Simple and Professional Office Invoice Template for Your Business

In any business, managing financial transactions efficiently is crucial for maintaining smooth operations. One of the key aspects of this is creating clear and professional documents that detail the services or products provided and the amounts owed. These documents serve as both a record and a communication tool between businesses and clients.

Having a well-organized structure for these documents not only helps in maintaining professionalism but also ensures accurate tracking of payments and timely follow-ups. By using the right format, you can save time and reduce errors, making it easier to focus on growing your business.

Whether you’re just starting out or looking to improve your current processes, implementing a standardized system can make all the difference. It provides consistency, builds trust with clients, and supports better financial management across the board. Adopting an effective document format is an essential step towards creating a seamless billing workflow.

Understanding Office Invoice Templates

Every business needs a consistent way to communicate payment expectations to clients. A standardized document serves as a formal request for payment and provides a clear outline of services rendered, amounts due, and other important details. These documents ensure both parties are on the same page regarding the transaction and can help in maintaining financial clarity and professionalism.

The format of these documents may vary, but certain core elements remain constant. The use of a structured layout can enhance readability, helping clients quickly find important information. This approach not only speeds up the payment process but also reduces the chance of disputes or misunderstandings.

Key Components of a Payment Document

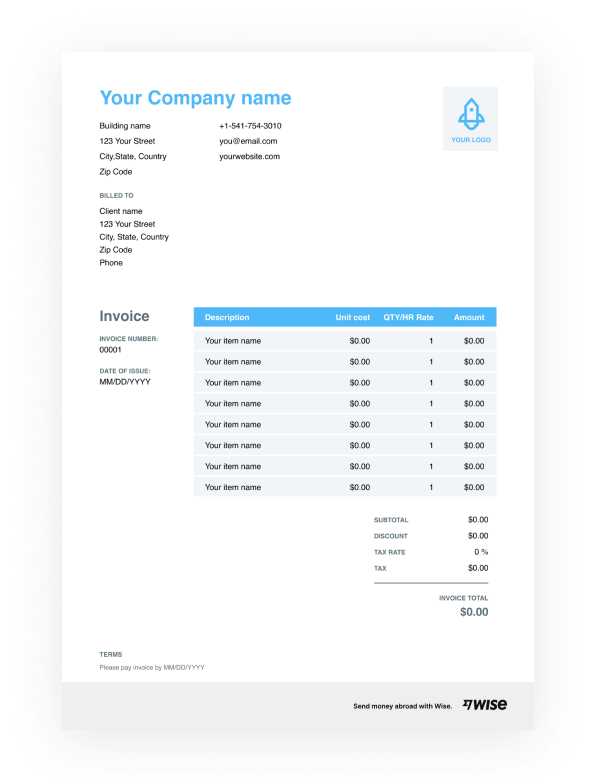

A well-designed document typically includes several essential parts, such as the business name, client details, a description of the products or services provided, and a clear breakdown of the total amount due. It should also include payment terms and deadlines to establish expectations and ensure timely settlements.

Customizing to Suit Your Needs

While there are many ready-made designs available, it’s important to tailor your document to fit the specific needs of your business. Adjusting elements like layout, color schemes, and terminology can help reinforce your brand identity and improve communication with clients.

Why Use an Office Invoice Template

Creating accurate and professional financial documents is essential for any business transaction. Using a pre-designed structure allows businesses to maintain consistency, reduce errors, and save time. By leveraging a ready-made layout, companies can ensure their documents are both clear and effective in communicating payment details to clients.

Here are several reasons why adopting a standardized document format is beneficial:

- Efficiency: Pre-designed formats streamline the process, allowing you to create payment requests quickly without having to start from scratch each time.

- Accuracy: A well-structured format reduces the likelihood of missing important details, such as payment terms or amounts owed.

- Professionalism: Using a polished, consistent design builds trust with clients and gives your business a more polished image.

- Time-saving: Having a reusable format eliminates the need for repeated formatting or layout adjustments for each new document.

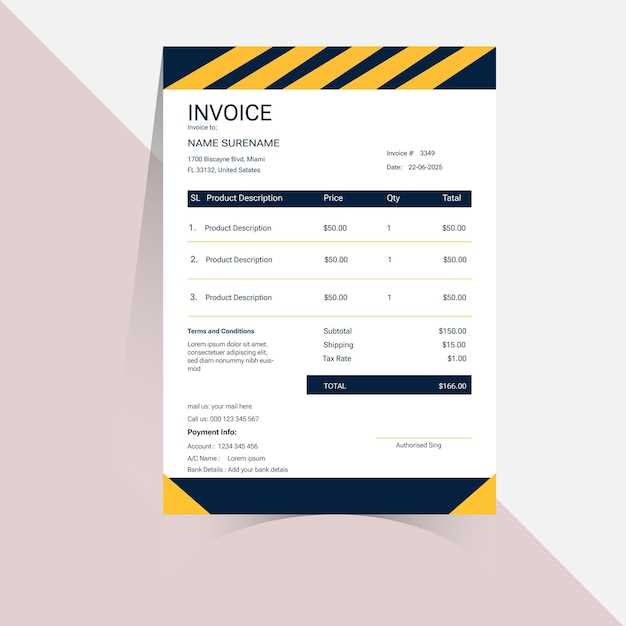

Consistency and Branding

Utilizing a consistent design for all client communications helps reinforce your brand identity. Customizing the layout to match your business colors, fonts, and logo creates a cohesive experience for clients and helps you stand out in a competitive market.

Legal and Tax Benefits

Clear, accurate documents also help in legal matters and during tax reporting. By ensuring that every detail is outlined properly and consistently, you reduce the risk of errors or misunderstandings when it comes to accounting or legal compliance.

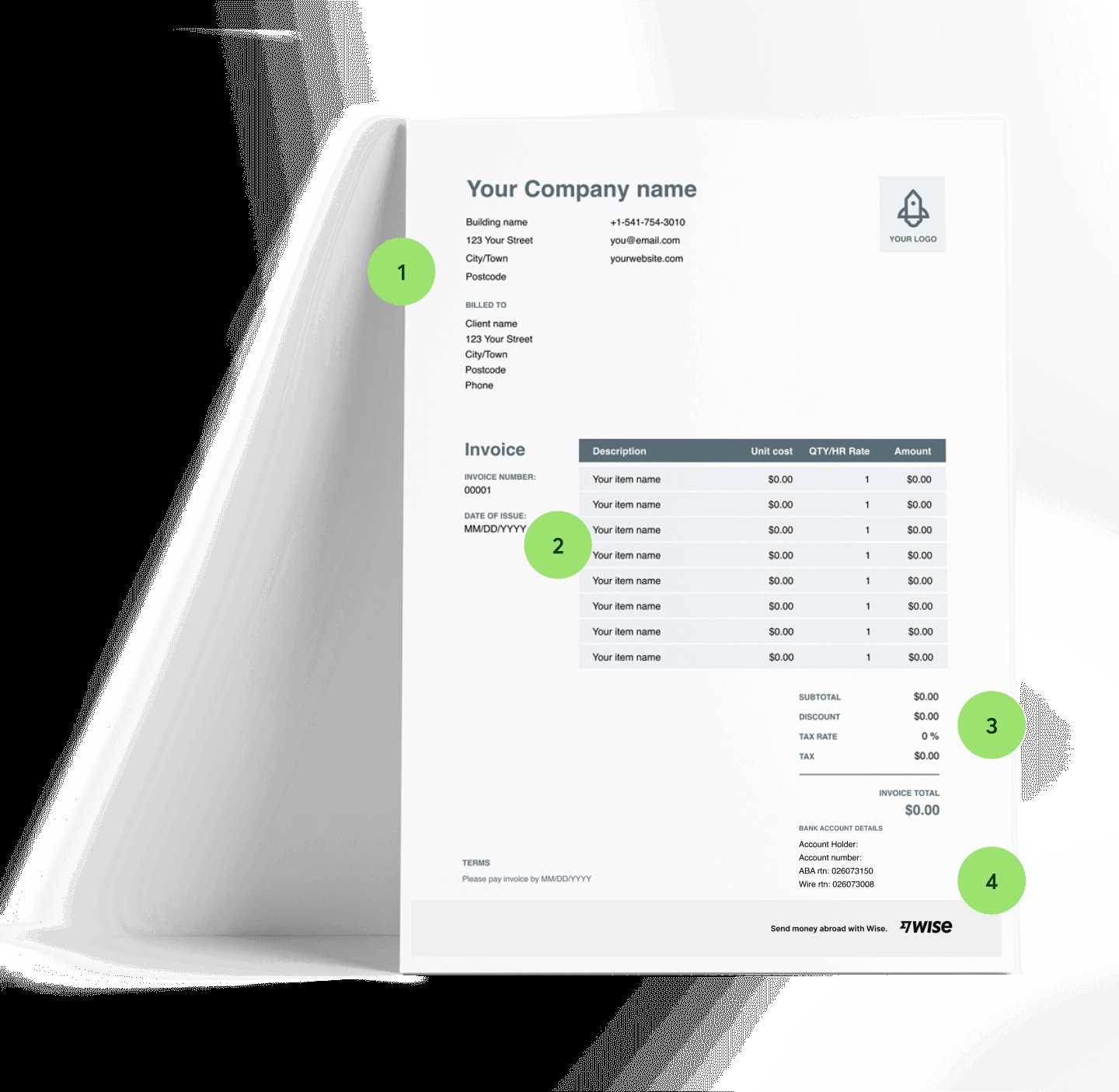

Key Elements of a Professional Invoice

For any business, clear communication with clients regarding payments is crucial. A professional financial document not only serves as a formal request for payment but also provides a comprehensive record of the transaction. To ensure your document is effective and legally sound, certain elements must be included in every version you send out.

Here are the essential components that make up a well-crafted payment request:

- Business Information: Your company name, address, phone number, and email address should be prominently displayed at the top. This makes it easy for the client to contact you if needed.

- Client Information: Including the recipient’s details, such as their name, business name (if applicable), address, and contact information, helps personalize the document and ensures accuracy in billing.

- Unique Identification Number: A reference number is vital for tracking and organizing transactions. It can help both you and your clients easily identify the document for future reference.

- Itemized List of Products or Services: Clearly describe each product or service provided, along with the corresponding price. This transparency builds trust and avoids confusion.

- Amount Due: The total sum owed should be clearly indicated, along with a breakdown of taxes, discounts, or additional fees, if applicable.

- Payment Terms and Due Date: Stating the payment deadlines and accepted methods (e.g., bank transfer, credit card) helps ensure timely payments. Include any late fees if applicable to encourage prompt payment.

- Notes or Additional Information: Adding space for any special instructions or terms can be useful, especially for customized services or one-time agreements.

Including these key components will not only ensure that your financial documents are legally valid but also help maintain a professional image and smooth business transactions.

How to Customize Your Invoice Template

Adapting a pre-made document to fit your business’s needs is a straightforward way to ensure that each payment request aligns with your brand and provides all necessary details. Customization allows you to modify key sections such as your company’s information, layout, and even the design, ensuring consistency and professionalism in every transaction.

Here are the steps to personalize your payment document:

- Add Your Branding: Include your company logo, choose appropriate colors, and select fonts that reflect your brand identity. A consistent design across all client communications strengthens your brand image.

- Adjust the Layout: You can modify the layout to prioritize specific information, such as highlighting the total amount due or payment terms. Customizing the structure ensures the most important details stand out.

- Personalize the Content: Tailor the descriptions of services or products to fit your business. You can add or remove sections depending on the complexity of your offerings or any special conditions for a particular transaction.

- Set Payment Methods and Terms: Make sure to include all acceptable payment methods and specify any conditions, such as discounts for early payments or penalties for late fees.

Sample Layout for Customization

Here’s a basic structure you can follow to ensure all the critical information is covered:

| Section | Details to Include |

|---|---|

| Company Information | Name, address, phone number, email |

| Client Information | Name, company name, address |

| Itemized List | Description of products or services, quantity, unit price |

| Total Amount | Breakdown of subtotal, taxes, and discounts |

| Payment Terms | Due date, payment methods, late fees |

Customizing your documents in this way ensures clarity and maintains consistency in all tra

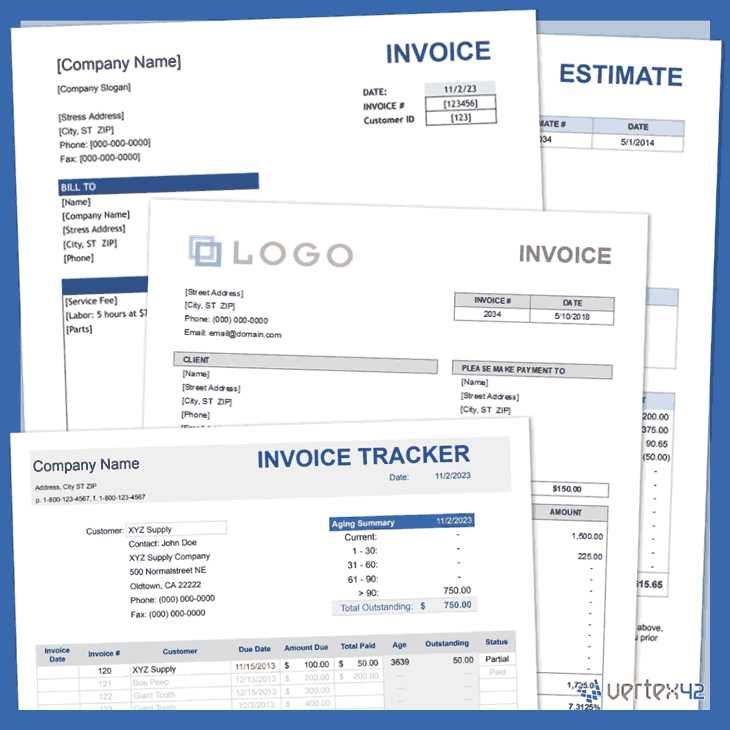

Free Office Invoice Templates Available Online

For businesses looking to streamline their payment processes, there are a variety of free, pre-designed formats available on the internet. These resources can be particularly useful for small businesses or freelancers who need a professional, ready-made solution without the need for expensive software or extensive design work. By using these free resources, companies can create effective billing documents in minutes.

Here are some options for finding free downloadable formats:

- Google Docs: Offers simple, customizable layouts that can be accessed and edited directly in the cloud, perfect for quick edits and sharing with clients.

- Microsoft Word: A variety of free templates are available within the software or via Microsoft’s online portal. These options are often more traditional and can be easily modified to suit specific business needs.

- Excel Spreadsheets: Spreadsheet-based designs allow for automatic calculations, which is particularly useful for businesses that need to deal with varying quantities or complex pricing structures.

- Online Tools: Websites like Canva and Invoice Generator offer free, user-friendly platforms where you can customize and download your document directly.

Sample Free Options to Explore

Here is a quick overview of some popular online platforms offering free downloadable formats:

| Platform | Features | |||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Google Docs | Simple and collaborative, integrates well with Google Workspace | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Microsoft Word | Traditional design, customizable, works offline | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Canva | Drag-and-drop interface, visually appealing, customizable layout | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Invoice Generator | Quick and easy to use, no

Benefits of Using Digital Invoice TemplatesAdopting a digital approach to creating financial documents offers numerous advantages for businesses of all sizes. From saving time and reducing human error to improving organization and streamlining communication, digital formats are a practical solution to modernize your billing process. These benefits go beyond just convenience and can have a lasting impact on the efficiency and professionalism of your operations. Here are some key benefits of using digital formats for payment requests:

By switching to digital solutions, businesses can not only enhance their billing system but also improve overall operational efficiency, communication, and client satisfaction. Choosing the Right Invoice Format for Your BusinessSelecting the appropriate structure for payment documents is crucial for maintaining efficiency and professionalism in your business transactions. The right layout should reflect the complexity of your offerings, the preferences of your clients, and your overall branding. By choosing a format that aligns with your business operations, you can streamline the billing process and ensure clarity in every transaction. There are several factors to consider when choosing the ideal format for your needs:

Ultimately, the right structure will depend on your specific business requirements. Whether you opt for a simple, no-frills design or a more complex, detailed format, ensuring that it suits your workflow and meets your client expectations is key to maintaining a smooth and professional billing process. Common Mistakes to Avoid in InvoicesWhile creating a payment request document may seem straightforward, small mistakes can lead to confusion, delayed payments, or even disputes with clients. Ensuring that your documents are accurate, clear, and professional is essential for maintaining a smooth cash flow and positive client relationships. Avoiding common errors will help you improve your billing process and reduce unnecessary complications. 1. Missing or Incorrect Client InformationOne of the most critical mistakes is failing to include accurate client details. Always double-check the name, address, and contact information before sending a document. Incorrect or missing information can lead to payment delays or misunderstandings. Make sure to personalize each document with the correct client data to avoid confusion and ensure timely communication. 2. Unclear Payment Terms and Due DatesAnother common issue is not clearly outlining payment terms. Whether it’s the payment deadline, acceptable methods, or potential late fees, all terms should be easy to find and understand. Vague or missing terms can lead to misunderstandings, causing payment delays and frustration. Be specific about when and how you expect to be paid, and include any penalties for late payments if applicable. Other common mistakes to watch out for include incorrect item descriptions, missing taxes or discounts, and unclear totals. By carefully reviewing each document and ensuring all necessary information is present and accurate, you can avoid these issues and present a professional, reliable image to your clients. How to Add Payment Terms to Your InvoiceClearly outlining payment terms is an essential part of any financial document. These terms set the expectations for both you and your client, ensuring that both parties are on the same page regarding the timeline and method of payment. Including payment terms helps avoid misunderstandings and ensures timely transactions. It also provides a formal structure in case of late payments or disputes. When adding payment terms to your document, there are several key elements to consider: 1. Define the Due DateOne of the most important components is specifying the due date for payment. Clearly state when the payment should be made to avoid confusion. A specific date, rather than just “30 days,” helps eliminate ambiguity. You can also provide different options, such as “due upon receipt” or “due within 15 days,” depending on your preferences. 2. Include Accepted Payment Methods

Be sure to list all acceptable methods of payment, such as bank transfer, credit card, PayPal, or other platforms. This reduces confusion for the client and makes it easier for them to pay promptly. Providing detailed payment instructions can help avoid delays. 3. Mention Late Fees or Penalties

Including a late fee clause is important for encouraging timely payments. You can specify a percentage or flat fee that will be added to the total amount if the payment is overdue. This clause should be clear and reasonable to avoid misunderstandings. Sample Payment TermsHere’s an example of how to structure payment terms on your document:

|