Free Blank Invoice Template to Print and Use

In any business, managing finances and ensuring timely payments is crucial. One of the most efficient ways to streamline this process is by using pre-designed forms that can be easily filled out for each transaction. These forms help save time, avoid errors, and ensure consistency in your financial records.

Whether you’re a freelancer, small business owner, or part of a larger company, having a ready-made structure for your financial requests can make a significant difference. With customizable options, you can quickly generate documents that meet both your personal and client needs without needing to start from scratch each time.

Having the right resources at your fingertips is key to maintaining professionalism and organization in your financial dealings. A well-structured document allows you to focus on what matters most–growing your business–while also keeping your transactions clear and transparent for clients and partners alike.

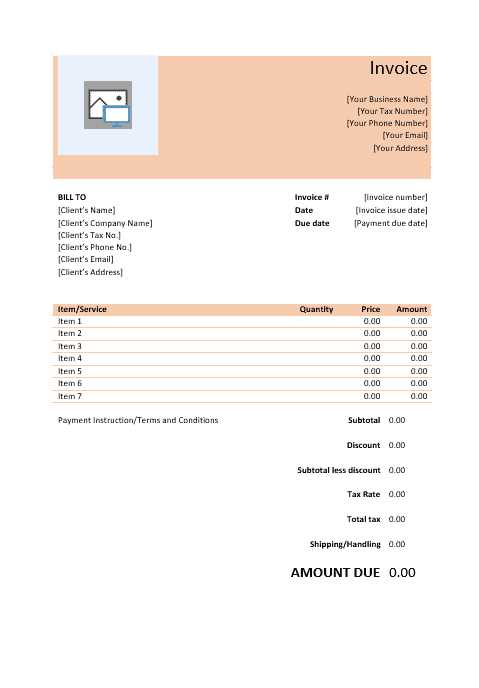

Blank Invoice Template to Print

When it comes to requesting payment or documenting a transaction, using a standard form can greatly simplify the process. These pre-designed documents provide a structured layout, allowing you to fill in the necessary details quickly and efficiently. They are perfect for businesses of all sizes, helping maintain professionalism while ensuring all relevant information is included.

Why You Need a Pre-Formatted Document

Using a ready-made document reduces the time spent on creating a new one from scratch every time you need to bill a client. It ensures consistency in your business communications, making it easier for clients to understand and process payments. In addition, these forms typically include all the essential sections such as service descriptions, dates, payment terms, and totals, so you don’t have to worry about forgetting important details.

Where to Find Ready-to-Use Documents

There are many sources online offering downloadable, ready-to-use forms that can be easily customized to suit your specific needs. Whether you’re looking for a basic structure or a more detailed design with branding, you can find a variety of options. Most are available in common formats like PDF or Word, making them simple to download and fill out on your computer or mobile device.

Why Use a Blank Invoice Template

Having a pre-designed form for billing makes the entire payment process smoother and more efficient. These ready-to-use documents ensure that no important details are left out, while also offering a quick way to generate professional-looking requests for payment. By using a standardized structure, businesses can focus on their work rather than wasting time on formatting each document from scratch.

Here are some key reasons why using a pre-made billing structure is beneficial:

| Benefit | Description |

|---|---|

| Consistency | Using the same layout for all transactions ensures that clients can easily understand your requests, reducing confusion. |

| Time-Saving | A pre-filled structure saves time, allowing you to focus on other important tasks while speeding up the billing process. |

| Professionalism | By presenting a polished, consistent format, you enhance your company’s image and maintain a professional standard in financial dealings. |

| Accuracy | With a pre-set format, you are less likely to overlook important details, ensuring the information is accurate every time. |

| Customizability | Even though these documents follow a standard structure, they can still be tailored to your business needs, from adding logos to modifying terms. |

By using such resources, businesses can streamline their financial operations, ensuring that every billing cycle is completed without unnecessary delays or mistakes.

Benefits of Printable Invoice Templates

Using a pre-designed document for billing offers several advantages for both businesses and freelancers. It simplifies the process of generating financial records, ensuring accuracy and consistency across all transactions. These ready-to-use forms allow for quicker billing, reducing administrative workload while maintaining a professional appearance.

Here are some key benefits of using such documents for your billing needs:

- Time Efficiency: Pre-designed documents allow you to complete billing tasks in a fraction of the time it would take to create one from scratch.

- Consistency: By using the same structure for every transaction, you ensure that your communications remain uniform, making it easier for clients to understand and process payments.

- Professional Appearance: A well-structured, clean design gives your business a professional edge, helping you build trust with clients.

- Easy Customization: These documents are customizable to suit your branding, including adding your logo, payment terms, and business details.

- Accuracy and Clarity: A standardized form ensures all essential information is included and correctly formatted, minimizing the chance for errors.

- Paper and Digital Options: Many of these forms can be used both digitally and in printed form, offering flexibility depending on your needs.

Overall, using pre-made billing documents enhances your business’s workflow, helping you focus on what really matters while maintaining accurate and timely financial records.

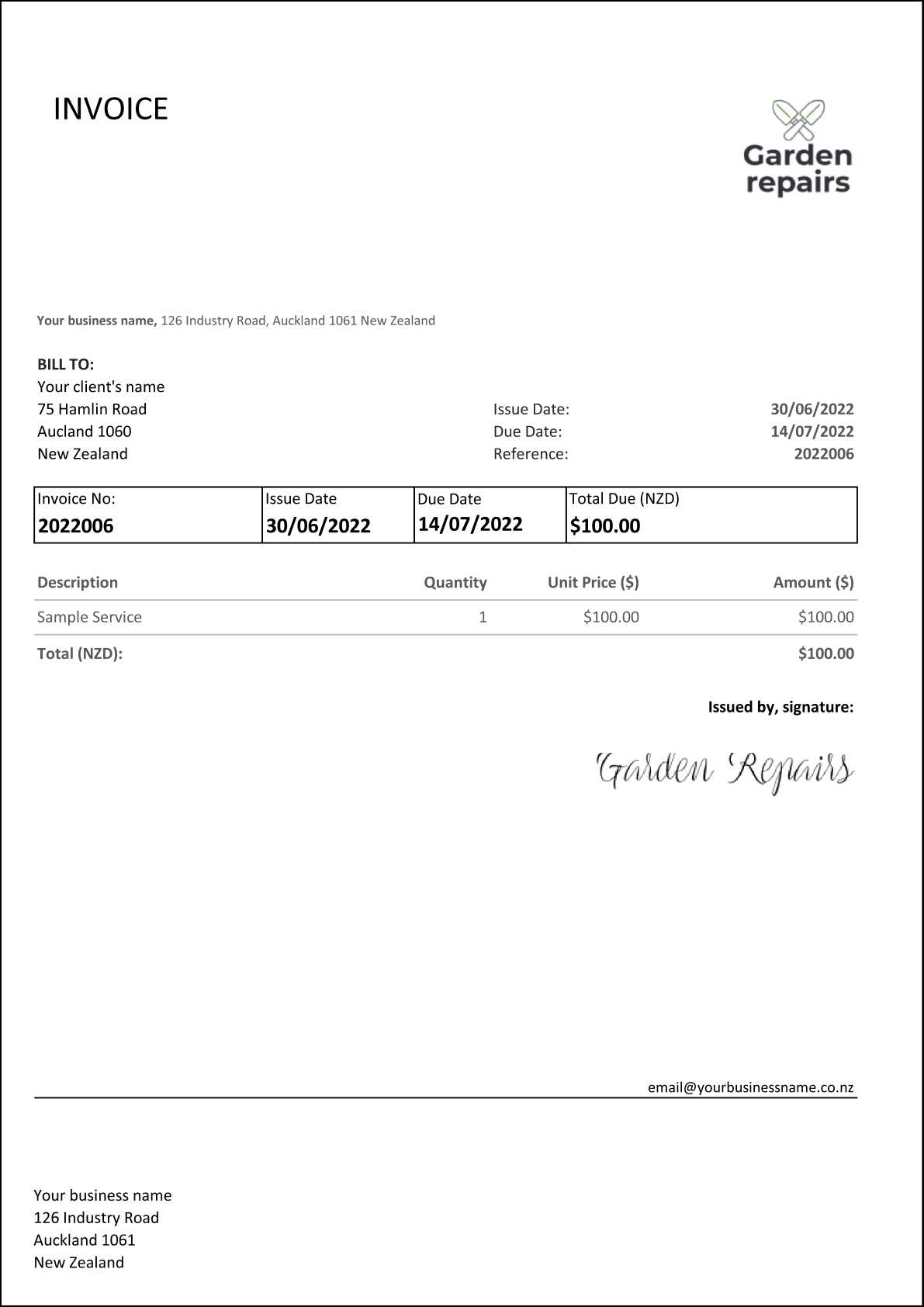

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to your business’s specific needs and ensure it aligns with your brand identity. Whether you need to adjust the layout, add your logo, or change the payment terms, personalizing these forms is a simple yet effective way to enhance your professionalism and communicate clearly with clients.

Steps to Personalize Your Billing Form

Customizing your document can be done quickly by following these simple steps:

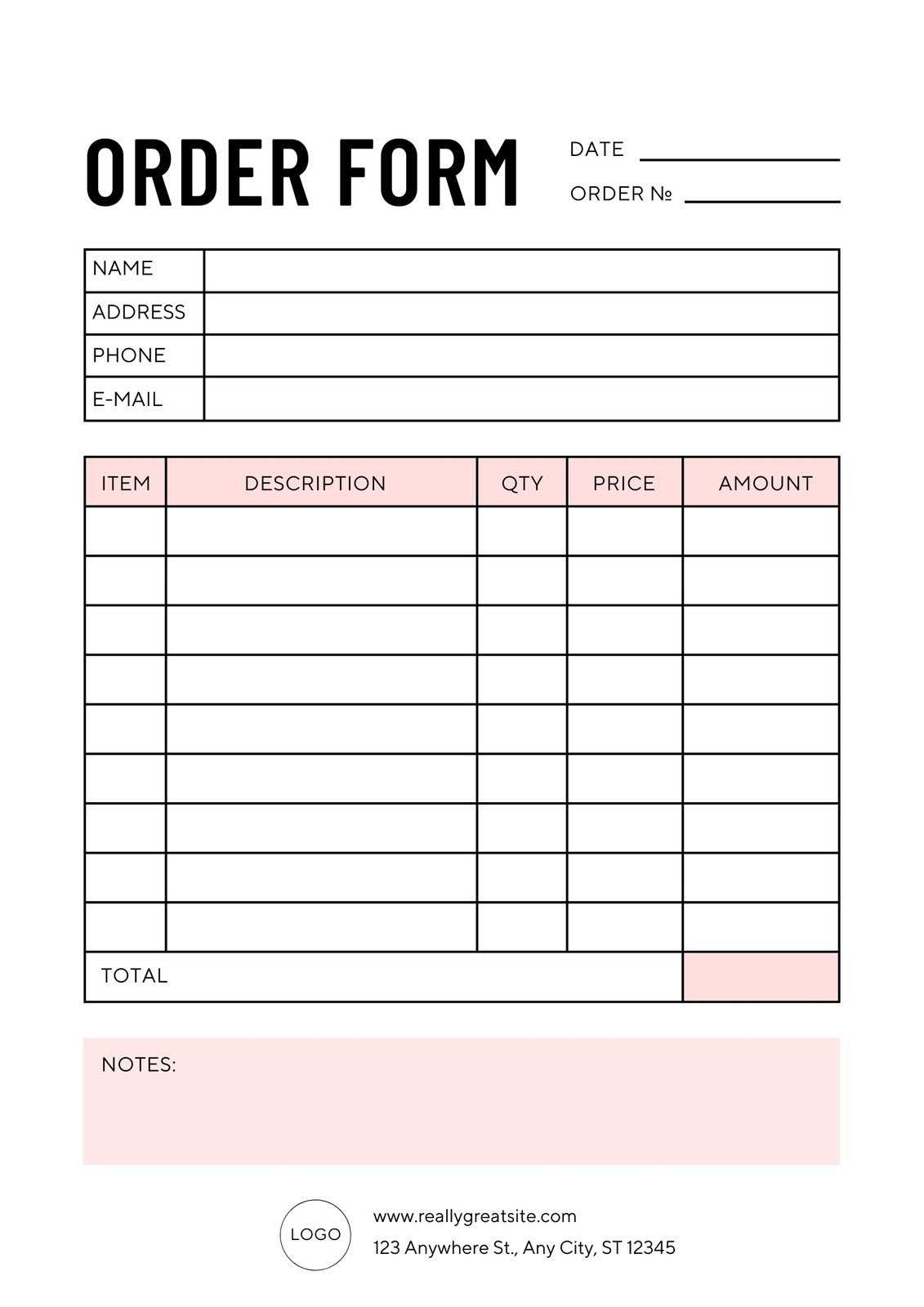

- Update Business Information: Add your company’s name, address, phone number, and email address at the top for easy identification.

- Incorporate Your Logo: Adding your logo to the document reinforces your brand and gives it a more polished, professional appearance.

- Adjust Payment Terms: Modify the payment due date and terms to match your business practices (e.g., “Due within 30 days” or “Late fee applies after 10 days”).

- Include Client Details: Ensure you include the client’s name, address, and contact information for clarity and proper communication.

- Customize Service Descriptions: Tailor the list of services or products you provide to reflect the specifics of the transaction, including quantities and prices.

Additional Customization Tips

- Design Adjustments: Modify the layout, font style, and colors to match your brand’s visual identity, making it more recognizable.

- Discounts or Additional Charges: Include spaces for offering discounts or adding additional charges like taxes or shipping fees.

- Notes Section: Add a custom message or reminder for the client, such as a th

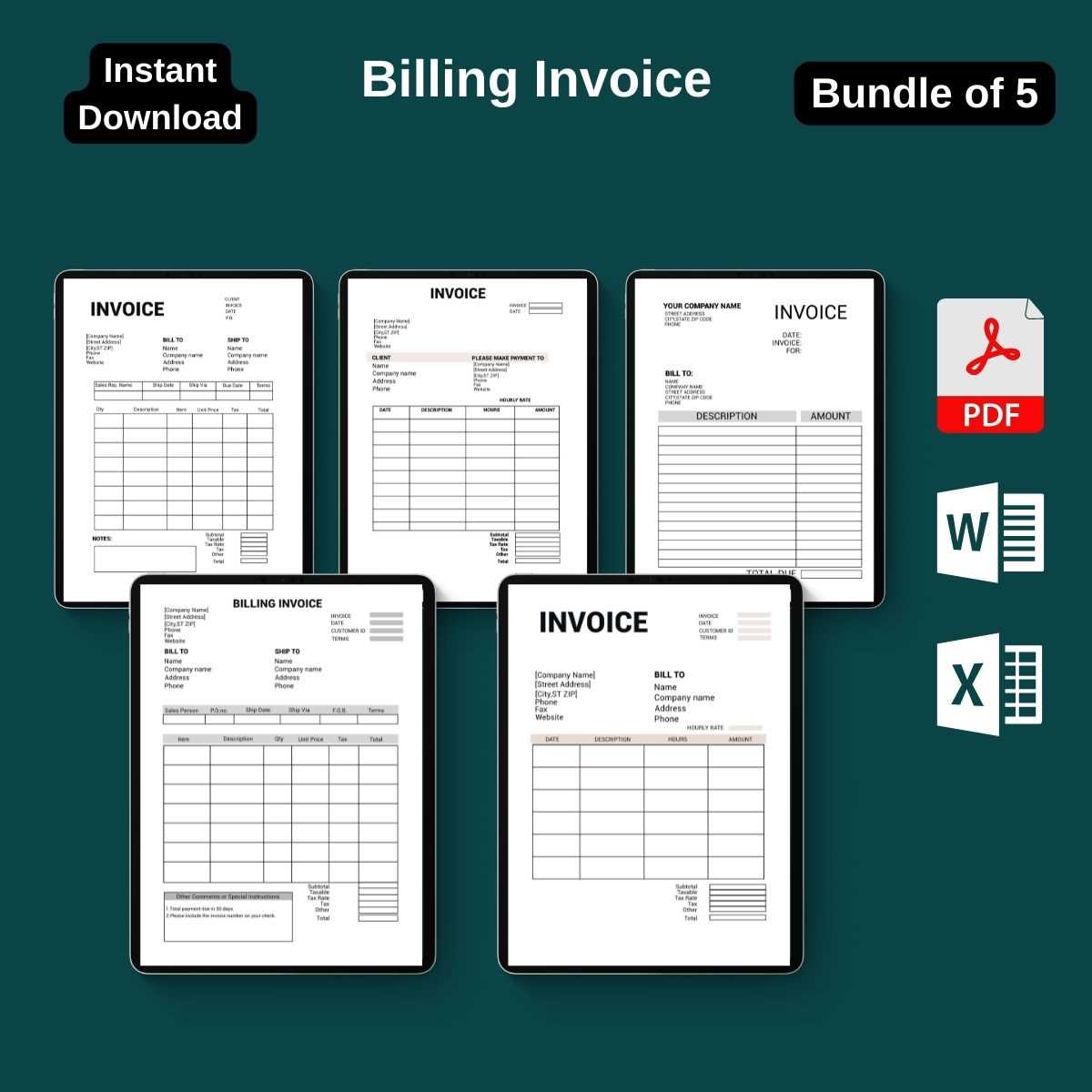

Where to Find Free Invoice Templates

When looking for ways to manage financial transactions effectively, having a well-organized document for billing is essential. Luckily, there are numerous online resources where you can access ready-made designs to suit various business needs without any cost. These options allow users to download and customize documents for their own use, saving both time and effort.

Online Platforms Offering Free Resources

Several websites provide an extensive collection of documents for generating financial records. Many of these platforms offer free downloads and allow for quick customization, ensuring that you can create professional-looking forms in no time.

- Google Docs and Microsoft Office: Both platforms offer free, editable files through their online services. These can be tailored easily to your specifications and saved for future use.

- Canva: Known for its user-friendly interface, Canva provides visually appealing designs that can be personalized for various business purposes, including financial documentation.

- Zoho: This platform offers free tools for generating professional documents, with options for customization to meet specific business needs.

Additional Sources for Templates

Beyond the popular services, there are other lesser-known websites that cater to this need, offering free designs and formats that are perfect for various industries.

- Invoice Generator: A straightforward website that allows you to quickly create and download formatted documents without the need for any special software.

- Template.net: This site provides a wide range of free and customizable options for those in need of professional-grade forms for financial transactions.

- FreshBooks: Primarily known for its accounting software, FreshBooks also offers free resources for simple billing and documentation that can be adjusted to your requirements.

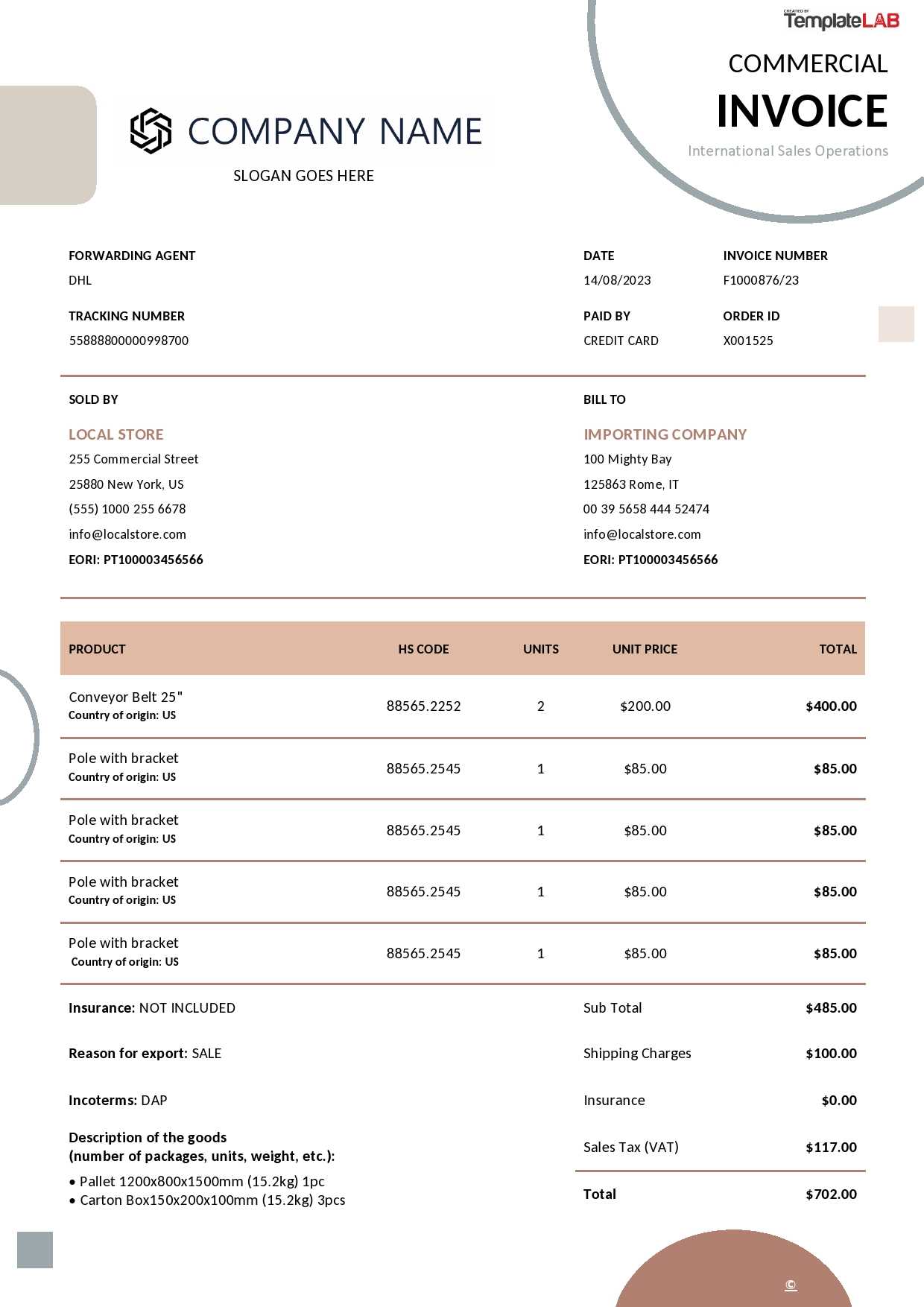

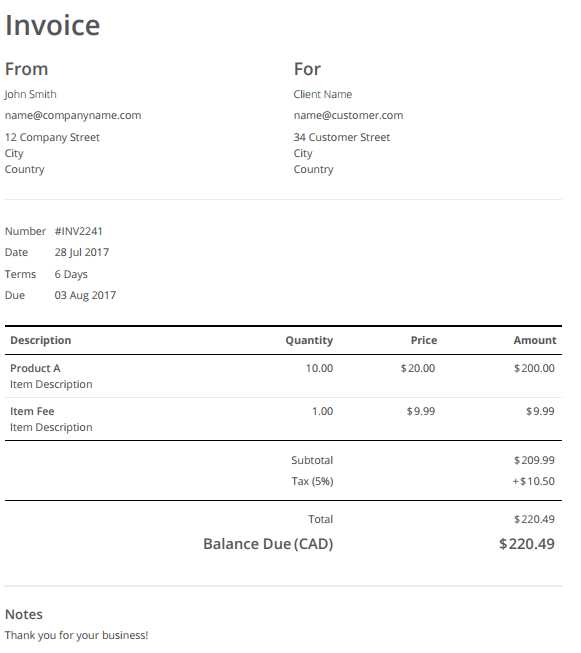

Essential Elements of an Invoice

When creating a document for billing, it’s crucial to include certain key details to ensure clarity and professionalism. These components not only help in maintaining accurate records but also ensure that the transaction process is transparent for both parties involved. A well-structured document provides all necessary information to avoid confusion and facilitate prompt payment.

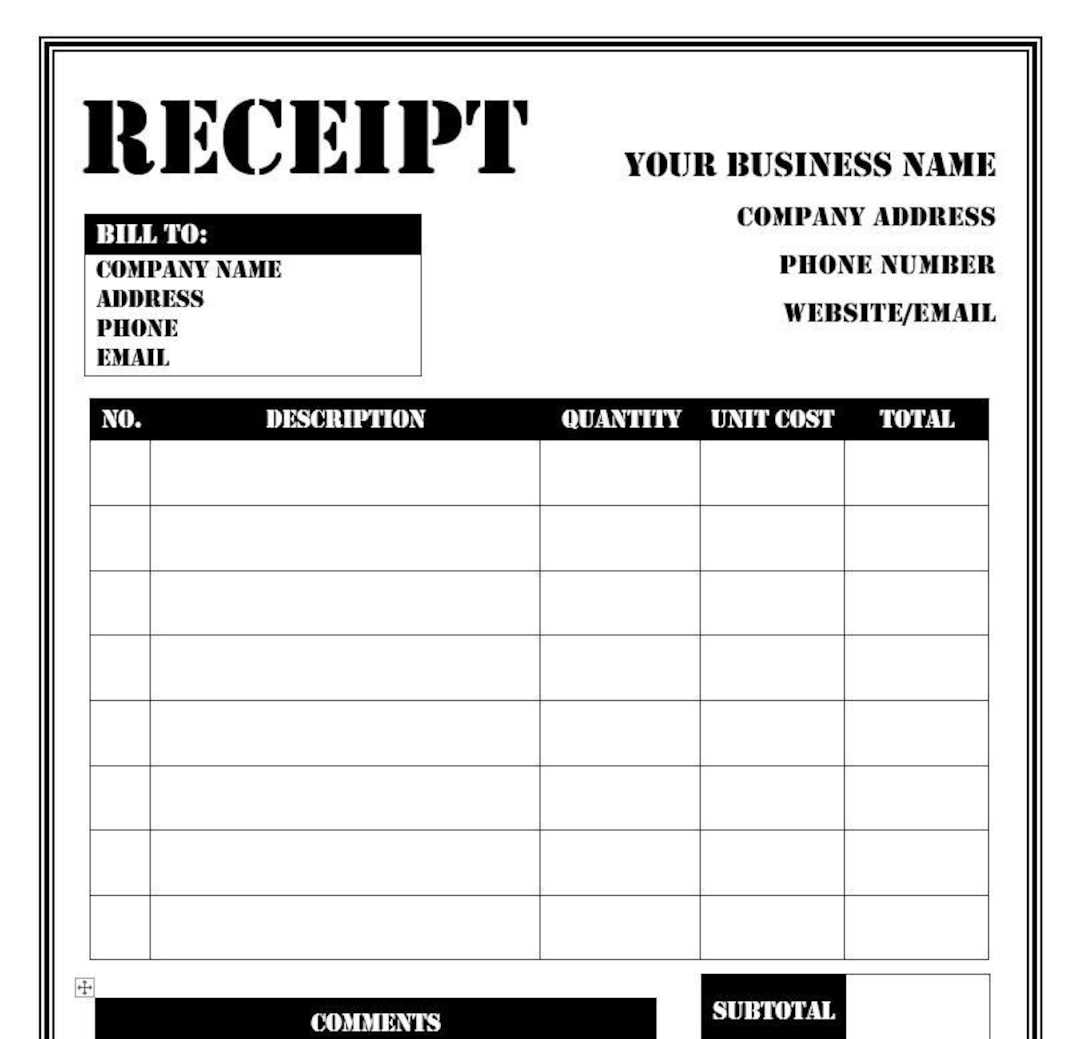

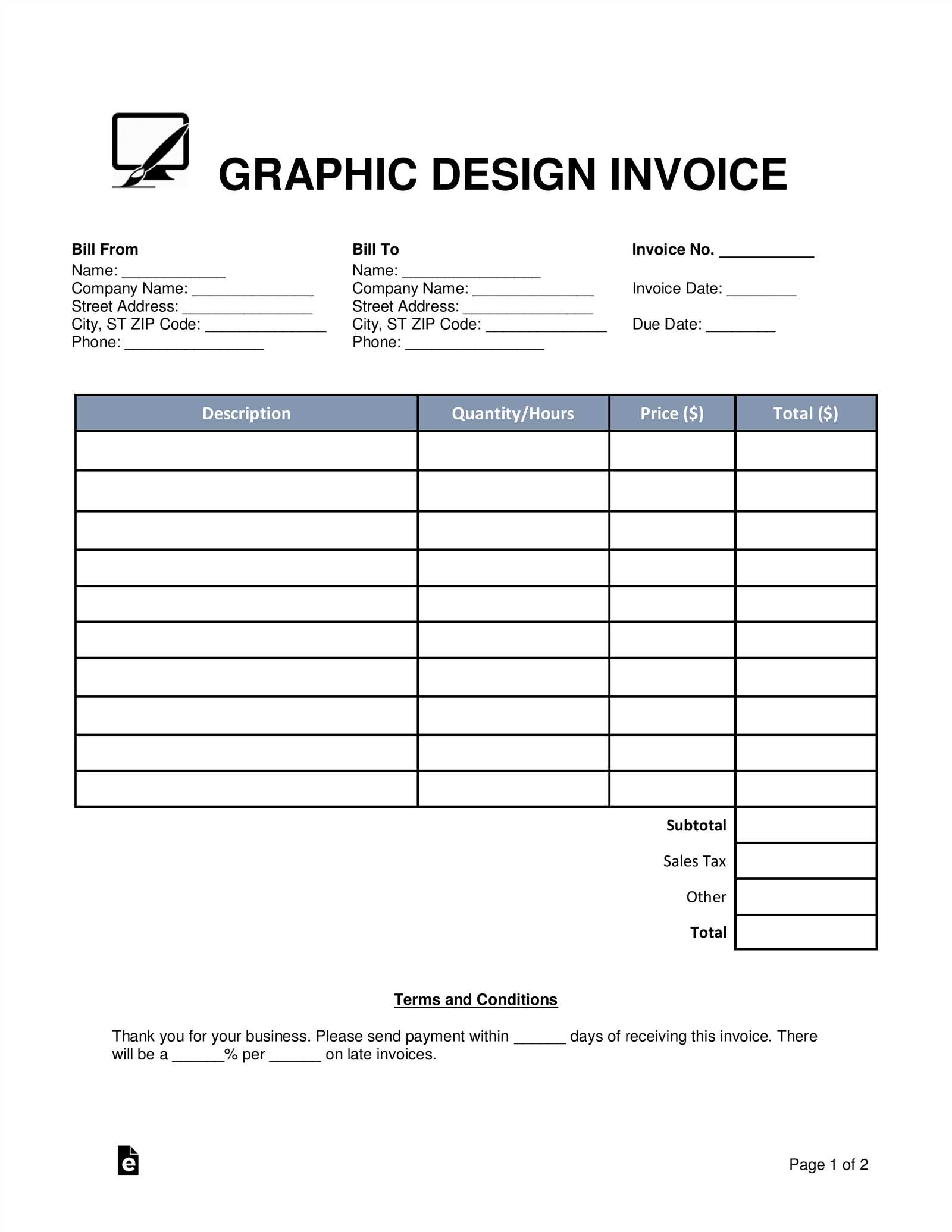

- Header Section: This should clearly indicate the nature of the document. It often includes labels such as “Receipt,” “Billing Statement,” or simply “Details of Services Rendered” to establish the purpose of the document.

- Business Information: The name, address, and contact details of the company or individual issuing the document should be prominently displayed. This helps the recipient identify the source and contact the issuer if necessary.

- Recipient’s Information: Include the name and address of the person or company receiving the document. This ensures that the correct party is being billed and allows for efficient correspondence if needed.

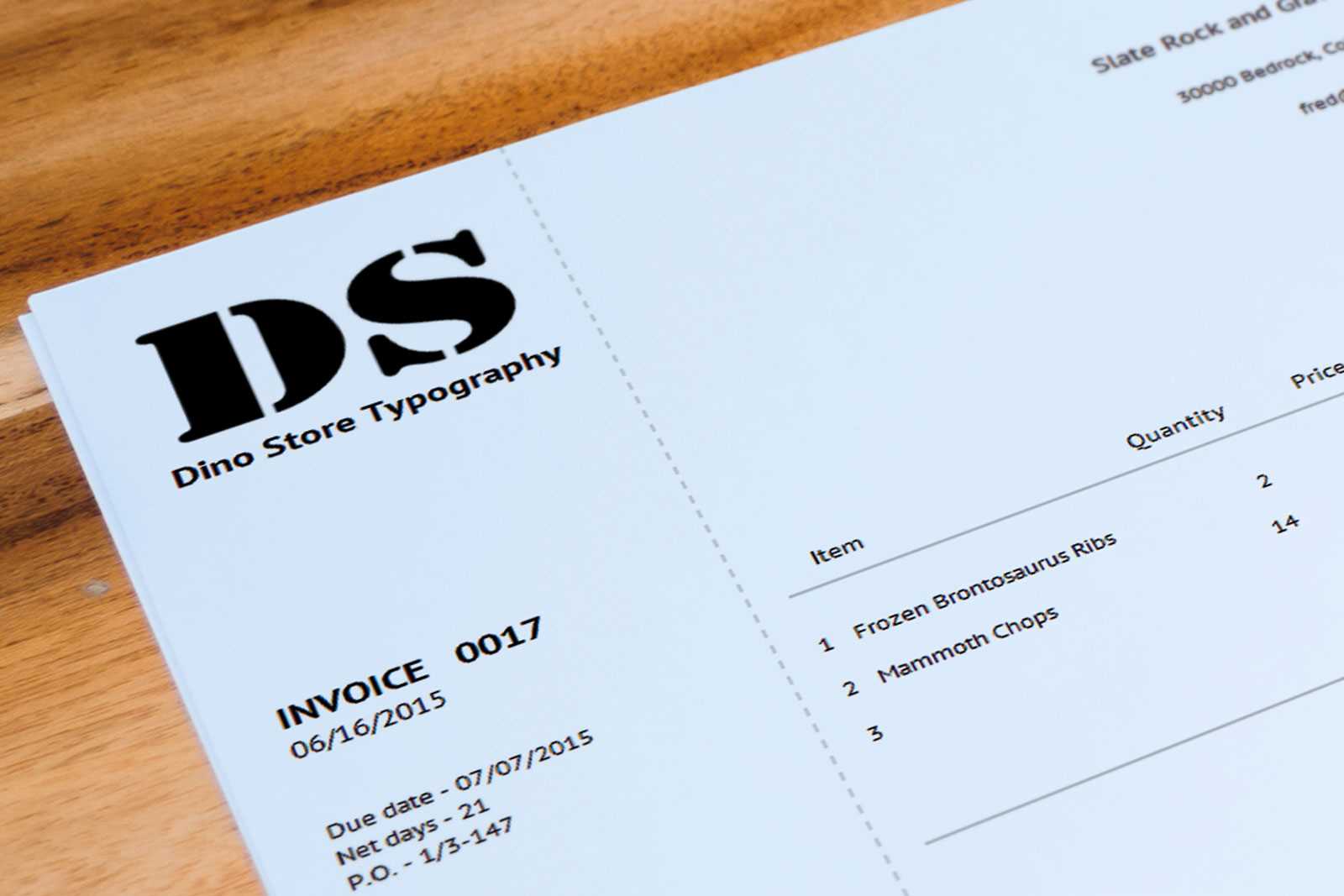

- Unique Reference Number: A unique identification number is essential for tracking and referencing the transaction. This can be used in correspondence or future inquiries to find the specific record quickly.

- List of Products or Services: Provide a detailed breakdown of what is being charged, including descriptions, quantities, and prices. This allows both the issuer and recipient to verify the services or goods exchanged.

- Total Amount Due: This section clearly states the total cost that needs to be paid, including any taxes or additional fees, to avoid misunderstandings regarding the final sum.

- Payment Terms: Outline the payment deadline, accepted payment methods, and any late fees or discounts applicable. This ensures that both parties are aware of the expectations regarding the transaction timeline.

- Notes or Additional Information: Optional details such as terms and conditions, thank-you messages, or further clarifications can be included in this section to add professionalism and transparency.

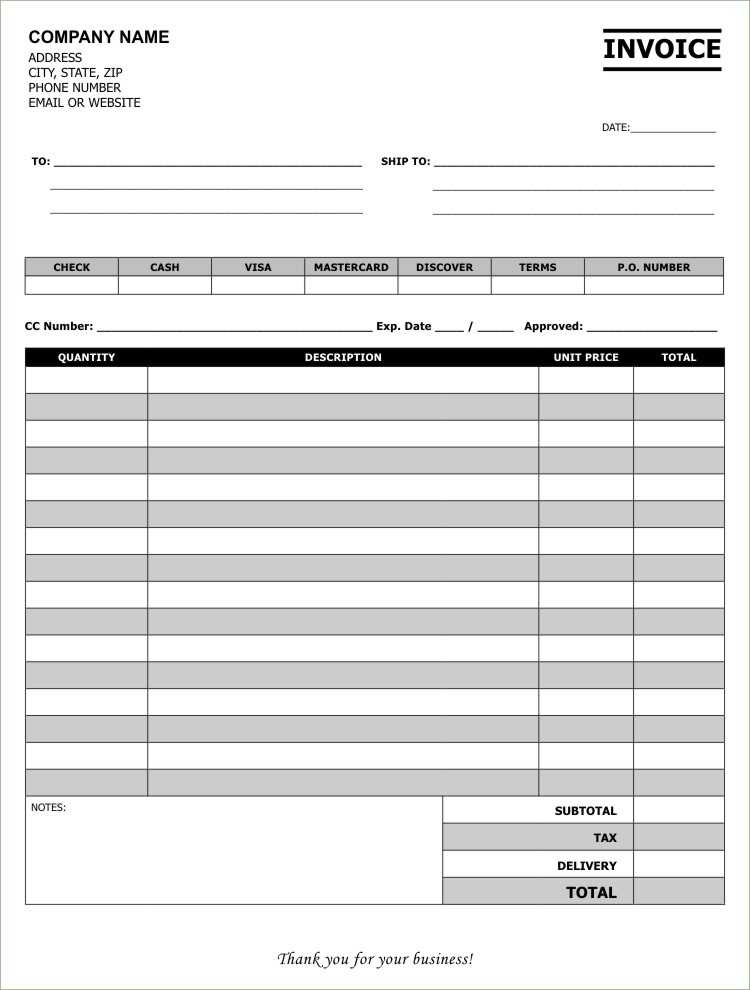

Choosing the Right Format for Your Invoice

Selecting the correct layout for your billing document is essential to ensure that it is both easy to understand and professional in appearance. The format you choose will impact how clearly the details are presented and how smoothly the payment process will unfold. A well-organized structure can make it easier for clients to review and process their payments, leading to fewer disputes and delays.

Factors to Consider When Choosing a Layout

Several key elements should influence your choice of format. Consider your business type, the complexity of the transactions, and how often you need to create such documents. A simple structure may suffice for small businesses with straightforward services, while more detailed formats might be needed for larger, more complex transactions.

- Business Size: Larger businesses or those offering a variety of services may require more detailed layouts to accommodate additional information such as service descriptions, itemized charges, and multiple payment options.

- Client Preferences: Some clients might prefer minimalist, easy-to-read documents, while others may require more detailed breakdowns or specific legal terms. Understanding your client base can help tailor the format to their needs.

- Document Purpose: If the document serves as a receipt or confirmation of payment, the layout may be simpler. However, if it’s a detailed bill for a complex service, a more structured format might be necessary to cover all the required details.

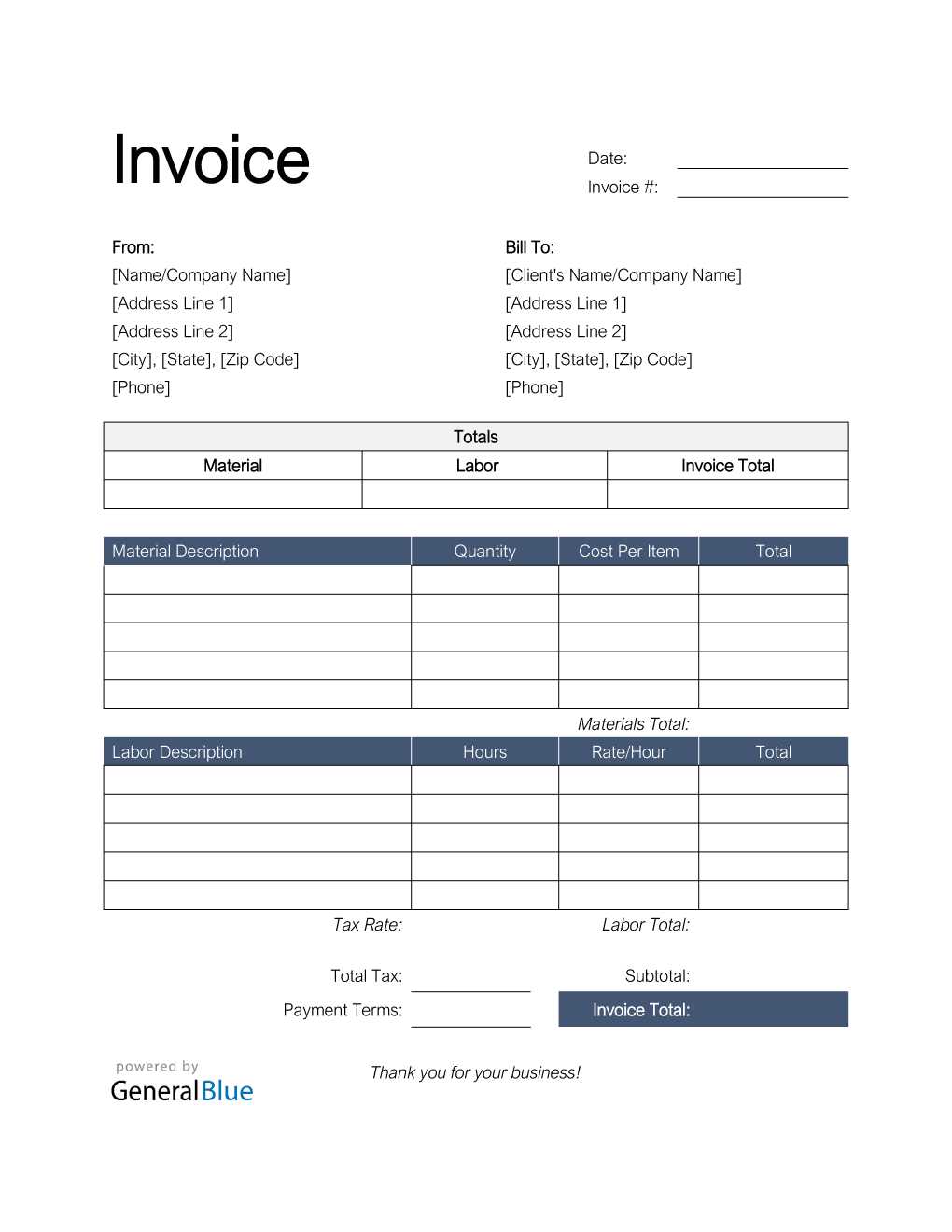

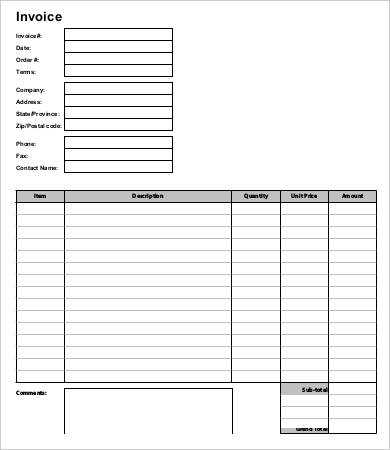

Common Layout Styles

Depending on your needs, you can choose from several different format styles that are commonly used in the industry. Each style has its strengths, and selecting the right one will help streamline communication with your clients.

- Basic Format: Suitable for small businesses or freelancers, this style typically includes essential details like the total amount due, recipient’s information, and brief descriptions of products or services.

- Itemized Format: Ideal for businesses offering multiple products or services, this layout breaks down each charge with detailed descriptions, quantities, and individual prices, providing transparency for the client.

- Professional Format: Often used by larger companies or in industries where compliance and detailed records are necessary, this format is more formal and includes all necessary legal and contractual terms along with payment instructions.

Common Mistakes When Creating Invoices

When preparing documents for billing purposes, it’s easy to overlook important details that can lead to confusion or delays in payment. Small errors can cause significant issues, from misunderstandings with clients to problems with accounting. Recognizing common pitfalls can help ensure that your financial documents are clear, professional, and efficient in securing timely payments.

Frequent Errors to Avoid

Many of the mistakes made during document creation can be easily avoided with attention to detail. Here are a few common issues to watch out for:

- Incorrect or Missing Contact Information: Always double-check the recipient’s details. Incorrect addresses, phone numbers, or email addresses can result in the document being lost or delayed.

- Failure to Include a Unique Identifier: Not using a reference number can lead to confusion, especially when clients are dealing with multiple transactions or accounts. A unique number ensures that each document can be quickly referenced and tracked.

- Ambiguous Descriptions of Products or Services: Vague descriptions of what was provided can lead to misunderstandings. Clear, detailed descriptions help avoid disputes and ensure the client knows exactly what they are being charged for.

- Mathematical Errors: Double-check all calculations. Mistakes in adding up totals or calculating taxes can undermine the professionalism of the document and delay payments.

- Omitting Payment Terms: Not specifying when payment is due, what methods are accepted, or if there are any late fees can lead to delays or missed payments. Make sure this section is clear to avoid any

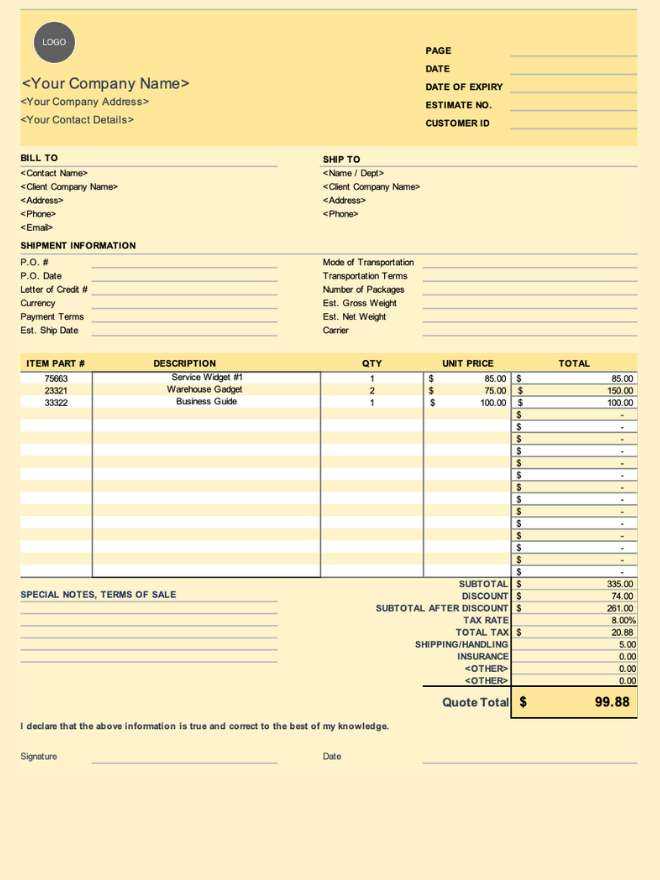

How to Add Taxes to Your Invoice

Including taxes in your billing documents is an essential step in ensuring that both you and your client are clear about the total amount due. Taxes vary depending on the region and the nature of the goods or services provided, so it’s important to apply the correct rate and display it clearly to avoid misunderstandings. Adding taxes properly not only helps you stay compliant with local regulations but also keeps your financial records accurate and transparent.

To include taxes in your document, start by determining the applicable tax rate for the goods or services you’re providing. This could be a sales tax, VAT, or another type of tax based on local laws. After calculating the tax, it’s important to clearly show both the subtotal (before tax) and the total amount (after tax) to make it easy for your client to understand the breakdown of charges.

Here are the steps to follow when adding taxes to your billing document:

- Step 1: Identify the correct tax rate. Research the local or national tax rate that applies to your product or service. Tax rates can vary by region, so make sure you’re using the right one for the location of your business or the client.

- Step 2: Calculate the tax amount. Multiply the subtotal (the total cost of your products or services before tax) by the tax rate. For example, if the subtotal is $100 and the tax rate is 10%, the tax amount will be $10.

- Step 3: List the tax amount. Clearly display the calculated tax amount on the document, either as a line item or in a separate section labeled “Tax” or “Sales Tax.”

- Step 4: Add the tax to the subtotal. After calculating the tax, add it to the subtotal to get the final total amount due, and ensure that this is clearly marked as the “Total” at the bottom of the document.

- Step 5: Provide tax information if necessary. In some cases, it may be important to include your tax identification number or other relevant details, especially for businesses that are required to report taxes or file returns.

Being tra

Printable Invoice Template for Small Businesses

For small businesses, managing billing efficiently is key to maintaining smooth cash flow and building strong client relationships. Having a well-structured document for detailing charges ensures professionalism and helps prevent misunderstandings. With the right format, business owners can easily create customized billing records that look polished and help track payments accurately.

Why Small Businesses Need a Customizable Billing Document

Small businesses often need a solution that is both simple and professional. A customizable format enables business owners to adapt the document to different types of transactions, whether they are offering services, selling goods, or working on project-based contracts. By using a flexible format, entrepreneurs can quickly create accurate, clear records without the need for expensive software or complicated systems.

- Simplicity: Small businesses often deal with a variety of clients, and keeping the process straightforward is essential. A simple structure helps avoid confusion and makes it easy to understand for both the issuer and recipient.

- Customization: Having a format that can be personalized allows business owners to adjust it for different industries, services, and client needs. This flexibility helps ensure that each document is relevant and appropriate for the specific transaction.

- Professional Appearance: Presenting clients with well-organized, clean documents can improve your business image. It shows that you take your operations seriously and enhances client trust.

Key Features of an Effective Billing Document for Small Businesses

When creating a document for billing, certain elements are crucial for clarity and efficiency. A properly designed structure should include all necessary details without being overwhelming. Below are some features that every small business should consider:

- Company and Client Information: Clear identification of both parties is essential for accountability and easy contact in case of issues.

- Itemized Charges: A breakdown of services or products provided ensures transparency and allows clients to see exactly what they are being charged for.

- Payment

Creating Professional Invoices on a Budget

For small businesses or freelancers, creating professional billing documents doesn’t have to come with a hefty price tag. With the right tools and resources, you can design and issue clear, well-organized financial documents that reflect the quality of your work, all while keeping costs low. There are many ways to ensure that your records appear polished and trustworthy without spending money on expensive software or services.

Low-Cost Tools for Crafting Billing Documents

There are several free or low-cost tools available that can help you create high-quality documents without the need for expensive design programs. Many of these tools come with customizable options that allow you to add your branding and tailor the format to your specific needs.

- Google Docs or Google Sheets: These free tools allow you to create custom documents using pre-built designs or by starting from scratch. With simple formatting options and the ability to save and send documents in PDF format, they are perfect for small businesses on a budget.

- Microsoft Office Online: If you already have a Microsoft account, you can access free versions of Word and Excel that can be used to create customized financial records with easy-to-use templates.

- Canva: Known for its intuitive drag-and-drop interface, Canva offers free and low-cost design options that can be used to create visually appealing documents. With ready-made layouts for various industries, Canva helps you produce professional-looking forms quickly.

Essential Tips for Making Your Documents Look Professional

While creating professional documents on a budget, it’s important to focus on elements that enhance the overall presentation. Even with basic tools, you can ensure that your records convey professionalism by keeping a f

How to Avoid Invoice Payment Delays

One of the biggest challenges for businesses, especially small ones, is ensuring timely payment for services rendered or goods delivered. Payment delays can disrupt cash flow, leading to unnecessary stress and administrative headaches. Fortunately, there are several strategies you can implement to minimize the chances of late payments and make the billing process smoother for both you and your clients.

Clear and Detailed Communication

One of the main reasons for payment delays is confusion about the terms and amounts due. To avoid this, it is essential to communicate all relevant details clearly from the outset. Be sure to outline all charges, deadlines, and expectations in your financial documents.

- Clearly State Payment Terms: Always specify when the payment is due. If you offer any early payment discounts or impose late fees, make these terms clear upfront.

- Include All Necessary Details: Ensure that all information, such as the recipient’s name, services provided, total cost, and payment instructions, is easy to understand and free from ambiguity.

- Provide Multiple Payment Options: The more payment methods you offer, the easier it will be for clients to settle their bills on time. Include options such as credit card payments, bank transfers, or even online payment services like PayPal.

Effective Follow-Ups and Reminders

Even with clear terms, sometimes payments are delayed simply due to forgetfulness or oversight. Establishing a system for regular follow-ups can help ensure that your clients don’t miss payment deadlines.

- Send Reminders: A few days before the due date, send a polite reminder to your clients about the upcoming payment. This can be done via email or through automated reminders if you’re using online invoicing tools.

- Follow Up on Overdue Payments: If the payment has passed its due date, don’t hesitate to follow up. Be polite but firm in asking when you can expect payment. Keep a record of all communications to avoid misunderstandings later on.

- Use Automatic Late Fee P

Using Invoices for Better Record Keeping

Proper documentation is essential for maintaining organized and accurate business records. A well-maintained record-keeping system helps ensure that financial transactions are tracked effectively, taxes are filed correctly, and business operations run smoothly. Regularly creating and managing billing documents provides a clear history of transactions, which can be invaluable for future planning, audits, and maintaining professional relationships with clients.

The Benefits of Detailed Record-Keeping

Using detailed billing records as part of your financial management system offers a range of advantages, including improved cash flow management, better decision-making, and the ability to quickly resolve any discrepancies or disputes. Here are some key benefits:

- Improved Financial Overview: By maintaining accurate and up-to-date records, you gain a clear understanding of your income, expenses, and overall financial health. This visibility allows for smarter budgeting and forecasting.

- Tax Compliance: Detailed documentation ensures that you have all the necessary information to file taxes correctly, reducing the risk of errors and audits. It also helps track deductible expenses, which can minimize tax liabilities.

- Faster Dispute Resolution: Clear records provide solid evidence in case of any payment disputes with clients. Being able to refer to specific documents and details helps resolve issues more efficiently.

Best Practices for Using Billing Documents in Record Keeping

To make the most of your financial records, it’s important to follow best practices for organizing and storing them. These simple steps can help you keep everything in order:

- Keep Copies of All Records: Always retain a copy of every billing document for future reference. Whether physical or digital, ensure that you can easily retrieve any record when needed.

- Organize by Date and Client: Sorting documents chronologically and by client makes it easier to track payments, identify overdue accounts, and retrieve information for financial reporting.

- Use Cloud Storage: For digital documents, consider using cloud storage to back up records. This ensures that your data is safe, accessible from anywhere, and protected against physical damage or loss.

- Regularly Update Your Records: Consistently update your financial documents to reflect new transactions and payments. Timely record-keeping helps maintain accuracy and pr

When to Send Your Invoice

Determining the right moment to issue a request for payment is essential for maintaining smooth financial operations and good relationships with clients. Timing can influence the promptness of payment and the overall cash flow of your business. While some prefer to send requests immediately after the completion of services, others may wait for a more strategic moment. The decision depends on your specific business practices, client preferences, and contractual agreements.

Immediate After Completion

One of the most common approaches is to send the payment request right after delivering the agreed work or product. This approach ensures that the client is still actively engaged with the project and can easily review the work before making the payment. It’s particularly effective when dealing with short-term or one-time projects, as it allows you to close out the transaction quickly.

Upon Reaching Milestones

For long-term projects or ongoing services, it may be more appropriate to issue payment requests at specific milestones or intervals. By breaking down larger tasks into smaller, manageable portions, both parties can track progress and ensure fairness in compensation. This method helps maintain steady cash flow throughout the project’s duration, without waiting until the very end.

Tips for Making Your Invoices Stand Out

Creating professional and memorable documents for payment requests can significantly impact your brand image and help improve client relationships. By focusing on design, clarity, and attention to detail, you can ensure that your requests are not only seen but also respected and paid on time. A well-crafted payment document can leave a lasting impression and foster a sense of professionalism, encouraging clients to treat your business with the same level of respect.

Start by ensuring your documents are visually appealing. A clean, modern design that aligns with your business’s branding can create a strong first impression. Use your company logo, consistent fonts, and a color scheme that reflects your brand identity. This not only makes the request more attractive but also reinforces your company’s professionalism.

Another key aspect is providing clear, concise information. Make sure all essential details, such as services rendered, payment terms, and contact information, are easy to read and understand. Including a personal touch, such as a friendly thank-you note or reminder, can also create a positive experience for the client and increase the likelihood of prompt payment.

Finally, consider adding some customization. Tailor each document to your clients, showing that you value their business. This could include adding specific references to the project or highlighting key points that are important to the client, such as discounts or special terms. This level of personalization can help differentiate your business and build stronger client loyalty.

How to Save and Print Your Invoice

Once your payment request document is ready, it’s important to know how to properly save and share it with your clients. Ensuring that the document is stored in a reliable format and can be easily accessed or sent is crucial for maintaining professionalism and organization. Whether you choose to email or deliver it in person, following the right steps will streamline your billing process.

Saving Your Document

The first step is to save the document in a format that preserves its layout and is widely accessible. Most commonly, documents are saved as PDF files, which are ideal for ensuring that the layout remains intact across different devices and platforms. Once saved, store the file in a well-organized folder on your computer or cloud storage for future reference. This makes it easy to locate previous requests or make necessary updates.

Sharing or Sending Your Request

Once your document is saved, you can send it via email or other electronic means to the client. Ensure that the email is clear and professional, with a brief message that includes all necessary details. If you need to provide a physical copy, you can simply print the saved file, making sure to use good quality paper and a reliable printer for a polished result. Keep in mind to store a copy for your own records, either digitally or in hard copy, for future reference.