Free Invoice Template Word Document for Easy Billing

Creating accurate and professional billing records is essential for any business. Whether you are a freelancer or run a larger organization, simplifying the process of generating payment requests can save time and reduce errors. With the right tools, creating invoices can be a smooth, efficient task that enhances your overall workflow.

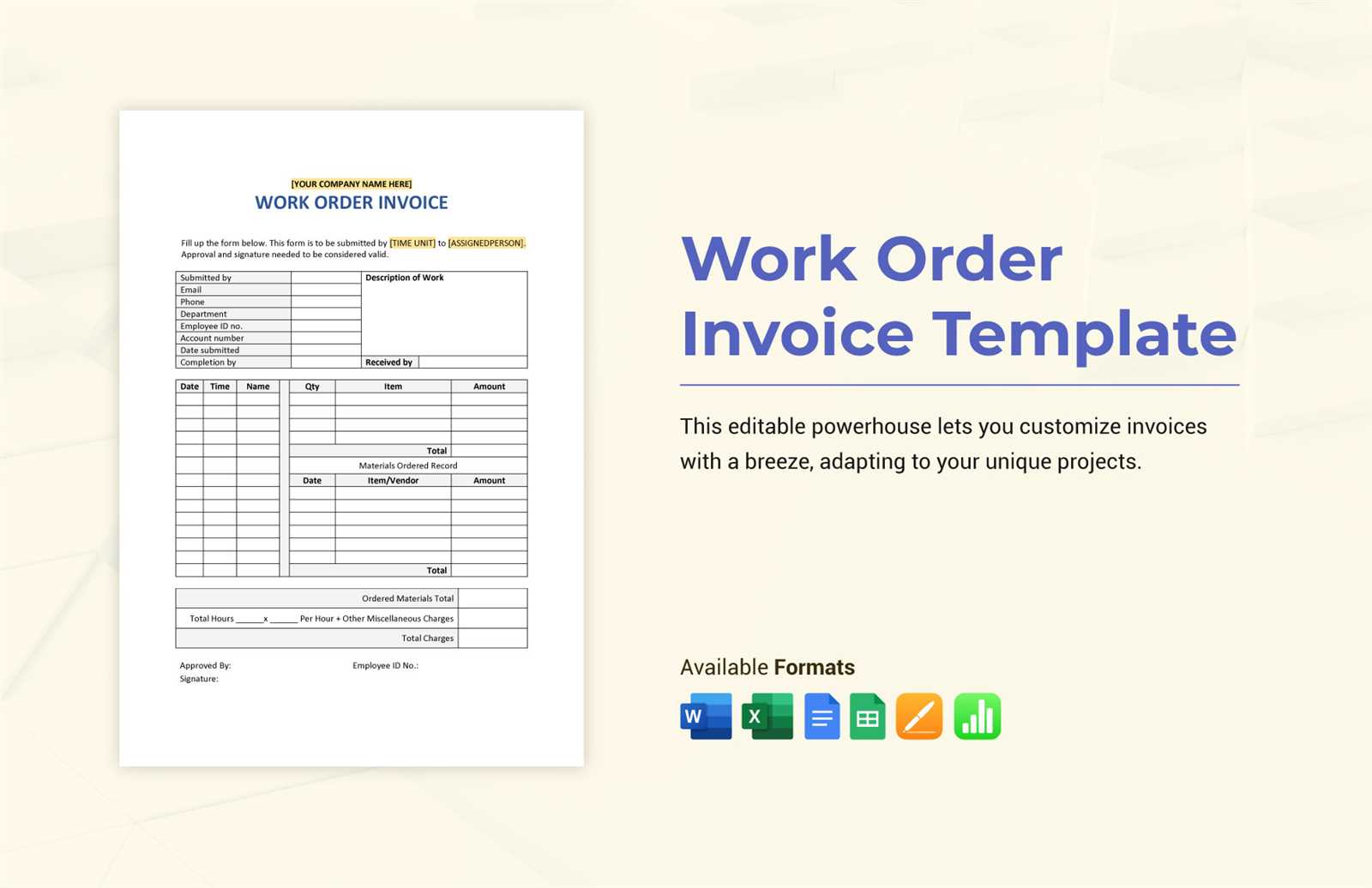

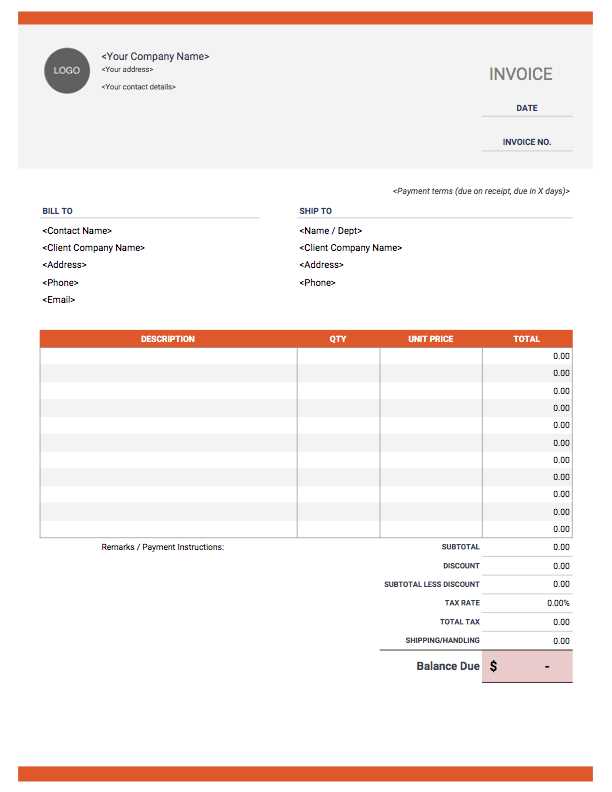

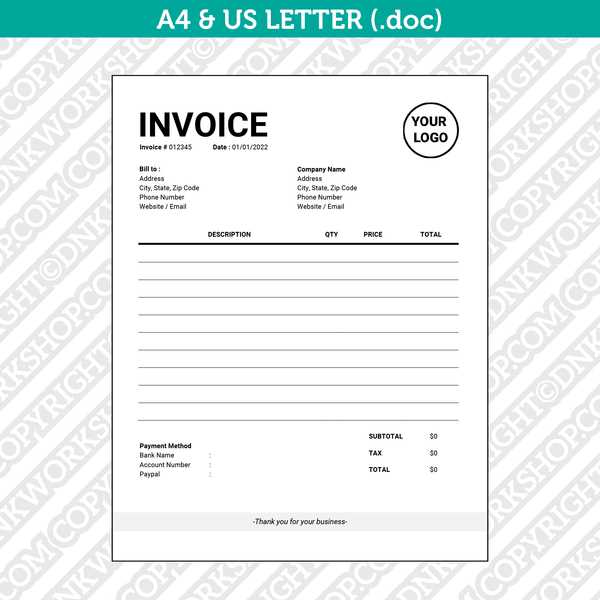

Pre-designed solutions allow you to quickly create clear and organized bills. By using customizable formats, you can easily adjust content and layout to fit your specific needs, whether it’s for a one-time project or recurring services. These resources help ensure that all the essential information, such as payment terms, itemized charges, and contact details, are presented in a clean, professional manner.

Adopting a streamlined approach to invoicing not only improves accuracy but also boosts your credibility with clients. It allows for consistency and reliability, ensuring that all business transactions are documented clearly and effectively. In this article, we’ll explore how to take full advantage of ready-to-use billing formats to enhance your invoicing system.

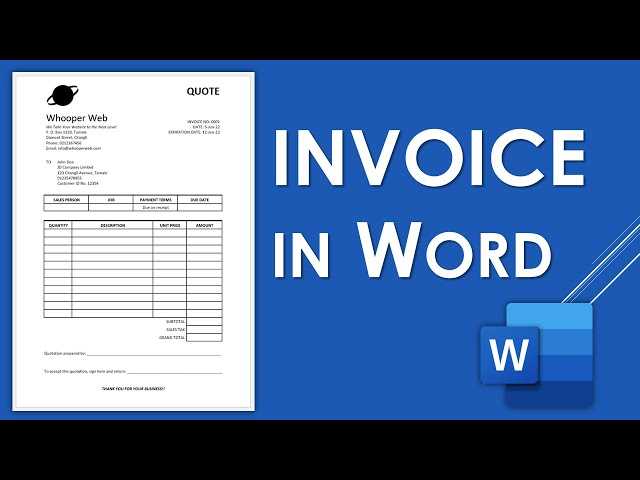

How to Create an Invoice in Word

Creating a professional payment request can be a simple process when you know the right steps. With a few adjustments, you can quickly generate a clear and concise document that includes all necessary details, such as services provided, payment terms, and amounts owed. This guide will walk you through the process of generating a formal billing record in an easy-to-use word processing application.

Step 1: Start with a Blank Page

The first step is to open a new file in your preferred word processing software. Start with a clean, blank page to ensure you have full control over the layout and content of the payment request.

Step 2: Add Your Business Information

In the top section of the page, include your company name, address, phone number, email, and any other relevant contact details. This section helps the recipient easily identify the source of the payment request.

Step 3: Include Client’s Information

Below your business details, add the recipient’s information. This should include the client’s name or company name, address, and contact details. This ensures the payment request is clearly addressed and avoids any confusion regarding who the request is for.

Step 4: Detail the Services or Products

Clearly list the services rendered or products sold along with their individual prices. Use a table to make this section more organized and easier to read.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $50 | $250 |

| Graphic Design | 1 project | $300 | $300 |

Step 5: Calculate the Total Amount Due

Once all the items and services are listed, calculate the total amount due. You can include any applicable taxes, discounts, or additional fees to arrive at the final balance. It is important to ensure that this section is clear and accurate.

Benefits of Using a Word Invoice Template

Utilizing pre-designed structures for creating billing records offers significant advantages, especially for businesses looking to streamline their operations. These ready-made formats simplify the process of generating formal requests for payment while ensuring consistency, professionalism, and accuracy. By opting for a structured approach, companies can save time and reduce the risk of errors, ultimately improving cash flow and client satisfaction.

Time-Saving and Efficiency

One of the main benefits of using a pre-designed billing format is the time saved in document creation. Instead of starting from scratch, a predefined structure allows you to focus on the details of the transaction. The layout is already set, which means less effort is required to format the content. Some of the key advantages include:

- Quick Setup: Fill in relevant details without worrying about layout and design.

- Consistency: Ensure uniformity across all your payment requests, creating a professional image.

- Effortless Customization: Easily adjust information to fit different clients or services.

Improved Accuracy and Professionalism

Having a structured approach minimizes the chances of making mistakes. A well-organized record ensures that all necessary information is included and presented correctly. This not only improves internal workflows but also enhances your reputation with clients. Some of the benefits include:

- Clear Communication: Ensures all relevant details, such as payment terms and contact information, are included.

- Professional Appearance: A polished and formal layout helps establish trust with clients.

- Error Reduction: Templates often come with built-in checks to ensure that important fields are filled in properly.

Incorporating these pre-made formats into your business processes helps maintain a high standard of organization and professionalism. It saves time, reduces errors, and ensures that every client interaction is seamless and efficient.

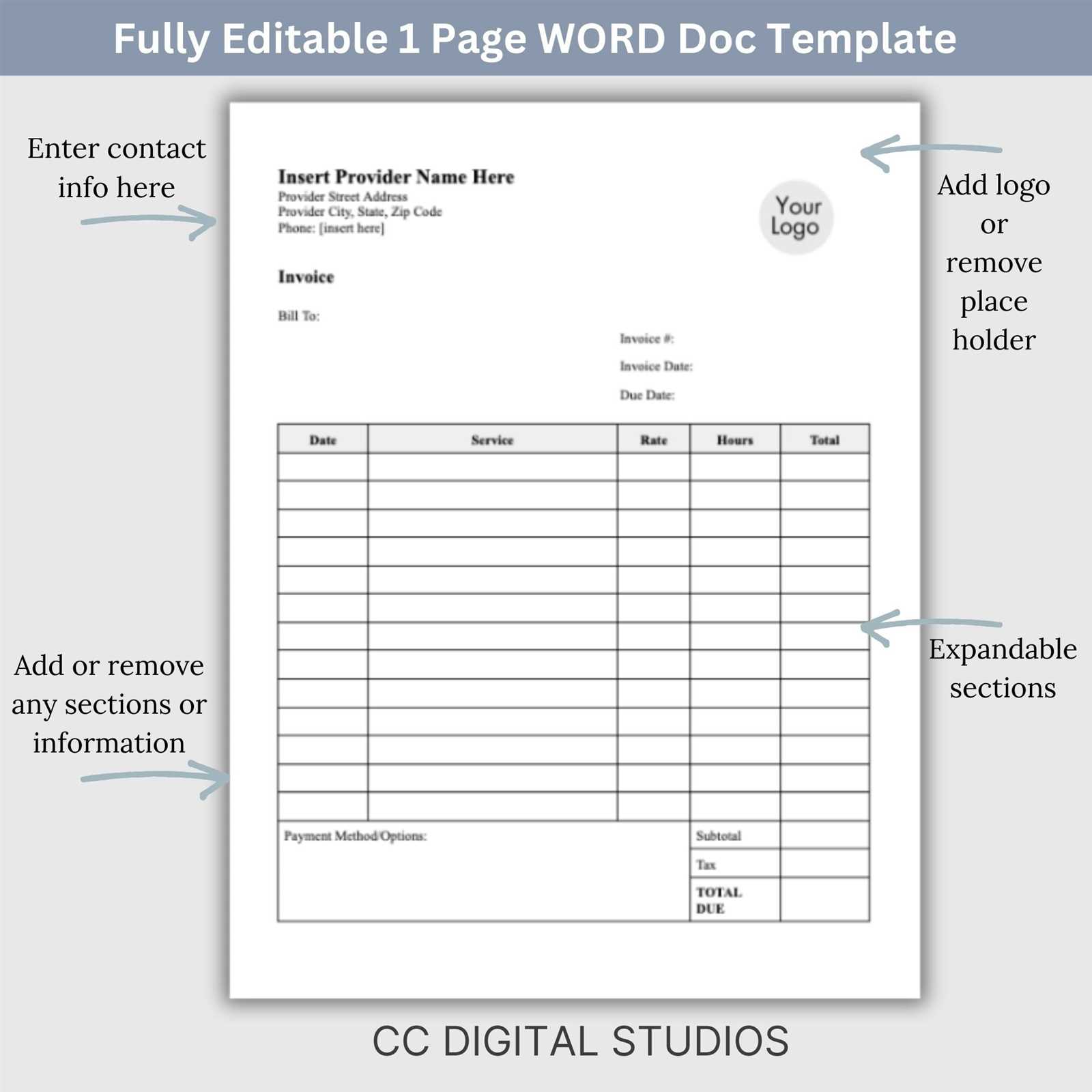

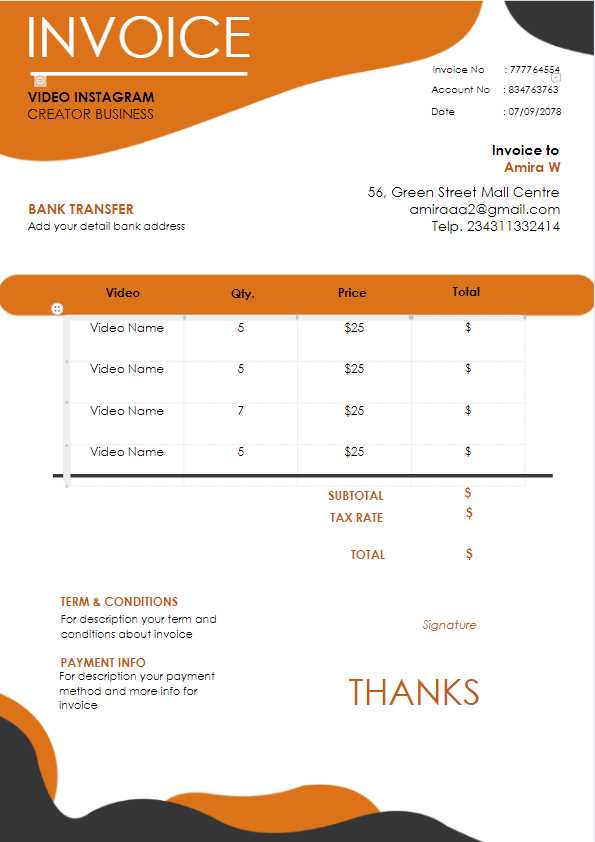

Customizing Your Billing Record Template

Personalizing your billing format allows you to better reflect your brand identity while ensuring that all essential details are clearly presented. Customization ensures that the final document fits your business needs and is aligned with your professional image. This section will guide you through the steps to tailor a pre-designed structure, from adding your company’s branding to adjusting the layout and content.

Step 1: Add Your Company Branding

One of the first steps in customizing your billing layout is incorporating your company logo and brand colors. This helps create a more cohesive look across all your business documents. To do this, simply insert your logo at the top of the page and adjust its size accordingly. Additionally, you can modify the font style and color to match your company’s branding guidelines.

Step 2: Adjust the Layout to Suit Your Needs

Every business is unique, and your billing record should reflect that. You may want to rearrange sections or add extra fields to capture additional details, such as special terms or references. You can modify the layout by adjusting column widths, adding rows for itemized lists, or even changing the alignment of text. Ensure all important sections are easy to read and that the document is logically structured for quick reference by your clients.

Step 3: Personalize Payment Information

It’s important to make sure that all payment-related details are clear and tailored to your specific processes. You can add custom payment terms, including discounts, late fees, or specific instructions on how clients should make payments. This ensures that both parties are on the same page regarding expectations. Additionally, you may want to include preferred payment methods or bank account details, depending on your business requirements.

Customizing your billing format in this way makes the process more efficient, reduces confusion, and helps establish a more professional image when communicating with clients.

Step-by-Step Guide to Invoice Creation

Creating a clear and accurate payment request requires a structured approach. By following a few simple steps, you can ensure that all the necessary details are included, providing both you and your client with a professional and efficient document. This guide will walk you through the process of creating a billing record from start to finish, ensuring that each essential element is properly covered.

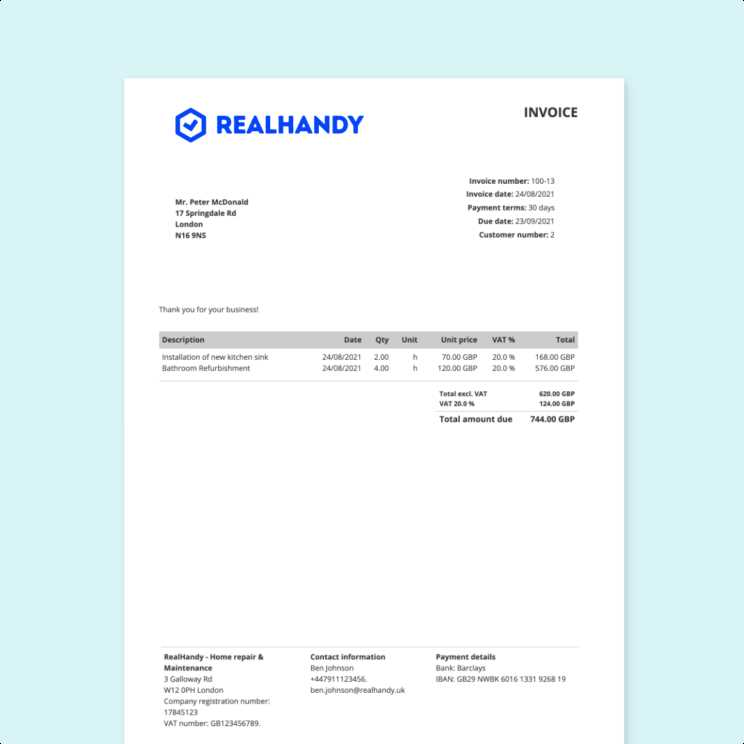

Step 1: Start with Basic Information

The first section of your billing request should contain essential contact details. These include both your business information and your client’s details. This helps clearly identify the parties involved in the transaction.

- Your Business Details: Name, address, phone number, email, and website (if applicable).

- Client Information: Name, company name, address, and contact details.

Step 2: Add a Clear Reference Number

To keep track of your records, assign a unique reference number for each payment request. This number will help both you and your client track and reference the document easily. It is often recommended to follow a numbering system that fits your business needs, such as sequential numbers or a combination of letters and numbers.

Step 3: Detail the Services or Goods Provided

Provide a detailed list of the services rendered or goods delivered. Be clear about the quantity, description, and price of each item. If applicable, you can also include the date the service was provided or the items were delivered.

- Description: A brief explanation of the product or service.

- Quantity: Number of units or hours worked.

- Unit Price: Cost per unit or hour.

- Total: Multiply quantity by unit price.

Step 4: Calculate the Total Amount Due

Once all items are listed, calculate the total amount due by adding up the individual totals. Be sure to include any additional fees, taxes, or discounts. Clearly separate these additional charges to avoid confusion.

Step 5: Inclu

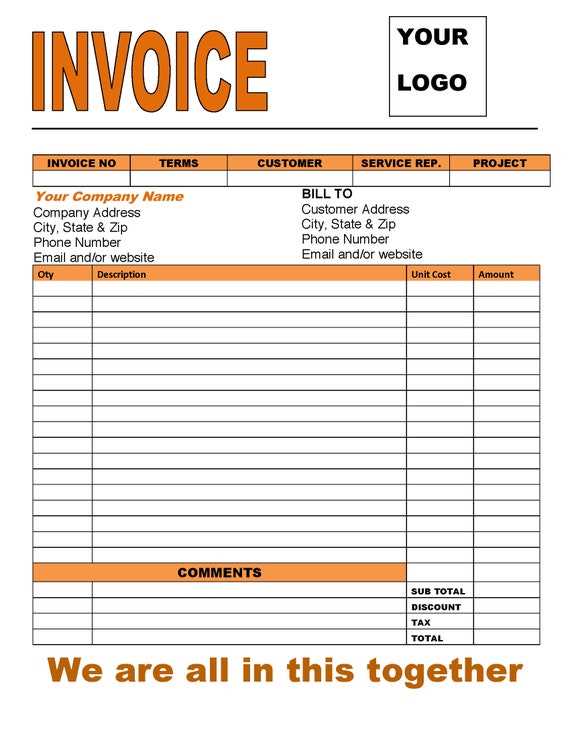

Free Invoice Templates for Microsoft Word

If you’re looking to simplify the process of creating billing statements, free pre-designed formats are a great solution. These ready-made layouts allow you to quickly generate professional payment requests without needing to create one from scratch. By using free resources available online, you can save both time and effort while ensuring that your requests are clear, organized, and aligned with your business needs.

Where to Find Free Billing Formats

Many online platforms and software providers offer a variety of free options for creating payment requests. These free formats can often be downloaded directly from the provider’s website or through popular platforms like Microsoft Office or Google Docs. Some places where you can find these resources include:

- Microsoft Office Templates: A wide range of free billing formats are available within Microsoft’s template gallery.

- Online Template Libraries: Websites like Vertex42 and Template.net offer downloadable formats for different business needs.

- Freelance Marketplaces: Freelance platforms sometimes provide free tools as a part of their service offerings to small businesses.

Benefits of Using Free Billing Layouts

Using free pre-made structures offers a range of benefits. First, it saves you time by eliminating the need to start from scratch. Second, these formats are often designed by professionals, meaning they already follow best practices for formatting and layout, ensuring clarity and accuracy. Some other advantages include:

- Time Efficiency: Quickly create clear and professional payment requests without having to design your own layout.

- Variety of Styles: Choose from multiple design options to find one that suits your business style or industry.

- Easy Customization: Pre-made formats are easy to adjust for your specific needs, such as adding company logos or modifying payment terms.

These free resources make it easier than ever to stay organized and professional while handling billing. Whether you’re a freel

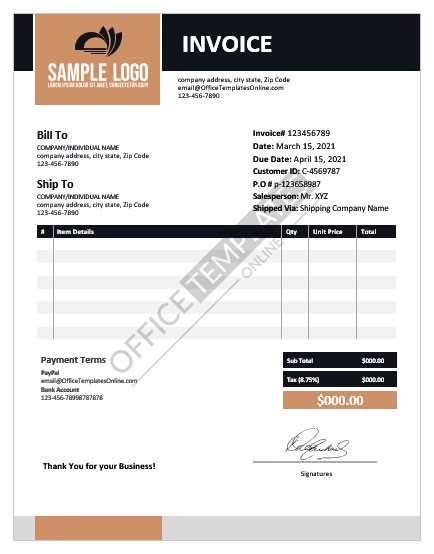

Best Practices for Invoice Formatting

Creating a professional and effective billing record goes beyond just adding numbers and names. The way you structure and present the information plays a crucial role in ensuring clarity, reducing confusion, and making it easy for clients to process their payments. Adopting best practices for organizing and formatting your payment requests can help you maintain consistency, professionalism, and accuracy across all your business transactions.

1. Keep It Simple and Clean

A cluttered or overly complex layout can confuse your clients and may delay payments. It’s important to use a clean and easy-to-read design. Avoid unnecessary graphics or excessive text. The main sections should be clearly separated and well-aligned. To ensure readability, use simple fonts like Arial or Calibri, and avoid using too many colors or styles in the text.

2. Consistent Use of Headings and Subheadings

Organize the content with clear headings and subheadings to guide the reader through each section. This makes it easier for your client to find the information they need quickly, such as the total amount due, payment terms, and service details. Proper use of bold or underlined text can help highlight important sections.

3. Accurate and Detailed Information

Ensure that every section of the billing record includes accurate and up-to-date details. Double-check for errors in the client’s information, payment amount, and any additional charges. A clear breakdown of the products or services provided, along with corresponding prices, will avoid misunderstandings. Be sure to include any necessary references or purchase order numbers, if applicable.

4. Clear Payment Terms

Always include explicit payment terms, including the due date and acceptable methods of payment. Specify any late fees or discounts for early payments. This clarity helps set expectations and makes it easier for the client to follow through with the payment in a timely manner.

5. Avoid Overloading with Information

While it’s important to be detailed, don’t overwhelm your client with irrelevant or unnecessary information. Keep the focus on what’s essential, such as the services rendered, the amounts owed, a

Adding Your Business Details to an Invoice

Including your business information in a billing statement is essential for clarity and professionalism. This section not only helps your client easily identify the source of the request but also provides them with the necessary details to contact you if needed. Properly displaying your business’s name, address, and contact information ensures smooth communication and strengthens your brand identity.

Key Business Information to Include

There are several important pieces of information that should always appear at the top of the payment request. These details help your client know exactly who the request is from and provide them with necessary contact details. The essential business information typically includes:

- Business Name: The legal name of your company or business.

- Business Address: Physical or mailing address where your company is located.

- Phone Number: A contact number for any inquiries related to the billing.

- Email Address: A professional email for communication regarding the payment.

- Website URL (optional): Your company’s website if applicable.

- Tax Identification Number (optional): For legal or tax purposes, depending on your location and business structure.

Displaying Your Information Professionally

The way you display this information is equally important. It should be positioned at the top of the page, usually aligned to the left or center, ensuring it stands out. Here’s an example of how to organize this data for maximum clarity:

| Business Name | Address | Phone Number | Email Address |

|---|---|---|---|

| Your Company Name | 123 Business St, City, Country | (123) 456-7890 | [email protected] |

By including these key details and organizing them clearly, you ensure that your billing records are both professional and functional, making it easy for clients to reach you and process their payments promptly.

Incorporating Payment Terms in Invoices

Including clear payment terms in your billing statements is crucial for setting expectations and ensuring that both you and your client are on the same page regarding the financial aspects of your transaction. By outlining payment deadlines, methods, and any penalties or discounts, you can avoid misunderstandings and ensure timely payments. This section covers the essential elements to include when specifying payment conditions in your billing requests.

Key Elements to Include in Payment Terms

Payment terms should be concise yet comprehensive, covering everything necessary for your client to understand when and how payment is expected. Here are the key components to include:

- Due Date: Clearly specify when the payment is due, whether it’s a specific date or a time frame (e.g., “30 days from the date of issue”).

- Accepted Payment Methods: List the payment options available, such as credit card, bank transfer, PayPal, or check.

- Late Fees: State any penalties for delayed payments, such as a fixed late fee or an interest rate applied to overdue balances.

- Early Payment Discounts: If applicable, mention any discounts for early settlement (e.g., “5% discount for payments made within 10 days”).

How to Format Payment Terms for Clarity

Make sure the payment terms are easily visible and easy to understand. It’s best to place them in a dedicated section, typically near the total amount due or at the bottom of the statement. Using bold text or bullet points can help emphasize important details. Below is an example of how payment terms might be displayed:

| Payment Term | Details | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Due Date | 30 days from the date of issue | ||||||||||||||||||||||||||||||||

| Accepted Payment Methods | Bank transfer, PayPal, Cre

How to Save and Share Your Billing RecordOnce you have created a payment request, the next step is to save it properly and share it with your client. Ensuring that your file is saved in a secure format will help prevent any accidental changes, while choosing the right method to share the file can make the process more efficient. This section will guide you through the best practices for saving and distributing your billing records. Saving Your Billing RecordChoosing the right format to save your payment request is important for maintaining its integrity and ensuring compatibility with your client’s software. Here are the most common options for saving your file:

Sharing Your Billing RecordOnce your record is saved, you’ll need to send it to your client. Below are some of the most common methods for sharing payment requests:

|

||||||||||||||||||||||||||||||||