Automated Invoice Template for Efficient Billing

Managing financial documentation can often be a time-consuming task, especially for businesses handling frequent transactions. Streamlining this process is essential for ensuring that records are clear, accurate, and easy to track. An efficient setup can reduce both human error and time spent, offering businesses a more organized approach to financial operations.

Modern solutions now provide businesses with tools to simplify this critical part of their workflow. These tools are designed to create clear, customizable forms that capture all necessary details with minimal effort, ensuring that every transaction is documented precisely. With automation, businesses can increase their productivity by focusing on their core tasks, while their documentation processes become swift and error-free.

Choosing the right format for financial records allows for greater flexibility and adaptability across different business needs. Businesses can also integrate these solutions with various accounting software, ensuring seamless data synchronization.

Automated Invoice Template Guide

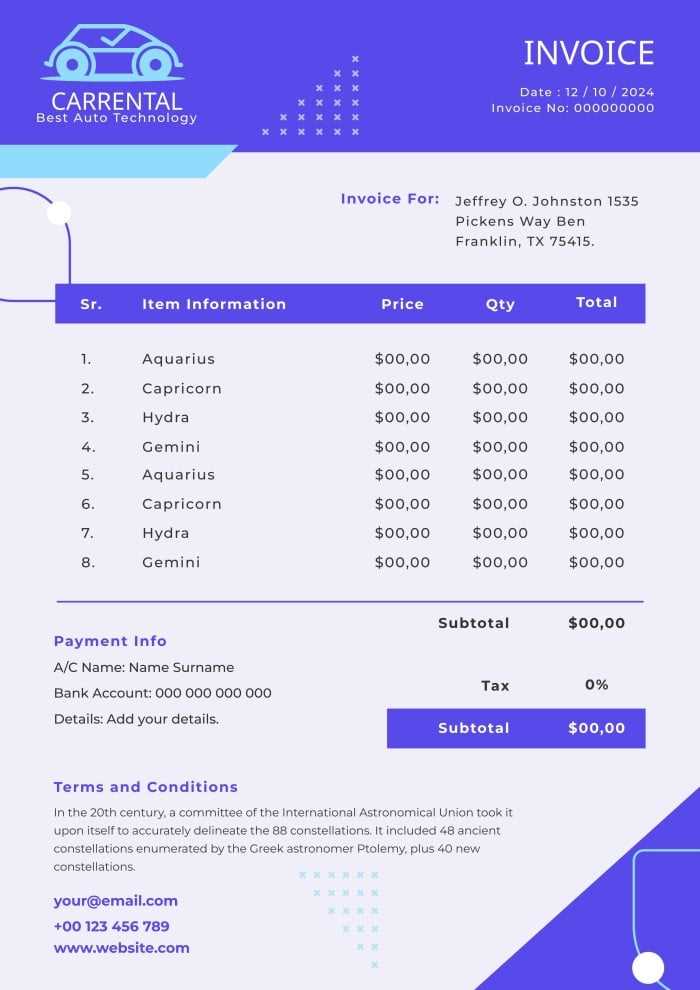

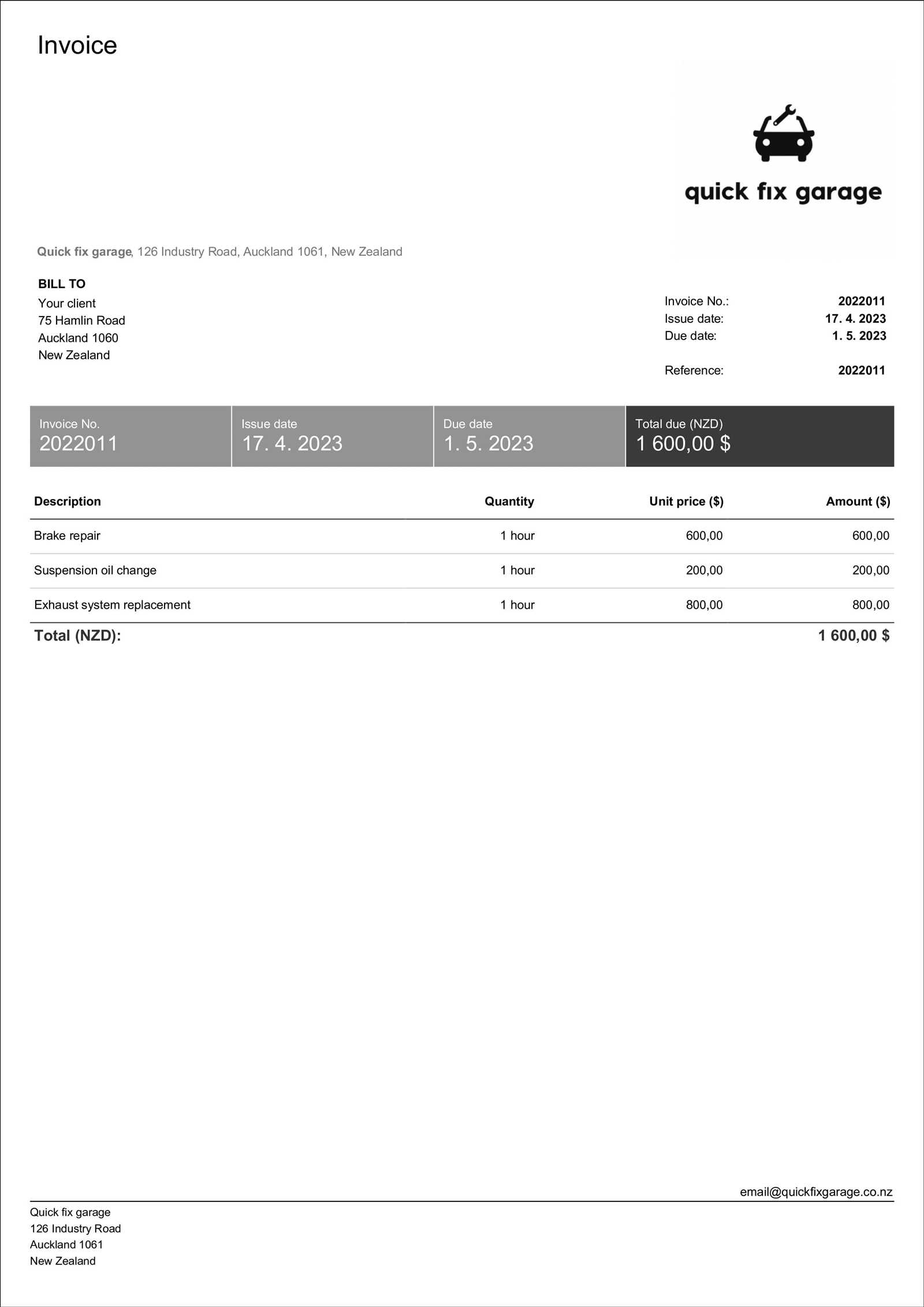

Creating structured documents for billing simplifies financial tasks and helps ensure accuracy in records. This approach enables businesses to handle billing more efficiently, providing a reliable way to keep transactions organized and professional. By leveraging ready-made forms, companies can quickly generate documents that reflect their brand and meet their unique requirements.

Setting Up for Efficiency

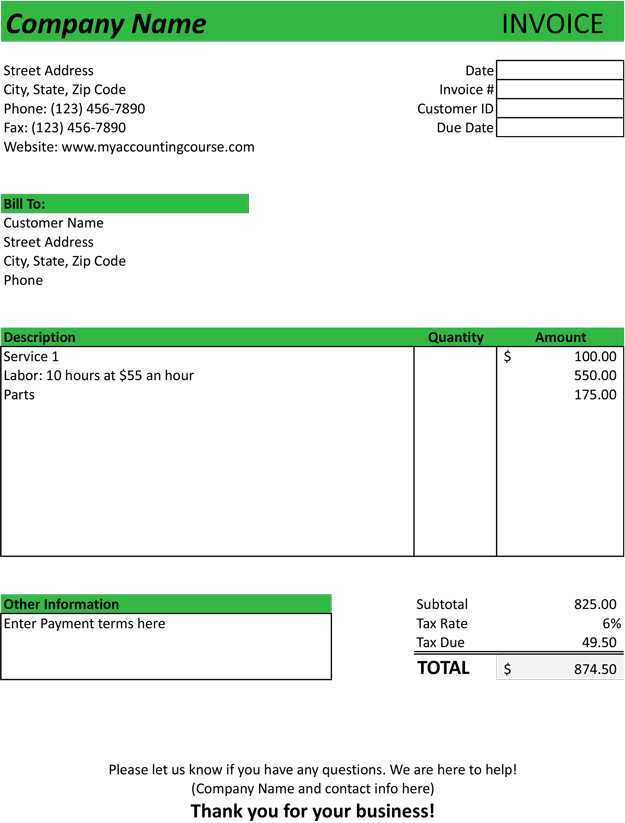

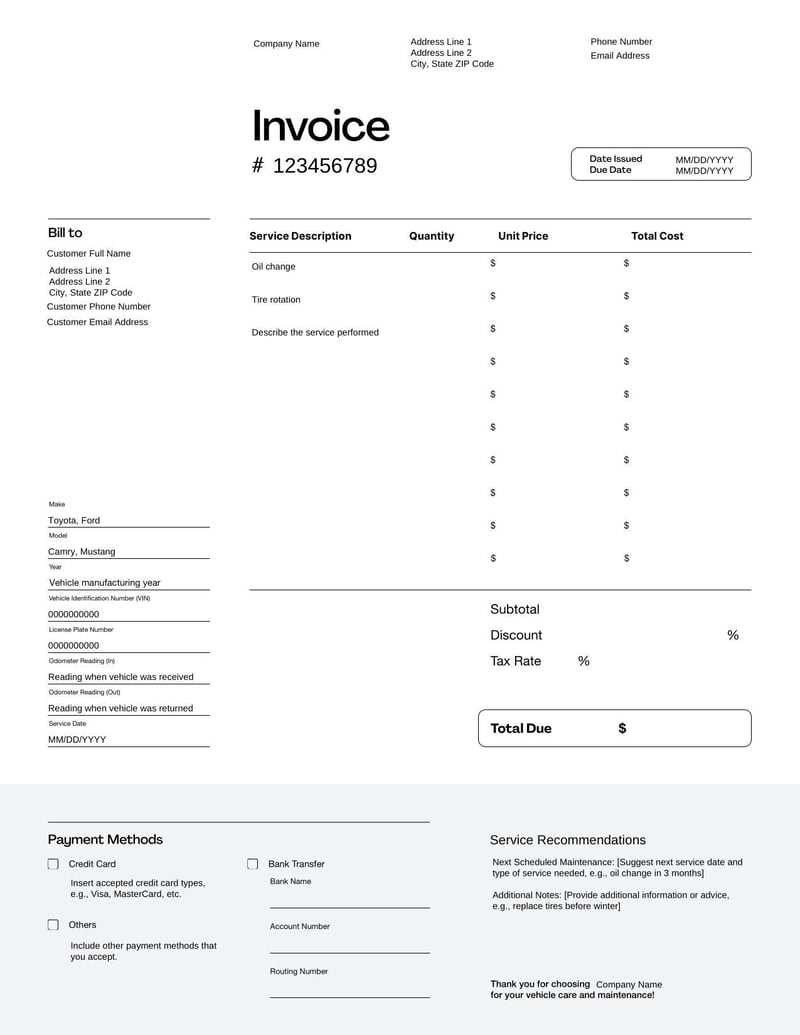

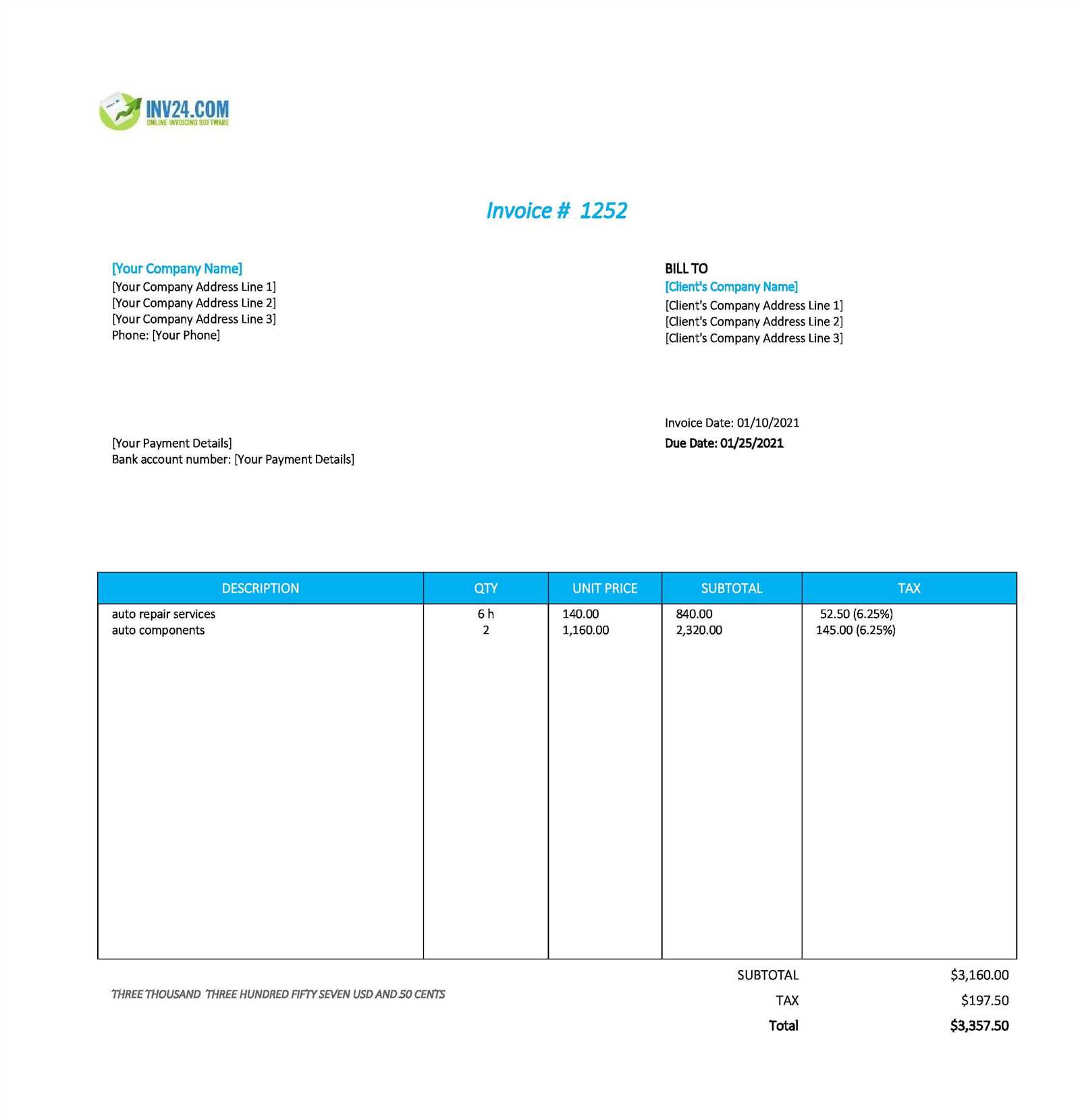

To get started, it’s essential to choose a format that aligns with your business model. This includes selecting fields that capture the necessary details, such as transaction dates, descriptions, and payment terms. Tailoring these elements allows for a more streamlined process, reducing time spent on each transaction and making data entry simpler and more consistent.

Advantages of Consistent Document Structures

Consistent formats help create a cohesive system where every record follows a standardized format. This consistency improves workflow, reduces the likel

Benefits of Using Automated Templates

Implementing structured digital forms for billing operations offers significant advantages, simplifying processes and enhancing the quality of financial documentation. Such methods contribute to improved accuracy and efficiency, allowing companies to dedicate more time to core activities and less to repetitive administrative tasks.

Benefits of Using Automated Templates

Implementing structured digital forms for billing operations offers significant advantages, simplifying processes and enhancing the quality of financial documentation. Such methods contribute to improved accuracy and efficiency, allowing companies to dedicate more time to core activities and less to repetitive administrative tasks.

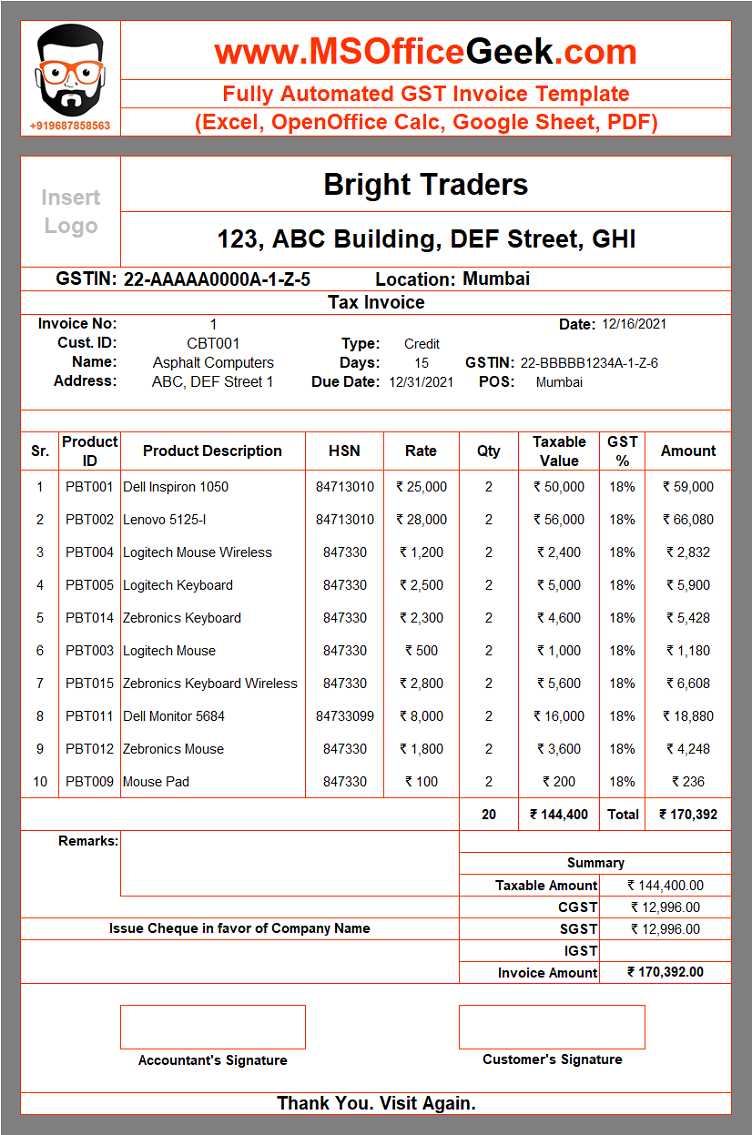

Below is a table highlighting some key advantages of utilizing organized digital formats in financial workflows:

| Benefit | Description |

|---|---|

| Time Efficiency | Reduces the time required to generate and complete forms, streamlining the entire billing process. |

| Error Reduction | Minimizes manual input mistakes, leading to more reliable records and fewer discrepancies. |

| Consistency | Ensures all documents follow a standardized structure, making them easier to understand and manage. |

| Professionalism | Enhances the presentation of billing documents, reinforcing the brand’s image and trustworthiness. |

| Integration Capability | Allows seamless integration with other financial tools, giving businesses a complete view of their financial activities. |

By adopting these structured formats, businesses not only benefit from a more streamlined workflow but also enjoy increased accuracy and enhanced client relationships through a more professional approach to billing.

Setting Up a Custom Invoice Template

Creating a personalized format for billing documents helps align the payment process with a company’s unique requirements and branding. By customizing specific details, businesses can ensure that each record not only includes essential information but also reflects a professional and cohesive image.

To set up a tailored format effectively, consider the following key steps:

- Define Essential Fields

- Include basic transaction information, such as date, payment terms, and amounts due.

- Determine which additional details, like purchase descriptions or account numbers, are necessary for clarity.

- Incorporate Branding Elements

- Add your company’s logo, color scheme, and font style to maint

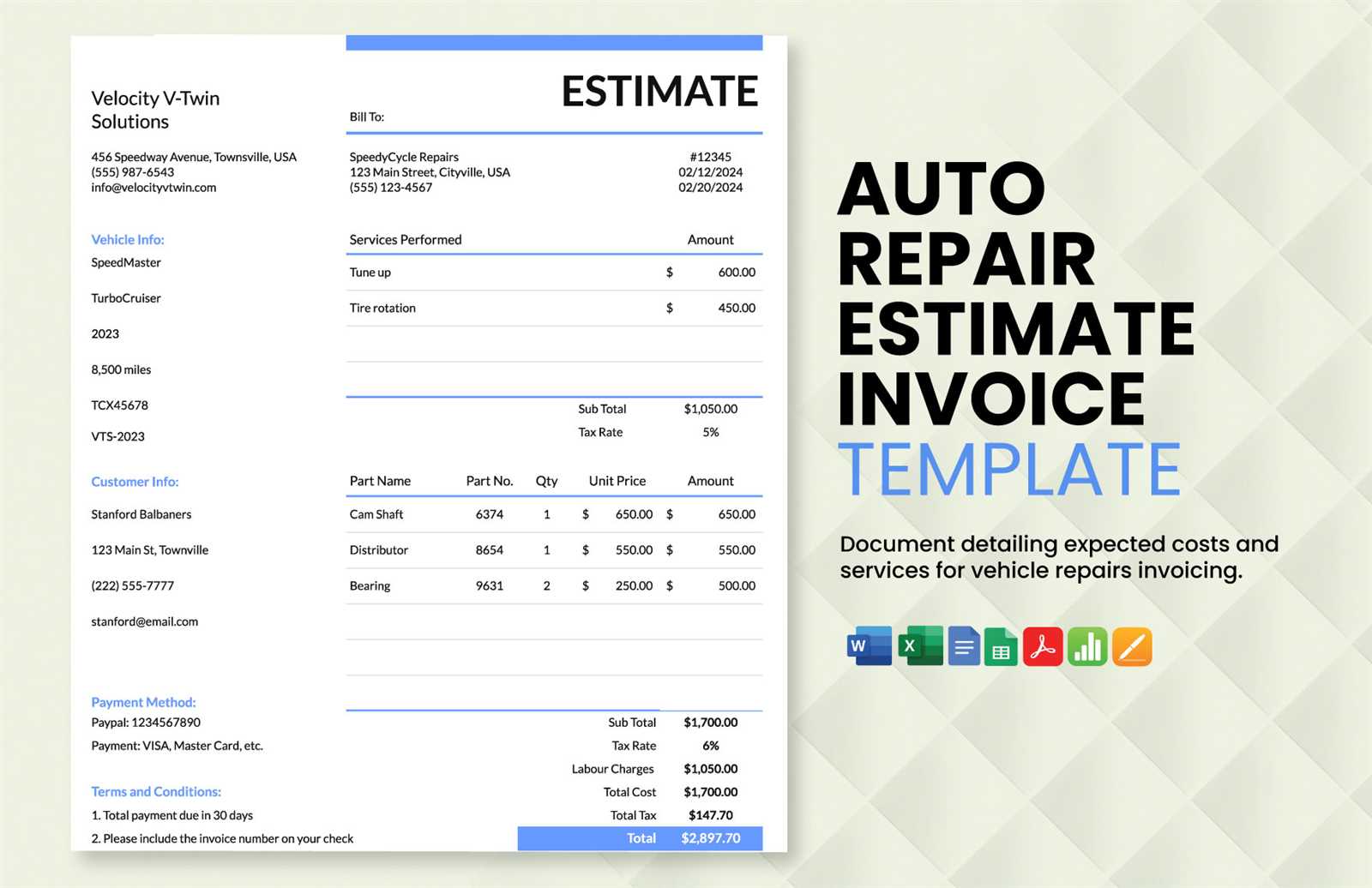

Key Features of Automated Invoices

Modern digital billing solutions come equipped with various functions that make the payment process faster, more accurate, and easier to manage. These features help streamline repetitive tasks, reduce errors, and provide businesses with a reliable way to handle transactions efficiently.

Here are some of the essential features to look for:

- Customizable Fields

- Adapt forms to fit specific business needs by adding or modifying fields for unique data requirements.

- Include personalized details such as customer-specific notes or service descriptions.

- Automatic Calculations

- Built-in fo

Key Features of Automated Invoices

Modern digital billing solutions come equipped with various functions that make the payment process faster, more accurate, and easier to manage. These features help streamline repetitive tasks, reduce errors, and provide businesses with a reliable way to handle transactions efficiently.

Here are some of the essential features to look for:

- Customizable Fields

- Adapt forms to fit specific business needs by adding or modifying fields for unique data requirements.

- Include personalized details such as customer-specific notes or service descriptions.

- Automatic Calculations

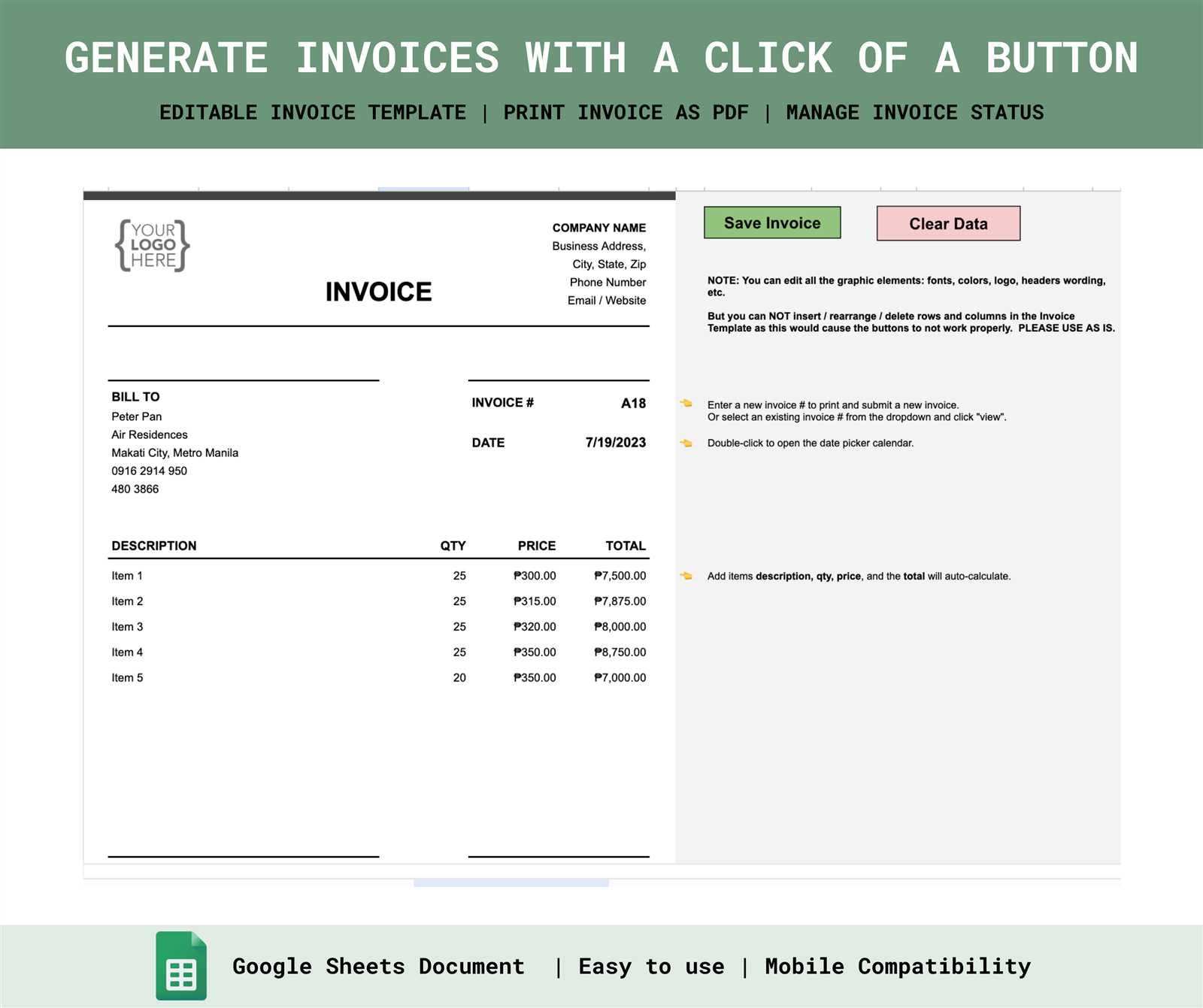

- Built-in formulas instantly calculate totals, taxes, and discounts, ensuring accuracy without manual input.

- Eliminates the risk of calculation errors, providing both you and the client with reliable figures.

- Scheduled Reminders

- Set up automatic notifications to remind clients of upcoming or overdue payments.

- Improve cash flow by reducing delays in receiving payments.

- Seamless Data Integration

- Syncs with accounting software and customer management systems, keeping records consistent and updated.

- Enables easy data sharing between departments for more efficient management.

- Detailed Tracking and Reporting

- Monitor the status of every transaction, from creation to payment.

- Generate reports on client payment habits, outstanding amounts, and revenue trends for better business insights.

These features make digital billing solutions an invaluable tool for businesses, helping to create a smooth and reliable transaction experience while maintaining accuracy and consistency in every document.

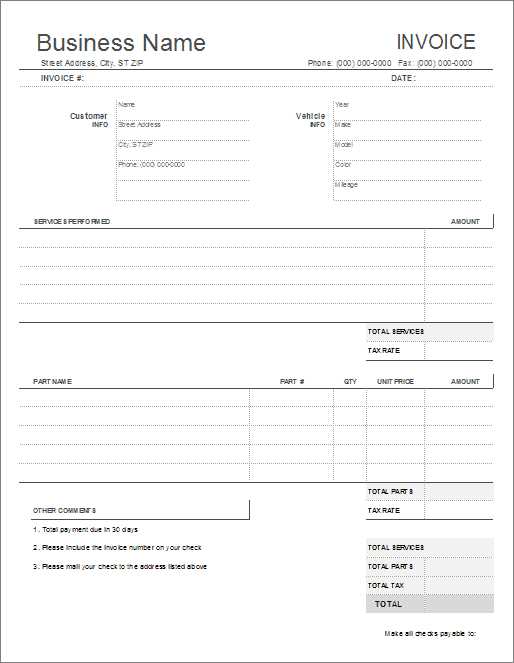

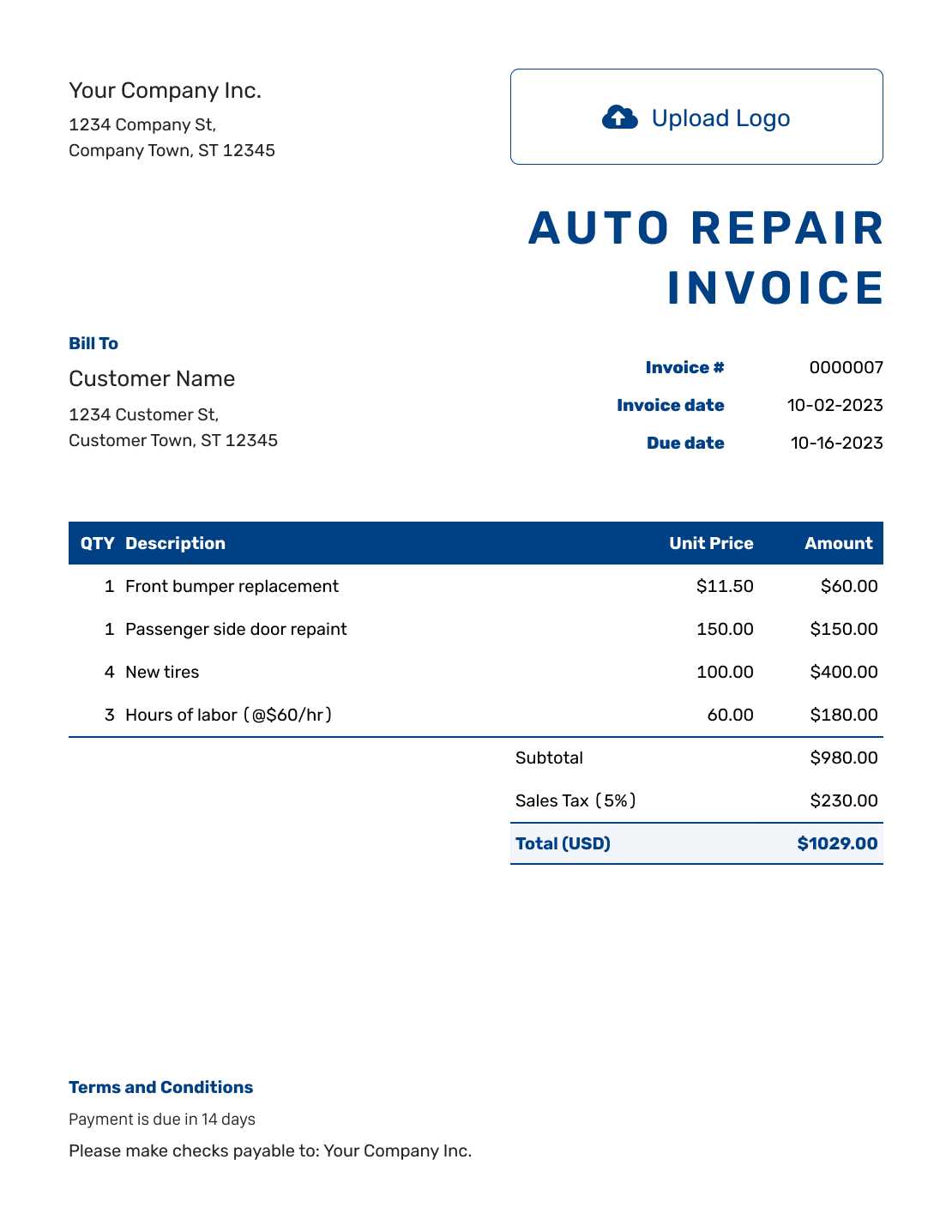

Reducing Errors in Billing Processes

Minimizing mistakes in financial documentation is essential for maintaining accurate records and ensuring customer satisfaction. By using a structured approach to billing, businesses can reduce the likelihood of discrepancies, improve consistency, and provide a smoother experience for clients.

Implementing Clear Data Entry Standards

One effective way to prevent errors is by establishing clear guidelines for data entry. Having standardized fields and formats allows team members to input information correctly and consistently. Mandatory fields for key details, such as client information, service descriptions, and amounts, help ensure that no critical information is overlooked.

Using Validation and Review Processes

Another crucial step in error reduction is the use of validation rules and periodic checks. Automated checks can alert team members to missing or inconsistent data, while

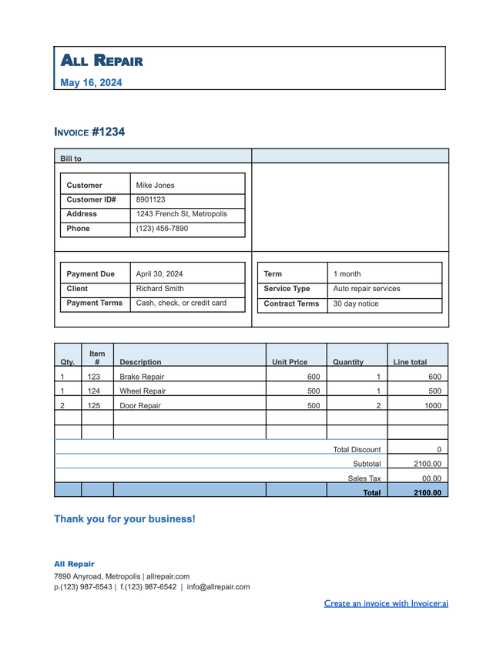

Choosing the Right Invoice Template

Selecting the appropriate format for billing documents is crucial for ensuring clarity and professionalism in financial transactions. A well-chosen layout not only enhances readability but also aligns with a company’s branding and operational requirements, contributing to a positive client experience.

Assessing Business Needs

Before deciding on a specific format, it is essential to evaluate the unique needs of your business. Consider the following factors:

- Nature of Services or Products

- Choose a layout that effectively communicates the details of the services or goods provided.

- Ensure that any industry-specific requirements are accommodated within the format.

- Client Preferences

- Understand the expectations and preferences of your clients regarding billing documentation.

- Consider whether a more traditional or modern approach suits your clientele better.

- Scalability

- Select a format that can grow with your business and adapt to changing needs over time.

- Ensure that it allows for the addition of new services or customization options as required.

Evaluating Design and Functionality

Once you have identified your needs, focus on the design and functionality of potential formats. Look for:

- Clarity and Simplicity

- A clean design that emphasizes important information like totals and due dates.

- A layout that avoids clutter, ensuring that clients can easily navigate through the document.

- Customizability

- Options to modify elements such as colors, fonts, and fields to reflect your brand.

- Flexibility to incorporate additional notes or terms relevant to specific transactions.

By carefully assessing your business needs and evaluating design options, you can select a suitable format that enhances your billing processes and improves communication with clients.

Integrating Templates with Accounting Software

Seamlessly combining billing formats with financial management tools is vital for streamlining operations and enhancing productivity. This integration not only simplifies the invoicing process but also ensures that all financial data is accurately recorded and easily accessible.

Benefits of Integration

Integrating billing formats with accounting systems offers numerous advantages:

- Efficiency Improvement

Automating data transfer reduces the need for manual entry, minimizing errors and saving time.

- Real-Time Financial Tracking

Integrated systems allow for immediate updates to financial records, providing an accurate overview of cash flow and outstanding payments.

- Enhanced Reporting

Access to consolidated data improves the ability to generate comprehensive reports for analysis and decision-making.

Steps for Successful Integration

To effectively integrate billing formats with accounting software, follow these key steps:

- Choose Compatible Software

Select accounting tools that support the formats you plan to use, ensuring they can easily communicate with one another.

- Set Up Data Mapping

Define how information from the billing documents will correspond with fields in the accounting system, ensuring accuracy and completeness.

- Test the Integration

Run tests to verify that data transfers correctly and that all necessary information is accurately reflected in the accounting software.

By integrating your billing formats with accounting systems, you can create a more efficient workflow that enhances financial management and improves overall business performance.

Tracking Payments Automatically

Efficiently monitoring financial transactions is essential for maintaining a healthy cash flow and ensuring timely revenue collection. Implementing systems that can track payments in real-time not only streamlines operations but also enhances overall financial visibility.

Advantages of Automated Tracking

Utilizing technology for payment tracking offers several benefits:

- Time Savings

Automated systems eliminate the need for manual tracking, allowing businesses to focus on more strategic tasks.

- Increased Accuracy

Reducing human error ensures that all payment records are precise, leading to fewer discrepancies and improved trust with clients.

- Real-Time Insights

Instant access to payment status allows businesses to identify overdue accounts quickly and take necessary actions.

Implementing Payment Tracking Systems

To effectively set up automatic payment monitoring, consider the following steps:

- Select Suitable Software

Choose financial management tools that offer integrated payment tracking capabilities, ensuring they align with your business needs.

- Establish Notification Preferences

Configure alerts for payment confirmations, overdue reminders, and any other relevant notifications to keep all stakeholders informed.

- Regularly Review Reports

Utilize reporting features to analyze payment trends, helping to identify patterns that can inform future financial strategies.

By implementing systems that track payments automatically, businesses can enhance their financial operations, improve cash flow management, and foster better relationships with their clients.

Improving Customer Experience with Automation

Enhancing the overall satisfaction of clients is crucial for any business aiming to foster loyalty and drive growth. Leveraging technology to streamline processes can significantly contribute to a more positive experience for customers, ultimately leading to better retention rates and increased referrals.

Streamlined Communication

Efficient communication is vital for customer engagement. By using automated systems, businesses can:

- Provide Instant Responses

Automation enables quick replies to customer inquiries, reducing wait times and improving satisfaction.

- Send Personalized Updates

Clients appreciate tailored communications, such as order confirmations and shipping notifications, enhancing their overall experience.

- Facilitate Feedback Collection

Automatically gathering feedback through surveys helps businesses understand client needs and improve services accordingly.

Enhanced Service Efficiency

Implementing automated solutions can also improve service delivery in various ways:

- Faster Processing Times

Automated workflows minimize delays in service provision, allowing clients to receive their products or services more swiftly.

- Consistent Quality

Automation helps maintain high standards by standardizing processes, ensuring that all clients receive the same level of service.

- Proactive Issue Resolution

By monitoring transactions and customer interactions, businesses can identify and address potential issues before they escalate, further enhancing satisfaction.

By integrating automation into customer interactions and service delivery, businesses can create a seamless and enjoyable experience that not only meets but exceeds client expectations.

Top Software for Invoice Automation

Choosing the right software is essential for streamlining billing processes and enhancing overall efficiency. Various solutions are available in the market, each offering unique features designed to simplify the management of financial documents. Selecting the appropriate software can significantly impact a business’s ability to manage its financial transactions smoothly.

Essential Features to Consider

When evaluating different options, consider the following features that can enhance usability:

- User-Friendly Interface: A simple and intuitive design makes it easy for users to navigate the software.

- Customizable Options: The ability to tailor documents to fit specific business needs ensures that branding is maintained.

- Integration Capabilities: Compatibility with other accounting or business management tools is vital for a seamless workflow.

- Automated Reminders: This feature helps ensure timely payments by sending notifications to clients.

Comparison of Leading Software Solutions

Software Name Key Features Pricing FreshBooks Time tracking, customizable invoices, expense tracking Starting at $15/month Zoho Invoice Multi-currency support, automated workflows, recurring billing Free for up to 5 customers, paid plans start at $9/month QuickBooks Online Comprehensive accounting features, reports generation, integrations Starting at $25/month Wave No cost for basic features, customizable invoices, payment processing Free for basic features, transaction fees for payments By assessing the features and pricing of these top solutions, businesses can make informed decisions that will enhance their financial management processes and improve efficiency.

Managing Invoices Efficiently

Effective management of financial documents is crucial for maintaining cash flow and ensuring timely payments. Streamlining processes can lead to reduced errors and increased productivity. By implementing best practices and utilizing appropriate tools, businesses can enhance their operational efficiency and minimize the time spent on billing tasks.

Best Practices for Streamlined Management

To ensure a smooth workflow in handling financial documents, consider the following best practices:

- Centralized Document Storage: Keep all billing records in one accessible location to reduce search time and maintain organization.

- Consistent Formatting: Use a standardized format for all documents to ensure clarity and professionalism.

- Regular Audits: Perform periodic reviews of billing processes to identify areas for improvement and ensure compliance.

- Clear Communication: Maintain open lines of communication with clients regarding payment terms and outstanding balances.

Tools for Efficient Management

Utilizing software solutions can significantly enhance the efficiency of managing financial documents. Here’s a comparison of some popular options:

Software Name Key Features Pricing Bill.com Automated approvals, payment scheduling, integration with accounting software Starting at $39/month Square Invoicing, payment processing, inventory management No monthly fees, transaction fees apply Xero Comprehensive reporting, bank reconciliation, multi-currency support Starting at $13/month Invoicely Time tracking, client management, customizable invoices Free for basic features, paid plans start at $9.99/month By adopting best practices and leveraging appropriate tools, businesses can enhance their ability to manage financial documents efficiently, ensuring smoother operations and improved cash flow.

Security Tips for Digital Transactions

As businesses increasingly rely on electronic documentation for financial exchanges, safeguarding these records becomes paramount. Implementing robust security measures is essential to protect sensitive data from unauthorized access and cyber threats. By following best practices and utilizing the right tools, organizations can enhance their security posture and ensure the integrity of their financial transactions.

Essential Security Practices

To maintain the security of digital documents, consider adopting the following essential practices:

- Use Strong Passwords: Create complex passwords and change them regularly to prevent unauthorized access.

- Enable Two-Factor Authentication: Implement additional verification methods to add an extra layer of security.

- Regular Software Updates: Keep all software up to date to protect against vulnerabilities.

- Secure Networks: Use encrypted connections and secure Wi-Fi networks to safeguard data in transit.

Tools for Enhanced Security

Utilizing specialized tools can significantly bolster the security of digital records. Below is a comparison of some popular security solutions:

Security Solution Key Features Pricing LastPass Password management, secure sharing, dark web monitoring Free for basic, Premium starts at $3/month McAfee Total Protection Antivirus protection, secure VPN, identity theft protection Starting at $34.99/year NordVPN Secure VPN, no-log policy, multi-device support Starting at $3.71/month Bitdefender Malware protection, secure browsing, anti-phishing Starting at $19.99/year By implementing these security practices and utilizing appropriate tools, businesses can effectively protect their digital documentation and maintain the confidentiality of their financial transactions.

- Customizable Fields

- Built-in fo

- Customizable Fields

- Add your company’s logo, color scheme, and font style to maint