Tree Removal Invoice Template for Simple and Professional Billing

Managing finances and ensuring smooth transactions is crucial for any service-oriented business. Having a clear and well-structured document that outlines the services provided and the corresponding charges is essential for maintaining professionalism and improving client satisfaction. Such documents not only help you stay organized but also facilitate timely payments and reduce misunderstandings.

By using customizable formats, business owners can streamline the billing process, ensuring all necessary details are included in a consistent manner. A properly crafted statement includes key components such as service descriptions, costs, payment terms, and contact information, which help to avoid confusion and promote transparent communication.

Whether you are offering landscaping, maintenance, or other outdoor services, understanding how to create an efficient financial document is a vital skill. This guide will walk you through the important elements to include, tips for customization, and the advantages of using digital solutions to automate your billing process.

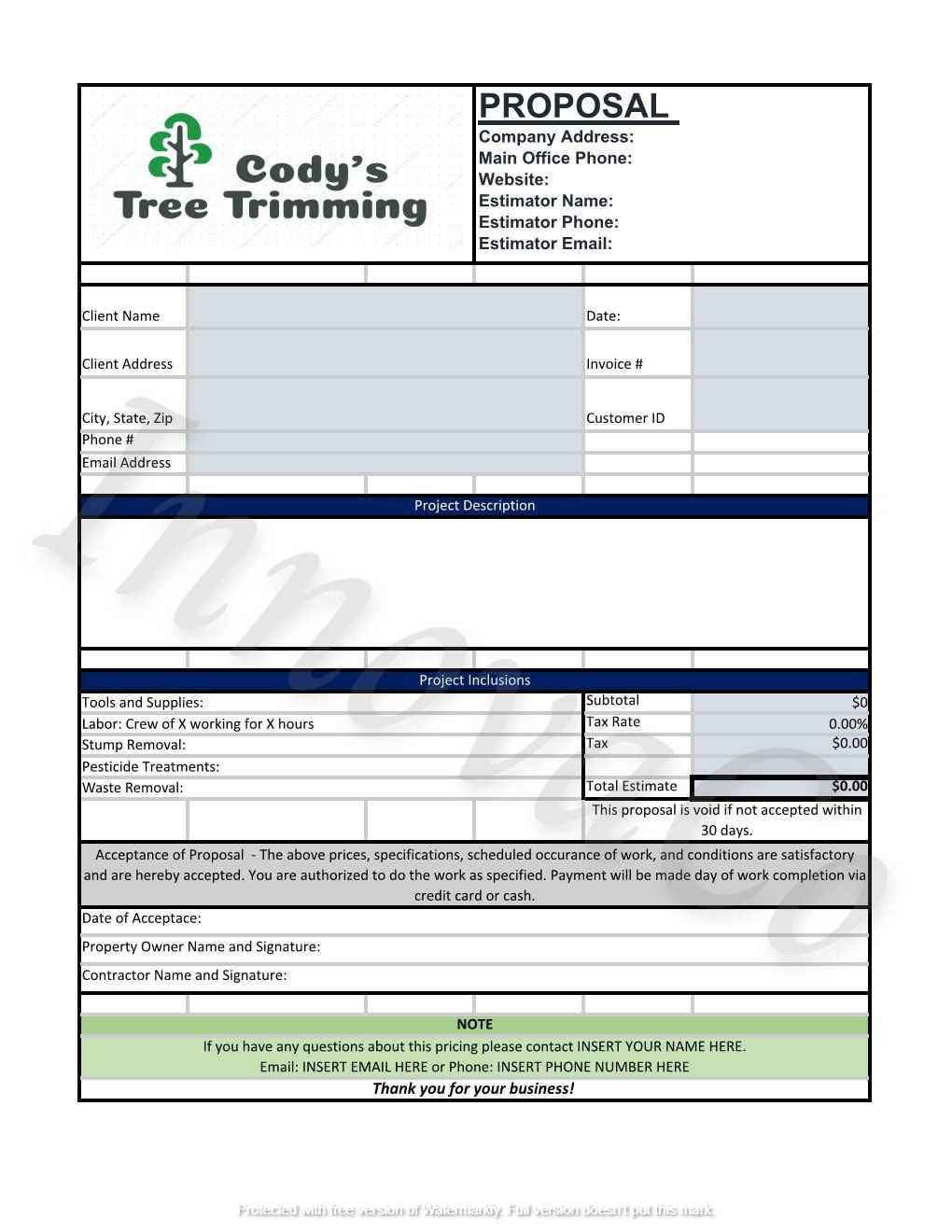

Tree Removal Invoice Template Overview

When providing outdoor services that involve the removal or management of large plants, it’s essential to issue a clear, professional document that reflects the work done and the amount owed. A well-organized billing statement helps establish trust with clients and ensures that both parties are on the same page regarding the scope of work and associated costs.

These documents are a crucial part of any business’s financial workflow. A structured format includes vital information such as descriptions of tasks completed, itemized fees, payment terms, and your business contact details. This ensures transparency, reduces potential disputes, and accelerates the payment process.

Why a Structured Billing Document is Important

Having a standardized document not only makes the billing process more efficient but also enhances professionalism. It allows businesses to keep track of completed projects, making accounting and tax filing simpler. Additionally, clients appreciate the clarity and organization that comes with a well-constructed statement.

Key Components of an Effective Billing Document

An ideal document should include specific details like the service performed, the cost for each part of the job, and the agreed-upon terms. Including sections for payment deadlines, methods of payment, and any applicable taxes ensures the statement covers all financial aspects. This format provides both the service provider and the client with a reliable reference for payment expectations.

Why Use an Invoice Template

Having a pre-designed format for billing is essential for businesses that provide services. Instead of manually creating a new document for each project, using a consistent layout streamlines the process, saving time and reducing errors. A well-organized document can enhance professionalism and ensure that all necessary details are clearly communicated to clients.

By using a standardized approach, you eliminate the risk of forgetting important information or overlooking key sections that could delay payment. The right structure also helps in maintaining consistency across all transactions, which can be crucial for accounting and financial tracking.

Benefits of Using a Standardized Format

- Time Efficiency: You can quickly fill in the necessary details without needing to create a new format every time.

- Professional Appearance: A polished, consistent layout reinforces your brand and builds trust with clients.

- Reduced Errors: A ready-made structure helps ensure all essential components are included, minimizing the chance of mistakes.

- Better Organization: It allows for easy tracking of past transactions and simplifies accounting tasks.

How It Improves Client Relationships

Clients appreciate clarity and transparency when it comes to financial matters. Using a clear and professional layout ensures that the client understands the charges and the services rendered. This, in turn, fosters trust and can lead to repeat business and positive referrals.

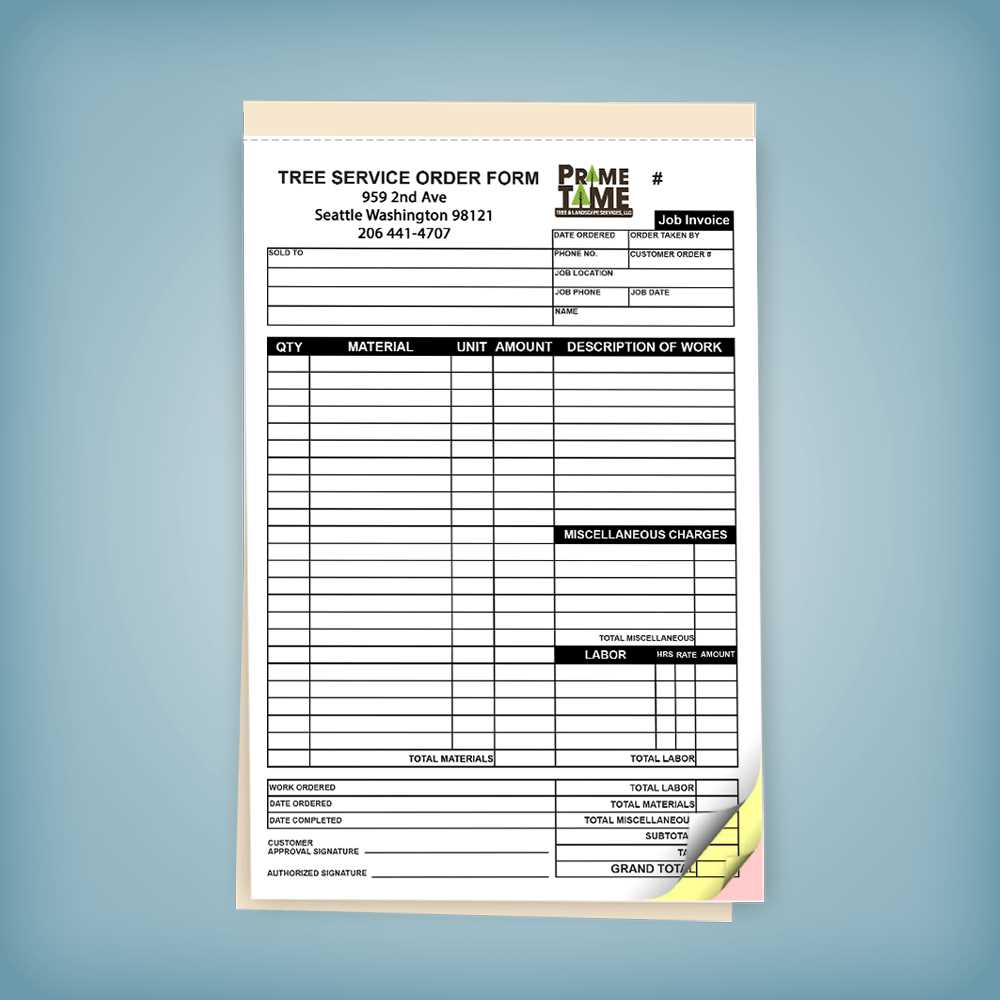

Key Features of a Tree Removal Invoice

For businesses offering outdoor services, creating a clear and comprehensive document is essential for ensuring accurate payments. A well-structured billing statement should include several key elements that provide transparency to clients and establish a professional image. These elements help both the service provider and the client to easily understand the charges and the work completed.

Each section should clearly describe the services provided, the cost for each, and any applicable terms or conditions. A well-organized document ensures all necessary information is readily available, helping to avoid confusion or disputes during the payment process.

Essential Information to Include

- Service Description: A detailed summary of the work done, including any specific tasks or materials used.

- Cost Breakdown: Clear itemization of the charges for each part of the job, helping the client understand the pricing structure.

- Payment Terms: Details on when payment is due, accepted payment methods, and any late fees for overdue payments.

- Business Information: Include your contact details, business name, address, and any relevant licensing or insurance numbers.

Additional Considerations

- Project Timeline: If applicable, provide the date or time frame when the work was completed.

- Taxes and Fees: Clearly specify any sales tax or additional fees added to the total amount.

- Terms and Conditions: Outline any relevant policies or guidelines that apply to the services rendered.

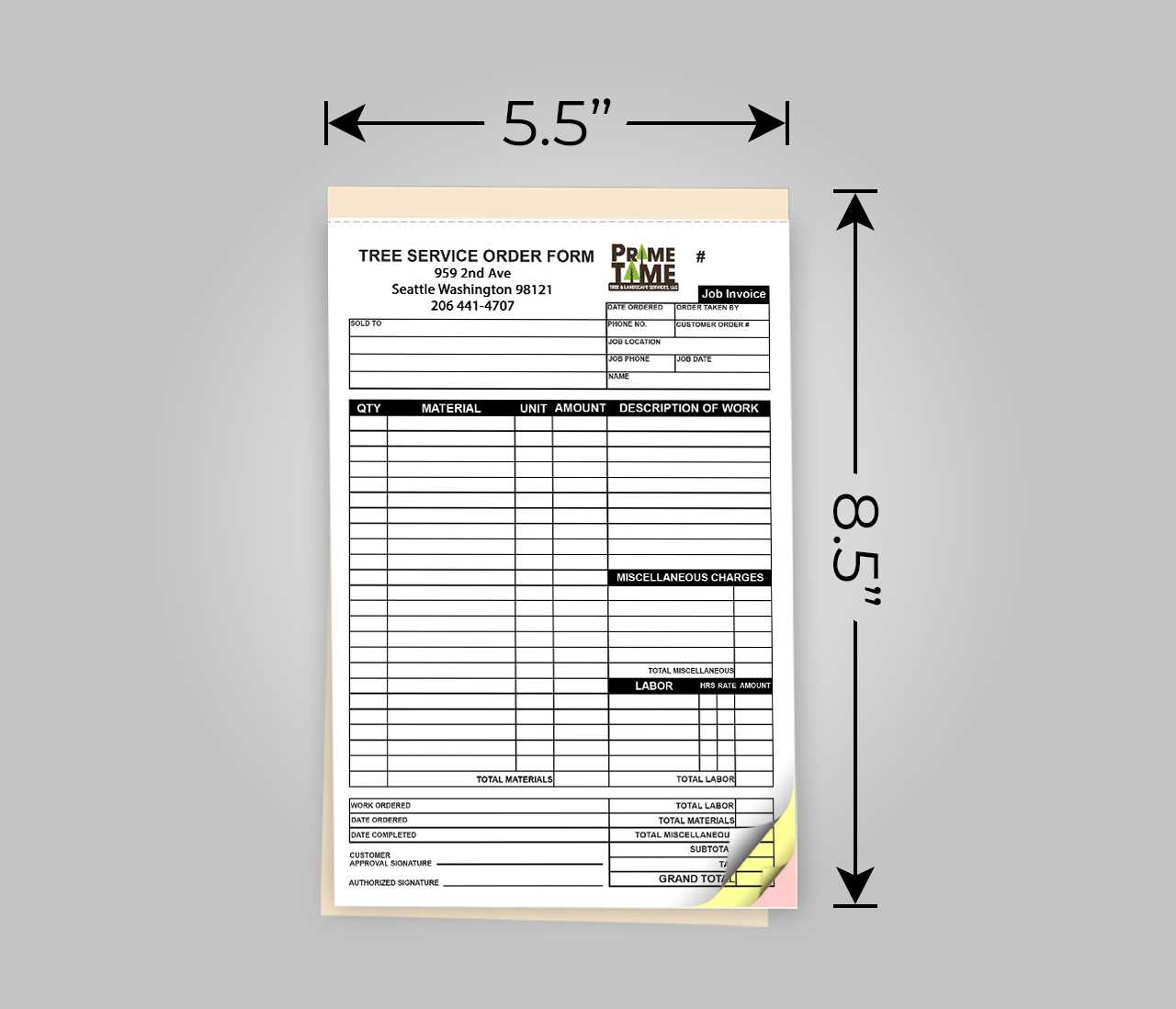

How to Customize Your Invoice Template

Customizing a billing document is an important step in creating a personalized and professional experience for your clients. A well-tailored format allows you to include specific details relevant to your services and business while ensuring clarity and accuracy in the final statement. By adjusting the design and content, you can make the document not only functional but also aligned with your brand’s identity.

The process of customization typically involves modifying sections like service descriptions, payment terms, and your business information. With the right adjustments, your billing format can reflect your unique style while maintaining professionalism and ease of use.

Steps to Personalize Your Document

- Branding: Include your company’s logo, color scheme, and contact details to make the document instantly recognizable.

- Service Descriptions: Tailor the descriptions to match the exact work provided, ensuring clarity and avoiding ambiguity.

- Payment Terms: Adjust payment due dates, methods, and penalties for late payments based on your business policies.

- Additional Notes: Add any specific instructions or client-specific terms, such as warranties or follow-up services.

Choosing the Right Layout and Design

- Clean Structure: Keep the format simple and well-organized for easy reading and understanding.

- Font Selection: Choose clear, professional fonts that are easy to read, with appropriate emphasis on headings and totals.

- Consistent Formatting: Maintain uniform spacing, alignment, and style throughout the document to enhance its visual appeal.

Essential Information to Include in an Invoice

To ensure smooth transactions and avoid any confusion, it’s important to include all the necessary details in a billing document. A well-drafted statement should cover specific information that outlines the services rendered, the costs, and any terms agreed upon. This ensures both parties are clear on the financial aspect of the service, reducing the risk of misunderstandings or delays in payment.

When customizing your document, make sure that the following key elements are included for both transparency and professionalism.

Key Elements to Include

- Service Description: Clearly describe the tasks completed, including any materials or equipment used. This helps the client understand exactly what they are paying for.

- Itemized Costs: Break down the costs for each part of the job, so the client can see how the total amount was calculated.

- Business Information: Include your company name, address, phone number, and email to ensure clients can contact you if needed.

- Client Information: Include the client’s name, address, and any reference numbers or accounts associated with them to ensure the document is linked to the correct customer.

Payment Terms and Conditions

- Payment Due Date: State when payment is expected to be made to avoid delays.

- Accepted Payment Methods: Specify the forms of payment you accept, such as bank transfers, checks, or online payment options.

- Late Fees or Penalties: Outline any additional charges for overdue payments to encourage timely

Benefits of Using Professional Invoice Templates

Utilizing a professionally designed billing document provides numerous advantages for service-oriented businesses. Not only does it save time and effort in the billing process, but it also ensures that your communications are clear, consistent, and credible. A standardized format helps to eliminate mistakes, maintains a polished appearance, and contributes to the overall efficiency of your financial management.

Adopting a professional layout for your financial documents also enhances customer trust. Clients are more likely to feel confident in working with a business that provides clear, structured billing that reflects attention to detail and professionalism.

Increased Efficiency and Time Savings

- Quick Generation: With a pre-made structure, you can easily create new documents without having to start from scratch every time.

- Reduced Errors: A ready-to-use format helps ensure that important details are not overlooked or forgotten, reducing the risk of discrepancies.

- Streamlined Process: Consistency in formatting makes it easier to process and track payments, saving you time during accounting tasks.

Enhanced Professional Image

- Branding Consistency: A customized format can include your company logo and color scheme, reinforcing your brand identity.

- Clear and Transparent: Clients appreciate clarity, and a well-structured document ensures they understand the charges and services without confusion.

- Trust-Building: Providing a polished and professional statement reflects well on your business and helps establish long-term customer relationships.

Common Mistakes in Tree Removal Invoices

Even with the best intentions, businesses can make errors when creating financial documents for services provided. These mistakes can lead to confusion, delays in payment, or even damage to your professional reputation. Understanding common pitfalls in the billing process is essential for ensuring that your documents are accurate, clear, and effective in securing timely payments.

By being aware of the most frequent mistakes, you can avoid these issues and ensure your billing process runs smoothly and professionally.

Typical Errors to Avoid

- Missing Service Details: Failing to provide a clear description of the tasks performed can lead to misunderstandings and disputes over what was actually completed.

- Unclear Payment Terms: Not specifying payment deadlines, accepted methods, or late fees can cause confusion about when and how clients should settle their balance.

- Incorrect Pricing: Inaccurate pricing or missing itemized costs can lead to overcharging or undercharging, both of which can harm your relationship with clients.

- Omitting Contact Information: Forgetting to include your company’s contact details or your client’s information can make it difficult to resolve any issues or follow up on payments.

- Neglecting to Include Taxes or Fees: Not adding applicable taxes or service fees can cause unexpected discrepancies and dissatisfaction with the client upon receiving the final bill.

- Using Inconsistent Formats: Using a non-uniform or unprofessional layout can give the impression of disorganization and lack of attention to detail.

How to Avoid These Pitfalls

- Doubl

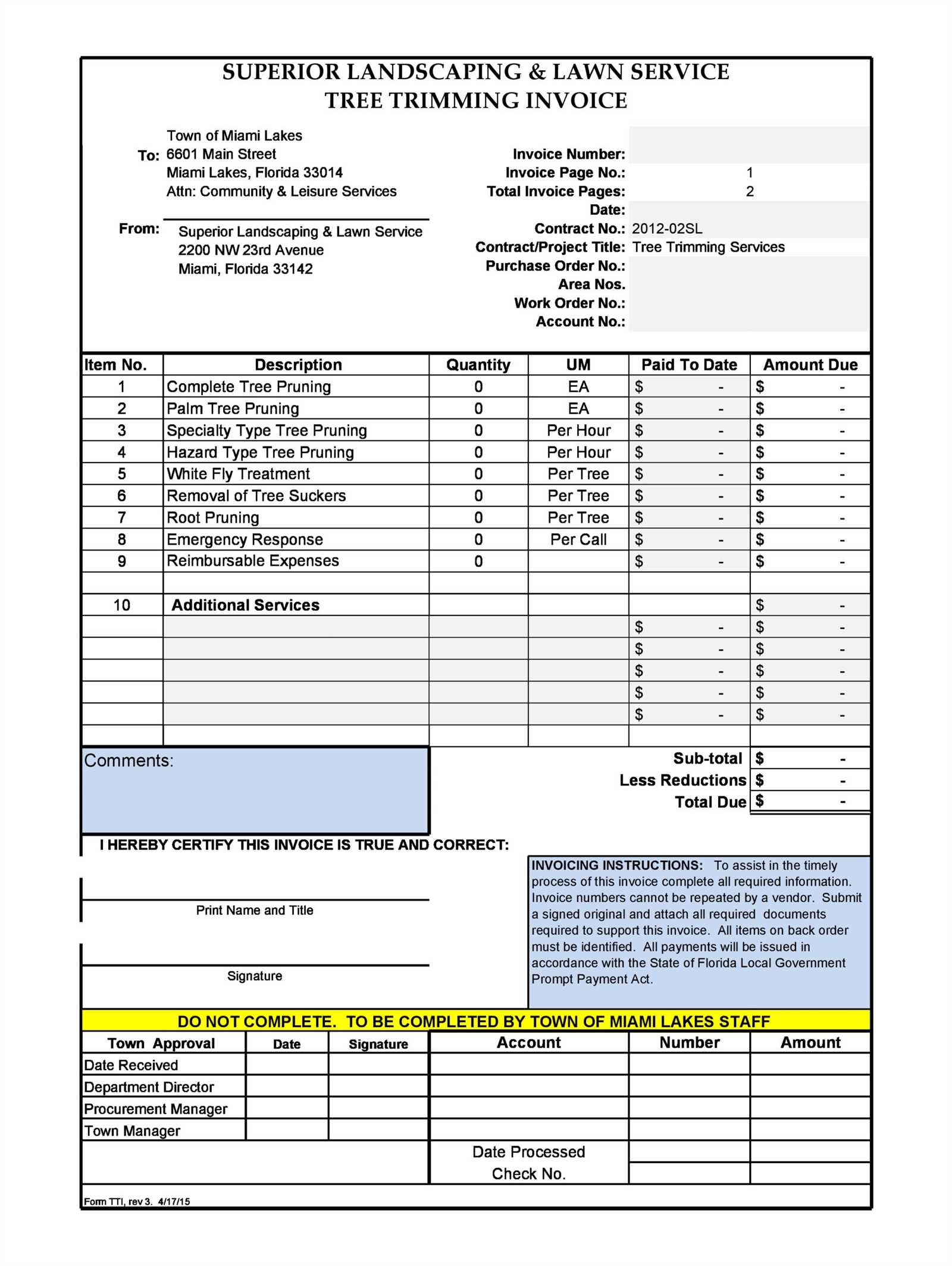

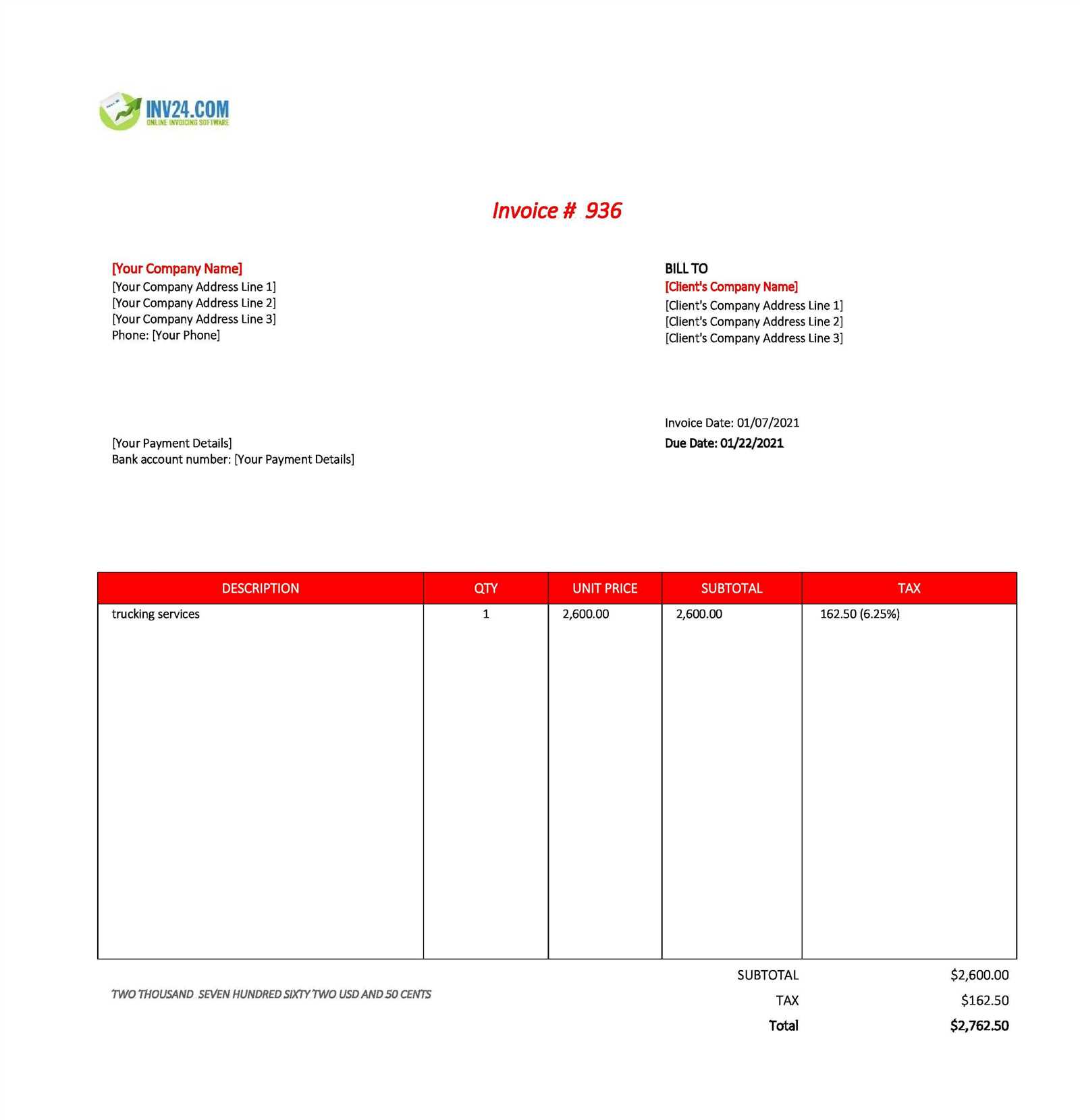

How to Add Service Charges and Fees

Including additional charges and fees in your billing documents is crucial for covering extra costs incurred during the execution of a job. These charges can reflect factors such as special equipment use, transportation, or unexpected complications. It’s important to clearly outline these fees so that clients fully understand the total cost of the service.

To add charges and fees correctly, you need to identify the type of costs involved and explain them clearly in the document. Be transparent about what each fee is for and ensure the amounts are accurate to avoid misunderstandings or disputes.

Types of Additional Charges to Include

- Labor Fees: If the service took more time or required extra workers, include the hourly rate and the total number of hours worked.

- Material Costs: If special materials or equipment were needed, itemize these expenses separately and list their costs.

- Transportation Fees: If travel or transport of equipment was involved, include a flat fee or per-mile rate to cover this expense.

- Emergency or After-Hours Charges: If the work was done outside of regular business hours or in urgent circumstances, add a surcharge to reflect this increased cost.

- Disposal Fees: If there were costs associated with removing debris or waste from the site, include these charges as a separate line item.

Best Practices for Adding Charges

- Be Clear and Detailed: Provide specific explanations for each additional charge to ensure there’s no confusion.

- Itemize Charges: List each fee separately to give the client a breakdown of the overall cost. This makes the charges transparent and easier to understand.

- Justify the Fees: If possible, include a note or explanation that justifies

Creating a Clear Payment Structure

Establishing a clear and transparent payment structure is essential for maintaining smooth business operations and ensuring timely payments. By clearly outlining the terms of payment, you reduce the risk of confusion or disputes with clients. A well-defined payment schedule helps both parties understand the expectations and prevents unnecessary delays in the financial process.

To create an effective payment structure, it’s important to define key elements such as due dates, accepted methods of payment, and any penalties for late payments. This structure not only promotes prompt settlement but also reinforces your professional approach to handling financial transactions.

Key Components of a Payment Structure

- Payment Due Date: Clearly state when the payment should be made, whether it’s upon completion of the service or within a set number of days after the work is finished.

- Accepted Payment Methods: Specify the forms of payment you accept, such as credit cards, bank transfers, checks, or online payment systems.

- Deposit Requirements: If applicable, request a deposit upfront or a partial payment before beginning work. This helps cover initial costs and assures the client is committed.

- Late Fees: Include terms for late payments, such as a fixed fee or percentage added to the total amount for each day the payment is overdue.

How to Communicate Payment Terms Effectively

- Be Clear and Direct: Use simple, straightforward language to ensure your clients understand the payment terms.

- Provide Multiple Payment Options: Offering various payment methods can make it easier for clients to settle their balance on time.

- Highlight Important Details: Make sure payment terms are prominently displayed on your financial documents to

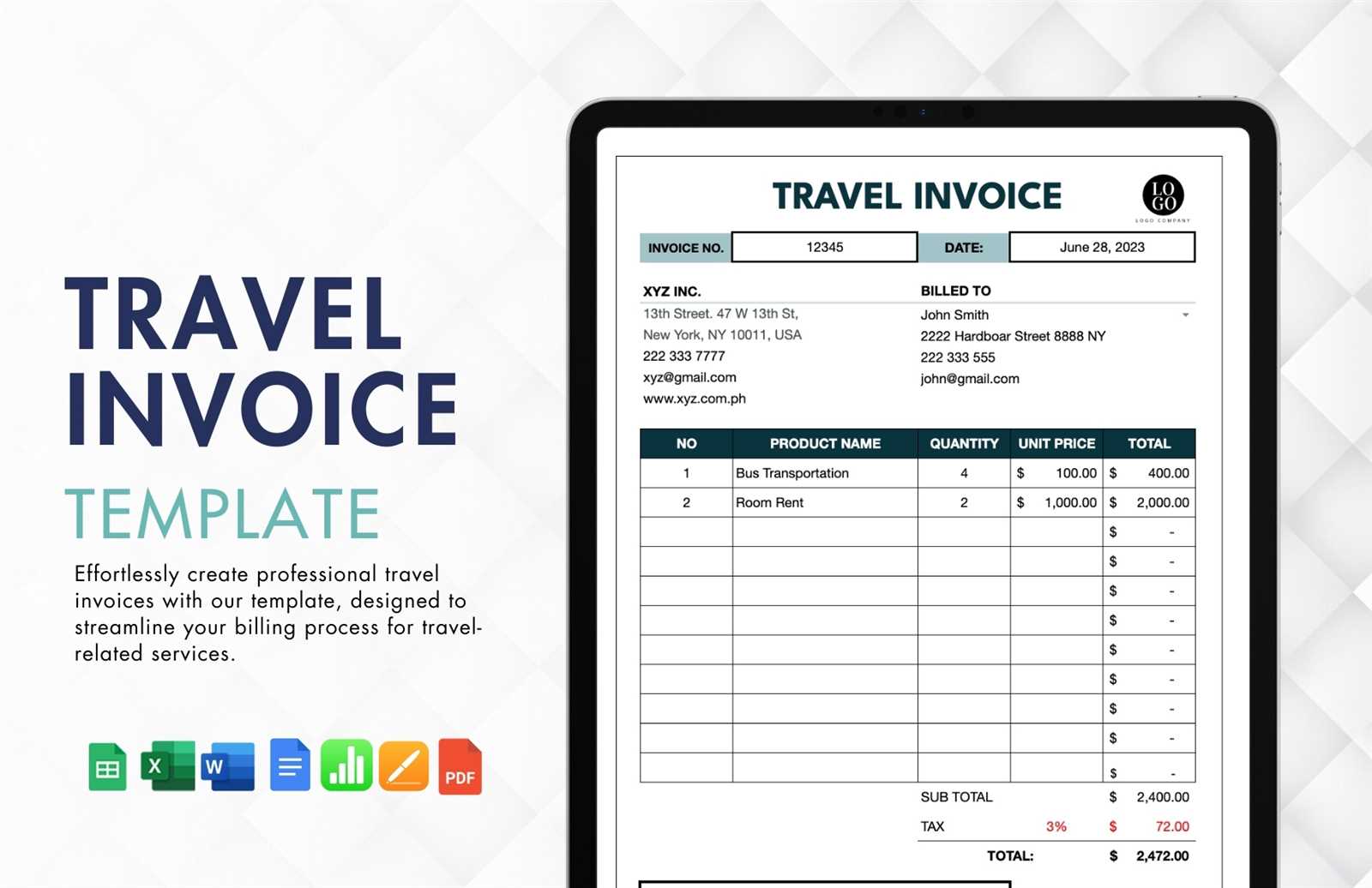

Using Software to Generate Invoices

Using specialized software to create billing documents streamlines the process, making it faster, more efficient, and less prone to errors. These tools often come with pre-designed layouts and automated features, allowing you to generate professional-looking statements with minimal effort. Software solutions can also help keep track of payments, automate recurring charges, and maintain a record of past transactions for easy reference.

With the right software, you can save time, enhance accuracy, and ensure that your financial documents are consistent and polished. This approach is especially helpful for businesses that generate multiple documents on a regular basis and want to maintain a high level of professionalism and organization.

Advantages of Using Software for Billing

- Time Efficiency: Quickly create and send out documents without manually entering all the details every time.

- Customization: Easily tailor the layout and content to match your brand, including logos, colors, and contact information.

- Tracking and Reminders: Set up automated reminders for overdue payments, ensuring you follow up on outstanding balances in a timely manner.

- Reporting: Generate financial reports to monitor cash flow and easily track payment history for your business.

How to Choose the Right Software

- User-Friendliness: Choose a platform that is intuitive and easy to use, even for those without advanced technical skills.

- Integrations: Consider software that integrates with your existing accounting or CRM systems to simplify workflow and reduce manual data entry.

- Cost: Look for a solution that fits your budget, whether it’s a one-t

Best Practices for Sending Tree Removal Invoices

Sending billing documents promptly and professionally is key to maintaining a healthy cash flow and fostering good relationships with clients. Timely delivery, clear communication, and well-structured statements ensure that clients understand the charges and make payments without delay. Following best practices for sending these documents helps build trust, reduce confusion, and streamline the payment process.

By adhering to certain guidelines, you can ensure that your billing process is both effective and efficient, while maintaining professionalism throughout your interactions with clients.

Key Practices for Efficient Billing

- Send Promptly: Ensure that you send out the billing document as soon as the work is completed or according to the terms agreed upon with the client.

- Use Clear Language: Avoid jargon or overly complex terms. Make sure the charges, payment terms, and services provided are easy for the client to understand.

- Include All Relevant Details: Ensure that all essential information, such as service description, payment terms, and deadlines, is included in the document.

- Send via Preferred Method: Choose a communication method that the client prefers, whether by email, postal mail, or through an online platform, to ensure it’s received promptly.

Maintaining Professionalism in Billing

- Follow Up: If the payment is not received by the due date, send a polite reminder, ensuring that the client knows when and how to settle the bill.

- Offer Multiple Payment Options: Make it as easy as possible for clients to pay by offering various methods, such as bank transfers, credit cards, or online payment systems.

- Keep Records: Always retain copies of sent billing documents for your own records, ensuring that you have accurate information on hand in case of disputes or follow-ups.

Tracking Payments and Outstanding Invoices

Effectively managing payments and keeping track of outstanding balances is crucial for maintaining a steady cash flow and ensuring that all services are paid for in a timely manner. By systematically tracking payments, businesses can identify overdue accounts, address potential issues promptly, and reduce the risk of unpaid debts. Establishing a reliable method for monitoring outstanding balances helps ensure that your financial records remain accurate and up-to-date.

With the right tools and strategies in place, you can stay on top of payments, avoid administrative headaches, and provide excellent customer service by addressing billing issues efficiently.

Strategies for Managing Payments

- Use Accounting Software: Implement an automated accounting system that tracks payments, due dates, and outstanding balances, so you don’t have to manually manage each transaction.

- Set Up Payment Reminders: Use automated reminders to notify clients of upcoming or overdue payments, helping to reduce delays and keep the payment process on track.

- Monitor Payment Status Regularly: Regularly review your accounts receivable to stay on top of which payments are pending and which have been settled.

- Offer Payment Plans: For larger balances, offer flexible payment options to help clients manage the cost while ensuring you still receive payment.

Handling Late Payments

- Send Polite Reminders: If a payment is overdue, send a courteous reminder, outlining the outstanding balance and the agreed-upon payment terms.

- Set Late Fees: Establish clear late payment policies, including late fees or interest, to encourage clients to settle their balances on time.

- Communicate Openly: Maintain open lines of communication with clients, addressing any issues they may have in making the payment, while still emphasizing the importance of timely settlement.

How to Handle Late Payments

Late payments are a common challenge for many businesses, but addressing them effectively is essential to maintaining cash flow and keeping operations running smoothly. When clients fail to pay on time, it’s important to respond in a professional, proactive manner. Handling overdue balances promptly and with clarity can help prevent further delays and preserve your business relationships.

By having a clear strategy in place for managing late payments, you can minimize disruptions to your financial process and maintain professionalism in all interactions with clients.

Steps to Take When Payments Are Late

- Send a Friendly Reminder: Start by sending a polite reminder soon after the payment due date has passed. This can be a gentle nudge to let the client know the payment is overdue without causing any tension.

- Follow Up with a Formal Notice: If no response is received after the initial reminder, send a more formal notice detailing the overdue amount and requesting immediate payment. Clearly outline any late fees or penalties that may apply.

- Offer Flexible Payment Options: In some cases, clients may be experiencing financial difficulties. Offering payment plans or extensions can help resolve the situation while keeping the client satisfied.

- Reassess Terms for Future Transactions: If late payments are a recurring issue, consider adjusting your payment terms for future work, such as requiring deposits or shortening the payment period.

Dealing with Persistent Late Payers

- Set Clear Consequences: Establish clear late payment policies in your service agreement, such as charging interest or suspending services until the outstanding balance is paid.

- Seek Professional Help: If a payment remain

Design Tips for an Effective Invoice

The design of your billing documents plays a significant role in how professional and clear your communication appears to clients. A well-organized and visually appealing document can enhance the client’s understanding of the charges and help foster timely payments. The goal is to create a document that is easy to read, includes all necessary details, and reinforces your brand identity.

By following a few key design principles, you can ensure that your billing statements are both functional and professional, promoting smooth transactions and positive client relationships.

Key Design Elements for Clarity

- Simple Layout: Avoid clutter. A clean, organized layout makes it easier for clients to quickly understand the details. Use sections to separate important information like charges, payment terms, and client details.

- Consistent Branding: Include your company logo, color scheme, and font choices to reinforce your brand identity and make your documents instantly recognizable.

- Readable Fonts: Use easy-to-read fonts for all text, including headings, descriptions, and figures. Avoid overly stylized fonts that may confuse the reader.

- Logical Information Flow: Present information in a logical order: from client and service details to itemized charges and total amounts. This ensures clients can follow the document easily.

Design Features to Improve Client Experience

- Highlight Important Details: Use bold or larger fonts for key information such as the total amount due, payment terms, and due dates. This helps ensure clients don’t miss important details.

- Include Contact Information: Make it easy for clients to contact you for questions or clarifications by including your phone number, email, and business address in a prominent spot.

- Interactive Features: If using digital billing platforms, consider adding clickable links for payments or attachments (e.g., receipts or terms), making it easier for clients to settle their balances online.

- Use Itemized Lists: When detailing services, break down charges line by line. This adds transparency and ensures clients understand the value of each service rendered.

Legal Considerations for Invoicing

When preparing billing documents, it is essential to be aware of the legal aspects that govern transactions and payment terms. Properly structuring these documents not only ensures that you are paid on time but also protects both parties in case of disputes. Understanding the legal requirements of billing, such as including certain terms and complying with tax regulations, is crucial for operating in a lawful and professional manner.

By being mindful of these legal considerations, you can avoid potential legal issues, build trust with your clients, and ensure that your business remains in compliance with relevant laws.

Important Legal Aspects to Include

- Clear Payment Terms: Always specify the agreed-upon payment deadlines, including any late fees or penalties for overdue payments. This ensures both parties are on the same page regarding expectations.

- Legal Business Information: Include your registered business name, tax identification number, and other relevant company details as required by local regulations.

- Tax Compliance: Make sure to include applicable taxes, such as sales tax or VAT, in your billing documents. Ensure that tax rates and amounts are accurate and in line with the laws of your jurisdiction.

- Client Information: Ensure that the billing document includes the client’s full name or company name, address, and contact information for proper identification and correspondence.

Protecting Your Business Legally

- Service Agreement: It’s advisable to have a clear service contract or agreement in place before any work begins. This contract should outline payment terms, the scope of services, and other critical details to avoid misunderstandings.

- Dispute Resolution: Include terms that specify how disputes will be handled, such as whether arbitration or mediation will be used, and where legal proceedings will take place if necessary.

- Record Keeping: Retain copies of all billing documents, contracts, and correspondence for legal protection and to provide evidence in case of a dispute.

How to Automate Invoice Generation

Automating the creation of billing documents can save a significant amount of time and reduce the risk of human error. With the right tools and systems in place, you can streamline the entire process, from generating statements to sending them to clients. Automation ensures that every document is accurate, timely, and consistent, which can enhance both your workflow and customer satisfaction.

By leveraging software solutions or integrated platforms, you can set up automatic triggers that generate and deliver these documents, allowing you to focus on other important aspects of your business.

Steps to Automate Billing Document Creation

- Choose the Right Software: Select a platform that offers automatic generation of billing documents, integrates with your accounting software, and supports customization of your forms.

- Set Up Client Profiles: Create detailed profiles for each client, including their contact details, service preferences, and payment terms. This ensures that each document is personalized and accurate.

- Establish Triggers: Define events that will automatically trigger document creation, such as the completion of a service, the end of a billing cycle, or when a payment is due.

- Automate Delivery: Once your document is generated, configure the system to automatically send it to the client via their preferred communication channel, such as email or an online portal.

Additional Features to Enhance Automation

- Recurring Billing: For clients with ongoing or subscription-based services, set up recurring billing schedules that generate and send statements automatically at regular intervals.

- Payment Reminders: Automate reminders for upcoming or overdue payments to ensure that clients are aware of their financial obligations without you needing to manually follow up.

- Customizable Notifications: Set up notifications that inform you when a document has been sent, viewed, or paid, allowing you to track the status in real-time.

- Integration with Payment Systems: Link your automated billing system with payment processors, so clients can pay directly through the generated documents, simplifying the entire transaction process.

Integrating Billing Documents with Accounting Tools

Connecting your billing system with accounting software can significantly streamline your financial processes. By automating the transfer of payment data and ensuring consistency between your accounts and payment records, you can minimize the risk of errors and improve your overall efficiency. Integration simplifies data entry, helps keep track of outstanding payments, and provides real-time updates on your financial status.

By integrating these systems, you can maintain accurate financial records, avoid double entry, and ensure that both your business and clients are up-to-date with their obligations.

Benefits of Integration

- Automatic Data Sync: Payment information from billing documents can be automatically transferred to your accounting software, ensuring that all records are synchronized without manual input.

- Improved Accuracy: Integration reduces the risk of human error, as there’s no need to enter the same data into multiple systems.

- Time Savings: Automating the data transfer between systems saves time and reduces the administrative workload, freeing you up to focus on other aspects of your business.

- Real-Time Financial Reporting: With integrated systems, you can easily generate up-to-date reports and gain better insight into your financial health.

How to Integrate Billing with Accounting Tools

- Select Compatible Systems: Ensure that your billing software is compatible with your accounting tools. Many platforms offer integrations or have APIs that allow seamless data transfer between systems.

- Set Up Automatic Sync: Configure your system to automatically sync data between your billing and accounting tools. This might include syncing client payment information, dates, and amounts.

- Regularly Monitor Integration: While automation reduces manual tasks, it’s important to periodically check that the integration is functioning properly and data is being transferred accurately.

- Utilize Accounting Features: Take advantage of the additional features offered by your accounting software, such as expense tracking, profit analysis, and tax calculations, to gain a full view of your financial situation.

How to Maintain Accurate Financial Records

Accurate financial recordkeeping is crucial for the smooth operation of any business. It helps you track revenue, expenses, and profits, and ensures compliance with tax regulations. Maintaining organized and up-to-date financial records can prevent costly mistakes and provide valuable insights into the financial health of your business.

By implementing efficient processes and using the right tools, you can simplify the process of managing your financial data, reduce errors, and stay on top of your financial responsibilities.

Key Practices for Keeping Accurate Records

- Regularly Update Records: Make it a habit to record transactions as soon as they occur. This prevents backlog and reduces the chances of overlooking or forgetting important details.

- Use Accounting Software: Invest in reliable accounting software to automate and streamline recordkeeping. These tools can categorize transactions, generate reports, and ensure everything is in order.

- Organize Receipts and Documents: Keep a systematic filing system, whether digital or physical, for all receipts, contracts, and transaction records. This will make it easier to reference and verify information when needed.

- Reconcile Accounts Regularly: Reconcile your records with bank statements and other financial documents on a regular basis. This ensures that there are no discrepancies and helps you identify errors quickly.

Additional Tips for Maintaining Accuracy

- Separate Personal and Business Finances: Open a separate account for your business transactions to avoid mixing personal and professional finances. This simplifies tracking and minimizes errors.

- Stay Consistent with Your Categories: Categorize all income and expenses clearly and consistently. This ensures you can easily track spending and identify trends over time.

- Back Up Your Data: Regularly back up your financial records to avoid losing important information due to technical issues. Use cloud storage or external drives for extra security.

- Consult a Professional: If needed, consult with an accountant or financial advisor to ensure that your records ar