Free Commercial Invoice Template for Easy Business Transactions

Efficient management of transactions and shipments requires well-structured documentation. Having the right form for recording business details can save time, reduce errors, and ensure compliance with regulations. Whether you’re handling exports, invoicing clients, or organizing financial records, using a proper document format simplifies the entire process.

Understanding the key components of such documents is essential for ensuring they meet legal standards and are accepted by customs, clients, and financial institutions. A good document should clearly state the value of goods, their description, the parties involved, and other relevant details. Customizing it to fit your specific needs is often necessary, and with the right framework, this becomes a seamless task.

In this guide, we’ll explore how to create and use the perfect format to streamline your business operations. Whether you’re new to international trade or simply looking to optimize your internal processes, having the right tool at hand will improve both efficiency and professionalism.

What is a Commercial Invoice Template

In the world of global business, a standard document that details the exchange of goods and services is essential. This document ensures transparency and accuracy in transactions, allowing both parties to have a clear record of the terms, quantities, and values of the exchanged items. It also plays a vital role in customs clearance and accounting, making it indispensable for international trade.

Purpose of the Document

The primary goal of this document is to formalize the details of a transaction. It serves as a request for payment and includes important data such as the seller’s and buyer’s information, product descriptions, quantities, and prices. Additionally, it outlines any applicable shipping terms, taxes, and payment methods, ensuring that both parties are aligned on the conditions of the trade.

Importance in Business Operations

Without this crucial document, businesses may face complications with customs, delayed shipments, and disputes over payment. It acts as a legal agreement between the buyer and the seller, reducing the risk of misunderstandings. In some cases, it is even required by law or by international shipping regulations to accompany goods crossing borders.

Having a standardized format makes creating and processing such documents faster and more reliable. With the right structure in place, it becomes easier to adapt the document to specific needs and ensure that all necessary information is included accurately.

Importance of Commercial Invoice for Businesses

In business transactions, proper documentation is crucial to ensure smooth operations and compliance with financial regulations. This record serves as a detailed summary of a transaction, outlining the goods or services exchanged, the involved parties, and the terms agreed upon. It plays a key role in maintaining transparency, managing cash flow, and avoiding potential disputes between sellers and buyers.

When engaging in international trade, this document becomes even more important. It is often required by customs authorities to facilitate the smooth passage of goods across borders. In addition, it helps businesses track sales, manage taxes, and ensure that payments are processed accurately and on time.

Key Benefits for Businesses

| Benefit | Description |

|---|---|

| Legal Protection | Acts as a legally binding agreement that ensures both parties adhere to agreed-upon terms. |

| Tax Compliance | Facilitates accurate reporting of sales and taxes, ensuring compliance with local and international tax laws. |

| Customs Clearance | Essential for ensuring that goods pass through customs without delay, avoiding potential fines and complications. |

| Payment Tracking | Helps businesses track payments and manage cash flow by clearly stating amounts owed and due dates. |

By using a structured format for this document, businesses can increase operational efficiency and reduce the risk of financial errors. It also helps in maintaining professional relationships, as clear and accurate documentation fosters trust and confidence between trading partners.

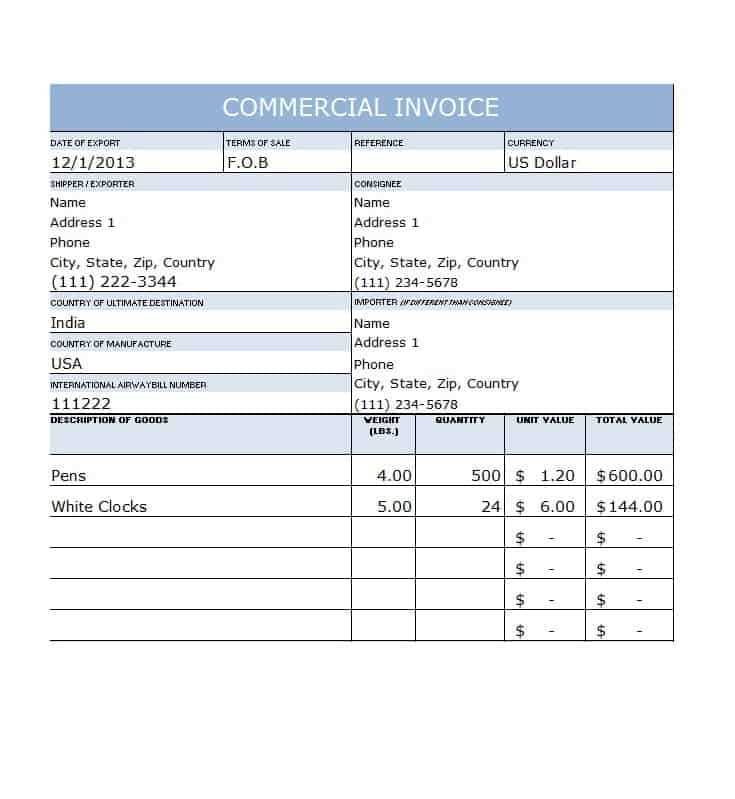

How to Create a Commercial Invoice

Creating a proper business document is essential for any transaction, whether it’s a local sale or an international shipment. This document not only ensures that both parties are clear on the terms but also helps in tracking payments, managing finances, and complying with legal and customs requirements. A well-structured form can save time, reduce errors, and streamline business operations.

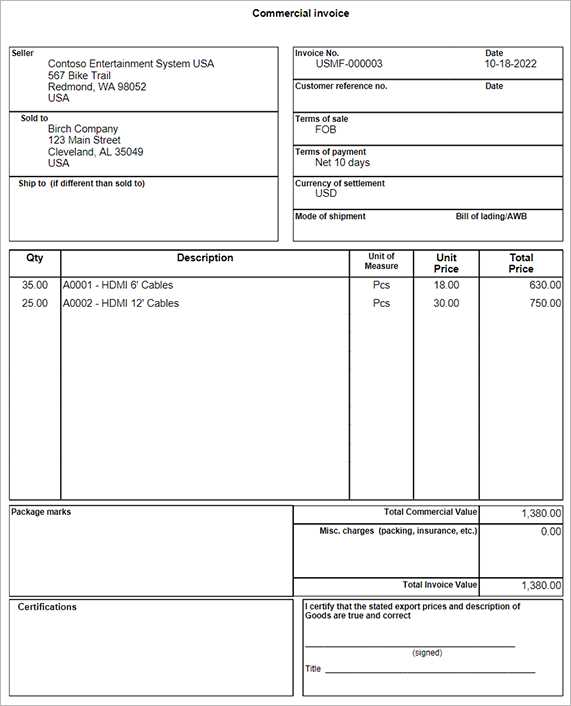

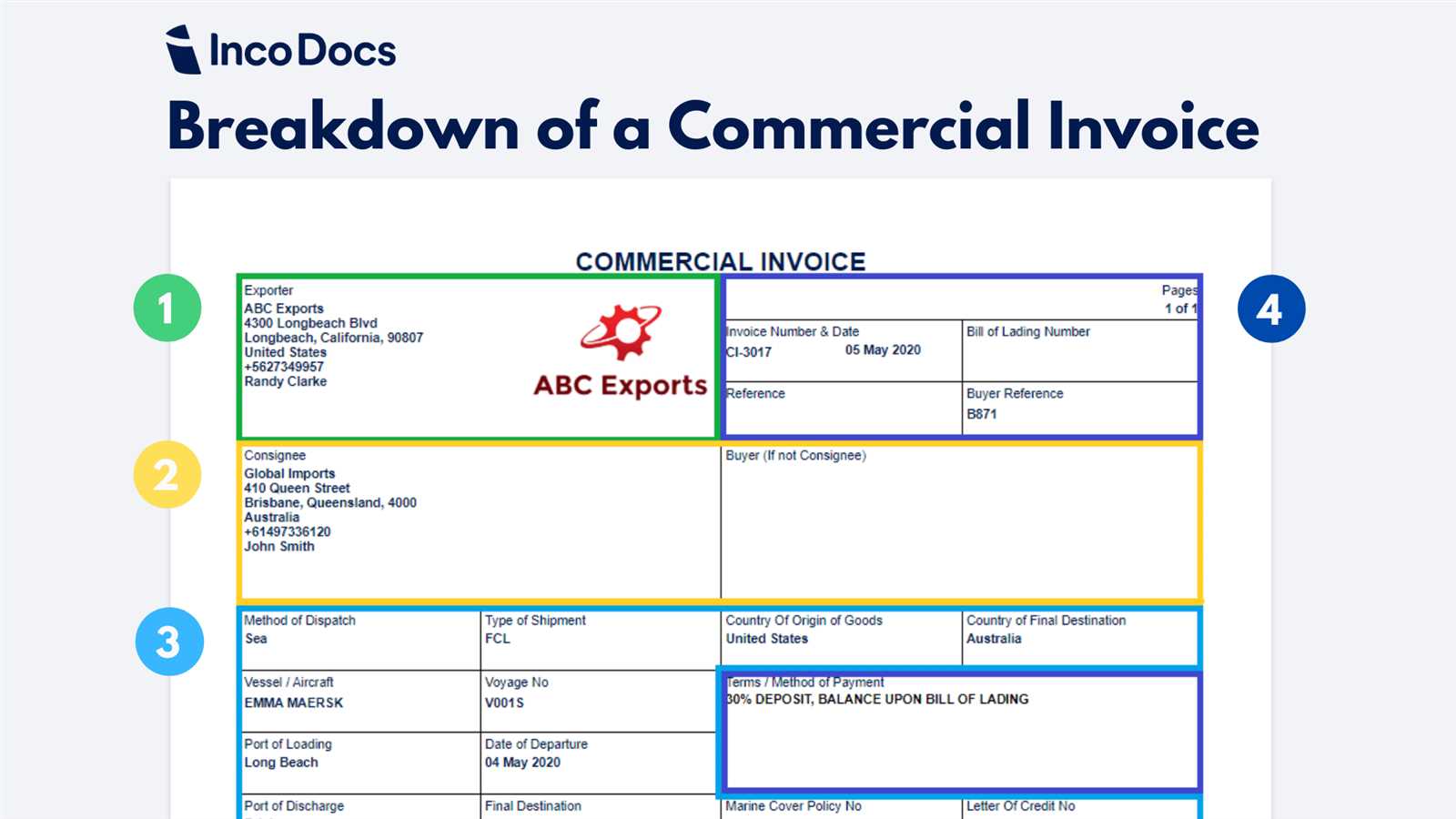

Step 1: Include Business Information

The first step in crafting a professional document is to include the relevant details of both the seller and the buyer. This includes full names or company names, addresses, contact information, and registration numbers where applicable. Accurate contact details ensure that both parties can easily reach each other in case of any issues or follow-ups.

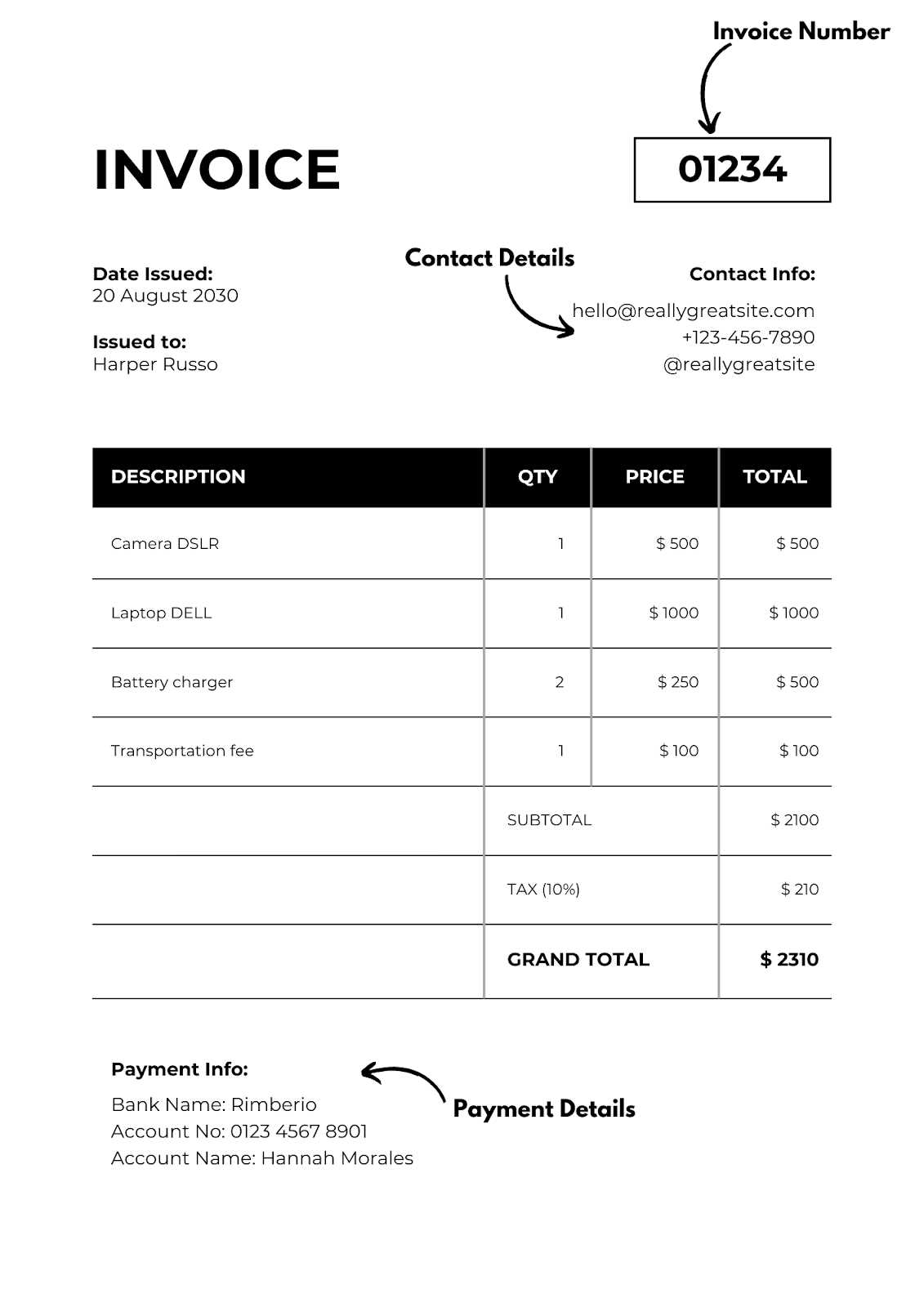

Step 2: Describe Goods or Services

Next, a clear description of the goods or services being exchanged should be provided. Include the product name, model number, quantity, unit price, and total value. Be as specific as possible to avoid any confusion. For international transactions, make sure to include additional information such as the country of origin or harmonized codes for customs purposes.

Additional Elements such as payment terms, delivery method, and tax information are also important to include. These details help ensure transparency and avoid future disputes. Once all sections are filled out, double-check that the document is complete and accurate.

Creating this document accurately not only simplifies the process but also helps build trust with your customers and partners, reducing the likelihood of misunderstandings or delays in payment or delivery.

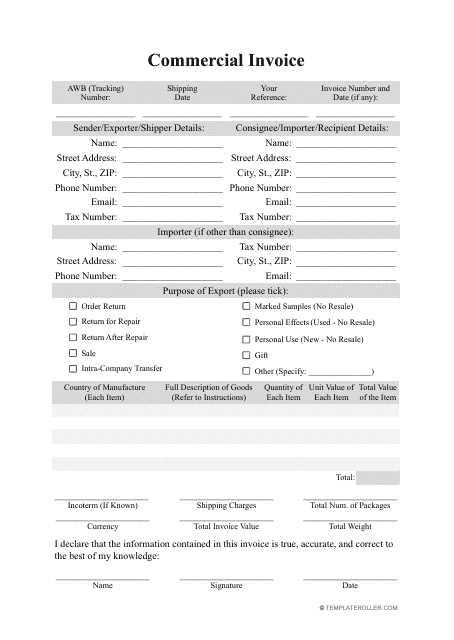

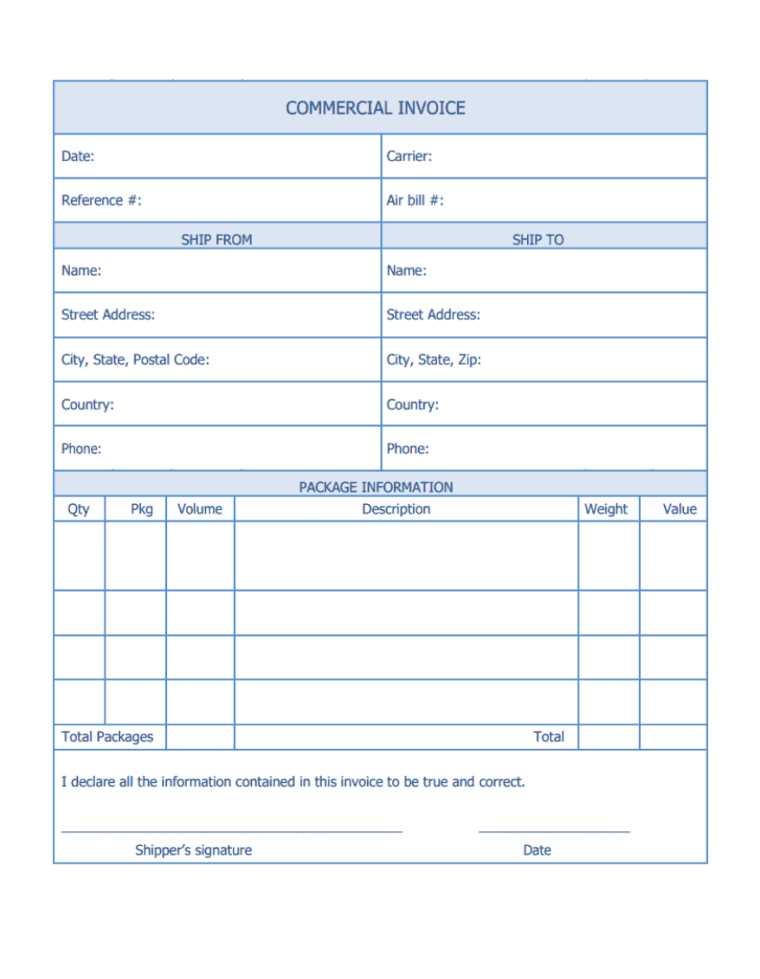

Key Elements of a Commercial Invoice

To ensure smooth transactions and prevent errors, it’s crucial to include the right information in any official document related to goods and services exchanged. This document serves as a record of the sale, outlining the details of the items, the parties involved, and the terms of the deal. A well-organized structure helps facilitate payments, customs clearance, and compliance with relevant regulations.

1. Seller and Buyer Information

The first essential component is the clear identification of both the seller and the buyer. This should include full company names (or individual names), addresses, and contact details such as phone numbers or email addresses. Accurate information ensures that all communication can be carried out without delay, and any disputes can be resolved promptly.

2. Description of Goods or Services

Next, the document must include a detailed list of the goods or services being provided. Each item should have a specific description, quantity, unit price, and total value. For clarity, it’s helpful to provide item codes, serial numbers, or product categories, especially in international transactions. This helps both parties know exactly what is being exchanged and at what value.

Payment and Shipping Terms are another crucial part of the document. These specify how payment will be made (e.g., through bank transfer, credit terms, or prepayment), as well as the method and expected timeframe for delivery. Clearly stating these conditions helps to avoid confusion and ensures both parties are in agreement before the transaction is finalized.

Including these key elements ensures that the transaction is properly documented, legally binding, and easy to process for both parties.

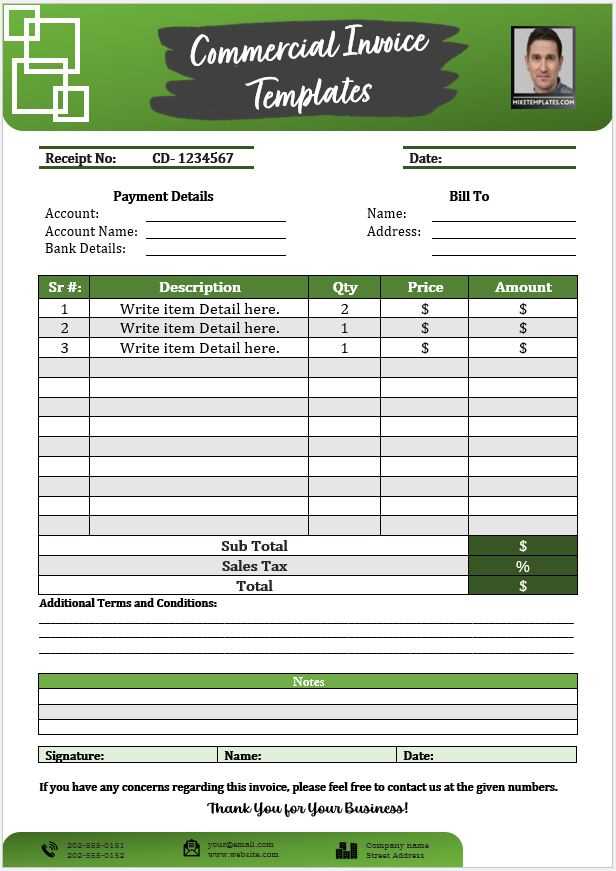

Free Commercial Invoice Templates for Download

For businesses that engage in global trade, it is essential to have the proper documentation to facilitate smooth transactions. Having access to ready-made documents ensures that all required details are included and organized in a professional manner. Fortunately, there are numerous resources where these important files can be easily downloaded, saving time and effort when preparing the necessary paperwork.

Why You Should Use Ready-Made Files

Using pre-designed documents helps avoid errors, ensuring that all important information is present and formatted correctly. These files often include specific fields and sections that are crucial for both sellers and buyers, such as shipping details, product descriptions, and payment terms. By utilizing these resources, companies can streamline their workflow and reduce the likelihood of missing critical information.

Where to Find Quality Documents

Several websites offer free, downloadable forms that are easily customizable to suit the specific needs of any business. These can be used as a quick solution for any transaction, and many offer multiple language options to cater to international clients. Simply search online, and you will find various platforms offering high-quality, editable files that are both practical and convenient.

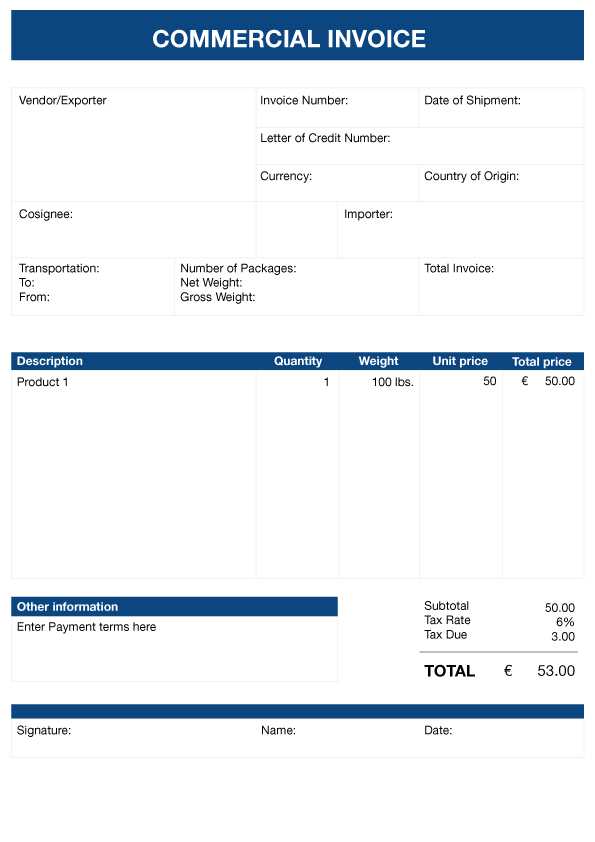

Choosing the Right Template for Your Business

Selecting the right document structure is crucial for ensuring your business transactions are clear, professional, and legally sound. The appropriate format not only ensures that all necessary information is included but also reflects the brand’s credibility and attention to detail. When deciding on the best option, it is important to consider several factors to meet the unique needs of your operations.

Key Factors to Consider

- Industry Requirements: Different sectors may have specific legal or regulatory requirements regarding the content and format of important documents.

- Business Size: Small enterprises may prefer simple, easy-to-use formats, while larger companies might need more detailed documents with additional fields.

- Client Expectations: Consider what your clients might expect from such paperwork. International customers, for example, may require additional language options or more detailed descriptions.

- Customization Options: Choose a layout that allows flexibility in modifying sections, fields, and other details to match the specifics of each transaction.

Where to Find the Best Options

- Explore trusted business platforms and websites offering customizable documents.

- Look for resources that provide multiple formats, such as Word, Excel, or PDF, to cater to different preferences.

- Ensure the provider offers easy editing tools, allowing quick adjustments when necessary.

Common Mistakes When Filling Out an Invoice

When preparing important transaction documents, even small errors can lead to delays, confusion, or financial discrepancies. Whether it’s missing crucial information or incorrect formatting, these mistakes can complicate the payment process and affect your business relationships. It is essential to pay close attention to each detail to avoid common pitfalls.

| Error | Consequences | How to Avoid |

|---|---|---|

| Incorrect Dates | Delayed payments, confusion over due dates | Double-check the issue and due dates before sending out the document |

| Missing Contact Information | Difficulty in reaching parties for clarification or payment | Ensure both sender and receiver contact details are clearly listed |

| Incorrect Pricing or Quantities | Payment disputes, possible overcharges or undercharges | Review each item and its price carefully before submission |

| Lack of Detailed Descriptions | Ambiguity, confusion for the recipient | Include clear, concise descriptions for each item or service provided |

| Missing Terms and Conditions | Legal issues, misunderstanding of payment terms | Clearly state payment terms, delivery methods, and any penalties for late payment |

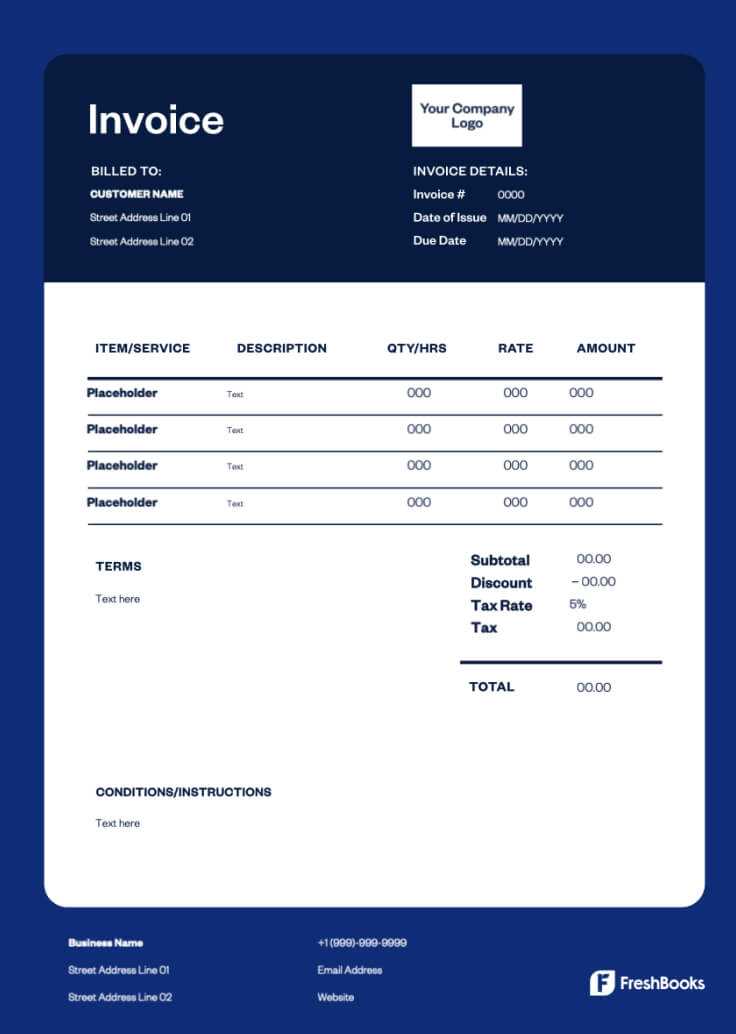

How to Customize Your Commercial Invoice

Personalizing important transaction documents is crucial to ensure they meet the specific needs of your business and clients. Customization allows you to highlight key details, align with your brand identity, and ensure all required fields are properly filled. By making adjustments to certain elements, you can make the process smoother and more professional.

Key Elements to Personalize

- Logo and Branding: Add your company logo, colors, and font style to make the document consistent with your brand’s identity.

- Payment Terms: Clearly state your preferred payment methods, due dates, and any late fee policies.

- Client Information: Ensure that the recipient’s name, address, and contact details are correct to avoid any delivery or communication issues.

- Itemized List: Customize the description of goods or services to reflect the specifics of each transaction.

- Shipping Information: Add or update shipping methods, tracking numbers, and delivery addresses where necessary.

Steps to Edit and Adjust

- Choose an editable document format, such as Word, Excel, or PDF.

- Fill in all required fields, ensuring accuracy and clarity.

- Update any terms, payment options, and delivery details as per the agreement.

- Double-check the layout to make sure everything is properly aligned and readable.

Legal Requirements for a Commercial Invoice

When preparing official transaction documents, it is essential to comply with legal standards to ensure smooth international trade and prevent potential issues with customs or tax authorities. Each country has its own set of requirements that must be met, and failing to include necessary details can lead to delays, fines, or disputes. Understanding and adhering to these regulations is key to maintaining compliance and facilitating hassle-free payments and shipments.

Some common legal elements include accurate descriptions of goods or services, the correct classification codes, and clear payment terms. Additionally, certain jurisdictions may require specific certifications or declarations, particularly for cross-border shipments. Therefore, it is important to stay informed about local laws and ensure that each document is tailored to meet both the general and specific legal obligations of the transaction.

Understanding Commercial Invoice Terms and Conditions

In every transaction, it’s important to clearly outline the agreed-upon terms to avoid confusion and ensure both parties understand their responsibilities. These terms cover a range of aspects, from payment schedules to delivery expectations. Properly understanding and detailing these conditions is essential for preventing disputes and ensuring that the transaction is completed smoothly and fairly for both buyer and seller.

Terms and conditions can include a variety of factors, such as payment deadlines, delivery methods, and tax obligations. Additionally, these agreements often outline penalties for late payments or returns and refund policies, ensuring that both parties are aware of the consequences should the terms not be met. By carefully stating these conditions, businesses create a clear framework that protects their interests while promoting trust and transparency.

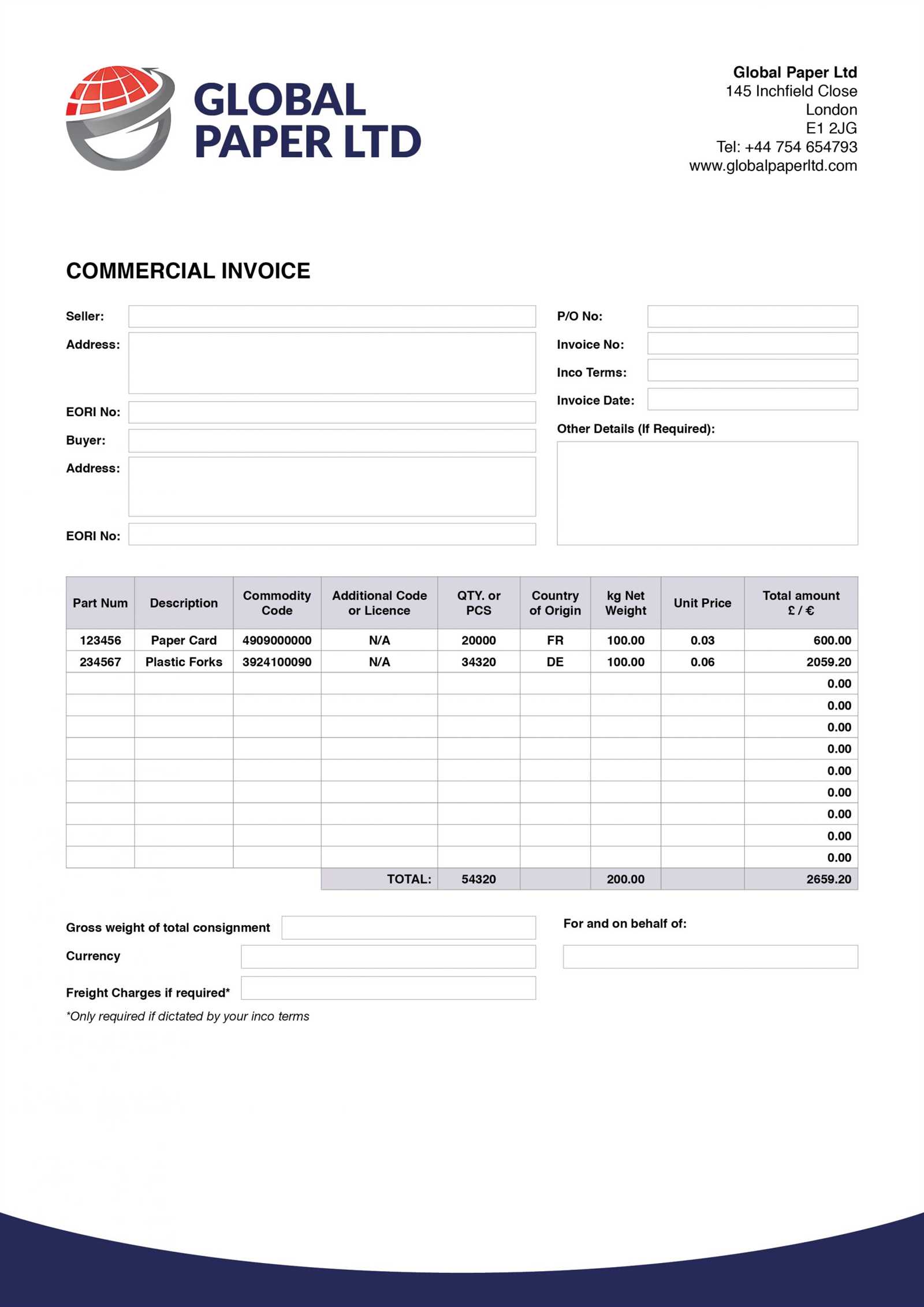

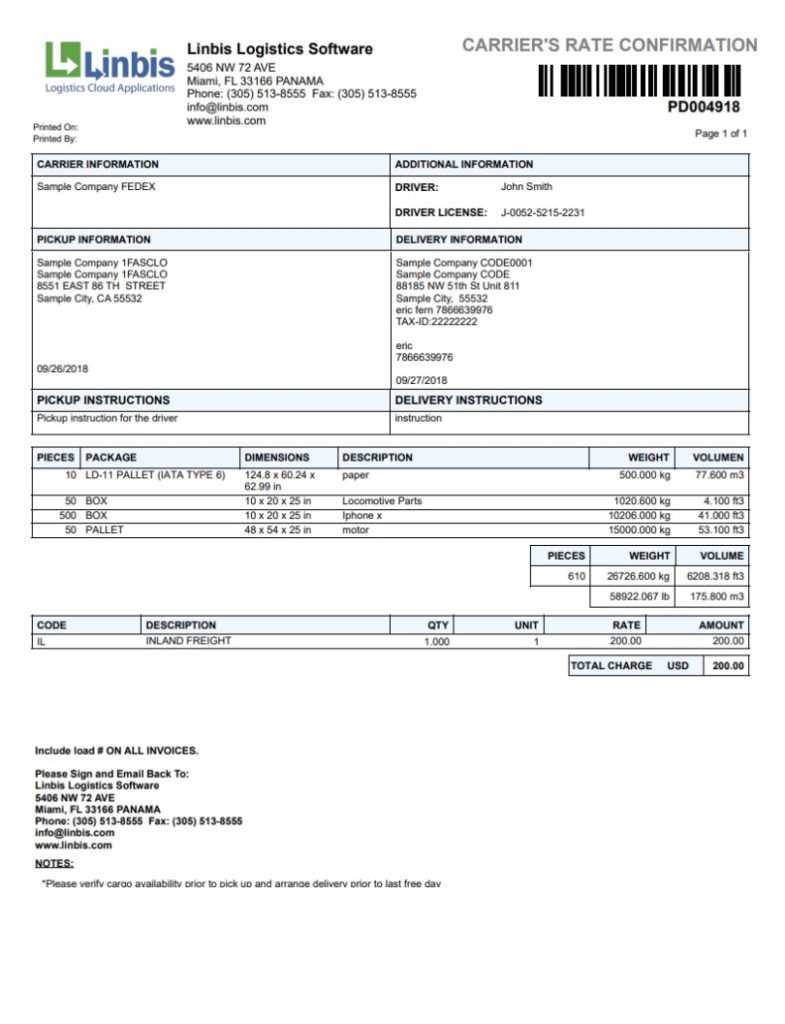

How Commercial Invoices Help with Customs

When goods cross international borders, proper documentation is essential to ensure compliance with customs regulations. These documents provide detailed information about the contents of a shipment, its value, and its origin, which helps customs authorities assess duties and taxes. Having accurate and complete records is crucial for smooth customs clearance and avoiding delays or penalties.

Here are some key ways in which these documents assist with customs procedures:

- Declaration of Value: They provide a clear statement of the transaction amount, helping customs determine the correct duties and taxes to apply.

- Detailed Description of Goods: Descriptions of the items being shipped help authorities understand the nature of the goods, ensuring they are classified correctly for tariff purposes.

- Country of Origin: The document often includes information about where the goods were produced, which can affect tariff rates and eligibility for trade agreements.

- Quantity and Weight: Accurate data on the number of items and their weight ensures that shipments comply with import/export restrictions and guidelines.

Inaccurate or incomplete information can lead to customs delays, fines, or even confiscation of goods. Therefore, ensuring that each document is correctly filled out and submitted is vital for hassle-free border crossing and efficient global trade.

Best Practices for Using Commercial Invoices

Creating clear and accurate documentation is essential for ensuring smooth transactions, compliance with regulations, and avoiding disputes. By following best practices, businesses can ensure that all the necessary details are included, reducing errors and improving the overall efficiency of the payment and shipping processes. Whether you are sending goods internationally or processing local orders, these guidelines will help you get it right every time.

Key Tips for Accuracy

- Double-check Information: Ensure all details–such as product descriptions, prices, and shipping terms–are correct before submission. Mistakes can lead to delays or even fines, particularly for international shipments.

- Include Complete Contact Details: Make sure that both the sender’s and receiver’s contact information is clear and up-to-date. This will help avoid confusion and speed up delivery times.

- Use Clear Item Descriptions: Provide detailed and accurate descriptions of each product or service. This helps to avoid misunderstandings and ensures that goods are classified correctly for customs purposes.

Organizational Best Practices

- Use Consistent Format: Keeping a standardized format for all documents ensures consistency and professionalism in every transaction.

- Keep a Record: Retain copies of all documentat

Digital vs Paper Commercial Invoices

As businesses continue to evolve in the digital age, the choice between using electronic or physical documentation for transactions becomes increasingly relevant. Both methods offer distinct advantages and potential drawbacks. Understanding the differences between digital and paper records can help businesses determine the most efficient and practical solution for their operations, compliance needs, and customer preferences.

Advantages of Digital Documentation

- Speed and Efficiency: Sending electronic files allows for faster processing, immediate delivery, and quicker response times from clients or suppliers.

- Cost-Effective: Digital formats eliminate the need for printing, paper, and postage, reducing overhead costs.

- Storage and Organization: Digital records are easy to store, search, and retrieve, making them ideal for long-term record-keeping and organization.

- Environmentally Friendly: Reducing paper usage contributes to sustainability efforts and reduces the environmental impact of business operations.

Benefits of Paper Documentation

- Familiarity and Security: Physical documents are often preferred by businesses and clients who are more comfortable with traditional paperwork, especially in regions with less access to digital tools.

- Legal Compliance: In some jurisdictions, paper records may still be required for certain legal or regulatory purposes, particularly for customs or tax reporting.

- Less Technical Dependency: Paper documents do not rely on technology, which can be an advantage in areas with limited internet access or when facing technical difficulties.

How to Integrate Commercial Invoices with Accounting Software

Integrating billing documents with financial management systems can streamline administrative tasks and reduce human error. By syncing sales data with accounting platforms, businesses can automate key processes such as tracking payments, managing expenses, and generating reports. This integration allows for a seamless flow of financial information, ensuring accuracy and efficiency in day-to-day operations.

Step 1: First, ensure the software you use supports automatic data synchronization. Many platforms offer built-in tools or third-party integrations to connect with billing software. Review the documentation to verify compatibility and set up necessary APIs or connectors.

Step 2: Map out the key fields and data points you need to transfer. Common fields include payment terms, client details, and amounts due. Make sure the data formats align between the two systems to avoid discrepancies.

Step 3: Once the systems are linked, configure your software to automatically update financial records every time a new transaction is recorded. This eliminates the need for manual data entry and minimizes the risk of mistakes.

Step 4: Finally, test the integration thoroughly to ensure data flows smoothly between both platforms. Perform mock transactions to check that all details are transferred correctly, and adjust the settings if needed to improve accuracy.

Top Tools for Creating Commercial Invoices

There are a variety of platforms designed to simplify the creation of billing documents, each offering unique features tailored to different business needs. These tools help automate document generation, track payments, and ensure accuracy in financial records. Whether you need basic functionality or advanced reporting, these solutions make it easier to handle transactions efficiently.

1. FreshBooks – This user-friendly software is ideal for small businesses, offering customizable layouts and easy integration with accounting systems. It simplifies the process of managing payments and invoicing clients.

2. Zoho Invoice – Zoho provides an intuitive platform with a wide range of customization options, allowing users to create professional-looking documents quickly. The tool supports multi-currency transactions, time tracking, and expense management.

3. QuickBooks Online – QuickBooks is a popular choice for businesses seeking a complete financial management solution. It includes billing features that can be linked with accounting tools to streamline business operations and reporting.

4. Wave – This free platform offers essential features for small businesses, including automatic reminders and payment tracking. It also allows for easy customization and integrates with other financial management tools.

5. PayPal Invoicing – PayPal’s invoicing feature is a simple tool for businesses already using their payment platform. It allows users to generate and send professional documents directly from their PayPal account.