Motorcycle Repair Invoice Template for Streamlined Billing

When managing a service-based business, having a clear and structured document for recording client transactions is essential. Such a document helps maintain accuracy, ensures smooth operations, and fosters trust with customers. This guide explores how to create a professional and effective document for your business needs.

Whether you’re a small shop or a large service center, using a well-organized billing form can simplify the process of tracking services and payments. By customizing a document with all the necessary details, you can streamline your workflow and reduce errors. A well-prepared form can make both the client’s experience and your internal processes more efficient.

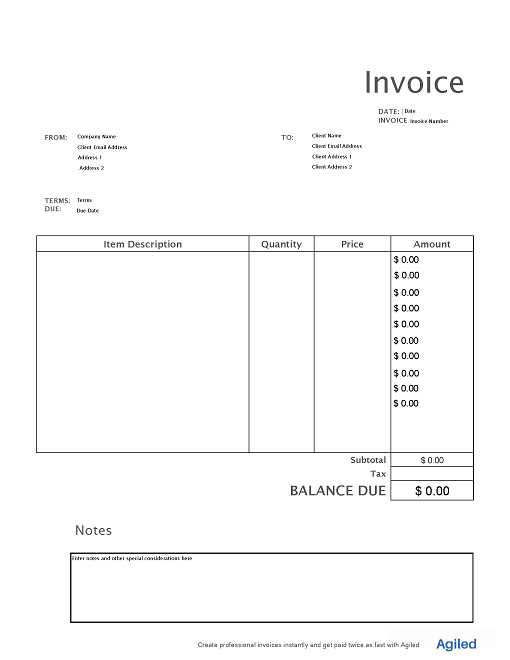

Key features such as itemized lists, clear payment terms, and appropriate fields for services provided are crucial for ensuring everything is recorded accurately. Additionally, digital tools have made it easier to create, store, and send these documents in a professional manner, allowing businesses to focus more on service delivery.

Motorcycle Repair Invoice Template Overview

In any service-based business, having a document to record transactions is crucial for maintaining transparency and organization. This structured form provides a clear record of services rendered, costs involved, and payment details. By using such a document, businesses can ensure that every transaction is properly documented and easily accessible for both the service provider and the customer.

These documents typically include sections to list the parts used, labor charges, taxes, and payment terms. A well-designed form helps prevent misunderstandings and ensures that both parties are on the same page regarding the work completed and the amount due. With the rise of digital tools, creating and managing these forms has become even more efficient, offering features like automatic calculations and easy customization.

Customization plays a key role in adapting the form to the specific needs of the business. The flexibility to add personalized details, such as business branding or additional service descriptions, can enhance professionalism. Digital formats also allow for easy storage and sharing, making them a practical solution for both small businesses and larger enterprises.

Why You Need an Invoice Template

Having a standardized form to document business transactions is essential for maintaining professionalism and accuracy. This structured document ensures that all relevant details about services, pricing, and payment terms are clearly communicated to clients. It not only helps organize your workflow but also minimizes the risk of errors and confusion between you and your customers.

Ensures Clear Communication

By using a predefined document, you can ensure that all important aspects of the transaction are captured consistently. This helps avoid misunderstandings and sets clear expectations for both parties. A well-constructed form can prevent disputes over pricing, payment deadlines, and services provided, contributing to smoother interactions and stronger client relationships.

Streamlines Your Workflow

Creating a personalized document makes the process faster and more efficient. Instead of writing out the same details repeatedly for each customer, you can use a ready-made structure that allows for quick adjustments. This not only saves time but also improves your overall productivity by focusing on the service itself, while the document automatically handles all necessary details.

Essential Elements of a Repair Invoice

A well-structured document for tracking services and payments should include several key components to ensure clarity and completeness. These essential elements provide a clear breakdown of the transaction and help both the service provider and the customer stay informed about the details of the work performed and the associated costs.

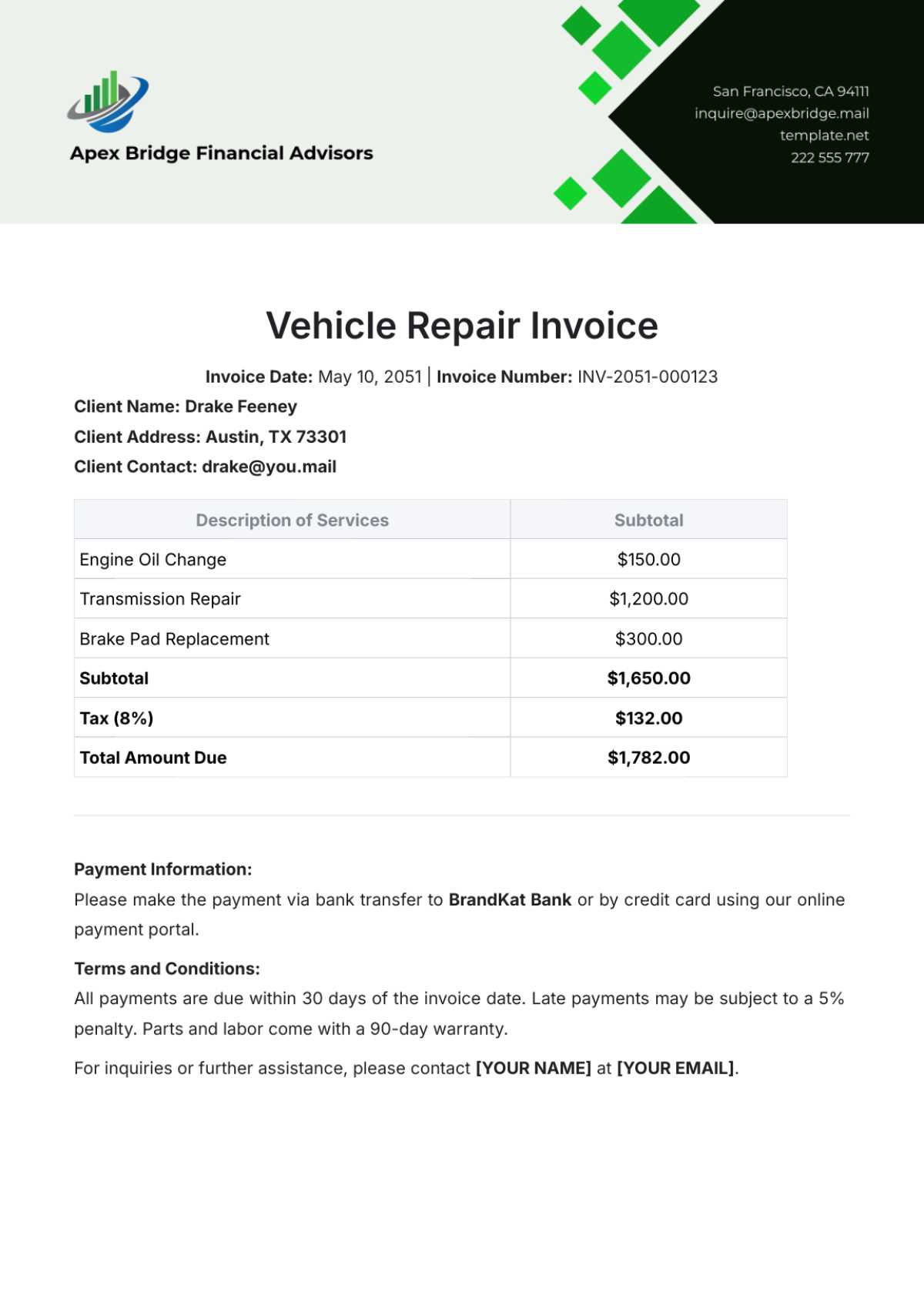

First, the document should include basic information such as the service provider’s business name, contact details, and a unique reference number for easy tracking. It should also specify the client’s name and contact information. Additionally, a detailed description of the work done, including any parts used and hours worked, helps clarify the scope of the service and justifies the final cost.

Another critical element is the pricing breakdown, which clearly shows the cost for each service or item provided, any taxes, and the total amount due. Payment terms, such as the due date and acceptable methods of payment, are also important for setting expectations and preventing confus

How to Customize Your Template

Adapting a billing document to fit your specific business needs is crucial for ensuring both professionalism and efficiency. Customization allows you to tailor the structure and details, making it more relevant to the services you offer and the way you interact with clients. By adjusting various elements, you can create a more personalized experience while keeping the document organized and functional.

Personalizing Business Details

One of the first things you should customize is the header section, where you can add your business name, logo, and contact information. This ensures that your document looks professional and reinforces your brand identity. Additionally, including your business address and website can provide clients with easy access to further information about your services and contact options.

Adjusting Service Descriptions and Pricing

Depending on the type of work you do, you may need to adjust the sections describing the services provided. Adding detailed descriptions for each task can help clarify the work completed and justify the charges. You can also customize the pricing structure by including different service rates, material costs, and taxes that are specific to your business. Using clear pricing breakdowns ensures transparency and builds trust with your clients.

Flexibility in customization also extends to payment terms and instructions. You can adjust these sections to reflect your preferred methods of payment and set due dates or installment options as needed. By customizing these key areas, you can create a seamless and professional experience for both you and your customers.

Benefits of Using Digital Invoices

Switching from paper-based to digital billing documents offers numerous advantages for businesses. Not only does it streamline the administrative process, but it also enhances efficiency, reduces errors, and improves overall customer satisfaction. The convenience of digital tools allows for faster, more reliable transactions, benefiting both the service provider and the client.

Here are some key benefits of using digital forms for recording transactions:

- Faster Processing: Digital documents can be created, sent, and tracked instantly, eliminating the delays associated with printing and mailing paper forms.

- Easy Storage and Retrieval: Digital records are easy to store, organize, and retrieve, helping businesses maintain accurate and accessible records for future reference.

- Reduced Errors: Automated calculations and pre-filled fields minimize the chances of manual mistakes, ensuring more accurate billing.

- Environmental Impact: By reducing the need for paper, businesses contribute to environmental sustainability.

- Cost-Effective: Digital tools eliminate the need for printing, postage, and storage space, which can reduce overhead costs in the long term.

- Improved Professionalism: Digital forms allow businesses to present a polished, modern image, which can help build trust with clients.

By adopting digital forms, businesses can improve operational efficiency, reduce overhead costs, and offer a more seamless experience for their customers. These benefits make digital options an invaluable tool for any business looking to optimize its billing process.

Common Mistakes in Repair Invoices

Creating a billing document may seem straightforward, but there are several common mistakes that can undermine its effectiveness. These errors can lead to confusion, disputes, and delays in payment. Identifying and avoiding these mistakes is crucial for maintaining a smooth and professional business operation.

Missing or Incorrect Client Information

One of the most common errors is failing to properly capture the client’s contact details. Missing or incorrect information, such as an incomplete name, address, or email, can delay communication and cause misunderstandings. It’s essential to verify client details before finalizing the document to ensure that all information is accurate and up-to-date.

Unclear or Incomplete Service Descriptions

A lack of detail in the description of services performed can lead to confusion about what was done and why certain charges were applied. A clear, concise description of each service, including time spent and materials used, is crucial for both transparency and customer satisfaction. If these details are vague or missing, it can result in unnecessary disputes and delayed payments.

Inconsistent Pricing is another mistake that can arise when rates are not properly listed or when different pricing structures are used for similar services. This inconsistency can create confusion for clients and can affect trust. Always ensure that pricing is clear, consistent, and in line with the agreed-upon terms.

Failure to include payment terms is also a common mistake. Without clear instructions on payment deadlines, acceptable payment methods, or penalties for late payments, clients may not prioritize paying on time, leading to cash flow problems for the business.

Best Practices for Invoice Accuracy

Maintaining accuracy in billing is essential for ensuring smooth transactions and building trust with clients. Small errors can lead to confusion, disputes, or delays in payment. Implementing a few best practices can help avoid common mistakes and improve the overall reliability of your documents.

Key Practices for Ensuring Accuracy

- Double-Check Client Details: Always verify that client information such as name, address, and contact details are accurate before finalizing the document.

- Itemize Services Clearly: Break down each service performed, specifying labor hours, parts used, and their respective costs to avoid misunderstandings.

- Be Consistent with Pricing: Ensure that rates for services are consistent and in line with the agreed-upon terms. Clearly outline any special charges, taxes, or fees.

- Use Standardized Formats: A consistent format for all billing documents helps avoid omissions or confusion. Pre-built formats can help keep your records aligned.

- Automate Calculations: Use digital tools that automatically calculate totals, taxes, and discounts to reduce human error.

Review and Confirm Before Sending

Before sending out any document, always review the content for accuracy. Ensure that all the details are correct, including the service descriptions, charges, and payment terms. It’s also important to check for any typographical or formatting errors that could cause confusion. Having a second set of eyes review the document can provide an added layer of assurance.

By adopting these best practices, you can ensure that your billing documents are not only accurate but also professional, which can enhance client relationships and streamline your business operations.

Choosing the Right Invoice Format

Selecting the right format for your billing documents is essential to ensure clarity, professionalism, and efficiency in transactions. The format you choose should align with the nature of your services, your business size, and your client’s preferences. A well-chosen structure can make processing easier and ensure that all necessary details are included while minimizing errors.

Factors to Consider When Choosing a Format

When deciding on the most suitable format for your billing records, several factors come into play:

- Client Needs: Consider whether your clients prefer paper-based records or digital ones. Some clients may require printed copies, while others may appreciate electronic versions for easier storage and tracking.

- Business Type: The complexity of your services may determine the level of detail needed. A straightforward business may only require a simple format, while more complex services might need a detailed, itemized breakdown.

- Software Integration: Choose a format that can easily integrate with accounting or management software. Digital formats often provide the flexibility to automate calculations and store records efficiently.

Table Breakdown of Common Formats

Here’s a comparison of some of the most commonly used formats:

| Format | Best For | Benefits | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Paper-Based | Small businesses or clients who prefer physical copies | Simple and familiar, no need for digital tools | ||||||||||||||||||||||||||||||||||||||||||

| Digital (PDF) | Businesses looking for professional, easy-to-share formats | Can be emailed, easily stored, and edited with digital tools | ||||||||||||||||||||||||||||||||||||||||||

| Online Billing Software | Businesses that require automation and integration with accounting tools | Automates calculations, integra

Integrating Payment Details in InvoicesClearly outlining payment information in your billing documents is crucial for ensuring timely and smooth transactions. A well-organized payment section helps clients understand their obligations and provides the necessary details for making payments without confusion. This clarity can enhance customer satisfaction and streamline the payment process. Essential Payment Information to IncludeWhen preparing a billing record, including the right payment details is vital. Below are the key elements that should be clearly presented:

Example of a Payment SectionThe following table illustrates a typical payment section within a billing document:

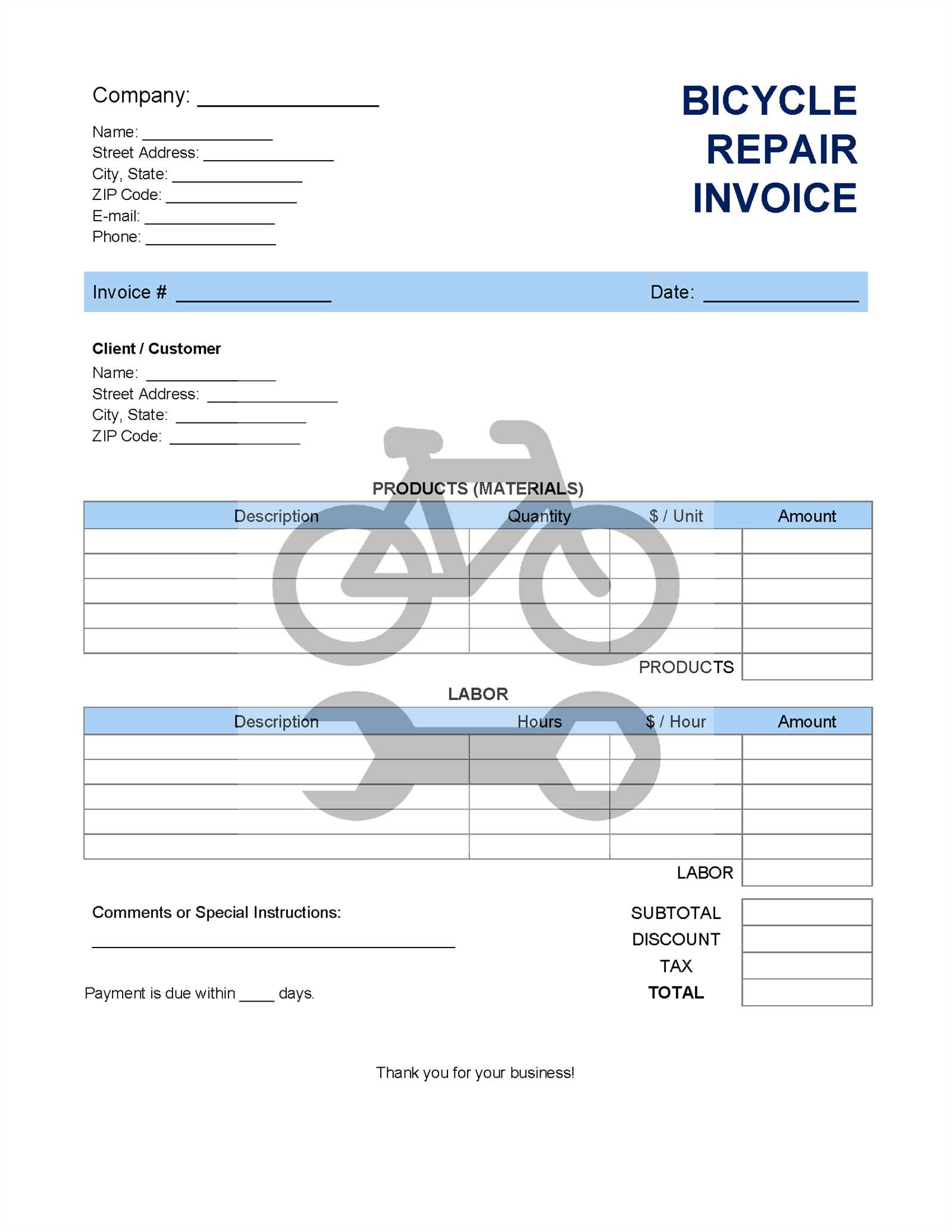

By providing these essential payment details, you can ensure that clients have all the information they need to complete their transactions on time and without confusion. This proactive approach reduces the likelihood of delayed payments and helps maintain a professional relationship with clients. How to Add Parts and Labor CostsIncluding accurate costs for materials and services is crucial for transparency and ensuring clients understand the charges. It’s essential to clearly distinguish between the cost of items used and the charges for the work performed, providing a breakdown that is easy to follow. This helps avoid confusion and ensures that both the client and service provider are on the same page regarding the financial details. Parts Costs: The cost of parts or materials should be itemized in the document. Each part should be listed separately along with its price. If applicable, include the part number or a description to avoid any ambiguity. Labor Costs: Labor charges should be based on the time spent on the job and the hourly rate agreed upon. Be sure to mention the number of hours worked, the hourly rate, and the total labor cost. Providing a breakdown of the time spent on each task can add clarity, especially for more complex jobs. Here’s an example of how to add both parts and labor costs to your billing record:

By separating parts and labor costs in this way, your client will have a clear understanding of how t How to Add Parts and Labor CostsIncluding accurate costs for materials and services is crucial for transparency and ensuring clients understand the charges. It’s essential to clearly distinguish between the cost of items used and the charges for the work performed, providing a breakdown that is easy to follow. This helps avoid confusion and ensures that both the client and service provider are on the same page regarding the financial details. Parts Costs: The cost of parts or materials should be itemized in the document. Each part should be listed separately along with its price. If applicable, include the part number or a description to avoid any ambiguity. Labor Costs: Labor charges should be based on the time spent on the job and the hourly rate agreed upon. Be sure to mention the number of hours worked, the hourly rate, and the total labor cost. Providing a breakdown of the time spent on each task can add clarity, especially for more complex jobs. Here’s an example of how to add both parts and labor costs to your billing record:

By separating parts and labor costs in this way, your client will have a clear understanding of how the total amount was calculated. This breakdown enhances the professionalism of your billing system and can lead to better client satisfaction and timely payments. Tracking Payments Through InvoicesEffective payment tracking is an essential part of maintaining smooth financial operations. By systematically recording and monitoring payments, businesses can ensure that no transactions are overlooked, helping to avoid late fees and discrepancies. A well-organized method for tracking payments makes it easier to stay on top of your cash flow and ensures that clients fulfill their financial obligations on time. Key Methods for Tracking PaymentsThere are several ways to track payments through your billing documents, and the best method will depend on your preferences and the tools you use. Below are some effective methods:

Steps to Efficiently Track PaymentsTo effectively track payments, follow these steps:

By staying organized and consistent with payment tracking, businesses can reduce the risk of overdue payments and maintain healthier financial practices. This methodical approach also improves customer relationships by ensuring clear and accura Legal Considerations for Repair InvoicesWhen creating any billing document, it’s essential to consider the legal aspects involved. Ensuring compliance with local laws and regulations can protect both businesses and clients from potential disputes. Clear, accurate, and legally sound documentation helps safeguard against legal challenges and ensures that the transaction process remains transparent and fair. Legal Requirements for Documentation: Depending on the jurisdiction, certain elements must be included in billing records to meet legal requirements. These may include the business name and contact information, a unique reference number, and an itemized list of services or products provided. It’s essential to check your local laws to ensure that all mandatory details are incorporated into your documents. Terms and Conditions: Including clear terms and conditions is another vital aspect of legal compliance. This section typically outlines the agreed-upon payment terms, including the due date, any penalties for late payments, and the method of payment. Having these terms clearly stated helps prevent misunderstandings and protects both parties in case of a dispute. Retention of Records: Businesses are often required to keep records of transactions for a certain period. This helps ensure that any potential audits or legal claims can be resolved with proper documentation. Make sure to maintain copies of all billing documents and correspondence related to the transaction, especially for large projects or long-term clients. By adhering to these legal considerations, businesses can minimize the risk of disputes and ensure that the billing process remains efficient, fair, and legally compliant. Invoice Template for Small ShopsFor small businesses, managing financial transactions efficiently is crucial. An organized, easy-to-use document can help keep track of payments, services, and customer details. A simplified version of a formal document, tailored to the needs of small shops, ensures that billing remains straightforward and professional without becoming overwhelming. Key Features of a Small Business DocumentFor small shops, the document should contain all necessary details without being overly complex. Below are key features to consider:

Benefits of Using a Simplified DocumentFor smaller businesses, a straightforward document reduces the time spent on administrative tasks, allowing owners to focus on their core operations. By using a streamlined approach, small shops can maintain professionalism while also ensuring that all essential information is present for both the business and the customer. Ultimately, a well-structured document provides clarity, helps maintain accurate records, and supports a smooth transaction process, making it an essential tool for any small business. Creating Recurring Invoice TemplatesFor businesses with ongoing services or regular clients, setting up a document that automates recurring charges can save time and reduce administrative overhead. By creating a document that automatically generates for each billing cycle, you can ensure consistent, accurate billing without the need for manual input every time. This approach not only streamlines operations but also helps maintain financial predictability. Key Elements of a Recurring DocumentWhen designing a recurring billing document, it’s essential to include specific details to ensure consistency across all cycles. Below are important elements to include:

Advantages of Automating Recurring ChargesAutomating the billing process for regular charges offers several benefits for both businesses and clients:

Incorporating recurring billing into your business workflow ensures smooth operations and reduces the risk of human error, making it an ideal solution for businesses with regular clients or services. Improving Customer Relations with InvoicesEffective communication and transparency are key to building strong relationships with clients. By ensuring that all transactional documents are clear, detailed, and professional, businesses can foster trust and improve customer satisfaction. A well-structured document can be more than just a payment request; it can be an opportunity to strengthen client interactions and ensure they feel valued. Building Trust Through ClarityCustomers appreciate when they can easily understand the charges for the services or products provided. A well-organized document helps to eliminate confusion and demonstrates professionalism. Consider including the following elements to enhance the customer experience:

Fostering Long-Term Relationships

Consistent, clear communication via transactional documents also plays a role in retaining customers. By offering easy-to-understand and accurate billing, businesses show respect for their clients’ time and finances. This can encourage repeat business, customer loyalty, and positive word-of-mouth recommendations. Here’s how a well-crafted document can help:

By focusing on transparency, professionalism, and attention to detail, businesses can strengthen their relationships with clients and improve overall customer satisfaction. |