Comprehensive Guide to Agent Commission Invoice Template

In today’s fast-paced business environment, maintaining precise financial records is essential for success. One key aspect of this is ensuring that all payments are tracked and processed smoothly. Having a structured approach to documenting transactions can significantly enhance the billing process, ensuring that both service providers and clients have clear and consistent records.

Creating a well-organized billing document can streamline the payment collection process and reduce misunderstandings. By utilizing a standardized format, individuals can focus on what truly matters–delivering exceptional services while managing their finances effectively. This article will explore how an effective billing document can simplify operations, improve cash flow, and foster positive relationships between service providers and their clients.

As we delve into this topic, we will cover the essential elements that make a billing document not only functional but also beneficial for all parties involved. From layout considerations to the critical information that must be included, understanding these factors can lead to a more efficient and transparent billing experience.

Understanding Billing Documents

A well-structured financial document plays a crucial role in facilitating transactions between service providers and their clients. These records not only serve as proof of services rendered but also detail the payment terms, making it easier for all parties to understand their financial obligations. A clear and concise format helps prevent misunderstandings and ensures that everyone is on the same page.

Such documents typically include essential details such as the service description, amounts due, and due dates. By incorporating standardized sections, businesses can enhance their efficiency in tracking payments and managing accounts. This approach allows for better cash flow management, ensuring that service providers receive timely compensation for their efforts.

Additionally, a thoughtfully designed billing document fosters professionalism and instills confidence in clients. When recipients see a well-organized record, they are more likely to process payments promptly, leading to a smoother financial relationship. Overall, understanding the components and purpose of these documents is vital for optimizing billing practices and achieving business success.

Importance of Accurate Billing Practices

Maintaining precise financial records is essential for any business looking to foster trust and transparency with its clients. When service providers ensure that their billing practices are accurate, they not only enhance their professional reputation but also reduce the likelihood of disputes and payment delays. An effective billing system can significantly impact overall business operations and client relationships.

Benefits of Precision in Billing

Accurate billing brings a range of advantages that contribute to smoother financial interactions. Here are some key benefits:

| Benefit | Description |

|---|---|

| Reduced Errors | Minimizing mistakes helps avoid costly corrections and misunderstandings. |

| Timely Payments | Clear and accurate records encourage prompt payment from clients. |

| Improved Cash Flow | Reliable billing practices enhance the management of cash flow and financial forecasting. |

| Stronger Client Relationships | Transparency fosters trust and strengthens the bond between providers and clients. |

Consequences of Inaccurate Billing

Failure to maintain accurate records can lead to significant repercussions, including damaged relationships and lost revenue. Disputes over charges can erode client trust, making them hesitant to engage in future business. Therefore, prioritizing accurate financial documentation is crucial for long-term success and stability.

How to Create a Billing Document

Designing a structured financial record can greatly enhance your efficiency in managing transactions and ensuring timely payments. A well-crafted document not only presents the necessary information clearly but also contributes to a professional image. By following a few straightforward steps, you can create a document that meets your business needs and fosters positive client interactions.

Here are the essential elements to include when constructing your financial record:

| Component | Description |

|---|---|

| Your Business Information | Include your name, address, phone number, and email for easy contact. |

| Client Information | Provide the recipient’s name and contact details to personalize the document. |

| Date of Issue | Clearly state when the record is issued to track payment timelines. |

| Itemized Services | List services provided, including descriptions and corresponding fees. |

| Total Amount Due | Clearly indicate the total that the client needs to pay. |

| Payment Terms | Specify due dates and accepted payment methods for clarity. |

Once you have included all necessary components, review the document for accuracy and clarity. Utilizing software or online tools can streamline the process and provide additional features such as automatic calculations. A well-organized financial record not only simplifies transactions but also reflects your commitment to professionalism in your business practices.

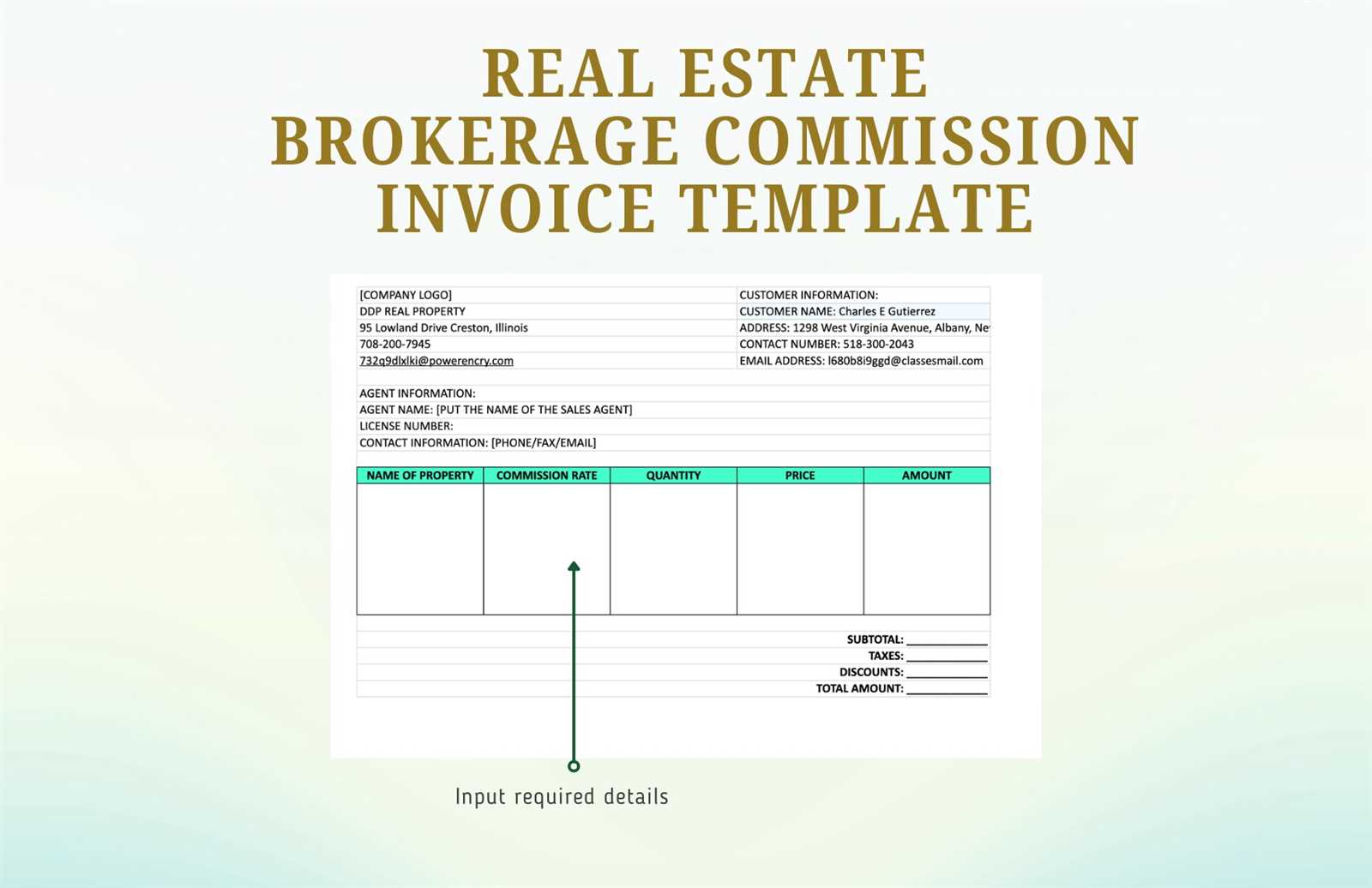

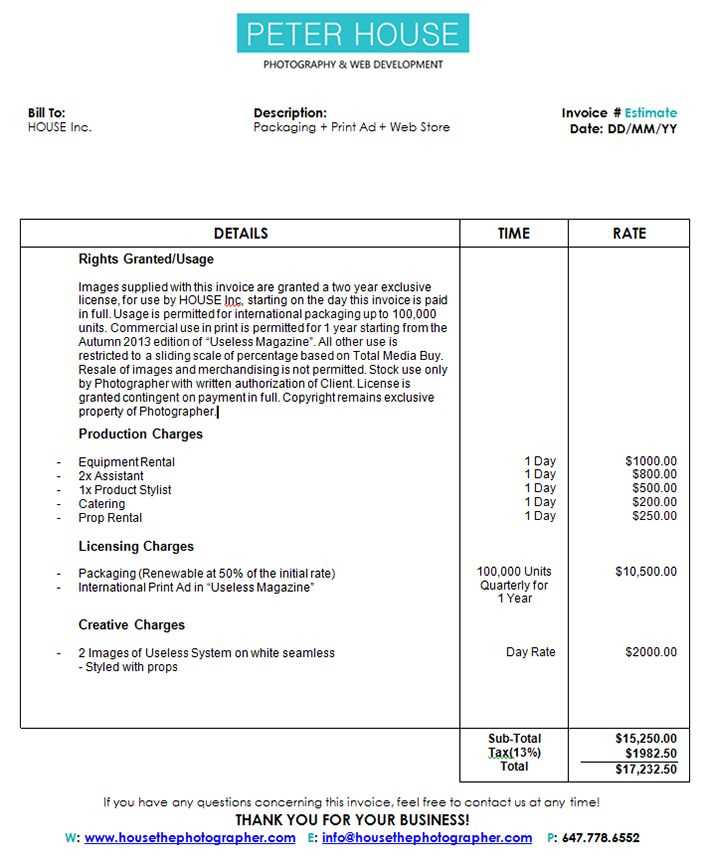

Essential Components of Billing Documents

Creating a detailed financial record is crucial for ensuring clarity and transparency in transactions. Each section of the document plays a vital role in conveying important information to clients and establishing trust. By incorporating the right elements, you can create a comprehensive record that facilitates smooth payment processing and enhances your professional reputation.

Key Elements to Include

Here are the fundamental components that should be present in your financial document:

| Element | Description |

|---|---|

| Business Details | Your company’s name, address, and contact information should be clearly stated. |

| Recipient Information | Include the name and contact details of the person or company receiving the document. |

| Document Date | Clearly indicate the date when the document is issued for accurate record-keeping. |

| Service Description | Provide a detailed list of services rendered, including any relevant dates and quantities. |

| Fees and Charges | Break down the costs associated with each service to ensure transparency. |

| Total Amount | Clearly state the total sum due to make payment straightforward. |

| Payment Instructions | Specify accepted payment methods and terms to avoid confusion. |

Creating a Professional Appearance

In addition to the essential components, consider the overall layout and design of your financial record. A clean and organized format not only enhances readability but also leaves a lasting impression on clients. Investing time in crafting a professional-looking document can lead to improved client satisfaction and timely payments.

Benefits of Using Billing Templates

Utilizing structured documents can significantly enhance the efficiency and professionalism of financial transactions. By adopting pre-designed formats, businesses can streamline their billing processes, ensuring that every transaction is documented accurately and consistently. This practice not only saves time but also minimizes errors that can arise from creating documents from scratch.

Enhanced Professionalism

One of the primary advantages of employing structured records is the improvement in your business’s image. A well-organized and visually appealing document reflects a level of professionalism that instills confidence in clients. When recipients receive clear and consistent documentation, they are more likely to view your business as credible and trustworthy.

Time Efficiency

By using pre-established formats, businesses can significantly reduce the time spent on administrative tasks. Creating detailed records from scratch can be tedious, but with a ready-to-use format, you can quickly fill in the necessary details and send them off. This efficiency allows you to focus on more critical aspects of your operations while ensuring that all financial interactions are handled smoothly.

Additionally, consistent use of structured documents can aid in record-keeping, making it easier to track payments and follow up on outstanding balances. Overall, implementing these formats can lead to better organization and a more effective approach to managing financial transactions.

Customizing Your Billing Document

Tailoring your financial records to fit your specific needs is an essential aspect of maintaining professionalism and ensuring clarity in transactions. Personalization allows you to reflect your brand identity and meet the unique requirements of your clients. By adapting the format and content of your documents, you can create a more engaging experience for recipients and facilitate smoother communication.

Incorporating Branding Elements

One effective way to customize your financial record is by integrating branding elements. This can include your company logo, color scheme, and fonts that represent your brand’s identity. When clients receive a document that visually aligns with your business, it reinforces brand recognition and conveys a sense of professionalism. Using consistent branding across all your documents helps establish trust and credibility with clients.

Adjusting Content to Fit Client Needs

Another important aspect of personalization is adjusting the content to meet the specific needs of your clients. Consider including customized notes or specific service descriptions that resonate with the recipient. This personal touch can enhance client satisfaction and demonstrate your attentiveness to their requirements. Tailoring your documents shows clients that you value their business and are willing to go the extra mile to accommodate them.

By customizing your financial records effectively, you not only improve your brand’s image but also foster better relationships with your clients. A well-crafted document that reflects both your professionalism and attention to detail can lead to increased satisfaction and loyalty.

Common Mistakes in Billing

In the process of creating financial documents, various pitfalls can arise that may lead to confusion or delays in payment. Being aware of these common errors can significantly enhance the effectiveness of your records and improve client relationships. By avoiding these mistakes, you can ensure a smoother billing process and maintain a professional image.

One frequent error is the omission of essential details. Failing to include vital information, such as the due date or a clear description of the services provided, can lead to misunderstandings and delayed payments. Additionally, inaccuracies in the pricing or calculation of totals can cause frustration for both parties. Double-checking your figures and ensuring that all relevant information is present can help mitigate these issues.

Another common mistake involves inconsistencies in the format. Using different styles or layouts for each document can create confusion and detract from your professionalism. Maintaining a consistent format across all financial documents not only helps with organization but also enhances your credibility. Establishing a standard format and sticking to it can greatly improve the clarity of your records.

Finally, neglecting to follow up on outstanding balances can lead to cash flow issues. It’s essential to track payments and communicate with clients regarding any overdue amounts. Implementing a systematic approach to follow-ups can improve payment timeliness and foster stronger relationships with clients.

Legal Considerations for Billing Documents

When creating financial records, it is crucial to understand the legal implications associated with them. Ensuring compliance with relevant laws and regulations not only protects your business but also builds trust with clients. A solid grasp of the legal landscape surrounding billing practices can prevent potential disputes and enhance your professional reputation.

One key aspect to consider is the necessity of including accurate and complete information. Most jurisdictions require that financial documents contain specific details such as the parties involved, the nature of the services rendered, and the agreed-upon compensation. Failing to provide this information can lead to complications in enforcing payment agreements and may undermine your legal standing in case of disputes.

Additionally, it is essential to be aware of local tax regulations. Different regions have varying requirements for tax collection and reporting. Understanding these rules ensures that you apply the correct tax rates and fulfill your obligations, reducing the risk of fines or legal repercussions.

Another important factor is the retention period for these financial documents. Many jurisdictions mandate that businesses keep records for a certain number of years. Maintaining organized and accessible records not only aids in compliance but also serves as valuable evidence should any disagreements arise.

Ultimately, being mindful of the legal aspects of billing documents helps create a professional framework for your transactions. By adhering to these considerations, you can foster trust with clients and safeguard your business from potential legal challenges.

Tools for Creating Billing Documents

Utilizing the right resources can streamline the process of generating financial records and enhance their professionalism. Numerous tools are available that cater to various needs, whether you prefer user-friendly software, customizable designs, or comprehensive accounting systems. Understanding these options will help you choose the best solutions for your specific requirements.

Software Solutions

Several software applications are designed specifically for creating financial documents. These tools often offer a range of features, including customizable layouts, automated calculations, and easy export options. Some popular software solutions include:

- FreshBooks: Known for its intuitive interface and robust features, this tool allows for easy invoicing and expense tracking.

- QuickBooks: A comprehensive accounting system that includes invoicing capabilities, suitable for both small businesses and larger enterprises.

- Zoho Invoice: Offers customizable designs and automation features, making it ideal for freelancers and small business owners.

Online Platforms

For those who prefer a web-based approach, numerous online platforms facilitate the creation of billing documents without requiring software installation. These platforms typically offer templates and customization options. Notable online options include:

- Canva: A graphic design tool that provides customizable templates for various documents, including financial records.

- Invoiced: An online invoicing solution that allows users to create, send, and manage billing records seamlessly.

- Wave: A free online platform that combines invoicing and accounting features, making it accessible for startups and freelancers.

By leveraging these tools, you can simplify the creation process, ensure accuracy, and present a polished image to your clients.

Best Practices for Invoice Management

Effectively handling financial documents is crucial for maintaining healthy cash flow and ensuring timely payments. Implementing best practices not only streamlines operations but also fosters positive relationships with clients. By adhering to certain strategies, businesses can enhance their invoicing process and minimize errors.

Organize and Automate

Establishing an organized system for managing billing records can significantly improve efficiency. Consider using software that allows for automation of repetitive tasks. This includes:

- Automated Reminders: Set up notifications to remind clients of upcoming due dates.

- Standardized Formats: Utilize consistent layouts to make documents easily recognizable.

- Centralized Storage: Keep all financial documents in a secure, accessible location to simplify tracking and retrieval.

Regularly Review and Update

Continuously reviewing and updating your practices ensures that your invoicing process remains effective. Key actions include:

- Assessing Payment Terms: Regularly evaluate and adjust payment terms to align with industry standards and client expectations.

- Tracking Payment History: Monitor clients’ payment patterns to identify any issues and address them proactively.

- Feedback Collection: Gather input from clients about their experiences to improve the overall billing process.

By incorporating these best practices, businesses can achieve greater accuracy, enhance client satisfaction, and ultimately ensure a smoother financial operation.

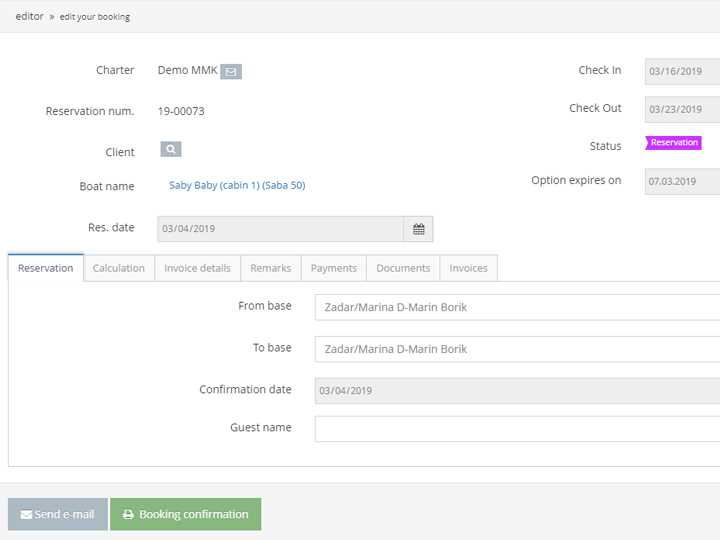

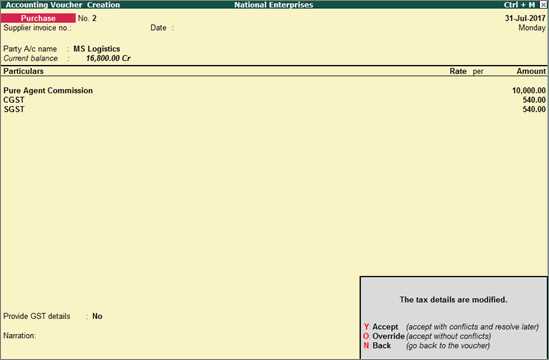

Tracking Payments and Commissions

Maintaining a precise record of financial transactions is essential for any business. This practice not only helps in managing cash flow but also provides valuable insights into the profitability of various services or products offered. Effective monitoring allows for timely follow-ups on outstanding amounts and ensures that all earned revenue is accurately accounted for.

Implementing a systematic approach to track payments and earnings involves several key strategies:

Utilize Software Solutions: Adopting accounting software can greatly simplify the tracking process. Many applications offer features such as automated reminders for overdue payments, detailed reporting on income, and customizable dashboards that provide an overview of financial status at a glance.

Establish Clear Records: It’s vital to maintain organized documentation of all transactions. This includes detailed logs of each payment received, along with dates and amounts. A structured record system facilitates quick retrieval of information, which is essential for audits or client inquiries.

Regular Reconciliation: Periodically reconciling financial records with bank statements helps identify discrepancies early. This process ensures that all transactions are accurately reflected in your accounts, reducing the risk of errors and enhancing financial integrity.

By prioritizing these tracking methods, businesses can enhance their financial management processes, promote transparency, and foster trust with clients and stakeholders.

How to Send Invoices Effectively

Delivering billing statements in a timely and organized manner is crucial for maintaining healthy cash flow in any business. An effective approach not only ensures that clients receive their financial documents promptly but also fosters professionalism and encourages prompt payment. Understanding the best practices for sending these documents can greatly enhance communication with clients.

Choose the Right Delivery Method

Selecting an appropriate method for sending financial documents can impact the recipient’s response time. Email is often the quickest and most efficient way, allowing for instant delivery and easy access. For clients who prefer physical copies, consider using postal services to ensure that the documents reach them safely and on time.

Craft Clear and Professional Communication

When sending billing statements, it’s essential to include a brief yet informative message. This communication should outline the purpose of the document and any relevant details, such as payment deadlines and accepted payment methods. A clear and concise message not only helps the client understand their obligations but also reflects professionalism.

Attach Necessary Documentation: Always ensure that the financial document is attached in a commonly used format, such as PDF. This format preserves the layout and makes it easily accessible for the recipient.

Follow Up: If payment is not received within the stipulated timeframe, consider sending a friendly reminder. This can be done through a follow-up email or phone call. Maintaining communication demonstrates your commitment to service and helps keep the payment process on track.

By implementing these strategies, businesses can enhance their billing efficiency and foster positive relationships with clients, ultimately leading to timely payments and improved cash flow.

Dealing with Late Payments

Managing delayed payments can be a challenging aspect of running a business, as it directly impacts cash flow and financial stability. It is essential to approach these situations with a blend of professionalism and assertiveness to maintain relationships while ensuring that funds are collected in a timely manner.

Here are some effective strategies to handle situations when payments are not received on time:

- Review Payment Terms: Ensure that the client is aware of the payment terms agreed upon at the outset of your collaboration. A clear understanding can help mitigate misunderstandings.

- Send a Friendly Reminder: A gentle reminder can often prompt action. Draft a polite message reiterating the payment due date and the amount owed.

- Establish a Follow-Up Schedule: If payments continue to be late, create a structured follow-up process. This may include sending reminders at regular intervals.

- Communicate Openly: Reach out to the client to discuss any potential issues they may be facing. Open communication can reveal underlying problems and facilitate finding a solution.

- Consider a Late Fee: If late payments become a recurring issue, consider implementing a policy for late fees. Clearly communicate this to clients beforehand to set expectations.

- Offer Payment Plans: For clients struggling to make payments, consider offering flexible payment options. This can foster goodwill and increase the likelihood of receiving the owed amount.

By adopting these strategies, businesses can effectively manage late payments while maintaining positive client relationships, ensuring ongoing collaboration and financial health.

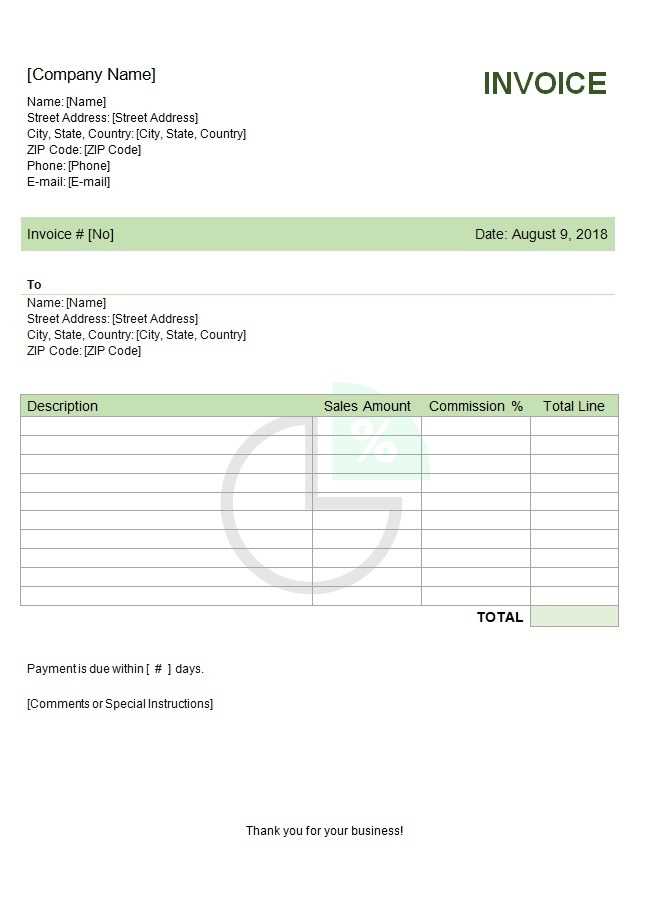

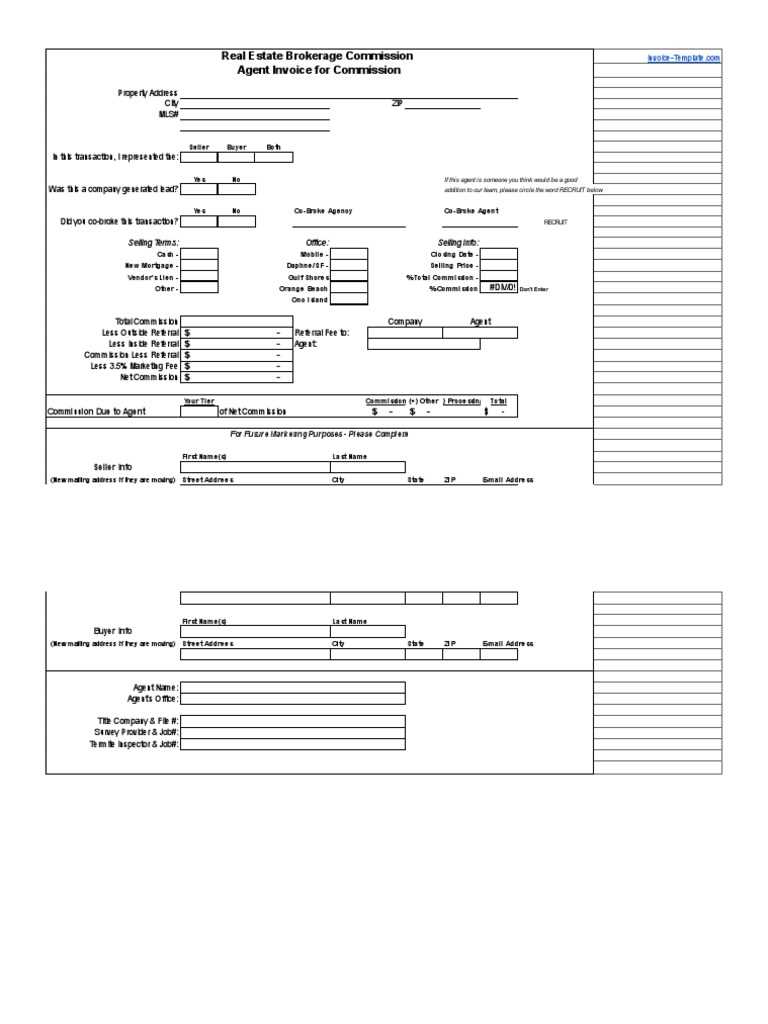

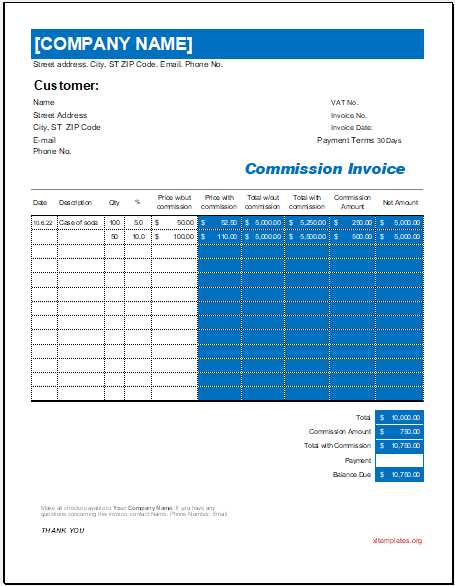

Examples of Effective Invoice Templates

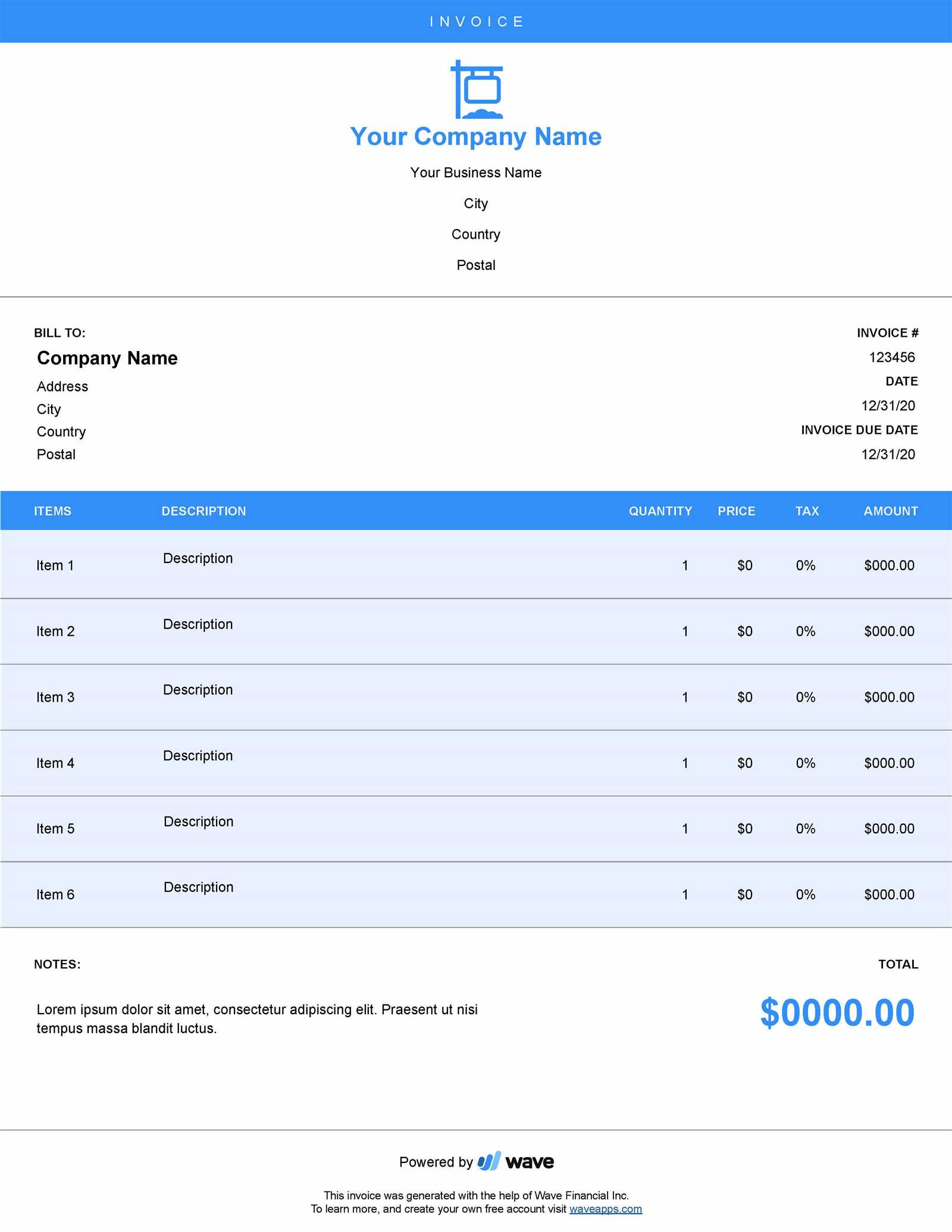

Utilizing well-designed billing documents can significantly enhance the professionalism of your business transactions. A thoughtfully crafted document not only conveys essential information but also leaves a positive impression on clients. Below are some notable styles that have proven effective in various industries.

1. Minimalist Design

A clean and simple layout focuses on the most crucial details. This style avoids unnecessary clutter, ensuring that clients can quickly understand the financial obligations. Key elements include:

- Clear headings: Highlight sections such as services rendered, total amount due, and payment instructions.

- Ample white space: Use space effectively to guide the reader’s attention to important areas.

2. Branded Format

Incorporating brand elements creates a cohesive identity across all communications. This approach can include:

- Logo placement: Prominently feature your logo at the top of the document.

- Color scheme: Utilize brand colors to enhance visual appeal while maintaining readability.

By implementing these styles, businesses can ensure that their financial documents not only convey necessary information but also reinforce their brand image, leading to improved client relations and satisfaction.

Future Trends in Invoice Processing

The landscape of billing document management is continually evolving, driven by technological advancements and changing business needs. As organizations seek greater efficiency and accuracy in their financial processes, several emerging trends are poised to shape the future of how these documents are handled.

Automation and Artificial Intelligence

Automation technologies are increasingly becoming integral to managing financial transactions. Utilizing artificial intelligence can streamline data entry, enhance accuracy, and reduce the time required for processing. Key benefits include:

| Benefit | Description |

|---|---|

| Efficiency | Automated systems can handle repetitive tasks, freeing up staff for more strategic work. |

| Accuracy | AI minimizes human error by validating data against predefined parameters. |

Integration with Cloud Solutions

As businesses continue to embrace digital transformation, the shift toward cloud-based systems is accelerating. This approach offers significant advantages:

- Accessibility: Cloud solutions allow authorized personnel to access financial documents from anywhere, facilitating remote work.

- Collaboration: Teams can work together in real-time, improving communication and reducing delays in processing.

By adapting to these trends, organizations can enhance their financial management practices, leading to improved operational efficiency and better client relationships.

Resources for Further Learning

Expanding your knowledge in the field of financial documentation and management can significantly enhance your skills and efficiency. There are numerous resources available, including online courses, books, and articles that can provide valuable insights into best practices and emerging trends.

Online Courses

Participating in structured learning can be beneficial. Consider exploring the following platforms:

- Coursera: Offers a variety of courses related to financial management and best practices in document handling.

- Udemy: Features practical courses focusing on software tools and techniques for efficient transaction management.

- LinkedIn Learning: Provides access to a wide range of tutorials on financial skills and software applications.

Books and Articles

Diving into literature can deepen your understanding. Recommended readings include:

- “The Basics of Financial Management” by David H. Bangs – A foundational text covering essential concepts.

- “Effective Financial Management” by Alan M. Weiss – Offers insights into optimizing financial processes.

- Online blogs: Websites such as HubSpot and QuickBooks regularly publish articles on effective financial practices and innovations.

Utilizing these resources will not only enhance your comprehension but also equip you with the tools necessary to improve your financial workflows.