Essential SaaS Invoice Template for Streamlined Billing and Payments

For businesses that operate on a subscription model, managing payments and ensuring timely billing can be complex. Clear and accurate financial documents play a vital role in maintaining smooth operations, reducing errors, and improving cash flow. A well-structured billing document can enhance professionalism and ensure transparency between companies and clients.

Customization and automation are key when creating these financial documents, as they help businesses scale and meet specific client needs without unnecessary overhead. By using tools that simplify the process, companies can reduce manual work and focus on growth while keeping financial records organized and easily accessible.

In this article, we’ll explore how to craft effective billing statements for subscription services, highlighting best practices, essential features, and the tools available to simplify the entire process.

What is a SaaS Invoice Template

For businesses that offer subscription-based services, having a consistent and clear way to request payments from customers is crucial. These financial documents serve as a formal request for payment, detailing the amount owed and the terms of the agreement. A well-designed document can streamline the billing process, ensure accuracy, and help maintain a professional relationship with clients.

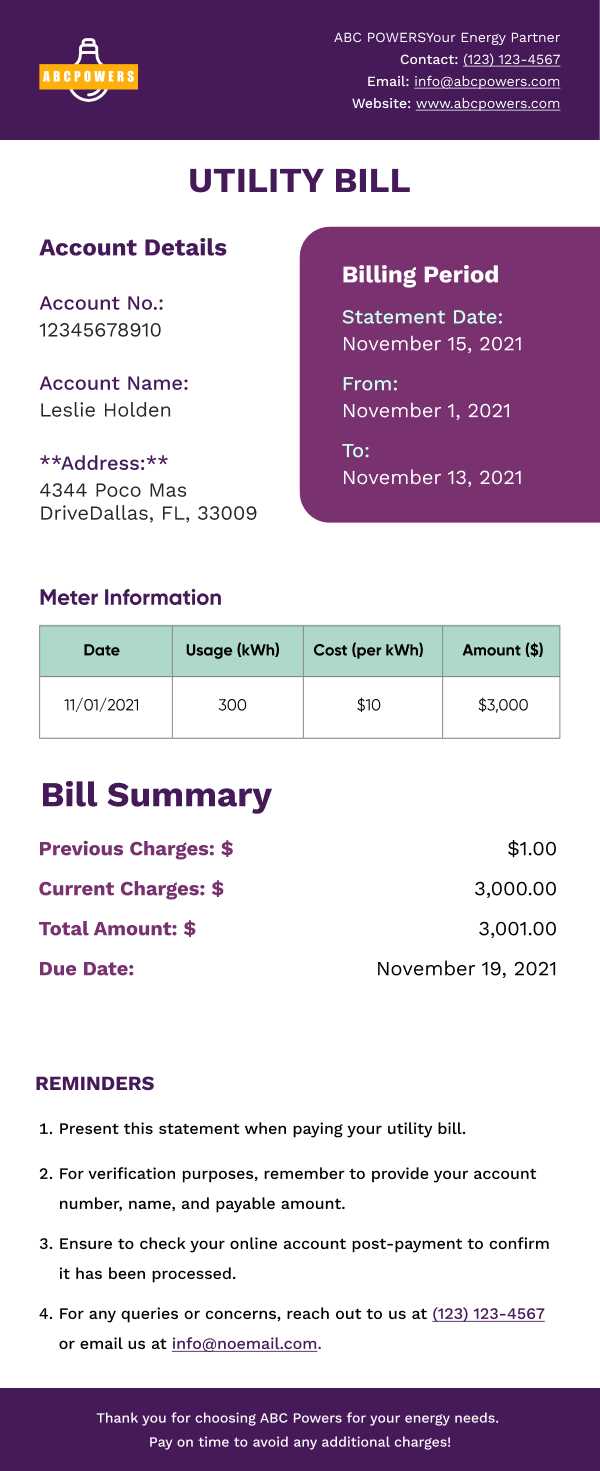

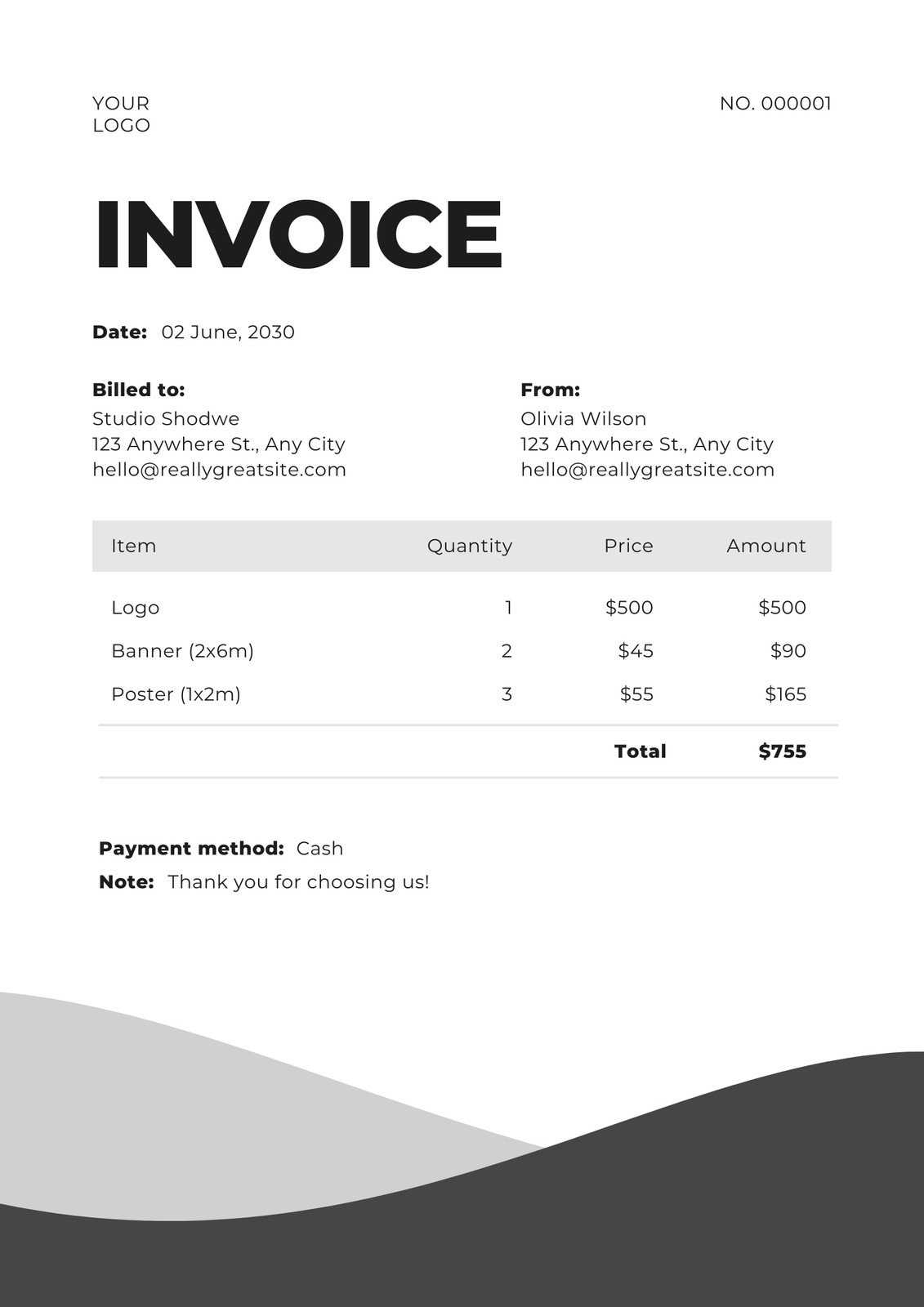

A document used for this purpose typically includes several essential elements such as the service description, pricing, and payment deadlines. It also provides a standardized structure that can be customized to suit the unique needs of each transaction. These documents are typically generated and sent automatically to save time and reduce human error.

Core Features of a Billing Document

While there are various formats and designs, the following elements are commonly found in these types of financial requests:

| Element | Description |

|---|---|

| Service Description | A detailed explanation of the products or services provided to the client. |

| Amount Due | The total cost for the services rendered, including any taxes or fees. |

| Payment Terms | Details regarding the due date, late fees, and payment methods. |

| Contact Information | Business contact details in case the client has questions or concerns. |

Why It’s Important for Subscription Services

For companies offering recurring services, maintaining clarity in payment requests is vital to ensure that clients understand what they are being charged for and when the payment is due. It reduces the chances of disputes and ensures smooth cash flow for the business. By automating this process with pre-designed forms, companies can save significant time and effort while ensuring a professional image.

Benefits of Using an Invoice Template

Utilizing a pre-designed structure for billing and payment requests offers numerous advantages for businesses, particularly those with recurring transactions. By adopting a standardized approach, companies can streamline their payment processes, reduce administrative overhead, and minimize errors. This efficiency not only saves time but also improves professionalism and ensures consistency across all client communications.

Time and Effort Savings

Manual creation of financial documents can be time-consuming and error-prone. With a pre-built structure, the process becomes much faster and more efficient. Key benefits include:

- Quick Generation: Pre-set designs allow for rapid creation of each document, cutting down the time spent on formatting and data entry.

- Consistency: Each document follows a standardized format, ensuring that every client receives the same professional presentation.

- Automation: Many platforms allow for automated generation and delivery of these documents, freeing up time for other tasks.

Improved Accuracy and Compliance

Standardizing financial documentation reduces the likelihood of mistakes, such as missing information or incorrect calculations. A well-structured design ensures the following:

- Reduced Human Error: With all essential fields pre-populated, the chances of making mistakes during the billing process are minimized.

- Legal and Tax Compliance: Pre-designed forms often include built-in fields to help businesses comply with local tax laws and legal requirements.

- Clear Payment Terms: A consistent structure ensures that all payment deadlines, fees, and terms are clearly outlined, reducing confusion and disputes.

By using a ready-made solution, businesses can focus more on their core operations while knowing that the financial aspect is being handled accurately and efficiently.

How to Create a Custom SaaS Invoice

Creating a personalized payment request for your subscription-based services involves tailoring a standard document to fit your business needs and ensure all necessary details are included. A custom billing document can help reflect your company’s brand, clarify payment terms, and prevent misunderstandings. By adjusting certain elements, you can ensure the document is aligned with your unique business model and customer expectations.

Steps to Create a Custom Billing Document

Follow these steps to create a personalized financial request for your clients:

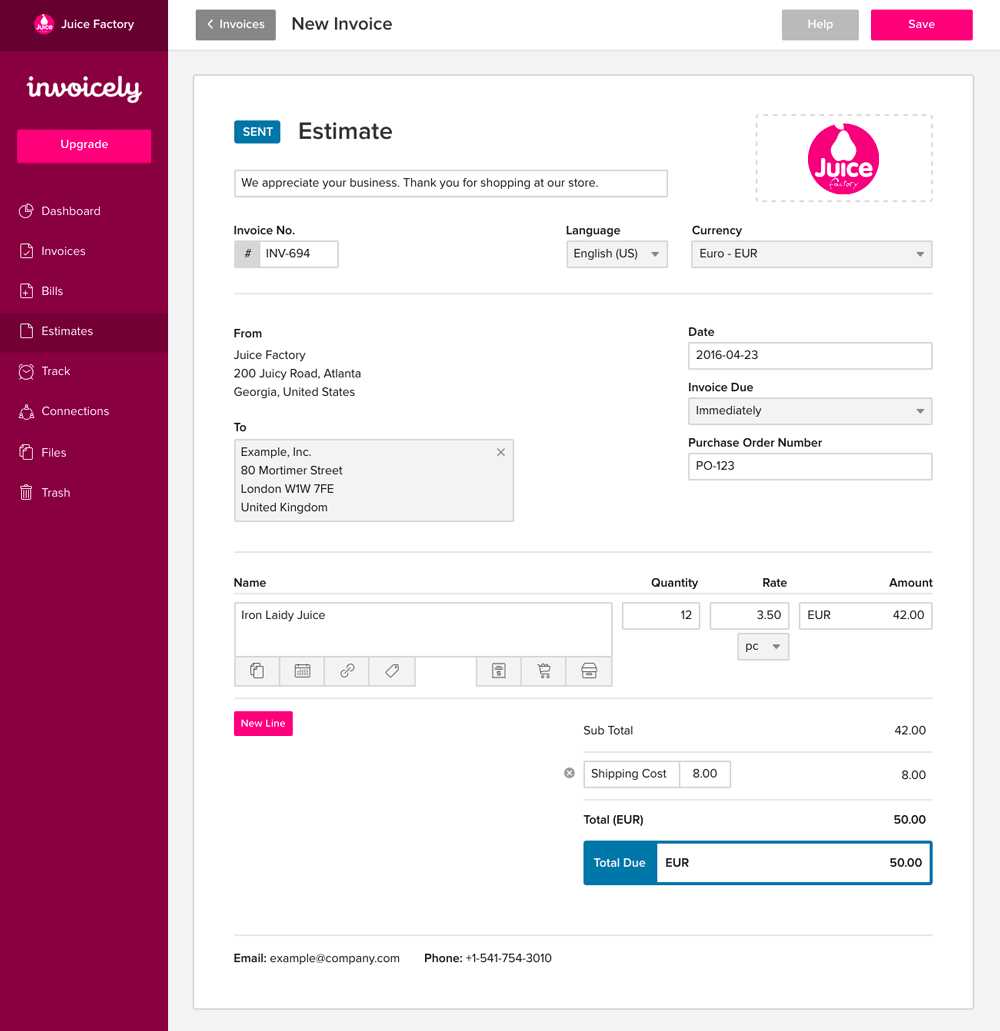

- Choose a Platform: Select a tool or software that allows for customization of your financial documents. Many accounting tools offer pre-built options that can be easily tailored to your needs.

- Add Your Branding: Incorporate your logo, business name, and contact details to give the document a professional look. Consistent branding helps build trust and recognition.

- Include Clear Service Descriptions: Clearly outline the services provided and any relevant details. This can include subscription plans, usage details, or any extra services included in the billing cycle.

- Specify Payment Terms: Ensure payment deadlines, late fees, and accepted payment methods are clearly stated. This helps avoid confusion and ensures timely payments.

- Double-Check for Accuracy: Before sending out the request, verify all details such as the client’s information, billing amounts, and any applicable taxes.

Important Elements to Include

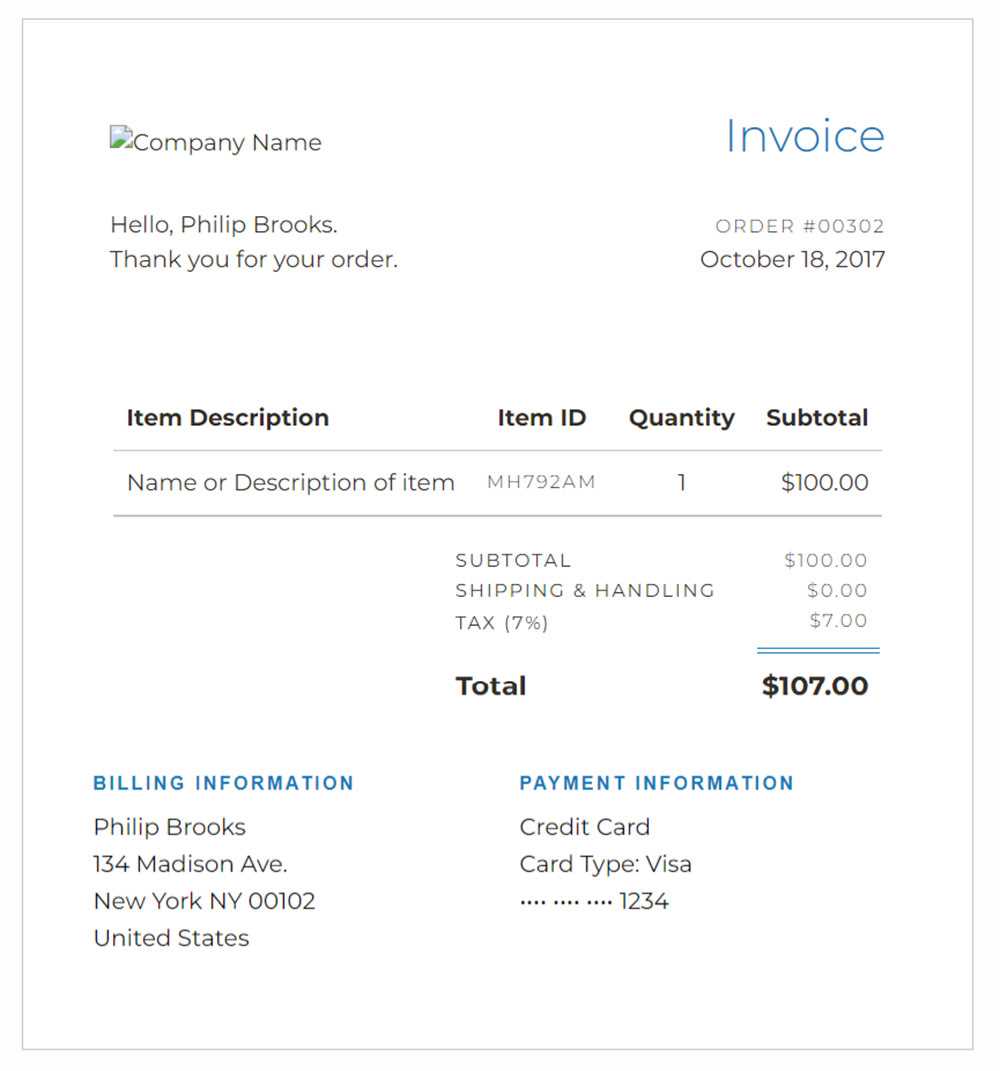

To ensure that your customized document is complete and effective, make sure to include the following key elements:

- Client Information: Name, address, and contact details of the customer receiving the billing request.

- Itemized Breakdown: A detailed list of the services provided, including subscription plans, add-ons, and any applicable fees.

- Total Amount: Clearly display the total amount due, including taxes and any discounts that may apply.

- Due Date:

Key Elements in SaaS Invoices

For businesses that operate on a subscription model, creating clear and accurate payment requests is essential. These documents serve as a formal agreement between the service provider and the client, outlining the details of the services rendered and the amount due. By including the right components, businesses can ensure that clients fully understand what they are being charged for, which reduces the potential for confusion and disputes.

Every billing document should contain specific elements to ensure completeness and transparency. These include details about the service, payment terms, and other important factors that define the transaction. Below are the key components that should be included in any billing document for recurring services.

Essential Components

- Client Information: The name, address, and contact information of the client receiving the bill. This ensures proper identification and prevents any issues with miscommunication.

- Service Description: A clear and concise description of the services or products provided, including any relevant details about the subscription plan, features, or time period covered.

- Amount Due: The total sum owed by the client. This should include a breakdown of charges, such as the base price, any taxes, and additional fees (if applicable).

- Payment Terms: Information about the payment deadline, any penalties for late payment, and accepted payment methods. Clear payment terms ensure both parties are on the same page.

- Invoice Number: A unique identifier for each document. This helps with organization and serves as a reference in case of inquiries or disputes.

Additional Considerations

- Tax Information: Include the relevant tax rates and the amount of tax charged, especially for businesses that operate in regions where sales tax applies to subscription services.

- Discounts or Credits: Any discounts or promotional credits applied to the client’s account should be clearly indicated, along with the total discount amount.

- Due Date: Specify the exact date by which the payment must be received. This helps avoid delays and keeps cash flow steady.

- Contact Information: Provide a way for clients to get in touch with your company in case they have questions or concerns regarding the bill.

By incorporating these essential elements, you can ensure that your payment requests are clear, professional, and effective. A well-structured document not only helps facilitate smooth transactions but also builds trust with your clients, ensuring long-term business success.

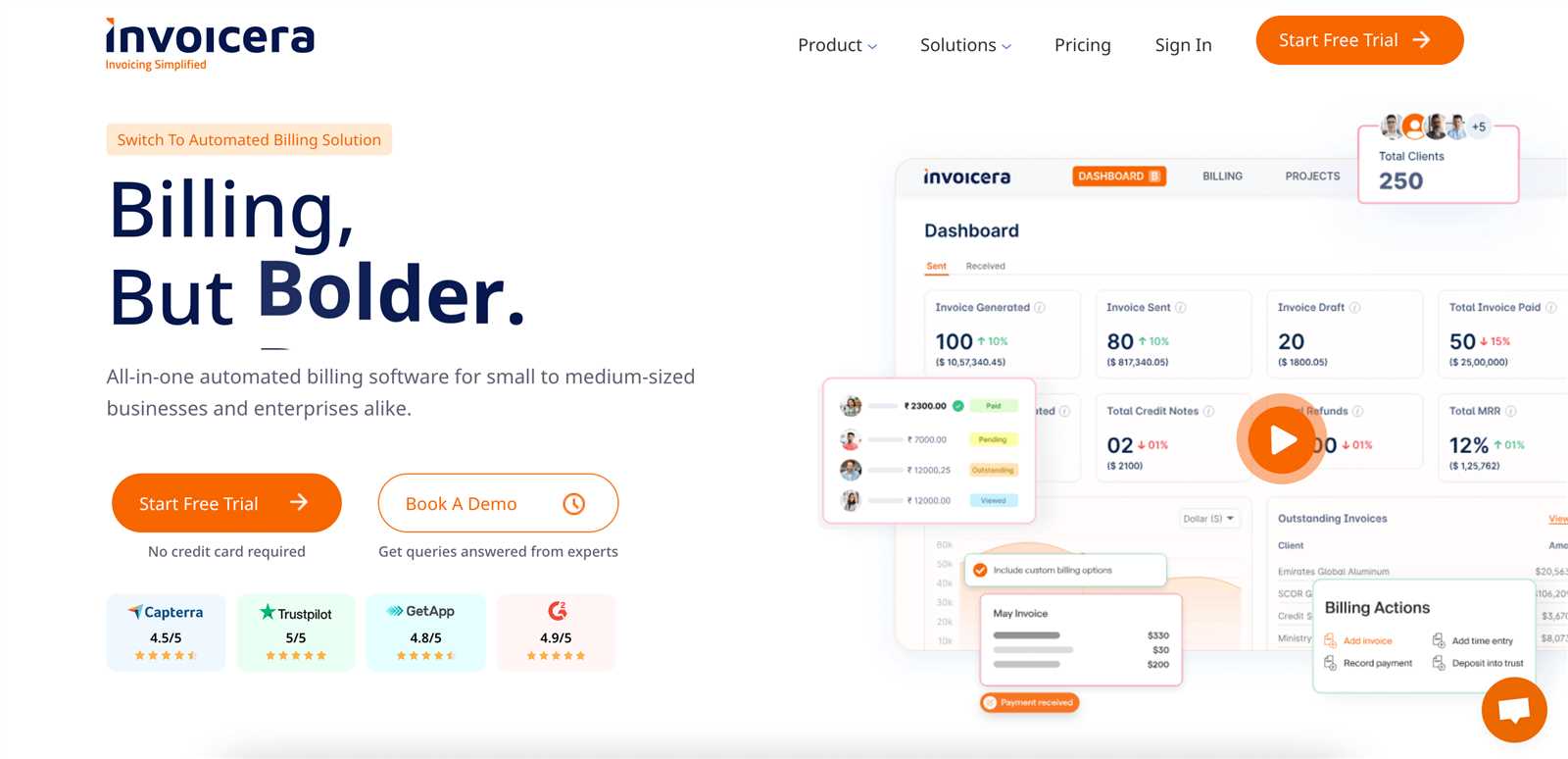

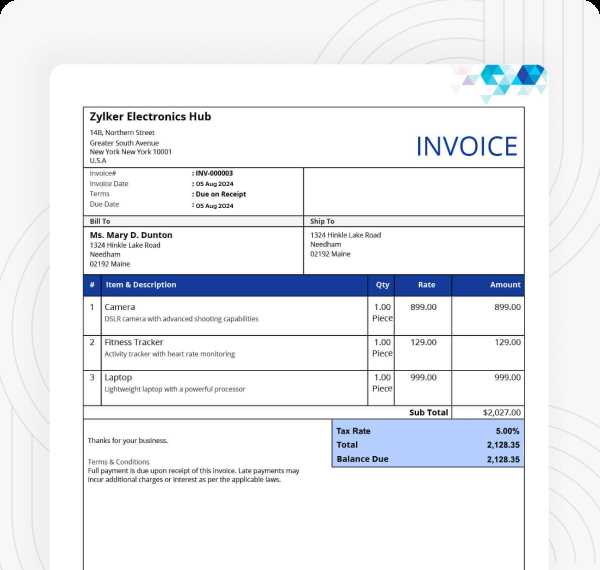

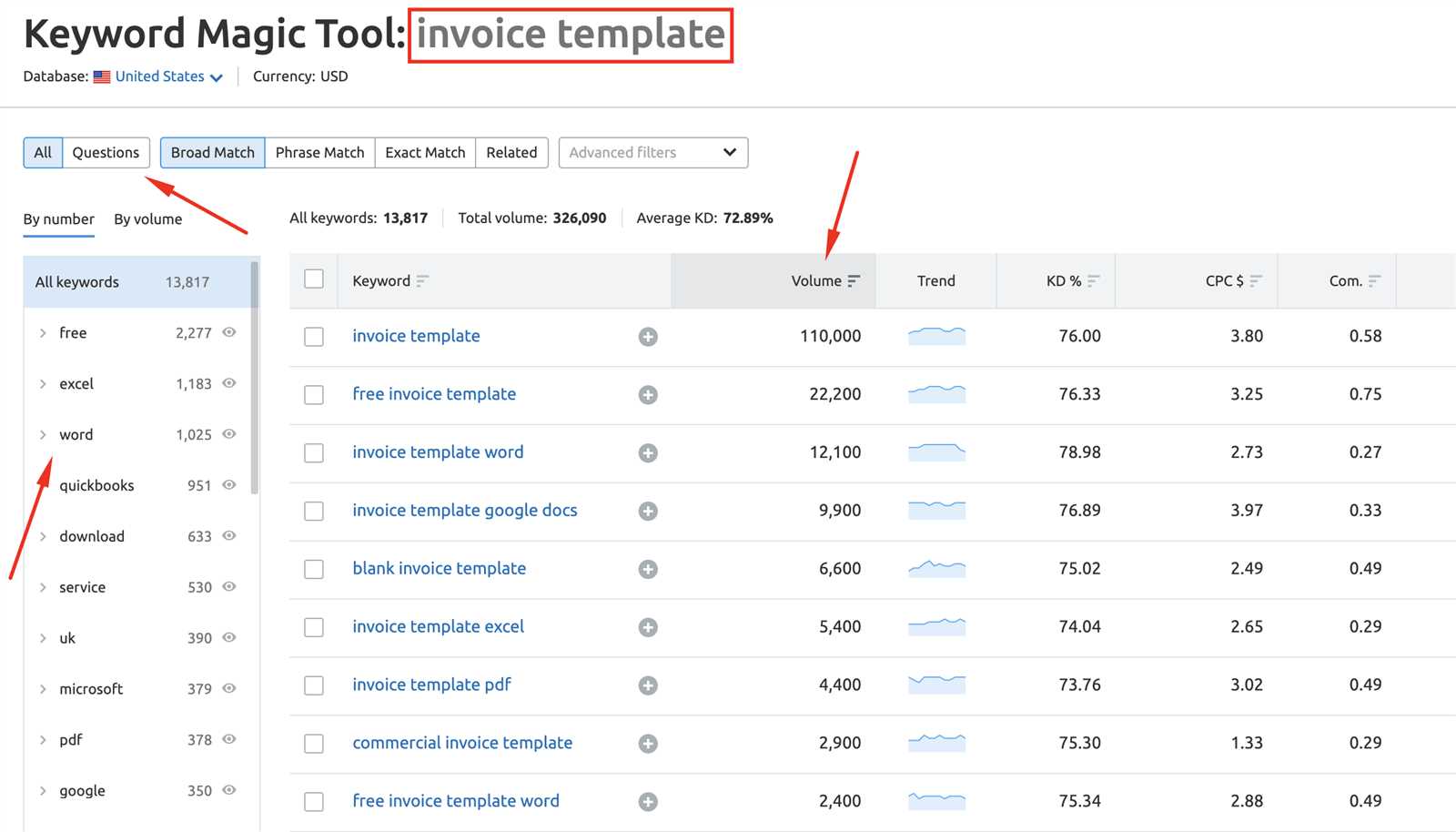

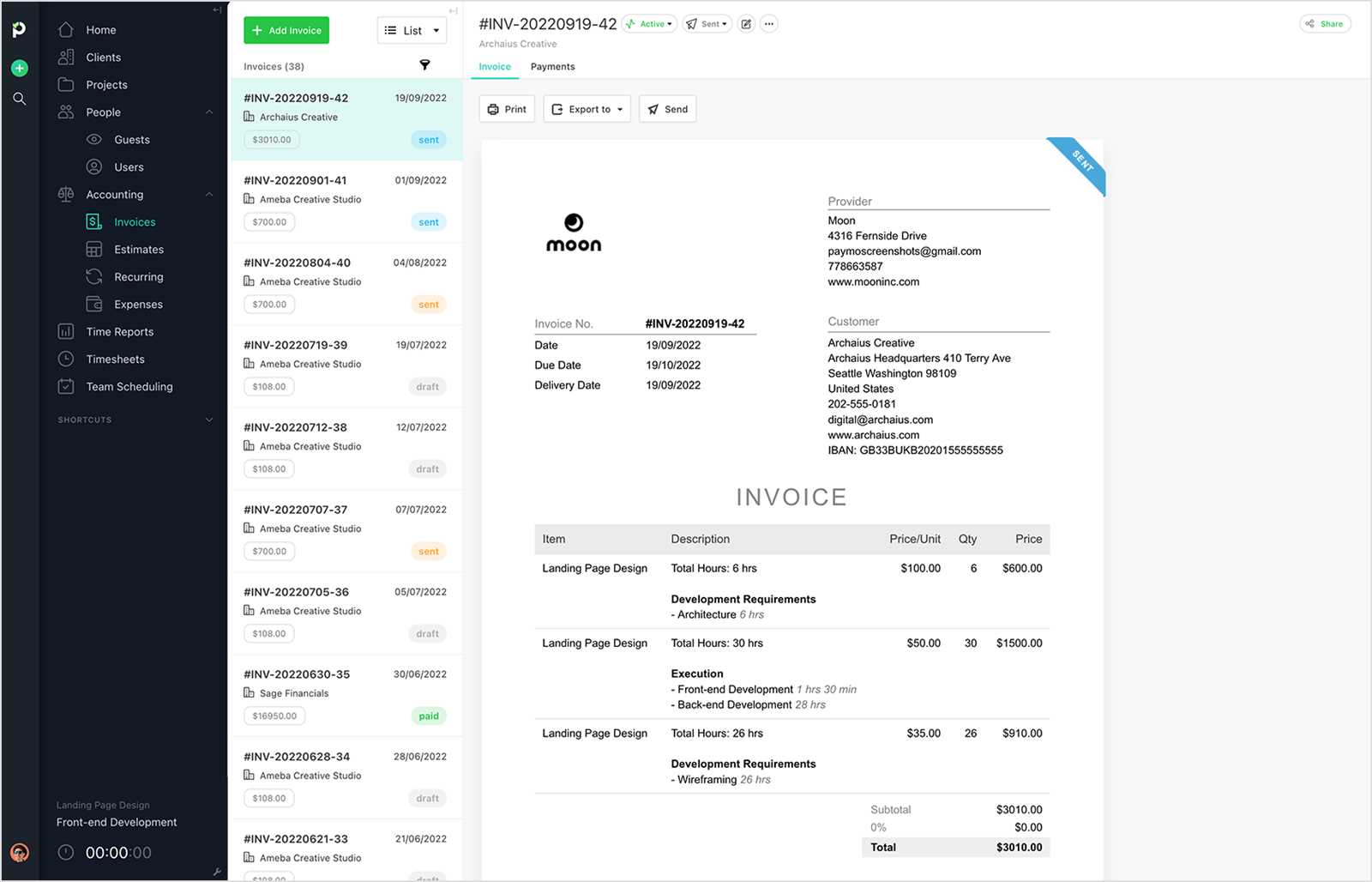

Top SaaS Invoice Software Solutions

For businesses that rely on recurring revenue models, using dedicated software to manage billing and payments can significantly improve efficiency. These tools streamline the creation and management of financial documents, reduce manual errors, and ensure timely payments from clients. By automating key tasks like generating payment requests, tracking overdue bills, and integrating with accounting systems, businesses can save valuable time and focus on growth.

Several software platforms stand out for their ability to support subscription-based companies, offering features tailored to recurring billing, tax management, and client communication. Below are some of the top solutions available on the market today.

Top Software Solutions for Billing Automation

- FreshBooks: Known for its user-friendly interface, FreshBooks offers a robust suite of tools for generating professional billing documents, tracking payments, and handling taxes. It also integrates with multiple payment gateways for easy collection.

- QuickBooks: A comprehensive accounting platform, QuickBooks helps businesses manage subscriptions, create detailed financial documents, and keep track of payments. Its customizable options make it suitable for various business needs.

- Zoho Subscriptions: This software is specifically designed for subscription-based businesses. It automates billing cycles, sends reminders for overdue payments, and integrates with other Zoho apps for seamless accounting.

- Wave: A free accounting software with features designed for small businesses, Wave offers tools for generating and managing recurring billing, expense tracking, and reporting. It’s a great option for businesses on a tight budget.

Key Features to Look For

When choosing the right billing software for your business, look for solutions that offer the following essential features:

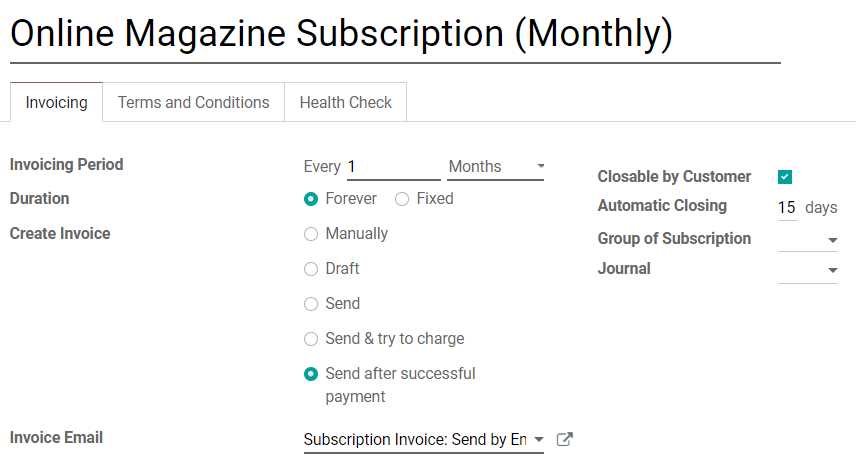

- Recurring Billing: The ability to automatically generate and send payment requests on a regular schedule, based on your client subscriptions.

- Tax Management: Built-in tools for calculating taxes based on location or service type, ensuring compliance with local tax laws.

- Payment G

Why Automation Matters in Billing

In today’s fast-paced business environment, managing recurring payments manually can be time-consuming and error-prone. Automation is the key to improving efficiency, ensuring accuracy, and saving valuable resources. By automating key aspects of the billing process, businesses can focus more on growth and less on administrative tasks, while also improving client satisfaction and reducing late payments.

Automation not only simplifies the creation and delivery of financial documents but also ensures that payment cycles are consistent and timely. This technology can also help businesses stay organized by tracking overdue payments and sending reminders automatically, reducing the need for manual follow-ups.

Key Benefits of Automation

- Time Savings: Automating billing tasks such as document generation and payment reminders eliminates the need for manual input, allowing businesses to save time and direct their efforts to more strategic activities.

- Reduced Human Error: Automated systems help eliminate common mistakes like incorrect billing amounts or missed deadlines, ensuring that every transaction is accurate and processed on time.

- Consistency: Automation ensures that each client receives a standardized document that follows the same format and includes all necessary details, reducing the chances of confusion or disputes.

- Improved Cash Flow: By automating payment collection and reminders, businesses can accelerate the payment process, improving cash flow and reducing the likelihood of delayed payments.

How Automation Enhances Client Experience

Clients appreciate a smooth and seamless billing experience. Automated billing systems provide them with clear and timely payment requests, reducing the chances of late payments or misunderstandings. Additionally, automated reminders help clients stay on top of their financial commitments, fostering trust and improving long-term business relationships.

By leveraging automation in billing, businesses can create a more efficient and professional process, benefiting both the company and its clients. Automation leads to fewer errors, better customer satisfaction, and faster payment cycles, contributing to overall business success.

Common Mistakes to Avoid in Invoices

While creating payment requests for clients may seem straightforward, there are several common mistakes that can lead to confusion, delays in payments, or even disputes. Even small errors can impact your professionalism and cash flow. By understanding and avoiding these common pitfalls, businesses can ensure that their billing process is smooth, clear, and effective.

Below are some of the most frequent errors businesses make when preparing payment requests, and how to avoid them:

Common Mistake Impact How to Avoid Missing or Incorrect Client Information Delays in payment due to confusion about who the bill is for or where it should be sent. Always double-check the client’s name, address, and contact information before sending the document. Vague Service Descriptions Clients may not understand what they are being charged for, leading to disputes or non-payment. Provide detailed descriptions of services, including the scope, duration, and any additional charges. Incorrect Payment Amounts Clients may dispute the amount due, leading to delays and potentially harming the business relationship. Carefully check the amounts listed, including any taxes or discounts, before finalizing the document. Unclear Payment Terms Confusion over payment due dates, late fees, or payment methods can result in missed payments. Clearly state the payment terms, including the due date, any applicable late fees, and accepted payment methods. Failure to Include a Unique Reference Number Difficulty tracking payments, especially if there are multiple clients or transactions. Assign a unique reference number to each document for easy tracking and identification. How to Ensure Accurate Billing for SaaS

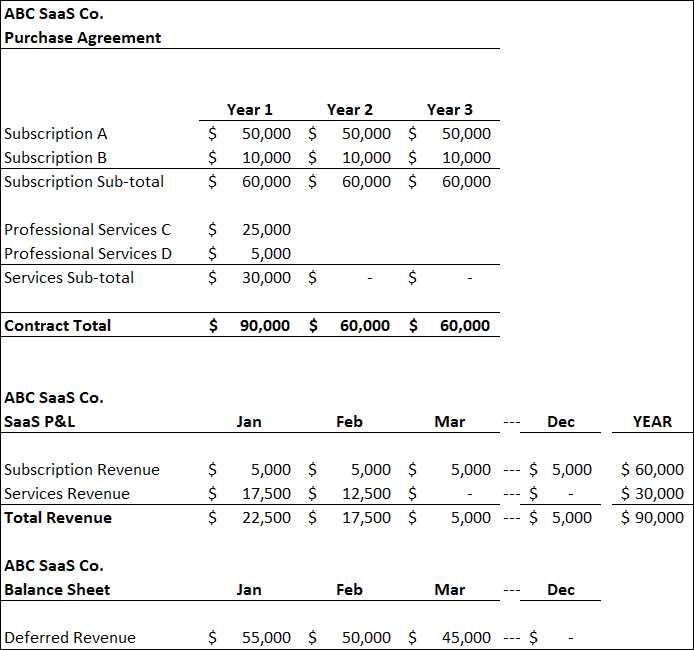

Accurate billing is critical for subscription-based businesses to maintain healthy cash flow and positive customer relationships. Inaccuracies, whether they result from overcharging, undercharging, or missing details, can cause significant issues such as delayed payments, customer dissatisfaction, or even disputes. Ensuring precision in every transaction is essential for business success and client trust.

To avoid billing errors and ensure your clients are charged correctly, it’s important to implement a structured approach. Below are key strategies for achieving accuracy in your billing process:

Key Strategies for Accurate Billing

- Automate Billing Cycles: Use automated systems to schedule and generate billing documents. Automation reduces human error and ensures that clients are charged on time, every time.

- Track Usage and Subscriptions: Regularly monitor and track client usage or subscription plan changes. Ensure that the billing reflects any upgrades, downgrades, or service modifications in real-time.

- Clearly Define Terms: Ensure that all payment terms are transparent and easily understood by your clients. This includes billing frequency, cancellation policies, and renewal terms.

- Review and Reconcile Regularly: Perform regular checks and reconciliation of your billing records against payment received. This helps identify discrepancies early and avoid issues with outstanding payments.

Tools for Ensuring Billing Accuracy

- Integrated Payment Gateways: Choose platforms that integrate with payment processors and accounting software to streamline data flow and reduce manual input, ensuring consistency across systems.

- Customizable Billing Software: Select software that allows for the easy customization of client charges, including discounts, taxes, and unique fees based on individual agreements or usage patterns.

- Real-time Notifications and Alerts: Set up automated reminders and alerts for upcoming payments, changes in client status, or failed transactions. This will ensure that you and your clients stay informed at all stages of the billing process.

By implementing these strategies and using the right tools, you can avoid costly mistakes, improve operational efficiency, and foster strong, long-term relationships with your clients. Accuracy in billing not only builds trust but also ensures t

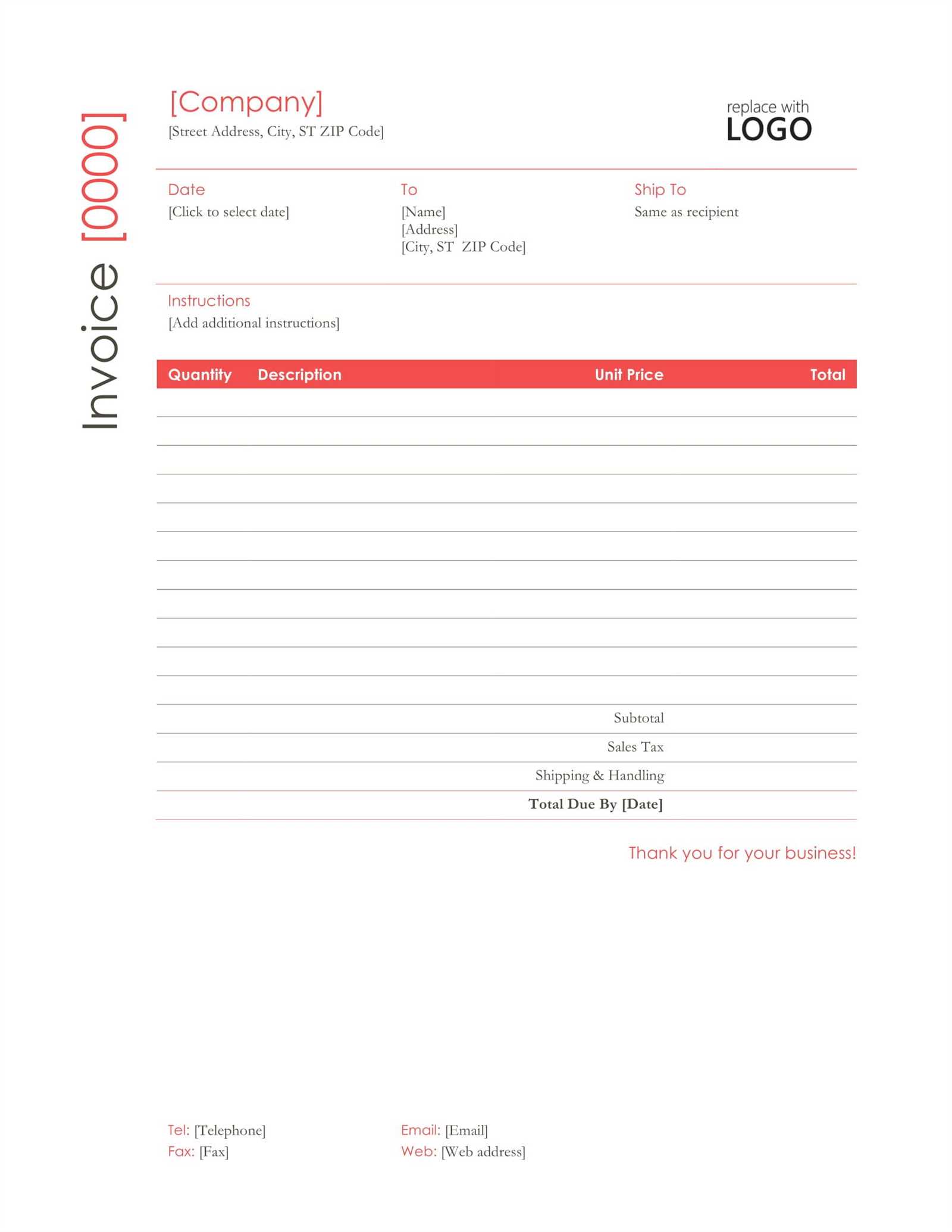

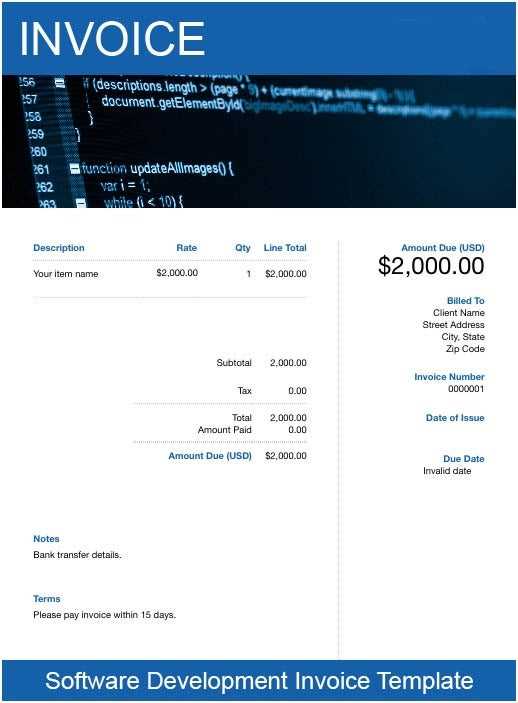

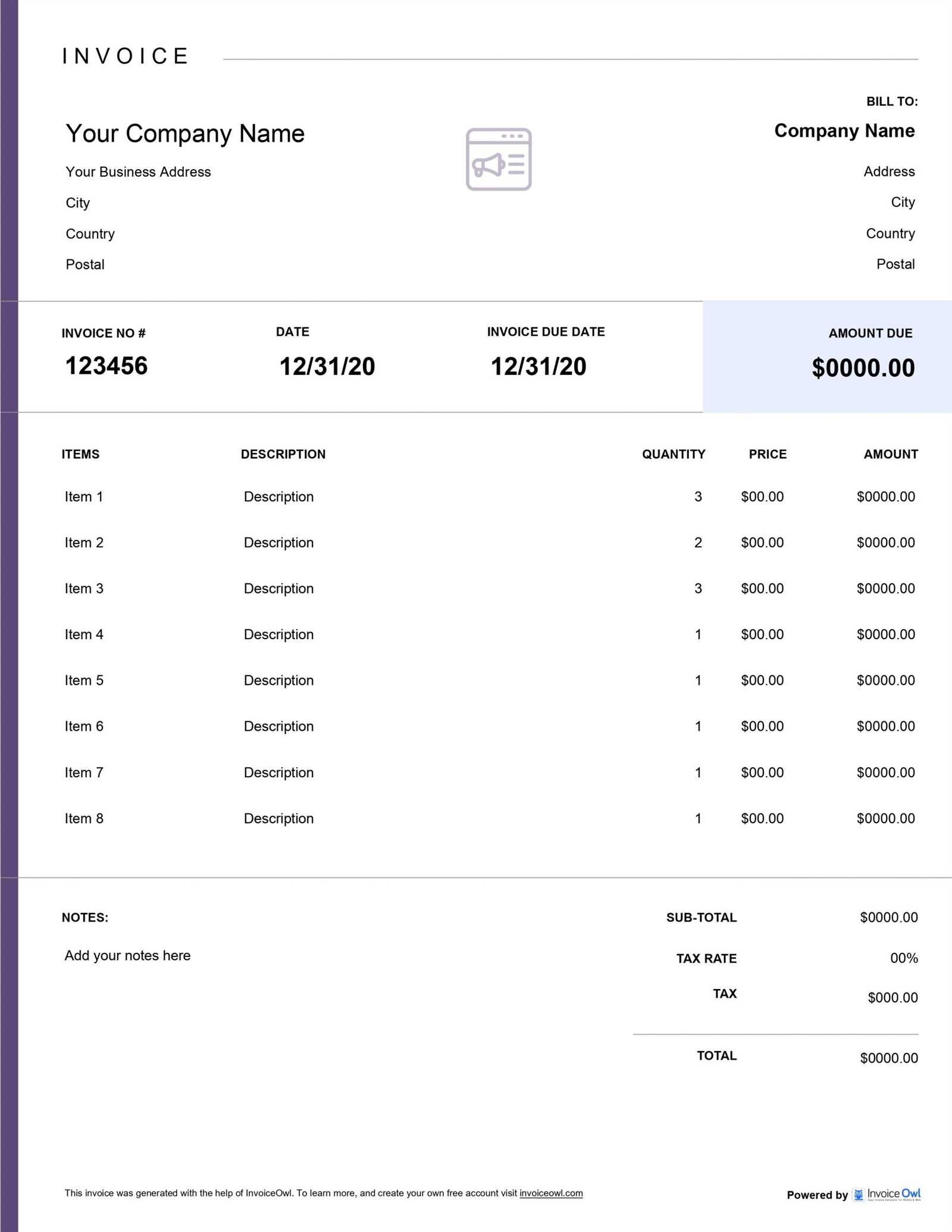

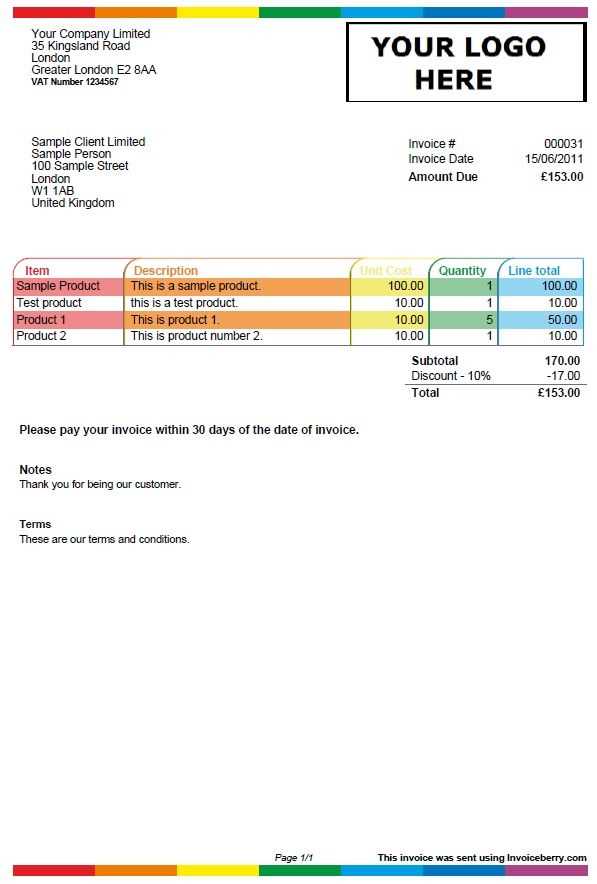

Choosing the Right SaaS Invoice Design

The design of your billing documents plays a crucial role in how your clients perceive your business. A well-designed payment request not only looks professional but also helps your customers quickly understand the details of the transaction. The right design can improve clarity, reduce confusion, and enhance the overall client experience, which is essential for maintaining strong business relationships.

When selecting a design for your financial documents, it’s important to consider both aesthetics and functionality. A clean, organized layout ensures that all necessary information is presented clearly, while also reflecting your company’s brand and values. Below are key considerations when choosing the right design for your payment requests:

Factors to Consider When Choosing a Design

- Brand Consistency: Ensure that your design aligns with your company’s branding guidelines. The use of your logo, color scheme, and fonts helps create a cohesive experience for your clients.

- Clarity and Simplicity: Keep the design simple and organized. Avoid cluttering the document with unnecessary elements. Clients should be able to easily identify important information such as the amount due, payment due date, and service details.

- Mobile-Friendly Design: Many clients access billing documents on their smartphones. Make sure the design is responsive and looks good across various devices and screen sizes.

- Customizable Layout: Choose a design that allows you to customize the document to reflect any unique aspects of your business or client agreements. This might include personalized messages, custom service descriptions, or specific payment terms.

Common Design Elements to Include

- Service Breakdown: Clearly list the services provided, along with their respective costs, to ensure transparency.

- Payment Instructions: Make sure payment methods, deadlines, and instructions are easy to find, minimizing confusion for your clients.

- Contact Information: Include your business’s contact details in case the client has any questions or concerns about the billing document.

- Visual Hierarchy: Use headings, bullet points, and bold text to highlight key information, such as the total amount due and payment terms.

How to Handle Subscription-Based Charges

Managing recurring charges is a critical aspect of running a subscription-based business. These regular transactions require careful tracking to ensure accuracy and prevent billing errors. Subscription plans often involve different pricing tiers, additional fees, or discounts, and it’s essential to handle each of these elements with precision to maintain a smooth payment process and satisfied clients.

Properly managing subscription-based charges involves several key practices, from setting up clear pricing structures to tracking usage and automatically adjusting the amounts due. Below are some best practices for managing recurring payments effectively:

Best Practices for Handling Subscription Charges

- Define Clear Pricing Models: Ensure your pricing structure is easy to understand and transparent for customers. Clearly communicate whether your services are billed monthly, annually, or on another schedule, and include any setup fees, taxes, or additional charges.

- Offer Flexible Payment Plans: Many customers appreciate flexibility. Offering options like monthly, quarterly, or annual billing can help cater to different preferences and improve client retention.

- Track Usage and Adjust Charges: If your service includes variable usage or add-ons (such as data usage or premium features), set up a system to monitor and adjust charges based on the customer’s actual usage. This ensures fair billing for both you and your clients.

- Automate Renewals and Payments: Automating the renewal process and recurring payment collection minimizes human error, ensures consistency, and helps prevent service interruptions due to missed payments.

How to Manage and Track Subscription Charges

To keep your billing process running smoothly, it’s important to use the right tools for tracking subscription charges. Many platforms allow you to automate renewals, calculate taxes, and apply discounts, which helps avoid errors in your payment requests.

Subscription Management Task Purpose Best Tools Recurring Billing Setup Automates the collection of payments at regular intervals, reducing manual work. Stripe, PayPal, Chargebee Usage Tr Customizing Your SaaS Invoice Template

Creating personalized billing documents that align with your brand and business needs is a crucial step in professionalizing your financial communication. Customizing these documents allows you to reflect your company’s identity, ensure consistency, and enhance customer experience. A well-designed, tailored document not only makes a lasting impression but also helps convey important information clearly and accurately.

Customization involves more than just altering the layout. You need to ensure that the document includes all the essential elements, such as a detailed service breakdown, payment terms, and contact information, while maintaining a professional and branded appearance. Below are some key aspects to consider when personalizing your financial documents:

Key Elements to Personalize

- Brand Identity: Incorporate your company’s logo, colors, and fonts to maintain a consistent brand image. This helps reinforce your professionalism and builds trust with clients.

- Service Details: Ensure that all provided services are clearly outlined with accurate descriptions and pricing. Include any relevant terms such as subscription cycles, upgrades, or additional charges.

- Payment Terms and Instructions: Clearly state the due date, accepted payment methods, and late fees (if applicable). Providing easy-to-understand instructions helps avoid confusion and delays.

- Client-Specific Information: Tailor the document with each client’s name, contact information, and custom pricing or discounts. Personalizing documents enhances the customer experience and shows attention to detail.

Tools and Software for Customization

- Invoicing Software: Tools like FreshBooks, QuickBooks, and Xero offer customizable templates that allow you to incorporate your branding and specific pricing details.

- Design Platforms: Use platforms like Canva or Adobe InDesign for complete design flexibility, ensuring your financial documents align with your brand aesthetics.

- Automation Tools: Implementing automation tools like Stripe or Zoho Subscriptions ensures that the customization process is automated while still keeping each document unique to the client.

By investing the time to customize your payment requests, you can create professional, clear, and branded documents that reflect the quality of your business. This not only improves client satisfaction but also strengthens your brand’s credibility and professionalism in the eyes of your customers.

Best Practices for SaaS Payment Terms

Establishing clear and effective payment terms is essential for maintaining healthy cash flow and fostering strong relationships with clients in any subscription-based business. Payment terms set the expectations for both the business and the customer, defining when and how payments are to be made. By defining these terms clearly, you ensure that your clients are aware of their obligations, and you minimize the risk of late payments or disputes.

Best practices for payment terms go beyond simply setting a due date. They involve being transparent about payment methods, fees, and consequences of late payments. Below, we explore some key practices for crafting effective and customer-friendly payment terms.

Key Elements of Clear Payment Terms

- Payment Frequency: Define the frequency at which payments will be collected, such as monthly, quarterly, or annually. Clear communication of billing cycles helps customers plan accordingly.

- Due Dates: Specify a clear due date for each payment. This eliminates ambiguity and helps ensure timely payments.

- Accepted Payment Methods: Clearly outline the payment methods you accept, whether it’s credit cards, bank transfers, or online payment platforms.

- Late Fees and Penalties: If applicable, set a reasonable late fee for missed payments. Be transparent about how penalties will be applied to avoid confusion or disputes later on.

How to Communicate Payment Terms Effectively

- Client Agreements: Ensure that your payment terms are clearly included in the client agreement or contract. This document should be signed by both parties to ensure mutual understanding.

- Regular Reminders: Set up automated reminders to notify clients of upcoming payment due dates. These reminders can be sent a few days before the payment is due, helping to reduce late payments.

- Flexible Options: Offer flexibility in payment methods or schedules to accommodate clients with different preferences. For instance, allowing clients to switch from annual to monthly billing can improve satisfaction and retention.

Table of Best Practices for Payment Terms

Best Practice Why It Matters Example Clear Due Dates Reduces confusion and ensures timely payments “Payments are due by the 1st of each month.” Transparent Late Fees Incentivizes clients to pay on time and prevents disputes “A late fee of 5% will be applied if payment is not received within 7 days of the due date.” Flexible Payment Options Provides convenience for clients and enhances customer satisfaction “Clients can choose between monthly or annual billing cycles.” Automate Managing Taxes on SaaS Invoices

Handling taxes on billing documents for subscription-based services can be complex, as it varies by location, service type, and the specific laws governing digital transactions. Accurate tax management ensures compliance with local regulations and helps avoid penalties. It also provides clarity for customers regarding the total amount they owe. As tax laws are frequently updated, businesses must keep track of changes and apply the correct rates to each transaction.

Managing taxes effectively involves understanding the tax implications of your business, ensuring the correct tax rate is applied, and keeping detailed records. Below are some essential tips for managing taxes on your payment requests:

Key Considerations for Tax Management

- Understand Local Tax Regulations: Tax requirements for digital products and services vary widely by country and even by state or province. Make sure you are familiar with the specific tax laws in the regions where your clients are located.

- Determine Taxable Services: Not all services are taxable. It’s important to determine which aspects of your offerings are subject to tax. For example, some jurisdictions may tax digital subscriptions but not one-time purchases or consultations.

- Accurately Track Client Location: Tax rates often depend on the customer’s location. Use reliable methods to determine where your customers are based so that the correct rate is applied. Many invoicing platforms offer automatic tax calculation based on location.

- Regularly Update Tax Rates: Tax laws are subject to change, and rates can fluctuate depending on where your business operates. Make sure your tax rates are up-to-date to avoid overcharging or undercharging your customers.

How to Streamline Tax Management

- Use Automated Tax Calculation Tools: Leverage software that automatically calculates tax rates based on the customer’s location. This reduces the risk of manual errors and ensures that your business stays compliant with tax laws.

- Provide Transparent Tax Information: Clearly display the breakdown of taxes on your payment requests. This includes showing the tax amount separately from the total and specifying which se

Improving Client Communication through Invoices

Billing documents are not just a tool for collecting payments–they also serve as a vital communication channel between businesses and their clients. Clear, well-organized documents provide an opportunity to keep clients informed, reinforce the professional image of your business, and build trust. By enhancing the communication in your payment requests, you ensure that clients fully understand their charges, deadlines, and any relevant details that could affect their experience with your services.

Improving client communication through billing documents involves focusing on clarity, transparency, and accessibility. Whether it’s outlining charges in detail or offering easy-to-understand payment instructions, the goal is to make every interaction as seamless and customer-friendly as possible. Below are some key strategies for using your payment documents to enhance communication with your clients:

Strategies for Clear Communication

- Breakdown of Charges: Provide a detailed breakdown of the services rendered, including itemized costs, taxes, and any additional fees. This transparency helps clients see exactly what they are being charged for, minimizing confusion.

- Clear Payment Instructions: Ensure that payment methods, due dates, and any penalties for late payments are clearly stated. The simpler and more straightforward this information is, the less likely clients will encounter any misunderstandings.

- Personalized Messaging: Include personalized notes or reminders that make the document feel more like a tailored communication rather than a generic statement. This could be thanking them for their business, offering a discount, or reminding them of upcoming renewals.

Enhancing Client Relationships through Billing

- Timely and Regular Reminders: Keep your clients informed of upcoming payments with reminders sent in advance. Automated reminders ensure that clients are never caught off guard by an unexpected charge or due date.

- Clear Contact Information: Always include up-to-date contact details for customer support. Whether it’s for billing inquiries or general questions, providing easy access to your team fosters a more open and communicative relationship.

- Responsive Communication: When clients reach out with questions about their payment requests, respond promptly and professionally. A well-handled inquiry builds customer confidence and can even strengthen client loyalty.

By improving the clarity and communication of your billing documents, you foster a more positive relationship with your clients. This simple yet effective practice not only improves the customer experience but also reduces the likelihood of disputes and late payments, contributing to a smoother and more efficient business operation.

How to Track SaaS Payments Effectively

Keeping track of payments for subscription-based services is critical for maintaining a healthy cash flow and ensuring that your business operates smoothly. Without effective tracking, it can be challenging to identify overdue payments, reconcile accounts, and manage renewals. A robust payment tracking system not only helps with billing accuracy but also improves customer service by providing real-time data and insights into account status.

To track payments efficiently, it’s essential to use tools and processes that can automatically record and update transaction data. This not only saves time but also minimizes the risk of errors. Below are some key practices for effectively managing payments in a subscription-based business:

Best Practices for Payment Tracking

- Automate Payment Recording: Use software that integrates with your payment gateway to automatically track payments. This reduces the need for manual input and ensures that every payment is accurately recorded in your system.

- Set Up Payment Reminders: Automated reminders can be sent to clients before payment due dates to reduce the likelihood of late payments. These reminders can also be set for overdue payments to prompt clients to take action quickly.

- Use a Centralized Payment Dashboard: Implement a centralized system where all payment information is stored and accessible. This allows you to quickly review transaction histories, monitor outstanding balances, and track payment trends.

- Track Multiple Payment Methods: If you accept multiple payment methods, ensure that your system can track payments from various sources, such as credit cards, bank transfers, and online payment platforms. This enables more efficient reconciliation.

Tools and Software for Efficient Tracking

- Payment Management Platforms: Tools like Stripe, PayPal, or Square offer comprehensive payment tracking features that integrate seamlessly with accounting systems. These platforms automatically record payments, send reminders, and provide transaction history reports.

- Accounting Software: Solutions like QuickBooks, Xero, and Fres

Legal Considerations for SaaS Invoicing

When running a subscription-based service, it’s important to be aware of the legal requirements surrounding payment requests and billing practices. Legal considerations ensure that both your business and your clients are protected and that you comply with regulations in various jurisdictions. Properly handling these aspects not only helps you avoid legal complications but also fosters trust with your clients.

From clear contract terms to tax compliance and data protection, understanding the legal landscape is crucial to managing billing processes effectively. Below are some of the key legal factors to consider when issuing payment requests:

Key Legal Aspects to Consider

- Clear Terms and Conditions: Ensure that your contract or agreement with clients outlines the terms of service, including payment schedules, fees, cancellation policies, and renewal clauses. Clear communication of these terms helps prevent misunderstandings and legal disputes.

- Tax Compliance: Understand the tax obligations in different regions where your clients are based. Some jurisdictions require businesses to apply sales tax, value-added tax (VAT), or other forms of tax on digital goods or services. It is essential to comply with these tax regulations to avoid penalties.

- Data Protection Laws: Ensure that any personal or financial data collected from clients is handled in accordance with privacy laws such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA). Secure payment processing and data storage are critical for legal compliance.

- Refund Policies: Having a transparent refund policy is essential to managing client expectations and avoiding disputes. This should be clearly stated in your terms and should outline under which conditions clients are eligible for a refund.

How to Protect Your Business Legally

- Contractual Clarity: Be explicit about payment terms, late fees, and renewal cycles in your agreements. A well-defined contract can prevent payment-related disputes and ensure that both parties understand their responsibilities.

- Maintain Proper Documentation: Keep accurate records of all billing communications, payments, and contractual agreements. This documentation is crucial in case of audits, disputes, or legal challenges.

- Seek Legal Advice: Consult with a lawyer to ensure that your payment processes and contracts comply with applicable laws. Legal professionals can help you navigate complex regulatory environments and protect your business from potential risks.

By taking the time to understand and address legal requirements, you can safeguard your business, maintain strong client relationships, and avoid costly mistakes. Legal considerations in billing are not just about compliance; they also demonstrate your commitment to transparency and fairness in your business operations.