Consultancy Invoice Template for Easy and Professional Billing

Managing financial transactions efficiently is a key aspect of running a successful business. Professionals across various industries often require a clear, organized document to request payment for their services. This essential tool ensures that clients receive accurate details of the work completed and the corresponding charges, while also helping service providers maintain financial records with ease.

Creating a well-structured payment request is not only about professionalism but also about clarity. It allows both parties to understand the agreed terms and avoid confusion or delays. A good document serves as a legal record of the transaction and can significantly streamline the process of receiving compensation for work done.

In this guide, we will explore the best practices for designing a practical billing document, offering insights into customization, essential components, and tips for maintaining a smooth cash flow. Whether you’re new to freelancing or managing a larger enterprise, this information will help you navigate the administrative side of your business with confidence.

Consultancy Invoice Template Overview

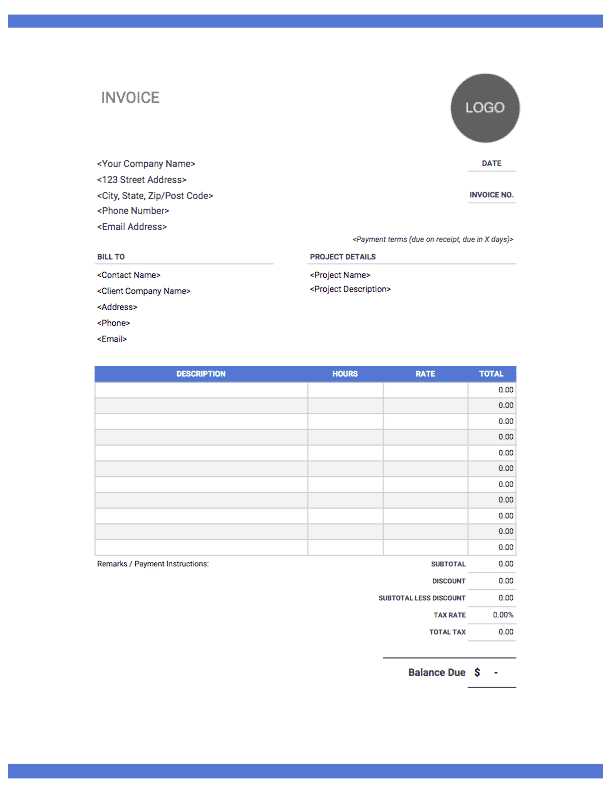

When working as an independent professional, having a clear and organized way to request payment is crucial. A well-designed document can simplify the billing process, ensure all necessary details are included, and help both you and your client stay on the same page. This section will provide an overview of what a standard billing document includes and why it is essential for service providers.

At its core, a billing request is a formal record of the services rendered, the amount owed, and any agreed-upon terms. This document is not only a request for payment but also serves as a legal agreement between the service provider and the client. By ensuring that all essential information is present, professionals can avoid misunderstandings and improve their cash flow management.

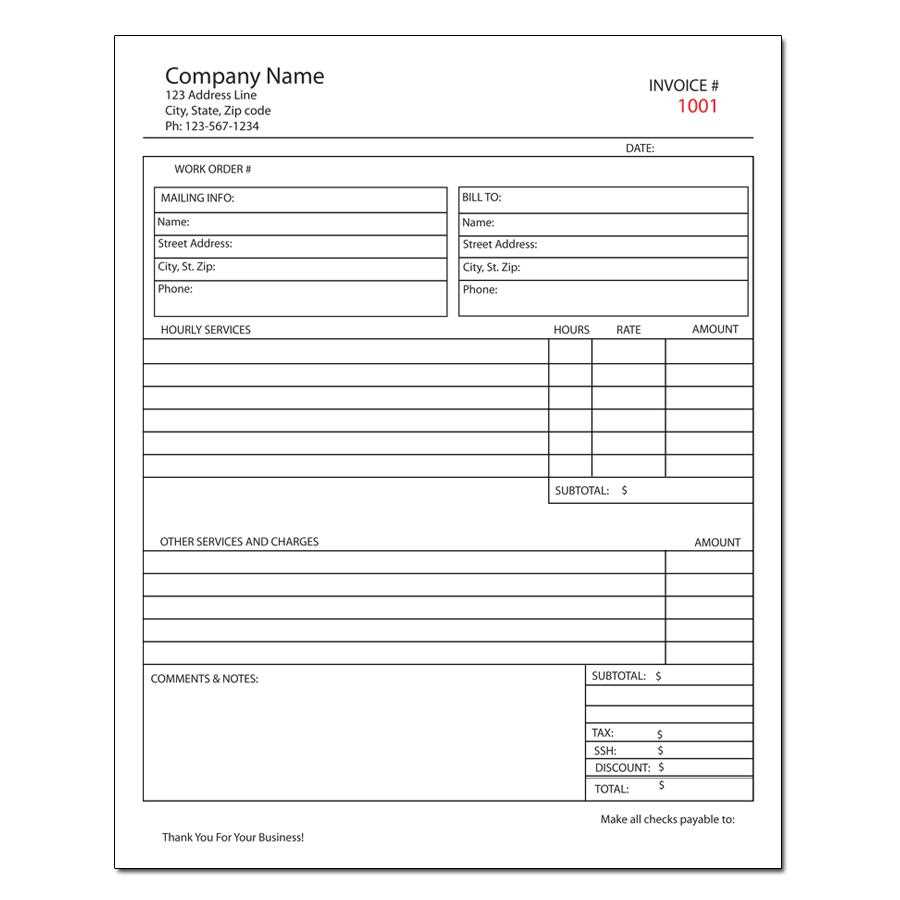

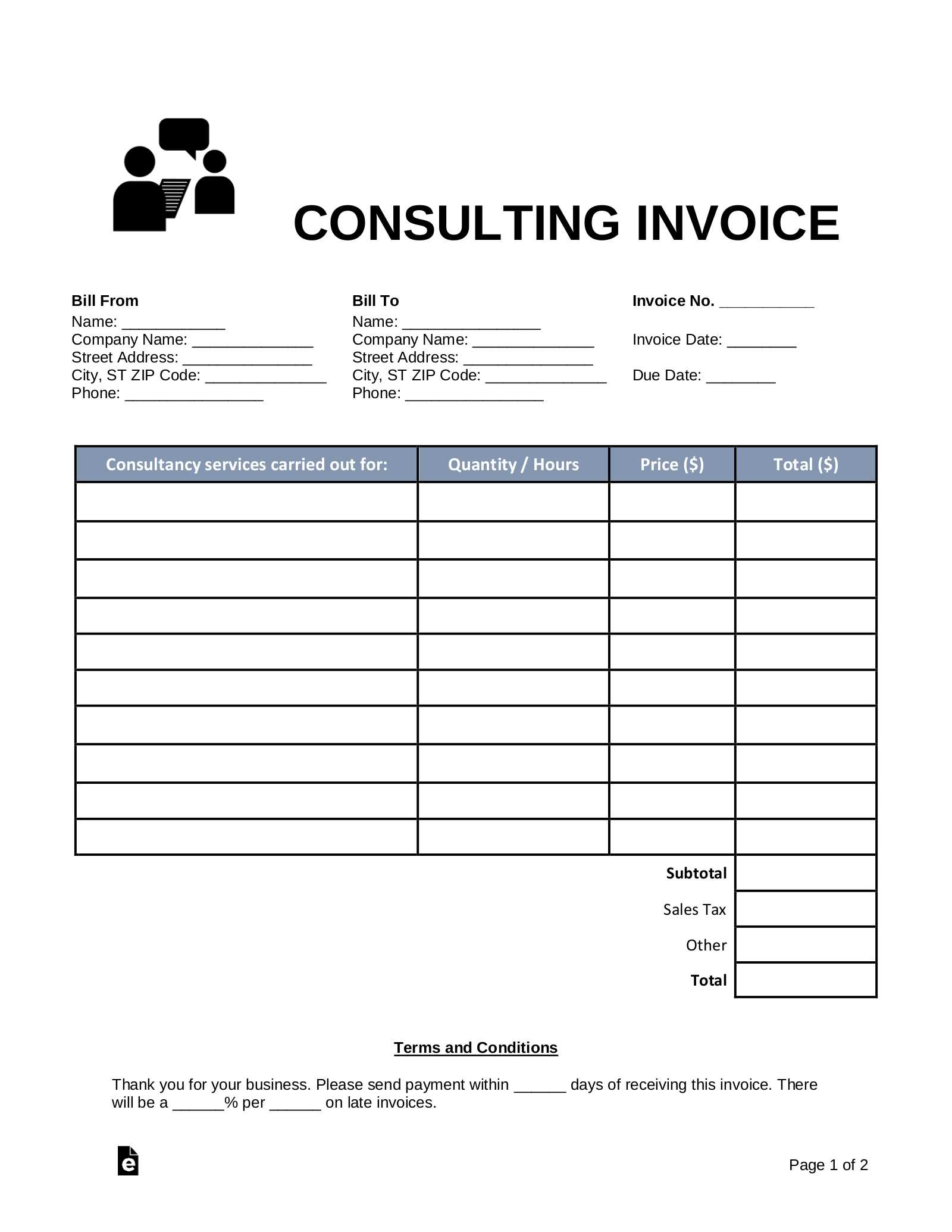

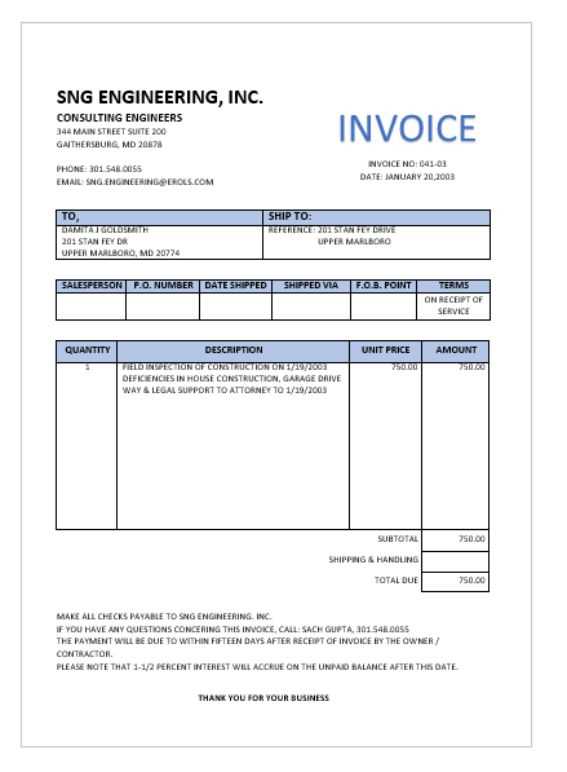

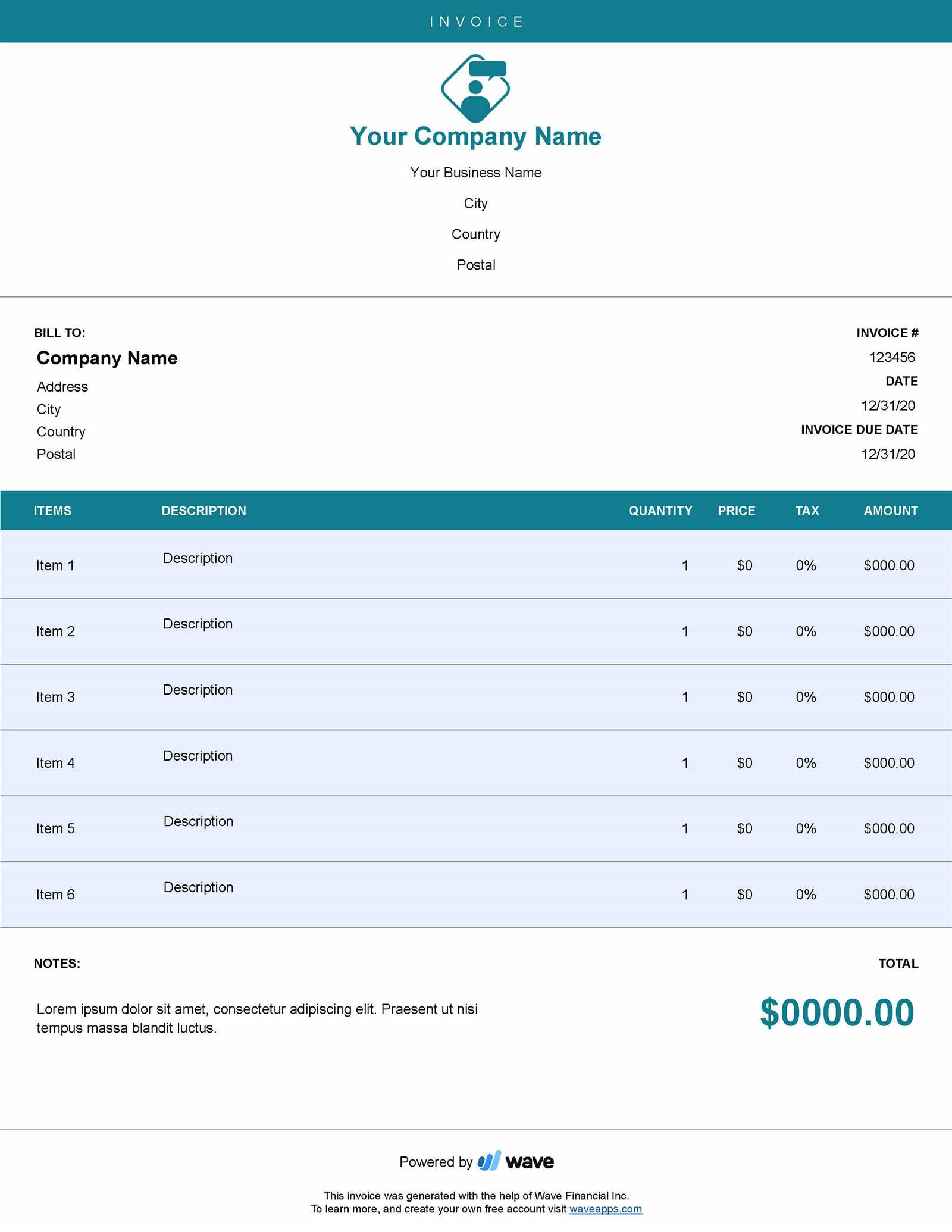

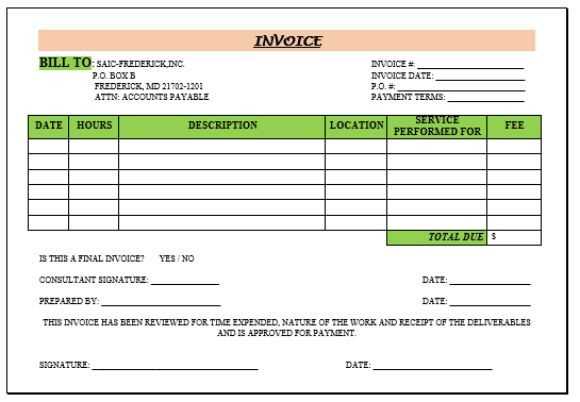

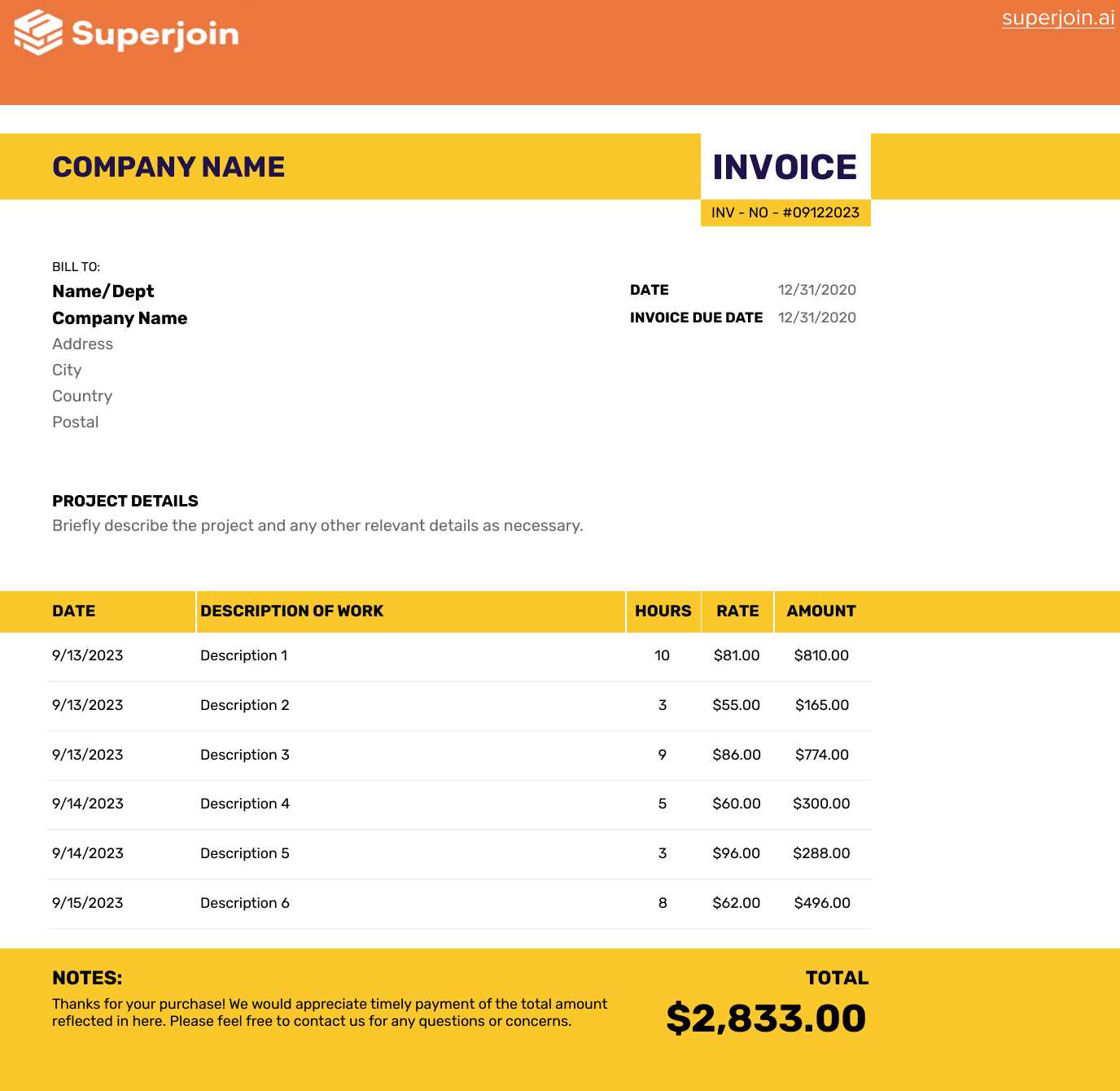

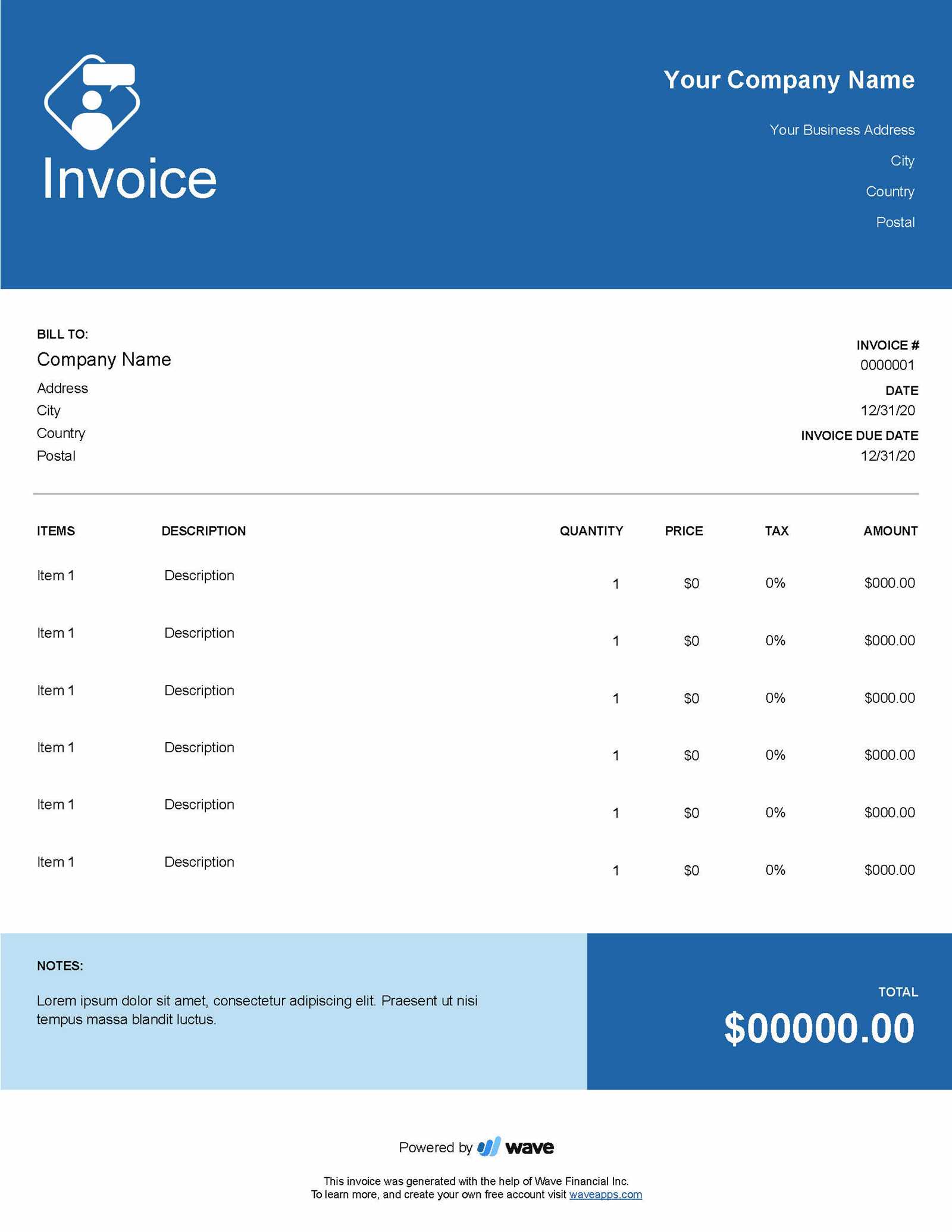

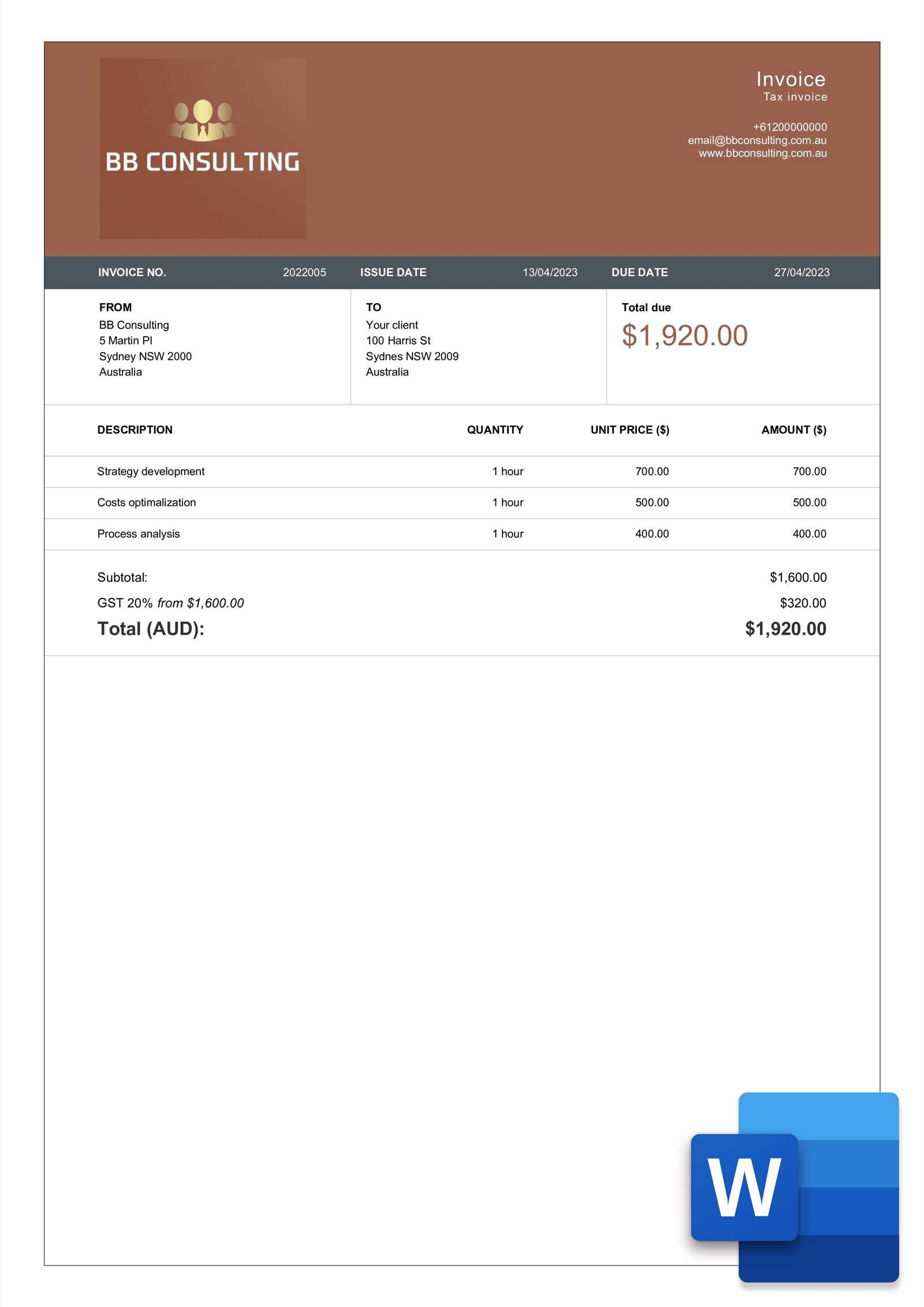

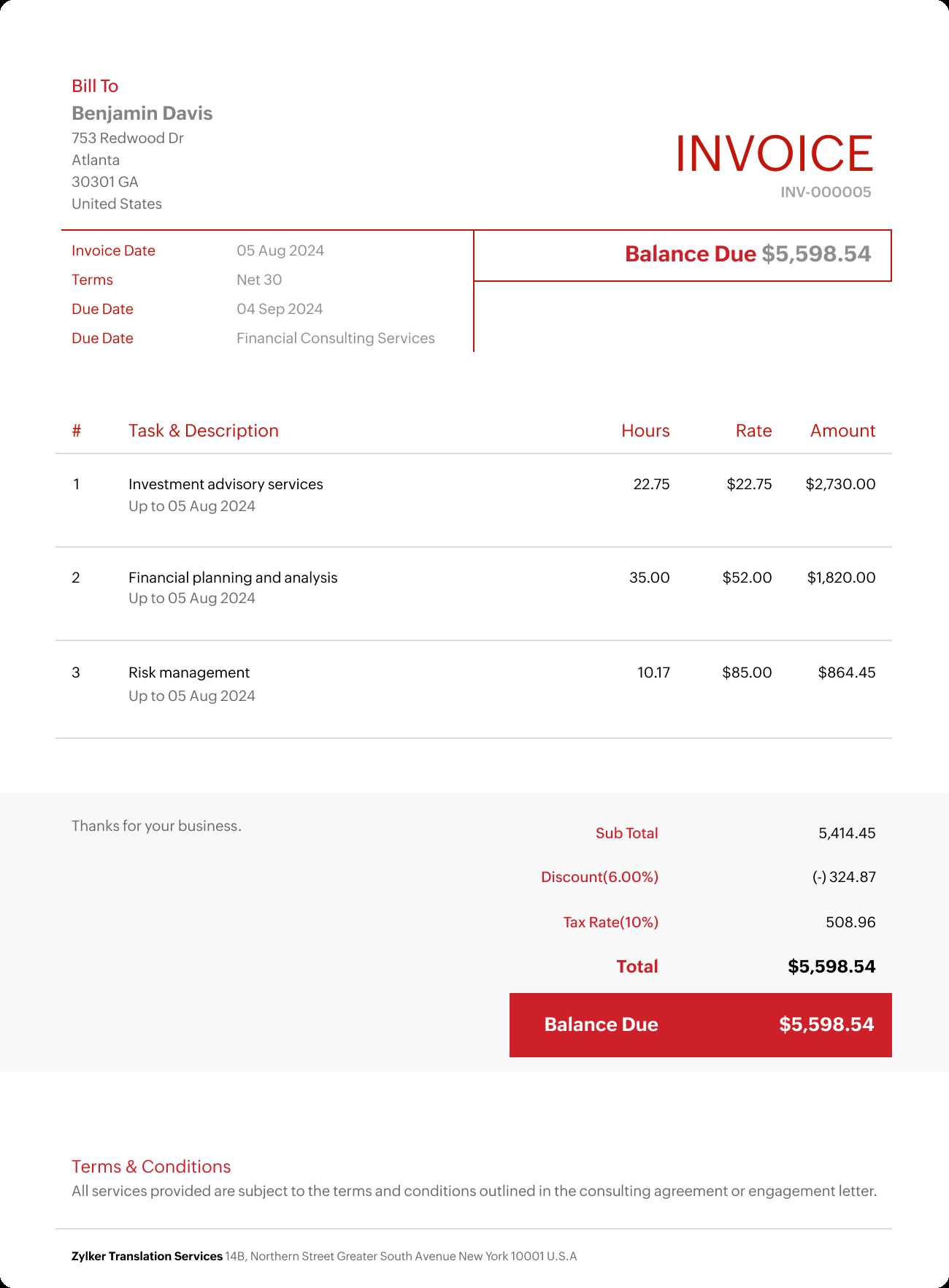

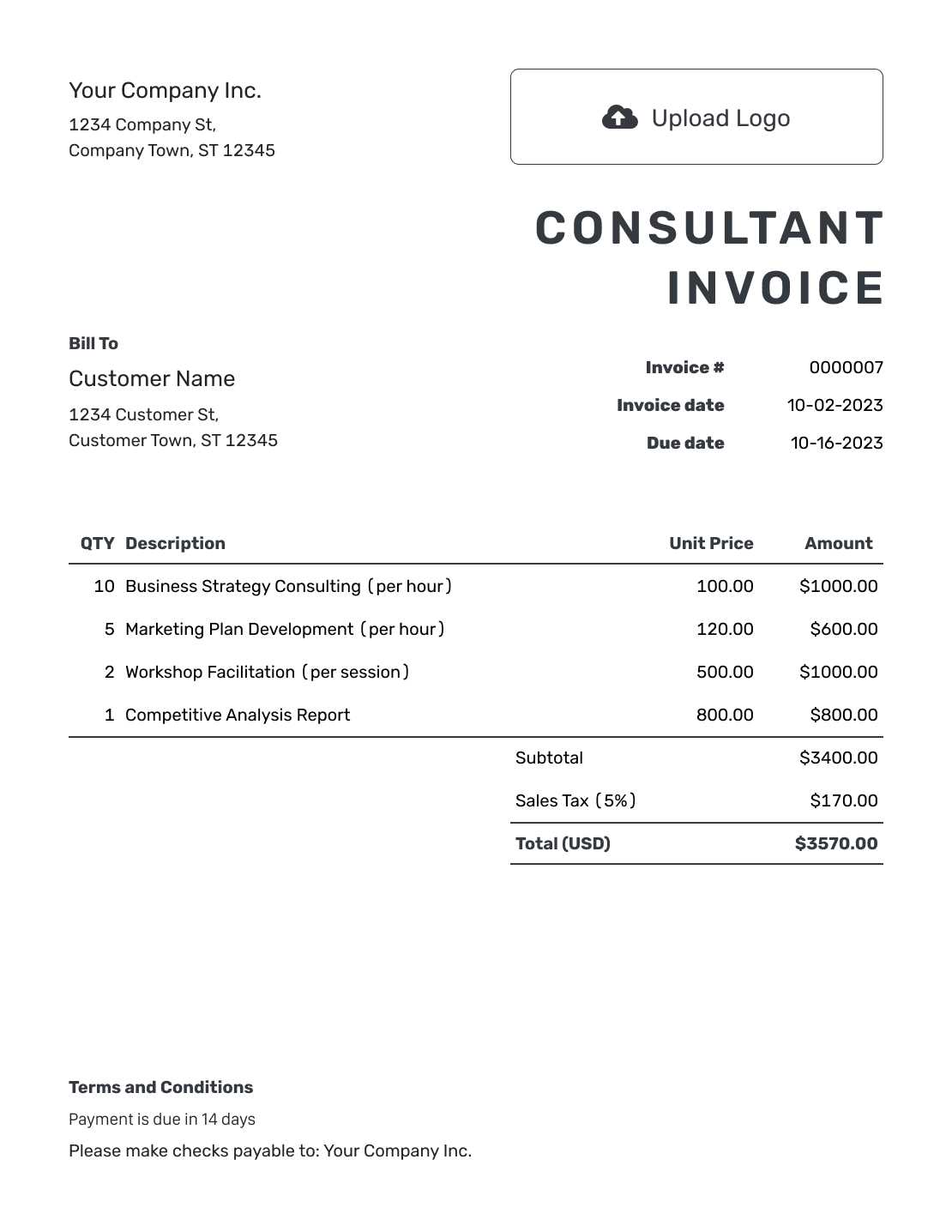

Here are some key elements that should be included in an effective payment request document:

- Service Description: A clear breakdown of the services provided, including any milestones or deliverables.

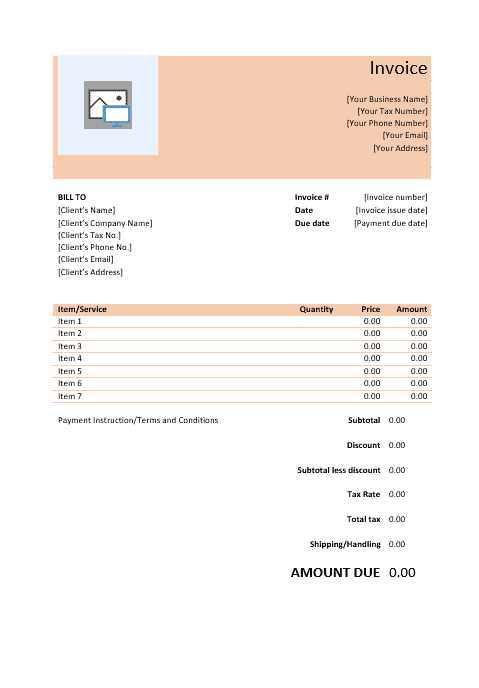

- Payment Amount: The total cost for the services rendered, along with any applicable taxes or fees.

- Payment Terms: The due date, late fees, and payment methods accepted.

- Client Details: The name, address, and contact information of the client being billed.

- Provider Details: Your business or personal information, including your name, address, and contact information.

- Invoice Number: A unique identifier to track the document for record-keeping purposes.

By using a well-structured billing document, service providers can ensure transparency, reduce the chances of delayed payments, and maintain a professional relationship with clients. Moreover, it simplifies the process of record-keeping and tax filing.

Why Use a Consultancy Invoice Template

Having a standardized approach to requesting payments can save significant time and reduce the risk of errors. For professionals offering their services, a structured document provides clarity, ensures consistency, and helps maintain a professional image. By using a pre-designed format, you can focus more on your work and less on administrative tasks.

Efficiency and Time-Saving

Creating a new document from scratch for each client can be time-consuming. Using a pre-built format allows you to quickly generate the necessary paperwork without having to worry about formatting or missing important details. This streamlined process saves time and reduces the chances of making mistakes.

- Faster Document Creation: Simply fill in the required fields and generate a professional document in minutes.

- Consistency: Every document looks the same, providing a sense of order and professionalism.

- Reduced Risk of Errors: A standardized layout ensures that no essential information is overlooked.

Professionalism and Clarity

A well-structured payment request helps reinforce trust and professionalism in business relationships. Clients are more likely to take your work seriously if the paperwork reflects a high standard of organization. Additionally, clarity in the document helps prevent misunderstandings between you and your clients.

- Clear Breakdown of Charges: A detailed list of services and costs makes it easy for the client to understand exactly what they are paying for.

- Legal Protection: A properly structured document acts as a formal agreement that both parties can refer to in case of any disputes.

- Enhances Communication: The more transparent and organized your billing is, the more likely clients are to trust your professionalism.

In conclusion, using a ready-made format can streamline your billing process, help you maintain consistency, and improve communication with clients. It is an effective tool for any professional looking to reduce administrative burden while keeping their operations smooth and efficient.

Key Elements of a Consultancy Invoice

When creating a payment request document, it’s important to ensure that all necessary information is clearly presented. A well-structured document includes key details that help both you and your client understand the terms of the transaction. These components not only make the document easier to process but also protect both parties in case of any future disputes.

Below are the essential elements that should be included in any service billing document:

| Element | Description | |||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service Description | A clear outline of the work performed, detailing the tasks, hours worked, or milestones completed. | |||||||||||||||||||||||||||||||||||||||

| Amount Due | The total cost for the services, including any additional fees, taxes, or discounts. | |||||||||||||||||||||||||||||||||||||||

| Client Details | The name, address, and contact information of the client who is being billed. | |||||||||||||||||||||||||||||||||||||||

| Provider Details | Your business or personal information, including your name, address, and contact details. | |||||||||||||||||||||||||||||||||||||||

| Payment Terms | Details about the payment due date, acceptable payment methods, and any late fees or penalties. | |||||||||||||||||||||||||||||||||||||||

| Invoice Number | A unique identifier for tracking and referencing the payment request. | |||||||||||||||||||||||||||||||||||||||

| Date of Issue | The date when the document is created and sent to the client. | |||||||||||||||||||||||||||||||||||||||

| Due Date | The date by which the client is expected to pay

How to Customize Your InvoicePersonalizing your payment request document is crucial to reflect your brand and make it stand out. A customized format not only gives a professional appearance but also ensures that all the necessary details specific to your business and clients are included. Customization allows you to adapt the document to your unique needs while maintaining clarity and consistency. Here are a few steps to follow when tailoring your payment request document:

By customizing your payment request document, you ensure that it aligns with your specific business model, client expectations, and professional standards. A personalized approach helps reinforce trust and credibility, making it easier to establish long-term working relationships. Best Practices for Invoicing ClientsEffective billing practices are essential for maintaining smooth cash flow and fostering positive client relationships. Clear, professional, and timely payment requests help ensure that you receive payment promptly while also promoting trust and transparency. Following best practices in how you structure and send these documents can prevent confusion and minimize delays in payments. Here are some best practices to consider when preparing payment requests for your clients:

By adhering to these practices, you can streamline the billing process, reduce payment delays, and maintain positive, professional relationships with your clients. A well-managed billing system is a cornerstone of successful business operations. Common Mistakes in Consultancy Invoices

When requesting payment for services rendered, even small errors in the document can cause confusion, delays, or even disputes. While it might seem simple, creating a clear and accurate payment request is essential to ensure smooth transactions with clients. In this section, we will highlight some of the most common mistakes professionals make when drafting their payment documents and how to avoid them. Typical Errors to AvoidMany professionals make easily avoidable mistakes when preparing payment requests. These can range from missing information to failing to follow up properly. Below are some of the most frequent issues:

How to Correct These MistakesTo avoid these common errors, it’s essential to create a checklist for each document you send. Ensuring accuracy and clarity in every detail will improve your professionalism and the likelihood of getting paid on time. Additionally, using accounting or billing software can automate many aspects of this process, reducing human error. By paying close attention to the details and following best practices, you can avoid these mistakes and ensure smoother transactions with your clients. Choosing the Right Invoice Format

Selecting the correct layout for your payment request document is essential to ensure clarity, professionalism, and easy communication with clients. The format you choose should align with the nature of your services, the complexity of your billing, and your clients’ expectations. A well-chosen format makes it easier to detail the work performed, the charges applied, and the payment terms, ensuring a smooth transaction process. Factors to Consider When Choosing a FormatThere are several factors to consider when deciding on the best structure for your payment request. The right format can save time, minimize confusion, and promote better communication with your clients. Below are key considerations for selecting the ideal layout:

Common Format TypesThere are several common formats to consider when choosing how to structure your payment request. Each has its advantages, depending on the nature of your business and client preferences:

By carefully selecting the right format for your business and clients, you can enhance the professionalism of your payment requests and ensure a more efficient and successful billing process. How to Add Payment TermsIncluding clear and precise payment terms in your billing document is crucial to avoid confusion and ensure timely compensation. These terms outline when and how the payment should be made, and they help both you and your client understand the expectations surrounding the financial transaction. Properly defined payment terms also protect you in case of delayed payments or disputes. Key Payment Terms to IncludeWhen adding payment terms, it’s important to be as specific as possible to prevent any misunderstandings. Here are the key elements to consider:

Best Practices for Clear Payment TermsTo make sure your payment terms are clear and effective, consider the following best practices:

By carefully adding and clarifying your payment terms, you can help ensure that your business receives timely compensation while maintaining a positive relationship with your clients. Importance of Invoice NumberingAssigning a unique number to each payment request is a crucial practice for organizing and tracking your financial transactions. A structured numbering system not only helps you keep records in order but also makes it easier to manage client communications, accounting, and potential audits. Without a clear numbering system, it can become challenging to track payments, identify discrepancies, and maintain a smooth workflow. Why a Unique Number MattersHere are some key reasons why it is important to use a numbering system for your payment documents:

Best Practices for NumberingTo ensure your numbering system works effectively, consider the following best practices:

|