Invoice Reimbursement Template for Streamlined Expense Tracking

Managing employee expenses and ensuring timely compensation can be a complex and time-consuming task for any business. With the right tools in place, however, this process can be simplified significantly, saving both time and resources. Clear and efficient documentation is key to maintaining accurate records and avoiding errors that could lead to delays or disputes.

Structured expense forms allow organizations to track, approve, and process reimbursements more smoothly. These documents act as a clear record of what was spent, when, and for what purpose, ensuring that employees receive their due amounts quickly. With the help of a well-organized system, businesses can ensure accuracy while keeping things simple and transparent for all involved parties.

By creating and implementing a standardized format for expense claims, companies can reduce confusion and ensure compliance with internal policies. This approach also enhances financial oversight, making it easier for accounting teams to track costs and maintain budgets. In the following sections, we will explore how to set up an efficient process for handling financial reimbursements and managing related paperwork.

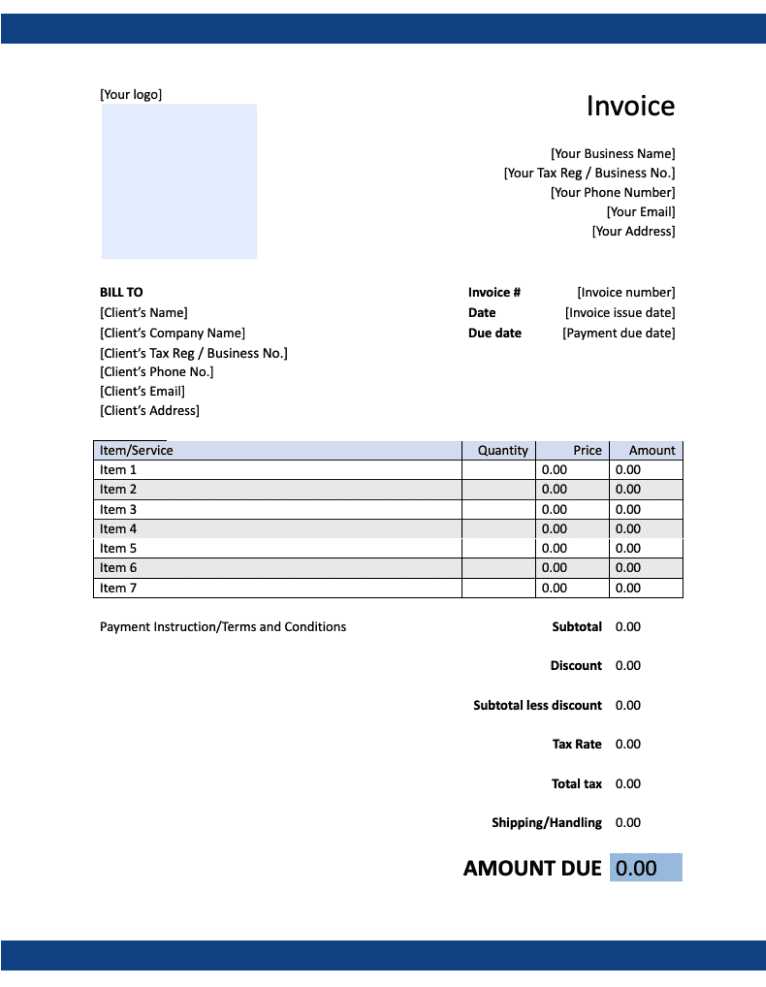

Invoice Reimbursement Template Overview

Efficient management of employee expenses requires a well-organized and clear system for submitting and processing claims. A streamlined approach helps businesses track costs accurately, ensuring employees are reimbursed promptly while maintaining financial control. One of the most effective ways to achieve this is by using a structured form that captures all necessary details, reducing errors and simplifying approvals.

Key Features of an Effective Form

A well-designed form typically includes fields for basic information such as the claimant’s name, date, purpose of the expense, and amounts. It should also allow for easy entry of relevant receipts or supporting documentation. This ensures that both the employee and the accounting department have a clear understanding of the claim being submitted, which helps in faster processing and reduces the chance of discrepancies.

Why Standardization Matters

Standardizing the process of submitting expense claims not only increases efficiency but also enhances transparency. By using a consistent structure, businesses can quickly assess the validity of claims, ensure they align with company policies, and easily track expenses for budgeting purposes. This consistency is crucial for maintaining both internal and external financial reporting standards.

Benefits of Using a Reimbursement Template

Utilizing a structured document for processing employee expense claims offers numerous advantages for both businesses and employees. A standardized approach ensures smooth and efficient handling of financial transactions, reduces errors, and promotes transparency. By integrating a clear process, companies can streamline their operations and improve overall financial management.

- Improved Accuracy: A standardized form ensures all required details are included, reducing the risk of missing information or errors in calculations.

- Time Efficiency: Both employees and finance teams benefit from a simplified process, cutting down the time spent on approvals and paperwork.

- Transparency: A consistent format allows both parties to track and understand the status of claims, enhancing trust and clarity throughout the process.

- Better Record Keeping: By maintaining organized records, companies can more easily manage and report expenses, ensuring better financial oversight and easier audits.

- Policy Compliance: Using a pre-designed document helps ensure that all claims align with company policies, preventing misuse or inconsistencies.

In summary, using a structured approach to managing employee expense claims helps businesses save time, reduce errors, and maintain clear financial records, all while ensuring policy compliance and enhancing overall operational efficiency.

How to Create an Invoice Reimbursement Template

Creating a structured document for submitting and processing expense claims involves careful planning to ensure it captures all essential details. A well-organized form helps both employees and the finance team to understand and verify claims more easily, promoting quicker approval and reducing errors. Below are the key steps to follow when designing a claim submission form that works effectively for your business.

Essential Elements of the Document

- Header Information: Include fields for the claimant’s name, department, and date of submission. This basic information helps identify the source of the claim and the timing of the request.

- Expense Details: Provide space to list each expense separately, including the date of purchase, description of the item or service, and the total amount claimed.

- Supporting Documentation: Add an option to attach receipts or other proof of purchase to validate the claim. This step is crucial for ensuring transparency and accuracy.

- Total Amount: Include a section where the total amount being claimed is clearly displayed. This helps both the employee and the finance team to easily identify the sum for approval.

- Approval Section: Create a designated area for the manager or accounting team to sign or mark the claim as approved or rejected, ensuring accountability.

Design Considerations

- Clarity: Ensure that each section is clearly labeled and easy to fill out, minimizing confusion during the submission process.

- Consistency: Use consistent formatting for dates, amounts, and descriptions to improve readability and make data entry more efficient.

- Flexibility: De

Essential Elements of a Reimbursement Invoice

A well-structured expense claim form ensures that all necessary details are captured for review and approval. This clarity helps both the employee submitting the claim and the finance department reviewing it. Properly outlining essential elements within the document helps streamline the entire process and minimizes errors or misunderstandings.

Key Information to Include

The following key elements should be incorporated into any expense claim form to ensure all relevant data is available for processing:

Element Description Claimant Information Include the name, department, and contact details of the employee submitting the claim. Expense Date Specify the date the expense was incurred to maintain a clear timeline for processing. Description of Expense Provide a brief explanation of the expense, such as the nature of the purchase or service. Amount Claimed State the total amount being requested for reimbursement, broken down if necessary. Supporting Documentation Attach receipts, invoices, or other proof of purchase to validate the expense. Approval Section Leave space for the reviewer’s signature or digital approval to confirm the validity of the claim. Ensuring Completeness and Accuracy

It’s important that the document includes all the required information to avoid delays. By ensuring that each of these elements is clearly laid out, companies can avoid confusion and improve the overa

Common Mistakes in Invoice Reimbursement

When managing employee expense claims, certain errors can disrupt the approval process and lead to unnecessary delays. These mistakes often stem from incomplete or inaccurate documentation, which can cause confusion for both employees and the finance department. Identifying these common issues is essential for improving efficiency and ensuring claims are processed smoothly.

Typical Errors in Expense Claims

Below are some of the most frequent mistakes made during the submission and review of expense claims:

Error Explanation Missing Receipts Failing to attach supporting documents, such as receipts or invoices, can delay processing and lead to claims being rejected. Incorrect or Incomplete Information Omitting key details such as the date of the expense, the purpose, or the amount can lead to confusion and slow down the approval process. Exceeding Policy Limits Submitting claims for amounts that exceed company policy or budget limits can result in denied requests and frustration for employees. Lack of Proper Approval Not obtaining the necessary signatures or digital approvals before submission can cause delays, as claims must be verified before processing. Submitting Claims Too Late Failure to submit claims within the required time frame can result in rejection or longer processing times, leading to payment delays. Avoiding These Pitfalls

By clearly understanding these common mistakes and taking steps to avoid them, both employees and finance teams can ensure that expense claims are processed promptly and without complications. Implementing a checklist or standardized review process can help catch errors before they delay the approval process and ensure that all claims meet comp

Tips for Streamlining Expense Reimbursement

Streamlining the process of submitting and processing employee expenses is essential for improving efficiency and reducing administrative burden. A well-organized system helps speed up approvals, minimizes errors, and ensures timely payments. Below are some practical strategies that can help businesses optimize the expense handling process.

Organizational Strategies

- Standardize the Submission Process: Use a consistent form or structure for submitting all claims. This ensures that employees provide the necessary details, making the approval process quicker and more accurate.

- Set Clear Guidelines: Establish clear policies on what expenses are eligible for reimbursement and communicate these rules to employees. This helps avoid confusion and reduces the chances of rejected claims.

- Implement Deadlines: Set deadlines for submitting claims, such as within a certain number of days after the expense occurs. This keeps the process on track and prevents backlogs.

- Automate Where Possible: Use software that automates expense tracking and approvals, allowing employees to submit their claims easily and managers to review them efficiently.

Improving Efficiency with Technology

- Use Digital Tools: Leverage digital platforms for employees to upload receipts, track expenses, and submit claims electronically. This eliminates the need for paper forms and makes the process faster.

- Integrate with Accounting Software: Integrate expense management systems with your company’s accounting software. This enables automatic data entry and reduces the time spent on manual calculations.

- Enable Mobile Submissions: Allow employees to submit claims via mobile apps, making it easier for them to claim expenses on the go.

By following these tips, companies can make the process of managing employee expenses smoother, faster, and more efficient, while ensuring compliance with company policies and reducing the administrative load on a

Choosing the Right Template for Your Business

Selecting the appropriate form or document for processing employee expense claims is a crucial decision that can greatly impact the efficiency of your workflow. A well-chosen structure ensures that all relevant data is captured, simplifies the review process, and reduces the chances of errors. The right system will align with your company’s needs, improve the accuracy of financial tracking, and save time for both employees and the accounting team.

Factors to Consider

- Business Size: For smaller companies, a basic form may suffice, while larger organizations might require more complex structures to handle multiple departments or types of expenses.

- Employee Needs: Consider whether employees need a simple, quick submission process or if they require more detailed fields to account for a variety of expenses.

- Company Policies: Choose a format that allows for easy customization to match company-specific rules regarding what expenses can be claimed and the approval process.

- Integration with Existing Systems: Ensure that the format works well with your current accounting or financial management software for seamless data entry and reporting.

Customization and Flexibility

- Easy Customization: The structure should be easy to modify so you can adapt it to changing company policies or specific needs, such as adding new expense categories.

- Clear and Simple Design: The form should be intuitive for employees to fill out without confusion, ensuring that all required information is provided upfront.

- Support for Multiple Formats: Consider formats that allow for both digital and paper submissions, giving employees flexibility in how they submit their claims.

By carefully considering your company’s size, needs, and existing tools, you can select the best format that will streamline the claims process, reduce errors, and improve efficiency in managing employee expenses.

Customizing Invoice Templates for Different Needs

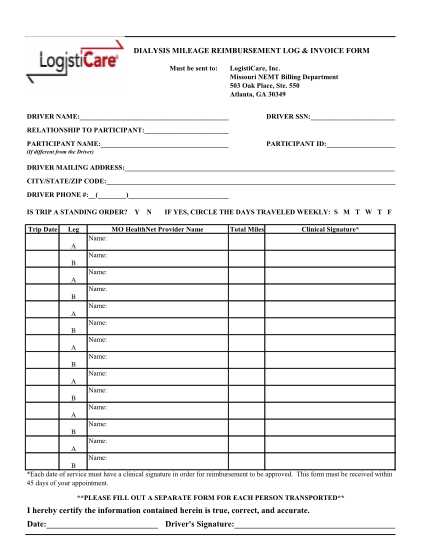

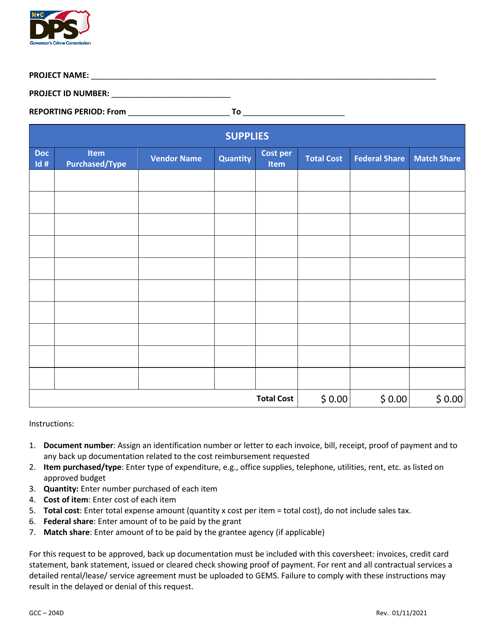

Adapting expense claim forms to suit the unique requirements of your business is essential for maintaining accuracy and efficiency. Customization allows you to ensure that the necessary information is captured, meets company policies, and aligns with industry standards. Different departments or types of expenses may require specific fields or structures to streamline the approval and processing process.

Below are some considerations for adjusting the layout and content of claim forms to address diverse needs:

Customization Aspect Purpose and Benefits Expense Categories Customizing the form to include specific expense categories (e.g., travel, office supplies, meals) helps categorize costs for easier review and approval. Multiple Approval Levels If your company has several layers of approval (e.g., manager, department head, finance), adding signature fields or approval checkboxes for each level ensures a clear review process. Currency and Tax Fields For global businesses or multi-location companies, integrating multiple currencies and tax calculation fields ensures claims are processed according to local regulations. Time-Sensitive Fields Including date fields and submission deadlines ensures claims are submitted in a timely manner and helps avoid late submissions that could delay approvals. Attachment Sections Customize sections to easily upload receipts, invoices, or other supporting documentation, reducing the need for manual tracking and verification. By tailoring the form to suit specific business requirements, you ensure that the expense claims process remains organized, compliant, and efficient. Customization also helps reduce the chance of errors, making the entire process smoother for both employees and the finance team.

How to Ensure Accurate Expense Tracking

Maintaining accurate records of employee expenses is essential for proper financial management. A well-organized system helps ensure that all transactions are recorded correctly, making it easier to manage budgets, prepare financial reports, and avoid discrepancies. Implementing clear processes and utilizing the right tools can significantly improve the accuracy and efficiency of expense tracking.

Key Strategies for Accurate Tracking

- Establish Clear Policies: Set clear guidelines on what types of expenses are eligible for submission and the documentation required for approval. This helps prevent unauthorized or incorrect claims.

- Standardize Submission Forms: Use a consistent format for all expense submissions, ensuring that employees include the necessary details such as date, amount, and purpose of the expense.

- Require Supporting Documentation: Always request receipts or other proof of purchase to verify the legitimacy of claims. This ensures that expenses are genuine and within the company’s policies.

- Set Deadlines for Submission: Establish clear timelines for when expenses must be submitted to prevent backlogs and ensure timely processing of claims.

- Use Expense Tracking Software: Implement digital tools or accounting software that automatically tracks and categorizes expenses, reducing manual entry errors and improving reporting accuracy.

Review and Approval Processes

- Conduct Regular Audits: Regularly audit submitted claims to ensure compliance with company policies. This helps identify patterns or errors early on.

- Implement Multi-Level Approvals: Use a multi-step approval process to catch errors before payments are processed. This may include approval from a manager and accounting department.

Integrating Invoice Templates with Accounting Software Connecting expense claim forms with accounting software can significantly streamline the financial management process. This integration allows for automatic data transfer, reducing the need for manual entry and minimizing the potential for errors. By linking these systems, businesses can ensure that all submitted claims are promptly recorded, verified, and processed for payment, ultimately improving efficiency and accuracy.

Benefits of Integration

- Improved Accuracy: Automatic data entry from forms to accounting systems reduces human errors, ensuring that the amounts and details are correctly recorded.

- Time Savings: Integration eliminates the need for manual data transfer, saving time for both employees and finance teams.

- Real-Time Tracking: Expenses are updated in real time, allowing for immediate insights into company spending and budget management.

- Streamlined Approval Process: Integration can facilitate faster approvals by providing instant access to all necessary information in the accounting system.

- Better Reporting: Integrated systems allow for better financial reporting, as all expense claims are automatically categorized and tracked for future analysis.

How to Integrate Expense Forms with Accounting Software

To ensure a smooth integration between your expense submission process and accounting software, follow these steps:

Step Action 1. Choose Compatible Software Ensure that the form submission system and your accounting software are compatible or can be linked using third-party tools or plugins. 2. Set Up Data Mapping Configure the software to recognize and map specific fields from your claim forms (e.g., amount, date, category) to the corresponding fields in the accounting system. 3. Automate Data Transfer Set up automated data transfer between the two systems, so submitted claims are immediately recorded in the accounting system without manual input. 4. Test the System Run tests to ensure the integration is working properly, with data syncing accurately between both systems without errors. 5. Provide Training Train employees and finance teams on how to use the integrated system for submitting and approving claims, ensuring smooth operation across Expense Claim Form for Small Businesses

For small businesses, managing employee expenses can be a challenge, especially when resources are limited. A streamlined and easy-to-use system for submitting and processing expense claims helps maintain financial control while ensuring that employees are reimbursed in a timely manner. A simple and clear structure for expense submissions can save time, reduce errors, and improve overall efficiency within the organization.

For small businesses, the key is to find a solution that fits the company’s size and budget. The system should be intuitive, requiring minimal administrative overhead while still providing the necessary details for accurate record-keeping and compliance. Below are some recommendations for creating an effective expense submission process for small businesses:

Essential Features for Small Business Expense Claims

- Simple Design: A straightforward form with clearly labeled fields makes it easy for employees to submit their claims without confusion.

- Clear Expense Categories: Categorizing expenses (such as travel, supplies, meals) helps with efficient review and tracking of costs.

- Amount Breakdown: Employees should provide itemized details of the claimed amounts to ensure transparency and accuracy in calculations.

- Supporting Documents: Include a section for attaching receipts or invoices to substantiate each expense, helping to avoid disputes or confusion.

- Approval Section: Clearly defined approval sections for managers or supervisors to review and sign off on claims ensures accountability.

Benefits for Small Businesses

- Cost-Effective: A simple form or digital system helps small businesses avoid unnecessary costs associated with complex solutions, keeping things manageable and within budget.

- Efficiency Gains: Employees can submit claims easily, and managers can quickly review and approve them, speeding up the entire process.

- Improved Accuracy: Clear guidelines and structured forms help ensure all necessary information is captured correctly, reducing errors and discrepancies.

By creating a user-friendly expense submission system, small businesses can maintain financial control without overwhelming their staff with complicated processes. An effective solution can save time, improve accuracy, and ensure that employees are reimbursed fair

Tracking Payments with Reimbursement Templates

Effective tracking of employee claims is crucial for ensuring timely payments and maintaining accurate financial records. A well-organized system for tracking submitted expenses and their corresponding payments helps prevent errors, reduces the risk of overpayments, and ensures compliance with company policies. With the right structure, businesses can easily monitor the status of claims and ensure that employees are reimbursed promptly.

Using a clear and consistent system to track the status of each claim, from submission to final payment, is essential for maintaining control over finances. This process helps businesses keep a detailed record of all transactions, providing transparency for both employees and the finance team. Below are some best practices for efficiently tracking payments related to employee expenses:

Best Practices for Tracking Payments

- Use a Centralized System: A centralized database or digital platform allows for easy tracking of all claims, approvals, and payments in one place, making it easier to monitor the process.

- Maintain a Status Tracker: Include a status field on your submission forms to track the current stage of the claim (e.g., “Submitted,” “Approved,” “Paid”). This provides clear visibility into where each expense is in the process.

- Track Payment Dates: Ensure that payment dates are recorded and updated in the system as soon as claims are paid, so that employees know when to expect reimbursement.

- Automate Notifications: Set up automated notifications to alert both employees and the finance team when a claim is approved or paid. This keeps everyone informed of the status of claims without the need for manual follow-up.

- Reconcile Payments Regularly: Conduct regular audits or reconciliations to ensure that all payments match the amounts recorded in the system. This helps prevent discrepancies and ensures that no claims are overlooked.

Benefits of Efficient Tracking

- Improved Cash Flow Management: By tracking payments effectively, businesses can better predict cash flow and ensure that funds are available to cover employee claims.

- Increased Transparency: Employees are more likely to trust the system if they can easily track t

Creating a Reimbursement Policy for Employees

Establishing a clear and effective policy for handling employee expenses is vital for maintaining consistency and fairness in the workplace. A well-drafted policy sets expectations for both employees and management, ensuring that all claims are processed efficiently, accurately, and in compliance with company rules. A solid policy will also help prevent misunderstandings, reduce the risk of fraud, and provide a transparent framework for submitting and approving expenses.

When developing a policy for employee expenses, it is important to cover several key areas to ensure clarity and ease of use. Below are essential components to consider when creating your company’s expense handling guidelines:

Key Components of an Expense Policy

- Eligible Expenses: Clearly define what types of costs are acceptable for reimbursement. For example, travel, meals, office supplies, and other business-related expenditures.

- Documentation Requirements: Specify the need for receipts, invoices, or other supporting documents to substantiate each claim. This ensures that all claims are verifiable and meet the company’s standards.

- Submission Deadlines: Set a deadline for employees to submit their claims (e.g., within 30 days of the expense being incurred) to prevent delayed claims and ensure timely processing.

- Approval Process: Outline the approval process, including who is responsible for reviewing and approving claims, whether it is the employee’s supervisor, the finance team, or department heads.

- Spending Limits: Define any maximum allowable amounts for different types of expenses (e.g., daily meal allowances, travel limits) to prevent overspending and ensure budget control.

- Payment Timelines: Provide a clear timeline for when employees can expect to receive their payments, whether it’s after approval or a set period (e.g., within two weeks).

- Consequences of Non-Compliance: Establish penalties or consequences for employees who fail to follow the expense policy, including late submissions, submitting non-eligible expenses, or providing false documentation.

Steps to Implement a Reimbursement Policy

- Review Company Needs: Assess the types of expenses your company typicall

Legal Considerations for Reimbursement Invoices

When managing employee expense claims, it is important for businesses to be aware of the legal aspects involved. A well-structured system not only ensures smooth internal operations but also ensures compliance with tax laws and other legal regulations. Understanding the legal framework behind expense claims is essential to avoid potential liabilities and ensure that all claims are handled fairly and transparently.

Businesses should be aware of several legal considerations to ensure that expense management processes are compliant with applicable laws and regulations. These considerations often include tax laws, documentation requirements, and contractual obligations. Below are some critical legal factors to consider when managing employee expense claims:

Key Legal Factors to Consider

Legal Factor Description Tax Implications Depending on the jurisdiction, some expenses may be considered taxable income to the employee. Employers must ensure that reimbursements are handled in a way that complies with tax regulations and avoid over-reporting or under-reporting reimbursements to tax authorities. Documentation Requirements To comply with tax laws and prevent fraud, businesses must require proper documentation, such as receipts, invoices, and detailed expense reports. Failure to maintain sufficient records can result in penalties during audits. Employee Contracts Some contracts may include specific clauses regarding the types of expenses that are reimbursable and the process for submitting claims. Employers should ensure that policies align with contractual obligations to avoid disputes. Compliance with Local Labor Laws Employers must adhere to local labor laws that govern employee expenses. In certain jurisdictions, employers are legally required to reimburse employees for specific expenses (e.g., business travel costs) even if not explicitly stated in company policies. Fraud Prevention Employers must establish procedures to detect and prevent fraudulent claims. This includes maintaining a clear approval process and implementing checks to verify the legitimacy of the expenses be Reducing Errors with Expense Claim Forms

Managing employee expense claims can be prone to errors, whether due to incorrect calculations, missing information, or miscommunication between employees and finance teams. To minimize these mistakes, it is essential to establish a streamlined process that reduces the potential for human error. By creating a clear and structured submission process, businesses can ensure more accurate records and faster processing times, ultimately improving efficiency and reducing frustration for both employees and administrators.

A well-designed claim form helps standardize submissions, ensuring that employees provide all necessary information and follow consistent guidelines. This reduces the likelihood of mistakes and allows the finance team to quickly verify and process the claims. Below are some key strategies for reducing errors in the expense submission process:

Strategies for Minimizing Errors

Strategy Description Clear Form Fields Ensure that all required fields are clearly labeled and easy to understand. This helps employees provide accurate and complete information, reducing the chances of missing details or submitting incomplete claims. Automated Calculations Use automated tools or formulas for calculating totals or tax rates. This minimizes the risk of human error in basic arithmetic and ensures consistency across all claims. Mandatory Documentation Require all claims to include proper receipts, invoices, or other supporting documents. This not only ensures accuracy but also provides a basis for verifying the legitimacy of each expense. Predefined Expense Categories Establish predefined categories for common expense types (e.g., travel, meals, office supplies). This helps employees properly categorize their claims and ensures that the finance team can quickly process them. Approval Workflow Implement a clear approval process that includes multiple levels of review. This provides an opportunity to catch errors before they are finalized, reducing the risk of incorrect or fraudulent claims slipping through the cracks. Additional Tips for Improving Accuracy

- Regular Training: Ensure that employees are familiar with the expense submission process and the required documentation. Ongoing training helps reduce mistakes caused by misunderstandings or lack of knowledge.

- Feedback System: Establish a feedback loop where employees can ask questions or clarify doubts before submitting their claims. This helps prevent errors before they occur.

- Digital Solutions: Use digital platforms for expense management that provide built-in checks and balances. Many software solutions can automatically flag common errors, such as missing receipts or invalid expense catego

Best Practices for Submission of Expense Claims

Submitting expense claims in an organized and efficient manner is crucial for both employees and businesses. A well-structured submission process helps ensure that claims are processed quickly and accurately, reducing the chances of errors and delays. By following best practices, employees can avoid common mistakes, and businesses can maintain better control over their finances while ensuring a smooth workflow for everyone involved.

Below are some key practices to follow when submitting expense claims, which can help streamline the process and improve accuracy:

- Follow Company Guidelines: Always adhere to the specific guidelines set by the company regarding eligible expenses, documentation requirements, and submission deadlines. This ensures that your claims will be accepted and processed without unnecessary delays.

- Include Complete Documentation: Attach all necessary receipts, invoices, or supporting documents to each claim. Incomplete submissions can cause delays as they may require additional follow-up and clarification.

- Ensure Accuracy: Double-check all amounts, dates, and descriptions before submitting. Simple errors such as incorrect totals or missing information can result in rejections or delays in processing your claim.

- Use Clear and Consistent Descriptions: Provide clear, concise descriptions of each expense. This helps the finance team quickly understand the nature of the expense and ensures that it is classified correctly.

- Submit on Time: Be mindful of the submission deadlines. Late submissions may not be processed in time, leading to potential delays in receiving reimbursement or even disqualification of certain claims.

- Use Digital Tools: Where possible, utilize digital tools or platforms for submission. These systems often have built-in checks to ensure that claims are properly completed and can help expedite the approval process.

- Keep Copies of Your Claims: Always maintain a copy of your submitted claims and receipts for your records. This is essential in case there are any discrepancies or you need to reference a past claim in the future.

By adhering to these best practices, employees can ensure that their expense claims are processed smoothly and efficiently, while businesses can maintain a more organized, transparent system for handling employee expenses. Clear communication, proper documentation, and timely submission are all k

How to Automate the Expense Claim Process

Automating the expense claim process is a highly effective way to improve efficiency, reduce errors, and save valuable time for both employees and finance teams. By leveraging automation tools, businesses can streamline the submission, approval, and payment stages, ensuring a smoother experience for all parties involved. Automation helps eliminate manual tasks, reduces administrative overhead, and enhances accuracy in processing claims.

There are several key steps to follow when automating the expense management process. Below are some of the most effective approaches to implementing automation in your business:

Steps to Automate the Expense Process

- Choose the Right Software: Start by selecting an automated solution tailored to your business needs. Many expense management platforms offer features such as automatic expense categorization, approval workflows, and real-time tracking of claims. Look for software that integrates well with your existing accounting system for seamless data flow.

- Set Up Clear Approval Workflows: Configure the software to include automated approval processes. Define who can approve claims at each stage, ensuring that all claims are reviewed by the appropriate individuals before being processed. This eliminates the need for manual checks and ensures that claims are reviewed consistently.

- Enable Direct Uploads: Allow employees to submit receipts and supporting documents directly through the automated system. Optical character recognition (OCR) technology can be used to automatically extract information from receipts, reducing the need for manual entry.

- Automate Expense Categorization: Use automation tools to categorize expenses based on pre-defined categories (e.g., travel, meals, office supplies). This ensures consistent classification and reduces the chances of errors when reviewing claims.

- Integrate with Payroll Systems: For streamlined payments, integrate your expense management system with your payroll platform. This allows automatic transfer of approved amounts directly into employees’ accounts, reducing the time spent o