Gym Membership Invoice Template for Easy Billing and Management

Running a fitness facility requires efficient and accurate financial management. One crucial aspect of this is ensuring that clients are billed correctly for their services, whether for a monthly plan, personal training sessions, or additional offerings. A well-organized billing document helps keep track of payments, prevents errors, and enhances professionalism. It also provides clients with clear details about the services they’ve received and the amounts due, fostering trust and transparency.

Having a ready-made structure to customize for each client can save time and reduce the chances of mistakes. A structured approach to billing also makes it easier to maintain consistent communication with your customers and stay on top of overdue payments. Additionally, offering a clean and professional-looking receipt makes a positive impression, reinforcing the reliability of your business.

In this guide, we will explore how to create an effective and customizable billing document for your clients. Whether you’re managing individual memberships or group packages, the right format can streamline your operations and improve your customer relations.

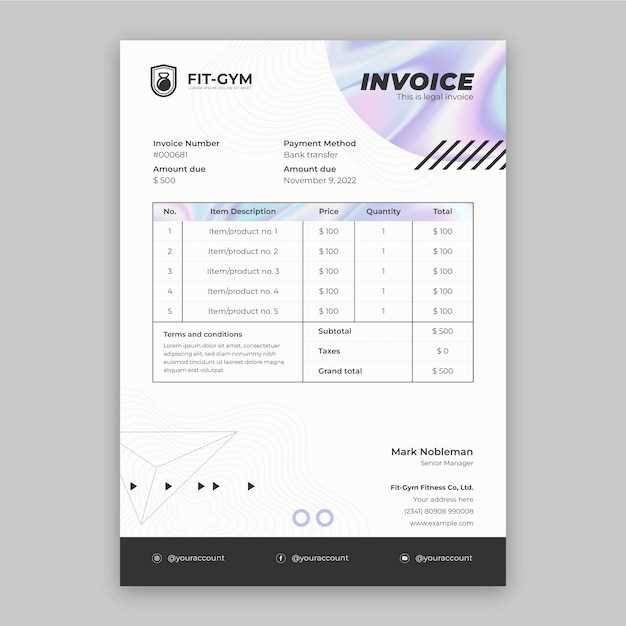

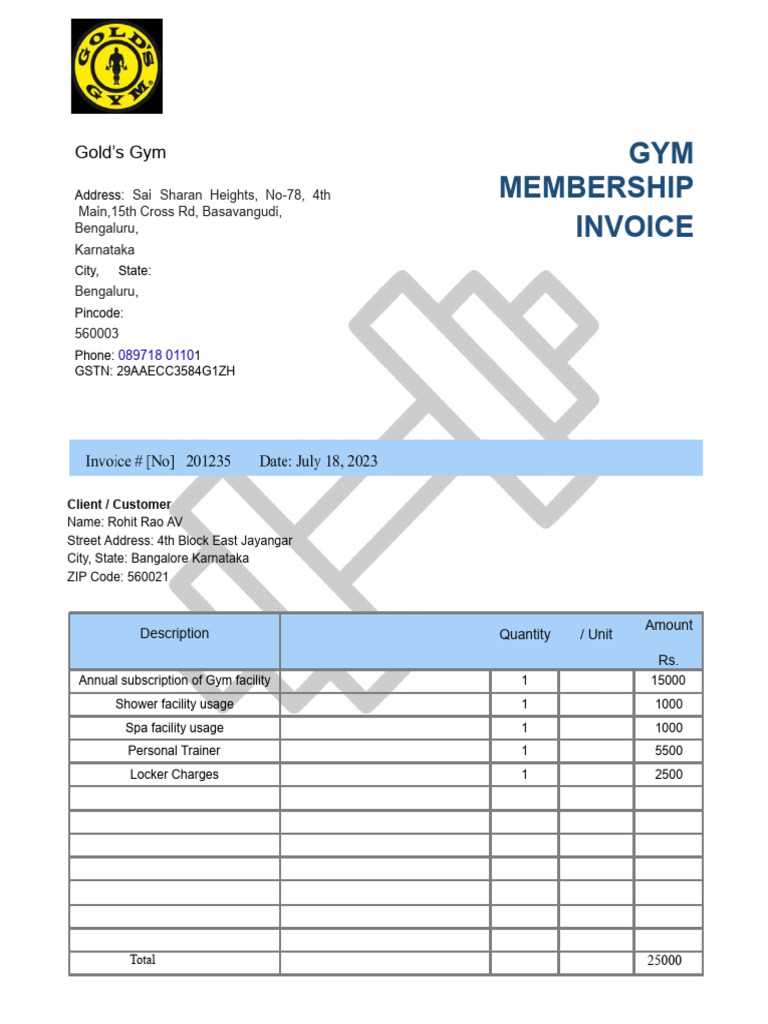

Gym Membership Invoice Template Overview

Managing payments efficiently is an essential part of running any fitness business. A well-structured billing document not only simplifies the payment process but also ensures clarity and consistency between the business and its clients. This document serves as a formal record of the services provided and the amount due, offering both the client and business a clear understanding of the transaction.

With a properly designed format, it’s possible to include key details such as the services offered, payment terms, and the due date. This organized approach helps avoid confusion, reduces administrative work, and enhances the overall experience for both the business owner and the customer. Additionally, an easy-to-follow format contributes to better financial tracking and more efficient management of client accounts.

In the following sections, we will break down the elements of a well-crafted payment document, discuss the various types of details to include, and explore the advantages of using a customizable format for diverse client needs.

Why You Need an Invoice Template

Having a standardized method for documenting payments and services is essential for any business. It simplifies the process of recording transactions, ensuring that all relevant information is captured accurately and consistently. With a ready-made document structure, you eliminate the need to start from scratch each time a new transaction occurs, making your workflow more efficient and reducing the likelihood of mistakes.

Save Time and Increase Efficiency

By using a pre-designed format, you can quickly input client details and services rendered, which streamlines your administrative tasks. This approach saves valuable time, especially when managing multiple clients or handling recurring payments. With a consistent format, you can easily track outstanding balances and maintain a clear overview of your finances without additional effort.

Enhance Professionalism and Transparency

A clear and well-organized document not only improves internal operations but also fosters trust with your clients. When clients receive a detailed and professional-looking record of their payments, it reinforces the reliability of your business. Transparency regarding payment amounts, dates, and services provided helps build long-term relationships and reduces potential misunderstandings.

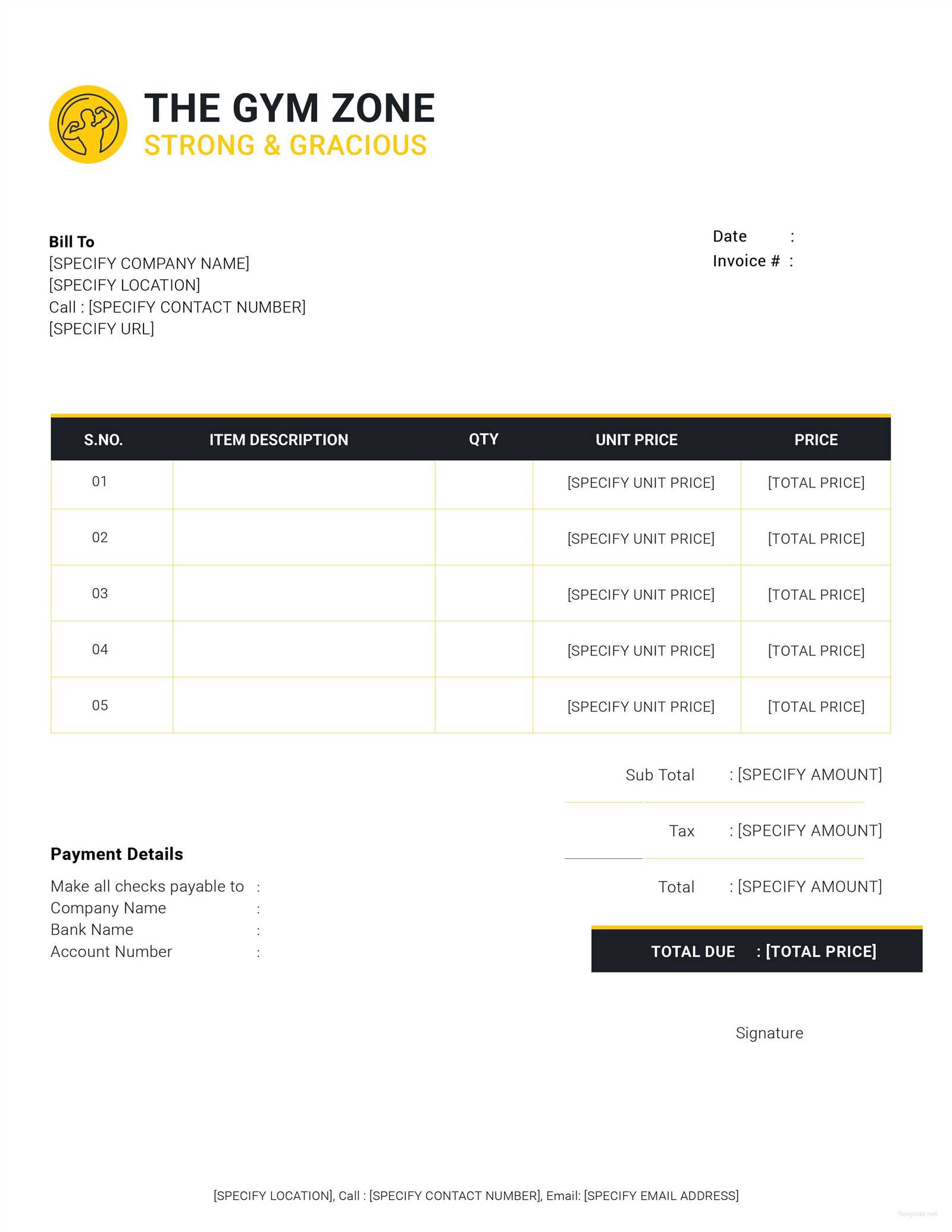

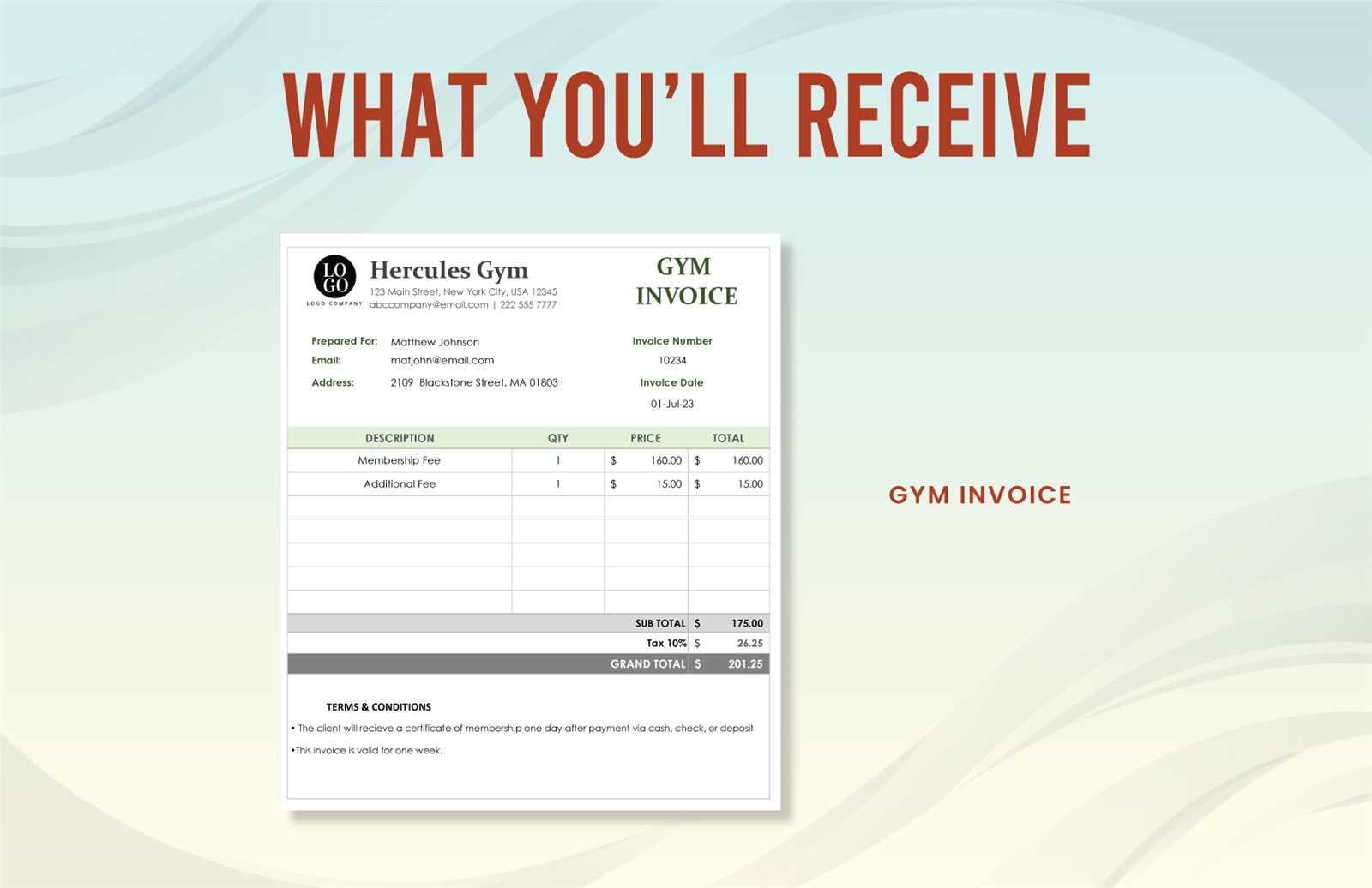

Key Elements of a Gym Invoice

To ensure clarity and accuracy in financial transactions, certain details must be included in every payment record. These elements help both the business and the client understand the terms of the transaction, the services provided, and the total amount due. A well-organized document not only reduces errors but also creates a professional appearance, which can improve client satisfaction and trust.

| Element | Description |

|---|---|

| Client Information | Include the client’s name, address, and contact details to personalize the document and avoid confusion with other accounts. |

| Services Provided | Clearly list all services rendered, such as training sessions or access to facilities, including any applicable dates or duration. |

| Amount Due | Specify the total cost for the services provided, including any taxes or discounts if applicable. |

| Payment Terms | Outline payment methods, due dates, and any late fees or installment options to ensure clear expectations. |

| Business Details | Include the name, address, and contact information of the business for transparency and accountability. |

By including these key components in each document, you ensure that both parties are fully informed, and the financial transaction is documented with precision. This structure is essential for maintaining smooth operations and fostering positive client relations.

How to Create a Custom Invoice

Creating a personalized payment document tailored to your specific needs can be a straightforward process if you follow a clear, step-by-step approach. Customizing your billing format allows you to reflect your business’s unique structure, payment methods, and client preferences. By adjusting elements such as pricing, service descriptions, and layout, you can create a professional record that is both functional and appealing.

Step 1: Gather the Necessary Information

Before you begin creating the document, ensure that you have all the relevant details at hand. This includes both your business and client information, as well as the specific services rendered. Make sure to capture the following:

- Client’s full name and contact information

- Business name, address, and contact details

- Services provided, including dates and descriptions

- Total amount due, taxes, and discounts

- Payment methods and due dates

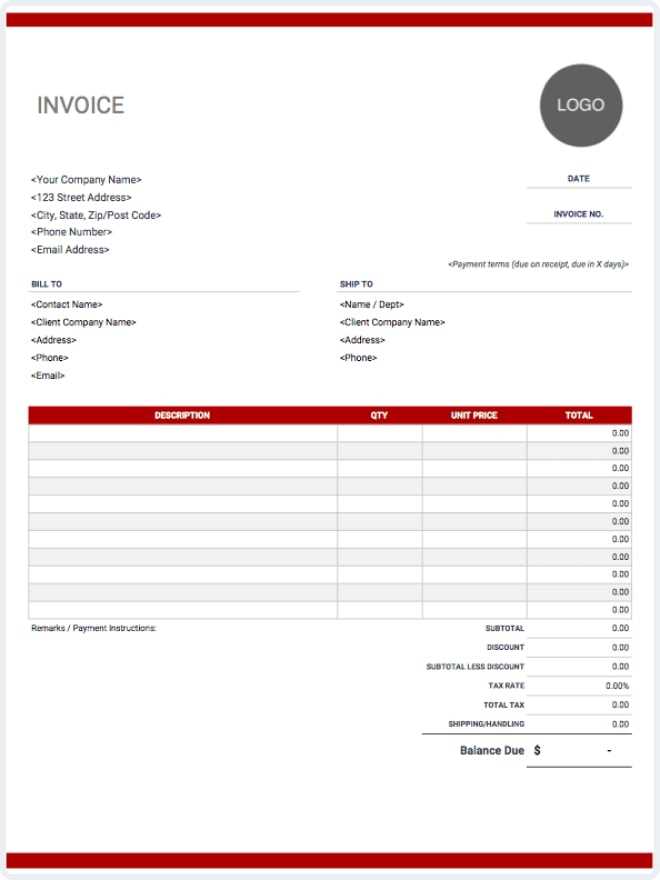

Step 2: Choose a Format and Design

The next step is to decide on the design and layout of the document. Whether you are creating it manually, using a word processor, or an online tool, the layout should be clear and professional. Consider the following elements:

- Use a simple, clean font that is easy to read.

- Organize the sections logically, with clearly labeled headers.

- Highlight important information, such as due dates and total amounts, to make it stand out.

- Ensure the document is well-spaced and uncluttered for easy understanding.

Once all the relevant details are included and the design is set, save the document in a format that can be easily shared with clients, such as a PDF or a digital file. This method not only saves time but also helps you maintain consistency in your billing practices.

Choosing the Right Format for Your Template

Selecting the ideal format for your billing document is crucial to ensuring smooth operations and ease of use. The right format not only makes it easier to fill in the necessary details but also ensures that the final document is clear, professional, and easy to share with clients. Your choice of format will depend on your specific business needs, the tools you have at your disposal, and how you plan to distribute the document.

Consider These Key Factors When Choosing a Format:

- Ease of Customization: Choose a format that allows you to quickly update information for different clients, services, and payments.

- Compatibility: Ensure the format is compatible with the tools and software you use. For example, if you prefer to work in a word processor, a simple document format like Word or Google Docs may be best.

- Professional Appearance: The document should have a clean, organized design. Formats like PDF or specialized online tools provide a polished look that builds credibility.

- Sharing and Storage: Consider how you will distribute and store the documents. Digital formats such as PDFs are easy to email, while paper copies may require manual storage and handling.

Popular Formats for Billing Documents:

- Word Processor (e.g., Microsoft Word or Google Docs): Great for manual customization, especially if you need to add detailed descriptions or change layouts frequently.

- Spreadsheet (e.g., Excel or Google Sheets): Ideal for businesses that deal with multiple clients or recurring payments, as you can easily manage calculations and track balances.

- PDF: A popular format for finalizing documents to be shared electronically. PDFs preserve the layout and are easily printable.

- Online Billing Platforms: Many platforms offer customizable options that streamline the process, automatically generate documents, and handle payments.

Ultimately, the format you choose should align with how your business operates and the level of customization you need, ensuring

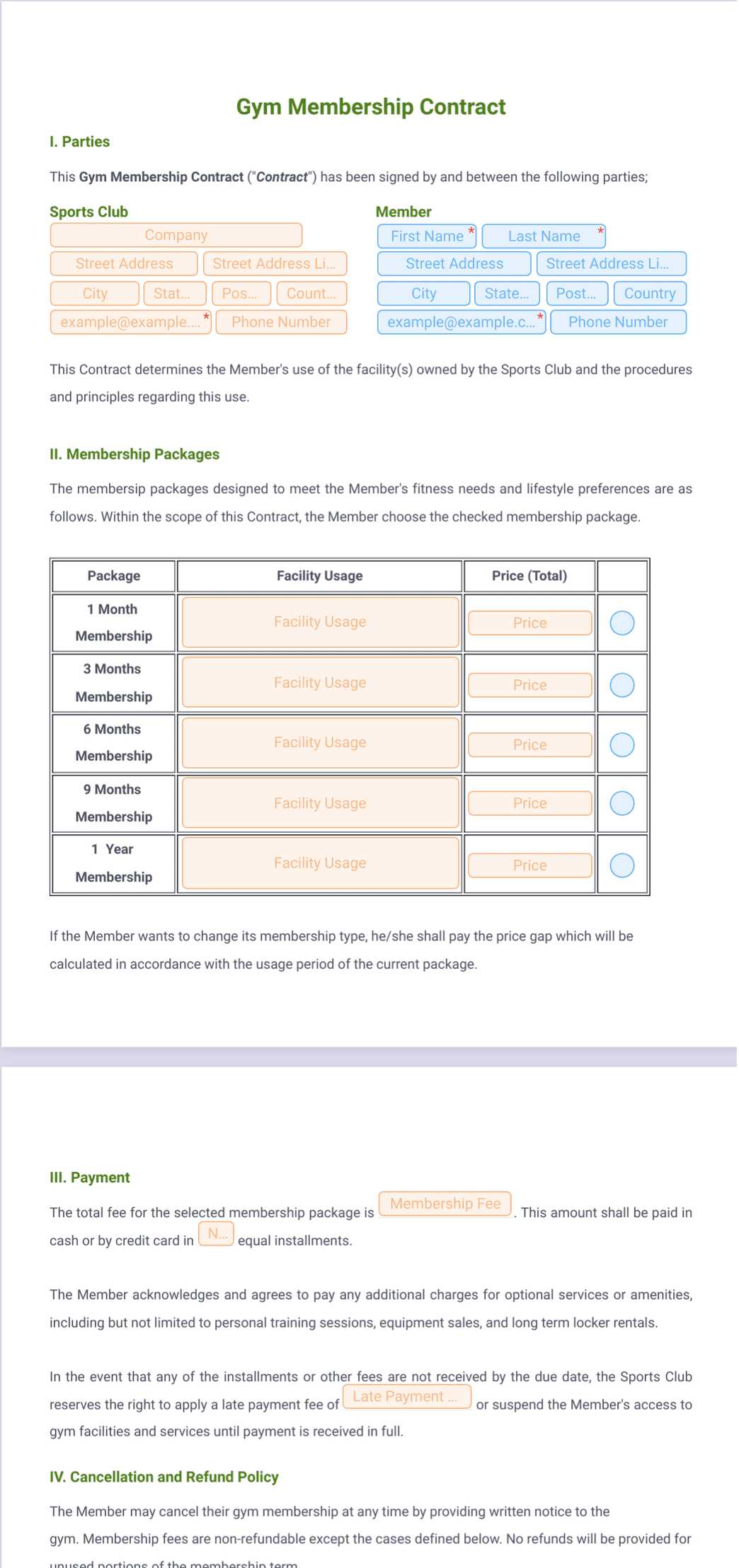

How to Include Membership Details

When creating a payment document for your clients, it’s essential to provide all relevant details regarding the services they have subscribed to. This information ensures transparency and helps clients understand exactly what they are paying for. Including specific details about the services offered allows for accurate billing and eliminates confusion over charges.

Key Information to Include

- Subscription Type: Clearly specify the plan or package the client is enrolled in, such as a monthly or yearly plan, group training, or personal sessions.

- Start and End Dates: Include the dates that the services start and end, ensuring clients know exactly what time period they are being charged for.

- Frequency of Payments: If applicable, mention how often the client is charged (e.g., weekly, monthly, quarterly) and whether any auto-renewal options apply.

- Additional Services: Include any extra services or features that were requested, such as personal coaching, access to premium content, or additional sessions.

- Terms and Conditions: Clearly outline any terms related to the membership, such as cancellation policies, renewal fees, or discounts for extended commitments.

How to Format This Information

Once you’ve gathered the relevant details, ensure they are presented in a clean, readable format. Organize the information in a list or table to make it easy for your client to understand their subscription. This clarity helps avoid disputes and ensures a smoother payment process for both parties.

- Use bullet points or numbered lists for clarity.

- Bold key information like payment amounts or deadlines to highlight them.

- If possible, provide a breakdown of the services and corresponding costs.

By including these details, you not only ensure accurate billing but also build trust with your clients, as they can clearly see what they are paying for and when.

Adding Payment Terms and Conditions

When creating a billing document, it’s crucial to clearly outline the payment terms and conditions to avoid misunderstandings and ensure smooth transactions. These terms set expectations for both the business and the client, outlining how and when payments should be made, as well as any penalties or additional charges for late payments. Including these details helps maintain transparency and protects both parties involved.

Key Payment Terms to Include

To make sure your terms are clear and comprehensive, consider including the following:

- Due Date: Specify the exact date by which the payment must be made. This is crucial for avoiding confusion or delayed payments.

- Accepted Payment Methods: List all the methods through which payments can be made, such as credit cards, bank transfers, checks, or digital payment platforms.

- Late Payment Fees: Mention any

Designing an Easy-to-Read Layout

Creating a well-organized and easy-to-read layout is essential for ensuring your clients can quickly find and understand the details of their charges. A clear, visually appealing format not only enhances professionalism but also reduces confusion. When designing your document, it’s important to focus on readability, logical structure, and user-friendly design elements that guide the reader’s eye to the most important information.

Key Design Principles

To achieve a clean, readable layout, follow these basic principles:

- Simple Fonts: Use legible, straightforward fonts like Arial, Calibri, or Times New Roman. Avoid overly decorative fonts that may distract or confuse the reader.

- Consistent Spacing: Adequate spacing between sections, rows, and columns ensures that the information doesn’t appear cramped. White space helps break up the content, making it easier to digest.

- Clear Section Headings: Use bold or larger font sizes for section titles like “Payment Details” or “Services Provided.” This helps the reader quickly locate key sections.

- Highlight Key Information: Important details such as the total amount due, due date, and payment methods should stand out, either through bold text or larger font sizes.

Formatting Tips for Clarity

When formatting your document, make sure the structure is intuitive:

- Use Tables for Organization: Organizing the charges and services in a table format allows the reader to see the breakdown at a glance.

- Limit Colors: While color can add a professional touch, keep it minimal. Stick to neutral tones and use color sparingly to highlight important information.

- Alignment: Align text to the left or center for consistency. Avoid excessive indentation or uneven alignment, which can make the document look cluttered.

A well-designed document makes the payment process smoother for your clients and strengthens the professionalism of your business. By following these guidelin

Benefits of Automated Invoice Templates

Automating the process of creating and sending billing documents offers numerous advantages for businesses. It reduces the time spent on manual tasks, minimizes human error, and ensures a consistent and professional presentation every time. By leveraging automated systems, you can streamline operations, improve efficiency, and focus more on growing your business rather than managing administrative details.

Time Savings and Efficiency

One of the primary benefits of automated billing systems is the significant time savings they provide. Instead of manually entering data for each transaction, an automated tool allows you to generate documents quickly by populating fields with pre-set client information and services. This automation eliminates the need for repetitive work and reduces the chances of errors.

- Faster Processing: Generate and send documents within minutes instead of hours.

- Consistency: Ensure that all documents follow the same format, reducing the chances of oversight or inconsistencies.

- Improved Organization: Track and store billing records in a digital system, making it easier to retrieve past documents when needed.

Accuracy and Reduced Errors

Manual data entry is prone to mistakes, especially when dealing with large volumes of transactions. Automated systems reduce this risk by pulling in client and service details directly from your database. This means fewer errors in calculations, dates, and payment terms, leading to more accurate billing and fewer disputes.

- Automatic Calculations: Automatically calculate totals, taxes, and discounts to eliminate human error.

- Pre-Filled Client Information: Ensure that all client details are consistently filled in without having to enter them manually each time.

By adopting automated systems, businesses can save valuable time, improve their workflow, and ensure greater accuracy in their financial records. These benefits ultimately lead to enhanced client satisfaction and reduced administrative burden.

Best Software for Invoice Creation

Choosing the right software for generating billing documents is crucial for any business looking to streamline its financial processes. The right tool can help automate data entry, ensure accuracy, and save time, all while providing a professional, polished document for clients. With numerous options available, it’s important to select a solution that best suits your business needs, whether you’re looking for basic features or advanced customization options.

Top Features to Look for in Software

When selecting software for creating billing documents, it’s essential to consider the following key features:

- Ease of Use: The software should have an intuitive interface that allows for quick setup and easy document generation.

- Customizability: Choose a solution that allows you to tailor the layout, fields, and branding to fit your business’s needs.

- Payment Integration: Some software includes built-in payment processing features, making it easier to track payments and manage accounts.

- Automation: Look for tools that allow you to automate recurring payments, reminders, and document generation.

- Cloud Storage and Accessibility: Cloud-based solutions provide secure storage and easy access to documents from anywhere, on any device.

Popular Software for Billing Document Creation

Here are some of the best software options available for generating billing documents:

- QuickBooks: One of the most widely used financial tools, QuickBooks allows you to create, send, and manage billing documents while also offering accounting and reporting features.

- FreshBooks: Ideal for small businesses, FreshBooks offers a user-friendly platform with customizable documents, automated reminders, and easy client management.

- Zoho Invoice: A versatile tool with customization options, automated workflows, and multi-currency support for businesses with international clients.

- Wave: A free, easy-to-use platform that provides billing features, accounting tools, and integrations with various payment gateways.

- Invoice Ninja: This open-source software allows for extensive customization, recurring billing, and payment integrations, making it a great option for growing businesses.

Each of these tools offers a range of features that can help streamline your billing process, improve efficiency, and maintain a professional appearance. The best option for your business depends on your specific needs, budget, and how you plan

Tracking Membership Payments with Invoices

Keeping track of client payments is essential for maintaining accurate financial records and ensuring that all dues are paid on time. Using structured billing documents can help businesses monitor outstanding balances, payment dates, and the status of transactions. Proper tracking of these details not only improves cash flow but also helps with financial forecasting and planning.

Organizing Payment Records

To efficiently track payments, it’s important to organize the information in a way that makes it easy to understand and update. This can be achieved by including key details such as the amount due, the payment date, and the payment method. Here’s how you can structure your records for clarity:

- Client Information: Always include the client’s name, contact information, and account number for easy reference.

- Payment Amount: Clearly list the amount owed and any applicable taxes or discounts.

- Payment Date: Record the due date and the actual payment date to track any delays.

- Payment Status: Indicate whether the payment has been completed, is pending, or overdue.

- Payment Method: Note whether the payment was made via credit card, bank transfer, check, or online system.

Monitoring Overdue Payments

For businesses offering recurring services or subscriptions, overdue payments can become a common issue. It’s important to have a clear system in place for tracking late payments and sending reminders to clients. Automated systems can help with this by sending notifications when payments are overdue and providing a record of communication.

- Automated Reminders: Set up automated payment reminders to notify clients of upcoming or overdue payments.

- Late Fees: If applicable, clearly outline the penalties for late payments to encourage timely transactions.

- Account Status: Keep a log of each client’s payment history, making it easy to identify those with outstanding balances or recurring issues.

By consistently tracking payments and staying organized, businesses can improve cash flow, reduce administrative errors, and maintain strong relationships with clients. A clear and structured approach ensures both the business and its

How to Customize for Different Plans

When offering various service options to clients, it’s important to customize your billing documents to accurately reflect the specific details of each plan. By tailoring the information to match the features and pricing of different plans, you ensure transparency and avoid confusion. This customization also allows you to easily distinguish between different service levels and payment structures, making the process smoother for both your business and your clients.

Key Customization Elements for Different Plans

To effectively customize your billing documents for each plan, include the following elements:

- Plan Type: Clearly specify the type of service the client is subscribed to, such as basic, premium, or advanced. This helps clients understand what they are paying for and highlights the differences between plans.

- Duration: Include the duration of the plan, whether it is a monthly, quarterly, or annual subscription, and any renewal terms if applicable.

- Price Breakdown: List the cost of the plan and any additional fees or discounts associated with that specific service level. This gives clients a clear picture of the overall cost.

- Extra Features: If a plan includes additional benefits or services (such as extra features or bonus options), ensure these are clearly stated, so clients know exactly what they are receiving.

Organizing Multiple Plans in One Document

If a client subscribes to more than one service or plan, or if you offer tiered pricing, it’s essential to present this information in a clear and organized way. Consider using tables or itemized lists to differentiate between the various plans and show how charges are applied for each.

- Table Format: Use tables to list out each plan’s features, pricing, and duration side by side, making it easier for clients to compare their options.

- Itemized List: Break down the charges by plan, showing any adjustments, taxes, or additional costs for each service level.

- Highlight Upgrades or Add-Ons: If the client has selected add-ons or upgrades, make sure these are clearly identified, with their corresponding costs.

Legal Considerations for Billing Documents

When creating billing documents for your clients, it’s important to ensure that they comply with applicable laws and regulations. These legal requirements help protect both your business and your clients, ensuring that all transactions are transparent, fair, and properly documented. Understanding the key legal considerations can help prevent disputes, improve trust, and avoid potential legal issues.

Essential Legal Information to Include

To ensure that your billing documents meet legal standards, include the following essential information:

- Clear Payment Terms: Specify when payments are due, whether there are any late fees for overdue payments, and the consequences of non-payment. This ensures both parties understand their obligations.

- Cancellation and Refund Policy: Outline the process for cancellations and refunds, including any conditions under which a refund can be issued. This helps to avoid confusion if a client decides to discontinue the service.

- Taxes: Ensure that the applicable taxes are clearly listed, including any regional or national tax requirements. Failure to include the correct tax rate may lead to legal complications.

- Business Information: Include your business name, address, and legal registration details. This helps verify your identity and adds a layer of professionalism and accountability.

Consumer Protection Laws and Compliance

It’s also important to be aware of local and national consumer protection laws that may affect how you issue billing documents. These laws are designed to protect the consumer from unfair practices and ensure that billing processes are transparent and equitable. Here are some key considerations:

- Transparency: All charges should be clear and easy to understand, with no hidden fees or ambiguous terms.

- Data Privacy: Ensure that any personal or payment information is securely stored and complies with data protection regulations, such as GDPR or CCPA, depending on your location.

- Contractual Agreement: The terms outlined in the document should match what was agreed upon by both parties in any prior contracts or agreements. Make sure to reference any signed contracts if applicable.

Adhering to these legal requirements not only helps maintain a professional reputation but also

Common Mistakes in Billing Documents

Creating accurate and professional billing documents is essential for maintaining smooth financial operations. However, even experienced businesses can make mistakes that lead to confusion, delayed payments, or legal issues. Identifying and understanding common errors can help you avoid costly oversights and improve the overall quality of your documentation.

Frequent Errors to Watch For

Below are some of the most common mistakes made when preparing billing documents:

- Incorrect Client Information: Failing to update client details, such as addresses or contact numbers, can lead to misplaced documents or missed payments.

- Missing Payment Terms: If payment due dates, penalties for late payments, or available payment methods are not clearly stated, clients may misunderstand when and how to pay.

- Ambiguous Charges: Including vague or unexplained charges can lead to confusion and disputes. Always break down services and their costs in detail.

- Failure to Include Tax Information: Neglecting to apply or properly calculate applicable taxes can result in legal trouble, particularly if your business is audited.

- Inaccurate Totals: Simple calculation errors can cause problems, especially if clients are charged more or less than they owe. Always double-check total amounts and individual line items.

Formatting and Presentation Errors

In addition to content mistakes, poor formatting can negatively affect the readability and professionalism of your billing documents. Some of the key issues to avoid include:

- Unclear Layout: A disorganized or cluttered layout makes it difficult for clients to find important details like the total amount due, payment deadline, and service description.

- Overcomplicated Language: Using complex terminology or legal jargon without proper explanation can confuse clients and lead to misunderstandin

How to Send Billing Documents Effectively

Sending clear and timely billing documents is a crucial part of maintaining healthy financial relationships with your clients. Ensuring that your clients receive their payment requests in the correct format and at the right time can lead to faster payments, fewer disputes, and a more professional reputation. There are several strategies you can adopt to make this process more efficient and client-friendly.

Key Steps for Effective Delivery

Here are some essential steps to consider when sending billing documents to clients:

- Choose the Right Delivery Method: Decide whether to send documents via email, physical mail, or a digital platform. Digital options are faster and can be more convenient, while physical mail may be necessary for clients who prefer hard copies.

- Double-Check the Accuracy: Before sending, ensure that all client information, payment details, and service descriptions are correct. This helps avoid confusion and delays.

- Set Clear Deadlines: Make sure the document clearly indicates the due date for payment and any late fees or penalties that may apply for missed payments. This encourages prompt payment.

- Provide Multiple Payment Options: Offer various methods for clients to pay, such as credit card, bank transfer, or online payment portals, to make the process as easy as possible.

Sending Documents via Email

Email is one of the most common and efficient methods for sending billing documents. Here are some tips to optimize your email communication:

- Use a Professional Subject Line: Craft a subject line that clearly indicates the purpose of the email, such as “Your Payment Request for [Service Name] – [Date].”

- Attach the Document: Ensure that the billing document is attached in an accessible format, such as PDF, to avoid compatibility issues. This also makes it easy for the client to download and store the document.

- Include a Friendly Message: Briefly explain the attachment and politely remind the client of the payment dead

Improving Customer Experience with Clear Billing Documents

Providing clients with transparent, easy-to-read financial documents can significantly enhance their overall experience with your business. When payment requests are clear and well-organized, clients are less likely to feel confused or frustrated, which can help build trust and foster long-term relationships. By focusing on clarity and simplicity, you ensure that your clients fully understand what they’re being charged for, when payments are due, and how they can settle their accounts.

Key Elements for a Clear Billing Document

To improve your clients’ experience, ensure that the following elements are included in your billing documents:

- Detailed Breakdown of Charges: List each service or product provided with its corresponding cost. This transparency helps clients understand exactly what they’re paying for and reduces potential disputes.

- Clear Payment Terms: Clearly state when payments are due, any late fees, and available payment methods. Clients appreciate knowing what to expect and when.

- Client Information Accuracy: Ensure that the client’s name, contact details, and service information are accurate. This reduces confusion and ensures your client receives the correct document.

- Readable Format: Use clean, well-organized formatting, including headings, bullet points, and tables, to make the document easy to navigate. Avoid cluttered designs that can overwhelm the reader.

How Clarity Enhances Customer Relationships

When clients receive clear and easy-to-understand billing documents, it has a positive impact on their overall experience with your business. Some of the benefits include:

- Builds Trust: Transparency in billing demonstrates professionalism and shows that your business values honesty, which builds trust between you and your clients.

- Reduces Confusion: A well-organized document minimizes misunderstandings, ensuring that clients know exactly how much they owe and when. This leads to fewer payment delays and inquiries.

- Improves Payment Speed: When clients ha

How to Store and Organize Billing Documents

Efficiently storing and organizing your financial records is essential for smooth business operations. Proper organization not only helps you quickly access important information but also ensures that your records are secure, well-maintained, and easy to track. Whether you prefer physical or digital storage, having a systematic approach to managing these documents is key to avoiding confusion and streamlining your business processes.

Effective Methods for Storing Documents

There are two primary ways to store financial documents: physical storage and digital storage. Both methods have their benefits, but it is important to choose the one that suits your business needs and legal requirements. Here are some common storage options:

- Physical Storage: For those who prefer keeping hard copies of their records, filing cabinets, binders, or secure storage boxes can be used. Be sure to label folders clearly and keep documents in a safe, organized location to prevent loss or damage.

- Digital Storage: Digital storage offers several advantages, including easier access, better security, and more efficient backup options. You can store records on local drives, cloud platforms, or specialized financial management software.

Organizing Your Billing Documents

Effective organization is crucial for easy access and tracking of your records. Here are some best practices for keeping your billing documents well-organized:

- Label and Categorize: Organize documents by client, service, or date. Use clear, consistent naming conventions and file folders to keep related documents together. This will make it easier to find specific records when needed.

- Use Digital Folders: Create separate folders on your computer or cloud platform for different categories, such as “Paid,” “Unpaid,” or “Overdue,” to quickly differentiate between records that need action.

- Track Payment Status: Keep track of which documents have been paid and which are still outstanding. This can be done manually with a spreadsheet or automatically with financial software that integrates payment tracking.

- Maintain Consistency: Consistent organization methods make it easier to retrieve documents when required. Stick to a filing system that works for you and ensures that every document is appropriately labeled and placed in the correct folder.

Best Practices for Securing Billing Records

Security is critical when handling financial documents. Protecting your billing records from unauthorized access or damage is vital for both your business and your clients. Here are some tips for securing your records:

- Use Password Protection: If storing records digitally, ensure that sensitive documents are password-protected or encrypted. This ensures that only authorized personnel can access them.

- Regular Backups: Digital documents should be backed up regularly to avoid data loss in case of system failure or accidental deletion. Use cloud storage solutions or external drives for backups.

- Limit Access: Restrict access to sensitive financial documents to only those who need it. This will reduce the risk of misuse or data breaches.

- Physical Security: For physical documents, store them in a locked filing cabinet or secure room. If you must transport records, ensure they are in a secure, confidential envelope or case.

Benefits of Proper Document Storage

Maintaining an organized system for storing your billing documents offers several advantages for your business:

- T