Excel Invoice Tracking Spreadsheet Template for Easy Financial Management

![]()

Managing business finances can often become overwhelming, especially when keeping track of payments, due dates, and amounts. A streamlined approach to organizing this data can make all the difference, saving you time and ensuring accuracy in your financial records.

Simple yet powerful solutions can significantly enhance the way you monitor and manage incoming and outgoing transactions. With a well-organized system in place, you can easily spot outstanding balances, monitor payment schedules, and maintain clarity over your financial status. The right structure also helps avoid common errors, such as missed deadlines or incorrect calculations, which can lead to financial discrepancies.

For small businesses and freelancers, using a clear, adaptable system is essential to maintaining healthy cash flow and strong client relationships. In the following sections, we’ll explore how a basic yet highly effective tool can assist you in keeping your financial processes in order without the need for complex accounting software.

Excel Invoice Tracking Spreadsheet Template

Organizing your business transactions efficiently is key to maintaining smooth operations and avoiding payment delays. A well-structured document can serve as an effective tool for managing financial records, providing clarity on outstanding amounts, payment dates, and client statuses. By using a simple yet functional design, you can keep track of all necessary details without complex software, ensuring your financial tasks are handled with ease.

Key Features to Include

To create an effective tool for managing financial data, several essential features should be included. These elements will help you stay on top of your payment schedule and ensure all critical information is easily accessible.

- Client Information: Store important details such as client name, contact info, and billing address.

- Transaction Amount: Include columns for the total amount due, paid amount, and any applicable taxes or discounts.

- Due Dates: Track deadlines to ensure payments are received on time.

- Payment Status: Use simple categories like “Paid”, “Pending”, or “Overdue” to monitor progress.

- Notes: Add a section for additional remarks, such as payment terms or special instructions.

Advantages of Using a Simple Financial Management System

Adopting an uncomplicated tool for your financial record-keeping offers a variety of benefits for small businesses and independent contractors. Here are some key reasons to consider:

- Cost-effective: No need for expensive software or subscriptions–just a basic structure that suits your needs.

- Ease of Use: Simple to set up and use, with no need for advanced technical skills.

- Customizable: Adapt the format to fit your unique workflow, whether you need more detail or prefer a minimalist approach.

- Improved Accuracy: Reduces the risk of errors that can occur when managing payments manually.

- Time-saving: Quick to update and review, helping you

Why Use Excel for Invoice Tracking

Managing financial records efficiently is crucial for any business. While there are various tools available, a simple, widely accessible solution can offer a combination of flexibility and functionality that helps you stay organized without unnecessary complexity. Using a basic tool to track payments and manage financial data allows you to stay in control of your business’s cash flow and maintain accuracy with minimal effort.

Here are some reasons why this approach works well for small businesses and freelancers alike:

- Cost-effective: No need for expensive software or ongoing subscriptions–just a tool that is easy to use and widely available.

- Customization: Adjust the layout to your specific needs, whether it’s adding new fields, changing columns, or creating custom categories for payment statuses.

- Ease of Access: It’s simple to store, edit, and share documents, allowing for easy collaboration with team members or clients without any complex setup.

- Integration with Other Tools: You can easily import and export data, ensuring compatibility with other systems or reports you may be using.

- Familiarity: Most people are already familiar with the basic features of this tool, making it easier to get started without steep learning curves or technical support.

Using such a system allows you to manage all your payment records in one place, track due dates, and stay on top of your finances in a way that’s clear and simple. The ability to make quick adjustments as your needs change is one of the primary reasons this method is popular among small business owners.

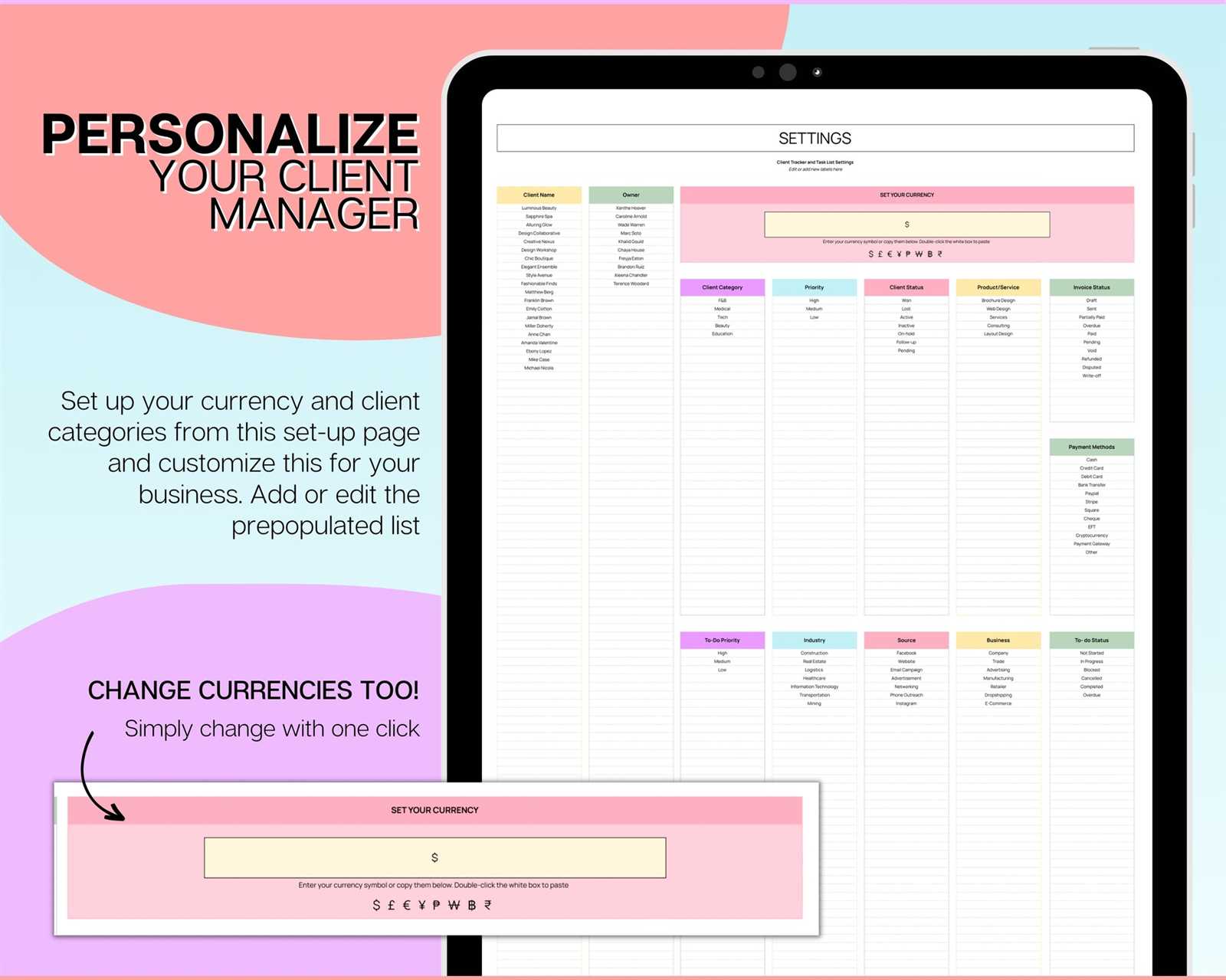

Benefits of Customizable Invoice Templates

Having a flexible system to manage your financial documents provides numerous advantages for businesses of all sizes. Customizable formats allow you to tailor the structure to your specific needs, making it easier to track payments, monitor due dates, and maintain a professional appearance. Whether you’re a freelancer or a growing company, the ability to adjust your document layout can significantly improve organization and efficiency.

Enhanced Organization and Efficiency

One of the key benefits of a customizable system is the ability to organize your data in a way that makes sense for your workflow. By adjusting categories and fields, you can ensure that the most important information is front and center. This level of organization reduces the chances of missing key details or making errors when entering data.

- Easy Data Entry: Custom formats allow you to define the exact fields you need, making it quick and straightforward to enter information.

- Clear Overview: With the ability to highlight critical data, such as overdue payments or amounts due, it’s easy to prioritize tasks and stay organized.

- Flexibility: As your business needs evolve, your document structure can be easily modified to keep up with changes in your workflow.

Professional Appearance and Brand Consistency

A customized layout doesn’t just improve functionality–it also enhances your brand’s image. A professional and personalized format ensures that all of your financial documents reflect a consistent visual identity, helping to establish trust with clients.

- Custom Branding: Add logos, colors, and fonts that match your company’s branding to make your documents stand out.

- Consistency: Having a uniform look across all financial documents strengthens your company’s professionalism.

- Client Perception: A polished document can leave a positive impression, suggesting that your business is organized and trustworthy.

In summary, a customizable approach to managing financial records offers both practical and aesthetic benefits, making it easier to stay organized, efficient, and professional in your financial dealings.

How to Create Your Own Template

Creating your own document for managing payments and financial data gives you full control over the design and functionality. By following a few simple steps, you can build a customized structure that suits your specific business needs, whether you need to track payments, record transactions, or simply maintain an organized system. With just a few adjustments, you can create a tool that streamlines your process and improves efficiency.

Step-by-Step Guide

Follow these easy steps to create your personalized system for managing financial data:

- Step 1: Start by determining the key information you need to track. This may include client details, payment amounts, dates, and statuses.

- Step 2: Organize your fields in a way that makes the most sense for your workflow. Prioritize the most important data so that it’s easily accessible.

- Step 3: Customize the layout by adjusting columns, adding colors or bold text for emphasis, and including any other visual elements that help highlight key information.

- Step 4: Test the structure by inputting sample data and making adjustments as necessary to ensure ease of use and clarity.

Example Layout for Your Financial Document

Here’s an example layout that you can follow for your own customized document:

Client Name Amount Due Payment Status Due Date Notes John Doe $500 Paid 01/15/2024 Payment received on time Jane Smith $250 Pending 01/20/2024 Payment expected soon This is a basic example, but you can adjust the fields, layout, and design to suit your

Key Features of Invoice Tracking Spreadsheets

A well-designed document for managing financial transactions can significantly improve how you handle payments and outstanding balances. The key features of such a system allow for easy access to crucial information, helping you stay on top of your finances and ensuring that all transactions are recorded accurately. By focusing on the right elements, you can streamline your workflow and reduce the risk of errors or missed payments.

Essential Components for Effective Management

To create an effective document for monitoring financial data, the following features should be included:

- Client Information: Store key details such as client names, contact information, and billing addresses, which makes it easy to reference or communicate with customers.

- Transaction Amounts: Include columns for both total amounts and partial payments to track what’s owed and what’s been paid.

- Payment Status: A clear indication of whether the payment has been completed, is pending, or is overdue helps you quickly assess the situation.

- Due Dates: Clearly marked deadlines ensure that you can track when payments are due and take action if necessary.

- Notes Section: A dedicated space for additional information like payment terms, agreements, or reminders ensures nothing is overlooked.

Additional Features to Enhance Functionality

For even greater control and ease of use, consider incorporating these additional features:

- Automated Calculations: Use basic formulas to automatically calculate totals, taxes, and discounts, saving you time and reducing the chance of errors.

- Customizable Categories: Adjust the categories to match your specific business needs, whether you’re working with recurring payments, discounts, or multiple currencies.

Step-by-Step Guide to Template Setup

Setting up a system for managing financial transactions is an essential step in staying organized and efficient. By following a clear and simple process, you can create a structure that allows you to record and monitor payments, manage due dates, and keep track of outstanding balances. This guide will walk you through the steps needed to set up an effective document tailored to your business needs.

1. Plan Your Layout

Before diving into the details, take a moment to plan the overall structure. Think about the information you need to capture and how it should be organized for easy access. The most basic components to consider include:

- Client Details: This section should include names, contact information, and billing addresses.

- Amount Owed: Record the total amount due, including any taxes or discounts.

- Payment Status: Keep track of whether payments have been made, are pending, or are overdue.

- Due Dates: Mark important deadlines to ensure timely payments.

2. Build Your Document

Now that you have a clear layout in mind, it’s time to create your document. Follow these steps to get started:

- Step 1: Create a table with columns for all the key information you identified. This can include client names, amounts, due dates, and payment statuses.

- Step 2: Add additional columns for notes, discounts, or other relevant data that will help you track specific details.

- Step 3: Use basic functions to calculate totals, taxes, or outstanding balances automatically. This will save time and reduce the risk of errors.

3. Customize and Test Your Setup

Once your layout is complete, customize it to suit your needs. You can adjust colors, fonts, and cell sizes to create a visually appealing document. Don’t forget to test the setup by inputting sample data to

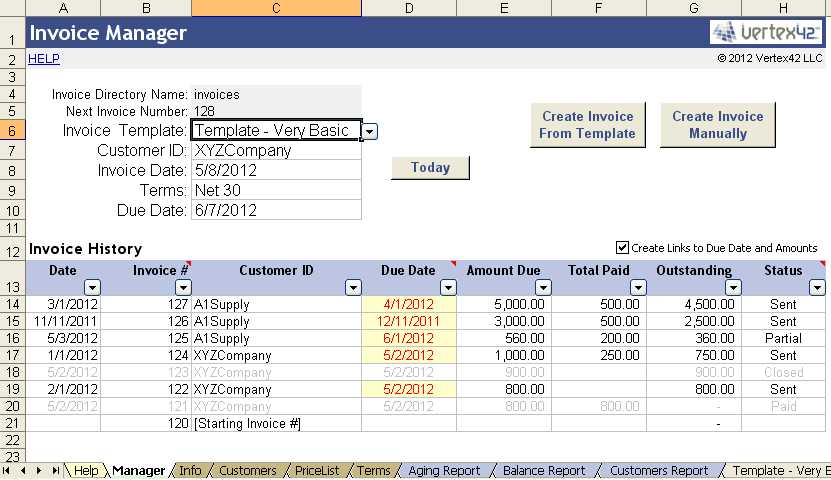

Managing Multiple Invoices Efficiently

Handling several financial transactions at once can be challenging, especially when you’re trying to keep everything organized and ensure no payments are missed. Whether you’re dealing with multiple clients or several outstanding amounts, a well-structured system can help you stay on top of each detail. By setting up an organized system for managing multiple records, you can improve efficiency and minimize errors.

1. Use Clear Categorization

When managing multiple records, it’s important to categorize information clearly. Grouping similar items together, such as by client or payment status, makes it easier to focus on specific areas and prioritize tasks. Here’s how you can structure your categories:

- Client Segmentation: Keep separate sections for different clients or projects to avoid confusion.

- Payment Status: Create categories for “Paid,” “Pending,” and “Overdue” to easily identify which payments require attention.

- Due Dates: Organize your entries by the due date, helping you stay ahead of upcoming deadlines.

2. Automate Key Processes

To save time and reduce manual errors, incorporate basic calculations and functions that automate key tasks. You can set up formulas to calculate totals, outstanding balances, or even automatic alerts for overdue amounts. This allows you to focus on high-priority tasks rather than manual updates.

- Automated Calculations: Use simple formulas to calculate amounts due, paid, and remaining balances.

- Conditional Formatting: Highlight overdue records in a different color to draw attention to them.

- Sorting and Filtering: Filter by due date or client to view only the most relevant records at any given time.

3. Regularly Update and Review

To ensure accuracy and prevent mistakes, make it a habit to regularly update your records. Check for missing data, errors, or any discrepancies that may arise from data entry. Regular review helps keep everything current and ensures that you aren’t overlooking any important tasks.

- Review Weekly: Set aside time each week to review all outstanding payments and ensure records are up to date.

- Confirm Payment Status: Double-check that payments are marked correctly, and resolve any discrepancies quickly.

By implementing these strategies, you can efficiently manage multiple recor

How Excel Improves Payment Tracking

Efficiently managing payments is a crucial aspect of any business. Without the right tools, it’s easy to lose track of due amounts, missed payments, and overdue balances. A flexible and widely available tool can simplify this process, allowing you to stay on top of payments, reduce errors, and ensure that financial records are always up-to-date. By offering clear organization and automation options, this system helps you monitor every transaction effortlessly.

Key Benefits for Payment Management

Using a structured document for financial management offers several advantages when it comes to handling payments:

- Instant Overview: With a well-organized document, you can quickly assess the status of all payments in one view. This allows you to identify overdue amounts or clients with outstanding balances at a glance.

- Automated Calculations: Built-in formulas allow you to automatically calculate totals, remaining balances, and due amounts, reducing the need for manual calculations and minimizing the risk of errors.

- Customizable Alerts: You can set up conditional formatting or notifications to highlight overdue payments or remind you when a payment is approaching, ensuring you don’t miss important deadlines.

How It Helps Organize and Prioritize Payments

A structured financial management system allows you to stay organized, making it easier to prioritize outstanding payments based on their due date or amount. Here’s how:

- Sorting and Filtering: Quickly sort your records by due date, amount, or client name, so you can focus on the most urgent payments first.

- Detailed Notes: Adding notes and payment terms directly to your document helps you track specific agreements or conditions, preventing misunderstandings with clients.

- Easy Updates: Updating your payment records is simple, allowing you to track new payments as they are received and adjust any previous entries as needed.

By adopting this organized and automated approach, you can improve the efficiency of your financial management process, ensuring that you never miss a payment and that all records are accurate and current.

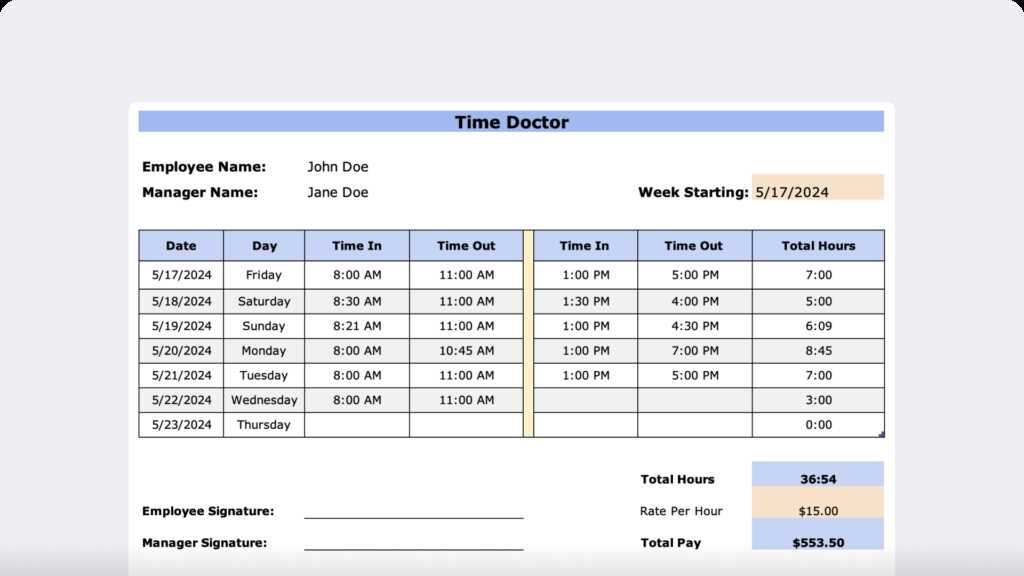

Automating Calculations in Invoice Templates

Automating calculations within financial documents not only saves time but also ensures accuracy and consistency across all records. Instead of manually adding amounts or applying formulas for taxes, discounts, and totals, you can set up automatic calculations that update in real-time as you enter data. This eliminates the risk of human error, streamlines the process, and enhances efficiency, allowing you to focus more on strategic tasks rather than routine calculations.

Here are several ways you can automate key calculations in your financial document:

- Automatic Totals: Set up formulas that automatically calculate the total amount based on unit prices and quantities, ensuring that totals are always accurate without having to manually add them up.

- Tax Calculations: Incorporate a formula to automatically apply the appropriate tax rate based on the subtotal, ensuring consistency and reducing the time spent manually applying rates.

- Discounts: If discounts are part of your pricing structure, you can create formulas to automatically apply percentage-based or fixed discounts, reducing the need for recalculation each time.

- Outstanding Balances: Set up a formula to subtract payments from the total amount due, automatically calculating how much is left to be paid. This helps you keep track of payments and balances effortlessly.

By automating these essential calculations, you can ensure that your financial documents are accurate, up-to-date, and free from common manual errors. This automation not only improves efficiency but also reduces the time spent on repetitive tasks, allowing you to focus on growing your business or managing client relationships.

How to Track Payment Statuses in Excel

Efficiently managing the status of payments is essential for maintaining cash flow and ensuring timely collections. By creating a simple yet effective system to monitor whether payments have been completed, are pending, or are overdue, you can stay organized and avoid missing any critical deadlines. A well-structured financial document allows you to quickly identify which transactions need attention and which are on track.

Here’s how you can set up a clear system to track payment statuses:

1. Define Payment Status Categories

To start, define the different payment statuses that are relevant to your business. This could include categories such as:

- Paid: This status indicates that the full amount has been received and no further action is required.

- Pending: Used when a payment is expected but has not yet been completed.

- Overdue: This status is assigned when a payment has not been received by the agreed-upon due date.

- Partially Paid: Used when only part of the total amount has been paid, and the remaining balance is still due.

2. Set Up a Status Column

In your financial management document, create a dedicated column where you will manually or automatically assign each transaction to one of the payment status categories. This column should be updated regularly to reflect any changes in the payment status.

- Manual Entry: You can enter the status manually as payments come in, simply updating the status for each client.

- Conditional Formatting: Use conditional formatting to color-code different statuses (e.g., green for “Paid,” red for “Overdue”) to make it easy to see the current state at a glance.

3. Automate Alerts for Overdue Payments

For added efficiency, set up automated alerts to highlight overdue payments. This can be done by using conditional formatting or setting up reminders when due dates pass without payment.

- Conditional Alerts: Use formulas

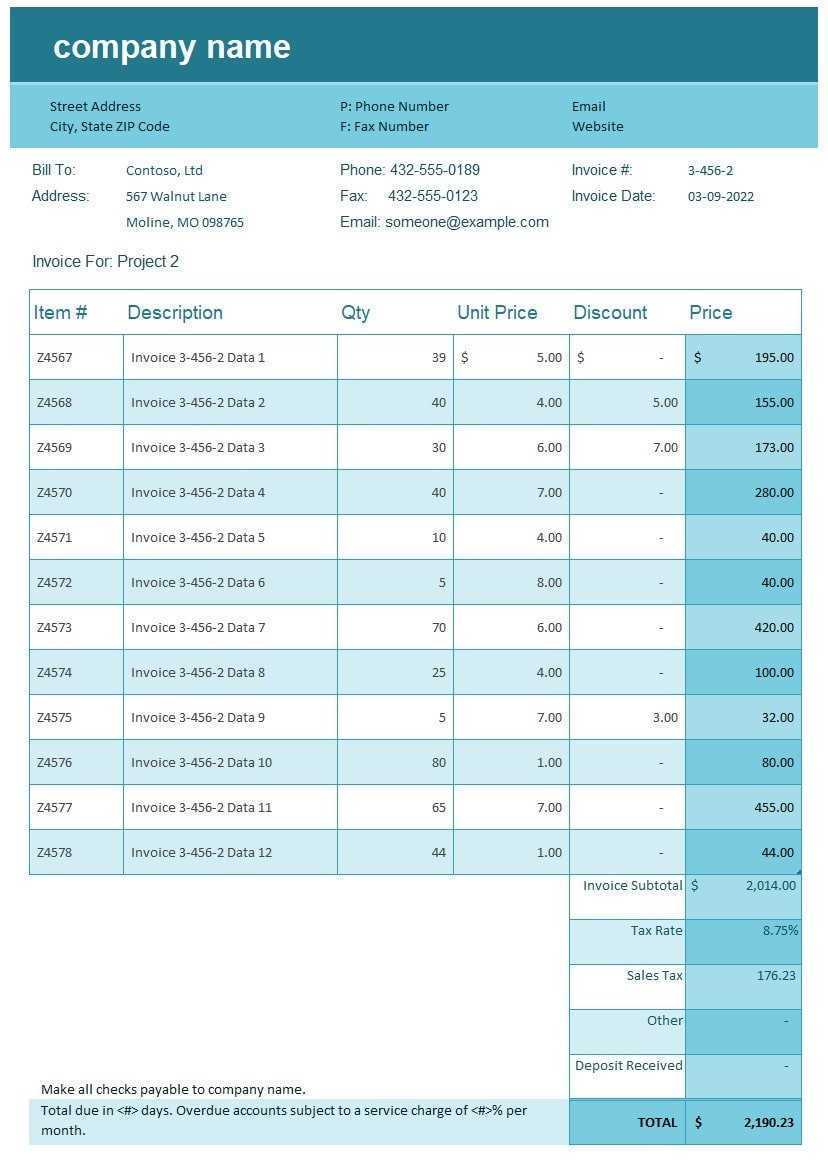

Design Tips for Professional Invoice Layouts

A well-designed document for billing not only makes your business look more professional but also ensures clarity and ease of use for both you and your clients. The layout of this document plays a crucial role in how the information is received and processed. Clear organization, easy-to-read fonts, and strategic use of space can significantly enhance the user experience and reduce the likelihood of mistakes. By focusing on key design elements, you can create a visually appealing and functional document that reflects your brand’s professionalism.

1. Prioritize Clarity and Simplicity

When it comes to financial documents, simplicity is key. A cluttered layout can confuse clients and lead to errors. Keep the design clean by organizing information into clear sections, using bullet points or tables where appropriate. Here are a few tips to achieve a straightforward layout:

- Use Clear Headings: Divide the document into logical sections such as “Client Details,” “Service/Products,” and “Payment Summary.” This makes it easier for recipients to quickly find the information they need.

- Limit Fonts and Colors: Stick to a maximum of two or three fonts and use a consistent color scheme. Avoid using too many bold or italicized elements that could overwhelm the reader.

- Whitespace is Important: Proper spacing between sections helps make the document less dense and more visually appealing. Ensure there is enough room between lines and columns for readability.

2. Organize Information Effectively

How you present the details of the transaction is just as important as the aesthetic design. Organizing information logically ensures that it’s easy to understand. Consider these tips:

- Use Tables for Financial Information: Tables are perfect for displaying product/service descriptions, quantities, rates, and total amounts. Make sure the columns are aligned properly for easy reading.

- Highlight Important Information: Bold or highlight critical elements such as total due amounts or payment deadlines

How to Handle Late Payments Using Excel

Late payments can disrupt cash flow and cause unnecessary stress in any business. However, with the right approach, you can efficiently manage overdue payments and ensure that they’re addressed in a timely manner. By setting up a system to track due dates, outstanding balances, and follow-up actions, you can stay organized and take appropriate steps to resolve payment delays. Utilizing a simple and effective structure to handle late payments can also help improve client communication and avoid future delays.

1. Identify Overdue Payments

The first step in addressing late payments is identifying which transactions have passed their due dates. You can set up your document to automatically flag overdue payments using a combination of dates and conditional formatting:

- Use Due Date Columns: Include a column for the payment due date in your records. This allows you to compare each transaction’s due date with the current date.

- Conditional Formatting: Set up rules to automatically highlight overdue payments in a different color, making them stand out at a glance.

- Outstanding Balances: Create a column to track the remaining amount due. Any payment that has not been fully received can be flagged for follow-up.

2. Automate Payment Reminders

Once you’ve identified overdue payments, it’s crucial to follow up promptly. You can automate this process to ensure timely reminders to clients:

- Set Automatic Alerts: Use date comparison formulas to trigger reminders as soon as a payment becomes overdue, helping you to take immediate action.

- Draft Standard Follow-Up Messages: Prepare template messages that you can quickly send to clients regarding overdue payments. This reduces time spent drafting emails and helps maintain professionalism in communication.

- Track Communication: Keep a log of all communication with clients regarding overdue payments. This can be included in your document for easy reference.

3. Apply Late Fees or Penalties

If your payment terms include late fees or penalties, you can calculate these automatically using formulas. This encourages clients to make payments on time and compensates for

Excel Templates for Small Business Owners

Running a small business requires effective management of numerous tasks, from client communications to financial records. Having a structured system in place can save time, reduce errors, and help maintain organization. Pre-designed documents for tasks such as billing, budgeting, and inventory tracking can be customized to meet specific business needs. These tools provide a practical way to streamline operations, keep track of essential data, and improve overall productivity without the need for complex software solutions.

1. Simplifying Financial Management

For small business owners, maintaining accurate financial records is crucial. Ready-to-use documents can help you manage your finances without the hassle of manual calculations. Common features of such documents include:

- Income Tracking: Automatically record revenue from sales, services, or other business activities to monitor cash flow.

- Expense Management: Track business expenses such as materials, utilities, and payroll, ensuring that costs are well-documented.

- Profit and Loss Calculation: Easily calculate your profit by comparing income with expenses, helping you assess the financial health of your business.

2. Managing Client Relationships

Maintaining strong relationships with clients is essential for the growth of any business. Using a structured approach for client management can help you stay organized and ensure that nothing falls through the cracks. Key features include:

- Contact Information: Organize customer contact details, including phone numbers, emails, and billing addresses, all in one place.

- Communication Logs: Keep track of communication history, follow-up dates, and client preferences to provide personalized service.

- Contract and Payment Records: Maintain a detailed history of contracts, payments, and outstanding balances to keep your business running smoothly.

3. Inventory and Stock Management

For businesses that deal with physical products, managing inventory is vital. Having a dedicated system for tracking stock levels, sales, and reordering can prevent shortages and overstocking. Key features include:

- Stock Tracking: Record the quantity of products in stock, their prices, and reorder thresholds.

- Sales Reporting: Generate reports based on sales data to identify popular products, seasonal trends, and stock depletion rates.

- Supplier Information: Keep track of supplier

Common Mistakes in Invoice Tracking

Managing payment records can be challenging, especially for small business owners who juggle multiple tasks at once. Even with the best intentions, mistakes can occur, leading to confusion, missed payments, and financial discrepancies. These errors, if not addressed promptly, can affect cash flow and customer relationships. Understanding common pitfalls can help you avoid these issues and ensure smoother operations when managing financial records.

1. Failing to Update Payment Status Regularly

One of the most common mistakes in managing payment records is not updating the status of payments frequently enough. When payment statuses are not accurately reflected in your records, it can lead to confusion about which balances have been cleared and which are still outstanding. Here’s how to avoid this mistake:

- Regular Updates: Make it a habit to update the payment status each time a transaction is completed, whether it’s paid, partially paid, or overdue.

- Consistency: Ensure that every payment, even those that are partially completed, is accurately tracked to avoid discrepancies.

- Automated Reminders: Set up automated alerts to remind you to update the status or follow up with clients on outstanding payments.

2. Ignoring Due Dates and Payment Terms

Another common mistake is failing to properly track due dates or neglecting the payment terms agreed upon with clients. This can lead to delayed payments and misunderstandings between businesses and customers. Here are some tips to prevent this mistake:

- Highlight Due Dates: Clearly mark due dates for each transaction and ensure they are easily visible in your records to avoid overlooking them.

- Payment Terms Review: Regularly review your payment terms and ensure they are understood by both parties to prevent confusion about deadlines.

- Use a Calendar: Use a calendar or reminder system to track when payments are due or overdue, helping you stay on top of deadlines.

3. Not Including Detailed Information

Another mistake is failing to include detailed information about each transaction, such as payment amounts, client names, or descriptions of goods or services provided. Without this detail, it becomes difficult to identify transact

How to Secure Your Invoice Data

Protecting your financial records is essential to maintaining the confidentiality and integrity of your business transactions. Sensitive data such as client information, payment details, and transaction history should be stored and managed with care to prevent unauthorized access and potential fraud. By implementing proper security measures, you can ensure that your data remains safe while you stay organized and efficient in your business operations.

1. Use Strong Password Protection

One of the simplest yet most effective ways to secure your data is by using strong password protection. A weak password can leave your records vulnerable to unauthorized access. To protect your files:

- Choose Complex Passwords: Use a combination of uppercase and lowercase letters, numbers, and symbols to create a strong, hard-to-guess password.

- Avoid Common Passwords: Refrain from using easy-to-guess passwords such as “123456” or “password.” Instead, use unique and random phrases.

- Enable Two-Factor Authentication: Whenever possible, use two-factor authentication (2FA) for an additional layer of security, especially when storing or sharing sensitive information online.

2. Encrypt Your Data

Encryption is a powerful tool for protecting sensitive data by converting it into a format that is unreadable without the proper decryption key. This ensures that even if unauthorized individuals gain access to your files, they won’t be able to make sense of the information. Here’s how to use encryption effectively:

- Encrypt Documents: Use encryption software to secure any financial documents you store digitally. This adds an extra layer of protection against data breaches.

- Use Encrypted Cloud Storage: If you store your records online, ensure the service provider offers end-to-end encryption to safeguard your data from hackers.

- Encrypt Email Attachments: When sending sensitive financial documents via

How to Secure Your Invoice Data

Protecting your financial records is essential to maintaining the confidentiality and integrity of your business transactions. Sensitive data such as client information, payment details, and transaction history should be stored and managed with care to prevent unauthorized access and potential fraud. By implementing proper security measures, you can ensure that your data remains safe while you stay organized and efficient in your business operations.

1. Use Strong Password Protection

One of the simplest yet most effective ways to secure your data is by using strong password protection. A weak password can leave your records vulnerable to unauthorized access. To protect your files:

- Choose Complex Passwords: Use a combination of uppercase and lowercase letters, numbers, and symbols to create a strong, hard-to-guess password.

- Avoid Common Passwords: Refrain from using easy-to-guess passwords such as “123456” or “password.” Instead, use unique and random phrases.

- Enable Two-Factor Authentication: Whenever possible, use two-factor authentication (2FA) for an additional layer of security, especially when storing or sharing sensitive information online.

2. Encrypt Your Data

Encryption is a powerful tool for protecting sensitive data by converting it into a format that is unreadable without the proper decryption key. This ensures that even if unauthorized individuals gain access to your files, they won’t be able to make sense of the information. Here’s how to use encryption effectively:

- Encrypt Documents: Use encryption software to secure any financial documents you store digitally. This adds an extra layer of protection against data breaches.

- Use Encrypted Cloud Storage: If you store your records online, ensure the service provider offers end-to-end encryption to safeguard your data from hackers.

- Encrypt Email Attachments: When sending sensitive financial documents via email, consider using encryption tools to protect the data in transit.

3. Regular Backups

Data loss can happen unexpectedly due to hardware failures, cyber-attacks, or accidental deletions. To protect your records, it is essential to back up your files regularly. Consider these best practices:

- Automate Backups: Set up automatic backups on a secure server or cloud storage to ensure your data is regularly copied without manual effort.

- Use Multiple Backup Locations: Store backups in both physical and online locations for redundancy. This reduces the risk of losing everything if one backup source fails.

- Test Your Backups: Regularly test your backup system to ensure that your data can be restored successfully in case of an emergency.

4. Limit Access to Sensitive Information

Not everyone in your organization needs access to all of your financial records. Limiting access to sensitive information ensures that only authorized individuals can view or modify critical data. To manage access effectively:

- Set User Permissions: Restrict access based on role. For instance, only allow accounting staff to access financial records, while customer service agents should only have access to client contact information.

- Monitor Access Logs: Keep track of who accesses your records and when, to detect any unusual or unauthorized activity.

- Use User Authentication: Require authentication for anyone accessing sensitive documents, using passwords or biometric verification to confirm their identity.

5. Stay Informed About Security Threats

The digital landscape is constantly evolving, and so are the methods used by cybercriminals. Staying informed about the latest security threats can help you take proactive measures to protect your data:

- Follow Security News: Regularly check for updates on cybersecurity threats and best practices to stay ahead of potential risks.

- Update Software Regularly: Ensure that your security software, such as antivirus programs and firewalls, is always up-to-date to protect against the latest vulnerabilities.

- Train Your Team: Educate employees on safe data practices, such as recognizing phishing emails and avoiding suspicious downloads, to reduce the risk of security breaches.

By taking these steps, you can secure your financial records and maintain the confidentiality of your transactions. Implementing strong security measures not only protects your business but also builds trust with clients and ensures that your operations run smoothly without the risk of data loss or theft.

How to Integrate Excel with Accounting Software

Connecting financial data stored in a simple document with advanced accounting software can greatly streamline your business processes. By integrating both systems, you can automatically sync transaction details, minimize manual data entry, and reduce the risk of errors. This integration allows for smoother financial reporting, quicker invoice processing, and better overall management of your business finances. The following steps outline how to successfully integrate these two tools to improve your workflow.

1. Choose the Right Accounting Software

Before integrating, it is essential to choose the right accounting software that suits your business needs. Many accounting platforms offer built-in features or third-party apps that allow seamless data import and export. Consider the following:

- Compatibility: Ensure that the software supports file formats compatible with your existing documents (e.g., .csv, .xlsx, or .txt).

- Automation Features: Look for platforms that provide automation options, such as automatic imports of financial data from your document to the accounting software.

- Scalability: Choose software that can grow with your business and handle increasing volumes of transactions as your business expands.

2. Use Data Import/Export Functions

Many accounting systems allow users to import data from external files. By exporting your data from your document and importing it into the software, you can ensure accurate and efficient record-keeping. Steps for a successful import include:

- Export Your Data: Export the data from your document into a compatible file format such as .csv or .xlsx. Make sure the data is well-organized and ready for import.

- Map Fields Correctly: When importing data, ensure that fields like payment dates, amounts, and customer names are mapped correctly to corresponding fields in the software.

- Verify Imported Data: After importing, always double-check to ensure that all records were transferred accurately without any missing or incorrect information.

3. Use Integration Tools and Add-ons

For businesses that require frequent updates between their document and accounting software, consider using third-party integration tools or add-ons that facilitate automatic synchronization. These tools allow real-time updates and reduce manual intervention. Here’s how you can integrate the systems:

- Choose an Integration Tool: Tools like Zapier, Integromat, or Microsoft Power Automate can help link your document with various accounting platforms, automating the flow of data.

- Set Up Triggers: Configure triggers to automate data synchronization at regular intervals. For example, set a trigger to update your accounting software whenever a new record is added or updated in your document.

- Test and Adjust: Once the integration is set up, run a few tests to ensure that data is syncing correctly and that there are no errors in the process.

4. Regularly Reconcile Data

Even after integration, it’s important to regularly reconcile the data between your document and accounting software to ensure consistency and accuracy. Reconciliation helps identify discrepancies early on, reducing the risk of errors or financial misstatements. Follow these steps:

- Monthly Reconciliation: Set aside time each month to compare data in your document with that in the accounting software to ensure everything matches.

- Fix Errors Promptly: If discrepancies arise, address them immediately by updating the relevant data in either the document or the accounting platform.

- Automated Reports: Use automated reports to verify balances, transaction history, and custome