Proforma Invoice Template for Canada Businesses

In the world of business, accurate and efficient documentation is crucial for smooth transactions. One essential document often used in trade is a preliminary statement outlining goods or services before the final agreement. This document helps both parties confirm the terms of the deal, including pricing, quantity, and delivery details, ensuring clarity and avoiding potential misunderstandings.

When dealing with domestic or international trade, having a reliable structure for these documents can save time and effort. Tailoring such documents to specific needs allows for flexibility while maintaining consistency in the details. These records are not legally binding like formal contracts, but they serve as a clear reference for both parties.

Whether you’re an entrepreneur or a large corporation, mastering the creation and use of these preliminary statements can enhance operational efficiency. A well-structured document can help ensure accuracy in all future steps, from shipping to invoicing, and can contribute to smoother business operations.

Proforma Invoice Template Overview

In business transactions, it’s essential to have a clear and structured document that outlines the specifics of a deal before finalizing it. This preliminary document acts as a proposal that lists the items or services, their quantities, and the agreed-upon price. It provides both the seller and the buyer with a reference point, offering transparency and ensuring mutual understanding of the terms.

Key Features of a Preliminary Document

One of the most important aspects of such a record is the clarity it brings to the transaction. A properly structured record will include essential details such as product descriptions, quantities, pricing, and delivery schedules. It also serves as a confirmation that both parties are on the same page before moving forward with the actual sale or shipment.

Why Use This Document in Business Deals

For businesses engaged in both local and international trade, these documents help avoid confusion or disputes later in the process. While it is not a legally binding contract, it serves as an initial understanding between parties. Using a well-prepared record allows businesses to stay organized and minimizes risks that could arise from unclear agreements.

Importance of Proforma Invoices for Businesses

In any business transaction, clear communication and documentation play a critical role in preventing misunderstandings. A preliminary document outlining the terms of a deal provides both parties with a detailed overview before finalizing the transaction. This practice helps in establishing mutual expectations and reduces the likelihood of disputes later on.

Enhancing Transparency in Business Transactions

These documents serve as a tool to ensure both the seller and the buyer are aligned on the goods or services being exchanged. They provide a clear list of what is being offered, the agreed-upon costs, and expected delivery dates. Having this information in writing reduces the chances of miscommunication and ensures that all terms are understood by both parties. Transparency in business dealings fosters trust and confidence, which is essential for long-term relationships.

Risk Reduction and Financial Planning

Using these documents effectively also mitigates financial risks. For businesses engaged in international trade, it ensures compliance with customs regulations and can streamline the shipping process. By confirming the terms early on, companies can better plan for expenses, taxes, and potential delays. This kind of advanced clarity helps organizations stay organized and financially prepared throughout the course of a transaction.

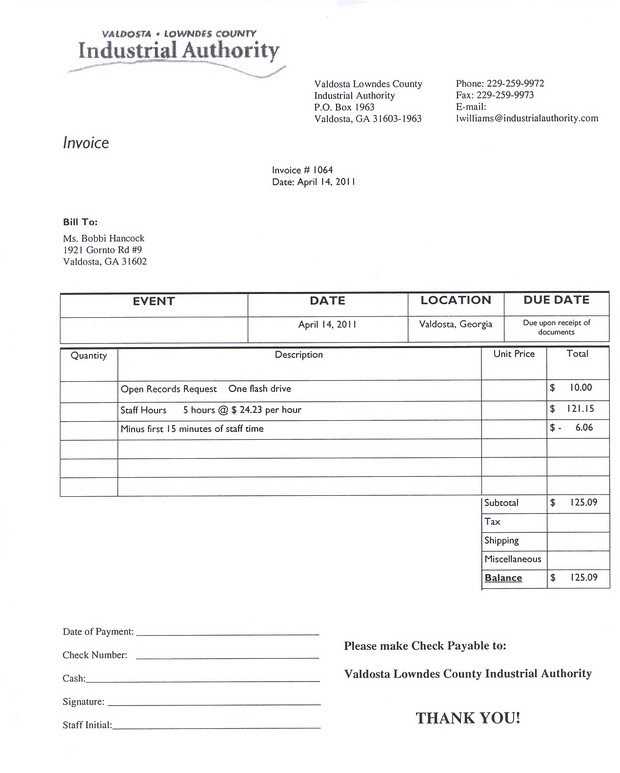

Key Elements of a Proforma Invoice

When creating a preliminary document for a business transaction, certain details must be included to ensure clarity and prevent misunderstandings. This document serves as an initial agreement between parties, outlining the main aspects of the deal before it is finalized. It includes crucial information that helps both the buyer and the seller confirm their understanding of the terms of the transaction.

Basic Information and Contact Details

One of the first elements to include is the contact information of both the seller and the buyer. This typically consists of names, addresses, and phone numbers, ensuring that both parties can easily communicate if necessary. Including accurate details about both companies helps establish legitimacy and makes it easier to address any issues that may arise during the process.

Product Description, Quantities, and Pricing

The most important part of the document is the itemized list of goods or services being exchanged. Each product or service should be described clearly, with specific quantities, unit prices, and total costs for each item. This section ensures that both parties agree on what is being sold, how much is being purchased, and the total financial commitment involved. Providing this level of detail helps avoid confusion or disputes down the line.

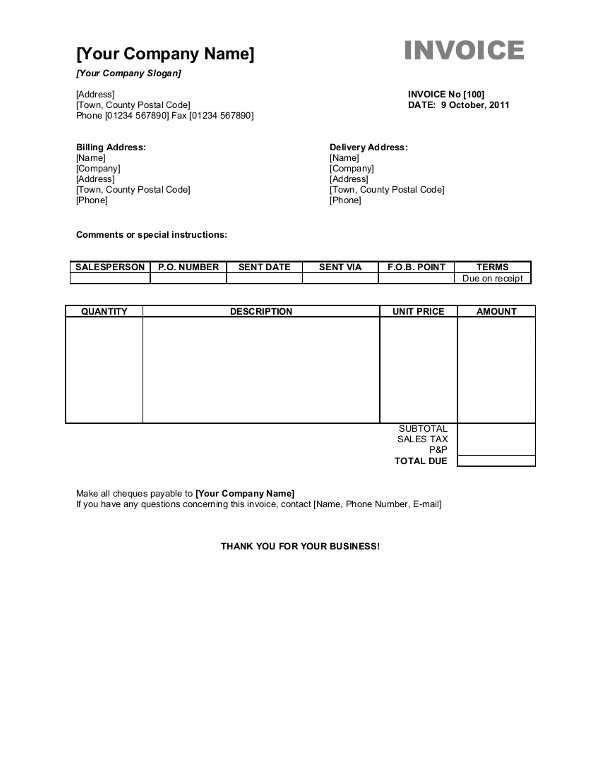

How to Create a Proforma Invoice

Creating a preliminary business document involves following a clear structure to ensure accuracy and consistency. The process requires attention to detail, as this record serves as a reference point before finalizing a sale. Below is a step-by-step guide to crafting a well-organized document that outlines all essential terms of the transaction.

Step-by-Step Guide

Follow these steps to create an effective document:

- Start with Basic Information: Include the names, addresses, and contact information of both the seller and the buyer. This ensures clarity and facilitates communication.

- List of Products or Services: Provide a detailed description of each item, including quantity, unit price, and any relevant specifications. Make sure all information is clear and unambiguous.

- Specify Terms and Conditions: Outline payment terms, delivery schedules, and any other relevant details. This helps set expectations for both parties.

- Calculate Total Costs: Include a breakdown of the total cost for each item, along with the overall amount due. This should be clear and easy to understand.

- Include a Reference Number: Assign a unique reference number to the document for tracking purposes and easy future reference.

- Review and Finalize: Ensure that all details are accurate before sending. Double-check for any errors that could lead to confusion or disputes later.

Additional Tips

- Always use a professional layout that reflects your business’s standards.

- Consider using specialized software or online tools to streamline the process and avoid mistakes.

- Make sure to communicate any changes in pricing or terms promptly to avoid misunderstandings.

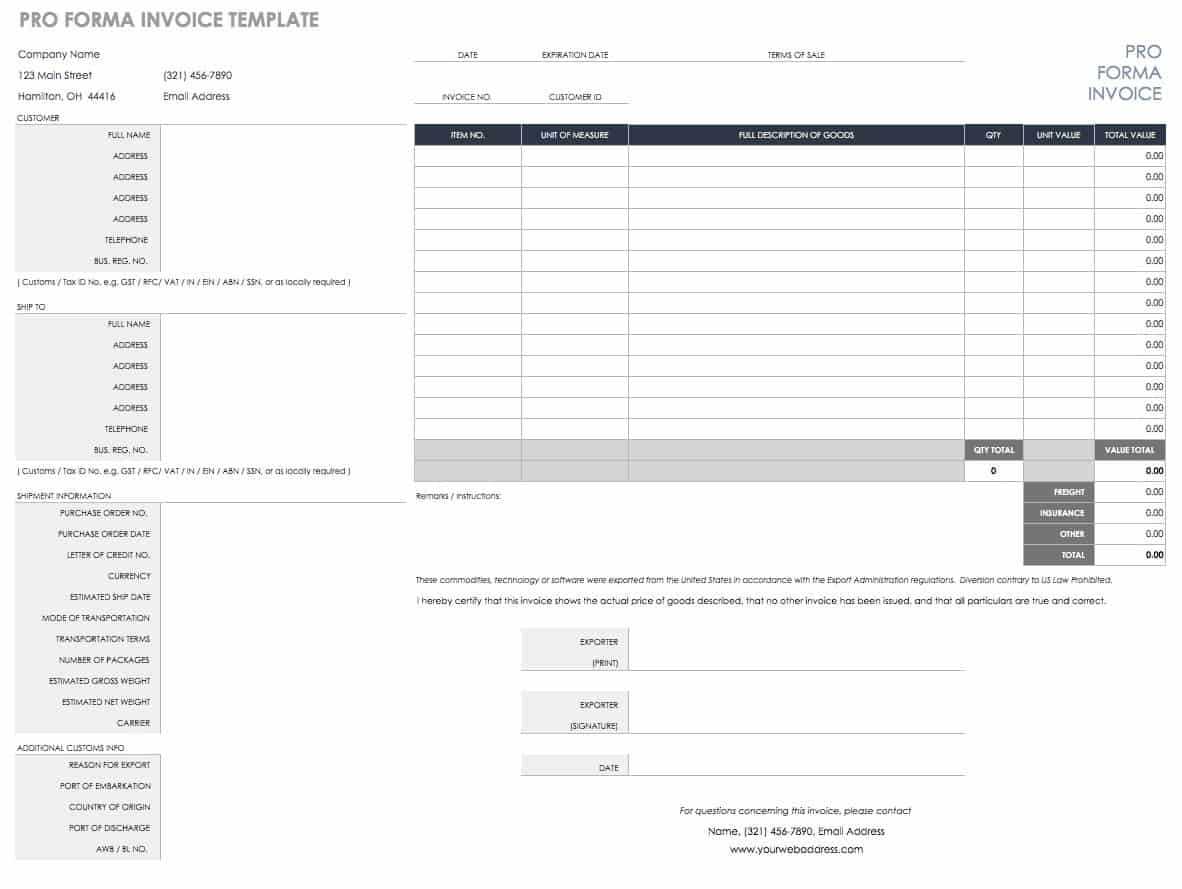

Legal Requirements for Proforma Invoices in Canada

When creating a preliminary document for a business transaction, it’s important to ensure that it aligns with legal standards. While this type of document is not a legally binding contract, it must still meet certain regulatory requirements, especially in terms of transparency, accuracy, and information provided to both parties. Understanding these requirements helps ensure compliance and smooth processing of transactions, particularly when dealing with customs or international trade.

Essential Legal Information

There are specific elements that should be included in any such document to ensure that it meets the necessary legal criteria. Below is a table summarizing the key information that must be present:

| Required Element | Description | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Seller and Buyer Details | Names, addresses, and contact information of both parties to establish identity and facilitate communication. | ||||||||||||||||||||||||||||||||||||

| Detailed Description of Goods or Services | Clear information about each product or service, including quantity, unit price, and any specifications or terms. | ||||||||||||||||||||||||||||||||||||

| Payment Terms | Details on the agreed method of payment, including deadlines and any applicable taxes or fees. | ||||||||||||||||||||||||||||||||||||

| Delivery Information | Delivery terms, including expected dates, shipping methods, and related costs. | ||||||||||||||||||||||||||||||||||||

| Reference Number | A unique number for tracking and identifying the transaction for future reference. | ||||||||||||||||||||||||||||||||||||

| Legal Disclaimer | A note indicat

Common Mistakes in Proforma InvoicesWhen preparing preliminary business documents, small errors can lead to significant issues down the line. These documents are meant to outline the terms of a transaction before it is finalized, but any inaccuracies can cause confusion, delay the process, or even result in financial disputes. Below are some of the most common mistakes to watch out for when creating these records. Frequent Errors to AvoidBelow is a table summarizing common mistakes and their potential consequences:

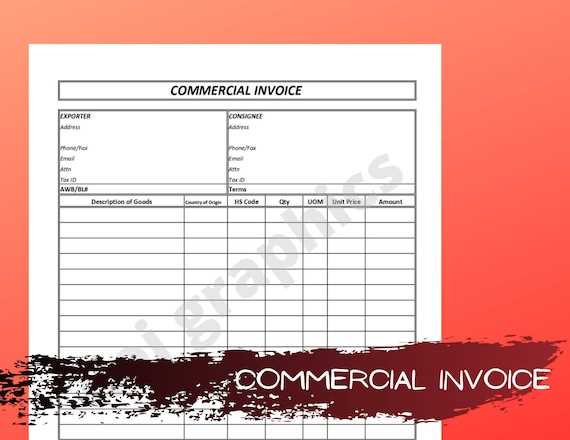

By carefully reviewing the document and avoiding these common mistakes, businesses can ensure that all terms are clearly communicated and that both parties are satisfied with the agreement. Double-checking the details is essential for maintaining professionalism and ensuring smooth transactions. Benefits of Using Proforma InvoicesUtilizing a preliminary document in business transactions offers numerous advantages for both the seller and the buyer. It serves as a crucial step before the actual sale, allowing both parties to review and confirm the details of the deal. The main benefits of using such a document include enhanced clarity, reduced risks, and better financial planning. Improved Communication and TransparencyOne of the most significant advantages of this document is that it fosters clear communication between all parties involved. By outlining all the terms of the deal–such as product descriptions, prices, and delivery timelines–both the buyer and seller can verify that there are no misunderstandings. This ensures that each party is aligned on the expectations, reducing the chance of disputes or confusion later in the transaction process. Financial Planning and Risk MitigationFor businesses, using such a document helps with financial forecasting and ensures that there are no surprises. It provides a breakdown of all costs, which helps in budgeting and setting aside funds for the upcoming transaction. It also allows companies to identify potential issues early on, such as pricing errors or logistical concerns, minimizing risks associated with unplanned expenses or delays. Incorporating this kind of document into the process streamlines the transaction and builds trust between parties, setting the stage for a successful business relationship. Proforma vs Commercial Invoice DifferencesWhile both types of business documents play a critical role in the transaction process, they serve distinct purposes and are used at different stages of a deal. Understanding the key differences between these two records is essential for businesses to ensure compliance and efficiency in their financial dealings. The primary difference lies in the nature of the document. A preliminary document is used before the final sale is confirmed. It outlines the intended terms, but it does not represent a final agreement. On the other hand, a commercial document is issued after the sale is completed and reflects the final transaction, including taxes and payment details. It serves as an official request for payment and can be used for customs clearance in international trade. Another important distinction is in their legal implications. While the preliminary document is not a binding contract, the commercial document serves as an official record of the sale, which can be used to resolve disputes or for financial and tax purposes. Understanding when and how to use each of these documents ensures that businesses operate smoothly and within the bounds of the law. Customizing Your Proforma Invoice TemplatePersonalizing your preliminary business document allows you to reflect your brand, streamline your processes, and ensure all necessary information is clearly presented. Customization ensures that the document aligns with your specific business needs while maintaining a professional appearance. Tailoring the format and layout not only improves readability but also helps your clients understand the terms more easily. To begin with, consider adjusting the layout and design to match your company’s branding. This includes incorporating your logo, adjusting font styles, and choosing colors that align with your brand’s visual identity. A well-designed document makes a lasting impression and adds a layer of professionalism to your communication. Next, review the content fields to ensure that all necessary information is included. For example, ensure that your company’s contact information, terms of payment, delivery details, and item descriptions are prominently displayed. By adding custom fields specific to your business or industry, you can make sure the document serves all necessary functions while providing clear instructions for the transaction. Lastly, updating your document regularly is key. As your business evolves, so should the documents you use. Stay on top of any changes in tax rates, delivery terms, or company policies to make sure the preliminary document remains accurate and relevant. Using Proforma Invoices for International TradeIn international transactions, providing clear and comprehensive documentation is essential for smooth operations. A preliminary business document is often used in the initial stages of an international sale to outline the agreed terms before the final transaction. It plays a crucial role in securing trust between parties and ensuring compliance with customs regulations and trade laws. Benefits for International TradeWhen used in global transactions, this document helps mitigate risks and clarify the terms for both the buyer and the seller. Here are the key advantages:

Key Considerations for Global TransactionsFor international trade, it’s important to tailor the document to include the following details:

By using this document effectively, businesses can ensure smoother and more secure international trade transactions while minimizing confusion and preventing costly mistakes. Proforma Invoice Templates for Different IndustriesEvery industry has unique needs and requirements when it comes to initial business documents. Tailoring the structure and details of these records ensures that businesses can clearly outline their transactions while adhering to industry-specific standards. Whether you’re in manufacturing, retail, or services, customizing the document to fit your sector can streamline processes and prevent misunderstandings. Different industries require varying details and formats for their preliminary documents. Below is an overview of the typical customizations needed across various sectors:

By customizing your document to meet the specific requirements of your industry, you can create a more efficient and transparent process for both parties involved. This not only improves the overall transaction but also builds trust with your clients and partners. How to Issue a Proforma Invoice Properly

Issuing a preliminary business document correctly is essential for maintaining clarity and professionalism in your transactions. This document serves as a formal declaration of the expected terms of a deal, outlining product or service details, pricing, and delivery schedules. Properly issuing this document ensures transparency and helps avoid misunderstandings between the buyer and seller. To issue the document accurately, follow these key steps:

Once the document is finalized, ensure it is sent in a timely manner to the recipient, and keep a copy for your records. Proper documentation not only facilitates smoother transactions but also promotes trust and reliability with clients and partners. Best Software for Proforma Invoice CreationCreating accurate and professional business documents is essential for streamlining transactions and ensuring clarity between businesses and clients. Using the right software can significantly enhance the efficiency and accuracy of these records. With the right tool, businesses can automate the process, maintain consistency, and avoid errors in their documentation. Below are some of the best software options available to assist in generating professional documents for your business: 1. FreshBooks

2. QuickBooks

3. Zoho Invoice

4. Wave

5. Invoice2go

By using one of these software solutions, you can ensure that your documents are created quickly, accurately, and professionally. These tools not only save time but also help maintain consistency and complian Formatting Tips for Proforma InvoicesEnsuring your business documentation is both clear and professional is essential for maintaining a positive relationship with clients and partners. The formatting of your business documents plays a significant role in how your company is perceived. A well-structured document not only ensures that important information is easily accessible but also minimizes the risk of errors or confusion. Here are some formatting tips to help you create polished, easy-to-read documents:

By following these formatting guidelines, you can create clear, well-organized documents that will not only enhance your professional image but also improve communication with your clients and suppliers. Proforma Invoice Templates for Canadian EntrepreneursFor entrepreneurs in Canada, ensuring the smooth operation of their business transactions is crucial. A well-designed document for outlining expected payments helps establish trust and clarity between businesses and clients. These documents are essential for managing pre-sale agreements, providing customers with a clear understanding of the product or service details, pricing, and other critical terms. When creating such documents, Canadian business owners should focus on several key elements to ensure compliance with local regulations while maintaining professionalism:

By customizing your business documents to reflect both local standards and international expectations, you can streamline your business operations and build lasting relationships with clients and partners. Using the right tools to create these documents will help you maintain consistency and ensure all necessary information is included in every transaction. Managing Proforma Invoices in CanadaEffectively managing financial documents for your business is crucial to maintaining smooth transactions and ensuring that all parties involved have a clear understanding of the terms. For businesses operating in Canada, it’s important to streamline the process of creating, issuing, and tracking these documents to ensure clarity, compliance, and accurate record-keeping. When managing these types of documents, consider the following best practices:

By managing these documents effectively, you can streamline your business operations, reduce errors, and improve client relationships. Proper management also ensures that your business remains compliant with local laws and maintains a professional image with clients, whether domestic or international. Understanding Proforma Invoice for Customs ProceduresWhen dealing with international shipments, one of the key documents required for customs clearance is a financial document that outlines the details of the goods being exported or imported. This document helps customs authorities assess duties, taxes, and compliance with local and international trade regulations. Understanding how to prepare and use this document correctly is essential for businesses involved in cross-border trade. Here are some important points to consider when using this type of document for customs procedures: Key Information Required

How This Document Helps with Customs ClearanceThis document plays a crucial role in expediting the clearance process by providing customs authorities with the information they need to assess the shipment’s value, classification, and duty obligations. Without accurate and detailed information, customs clearance can be delayed, resulting in additional costs and time. Proper documentation ensures smoother and faster processing, helping businesses avoid penalties and keep shipments on track. By understanding how to properly prepare this document, businesses can facilitate smoother cross-border transactions and minimize delays during customs procedures. |