Free Roofing Invoice Template for Contractors and Roofing Businesses

For any business in the construction industry, clear and accurate billing is crucial to ensure timely payments and maintain good client relationships. Whether you’re working on residential or commercial projects, providing a detailed statement of services rendered is an essential part of your workflow. Without an efficient system, you risk confusion, delayed payments, or even disputes that could harm your reputation.

Streamlining the billing process can save valuable time and help maintain professionalism. A well-structured document not only reflects the quality of your work but also ensures that both parties understand the financial aspects of the agreement. By using a pre-designed format, you can easily include all the necessary details without overlooking important elements like payment terms, job descriptions, or due dates.

With the right tools, managing finances for construction projects becomes simpler and more organized. Adopting a standardized approach to billing can minimize errors and improve cash flow management. This guide will provide you with the key aspects to consider when creating a professional and efficient statement of charges for your business.

Understanding the Importance of Billing Documents

In any service-based industry, clear and transparent billing is essential for maintaining smooth operations and ensuring timely payments. Proper documentation not only helps businesses track their work but also builds trust with clients by clearly outlining the services provided and associated costs. For contractors and service providers, these records are crucial to avoid misunderstandings and to keep cash flow on track.

Clarity and Professionalism

Providing clients with a well-structured statement of charges shows professionalism and attention to detail. A clear document can help avoid confusion about pricing, work completed, and payment expectations. This kind of transparency is essential for building long-term client relationships, as it sets a positive tone for future business interactions.

Legal and Financial Protection

Accurate records also serve as important legal documents in case of disputes. In the event of a disagreement regarding payment, a properly formatted document can be used as evidence of the agreed-upon terms. Additionally, these documents help keep your financial records in order, simplifying accounting and tax reporting processes.

Why a Billing Document Format Matters

In any service industry, having a consistent format for financial documentation is essential. Using a pre-designed structure helps ensure that all necessary details are included, reducing the likelihood of errors and streamlining the payment process. By adopting a professional, standardized approach to charges, businesses can maintain clarity and avoid potential disputes with clients over costs and services provided.

A well-organized financial record not only improves internal operations but also enhances your business’s credibility. Clients are more likely to trust a service provider who presents clear, detailed documents that outline all terms and pricing. Furthermore, standardized records help businesses stay on top of their accounting and tax reporting, keeping everything in order for future reference.

| Key Benefit | Description |

|---|---|

| Consistency | Using a fixed structure ensures that every document is uniform and professional, reducing mistakes. |

| Efficiency | A standardized document saves time, as all essential fields are already defined. |

| Transparency | A clear format helps clients understand exactly what they are paying for, fostering trust. |

| Organization | Pre-designed forms help maintain better financial records, which is crucial for accounting and taxes. |

Key Features of a Billing Document Structure

An effective billing record should contain all the essential information to ensure both the service provider and client are clear on the terms of the transaction. A structured document includes specific sections that outline services rendered, payment amounts, due dates, and other important details. This helps avoid confusion and ensures prompt payment. Below are some critical features that a well-designed record should include.

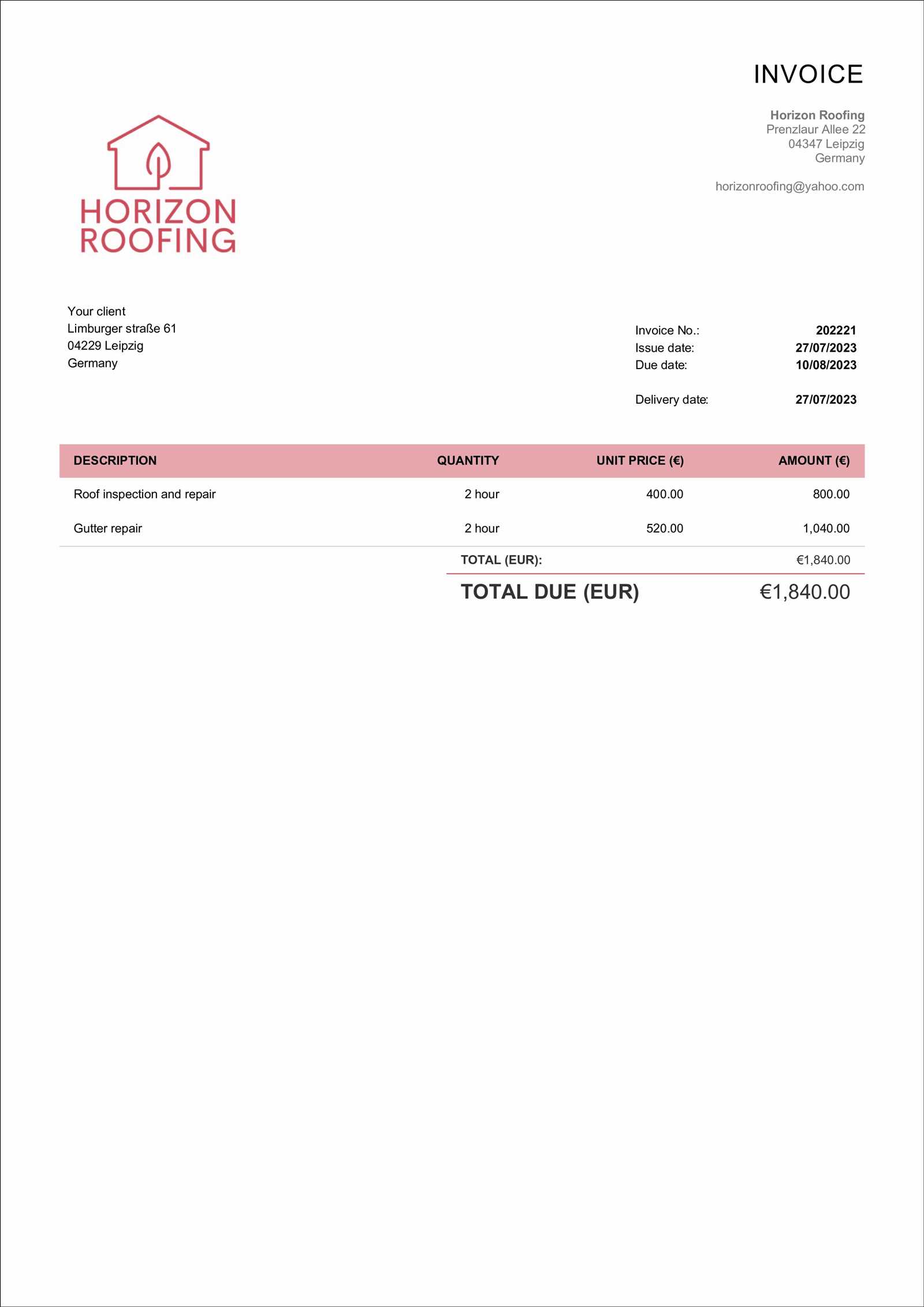

Detailed Service Breakdown

One of the most important aspects of a financial document is providing a clear description of the work performed. Listing each task or service separately with its corresponding cost helps the client understand exactly what they are being charged for. This transparency is key to maintaining good client relationships and reducing potential disputes over pricing.

Payment Terms and Deadlines

Clearly outlining the payment terms is vital for managing cash flow and ensuring timely payments. The document should include payment due dates, accepted payment methods, and any late fees or discounts for early payment. By setting these expectations upfront, both parties are on the same page, making it easier to track outstanding balances and minimize delays.

How to Create a Professional Billing Document

Creating a professional financial record is essential for any business looking to maintain organization and credibility. A well-crafted document not only helps clients understand the charges but also reflects your business’s professionalism and attention to detail. By following a few simple steps, you can ensure that your records are clear, accurate, and effective at facilitating timely payments.

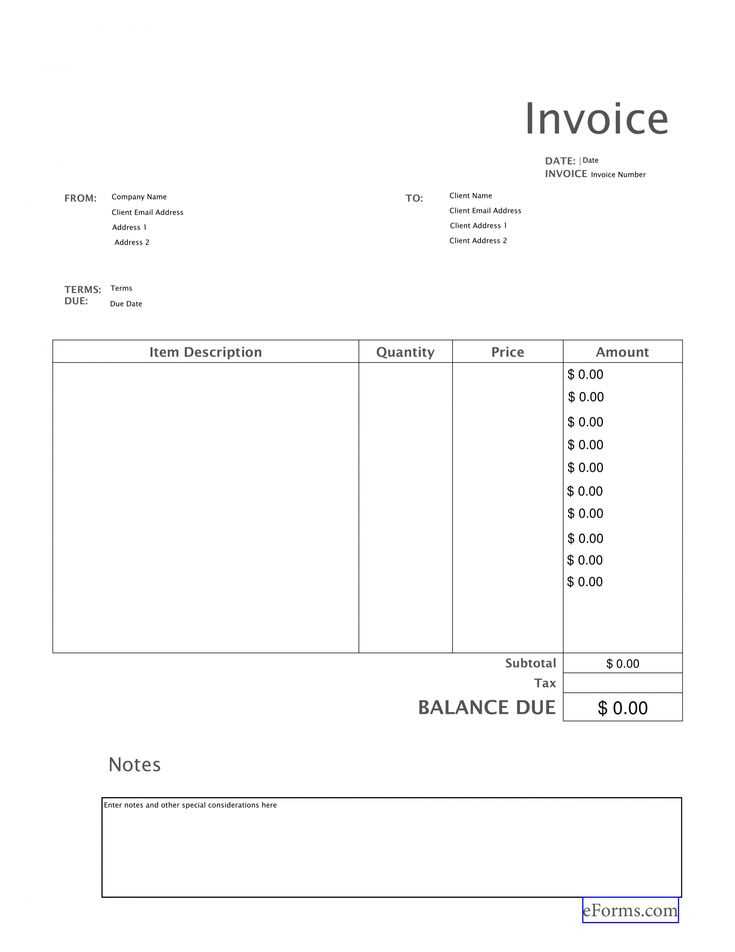

Step 1: Include Essential Information

Start by including all the necessary details at the top of the document. This should include your business name, contact information, and any applicable license numbers. Similarly, include the client’s name, address, and contact details. Clearly mark the document as a financial record and include a unique reference number to make it easily identifiable in case of follow-up or future reference.

Step 2: Break Down the Services and Costs

Next, provide a detailed list of the work performed, breaking it down into individual tasks or services. For each entry, include a description, quantity, rate, and total cost. This level of detail helps prevent confusion and makes it easy for clients to see exactly what they are paying for. You can also group related tasks together for simplicity, but always ensure clarity in your breakdown.

Tip: Always double-check the amounts and make sure your totals are accurate before sending the document to avoid mistakes that could lead to delays in payment.

Step 3: Set Payment Terms and Due Dates

Clearly outline your payment terms, including the total amount due, payment methods, and the due date. If applicable, include any late payment fees or discounts for early settlement. This ensures both parties are clear on when and how payments should be made, reducing the chances of delayed or missed payments.

Customizing Your Billing Document Format

Tailoring your financial records to fit your business’s needs is an important step in creating a professional and efficient system. Customization allows you to ensure that all the relevant details are captured and presented in a way that aligns with your brand while also making it easy for clients to understand. There are several key areas where customization can add value to your documents.

Branding and Personalization

One of the first things to customize is the appearance of your document. Adding your business’s logo, colors, and contact information not only enhances your brand’s identity but also makes the document look more official. Here are a few ways to personalize your billing record:

- Include your company logo at the top of the document.

- Use company colors or fonts to match your brand’s aesthetic.

- List your business address, phone number, email, and website in the header or footer.

Adjusting Payment Terms and Conditions

Another important aspect to customize is the payment section. Depending on your business model, you may have different payment terms, such as deposits, milestones, or discounts for early payments. Here’s how you can adjust this section:

- Specify the due date for payments and any late fees that may apply.

- Include payment options, such as bank transfers, checks, or online payment methods.

- Offer discounts or incentives for early payments, if applicable.

By adjusting these elements to suit your specific needs, you can make your financial records more efficient and professional, leading to smoother transactions and stronger client relationships.

Top Mistakes to Avoid in Billing Documents

Creating a clear and accurate financial record is essential for maintaining smooth business operations and positive client relationships. However, even small mistakes in the way you present charges can lead to confusion, delays, and even disputes. Avoiding common errors when preparing these documents can help you ensure timely payments and reduce the risk of misunderstandings.

1. Lack of Clear Descriptions

One of the biggest mistakes is not providing sufficient detail about the services rendered. Clients should easily understand what they are paying for, and any ambiguity can lead to questions or disputes. A detailed breakdown not only improves clarity but also reinforces trust between you and your clients.

Tip: Always include specific descriptions of each task, along with quantities and rates, to avoid confusion.

2. Missing or Incorrect Payment Terms

Another common error is failing to clearly outline payment terms, such as due dates, accepted payment methods, or penalties for late payments. Missing this information can lead to delayed payments and affect your cash flow. Similarly, incorrect or vague terms can result in disagreements with clients.

Tip: Make sure your payment expectations are clearly stated, including the total amount due and any specific conditions for payment.

By avoiding these mistakes, you can ensure that your financial records are clear, accurate, and professional, which will help you maintain a smooth billing process and foster better relationships with your clients.

Essential Information for Billing Documents

To ensure that your financial records are clear and effective, it’s important to include all necessary information. A comprehensive billing document should cover key details about both the services provided and the terms of payment. Having this information clearly outlined will help avoid confusion and ensure that clients understand exactly what they are being charged for, which in turn leads to faster payments.

Key Elements to Include

There are several vital pieces of information that should be present in every document to ensure clarity and accuracy:

- Your Business Details: Include your business name, contact number, email, and address at the top of the document.

- Client Information: Always include the client’s name, address, and contact details to ensure the record is easily identifiable.

- Unique Reference Number: A unique identifier for the document helps in tracking and managing multiple records, particularly for large or ongoing projects.

- Service Description: Provide clear details of the work performed, including quantities, rates, and any other relevant specifications.

- Payment Terms: Specify the total amount due, payment due dates, and acceptable payment methods (e.g., bank transfer, check, credit card).

- Due Date: Clearly state the payment deadline, and mention any penalties for late payments to set expectations.

Additional Information

While the above items are essential, including optional details such as a thank-you note or referral discounts can further enhance your professionalism and encourage repeat business. These small touches can help maintain positive relationships with clients.

Ensuring that these key details are included will make your financial records more transparent, professional, and effective in securing timely payments.

How to Organize Billing for Construction Projects

Proper organization of financial records is crucial for any construction project, especially when dealing with multiple tasks, timelines, and payments. A well-structured approach ensures that all charges are accounted for, clients are kept informed, and payments are received on time. By organizing your billing process effectively, you can streamline operations and reduce the chances of errors or disputes.

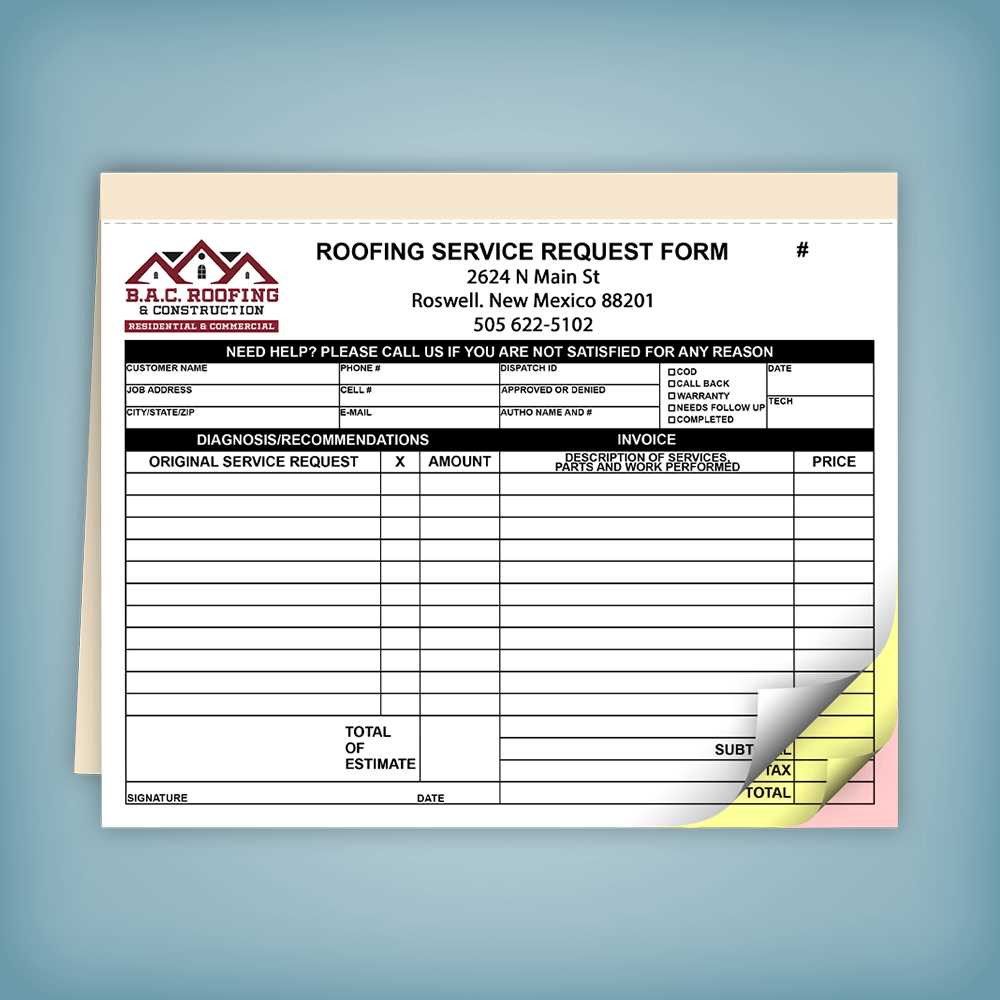

1. Break Down the Project into Phases

One of the best ways to organize billing is by dividing the project into phases or milestones. This method allows you to bill clients progressively as each phase of the work is completed. For example, you can bill for the initial consultation, materials, labor, and then final touches separately. This approach provides a clear understanding of what the client is paying for at each stage, reducing the risk of confusion.

Tip: Ensure each phase has clear deliverables and timelines to avoid ambiguity about what is included in each billing cycle.

2. Set Clear Payment Terms

Establishing payment terms from the outset of the project is key to ensuring a smooth financial process. Specify when payments are due, what methods are accepted, and any penalties for late payments. You can consider offering discounts for early payment or require a deposit before beginning work to secure funds upfront. Setting these expectations at the start helps avoid issues later in the project.

- Define the total amount due and break it down according to the phases of work.

- Include any applicable taxes or additional fees.

- List payment methods, such as checks, bank transfers, or online payment platforms.

- State the due dates for each payment or milestone.

By organizing your financial records and setting clear expectations with your clients, you can keep the billing process efficient and transparent throughout the project. This reduces delays and ensures you receive timely payments for your work.

Choosing the Right Billing Document Format

When preparing financial documents for your business, selecting the appropriate format is crucial for ensuring clarity and ease of use. The right structure helps streamline the payment process, making it easier for both you and your clients to track charges and payments. Whether you are working with a simple project or a complex job with multiple stages, choosing a format that suits your needs will improve efficiency and professionalism.

There are different formats available, depending on the complexity of the work and the level of detail required. For smaller, straightforward jobs, a simple format may suffice, whereas larger projects may require a more detailed structure with multiple sections to cover each phase of the work.

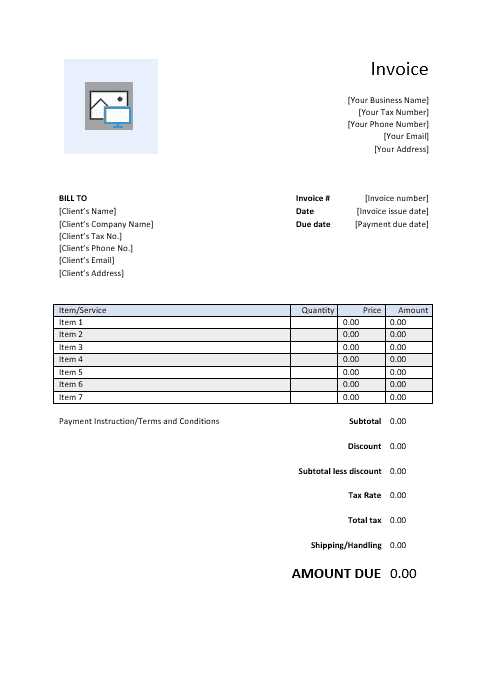

Standard vs. Custom Formats

For many businesses, a standardized approach to billing documents is sufficient. These formats are typically easy to use and ensure consistency across all records. However, in certain cases, a more customized format may be necessary to reflect the specific needs of a project or business. Custom formats allow you to include additional details such as payment milestones, discounts, or taxes, providing a clearer picture of the financial agreement.

Tip: Always choose a format that is clear, professional, and aligns with your business model to avoid confusion and improve client satisfaction.

Digital vs. Paper Formats

Another consideration when choosing a format is whether to use a digital or paper document. Digital formats are often more convenient, as they can be easily shared via email or through online platforms. They also allow for automatic calculations and integration with accounting software. Paper documents, on the other hand, may be preferred for clients who are more traditional or when physical signatures are needed.

Ultimately, the best format for your financial documents depends on your business’s needs, your client base, and the type of projects you manage. Choose the format that offers the most clarity, accuracy, and ease of use.

Using Digital vs Paper Billing Documents

When choosing how to issue financial records for your business, the decision between digital and paper formats can significantly impact both efficiency and client experience. Each approach has its own set of advantages, and understanding these can help you determine which is best suited for your operations. While digital documents offer convenience and speed, paper records can be more familiar and reliable for certain situations. Below, we explore the key differences between these two options.

| Feature | Digital Format | Paper Format |

|---|---|---|

| Convenience | Easy to send via email or upload to online platforms. | Requires physical delivery or mailing, which can be slower. |

| Cost | No printing or postage costs. | Involves expenses for printing, postage, and storage. |

| Speed | Instant delivery and easy access for clients. | Delivery time can be delayed, especially for long-distance clients. |

| Record Keeping | Can be automatically stored and backed up in digital systems. | Requires physical storage, which can be cumbersome and prone to damage. |

| Client Preferences | Preferred by clients who are comfortable with technology and digital payment methods. | Some clients may prefer physical copies for their records or may not be comfortable with digital transactions. |

Tip: If you are dealing with clients who are accustomed to traditional methods, offerin

How a Template Saves Time and Effort

Using a pre-designed structure for financial documents can greatly reduce the amount of time and effort spent on each record. A ready-made format ensures that all necessary fields are present and organized, eliminating the need to create each document from scratch. This efficiency allows you to focus on other important tasks while maintaining accuracy and professionalism in your paperwork.

Benefits of Using a Pre-Designed Format

Here are some key advantages of utilizing a structured document format:

- Consistency: A standardized format ensures that every document follows the same structure, which makes your business appear more organized and professional.

- Reduced Errors: With predefined sections, you are less likely to miss important details, such as payment terms or service descriptions.

- Faster Turnaround: By using an existing structure, you can fill in specific project details more quickly, speeding up the process of creating and sending records.

- Time-Saving: Templates allow you to reuse the same format across multiple projects, reducing the amount of time spent on document creation.

How It Works in Practice

Instead of starting from scratch every time, you can input project-specific details into a pre-made format. This allows you to focus on the essential parts, such as task descriptions and costs, while the rest of the document remains consistent. Over time, this not only saves time but also helps you stay more organized, especially when managing multiple clients and projects.

By incorporating a pre-designed structure, you streamline your administrative work, reduce the likelihood of mistakes, and ensure that your financial records are both efficient and professional.

Incorporating Payment Terms in Billing Documents

Clearly defining payment terms in your financial records is essential for ensuring smooth transactions and maintaining good relationships with clients. By outlining payment expectations, including deadlines, methods, and penalties for late payments, you create a clear framework for both parties. This not only helps set professional standards but also minimizes the risk of delays and misunderstandings.

Including specific payment terms is an effective way to establish accountability and ensure timely settlements. Whether you are working with a large-scale project or smaller jobs, setting clear guidelines will ensure both parties are on the same page regarding financial expectations.

Key Elements to Include

Here are some crucial components to incorporate when defining payment terms:

- Due Date: Clearly specify when the payment is due. This helps avoid any confusion about the timeline for payment.

- Accepted Payment Methods: List the methods you accept for payments, such as credit card, bank transfer, or online payment platforms.

- Late Fees: Include any penalties for late payments, such as a percentage of the total amount due for each day or week past the due date.

- Deposit Requirements: If applicable, specify the amount or percentage required as an upfront deposit before work begins.

Why Payment Terms Matter

Payment terms not only protect your business by ensuring timely payments, but they also give clients clarity about their financial obligations. When clients are aware of the consequences of late payments or the benefits of early settlements, they are more likely to adhere to the agreed terms. Moreover, clear payment guidelines can help avoid disputes and facilitate smoother project completion.

By setting transparent payment terms, you reduce the potential for miscommunication and ensure both parties remain accountable throughout the project.

Best Practices for Clear Billing Records

Maintaining clarity in your financial documents is essential for both your business and your clients. A well-organized and easily understandable document helps avoid confusion and ensures that all terms and charges are transparent. Adhering to best practices when preparing these documents not only reflects professionalism but also leads to faster payments and fewer disputes. Below are some of the most important practices for creating clear and effective billing records.

Key Practices for Effective Billing

To make sure your financial documents are as clear as possible, follow these best practices:

| Best Practice | Description |

|---|---|

| Itemized Charges | Break down the work and costs into clear categories so clients can easily understand what they are being charged for. |

| Clear Dates | Include both the date of service and the due date for payment to avoid misunderstandings about deadlines. |

| Accurate Totals | Ensure that all calculations are accurate and that the total amount is clearly stated. Double-check your math. |

| Contact Information | Provide both your contact details and your client’s details so that both parties can easily reach out if any questions arise. |

| Payment Terms | Clearly specify due dates, accepted payment methods, and any penalties for late payments. |

Why These Practices Matter

By following these best practices, you not only make it easier for clients to understand and process payments, but you also present your business as organized and professional. Clear records reduce the chances of disputes, build trust with clients, and ensure that your cash flow remains consistent. A well-structured document makes a significant difference in how your business is perceived and in the efficiency of your financial operations.

Implementing these practice

Integrating Your Billing Records with Accounting Software

Integrating your financial documentation with accounting software can significantly improve the efficiency and accuracy of your business’s financial management. By automating the process, you reduce the risk of errors, save time on manual data entry, and ensure that all records are up-to-date and easily accessible. This integration also helps streamline your accounting processes, allowing you to manage invoices, payments, and financial reports more effectively.

When you integrate billing records with accounting tools, you enable real-time synchronization between payments, client data, and other financial details. This integration provides a more organized and seamless workflow for managing your business’s finances.

Benefits of Integration

Here are some of the key advantages of integrating your financial records with accounting software:

- Automation: Automatically track payments and update financial statements without having to manually enter data.

- Accuracy: Reduces the chance of human error when transferring financial data between documents and accounting systems.

- Time-Saving: Streamlines the entire process, saving you time on administrative tasks so you can focus on other areas of your business.

- Real-Time Updates: Get immediate updates on payment status, balances, and outstanding amounts, ensuring that your records are always current.

- Tax Compliance: Simplifies tax reporting by ensuring that all transactions are recorded and categorized properly, reducing the risk of errors during tax season.

How to Integrate Your Financial Records

To integrate your billing documents with accounting software, follow these simple steps:

- Choose accounting software that offers integration with your preferred billing system or format.

- Set up your client and payment details in the software to allow seamless transfer of information.

- Ensure your financial records are properly categorized and linked

Common Questions About Billing Records

When it comes to managing financial records for your business, there are several common questions that arise. Many business owners and clients seek clarification on various aspects, from payment schedules to the level of detail needed in the document. Understanding the key points surrounding billing documents can help you avoid confusion and ensure smooth transactions with your clients.

Frequently Asked Questions

Here are some of the most common inquiries regarding financial documents and the best practices for handling them:

- What should be included in a billing record? A comprehensive document should include the client’s details, a description of the services provided, the total amount due, payment terms, and the due date. Additionally, it’s important to specify any deposit requirements, late fees, or taxes that may apply.

- How do I handle partial payments? When a client makes a partial payment, it’s important to update the record to reflect the amount paid and show the remaining balance. Including clear payment milestones in your financial documentation helps prevent confusion in case of multiple payments.

- How do I ensure my records are accurate? Double-checking your figures, ensuring all services are accounted for, and using a consistent format across all records helps ensure accuracy. Utilizing digital tools or accounting software can further reduce the chance of human error.

- Should I include taxes in my financial records? Yes, if applicable, taxes should be clearly stated in the document. It’s essential to break down the tax amount separately from the main charges to ensure transparency for your clients.

- How can I make sure my clients pay on time? Clearly state payment terms, due dates, and penalties for late payments in your documents. Providing multiple payment options and sending reminders before the due date can also encourage timely payments.

Clarifying Payment Terms and Expectations

For both clients and service providers, understanding the payment terms is crucial. Whether it’s a one-time payment or an installment plan, having these details outlined in the document can prevent misunderstandings and ensure that both parties are clear on expectations. Offering flexibility in payment options or discussing terms beforehand can help maintain a good business relationship and avoid disputes.

By addressing common questions and clearly outlining expectations, you can make the financial aspect of your business much smoother and more transparent for all involved.

How to Manage Late Payments Effectively

Late payments can disrupt cash flow and create unnecessary stress for business owners. Managing overdue payments in a professional and effective manner is crucial to maintaining a healthy business. By setting clear expectations from the beginning and taking the right steps when payments are delayed, you can minimize the impact of late settlements on your operations.

Handling overdue payments requires a balance of firmness and professionalism. By establishing a clear process for dealing with delays, you can ensure that clients remain accountable while maintaining good relationships. Below are key strategies for managing late payments effectively.

Set Clear Payment Terms

The first step in preventing late payments is to establish clear payment terms upfront. Be specific about:

- Due Dates: Clearly state when payments are due and ensure clients understand the timeline.

- Late Fees: Include penalties for late payments, such as interest charges or fixed fees for each day a payment is delayed.

- Accepted Payment Methods: List the payment methods you accept to avoid any confusion.

By setting these expectations from the start, you create a framework that both parties can refer to if payments are delayed.

Follow Up on Late Payments

When a payment is overdue, it’s important to follow up promptly. A courteous reminder is often enough to get the process back on track. Here are some tips for effective follow-up:

- Send a Polite Reminder: Reach out to your client via email or phone to remind them of the missed payment.

- Be Clear and Professional: Keep your tone respectful but firm. Reinforce the payment terms and the importance of meeting deadlines.

- Offer Payment Solutions: If your client is facing financial difficulties, consider offering installment plans or adjusting the payment schedule to facilitate timely payments.

Being proactive and consistent with your follow-ups is key to minimizing delays and ensuring clients are reminded of their obligations.

Consider Legal Action if Necessary

If payments continue to be overdue despite multiple reminders, you may need to consider legal options. Before taking this step, make sure you have:

- Docu