How to Print a Free Invoice Template

When managing a business or freelance work, having a reliable and simple way to generate official payment records is crucial. Whether you’re invoicing clients for services or products, using well-designed documents ensures clarity and professionalism. This section will explore how you can easily access and customize ready-to-use forms that help streamline this process.

Efficient record-keeping is essential to maintaining good financial practices. By using accessible document formats, you can focus on your work rather than worrying about the layout or structure. Customizable options allow you to tailor the details to your specific needs, ensuring that your documents meet the standards of your industry.

Using such materials not only saves time but also helps you present your business in a professional light. By having customizable documents at your fingertips, you can enhance your workflow and avoid unnecessary delays. Let’s explore how to use these tools effectively for your business transactions.

Benefits of Using Free Invoice Templates

Utilizing pre-designed billing documents offers numerous advantages for businesses of all sizes. Instead of starting from scratch, you can take advantage of structured formats that are both efficient and easy to modify. This not only saves valuable time but also ensures that your paperwork remains consistent and professional.

Time and Cost Savings

One of the primary benefits is the time efficiency it offers. Instead of spending hours creating custom designs, ready-made formats allow you to quickly insert necessary details and focus on your work. Additionally, there’s no need for expensive software or design services, as these documents are accessible at no cost, making them ideal for small businesses or freelancers operating on a budget.

Consistency and Professionalism

Another significant benefit is maintaining a consistent appearance across all your client communications. Using standardized forms helps you avoid mistakes in layout and ensures a polished presentation every time. This consistency enhances your business’s image, making it appear organized and trustworthy in the eyes of your clients.

Choosing the Right Template for Your Needs

When selecting a document format for billing, it’s important to consider your specific business requirements and the type of transaction. The right choice ensures smooth communication with clients and facilitates timely payments. Depending on your industry, the level of detail, and the style of your business, there are different formats to suit various needs.

Factors to Consider

- Industry Requirements: Some businesses require detailed descriptions or itemized lists, while others may only need basic payment terms.

- Customization: Choose a format that allows you to easily adjust sections, such as adding or removing fields as needed.

- Professional Appearance: Ensure the layout is neat, legible, and aligned with your brand identity.

Types of Formats Available

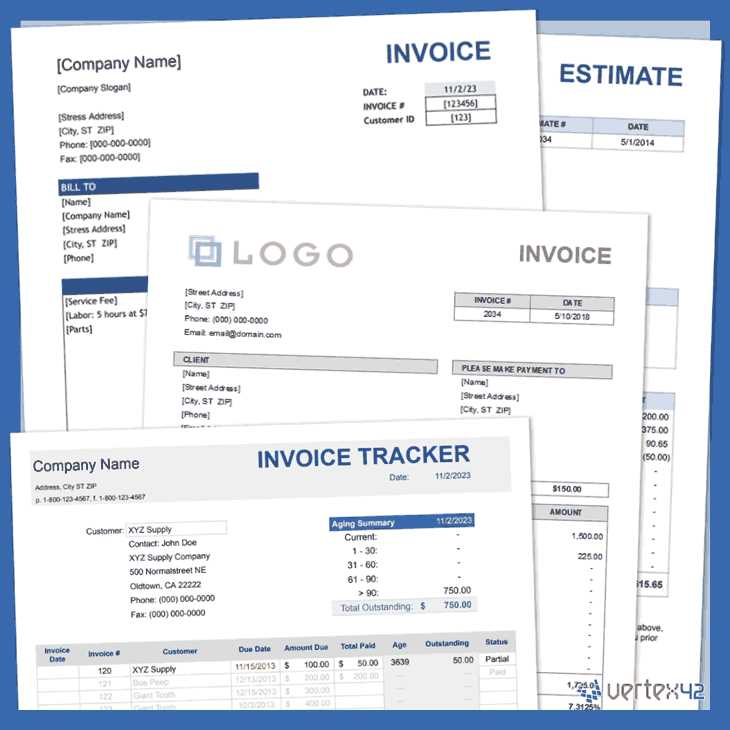

- Simplified Layouts: Ideal for freelancers and small businesses, these are straightforward and minimalistic, focusing on essential information.

- Itemized Formats: Best suited for product-based businesses, offering detailed descriptions and prices for each item or service.

- Modern Designs: For businesses aiming for a more contemporary look, these formats may include advanced features such as logos and custom color schemes.

By understanding the specific needs of your business, you can select the most suitable structure that aligns with your workflow and enhances client relations.

Steps to Download and Print Invoices

Generating professional payment documents for your clients involves a few simple steps. By following a structured process, you can easily create, modify, and finalize these records. This section will guide you through the necessary actions to ensure that your forms are ready for distribution.

Step-by-Step Process

- Find a Suitable Format: Begin by selecting a layout that matches your business needs. Look for one that suits the level of detail required and fits your brand’s style.

- Download the Document: Once you’ve chosen the right design, download the file to your computer. Most sources offer the document in popular formats such as PDF or Word for easy access.

- Customize the Fields: Open the document and fill in the required information, such as client details, payment terms, and amounts. Ensure all fields are correctly filled out to avoid confusion.

- Review the Content: Before finalizing, double-check all details to ensure accuracy. Verify that the dates, amounts, and contact information are correct.

- Save the Document: After reviewing, save the modified file in a secure location for easy access and future reference.

- Distribute the File: Finally, send the document to your client through email, or prepare it for physical delivery if necessary.

Following these steps ensures that your records are accurate, professionally formatted, and ready for use without unnecessary delays.

Customizing Your Invoice for Business Use

When using a pre-designed document for client billing, customization is key to ensuring that it meets your business’s specific needs. Tailoring the format to reflect your brand, services, and payment structure helps maintain professionalism while making the process more efficient. This section will highlight how to modify the standard layout for optimal use in your business.

Essential Customization Features

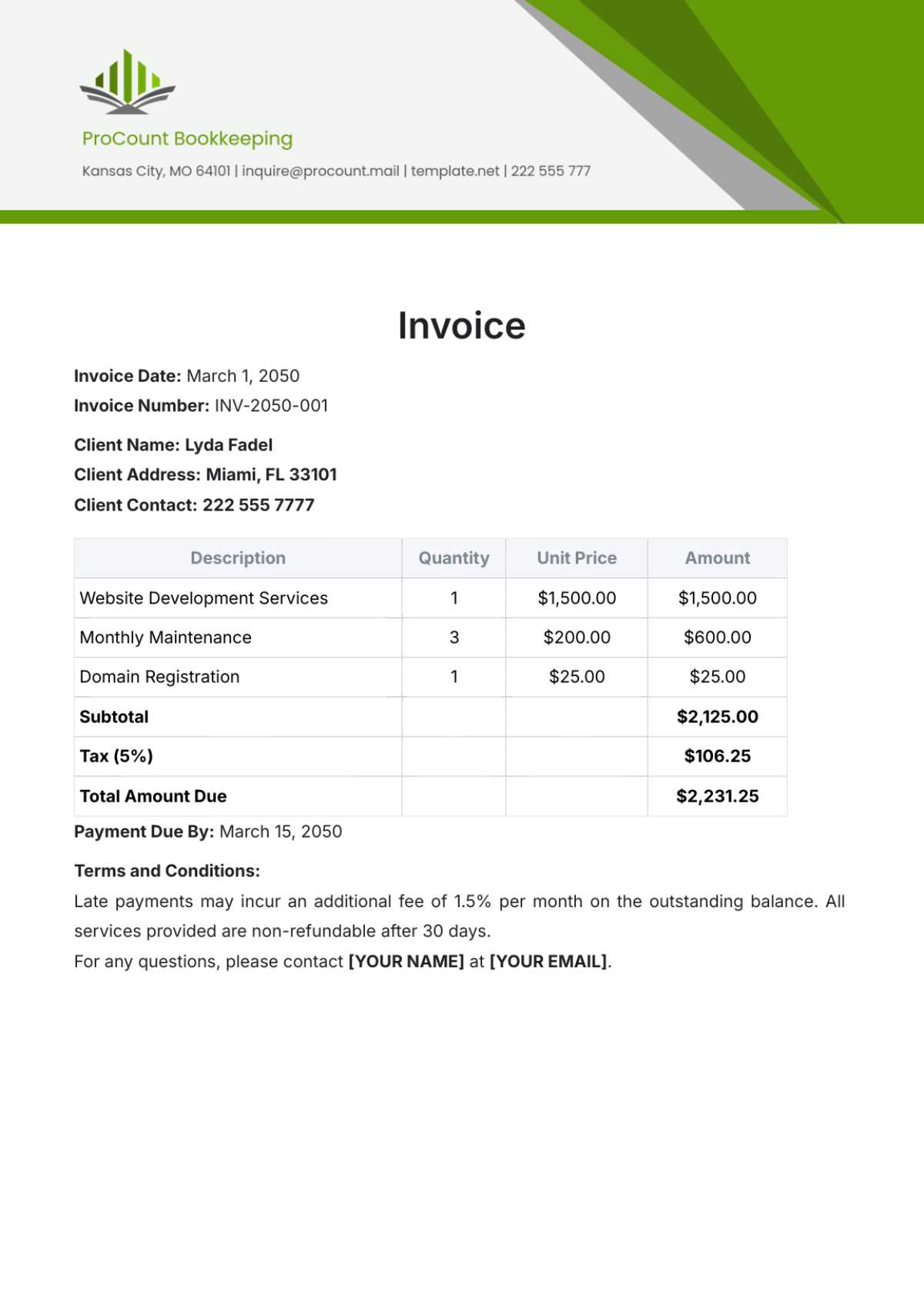

- Company Branding: Add your logo, business name, and contact details to ensure your document aligns with your brand identity.

- Payment Terms and Conditions: Clearly define the payment deadlines, late fees, and any other terms relevant to your services or products.

- Customizable Fields: Include any specific fields relevant to your industry, such as job codes, order numbers, or purchase orders, to better track transactions.

Design and Layout Adjustments

- Text Style: Modify font types, sizes, and colors to align with your company’s style guide, while ensuring readability and clarity.

- Section Organization: Arrange sections based on your workflow, such as moving contact details or payment instructions to the top for better visibility.

- Itemized Lists: For product-based businesses, make sure each item or service is listed clearly with descriptions and prices, helping avoid confusion.

Customizing these elements ensures that the final document is not only functional but also reflects the professionalism and reliability of your business.

How Free Templates Save You Time

Time is one of the most valuable resources when managing a business, and using pre-designed formats can greatly enhance your efficiency. These ready-to-use forms eliminate the need to create documents from scratch, allowing you to focus on other essential tasks. By automating the structure and layout, you can generate consistent and accurate documents with minimal effort.

Key Time-Saving Benefits

- Reduced Design Time: Pre-made documents are already structured and ready for customization, so you don’t have to spend hours designing or formatting from the beginning.

- Faster Turnaround: Filling out a pre-designed document is quick and easy, allowing you to complete tasks like billing or payments faster than if you had to create new ones each time.

- Consistency Across Documents: With a standardized format, you ensure that all your paperwork is uniform, which saves time spent on adjustments and revisions.

Time Comparison: Manual Creation vs. Pre-Designed Forms

| Task | Manual Creation | Pre-Designed Form |

|---|---|---|

| Designing the Layout | 2-3 hours | None |

| Filling Out the Document | 1 hour | 15-20 minutes |

| Proofreading and Adjustments | 30-45 minutes | 5-10 minutes |

By using pre-designed documents, you significantly reduce the time spent on administrative tasks, allowing you to focus on the growth of your business while maintaining professionalism.

Common Mistakes to Avoid When Printing

While preparing documents for client transactions, it’s easy to overlook some key details that can lead to costly errors. Avoiding common pitfalls in the process can ensure that your paperwork is accurate, professional, and delivered without issues. In this section, we’ll highlight frequent mistakes and how to prevent them.

Common Errors to Watch Out For

- Missing or Incorrect Details: Ensure that all fields, such as client names, dates, amounts, and terms, are filled in correctly. Missing or inaccurate information can cause delays or misunderstandings.

- Formatting Issues: Pay attention to the alignment and structure of the content. Misaligned text or tables can make the document look unprofessional and harder to read.

- Using Outdated Versions: Always use the most current version of your document to avoid any outdated terms or pricing. This can be particularly important for businesses with changing rates or services.

How to Ensure Accuracy

- Double-check All Information: Before finalizing, review the document thoroughly. Pay close attention to client contact details, payment terms, and item descriptions.

- Test Print First: Always print a test copy to check for any formatting or layout issues before sending the final version.

- Use Clear Fonts: Ensure that the font is legible and professional. Avoid using overly decorative fonts that may make the document hard to read.

By staying mindful of these common mistakes and taking the necessary precautions, you can create professional and accurate documents that leave a positive impression on your clients.

Best Sources for Free Invoice Templates

Finding reliable sources for downloadable billing forms is essential for businesses looking to streamline their payment processing. There are a variety of platforms that offer high-quality, professional formats at no cost. These sources allow users to select from a range of styles, from basic layouts to more intricate designs, depending on their specific needs.

Top Websites Offering Templates

- Microsoft Office Templates: A trusted source with a wide variety of pre-designed forms that can be customized for your business needs. These templates are compatible with Word and Excel for easy editing.

- Google Docs: Offers a range of free documents that can be easily edited and saved in the cloud, allowing for easy access from anywhere.

- Zoho Invoice: Provides an array of professional designs that can be tailored to your business requirements. It also allows for online tracking of payments and client management.

Additional Helpful Resources

- Canva: Known for its user-friendly design platform, Canva provides visually appealing billing forms that can be customized with logos, colors, and other branding elements.

- Template.net: Offers a vast collection of free, editable designs, with the ability to download in various file formats such as PDF, Word, or Excel.

Utilizing these resources will help you quickly find the right format and reduce the time spent on administrative tasks, allowing you to focus on your core business activities.

How to Add Payment Details on Templates

Incorporating clear and accurate payment information into your documents is essential for ensuring smooth transactions with clients. Customizing the layout to include all necessary details helps both you and your clients stay on the same page. This section will guide you through the process of adding and organizing payment instructions within your document.

Essential Payment Information

When adding payment details, ensure that the following information is included:

- Payment Methods: Specify which forms of payment are accepted, such as bank transfers, credit cards, or digital wallets.

- Bank Account Details: Include account numbers, routing codes, or IBAN for wire transfers, if applicable.

- Payment Due Date: Clearly state the due date for payments to avoid misunderstandings and ensure timely processing.

- Late Fees: If applicable, mention any additional fees for late payments and the terms under which they apply.

Organizing Payment Information in Your Document

Once you have the necessary details, it’s important to organize them clearly in the layout. Here’s a simple table format you can follow:

| Payment Method | Details |

|---|---|

| Bank Transfer | Bank Name: XYZ Bank Account Number: 123456789 Routing Number: 987654321 |

| Credit Card | We accept Visa, MasterCard, and American Express. |

| Due Date | Payments must be received by the 15th of each month. |

| Late Fee | A fee of 5% will be charged for late payments. |

By including this information in a clear and concise format, you help prevent confusion and streamline the payment process f

Ensuring Professionalism with Your Invoice

Maintaining a professional image in all aspects of business communication is essential, and your financial documents are no exception. A well-organized, polished format not only reflects positively on your business but also builds trust and credibility with your clients. In this section, we’ll explore key elements that contribute to creating a professional document.

Key Elements for a Professional Appearance

- Clear and Legible Layout: Ensure that the content is easy to read by using clean fonts, appropriate font sizes, and sufficient spacing between sections.

- Accurate Branding: Incorporate your company’s logo, colors, and contact details at the top of the document to enhance brand recognition and consistency.

- Consistent Formatting: Use a uniform style throughout the document, including the same font type, size, and alignment, to create a cohesive look.

- Professional Language: Keep the tone formal and polite. Avoid using casual or informal language, and make sure all the information is clear and straightforward.

Additional Tips for Refining Your Document

- Include All Necessary Information: Don’t leave out important details such as payment terms, due dates, and itemized charges. Complete and accurate documents help to avoid confusion.

- Proofread Carefully: Double-check for any grammatical errors or formatting inconsistencies before sending the document. Mistakes can undermine professionalism.

- Use High-Quality Materials: Whether you’re sending a digital or printed document, ensure the quality is high. Poor resolution or blurry images can negatively affect the document’s credibility.

By paying attention to these details, you’ll ensure that your documents reflect the professionalism of your business and help to foster strong client relationships.

Why You Should Avoid Templates with Watermarks

While it may be tempting to use pre-designed documents that are available online, it’s important to be cautious when selecting those that include watermarks. Watermarks are often placed on templates to indicate ownership or to prevent unauthorized use. However, when it comes to professional transactions, these marks can detract from the overall appearance and credibility of your work.

Here are some reasons why you should avoid using such documents for your business needs:

- Unprofessional Appearance: Watermarks can make your document look incomplete or unfinished, which could give the impression of a lack of attention to detail.

- Potential Legal Issues: Using a template with a watermark may violate copyright laws or the terms of use set by the creator. This could lead to potential legal complications.

- Client Distraction: Watermarks can distract clients from the important information in your document, reducing clarity and making the overall layout seem cluttered.

To maintain a polished, professional image, it’s best to avoid using watermarked designs and instead opt for clean, unbranded options that align with your business’s visual identity.

How to Handle Tax Information in Templates

Incorporating tax details into your financial documents is essential for compliance and clarity. Accurate tax information ensures that both you and your clients understand the financial obligations involved in the transaction. This section will guide you on how to manage and present tax-related details effectively.

Essential Tax Information to Include

- Tax Identification Number (TIN): Always include your TIN or VAT number to ensure your clients know you are a registered business entity for tax purposes.

- Applicable Tax Rates: Clearly state the tax rate applied to the total amount. This could be a percentage depending on local tax laws or industry standards.

- Tax Breakdown: For transparency, itemize the tax charges separately from the total amount so that clients can easily see how much they are being charged for taxes.

- Taxable Amount: Indicate the amount of the transaction that is subject to taxation, especially if certain items or services are exempt from tax.

Formatting Tax Information for Clarity

To ensure that tax information is clear and easy to follow, use the following layout:

- Separate tax from the total cost: Present the tax charges in a distinct section, so clients can easily identify the tax and understand how it affects the total amount due.

- Provide itemized tax calculations: For detailed records, break down the tax for each item or service provided. This provides full transparency to your clients.

- Use clear headings and labels: Label the tax rate, taxable amount, and total tax clearly. This will avoid any confusion regarding the charges.

By ensuring proper handling of tax information, you not only stay compliant with regulations but also build trust with your clients through clear and transparent communication.

Legal Considerations When Using Templates

When incorporating pre-designed documents into your business practices, it’s crucial to be aware of the legal aspects that come with their use. Certain documents, especially those available online, may be subject to copyright laws, licensing agreements, or other regulations that could affect their legality in your business transactions. In this section, we’ll cover the key legal considerations to keep in mind when utilizing ready-made forms.

- Copyright and Ownership: Many pre-made documents are protected by copyright laws. Ensure that you have the right to use and modify these materials, particularly if you’re using them for commercial purposes. Always check the licensing terms associated with the document.

- Modification Rights: Some documents may be available for free or for purchase, but with restrictions on how they can be altered. Before making changes, confirm that the modifications are permitted under the license or terms of use.

- Accuracy of Legal Clauses: If you’re using a document template that includes legal terms or conditions, ensure that the content is relevant and up-to-date with the laws of your jurisdiction. Using outdated or incorrect legal clauses can lead to potential issues.

- Disclaimers and Conditions: If you use third-party templates, always include any necessary disclaimers or attributions as required by the terms of use. This ensures compliance and transparency with the creator’s terms.

By carefully considering these legal factors, you can ensure that you are using these resources in a way that protects both your business and your clients, while avoiding potential legal disputes.

Using Invoice Templates for Small Business

For small business owners, maintaining a streamlined and efficient process for managing financial transactions is essential. One of the simplest ways to achieve this is by utilizing pre-designed forms to manage payments and receipts. These ready-to-use documents help ensure that your financial records are accurate and professional, saving both time and effort when dealing with clients.

Why Small Businesses Benefit from Pre-designed Forms

- Saves Time: By using pre-designed documents, small business owners can quickly generate professional records without having to design them from scratch.

- Improves Consistency: Consistent and standardized documents create a professional image and help reduce mistakes.

- Cost-Effective: Many forms are available for free or at a low cost, making it an affordable solution for businesses with limited resources.

- Customization Options: These forms are often customizable, allowing businesses to tailor them to their specific needs while maintaining professionalism.

Key Components of Financial Documents for Small Businesses

While using pre-made forms, it’s important to include all relevant information to ensure clear communication with clients and compliance with tax regulations. Below is a table of the key elements that should be included in a well-structured document:

| Key Component | Description | ||||

|---|---|---|---|---|---|

| Business Information | Include your business name, address, contact details, and tax ID to ensure identification and easy communication. | ||||

| Client Information | Provide the client’s name, address, and contact information for proper reco

How to Print Multiple Invoices EfficientlyWhen managing a large volume of client transactions, it’s important to streamline the process of creating and distributing financial documents. Efficiently handling multiple records at once not only saves time but also minimizes the risk of errors. This section will guide you through strategies to optimize this process, ensuring smooth operation for both small and large-scale businesses. To achieve maximum efficiency, consider batch processing your records. Instead of printing each document individually, which can be time-consuming, look for methods to combine and print multiple files in one go. This approach allows you to complete the task in less time while ensuring consistency across all documents. Steps for Efficient Bulk Printing

Recommended Tools for Bulk PrintingThere are several tools available that can help speed up the process of handling large volumes of documents. Here’s a table of the most commonly used software and tools:

|