Free Florist Invoice Template for Easy Billing and Professional Transactions

Running a successful flower business requires not only creativity but also strong organizational skills. One of the most important aspects of managing a floral shop is ensuring that all transactions are documented clearly and professionally. Having a standardized system for creating financial documents can save you time and reduce errors, allowing you to focus on what you do best–designing beautiful arrangements.

A well-structured document for recording sales helps maintain a smooth cash flow, sets clear payment terms, and provides customers with transparent details about their purchases. It also plays a key role in managing finances and staying compliant with tax regulations. Whether you’re working with individuals or corporate clients, having a uniform way to present charges can enhance your business’s credibility and streamline your operations.

In this article, we’ll explore various ways to create and use financial records for your shop, highlighting the most essential elements to include and the best tools available to simplify the process. By implementing a reliable system, you’ll be able to improve both the efficiency and professionalism of your daily transactions.

Essential Guide to Florist Invoice Templates

For any flower shop or floral business, having a standardized way to record and present financial transactions is crucial. A well-crafted billing document serves as both a professional representation of your services and a clear record for your customers. It ensures that all sales, charges, and payments are accurately documented, which can help prevent misunderstandings and provide a streamlined approach to managing your business’s finances.

In this guide, we’ll cover the essential components that should be included in any financial record for your shop. Understanding these key elements will not only help you maintain organization but also make it easier to track payments, follow up on outstanding balances, and stay compliant with tax laws. Whether you’re just starting your business or looking to improve your current process, having a solid system in place is the foundation of effective financial management.

Why Florists Need an Invoice Template

For any flower shop or floral business, having a clear and organized system for billing is essential. Without a standardized document for recording sales and payments, managing financial transactions can quickly become chaotic. By using a structured format, you ensure that all charges are presented clearly and professionally, helping to maintain trust with clients and stay organized in your business dealings.

Professionalism and Clarity

A well-organized billing document provides your customers with clear information about the services provided, the costs, and payment terms. This level of transparency builds trust, encouraging repeat business and positive word-of-mouth recommendations. Clients appreciate a detailed and easy-to-understand receipt, as it helps them keep track of their own finances while reflecting well on your professionalism.

Efficiency and Time Savings

Creating a standard document for every transaction eliminates the need to start from scratch each time. It allows you to quickly fill in the relevant details, saving you time and reducing the chance of mistakes. Whether you’re managing multiple orders in a busy season or simply want to streamline your workflow, an efficient system is key to running a successful business.

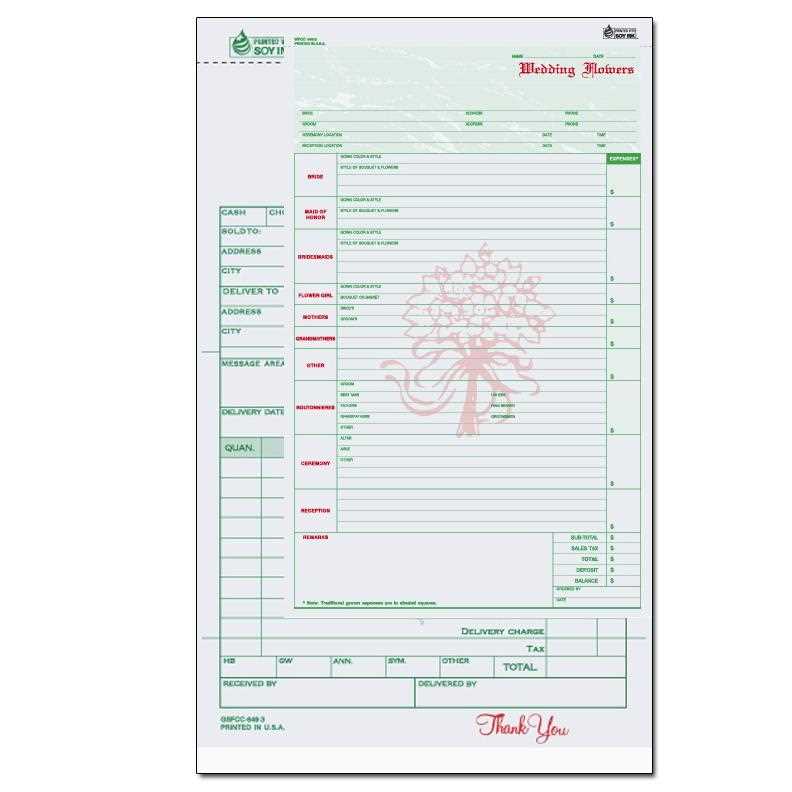

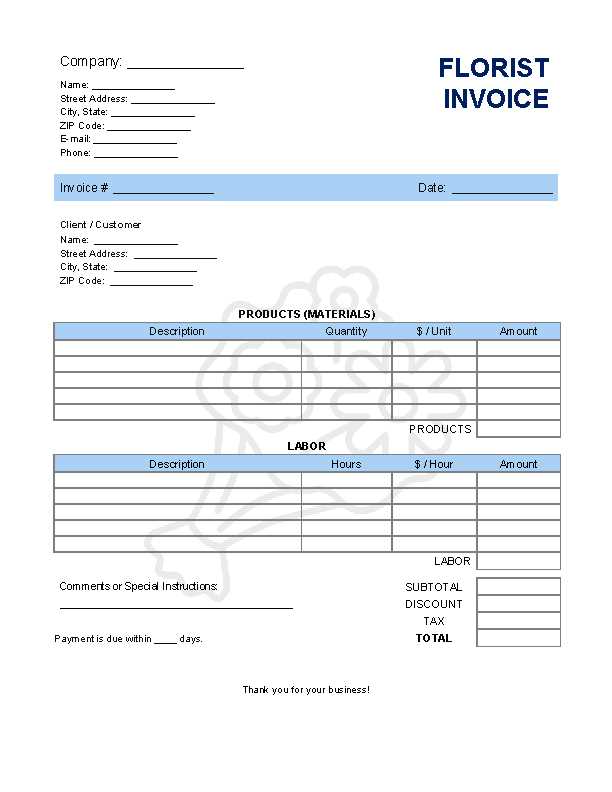

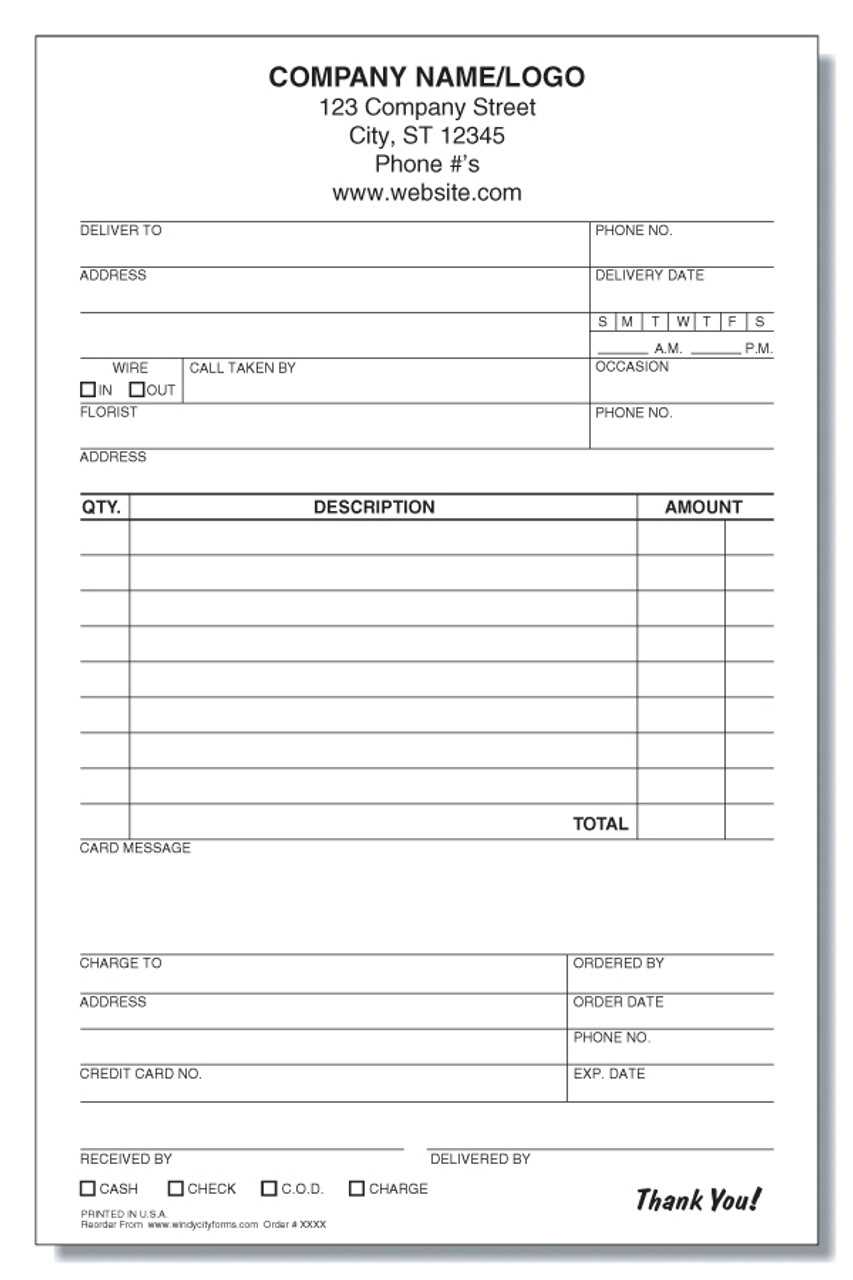

Key Features of a Florist Invoice

When creating a financial document for your flower business, it’s important to include certain key elements that ensure clarity and professionalism. These features help not only to accurately reflect the transaction but also to create a smooth experience for both you and your customers. A well-organized record is essential for maintaining transparent communication and efficient management of your finances.

Essential Information for Accuracy

One of the most important aspects of any billing document is ensuring all relevant details are included. This includes the customer’s name, contact information, and a clear description of the services provided. It’s also critical to list the costs for each item or service, along with any applicable taxes. This allows for transparency and prevents confusion, ensuring that both parties are on the same page regarding charges.

Payment Terms and Instructions

Another key feature is outlining the payment terms. This includes the due date, any late fees, and accepted payment methods. By clearly stating these terms, you set expectations and avoid misunderstandings. Additionally, providing detailed instructions on how the customer can pay, such as bank account information or online payment options, streamlines the process and encourages prompt payment.

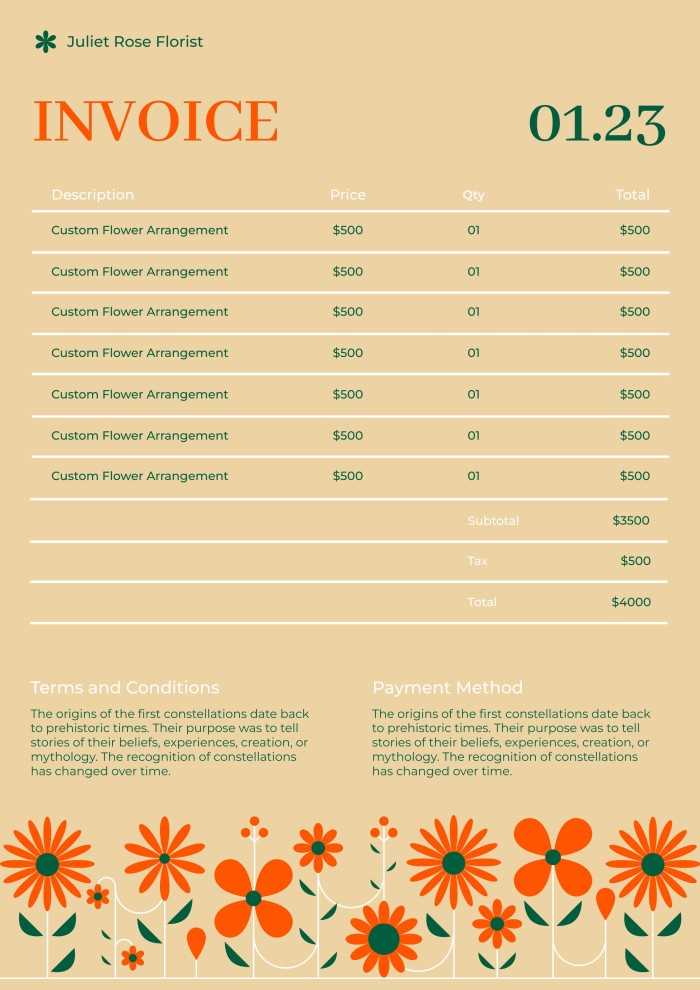

How to Customize Your Invoice Template

Customizing your billing document to fit the unique needs of your business is essential for maintaining consistency and professionalism. By tailoring your records to reflect your shop’s branding and specific service offerings, you create a more personalized experience for your customers. Customization also ensures that the document includes all necessary details relevant to your business, making it easier to manage and track payments.

Adding Your Business Branding

One of the first steps in customizing your financial document is incorporating your shop’s branding. This includes adding your business logo, name, and contact details at the top of the page. By doing so, you make the document instantly recognizable and help reinforce your brand identity. Additionally, consider using your shop’s colors and fonts to maintain a cohesive look across all your communications.

Tailoring Content to Your Services

Next, adjust the content sections to reflect the services and products you offer. For example, you can add specific categories like arrangements, delivery charges, or any other unique service your shop provides. This ensures that the document is relevant and accurate, giving your customers a clear breakdown of what they are paying for. Don’t forget to leave space for custom notes or special instructions that may be necessary for individual orders.

Common Invoice Mistakes Florists Should Avoid

Even with a well-structured billing document, mistakes can still occur, leading to confusion and delays in payment. These errors can affect your business’s credibility and may create unnecessary complications in managing finances. Understanding the most common mistakes will help you avoid them, ensuring smoother transactions and better client relationships.

Missing or Incorrect Contact Information

One of the most frequent errors is failing to include accurate contact details for both your business and your customers. If your client cannot reach you easily for questions or concerns, it could delay payment. Always double-check the contact information to ensure that the address, phone number, and email are correct. This simple step can save time and help you avoid miscommunication.

Unclear Payment Terms

Another common issue is not clearly outlining the payment terms. Without specific details regarding due dates, late fees, or accepted payment methods, your clients may be confused about when or how to pay. It’s essential to state exactly when the payment is due, along with any penalties for overdue amounts. A transparent, well-defined payment schedule helps ensure timely payments and reduces disputes.

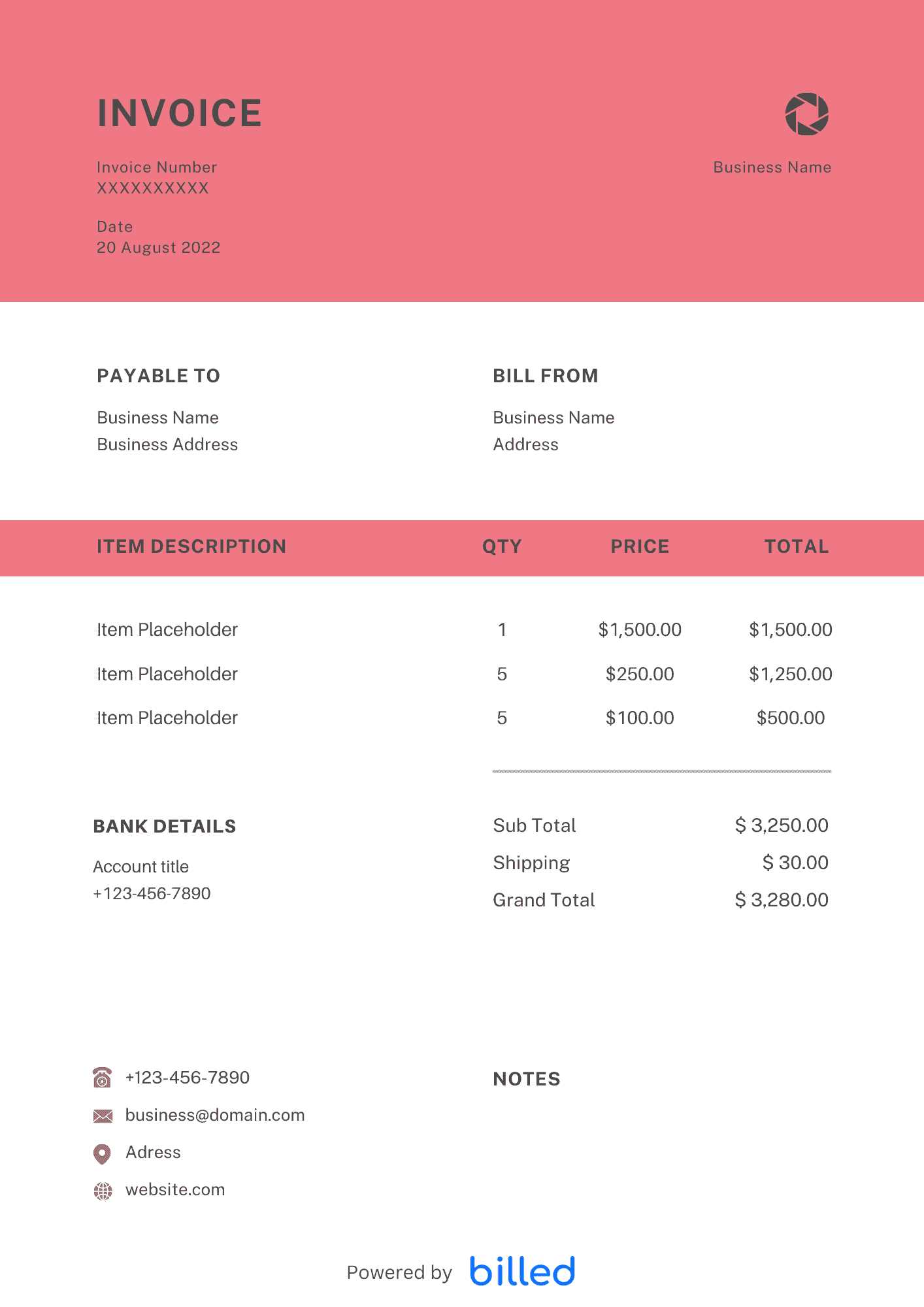

Choosing the Right Invoice Format for Your Business

Selecting the right format for your billing documents is essential for both efficiency and professionalism. Whether you are a small shop or a growing business, the format you choose will impact how you track payments, communicate with clients, and manage your financial records. The goal is to find a structure that suits your business needs while also ensuring that your customers have all the information they need to complete their transactions smoothly.

Digital vs. Paper Formats

One of the first decisions to make is whether to use a digital or paper format for your financial records. Digital documents offer several advantages, including ease of customization, quick delivery via email, and the ability to store and manage records more efficiently. On the other hand, a paper format may still be preferred by some clients who prefer physical copies for their records. Consider your customers’ preferences and the resources available to you when choosing between these options.

Simple vs. Detailed Layouts

Another important consideration is the level of detail your documents should include. For smaller orders or repeat clients, a simple layout may be sufficient, listing only the necessary information like service descriptions and totals. However, for larger or more complex transactions, a more detailed layout may be required, including sections for discounts, taxes, and additional charges. Choose a layout that balances clarity with thoroughness, ensuring that all relevant details are easy to understand.

Benefits of Using a Digital Invoice Template

Switching to a digital format for your billing documents offers numerous advantages, particularly when it comes to efficiency, organization, and accessibility. Using a structured digital document helps simplify your administrative tasks, reduces the risk of errors, and streamlines your financial workflow. Here are some key benefits that can improve how you manage transactions and communicate with clients.

- Time-Saving and Convenience: With digital documents, you can quickly generate and send bills without the need to print or mail physical copies. This reduces administrative time and allows for faster payment processing.

- Easy Customization: Digital records can be easily edited and tailored to suit specific transactions or client needs. You can update templates with new services, pricing, or promotions without starting from scratch each time.

- Efficient Record-Keeping: Storing digital files helps you stay organized and makes it easier to track previous transactions. You can easily search for past records, monitor payments, and maintain a comprehensive financial history.

- Environmentally Friendly: By reducing paper usage, you are also contributing to a more sustainable business model, which can appeal to environmentally conscious clients.

- Better Payment Tracking: Many digital platforms allow you to set reminders for overdue payments and track whether a bill has been paid or is still pending, helping to reduce the chance of missed payments.

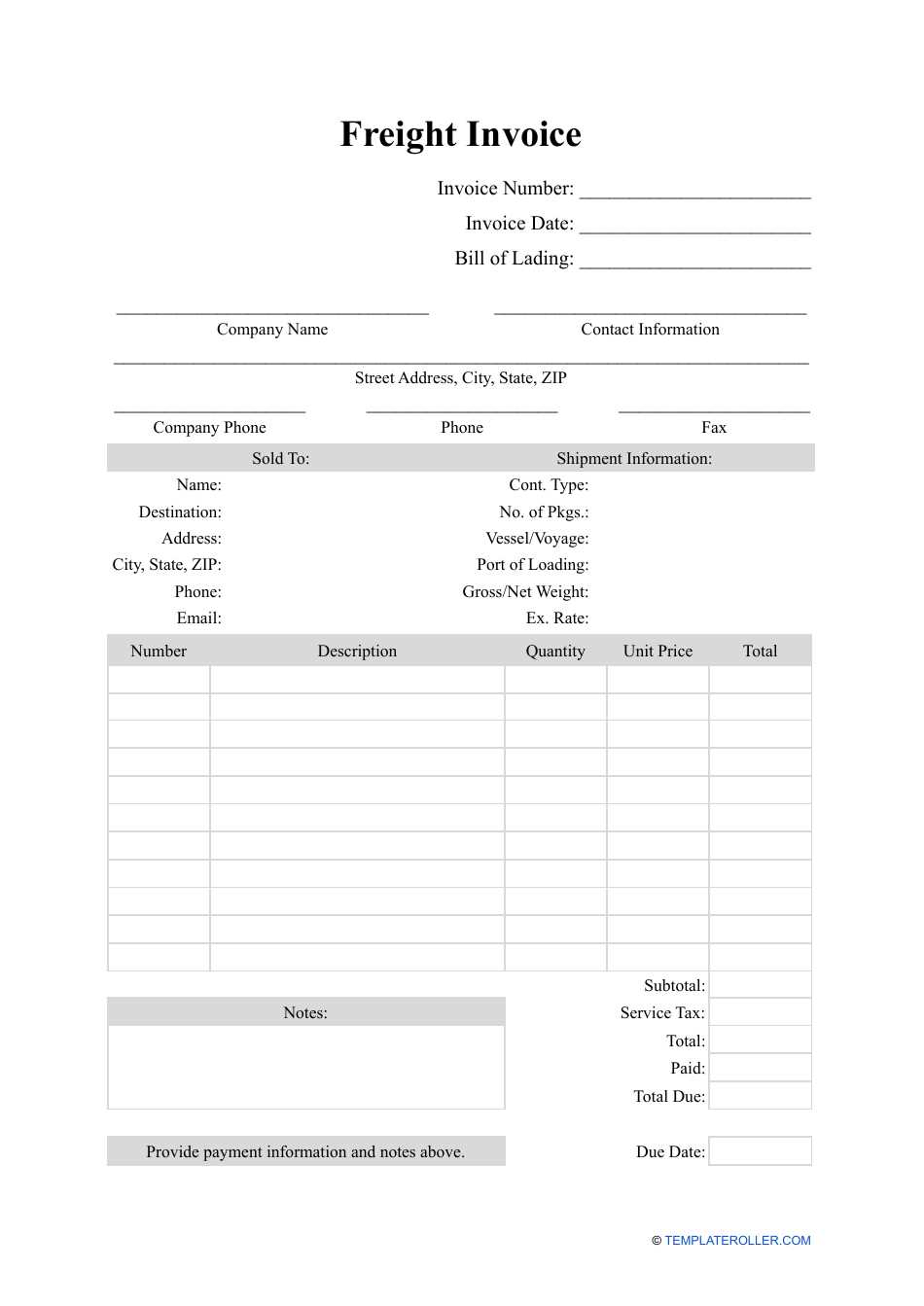

How to Create a Professional Billing Document

Creating a professional billing record is crucial for establishing trust with your clients and ensuring that all financial transactions are clearly documented. A well-designed document reflects the quality of your business and helps to maintain a smooth and efficient payment process. Here are the key steps to follow when crafting a polished and professional financial statement for your flower shop or any related business.

- Include Your Business Information: At the top of the document, clearly list your shop’s name, address, phone number, and email address. This makes it easy for clients to reach you if they have any questions about their transaction.

- Detail the Client’s Information: Include your customer’s name, address, and contact details. This ensures the document is properly personalized and easily identifiable for both parties.

- Provide a Unique Identification Number: Assigning a unique number to each billing record helps you stay organized and track payments. This number should be easy to reference for both you and your clients.

- List Services and Products: Clearly describe each service or product provided, including quantities and prices. Be specific to avoid confusion, and break down the charges as needed (e.g., for delivery or special requests).

- Include Payment Terms: Specify the total amount due, payment methods accepted, and due date. If applicable, outline any late fees or discounts for early payments.

- Use a Clean and Organized Layout: A well-organized document with clear headings and spacing makes it easier for the client to read and understand the charges. Use a simple, professional font and keep the design uncluttered.

By following these steps, you can create a billing record that enhances your professionalism and supports efficient business operations. Ensure that all the relevant information is included and presented in a clear, easy-to-read format, and your clients will appreciate the transparency and attention to detail.

How to Include Taxes in Your Billing Document

Including taxes in your billing records is an important step in ensuring compliance with local regulations and providing clear financial information to your clients. Properly calculating and displaying tax amounts helps prevent confusion and keeps both parties aligned on the total payment due. Here are some steps to follow when incorporating taxes into your financial statements.

- Determine the Appropriate Tax Rate: Before including taxes, you need to know the correct rate to apply. This will depend on your location and the type of products or services you provide. Make sure you are up-to-date with local tax laws and regulations.

- Break Down Tax Information: Clearly separate the tax amount from the total charges. Display both the subtotal (before tax) and the total amount (after tax) so that the client can easily see how the tax affects the overall cost.

- Include Tax Identification Number: In many regions, it is a requirement to display your business’s tax ID number on financial documents. This adds an extra layer of professionalism and ensures transparency in your transactions.

- Specify the Tax Jurisdiction: In some cases, especially for businesses that operate in multiple locations, it’s helpful to specify the tax jurisdiction on the document. This ensures that your clients understand which local tax rates are being applied.

- Apply Discounts Before Tax: If you’re offering a discount on an order, apply the discount to the subtotal first, before calculating the tax. This way, the tax is only calculated on the reduced amount, which can result in a lower overall tax liability for your client.

By clearly displaying taxes and following the appropriate steps for your region, you help ensure that your financial records are accurate and compliant. Being transparent with tax information also builds trust with your customers, as they can see exactly what they are paying for and why the charges are applied.

Adding Payment Terms to Your Billing Document

Clearly defined payment terms are crucial for establishing expectations between you and your clients. Including these terms in your financial records not only helps ensure timely payments but also avoids potential misunderstandings regarding due dates, late fees, and accepted payment methods. Setting clear conditions for payment allows both parties to know exactly what is expected and when.

Key Elements to Include in Payment Terms

- Due Date: Specify when the payment is expected. This could be a fixed date, such as “30 days from the date of the document,” or an event-based date, such as “Upon receipt of goods.” A clear due date encourages prompt payment.

- Accepted Payment Methods: List the types of payment you accept, such as credit cards, bank transfers, checks, or online payment systems. This ensures that clients know how they can make payments.

- Late Fees or Penalties: If you plan to charge a fee for overdue payments, clearly state this in your terms. For example, “A 5% late fee will be applied to overdue balances after 30 days.” This can encourage timely payments and protect your cash flow.

- Early Payment Discounts: Offering a discount for early payment can be a great incentive. If applicable, specify the percentage discount and the deadline for qualifying. For example, “2% discount for payments made within 10 days.”

- Partial Payments: If you allow partial payments or installment plans, make sure to outline these details clearly. Specify the amount of each installment and the due dates for each payment.

Best Practices for Payment Terms

- Keep it Simple: Avoid overly complex language and ensure that the terms are easy to understand. Clear, concise instructions make the payment process smoother for your clients.

- Highlight Important Information: Use bold or italics to emphasize critical details like due dates, late fees, and discounts, so clients don’t miss them.

- Be Consistent: Use the same terms across all transactions to avoid confusion and maintain a consistent payment process.

By clearly outlining payment terms in your financial documents, you help establish a transparent and professional relationship with your clients. These terms ensure that both you and your customers are on the same page and minimize the chances of disputes over payments.

Best Software for Managing Billing Documents

Choosing the right software to manage your billing records can significantly improve the efficiency and accuracy of your financial processes. With the right tools, you can easily create, send, and track payments, all while keeping your records organized. Here are some of the best software options available to help streamline your billing tasks, making it easier to run your business and get paid on time.

- QuickBooks: QuickBooks is one of the most popular accounting software options for small businesses. It offers customizable features that allow you to create professional billing documents, track payments, and manage taxes. With robust reporting tools and integration with various payment gateways, it helps you stay on top of your finances.

- FreshBooks: FreshBooks is a user-friendly platform ideal for businesses that need simple yet effective invoicing and accounting features. It allows you to create and send customized records, track time, and manage expenses. The platform also offers automatic payment reminders and integrates with several payment processors, ensuring fast and secure transactions.

- Zoho Books: Zoho Books is an excellent choice for businesses that want a comprehensive accounting solution. It provides tools for creating detailed records, managing taxes, and keeping track of outstanding payments. The software is customizable, offering various templates and automated workflows, making it easy to streamline your entire billing process.

- Wave: Wave is a free, cloud-based accounting tool that includes everything you need for creating and sending billing documents. It’s especially suited for smaller businesses, offering easy-to-use features for invoicing, expense tracking, and financial reporting. With no monthly fees, Wave is a great option for those just starting out or looking to manage finances on a budget.

- Invoice2Go: Invoice2Go is a mobile-friendly software designed for businesses on the go. It offers simple and intuitive tools for creating professional records, managing payments, and sending reminders. With customizable

How to Manage Payments Using Billing Records

Managing payments efficiently is essential for maintaining smooth business operations and ensuring timely cash flow. A well-structured financial document can play a key role in this process by providing both you and your customers with clear details about the amounts due, payment methods, and due dates. By using properly formatted records, you can easily track payments, reduce errors, and speed up the overall payment process.

Key Steps to Effectively Manage Payments

- Include Clear Payment Terms: Always specify the payment due date, accepted payment methods, and any applicable late fees. This helps set expectations for your customers and encourages timely payments.

- Provide Payment Instructions: Include clear instructions on how clients can pay–whether by credit card, bank transfer, or online payment platform. Offering multiple options can make the payment process more convenient for customers.

- Track Payments: After sending the billing record, regularly monitor payments and check whether they’ve been made. Most financial software or digital records allow you to mark payments as “paid” once received, helping you keep track of outstanding balances.

- Send Payment Reminders: If a payment is overdue, use reminders to encourage prompt payment. Sending polite but firm reminders can help avoid delays while maintaining good relationships with your clients.

- Offer Discounts for Early Payments: Providing a discount for early payments can incentivize customers to pay ahead of time. For example, you can offer a 5% discount if the payment is made within 10 days of receipt of the document.

Using Digital Tools to Manage Payments

- Automation: Many digital platforms allow you to set up automatic reminders or recurring billing, which can save time and reduce the risk of missed payments. These tools automatically notify clients of upcoming due dates and track payment status.

- Payment Integration: Many accounting or financial platforms integrate with popular payment systems, making it easier for clients to pay directly through the billing document. This ensures faster transactions

Streamlining Your Billing Process with Templates

Optimizing your billing workflow can save both time and effort, allowing you to focus more on running your business rather than spending excessive time on administrative tasks. Using pre-designed formats for your financial documents is a powerful way to streamline this process. With the right setup, you can quickly create accurate, professional records, ensuring that your clients receive clear details on charges and payment terms while you maintain organized financial tracking.

One of the key benefits of using structured formats is consistency. A standardized layout helps you avoid mistakes by ensuring that all necessary details are included in every document, from service descriptions to payment terms. This consistency also provides a professional image, making it easier to manage multiple transactions efficiently.

Additionally, using pre-made designs that are customizable allows you to save time on each new transaction. Instead of starting from scratch every time, you can simply update the necessary details, such as client names, services provided, and amounts due. This quick and easy process not only boosts productivity but also helps ensure accuracy in your financial records.

Furthermore, digital formats often offer integration with payment systems, allowing for faster processing and payment tracking. With automatic updates and reminders, you can manage overdue payments more effectively, enhancing your cash flow management and minimizing administrative burdens.

In summary, leveraging pre-designed formats can significantly simplify the way you handle financial documentation, making it easier to track payments, maintain accurate records, and provide a smooth experience for both you and your clients.

Legal Considerations for Billing Documents

When managing billing records, it is crucial to be aware of the legal requirements that govern business transactions. Properly formatted documents not only help maintain professionalism but also ensure that your business is in compliance with tax laws, consumer protection regulations, and contractual obligations. Understanding these legal considerations can help you avoid disputes, reduce potential liabilities, and safeguard your business interests.

First and foremost, it is essential to include all necessary details, such as your business name, address, and tax identification number, as required by local laws. These elements help establish the legitimacy of the transaction and make it easier for authorities to verify the document if needed. In addition, providing clear payment terms, including due dates and any penalties for late payments, ensures that both parties are on the same page regarding expectations.

- Tax Compliance: Depending on your location, you may be required to collect sales tax on certain products or services. Make sure to clearly show the tax rate and amount on each document to stay compliant with tax regulations. Failure to include tax details can result in penalties or fines.

- Consumer Protection Laws: In some regions, businesses must comply with specific consumer protection laws that require clear and transparent billing practices. This includes outlining return policies, warranties, and the right to dispute charges. Always ensure that these are stated in your terms and conditions.

- Data Protection and Privacy: With growing concerns about data privacy, it is essential to handle client information responsibly. Ensure that personal and payment details are securely stored and comply with data protection laws such as GDPR (General Data Protection Regulation) if applicable in your region.

Additionally, including a unique reference number for each billing record can be helpful for both tracking and legal purposes. This helps in case of any future disputes, as it provides a clear point of reference for both you and your clients.

By understanding and adhering to these legal considerations, you c

How to Track Outstanding Payments Effectively

Tracking unpaid balances is essential for maintaining healthy cash flow and ensuring that your business operations run smoothly. Effective payment tracking helps you stay organized, follow up on overdue accounts, and minimize the risk of missed payments. By using systematic methods and tools, you can keep a close eye on pending payments and take timely action when necessary.

Steps for Efficient Payment Tracking

- Set Clear Payment Terms: Before anything else, make sure your payment terms are clearly defined and agreed upon. Include due dates, payment methods, and penalties for late payments to avoid confusion down the line.

- Use Payment Management Software: Digital tools can significantly simplify the process of tracking payments. Software like QuickBooks, FreshBooks, or other accounting platforms automatically update payment statuses and send reminders for overdue amounts, helping you stay on top of accounts.

- Record Each Transaction: Every payment or pending amount should be recorded in your system immediately after a transaction takes place. This way, you can easily monitor who has paid and who still owes money.

- Create a Payment Schedule: For clients with multiple payments or installments, a detailed schedule helps track when each payment is due. This makes it easier to see if someone is falling behind and allows you to follow up promptly.

Methods for Following Up on Unpaid Balances

- Send Friendly Reminders: If a payment is overdue, start with a polite reminder. Sending a gentle but firm email or message can often resolve the issue before it becomes a bigger problem.

- Offer Flexible Payment Plans: For clients struggling to pay the full amount, consider offering flexible payment options. Breaking down larger amounts into smaller, manageable payments can encourage prompt settlement.

- Track and Update Payment Status: Regularly review and update the status of outstanding payments. This will help you identify patterns in late payments and take corrective actions, such as adjusting credit terms or offering discounts for early payment.

By staying organized and proactive, you can track outstand

Free vs Paid Billing Document Formats

When choosing the right format for your financial documents, businesses often face the decision of whether to go with free or paid solutions. Both options have their advantages, but understanding the key differences can help you select the one that best fits your business needs. Free formats are accessible and cost-effective, but paid options typically offer more advanced features and customization. Below is a comparison of both types to help you make an informed choice.

Feature Free Options Paid Options Customization Limited customization, often with predefined designs Highly customizable, with options to tailor the format to your brand Design Quality Basic designs, may lack professional appeal High-quality, professional designs that reflect your business image Features Basic features, may not include advanced functions like automatic calculations Advanced features such as tax calculations, payment tracking, and integration with accounting software Support Limited or no customer support Full customer support, often with training materials or live help Cost Free of charge Subscription or one-time fee Security May have limited data protection or sec