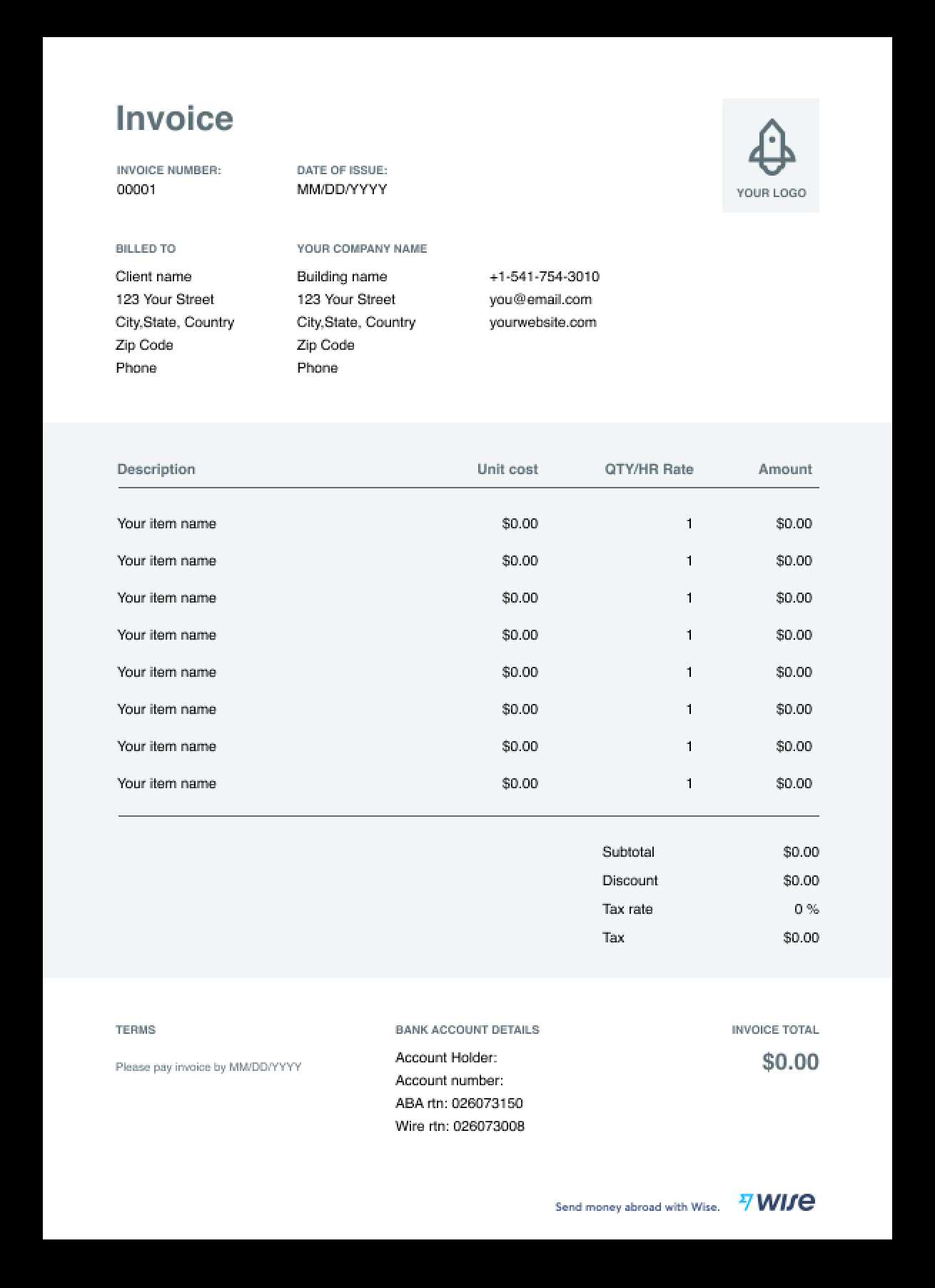

Free Tax Invoice Template in Word Format

In the world of business, accurate and well-organized billing is essential for maintaining a smooth workflow and fostering professional relationships with clients. Having a ready-made structure for documenting transactions not only saves time but also ensures consistency across all business communications. A well-prepared document can reflect the professionalism of your business and provide clarity to both parties involved.

One of the most effective ways to streamline this process is by using pre-designed formats that can be quickly customized to fit your needs. By leveraging simple tools, you can create clean, clear records for payments, fees, and services provided. These files can be easily tailored to include necessary details such as client information, dates, and amounts, making them suitable for any business transaction.

Whether you are a freelancer, a small business owner, or part of a larger corporation, having access to ready-to-use formats will save you time and effort. This method not only ensures accuracy but also helps you maintain a professional image. The simplicity and flexibility of such files allow for quick adjustments, ensuring that every document is up to date and tailored to your specific requirements.

Understanding Tax Invoices and Their Importance

Proper documentation of financial transactions plays a crucial role in any business. These records are not only essential for maintaining transparency but also for ensuring that all parties involved are on the same page regarding the terms of the agreement. Clear and precise paperwork helps avoid misunderstandings and establishes a professional standard that clients and vendors can rely on.

Why Accurate Records Matter

Having well-structured documentation serves multiple purposes. First, it provides a clear summary of the services or products exchanged, which is important for both parties’ financial records. Second, it acts as proof of a transaction, which can be necessary for audits, legal matters, or financial reporting. This clarity fosters trust and smooth business operations.

Ensuring Legal Compliance

One of the key reasons for using these documents is to ensure compliance with legal and financial regulations. Many regions require businesses to keep detailed records of transactions for tax purposes. Without a well-documented paper trail, companies may face penalties or fines. Having a standardized way to create these records ensures that you meet all regulatory requirements efficiently.

What is a Tax Invoice Template

At its core, a structured form for documenting business transactions simplifies the process of recording payments between parties. This standardized format is designed to include all necessary details, making it easier to track exchanges, maintain records, and ensure accuracy. By using a pre-designed structure, businesses can save time while ensuring consistency across every transaction.

| Field | Description |

|---|---|

| Business Information | Details of the seller, such as name, address, and contact info. |

| Client Information | Details of the buyer, including name and contact information. |

| Transaction Date | The date when the services or goods were exchanged. |

| Itemized List | A breakdown of items or services provided, including prices and quantities. |

| Total Amount | The total amount owed, including any applicable fees. |

This basic structure provides clarity and helps ensure that all necessary information is included in each transaction record. With this format, businesses can avoid mistakes and minimize confusion, making it a valuable tool for both routine exchanges and larger financial dealings.

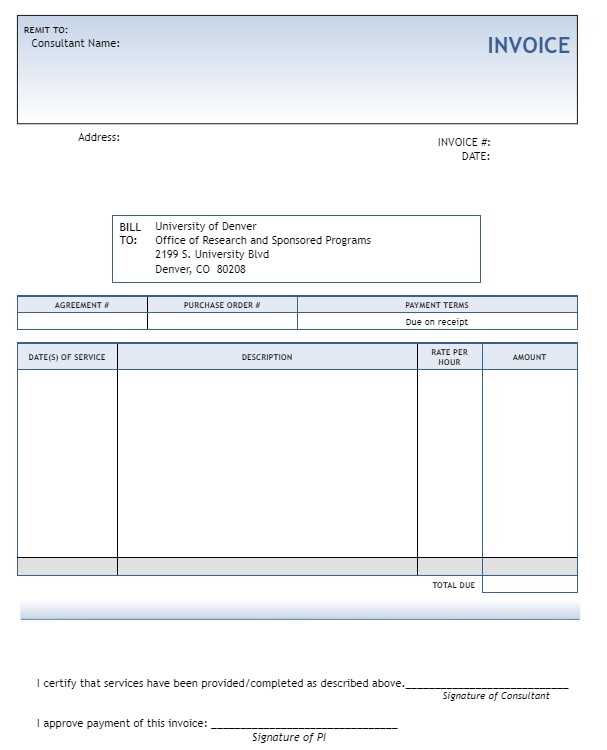

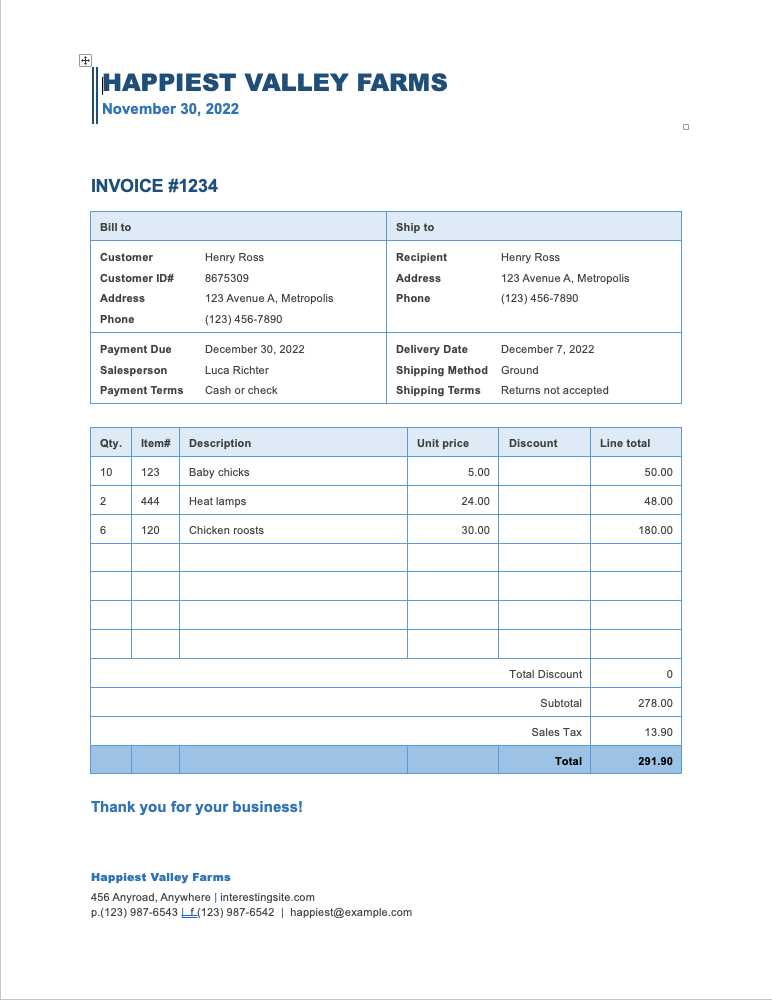

How to Create a Business Billing Document in Word

Creating a well-organized and clear record for financial transactions is essential for any business. Using a simple text processing tool, you can design and customize such a document to suit your needs. The process involves filling in key details about the transaction, which can be done quickly and efficiently while ensuring accuracy in every entry.

Step-by-Step Guide to Creating a Transaction Record

To begin, open your text editing software and start a new blank document. You can structure the page with sections for both the seller and buyer’s information, a description of the products or services exchanged, and the payment details. Start by including the following fields:

- Business Details: Include your company name, contact information, and address.

- Client Details: Provide your client’s name, address, and contact info.

- Itemized List: Include a breakdown of goods or services provided, their quantity, price per item, and the total cost.

- Total Amount: Add the total sum owed, including any additional charges or discounts.

- Transaction Date: Clearly indicate the date of the transaction.

Formatting and Customizing Your Document

Once you have entered the necessary information, it’s important to format your document for easy reading. Use tables for a clean layout, making the details more organized. You can also highlight certain sections, such as the total amount, by using bold or italics for better visibility. Don’t forget to save your document, and keep a copy for your records. If you need to create multiple versions, simply reuse this layout and modify the details for each new transaction.

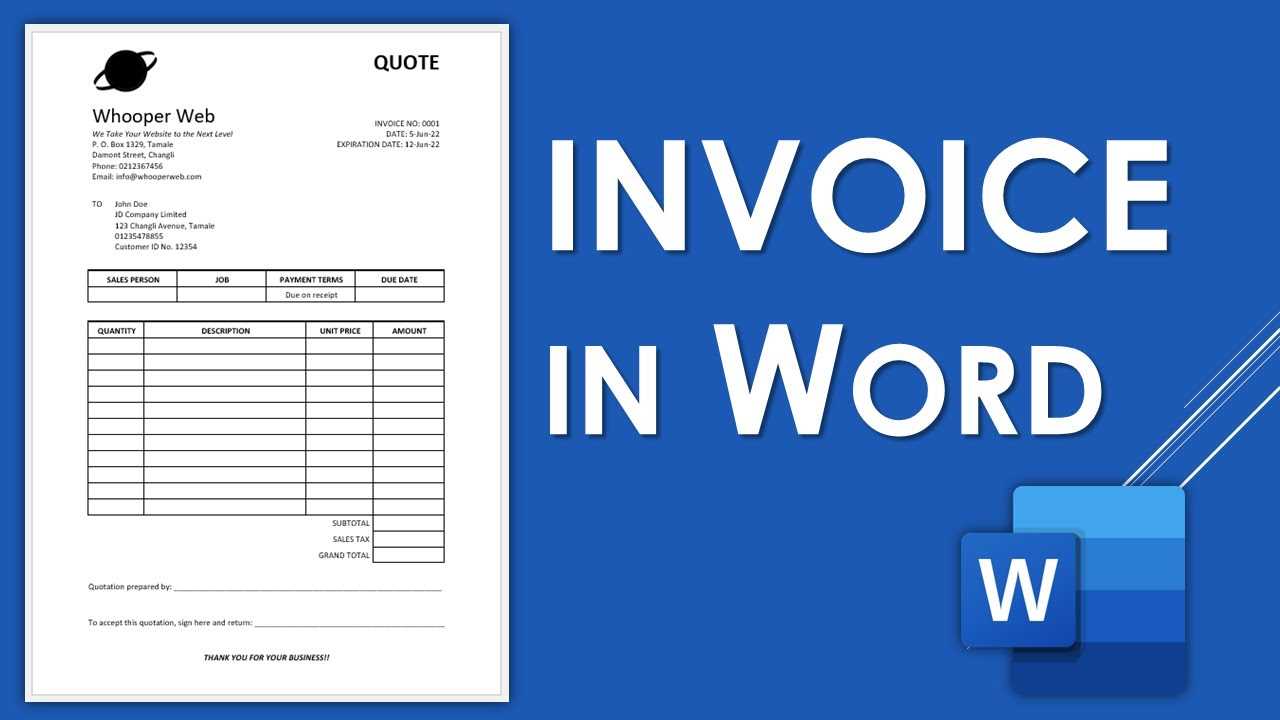

Benefits of Using Word for Business Billing Documents

Choosing the right tool for creating financial records is key to ensuring both efficiency and professionalism in your business. A popular choice is using text editing software, as it provides flexibility and ease of use while allowing you to produce high-quality documents quickly. Below are the key advantages of using this software for your business billing needs.

- Customization: You can easily customize layouts and fields to suit your specific needs, ensuring that each document is tailored to your business and the nature of the transaction.

- Easy Formatting: With built-in tools for formatting text, adding tables, and organizing content, creating a professional-looking document is straightforward. You can make sections bold, italicized, or underlined to emphasize key information.

- Accessibility: This software is widely available on most devices, making it easy to access and edit documents wherever you are, whether you’re at the office or on the go.

- Templates and Pre-Designed Layouts: Many platforms offer ready-to-use layouts, which can save you time and effort while maintaining consistency across all your documents.

- Easy Sharing and Storage: Once you’ve created your document, it’s simple to share it via email or store it digitally, making it accessible for future reference or updates.

- Cost-Effective: This software is often available as part of office suites, making it a budget-friendly option compared to specialized invoicing tools or software subscriptions.

Using text processing tools for financial records not only streamlines your workflow but also ensures that you can create professional documents in a fraction of the time, with all the necessary details clearly presented. Whether you are a freelancer or a larger business, this approach can simplify your administrative tasks and contribute to smoother operations.

Essential Elements of a Tax Invoice

When creating a formal financial record for business transactions, certain key components must be included to ensure that the document serves its intended purpose. These elements not only verify the legitimacy of the transaction but also ensure compliance with legal and regulatory requirements. A well-structured document should include both transactional details and specific identifiers that are recognized by authorities.

Key Information for Accurate Record Keeping

To guarantee that the document meets the required standards, it should include the following critical details:

| Component | Description |

|---|---|

| Unique Identifier | A distinct number or code for easy reference. |

| Seller’s Information | Full name, address, and contact details of the business. |

| Buyer’s Information | Name and contact information of the purchasing party. |

| Transaction Date | The exact date of the transaction. |

| Item Description | Detailed list of the products or services exchanged. |

| Total Amount | The sum of the transaction, including applicable fees or taxes. |

| Payment Terms | Details on how and when payment is expected to be made. |

Additional Considerations for Legality and Clarity

Beyond the essential details, it’s also important to include any relevant legal disclaimers or notices regarding the transaction, such as refund policies or any regulatory obligations. Clear, precise language ensures that both parties understand their rights and responsibilities, reducing potential disputes.

Why Use a Template for Invoices

Utilizing a pre-designed structure for documenting business transactions offers numerous benefits. It ensures consistency, reduces errors, and saves valuable time. By using a standardized format, businesses can streamline their financial processes, enhance professionalism, and maintain accuracy in their records, all while minimizing the risk of overlooking important details.

Efficiency and Time-Saving

One of the primary advantages of adopting a pre-designed format is the time saved in creating each new record. Instead of manually entering the same information repeatedly, the format allows for quick input of specific details. This efficiency not only speeds up the process but also ensures that every required field is completed correctly.

| Advantage | Description |

|---|---|

| Consistency | A fixed structure ensures uniformity in all documents, making them easy to understand and compare. |

| Accuracy | Pre-set fields and format reduce the likelihood of missing crucial details or making mistakes. |

| Professional Appearance | A polished, consistent layout helps enhance the credibility of the business. |

| Legal Compliance | Including all necessary legal information in the right format ensures compliance with regulations. |

Customization and Flexibility

While a pre-designed format simplifies the process, it also offers flexibility. Businesses can adjust the layout and fields according to their specific needs, ensuring that unique elements are addressed without compromising on the document’s overall structure. This adaptability makes it a valuable tool for a wide range of industries and transaction types.

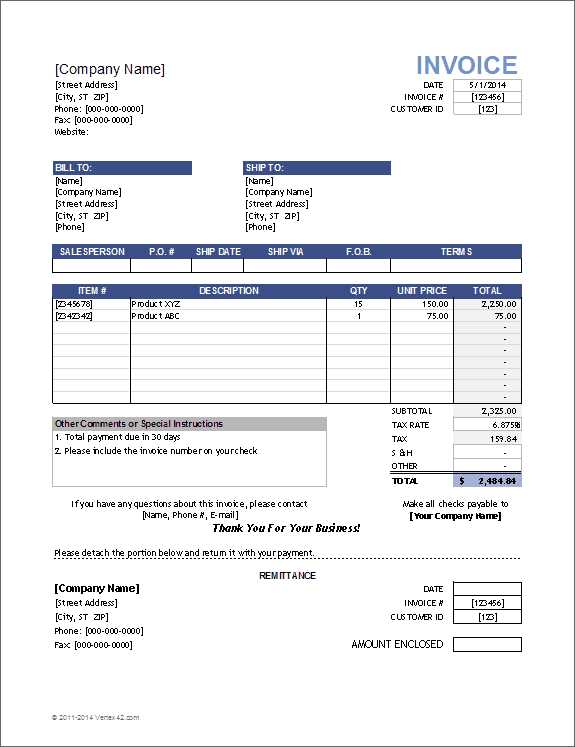

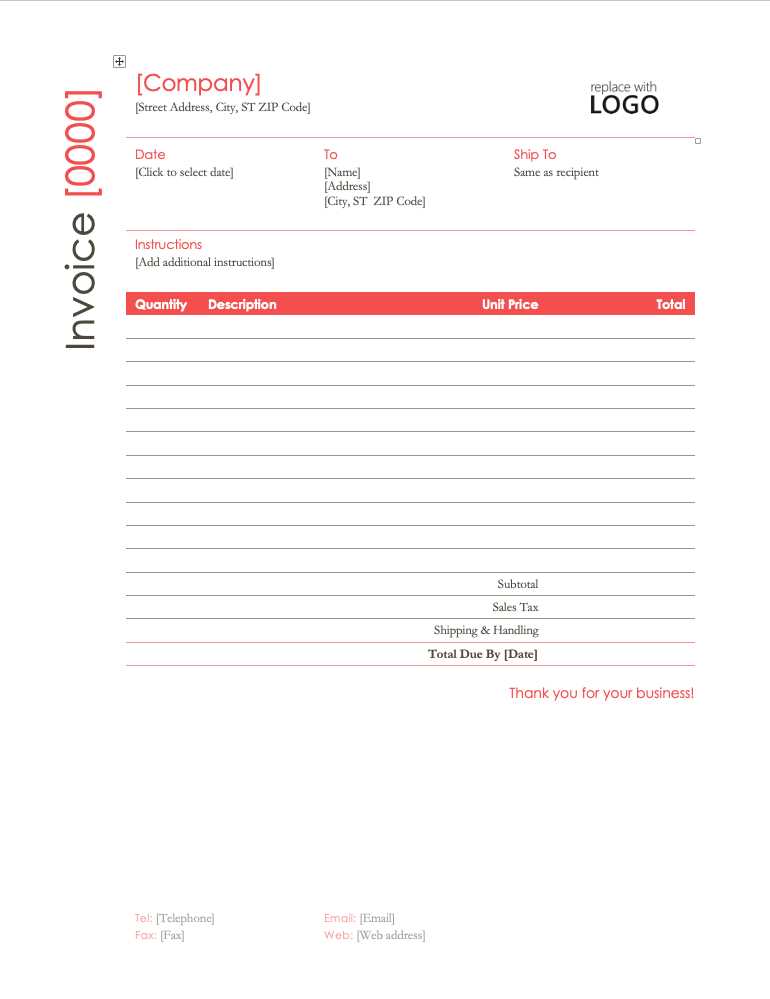

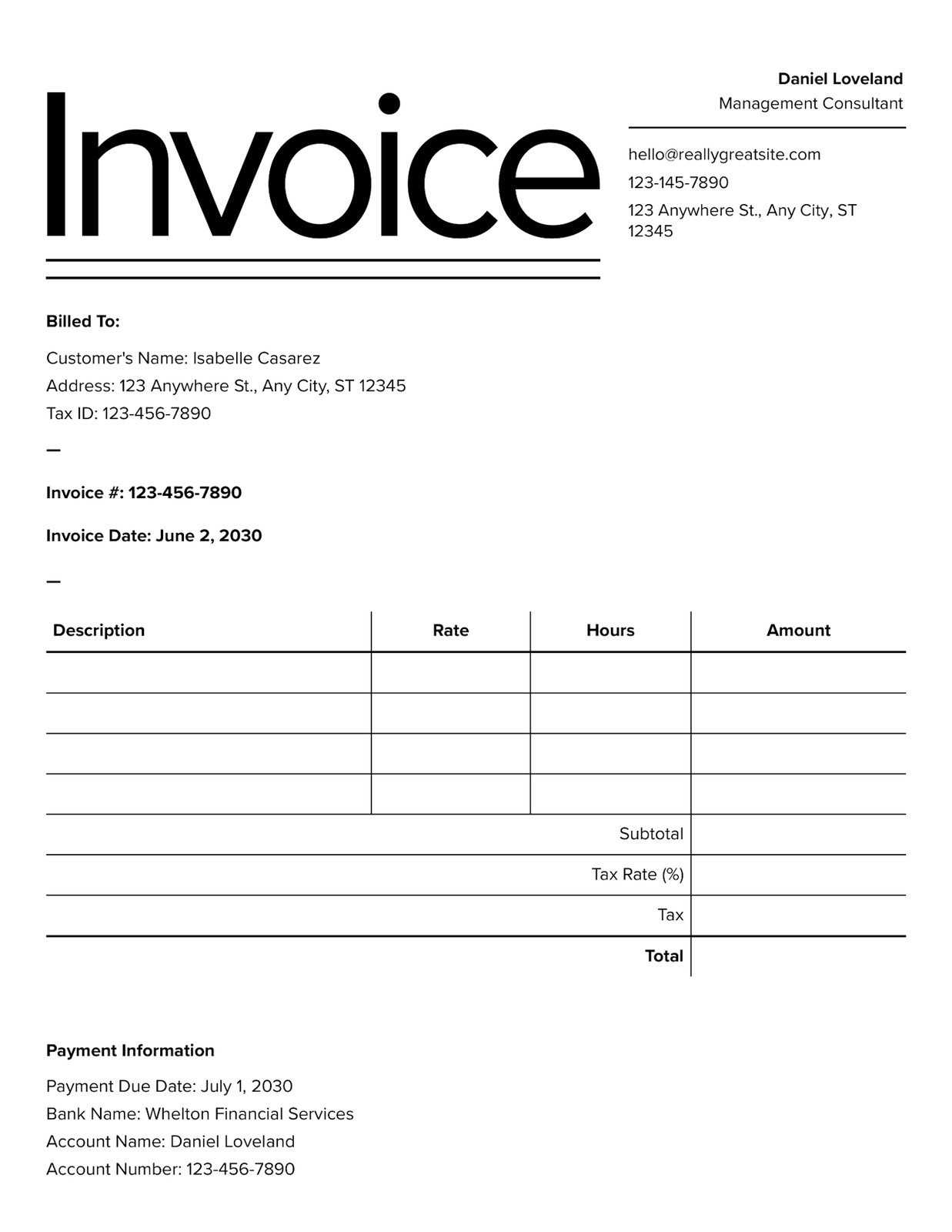

How to Customize Your Invoice Template

Personalizing your business transaction records is essential for reflecting your brand identity and ensuring that the document meets specific needs. Customizing the format allows you to adjust key elements, such as layout, colors, and included details, so that they align with your business practices and customer expectations. This adaptability ensures that every document you create is both functional and professional.

To get started with customizing your document structure, focus on the following areas:

- Logo and Branding: Add your company logo and adjust the color scheme to reflect your brand’s identity. This adds a professional touch and makes your document instantly recognizable.

- Contact Information: Ensure that your business contact details–such as address, phone number, and email–are clearly visible, and consider adding a link to your website for added convenience.

- Layout and Design: Adjust the overall layout to make the document easy to navigate. This includes organizing sections like item descriptions, pricing, and payment terms logically, with enough space for clarity.

- Additional Fields: Depending on your industry, you may need to add custom fields for specific information such as order numbers, shipping details, or service descriptions.

By making these adjustments, you not only create a document that is tailored to your business but also ensure that it is visually appealing and easy for your customers to read and understand.

Common Mistakes to Avoid in Business Transaction Records

When creating official records for business transactions, it’s essential to ensure all details are accurately presented. Small errors can lead to confusion, delayed payments, or even legal complications. Recognizing common pitfalls can help you avoid mistakes that might undermine the professionalism of your documents or cause issues with your clients and authorities.

Typical Errors in Document Creation

Below are some of the most frequent mistakes that businesses make when preparing financial documents:

| Error | Impact |

|---|---|

| Missing Unique Identifier | Lack of a clear reference number can cause confusion and make tracking payments difficult. |

| Incorrect Contact Details | Providing inaccurate contact information can lead to delayed communication and payment issues. |

| Incomplete Transaction Description | Vague or missing details about the products or services provided can result in misunderstandings. |

| Failure to Include Payment Terms | Not specifying when or how payments are due can lead to confusion and delays in settlement. |

| Wrong or Missing Legal Information | Failure to include necessary legal disclaimers or tax rates can result in compliance issues. |

How to Prevent These Mistakes

To avoid these errors, always double-check the document before sending it out. Use a standardized format, ensure all fields are completed, and review for accuracy. Taking the time to proofread and verify details will not only prevent mistakes but also reinforce your business’s credibility.

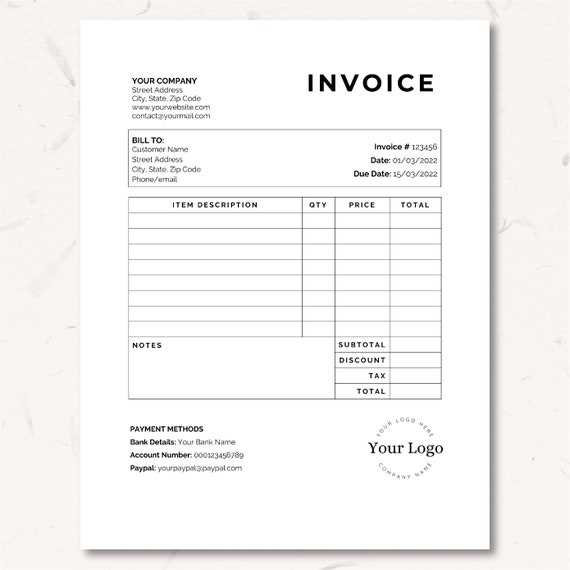

Formatting Tips for Professional Invoices

A well-formatted business document can enhance your professional image and ensure clarity for both your company and your clients. Proper formatting not only makes the document easy to read, but also helps prevent misunderstandings and fosters trust. By following a few key principles, you can create a polished and effective document that stands out.

Key Design Elements for a Clear Layout

When designing your business records, the following elements will help ensure that the document is both functional and aesthetically pleasing:

- Consistency in Structure: Stick to a consistent layout for every document. Include all necessary sections like contact details, product descriptions, and totals in the same order each time. This consistency ensures your records are easily navigable.

- Readable Fonts: Choose clear, easy-to-read fonts such as Arial or Helvetica. Avoid using too many different fonts, as this can make the document look cluttered and unprofessional.

- Appropriate Font Size: Keep text sizes between 10 and 12 points for readability. Ensure headings are slightly larger to differentiate them from body text, creating a visual hierarchy.

- Use of White Space: Proper spacing between sections, lines, and text allows for easy scanning of the document. Avoid crowding content and leave enough margin space for a clean look.

Ensuring Clarity with Alignment and Details

Accurate alignment and the inclusion of essential details are vital to ensuring the document’s clarity:

- Align Text Properly: Align numbers, such as prices and totals, to the right for easy reading. This helps clients quickly understand the financials without confusion.

- Highlight Important Information: Use bold or italics for key sections, like totals or due dates, to make them stand out. This draws attention to critical details that need prompt action.

- Clear Item Descriptions: Provide a concise, but detailed description of each item or service. Avoid using abbrevi

How to Add Tax Details on Invoices

Including accurate financial details, such as applicable charges and rates, is essential for both transparency and compliance. When preparing official documents for transactions, it is important to clearly specify any additional costs that arise from required fees. This ensures that both the business and the client are on the same page and that all obligations are properly met.

To properly include these details, follow these key steps:

- Specify the Rate: Clearly indicate the percentage of the applied fee. This should be shown as a separate line item to avoid confusion. For example, “10% Service Charge” or “5% VAT” should be listed with the appropriate amount calculated.

- Separate Itemization: When listing the charges, include the original price of the products or services, the applied fee, and the final total. This provides transparency and helps the client understand how the total amount was reached.

- Provide Legal Information: In some cases, you may be required to include specific legal details, such as your business’s registration number or the governing law for the fees. Be sure to include any such details to maintain compliance.

- Highlight the Total Amount: Clearly highlight the total amount due, including the base price and all additional fees. This ensures that clients are aware of the final sum they need to pay.

Example:

- Product Cost: $100.00

- Service Fee (10%): $10.00

- Total Due: $110.00

By breaking down the amounts clearly, you avoid any confusion and ensure that your clients can easily see what they are paying for.

Best Practices for Tax Invoice Design

Designing a professional and effective document for business transactions is essential for both clarity and credibility. A well-organized layout not only ensures that all necessary details are communicated clearly but also reflects positively on your business. Following best practices in design helps prevent confusion and ensures smooth communication between you and your clients.

Key Design Principles

- Consistency in Layout: Keep a consistent structure across all documents. Use the same format for all sections, including your business details, transaction information, and total amount. This helps your clients become familiar with the layout, making the document easier to understand.

- Clear Section Headers: Use bold and larger font sizes for section headings like “Product Description,” “Payment Terms,” and “Total Amount.” This improves readability and ensures that the document is easy to navigate.

- Logical Flow: Arrange the content in a logical sequence. Start with your business and client information, followed by the list of products or services provided, and end with the financial summary. This helps the reader easily follow the document’s structure.

- Visual Hierarchy: Use font size and boldness to create a visual hierarchy. Important details like the total due or due date should stand out, while less crucial information should be smaller and placed in less prominent areas.

Additional Design Tips for Professionalism

- Whitespace: Avoid clutter by leaving adequate space between sections. This gives the document a clean and organized look and makes it easier for the client to find key information quickly.

- Highlight Key Information: Use shading, bold text, or borders to emphasize critical elements like the total amount due, payment terms, or the due date.

- Accurate and Complete Information: Ensure that all fields are completed accurately. Missing or incorrect details can cause confusion and delay payments. Double-check all figures and text before finalizing the document.

- Branding: Include your company logo, color scheme, and contact information to reinforce your brand identity. A consistent brand presence adds professionalism and makes your business appear more trustworthy.

Avoiding Common Design Mistakes

- Overcrowding the document with too much information. Keep it simple and focused on what’s necessary.

- Using hard-to-read fonts or excessive text decoration. Stick to clean, readable fonts like Arial or Helvetica.

- Leaving out important details like payment terms, contact information, or a unique reference number.

- Inconsistent formatting. Make sure that your layout, fonts, and colors remain uniform throughout the document.

By following these best practices, you ensure that

Saving and Printing Your Document

Once you have completed your business transaction document, it’s important to save it correctly and prepare it for printing or digital distribution. Proper saving ensures that you can easily access and share your document when needed, while following the right printing steps ensures that it maintains its professional appearance when presented to clients or kept for your records.

How to Save Your Document Correctly

- Choose the Right Format: When saving your document, select a file format that is universally accessible. The most common formats are PDF for easy sharing or DOCX for future editing.

- Use Clear File Naming: Name the file in a way that makes it easy to identify later. Consider including the client’s name, the transaction date, and a reference number in the filename (e.g., “ClientName_TransactionDate_RefNumber”).

- Save in Multiple Locations: To avoid losing important documents, save the file in multiple places. For example, store it on your computer, a cloud storage service, and an external drive for backup.

- Use Folders for Organization: Create folders for different clients or periods (e.g., monthly or yearly folders) to keep everything organized and easy to find when you need it.

How to Print Your Document

- Check Layout and Formatting: Before printing, ensure that the document’s layout and formatting appear as intended. Preview the document to check for any alignment issues, missing details, or excessive blank space.

- Use High-Quality Paper: For a professional appearance, print your document on high-quality paper. A crisp, clear printout reflects well on your business.

- Printer Settings: Ensure that your printer is set to the correct paper size and quality. Most printers allow you to adjust settings to print at a higher quality, which is recommended for documents that you present to clients.

- Print a Test Copy: Before printing the final version, print a test copy to ensure that everything looks right. This step helps avoid wasting paper and ink if there are formatting issues.

Digit

How to Automate Invoice Creation in Word

Automating the process of creating business transaction documents can save a significant amount of time and reduce the likelihood of errors. By using built-in tools and customizing your document, you can streamline repetitive tasks such as filling in client details, item lists, and amounts. This approach ensures consistency, accuracy, and efficiency, especially when you need to generate multiple records quickly.

Steps to Automate Document Creation

Follow these simple steps to set up automation within your document creation process:

- Use Fields and Formulas: Word offers the ability to insert fields and formulas that automatically calculate totals, dates, and other necessary details. For example, use the “DATE” field to auto-populate the current date or the “FORMULA” field to sum up the cost of services and products.

- Create Custom Styles: Set up custom styles for your document sections (such as headings, item lists, and totals). This ensures consistency and speeds up the process when adding new content to your document.

- Set Up Mail Merge: If you have a large client base, use the Mail Merge function to automatically pull in client details from a database or spreadsheet. This can save time when filling in repeated information like client names, addresses, or payment terms.

Using Tables for Structured Data Entry

Tables can greatly assist in structuring the content of your document, especially when dealing with lists of items or services. By creating a table with predefined columns for descriptions, quantities, prices, and totals, you can automate the calculation and organization of this data.

Item Description Quantity Price Total Product 1 2 $50.00 Free Resources for Tax Invoice Templates

If you’re in need of a convenient way to create billing documents without spending money, numerous free options are available online. These resources offer customizable designs and formats, ensuring that you can create professional and clear statements with ease. Whether you’re a freelancer, small business owner, or just starting out, these tools provide a great way to handle financial documentation efficiently.

Many platforms offer free downloadable versions that cater to various needs, including both simple and more complex layouts. These resources are designed to be user-friendly, allowing quick edits and adjustments to suit your specific business requirements. From basic fields to advanced options, there is a wide range of layouts to choose from.

Additionally, some sites provide step-by-step guides, ensuring that even those with little experience in document creation can generate professional outputs. These platforms are accessible to anyone, with no hidden fees or subscriptions required.

How to Ensure Legal Compliance with Invoices

Maintaining compliance with legal requirements is essential when preparing financial documentation for your business. This ensures that all transactions are recorded accurately and that you meet the necessary regulations in your jurisdiction. A clear understanding of the key components and requirements will help you avoid potential legal issues and penalties.

Key Elements for Legal Compliance

To ensure that your documents meet the legal standards, it’s important to include certain mandatory information. Below is a table of essential details that should be present in every business statement to stay compliant:

Element Description Business Information Include the full name, address, and registration number of your company or business. Client Details Provide the customer’s full name, address, and any other identifying information necessary. Unique Identifier Assign a unique reference number to each document for easy tracking and reference. Date of Transaction Record the exact date when the product or service was provided to the client. Payment Terms Specify when the payment is due and any applicable late fees or discounts. Description of Goods/Services Provide a clear breakdown of the goods or services provided, including quantities and prices. Additional Considerations

In some regions, businesses must also ensure that certain regulatory obligations are met, such as including specific tax numbers or providing evidence of payment methods. Always consult a legal expert or accountant familiar

When to Update Your Invoice Template

Regularly updating your business documents is crucial for staying organized and maintaining accuracy. Changes in your business operations, local regulations, or financial needs may require modifications to the way you present your billing records. Keeping your documents up-to-date not only improves professionalism but also ensures compliance with the latest standards.

When Business Information Changes

If there are any updates to your company’s name, address, contact information, or registration details, it’s essential to revise your records accordingly. Accurate and current contact details help prevent delays in payments and ensure that clients can reach you without issues. This also applies when you rebrand or change your business structure, such as switching from a sole proprietorship to a limited liability company (LLC).

Changes in Legal Requirements or Rates

Legal regulations regarding financial documentation, including tax rates or required information, may change over time. For example, a new law could mandate the inclusion of specific details or adjustments in payment methods. Similarly, if your pricing structure or service offerings change, updating the document ensures that your clients receive accurate and transparent records.

Additionally, if you start offering new products or services, your records should reflect these additions. Keeping your documents aligned with business changes minimizes errors and ensures smooth operations.

How to Share Invoices with Clients

Once you have prepared your billing documents, it’s important to send them to your clients in a professional and efficient manner. The method you choose can impact how quickly you receive payment and how clearly your client understands the details of the transaction. There are several ways to share your documents, each with its own advantages and considerations.

Common Methods for Sharing

There are a variety of channels you can use to send your documents to clients. Below are some of the most common methods:

- Email: The most common and convenient method. Attach your file in PDF format for easy readability and to ensure the document cannot be easily edited.

- Online Payment Systems: If you’re using platforms like PayPal, Stripe, or similar, you can directly send the documents through the platform’s interface, which often integrates with payment features.

- Cloud Storage: Upload the document to a cloud service such as Google Drive, Dropbox, or OneDrive and share the link with your client. This option is ideal for larger files or if you need to collaborate on the document in real-time.

- Postal Mail: For clients who prefer physical copies, sending printed documents via mail can be a more formal approach. This method may take longer but could be preferred in certain industries or regions.

Best Practices for Sharing Billing Documents

When sending your documents, consider the following tips to ensure clarity and professionalism:

- Double-check the information: Make sure all details are accurate before sending to avoid delays or confusion.

- Use a clear and descriptive subject line: If sending via email, the subject should clearly indicate the purpose of the message (e.g., “Payment Request for [Service/Product Name]”).

- Follow up: If you don’t receive acknowledgment or payment within the agreed timeframe, send a polite follow-up reminder.

- Consider client preferences: Some clients may prefer electronic methods, while others may request paper copies. Be flexible in accommodating these preferences when possib