Custom Invoice Templates for QuickBooks to Simplify Your Billing

Managing financial transactions efficiently is a critical aspect of running any successful business. One of the most important elements of this process is creating professional documents that accurately reflect your services and facilitate smooth payments. By utilizing tailored document layouts, businesses can ensure that every bill sent to clients looks polished and is easy to understand.

Designing personalized documents not only saves time but also enhances the overall client experience. With the right tools, you can adjust elements like logos, payment terms, and itemized lists to better fit your brand and specific business needs. This approach helps in maintaining consistency and professionalism in all your financial communications.

By integrating these personalized designs into your workflow, businesses can automate processes that would otherwise be repetitive and prone to errors. Streamlining this part of the accounting process allows more time to focus on growing the business while keeping track of all necessary transactions seamlessly.

Personalized Billing Documents for QuickBooks

In the modern business world, having a flexible and efficient way to create and manage financial documents is essential. Tailoring these documents to match your specific needs allows businesses to present professional, accurate records to clients while streamlining the administrative workload. When using the right tools, it’s easy to design professional-looking statements that align with your company’s branding and business practices.

Why Personalization Matters

Customizing your financial documents ensures that each one is clear, consistent, and properly reflects the services provided. Instead of using a generic format, personalized designs enable businesses to add important details, such as company logos, payment terms, and itemized lists, in a way that aligns with their unique operational style. This not only improves readability but also strengthens your brand’s identity.

Integrating with Your Accounting Software

When you integrate personalized document designs with your accounting software, you streamline the entire billing process. Automation can be set up to quickly generate and send out professionally formatted records without manual input. This reduces the likelihood of errors and helps ensure that all financial data is accurate and up-to-date. With this integration, your business saves time, boosts efficiency, and enhances the client experience.

Why Choose Personalized Document Designs

Opting for tailored document layouts provides businesses with numerous advantages that go beyond simply presenting financial data. A well-designed document allows you to establish a professional tone, reflect your brand identity, and ensure that your communication with clients is clear and accurate. Whether you’re billing a single client or managing multiple accounts, personalized designs can help you maintain consistency and avoid common issues related to generic formats.

Key Benefits of Tailored Document Designs

- Brand Identity: A personalized layout gives your company a unique look, helping to distinguish it from competitors.

- Increased Accuracy: Tailoring your documents ensures that all necessary information is included, reducing the risk of errors and omissions.

- Improved Professionalism: Clients are more likely to trust and pay attention to well-designed and clear financial documents.

- Faster Processing: Customized layouts allow you to automate and streamline the billing process, saving time and effort.

How Personalization Enhances Client Relations

When you use personalized document designs, it signals to your clients that you care about the details and are committed to delivering a high-quality service. This not only improves your professional image but also helps foster trust and long-term business relationships. Clear, professional documents can improve communication, making it easier for clients to understand the terms and services you provide.

Benefits of Using QuickBooks Billing Designs

Leveraging pre-designed billing formats within your accounting software offers numerous advantages for businesses looking to streamline their financial operations. These ready-made formats are optimized to save time, reduce errors, and ensure consistency across all client communications. By using efficient layouts, businesses can focus on what matters most–serving clients and growing operations–without getting bogged down by repetitive administrative tasks.

Efficiency and Time Savings

One of the main reasons to use pre-configured billing formats is the significant time savings they offer. Instead of manually creating each document from scratch, users can quickly fill in the necessary details and generate a professional document in minutes. Automation tools within the software allow for rapid processing, reducing the time spent on each transaction and freeing up valuable resources.

Improved Accuracy and Consistency

By using standardized designs, businesses can ensure that each document follows the same structure and includes all necessary information, minimizing the risk of missing details or errors. This consistency helps create a professional image and makes it easier for clients to understand the terms, due dates, and payment methods. Over time, this leads to fewer disputes and smoother transactions.

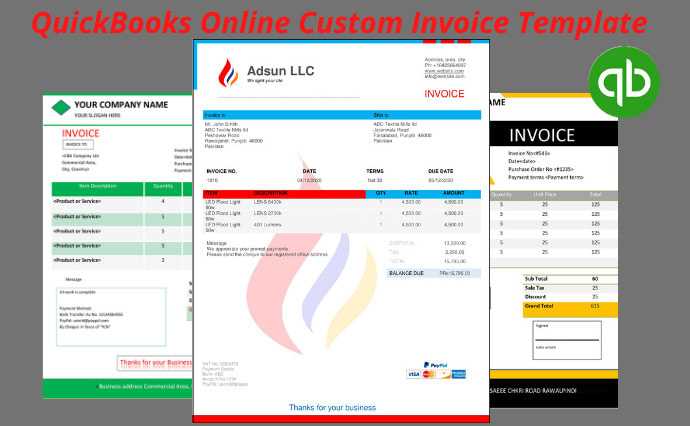

How to Create a Personalized Billing Document in QuickBooks

Designing a personalized billing document in your accounting software is a straightforward process that allows you to tailor the appearance and structure to suit your business’s needs. By customizing the layout, you can add elements such as logos, terms, and specific details related to your services. This ensures that each document you send out reflects your brand identity while providing clear and professional communication to your clients.

Step-by-Step Guide to Designing Your Document

Follow these simple steps to create a tailored document in your accounting software:

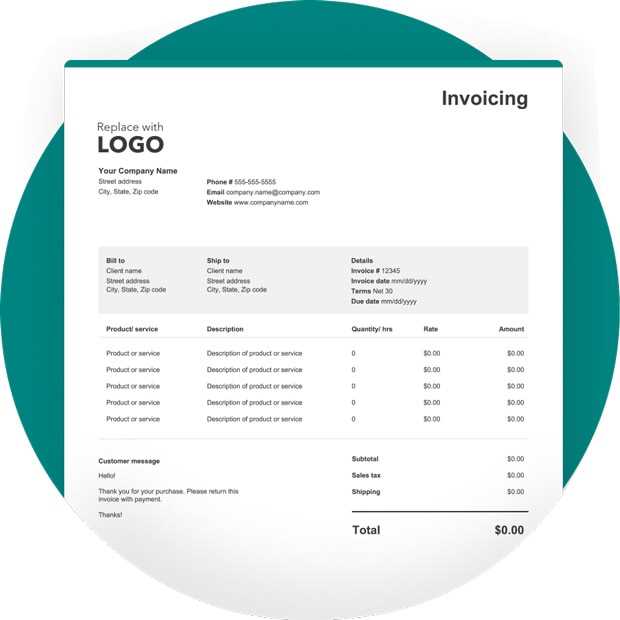

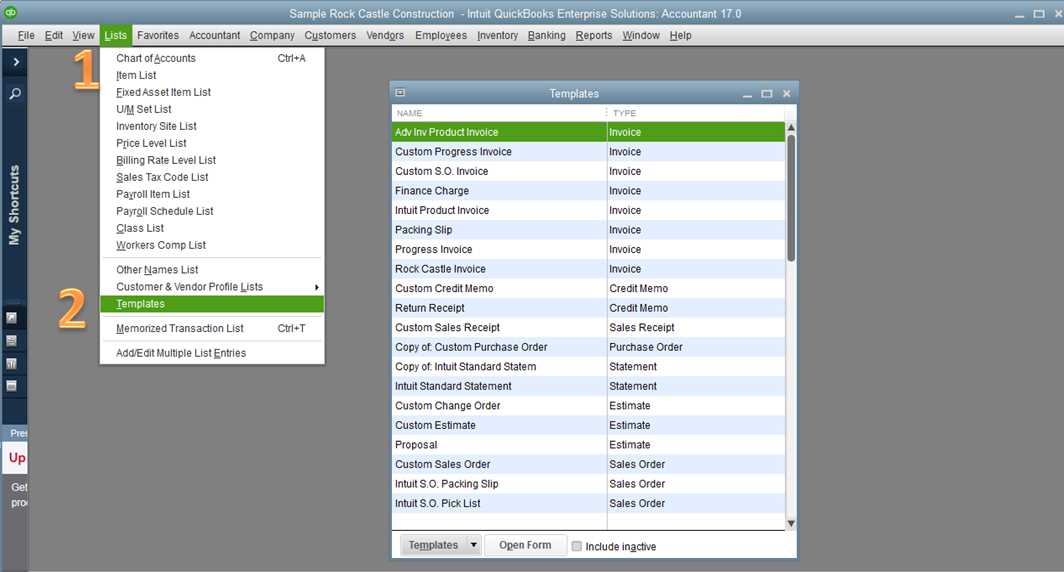

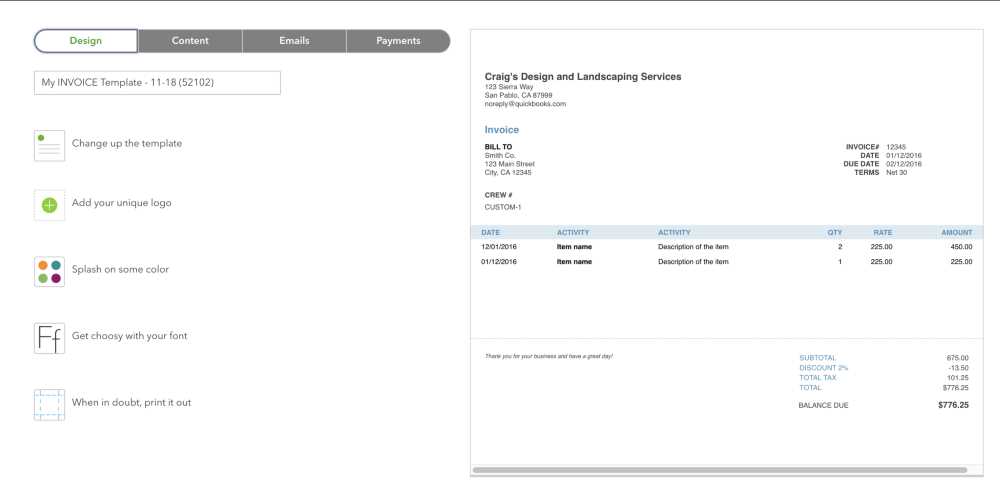

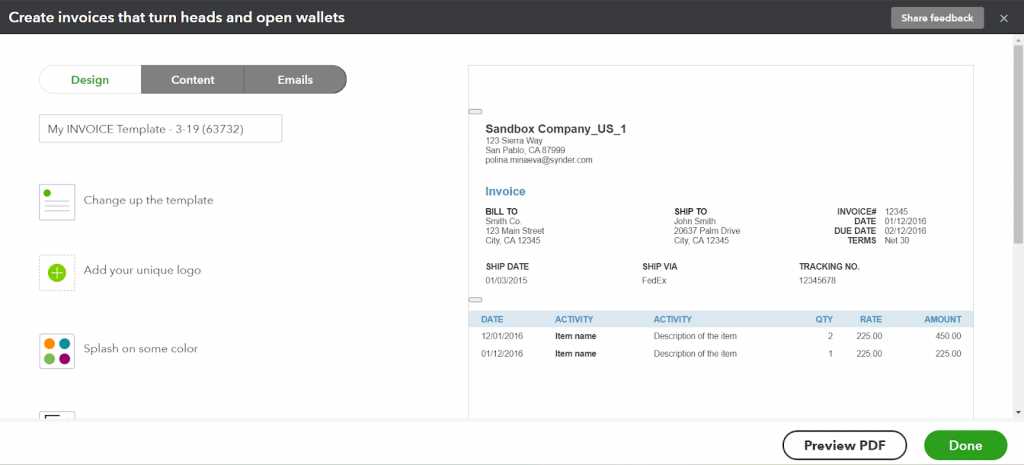

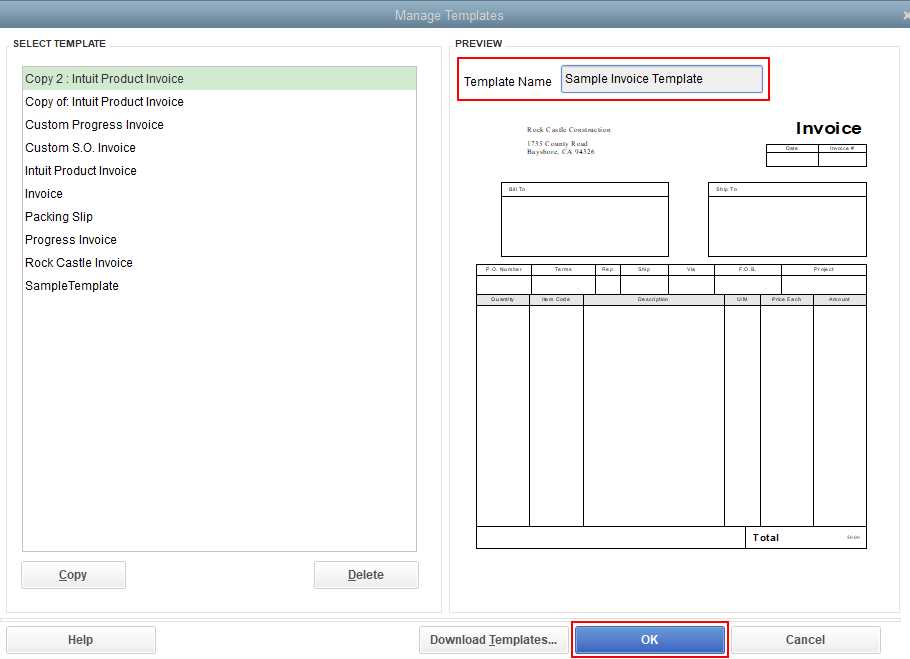

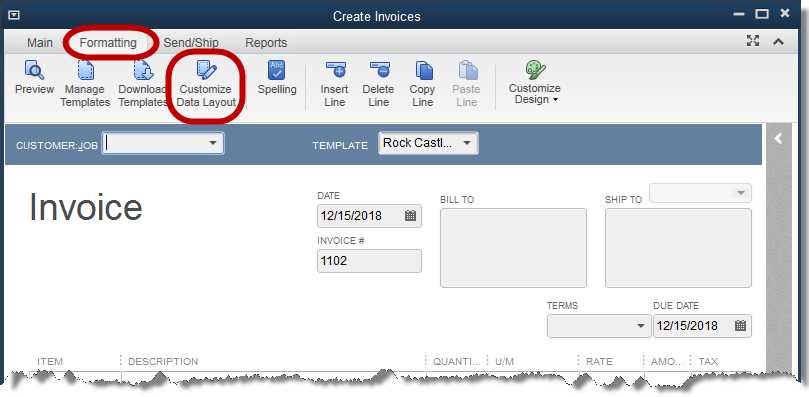

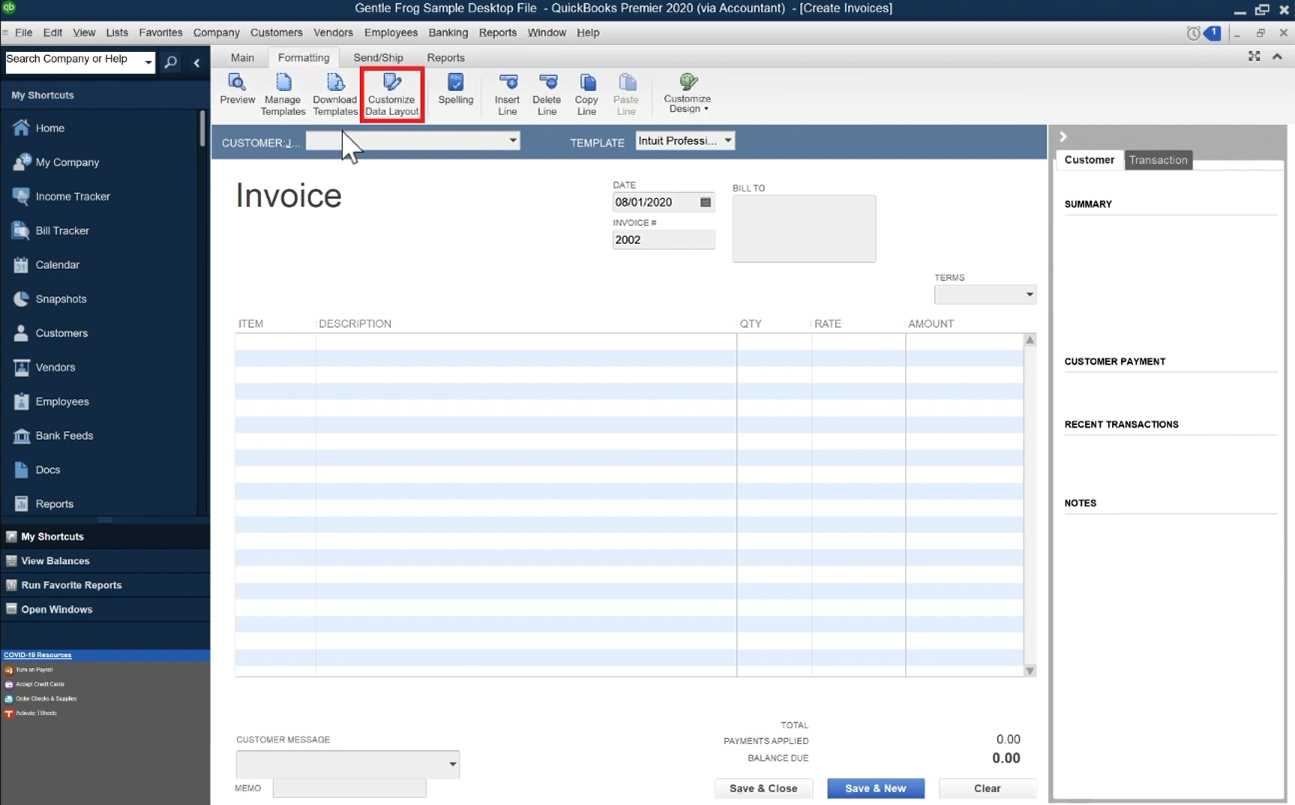

- Access the Template Settings: Go to the settings or preferences section in the software where you can manage document formats.

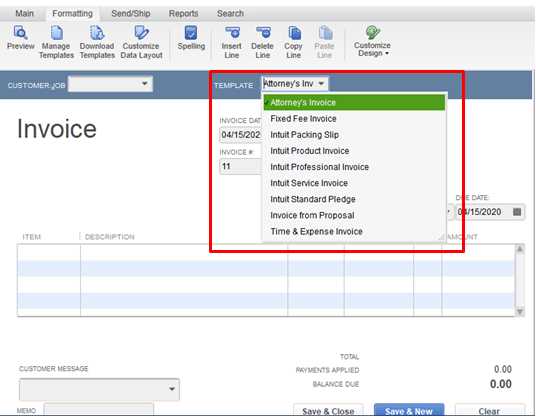

- Select a Layout: Choose from the available pre-designed layouts that fit your business style. These can be further modified to match your brand’s specific requirements.

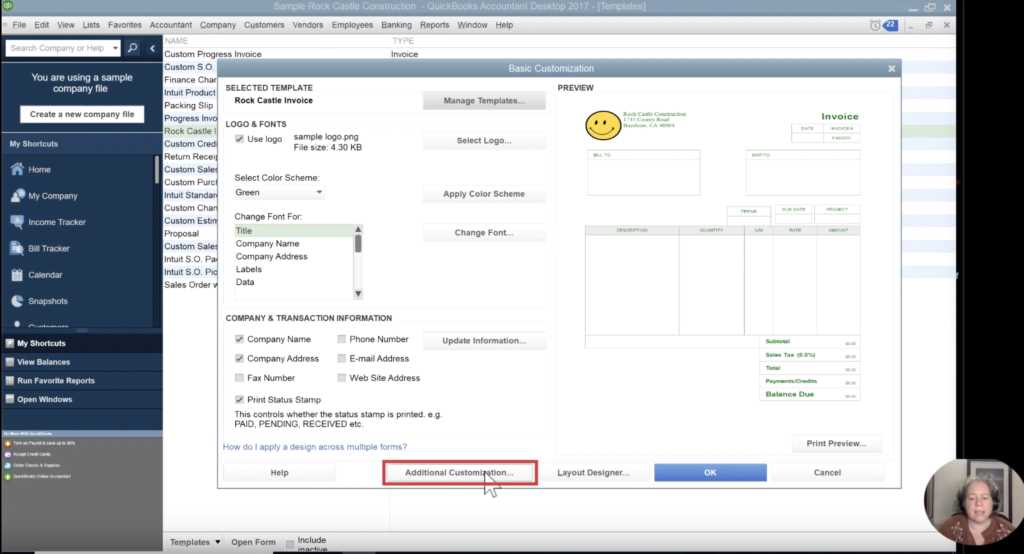

- Add Your Business Information: Include details such as your company logo, contact information, and payment terms. This can typically be done through an easy-to-use editing interface.

- Modify the Layout: Adjust text boxes, columns, and fields to ensure all relevant information is displayed clearly. You can add or remove sections as needed.

- Save and Apply: Once you’re satisfied with the design, save the template and apply it to your billing process.

Table of Key Elements to Include in Your Document

| Element | Description | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

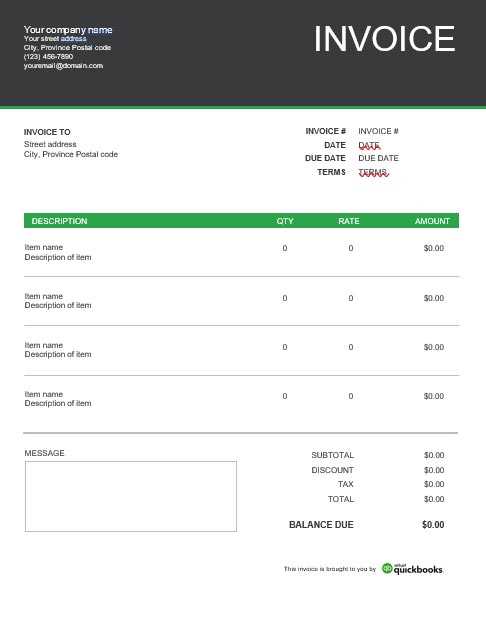

| Logo | Your company’s logo should be placed prominently at the top for brand recognition. | ||||||||||

| Contact Information | Include your business name, address, email, and phone number for easy communication. | ||||||||||

| Itemized List | Provide a clear breakdown of services or products, including quantities, prices, and any discounts applied. | ||||||||||

| Payment Terms | Specify payment methods, due dates, and

Top Features to Look for in Billing FormatsWhen selecting a layout to create financial documents, it’s important to choose one that not only meets your needs but also enhances your workflow. The right design can streamline the billing process, making it easier to send out accurate, professional records to clients. Below are some key features to consider when choosing a layout for your financial documentation. Essential Features in Billing Layouts

Why These Features Matter

|