Download Free Cake Invoice Template for Your Bakery

Running a bakery or custom dessert business involves much more than just creating delicious treats. It requires efficient management of orders, payments, and customer relationships. One essential aspect of this is ensuring that your business transactions are clear, professional, and well-organized.

Having a structured way to bill clients not only saves time but also helps maintain accuracy. A well-designed document can serve as both a record of your transactions and a formal request for payment. It also establishes trust with your customers, showing them that your business is both professional and reliable.

In this guide, we will explore how using a ready-made billing document can simplify your financial processes. From customization to best practices, we’ll cover everything you need to know to make your payment system more efficient and effective. Whether you’re just starting out or looking to refine your current methods, these tools are essential for smooth operation.

Why You Need a Billing Document

For any business that handles custom orders and payments, clear and professional documentation is crucial. A well-organized billing system ensures both you and your clients are on the same page regarding charges, payment deadlines, and services rendered. It also helps streamline communication and minimizes the risk of confusion or disputes.

Having a ready-to-use document designed for these transactions not only saves you valuable time but also adds a layer of professionalism to your business operations. It provides a formal structure that outlines all necessary details, from itemized costs to terms and conditions, making it easier for customers to understand what they’re paying for.

Furthermore, using such a document helps keep accurate financial records, which are essential for tax purposes and financial planning. Whether you’re a small business owner or managing a larger operation, consistency in billing is key to maintaining a smooth workflow and positive customer relationships.

Key Features of a Billing Document

When selecting a document for managing transactions, it’s essential that it includes all necessary elements to ensure clarity and professionalism. A well-designed structure ensures that both you and your customers understand the terms of the transaction, while also providing a record for future reference.

Clear Breakdown of Costs

One of the most important aspects is a detailed list of charges. This includes the cost of services, any additional fees, and applicable taxes. Providing an itemized breakdown makes it easier for your clients to see exactly what they are paying for, reducing the likelihood of misunderstandings.

Payment Terms and Deadlines

Equally important is the inclusion of payment terms. A document should specify when payment is due, any applicable late fees, and the accepted payment methods. This ensures that there are no surprises for the customer and helps streamline the financial side of your business.

These essential features ensure that all parties involved are clear on expectations, creating a professional and organized transaction process. By utilizing such a system, you can avoid confusion and maintain smooth, reliable interactions with your clients.

Key Features of a Billing Document

When selecting a document for managing transactions, it’s essential that it includes all necessary elements to ensure clarity and professionalism. A well-designed structure ensures that both you and your customers understand the terms of the transaction, while also providing a record for future reference.

Clear Breakdown of Costs

One of the most important aspects is a detailed list of charges. This includes the cost of services, any additional fees, and applicable taxes. Providing an itemized breakdown makes it easier for your clients to see exactly what they are paying for, reducing the likelihood of misunderstandings.

Payment Terms and Deadlines

Equally important is the inclusion of payment terms. A document should specify when payment is due, any applicable late fees, and the accepted payment methods. This ensures that there are no surprises for the customer and helps streamline the financial side of your business.

These essential features ensure that all parties involved are clear on expectations, creating a professional and organized transaction process. By utilizing such a system, you can avoid confusion and maintain smooth, reliable interactions with your clients.

Benefits of Using a Billing Document

Using a structured document for transactions provides numerous advantages, especially when managing custom orders and payments. It offers clarity for both the business owner and the client, ensuring that all details are properly recorded and agreed upon. Here are some key benefits of using such a system in your business operations:

Professionalism and Trust

- Establishes credibility: A well-organized document shows clients that you are serious about your business and committed to maintaining clear communication.

- Builds trust: By providing detailed records of the services rendered and the costs involved, you show your clients that they are dealing with a reliable professional.

Improved Financial Management

- Accurate record-keeping: A billing document ensures that every transaction is documented, which is crucial for tracking sales and monitoring cash flow.

- Tax and reporting ease: Organized records make tax filing simpler and help keep your financial situation transparent for audits and reports.

With these benefits, implementing such a document not only simplifies the billing process but also helps streamline other aspects of your business, such as inventory management and customer service. By using a consistent and professional approach, you enhance the overall efficiency of your operations and build a positive reputation with your clients.

Essential Information for Billing Documents

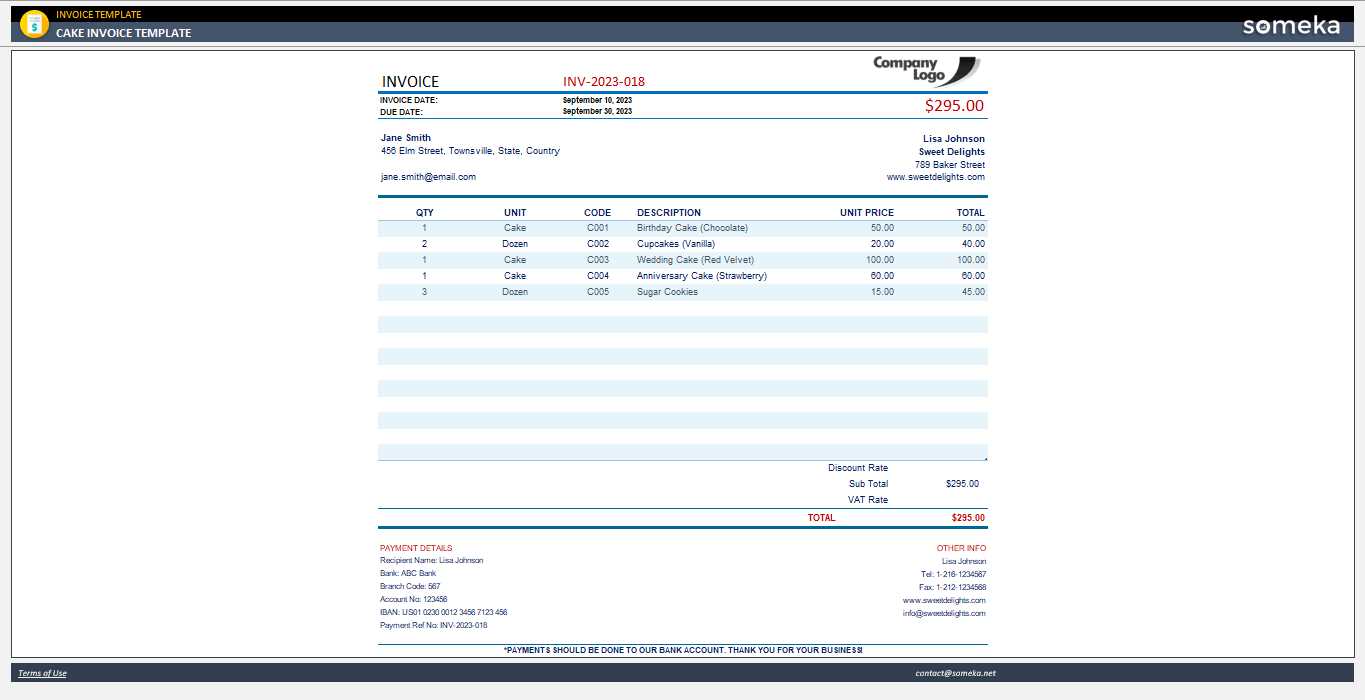

For any business that involves transactions, providing complete and clear details is crucial. A comprehensive billing document ensures that both the service provider and the client have a mutual understanding of what is being offered, the costs involved, and the agreed-upon terms. Here are the key elements that should always be included:

Basic Business Information

- Business Name and Logo: Including your business name and logo helps identify your brand and gives the document a professional touch.

- Contact Details: Ensure your business’s phone number, email address, and physical address are clearly listed for any communication needs.

- Client Information: Include the client’s name, address, and contact details to ensure proper record-keeping and facilitate communication if needed.

Transaction Details

- List of Services or Products: Be sure to include a clear breakdown of what was provided, including quantities and descriptions.

- Prices and Subtotals: Show the cost for each item or service and calculate the subtotal before taxes and discounts.

- Payment Terms: Include the due date, accepted payment methods, and any late fees that may apply if payment is delayed.

These essential elements help avoid confusion and ensure that all parties involved are aware of their responsibilities. By including this information, you can maintain transparency and streamline the entire transaction process, making it easier to manage your finances and customer relationships.

How to Track Orders with Billing Documents

Efficiently managing orders is a vital part of any business. A structured billing document plays a crucial role in keeping track of orders, payments, and delivery statuses. By using a clear system, you can easily monitor each order’s progress and ensure that all payments are processed correctly. Here’s how you can utilize such documents to stay organized:

Track Order Details

- Order Number: Assign a unique number to each order to make it easy to track in your records and avoid confusion.

- Customer Information: Keep all relevant details about the client, such as their name, contact info, and order preferences, linked to each transaction.

- Items Ordered: List every item or service requested, including quantities and any specific customization instructions, to ensure accuracy in fulfilling the order.

Monitor Payment Status

- Payment Due Dates: Include clear payment deadlines to help you track when payments are expected and follow up if necessary.

- Payment Received: Keep track of payments made and confirm if the client has settled their balance.

- Outstanding Amounts: Note any unpaid amounts, including late fees, to ensure they are followed up in a timely manner.

By using these methods, you can stay on top of your orders and ensure smooth financial management. These documents not only provide an organized way to track each transaction but also help maintain clear communication with your clients throughout the process.

Best Practices for Creating Billing Documents

Creating a professional and efficient document for transactions is essential for maintaining a smooth workflow in any business. A well-designed document not only helps ensure that your clients are satisfied with their purchases but also contributes to the overall professionalism of your business. Following a few best practices can make the process more efficient and effective. Here are some tips for creating the most effective billing documents:

Maintain Consistency and Clarity

- Use a Standard Format: Keep the layout simple and consistent for all transactions. A familiar format will help both you and your clients easily understand the document.

- Be Clear and Concise: Avoid unnecessary jargon or complex language. Keep descriptions and terms straightforward, ensuring the client knows exactly what they are being charged for.

- Organize Information Effectively: Present all the essential details in a logical order. Start with contact information, followed by itemized charges, and finish with payment terms and due dates.

Incorporate Customization and Flexibility

- Customize for Each Client: Adjust the document to suit the specific needs of each client. This includes any special requests or customized services, ensuring that the document reflects the unique aspects of their order.

- Include Payment Options: Offer multiple methods of payment to accommodate different preferences. Clearly outline the payment options to make the transaction as convenient as possible for the client.

- A

How to Handle Payments in Billing Documents

Managing payments effectively is a key aspect of running a successful business. A clear and efficient way to handle payments ensures that your clients are well-informed about their obligations, and that your business maintains a steady cash flow. Properly structuring payment details in your documents will help avoid confusion and streamline the transaction process. Here are a few tips for handling payments smoothly:

- Set Clear Payment Terms: Clearly define when payments are due, whether immediately, within a specific number of days, or after delivery. Be transparent about late fees or penalties to prevent misunderstandings.

- Offer Multiple Payment Methods: Provide your clients with various options for paying, such as credit cards, bank transfers, or online payment systems. The more choices you offer, the easier it will be for clients to complete their transactions.

- Track Payment Status: Keep a detailed record of payments, including the date received and the amount. This will help you monitor outstanding balances and avoid any missed payments.

- Confirm Payments: Once a payment has been made, promptly acknowledge it with a receipt or confirmation. This reassures clients that their transaction is complete and ensures that there are no discrepancies.

By incorporating these practices, you ensure that payments are handled professionally and efficiently, keeping your business operations running smoothly and fostering positive relationships with your clients.

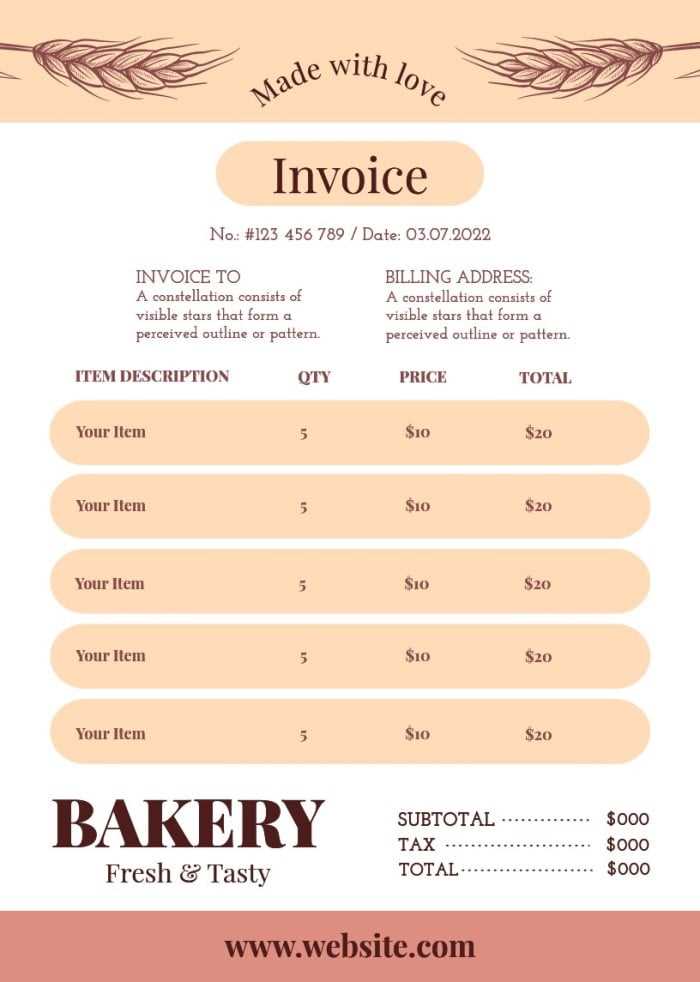

Design Tips for Professional Billing Documents

The appearance of your billing document plays an important role in how your business is perceived. A well-designed document not only looks more professional but also helps improve clarity and organization, making it easier for clients to understand the details of their transactions. Here are some design tips to ensure your documents leave a positive impression:

- Keep it Simple and Clean: Avoid clutter by using ample white space. A clean, uncluttered design makes the document easier to read and gives it a polished, professional look.

- Use Your Brand Colors and Logo: Incorporate your business’s branding elements, such as colors and logo, to make the document visually cohesive with your overall brand identity.

- Readable Fonts: Choose fonts that are easy to read, such as sans-serif styles. Make sure the text is large enough to be legible, with clear headings to separate different sections.

- Organize Information Clearly: Break down the content into logical sections, such as client details, services or products provided, costs, and payment terms. Use bullet points or tables to structure the information neatly.

- Highlight Important Details: Use bold or colored text for key information, such as payment due dates or total amounts, to make sure these details stand out and are easily noticed.

By following these design tips, you can create a billing document that not only looks professional but also ensures that all relevant information is easily accessible and clearly communicated to your clients.

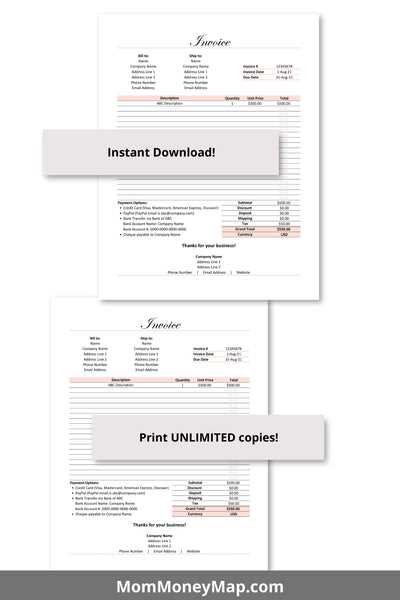

Free Billing Documents to Download

If you’re looking for a simple way to create professional transaction records without starting from scratch, downloadable documents can save you time and effort. These ready-made documents are designed to help you streamline the process and ensure that all necessary details are included. Here’s how you can benefit from using free downloadable documents for your business:

- Convenience: Downloadable files allow you to quickly access pre-formatted designs that are ready to use. You don’t need to spend time creating a document from the ground up.

- Customization: Many of these files are fully editable, so you can personalize them to suit your specific needs, including adding your branding, adjusting fields, or changing the layout.

- Professional Design: These documents are designed with professionalism in mind, ensuring that your transaction records look clean, clear, and organized.

- Free Access: A variety of high-quality documents are available at no cost, allowing you to get started immediately without any financial commitment.

By utilizing these free downloads, you can create effective and professional records for your business in just a few clicks. They help save time while ensuring that every transaction is documented properly, which is essential for maintaining transparency and organization.

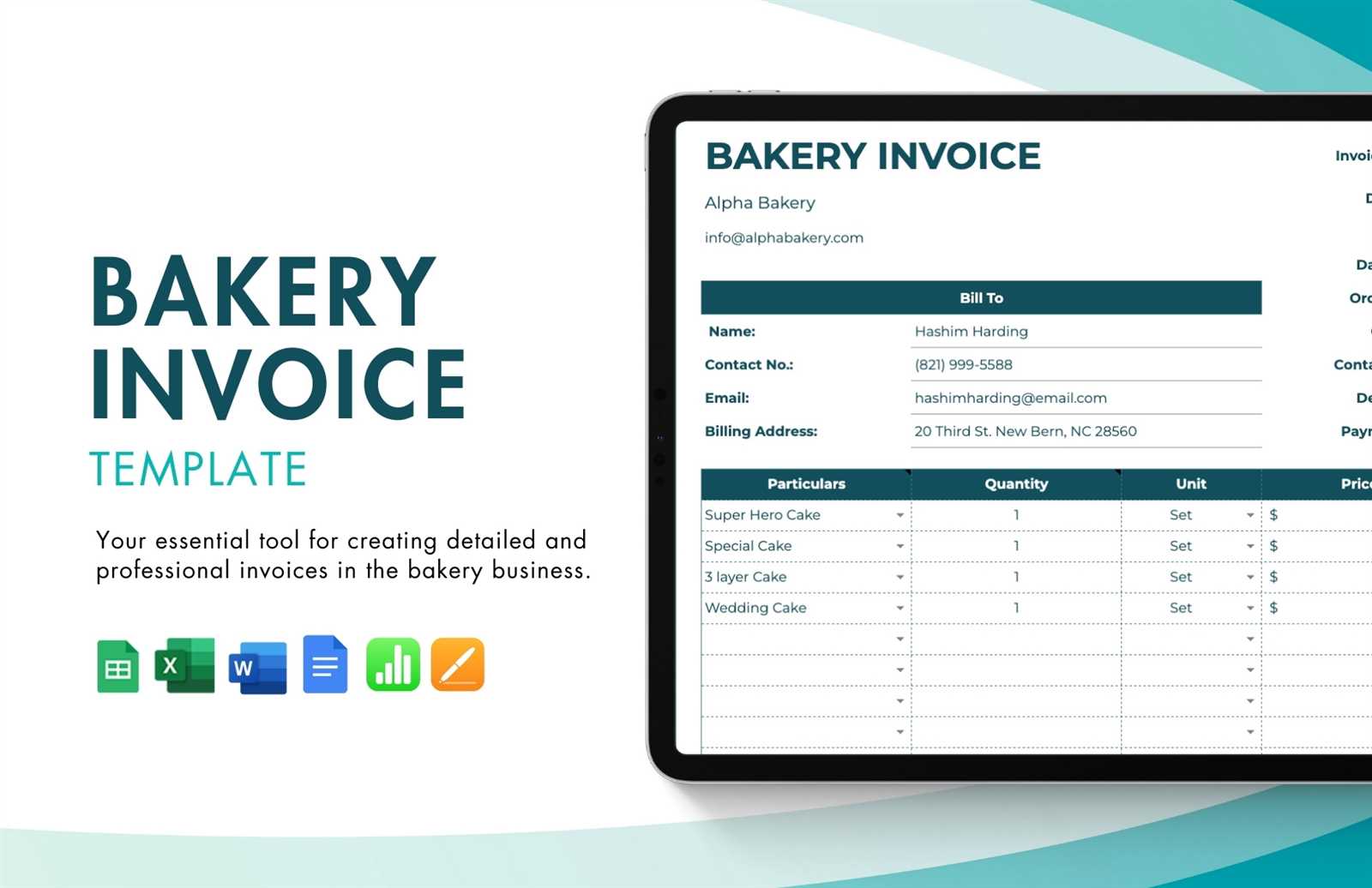

Top Software for Billing Documents

Using the right software can make managing transactions, payments, and records much more efficient. With the right tools, you can automate many aspects of your workflow, ensuring accuracy and saving valuable time. Below are some of the top software options for creating and managing billing records in your business:

1. QuickBooks

QuickBooks is one of the most popular choices for small business owners. It offers a comprehensive suite of features, including customizable billing documents, easy tracking of payments, and detailed financial reports. QuickBooks is especially useful for businesses that need to manage not only billing but also accounting, payroll, and expenses.

2. FreshBooks

FreshBooks is an excellent option for small businesses and freelancers. It provides a user-friendly interface with options to create customized transaction records, track time, and manage payments. FreshBooks also integrates seamlessly with many payment platforms, making it easy to collect payments online.

3. Wave

Wave is a free software solution that is perfect for small businesses. It offers invoicing, accounting, and receipt scanning features all in one. Wave’s billing functionality is simple yet effective, with customizable fields and automatic payment reminders.

4. Zoho Books

Zoho Books is a powerful accounting tool that also includes easy-to-use billing features. With Zoho, you can create detailed transaction records, track expenses, and set up automated reminders for clients. It is ideal for businesses that require both financial management and customer relationship management (CRM) in one platform.

Choosing the right software depends on your business’s specific needs. These options provide various features that can help you streamline your billing processes, keep track of payments, and improve your overal

Common Mistakes to Avoid in Billing Documents

While creating billing records may seem straightforward, there are several common errors that can cause confusion, delay payments, or even harm your business’s reputation. It’s important to be mindful of these mistakes and ensure that each document is accurate, clear, and professional. Here are some of the most frequent issues to watch out for:

- Missing or Incorrect Contact Information: Always double-check that both your details and the client’s contact information are correct. Incorrect addresses or phone numbers can cause delays or missed communications, especially if follow-ups are necessary.

- Not Including a Unique Reference Number: Each transaction should have a unique reference number for easy identification and tracking. Failing to include this makes it difficult to follow up or reference a specific order later.

- Omitting Payment Terms: Clearly outline the due date for payment and any applicable late fees. If these are left out, clients may not be aware of their obligations, leading to delayed or missed payments.

- Inaccurate or Vague Descriptions: Avoid vague descriptions like “Miscellaneous services” or “Other.” Instead, provide detailed itemized lists of goods or services, so the client knows exactly what they are being charged for.

- Not Double-Checking Totals and Calculations: Mathematical errors can lead to incorrect totals, which may damage your credibility. Always double-check calculations for accuracy before sending out any document.

- Failure to Include Payment Methods: Be sure to include information on how clients can pay (e.g., bank transfer, credit card, online payments). Without this detail, clients may be unsure of how to settle their bills.

By avoiding these common mistakes, you can ensure that your billing process is smooth, professional, and efficient, helping you maintain p

How to Save Time with Pre-made Documents

Using pre-designed documents can drastically reduce the time spent on administrative tasks. By having a ready-to-use structure, you eliminate the need to recreate the same content over and over again. This allows you to focus more on delivering your services or products while ensuring all necessary details are included in each transaction record. Here’s how pre-made documents can save you time:

- Eliminate Repetitive Work: With a pre-designed structure, you only need to fill in the unique details for each transaction, such as client information, services provided, and amounts due. This saves you from starting from scratch every time.

- Reduce Errors: Using a standard format helps minimize the risk of omitting important details or making mistakes in calculations, as the structure is already established and tested.

- Increase Consistency: Having a consistent format for all your documents ensures that you maintain a professional appearance across all transactions. It also makes it easier for your clients to understand and reference past records.

- Speed up Client Communication: Pre-designed documents allow you to quickly send out billing records, which helps maintain efficient communication with clients and reduces delays in payment processing.

By incorporating pre-made documents into your workflow, you can save valuable time, reduce the chance for mistakes, and keep your business running smoothly and professionally.

Legal Aspects of Billing Documents

When creating billing documents, it’s important to consider the legal requirements that ensure both your business and your clients are protected. A properly structured document not only serves as a record of the transaction but also has legal implications, especially in the event of a dispute or audit. Below are some key legal aspects to keep in mind when preparing billing records:

- Accurate Business Information: Always include your full business name, address, and registration details. This ensures that your documents are legitimate and can be traced back to your business in case of legal inquiries.

- Clear Payment Terms: Clearly outline the payment due date, any interest on late payments, and applicable penalties. This protects both parties by establishing the terms of payment upfront and helps avoid misunderstandings later.

- Tax Compliance: Depending on your location and industry, there may be specific tax rules that apply to your billing documents. Include applicable tax rates and make sure your calculations comply with local tax laws to avoid penalties.

- Proof of Transaction: Your document acts as proof of the exchange between you and the client. Ensure that all relevant details–such as services rendered, products sold, and agreed-upon prices–are accurately listed to avoid future legal complications.

- Record Keeping: Legally, businesses are often required to retain billing documents for a certain period (e.g., 5-7 years) for tax purposes. Ensure that you maintain an organized system for storing these documents for future reference.

By paying attention to these legal considerations, you can ensure that your billing practices are compliant with the law and that your business is protected in case of any di

How Billing Documents Improve Customer Relations

Creating well-structured and professional billing records can have a positive impact on your relationship with clients. Clear, accurate, and timely documentation helps build trust and fosters a sense of professionalism that enhances customer satisfaction. Here’s how these documents can strengthen your client relationships:

- Transparency: Providing clear and detailed transaction records ensures that customers understand exactly what they are paying for. This reduces misunderstandings and demonstrates honesty in your business practices.

- Timely Communication: Sending prompt billing statements helps clients stay on top of payments, which builds a sense of reliability and trust. It shows that you are organized and that their time and business are valued.

- Professionalism: A professionally designed record reflects well on your business and helps you stand out. Clients appreciate working with companies that maintain high standards of professionalism, and well-crafted documents contribute to that image.

- Convenience: Offering easy-to-understand and accessible billing documents (such as digital versions) makes the process convenient for your clients. When clients don’t need to spend time deciphering complex or unclear records, it enhances their overall experience with your business.

- Easy Payment Tracking: Detailed records help customers keep track of their transactions. This not only ensures that payments are made on time but also strengthens the sense of reliability and accountability in your business relationship.

By maintaining clear, professional, and transparent billing practices, you can improve the overall experience for your clients, helping to foster trust, satisfaction, and loyalty over time.

Tips for Streamlining Billing Management

Managing transaction records can become overwhelming as your business grows, but with the right strategies in place, you can simplify the process and increase efficiency. Streamlining your management system helps you stay organized, save time, and reduce errors. Here are some practical tips to improve the way you handle billing records:

1. Automate Repetitive Tasks

- Use Accounting Software: Invest in reliable software that automates the creation, tracking, and sending of transaction records. This reduces the need for manual entry and minimizes the risk of errors.

- Set Up Recurring Transactions: For clients who make regular payments, set up recurring billing to save time and ensure that you don’t miss any payments.

2. Organize and Categorize Records

- Use a Centralized System: Store all your billing documents in one place, whether in a cloud-based system or a physical filing system. This allows for quick access and prevents documents from getting lost or misplaced.

- Tag and Label Documents: Implement a labeling or tagging system to categorize records by client, date, or service. This helps you retrieve specific information more efficiently when needed.

3. Stay Consistent

- Standardize Formats: Use a consistent layout and design for all your billing documents. This reduces confusion and allows both you and your clients to quickly navigate the key details.

- Define Clear Terms: Always include the same terms in each document, such as payment methods, due dates, and any late fees. Consistency helps clients un

How to Print and Share Your Billing Document

Once you’ve created a billing record, it’s important to ensure that it is easily accessible and shareable with your clients. Whether you prefer to send a hard copy or share a digital version, knowing how to print and distribute the document properly is key to maintaining a smooth workflow. Here are the steps you can follow to print and share your document:

1. Printing Your Billing Document

Before printing, review the document for any errors or missing information. Once everything is correct, follow these steps:

- Ensure your printer settings are configured to print in high quality.

- Check that the paper size is correct and matches your document layout.

- If your document contains multiple pages, ensure that they are properly formatted and aligned for consistent readability.

2. Sharing Your Document Digitally

Sharing your document electronically is a fast and efficient way to ensure clients receive it promptly. You can send your billing records via email or through a secure online platform. Follow these steps:

- Email: Save your document as a PDF or other common file type and attach it to an email. Make sure the subject line is clear (e.g., “Billing Record for [Client Name]”) and that you include a brief message explaining the document.

- Online Platforms: Use secure platforms or cloud storage services to share the document. These platforms allow for easy access and tracking of your shared files.

3. Sample Layout for Easy Reference

Here’s a quick reference table to help you understand the key sections of a typical billing document:

Section Description Client Information Includes the client’s name, address, and contact details. Transaction Details A detailed list of the products or services provided, with quantities and prices. Payment Terms Specifies the payment due date, amount, and any applicable fees. Payment Instructions Details on how and where the client can make the payment. By following these steps, you can ensure that your billing records are printed or shared efficiently, maintaining a professional image and promoting timely payment from your clients.