Commercial Invoice Template for International Shipping Explained

When conducting cross-border trade, proper documentation is crucial to ensure smooth customs clearance, avoid delays, and meet legal requirements. One of the key documents involved in this process serves as a formal record of the transaction between the buyer and seller, outlining the products, their value, and the terms of sale. Creating a reliable and accurate version of this document is essential for all parties involved, from logistics providers to customs officials.

This document not only facilitates the movement of goods across borders but also helps in calculating taxes, duties, and ensuring compliance with local regulations. A well-structured version of this document provides clear information about the items being transported, their origin, and other relevant details that can prevent misunderstandings and costly mistakes.

In this guide, we will explore how to create a comprehensive document for your cross-border shipments, focusing on essential components, common pitfalls, and best practices. With the right approach, this paperwork can streamline the process and ensure your goods reach their destination without unnecessary complications.

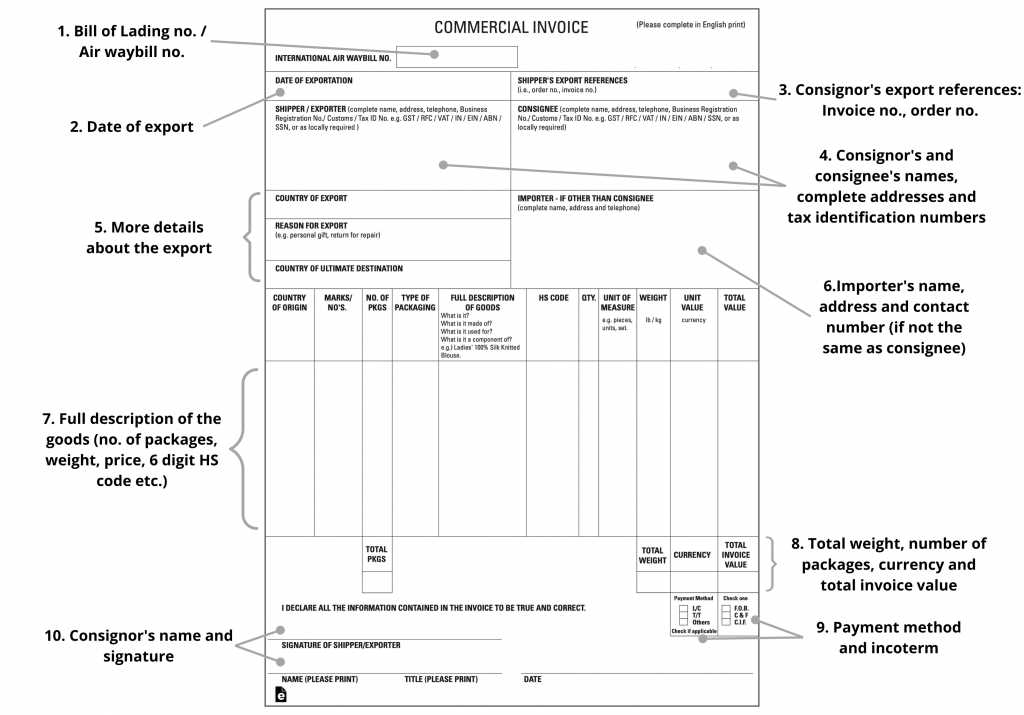

Document Structure for Global Trade Transactions

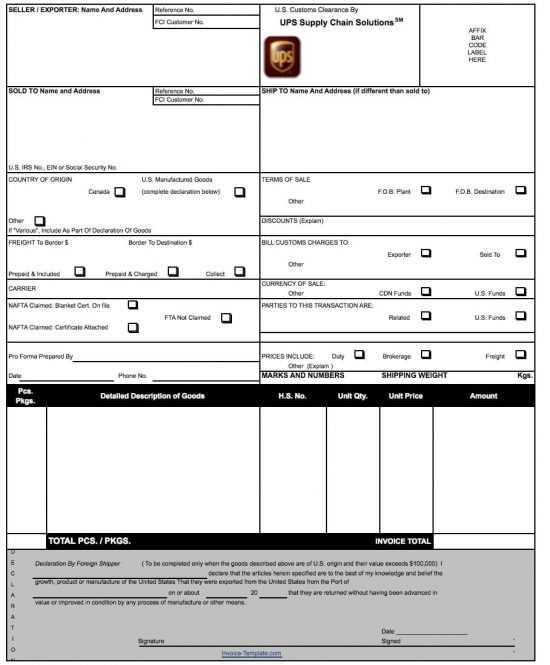

Creating a well-organized and accurate document is essential when sending goods across borders. It serves as proof of the transaction and helps customs officials assess the goods, their value, and the applicable taxes or duties. A carefully prepared document ensures compliance with regulations and minimizes delays during the process of moving goods between countries.

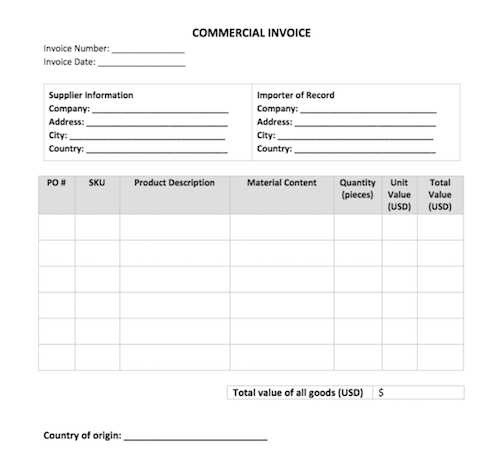

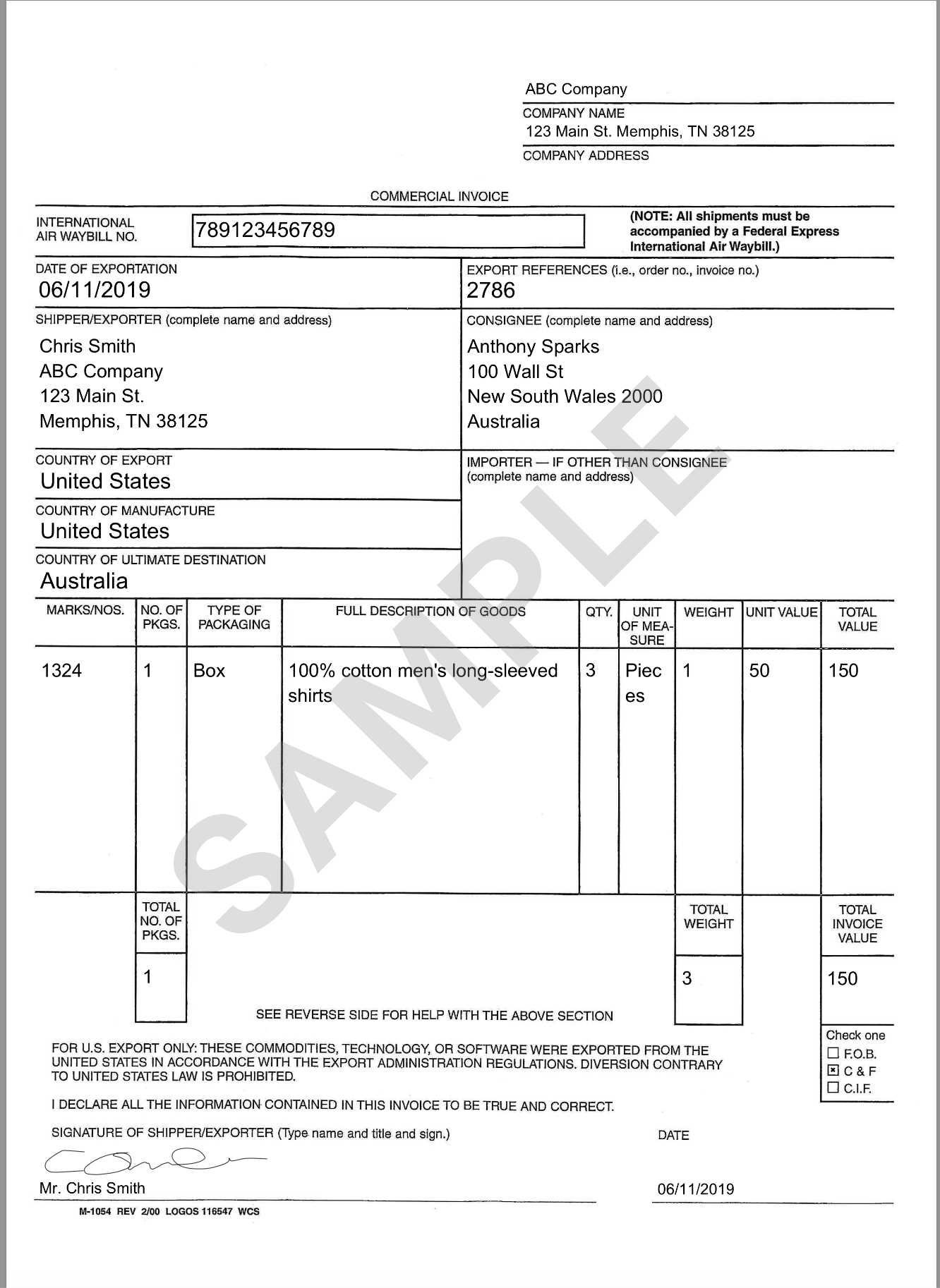

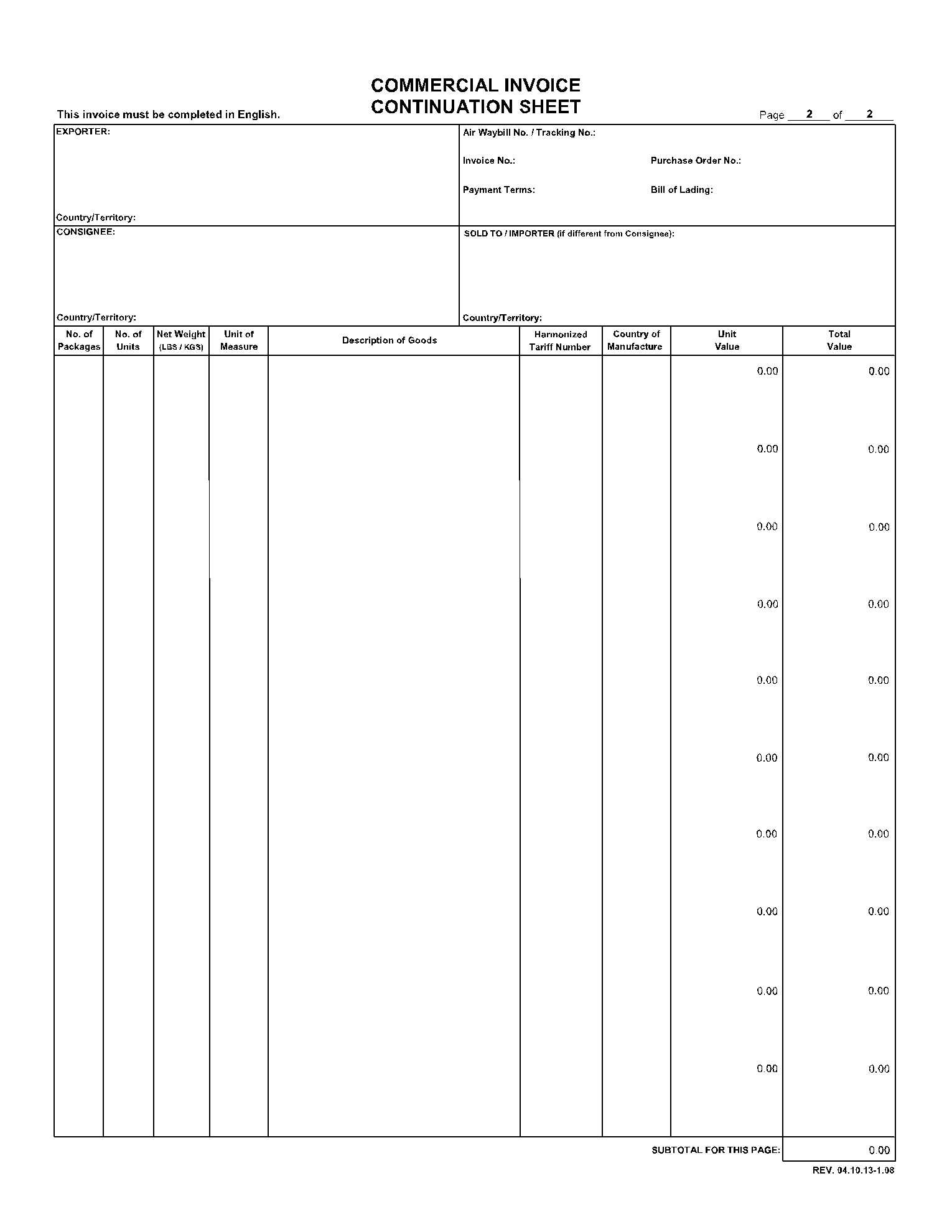

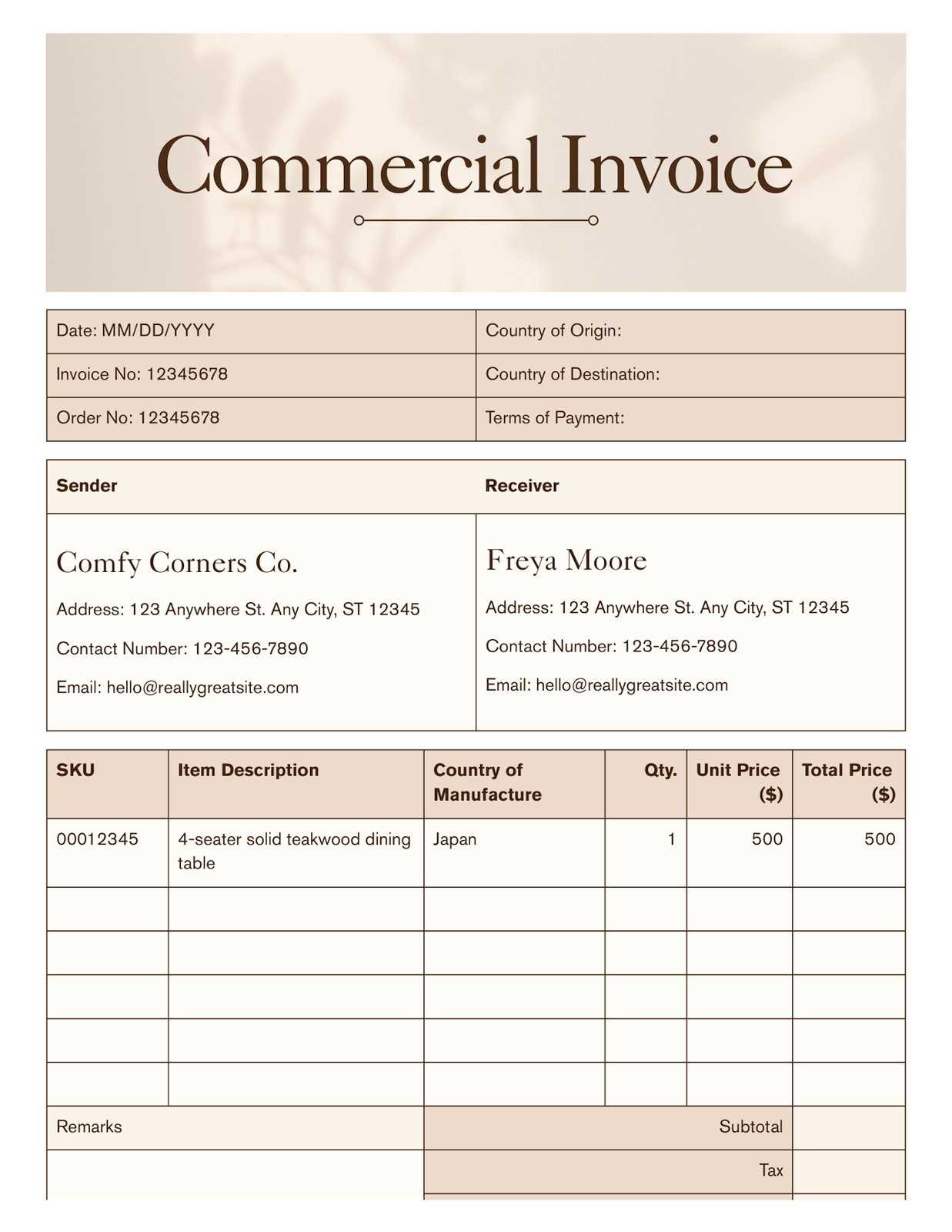

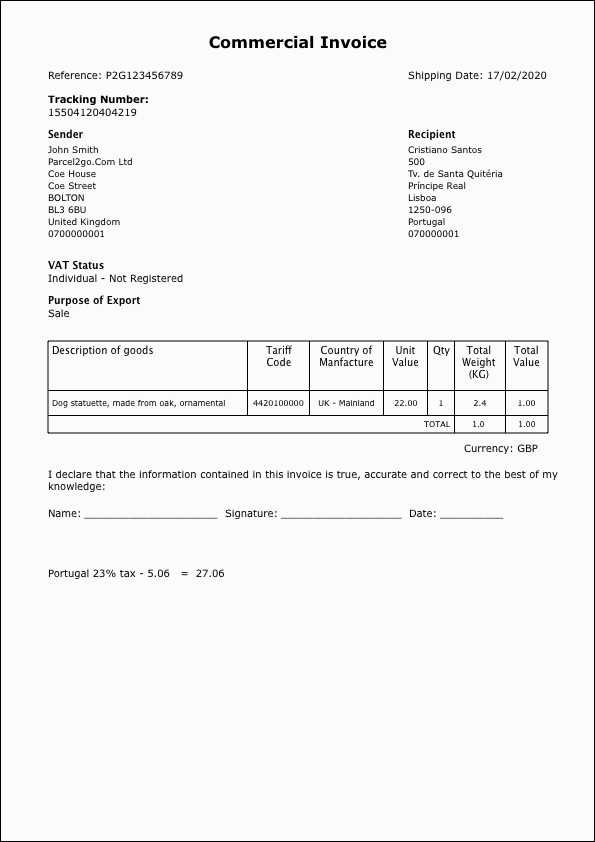

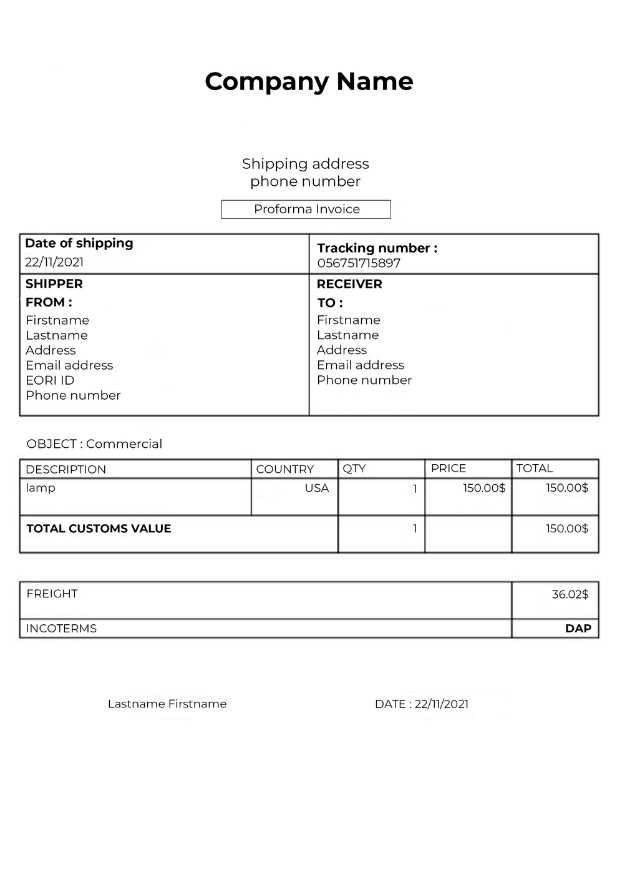

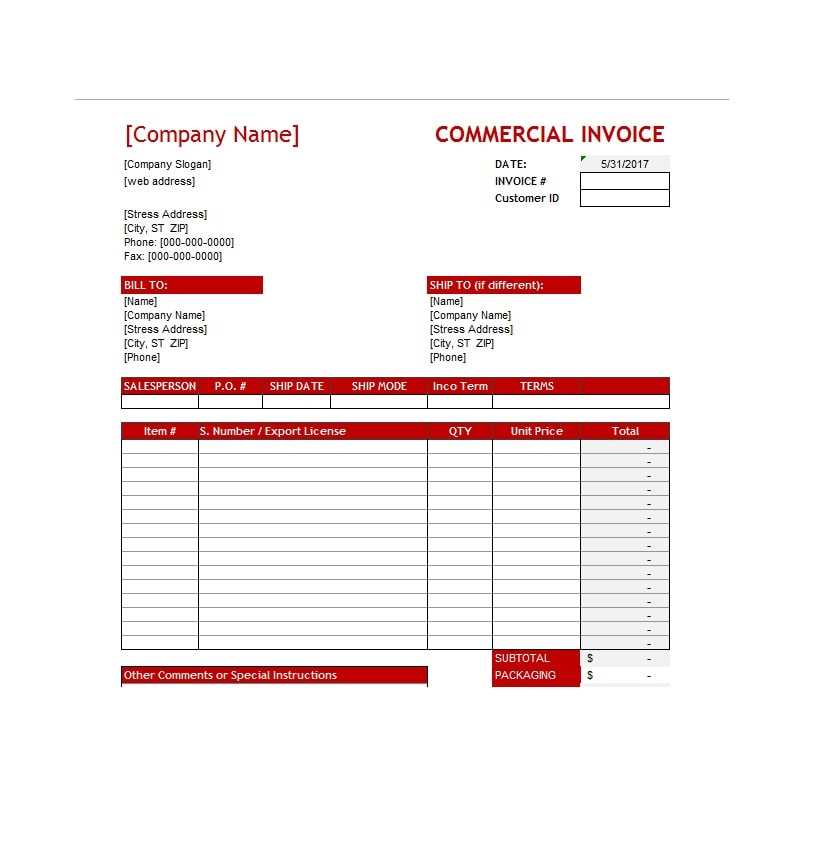

The layout of such a document should include all necessary details to avoid confusion and ensure transparency. It typically covers aspects like product description, value, origin, and shipping costs, and needs to be clear and precise. Below is an example of how you might structure this paperwork for a cross-border sale.

| Section | Description | |||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Seller Information | Name, address, and contact details of the seller. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Buyer Information | Name, address, and contact details of the buyer. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Product Description | A clear description of the items being sent, including quantity and unit of measurement. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Product Value | The total value of the goods, including currency and unit price. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Origin | Country where the goods w

What is a Commercial Invoice?A vital document in cross-border transactions, this paperwork serves as a detailed record of the sale between a seller and a buyer. It outlines the products being exchanged, their value, and essential details that help customs authorities assess the goods and determine any applicable taxes or duties. It is required not only for clearing customs but also for accounting and financial purposes. Key Features of This DocumentThis document includes essential elements like product descriptions, quantities, prices, and payment terms. Additionally, it serves to verify the legitimacy of the transaction and provides customs officials with the information needed to assess and clear goods without delay. The presence of accurate data is crucial to avoid complications and ensure smooth processing at borders. Why It’s Crucial in Global TransactionsWithout this essential paperwork, goods might be delayed or even rejected by customs, leading to financial losses and operational disruptions. A properly filled-out version minimizes risk and ensures compliance with local and international laws. In short, it acts as both a proof of purchase and a declaration for regulatory authorities. Key Elements of a Commercial Invoice

A well-structured document for global transactions includes several important details that ensure clarity and compliance with both parties and regulatory authorities. These elements are necessary not only to facilitate smooth customs processing but also to prevent misunderstandings between the buyer, seller, and other involved parties. A comprehensive document will cover all key information in a clear and organized manner. Essential Information to IncludeKey sections of this document provide insight into the specifics of the transaction, such as who is involved, what is being sold, and the financial aspects of the exchange. Below is an outline of the critical components that should be included for accuracy and compliance:

|