Download Free Email Invoice Templates

Managing financial transactions in a streamlined way is essential for any business. Using pre-designed documents can help you ensure consistency and professionalism when communicating with clients. By selecting the right format, you can save valuable time and reduce the likelihood of errors in your financial correspondence.

Easy access to ready-made forms allows you to quickly customize your billing statements without starting from scratch. Whether you run a small startup or a large organization, having these forms at your fingertips ensures smooth and efficient processing of payments.

Optimizing your workflow with pre-made solutions makes handling financial communication much easier. With a simple download and a few adjustments, you can create documents that are both accurate and visually appealing, strengthening your relationship with clients and improving your overall business operations.

How to Use Billing Forms Effectively

Using pre-made documents for payment requests is a smart way to simplify your financial communications. These ready-to-use forms ensure consistency, save time, and make it easier to manage transactions. Once you have the right forms, applying them to your workflow is straightforward and efficient.

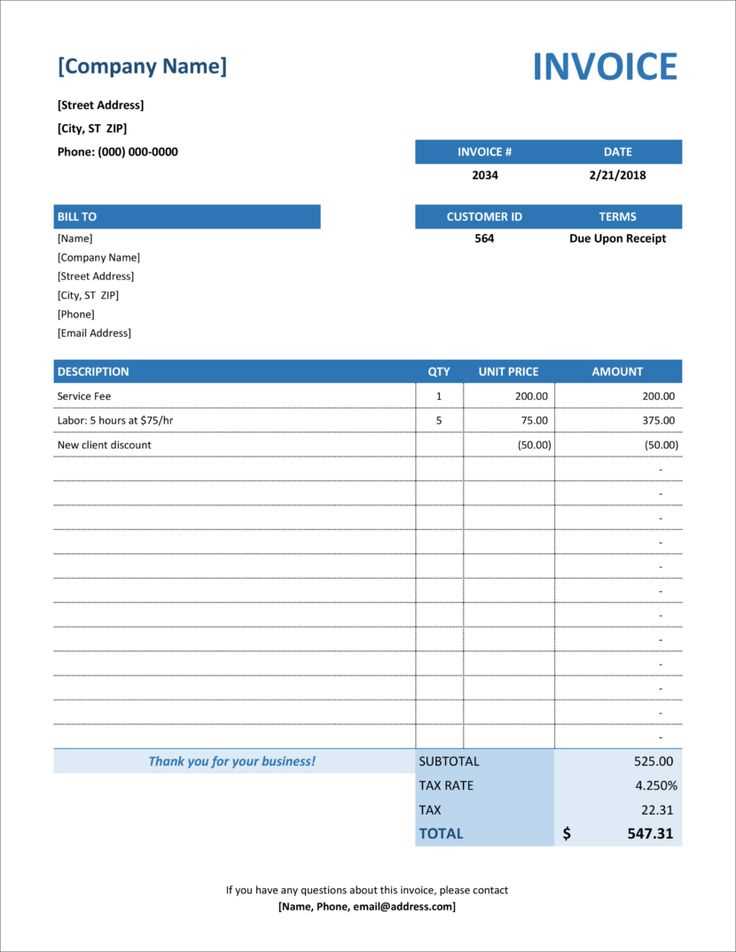

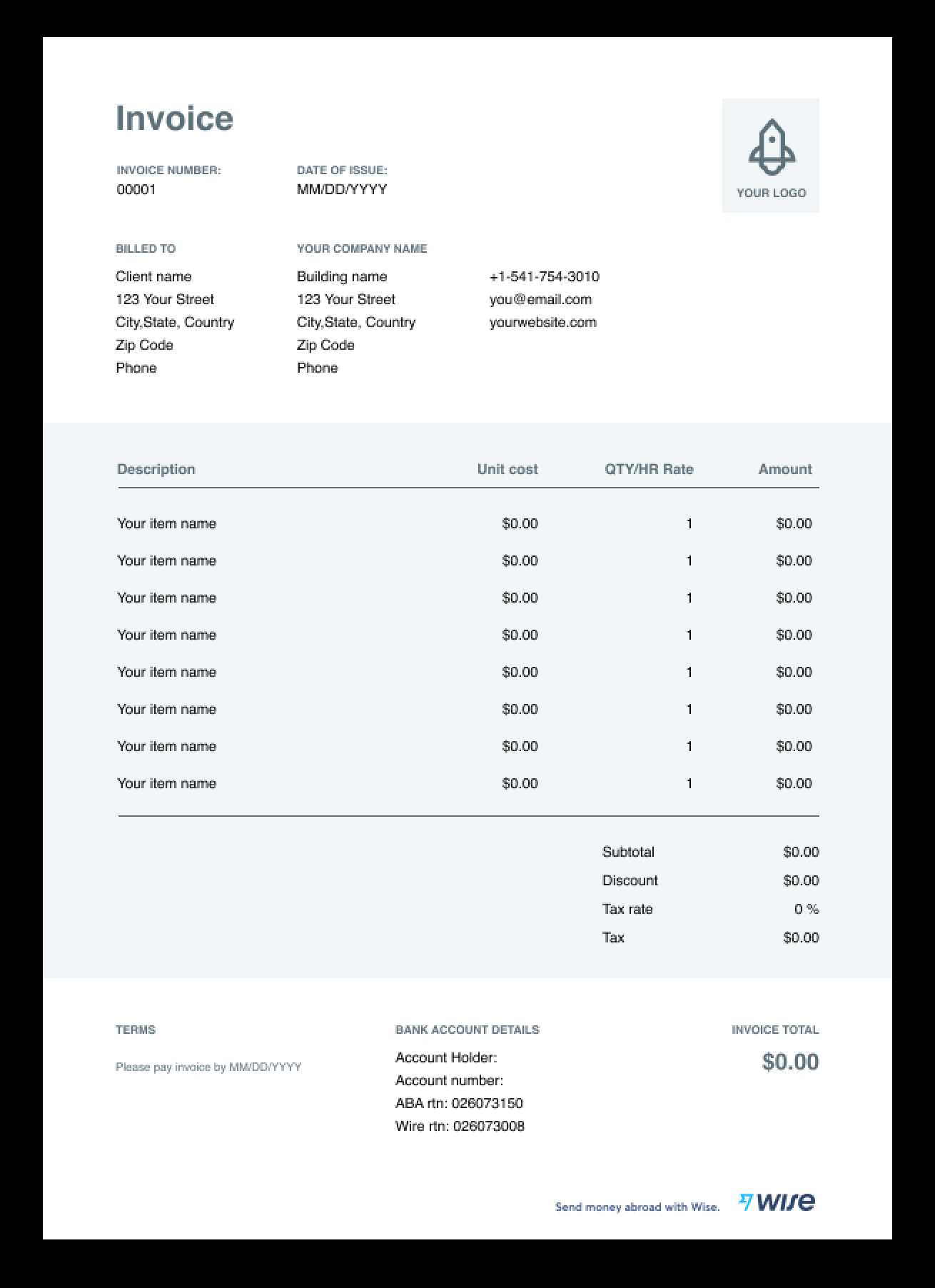

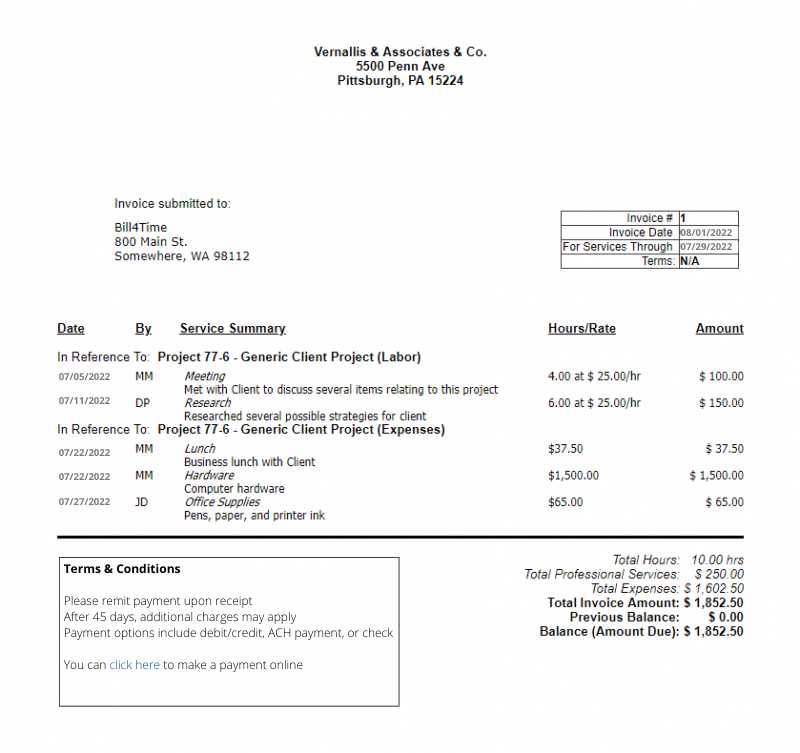

The first step is to choose a suitable format that matches your needs. These forms often come with various sections like business details, client information, payment terms, and line items. Once you have selected a form, it can be easily edited to reflect the specifics of each transaction.

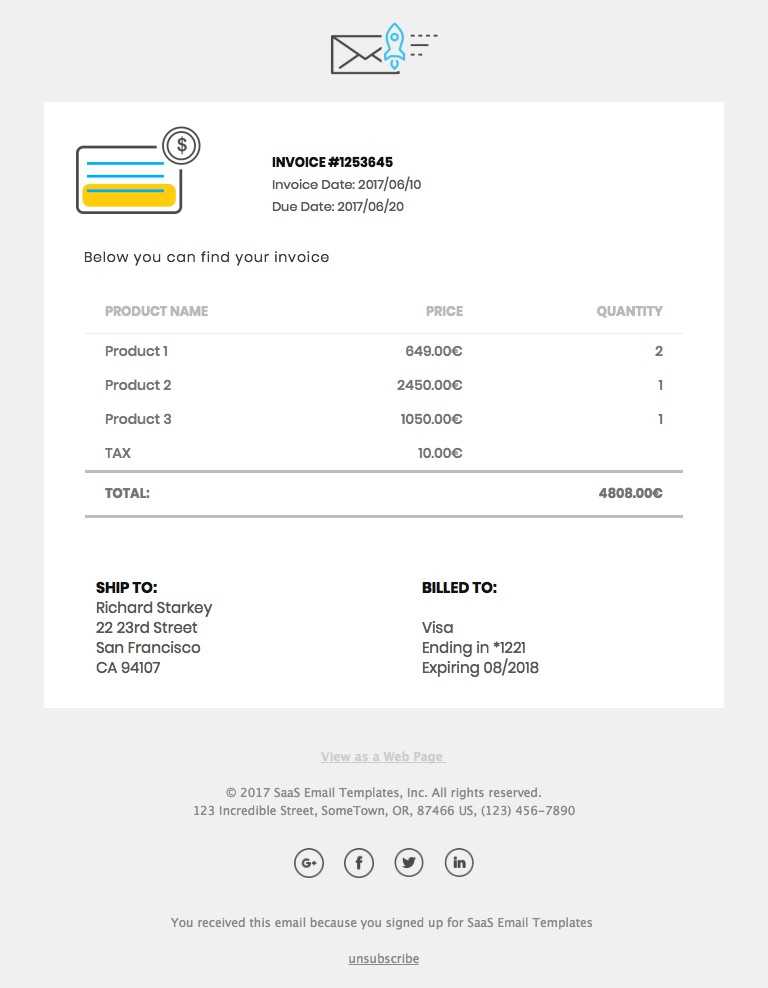

Here’s a simple example of how a completed form might look:

| Item | Description | Amount |

|---|---|---|

| Product A | High-quality item | $150 |

| Service B | Consultation fee | $100 |

| Total | $250 |

Once you have filled in the necessary details, the document is ready to be shared with clients. Make sure to double-check all information to avoid any discrepancies, and then send it in the most convenient format for both parties, such as through direct messaging or attached to an email.

Benefits of Using Pre-designed Billing Forms

Utilizing pre-made forms for your financial communications offers several advantages for businesses of all sizes. These ready-to-use documents save time, increase accuracy, and ensure that your payment requests are professional and consistent. By adopting such solutions, you can focus more on your core tasks and less on formatting and design.

Time Efficiency

Creating a financial request from scratch can be time-consuming and tedious. By using pre-designed solutions, you can skip the formatting process and focus on updating the details for each client. This allows for faster turnaround times, especially when managing multiple transactions.

Consistency and Professionalism

Maintaining a uniform style for all your financial communications is crucial for building trust with clients. Pre-designed forms ensure that every request looks polished and contains the necessary details in a consistent layout, enhancing your professional image.

- Quick customization: Easily adjust the information without altering the entire design.

- Clarity: Ensure that your clients understand all the important details in a structured manner.

- Reduced errors: Minimize the chance of forgetting key information by using a well-organized form.

Adopting ready-to-use solutions is an excellent way to streamline your billing process, improve customer experience, and maintain a professional standard in your communications.

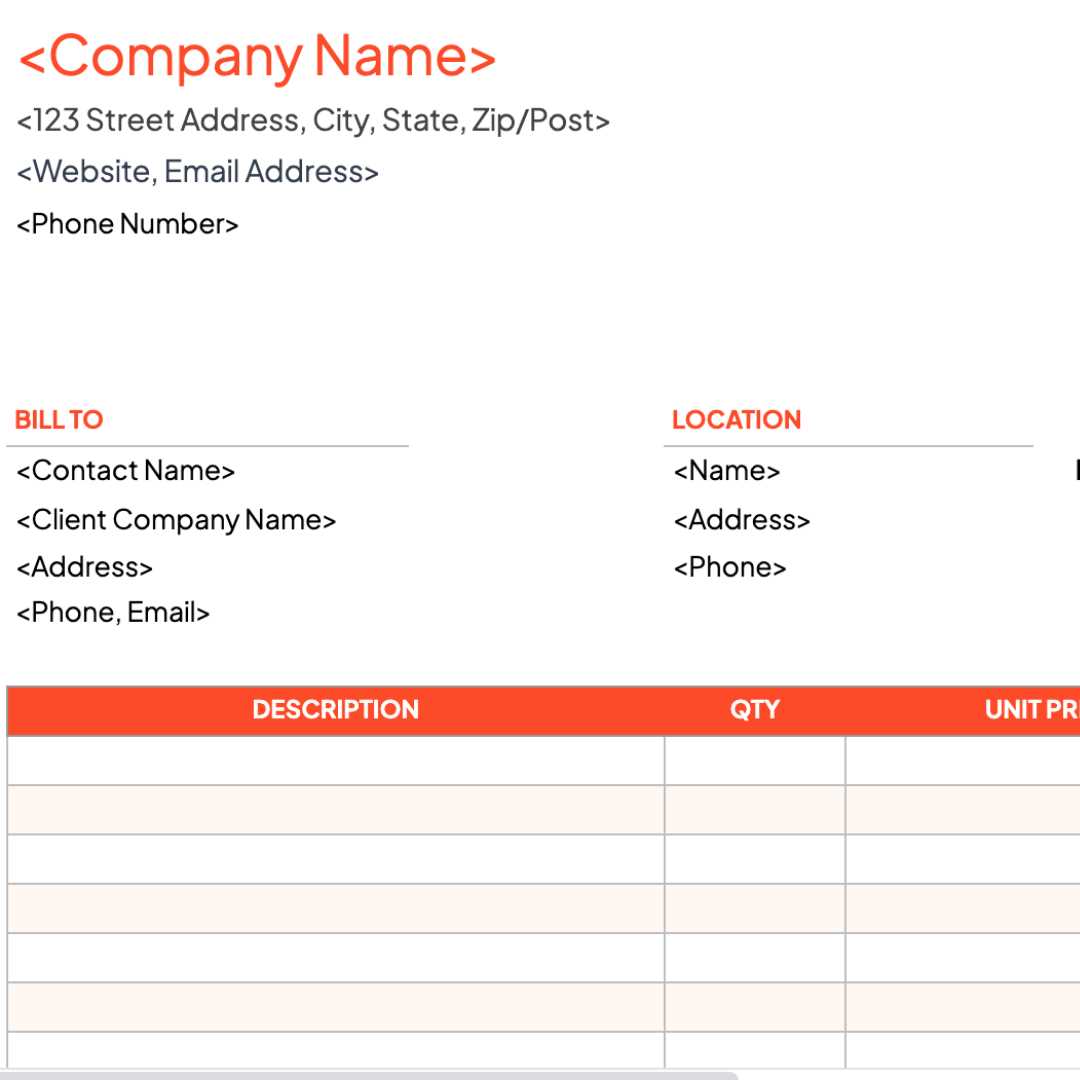

Creating Customized Billing Requests Easily

Personalizing your financial documents is a simple yet effective way to make your payment communications more engaging and relevant. By using a flexible approach, you can quickly adjust the design and content to suit each transaction, ensuring your clients receive accurate and tailored information every time.

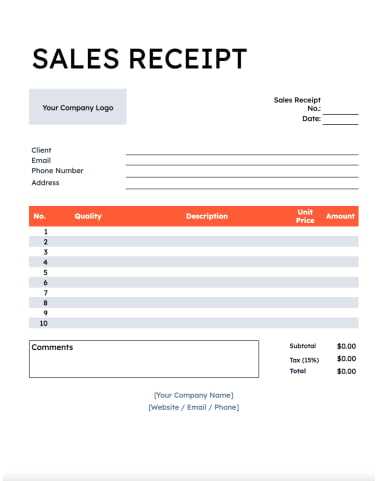

To create customized forms, start with a basic layout that includes all necessary fields. Once you have the structure, you can modify details such as the recipient’s name, products or services provided, and payment terms. This way, each document will reflect the specifics of the transaction while maintaining consistency in design.

- Personalization: Adjust the content to match each client’s details and specific charges.

- Branding: Add your company logo, colors, and fonts to create a professional and recognizable appearance.

- Clarity: Ensure all key information is easy to find, reducing the likelihood of errors or misunderstandings.

Creating personalized billing forms doesn’t require advanced design skills. With a few simple steps, you can create documents that are both functional and visually appealing, leaving a positive impression on your clients.

Top Features to Look for in Billing Forms

When selecting pre-designed forms for financial communications, certain features can make a significant difference in terms of usability, professionalism, and efficiency. By choosing a format that meets your needs, you can save time, improve accuracy, and ensure your documents meet industry standards.

- Clear Structure: Ensure the layout is easy to navigate, with clearly defined sections for important details like amounts, dates, and descriptions.

- Customizable Fields: Look for forms that allow you to adjust the content easily, such as adding your business information, product names, and client details.

- Professional Design: A clean and polished appearance is crucial for creating a good impression. Choose a format that reflects your brand’s style and tone.

- Editable Format: Make sure the document can be edited with common software, whether it’s a word processor or a spreadsheet tool.

- Automatic Calculations: Some forms include built-in formulas for adding totals, taxes, or discounts, which can save you time and reduce human error.

By considering these features, you can select the right form that not only suits your business needs but also enhances the overall experience for both you and your clients.

Free vs Premium Billing Forms

When choosing pre-made forms for financial transactions, businesses often face the decision between free and paid options. While both types can serve their purpose, there are key differences in terms of features, flexibility, and overall quality. Understanding these distinctions can help you decide which option best fits your needs.

Free options are easily accessible and can be a good starting point for small businesses or those just getting started. However, they often come with limited customization and fewer design choices. Premium options, on the other hand, typically offer more advanced features, including better formatting, customization options, and higher-quality designs.

Key Differences

| Feature | Free Option | Premium Option |

|---|---|---|

| Customization | Basic edits | Advanced personalization |

| Design Quality | Standard layout | Professionally designed |

| Features | Limited functionality | Additional tools and options |

| Support | Community support | Dedicated customer support |

While free forms can work for basic needs, premium options offer greater flexibility, enhanced features, and higher quality, making them a better choice for businesses looking to present a more polished and professional image.

Step-by-Step Guide for Accessing Billing Forms

Getting access to ready-made documents for financial transactions is a simple process that can help streamline your workflow. By following a few straightforward steps, you can quickly find and use the right form that suits your business needs. This guide will walk you through each phase of the process, from finding to saving the form.

Step 1: Search for the Right Form

The first step is to search for a suitable document that fits your requirements. Consider what features you need, such as customization options and layout. There are many platforms offering these documents, both free and paid, so take time to find the right one.

- Search online for forms that match your business type.

- Use filtering options to narrow down results based on design or features.

- Check reviews and ratings to ensure quality.

Step 2: Access and Save the Form

Once you have found the form that meets your needs, the next step is to access it and save it on your device. Depending on the source, this could involve clicking a link, signing up for an account, or agreeing to terms.

- Click the access link to open the form.

- Select the format that best suits your software (e.g., PDF, Word, Excel).

- Save the form to your device for future use.

Step 3: Customize and Use the Form

After saving the form, you can now personalize it with the relevant details for each transaction. Edit fields like client information, services provided, and payment terms. Once customized, your form is ready to send or print.

- Edit the fields according to your specific needs.

- Make sure to review the details for accuracy.

- Save a copy for your records and send it to your client.

By following these steps, you can quickly and efficiently access and use the right document for any business transaction, helping to keep things organized and professional.

How to Edit and Personalize Billing Documents

Personalizing pre-made documents for financial transactions is a key step in making sure your communications are tailored to each client and specific situation. By editing these ready-made forms, you can quickly add the relevant details, such as client information, services, and amounts, while ensuring the document reflects your company’s branding and style.

Step 1: Open the Document

To begin editing, open the saved document using the appropriate software. Whether it’s a word processor, spreadsheet application, or PDF editor, choose a program that allows you to make the necessary changes easily.

- For Word and Excel files, open them with the corresponding Microsoft Office application.

- If using a PDF, you might need a PDF editor to make changes directly within the file.

- Ensure the document is compatible with your editing software before proceeding.

Step 2: Update the Essential Details

The next step is to fill in or modify the sections that are specific to the transaction. This includes entering the client’s name, contact details, a description of the services or products, and the total amount owed.

- Client Information: Replace placeholders with the client’s name, address, and contact details.

- Service/Product Description: Update this section with a clear breakdown of the services or products provided.

- Amount and Payment Terms: Adjust the pricing, apply taxes or discounts, and set payment deadlines as needed.

Step 3: Add Your Brand Identity

To make the document align with your company’s professional image, you can customize it with your logo, colors, and fonts. This helps create a cohesive and branded experience for your clients.

- Insert your logo in the header or footer section.

- Choose colors that match your business’s branding for headers and section titles.

- Modify the fonts to reflect your preferred style, ensuring readability and consistency with your brand guidelines.

By following these steps, you can quickly personalize a financial document to suit your specific needs and present a professional and polished appearance to your clients.

Common Mistakes in Billing Documents

Even when using pre-designed forms for financial communications, errors can still occur. These mistakes may lead to confusion or delays in payment, which can harm both your business and client relationships. Understanding the most common pitfalls can help you avoid them and ensure smooth, professional communication.

Some of the most frequent mistakes include incomplete or inaccurate client details, missing or incorrect amounts, and unclear payment terms. These issues often arise from rushing through the document creation process or using generic forms without proper customization.

Another mistake is failing to include important payment instructions or the correct contact information for follow-up questions. A well-structured and clear document can help prevent misunderstandings and ensure that your client knows exactly what is expected and how to proceed with payment.

How to Ensure Professional Billing Document Design

Creating a well-organized and visually appealing document is key to ensuring that your communication with clients is both effective and professional. The layout and design elements of your financial statements should convey clarity, reliability, and attention to detail. A clean and polished document not only reflects positively on your business but also makes the transaction process smoother for your clients.

Step 1: Choose a Clean Layout

A clear and straightforward layout is essential for making sure that all information is easy to find. Avoid cluttering the document with excessive text or graphics that can distract from the key details. Instead, use ample white space to separate sections and guide the reader’s eye through the content.

- Use headings and subheadings to organize different sections clearly.

- Ensure that text is aligned properly, with consistent spacing between lines and sections.

- Consider using a grid layout for better structure and alignment of text and numbers.

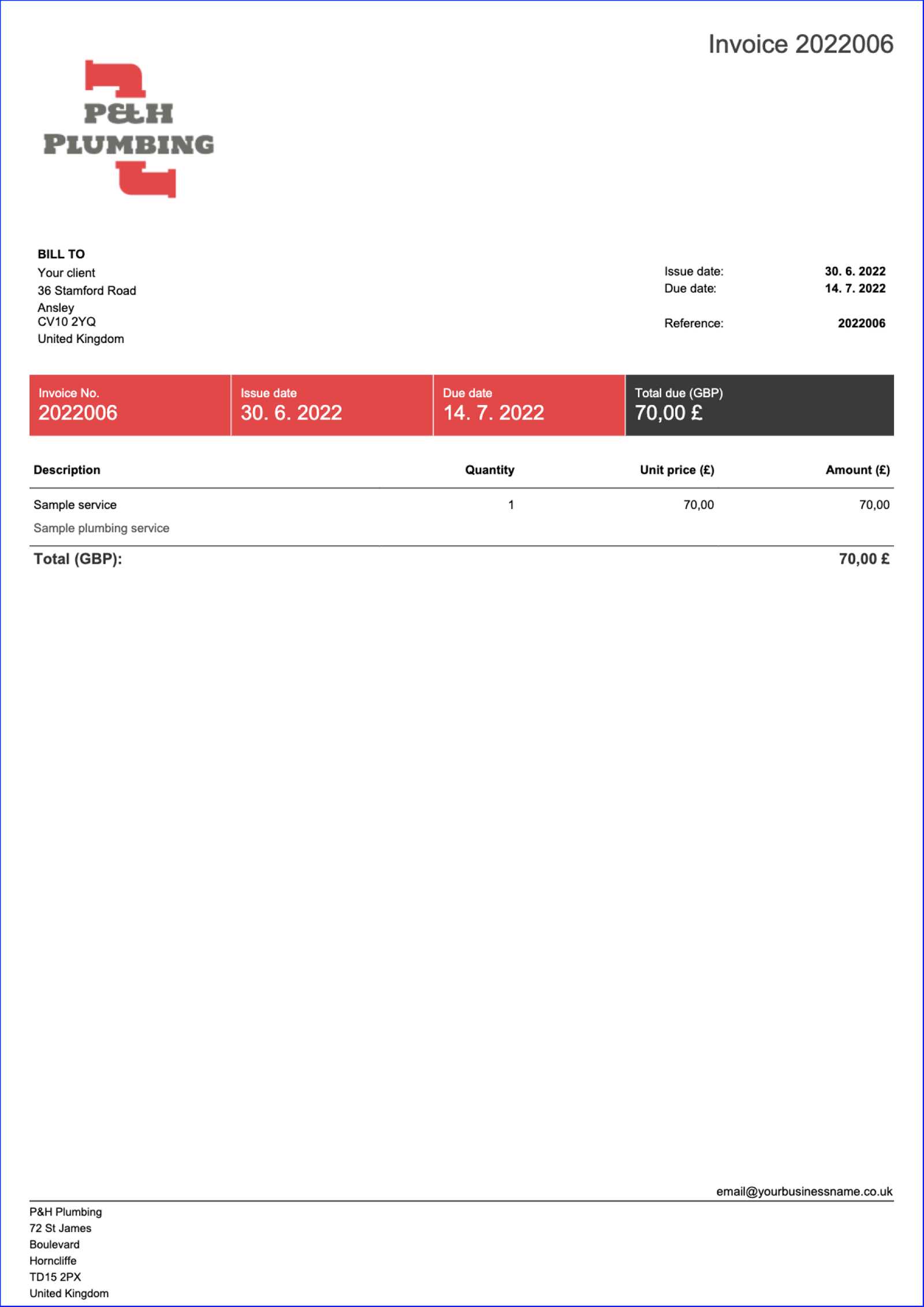

Step 2: Use Brand Colors and Fonts

To make your document stand out and reflect your company’s identity, integrate your business’s branding. Choose colors and fonts that align with your logo and other marketing materials to create a cohesive look.

- Pick a professional color palette that is easy on the eyes and avoids overwhelming the reader.

- Use a font style that is legible and clean, with clear differentiation between headings and body text.

- Avoid using too many fonts or colors, which can make the document appear chaotic.

By following these steps, you can ensure that your billing documents look professional, making it easier for clients to read and respond to your requests. A well-designed document shows your attention to detail and commitment to quality, leaving a positive impression on your clients.

What to Include in Your Billing Document

To ensure clarity and professionalism in your financial communication, it’s essential to include all necessary elements in your document. A well-structured record should provide the recipient with all the details needed to understand the transaction, make the payment, and keep accurate records. By including the right information, you can avoid confusion and ensure smooth processing of payments.

Essential Information to Add

The most important components of a comprehensive billing document include both business and client details, a clear breakdown of the charges, and the payment terms.

- Your Business Information: Include your company name, address, phone number, email, and website. This makes it easy for the client to contact you if needed.

- Client Details: Ensure the recipient’s name, address, and contact information are included to avoid confusion.

- Invoice Number: Assign a unique identifier to each document for easier tracking and reference.

- Date of Issue: Specify the date the document is created and, if applicable, the due date for payment.

Additional Details to Consider

Beyond the basics, there are a few additional elements that will enhance the clarity and functionality of your financial document.

- Description of Services/Products: Provide a detailed list of the goods or services rendered, including quantities and unit prices.

- Amount Due: Clearly state the total amount due, including any applicable taxes, fees, and discounts.

- Payment Instructions: Include clear instructions on how and where to make the payment, including accepted payment methods and account details.

By including these elements, you can ensure your billing document is thorough, professional, and easy to understand for the recipient. A well-prepared document not only helps prevent mistakes but also enhances your business reputation.

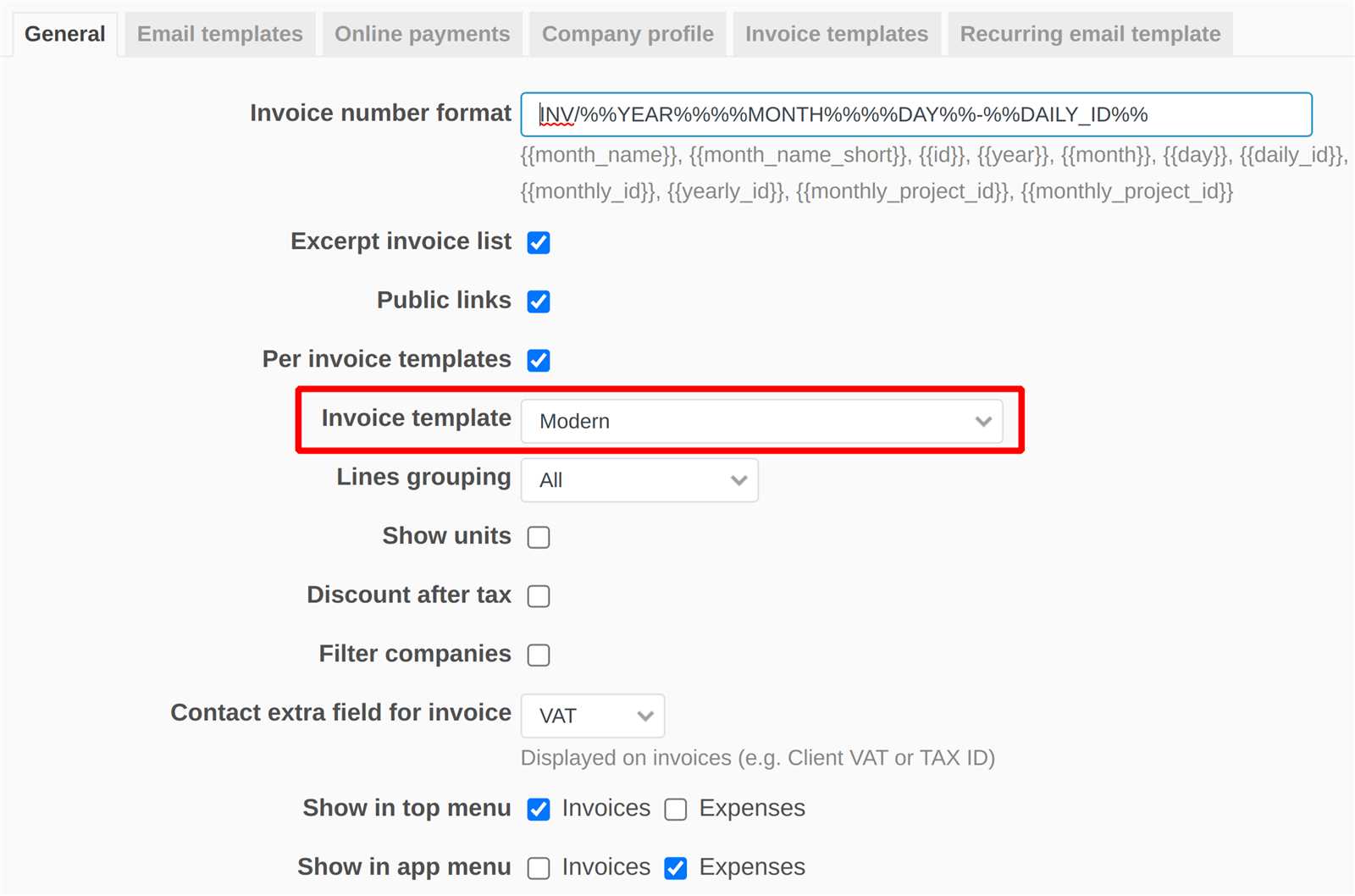

Integrating Documents with Accounting Software

For businesses looking to streamline their financial processes, integrating structured documents with accounting software can provide significant efficiency benefits. This integration allows for automated data entry, real-time updates, and smoother record-keeping. By combining the power of professional billing documents with advanced accounting tools, businesses can save time, reduce errors, and ensure consistency across their financial records.

Benefits of Integration

When properly integrated, accounting software can automatically populate the relevant fields of a billing document, reducing the need for manual input. This not only saves time but also reduces the risk of human error. Additionally, linking documents to accounting systems helps track payments, outstanding balances, and past transactions seamlessly.

- Accuracy: Automatic population of fields ensures that all numbers and details are correct and consistent.

- Time Savings: Integration eliminates repetitive tasks such as entering the same information into both the document and the accounting system.

- Real-Time Updates: When payment is received or details are updated, both the software and the document are synchronized instantly.

How to Integrate Your Billing Document

Integrating your billing documents with accounting software typically involves exporting or importing data between the two systems. Many accounting platforms provide built-in options for importing structured files, while others support integrations through third-party apps or direct APIs.

- Check Compatibility: Ensure the software you’re using supports the document format you need to work with.

- Use Integration Tools: Explore available plugins or apps that connect your document system to accounting platforms.

- Automate Synchronization: Set up automatic syncing so that your records are always up-to-date without manual input.

By integrating your financial documents with accounting software, you can greatly enhance the efficiency and reliability of your billing processes. This integration not only simplifies day-to-day operations but also provides better insight into your financial status in real-time.

How to Keep Billing Documents Organized

Efficient organization of financial documents is crucial for maintaining smooth business operations and ensuring that records are easily accessible when needed. By adopting a systematic approach to managing these records, you can reduce errors, save time, and simplify your accounting processes. Organizing your documents effectively can also make it easier to track transactions, reconcile accounts, and comply with tax regulations.

Strategies for Organizing Documents

One of the best ways to keep everything in order is to establish a consistent filing system. Whether you’re working with physical or digital records, having a clear structure in place will help you find the necessary information quickly and ensure that nothing is overlooked.

- Use Folders and Subfolders: Create main folders for different categories (e.g., client accounts, past transactions, payments) and use subfolders for specific time periods or projects.

- Label and Date Files: Properly label each document with a clear description and date to make it easier to locate specific records.

- Maintain Consistent Naming Conventions: Standardize file names to avoid confusion, such as including the client name and the date in each document’s name.

Utilizing Digital Tools for Better Organization

Digital tools can help streamline document management and provide additional features like search capabilities and automated sorting. Many accounting software programs offer features that allow you to store and organize your financial records in the cloud, making it easy to access them from anywhere and ensuring that your data is backed up securely.

- Cloud Storage: Use platforms like Google Drive or Dropbox to store and organize your records. Cloud storage offers the advantage of remote access and security.

- Document Management Software: Consider using specialized software to organize and track your billing documents. These programs can automate sorting and allow for quick searches based on keywords, dates, or client names.

- Integrate with Other Tools: Sync your records with other business systems (e.g., accounting or CRM software) to ensure that all your documents are organized and up to date.

By keeping your financial documents organized, you can save time, reduce stress, and improve the overall efficiency of your business operations. Whether using physical folders or advanced digital tools, developing good habits will ensure that your records are always in order when you need them.

Choosing the Right Format for Your Business

Selecting the appropriate format for your business communications is essential for ensuring professionalism, consistency, and clarity. A well-designed document not only reflects your brand identity but also helps in conveying important information to your clients in an organized manner. The right choice can enhance client satisfaction, facilitate quicker payments, and reduce misunderstandings. It’s important to consider several factors before making your selection.

Key Factors to Consider

Before choosing the ideal format for your business, evaluate the specific needs of your operations, the industry you’re in, and the preferences of your clients. Customizing your choice to align with these factors will make it easier to manage your records and maintain a professional image.

- Industry Requirements: Some industries may have specific standards or regulations for document layouts, so it’s essential to consider these factors when selecting a format.

- Brand Identity: Ensure that the format you choose reflects your company’s branding, such as incorporating logos, colors, and fonts that match your identity.

- Ease of Use: Opt for a format that is simple to update, customize, and manage, allowing for quick changes if necessary.

Types of Formats to Consider

There are various formats available that can meet different business needs. Whether you’re dealing with a high volume of transactions or a more personalized approach, choosing the right style will help streamline your processes.

- Minimalist Layouts: Perfect for businesses looking for simplicity and efficiency. These formats focus on key information with no unnecessary details, making it quick for clients to understand the charges.

- Detailed Designs: Ideal for businesses that require a comprehensive breakdown of services, including itemized lists and additional explanations.

- Customizable Formats: Useful for businesses that need the flexibility to adjust content or include specific fields based on the nature of the transaction.

Choosing the right format for your business involves balancing clarity, brand representation, and functionality. By taking the time to assess your needs and select a style that fits, you can improve both operational efficiency and client relationships.

Best Practices for Sending Business Documents

When sending important financial documents to clients, it’s crucial to maintain a professional approach. This ensures that your communications are clear, prompt, and well-received. By following a few best practices, you can avoid common errors, ensure timely payments, and strengthen your relationships with customers.

Key Guidelines for Sending Documents

- Ensure Accuracy: Double-check all the details before sending. This includes names, amounts, due dates, and any additional charges. Accuracy helps build trust and minimizes confusion.

- Use a Clear Subject Line: Make it easy for recipients to identify your message at a glance. A clear, concise subject line such as “Transaction Summary for [Date]” can help your clients prioritize their attention.

- Attach Relevant Documents: Include all supporting documents necessary for clarity. Whether it’s a breakdown of costs or a contract, ensure that everything is attached in a universally accepted format like PDF.

- Set a Professional Tone: The language you use should be formal and respectful. Avoid casual phrases or overly complex jargon. Clear communication is key to fostering a professional image.

Additional Tips for Smooth Transactions

- Send Timely Notifications: Don’t wait until the last minute to send your documents. Timely delivery allows clients to process and make payments ahead of time.

- Offer Clear Payment Instructions: Make it easy for clients to pay by providing all the necessary details, such as payment methods, account numbers, and any applicable reference codes.

- Follow Up If Necessary: If payment has not been made by the due date, consider sending a polite reminder. Make sure it is courteous, professional, and free from pressure.

- Maintain a Record: Keep a copy of every communication for your records. This helps with tracking payments, resolving disputes, or offering future references.

By following these best practices, you can ensure your business transactions run smoothly, maintain professionalism in your dealings, and build a positive reputation with your clients.