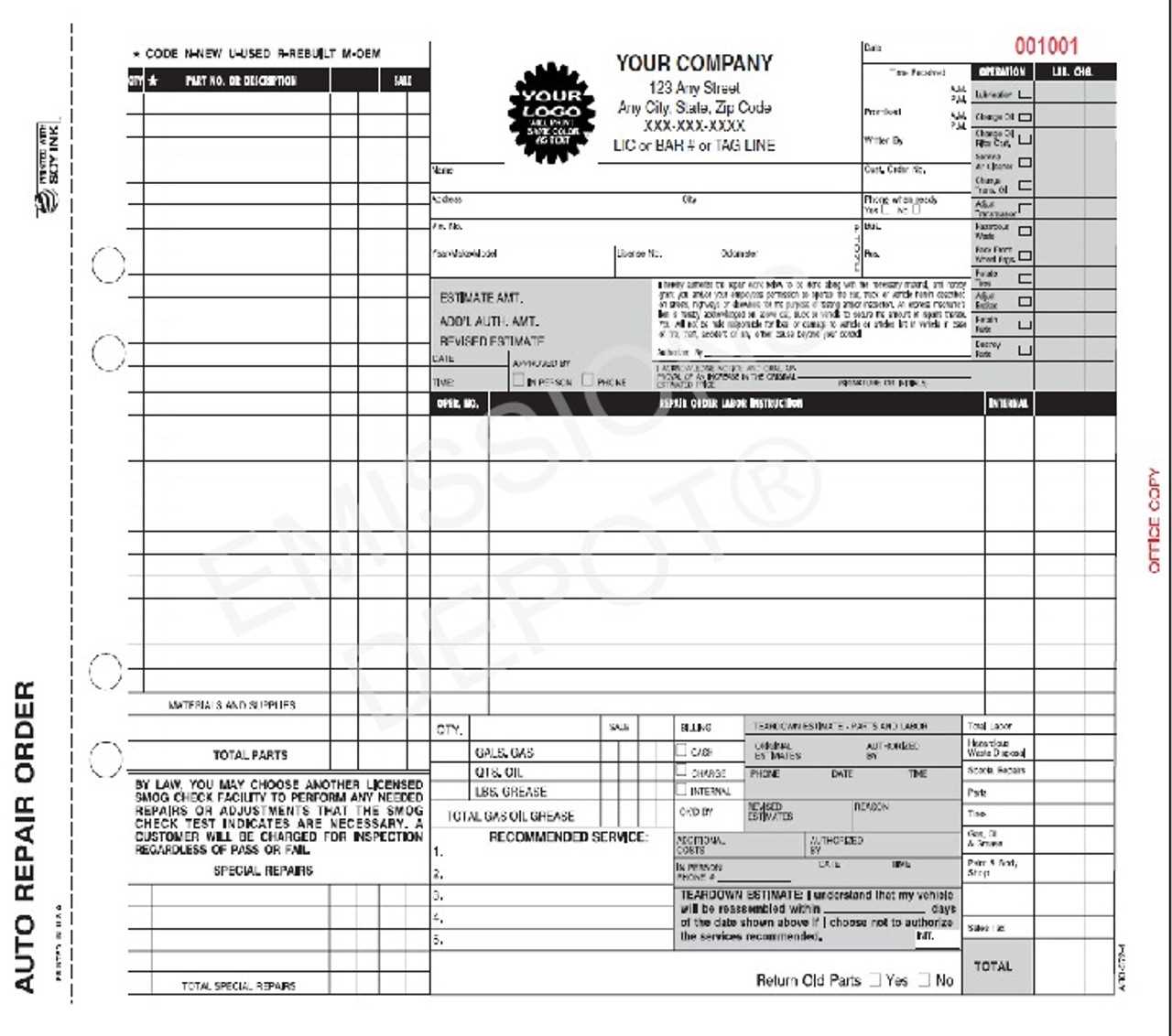

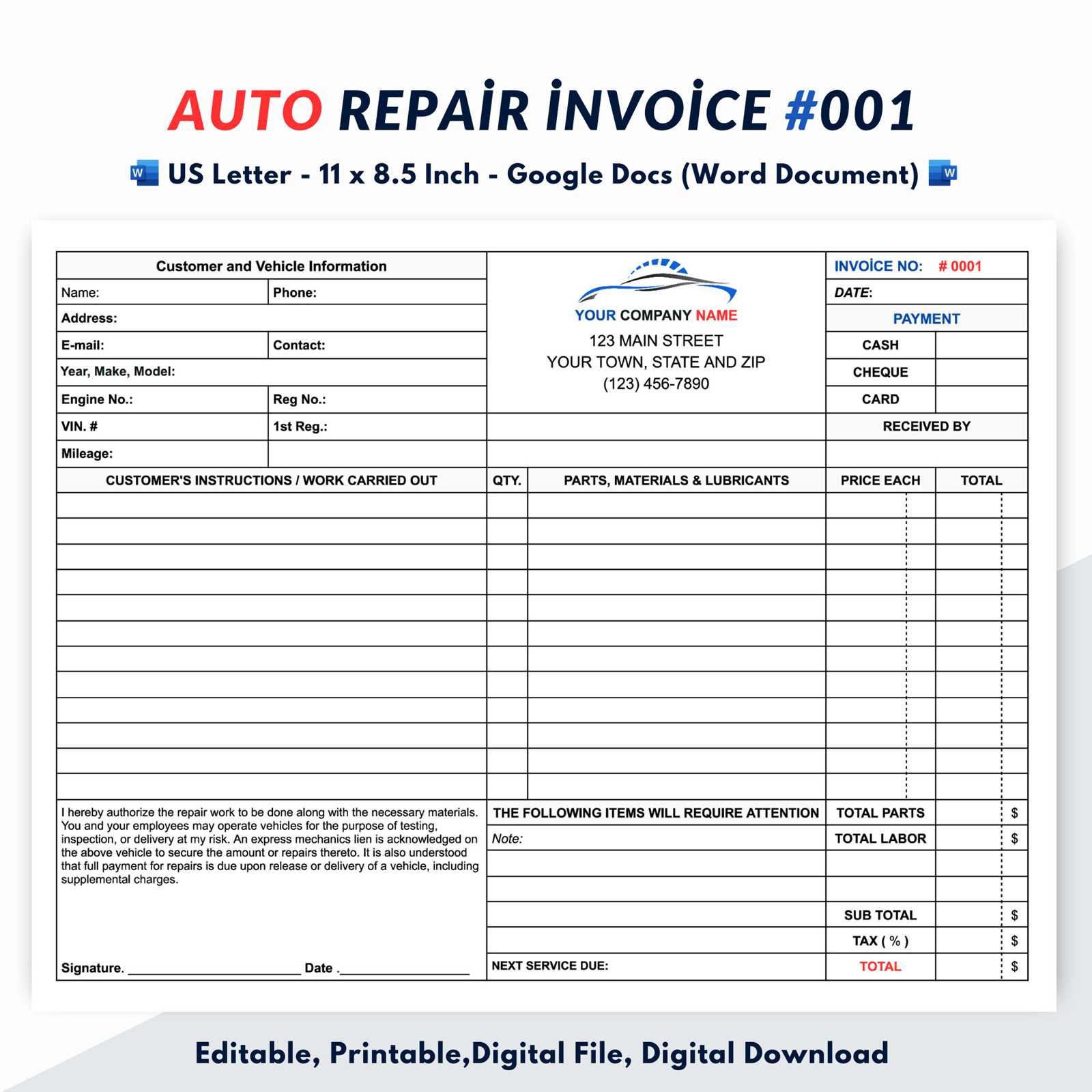

Customizable solutions designed for auto service businesses allow for flexibility in adapting to specific needs. These systems often include sections for detailing materials, labor, and service hours, offering a comprehensive summary of the work completed. This makes it easier for customers to understand what they’re being charged for and why, which in turn can improve trust and satisfaction. Additionally, it facilitates timely payments and smoother business operations.

Why Use a Billing Document for Auto Glass Services

For businesses providing vehicle glass services, having a standardized method for documenting each transaction is essential. A well-organized billing document helps ensure that both the service provider and the customer understand the costs involved, reducing the likelihood of disputes and promoting clear communication. By using a pre-designed system, businesses can save time, maintain accuracy, and improve their professionalism in every transaction.

Time-Saving and Efficiency

Creating a consistent and ready-to-use system significantly reduces the time spent on drafting payment requests. Instead of manually writing out each charge and detail, a pre-built solution allows businesses to quickly fill in the relevant information, ensuring faster processing and fewer errors. This efficiency frees up time for other important tasks, such as customer service and growing the business.

Improved Professionalism and Transparency

Using a formalized document adds a layer of professionalism that can build trust with customers. A detailed breakdown of services, parts used, and labor costs shows transparency and helps clients better understand the value of the work being done. When customers feel confident in the clarity of the transaction, they are more likely to return for future services and recommend the business to others.

Customizable systems also allow for flexibility, accommodating the unique needs of each business. With customizable sections for labor, materials, and other charges, these tools help ensure all aspects of the service are accounted for, promoting a smooth payment process and reducing the chance of misunderstandings.

Benefits of Using Billing Document Systems

Adopting a standardized approach for creating billing statements can offer significant advantages to businesses, particularly those in the vehicle glass service industry. Instead of drafting each payment request from scratch, a pre-designed system ensures consistency, accuracy, and efficiency, making the entire process smoother for both the service provider and the client. This streamlined method reduces errors, saves valuable time, and helps maintain a professional image.

Consistency and Accuracy

One of the key benefits of using a predefined system is the consistency it brings. By relying on a structured format, businesses can ensure that each transaction follows the same layout, with all the necessary details included. This reduces the risk of missing important information, such as labor hours, materials used, or specific costs, which can lead to confusion or disputes. Clients appreciate clear and accurate breakdowns of charges, enhancing their overall experience.

Time Efficiency and Professionalism

With a ready-to-use billing document, creating payment requests becomes a quicker and more efficient task. Rather than manually organizing each charge, the system allows for easy customization and quick input of details, which speeds up the billing process. Furthermore, presenting clients with well-organized, professional documents contributes to a positive perception of the business and reinforces its reliability.

Increased organization also helps businesses manage their finances better. These systems often integrate seamlessly with accounting software, allowing for easier tracking of outstanding payments and simplifying financial reporting. Ultimately, using a structured approach to billing contributes to better time management, smoother operations, and improved client satisfaction.

How to Customize Your Billing Document

Customizing a billing document allows businesses to tailor it to their specific needs and branding. By adjusting the layout, adding company details, and defining what information to include, you can create a document that reflects your services while ensuring clarity for the customer. Customization helps streamline the billing process and makes it easier to manage transactions more effectively.

Here are some key elements to consider when adjusting your billing document:

| Element | Customization Tips |

|---|---|

| Company Information | Include your business name, address, phone number, and email. This ensures your clients can easily reach you for questions or future services. |

| Customer Details | Personalize each document with the client’s name, contact details, and service address for more accurate communication. |

| Service Breakdown | Clearly outline the different aspects of the service, including labor, materials, and any additional fees. This ensures transparency and helps avoid confusion. |

| Payment Terms | Specify due dates, payment methods, and any late fees to set clear expectations for your customers. |

Design Elements such as logo placement, font style, and color scheme

Essential Information for Billing Statements

For any business providing vehicle glass services, ensuring that a billing statement includes all the necessary details is crucial for maintaining transparency and professionalism. A well-structured document not only helps clients understand what they are being charged for, but also protects the business by clearly outlining the agreed-upon costs and services. Including the right information ensures smooth transactions and fosters trust between the service provider and the customer.

Here are the key details that should always be included in each billing statement:

- Business and Client Information: Include the full name, address, and contact information for both your business and the client. This ensures easy communication and provides a record of who the transaction is between.

- Detailed Service Description: Break down the services provided with clear descriptions. Whether it’s labor, materials, or specific actions taken, providing clarity helps clients understand exactly what they are paying for.

- Dates: Include the date the service was performed and the date the payment is due. This helps avoid any confusion regarding timelines and payment expectations.

- Itemized Costs: List each service and product charge separately. This includes any parts used, labor hours, and any additional fees. Transparency in this section reduces the likelihood of disputes.

- Payment Terms: Clearly state the payment methods accepted, due date, and any penalties for late payments. This ensures that both parties are aware of the terms and avoid misunderstandings.

Accurate and comprehensive billing statements not only help maintain professionalism, but they also serve as an important financial record for both the business and the customer. By incorporating these essential details, you ensure that your clients have a clear understanding of the charges, and you protect your business from potential misunderstandings.

Choosing the Right Billing Document for Your Business

Selecting the right system for creating billing documents is an important decision that can streamline your workflow and enhance your professional image. The right solution should not only suit the specific needs of your business but also allow for easy customization, ensuring that you can provide clear, accurate, and consistent records for every client. A well-chosen billing format helps maintain efficiency and transparency while strengthening customer trust.

When choosing a system for your business, consider the following factors to ensure it aligns with your requirements:

| Factor | Considerations |

|---|---|

| Customization Options | Look for a system that allows easy modifications to include your company logo, contact details, and specific service categories. |

| Ease of Use | The system should be intuitive and simple to use, so your team can quickly generate professional documents without a steep learning curve. |

| Compatibility with Software | Ensure the system integrates smoothly with other tools you may use, such as accounting or scheduling software, to avoid manual data entry. |

| Payment Tracking Features | Choose a solution that allows you to track outstanding balances, payment dates, and payment methods directly within the document. |

| Design and Layout | Consider a professional design that reflects your business branding, making the document visually appealing and easy to read.

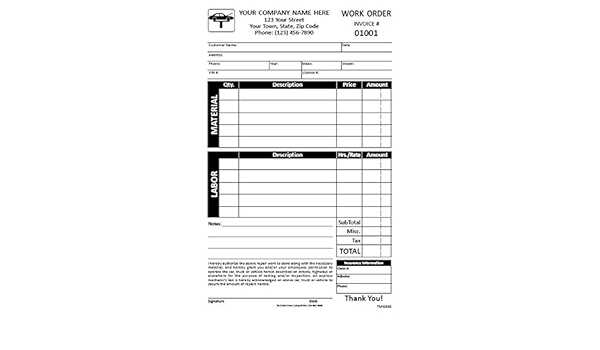

How to Add Labor and Material CostsIn any service-based business, accurately documenting both the labor and material costs is crucial for providing a transparent and fair billing statement. This ensures that the customer understands the breakdown of what they are being charged for, while also protecting your business by ensuring you’re compensated for all aspects of the work done. Including clear and precise details for both labor and materials helps build trust with clients and minimizes confusion about the final charges. When adding labor and material costs to a billing document, consider the following steps:

Clarity is key when detailing these charges. A well-organized breakdown not only ensures that the client sees the value of the service, but it also helps you track and justify costs effectively, ens Legal Requirements for Billing DocumentsWhen creating billing records for services rendered, businesses must adhere to certain legal standards to ensure compliance and avoid potential disputes. These legal requirements often vary by location and industry, but they generally serve to protect both the service provider and the customer. A properly constructed billing document not only ensures transparency but also provides necessary documentation for tax, warranty, and dispute resolution purposes. Key Legal Elements to IncludeTo ensure that your billing documents meet legal standards, it’s important to include specific information. Some of the most common requirements are:

Tax and Regulatory ComplianceDepending on the jurisdiction, businesses may also be required to include applicable tax information, such as sales tax or VAT. Ensuring that your billing statements comply with local tax laws not only helps avoid fines but also provides clear evidence of taxable transactions. In addition, certain industries may have extra regulatory requirements, so it’s vital to stay informed about any specific rules that a How to Track Payments and Due DatesKeeping track of payments and their respective due dates is essential for maintaining a healthy cash flow in any business. Without an efficient system for monitoring payments, it can become difficult to identify overdue accounts, follow up with clients, or ensure that no transactions are missed. A clear process helps both the business and the client stay organized, minimizing misunderstandings and ensuring that financial obligations are met on time. To effectively track payments and their due dates, here are some key strategies to implement:

Automated Tools can greatly simplify this process, allowing for real-time tracking and easy reporting. Many accounting and invoicing software options offer integrated systems that automatically update payment status and send reminders to both you and the client, reducing the administrative burden on your end. By staying on top of payment schedules and due dates, businesses can prevent late fees, improve cash flow, and create a more organized and professional experience for their clients. Implementing a simple but effective system for tracking payments ensures both parties fulfill their financial commitments in a timely Integrating Billing Documents with Accounting SoftwareIntegrating a structured billing document with accounting software can significantly streamline the financial management process for any business. By automating the flow of data between these systems, businesses can save time, reduce human error, and ensure accuracy in tracking financial transactions. This integration provides an efficient way to monitor payments, generate financial reports, and maintain organized records. Benefits of IntegrationConnecting billing records with accounting software offers several advantages, including:

How to Integrate Billing with Accounting SoftwareHere’s how you can integrate your billing documents with accounting tools:

Efficient data inte Streamlining Billing for Auto Service Shops

For auto service shops, simplifying the billing process is essential for improving efficiency, reducing errors, and maintaining smooth operations. A streamlined billing process not only saves time but also ensures that customers receive clear and accurate statements for the services they’ve received. Implementing an organized system can help the business stay on top of payments, track outstanding balances, and maintain a professional image. Key Strategies to Streamline BillingHere are several ways auto service shops can simplify their billing process:

Benefits of Streamlined Billing

By streamlining the billing process, auto service shops can benefit in several ways:

|