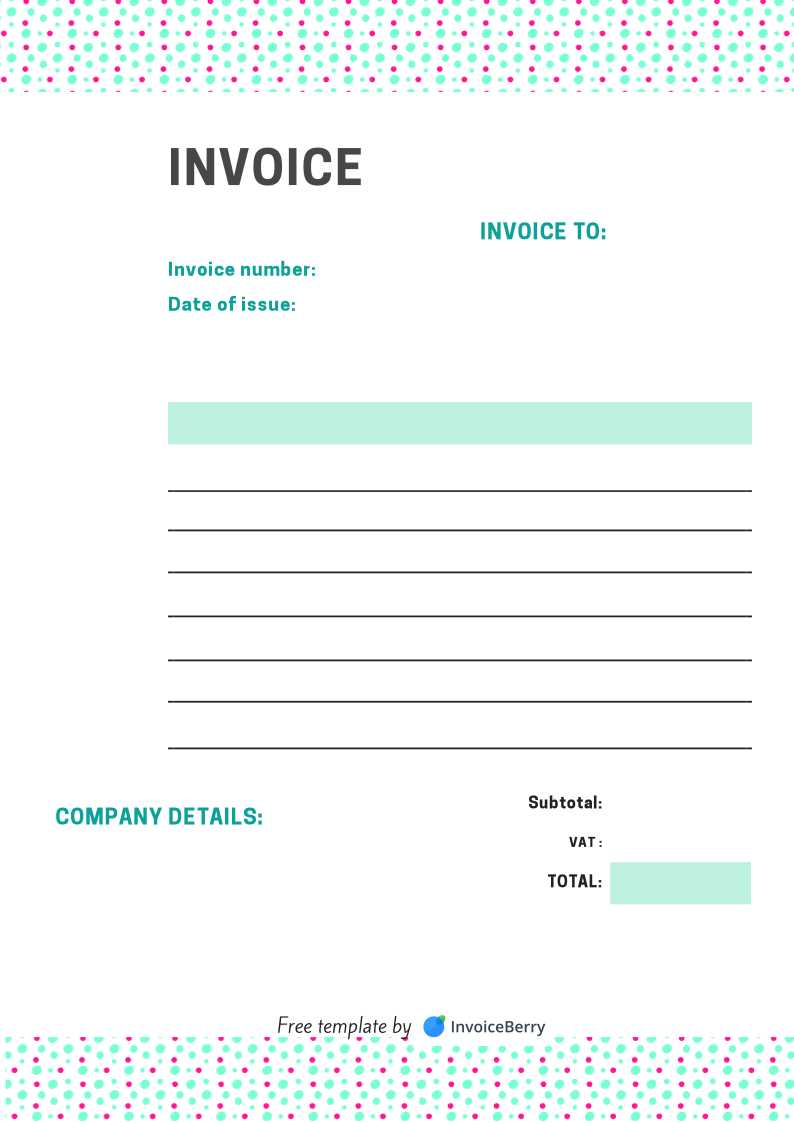

Free Usable Invoice Template for Effortless Billing

Managing financial transactions efficiently is a crucial part of any business. Having a well-organized system to issue and track payments helps maintain cash flow and ensures professional communication with clients. One of the simplest ways to achieve this is by utilizing ready-made documents designed to help businesses create clear and effective billing statements.

Designing and personalizing these documents is a straightforward task that can save time and reduce errors. Whether you’re a freelancer, a small business owner, or part of a larger organization, having the right tools can make invoicing quick and hassle-free. Customizable options provide flexibility, allowing you to adapt the format to your needs.

In this guide, we will explore various options available for crafting professional billing statements, offer tips on what features to look for, and explain how to use these documents to enhance your workflow. By choosing the right design, you can ensure that every transaction is clear, accurate, and easy for your clients to understand.

Why You Need a Free Invoice Template

Managing financial documentation is essential for any business. Having a structured way to document payments ensures clarity in transactions and helps avoid misunderstandings with clients. When you don’t have a standardized format, creating accurate records can become time-consuming and prone to errors. Using pre-designed tools to generate these records saves both time and effort while ensuring consistency.

Standardizing your records not only enhances professionalism but also streamlines the payment process. By using a ready-made format, you eliminate the need to create new documents from scratch each time. This allows you to focus more on the core aspects of your business, leaving the administrative side simpler and more organized.

Additionally, these documents are typically customizable to suit your specific needs, meaning you can add company details, payment terms, and other essential information. With a proper format, tracking outstanding payments and managing cash flow becomes much more straightforward, giving you greater control over your finances.

How to Choose the Right Template

Selecting the right tool for creating financial records is crucial for efficiency and accuracy. The design of the document should match your business needs while providing clarity and professionalism. It is important to choose a layout that is both functional and easy to customize, ensuring that you can add relevant details without hassle.

Consider Your Business Type

The style and structure of the document may vary depending on the nature of your business. A service provider may require a different format compared to a product-based business. Understanding the specific requirements of your industry will help you choose a format that accommodates necessary information like product descriptions, service hours, or payment terms.

Key Features to Look For

When selecting a ready-made format, look for the following essential features:

| Feature | Importance |

|---|---|

| Customizable Sections | Allows you to adapt the document to your unique needs. |

| Professional Design | Helps create a trustworthy image for your clients. |

| Clear Layout | Ensures that important details are easy to find and understand. |

| Payment Terms Fields | Clarifies deadlines and conditions for timely payments. |

By focusing on these key aspects, you can ensure that your chosen document structure meets both your business needs and your clients’ expectations, ultimately simplifying the billing process.

Benefits of Using an Invoice Template

Utilizing pre-designed documents for managing financial transactions offers numerous advantages for businesses of all sizes. These ready-made solutions help ensure consistency, accuracy, and professionalism, which are essential for maintaining a smooth billing process. By using a structured format, businesses can streamline their payment procedures and save valuable time.

Efficiency and Time-Saving are two of the most significant benefits. Instead of creating a new document from scratch each time, you can quickly generate a professional-looking statement by filling in the necessary details. This reduces manual effort and allows you to focus on more important aspects of your business.

Professionalism and Accuracy are also enhanced when using standardized formats. A clear, well-organized document not only reflects a professional image but also minimizes the risk of errors. By having a consistent structure, the chances of leaving out important information or miscalculating amounts are greatly reduced, leading to fewer disputes with clients.

Additionally, customization is another key benefit. Many pre-designed documents allow you to easily add your company logo, contact information, and other relevant details, ensuring that each statement is unique to your business while still maintaining a clean and uniform look.

Customizing Your Free Invoice Design

Personalizing your billing documents allows you to create a more professional and tailored experience for your clients. A customizable layout enables you to add business-specific details such as logos, colors, and payment terms, which can enhance your brand image and improve clarity. Modifying these documents to suit your needs is a simple process that can make your financial records stand out.

Personalization Options

When adjusting your document’s design, there are several key elements you can modify to better align with your business identity:

| Element | Customization Options |

|---|---|

| Logo | Add your company’s logo to the top of the page to increase brand visibility. |

| Color Scheme | Change colors to reflect your brand’s identity and make the document visually appealing. |

| Contact Information | Ensure that your business address, phone number, and email are clearly displayed. |

| Payment Terms | Specify your payment conditions and deadlines to avoid confusion with clients. |

Ensuring Consistency Across Documents

While customization is important, maintaining consistency across all your financial documents is equally essential. Keep the layout and fonts uniform so that your business records are easily recognizable and professional in appearance. By doing so, you create a cohesive brand image and make it easier for your clients to understand the information you provide.

Top Features in an Invoice Template

When selecting a document design for billing purposes, it’s important to focus on features that not only make the process easier but also enhance the overall professionalism of your communications. A well-structured document should include essential details and be easy to navigate, ensuring that both you and your clients have a clear understanding of the transaction.

Here are some of the most important features to look for when choosing a suitable document design:

- Clear Layout: A well-organized structure with easy-to-read sections ensures that all relevant information is visible and accessible.

- Customizable Fields: Fields that allow you to insert personalized details such as your business name, logo, payment terms, and client information.

- Automatic Calculations: Built-in formulas that help calculate totals, taxes, and discounts automatically, reducing errors and saving time.

- Due Date Section: A clearly marked area for payment deadlines helps avoid confusion and ensures timely payments.

- Multiple Currency Options: Support for different currencies is essential for businesses that operate internationally or deal with clients abroad.

By ensuring that your chosen document design includes these key features, you can create a smooth, efficient, and professional billing process, making it easier for both you and your clients to manage payments.

How to Download and Use Templates

Getting started with pre-designed billing documents is a simple and efficient way to streamline your payment process. These ready-to-use formats can be easily downloaded from various sources and customized to meet your business needs. Understanding how to access and modify these documents will save you time and ensure that all necessary information is included every time you send a request for payment.

Downloading a suitable document typically involves a few quick steps. Many websites offer these resources for free or as part of a service package. You can browse through a variety of designs and select one that aligns with your business requirements. Once downloaded, these files are usually in formats like Word, Excel, or PDF, making them easy to edit and distribute.

Using these documents effectively requires a few simple actions. Open the downloaded file using the appropriate software, and begin entering the necessary details, such as your business name, client information, products or services provided, and payment terms. Most formats are customizable, allowing you to adjust fields to match your specific needs. Once completed, save the document and send it to your client either digitally or by print.

Tip: Always double-check the document before sending it to ensure that all information is accurate and clearly presented. This will help avoid confusion and make your billing process more efficient.

Invoice Template Formats and Compatibility

When selecting a pre-designed document for managing financial records, it’s essential to consider the format in which the file is provided. Different formats offer varying degrees of flexibility and compatibility with various software applications. Understanding the available options will help you choose the most suitable one for your needs and ensure a seamless experience when creating or editing billing documents.

Popular Document Formats

Here are some of the most common formats for financial documents and their advantages:

- Word (.docx): Highly customizable, easy to edit and personalize. Ideal for users who want to adjust text, add logos, and format content.

- Excel (.xlsx): Excellent for calculating totals, taxes, and discounts automatically. Ideal for businesses that need advanced mathematical functions.

- PDF (.pdf): A universal format that maintains layout and design across different devices. Perfect for clients who prefer to receive a finalized version of the document.

- Google Docs/Sheets: Cloud-based formats that allow for easy collaboration and editing across multiple devices. Suitable for teams or businesses with remote workers.

Compatibility Considerations

When choosing the format, it’s important to ensure that the file is compatible with the software you are using. Most modern applications can handle a wide range of document types, but there are still a few things to keep in mind:

- Software Version: Make sure your editing software supports the format you’re working with, especially when using older versions of applications.

- File Size: Some formats, particularly PDFs with high-resolution images, may have larger file sizes. Check if your email service or storage solution can handle these files.

- Device Compatibility: Ensure the format works seamlessly on the devices you and your clients use. PDFs are widely supported across all platforms, while Word and Excel files may require specific software.

By understanding the formats and their compatibility, you can select the most efficient and effective file ty

Tips for Streamlining Your Billing Process

Optimizing the billing process is crucial for improving cash flow, reducing administrative workload, and ensuring timely payments. A smooth and efficient process not only saves time but also reduces the chances of errors, ultimately strengthening the relationship with clients. Implementing a few key strategies can help you streamline this task and make the entire process more efficient.

Automate Wherever Possible

Automation is one of the most effective ways to reduce the time spent on creating and sending billing documents. By using digital tools or software that generate pre-filled documents, you can minimize manual data entry. This also reduces the risk of human error, helping to ensure that all necessary information is correctly included in each transaction request.

- Recurring Payments: For clients with regular billing cycles, consider setting up automated payment reminders and recurring payment options.

- Pre-set Payment Terms: Save default payment terms and conditions to avoid re-entering them each time.

- Batch Billing: If you have multiple clients, try sending invoices in batches to save time and effort.

Maintain Consistent Documentation

Ensuring that your billing documents are consistently structured is vital for both you and your clients. Having a uniform format helps avoid confusion and ensures that all important details are included every time. Consider using a standardized structure for all your billing requests, such as the same fields, font size, and layout.

Pro Tip: Keeping your payment instructions and terms simple and clearly visible will help avoid delays caused by misunderstandings or unclear expectations.

By implementing these strategies, you can make your billing process faster, more efficient, and ultimately more professional, helping you focus on growing your business while keeping financial operations running smoothly.

Common Mistakes to Avoid in Invoices

While preparing billing documents, it’s easy to overlook small details that can lead to confusion or delays in payment. Even minor errors can disrupt cash flow, cause miscommunication with clients, and damage your business’s professional image. Being aware of the most common mistakes and taking steps to avoid them can help ensure your financial transactions proceed smoothly and efficiently.

Frequent Errors in Billing Documents

Here are some of the most common mistakes people make when creating financial documents and how to avoid them:

| Common Mistake | How to Avoid It |

|---|---|

| Missing Client Information | Ensure that all client details, including name, address, and contact information, are accurate and complete before sending the document. |

| Incorrect Payment Terms | Clearly define the payment due date, accepted payment methods, and any applicable late fees. Review terms regularly to keep them up-to-date. |

| Omitting Taxes or Fees | Always double-check that applicable taxes or additional fees are included in the final amount to avoid confusion or disputes. |

| Unclear Descriptions of Products or Services | Provide clear and concise descriptions of what is being billed. Avoid vague language and ensure your clients understand what they’re paying for. |

Other Key Considerations

Aside from common mistakes in the content, there are other elements to keep in mind:

- Formatting Issues: A cluttered or hard-to-read layout can make it difficult for clients to review your document. Keep things organized and visually clear.

- Errors in Total Amounts: Always double-check your calculations, especially when adding taxes or discounts. Even minor errors can damage trust.

- Lack of Invoice Number:

How to Add Payment Terms to Invoices

Clearly defining payment terms in your billing documents is essential for ensuring smooth financial transactions with clients. Payment terms set the expectations for when and how the client should make payment, and they can prevent misunderstandings or late payments. Adding well-structured payment conditions helps maintain a professional relationship and ensures timely compensation for your services or products.

To add payment terms to your documents, consider including the following key elements:

- Due Date: Clearly specify the date by which payment should be made. For example, “Due within 30 days from the issue date.” This helps set clear expectations.

- Accepted Payment Methods: List the methods through which you accept payments, such as bank transfers, credit cards, checks, or online payment platforms.

- Late Fees: If applicable, specify any penalties for overdue payments. For instance, “A late fee of 2% will be applied for every 30 days past due.”

- Discounts for Early Payment: Encourage prompt payments by offering discounts for early settlement. Example: “A 5% discount is available if payment is made within 10 days.”

- Payment Terms and Conditions: Include any additional conditions that apply to the transaction, such as deposits or installments. Make sure they are clearly stated to avoid confusion.

Including these elements not only helps ensure prompt payments but also provides a clear understanding of your expectations, which can lead to fewer disputes and better financial management.

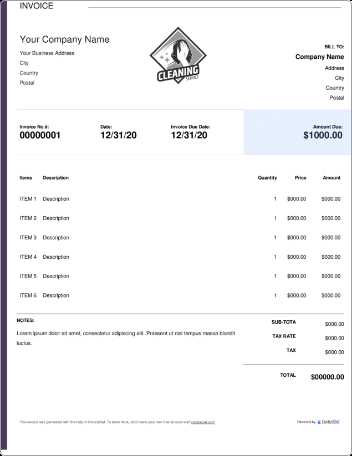

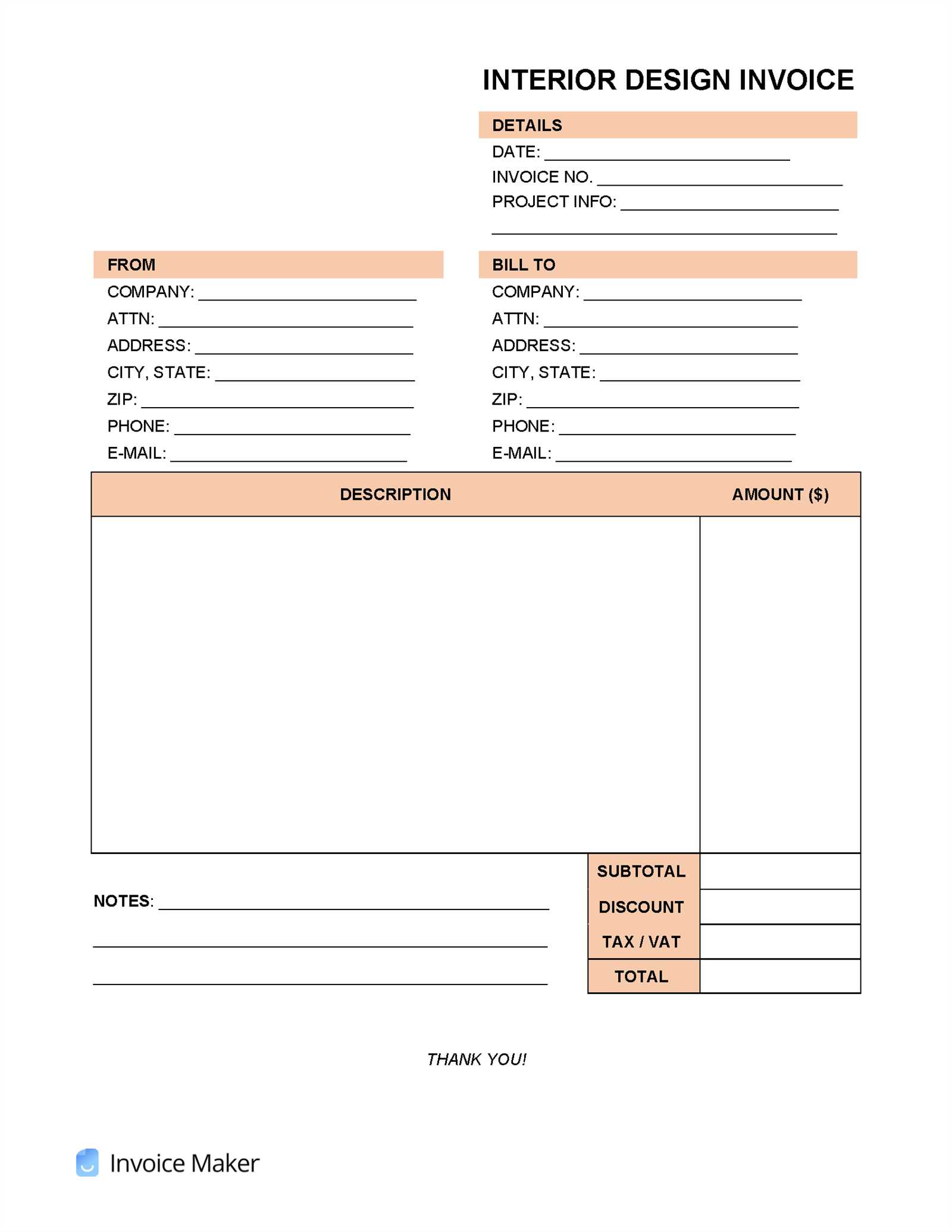

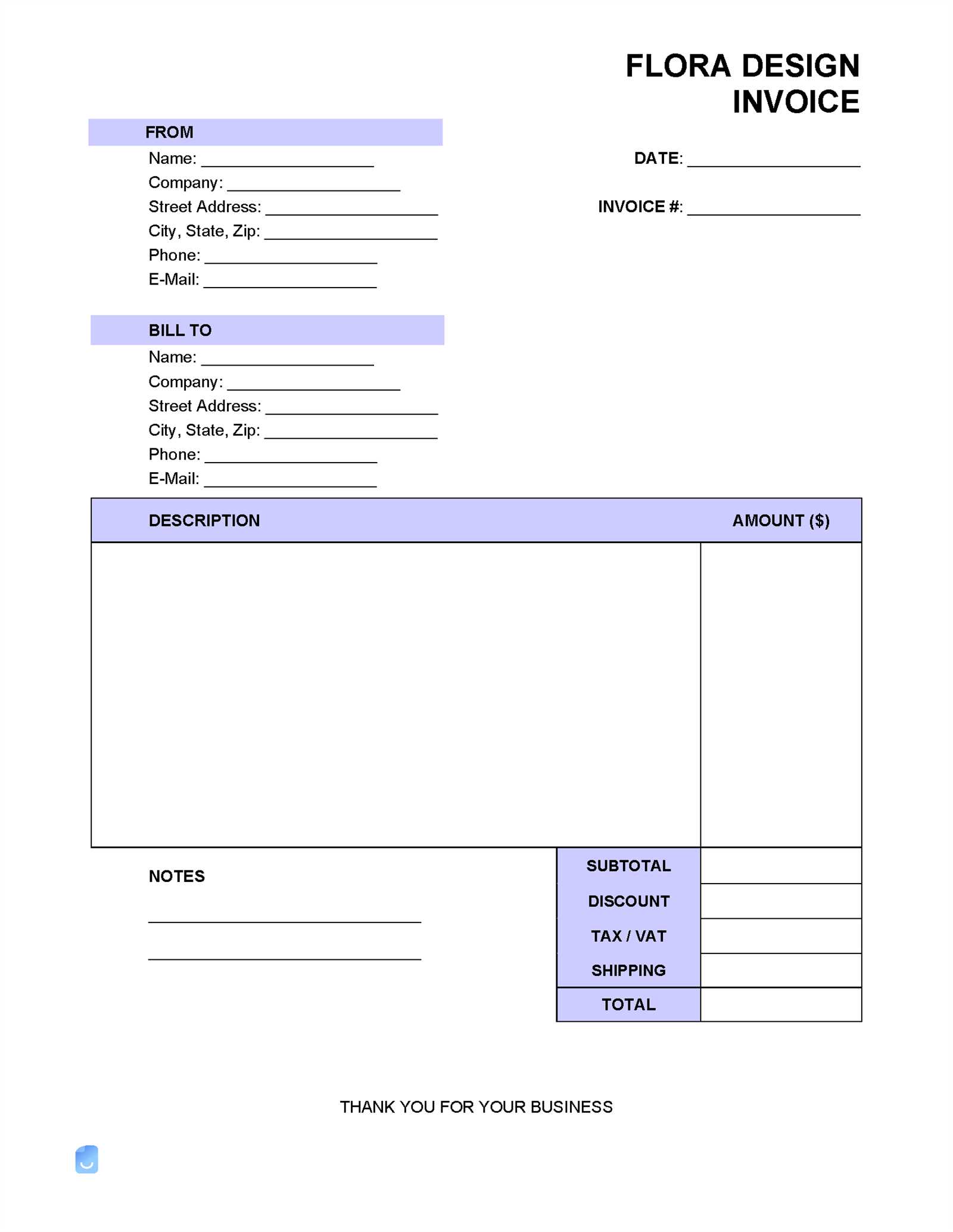

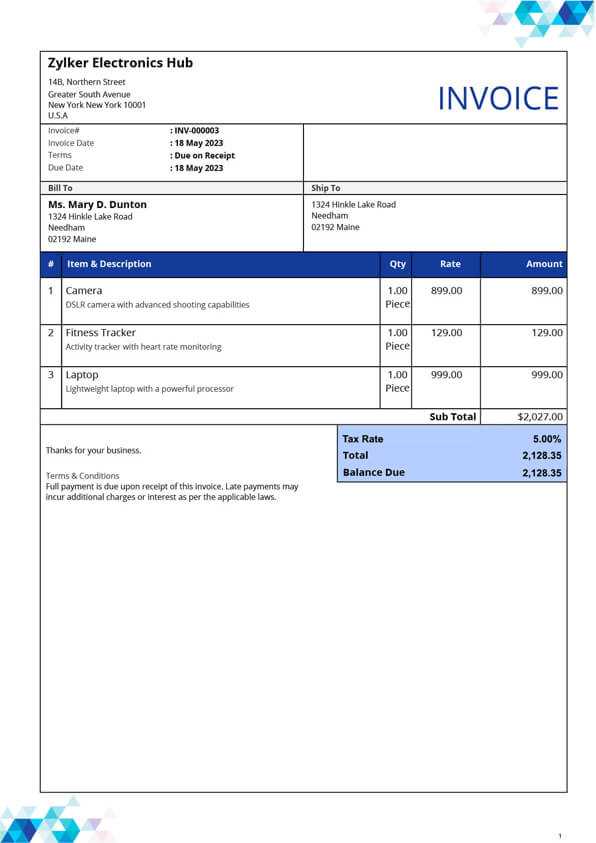

Best Free Invoice Templates for Small Businesses

For small business owners, using the right tools to streamline financial operations is crucial. Having access to professional-looking billing documents can save time, reduce errors, and enhance your brand’s image. Fortunately, there are several excellent resources available that offer customizable documents, making it easy for entrepreneurs to create effective and clear payment requests.

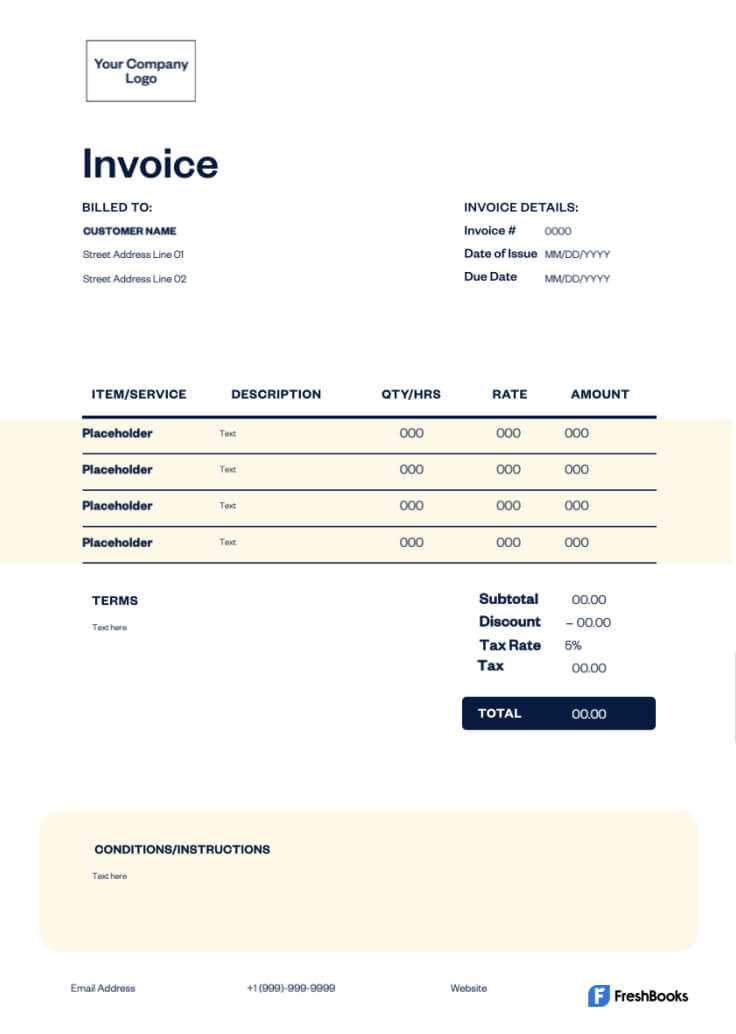

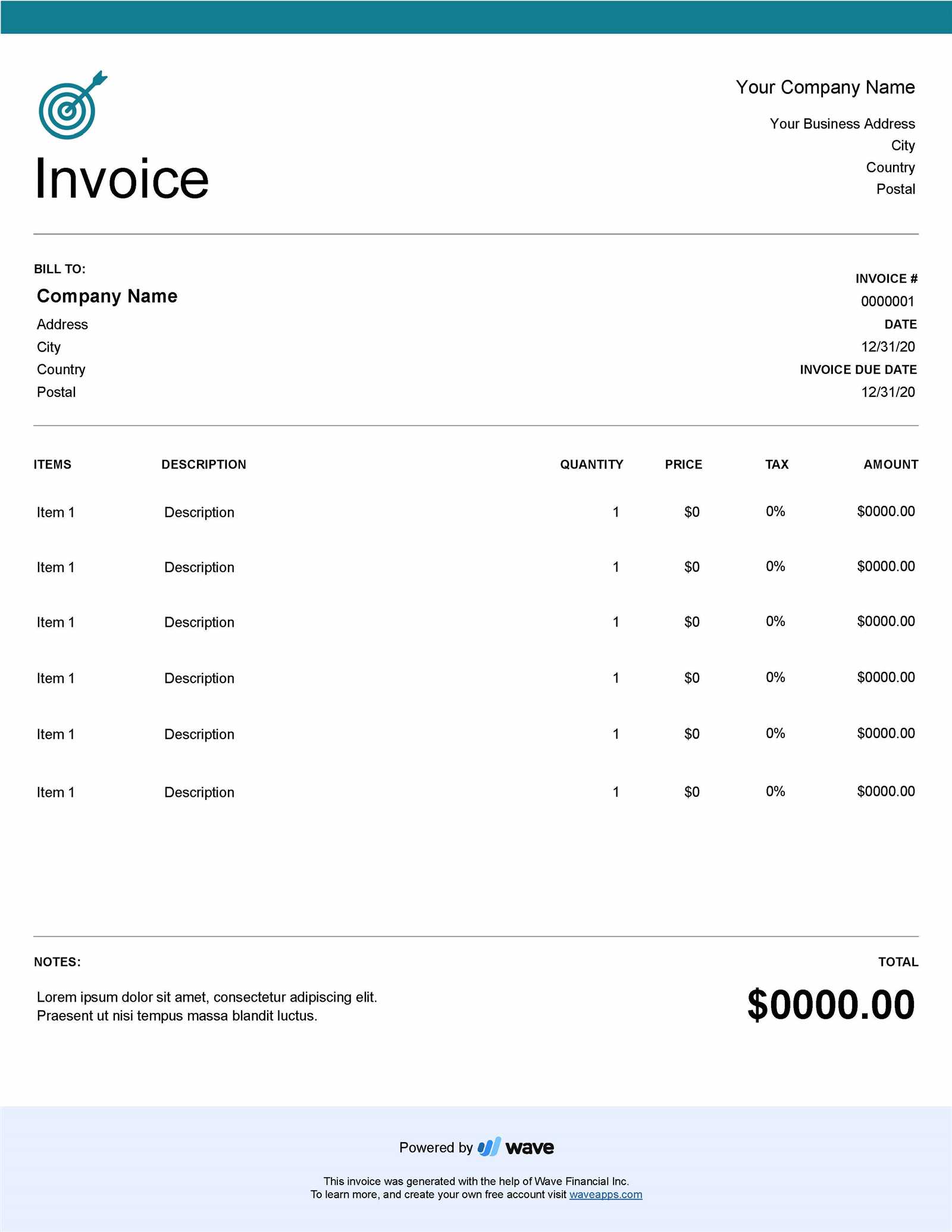

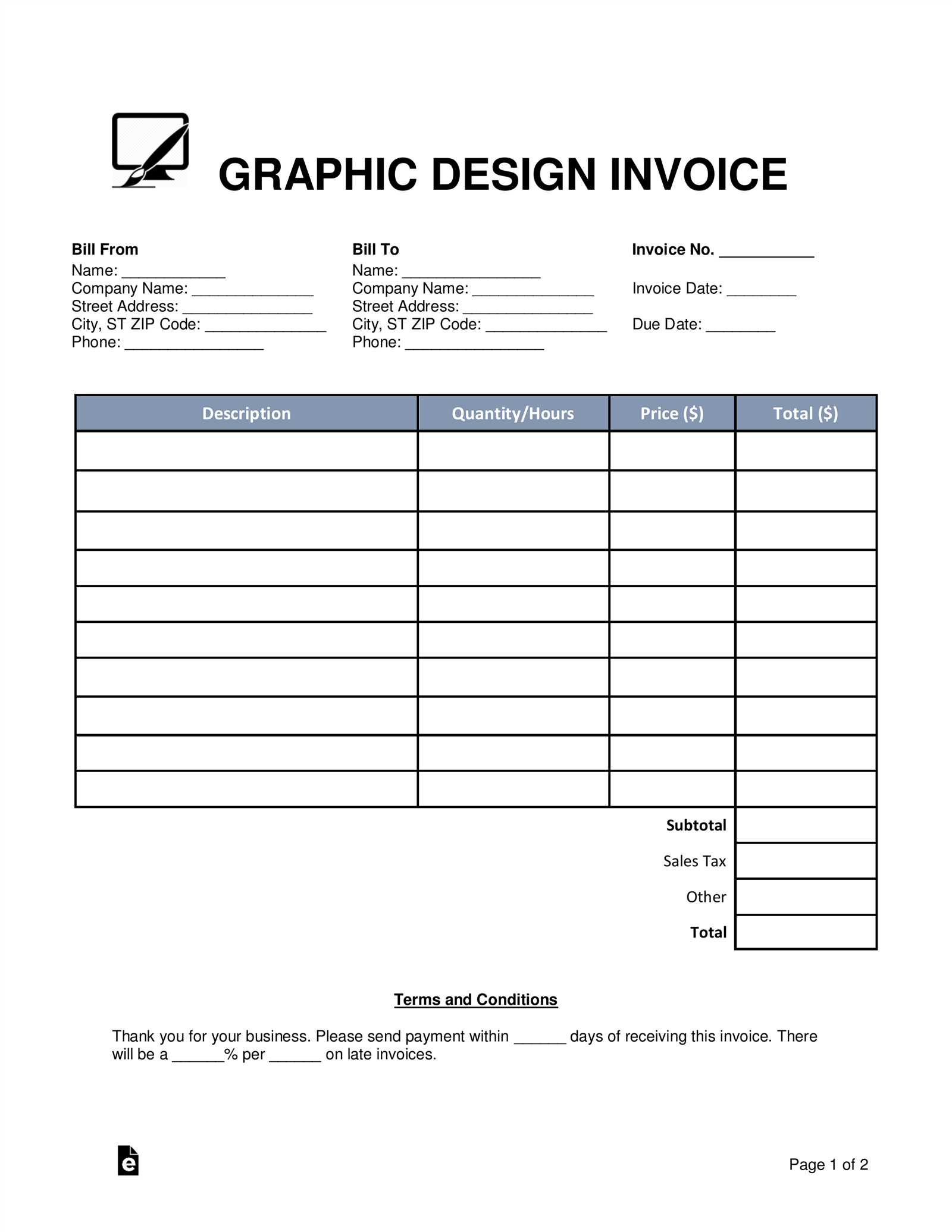

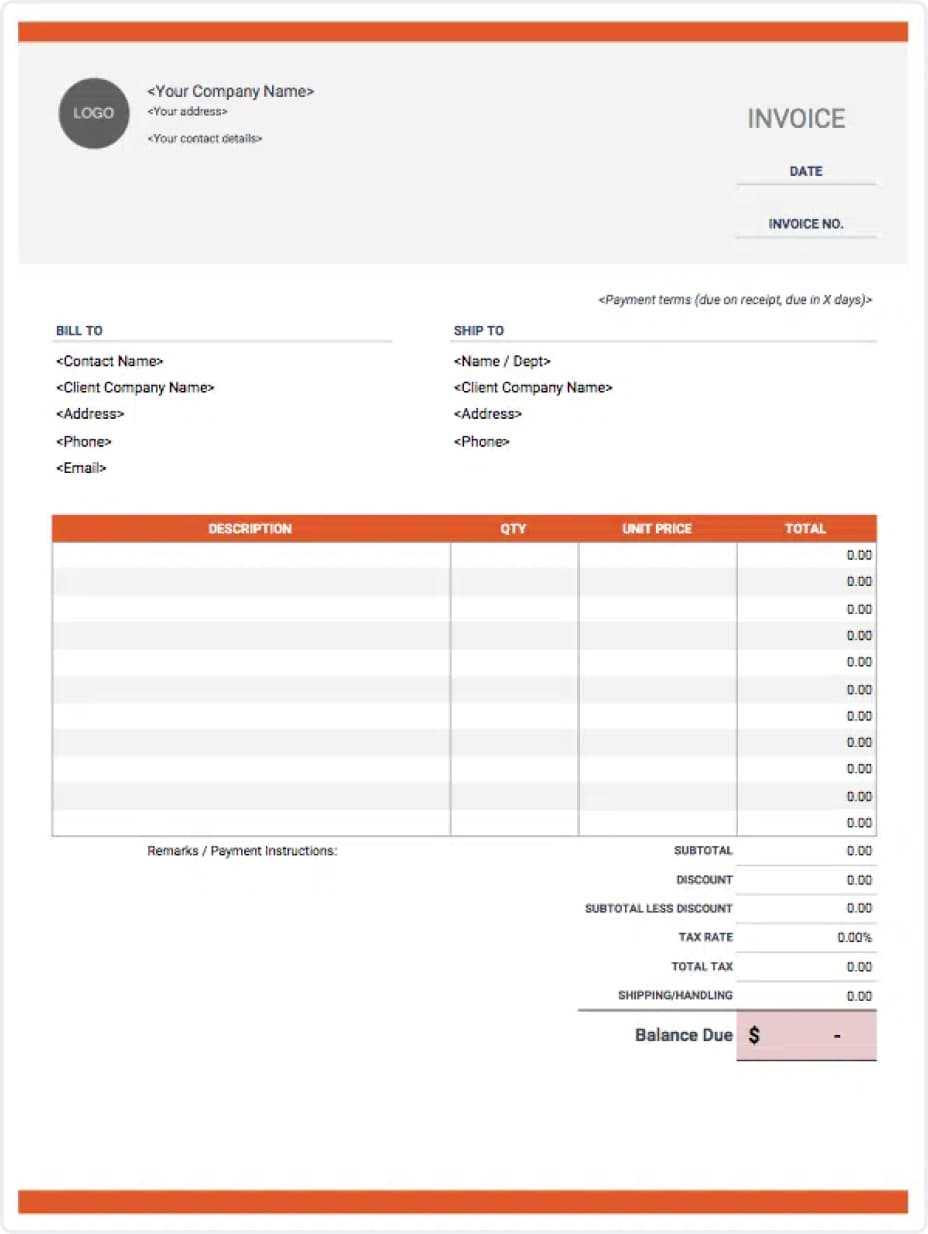

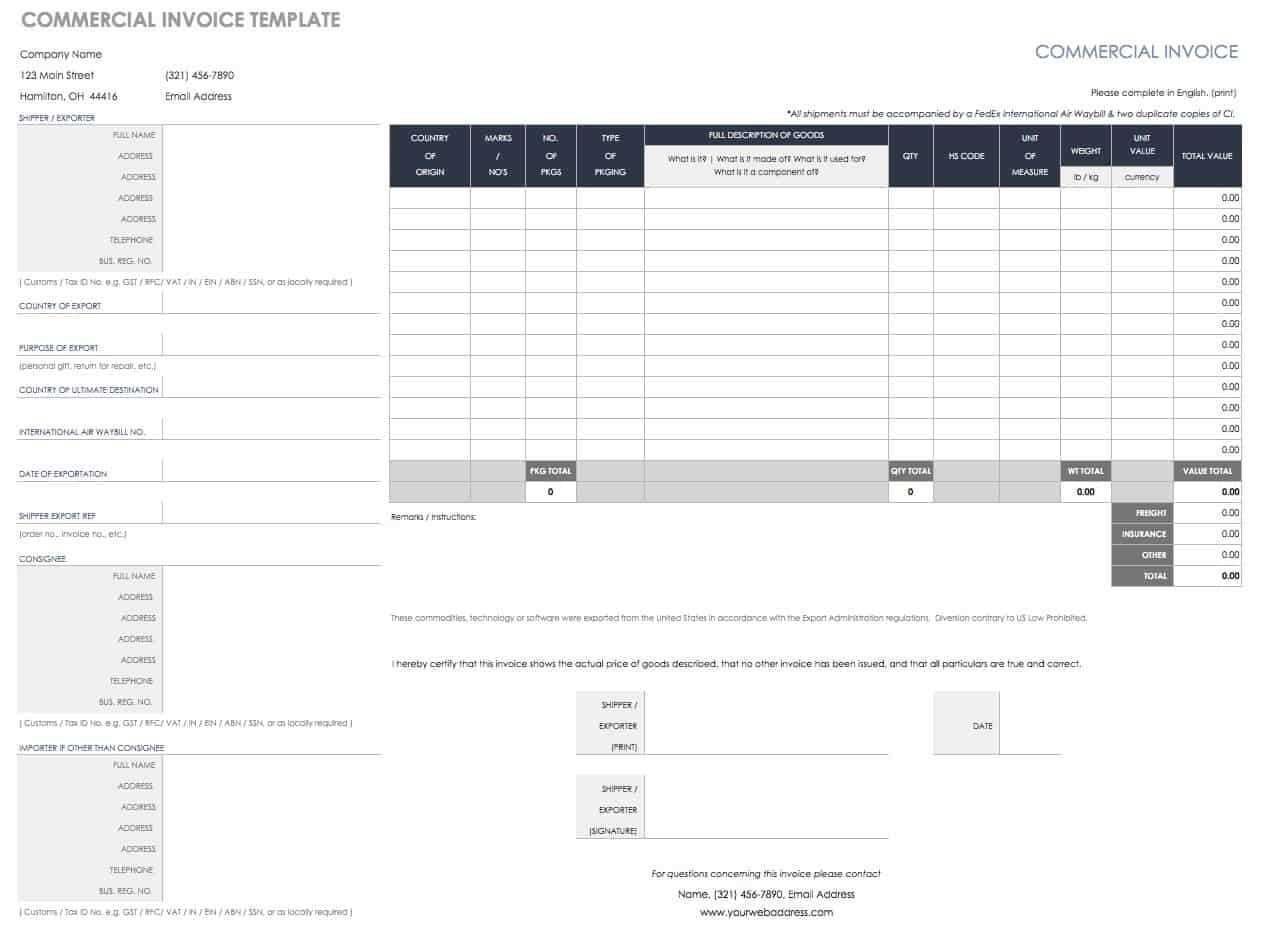

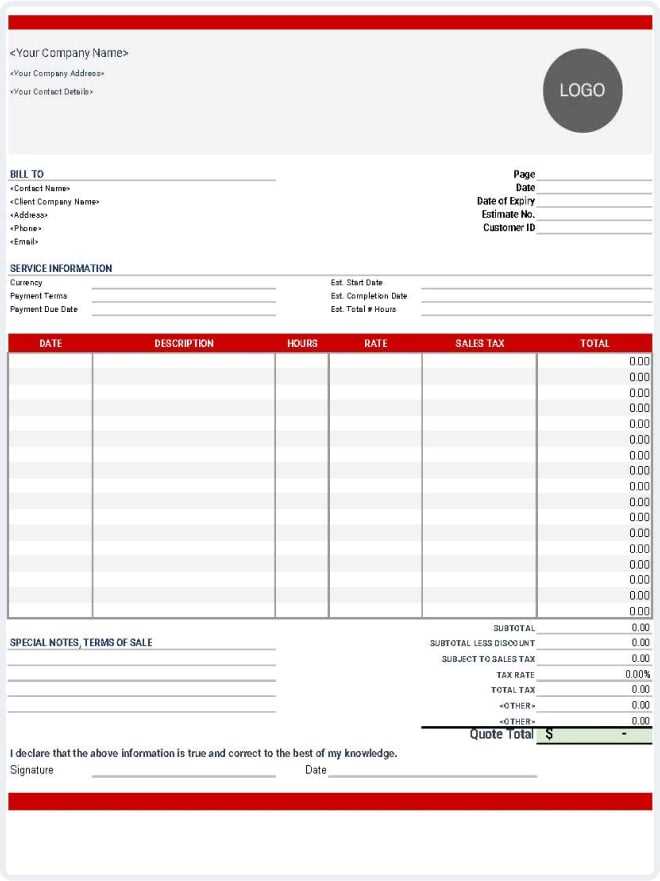

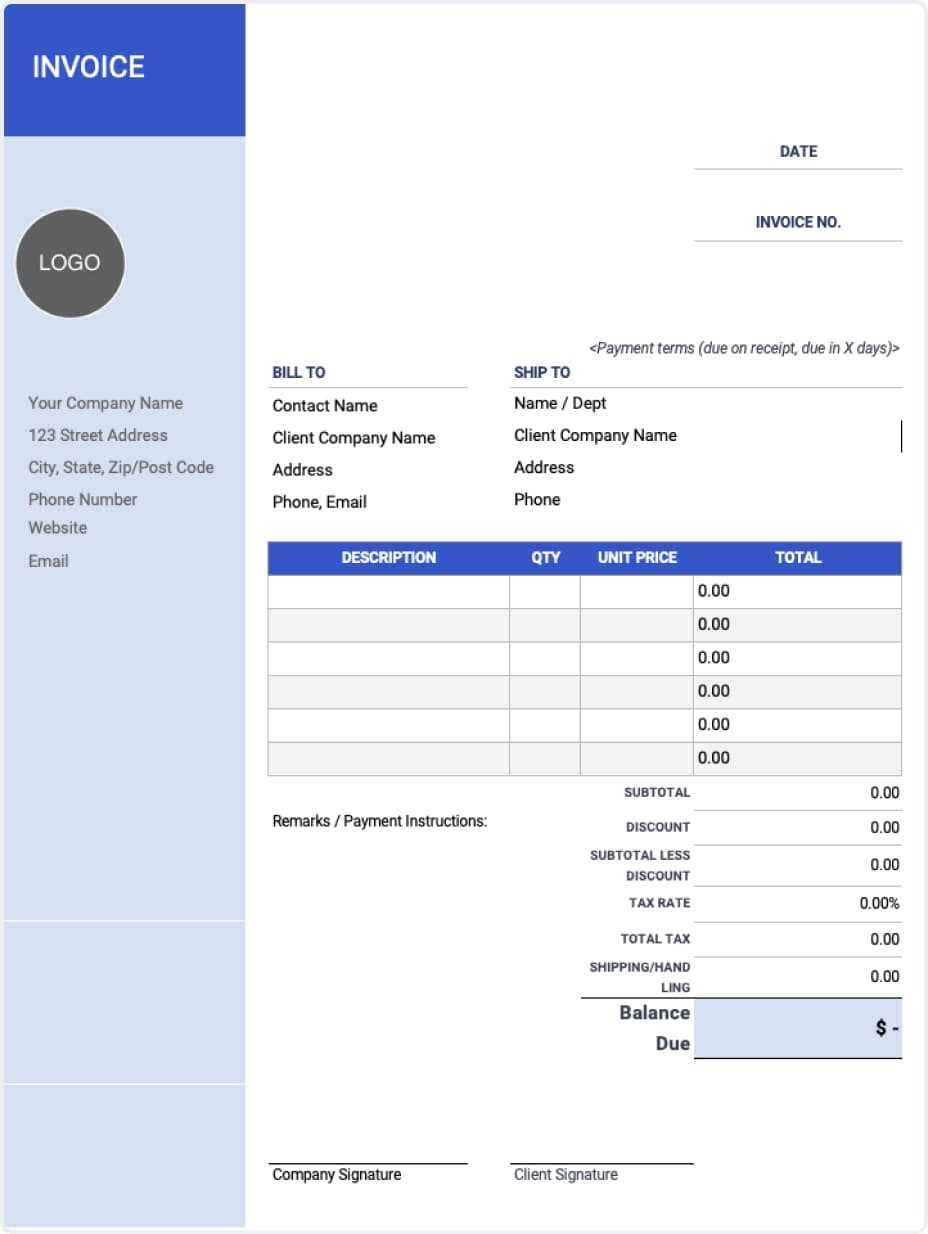

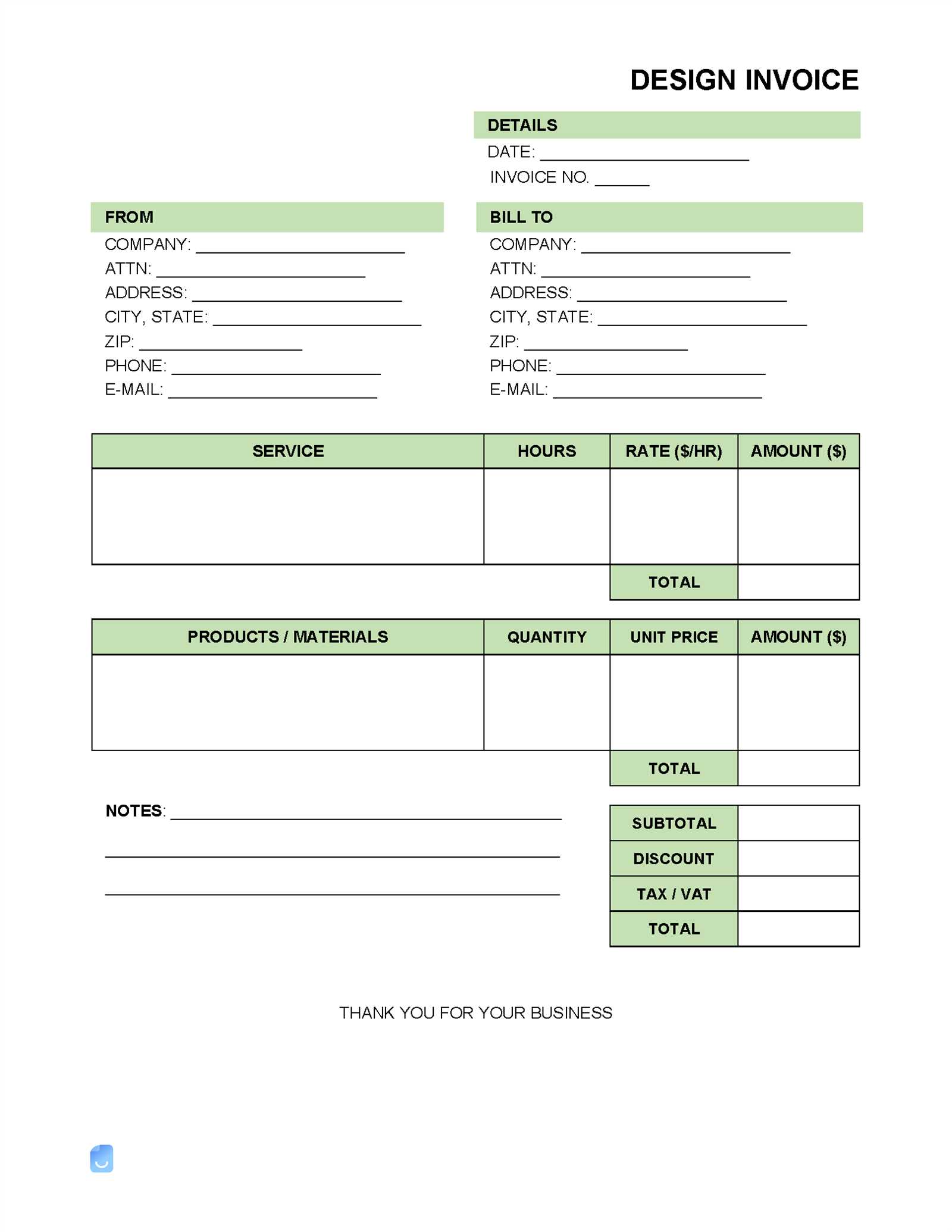

Here are some of the top options that can help you manage your billing processes more efficiently:

- Simple and Clean Designs: These options focus on simplicity, providing a straightforward layout with sections for all necessary details without overwhelming your clients. They are easy to customize and maintain a professional appearance.

- Itemized Breakdown: Templates that include space for listing products or services, with detailed descriptions and prices, help ensure clarity for both the sender and the receiver.

- Branding Features: For small businesses aiming to project a professional image, templates with customizable logos, colors, and fonts are ideal. This allows you to maintain consistency with your brand identity while keeping your financial documents organized.

- Multi-Currency Support: If you work with international clients, templates that offer multi-currency options can simplify cross-border transactions and ensure accuracy in payments.

- Pre-Built Payment Terms: Many templates come with predefined sections for adding payment terms, due dates, and conditions. These ensure that the necessary information is included without needing to recreate the format each time.

These customizable options are valuable for small businesses looking to maintain efficiency and professionalism in their financial dealings. By choosing the right layout and structure, you can save time while keeping your billing process organized and transparent.

How to Keep Your Invoices Professional

Maintaining a professional appearance in your billing documents is essential for creating a positive impression with clients. Clear, well-organized, and polished financial paperwork reflects your business’s credibility and can help build trust. Taking the time to ensure your documents are correctly formatted and contain all necessary information will prevent misunderstandings and contribute to smoother transactions.

Here are some key strategies to ensure your financial documents always look professional:

- Use a Clean and Simple Layout: Avoid cluttered designs. A straightforward, easy-to-read structure ensures that your clients can quickly understand the details of the transaction.

- Include All Essential Information: Always include your business name, address, and contact details, as well as the client’s information, the services/products provided, and a breakdown of costs. Accuracy and completeness are key.

- Consistent Branding: Incorporate your business’s logo, colors, and fonts to maintain consistency across all documents. A cohesive look helps reinforce your brand identity.

- Check for Errors: Double-check for any spelling, mathematical, or formatting errors. Small mistakes can damage your reputation and may lead to delayed payments.

- Set Clear Payment Terms: Clearly define payment due dates, accepted methods of payment, and any late fees or discounts for early payments. This transparency helps avoid confusion.

By following these guidelines, you ensure that your billing documents not only look professional but also function smoothly in helping manage your business’s financial transactions.

Integrating Templates with Accounting Software

Integrating billing documents with your accounting system can streamline your financial management and reduce errors. By linking your billing processes with accounting software, you can automate data entry, track payments, and generate reports, saving time and improving accuracy. This integration ensures that all financial information is updated in real-time, providing a more efficient workflow for small businesses.

Here are the key benefits of integrating your billing documents with accounting software:

- Automation of Data Entry: When your billing system is connected to accounting software, client information, amounts, and payment dates are automatically imported, reducing the risk of manual errors.

- Real-Time Updates: Any changes made in your billing documents, such as payment updates or adjustments, are instantly reflected in your accounting records, ensuring accuracy across your financial reports.

- Better Financial Tracking: Integration allows for more comprehensive tracking of outstanding payments and expenses, helping you to easily monitor cash flow and plan for future business needs.

- Time-Saving: By eliminating the need to manually enter the same information in multiple systems, you free up time for other important tasks, like growing your business.

- Easy Report Generation: Many accounting software platforms allow you to quickly generate financial statements, profit-and-loss reports, and tax summaries, all based on the data from your billing documents.

Integrating your documents with accounting software is a powerful way to improve the efficiency and accuracy of your business’s financial management. This process not only saves time but also minimizes the chance of errors, giving you greater control over your financial operations.

How to Save Time with Templates

Utilizing pre-designed documents can drastically reduce the time spent on repetitive administrative tasks. By streamlining the creation process, you can focus more on your business operations while ensuring consistency and accuracy in all of your records. This approach eliminates the need to manually create new forms for each client or transaction, allowing you to spend less time on paperwork and more on growing your business.

Key Time-Saving Benefits

- Quick Customization: Pre-made documents can be quickly adapted with just a few details, such as client names, dates, and amounts, without having to start from scratch.

- Reduced Error Rates: By using a standard structure, you minimize the risk of mistakes, which can take time to correct and cause delays in payments.

- Consistent Layout: Having a uniform format ensures all documents look professional and are easy to read, saving time when clients or colleagues refer to them later.

- Improved Workflow: With templates integrated into your business systems, creating and sending documents becomes a faster and smoother task, enabling you to manage more clients and projects simultaneously.

Practical Examples of Time Savings

- Automated Calculations: Many pre-designed documents come with built-in formulas, making tasks like totaling amounts or calculating taxes automatic.

- Faster Client Communication: Sending ready-to-use forms to clients eliminates the time spent manually typing out each document or formulating them individually.

- Tracking and Reporting Efficiency: With templates, it’s easier to track payments and outstanding balances, as all the necessary information is structured consistently for easier reference.

Incorporating ready-to-use documents into your business practices not only speeds up your administrative processes but also enhances overall efficiency. The time you save can be reinvested into other crucial areas of your business, such as customer service or expanding your offerings.

Ensuring Accuracy in Your Invoice Templates

Maintaining precision in your financial documents is crucial for a smooth billing process. Inaccurate records can lead to confusion, disputes, and delays in payments, all of which can damage your professional reputation. To avoid these pitfalls, it’s essential to ensure that your billing forms are error-free and reflect the correct information every time. Proper checks and thoughtful design can help achieve this goal and improve your workflow.

Key Factors to Ensure Accuracy

- Double-Check Client Information: Always verify that the recipient’s name, address, and contact details are correctly listed before sending the document. Incorrect client data can delay processing or lead to miscommunications.

- Accurate Dates and Payment Terms: Ensure that the issue date, due date, and payment terms are correct to avoid confusion over when payment is expected. This also helps maintain consistency across all records.

- Proper Itemization: List all services or products clearly with accurate descriptions, quantities, and prices. This allows the client to understand exactly what they are being charged for and can prevent disputes over billing.

- Tax Calculations: Review your tax rates and calculations to ensure that they align with the applicable laws in your region. Incorrect tax amounts can result in legal issues and financial discrepancies.

Tools and Practices for Accuracy

- Built-In Formulas: Many digital tools allow you to set up automatic calculations for totals, taxes, and discounts. These reduce the chances of manual errors and save time.

- Proofreading: Take time to thoroughly review all documents before sending them. A simple mistake in a price or quantity can lead to significant errors in the final amount due.

- Audit Trails: Keep a record of all edits and up