Retail Sales Invoice Template for Simple and Efficient Billing

Managing financial transactions effectively is crucial for any business. Ensuring that payments are tracked accurately and professionally can enhance customer satisfaction and improve cash flow. One of the most important tools for achieving this is a well-structured document that clearly outlines the details of each transaction.

By utilizing a customizable document design, businesses can create professional records that reflect their brand identity while ensuring all necessary details are captured. These documents are not only practical but also serve as an essential element in maintaining transparency and organization in financial dealings.

Customizable forms offer an efficient way to record transactions, making it easier to stay organized and reduce errors. Whether you’re handling small or large volumes of transactions, having a reliable structure in place can significantly simplify the process, save time, and minimize mistakes.

Retail Sales Invoice Template Overview

Effective record-keeping is essential for any business that involves exchanging goods or services for payment. A well-organized document helps businesses track transactions, manage payments, and maintain clear communication with customers. These documents are designed to provide all the necessary information in a structured format, ensuring clarity and efficiency in financial management.

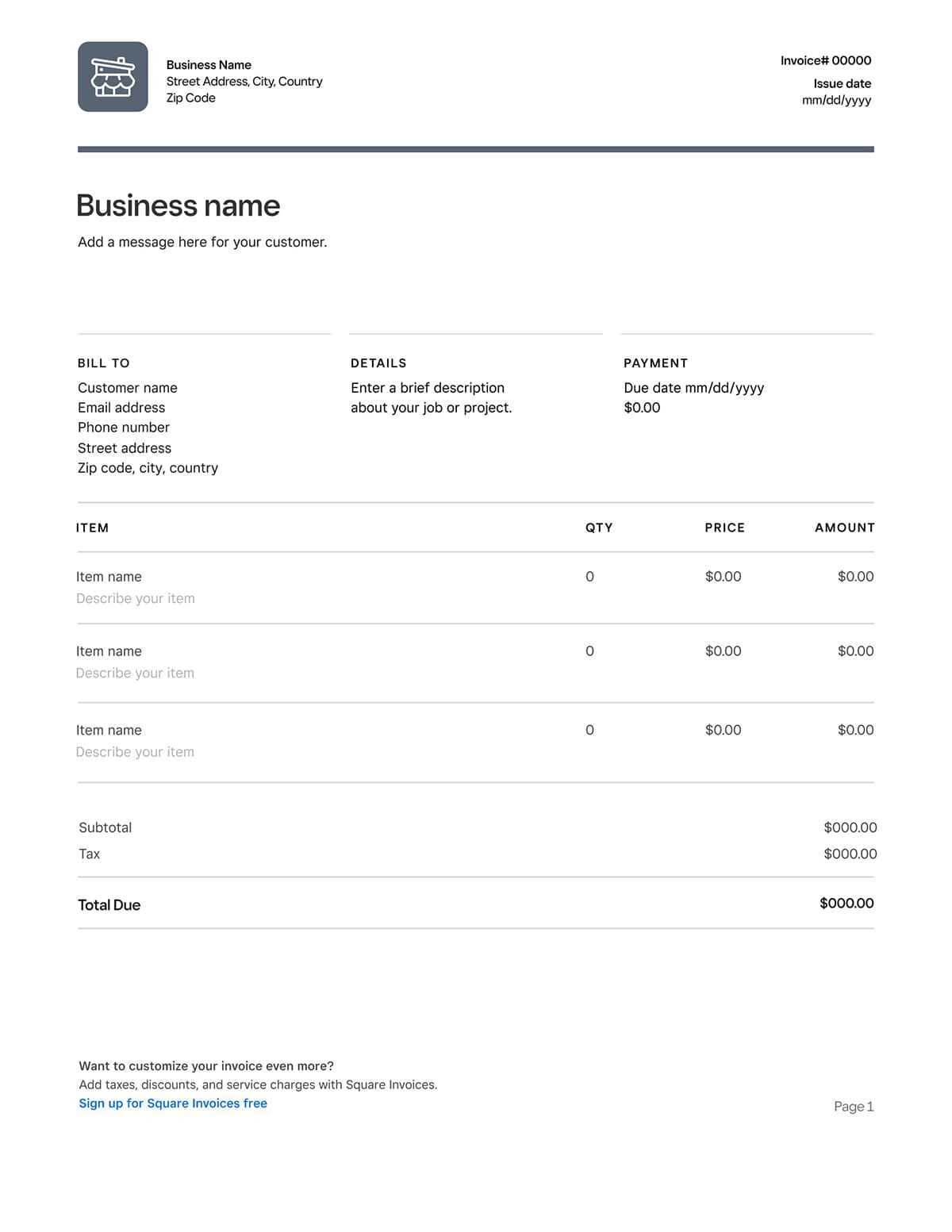

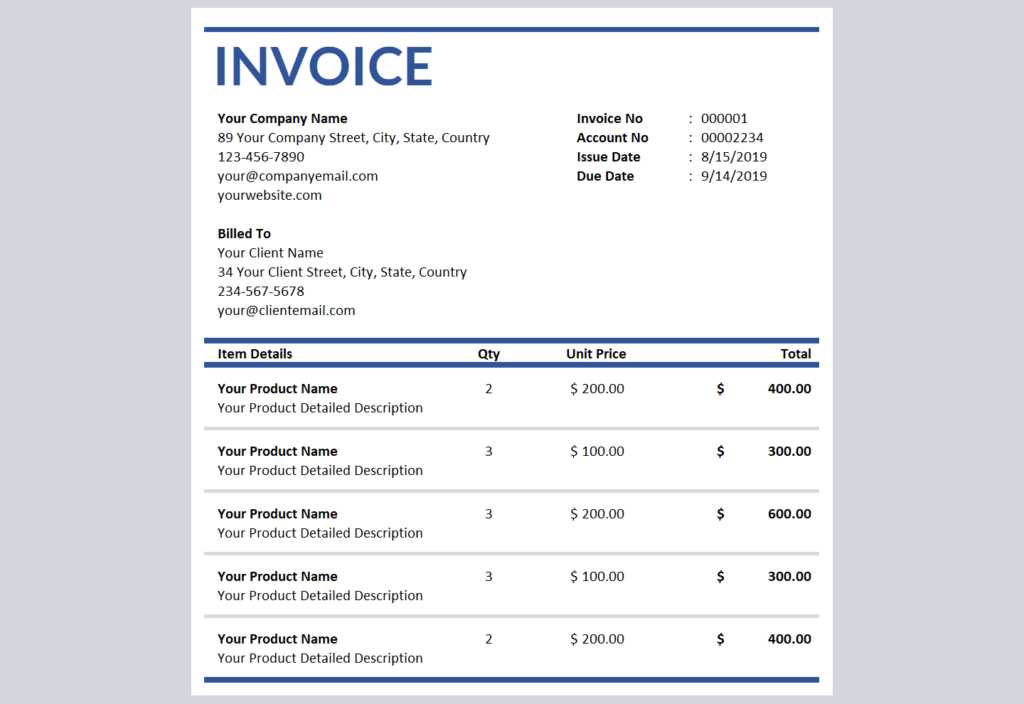

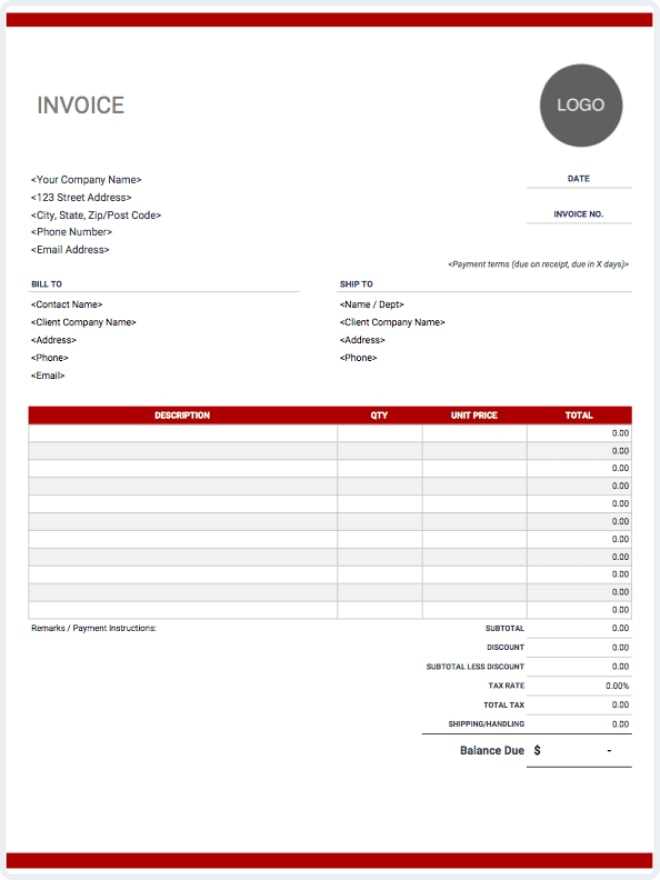

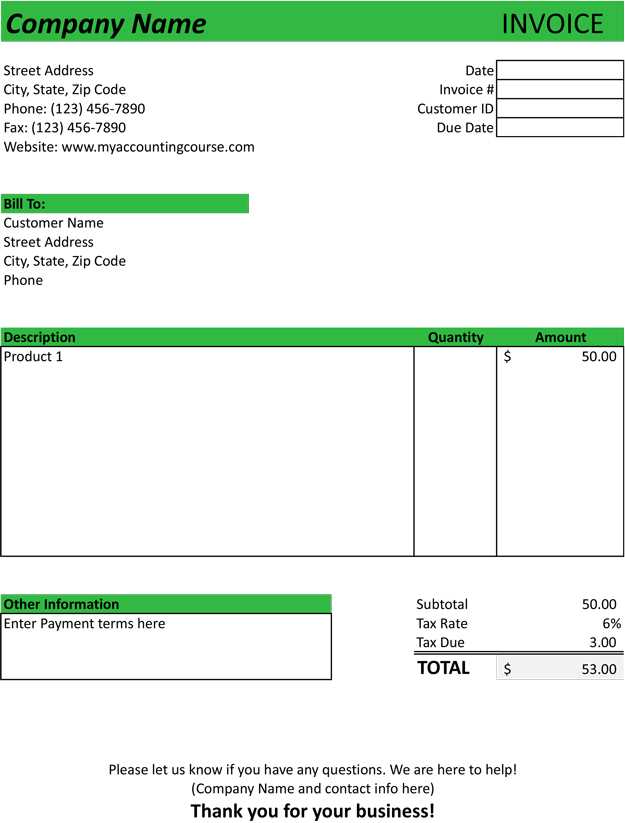

The primary goal of using a structured document for each transaction is to streamline the billing process. It not only facilitates quick payments but also serves as an official record of the transaction. A good document design includes fields for customer details, transaction items, pricing, and payment terms, offering both simplicity and professionalism.

Customizable structures allow businesses to tailor each record to their specific needs, ensuring that all necessary details are captured. With the right format, businesses can save time on administrative tasks while reducing the risk of errors. This tool becomes invaluable for tracking finances, organizing documents, and keeping everything in order.

What is a Retail Invoice Template

A document used to record transactions between a business and its customers is an essential tool for ensuring clear communication and smooth financial management. It contains important information about the products or services provided, as well as the terms of payment. Such a document serves as both a receipt for the customer and a record for the business, ensuring that everything is tracked accurately.

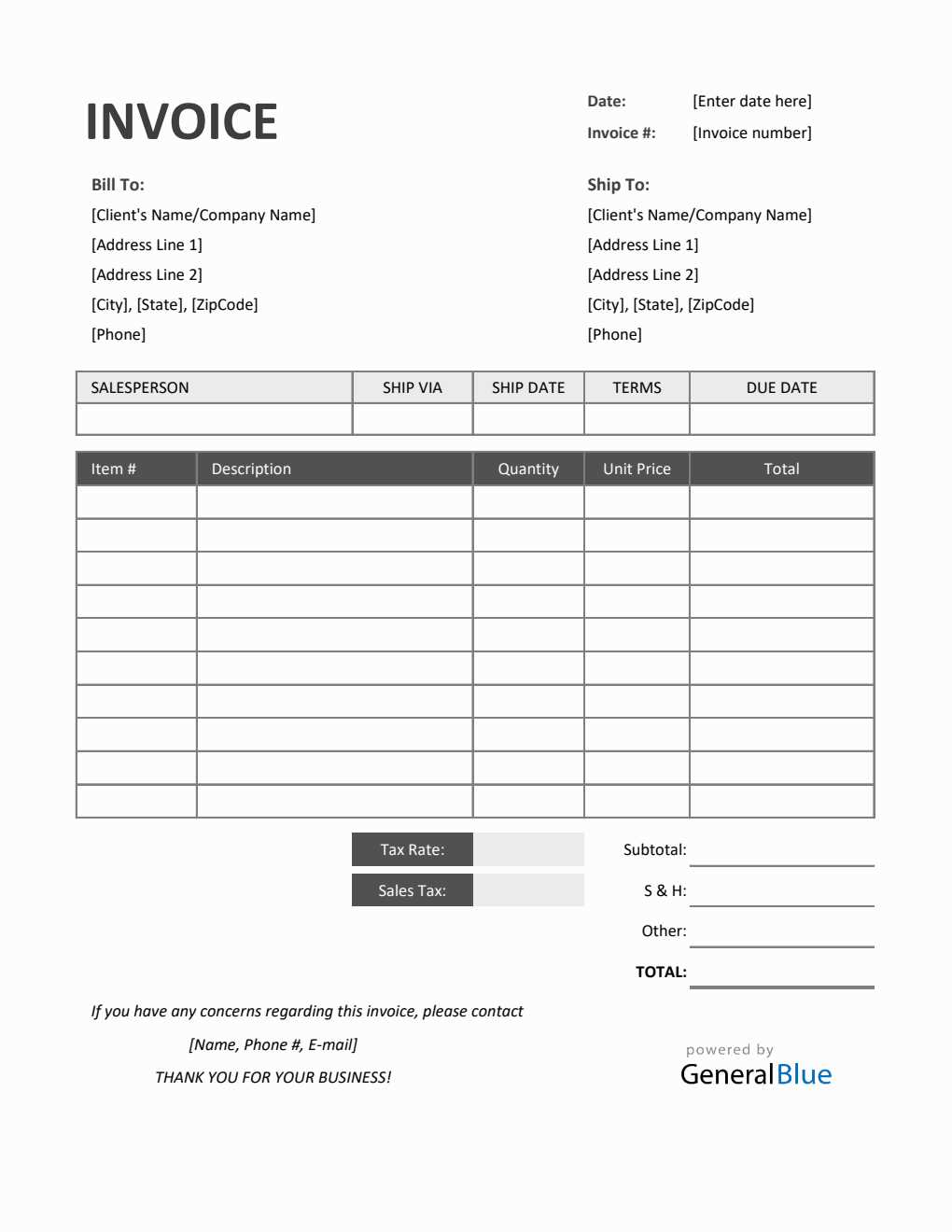

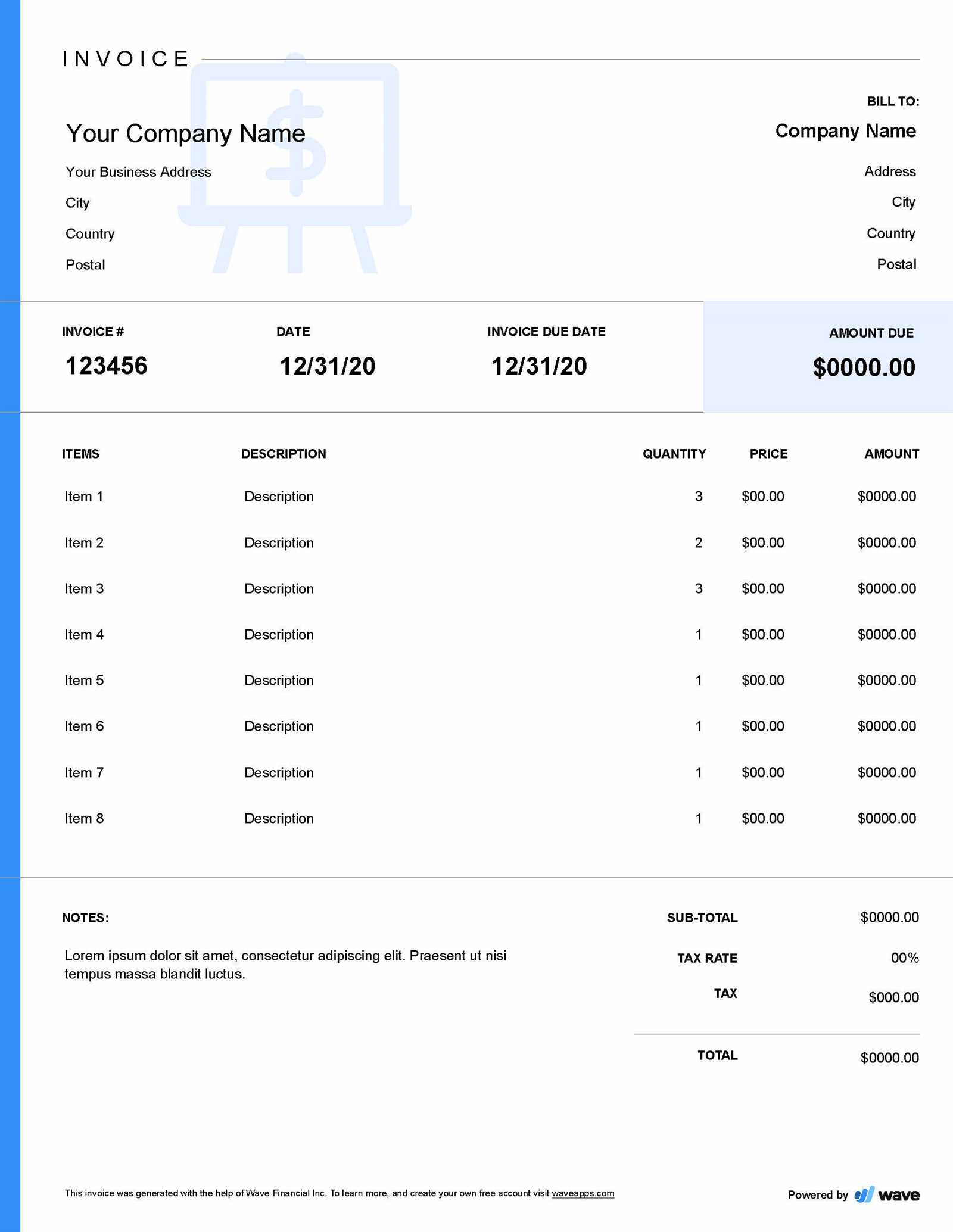

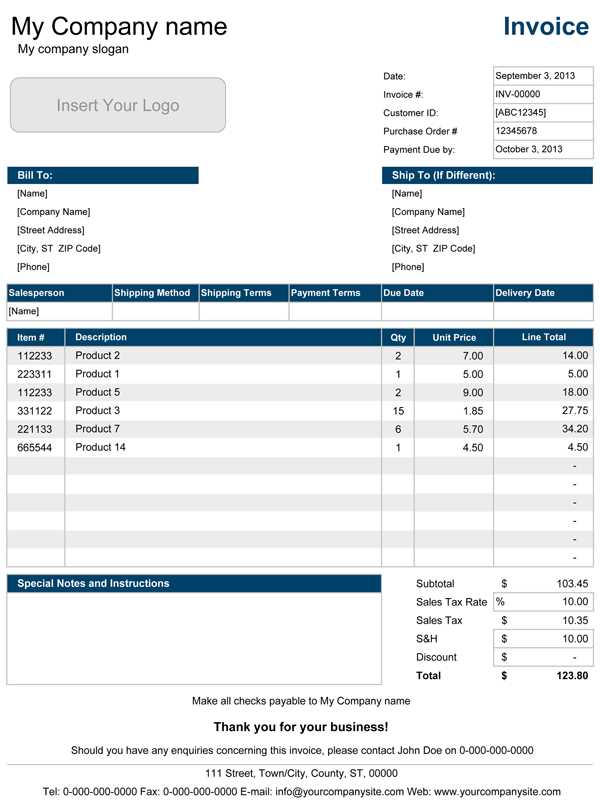

This document typically includes several key components that are important for both the business and the customer:

- Business Information: Name, address, contact details, and tax identification number.

- Customer Information: Name, address, and contact details.

- Transaction Details: A list of goods or services provided, with descriptions and quantities.

- Pricing: Prices for each item or service, along with the total cost.

- Payment Terms: Information about payment deadlines, methods, and any discounts or taxes applied.

Such a structured document simplifies the billing process and helps businesses maintain accurate financial records. It also provides a professional appearance and fosters trust between the business and its clients.

Benefits of Using an Invoice Template

Utilizing a pre-structured document for billing offers several advantages that simplify the financial management process for any business. By relying on a consistent format, companies can reduce errors, improve efficiency, and maintain a professional image with clients. These documents can be customized to fit specific business needs while retaining their fundamental purpose of ensuring clarity and accuracy in transactions.

Time Efficiency and Consistency

One of the key benefits of using a predefined document structure is the time saved. Instead of creating a new document from scratch for each transaction, businesses can simply fill in the relevant details. This approach ensures that each transaction is recorded quickly and uniformly, without the need for repetitive formatting. A consistent format helps in reducing the time spent on administrative tasks, allowing more focus on core business activities.

Improved Accuracy and Professionalism

A standardized structure reduces the chances of missing important details or making errors in calculations. By using a consistent layout, businesses ensure that every required piece of information is included, which helps prevent disputes or misunderstandings with customers. In addition, a well-designed document reflects professionalism, fostering trust and credibility with clients.

Essential Fields in a Retail Invoice

A well-organized document for recording transactions must contain specific details to ensure clarity and prevent confusion. These essential fields capture all the necessary information to document a transaction accurately, ensuring both the business and customer understand the terms and details of the exchange. Properly structured entries help businesses track sales, manage payments, and maintain organized financial records.

Key Information for Identification

The first step in creating a clear transaction record is to include details that identify both parties involved. This typically includes:

- Business Information: The company name, contact details, and tax identification number.

- Customer Information: The name and contact details of the buyer, allowing for easy follow-up if needed.

Transaction Specifics and Payment Terms

Next, the document should clearly outline the products or services provided, including the quantity and price for each item. This section typically contains:

- Item Descriptions: A clear list of products or services being exchanged.

- Pricing: Unit prices and totals for each item or service, as well as any applicable taxes or discounts.

- Payment Terms: Information about payment deadlines, methods, and any discounts for early payment.

How to Customize an Invoice Template

Customizing a document for recording transactions allows businesses to tailor it to their specific needs while ensuring it remains professional and effective. By adjusting the layout and content to reflect the brand and business practices, companies can enhance both the appearance and functionality of the document. Customization not only streamlines the process but also improves the customer experience and strengthens brand recognition.

Here are some key steps to customize the document structure:

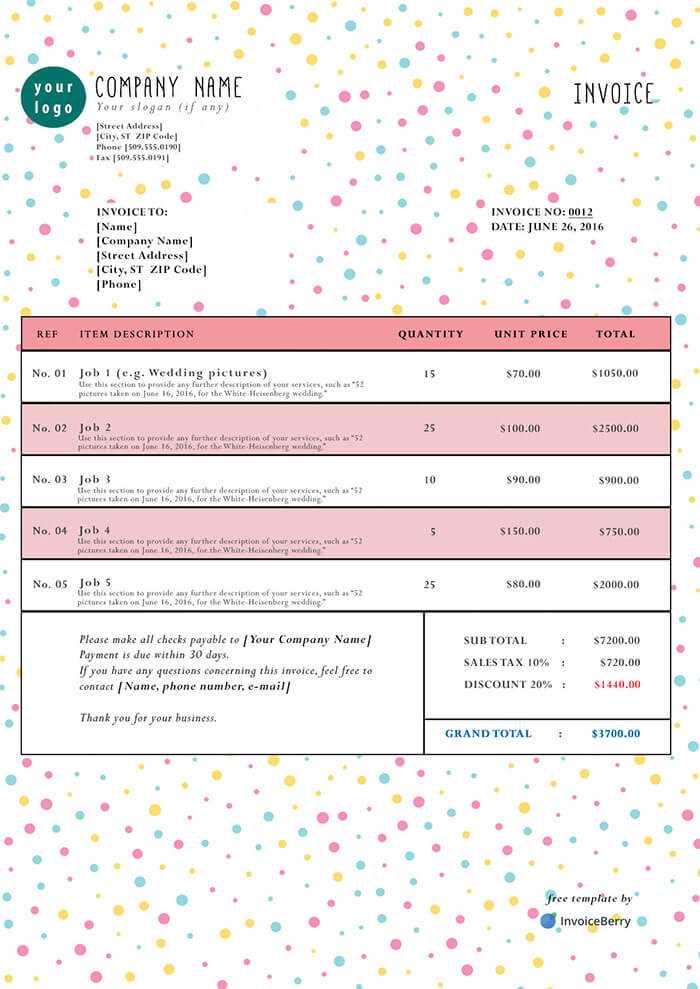

- Adjusting Layout and Design: Modify fonts, colors, and logos to match your business branding. A consistent design helps reinforce your company’s identity and makes the document more visually appealing.

- Adding or Removing Sections: Depending on your needs, you can add fields for additional details, such as discounts, shipping charges, or payment instructions, and remove unnecessary sections to keep the document streamlined.

- Personalizing Terms and Conditions: Customize the terms of payment, delivery instructions, and refund policies to suit your business’s practices, ensuring that both parties understand their obligations.

By following these steps, businesses can create a document that aligns with their workflow and presents a polished, professional appearance to customers.

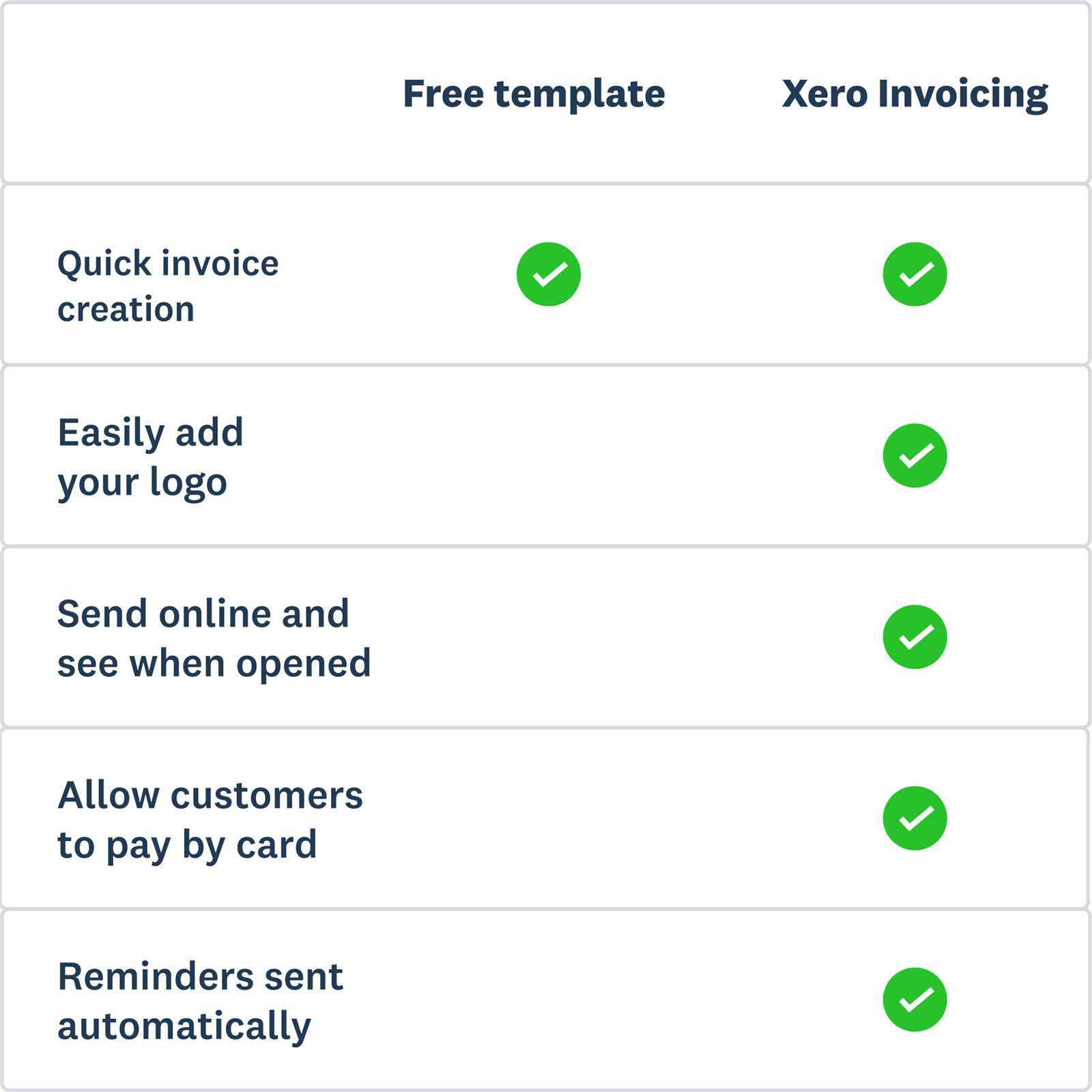

Free vs Paid Invoice Templates

When selecting a document structure for recording transactions, businesses often face the decision between using a free or paid option. Both have their advantages and limitations, depending on the business’s needs and the level of customization or features required. Understanding the differences between free and paid versions can help businesses make an informed choice that suits their operations.

Advantages of Free Options

Free document designs are appealing because they offer immediate access without any financial investment. However, they may come with limitations:

- No Cost: These options are available at no charge, which is ideal for businesses on a tight budget.

- Basic Features: While functional, free designs may have limited customization options and fewer fields for specific information.

- Limited Support: Free options typically offer little or no customer support if issues arise during use.

Benefits of Paid Options

Paid versions, on the other hand, provide more advanced features and greater flexibility, but come with a price tag:

- Advanced Features: Paid designs often include features such as automated calculations, integration with accounting software, and customizable fields tailored to specific business needs.

- Professional Appearance: These options are usually designed with a more polished, business-oriented layout, enhancing the professionalism of the documents.

- Ongoing Support: Paid versions typically offer customer support, ensuring that users can resolve issues quickly and easily.

Choosing between free and paid options depends on the specific needs of the business, such as budget, level of customization, and required features.

Top Features of a Good Template

A well-designed document for recording transactions is essential for ensuring accuracy, professionalism, and efficiency. A good structure makes it easy for businesses to keep track of financial exchanges and communicate important details to clients. To achieve this, the document should include a variety of key features that enhance its usability and effectiveness.

Key Elements for Functionality

For the document to serve its intended purpose, it must include the following:

- Clear Identification Information: Business name, address, contact details, and customer information should be easy to locate and fill in.

- Structured Layout: A clean, organized layout ensures that the document is easy to read and navigate, with designated areas for each key piece of information.

- Accurate Calculations: Automated features such as total amounts, tax calculations, and discounts reduce the risk of human error.

Customization and Flexibility

A versatile structure allows businesses to adapt the document to their specific needs:

- Branding Options: Customizable colors, fonts, and logos help reinforce your business identity and give the document a polished, professional look.

- Custom Fields: The ability to add or remove fields for additional details–such as terms and conditions or payment instructions–ensures that the document fits the unique requirements of each business.

- Multiple Payment Methods: Including options for different payment methods, such as credit card, bank transfer, or checks, increases the document’s versatility.

Creating Professional Invoices Quickly

Creating a polished, professional document for each transaction doesn’t have to be a time-consuming task. By utilizing the right tools and methods, businesses can streamline the process and generate these documents in no time. The key to efficiency is having a clear structure and the necessary fields ready to be filled out for each customer interaction.

Here are some tips for speeding up the creation process while maintaining a professional appearance:

- Use Pre-Formatted Structures: Pre-built designs with standardized sections save time, eliminating the need to start from scratch for every transaction.

- Automate Calculations: Automated fields for totals, taxes, and discounts ensure accuracy while reducing manual effort.

- Leverage Digital Tools: Online platforms or software can generate documents instantly, allowing you to input data and produce a finished result with minimal effort.

- Set Up Templates with Custom Fields: Prepare the document structure with fields that you often need for your business, such as payment terms, delivery instructions, or unique product codes.

By adopting these methods, businesses can ensure that each transaction is documented quickly without sacrificing quality or professionalism.

Legal Requirements for Retail Invoices

Every transaction document used by a business must comply with legal standards to ensure proper record-keeping and to avoid any potential legal issues. The required details in a transaction record vary depending on the country, industry, and type of business, but there are key elements that must always be included to meet regulatory standards. Businesses should be aware of the necessary information that needs to be present in such documents to remain compliant with tax and financial regulations.

The following table outlines the essential fields typically required for legal compliance in most jurisdictions:

| Required Field | Description |

|---|---|

| Business Information | Company name, address, and tax identification number (TIN) to ensure traceability and transparency. |

| Customer Information | Details of the buyer, including their name and contact information, for accountability and record-keeping purposes. |

| Date of Transaction | The date on which the goods or services were provided, which is necessary for tax reporting and payment tracking. |

| Product/Service Details | A detailed list of items sold, including quantities and descriptions, to clearly specify the exchange. |

| Total Amount and Taxes | The total value of the transaction, including applicable taxes, to ensure transparency and compliance with tax laws. |

| Payment Terms | Information about payment methods and due dates, which help avoid disputes and clarify expectations between parties. |

By including these critical details, businesses can ensure that their transaction records are legally sound and serve as reliable documentation for both internal use and external audits.

Invoice Design and Branding Tips

Creating a document for transactions is not only about functionality but also about presenting a professional image that aligns with your brand. A well-designed document can leave a lasting impression on clients and help reinforce your business identity. With the right balance of design elements, you can enhance both the appearance and usability of your business documentation.

Key Design Elements to Focus On

When designing your document, it’s important to focus on a few essential elements to ensure it looks polished and easy to navigate:

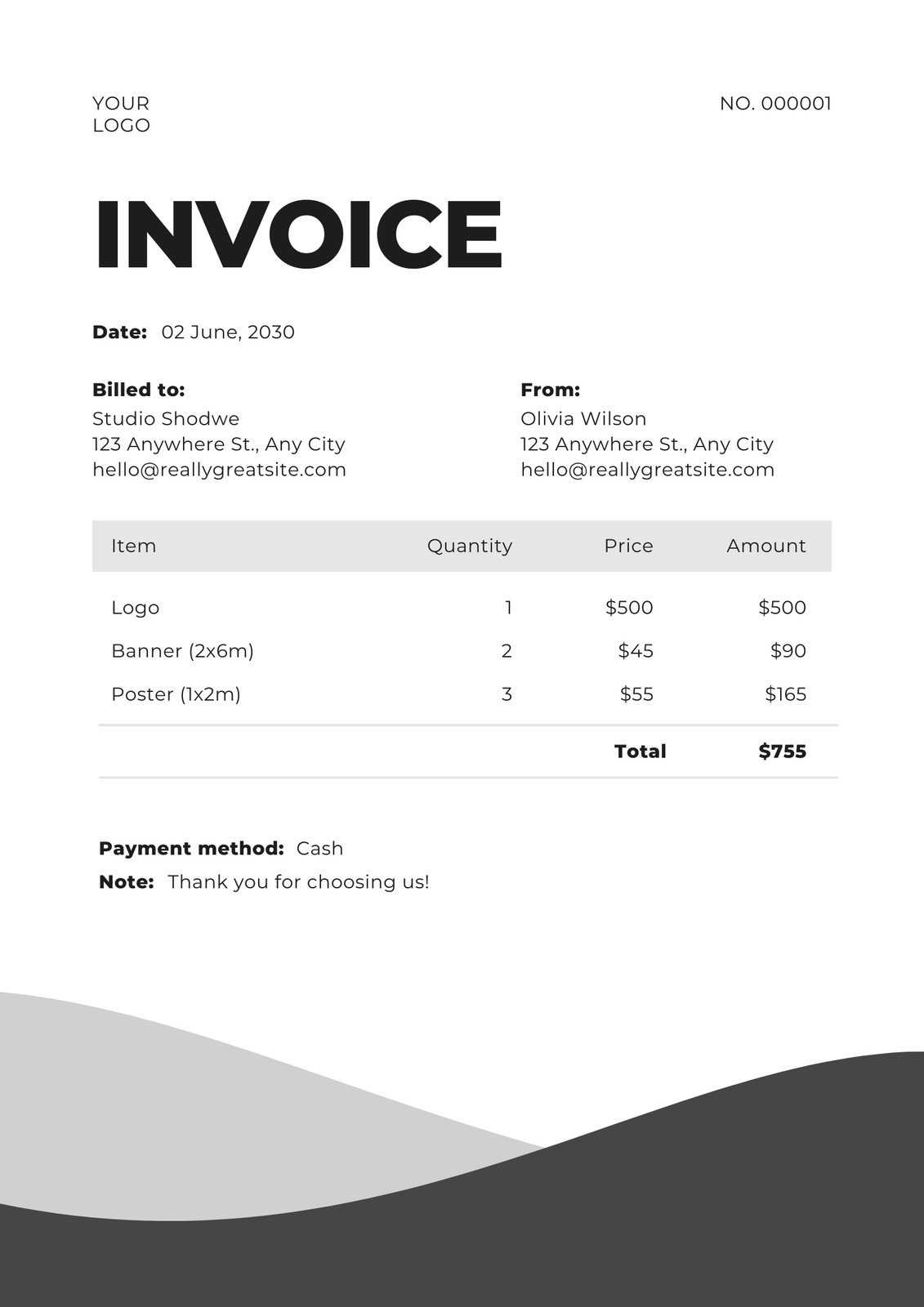

- Clarity and Simplicity: The document should be straightforward, with clear sections and a clean layout that makes it easy to read and understand.

- Consistent Fonts and Colors: Use fonts and colors that match your business’s branding. Consistency in these elements helps to reinforce your identity and ensures the document looks cohesive.

- Brand Logo Placement: Include your company logo at the top or in a prominent place to establish your business’s presence on the document.

Enhancing Professionalism with Branding

Incorporating branding elements into your document not only enhances its professionalism but also helps build recognition among your clients:

- Custom Design Elements: Consider adding design accents such as borders, icons, or custom sections that reflect your brand’s style.

- Personalized Content: Tailor the document with personalized messages or custom payment terms that make the communication feel more personal and attentive.

- Social Media Links: Including your social media handles or website links can further connect your clients with your online presence and encourage further engagement.

By paying attention to design and incorporating branding, your documents will not only function as records of transactions but also as an extension of your business’s identity and professionalism.

Tracking Sales with Invoice Templates

Accurately tracking transactions is a crucial aspect of managing any business. Using well-structured documents to record exchanges not only ensures that you maintain an organized system, but it also helps with financial forecasting, inventory management, and compliance. The right tools and methods for tracking these exchanges make it easier to stay on top of your business performance and improve decision-making.

How Organized Documents Help with Tracking

A clear structure allows businesses to quickly assess their revenue and identify trends. By keeping track of key details, you can improve the management of your operations:

- Clear Documentation: Every transaction is captured with essential details like the date, product or service provided, and amount charged. This allows for easy reference when needed.

- Transaction History: With proper records, you can review past exchanges to track the performance of your offerings and identify any fluctuations or patterns.

- Real-Time Monitoring: Updating records immediately after each exchange provides a live overview of your current business performance.

Using Records to Improve Decision Making

Once you have reliable records, you can use them to make informed decisions about your business. Here are some ways to utilize your tracked data:

- Identifying Bestsellers: Reviewing your transaction logs can help you spot the most popular products or services, guiding inventory and marketing decisions.

- Forecasting Revenue: Accurate transaction records help in projecting future earnings based on historical data, which can aid in financial planning and budgeting.

- Improving Customer Relations: Tracking recurring purchases allows you to spot loyal customers and offer personalized services or incentives.

By maintaining detailed and well-organized transaction records, you can easily track and analyze your business’s progress, helping to improve operations and make strategic decisions moving forward.

How to Save Time on Billing

Efficient billing processes are crucial for streamlining business operations and reducing administrative overhead. The more you can automate and simplify the tasks involved, the more time you’ll free up to focus on growing your business. With the right strategies, you can significantly reduce the time spent on creating and sending transaction documents.

Automating the Billing Process

Automation is one of the most effective ways to save time on billing tasks. By leveraging tools and software, you can quickly generate and send documents without manual input. Here are some automation strategies:

- Pre-filled Templates: Use pre-designed documents with fields that automatically populate with customer and transaction information, reducing the need for manual data entry.

- Recurring Billing: Set up automatic billing for regular customers or repeat transactions, allowing you to streamline the process for subscription-based services or products.

- Batch Processing: If you have multiple transactions, consider processing them in batches to minimize the time spent on individual tasks.

Optimizing Document Organization

Organizing your documentation effectively can help you quickly locate and manage transaction records, saving valuable time. Here are a few organizational tips:

- Digital Storage: Store all transaction documents digitally to avoid manual filing and searching through paper records.

- Cloud-Based Systems: Use cloud-based platforms to access documents from anywhere, reducing delays in document retrieval and enabling faster response times.

- Consistent Naming Conventions: Adopt clear and consistent naming conventions for your files to make searching and sorting easier.

Time-Saving Billing Tools

Many tools can help speed up the billing process. These solutions are designed to make generating and sending transaction records faster and more efficient:

| Tool/Method | Benefit | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Billing Software | Automates document creation, sends reminders, and integrates with payment systems for faster transactions. | ||||||||||||||||||||||||||||||

| Online Payment Systems | Allows for quick payments, reduc

Choosing the Right Format for TemplatesWhen selecting the appropriate structure for your billing documents, it is important to consider both functionality and ease of use. The format you choose should align with your business needs while ensuring that your records are clear, professional, and easy to maintain. Different formats can offer various advantages, so understanding the strengths of each is key to making the best decision for your business. Factors to Consider When Choosing a FormatBefore settling on a specific format for your billing records, take into account the following factors:

Popular Formats for Business RecordsThere are several popular formats available for creating business documents. Below are some of the most commonly used formats, each with its own set of benefits:

Choosing the right format is essential for ensuring that your documents are not only functional but also easy to handle. By carefully considering the factors above, you can select a structure that best fits your operational needs and ensures a professional experience for your clients. How to Automate Invoice GenerationAutomating the process of creating billing documents can significantly save time and reduce the chances of human error. By leveraging software tools and integrations, you can streamline the entire process–from data entry to document creation–ensuring that every detail is accurate and consistent. Automation not only speeds up the workflow but also helps in maintaining a professional and organized record of financial transactions. To begin automating the generation of documents, follow these key steps:

By automating this process, you can ensure that all documents are created quickly, with little effort on your part. The system will handle repetitive tasks, allowing you to focus on more critical aspects of your business, such as customer service and product development. Common Mistakes to Avoid in InvoicesCreating billing documents can sometimes feel like a straightforward task, but there are several common errors that can lead to confusion, delays, or even disputes. Whether you’re managing a small business or handling client transactions, avoiding these mistakes can help ensure a smooth process for both you and your customers. These errors can range from simple omissions to more complex issues that impact financial accuracy or customer satisfaction. Here are some of the most common mistakes to avoid:

By paying attention to these details and taking care to avoid these common pitfalls, you can create more professional and accurate billing documents that help foster trust and ensure timely payments from your clients. Integrating Billing Documents with Accounting Software

Linking your billing documents with accounting software is an effective way to streamline financial tracking and ensure accuracy in your business operations. By integrating these documents with your accounting tools, you can reduce manual data entry, minimize errors, and automatically update your financial records. This integration saves time and helps you keep a consistent flow of financial information without the need for redundant work. Here are some of the key benefits of this integration:

Most modern accounting software provides easy-to-use integrations with popular document management systems, enabling you to seamlessly connect your billing process to your financial tracking. Below is a table outlining some popular software options and their integration capabilities:

By adopting these integrations, businesses can achieve smoother financial management, allowing them to focus on core operations while maintaining |