Free Printable Invoice Template for Self-Employed

Managing payments and maintaining clear financial records are essential tasks for independent workers and entrepreneurs. Proper documentation of services provided ensures timely compensation and helps in building professional relationships with clients. However, creating professional and consistent statements can sometimes be time-consuming and complex without the right tools.

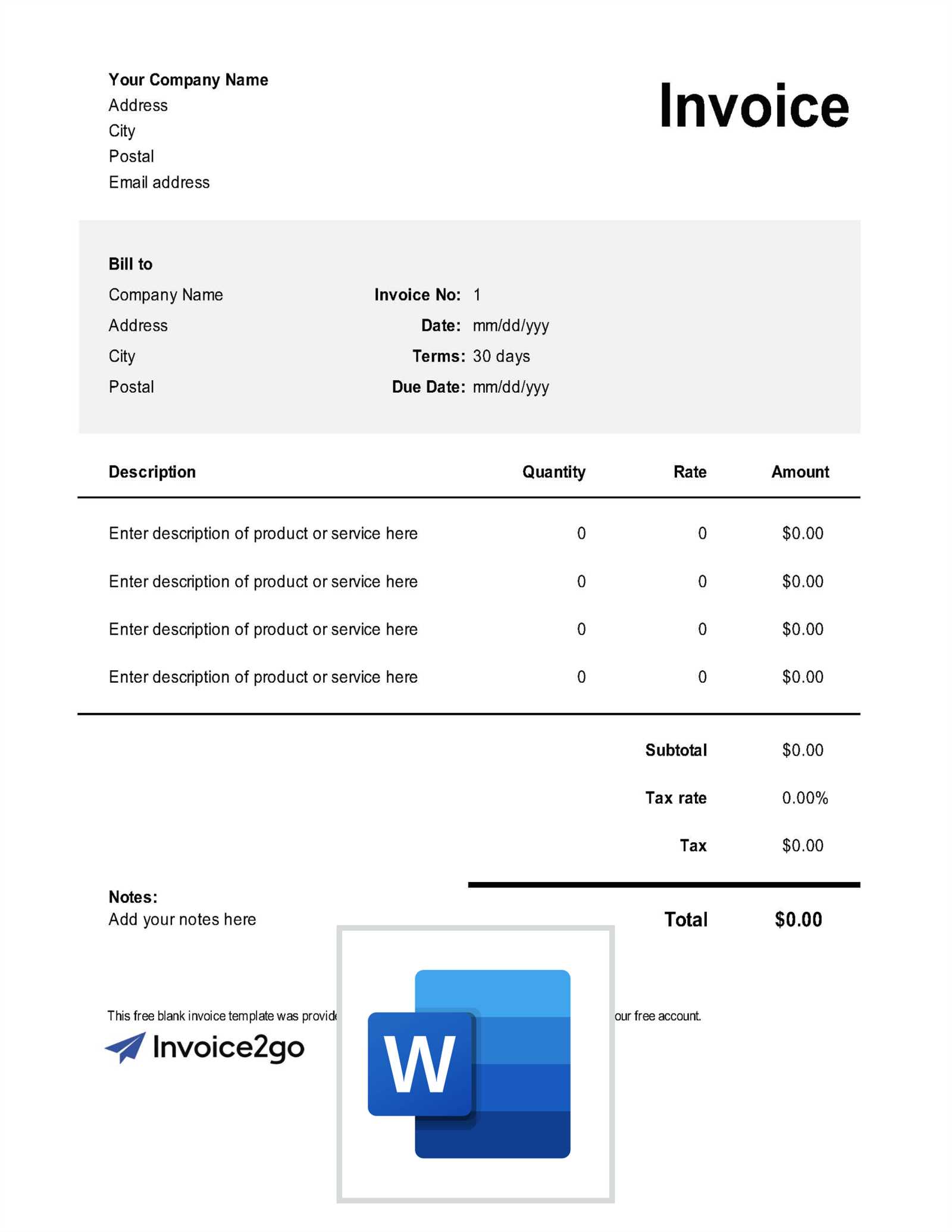

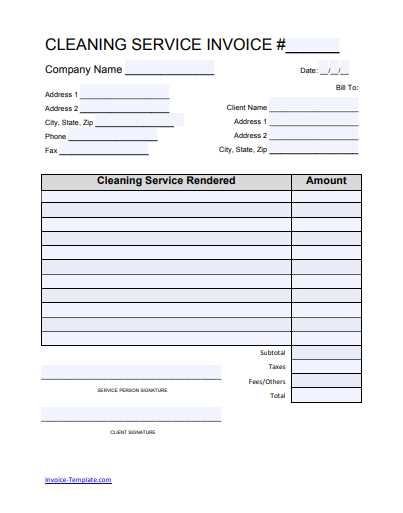

One of the most effective ways to simplify this process is by using ready-made documents designed for easy customization. These documents can help streamline billing, eliminate errors, and present a polished image to clients. With a range of features that cater to various business needs, these options are accessible and flexible for professionals in any field.

Whether you’re offering consulting, creative services, or any other freelance work, having an organized system for billing can make a significant difference in your day-to-day operations. By utilizing customizable options, you can save time, avoid confusion, and ensure that you maintain a clear financial record for both yourself and your clients.

Why Use a Free Invoice Template

For anyone working independently, maintaining clear and professional records is crucial for ensuring smooth financial operations. Using pre-designed documents can greatly simplify the process of billing, saving time and effort that would otherwise be spent creating custom forms from scratch. These ready-made solutions provide a structured format that helps to avoid errors and ensures consistency with every transaction.

Time and Efficiency

Creating a payment statement can take time, especially when you’re managing multiple clients and services. By relying on a ready-made structure, you eliminate the need to design each form individually. Customizable options allow you to fill in only the essential details, such as amounts, dates, and services provided, which speeds up the overall process. This is particularly helpful for those who bill regularly and need to stay on top of finances without getting bogged down in administrative work.

Professional Presentation

When you’re an independent worker, projecting a professional image is key to building trust with clients. Pre-designed billing formats offer a polished and well-organized appearance that reflects positively on your business. Consistency in your documents not only helps you stand out but also ensures that clients receive the information they need in a clear and concise way, enhancing the likelihood of prompt payment.

In addition, these structured formats often include sections for important details such as payment terms, contact information, and applicable taxes, helping you stay compliant and transparent with your clients. Using an established structure can also prevent any miscommunications or disputes related to billing, keeping your transactions professional and hassle-free.

Benefits of Printable Invoice Templates

Using a structured form for billing brings numerous advantages to professionals managing their own businesses. Not only does it streamline the process, but it also enhances overall accuracy, saving time and reducing errors. These organized forms allow for quick customization and ensure that all essential information is included in every transaction, promoting consistency across all client communications.

Key Advantages

- Time Efficiency: With a pre-made layout, you can fill in the necessary details quickly, eliminating the need to create a new document each time you need to request payment.

- Accuracy and Consistency: These forms provide a set structure, ensuring that you never miss any important details like payment terms, services rendered, or contact information.

- Professional Appearance: A well-designed document gives a polished and formal touch to your business dealings, reflecting positively on your reputation.

- Easy Customization: Most of these documents allow for simple adjustments, so you can tailor them to suit specific client needs or different types of work.

Additional Benefits

- Improved Cash Flow: With a clear and detailed request for payment, clients are more likely to understand and process your charges quickly, leading to faster payments.

- Tax Compliance: Ready-made billing forms often include necessary fields for taxes, helping you stay compliant with regulations while providing transparency for both you and your clients.

- Record Keeping: These documents are easy to store digitally or print, allowing for better organization of financial records that can be referred to later for accounting purposes.

How to Customize Your Invoice

Personalizing your billing document is essential for tailoring it to the specific needs of your business and clients. Customization allows you to highlight important details, adjust the layout, and include any necessary information to make the document clearer and more professional. By modifying the basic structure, you ensure that each transaction aligns with your unique services and business practices.

Steps to Personalize Your Billing Document

- Insert Your Business Information: Always include your name, address, phone number, and email at the top of the document. This makes it easy for clients to contact you with any questions or concerns.

- Modify the Design: Customize the color scheme, font style, and overall layout to reflect your brand. This adds a professional touch and makes the document stand out.

- Include Client Details: Add the recipient’s name, company name, and contact information. This ensures the statement reaches the correct person and is processed smoothly.

- Adjust Payment Terms: Specify the payment due date, late fees (if applicable), and any other terms related to the transaction. Clear payment instructions help clients avoid confusion.

Additional Customization Tips

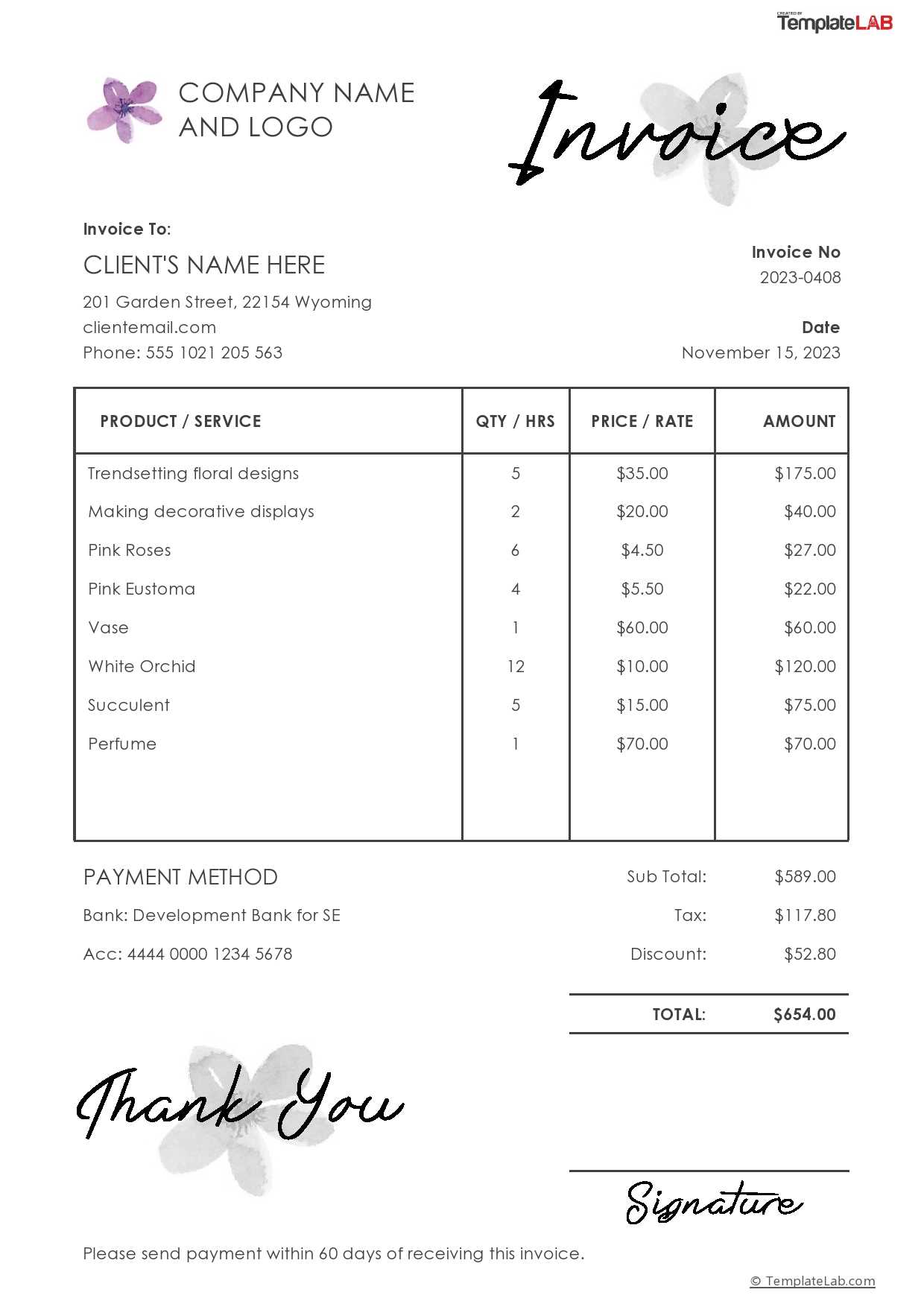

- List Services or Products Clearly: Ensure that the description of services or goods provided is detailed and easy to understand. This helps avoid any misunderstandings and clarifies what the client is being charged for.

- Incorporate Tax Information: If applicable, include the tax rate and total tax amount to ensure transparency and compliance with local tax laws.

- Add a Personal Touch: Adding a small note of thanks or a reminder of the value of your business relationship can leave a positive impression on clients.

Top Features of Self-Employed Invoices

When you manage your own business, creating a structured request for payment is essential. A well-designed billing document should be clear, professional, and tailored to meet both your and your client’s needs. Key features not only ensure accuracy but also make the entire payment process smoother and more efficient.

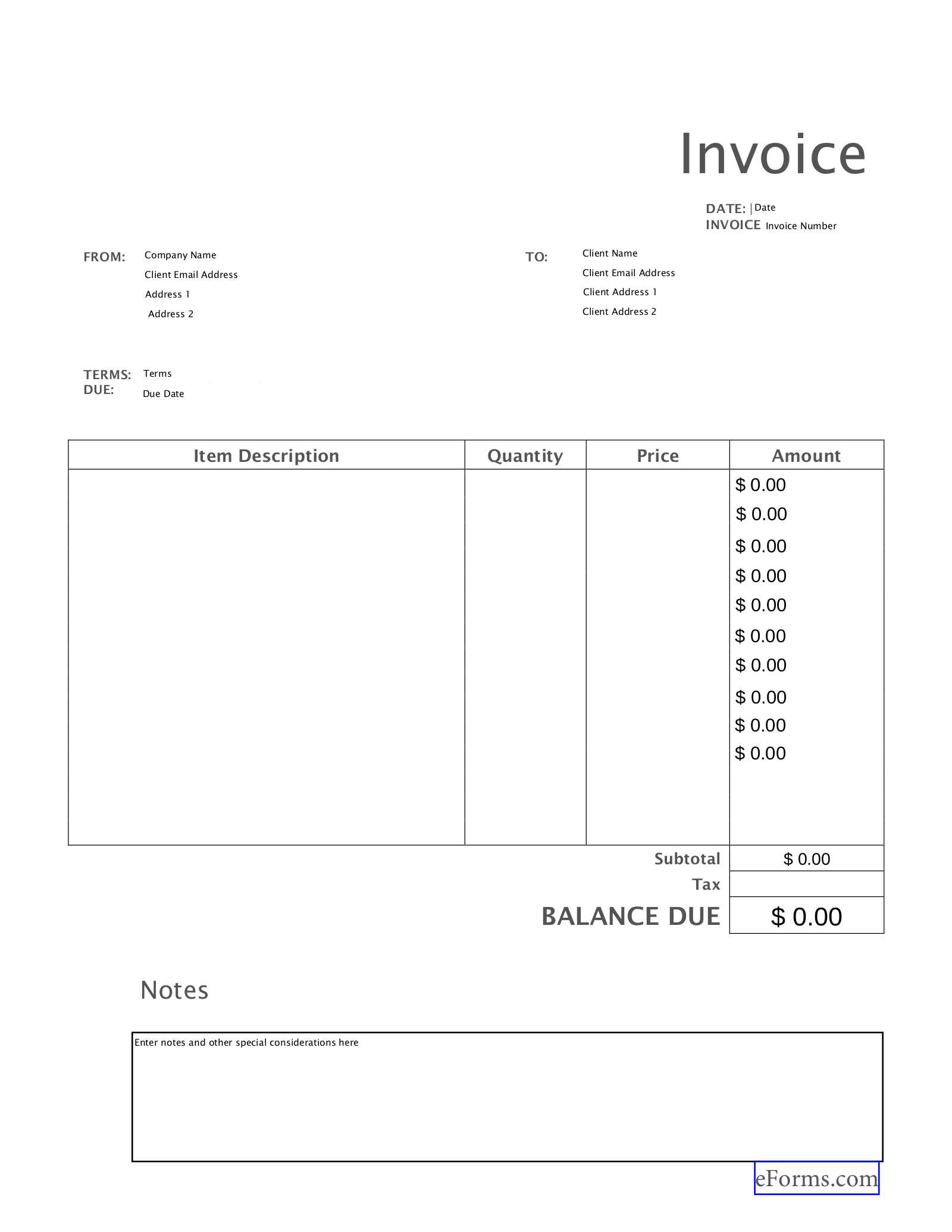

Essential Elements of a Professional Billing Document

- Contact Information: Both your details and those of your client should be clearly listed at the top. This makes it easy for your client to identify who the payment is from and ensures that any questions can be directed to the right person.

- Unique Identification Number: Assigning a reference number to each request helps you keep track of transactions. It also adds a level of professionalism and organization to your records.

- Clear Description of Services: Break down the work or goods provided in a straightforward way. Include quantity, unit price, and total amount, so there’s no ambiguity about the charges.

- Payment Terms: Outline payment expectations, such as the due date, acceptable payment methods, and any late fee policies. This prevents confusion and ensures timely payments.

Additional Features to Enhance Your Document

- Tax Breakdown: If applicable, showing the tax rate and the total tax amount separately ensures that both you and your client are clear about the financial details.

- Branding: Adding your logo, business name, and design elements helps reinforce your brand image and adds a professional look to the document.

- Notes or Special Instructions: Include a brief message of thanks, or provide any necessary instructions that the client should be aware of, such as how to make payments or the next steps after payment.

How to Create an Invoice for Freelancers

For freelancers, issuing a payment request is an essential step in securing income and maintaining professionalism. Creating a well-structured document helps ensure that clients understand the services provided, the payment amount due, and the terms of the transaction. Crafting a clear and accurate document also helps protect both you and your client in case of any disputes or misunderstandings.

To create an effective payment request, begin by ensuring that the essential details are included. Your name, contact information, and payment instructions should be clearly visible. Be sure to also include the client’s details, a breakdown of the services or products provided, and the corresponding amounts. Don’t forget to specify the payment due date and any additional terms, such as late fees or accepted payment methods. A simple and organized structure will not only make the process smoother but also reflect your professionalism.

Once the necessary elements are in place, you can choose to enhance your request with customization options such as your branding or a personal note. These small touches can leave a positive impression and help build a stronger business relationship. With these steps in mind, you can confidently create a clear and comprehensive request for payment that protects your interests and fosters trust with your clients.

What Information Should an Invoice Include

When requesting payment for your services or products, it’s crucial to include all necessary details to ensure clarity and prevent confusion. A well-structured document should contain specific information that helps both you and your client understand the terms of the transaction. By including all the essential elements, you make the payment process smoother and more professional.

Key Information to Include

- Your Business Details: Your full name or business name, address, phone number, and email should be clearly visible at the top. This makes it easy for clients to contact you if needed.

- Client Information: Include the client’s name or company name, address, and contact details. This ensures that the request is directed to the correct recipient and facilitates communication.

- Unique Reference Number: Assigning a number to each payment request helps keep your records organized and makes it easier to track payments.

- Description of Products or Services: List each item or service provided along with the quantity, rate, and total for each. This gives your client a clear understanding of what they are being billed for.

Additional Essential Elements

- Payment Due Date: Be sure to include the date by which payment is expected. This sets clear expectations and helps avoid delays.

- Payment Terms: Specify the acceptable payment methods, such as bank transfer, credit card, or PayPal, and outline any late payment fees or discounts for early payment, if applicable.

- Tax Information: If you’re charging taxes, clearly show the tax rate applied and the total tax amount. This ensures transparency and helps maintain compliance with tax regulations.

Choosing the Best Template for Your Business

Selecting the right format for your billing documents is a crucial decision that can impact your business operations. A well-chosen structure should reflect your brand, meet your specific needs, and be easy for both you and your clients to use. Whether you are working with small or large clients, the layout you choose should provide clarity, be professional, and help streamline your payment process.

Factors to Consider

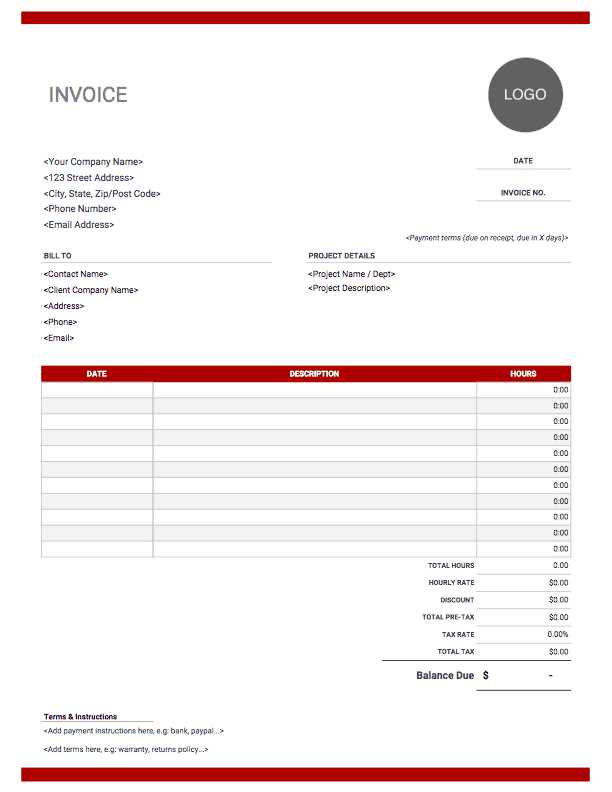

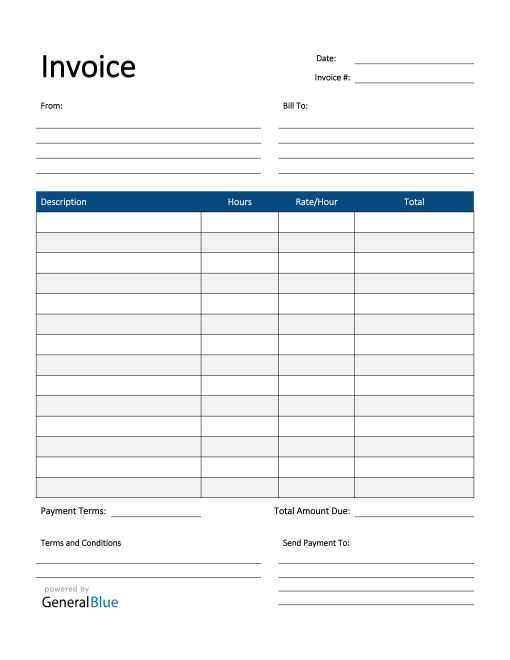

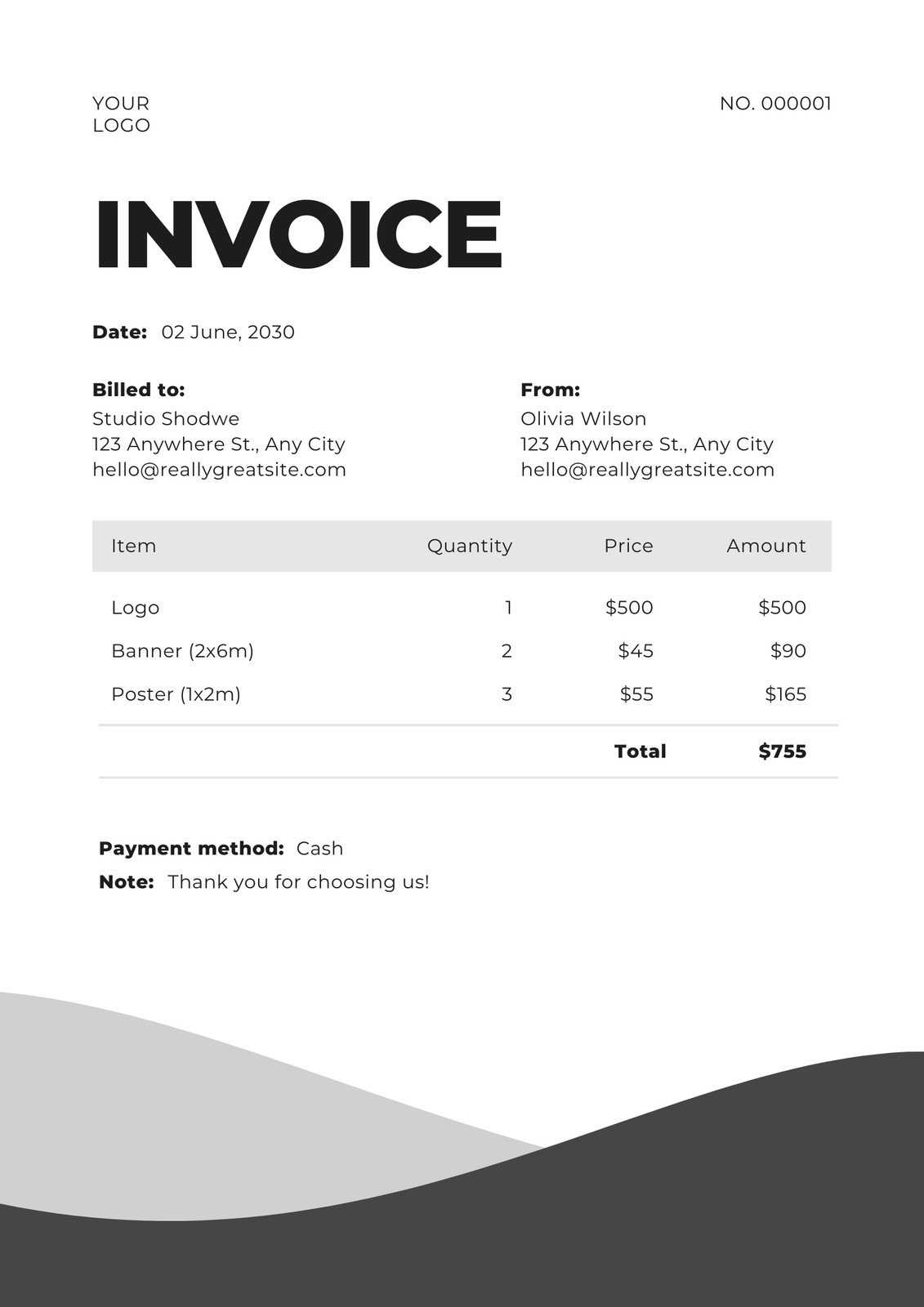

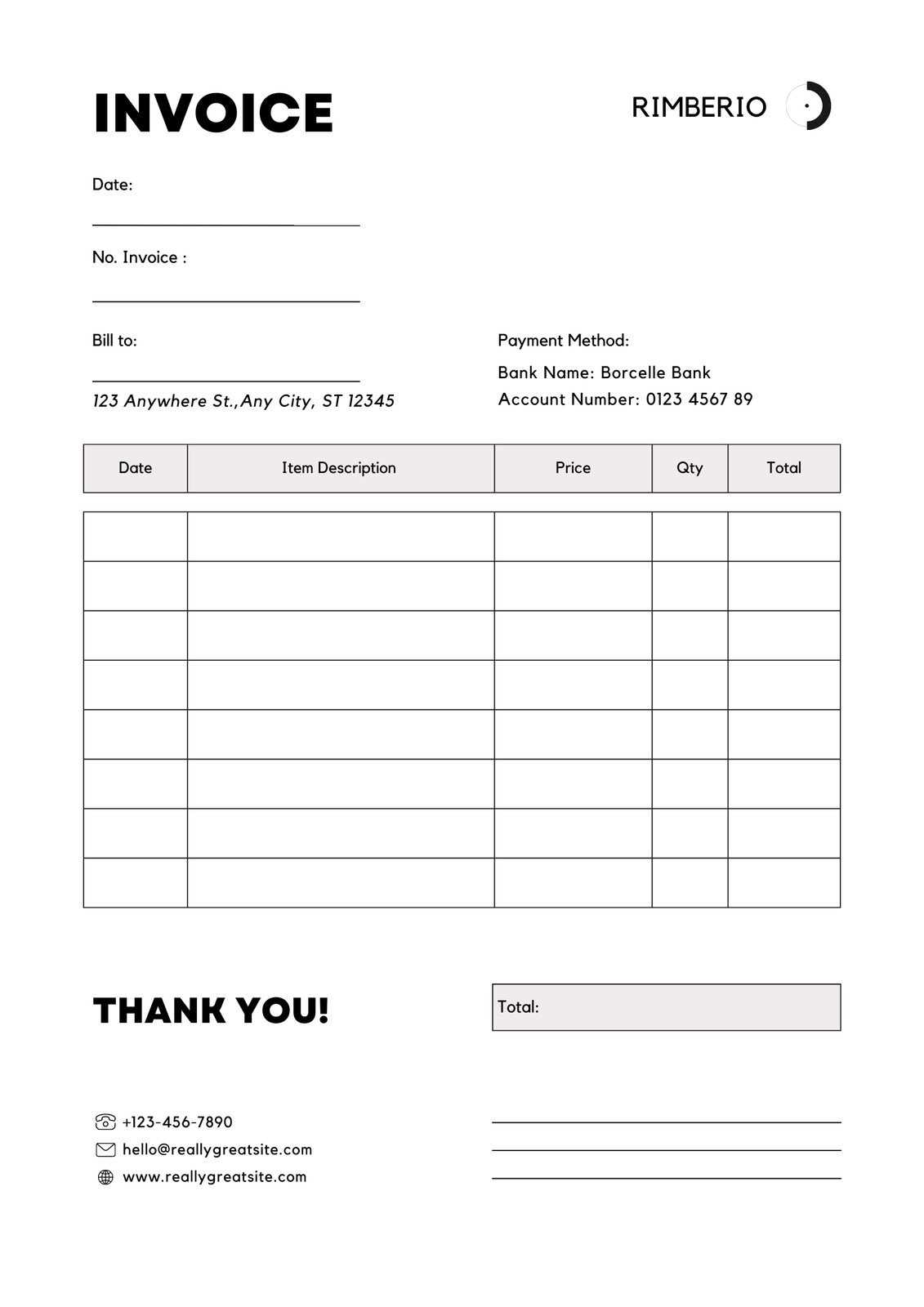

- Business Type: The format you choose should align with the nature of your work. For example, creative professionals may prefer a more visually appealing design, while consultants may prioritize a simple and straightforward layout.

- Customization Options: Look for a structure that allows easy adjustments, whether it’s adding your logo, changing colors, or modifying the content to fit specific needs.

- Ease of Use: The simpler the layout, the easier it will be to fill out. A complex format may take extra time to complete, while a clean and user-friendly one can speed up the billing process.

Comparison of Available Options

| Template Type | Best For | Key Features |

|---|---|---|

| Simple Design | Small businesses, freelancers | Clear, easy-to-fill fields, minimalistic style |

| Professional Design | Consultants, agencies | Branding options, multiple sections for detailed descriptions |

| Creative Layout | Designers, photographers | Customizable visuals, unique color schemes |

When choosing the most suitable format, keep in mind how it fits your workflow, the type of clients you serve, and your overall business image. The right choice can improve both your client relationships and the efficiency

Printable Invoices vs Online Invoice Software

When it comes to managing payment requests, there are two main approaches: using downloadable documents or leveraging cloud-based invoicing tools. Both methods have their own advantages and limitations, and choosing the right one depends on your business needs, preferences, and budget. Understanding the differences between these options can help you decide which method best suits your workflow.

Advantages of Using Downloadable Documents

Printable documents offer simplicity and control. You can create your payment request without needing an internet connection or relying on third-party software. These formats are typically customizable and easy to adapt to your specific requirements. Here are some key benefits:

- Offline Accessibility: You can work on your documents anytime, without needing to be connected to the internet.

- One-Time Cost: Most downloadable formats are available for free or require a one-time purchase, making them a budget-friendly option.

- Simplicity: These formats are straightforward, requiring minimal setup or learning curve. You can easily input your information and print it out quickly.

Advantages of Using Online Software

On the other hand, online software offers a more automated and integrated approach to billing. Cloud-based invoicing tools can streamline the process by allowing you to track payments, send reminders, and even generate financial reports. Here are some key benefits:

- Automation: Most software offers automated features such as recurring billing, payment tracking, and reminders for overdue payments, saving you time and effort.

- Cloud Storage: Your payment requests are stored securely online, reducing the risk of data loss and allowing for easy access from any device.

- Customizable Features: Many online tools offer advanced customization options, including different layouts, branding, and integrations with accounting software.

Ultimately, the choice between using downloadable documents and online invoicing software depends on the level of complexity your business requires. If you prefer simplicity and control, downloadable formats may be the best fit. However, if you need more features and automation, cloud-based tools could provide better efficiency and flexibility.

Understanding Invoice Numbering for Self-Employed

For independent workers, assigning a unique reference number to each payment request is essential for maintaining an organized and professional billing system. Numbering helps track transactions, ensures clarity, and allows both you and your clients to reference specific documents with ease. Without a proper system in place, it can become difficult to manage finances and maintain accurate records, especially as your business grows.

The numbering system you choose should be logical, simple, and consistent. A well-structured sequence helps avoid confusion and makes it easy to locate and retrieve past documents if needed. Whether you prefer sequential numbering or incorporating other identifiers, the key is to ensure that each document has a unique number that avoids duplication.

Best Practices for Numbering

- Sequential Numbers: The most common approach is to assign each payment request a number that follows a simple sequence, such as 001, 002, 003, etc. This ensures that every document is clearly numbered in order of issue.

- Incorporating Dates: Some independent workers prefer to include the year or month in the number, such as 2024-001 or 05-2024-001. This can help to quickly identify when the document was created and makes sorting easier.

- Client-Specific Prefixes: If you work with multiple clients, adding a short code or client ID at the beginning of the number (e.g., ABC-001) can help keep track of which client the request is associated with.

Why Numbering Matters

Proper numbering not only helps you stay organized, but it also contributes to the professionalism of your business. It shows clients that you are methodical and serious about your transactions. Furthermore, clear and unique identifiers make it easier to handle taxes, audits, and disputes, as each document is easily referenced without confusion.

Common Mistakes in Creating Invoices

Creating payment requests may seem like a simple task, but many people overlook important details that can lead to confusion, delays, or even disputes. Even small mistakes can affect your professionalism and result in unnecessary follow-ups with clients. Understanding the most common errors can help you avoid these pitfalls and ensure that your documents are clear, accurate, and effective.

Frequent Errors in Payment Requests

- Missing or Incorrect Contact Information: One of the most common mistakes is leaving out essential details, such as your business name, address, or client information. This can cause delays in communication and make it difficult for clients to process the payment.

- Unclear Descriptions of Services or Products: Vague or incomplete descriptions of the work performed can lead to misunderstandings. It’s important to be as specific as possible about what was delivered and the agreed-upon terms.

- Incorrect Payment Terms: Not clearly specifying the payment due date, methods of payment, or late fees can lead to confusion and missed deadlines. Make sure these terms are explicitly stated to avoid any potential issues.

- Forgetting to Include Taxes or Discounts: Failing to account for taxes or discounts when calculating the total can lead to discrepancies in the amount due. Always double-check that any applicable taxes are clearly listed, and discounts are correctly applied.

Other Common Oversights

- Lack of a Unique Reference Number: Without a unique reference number for each request, it can be difficult to track payments or resolve disputes. Always assign a number to each document to ensure easy identification and organization.

- Using an Outdated Template: Relying on an old or unprofessional format can make your documents look sloppy and detract from your business image. Regularly update your payment request format to keep it in line with your brand and professional standards.

- Not Following Up: Sometimes, clients forget to pay or miss the due date. Not following up in a timely manner can delay your cash flow. Set a reminder to follow up if payment hasn’t been received by the agreed-upon date.

By paying attention to these common mistakes and addressing them in advance, you can ensure that your paymen

How to Invoice Clients Professionally

When requesting payment for your services or products, maintaining a professional approach is crucial to building trust and ensuring prompt payment. A well-structured payment document not only reflects your business standards but also helps avoid misunderstandings with your clients. By following a few key guidelines, you can ensure that your requests are clear, organized, and professional.

Key Elements of a Professional Payment Request

| Element | Description | Why It Matters |

|---|---|---|

| Clear Contact Information | Include your name, business address, phone number, and email, as well as the client’s contact details. | Ensures easy communication and avoids confusion about who the payment is for or from. |

| Unique Reference Number | Assign a sequential or date-based number to each payment request. | Helps keep your records organized and makes it easier to track transactions. |

| Detailed Breakdown of Services | Provide a clear description of the services or products delivered, including quantities and rates. | Prevents misunderstandings about what is being charged and ensures transparency. |

| Payment Terms | Specify the payment due date, acceptable methods of payment, and any late fees or discounts. | Clarifies expectations and helps avoid payment delays or confusion. |

| Tax and Total Amount | Include applicable taxes and clearly show the final amount due. | Ensures accuracy in the amount being charged and complies with tax regulations. |

Additional Tips for Professionalism

- Be Timely: Send your payment request promptly after delivering the service or product. This shows clients that you value their time and ensures faster payment.

- Use a Clean Layout: A cluttered document can confuse clients. Keep the format simple and easy to follow.

- Personalize It: Adding a small note of appreciation or a friendly reminder helps strengthen your relationship with clients.

By incorporating these practices, you can ensure that your payment requests are not only professional but also effective in helping you get paid on time.

Design Tips for Simple Invoices

A well-designed billing document not only enhances professionalism but also makes the payment process smoother for both you and your client. While it’s important to keep the document clean and simple, there are several design elements that can help ensure clarity, readability, and ease of use. By focusing on key design aspects, you can create a document that is both functional and visually appealing.

Key Design Principles for Clarity

- Minimalistic Layout: Keep the design clean by using plenty of white space. Avoid cluttering the document with excessive text or graphics, as this can overwhelm your client and make it difficult to focus on the important details.

- Consistent Typography: Use clear, professional fonts for readability. Stick to one or two font styles–one for headings and another for body text–to maintain a cohesive and neat appearance.

- Logical Structure: Organize information in a way that makes it easy to follow. Group related information together, such as client details, services provided, and payment terms. A clear flow from top to bottom helps your client navigate the document easily.

- Use of Headers: Break the document into sections with bold headings (e.g., “Client Information,” “Description of Services,” “Total Amount Due”). This will guide the reader’s eyes to important details quickly.

Additional Design Tips for Better Presentation

- Highlight Key Details: Use bold text or color to emphasize important elements, such as the total amount due or the payment due date. This makes it easier for your client to find crucial informat

Legal Requirements for Freelance Invoices

When running your own business, it’s crucial to ensure that your payment requests comply with local regulations. Certain details are legally required to be included in every billing document to avoid potential issues with tax authorities or clients. Understanding these requirements can help protect you from legal complications and ensure that your business operates smoothly and professionally.

While the specific legal obligations can vary depending on the country or region, there are common elements that every payment request should include to meet legal standards. Failure to provide these details could lead to fines, delays in payment, or issues during audits.

Essential Legal Information to Include

- Business Identification Number: Depending on your jurisdiction, you may need to include your tax identification number (TIN) or business registration number. This helps to establish your legitimacy as a business entity.

- Client Information: Always include the full name or business name, address, and contact details of the client you are billing. This ensures that both parties can be easily identified in case of any disputes or questions.

- Clear Payment Terms: The payment due date, method of payment, and any late fees should be specified. In some regions, it’s also important to clarify whether the price is inclusive or exclusive of taxes.

- Tax Information: If applicable, make sure to list the taxes involved, such as VAT or sales tax. Your document should clearly show the tax rate and the total tax amount charged.

How to Send Your Invoice to Clients

Sending a payment request to your clients is an essential step in ensuring timely payment and maintaining a professional relationship. It’s important to choose the right method of delivery, be it digital or physical, and to follow a clear, consistent process. By doing so, you can avoid any confusion or delays and ensure that your clients receive the necessary information to process payments quickly.

Whether you’re delivering a payment request electronically or by mail, your communication should be clear and concise. Consider your client’s preferences, your business needs, and the level of formality required for the situation. Here are some common methods of delivery and tips on how to use them effectively.

Digital Delivery Methods

- Email: The most common and fastest way to send a payment request is via email. Attach your document as a PDF or another widely accessible format. Ensure that the email’s subject line is clear (e.g., “Payment Request for [Service Name]”). In the body of the email, briefly explain the document and include any key payment details.

- Online Payment Platforms: Using a payment processing platform (such as PayPal, Stripe, or QuickBooks) allows you to send a payment request directly through the service. These platforms often include automated reminders and allow your client to pay with a click of a button.

- Cloud Storage Links: If you are working with larger files or require clients to view multiple documents, you can use cloud storage services like Google Drive or Dropbox. Provide a link to the shared folder or specific document, ensuring that the file is easily accessible without requiring additional downloads or complex navigation.

Physical Delivery Methods

- Postal Mail: For clients who prefer physical copies or when a formal presentation is required, sending a printed payment request via postal mail may be the best option. Make sure to send it with tracking and ensure your client’s address is correct to avoid delays.

- Courier Services: If time is a factor or if the request needs to be delivered securely, courier services like FedEx or DHL can be used to deliver payment requests. This method ensures timely receipt, though it comes with a higher cost compared to regular postal mail.

Regardless of the method you choose, always follow up if you do not receive payment by the agreed-upon date. A polite reminder can help ensure your client stays on top of their payment schedule.

Managing Your Invoice Records Efficiently

Effective record-keeping is vital for any business, as it helps ensure financial clarity and smooth operations. When it comes to managing your payment documents, keeping everything organized, accessible, and up to date is key. This process not only simplifies tax filing but also allows you to track your cash flow and follow up on unpaid amounts quickly.

To make sure you are staying on top of your records, it’s important to use a consistent method for storing, categorizing, and reviewing payment documentation. Here are a few strategies for managing your records efficiently:

Organizing Your Documents

- Use Digital Storage Systems: Keep your records stored in a secure cloud-based system. This allows easy access to your documents from anywhere and ensures you can back up your files to prevent loss.

- Separate Personal and Business Records: Create distinct folders or categories for business-related documents and personal records. This simplifies both financial tracking and tax preparation.

- File by Date or Client: Organize your payment documents by date, client, or project. This system allows you to quickly locate specific records when needed and ensures you are tracking all payments and services effectively.

Tracking and Reviewing Payments

- Set Up a Payment Tracking System: Whether through accounting software or a simple spreadsheet, tracking payments and their due dates can help you identify overdue balances. Many tools allow you to set reminders for follow-ups on unpaid amounts.

- Review Records Regularly: Regularly audit your payment documentation to ensure everything is accurate and up to date. This practice helps prevent errors and ensures that your financial records are always current.

- Keep Copies of All Transactions: Retain copies of both sent payment requests and received payments. Having these records on hand can be important for reference, disputes, or tax audits.