Free Invoice Template Download for Word

In the fast-paced world of business, effective financial management is crucial. Utilizing well-structured documents to manage payments and requests can significantly enhance efficiency and professionalism. These documents serve as essential tools for maintaining clarity in transactions and fostering trust with clients.

Creating such documents from scratch can be time-consuming, but with readily available resources, the process becomes simpler. By utilizing customizable resources, businesses can tailor their documents to meet specific needs, ensuring that they reflect their brand identity while maintaining essential components. This adaptability not only saves time but also contributes to a polished and organized presentation.

Whether you are a freelancer, a small business owner, or part of a larger organization, having access to quality documents is vital. With a variety of styles and formats available, it is possible to find the perfect solution that aligns with your operational requirements. Explore your options and discover how these resources can elevate your financial interactions.

Free Invoice Templates for Your Business

In the realm of commerce, having access to well-designed documents is essential for maintaining professionalism and clarity in financial dealings. These resources not only streamline the billing process but also enhance the overall presentation of transactions. Utilizing high-quality documents can significantly impact client perception and facilitate smoother interactions.

Choosing the Right Design

Selecting an appropriate design is crucial for aligning your documents with your brand identity. Various styles are available, ranging from minimalistic and modern to traditional and elaborate. It’s important to choose a format that resonates with your target audience while ensuring that all necessary information is clearly presented.

Customization Options for Your Needs

Customization plays a vital role in creating documents that reflect your business values. Many resources allow for easy modifications, enabling you to add your logo, adjust colors, and personalize fields to suit your requirements. This level of adaptability ensures that your documents are not only functional but also a true representation of your brand.

Benefits of Using Invoice Templates

Utilizing well-structured financial documents offers numerous advantages for businesses of all sizes. These resources not only simplify the billing process but also contribute to improved organization and professionalism. Here are some key benefits of adopting such documents in your operations:

- Time Efficiency: Pre-designed formats allow for quick data entry, significantly reducing the time spent on creating documents from scratch.

- Professional Appearance: High-quality designs enhance the overall look of your documents, promoting a positive image to clients and partners.

- Consistency: Using standardized formats ensures uniformity in your financial communications, reinforcing your brand identity.

- Error Reduction: Templates often include essential fields and calculations, minimizing the risk of mistakes in important information.

- Customization: Many formats can be easily tailored to meet specific business needs, allowing for the inclusion of unique branding elements.

Incorporating these resources into your business processes not only enhances efficiency but also establishes a reliable framework for managing financial transactions. Embracing such solutions can lead to smoother operations and improved client satisfaction.

How to Create an Invoice in Word

Crafting a professional billing document is essential for any business that wants to manage transactions efficiently. Utilizing a word processing program offers a straightforward approach to generating these documents. Here are the steps to create a polished billing document that meets your business needs.

1. Open a New Document: Start by launching your word processing application and opening a new, blank document. This will provide a clean slate for your layout.

2. Set Up Your Layout: Consider the structure of your document. Include sections for your business name, contact information, and the recipient’s details at the top. This creates a clear distinction between the two parties involved.

3. Add Essential Information: Incorporate key details such as the date, payment terms, and a unique reference number. This information helps in tracking and organizing your documents.

4. List Services or Products: Create a table or list that outlines the services or products provided, including descriptions, quantities, and prices. Ensure that the format is easy to read and well-organized.

5. Calculate Totals: Include a section for totals, applicable taxes, and any additional fees. Providing a clear breakdown allows clients to understand the charges better.

6. Finalize and Save: Review your document for any errors, ensuring all information is accurate. Save the file in a desired format for easy access and sharing.

By following these steps, you can create an effective billing document that not only enhances professionalism but also streamlines the payment process for your business.

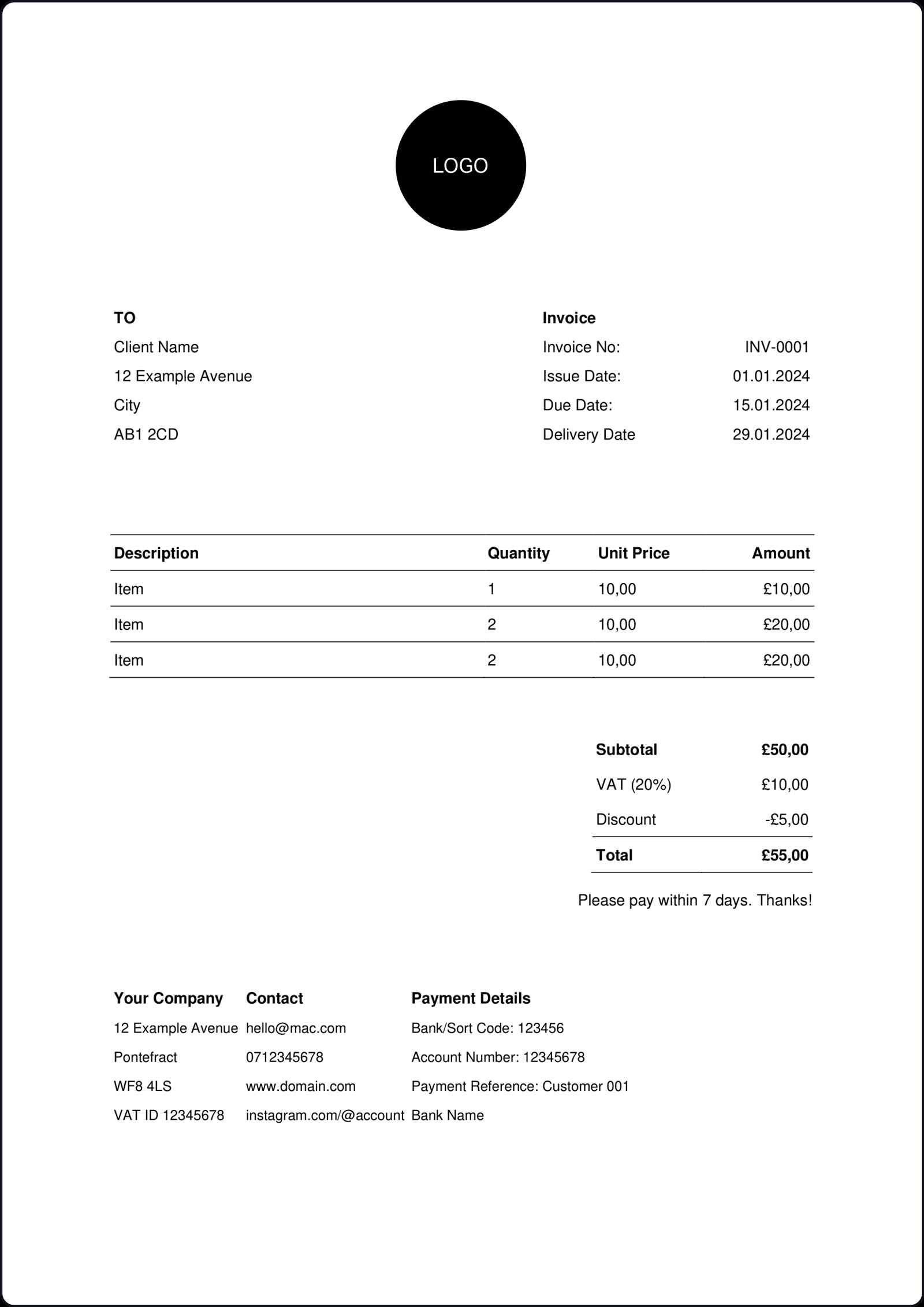

Essential Elements of an Invoice

Creating a comprehensive billing document requires careful consideration of its components to ensure clarity and effectiveness. Each section plays a vital role in communicating the necessary information to clients and facilitates smooth transactions. Here are the key elements that should be included in any billing document:

1. Business Information: At the top, include your business name, logo, and contact details. This establishes your brand and makes it easy for clients to reach you.

2. Recipient Details: Clearly state the name and contact information of the client or company receiving the document. This ensures that the correct party is billed.

3. Document Date: Indicate the date the document is issued. This is important for record-keeping and payment tracking.

4. Unique Identification Number: Assign a reference number to each document. This aids in organization and simplifies tracking for both parties.

5. Description of Services or Products: Provide a detailed list of the services rendered or products sold, including quantities and unit prices. This transparency helps clients understand what they are being charged for.

6. Total Amount Due: Clearly state the total amount owed, including any applicable taxes and fees. This section should be easy to find to avoid confusion.

7. Payment Terms: Outline the payment conditions, such as due date and accepted payment methods. This sets clear expectations for the client.

Incorporating these essential components ensures that your billing documents are both professional and effective, leading to better financial management and client relationships.

Customizing Your Invoice Design

Personalizing the appearance of your billing documents is a crucial step in establishing a strong brand identity and enhancing professionalism. A well-crafted design not only captures attention but also reflects the values of your business. Here are some effective ways to customize your document layout:

Select a Color Scheme: Choose colors that align with your brand. Consistent use of your brand colors throughout the document helps create a cohesive look and reinforces your identity.

Add Your Logo: Including your business logo at the top of the document provides immediate recognition. It enhances credibility and makes the document feel more official.

Choose Fonts Wisely: Opt for legible fonts that match your brand’s tone. A clean and professional font improves readability and leaves a positive impression on clients.

Incorporate Visual Elements: Use lines, borders, or background images to add visual interest without overwhelming the content. Subtle design elements can enhance the overall aesthetic.

Personalize Content Placement: Adjust the layout to prioritize the most important information. Ensure that key details are easily accessible and logically organized for quick reference.

By focusing on these aspects, you can create a visually appealing and effective billing document that resonates with your clients and reinforces your brand image.

Types of Invoices for Different Businesses

Every business has unique billing requirements that can vary based on industry, customer relationships, and the nature of the services or products provided. Understanding the different types of billing documents can help streamline operations and improve customer satisfaction. Here are some common types tailored to various business needs:

- Standard Billing Documents: These are the most common and include essential details such as services rendered, amounts due, and payment terms. They are suitable for most businesses.

- Recurring Billing Statements: Ideal for subscription-based services, these documents are sent regularly, often monthly, and outline the ongoing charges for continuous service.

- Proforma Bills: Used as a preliminary bill before actual goods or services are delivered, proforma documents help clients understand potential costs and approve payments in advance.

- Credit Notes: Issued to adjust or cancel a previous billing statement, these notes are essential for maintaining accurate financial records and fostering transparency with clients.

- Commercial Invoices: Typically used in international trade, these documents provide detailed information about the shipment, including the value of goods and applicable duties and taxes.

- Expense Reports: Often used in corporate settings, these documents summarize incurred costs that employees seek reimbursement for, ensuring accountability and proper record-keeping.

By selecting the appropriate type of billing document, businesses can ensure clearer communication with clients and more efficient financial processes.

Finding the Right Template Online

In the digital age, locating the perfect design for your billing documents can be a straightforward process, provided you know where to look and what to consider. The right layout not only enhances your business’s professional image but also simplifies the billing process for both you and your clients. Here are some effective strategies for finding suitable designs online:

Utilizing Reputable Websites

Many online platforms offer a variety of customizable designs. When searching for a layout, it’s important to choose reputable websites known for quality resources. Here’s a comparison of some popular options:

| Website | Features | Customization Options |

|---|---|---|

| Template.net | Wide selection, user-friendly interface | Extensive editing capabilities |

| Canva | Design-focused, visually appealing layouts | Drag-and-drop editing tools |

| Microsoft Office | Integrated with Office Suite, familiar format | Standard editing features |

Assessing Your Business Needs

Before selecting a design, consider your specific requirements. Reflect on factors such as the nature of your services, your brand identity, and your target audience. A suitable layout should not only meet aesthetic preferences but also accommodate all necessary information clearly and efficiently.

Editing Templates for Personal Use

Customizing existing designs for your own needs can significantly enhance the efficiency of your billing processes. Tailoring a layout not only reflects your personal style but also ensures that all relevant details are clearly communicated. By modifying a pre-existing structure, you can save time and effort while maintaining a professional appearance.

Understanding the Editing Process

Editing a design typically involves several straightforward steps. First, you need to select a suitable layout that aligns with your requirements. Once chosen, the following adjustments can be made:

- Modify Text Fields: Update all placeholders with your specific information, including your business name, address, and contact details.

- Adjust Layout Elements: Rearrange sections to better suit your workflow, ensuring that essential information is easily accessible.

- Add Branding: Incorporate your logo and brand colors to create a cohesive look that represents your business identity.

Saving and Exporting Your Customization

After making the necessary changes, it’s crucial to save your work in a format that suits your needs. Most design software allows you to export the finished document as a PDF or other widely accepted formats. This ensures that your finalized structure maintains its appearance when shared with clients or colleagues.

Tips for Professional Invoicing

Creating polished and effective billing documents is essential for maintaining a professional image and ensuring timely payments. Adhering to certain best practices can greatly enhance the clarity and professionalism of your documents, making them more appealing to clients. Here are some valuable tips to consider when preparing your billing statements:

| Tip | Description |

|---|---|

| Be Clear and Concise | Ensure that all details are straightforward and easily understood. Avoid jargon and provide clear explanations for all charges. |

| Include Essential Information | Always include your contact information, the client’s details, an itemized list of services provided, and payment terms to avoid confusion. |

| Maintain Consistency | Use a consistent format, font, and color scheme across all documents to create a cohesive brand identity and make recognition easier for clients. |

| Set Clear Payment Terms | Clearly define payment due dates, accepted payment methods, and any late fees to encourage timely payments. |

| Proofread Carefully | Always double-check for spelling and grammatical errors before sending. Mistakes can undermine your professionalism and lead to misunderstandings. |

Common Mistakes in Invoicing

Creating accurate billing documents is crucial for smooth financial transactions and maintaining professional relationships with clients. However, many individuals and businesses often overlook important details, leading to errors that can cause delays in payments and misunderstandings. Recognizing and avoiding these common pitfalls can significantly improve the efficiency of your billing process.

- Missing Client Information: Not including the client’s name, address, or contact details can lead to confusion and delays in payment.

- Incorrect Amounts: Errors in calculating totals or taxes can result in disputes and dissatisfaction, so double-check all figures.

- Lack of Clarity: Vague descriptions of services rendered can leave clients unsure about what they are paying for. Provide detailed, itemized listings.

- Unclear Payment Terms: Failing to specify payment methods, due dates, and penalties for late payments can lead to misunderstandings.

- Inconsistent Formats: Using different formats for each billing document can create confusion. Maintain a uniform style to enhance professionalism.

- Ignoring Follow-Ups: Not following up on overdue payments can result in cash flow issues. Regular reminders are essential for timely payments.

Tracking Payments with Invoice Templates

Effectively monitoring payments is essential for maintaining a healthy cash flow and ensuring the financial stability of any business. Utilizing structured billing documents can greatly assist in tracking received payments, outstanding amounts, and due dates. This practice not only keeps your records organized but also helps in building trust with clients by providing clear financial communications.

- Organized Records: Maintaining a clear format allows for easy tracking of paid and unpaid amounts, helping you quickly assess your financial status.

- Payment Status Updates: Regularly updating your records with payment statuses enables you to identify overdue amounts promptly and follow up as needed.

- Visual Tracking: Incorporating visual indicators, such as color codes or status tags, can provide a quick overview of which accounts are current or overdue.

- Automated Reminders: Using digital solutions can automate reminders for clients, ensuring timely payments while reducing the burden of manual tracking.

- Detailed Reporting: Generating reports from your organized records can help you analyze payment trends and forecast future income, aiding in better financial planning.

- Client Communication: Clear and concise billing documents facilitate communication with clients regarding their payment history, enhancing transparency and trust.

Integrating Invoices with Accounting Software

Linking billing documents with financial management tools streamlines the entire process of tracking revenue and expenses. This integration allows businesses to enhance their efficiency by automating various tasks, ensuring accurate record-keeping, and reducing the potential for human error. Moreover, a seamless connection between billing and accounting systems fosters better financial analysis and reporting capabilities.

| Benefit | Description |

|---|---|

| Time Savings | Automating data entry between systems minimizes manual tasks, allowing for more time to focus on core business operations. |

| Improved Accuracy | By reducing human intervention, the likelihood of errors in data entry and calculations is significantly lowered. |

| Real-Time Updates | Changes made in one system are instantly reflected in the other, providing up-to-date financial information. |

| Comprehensive Reporting | Integrating both systems allows for more detailed financial reports that encompass all aspects of the business. |

| Enhanced Cash Flow Management | Automated reminders and tracking features help manage receivables more effectively, improving cash flow. |

| Better Financial Insights | Access to integrated data enables businesses to analyze trends and make informed financial decisions. |

Using Invoices for Tax Purposes

Proper documentation of financial transactions is essential for ensuring compliance with tax regulations. Detailed records not only assist in accurate tax filing but also provide valuable information for business analysis. By maintaining thorough records of sales and expenses, businesses can minimize tax liabilities and maximize deductions, ultimately improving their financial standing.

Importance of Documentation

- Proof of Income: Detailed records provide evidence of earnings, which is crucial for tax reporting and audits.

- Deductions Tracking: By recording expenses accurately, businesses can identify all potential deductions, reducing overall taxable income.

- Audit Preparedness: Having organized records ensures that a business can easily present its financial information in the event of an audit.

Best Practices for Using Financial Documents

- Keep all records organized and accessible for easy retrieval.

- Use clear and concise descriptions for each transaction to avoid confusion during tax season.

- Regularly review and reconcile records to ensure accuracy and completeness.

- Consult with a tax professional to understand the specific documentation requirements relevant to your business.

Understanding Payment Terms and Conditions

Grasping the intricacies of payment agreements is vital for establishing clear expectations between parties involved in a transaction. These stipulations outline when and how payments should be made, which can help prevent misunderstandings and disputes. By clearly defining these terms, businesses can foster smoother financial interactions and enhance cash flow management.

Key Components of Payment Agreements

- Payment Due Date: Specifies when the payment is expected to be made, which can vary based on the nature of the agreement.

- Payment Methods: Outlines acceptable forms of payment, such as credit cards, bank transfers, or checks.

- Late Fees: Details any penalties for payments not received by the due date, incentivizing timely payment.

- Discounts for Early Payment: Provides incentives for prompt payment, which can improve cash flow.

Best Practices for Communicating Terms

- Clearly state all terms at the outset of a transaction to ensure mutual understanding.

- Use straightforward language to avoid ambiguity, ensuring that all parties comprehend the conditions.

- Regularly review and update terms as necessary to reflect any changes in business practices or regulations.

- Maintain open lines of communication to address any questions or concerns regarding payment conditions.

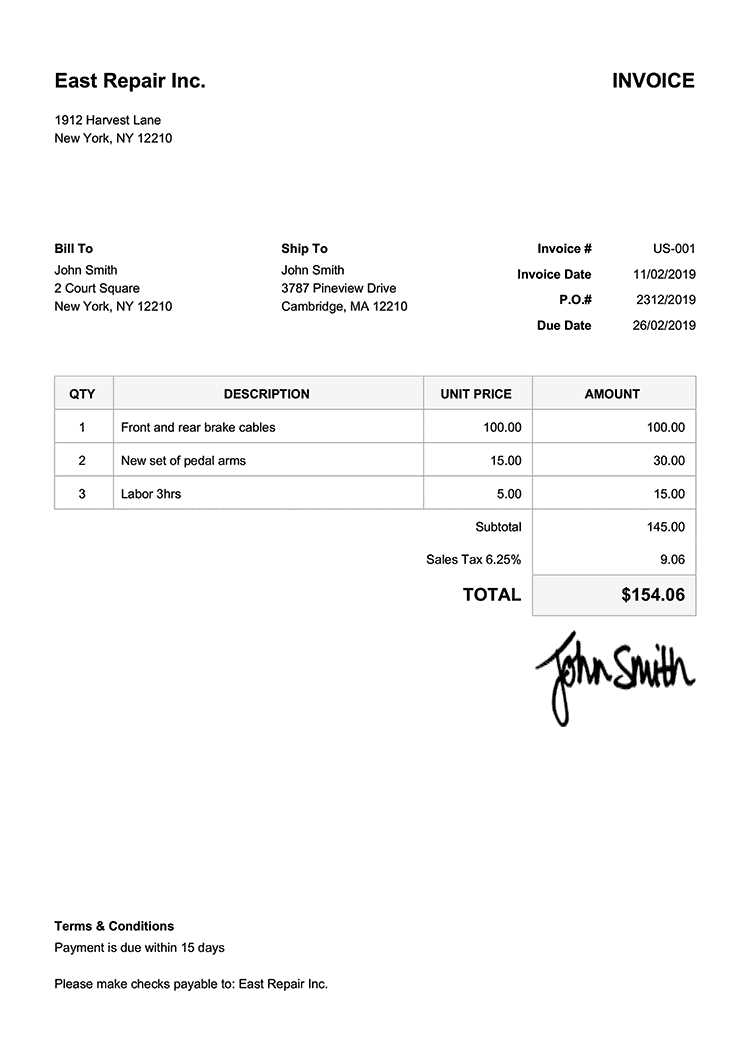

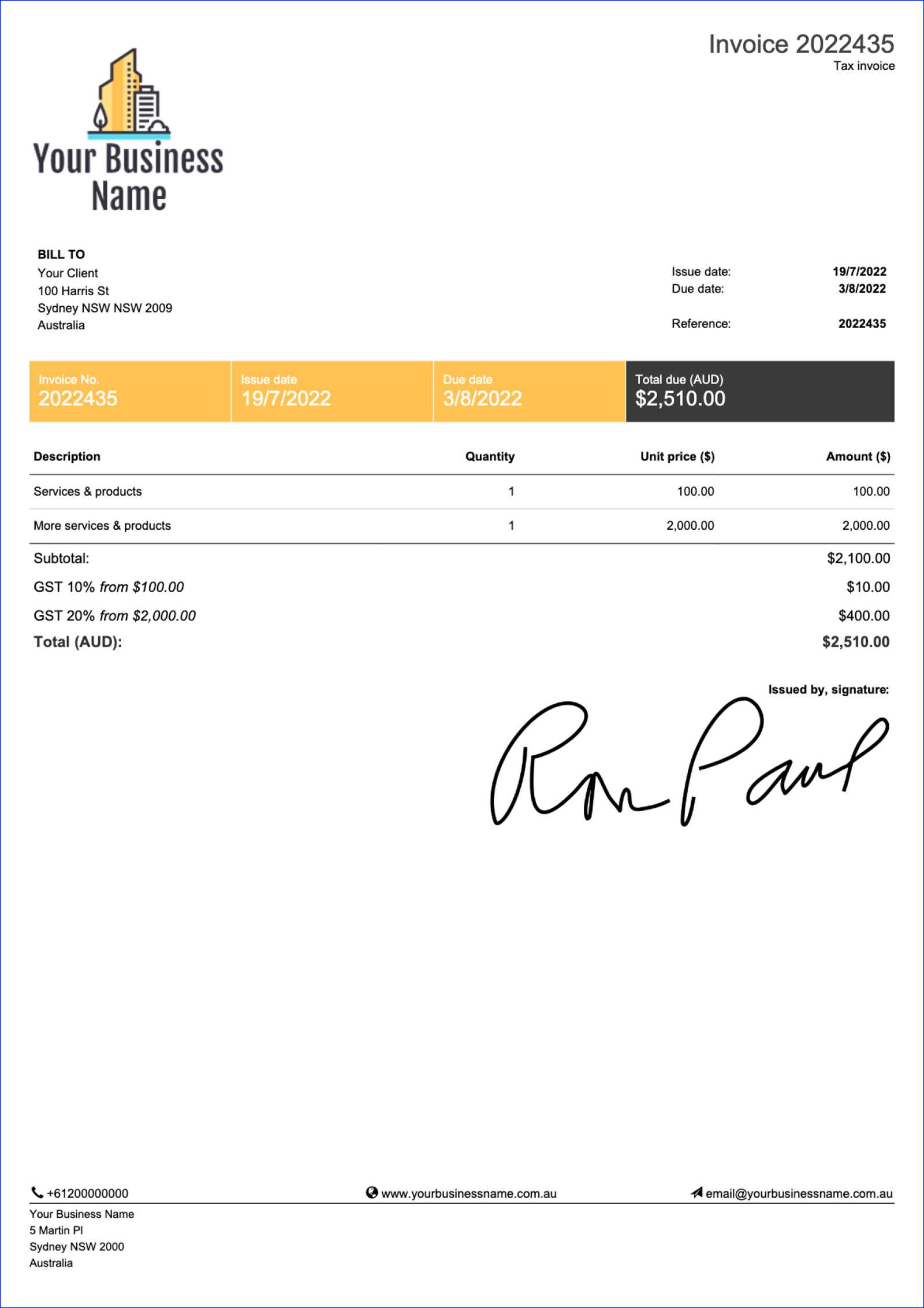

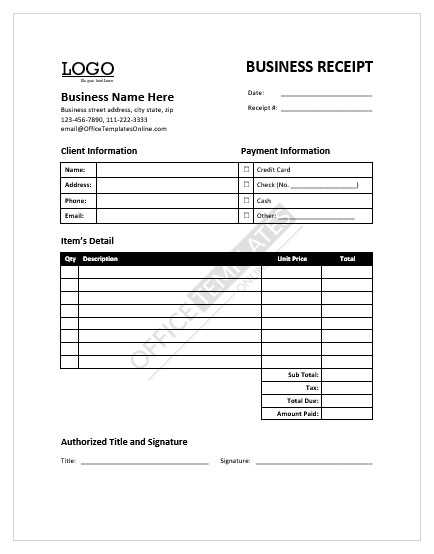

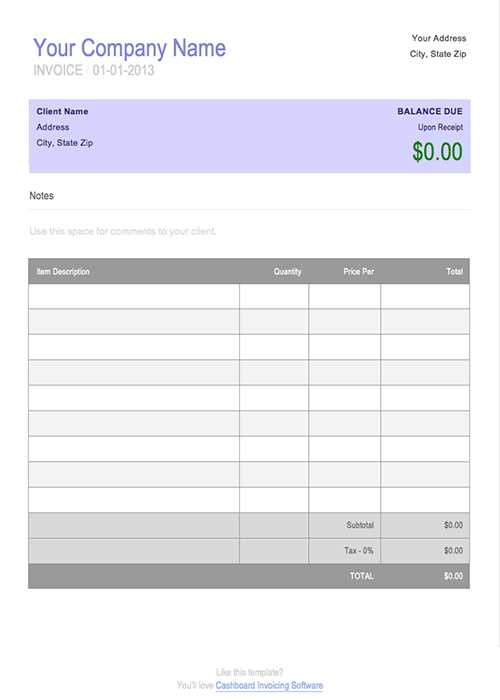

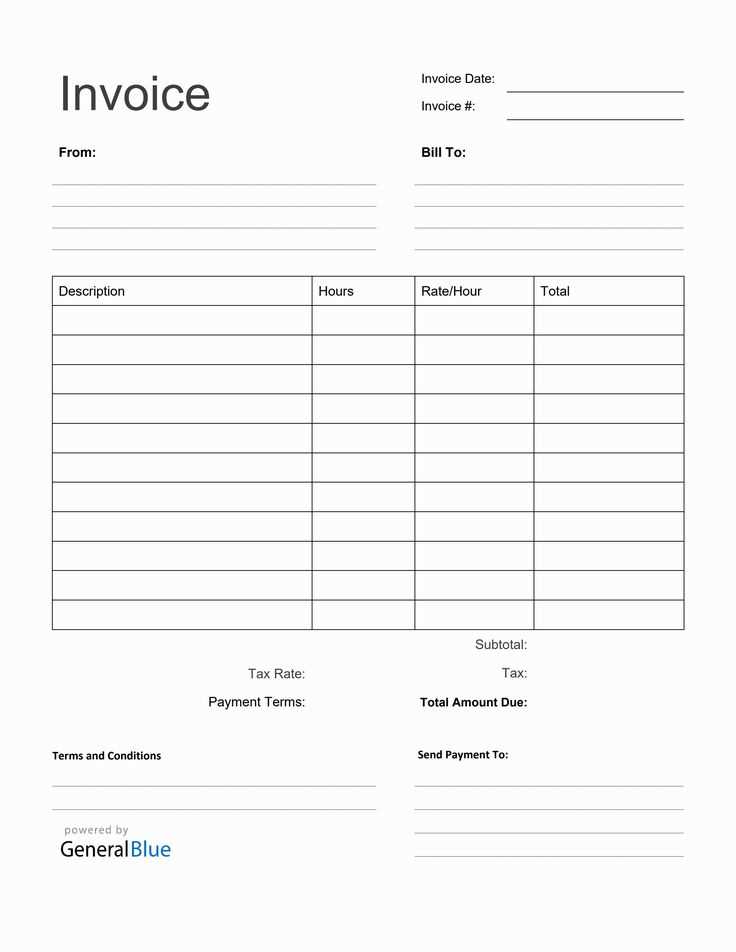

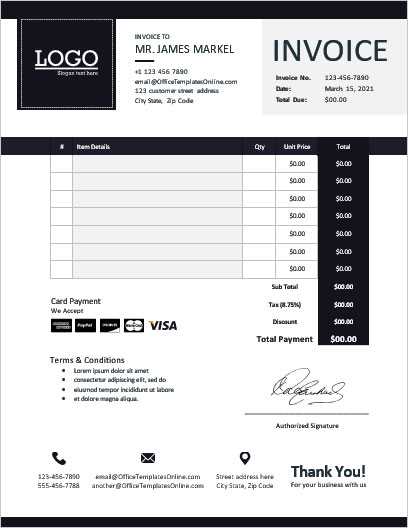

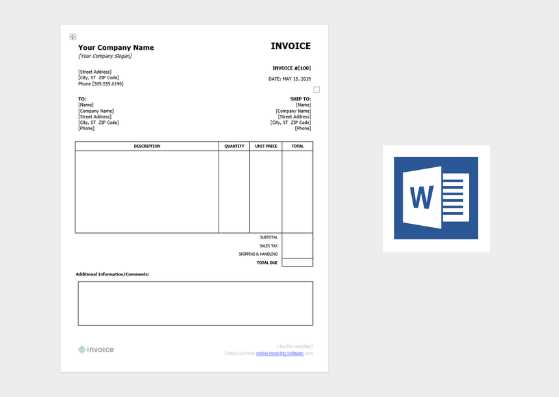

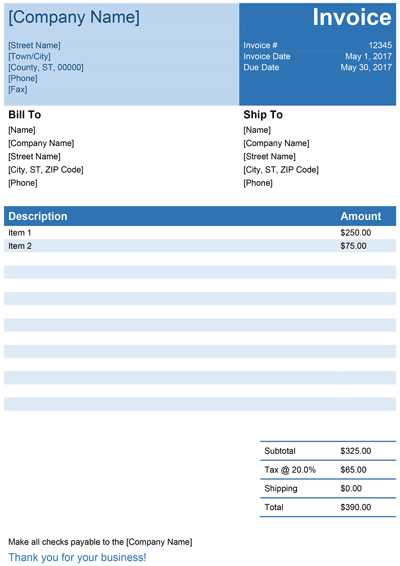

Examples of Effective Invoice Designs

Crafting visually appealing and functional billing documents is essential for enhancing professionalism and clarity in financial transactions. A well-designed document not only conveys necessary information but also reflects the brand’s identity and can leave a lasting impression on clients. Below are examples of effective styles that can elevate the overall presentation.

Minimalist Design

- Clean Layout: Utilizes ample white space to avoid clutter, allowing recipients to focus on essential details.

- Simple Fonts: Employs legible typography to enhance readability while maintaining an elegant appearance.

- Subtle Branding: Incorporates understated logo placement, subtly reinforcing brand identity without overwhelming the document.

Creative and Colorful Format

- Bold Colors: Uses vibrant hues to create an engaging layout that captures attention and differentiates the document from competitors.

- Graphics and Icons: Integrates relevant visuals to enhance communication and illustrate specific services or products.

- Unique Structure: Breaks away from traditional formats by incorporating columns or sections that guide the reader through the information seamlessly.

Professional and Formal Style

- Structured Format: Organizes information logically, using headings and subheadings to clearly delineate sections.

- Traditional Typography: Chooses classic fonts that convey reliability and professionalism, appealing to corporate clients.

- Consistent Color Scheme: Adopts a cohesive palette that aligns with company branding, ensuring a polished and unified look.

By drawing inspiration from these effective designs, businesses can create documents that not only serve their practical purpose but also enhance their professional image.

How to Save and Print Invoices

Managing the storage and printing of billing documents is crucial for maintaining accurate financial records and ensuring timely payments. Implementing effective practices in these areas can streamline business operations and enhance professionalism in client interactions. Here are some steps to help you save and print these essential documents effectively.

Saving Your Documents

Choosing the right format and location for saving billing statements can improve accessibility and organization.

- Select the Appropriate File Format: Consider saving your documents in universally accepted formats like PDF or Excel. PDFs preserve formatting and are ideal for sharing, while Excel files allow for easy editing.

- Organize Your Files: Create a dedicated folder structure on your computer or cloud storage. Use clear naming conventions that include dates and client names for easy retrieval.

- Back Up Regularly: Ensure you have a backup system in place, whether through cloud services or external drives, to prevent data loss.

Printing Your Documents

Preparing to print billing statements requires attention to detail to ensure quality and clarity.

- Check Printer Settings: Before printing, adjust settings such as paper size and quality. Use high-quality settings to produce clear and professional-looking documents.

- Print a Test Page: Always print a test copy to verify that all information is displayed correctly and aligned properly before printing multiple copies.

- Consider Using Professional Printing Services: For bulk printing or high-stakes documents, consider outsourcing to a professional printing service to achieve the best quality and presentation.

By following these guidelines for saving and printing, businesses can ensure that their financial documents are well-organized and presented in a professional manner, facilitating smoother transactions with clients.

Frequently Asked Questions about Invoices

Understanding the nuances of billing documents is essential for both businesses and clients. This section addresses common inquiries to help clarify important aspects of managing these financial records. Below are some frequently asked questions regarding billing practices and their answers.

General Questions

- What information should be included in a billing document?

- Business name and contact information

- Client name and address

- Description of goods or services provided

- Total amount due and payment terms

- Invoice number and date issued

- How can I ensure timely payments?

- Clearly state payment terms, including due dates and accepted payment methods.

- Follow up with reminders as the due date approaches.

- Consider offering discounts for early payments.

Specific Issues

- What should I do if a client disputes a charge?

- Review the documentation to verify the details of the transaction.

- Communicate openly with the client to address their concerns.

- Be willing to negotiate or adjust the charges if necessary.

- Can I customize my billing documents?

- Yes, many software solutions allow for personalization, including branding and formatting options.

- Ensure that any customizations still comply with legal requirements.

These frequently asked questions can serve as a guide to navigating the complexities of financial documentation, ensuring both clarity and efficiency in transactions.

Resources for More Invoice Templates

Accessing a variety of billing formats can significantly enhance the efficiency of financial documentation. There are numerous online platforms and resources that offer diverse designs suited for different business needs. This section highlights some of the best sources to find additional layouts tailored to various requirements.

Online Platforms

- Template Websites: Many websites specialize in providing ready-made designs that cater to various industries. Users can often filter by style, format, or specific needs to find the perfect match.

- Document Software: Programs like Microsoft Excel or Google Sheets often include built-in options for creating billing documents. These applications allow users to customize existing formats according to their preferences.

- Freelancer Marketplaces: Websites where freelancers offer their services may have professionals who can create personalized layouts based on specific business requirements.

Additional Tools

- Accounting Software: Many accounting platforms provide integrated tools for generating financial documents, often with customizable features to suit different businesses.

- Design Software: Applications like Canva or Adobe Spark allow users to create visually appealing documents from scratch or modify existing designs for a unique touch.

By utilizing these resources, individuals and businesses can enhance their financial documentation processes, ensuring they have the right format for every situation.