Invoice Letter Template in Word Format for Easy Customization

In any business, having a structured way to request payment is essential. Whether you are a freelancer, small business owner, or large corporation, ensuring that your financial communications are clear and professional can improve both efficiency and client relationships. With the right format, you can quickly produce professional documents that meet your needs and maintain a polished image.

Designing a proper payment request is crucial for conveying all the necessary details without confusion. The layout should be easy to follow, highlight important information, and allow for quick customization. By using a ready-made design, you can save time and avoid reinventing the wheel for each new transaction.

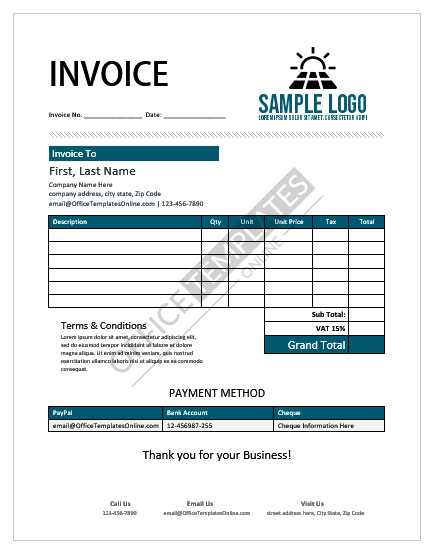

Tailoring these documents to fit your brand’s style and requirements is also key. Whether you’re adding your logo or adjusting the color scheme, having the flexibility to make small changes can enhance the overall presentation. This approach helps ensure that every request reflects your business’s professionalism and attention to detail.

Invoice Letter Template in Word Format

Creating professional documents for billing purposes doesn’t have to be complicated. By using a pre-designed format, you can easily structure all the necessary details without wasting time on layout or formatting. With the right tool, you can quickly generate customized requests that suit your business needs and maintain a consistent, polished appearance for every client interaction.

A digital file format offers the flexibility to make edits and adjustments, allowing you to tailor each document to a specific client or transaction. Whether you’re a freelancer, a small business owner, or part of a larger organization, using an editable document ensures that you can send clear, concise, and accurate payment requests every time.

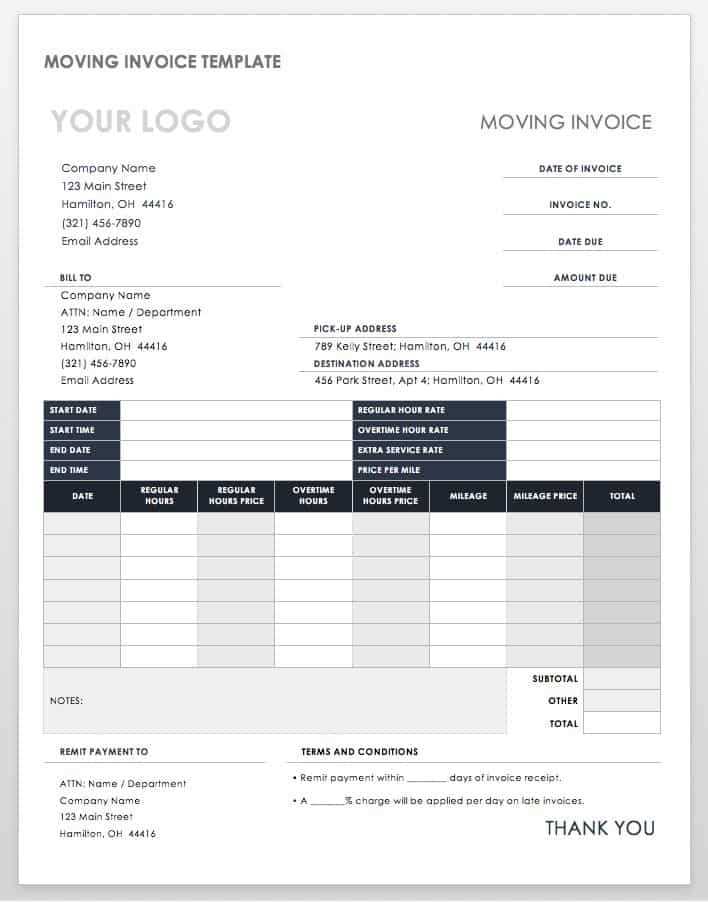

- Customizable fields for dates, amounts, and descriptions

- Professional design for clear communication

- Ability to easily update logos and business details

- Simple formatting for fast edits and revisions

- Compatible with most devices and software for quick sharing

Using such a format allows for consistency across all your communications, ensuring that your business presents itself in the best possible light. The simplicity of the layout combined with the ability to edit content ensures that you can meet your specific requirements while saving valuable time on administrative tasks.

Why Use an Invoice Letter Template?

Using a structured document for billing purposes offers numerous advantages, particularly when it comes to efficiency and consistency. Instead of drafting each request from scratch, a pre-designed format allows you to focus on the essential details, saving time and reducing the chance of errors. It also ensures that every transaction is presented in a clear, professional manner, which is crucial for maintaining positive business relationships.

Another key benefit is the ability to easily customize the document to fit your specific needs. Whether you need to update your contact information, adjust payment terms, or add a personalized message, an editable format gives you the flexibility to make these changes quickly. This consistency also helps in tracking payments and maintaining organized records over time.

Moreover, having a ready-to-use format guarantees that all the necessary components are included, such as payment instructions, due dates, and itemized charges. This not only speeds up the process but also enhances communication with clients, ensuring there is no confusion regarding the details of the transaction.

How to Create an Invoice Letter

Creating a professional payment request is a simple process when you follow a clear structure. The key is ensuring all necessary details are included, such as the recipient’s information, the amount owed, and the due date. With the right approach, you can quickly generate a document that is both effective and easy to understand for your clients.

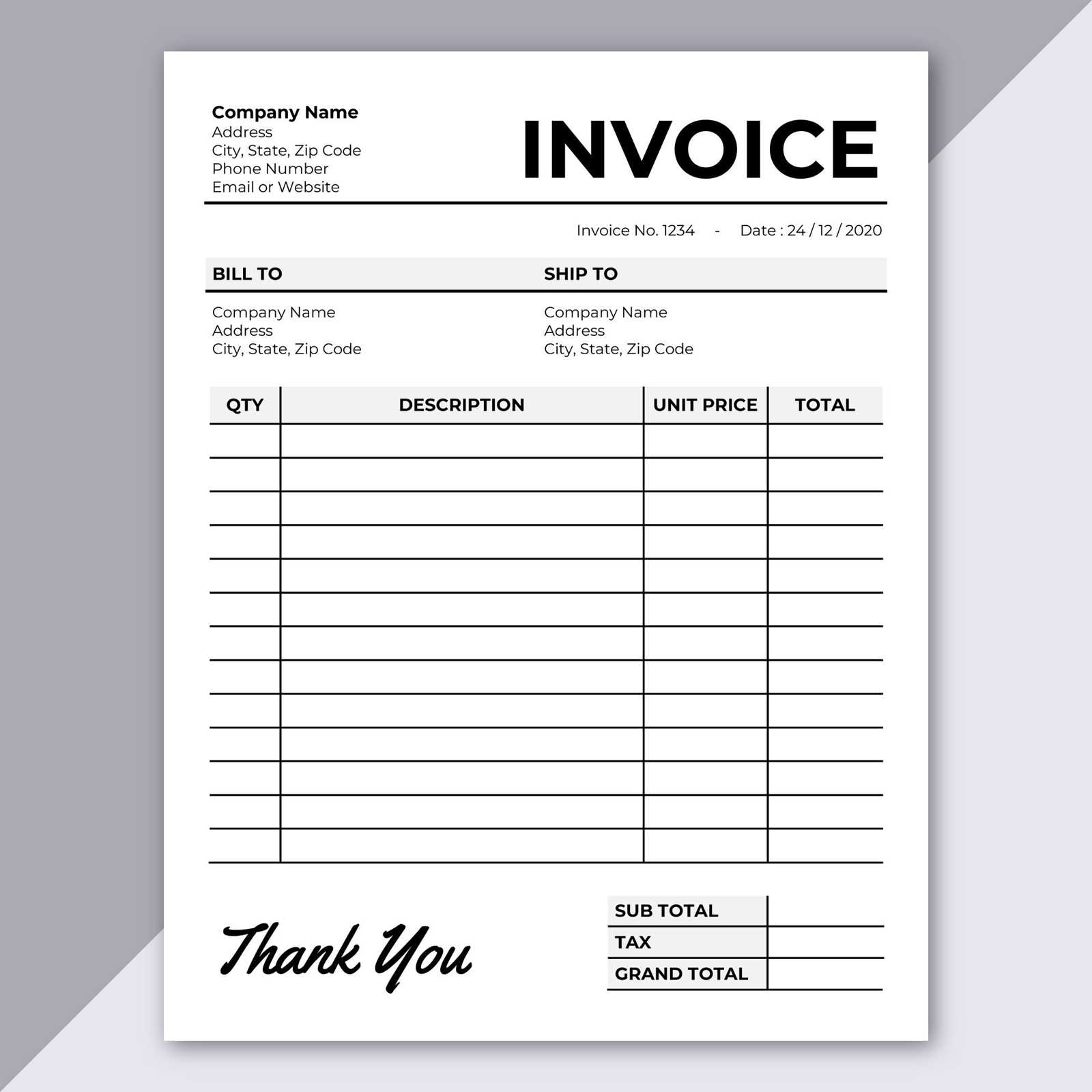

Start by adding your business information at the top, including your company name, address, and contact details. Then, include the recipient’s name and address. This provides a formal introduction and ensures the request is directed to the correct person or organization.

Next, list the services or products provided, along with the corresponding amounts. It’s important to be clear and specific, breaking down each charge if needed. Following this, include any relevant payment terms such as due dates and accepted payment methods. Finally, conclude with a polite message and a reminder of the payment expectations.

Customizing Invoice Templates for Your Business

Adapting a billing document to fit your specific business needs is an important step in maintaining a consistent and professional image. By customizing pre-designed formats, you can ensure that each document reflects your brand’s identity and includes all the necessary information tailored to your industry. Personalization helps create a seamless experience for your clients while reinforcing your professionalism.

One of the easiest ways to customize is by adding your logo, adjusting the color scheme, and including your business slogan or other branding elements. This ensures that each payment request is instantly recognizable as coming from your company, helping to build trust with your clients. Additionally, you can modify the layout to better match your style or simplify the process by only highlighting the most important details.

| Customization Aspect | How to Implement |

|---|---|

| Business Information | Add your company name, address, and contact details at the top. |

| Logo and Branding | Insert your company logo and adjust colors to match your branding guidelines. |

| Payment Terms | Modify terms and conditions based on your preferred payment schedules. |

| Itemized Charges | List products or services provided, with clear descriptions and prices. |

By making these adjustments, you can create a document that feels more personal and aligned with your company’s standards. The result is a polished, easy-to-read payment request that provides all necessary details while strengthening your brand identity.

Benefits of Using Word for Invoices

Using a popular word processing program to create billing documents offers numerous advantages, especially when it comes to flexibility and ease of use. Its user-friendly interface and wide compatibility make it an ideal choice for creating, editing, and sharing professional payment requests. Whether you’re a small business owner or a freelancer, this tool can streamline your administrative tasks and improve your overall efficiency.

- Ease of Customization: Quickly edit and personalize documents by adding logos, changing fonts, or adjusting the layout without needing advanced design skills.

- Compatibility: Easily share your documents across different platforms, ensuring your clients can view or print them without issues, regardless of their device or software.

- Professional Formatting: With built-in styles and formatting options, you can create polished and consistent payment requests every time.

- Templates and Automation: Use pre-made layouts to speed up the creation process, and automate recurring documents to save time on routine tasks.

- Track Changes: The ability to track changes allows for clear communication when collaborating or making updates to documents, ensuring all parties are on the same page.

With these benefits, it’s clear why using a familiar and versatile program can enhance your invoicing process, saving you both time and effort while maintaining a professional standard in your communication.

Steps to Edit an Invoice Template

Editing a ready-made billing document is a straightforward process that can be completed in just a few simple steps. With the right software, you can easily adjust various sections to suit your specific needs, whether it’s updating client details, adjusting amounts, or customizing the layout to match your brand. This flexibility ensures that every payment request is accurate, professional, and tailored to the situation.

Step 1: Open the document in your chosen program. Start by selecting the file you want to modify. If you are working with a pre-made design, it should open in editable mode by default.

Step 2: Modify contact details. Update the recipient’s name, address, and any other relevant contact information. Double-check that everything is correct before proceeding.

Step 3: Update the service or product information. Ensure that each item or service provided is listed clearly, along with the correct price. Adjust any quantities or descriptions as needed.

Step 4: Adjust payment terms. Modify the payment due date, accepted payment methods, or any special conditions that apply to the transaction. This is especially important if you have varying terms for different clients.

Step 5: Personalize the design. Customize the look of the document by changing fonts, adding your business logo, or adjusting the color scheme. This will help reinforce your branding and make the document more professional.

Step 6: Save and export. Once all changes are made, save the document. It’s also a good idea to export it to a PDF format for easy sharing and to ensure the formatting remains intact when sent to clients.

By following these simple steps, you can quickly adapt any pre-designed document to match your specific business requirements, ensuring that each request for payment is clear, accurate, and professional.

Free Invoice Templates for Word

Finding free resources to create professional payment requests can save time and reduce the cost of administrative tasks. A wide range of customizable layouts are available online, allowing you to easily create well-structured documents without the need for expensive software or complex design skills. These free tools offer simple yet effective solutions, whether you are just starting your business or need to streamline your current process.

Many of these free layouts come pre-designed with essential fields for client details, payment amounts, and terms. You can quickly fill in the necessary information and make any adjustments to match your branding or preferences. Whether you’re looking for a basic design or something more elaborate, these resources offer a variety of options to suit different industries and business sizes.

- Accessible and Cost-Free: Download at no cost and customize right away without hidden fees.

- Pre-Formatted for Ease: Ready-to-use with clear structures for easy editing and filling.

- Flexible Customization: Adjust fonts, colors, and layout to match your business’s style.

- Simple and Efficient: Save time on document creation with pre-made formats that streamline the process.

- Compatible Across Devices: Share or print the finished documents on various platforms and devices.

With a free layout, you can create professional and personalized documents without the hassle. Whether you’re a freelancer or running a small business, these free resources can help ensure your payment requests are clear, organized, and on-brand.

Top Features of Invoice Letter Templates

When choosing a ready-made format for creating payment requests, certain features can make the process much easier and more efficient. The best designs include essential elements that ensure clarity, professionalism, and flexibility. Whether you’re sending a basic request or a more detailed billing document, these key characteristics can help you produce accurate, polished documents in no time.

- Clear Structure: A well-organized layout with distinct sections for client information, services or products, amounts, and payment terms ensures that every detail is easy to find and understand.

- Customization Options: The ability to modify the design, such as adding your company logo, adjusting the color scheme, or altering font styles, allows you to align the document with your brand identity.

- Predefined Fields: Fields for basic information such as due dates, billing addresses, and item descriptions help streamline the process by eliminating the need to manually format each document.

- Professional Design: A polished and consistent look can make a lasting impression on clients. A clean, easy-to-read design reinforces credibility and trustworthiness.

- Flexible Formats: Whether you need to print or email your document, most formats are adaptable, ensuring compatibility with various devices and platforms.

- Payment Instructions: Including clear, concise instructions for payments, such as bank details or online payment links, helps avoid confusion and delays.

By incorporating these features, you can ensure that your payment requests are not only professional but also easy to create and manage, saving you both time and effort in the long run.

How to Save an Invoice Template in Word

Once you have customized your billing document to fit your needs, the next step is to save it properly so that it can be easily accessed and used again in the future. Ensuring that your document is saved in a suitable format helps maintain its structure and prevents any unwanted formatting changes when you need to edit or share it later.

Follow these steps to save your customized payment request for future use:

| Step | Action |

|---|---|

| Step 1 | Click on “File” in the top-left corner of the program. |

| Step 2 | Select “Save As” from the dropdown menu to choose where to save the file. |

| Step 3 | Choose the folder or location where you want to store the document for easy access. |

| Step 4 | Enter a descriptive file name, such as “Client_Name_Payment_Request,” for easier identification. |

| Step 5 | Select the preferred file format, such as the default (.docx) or PDF for sharing. |

| Step 6 | Click “Save” to store your document securely and make it available for future use. |

By following these simple steps, you can easily save and organize your payment documents, ensuring they are ready for quick edits or sharing whenever necessary.

Common Mistakes to Avoid in Invoices

Creating payment requests can be a straightforward process, but there are several common errors that can lead to confusion or delays in payments. Ensuring accuracy and clarity is crucial when drafting these documents. Small mistakes can have a big impact on your cash flow, client relationships, and overall professionalism. By being mindful of these potential pitfalls, you can improve the quality of your billing and avoid unnecessary issues.

- Incorrect or Missing Contact Information: Double-check the recipient’s name, address, and your business details. Missing or inaccurate contact info can cause delays and confusion.

- Ambiguous Payment Terms: Be clear about payment due dates, late fees, and accepted payment methods. Vague terms can lead to misunderstandings and missed deadlines.

- Errors in Amounts or Calculations: Ensure all amounts are correct, and check your math twice. Even small errors in totals or taxes can create trust issues and delay payments.

- Failure to Include Detailed Descriptions: Always provide a clear breakdown of products or services provided. Vague descriptions can confuse the client and slow down the approval process.

- Not Including a Unique Reference Number: Each payment request should have a unique identifier. This helps in tracking payments and avoiding confusion for both you and your client.

- Missing or Incorrect Dates: Always include the date the request was issued and the payment due date. Omitting this information can lead to miscommunication about when payment is expected.

- Unprofessional Layout: A cluttered or hard-to-read document can reduce your credibility. Use clear headings, sections, and readable fonts to ensure the information is easily accessible.

- Failure to Proofread: Never skip the final review. Typos, grammar mistakes, or formatting issues can make your documents appear sloppy and unprofessional.

By avoiding these common mi

Best Practices for Writing Invoice Letters

When creating payment requests, presenting clear, professional, and accurate information is crucial for maintaining strong relationships with clients. Following best practices ensures that your communication is both effective and efficient, reducing the risk of misunderstandings or delays. By incorporating these practices, you can streamline the billing process and maintain a positive reputation with your clients.

Here are some key guidelines to follow when drafting your payment request:

| Best Practice | Description |

|---|---|

| Use Clear, Concise Language | Ensure the content is easy to read and understand. Avoid jargon and keep the tone professional. |

| Include All Relevant Information | Provide the recipient’s details, the items or services provided, amounts, payment terms, and due dates. |

| Be Specific with Payment Terms | Clearly state the payment due date, accepted methods of payment, and any late fees or discounts for early payments. |

| Maintain Professional Formatting | Organize the document logically, using headings and bullet points to separate sections for easy readability. |

| Double-Check Accuracy | Review the document for errors in amounts, dates, and calculations to avoid confusion or disputes. |

| Include Contact Information | Make sure your business contact details are prominently displayed, allowing clients to reach out if they have questions or concerns. |

| Use a Professional Tone | Maintain a polite and respectful tone throughout, even if the payment is overdue. |

By following these

What to Include in an Invoice Letter

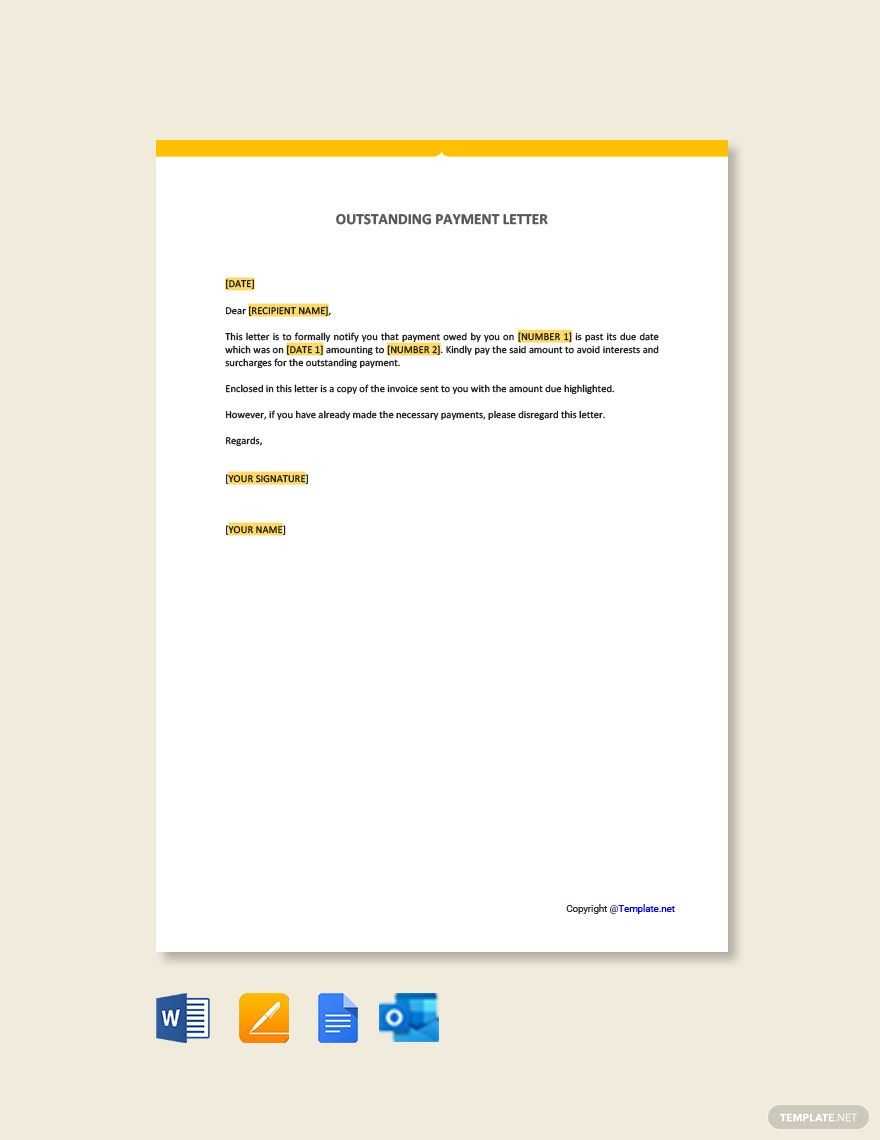

When creating a payment request document, it’s essential to include all the necessary details to ensure that both you and your client are on the same page. A well-structured document not only provides clarity but also helps prevent misunderstandings or delays in payments. Here are the key elements you should always include to ensure a smooth transaction.

- Sender’s Information: Include your business name, address, phone number, and email at the top of the document for easy contact.

- Recipient’s Information: Clearly list the client’s name, address, and contact details to ensure the document reaches the right person.

- Unique Reference Number: Each document should have a distinct identifier or number for tracking purposes.

- Issue Date: Mention the date the document is being sent. This helps both parties keep track of timelines.

- Detailed List of Products or Services: Provide an itemized breakdown of what was provided, including descriptions, quantities, and individual prices.

- Total Amount Due: Clearly state the total amount that is owed, along with any applicable taxes or additional charges.

- Payment Terms: Specify the due date for payment and any other relevant terms, such as late fees, discounts for early payment, or installment options.

- Accepted Payment Methods: List the various payment methods your business accepts (e.g., bank transfer, credit card, online payment platforms).

- Notes or Special Instructions: If needed, include any additional instructions or notes, such as return policies or payment instructions.

- Closing Statement: End with a polite statement, thanking the client for their business and providing contact details in case they have questions or concerns.

By including these essential elements, your payment request will be comprehensive, clear, and professional, ensuring that both yo

Invoice Template Design Tips

Creating a visually appealing and professional payment request document is essential for maintaining a positive image with your clients. A well-designed layout not only ensures that the document is easy to read and understand, but it also enhances your business’s professionalism. By following some simple design tips, you can create a document that stands out and is effective in conveying important details clearly.

- Keep It Simple: A clean, minimalistic design helps keep the focus on the most important information. Avoid clutter and excessive text. Stick to the essentials, such as client details, services provided, and payment terms.

- Use Clear Hierarchy: Organize your document with clear headings and subheadings to break up sections. This makes it easier for the reader to find relevant details quickly.

- Consistent Branding: Incorporate your business’s logo, colors, and fonts to create a cohesive brand identity. Consistency in design makes your documents look more professional and helps clients recognize your business.

- Readable Fonts: Choose easy-to-read fonts and maintain consistent font sizes throughout the document. Avoid overly decorative or hard-to-read styles, especially for critical details like numbers and dates.

- Spacing and Alignment: Proper spacing between sections, as well as consistent alignment of text, can greatly improve the readability of your document. Make sure everything is well-aligned and spaced evenly.

- Highlight Key Information: Use bold or larger fonts for important details such as the total amount due or the payment due date. This draws attention to the most crucial parts of the document.

- Use Color Wisely: A splash of color can make your document more visually appealing, but use it sparingly. Stick to one or two accent colors that match your branding and ensure readability. Avoid using too many contrasting colors that may distract from the key information.

- Keep It Organized: Ensure that all sections are clearly labeled, such as client information, payment terms, and service descriptions. This helps the reader quickly locate what they need and makes the document look more structured.

- Use Fields for Dynamic Data: Insert fields that automatically update with the client’s name, the date, and any other variable information. This can be done through the use of “merge fields” in the document, which pull in data from a database or pre-existing contact list.

- Set Up Default Content: Create a base document with pre-filled information that is common for all requests, such as your business name, terms, and standard service descriptions. This allows you to focus only on updating client-specific details.

- Leverage Macros: If your software allows, use macros to automate repetitive tasks, such as adding specific line items or calculating totals. This can significantly reduce the time spent formatting and ensuring accuracy.

- Integrate with Accounting Software: Many accounting programs allow integration with your document software, enabling automatic generation of payment requests based on your records. These integrations can pull data like due amounts, transaction histories, and client information directly into the document.

- Use Templates with Predefined Fields: Set up a standardized layout with editable fields for the client’s information and payment details. This way, you only need to update the variables for each transaction, and the rest of the document remains unchanged.

- Automate Sending: If you’re working with a client base that requires recurring requests, set up automatic email sending features to send the payment request directly after creation. Many software programs allow this kind of scheduling, helping you stay on top of deadlines without manual intervention.

- Unique Reference Number: Always assign a unique identifier to each payment request. This helps track individual transactions and reduces confusion when referencing specific bills.

- Payment Due Date: Clearly state the payment deadline to avoid ambiguity. This will help your clients understand the urgency and the terms surrounding late fees or penalties.

- Current Payment Status: Include an area where the payment status can be updated. You can mark if it’s paid, overdue, or pending, to easily track the current situation.

- Detailed Payment History: For recurring clients, include a section with previous payment records. This makes it easier to track past balances and payments.

- Payment Method Details: Specify the accepted payment methods and include necessary details like bank account numbers or payment links for quick processing.

- Manual Tracking: Keep a spreadsheet or physical record to log each transaction’s status. Be sure to update it regularly as payments are made or overdue.

- Use Accounting Software: Many accounting programs offer built-in payment tracking features. These tools automatically update payment statuses and send reminders when payments are overdue.

- Automated Reminders: Set up automated email reminders for clients as the due date approaches or when payments are overdue. This ensures you stay on top of pending transactions without manual follow-up.

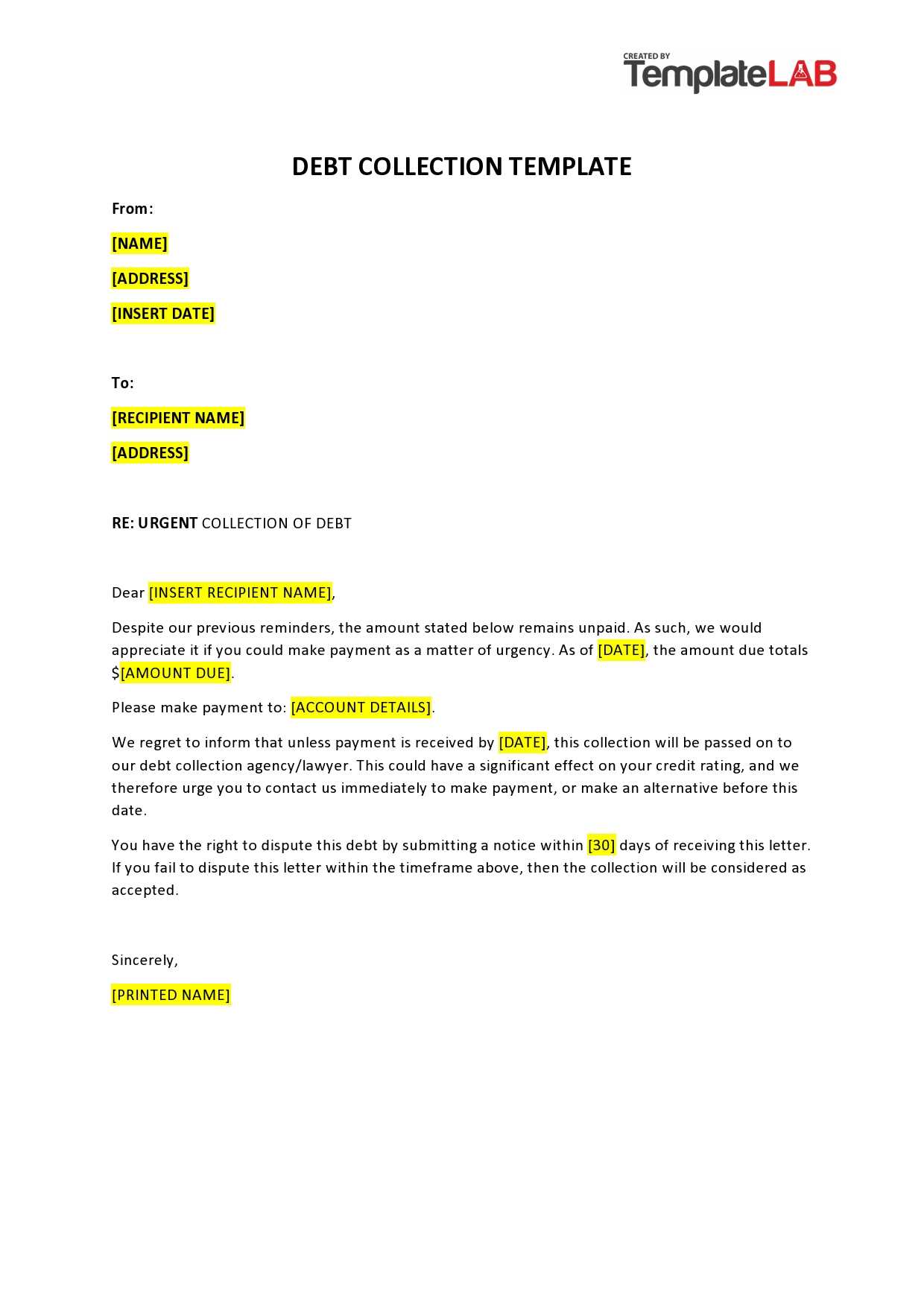

- Clear Payment Terms: Clearly outline payment due dates, acceptable methods of payment, and any penalties or interest fees for late payments. Having precise terms helps avoid confusion and legal disputes.

- Legal Name and Business Information: Make sure your business name, address, and contact information are included. This ensures that both parties are aware of who is involved in the transaction.

- Tax Identification Number (TIN): Depending on local regulations, you may be required to include your tax ID or VAT number. This helps validate your business’s legal standing and ensures tax compliance.

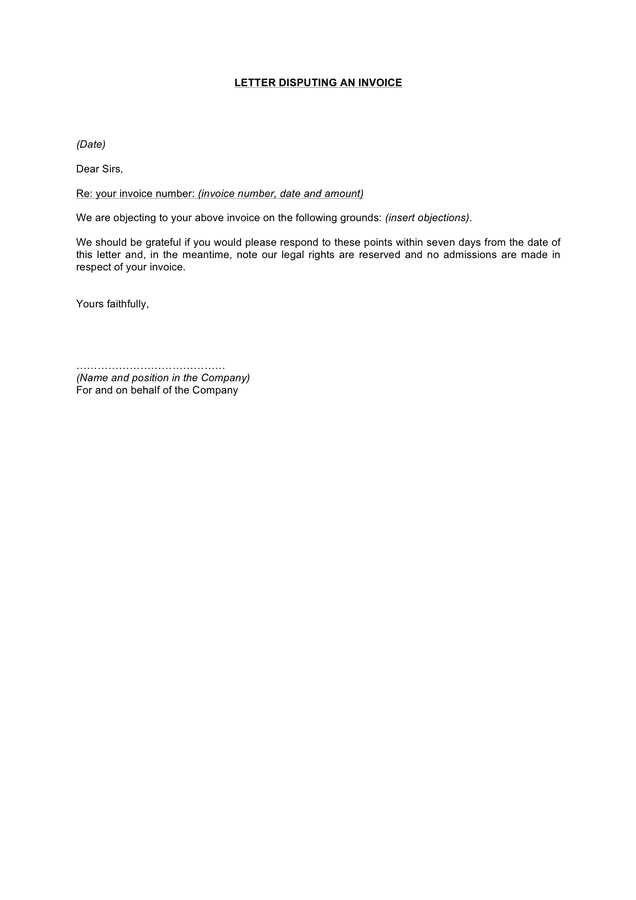

- Terms of Service or Contractual Agreements: If there are any contractual agreements between you and the client regarding payment, it’s crucial to reference these terms in the payment request to reinforce your rights.

- Late Fees and Dispute Resolution: Include a clause that explains what happens if the payment is late, such as late fees or other charges. Also, clarify the steps for dispute resolution, in case the client contests the charges.

- Consult Legal Professionals: If you’re unsure about the legal requirements for payment requests in your region, consult a legal professional to ensure compliance with local laws.

- Keep Records: Retain copies of all payment requests, communications, and receipts. These records serve as evidence if a legal dispute arises.

- Follow Industry Regulations: Certain industries may have specific requirements or standards for payment documentation. Familiarize yourself with these regulations to ensure your documents meet those criteria.

- Choose the Right Delivery Method: Depending on your client’s preferences, choose the most appropriate delivery method. This could be via email, post, or online invoicing platforms. For faster processing, emails or digital platforms are often the most efficient.

- Include Clear Instructions: Make sure that the payment terms and instructions are clearly outlined. Include the due date, accepted payment methods, and any additional details the client may need to know about the transaction.

- Personalize Your Message: A personalized email or message accompanying the payment request can help build stronger relationships with your clients. It shows professionalism and courtesy, and it can reduce the chances of misunderstandings.

- Send in Advance: Don’t wait until the last minute to send your request. Send it well in advance of the due date to give your client ample time to process the payment. A timely reminder shows that you are organized and professional.

- Double-Check for Accuracy: Before sending, make sure all details in the document are correct–such as the payment amount, due date, and recipient information. Mistakes can delay the payment process and damage your reputation.

- Track and Follow Up: After sending your request, track whether the payment is made on time. If the due date passes without payment, follow up promptly to remind your client. Many online invoicing tools have automatic reminders you can set to make this process easier.

- Standardized Layout: Use the same layout for all your payment requests. This includes the position of your business name, client details, itemized charges, and payment instructions. A well-organized layout improves readability and ensures that all important information is easy to find.

- Uniform Font and Style: Stick to one or two fonts throughout the document to ensure visual consistency. Avoid using too many different font styles or sizes, as it can create confusion. Choose clear and professional fonts such as Arial, Calibri, or Times New Roman for optimal readability.

- Consistent Use of Colors: If you’re using colors in your document, make sure they align with your brand and are used consistently. Avoid using too many bright or clashing colors, as this can make the document look unprofessional. Stick to subtle, complementary color schemes that help highlight important details like totals and due dates.

- Clear and Standardized Margins: Set consistent margins throughout your documents. Using the same margins ensures that your payment requests look neat and aligned. It also prevents text from being cut off if printed or viewed on different screen sizes.

- Numbered Sections: For longer documents, numbering key sections or line items can help improve readability. For example, numbering the list of services provided or individual product details ensures clarity and makes it easier for clients to cross-reference specific charges.

- Use Pre-designed Formats: Consider using pre-designed document formats that follow best practices in terms of layout and structure. These templates can be customized to fit your speci

How to Automate Invoices in Word

Automating your payment request documents can save valuable time and reduce the likelihood of errors. By using automation tools within your document creation software, you can streamline the process of generating and sending invoices, ensuring that each one is consistent and accurate. This is especially helpful for businesses that deal with multiple clients or recurring transactions.

Here are a few ways to automate the creation of payment requests in your document software:

Tracking Payments with Invoice Letters

Effectively tracking payments is essential for managing cash flow and maintaining good relationships with your clients. When creating billing documents, it’s important to include key elements that help both you and your clients track the status of payments. By incorporating tracking mechanisms, you can easily monitor outstanding balances, due dates, and ensure timely payments.

Key Elements to Include for Payment Tracking

How to Track Payments Effectively

By clearly outlining payment terms and tracking the status of each request, you can ensure a more efficient billing process and reduce the likelihood of missed pay

Legal Considerations for Invoice Letters

When creating payment requests, it’s important to consider the legal implications of the document. A payment request not only serves as a professional communication tool but also as a legal document that can be used in case of disputes. Ensuring that your document includes the necessary legal elements protects both you and your clients and helps maintain compliance with local regulations.

Key Legal Elements to Include

How to Protect Your Business Legally

By including these legal considerations in your payment request documents, you can protect your busine

How to Send Invoice Letters Effectively

Sending payment requests in a timely and professional manner is essential for ensuring that payments are processed promptly. The way you deliver these documents can impact how quickly and smoothly your clients settle their balances. Effective communication, proper timing, and clear instructions are key factors in optimizing the process.

Here are some tips for sending your payment requests effectively:

By following these steps, you ensure that your payment requests are sent in an organized and professional manner, increasing the likelihood of timely payments and maintaining posi

How to Maintain Consistent Invoice Formatting

Consistency in document formatting is essential for creating a professional and organized impression. Maintaining uniformity across your payment requests not only helps establish your brand identity but also ensures that your clients can easily read and process the details. Whether you send a single request or hundreds, a consistent format will help reinforce your professionalism and minimize errors.

Key Elements for Consistent Formatting

Tools to Help Maintain Consistency