Non-Profit Organization Invoice Template for Streamlined Billing

Managing financial transactions efficiently is crucial for any charitable endeavor, ensuring transparency and smooth operations. Having a well-organized system to track contributions, services, and payments not only helps maintain trust but also simplifies record-keeping. Whether you’re issuing receipts for donations or charging for specific services, it’s important to present a professional and clear request for payment.

One of the best ways to streamline this process is by using a standardized document that outlines the necessary payment details. This approach ensures consistency and accuracy, and also saves time when creating payment requests. By customizing such documents to fit specific needs, you can make your financial operations more efficient and reliable.

In this article, we’ll explore the key elements that should be included in such documents, the benefits of using a structured format, and tips on customizing them to meet the specific needs of your initiatives. With the right tools, managing financial exchanges becomes less of a chore and more of a simple, repeatable task.

Non-Profit Invoice Template Overview

When managing financial transactions for a charitable cause, clear communication of payment details is essential. A standardized document helps outline the terms of payment, ensuring that both parties understand what is expected. This type of document not only facilitates smooth financial exchanges but also ensures professionalism and consistency in all transactions.

By utilizing a well-structured document, entities can save valuable time while maintaining a high level of accuracy in their billing process. The key benefit of such a document is that it serves as a formal request for payment, which can be customized to suit the specific needs of the initiative, whether for one-time donations, recurring contributions, or payments for services rendered.

This section will guide you through the core elements of an effective financial request and explain how to adjust it to fit the needs of different situations. By the end, you’ll understand the importance of using a structured format and how it can improve your financial management practices.

Why Non-Profits Need Invoices

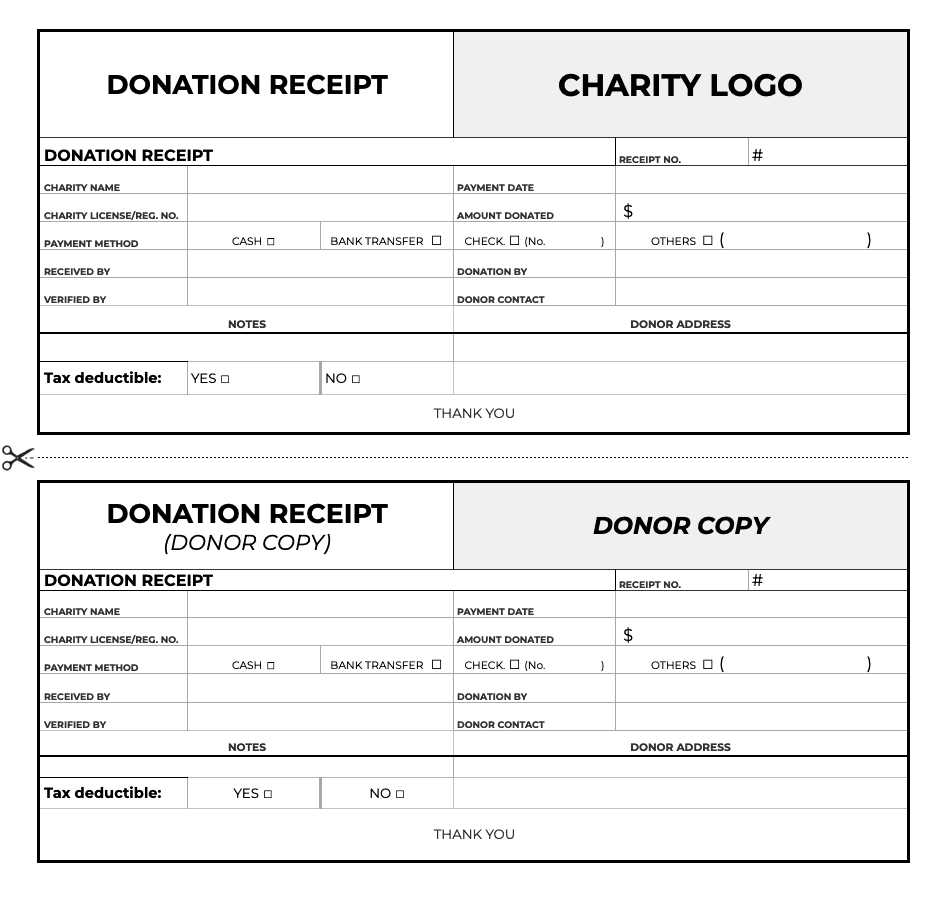

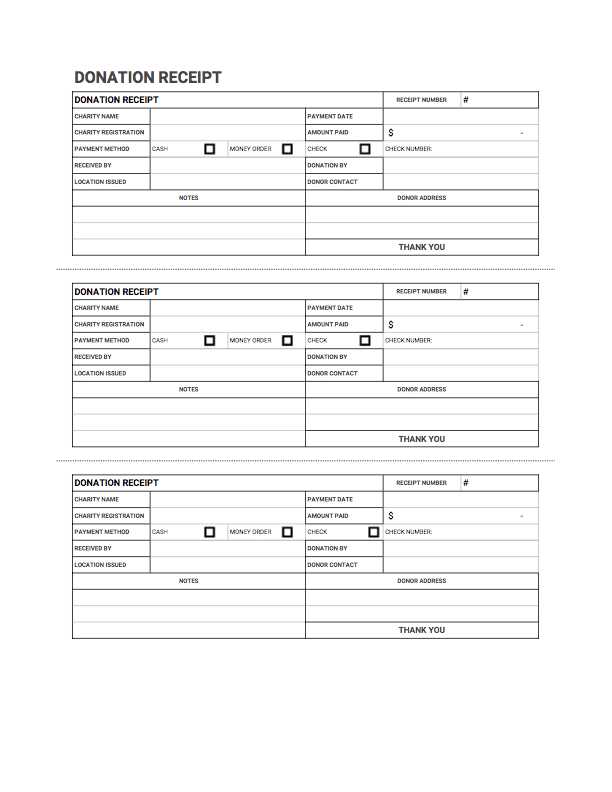

Clear documentation of financial transactions is vital for any initiative relying on donations or services. Properly detailing contributions and services helps ensure that all parties involved understand the terms of the transaction, promotes transparency, and fosters trust. Without a standardized approach to recording payments, the process can quickly become disorganized, leading to potential misunderstandings or missed opportunities for financial accountability.

Such documents also provide a formal record that can be referenced later, whether for tracking donations, fulfilling legal obligations, or preparing financial reports. They help establish a clear timeline for payment and ensure that all necessary details, such as payment amounts, due dates, and contact information, are outlined correctly. For groups that rely on external funding, this clarity is not only essential for internal operations but also for compliance with regulatory requirements.

The table below outlines some of the primary reasons why it’s important to use structured financial documents:

| Reason | Benefit |

|---|---|

| Clarity | Ensures all payment details are explicitly communicated. |

| Transparency | Fosters trust with donors and clients by providing clear financial records. |

| Record Keeping | Serves as a reference for future transactions and financial audits. |

| Legal Compliance | Helps meet regulatory requirements by maintaining formal payment records. |

| Efficiency | Simplifies the billing process and saves time on financial administration. |

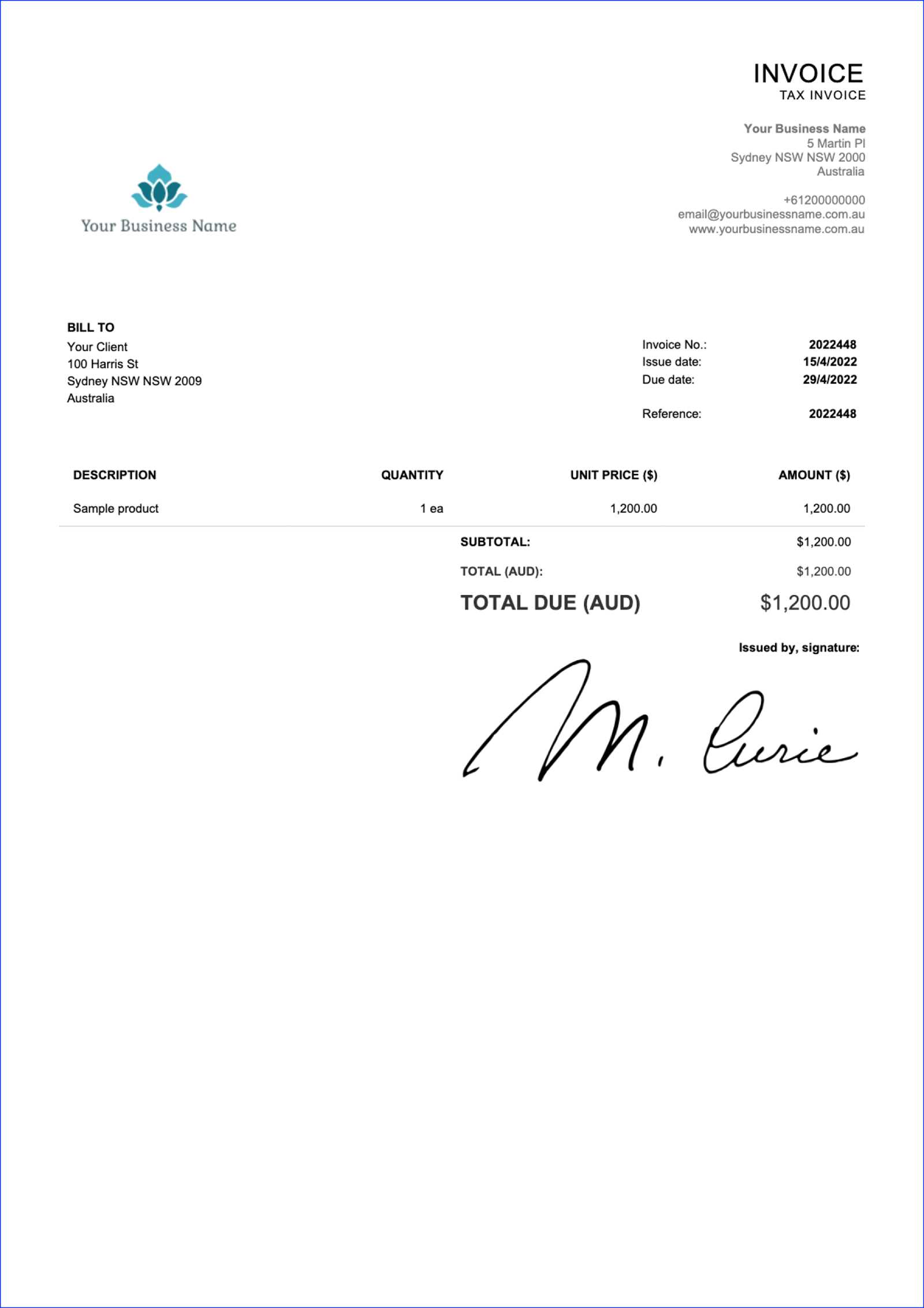

Key Components of an Invoice

For a payment request to be effective, it must contain specific details that clearly outline the terms of the transaction. These essential elements ensure that both the payer and recipient understand what is expected, preventing confusion or disputes. Each part serves a specific purpose, from identifying the parties involved to listing the exact amount due. Having all the right information in a structured format helps maintain professionalism and accuracy.

The following table highlights the key components that should be included in every financial request:

| Component | Description |

|---|---|

| Header Information | Includes the name and contact details of both the payer and recipient, along with the date of the transaction. |

| Unique Identifier | A reference number that helps track and organize the payment request for future reference. |

| Itemized List | A detailed breakdown of the services or contributions provided, including quantities, rates, and total amounts. |

| Payment Terms | Clarifies when payment is due, including any deadlines or conditions, such as discounts for early payment. |

| Total Amount Due | The sum of all charges, including any applicable taxes, fees, or adjustments. |

| Payment Instructions | Details on how to make the payment, including bank information, online payment links, or check instructions. |

| Legal or Tax Information | Any necessary disclosures or tax identification numbers, depending on regulatory requirements. |

Benefits of Using a Template

Utilizing a pre-structured document for payment requests offers several advantages, streamlining the process and ensuring consistency. By relying on a set format, you reduce the likelihood of errors, save valuable time, and ensure that all necessary details are consistently included. This approach also enhances professionalism, providing a polished and organized appearance for any financial transaction.

Efficiency and Time-Saving

One of the key benefits is the speed with which you can generate a formal request. Rather than creating a new document from scratch each time, a pre-designed structure allows for quick customization, significantly reducing administrative work. This can be especially helpful when managing multiple transactions, enabling you to focus on the core mission.

Accuracy and Consistency

By using a standardized layout, you ensure that every request contains all the required details, such as payment terms, amounts, and contact information. Consistency reduces the risk of missing important information, while accuracy guarantees that both parties are on the same page regarding payment expectations.

Customizing Your Payment Request Document

Personalizing your payment request format allows you to tailor it to the specific needs of your initiative, ensuring it aligns with your mission and the nature of the transaction. A customized document can include unique branding elements, specific payment terms, or detailed service descriptions, making the document both functional and representative of your cause.

By adjusting the layout and content, you can ensure that all necessary information is clear and relevant to the transaction at hand. Customization also allows you to integrate your organization’s logo, contact details, and specific instructions, which helps maintain a professional image and fosters trust with donors or clients.

Important Customization Tips:

- Include your branding, such as your logo and color scheme, for a more professional appearance.

- Tailor the payment terms to your specific needs, such as including discounts for early contributions or specifying payment deadlines.

- Provide a detailed breakdown of services or contributions to ensure transparency in every transaction.

Overall, making these adjustments ensures your document is not only functional but also aligns with your specific goals and needs, making the payment process smoother for both parties involved.

Essential Fields to Include in Payment Requests

For a financial document to be complete and effective, it must contain several key details. These essential components ensure clarity, prevent confusion, and guarantee that both parties understand the terms of the transaction. Including the right fields not only helps in tracking payments but also fosters trust and professionalism in every interaction.

Basic Information

First and foremost, both the payer and recipient’s contact details should be included, along with the date of the transaction. This is crucial for identification and for future reference, especially if there are any issues or questions that arise later. Additionally, a unique reference number helps keep transactions organized and easily searchable.

Detailed Breakdown of Charges

Another critical element is an itemized list of services or goods provided. This allows both parties to see exactly what the payment is for, along with the quantity and price. Clearly displaying this information reduces misunderstandings and ensures transparency in every financial exchange. It’s also important to include payment terms, such as due dates, any early payment discounts, or penalties for late payment.

Lastly, including a total amount due, along with any necessary tax information or legal disclosures, ensures that the request meets regulatory standards and leaves no room for ambiguity. The more thorough and accurate the fields, the smoother the payment process will be.

Common Mistakes to Avoid in Billing

Even with a standardized approach to creating payment requests, there are several common errors that can undermine the effectiveness of your financial documents. These mistakes can lead to confusion, delayed payments, and a lack of professionalism. By being aware of these issues, you can ensure that your financial transactions run smoothly and maintain positive relationships with contributors or clients.

Incorrect or Missing Payment Details

One of the most common mistakes is failing to include complete and accurate payment information. Missing details, such as the payment amount, due date, or payment methods, can cause delays and misunderstandings. It’s essential to include clear instructions on how the recipient should make the payment, whether through bank transfer, check, or an online platform. Additionally, ensure that all relevant account or payment information is correct to avoid errors in processing payments.

Lack of Itemization or Clear Descriptions

Another mistake is not providing enough detail in the list of services or products provided. An unclear or vague description can confuse the payer and create doubt about what they are being charged for. Always include a breakdown of services, including quantities, rates, and any applicable taxes or fees. This transparency helps ensure that both parties are on the same page and can prevent disputes.

Key Points to Remember:

- Double-check that all payment and account information is correct before sending.

- Be thorough in listing all services or contributions provided, along with clear descriptions.

- Ensure payment terms are easy to understand and accurately reflect the agreement.

By avoiding these simple mistakes, you can streamline your payment process and present a more professional image to those supporting your cause.

Legal Requirements for Payment Requests

When creating formal financial documents for a charitable initiative, it’s important to be aware of the legal requirements that govern such records. These requirements ensure compliance with tax laws, maintain transparency, and help prevent future legal issues. Failing to meet these obligations could lead to complications during audits or in the event of a dispute with a contributor or regulatory body.

Required Legal Information

For any formal request for payment, there are several key elements that must be included to comply with legal standards:

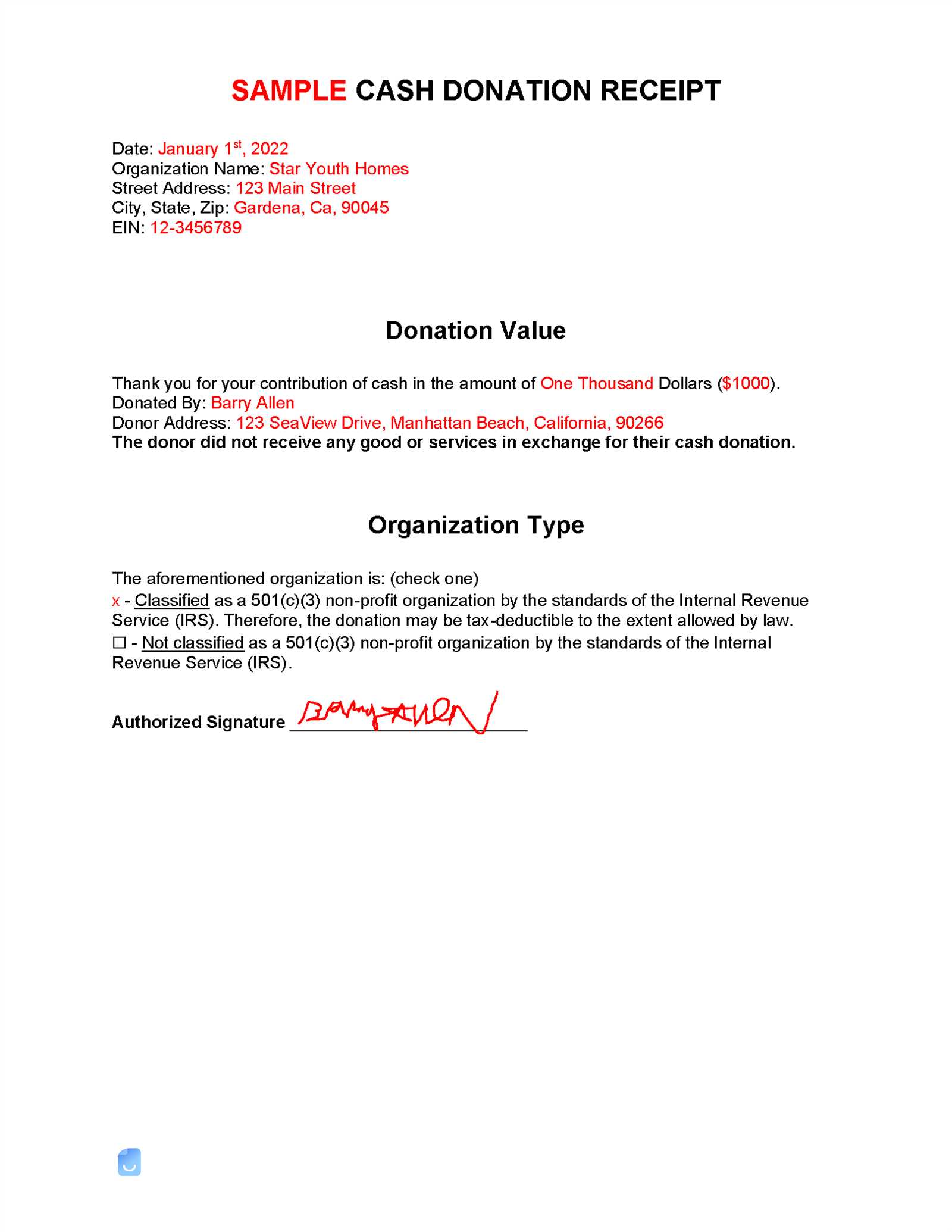

- Tax Identification Number (TIN): The tax ID number is often required for both the payer and recipient. This is especially important for entities that handle large sums of money or receive grants, as it ensures proper tax reporting.

- Proper Business Name: The full legal name of the entity or individual issuing the document must be clearly stated. This helps ensure the payment is attributed to the correct party.

- Tax Rates and Calculations: If applicable, sales tax or VAT must be clearly stated and calculated. This helps ensure that tax obligations are met and accounted for correctly.

- Legal Disclosures: Some jurisdictions require specific disclaimers or legal language regarding the tax status or purpose of the transaction. For example, certain groups may need to include a statement clarifying their status as a tax-exempt entity.

- Payment Terms: Clear terms and conditions, such as payment deadlines or late fees, should be included to avoid legal disputes over missed payments or misunderstanding of deadlines.

Compliance with Local and National Regulations

Each jurisdiction may have specific rules regarding what should be included in a financial document, especially for e

Free Payment Request Documents for Charitable Initiatives

Many charitable groups seek cost-effective solutions to manage their financial transactions. Fortunately, there are various free resources available online that provide well-designed, easy-to-use documents for generating payment requests. These free resources can help streamline the billing process, reduce administrative overhead, and ensure that each transaction is recorded in a professional manner.

Where to Find Free Resources

Several websites and platforms offer free customizable documents, allowing you to adjust them based on your specific needs. These resources often come with pre-filled fields for essential details, such as dates, amounts, and descriptions of services. Some popular sources include:

- Google Docs: Offers editable documents that can be customized and downloaded in multiple formats, including PDF and Word.

- Microsoft Office: Provides a range of free document templates that can be accessed through Word and Excel.

- Specialized Websites: Sites like Invoicely or Invoice Simple allow for free creation and downloading of structured forms.

Benefits of Free Resources

Using a no-cost option for creating formal payment requests provides several advantages, such as:

- Cost-Effective: Free resources eliminate the need for expensive software or services, making them an ideal choice for smaller groups with limited budgets.

- Easy to Customize: Many free options allow you to easily adjust the document’s layout, content, and design to fit your specific needs.

- Time-Saving: Pre-designed structures save time by reducing the effort required to create a document from scratch.

These free resources are an excellent starting point for creating well-structured and professional payment requests, helping ensure that your financial transactions are organized and efficient.

How to Format a Payment Request Document

Proper formatting is crucial when creating a formal payment request, as it ensures clarity and helps both the sender and recipient understand the details of the transaction. A well-organized document not only looks professional but also reduces the chance of mistakes or confusion. There are several key elements to consider when formatting a request for payment, from the layout to the inclusion of essential details.

Here’s a step-by-step guide on how to format your document effectively:

- Header Section:

- Include your full name or entity name at the top, along with contact information such as address, phone number, and email.

- Place the recipient’s details (name, address, etc.) clearly below or beside your own.

- Ensure the date of the transaction and the document number are easily visible for reference.

- Itemized List of Services or Contributions:

- Provide a clear description of each service, product, or donation received, including quantities, rates, and any applicable taxes or fees.

- List each item on a separate line with corresponding prices and a total for each section, if applicable.

- Payment Terms:

- Specify the due date and payment methods accepted (bank transfer, check, online platforms, etc.).

- If there are any early payment discounts or late fees, be sure to note them clearly.

- Total Amount Due:

- Clearly state the total sum that is due, including any applicable taxes, discounts, or adjustments.

- Payment Instructions:

- Provide clear instructions on how to make the payment, such as bank account details or online payment links.

- Legal or Tax Information:

- If applicable, include your tax identification number or any legal disclaimers regarding your status or the transaction.

By following this format, you

Automating the Payment Request Process

Streamlining the process of creating and sending financial documents can save valuable time and reduce human error. Automation tools can help create structured records with minimal effort, ensuring that each transaction is tracked accurately and on time. By automating repetitive tasks, you free up resources to focus on the core activities of your initiative, while maintaining consistency and professionalism in your financial dealings.

Several software solutions and online platforms can assist with this task. These tools allow you to set up recurring billing schedules, auto-generate payment requests based on predefined data, and even send reminders for overdue payments. Some key features of these systems include:

- Recurring Billing: Automatically generate and send requests at set intervals, saving time for regular transactions.

- Predefined Templates: Choose from a variety of pre-built layouts that can be customized to fit your specific needs.

- Payment Tracking: Track the status of payments and automatically mark them as paid once received.

- Reminder Notifications: Automatically send reminders to clients or contributors when payments are approaching or overdue.

- Customizable Fields: Tailor each document with specific details, such as project names, service descriptions, or donor information.

By automating the payment request process, you not only reduce administrative burdens but also ensure accuracy and timely follow-up, leading to a more efficient and effective financial management system.

Tracking Payments with Payment Requests

Effectively tracking financial transactions is essential to ensure that all contributions or payments are properly recorded and accounted for. By using structured payment documents, you can monitor the status of each payment, ensuring that your records are accurate and up to date. Keeping track of when payments are due, received, or overdue helps to maintain clear financial oversight and avoid any discrepancies in your accounting system.

Methods of Tracking Payments

There are several ways to keep track of payments through structured documents. These include:

- Payment Tracking Software: Use dedicated software or online platforms to automate payment tracking. These systems can mark transactions as paid once the payment is received and send reminders when payments are overdue.

- Manual Record-Keeping: Maintain a physical or digital ledger where each payment request is recorded with its status. This method requires regular updates to ensure accuracy.

- Spreadsheets: Many use spreadsheets to manually track payments. Create columns for the payment due date, amount, payment status, and transaction details.

Benefits of Proper Payment Tracking

Accurate payment tracking provides several key advantages:

- Transparency: Clear tracking of each payment ensures all parties are aware of the status and reduces confusion.

- Timely Follow-Ups: Tracking overdue payments allows you to send reminders promptly, ensuring that funds are collected on time.

- Financial Planning: Knowing when payments are received helps you better manage cash flow and plan for future expenses.

By implementing a reliable payment tracking system, you ensure financial clarity and can avoid potential issues such as missed payments or discrepancies in your records.

Design Tips for Payment Request Documents

Creating visually appealing and functional financial documents can make a significant impact on how they are perceived. A well-designed payment request not only helps convey professionalism but also makes the process of reviewing and paying easier for the recipient. By paying attention to layout, clarity, and branding, you can enhance the effectiveness of your financial communication.

Here are a few design tips to ensure your payment request is both aesthetically pleasing and functional:

- Keep It Simple: Avoid cluttering the document with unnecessary graphics or complex designs. A clean, simple layout ensures that the key information is easy to find and understand.

- Use Clear Headers: Break up the content with clearly defined headers. This helps the reader quickly navigate through the document and locate essential sections such as payment details and terms.

- Branding Consistency: Include your logo, consistent fonts, and color scheme to align the document with your branding. This not only looks professional but also reinforces your identity.

- Legible Fonts and Text Sizes: Use easy-to-read fonts and ensure that the text is large enough for clarity, especially for important information like payment amounts or due dates.

Structuring Your Payment Request

To create a well-organized document, divide it into clear sections. This will improve both readability and functionality:

| Section | Description |

|---|---|

| Header | Include your name or business name, contact information, and a unique reference number for easy tracking. |

| Recipient Details | Provide the full name and contact information of the recipient to ensure the payment request is directed correctly. |

I

How to Handle Payment DisputesDisputes over financial documents are a common challenge in any payment process. These disagreements can arise due to misunderstandings, errors in calculation, or differences in expectations. Regardless of the reason, it is essential to address these issues professionally and efficiently to maintain healthy relationships with contributors or clients and to ensure timely resolution. Steps to Resolve DisputesIf you find yourself facing a dispute, follow these steps to handle the situation effectively:

Preventing Future DisputesWhile disputes are sometimes inevitable, taking proactive measures can help reduce their frequency:

By following these steps and maintaining clear communication, you can resolve payment disputes professionally and prevent similar issues in the future. Using Payment Requests for Financial ReportingTracking and analyzing financial transactions is essential for effective financial reporting. Payment documents provide a clear record of money received and owed, which is crucial for creating accurate financial statements. By using these documents as part of your reporting process, you ensure transparency and accountability in managing funds. Whether for internal reviews or external audits, well-organized records help paint an accurate picture of financial health. Here’s how payment records can be integrated into your financial reporting: Benefits of Using Payment Records in Reports

Incorporating Payment Data into ReportsTo effectively use payment data in financial reports, consider these key steps:

By integrating payment records into your financial reporting process, you gain better control over your finances, enabling more informed decision-making and helping to meet compliance requirements. The systematic use of these records ensures that all financial transactions are accounted for and transparent. Integrating Payment Request Documents with Accounting Software

Seamlessly integrating financial records with accounting software can greatly improve efficiency and accuracy in managing finances. By connecting your payment request documents with your accounting system, you can automate key processes such as tracking transactions, generating reports, and reconciling accounts. This integration minimizes the chances of human error, speeds up data entry, and ensures that financial records are always up to date. Benefits of IntegrationHere are some of the advantages of integrating payment documents with accounting software:

How to Integrate Payment DataTo integrate your payment documents with accounting software, follow these steps:

|