Effective HVAC Invoice Templates for Easy Billing and Fast Payments

Efficient financial management is essential for maintaining smooth operations in any service-oriented business. A clear and organized billing system enhances transparency and ensures timely payments from clients.

Utilizing a standardized format for your financial documents can significantly reduce administrative burdens and minimize errors. This not only saves valuable time but also portrays a professional image to your customers.

Adopting the right tools and strategies for your billing process can lead to improved cash flow and stronger client relationships. Discover how to optimize your payment workflows and support the growth of your enterprise.

Comprehensive Guide to HVAC Invoice Templates

Efficient billing is a cornerstone of any successful service-based business. Having a well-structured and easy-to-use format for documenting transactions helps ensure clear communication with clients, reduces errors, and speeds up the payment process.

For those in the climate control industry, utilizing a consistent billing structure not only saves time but also helps maintain professionalism and trust. A well-crafted document should outline all essential details, such as services provided, pricing, and payment terms, in a clear and organized manner.

In this guide, we’ll explore the essential components of a properly designed billing document and offer advice on how to customize your own format to fit your business needs. By the end, you’ll understand how to streamline your financial workflows and improve your bottom line.

Understanding the Importance of Clear Invoicing

Clarity in financial documents plays a crucial role in the relationship between service providers and clients. When details are presented in a straightforward and understandable manner, it reduces confusion and helps avoid potential disputes over payments.

Providing well-structured statements can improve communication and ensure that both parties are on the same page regarding the work completed and the associated costs. It also enhances professionalism and builds trust, which can lead to better long-term client relationships.

Reducing Misunderstandings

A clear document eliminates ambiguity, making it easier for clients to review and approve charges. By listing services, materials, and labor costs in a transparent way, clients can quickly verify that the charges match the agreement, avoiding unnecessary delays in payment.

Faster Payments and Cash Flow

When documents are easy to read and understand, clients are more likely to settle their bills promptly. Timely payments are essential for maintaining healthy cash flow, allowing businesses to reinvest in resources and continue offering high-quality services.

How Billing Formats Benefit HVAC Businesses

Implementing standardized documents for financial transactions provides a range of advantages for service-oriented companies. These organized structures ensure efficiency, accuracy, and consistency, all of which are essential for smooth business operations and effective client communication.

By using a structured approach for outlining costs, services, and payment terms, businesses can significantly reduce administrative overhead, allowing more time for technicians to focus on their core tasks. This consistency not only increases operational efficiency but also ensures faster processing and payment from customers.

Time-Saving and Efficiency

Having a predefined structure in place allows businesses to quickly generate financial records without starting from scratch each time. This reduces the time spent on creating documents, enabling faster billing and payment cycles.

Minimizing Errors and Disputes

Clear and standardized records reduce the risk of mistakes in calculations or descriptions, which can lead to disputes with customers. With all essential details presented uniformly, both parties can easily understand and agree on the charges, minimizing the likelihood of issues arising after services are rendered.

| Benefit | Description |

|---|---|

| Consistency | Standardized documents provide uniformity across all customer interactions. |

| Time Efficiency | Quickly generate professional documents without recreating details for each transaction. |

| Reduced Errors | Predefined fields and sections help eliminate mistakes in service descriptions and pricing. |

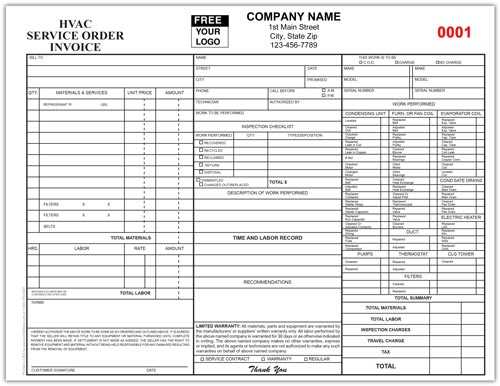

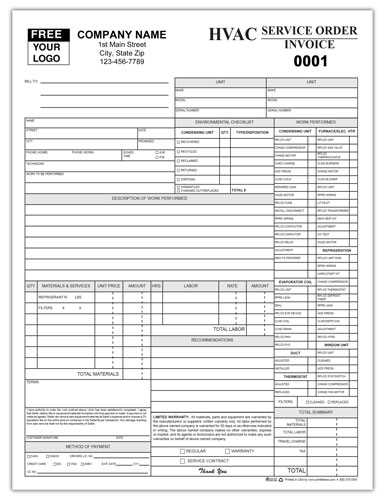

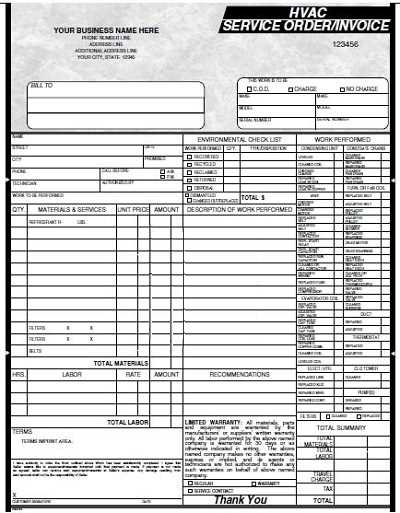

Top Features to Include in Your Billing Document

To create a professional and effective financial document, it’s important to include essential components that clearly outline the services provided and the associated costs. A well-designed structure will ensure both clarity and transparency, improving communication between service providers and clients.

Here are some of the key features that should be incorporated into every document to ensure it meets both business and client needs:

- Business Information: Include your company’s name, contact details, and logo for easy identification.

- Client Information: Always include the customer’s name, address, and contact details to ensure proper identification and communication.

- Service Details: Provide a detailed list of services performed, including descriptions, quantities, and any relevant materials used.

- Clear Pricing: Itemize each service and associated cost, making it easy for clients to see exactly what they’re paying for.

- Payment Terms: Specify when payments are due, accepted payment methods, and any applicable late fees.

- Unique Reference Number: Assign a unique number to each document for easy tracking and record-keeping.

- Tax Information: Clearly state any applicable taxes or VAT charges to avoid confusion.

- Due Date: Always indicate a clear due date to ensure timely payments.

Including these key elements will help streamline your financial process, reduce misunderstandings, and ultimately contribute to smoother business operations.

Creating an Invoice for HVAC Services

Designing a comprehensive and accurate financial document is essential for any service provider. It ensures clients understand what they are being charged for and helps maintain professionalism. This document should clearly outline the work completed, associated costs, and payment terms to prevent confusion and delays.

Here’s a step-by-step approach to crafting a clear and effective financial record for your services:

Key Steps for Crafting the Document

- Gather Client and Service Information: Collect all relevant details, including customer name, address, and a detailed description of the services performed.

- Itemize Charges: Break down the costs into specific categories such as labor, materials, and any additional fees. This transparency helps clients understand exactly what they are paying for.

- Include Dates: Specify the date the work was completed and the payment due date. This helps ensure clarity on timing.

- Specify Payment Terms: Clearly mention the acceptable payment methods and due date, including any penalties for late payments.

- Review for Accuracy: Double-check all details to ensure no errors in calculations or descriptions that might lead to disputes.

Best Practices for Formatting the Document

- Use a Professional Layout: Ensure the document looks polished and easy to read with clear headings and sections.

- Make It Customizable: Include fields that can be updated for each client, such as job details, pricing, and payment terms.

- Consider Digital Formats: Offering a digital version of your record can simplify the process and make it easier for clients to make payments.

Essential Elements for Professional Invoices

For a financial document to be effective, it must convey all necessary details clearly and professionally. The key to a successful transaction lies in providing all relevant information in a structured manner, ensuring both parties are on the same page regarding services, costs, and payment terms.

A well-organized record helps maintain transparency, avoids misunderstandings, and improves client trust. Here are the fundamental components that every professional document should include:

- Business Information: Include your company’s name, logo, address, and contact details to make your business easily recognizable.

- Client Information: Clearly state the customer’s name, address, and contact information to ensure proper identification and communication.

- Unique Identification Number: Assign a reference number to each document for easy tracking and record-keeping.

- Service Description: Provide a detailed account of the work performed, including dates and quantities. This ensures the client understands exactly what services they are being charged for.

- Pricing Breakdown: Itemize each charge separately, including labor, materials, and any additional costs. This allows clients to see exactly what they’re paying for.

- Payment Terms: Clearly outline the due date, accepted payment methods, and any penalties for late payments.

- Tax Information: Include any applicable taxes or VAT to ensure that clients are aware of additional charges.

- Payment Instructions: Provide clear instructions on how clients should make payments, including bank account details or online payment links, if applicable.

Including all of these elements will help you create a clear, professional document that reflects well on your business and encourages prompt payments.

How to Customize an HVAC Invoice

Tailoring your financial documents to match your business needs can enhance professionalism and improve communication with your clients. Customizing your billing records allows you to highlight specific details relevant to your services, making it easier for customers to understand what they are paying for and why.

Customizing your document goes beyond simple design changes; it also involves adjusting the content to reflect your unique pricing structures, terms, and service offerings. Here’s how to get started:

Adjusting for Business Needs

- Modify Header Information: Include your company’s name, logo, and other identifying details to ensure clients recognize your business at first glance.

- Include Specific Service Descriptions: Tailor the description section to your exact services, detailing any special processes, parts used, or timeframes to avoid confusion.

- Set Up Custom Pricing: Adapt pricing to reflect your rates and any discounts, ensuring that clients understand the value of the services provided.

- Add Special Payment Terms: Customize payment instructions and due dates according to your business practices. You can also include notes on deposit requirements or late fees.

Design and Formatting Customization

- Personalize Layout: Adjust the format to suit your brand’s look, whether through colors, fonts, or section placements, to give your document a professional, cohesive appearance.

- Make it Client-Friendly: Customize the design to ensure clarity. The easier it is for clients to read, the quicker they can process payments.

Tips for Accurate Service Descriptions

Clear and precise descriptions of the work performed are vital for maintaining transparency and ensuring that clients fully understand the services they are paying for. Well-written details not only help avoid misunderstandings but also demonstrate professionalism and build trust between the service provider and the client.

To make sure your descriptions are accurate and informative, follow these practical tips:

Be Specific and Detailed

- Break Down Each Task: Clearly outline each step of the service provided. Include relevant details such as the equipment used, procedures followed, and any parts installed.

- Avoid Ambiguity: Use precise terms and avoid vague language. Instead of saying “fixed equipment,” describe what exactly was repaired, replaced, or adjusted.

- Include Timeframes: If applicable, mention the amount of time spent on each part of the service. This can help justify the labor costs.

Ensure Clarity and Professionalism

- Use Simple Language: Write in a way that your clients can easily understand, avoiding overly technical jargon unless necessary. When technical terms are needed, explain them briefly.

- Focus on Benefits: Highlight how your services directly benefit the client, such as improving system efficiency or preventing future breakdowns.

- Stay Organized: Present each service item in a well-organized manner with clear headings and bullet points to make the document easy to read and navigate.

Ways to Organize Pricing and Costs

Properly structuring the costs of services is crucial for clarity and transparency. By breaking down prices in an organized manner, you can help clients understand exactly what they are paying for and ensure there are no misunderstandings. Clear pricing not only helps with customer satisfaction but also streamlines your financial processes.

Here are some effective strategies to organize pricing and costs in your financial documents:

Break Down Charges by Category

- Labor Costs: Itemize the hours spent on each task and multiply by the hourly rate. This gives clients a clear understanding of the time invested.

- Material Costs: List each material or part used along with its individual price. This ensures transparency about where costs are coming from.

- Service Fees: If applicable, include any fixed fees, such as diagnostic charges or travel fees, and make sure to explain these clearly.

Use a Structured Format

- Itemized List: Organize each cost item in a neat, itemized list to avoid confusion. This allows clients to easily see each charge and its corresponding amount.

- Totals and Subtotals: Provide clear totals and subtotals for each section (labor, materials, etc.) and a final total at the end, making it easy for clients to see the breakdown.

- Include Tax Information: Be sure to add any applicable taxes or VAT at the bottom of the breakdown so the client is fully aware of the final amount.

Setting Up Payment Terms for Clients

Establishing clear and fair payment terms is essential for maintaining a healthy cash flow and building trust with clients. Transparent payment expectations help avoid misunderstandings and ensure that both parties are aligned on deadlines and methods of payment. By clearly defining when and how payment is expected, you can reduce delays and foster long-term business relationships.

Here are several steps to effectively set up payment terms that benefit both your business and your clients:

Define Clear Payment Deadlines

- Specify Due Dates: Clearly state the date by which the client is expected to pay. Typically, payment terms are set to 30, 60, or 90 days after the service is completed, but this can vary depending on the agreement.

- Early Payment Discounts: Consider offering a small discount if the client pays before the due date. This can incentivize prompt payments and improve cash flow.

Outline Accepted Payment Methods

- Specify Payment Options: Include information about the methods of payment you accept, such as credit cards, checks, or bank transfers. Offering multiple options can make it easier for clients to pay on time.

- Late Payment Penalties: Clearly explain the consequences of late payments, such as interest charges or a flat late fee. This encourages clients to meet deadlines while protecting your business.

How to Ensure Invoice Compliance

Ensuring that your financial records meet legal and regulatory requirements is essential for maintaining trust with clients and avoiding potential legal issues. Compliance with local, state, and industry-specific standards can help prevent disputes, ensure accurate tax reporting, and safeguard your business from penalties. It’s crucial to establish clear practices for maintaining the integrity and legality of all billing documents.

Here are some steps to ensure that your documents remain compliant:

Stay Updated with Legal Requirements

- Research Local Laws: Regularly review tax and business regulations in your area to ensure that your records include all necessary information, such as tax rates or licensing details.

- Consult with a Professional: Consider consulting with a tax professional or accountant to ensure your financial documents meet all legal standards, especially for complex regulations.

Include Essential Compliance Information

- Correct Business Details: Include your registered business name, address, and tax identification number to ensure that your document complies with regulations.

- Clear Tax Information: Ensure that applicable taxes are listed correctly, with the tax rate and total tax amount clearly outlined.

- Proper Record Keeping: Maintain detailed records for every transaction, including signed agreements, to comply with both tax laws and industry standards.

Streamlining Payments with Digital Invoices

Adopting digital billing methods offers a more efficient way to manage payments and track financial transactions. Digital records streamline the process, reduce errors, and accelerate payment cycles, making it easier for both businesses and clients to stay on top of financial obligations. With the convenience of online platforms, payments can be processed faster, improving cash flow and simplifying bookkeeping.

Here are some key benefits of using digital billing to simplify payments:

Faster Processing and Payments

- Instant Delivery: Digital documents can be sent immediately via email or through an online portal, eliminating the delays of traditional mail and ensuring quicker payment receipt.

- Multiple Payment Methods: Digital systems allow businesses to offer various payment options, including credit cards, bank transfers, and online payment services, which can increase the likelihood of timely payments.

Enhanced Organization and Tracking

- Automated Reminders: With digital tools, automatic reminders can be sent to clients when payments are due, reducing the risk of late payments and improving overall cash flow management.

- Centralized Record Keeping: Digital platforms allow for easy tracking of all transactions, providing a clear and organized record of completed payments, outstanding balances, and financial history.

Best Practices for Tracking Invoices

Efficiently tracking financial documents is critical for maintaining accurate records and ensuring timely payments. By implementing organized systems, businesses can easily monitor outstanding amounts, prevent errors, and keep financial processes running smoothly. Proper tracking also helps in preparing for audits, managing cash flow, and maintaining transparency with clients.

Here are some best practices to keep track of your financial transactions effectively:

Organize Records Digitally

- Use Digital Systems: Leveraging accounting software or cloud-based platforms can automate tracking and centralize records for easy access and management.

- Label Documents Clearly: Assign a unique identifier or number to each record to avoid confusion and ensure that documents are easy to retrieve.

- Keep Backup Copies: Regularly back up your digital records to prevent data loss and ensure you have an archive in case of system failures.

Establish a Routine for Review

- Regular Reconciliation: Schedule routine checks to match records with actual payments and ensure that nothing is overlooked.

- Track Due Dates: Create a system to monitor when payments are due and follow up on overdue amounts to prevent delays.

- Monitor Discrepancies: Address any discrepancies or issues with clients promptly to maintain a clear and accurate record of financial transactions.

Reducing Errors in Your Billing Process

Errors in the billing process can lead to confusion, delays in payments, and dissatisfaction among clients. Ensuring accuracy at every step is crucial for maintaining strong business relationships and a smooth financial workflow. By implementing organized practices and leveraging the right tools, you can significantly reduce the chances of making costly mistakes.

Here are some strategies to minimize errors in your billing process:

Automate the Process

- Use Billing Software: Automation tools can handle repetitive tasks, such as calculating totals and tax rates, reducing the risk of human error.

- Set Up Templates: Pre-designed layouts with pre-filled details for common services can help prevent mistakes when creating new records.

Double-Check Details

- Review Before Sending: Always verify the details, such as service descriptions, amounts, and client information, before finalizing any document.

- Cross-Reference with Agreements: Compare billing details with any signed contracts or work orders to ensure accuracy and consistency.