Download Free Microsoft Excel Invoice Template for Easy Billing

Managing finances and ensuring timely payments is crucial for any business. Having a reliable system for creating detailed, clear, and professional bills can save time and reduce errors. Using a structured document that can be easily customized for different clients and services simplifies this process significantly.

Free resources provide a great solution for entrepreneurs and small businesses, offering the flexibility to tailor invoices to specific needs. With just a few adjustments, you can generate professional-looking documents that help keep financial transactions organized.

Instead of relying on complicated software, many prefer using simple, accessible options that provide all the necessary features. These tools allow you to track payments, set due dates, and add specific terms, making it easier to maintain clear communication with clients while staying on top of financial matters.

Why Use Excel for Invoices

Creating structured billing documents is essential for maintaining smooth financial operations in any business. The ease of customizing and organizing these documents in a simple, accessible program makes it an ideal choice for many professionals. With just a few clicks, you can generate professional records that meet all necessary standards, ensuring accuracy and clarity for both parties.

Key Advantages of Using Excel for Billing

- Cost-effective: No need for expensive software or subscriptions; a basic spreadsheet program provides all the tools you need.

- Customizable: You can tailor the layout, fonts, and structure to fit your branding and specific business needs.

- Easy to Update: Modify or update existing documents with ease, allowing for quick changes as your business evolves.

- Data Management: Store and organize client information in one file, streamlining record-keeping and retrieval.

Why It’s Ideal for Small Businesses

- Simple to Use: No steep learning curve or complex processes–just straightforward, user-friendly functionality.

- Track Payments: Easily monitor outstanding amounts and mark paid invoices, helping you stay on top of your cash flow.

- Templates for Efficiency: Start with a pre-designed structure and quickly adapt it to your needs, saving you time.

Benefits of a Free Invoice Template

Using a no-cost solution for generating professional billing documents offers numerous advantages, especially for small businesses and freelancers. Access to a ready-made structure can save both time and effort, while ensuring that your financial records remain organized and accurate. By using a pre-designed form, you can focus on your core tasks without worrying about formatting or technical issues.

Cost-Effective and Accessible

- No Hidden Fees: A free resource eliminates the need for expensive software, making it a budget-friendly option for any business.

- Easy to Access: Most resources are available online, allowing immediate access from any device with no need for installation or setup.

- Instant Start: Begin creating and sending professional documents right away without waiting for downloads or configuration.

Time-Saving and Convenient

- Pre-designed Structure: Skip the lengthy process of formatting and focus only on filling in the necessary details.

- Customizable for Specific Needs: Adjust the fields and layout according to your particular business requirements, ensuring all relevant information is included.

- Consistent Quality: Achieve uniform, well-organized documents every time, boosting your professional image with minimal effort.

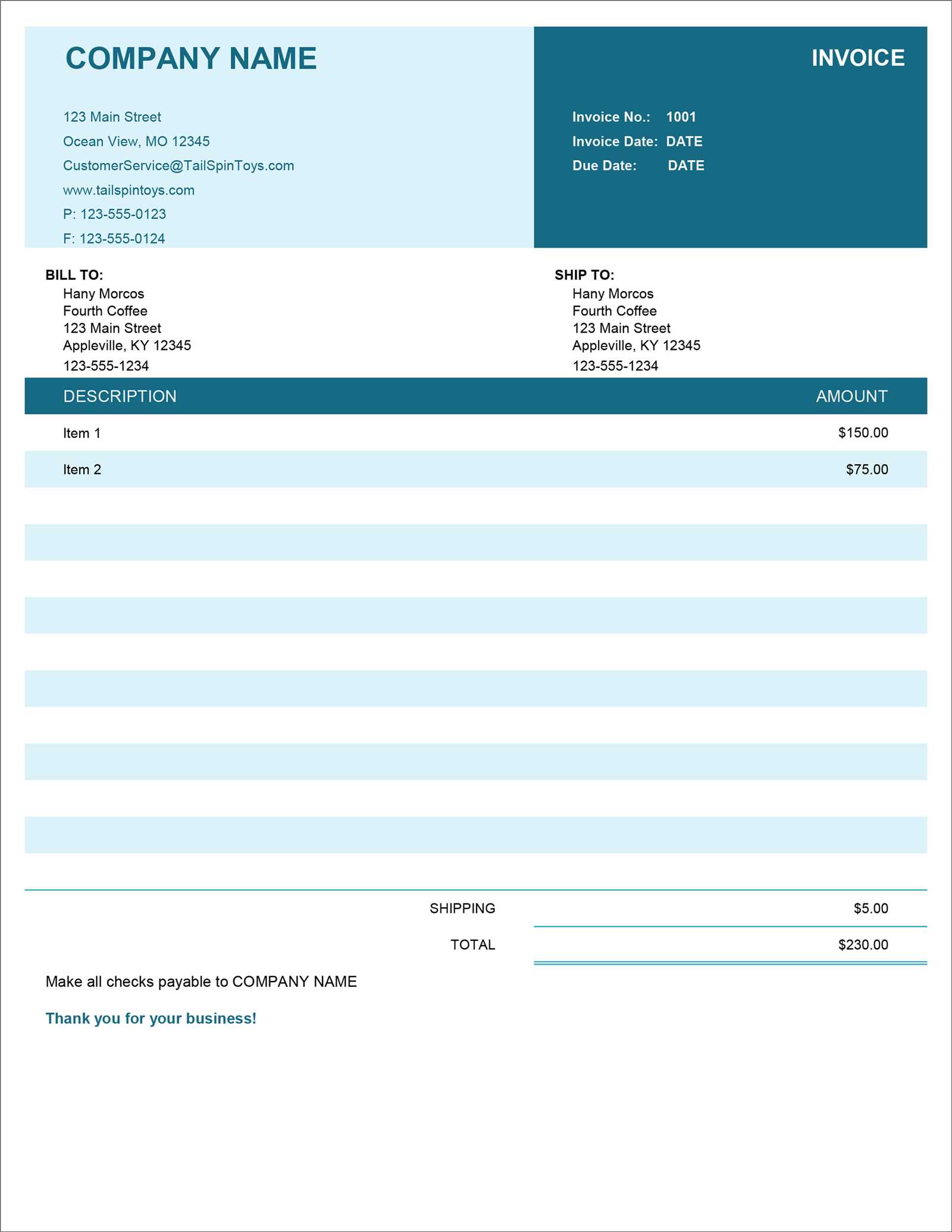

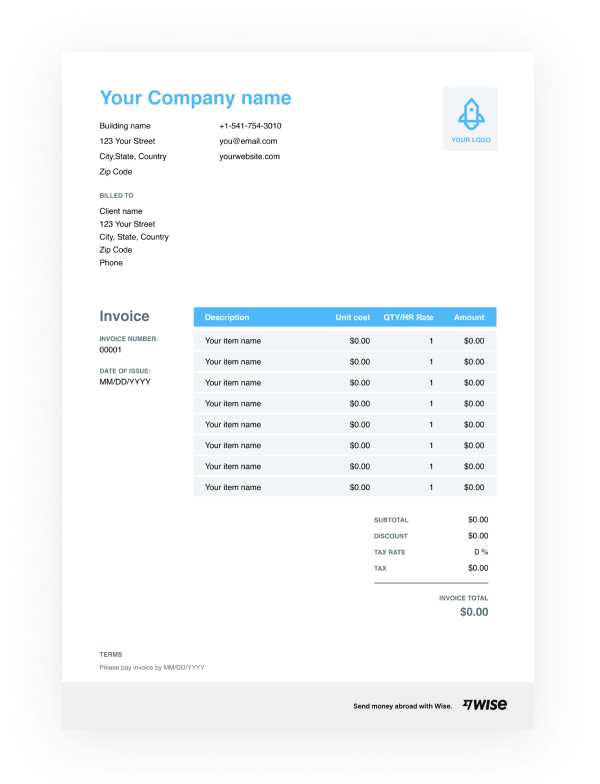

How to Customize Excel Invoice Templates

Adapting a pre-made billing document to your specific needs is a straightforward process that can be done quickly within a spreadsheet program. By making a few adjustments to the layout, fonts, and fields, you can create a personalized document that aligns perfectly with your brand and business requirements. Customization ensures that the document is not only functional but also visually appealing and professional.

Steps to Modify Your Billing Document

- Open the Document: Start by opening the file you wish to edit in your spreadsheet application.

- Edit Company Information: Replace the default business name, address, and contact details with your own. This ensures your document represents your brand.

- Adjust the Layout: If needed, modify the table layout to include or remove columns such as payment terms, due date, or item descriptions based on your needs.

- Change Fonts and Colors: Personalize the look by altering font styles, sizes, and colors to match your business identity.

- Add or Remove Fields: Include additional details, such as tax rates or discounts, or remove unnecessary fields to simplify the document.

Tips for Effective Customization

- Consistency is Key: Ensure that the formatting is consistent throughout the document for a clean, professional look.

- Keep It Simple: Avoid over-complicating the design–focus on clarity and ease of use for your clients.

- Save As a Template: Once you’ve customized your document, save it as a template for future use, ensuring you don’t need to repeat the process every time.

Top Features of Excel Invoice Templates

Pre-designed billing documents come with a range of useful features that make it easy to create accurate and professional financial records. These features are specifically designed to streamline the process of invoicing, saving you time and reducing the chance of errors. By utilizing these built-in tools, you can ensure that all necessary information is captured in a clear and organized manner.

Key Features to Look For

- Pre-set Fields: Important sections such as client name, address, payment terms, and itemized services are already included, allowing you to focus only on filling in the details.

- Automatic Calculations: Many resources come with built-in formulas that automatically calculate totals, taxes, and discounts, eliminating manual math errors.

- Customizable Layout: You can easily adjust the format to match your branding, including the ability to change fonts, colors, and add your logo for a personalized touch.

- Payment Tracking: Fields for due dates, outstanding amounts, and payment status allow you to keep track of your accounts with ease.

- Multiple Currency Support: Some resources allow you to select and work with different currencies, making it ideal for international transactions.

Additional Advantages

- Easy to Save and Reuse: Once customized, you can save the document and reuse it for future clients, saving time on repetitive tasks.

- Print and Email Ready: These documents are formatted for easy printing, and you can also export them as PDFs for quick emailing.

- Data Security: With password protection options, you can ensure that your financial information remains safe and confidential.

Download an Invoice Template in Minutes

Getting a professional document ready for billing doesn’t need to take hours. Whether you’re a freelancer, small business owner, or managing a team, you can have a ready-to-use payment sheet in just a few simple steps. The best part is that you don’t have to create it from scratch or spend valuable time designing one. With the right tool, you can quickly access a pre-designed structure, fill in your details, and have everything set up to send out to your clients in a matter of minutes.

Instantly Access a Ready-Made Document

No more complicated formatting or manual adjustments. By using a ready-made document, all you need to do is add specific information, such as client names, services rendered, and payment terms. These documents are structured to ensure accuracy and professionalism while saving you time. You’ll avoid common errors and streamline your workflow with templates that are adaptable to your needs.

Flexible and Customizable Options

These solutions are designed with flexibility in mind. You can personalize them by adjusting the fields, colors, or layout to match your brand’s style. Customize the content to include specific details relevant to your industry or adjust payment information according to your preferred terms. The ease of use ensures that even those with little to no design experience can create polished and functional documents effortlessly.

Save time, reduce stress, and look professional by using a pre-designed document that you can edit in just a few moments. Whether you’re dealing with one client or dozens, the process is quick and efficient, helping you stay organized and focused on growing your business.

Save Time with Pre-made Invoice Forms

Creating a professional billing document from scratch can be time-consuming and tedious. By using pre-made forms, you can skip the hassle of formatting and focus on more important tasks. These ready-to-use documents are designed to help you save time while ensuring that all the necessary information is organized and presented clearly, allowing you to send out payment requests quickly and efficiently.

Efficient and Ready for Use

Pre-designed forms come with a built-in structure that saves you the trouble of deciding where to place each element. They include all the essential sections–such as client details, itemized services, and payment terms–already arranged for you. All you need to do is add the specific details related to the transaction, which takes only a few minutes.

Consistency and Professionalism

These ready-made forms ensure consistency across all your billing communications. Whether you’re working with one client or many, each document will have the same polished, professional look. Customizable fields allow for some personalization, but the general layout and formatting remain uniform, helping you maintain a coherent brand image.

Speed and simplicity are key benefits of using pre-made forms. By eliminating the need for manual creation, you can focus more on serving your clients and growing your business, knowing that your billing process is streamlined and efficient.

Excel Templates vs Other Invoice Software

When it comes to generating professional billing documents, there are various options available. Some prefer using spreadsheet-based solutions, while others turn to specialized software designed specifically for managing payments and client transactions. Both approaches have their advantages, but understanding the differences can help you decide which one best suits your needs, workflow, and business size.

Spreadsheets: Simple, Flexible, and Cost-Effective

Spreadsheet-based solutions are a popular choice for many due to their flexibility and cost-efficiency. These documents are easy to set up and offer a high level of customization, allowing users to create a billing structure that meets their specific requirements. They also don’t require any additional software purchases or subscriptions, making them an attractive option for freelancers and small businesses. However, while they are versatile, users must manually input the data and ensure the layout remains consistent across documents.

Specialized Software: Streamlined and Feature-Rich

On the other hand, software designed specifically for generating billing documents offers additional features that can save even more time. These tools often come with automated functions, such as recurring billing, integration with payment gateways, and client tracking, which can simplify administrative tasks. However, they typically come with a cost–either a one-time purchase or a recurring subscription. While more advanced, these programs may have a steeper learning curve and might be more suited for larger operations that need enhanced capabilities.

Ultimately, the choice depends on your needs. If you’re a small business or independent worker seeking a simple, budget-friendly solution, a spreadsheet-based option may be sufficient. However, if you’re handling larger volumes of transactions or require automation, specialized software could be a more effective choice. Each option offers its own benefits, and evaluating your specific requirements will guide you to the right decision.

Creating Professional Invoices in Excel

Designing a polished and effective billing document can be an easy task with the right tools. By using a spreadsheet program, you can create a custom payment sheet that looks professional, while keeping the process simple and efficient. Whether you are a freelancer, a small business owner, or a contractor, creating an elegant, clear, and well-structured document is key to maintaining a professional image and ensuring clients understand the terms of payment.

Steps to Create a Polished Document

Creating a well-organized billing sheet involves a few key steps to ensure clarity and professionalism. Here’s a straightforward approach to get started:

- Choose the Layout – Decide on a clean, easy-to-read layout. Organize sections such as client information, list of services or products, and payment terms in a way that makes sense.

- Include Essential Details – Make sure to include:

- Your business name and contact information

- Client’s name and details

- Clear itemization of products or services provided

- Payment due date and terms

- Use Consistent Formatting – Keep font styles, sizes, and colors uniform throughout the document. This helps in creating a professional and cohesive look.

- Add Calculations – Use simple formulas to automatically calculate totals and taxes, ensuring accuracy and saving time.

Tips for Enhancing Your Documents

To make your document stand out even more, consider these enhancements:

- Branding – Incorporate your logo and brand colors for a personalized touch that strengthens your business identity.

- Clear Payment Instructions – Make sure your payment methods are easily understood. Include account details or payment links where necessary.

- Professional Language – Use clear and polite language in all sections, especially when stating payment terms and due dates.

With

How to Add Payment Terms in Excel

Including clear payment terms in your billing documents is essential for ensuring that both you and your client are on the same page when it comes to expectations. Adding these terms is a straightforward process that can be done in just a few simple steps. By defining the due date, payment methods, and any late fees or discounts, you can prevent misunderstandings and help ensure timely payments.

Step-by-Step Guide to Adding Payment Terms

Here’s a clear approach to incorporating payment terms into your billing document:

- Determine the Key Information – Before adding the terms, think about what you need to communicate. The basic details include:

- Due date of payment

- Accepted methods of payment (bank transfer, credit card, etc.)

- Late payment penalties or discounts for early payment

- Add a Payment Terms Section – Create a dedicated section in your document to clearly present these details. This can be placed near the bottom of the page, or in a prominent spot where it’s easy to find.

- Use Simple Language – Keep the terms easy to understand. For example, “Payment due within 30 days” or “5% discount if paid within 10 days” are clear and effective.

Formatting and Customization

You can enhance the payment terms section by formatting it clearly. Consider bolding or highlighting key points like the due date and late fees to ensure they stand out. This will help your client easily identify the most important information.

Being clear and specific about payment terms is crucial to ensuring smooth transactions. By following these simple steps, you can set clear expectations and avoid any confusion or delays in receiving payments.

Step-by-Step Guide to Excel Invoices

Creating a professional payment request doesn’t have to be complicated. By following a few easy steps, you can craft a clear, detailed, and polished document that ensures your clients understand exactly what they owe and when. This step-by-step guide will show you how to efficiently create a billing statement that’s both functional and professional, saving you time and reducing the chances of errors.

1. Set Up the Basic Structure

Start by creating a clean and organized layout. The document should include key sections like your business details, client information, itemized charges, and payment terms. These sections should be clearly defined to ensure that both you and your client can easily read and understand the details.

- Business Information: Include your company name, address, phone number, and email address at the top of the document.

- Client Details: Add the client’s name, address, and contact information below your own.

- Date and Invoice Number: Assign a unique invoice number for tracking purposes and list the date the request is issued.

2. List Services or Products

Next, break down the services or products provided. Each item should be listed with its description, quantity, rate, and total cost. This is where you can be detailed, ensuring the client understands exactly what they are paying for.

- Item Description: Clearly describe each service or product, avoiding ambiguity.

- Quantity and Rate: Indicate how many units or hours were provided, along with the agreed-upon rate.

- Total Amount: For each item, multiply the quantity by the rate to calculate the total for that line.

3. Calculate the Total Amount Due

Common Mistakes When Using Templates

While pre-designed documents can save a lot of time and effort, it’s easy to make mistakes when using them. These errors can lead to confusion, inaccuracies, or even damage your professional reputation. Understanding and avoiding common pitfalls will help you create more accurate and professional documents, ensuring smooth transactions with your clients.

1. Failing to Customize Key Information

One of the most frequent mistakes is neglecting to update the document with your own specific details. Using a generic format without adjusting names, addresses, or other client-specific data can cause confusion and result in errors. Always double-check that all information is correct before sending out any document.

| What to Update | Common Mistake |

|---|---|

| Your business name and contact info | Leaving placeholders or outdated details |

| Client details (name, address) | Using a previous client’s information |

| Payment terms and due dates | Forgetting to specify or update due dates |

2. Overlooking Accuracy in Calculations

Another common mistake is neglecting to double-check the math. Even though many documents have built-in formulas for calculations, errors can still occur if they’re not properly set up. Ensure that totals, taxes, and any discounts or fees are correctly calculated and updated.

Ensure accuracy by reviewing all numbers and verifying the formulas, especially when dealing with taxes or complex charges. Small errors can add up and affect your cash flow or create disputes with clients.

How to Protect Your Excel Invoice Files

When working with sensitive financial documents, it’s essential to ensure that your files are secure from unauthorized access, accidental changes, or loss of data. Protecting your billing sheets is not just about privacy; it’s also about ensuring the accuracy and integrity of your records. Here are several ways to safeguard your files and maintain control over your business documents.

1. Password Protection

One of the simplest and most effective ways to secure your documents is by setting a password. This prevents anyone from opening or modifying the file without the correct credentials. By requiring a password to access the document, you add an extra layer of security to sensitive client information and payment details.

- How to set a password: In the file settings, you can enable password protection by choosing “Encrypt with Password” under security options.

- Choose a strong password: Use a combination of letters, numbers, and special characters to make the password difficult to guess.

2. Locking Specific Cells or Sheets

For added protection, you can lock specific parts of your document to prevent any unwanted changes. This is particularly useful if you have sections of the document that should remain unchanged, like totals or client data. By locking certain cells or entire sheets, you can prevent accidental edits while allowing others to fill in necessary details.

- How to lock cells: Select the cells you want to lock, right-click, choose “Format Cells,” and then enable the “Locked” option under the protection tab. Once this is done, protect the entire sheet with a password.

- Protecting the entire file: You can also password-protect an entire sheet, preventing any changes to the entire document.

Securing your billing files is vital to maintaining control over sensitive information. By following these steps, you can prevent unauthorized access and ensure that your documents remain intact and error-free.

Best Practices for Invoice Formatting

When creating a billing document, clear and consistent formatting is crucial for making the document professional, easy to read, and accurate. Proper organization ensures that clients can quickly understand the charges, due dates, and payment methods. Following best practices for document layout will help you avoid confusion and improve your communication with clients.

1. Organize the Layout Clearly

The structure of the document should be simple, clean, and intuitive. Key information should be easy to locate at a glance, which can be achieved through a logical flow. Start with your business details at the top, followed by the client’s information, and then list the items or services provided in an organized manner.

- Header: Include your business name, logo, and contact information. Ensure this is clearly visible at the top.

- Client Information: Place the client’s name, address, and contact details directly below your own.

- Itemized List: Include each product or service provided, along with quantities, rates, and subtotals.

- Payment Terms: Clearly state the due date, accepted payment methods, and any late fees or discounts.

2. Consistent Formatting and Fonts

Consistency is key to creating a professional document. Use uniform fonts, sizes, and colors throughout the entire document. Avoid using too many different styles or colors, as it can make the document look cluttered and unprofessional.

- Font Size: Use a readable font size for the main content (10-12pt), and slightly larger sizes for headings or totals.

- Font Type: Stick to standard, easy-to-read fonts like Arial, Calibri, or Times New Roman.

- Alignment: Use left or center alignment for text, and right-align numerical values like totals and amounts.

How to Automate Excel Invoice Updates

Keeping track of payment details, client information, and transaction statuses can be time-consuming when done manually. By automating the process of updating data, you can save time and reduce the chances of errors. This section explores several ways to streamline the process using built-in features and formulas, allowing for seamless, real-time updates in your financial documents.

One of the most effective ways to automate these updates is by utilizing dynamic data references and formula-driven cells. By linking cells to external databases or using functions that update automatically when new information is entered, you can ensure that each document reflects the most recent figures without manual intervention.

| Automation Method | Description |

|---|---|

| Lookup Functions | Using VLOOKUP or INDEX-MATCH functions to automatically pull client or transaction data from a master list. |

| Dynamic Date Fields | Incorporating date functions like TODAY() to automatically update dates based on the current day. |

| Conditional Formatting | Highlighting certain data (e.g., overdue payments) using automated rules to visually flag important details. |

| Pivot Tables | Aggregating and summarizing data automatically by using pivot tables, enabling instant financial reporting. |

Additionally, automating tasks like calculating totals, taxes, or discounts can be done through built-in formulas such as SUM, SUMIF, or IFERROR. By setting up these functions, calculations are handled instantly whenever data is modified. This approach minimizes manual errors and ensures consistency across multiple documents.

To take things a step further, consider integrating cloud-based automation tools or external software that can sync data and update your financial records across different platforms. By doing so, you can centralize your data and reduce the need for repetitive updates.

Excel Invoices for Small Businesses

For small enterprises, managing financial records efficiently is essential to maintaining smooth operations. Utilizing simple, yet powerful, tools to track transactions and bill clients can save time and ensure accuracy. This section highlights how small business owners can create and manage customized billing documents to streamline their accounting processes.

Benefits of Using Spreadsheets for Billing

Using spreadsheets to create payment requests offers numerous advantages for small businesses:

- Cost-effective solution with no need for specialized software.

- Easy to customize and adjust as the business grows.

- Ability to track and organize payments and expenses in one document.

- Quick updates and edits to reflect the latest information.

How to Set Up Your Billing Documents

Creating a customized billing document can be done in a few simple steps:

- Create a clean and organized layout with sections for client details, payment amounts, due dates, and services/products provided.

- Incorporate formulas for automatic calculations of totals, taxes, and discounts.

- Use consistent formatting and include essential business information, such as contact details and payment methods.

- Consider adding a tracking system, such as unique numbers for each request, to easily monitor outstanding payments.

With these steps, small businesses can simplify their billing process, making it more efficient and professional.