Self Billing Invoice Template for Streamlined Invoicing

Managing financial transactions with clients can often be complex, especially when it comes to documenting charges and ensuring accuracy. Having a consistent and efficient method to generate necessary records can save time and prevent costly errors. By using a well-structured document for each transaction, businesses can enhance their administrative workflows and improve overall organization.

Whether you are an independent contractor or a small business owner, simplifying the process of creating payment records can significantly reduce the chances of misunderstandings. With the right system in place, you can easily customize the document to suit specific needs and ensure that all essential details are captured. This is particularly useful when working with multiple clients, allowing you to maintain a professional approach while managing various accounts.

Efficiency and accuracy are key when dealing with financial matters, and using the right tools can make all the difference. This guide will explore how adopting a reliable format can streamline the entire procedure, ensuring smoother interactions and more effective tracking of payments.

Self Billing Invoice Template Overview

In any business, keeping accurate records of payments and transactions is crucial. A well-structured document can streamline the process of creating payment statements, ensuring clarity for both the provider and the client. This organized approach allows for a smooth exchange of financial information, improving workflow and reducing potential disputes.

Such a document helps you efficiently track charges and guarantees that all required details are included, including dates, amounts, and relevant services. By using a consistent format, the process becomes quicker and more predictable, allowing for quicker turnover and enhanced professionalism in financial dealings.

Ultimately, adopting this method not only saves time but also offers better control over your finances. With the right system, you can create accurate records tailored to specific client needs, ensuring that every transaction is properly documented and easily accessible when necessary.

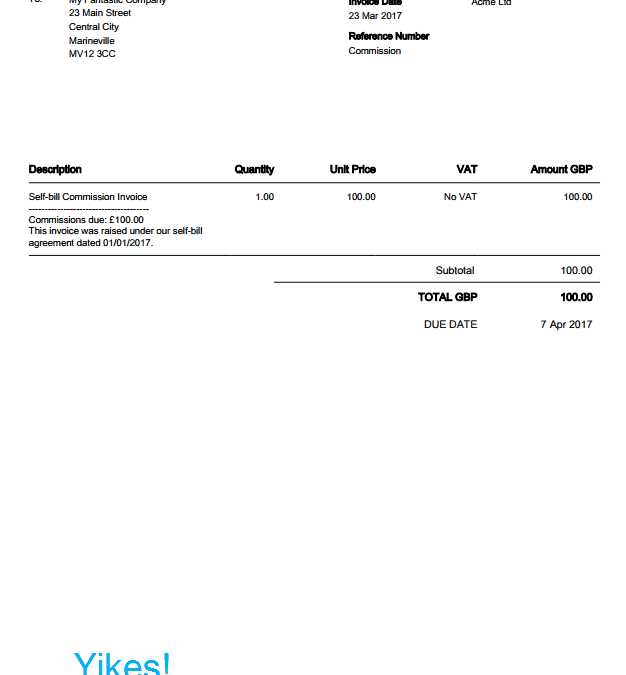

What is a Self Billing Invoice

When providing services or products, clear and transparent payment documentation is essential for both parties involved. A system where one party generates the financial document on behalf of the other ensures that the transaction details are accurately recorded and understood. This method simplifies the process, especially when dealing with multiple transactions, by removing any ambiguity regarding the agreed-upon amounts and terms.

In this arrangement, the party providing goods or services typically prepares the document, detailing the transaction specifics such as the amount owed, the date, and any relevant reference numbers. The recipient of the goods or services uses this document for their records, ensuring consistency and reducing errors in the payment process.

Below is a simple overview of the components typically found in such a document:

| Component | Description |

|---|---|

| Transaction Date | The date when the goods or services were provided. |

| Amount Due | The total charge for the goods or services provided. |

| Service/Product Description | A clear explanation of the products or services rendered. |

| Payment Terms | The agreed terms regarding payment, including deadlines and methods. |

| Recipient Information | Details of the party receiving the goods or services. |

Benefits of Using a Template

Adopting a structured document format for financial records offers several advantages, making the process more efficient and reliable. It reduces the chances of errors and ensures consistency in the information provided. Whether you are a freelancer or managing a small business, this organized approach helps streamline the creation of payment records and saves valuable time.

Improved Efficiency

Using a pre-designed structure allows for quick document creation, eliminating the need to start from scratch each time. It enables you to input necessary details easily and focus on other aspects of your business. By automating part of the process, you can handle more transactions without compromising accuracy or professionalism.

Consistency and Professionalism

With a standardized format, every transaction record will follow the same structure, ensuring uniformity in all communications. This consistency reflects well on your business, presenting you as organized and trustworthy. Clients appreciate clear and professional documentation, which in turn strengthens your reputation.

Efficiency and accuracy are essential for maintaining smooth operations, and utilizing a pre-structured document simplifies both aspects, allowing for better time management and clearer communication with clients.

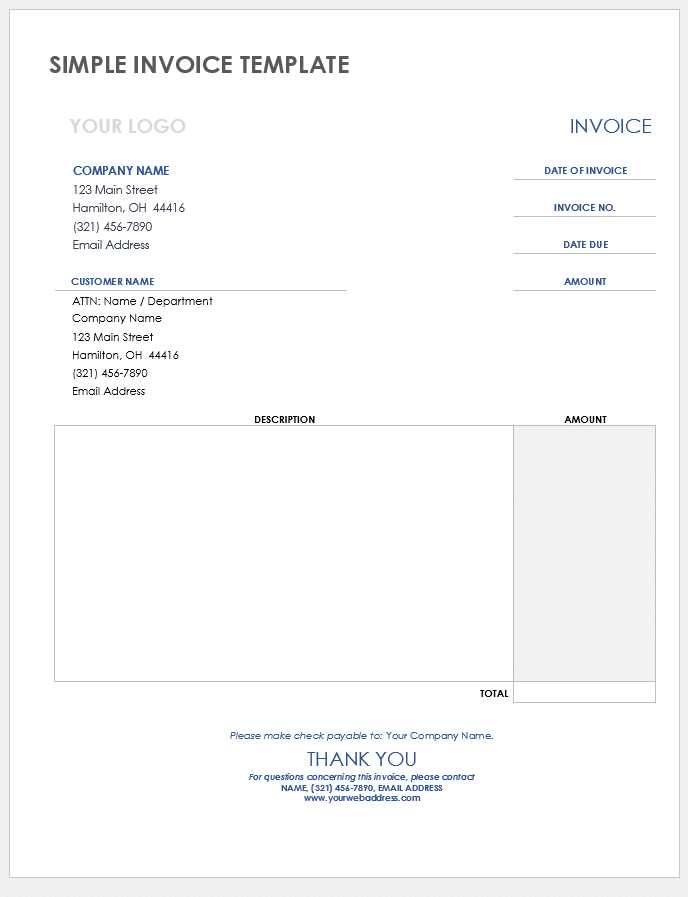

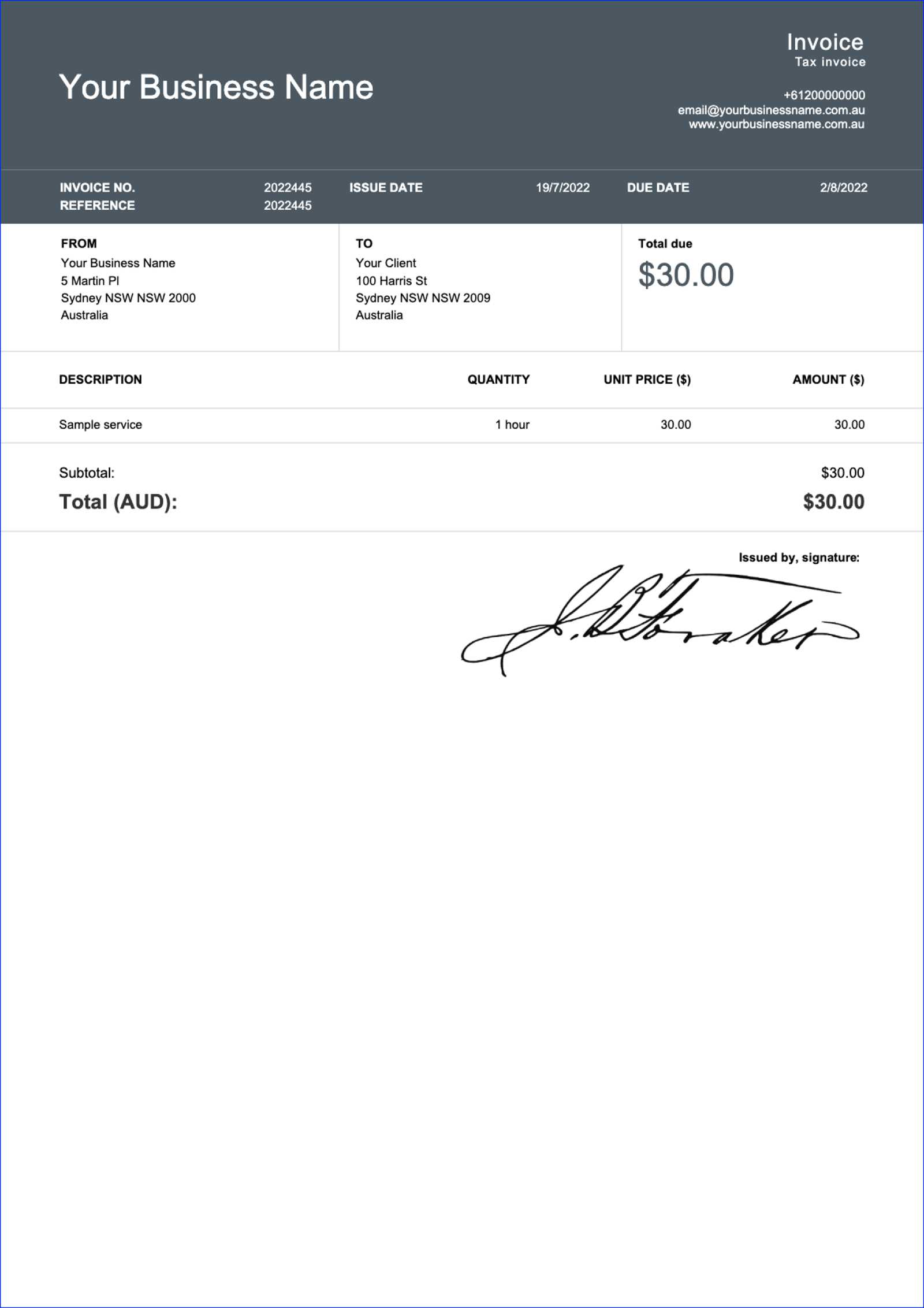

How to Customize Your Invoice

Personalizing your financial documents allows you to tailor them to your business needs and maintain a professional appearance. By adjusting the format and details, you can create records that reflect your brand identity and meet specific client requirements. Customization ensures that every document includes relevant information and aligns with your operational style.

Adjusting Design Elements

Start by selecting a layout that suits your business image. You can modify fonts, colors, and logos to make the document visually appealing and consistent with your branding. A well-designed record not only enhances professionalism but also makes it easier for clients to navigate through the provided information.

Incorporating Essential Details

Make sure to include all the necessary information for clarity and completeness. This includes payment terms, services or products rendered, and any applicable taxes or discounts. Customizing these sections ensures that the document is relevant and provides your clients with all the details they need.

Personalization and accuracy are key to ensuring your documents meet both your and your client’s needs. Customizing them gives you better control over the presentation and content of each transaction.

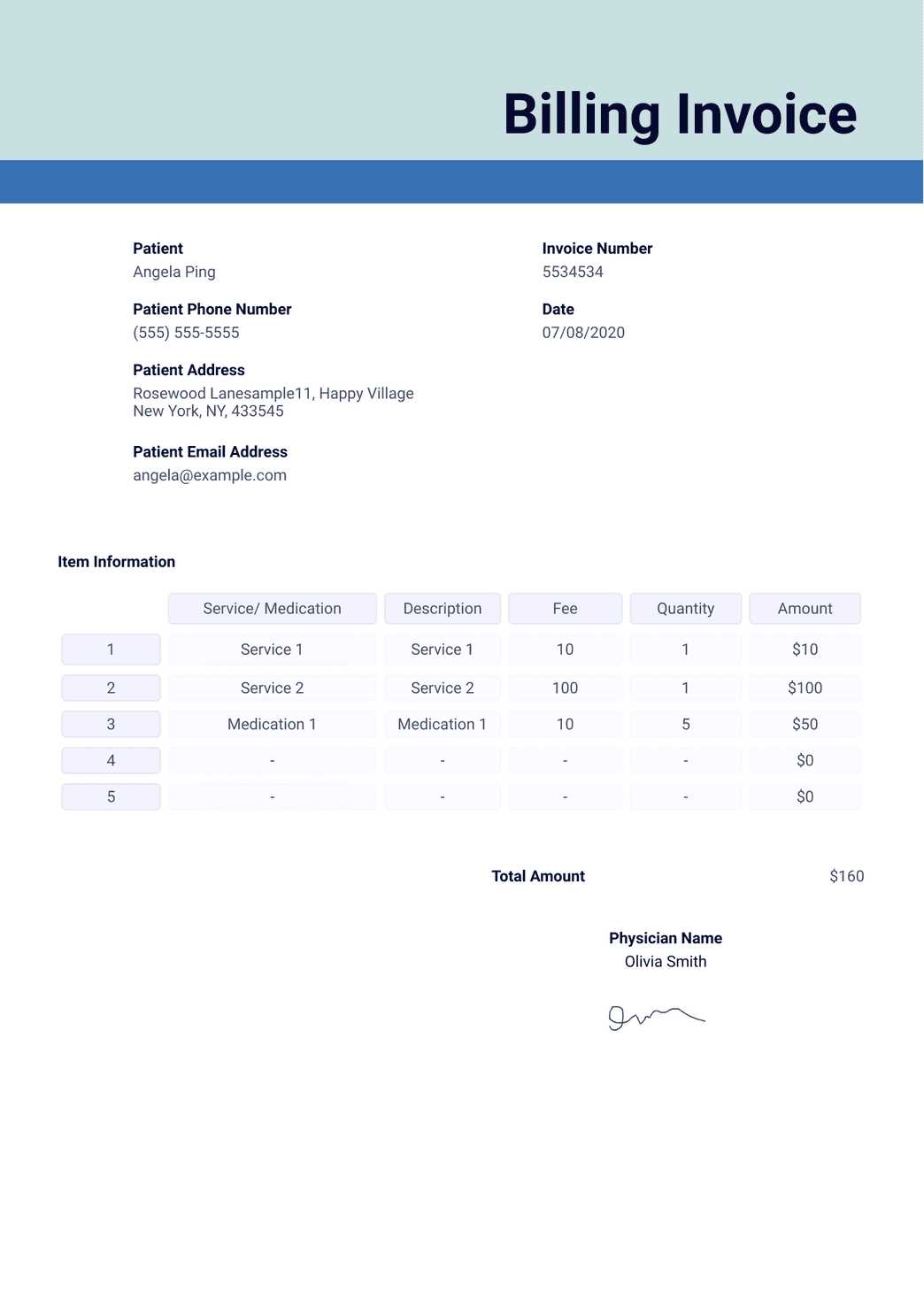

Essential Components of the Template

For any financial record to be complete and effective, certain elements must be included to ensure clarity and accuracy. These components provide both the provider and the recipient with all the necessary details about the transaction, helping to avoid confusion and facilitate smooth processing. Below are the key parts that should always be present in a properly structured document.

Key Elements to Include

- Transaction Date: The date the service was provided or the product was delivered.

- Unique Reference Number: A distinctive identifier for tracking the document and making future reference easier.

- Parties Involved: Names and contact details of both the service provider and the recipient.

- Description of Goods or Services: A clear, concise list or summary of the products or services exchanged.

- Total Amount: The full amount due, including any applicable taxes or additional charges.

- Payment Terms: Information about when and how the payment should be made, including any deadlines.

Additional Information

- Terms and Conditions: Any specific agreements or rules that govern the transaction.

- Discounts or Adjustments: If applicable, details of any discounts, rebates, or adjustments to the total amount.

- Payment Methods: Available options for making the payment, such as bank transfer or credit card.

Including all these elements ensures a comprehensive and transparent document that both parties can rely on for future reference.

Setting Up Your Business Information

Including accurate and detailed business information is crucial for any transaction document. This section ensures that your clients can easily identify your company, contact you when necessary, and know how to make payments. Proper setup of this information also promotes professionalism and builds trust with your customers.

Key Details to Include

- Business Name: Your official company name as registered.

- Contact Information: Include phone numbers, email addresses, and any other relevant contact details.

- Business Address: The physical address where your business operates or where invoices should be sent.

- Tax Identification Number (TIN): If applicable, include your TIN for tax purposes.

- Website or Online Presence: A link to your company’s website or any relevant social media platforms.

Additional Considerations

- Payment Terms: Clarify the payment deadlines and any penalties for late payments.

- Bank Details: If applicable, include your banking information for wire transfers or direct deposits.

- Company Registration Number: If required, include your registration or incorporation number.

Properly setting up your business details ensures that your clients have all the information they need for timely communication and payment processing.

Choosing the Right Format for Your Needs

Selecting the appropriate document format for your business transactions is essential for efficiency and clarity. The format you choose should not only align with your company’s operations but also suit the preferences of your clients. Having the right layout helps ensure smooth communication and reduces the chances of errors or misunderstandings.

Factors to Consider

- Ease of Use: Choose a format that is easy to fill out and understand for both you and your clients.

- Compatibility: Ensure the format is compatible with the software and devices your clients commonly use.

- Clarity: The format should clearly display all the necessary details without overwhelming the recipient.

Popular Formats

- PDF: Ideal for ensuring your document looks the same on any device while providing a professional appearance.

- Excel/CSV: Useful for businesses that require calculations and want to keep track of data in a spreadsheet format.

- Word: Perfect for businesses that want flexibility in editing the document content.

Choosing the right format based on these factors ensures that your documents meet both your and your client’s expectations, helping maintain a smooth workflow.

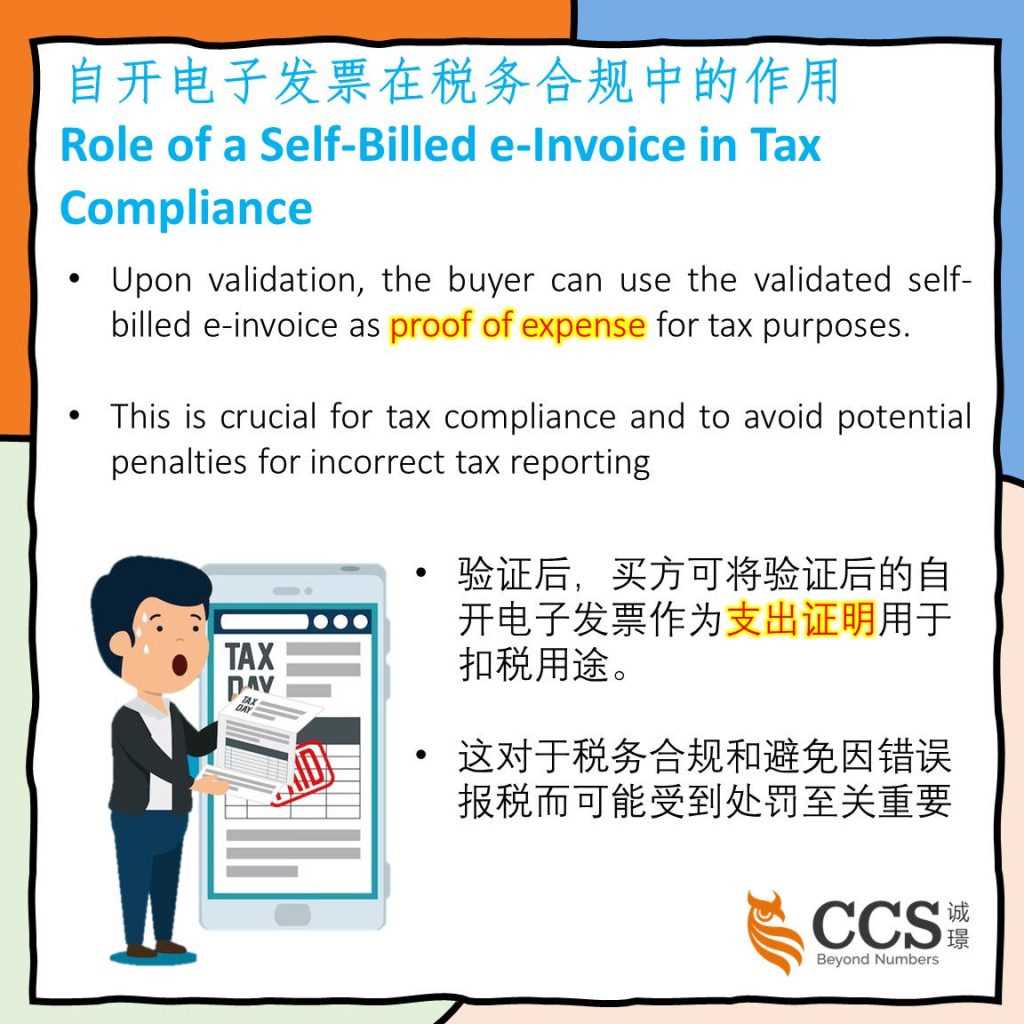

Legal Considerations for Self Billing

When engaging in automatic document creation for financial transactions, it’s important to ensure compliance with relevant laws and regulations. Legal considerations ensure that both parties involved are protected, that the document holds up in legal disputes, and that all required information is provided accurately. Understanding these aspects helps businesses avoid potential penalties and maintain trust with clients.

Key Legal Requirements

| Requirement | Description |

|---|---|

| Tax Compliance | Ensure that all required tax information, such as tax identification numbers and rates, is included in the document. |

| Accuracy of Information | Ensure that all business details, amounts, and dates are accurate to avoid disputes or legal issues. |

| Consent | Both parties should agree on the terms of document generation, including payment terms and conditions. |

| Retention Period | Comply with laws regarding how long financial documents must be retained for record-keeping or auditing purposes. |

Ensuring compliance with these legal requirements not only protects businesses but also builds confidence with customers by demonstrating professionalism and transparency in financial transactions.

How to Automate Invoice Generation

Automating document creation for transactions can significantly improve the efficiency of your business processes. By reducing the time spent on manual tasks, you can streamline operations and ensure that all necessary details are consistently included. This not only saves time but also reduces the likelihood of errors and ensures timely delivery of financial documents.

Steps to Automate the Process

- Choose the Right Software: Select a platform or tool that allows for easy integration with your accounting system and supports the customization of financial documents.

- Set Up Templates: Create pre-designed forms with all required fields that can be quickly filled in with transaction-specific details.

- Integrate with Payment Systems: Link your document generator with your payment processing system to automatically retrieve transaction data for each document.

- Automate Delivery: Configure automatic email notifications to send completed documents to the recipient upon creation.

Benefits of Automation

- Efficiency: Automating the process allows your business to handle a larger volume of transactions without increasing workload.

- Accuracy: By reducing human input, automation helps avoid mistakes such as incorrect data entry or missed information.

- Consistency: Every document generated follows the same structure and includes all necessary details, maintaining professional standards.

Automating this process allows businesses to focus more on growth and client relationships while ensuring timely and accurate documentation.

Common Mistakes to Avoid

When creating transaction documents, several common errors can lead to confusion or delays in processing. These mistakes often stem from missing information, incorrect formatting, or miscommunication between parties. By identifying and addressing these issues early, you can ensure smooth operations and maintain professionalism in your business transactions.

Key Mistakes to Watch For

| Common Mistakes | Consequences | How to Avoid |

|---|---|---|

| Missing Contact Information | Recipients may have difficulty reaching out for clarification or payment. | Ensure all contact details, including addresses and phone numbers, are included. |

| Incorrect Dates | Confusion over payment terms and deadlines. | Always double-check dates and due times before finalizing the document. |

| Unclear Payment Instructions | Delayed payments due to uncertainty on how to pay. | Provide clear, concise payment instructions and methods to the recipient. |

| Inconsistent Formatting | Affects the professional appearance and readability of the document. | Stick to a consistent format, including font styles, sizes, and document structure. |

| Omitting Important Details | Missing information may cause disputes or delays in processing. | Double-check that all required fields and details are filled in correctly. |

Tips for Improving Accuracy

- Review Each Document: Always go through the document before sending it to ensure all necessary details are included.

- Use Predefined Formats: Pre-designed templates can reduce the chance of missing information or making formatting mistakes.

- Implement a Review Process: Have a colleague or another team member review the document to catch any overlooked errors.

By avoiding these common mistakes, you ensure smoother transactions, more efficient workflows, and a higher level of professionalism in your business operations.

How to Track Payments Efficiently

Efficient payment tracking is essential for maintaining financial clarity and ensuring timely settlements. By organizing and monitoring payments systematically, businesses can stay on top of their finances, reduce errors, and prevent potential issues with customers or vendors. Implementing effective tracking methods can help you avoid unnecessary delays and enhance cash flow management.

Key Methods for Tracking Payments

| Method | Description | Benefits |

|---|---|---|

| Spreadsheet Tracking | Recording payments and due dates in a detailed spreadsheet. | Easy to use, customizable, and cost-effective for small businesses. |

| Accounting Software | Using digital tools designed to track and manage payments automatically. | Automation, error reduction, and real-time tracking of transactions. |

| Payment Reminders | Setting up automated reminders to notify customers of upcoming or overdue payments. | Helps reduce delays and maintain consistent cash flow. |

| Bank Reconciliation | Regularly comparing payment records with bank statements to identify discrepancies. | Ensures accuracy and helps identify unprocessed payments quickly. |

| Payment Logs | Maintaining a manual or digital log of all transactions with relevant details. | Provides a clear, concise record for reference and auditing purposes. |

Best Practices for Effective Payment Monitoring

- Stay Organized: Create a standardized system to track incoming and outgoing payments.

- Regular Reconciliation: Perform regular checks between your records and bank accounts to identify inconsistencies.

- Automate Where Possible: Leverage technology to reduce the chances of human error and streamline the process.

- Maintain Clear Communication: Always notify clients or vendors about the status of their payments and due dates.

By applying these methods and best practices, businesses can ensure they have an efficient and reliable system in place for tracking payments, ultimately improving financial management and business operations.

Integrating with Accounting Software

Integrating your financial management system with specialized accounting software can streamline your processes, reduce manual input, and ensure consistency across your records. This connection enables seamless tracking of transactions, automatic updates of financial data, and real-time reporting. By automating many tasks, you can focus on more strategic business decisions while improving accuracy and efficiency.

Key Benefits of Integration

Integrating your payment tracking and financial recordkeeping into an accounting platform offers several advantages. These include:

- Time Savings: Reduces the need for manual data entry and minimizes the risk of errors.

- Improved Accuracy: Automated processes eliminate human error and ensure consistency in records.

- Real-Time Data: Access up-to-date financial information for better decision-making.

- Compliance: Ensures that your financial records align with industry standards and tax regulations.

Choosing the Right Accounting Software

When selecting an accounting system for integration, consider factors such as ease of use, the features offered, and compatibility with your current processes. Popular options include cloud-based solutions that allow for access anywhere, at any time, as well as more traditional software tailored to specific industries. It’s essential to choose a platform that fits the unique needs of your business to maximize the benefits of integration.

By linking your payment systems with reliable accounting tools, you’ll enhance operational efficiency, improve cash flow management, and maintain a more organized approach to finances.

How to Handle Disputes or Errors

Addressing issues or inaccuracies in financial transactions is a crucial part of maintaining strong business relationships and ensuring proper recordkeeping. When discrepancies arise, prompt resolution is essential to avoid misunderstandings and maintain trust with clients or partners.

Steps to Resolve Discrepancies

To effectively manage disputes or errors, follow these steps:

- Identify the Source: Carefully review the details of the transaction and pinpoint the source of the issue.

- Communicate Promptly: Reach out to the concerned party to discuss the issue and find a resolution.

- Provide Evidence: Share relevant documentation or records to support your case and clarify the situation.

- Offer a Solution: Propose a reasonable resolution, such as a correction or adjustment to the terms of the agreement.

Preventing Future Errors

To minimize the chances of future issues, ensure that all relevant details are accurate from the outset. Implementing thorough checks and balances can help identify potential discrepancies early and streamline the process of resolving them.

Tips for Professional Presentation

Ensuring that documents are well-organized and visually appealing is key to creating a professional image for your business. A polished presentation helps build trust and conveys attention to detail, which can strengthen relationships with clients and partners.

Here are some tips to enhance the presentation of your records:

- Keep it Clean: Use a simple, clean layout with clear sections for each piece of information. Avoid clutter to ensure readability.

- Use Consistent Fonts: Stick to professional fonts and maintain consistency throughout. Choose legible sizes and styles for clarity.

- Include Your Brand: Incorporate your logo, company name, and branding elements to reinforce your business identity.

- Provide Clear and Accurate Details: Ensure that all numbers, dates, and descriptions are accurate and easy to follow.

- Stay Organized: Use logical organization for each section and provide helpful headings to guide the reader’s eye.

Managing Multiple Clients with One Template

Efficiently handling the needs of various clients can be simplified by using a single document structure that adapts to multiple situations. This approach saves time, reduces errors, and ensures consistency across all client interactions, making it easier to maintain accurate records and meet diverse expectations.

Key Strategies for Effective Management

- Personalize Client Details: Ensure that client-specific information such as name, contact details, and custom terms are easily adjustable for each entry.

- Use Dynamic Fields: Incorporate fields that automatically update with client-specific data, such as payment terms and item descriptions, to avoid manual adjustments.

- Include Customizable Sections: Customize sections like line items, pricing, and additional notes to meet the individual requirements of each client.

- Maintain Clear Identification: Clearly distinguish between each client’s records with unique reference numbers or client IDs to avoid confusion.

Benefits of a Universal Approach

- Time Efficiency: Manage multiple clients without starting from scratch each time, reducing the time spent on repetitive tasks.

- Consistency: Provide a uniform experience for all clients, ensuring that no important details are missed.

- Reduced Errors: Minimize mistakes by using a consistent format and structure for each client.

When to Update Your Invoice Template

It’s important to periodically review and refresh the structure you use for generating documents to ensure it stays relevant, compliant, and aligned with any changes in your business or legal requirements. Certain events or shifts may signal that it’s time for an update, ensuring that your records remain clear and professional.

- Changes in Pricing: If you adjust your rates or introduce new products/services, make sure to reflect these updates in the document structure.

- Regulatory or Legal Updates: When there are shifts in tax laws or invoicing regulations, update the format to stay compliant.

- Rebranding: Any changes to your company’s logo, name, or visual identity should be incorporated to maintain consistency with your brand image.

- Software Integration: When integrating new systems for managing finances or processing payments, it’s essential to adapt the format to work seamlessly with these tools.

- Client Feedback: If clients request specific adjustments or improvements to the design or layout, take their input into account during your review process.

Regular updates will help ensure that your documents remain accurate, professional, and fully aligned with your evolving business needs.