Premade Invoice Template for Effortless Billing

Running a business involves managing numerous tasks, and one of the most crucial is ensuring payments are processed smoothly and professionally. One way to simplify this aspect is by using ready-made documents designed for easy financial transactions. These pre-designed forms help maintain a consistent, organized approach to invoicing and reduce the time spent on creating them from scratch.

By utilizing such documents, business owners can focus more on delivering services and products while ensuring clients receive clear, professional statements. Whether you are a freelancer, a small business owner, or part of a larger organization, having a standardized method for requesting payments helps foster trust and improves overall workflow.

These solutions are not only practical but also customizable, allowing users to input necessary details like pricing, services rendered, and payment instructions. With a variety of designs and formats available, they offer a simple yet effective way to ensure all financial communications remain clear and consistent across different platforms and clients.

Premade Invoice Template Overview

Efficient billing is a cornerstone of any successful business. Simplifying the process of creating and sending payment requests not only saves time but also enhances professionalism. Ready-to-use billing documents provide a practical solution by offering a structured format that can be quickly filled out and sent to clients. These ready-made forms are designed to ensure that all necessary details are included, without the need to start from scratch every time.

Such documents typically include sections for services or products provided, payment amounts, due dates, and other relevant terms. The convenience of using these pre-designed options lies in their ability to maintain consistency across all communications, ensuring that clients always receive clear and professional statements. Whether for a one-time project or recurring work, having a standardized format can help maintain order in your financial operations.

Moreover, these tools are flexible and can be customized according to the specific needs of the business. From freelancers to large corporations, there are various designs and formats available that suit different industries and preferences. With just a few adjustments, these documents can be tailored to align with the brand identity and unique requirements of the user.

What is a Premade Invoice Template

A ready-made document designed to streamline the billing process is a practical tool used by businesses of all sizes. These pre-designed forms provide a structured layout that allows you to quickly fill in essential details such as services rendered, amounts due, and payment terms. Instead of creating a new document from scratch for each transaction, you can simply use these forms to save time and maintain consistency across all communications.

Key Features of Ready-Made Billing Documents

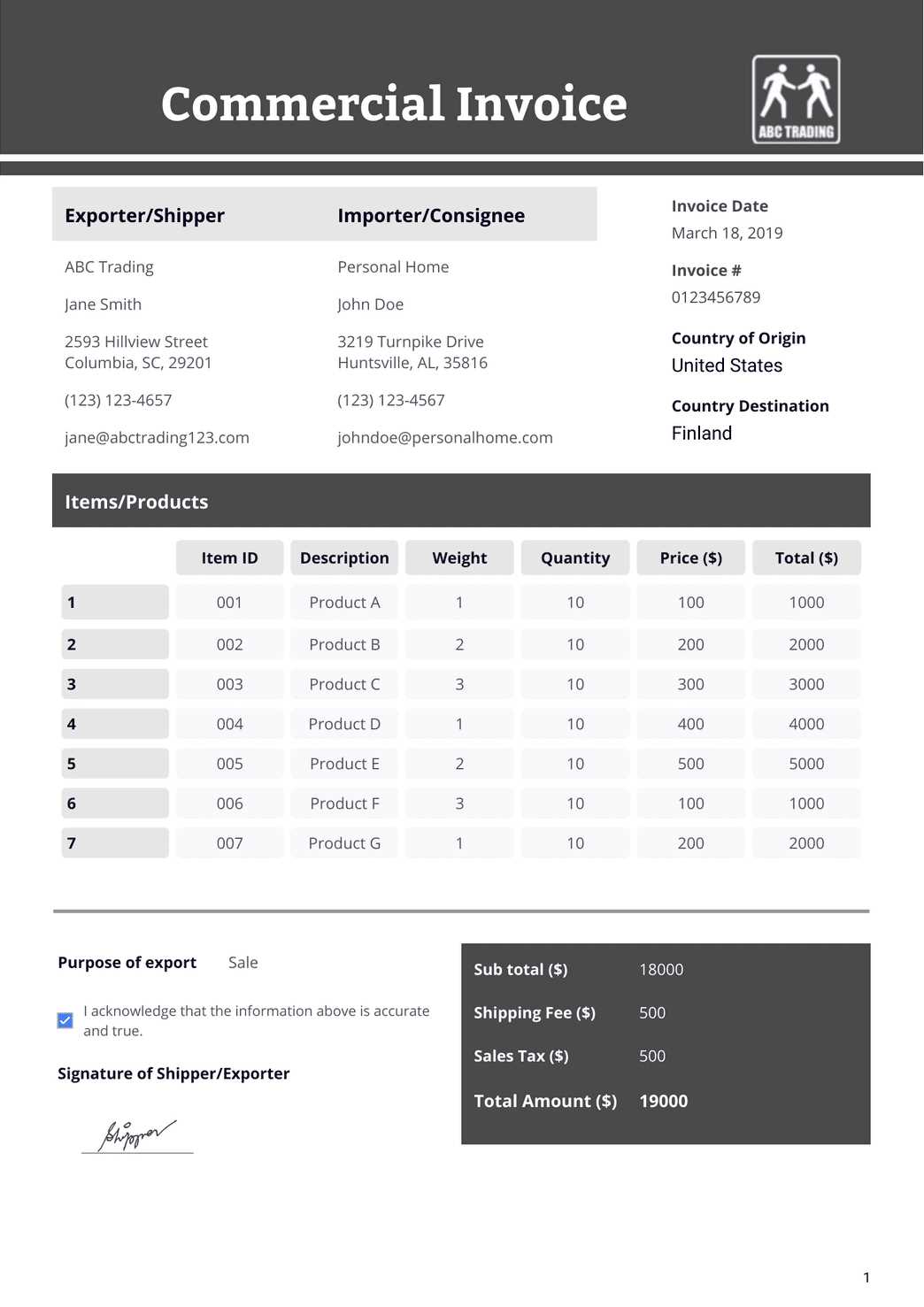

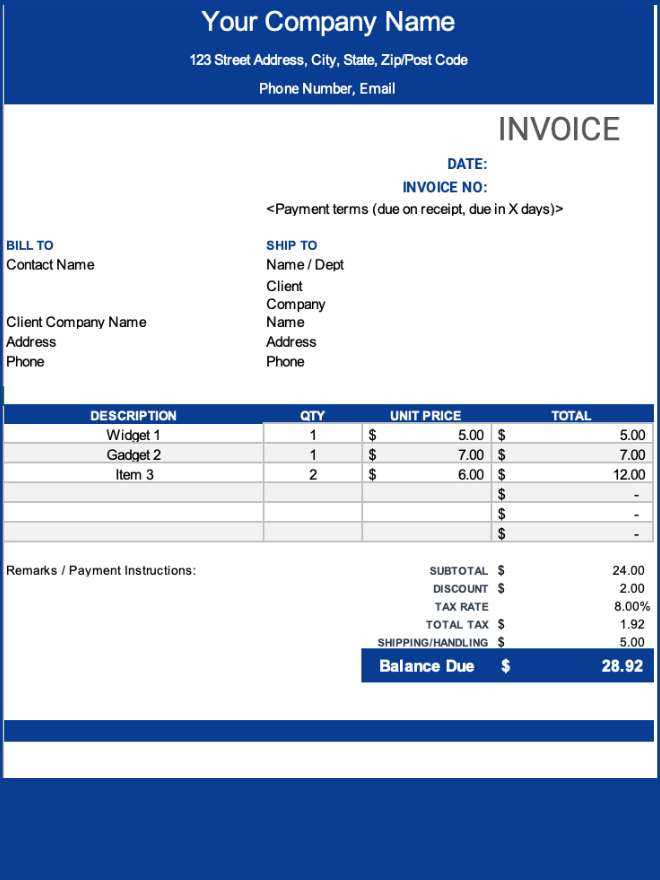

Typically, these documents include fields for the client’s contact information, a breakdown of the work completed or products delivered, payment terms, and any additional notes or taxes that may apply. The main goal is to ensure that all critical details are clearly presented and easy for the client to understand. Using such a structured approach helps avoid mistakes and ensures that important information is never overlooked.

Why Choose Ready-Made Billing Documents

Using a ready-made solution eliminates the need to spend time formatting each request individually. These documents are designed to be customizable, so they can be adjusted to meet specific business needs while offering a professional look. Whether you’re a freelancer or part of a larger organization, this approach allows you to focus on growing your business rather than managing administrative tasks.

Benefits of Using Invoice Templates

Utilizing pre-designed billing documents offers a range of advantages for businesses looking to streamline their payment process. These ready-made forms save time, reduce errors, and ensure that all essential information is consistently presented. By integrating such tools into your workflow, you can simplify the administrative side of your business and focus on what truly matters–serving your clients and growing your operations.

- Time Efficiency: Ready-to-use forms eliminate the need for starting from scratch with every billing cycle, allowing you to generate and send payment requests quickly.

- Consistency: By using standardized documents, you ensure that every client receives the same professional and polished communication, which helps maintain a cohesive brand identity.

- Reduced Errors: With pre-filled sections and clear instructions, the chances of missing important information or making mistakes are significantly reduced.

- Customization Options: Most ready-made forms can be customized to fit specific needs, including adjusting fields for different services, products, or payment terms.

- Legal Compliance: These documents often include all the necessary components required by law, such as tax information, ensuring your billing practices are compliant with regulations.

Incorporating ready-made billing forms into your operations can help boost overall productivity, improve client relations, and reduce administrative burden, making them a worthwhile investment for businesses of all sizes.

How to Customize an Invoice Template

Personalizing ready-made billing forms is a simple yet effective way to make them more suitable for your specific business needs. Customization allows you to align the document with your branding, adjust the layout, and ensure that all necessary details are included in a clear and professional manner. This flexibility can enhance your image and make the billing process smoother for both you and your clients.

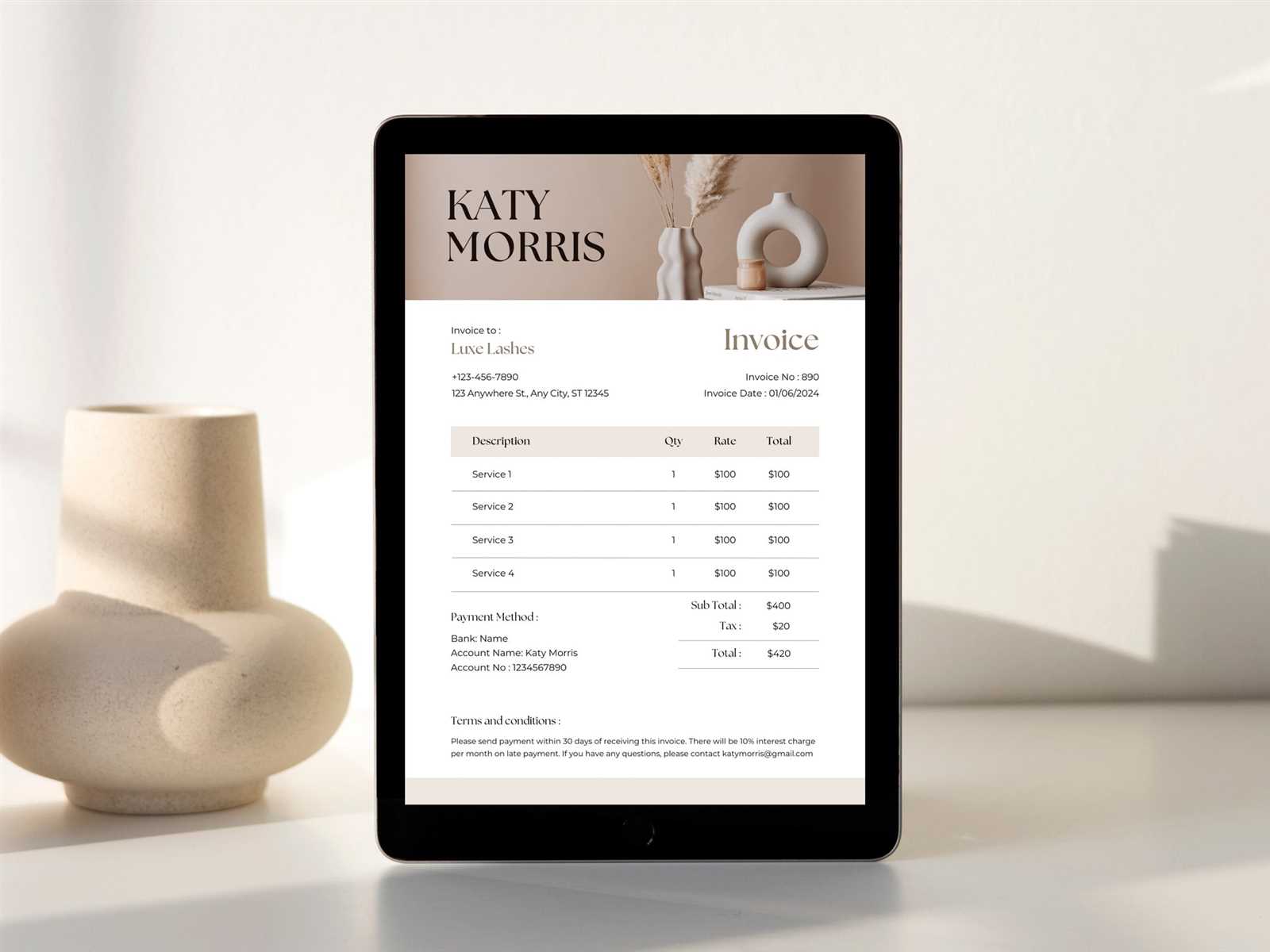

Step 1: Add Your Brand Elements

The first step in customization is incorporating your brand identity. This could include adding your logo, adjusting the color scheme to match your business’s colors, and selecting a font that reflects your brand’s style. Personalizing these elements helps create a consistent experience for your clients and reinforces your professional image.

Step 2: Modify Fields and Layout

Next, adjust the sections and fields within the document to suit your specific services or products. You may need to change labels, remove unnecessary sections, or add new fields that better reflect the nature of your work. For example, if you offer multiple services, consider adding extra lines for detailed descriptions or adjusting the payment terms to match your business practices.

Additionally, rearrange the layout if necessary, to ensure that the most important details–like due dates, total amounts, and payment instructions–are highlighted and easy for your clients to find. A well-organized document will ensure that nothing is overlooked and that the billing process is as efficient as possible.

Common Invoice Template Formats

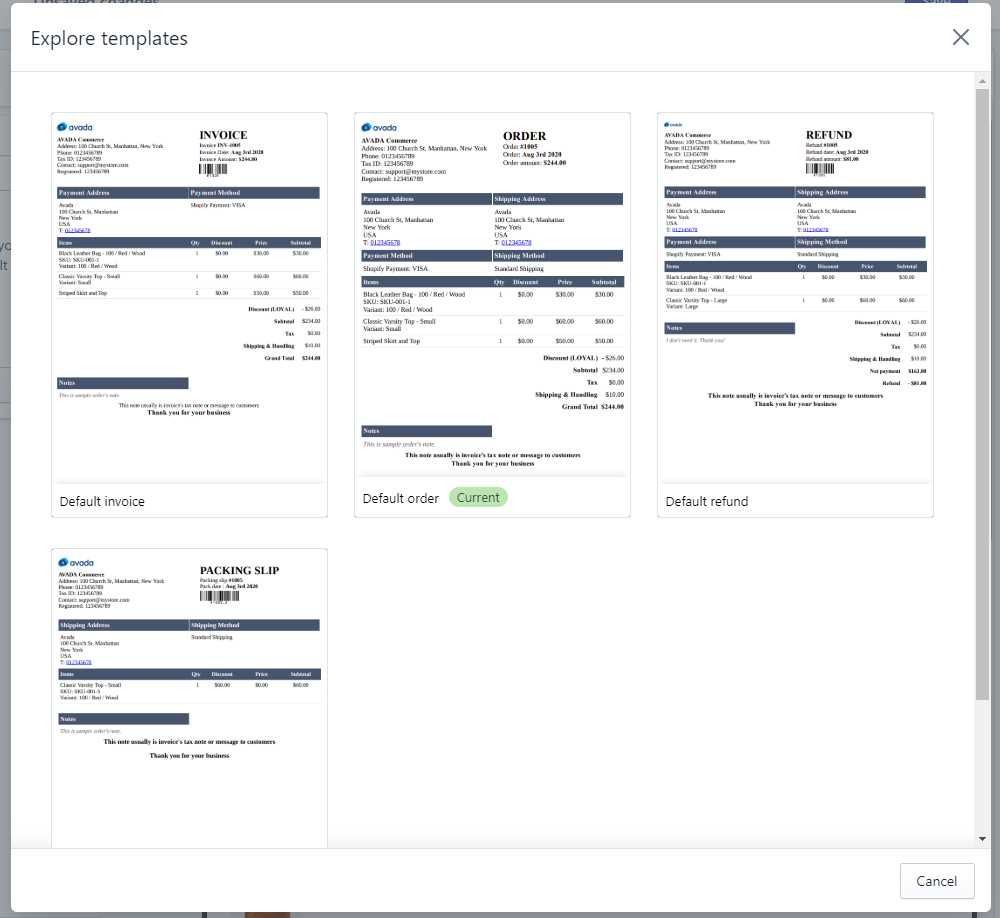

Ready-made billing forms come in various formats, each catering to different business needs and preferences. The structure and design of these documents can vary, but they all share the goal of providing a clear, professional means of requesting payment. Depending on the complexity of your business and the type of transaction, you can choose from several formats that are best suited to your workflow.

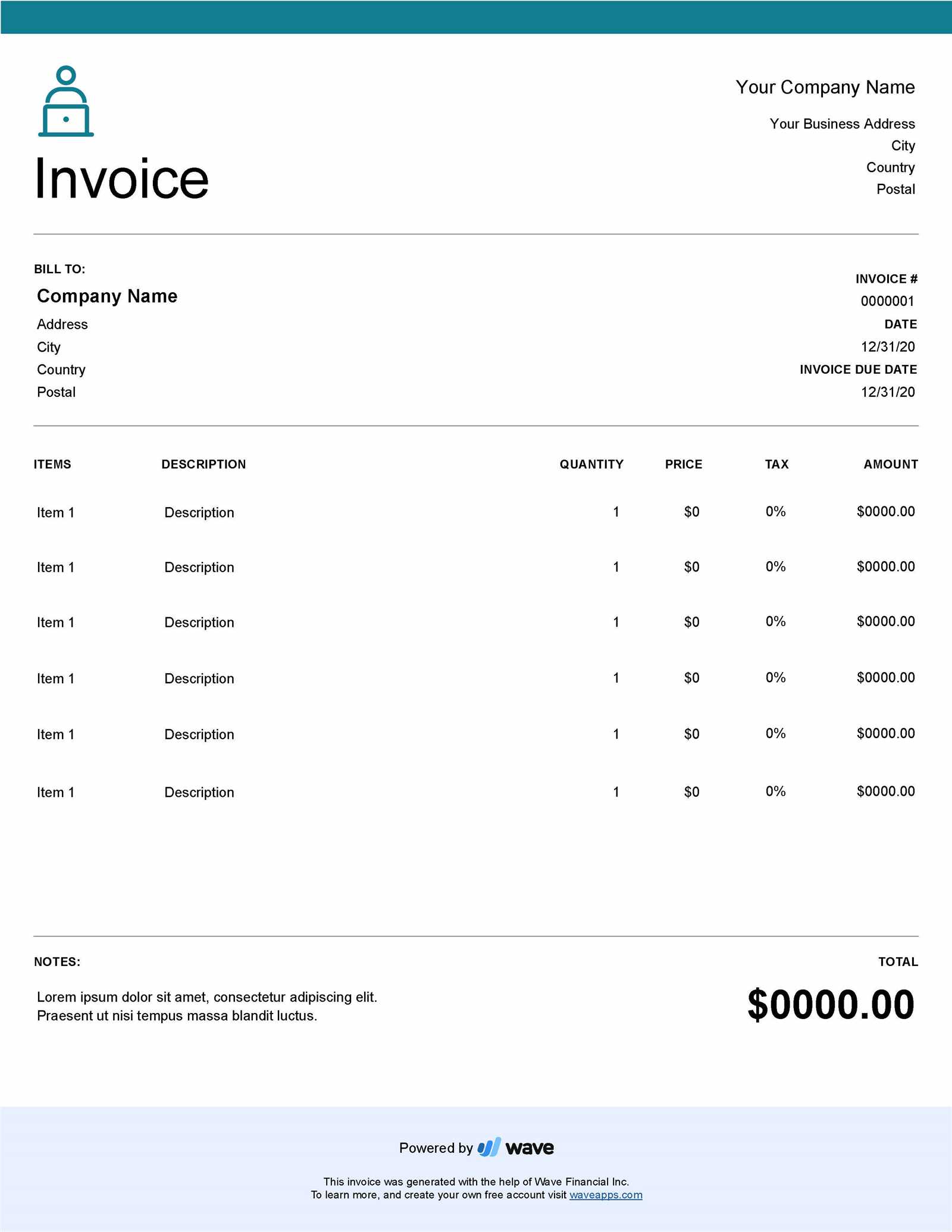

- Basic Billing Forms: Simple and straightforward, these are ideal for small businesses or freelancers who need a quick and easy way to bill clients without too many details. Typically, they include sections for the client’s information, services or products provided, and total amounts due.

- Itemized Billing Statements: These are commonly used by businesses that offer multiple products or services. The document breaks down each item or service with individual pricing, taxes, and subtotals, allowing clients to see exactly what they are paying for.

- Recurring Payment Forms: For businesses that offer subscription-based services or regular payments, these formats include sections for recurring payment details, such as the frequency of charges, total cost, and payment dates.

- Pro Forma Documents: A pro forma document is a preliminary version of a final bill, often used in international transactions or when the full payment is not expected immediately. These documents help clarify expected charges and terms before final payment is made.

- Digital and PDF Formats: These formats are often preferred by businesses that operate online. They can be easily filled out, customized, and sent via email or online platforms. Digital formats also allow for automatic calculations of totals, taxes, and discounts, making them more efficient.

Selecting the right format depends on the type of services you provide and how detailed your billing needs are. Each format offers its own advantages, and many can be adjusted to meet the unique needs of your business.

Top Invoice Templates for Small Businesses

For small business owners, having access to the right ready-made billing documents can significantly improve efficiency and professionalism. These forms help maintain consistent communication with clients, ensuring that all necessary payment details are clearly outlined. Below are some of the best options available, each designed to meet the unique needs of small businesses across various industries.

- Simple Billing Forms: Ideal for freelancers and small businesses with straightforward services, these documents offer a clean, no-frills design. They typically include sections for contact details, service descriptions, and total amounts due, making them perfect for quick transactions.

- Detailed Breakdown Statements: This option works well for businesses that provide multiple products or services. It allows you to itemize each service, include individual prices, apply taxes, and provide a subtotal. This format ensures clients clearly understand each charge and helps reduce disputes.

- Time-Based Billing Forms: For businesses that charge by the hour, these forms include fields to record the time spent on each task, hourly rates, and total charges. This format is commonly used by consultants, contractors, and service-based businesses.

- Recurring Payment Statements: Small businesses offering subscription-based services or regular billing can benefit from this format. It includes sections for payment frequency, due dates, and recurring charges, helping both businesses and clients track ongoing transactions.

- Online Billing Forms: For businesses that operate primarily online, digital forms that can be easily filled out and sent via email or payment platforms are an excellent choice. These forms often integrate features like automatic tax calculations, discounts, and editable fields for quick customization.

Choosing the right format depends on your business model and the level of detail required for your transactions. Each of these options offers flexibility, allowing small businesses to maintain a professional and organized billing process.

Creating Professional Invoices with Templates

Generating professional and accurate billing statements is crucial for maintaining a trustworthy relationship with clients. Using pre-designed forms simplifies the process by providing a clear structure, which ensures that all necessary information is included and presented in a professional manner. By utilizing these ready-made solutions, businesses can maintain consistency and efficiency, making the billing process seamless for both parties.

Key Steps for Creating Professional Documents

- Choose the Right Format: Select a layout that best suits your business type and services. For example, if you offer multiple products, an itemized layout will help break down charges clearly. If you work on a time-based billing system, ensure the form includes fields for hours worked and hourly rates.

- Incorporate Your Branding: Personalize the document with your company’s logo, brand colors, and professional fonts. This adds a polished, cohesive look that reflects the quality of your services and enhances brand recognition.

- Ensure Accuracy: Double-check that all information, including client details, dates, services rendered, and amounts due, is accurate. Mistakes in this area can lead to confusion or delayed payments.

Additional Tips for Enhancing Professionalism

- Provide Clear Payment Terms: Include detailed payment instructions, such as accepted methods and due dates, to avoid confusion. If you offer discounts for early payments or have late fees, be sure to state these terms clearly.

- Use a Consistent Format: Maintaining the same structure for every document helps create a sense of consistency and professionalism, making your business appear more organized and trustworthy.

- Stay Legally Compliant: Ensure your billing form includes all necessary legal information, such as tax identification numbers or VAT information, where applicable, to stay compliant with tax regulations.

By following these steps and customizing ready-made documents to fit your business needs, you can create billing statements that are both professional and efficient, enhancing your client relationships and improving your overall financial management.

Free vs Paid Invoice Templates

When it comes to selecting billing documents, businesses often face the decision between using free or paid options. Both types of ready-made solutions offer distinct advantages, but they also come with certain trade-offs. While free versions can be appealing due to their lack of cost, paid options often provide additional features and customization options that can better suit the specific needs of a business.

Advantages of Free Billing Documents

- No Initial Cost: The most obvious benefit of free forms is that they come at no charge, making them an attractive option for businesses with limited budgets.

- Basic Features: Free documents typically include essential fields for services rendered, payment terms, and total amounts, making them sufficient for businesses with straightforward billing needs.

- Ease of Use: Many free options are simple and easy to navigate, allowing businesses to quickly generate and send requests without complex customization or setup.

Advantages of Paid Billing Documents

- Customization Options: Paid solutions often offer more flexibility, allowing users to tailor the design, structure, and content to better match their business branding and unique requirements.

- Advanced Features: These documents may include features such as automatic tax calculations, recurring billing options, and integration with accounting software, which can significantly streamline your financial processes.

- Professional Designs: Paid options typically come with more polished and professional designs, which can help create a more impressive image for your business, particularly when dealing with high-value clients or large-scale transactions.

Choosing between free and paid billing solutions depends largely on your business’s needs. If your transactions are straightforward and you’re just starting out, a free option might be sufficient. However, as your business grows and your needs become more complex, investing in a paid solution can provide the flexibility and features necessary to improve your billing process and overall efficiency.

Invoice Templates for Different Industries

Each industry has its own unique billing needs, and using the right kind of ready-made documents can help businesses meet those needs efficiently. From freelancers to large corporations, billing documents should be tailored to reflect the specific services or products being provided, the payment structure, and any legal requirements specific to the industry. Below is an overview of how various industries can benefit from customized billing solutions.

| Industry | Key Features | Recommended Document Type | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Freelance & Creative Services | Simple format with sections for hourly rates, project descriptions, and due dates. | Basic billing forms with a focus on service details and time tracking. | |||||||||||||||||||||||||

| Construction & Contracting | Detailed breakdown of work completed, materials used, and subcontractor charges. | Itemized statements with multiple line items for tasks, materials, and costs. | |||||||||||||||||||||||||

| Retail & E-commerce | Clear item descriptions, pricing, taxes, and shipping charges. | Product-focused documents with sections for quantities, unit prices, and totals. | |||||||||||||||||||||||||

| Consulting & Professional Services | Time-based rates, project phases, and milestones with due payment dates. | Hourly or milestone-based documents with detailed project breakdowns. | |||||||||||||||||||||||||

| Healthcare & Medical Services | Insurance codes, patient details, and specific medical services provided. | Specialized forms with fields for insurance info, treatments, and medical codes. | |||||||||||||||||||||||||

| Software Development | Project phases, development m

How to Add Payment Terms in TemplatesIncluding clear payment terms in your billing documents is essential for ensuring smooth transactions and preventing misunderstandings with clients. Payment terms define the conditions under which payments should be made, including due dates, accepted payment methods, and any penalties for late payments. By clearly outlining these terms, businesses can establish expectations and avoid payment delays. To effectively include payment terms in ready-made billing forms, follow these steps:

By adding these key elements, your billing documents become more th Where to Find Quality Invoice TemplatesFinding high-quality ready-made billing forms can significantly simplify your business’s financial operations. Whether you’re looking for simple documents or ones with advanced features, there are various resources available online that offer both free and paid options. The key is to choose a reliable source that offers customizable, professional, and user-friendly documents tailored to your business needs. Top Sources for High-Quality Billing Documents

Things to Consider When Choosing a Source

|