Best Construction Invoice Template Excel for Easy Billing

Managing finances for any construction-related work can be a daunting task. Keeping track of expenses, payments, and client details requires precision and efficiency. A well-structured document can help simplify this process, ensuring that all financial transactions are recorded correctly and professionally. Whether you’re a contractor or project manager, having a reliable system in place for generating and sending payment requests is essential.

Many professionals rely on digital tools that offer flexibility and ease of use. With the right format, these documents can be tailored to suit any project size, while also maintaining a clean and professional appearance. By leveraging automated calculations and customizable fields, you can reduce human error and streamline your workflow.

In this guide, we’ll explore how to create and modify a financial document that suits your needs. You’ll learn how to track payments, apply taxes, and include essential project details without spending excessive time on administrative tasks. Implementing this system into your routine can significantly enhance your productivity and ensure that all financial aspects of your project are handled efficiently.

Construction Invoice Template Excel for Beginners

If you’re new to managing financial records for a building project, creating a document that tracks payments and expenses can feel overwhelming. The good news is that there are simple solutions available to help you organize these details efficiently. With the right tool, you can create a clear and professional document that covers all necessary information while saving you time and effort.

For beginners, using a customizable document that handles basic calculations and formatting is an ideal starting point. This allows you to focus on the actual details of your projects, such as labor, materials, and services provided, without worrying about the layout or manual math. Once you become familiar with the process, you’ll be able to tailor the document to fit your specific needs.

How to Get Started

To begin, find a pre-made file that offers an easy-to-use structure. It should include fields for client information, project details, and the ability to list various costs. After that, you can simply fill in the blanks for each new project. These documents often include automatic formulas to calculate totals, tax, and other fees, which saves you from manually doing the math every time.

Basic Elements to Include

Ensure that the file contains sections for the project name, work description, cost breakdown, payment terms, and due dates. This will make sure that both you and your client are on the same page and that all charges are clearly outlined. Adding a summary of charges at the end ensures a quick overview, while clear payment instructions help avoid confusion.

With just a bit of practice, using this tool will become second nature. As your experience grows, you’ll be able to adjust the structure to better meet the demands of each project, ensuring both accuracy and professionalism every time.

Why Choose an Excel Template for Invoices

When it comes to managing payments and tracking financial transactions, efficiency and accuracy are key. Using a digital document that automates calculations and allows for easy customization can greatly simplify the process. For many professionals, choosing a widely accessible software program that offers flexibility, precision, and ease of use is the ideal solution for handling financial records.

The primary advantage of using such a system lies in its ability to streamline repetitive tasks. By utilizing a pre-designed structure, you eliminate the need to start from scratch every time you need to create a payment request. This allows you to focus on the specific details of each project while ensuring all necessary elements are included and formatted correctly.

Additionally, the ability to use built-in formulas for calculations such as totals, taxes, and discounts makes the entire process faster and more reliable. It reduces the risk of human error and speeds up the creation of accurate documents, which is especially helpful for busy professionals managing multiple jobs at once.

Finally, this digital approach allows for easy editing, sharing, and storage of documents. Whether you’re sending it via email or keeping it in a cloud folder for later reference, the flexibility provided by this solution enhances both your productivity and your ability to stay organized across different projects.

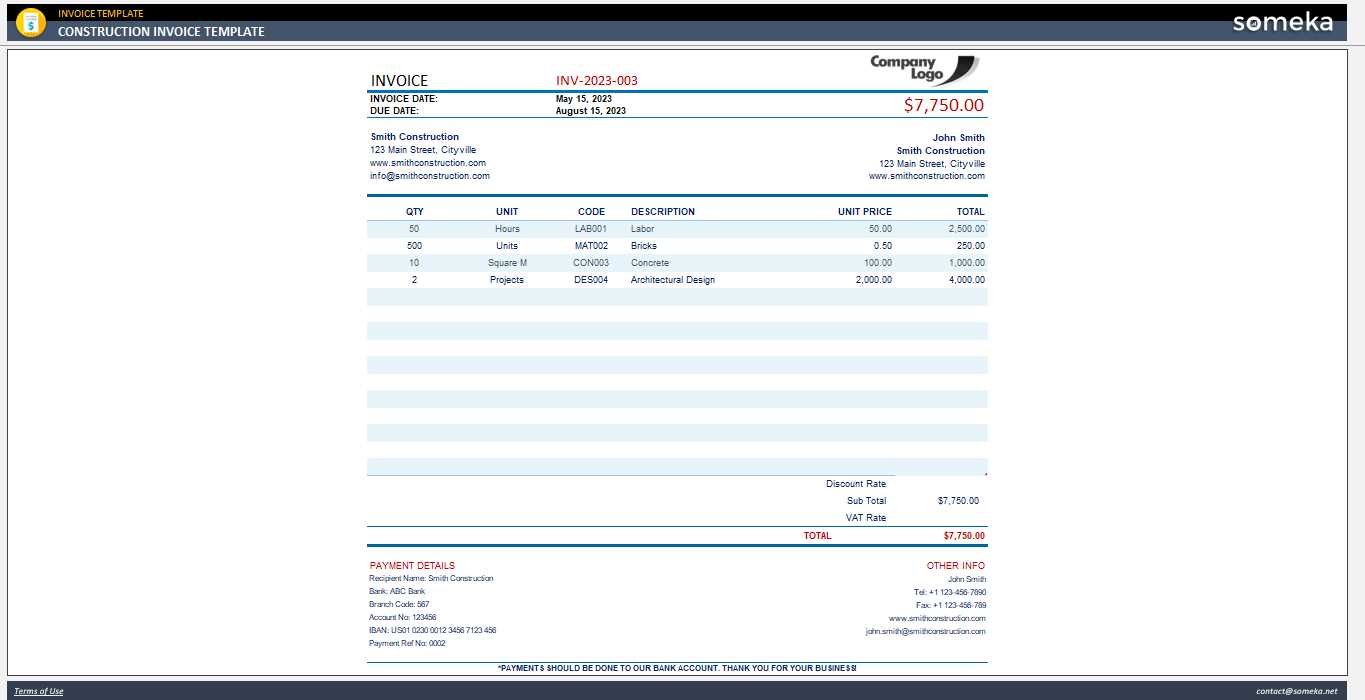

Key Features of Construction Invoice Templates

When managing payments for building projects, it’s essential to have a document that captures all the necessary details in a clear and organized manner. A well-designed document should not only list services rendered but also ensure that the financial information is presented professionally. Here are some of the key elements that make such documents highly effective for managing payments and staying organized.

1. Customizable Fields

One of the most important features of these documents is the ability to adjust and personalize the content to suit the specific needs of each project. Common customizable fields include:

- Client name and contact details

- Project description and timeline

- Work completed and itemized costs

- Discounts or additional fees

- Payment terms and due dates

2. Automatic Calculations

Another valuable feature is the automatic calculation of totals, taxes, and other charges. Built-in formulas help avoid errors and ensure that all calculations are accurate. This includes:

- Subtotals for labor and materials

- Tax calculation based on local rates

- Automatic summation of all costs

- Final total with adjustments and discounts applied

These features help save time and reduce the risk of mistakes, especially when managing multiple projects at once.

3. Professional Design

Well-structured documents should reflect professionalism. Features such as clean fonts, consistent formatting, and space for company branding create an impression of credibility and attention to detail. These documents can be shared with clients knowing that they will be easily understood and visually appealing.

With these key features, you can ensure your financial documents are organized, accurate, and reflect a high level of professionalism in every project you manage.

How to Customize Your Invoice Template

Customizing your financial document to fit the unique needs of each project can make the entire billing process more efficient and professional. By tailoring the format to match your business requirements, you ensure that all relevant details are included and presented clearly. Here are the key steps to personalize your document effectively.

Start by adjusting the basic structure of the file. This includes replacing placeholder text with specific project or client details such as the client’s name, project description, and dates. Make sure to update the fields for work done, labor charges, material costs, and any other items that apply to the current job.

Next, customize the appearance of the document. You can alter the fonts, colors, and layout to align with your brand identity. Adding your company logo at the top of the page gives a professional touch and reinforces your brand. Make sure that the design is clean, and that all sections are clearly labeled to make the document easy to navigate.

If necessary, update the payment terms section. You may want to adjust the due date, payment methods, or include late fees based on the nature of the agreement. Additionally, ensure that all calculations, such as taxes or discounts, are properly reflected and calculated based on the current project’s parameters. Many documents offer automatic formulas to make this process seamless, but it’s important to double-check for accuracy.

Finally, save your customized file for future use. Once you’ve set it up, it becomes easy to create similar documents for other projects with minimal adjustments. This time-saving approach will help you stay organized and ensure consistency across all your billing paperwork.

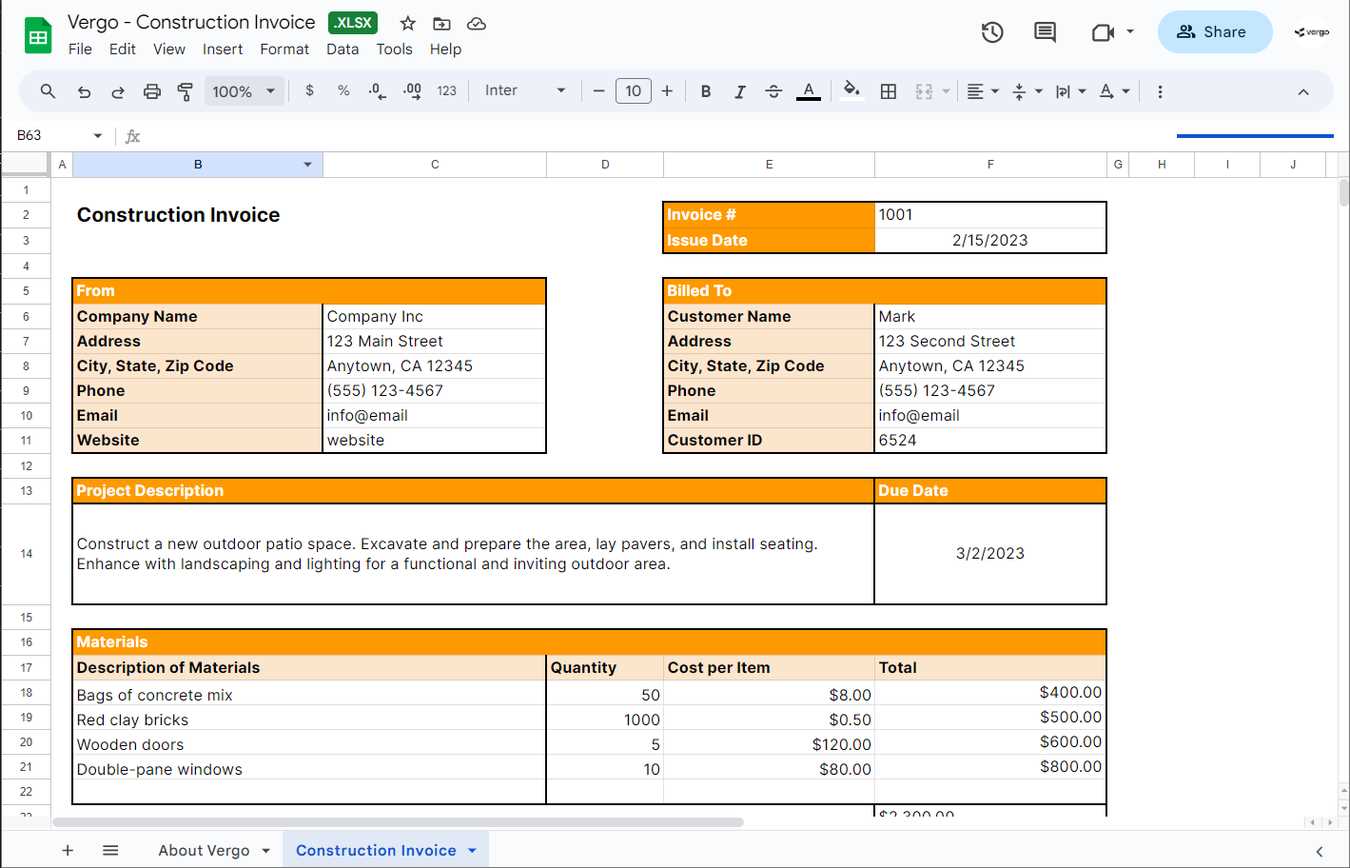

Steps to Create a Construction Invoice in Excel

Creating a professional payment request document for a building project can be a simple and efficient process. By following a few straightforward steps, you can ensure that all the necessary details are included and accurately presented. Here is a step-by-step guide to help you set up your document from start to finish.

Start by opening a new spreadsheet and setting up the basic structure. Begin with the header, which should include your company name, contact information, and project details. Then, create a section for the client’s name and address. This section ensures that both parties have clear reference points for the document.

Next, create a table to list the services or materials provided along with their corresponding costs. This will serve as the heart of the document, providing a detailed breakdown for the client. Below is an example layout of the table you can use:

| Description of Work | Quantity | Unit Price | Total Cost |

|---|---|---|---|

| Labor for foundation work | 10 hours | $50 | $500 |

| Concrete materials | 5 bags | $30 | $150 |

| Delivery charges | 1 | $100 | $100 |

Once you have filled in the work description and costs, calculate the subtotal by summing the total costs for each item. After this, apply any relevant taxes or discounts. These calculations can be done automatically using built-in formulas, which will help avoid errors and save time.

Finally, include the payment terms and due date at the bottom of the document. Be sure to specify the payment method, whether it’s bank transfer, c

Common Mistakes in Construction Invoices

Creating a payment request document for a building project requires attention to detail. Even small errors can lead to confusion, delays in payment, or disputes with clients. Understanding the most common mistakes and how to avoid them is essential for ensuring smooth transactions and maintaining professionalism in your financial documents.

1. Missing or Incorrect Client Information

One of the most common errors is failing to include or incorrectly entering the client’s name, address, or contact details. This can cause confusion and make it difficult for clients to identify the document. Always double-check the information you enter to ensure it’s accurate and up to date.

2. Inaccurate or Incomplete Cost Breakdown

Another frequent mistake is not providing a detailed and clear breakdown of services or materials. This can lead to misunderstandings about the charges and may cause delays in payment. It’s important to list every item or service provided, along with the quantity, unit price, and total cost. Below is an example of how to structure the cost breakdown:

| Description | Quantity | Unit Price | Total Cost |

|---|---|---|---|

| Labor for electrical installation | 15 hours | $60 | $900 |

| Materials (wires and cables) | 10 meters | $5 | $50 |

| Transport costs | 1 | $100 | $100 |

This ensures transparency and helps the client understand exactly what they are being charged for, avoiding any confusion or disputes later on.

3. Failing to Include Payment Terms

Many professionals forget to clearly outline payment terms, such as the due date, payment methods, and any late fees. This can create uncertainty and lead to delays. Always ensure that your document includes a section that clearly defines how and when payments should be made. Be specific about accepted payment methods and outline any penalties for overdue payments.

Tracking Payments with Excel Invoice Templates

Managing payments for building projects can quickly become overwhelming without a system in place to track what has been paid and what is still outstanding. Using a digital document designed for this purpose makes it easier to monitor payment status, reduce errors, and ensure that all financial details are up to date. With the right setup, you can track payments effectively and keep your projects on schedule.

One of the main benefits of using such a system is the ability to track the payment status of each project directly in the document. You can create columns to indicate whether a payment has been made, is pending, or is overdue. This will provide you with an at-a-glance overview of your financial situation, making it easier to follow up on any outstanding amounts.

Here’s an example of how you can structure the payment tracking section in your document:

| Project Name | Total Amount | Amount Paid | Balance Due | Status | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Electrical Work in Building A | $2,000 | $1,500 | $500 | Pending | |||||||||||||||||

| Roof Installation in Building B | $4,500 | $4,500 | $0 | Paid | |||||||||||||||||

| Plumbing in Building C | $3,200 | $1,000 | $2,200 | Over

Using Excel Formulas for Accurate CalculationsWhen managing financial documents for any building project, accuracy is key. One of the best ways to ensure precise calculations is by using automated formulas. These formulas eliminate the need for manual math, reduce the risk of errors, and save time, all while making sure your financial records are correct and professional. Understanding how to set up and use these formulas effectively can streamline your workflow and improve efficiency. 1. Basic Calculations: Adding and SubtractingThe most basic formulas you’ll need are for adding and subtracting costs. For example, you can automatically calculate the total cost for each item by multiplying the quantity by the unit price. To sum up the entire cost of a project, you can use the SUM function to add up all item totals. For subtraction, use simple formulas to calculate any discounts or deposits taken off the total amount due. Example for calculating the total cost of an item: =Quantity * Unit Price To find the sum of multiple amounts, use: =SUM(Cell Range) 2. Tax and Discount CalculationsAnother essential feature is the ability to automatically calculate taxes and discounts. You can set up formulas that apply a percentage to the total cost, saving you from manually calculating tax rates or deductions. For instance, if the tax rate is 10%, you can use a formula to calculate the tax on the subtotal. Similarly, you can calculate discounts based on certain criteria, like a flat percentage off or specific discounts for early payment. Formula for calculating tax (10% rate): =Subtotal * 10% Formula for applying a discount: =Total * (1 - Discount Percentage) These formulas help ensure consistency and reduce the chance of mistakes in calculations, providing peace of mind that everything is accounted for correctly. By incorporating these simple formulas into your financial documents, you can improve both the accuracy and efficiency of your billing Designing Professional Invoices for Construction ProjectsCreating a well-designed financial document for a building project not only ensures that your client clearly understands the charges, but also helps build your reputation as a professional. A well-organized and visually appealing document reflects the quality of your work and helps to facilitate smoother transactions. Proper formatting, clear sections, and a professional layout are key elements to include in every financial request. 1. Key Information to IncludeYour document should contain all relevant details to avoid confusion and ensure clarity for your client. The following information is essential:

2. Creating a Clean LayoutThe layout of your document should be simple, professional, and easy to read. Here are some design tips to keep in mind:

|