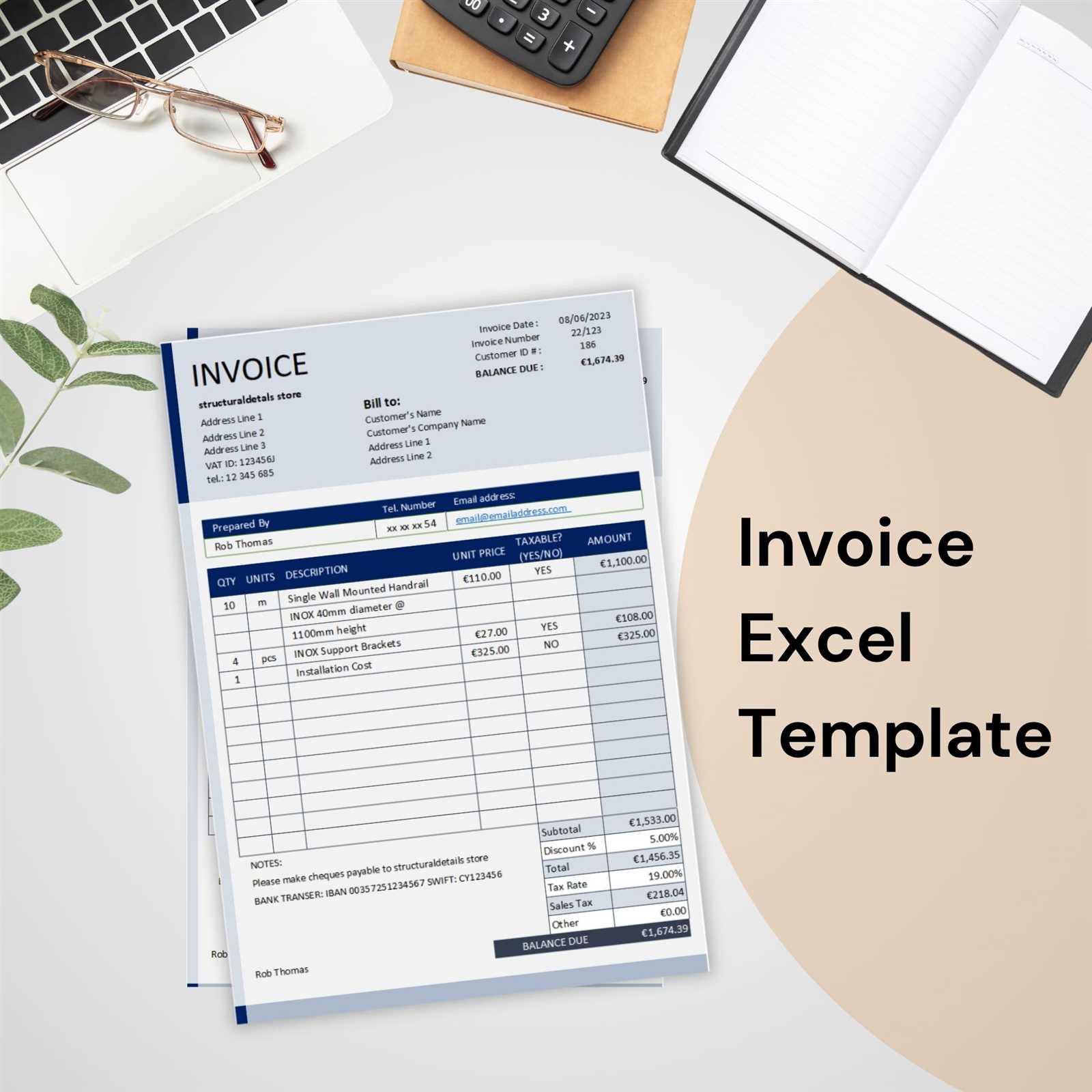

Excel Simple Invoice Template for Quick and Easy Billing

Efficiently managing financial transactions is essential for any business, large or small. The ability to quickly generate clear and professional documents for billing clients can save time and reduce errors. With the right tools, you can create customized records that meet your specific needs while maintaining a high level of professionalism.

There are various solutions available for creating these documents, but using a flexible, spreadsheet-based approach offers significant advantages. By leveraging pre-designed structures, you can easily input relevant details, perform calculations, and organize your records without the complexity of specialized software.

Whether you’re a freelancer, a small business owner, or part of a larger organization, this method can help you stay organized and ensure that all transactions are recorded accurately. In this guide, we will explore how to effectively use a basic structure to streamline your billing process and improve overall financial management.

Excel Invoice Templates for Beginners

For those new to creating billing documents, using pre-designed structures can be an invaluable tool. These ready-made formats allow users to quickly input necessary details, calculate totals, and maintain consistency across all business transactions. This approach eliminates the need for manually drafting a new document from scratch each time, saving both time and effort while ensuring accuracy.

Getting started with these pre-built formats is simple, even for those with little to no experience in financial management. Once you familiarize yourself with the layout and functionality, you’ll find it easy to adapt the structure to fit your own business needs.

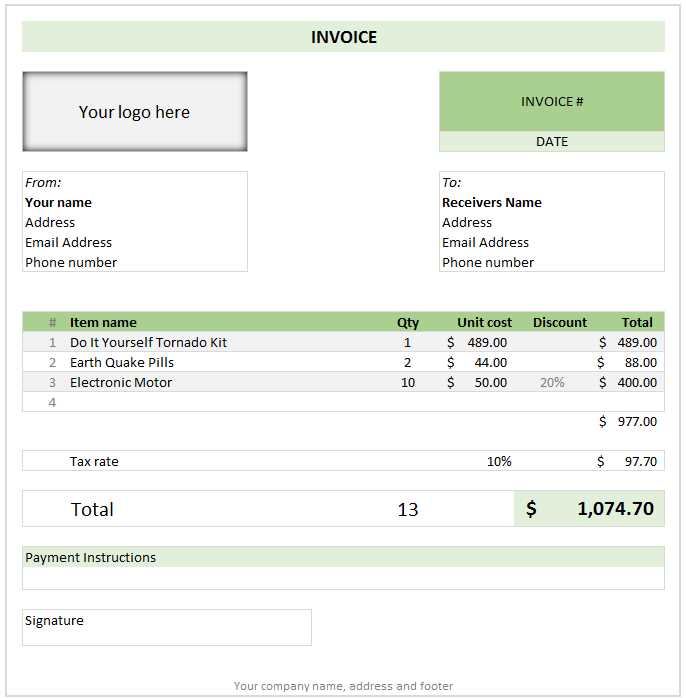

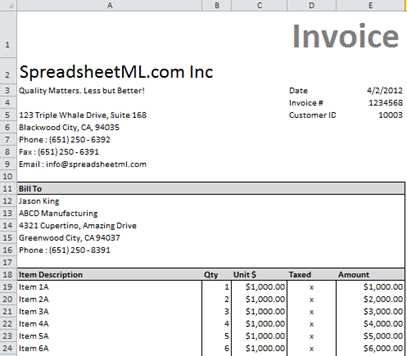

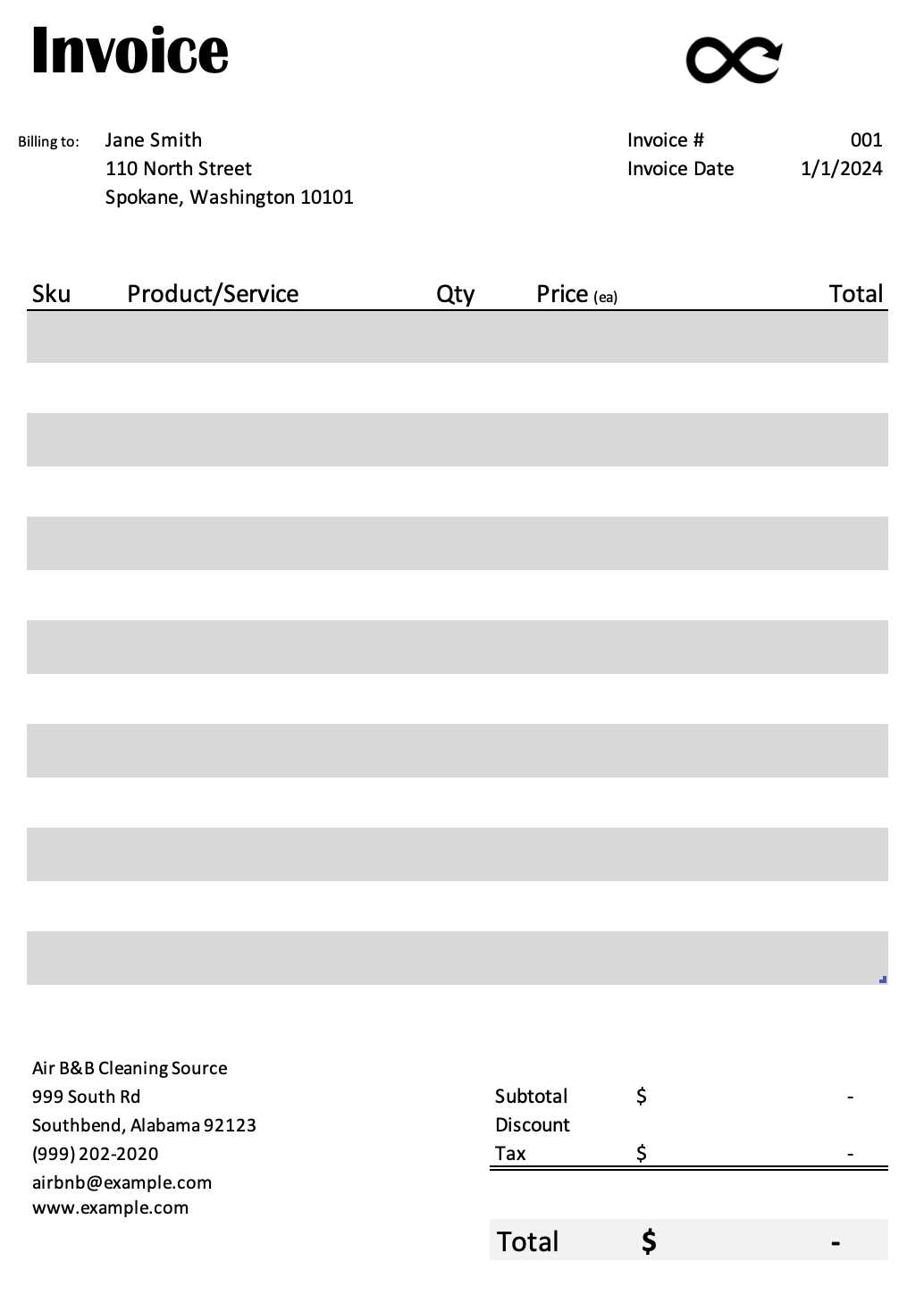

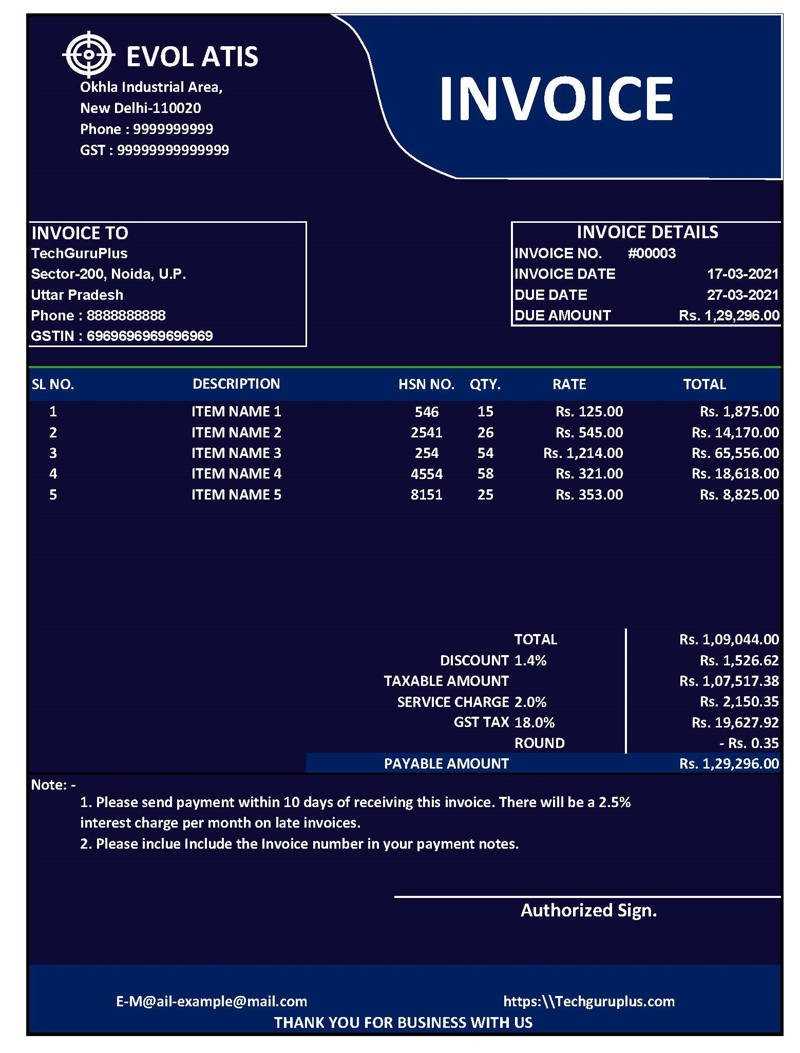

Understanding the Basics of a Billing Sheet

These pre-built formats generally consist of essential fields such as the recipient’s information, a breakdown of services or products, payment terms, and the total amount due. Each section can be quickly edited, allowing you to tailor the document to your unique situation. By using this approach, you can ensure that all necessary details are included without missing important information.

How to Customize Your Document

Once you’re comfortable with the basic structure, customizing the layout becomes straightforward. You can adjust the design, add or remove fields, and input your own company branding to create a personalized document. This customization ensures that the final product reflects your business’s professional image while meeting all necessary requirements for efficient billing.

Why Use Excel for Invoicing

When it comes to managing financial records, many people turn to spreadsheets as a reliable tool for organizing and calculating payment details. This approach provides flexibility and ease of use, making it an ideal option for individuals and small businesses looking to streamline their billing processes. Here are some reasons why a spreadsheet-based solution is a popular choice:

- Cost-Effective – Unlike specialized billing software, spreadsheets are often free or already included in office software suites, making them a budget-friendly option for many businesses.

- Customizable – With a spreadsheet, you can easily adjust the layout, content, and design to suit your specific needs. Whether you need to add new fields, change the formatting, or apply your company’s branding, the possibilities are endless.

- Ease of Use – Spreadsheets are intuitive and widely used, which means many people are already familiar with their basic functions. This makes creating financial documents much easier, even for beginners.

How to Create a Simple Invoice

Creating a clear and professional billing document doesn’t have to be complicated. By following a few simple steps, you can quickly generate a record that includes all necessary details and ensures accurate payment tracking. The key is understanding the basic structure of the document and knowing where to input relevant information.

Here’s a step-by-step guide to building a basic billing sheet:

Step 1: Include Essential Information

Your document should start with the most important details. This includes your business information, client’s name and address, and the unique reference number for the transaction. Then, list the products or services provided, along with quantities and prices. Finally, make sure to include the total amount due and any applicable payment terms.

Item Description Quantity Unit Price Total Web Design Services 1 $500 $500 Hosting Fee (1 Year) 1 $100 $100 Total $600 Step 2: Customize Your Layout

Once you’ve included the necessary fields, customize the layout to match your preferences or company branding. You can adjust fonts, colors, and add your logo or business name for a more professional appearance. It’s also useful to apply any necessary formulas to calculate totals automatically, which helps reduce human error and ensures consistency.

With these two steps, you’ll have a well-organized, functional document that is easy to generate and can be adapted for future use.

Benefits of Using Templates in Excel

Using pre-designed structures for billing and financial management can greatly simplify your workflow. These ready-made formats allow you to focus on the content rather than the layout, ensuring that all necessary elements are included without the need to manually create each document from scratch. This approach not only saves time but also ensures consistency across all business records.

Here are some key advantages of using these pre-built formats:

Time-Saving Efficiency

By utilizing a pre-configured structure, you eliminate the need for repetitive tasks. Fields such as customer information, itemized lists, and totals are already set up, allowing you to quickly input specific details without wasting time on formatting or calculations.

Benefit Description Quick Setup Pre-built structures save you from designing documents from scratch, allowing you to focus on content. Essential Elements of an Invoice

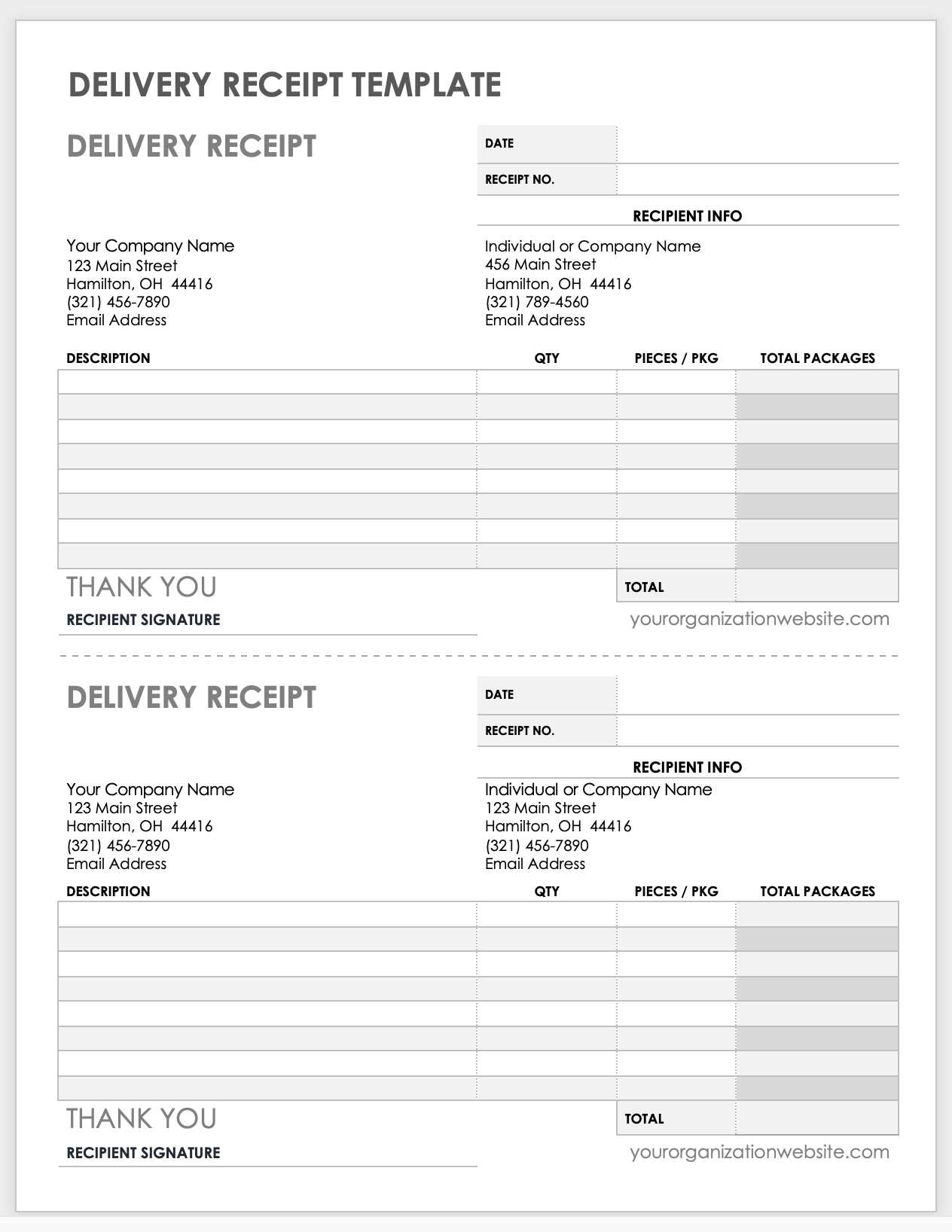

When creating a document to request payment, it’s important to include all the necessary information to ensure clarity and avoid confusion. A well-organized record serves as both a request for payment and a legal document that outlines the terms of the transaction. By including the right details, you can ensure that both you and your client are on the same page, which helps maintain professionalism and fosters good business relationships.

Key Information to Include

There are several critical components that every billing document should have. These elements make it easy to track payments and ensure that both parties understand the terms of the transaction:

- Business Information – This includes your company name, address, contact details, and any relevant registration or tax ID numbers. This helps identify your business and gives the client a point of contact in case of questions.

- Client Information – Include the client’s name, address, and contact details to ensure the document is properly directed. This prevents any confusion or delays in payment.

- Unique Reference Number – Assigning a unique number to each record helps both you and the client keep track of the transaction. This is especially important for accounting and record-keeping purposes.

- Detailed Description of Goods or Services – Clearly outline what is being provided. This includes the quantity, unit price, and any relevant descriptions of the items or services offered.

- Payment Terms – Clearly state the due date, any late fees, and accepted methods of payment. This ensures that the client knows when payment is expected and how to submit it.

Calculating the Total Amount Due

In addition to listing individual items or services, your document should include a total amount due. This total is typically calculated by multiplying the quantity by the price per unit and adding any applicable taxes or discounts. It’s important to be transparent with the math so that the client can easily verify the calculation.

By ensuring all of these key elements are present, you can create a clear, professional document that is easy for your clients to understand and act upon.

Customizing Your Excel Invoice Template

Creating a professional document to request payment is essential, but personalizing that document to reflect your business’s branding can take it to the next level. Customization allows you to adjust the structure, design, and layout to fit your needs, while ensuring that the document is consistent with your overall business image. By tailoring your billing sheet, you make it easier to convey important information in a way that’s both clear and professional.

When customizing a pre-designed layout, there are several aspects you can modify to make the document uniquely yours:

Adjusting the Layout and Design

The design of your document plays a key role in making it visually appealing and easy to understand. You can adjust the arrangement of the fields, add or remove sections, and change the font and color scheme. Here are some things to consider:

- Company Logo – Adding your logo to the top of the document creates a strong visual identity and makes the record look more professional.

- Header and Footer – Customizing the header and footer sections with your contact details or payment terms ensures that the client has easy access to important information.

- Cell Colors and Borders – Changing the colors of the cells or adding borders can help organize the document and make it more readable.

Including Additional Information

As you customize the document, you may find that you need to add extra details that are specific to your business. You can easily modify fields to include additional information such as:

- Discounts or Promotional Offers – If applicable, you can add a section to apply discounts or special offers to certain items.

- Terms and Conditions – Including any relevant terms or legal notes helps ensure that the client is aware of your policies, such as return policies or service warranties.

- Payment Instructions – If you accept various forms of payment, providing clear instructions for each method can help avoid confusion.

By customizing your document, you not only improve its appearance, but also ensure that it reflects the specific needs of your business, making it easier for your clients to understand and process payments.

Best Practices for Invoice Design

Designing a clear and effective billing document is essential for smooth transactions and maintaining a professional image. A well-structured document not only ensures that all necessary information is easy to read and understand but also contributes to a positive experience for your clients. By following best practices in design, you can create a document that is both functional and visually appealing.

Keep It Clean and Organized

The layout of your document plays a key role in its readability. A clean, well-organized structure helps clients quickly locate the details they need, such as the amount due and payment terms. To achieve this, focus on the following design elements:

- Use clear headings – Sections like “Itemized List,” “Payment Terms,” and “Total Due” should stand out with bold or larger text to guide the reader.

- Maintain consistency – Consistent font sizes, styles, and spacing across the document make it look more polished and easier to follow.

- Limit clutter – Avoid overwhelming the client with unnecessary text or graphics. Keep the design minimalistic and focused on the essentials.

Highlight Key Information

Important details such as the total amount due and payment deadlines should be easy to find. Consider using design elements to make these elements stand out:

- Bold and large font for totals – Make the total amount due prominent so that it can’t be missed.

- Color accents – Use subtle color highlights to draw attention to key figures without distracting from the rest of the content.

- Clear payment instructions – If you have specific payment methods or terms, ensure they are easily visible to avoid confusion.

By following these best practices, you’ll ensure that your document is both professional and effective in conveying all the necessary details to your clients, leading to faster payments and fewer misunderstandings.

Managing Payments with Excel Invoices

Efficiently tracking and managing payments is a crucial part of any business. By organizing payment details in a well-structured document, you can easily monitor outstanding balances, payment status, and ensure that clients settle their debts on time. With a spreadsheet-based approach, it becomes much easier to track financial transactions and maintain an organized record of all payments received or pending.

Using a structured format, you can create a payment management system that helps you stay on top of due amounts, payment deadlines, and client histories. This not only simplifies your financial workflow but also improves your ability to follow up on unpaid invoices.

Tracking Payment Status

One of the key features of managing payments through a spreadsheet is the ability to easily update and monitor payment status. You can include columns to track whether a payment has been made, the date of payment, and any outstanding balance. This allows you to have a clear view of what’s been paid and what’s still pending.

Client Name Amount Due Amount Paid Payment Date Status John Doe $500 $500 10/15/2024 Paid Jane Smith $350 $0 Pending Unpaid ABC Corp $1,200 $600 10/10/2024 Partially Paid By keeping track of the payment status for each client, you can quickly identify overdue accounts and

How to Track Invoice Status in Excel

Effectively tracking the status of your billing documents is essential for maintaining an organized financial system. By monitoring whether a payment has been received, is pending, or is overdue, you can quickly identify any outstanding debts and take necessary actions. Using a structured system, you can easily keep tabs on the progress of each transaction and ensure that your business stays on top of its cash flow.

Creating a Status Tracking System

To track the status of your billing documents, you’ll need a clear and organized system. This involves setting up columns within your sheet to capture key information, such as payment status, due dates, and amounts paid. Here’s how you can set up a tracking system:

- Payment Status Column – Add a column labeled “Status” to track whether the payment is “Paid,” “Pending,” or “Overdue.” This helps you quickly identify which transactions need attention.

- Due Date Column – Keep track of when payments are due by adding a “Due Date” column. This makes it easy to monitor upcoming deadlines.

- Amount Paid Column – Include a column for the amount paid to easily compare with the total amount due. This helps you see if a client has made partial payments.

- Notes or Follow-up Column – Use this to add any additional comments, such as payment arrangements or follow-up actions required.

Using Conditional Formatting for Alerts

Conditional formatting can help you quickly highlight overdue payments or transactions that are nearing their due date. By applying rules to your sheet, you can automatically change the color of cells based on certain criteria, making it easier to track late payments or follow up with clients.

- Highlight Overdue Payments – Set up a rule to turn the “Status” cell red if the due date has passed and no payment has been rece

Exporting and Sharing Excel Invoices

Once you have created and customized your billing document, the next step is to share it with your client or export it for record-keeping. Being able to send your documents quickly and securely is essential for smooth communication and efficient business operations. Whether you need to email a copy, store it in the cloud, or print a hard copy, there are various ways to export and share your financial records.

Exporting Your Document

To ensure that your billing document can be accessed on different devices or shared across various platforms, it’s important to export it in a format that’s widely accepted. Here are some common formats and their benefits:

- PDF Format – Exporting your document as a PDF is one of the most popular choices. It ensures that your layout, fonts, and design remain intact, no matter what device or software your client uses to open the file.

- CSV Format – If you need to export the data for further analysis or use in other systems (e.g., accounting software), a CSV file is ideal for managing raw data in a simple text format.

- Excel Workbook – If your client needs to make adjustments or track payments over time, sharing the original workbook format may be useful. This allows them to edit and update the document if

Common Excel Invoice Mistakes to Avoid

While creating a billing document might seem straightforward, there are several common errors that can cause confusion, delay payments, or even lead to financial discrepancies. By being aware of these mistakes, you can avoid unnecessary complications and ensure that your payment requests are clear, professional, and accurate. It’s important to focus on both the details and the overall structure to maintain a smooth transaction process with your clients.

Common Mistakes to Watch Out For

There are a number of common pitfalls that can undermine the clarity and effectiveness of your billing records. Below are some frequent errors and how to avoid them:

Error Explanation How to Avoid Incorrect Calculations Sometimes, automatic calculations can be missed or miscalculated, leading to inaccurate totals. Double-check all formulas and ensure that they are correctly applied across the entire document. Missing Payment Terms Omitting clear payment terms (such as due dates or late fees) can cause confusion about when payments are expected. Always specify clear payment deadlines and any additional terms, including late fees or discounts for early payments. Unclear Item Descriptions Vague or ambiguous descriptions of the goods or services provided can lead to misunderstandings and disputes. Provide detailed, specific descriptions for each item or service, including quantities, unit prices, and any relevant notes. Omitting Contact Information If your contact details are missing, clients may struggle to reach you for any questions or issues. Ensure that your business name, address, phone number, and email are clearly displayed on the document. Other

Automating Invoice Calculations in Excel

Automating calculations in your billing documents can save you a great deal of time and reduce the likelihood of errors. By using built-in functions and formulas, you can easily calculate totals, taxes, discounts, and balances due without having to manually input the numbers each time. This not only streamlines the process but also ensures consistency and accuracy in your financial records.

To automate calculations effectively, you need to understand how to set up basic functions that handle everything from adding items to calculating the final amount due. This approach allows you to focus more on the content and less on the math, while ensuring that all numbers are calculated correctly every time.

Basic Functions for Calculations

Here are some common functions you can use to automate the most important calculations in your billing records:

- Sums: The SUM function can be used to automatically add up the prices of individual items, calculating the subtotal. For example, `=SUM(B2:B10)` will add all values in cells B2 through B10.

- Multiplication: If you need to calculate the total for each item (price per unit multiplied by quantity), use the formula `=C2*D2`, where C2 is the unit price and D2 is the quantity.

- Tax Calculation: To automatically calculate tax, use a formula like `=Subtotal * Tax_Rate`, where Subtotal is the value you’ve already calculated and Tax_Rate is the applicable tax percentage (e.g., 0.1 for 10% tax).

- Discounts: Discounts can be automatically calculated by multiplying the subtotal by the discount percentage. For example, `=Subtotal * Discount_Rate` where Discount_Rate is a decimal (e.g., 0.15 for a 15% discount).

- Final Total: The final amount due can be calculated by adding the subtotal and tax, then subtracting any discount. Use a formula like `=Sub

Integrating Excel Invoices with Accounting Software

Seamlessly integrating your billing records with accounting software can streamline your financial management and reduce manual entry errors. By transferring data from your billing documents directly into your accounting system, you can automate many tasks such as expense tracking, payment reconciliation, and financial reporting. This integration helps maintain accuracy and saves time by reducing duplication of effort across systems.

Whether you use accounting software for bookkeeping, tax preparation, or generating financial statements, the ability to easily import or export your financial data is essential for keeping operations efficient. This section will guide you through the integration process, highlighting the key methods for linking your billing documents with your accounting software.

Methods of Integration

There are several ways to integrate your billing data with accounting software, depending on the tools you use and the complexity of your needs:

- Direct Import/Export: Many modern accounting systems allow for the direct import of data from spreadsheet files. You can export your billing documents in CSV or XLS format and upload them into the accounting software to automatically populate accounts and track payments.

- Cloud-Based Solutions: If your accounting software is cloud-based, you can use built-in integrations to automatically sync data between the spreadsheet and the accounting platform. This can be set up to occur in real-time, eliminating the need for manual updates.

- Third-Party Integration Tools: There are also third-party tools and add-ons that allow you to link your billing system with your accounting software. These tools often support batch imports and ensure that data flows between the systems without errors.

Best Practices for Integration

To ensure smooth integration and prevent errors, consider the following best practices:

- Standardize Your Data: Before exporting data to your accounting software, ensure that the format of your billing document is consistent with the system’s requirements. This includes making sure that fields like date, payment terms, and amounts are standardized.

- Automate Where Possible: Use automation features in your accounting software to reduce the manual effort needed to input or verify data. M

Using Excel for Recurring Billing

Managing ongoing payments for services or subscriptions can be challenging, especially when you need to keep track of multiple clients, due dates, and amounts. By utilizing a structured spreadsheet, you can streamline the process of creating and tracking recurring charges. Automating and organizing the process within a spreadsheet can save you time, reduce errors, and ensure timely billing.

Recurring billing typically involves invoicing clients at regular intervals, such as monthly or annually. Rather than manually creating a new billing record each time, automating these tasks in a spreadsheet allows for easy updates and efficient tracking. This section will show you how to set up and manage recurring billing within your spreadsheet system.

Setting Up Recurring Billing

To effectively manage recurring payments, you need to establish a system that tracks the necessary details, such as the billing cycle, amounts, and payment dates. Below are some key elements to include:

- Client Information: Maintain a column for client names, contact details, and service types.

- Billing Period: Include a column to specify the frequency of billing, whether it’s weekly, monthly, quarterly, or annually.

- Amount Due: Ensure that the billing amount is fixed or dynamically updated, depending on discounts, fees, or changes in service.

- Due Date: Automate the due dates based on the start date of the billing cycle and the frequency chosen by the client.

Automating Recurring Charges

To reduce manual work, you can use formulas that automatically calculate the due date and total amount due based on the start date and frequency. For example:

- Due Date Calculation: Use a formula like `=DATE(Y

How to Save and Organize Invoice Files

Properly saving and organizing billing records is essential for efficient financial management. It ensures that you can quickly access, review, and share documents when needed. By setting up a logical filing system, you can maintain a clear record of all transactions, making it easier to track payments, manage taxes, and respond to client inquiries.

Whether you prefer to store your documents digitally or physically, having a system in place will help you stay organized. In this section, we will explore some strategies for saving and categorizing your financial documents effectively.

Saving Files for Easy Access

When it comes to saving your billing documents, it’s important to use a clear and consistent naming convention. This will make it easier to locate specific records later on. Consider the following strategies:

- Use Date-Based Naming: A good practice is to include the date in the file name. This helps you sort documents chronologically. For example, “ClientName_Invoice_2024-11-05” ensures that files are easily organized by date.

- Include Key Information: If relevant, add other important identifiers such as the client’s name, the amount, or the service provided. For example, “ClientName_Services_Amount_2024-11-05” can give you a clear idea of what the file contains at a glance.

- Use Consistent File Formats: Save documents in widely used formats such as PDF or XLSX to ensure they are easily accessible across different devices and software.

Organizing Your Files

Once your documents are saved with a clear naming system, it’s time to organize them into folders. Here are some best practices for managing your files:

- Free and Paid Excel Invoice Templates

When it comes to generating billing documents, there are a variety of options available for those looking to streamline their financial processes. You can either opt for free resources or invest in paid solutions that offer additional features. Both options have their advantages, depending on your business needs and the complexity of your invoicing requirements.

Free templates can provide a quick and easy solution for businesses just starting out or those with simple billing needs. On the other hand, paid options may offer more advanced features, customization, and support, which can be useful as your business grows and your invoicing needs become more sophisticated. Below, we explore both free and paid options to help you decide which is the best fit for your business.

Type Features Pros Cons Free Resources Basic designs with essential fields such as client name, services provided, amount due, and due date. Cost-effective, easy to use, quick to implement. Limited customization, may lack advanced features, no customer support. Paid Resources Advanced features like recurring billing, automatic calculations, and customizable fields. Often includes customer support and integration options. Greater flexibility, professional design, more functionality, customer support. Initial cost, potential for more complex setups, subscription fees. Whether you choose a free or paid solution depends on the scale of your business and the complexity of your invoicing needs. For small businesses or freelancers, free options may suffice, while larger companies or those with more advanced billing requirements might benefit from the additional features offered by paid solutions.

Improving Workflow with Excel Invoicing

Streamlining your billing process is crucial for enhancing overall workflow efficiency. By integrating automated systems and simplifying repetitive tasks, you can save time, reduce errors, and ensure faster processing of client payments. Whether you’re managing a small business or freelancing, optimizing the way you generate, send, and track payment requests can have a significant impact on your productivity.

Implementing a structured and organized system for managing financial documents allows you to focus on more important aspects of your business while ensuring your records are accurate and up to date. In this section, we’ll discuss how you can improve your workflow by incorporating automation, organization, and time-saving techniques into your billing process.

Automating Calculations and Data Entry

One of the most effective ways to speed up your billing process is thr