Free Automotive Invoice Template for Car Dealerships and Auto Repair Shops

Efficient billing processes are essential for businesses in the automotive industry. Proper documentation ensures that both service providers and customers have a clear record of transactions, helping to prevent misunderstandings and errors. A well-organized system for issuing charges not only simplifies financial management but also boosts professionalism and customer trust.

For car dealerships, repair shops, and other vehicle-related businesses, having the right tools to handle payments is crucial. By using a structured document to itemize services, parts, and labor, businesses can maintain consistency and reduce administrative burdens. These records serve as important references for future transactions, tax filings, and financial planning.

In this article, we’ll explore how businesses can benefit from using a well-designed billing structure, offering tips on customization, legal requirements, and best practices for creating clear and efficient documents. With the right approach, managing financial exchanges becomes straightforward, allowing business owners to focus more on their work and less on paperwork.

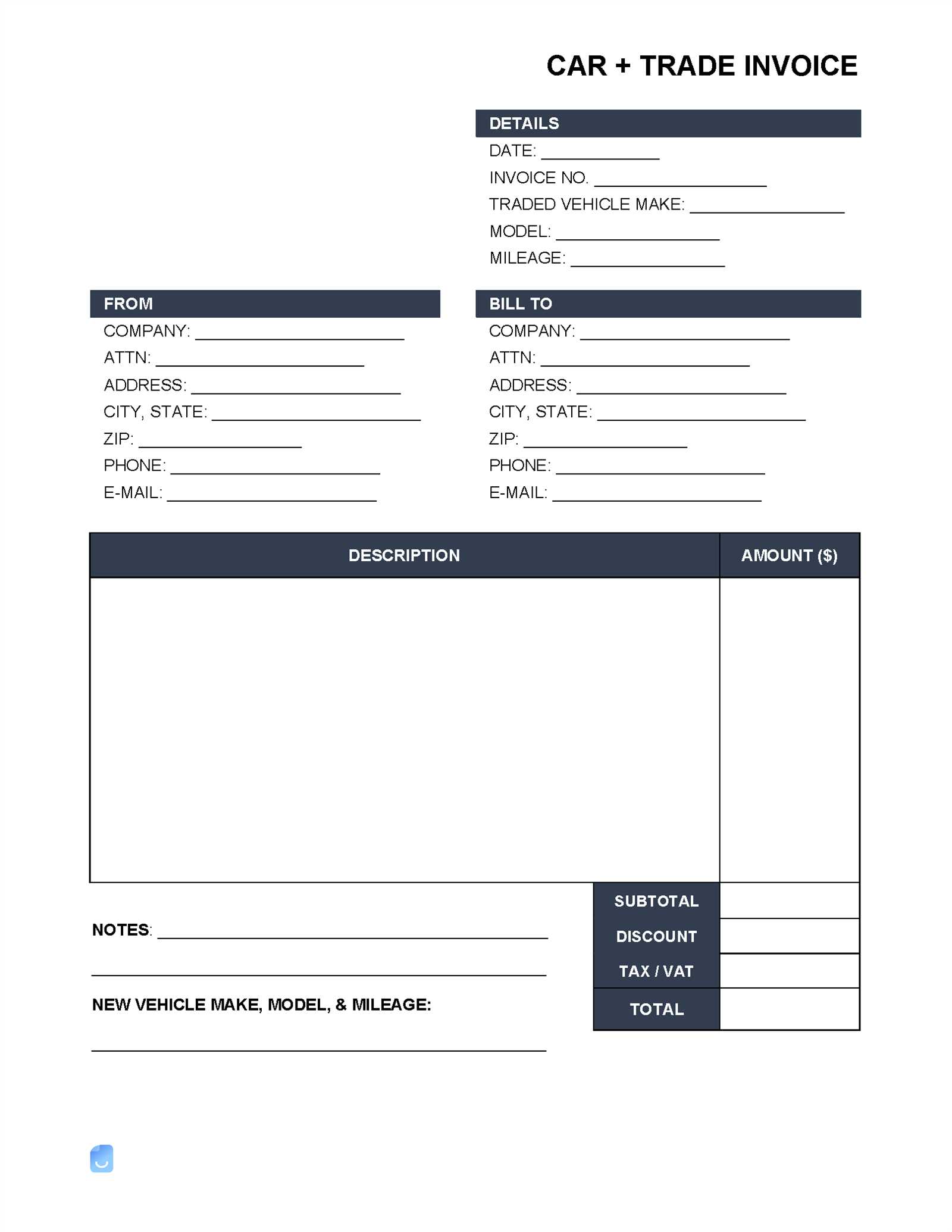

Automotive Invoice Template Overview

In any vehicle-related business, having a structured method for documenting charges is essential for smooth transactions. A well-organized document not only helps ensure accuracy but also makes the entire billing process more transparent. Such a system allows businesses to detail the services provided, list parts used, and clarify the total amount due, ensuring that both parties are on the same page.

These documents typically include key sections like service descriptions, pricing breakdowns, and payment terms. With a standardized format, businesses can save time and reduce errors, while customers benefit from clear and professional records of their purchases or repairs. This approach also supports smoother financial tracking, making it easier for companies to manage accounts and comply with tax regulations.

Ultimately, this type of billing record helps maintain a professional image, simplifies financial operations, and builds trust between service providers and their customers. It serves as a critical tool in maintaining order and efficiency in business transactions within the automotive industry.

Why Use an Automotive Invoice Template

For businesses in the vehicle service industry, maintaining a consistent and professional method for billing is crucial. Using a well-structured document for recording charges ensures that all details are captured accurately and presented clearly. This organized approach not only helps businesses stay on top of their finances but also fosters trust and transparency with clients.

One of the main advantages of utilizing such a document is the ability to reduce errors. With pre-designed formats, businesses can eliminate the need for manual calculations, making it less likely to overlook important information. Furthermore, a standardized approach saves time by streamlining the billing process, allowing employees to focus on customer service rather than administrative tasks.

Moreover, using a professional document reinforces the image of a reliable and well-managed business. Clients appreciate receiving clear, easy-to-understand records of their transactions, which can help prevent disputes. A consistent and polished billing format also ensures that the business stays compliant with tax regulations and maintains an organized financial system.

Key Features of an Invoice Template

A well-designed billing document should include several important elements to ensure clarity and accuracy in financial transactions. These essential features not only make it easier to track payments but also provide a professional appearance that reassures customers. A proper document should present all necessary details in an organized and easy-to-read format.

Firstly, clear identification of the business and customer is crucial. This includes the business name, contact information, and a unique reference number for each transaction. Itemized descriptions of services rendered or products provided are another key aspect, allowing both the service provider and customer to verify what is being charged. Additionally, specifying quantities, unit prices, and any applicable taxes helps avoid confusion.

Another important feature is the inclusion of payment terms, which outline the agreed-upon methods, due dates, and penalties for late payments. This ensures both parties understand the financial obligations. A total amount due, along with a breakdown of all charges, should be clearly visible at the bottom of the document, leaving no room for misunderstanding.

Benefits for Car Dealerships

For car dealerships, having a structured system for documenting transactions is essential for maintaining efficiency and professionalism. A clear and organized record helps streamline the sales process, reduce errors, and improve overall customer experience. By utilizing a standardized format, dealerships can better manage their finances and ensure smooth interactions with customers.

Improved Accuracy and Reduced Errors

One of the main advantages of using a consistent billing system is the reduction in errors. A well-designed document can automatically calculate totals, taxes, and other charges, minimizing the chances of human mistakes. This accuracy is essential for both the dealership and the customer, ensuring that all payments are correctly processed and avoiding costly discrepancies.

Enhanced Customer Satisfaction

Customers appreciate transparency and clarity when making a purchase, especially for significant investments like vehicles. By providing clear, detailed records, dealerships can help build trust with their clients. The simplicity of understanding all costs involved in the transaction fosters a positive experience, encouraging repeat business and word-of-mouth referrals.

Additionally, having a professional and organized document enhances the dealership’s reputation. It signals that the business is well-managed and dedicated to providing high-quality service, which can lead to stronger customer relationships and increased sales.

How to Customize Your Invoice

Tailoring your document to meet the specific needs of your business and customers is essential for creating a professional and efficient billing process. By adjusting various elements of the format, you can ensure that all necessary information is clearly presented and aligned with your company’s branding. Customization goes beyond basic adjustments, helping to build trust and streamline transactions.

Adjusting Key Information

The first step in personalizing your document is ensuring that all the critical details are included and accurate. This includes your business name, address, and contact information, as well as the recipient’s information. You can also add any legal or tax-related identifiers specific to your industry. Adjust the layout to ensure clarity, making sure all sections are easy to locate and understand.

Incorporating Branding Elements

Adding your company’s logo, selecting brand colors, and customizing fonts can greatly enhance the look and feel of your document. These elements not only help maintain consistency across your business materials but also create a sense of professionalism that clients will appreciate. Consider the tone you wish to convey, whether it’s formal or more relaxed, and make sure the visual elements reflect that style.

Best Practices for Invoicing Customers

Efficient billing practices are key to ensuring smooth transactions and maintaining strong relationships with clients. By following certain guidelines, you can ensure that the payment process is clear, professional, and timely. Adopting best practices not only reduces the chance of errors but also improves cash flow and helps avoid misunderstandings with customers.

Essential Tips for Clear Communication

To make sure your customers understand exactly what they are being charged for, follow these steps:

- Be specific: Clearly list all products, services, and charges.

- Use simple and easy-to-understand language, avoiding technical jargon unless necessary.

- Provide a detailed breakdown of costs, including taxes, discounts, and any additional fees.

- State payment terms clearly, including due dates and accepted payment methods.

Timeliness and Consistency

Maintaining a consistent and timely billing schedule helps establish trust with your clients. Here are a few practices to follow:

- Send your document promptly after services are rendered or goods are delivered.

- Stick to a regular billing cycle to avoid confusion and ensure consistency in your accounts receivable process.

- Follow up on overdue payments politely but promptly to ensure cash flow is maintained.

Choosing the Right Template for Your Business

Selecting the appropriate format for your billing and payment documents is crucial to maintaining a professional appearance and ensuring clear communication with clients. The right format should reflect your brand, be easy to read, and provide all necessary details without clutter. Customizing your document layout allows for better organization and a smoother transaction process, fostering trust and transparency.

Key Considerations for Choosing the Right Format

When deciding on a layout, consider the following factors to ensure it meets the needs of your business:

- Clarity and Simplicity: Choose a design that presents information in a straightforward and easy-to-understand manner.

- Branding: Ensure the design reflects your company’s identity through colors, fonts, and logos.

- Customization Options: Look for formats that allow you to add or remove sections based on your specific requirements.

- Legal Requirements: Ensure that the format includes all mandatory fields like tax identification numbers or other legal disclosures specific to your region.

Matching the Design to Your Business Type

Different industries may have unique requirements when it comes to the layout and details of such documents. Consider these factors when making your choice:

- Service-based businesses: A clean, simple design with clear descriptions of services rendered may be most effective.

- Product-based businesses: Detailed lists of items with quantities, prices, and product descriptions will be essential.

- Freelancers or consultants: A more personalized, less formal layout can work well, focusing on the hours worked or project milestones achieved.

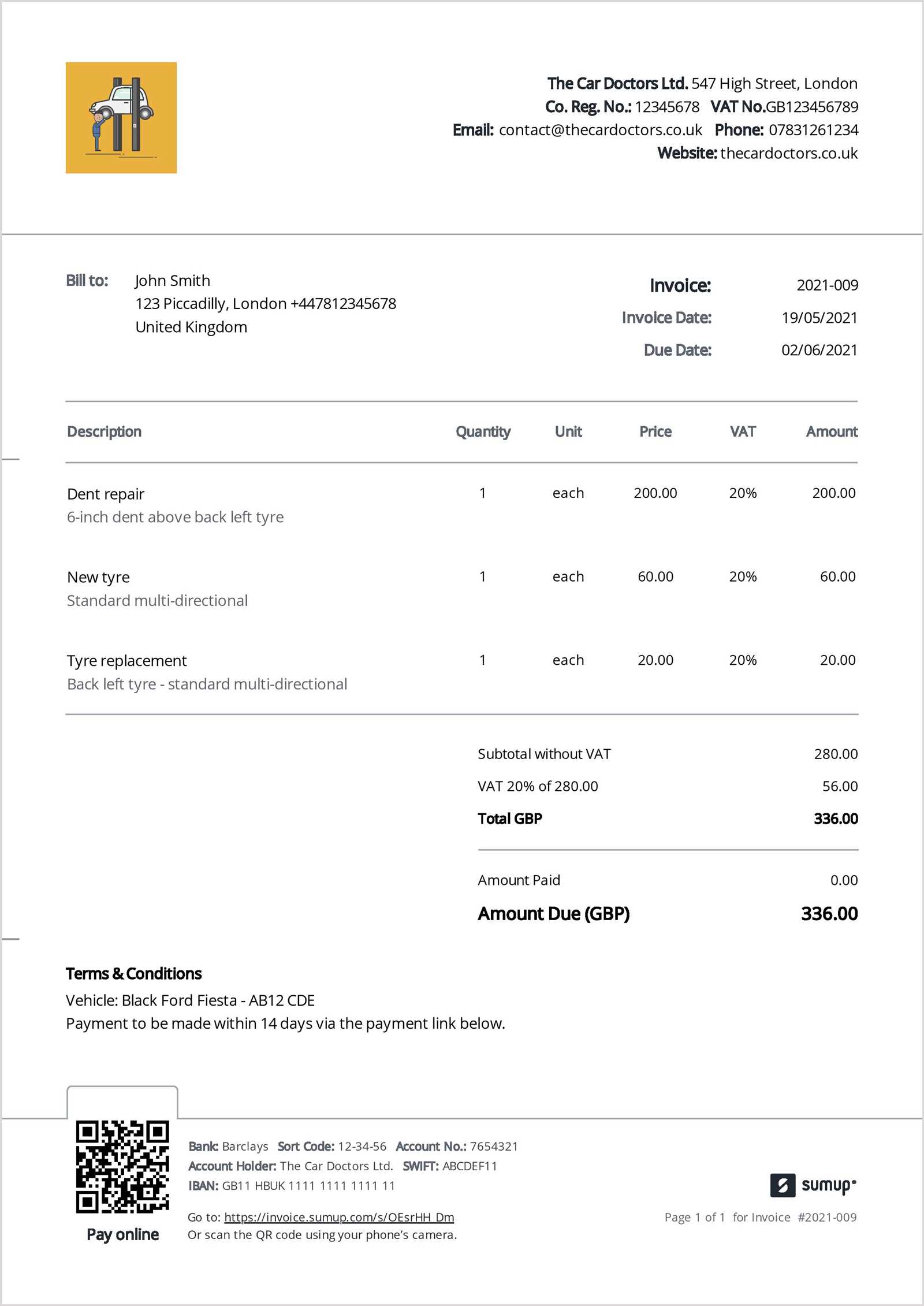

How to Include Taxes in Invoices

Properly accounting for taxes is essential to ensure compliance with legal requirements and to provide clear and accurate billing to your clients. Including the correct tax information in your documents helps avoid confusion and ensures that your customers understand the final cost of the products or services they are purchasing. It’s important to calculate and present taxes in a way that aligns with local regulations and your business practices.

Here are a few steps to effectively include taxes in your billing:

- Determine Applicable Tax Rates: Depending on your location and the nature of your products or services, you may need to apply different tax rates. Be sure to research the correct tax rates for your region and business type.

- Separate Tax from Total Amount: Clearly show the tax amount as a separate line item. This transparency allows your customers to easily see the tax applied to their total purchase.

- Specify the Tax Type: If multiple taxes apply (e.g., sales tax, VAT), list each type separately with its respective rate to avoid confusion.

- Ensure Correct Formatting: Clearly label the tax amount, such as “Sales Tax” or “VAT,” and include the percentage rate used. Make sure the total price reflects both the product or service cost and the tax amount.

By following these guidelines, you can ensure that your clients understand the breakdown of costs and that your transactions are fully compliant with tax regulations.

How to Include Taxes in Invoices

Properly accounting for taxes is essential to ensure compliance with legal requirements and to provide clear and accurate billing to your clients. Including the correct tax information in your documents helps avoid confusion and ensures that your customers understand the final cost of the products or services they are purchasing. It’s important to calculate and present taxes in a way that aligns with local regulations and your business practices.

Here are a few steps to effectively include taxes in your billing:

- Determine Applicable Tax Rates: Depending on your location and the nature of your products or services, you may need to apply different tax rates. Be sure to research the correct tax rates for your region and business type.

- Separate Tax from Total Amount: Clearly show the tax amount as a separate line item. This transparency allows your customers to easily see the tax applied to their total purchase.

- Specify the Tax Type: If multiple taxes apply (e.g., sales tax, VAT), list each type separately with its respective rate to avoid confusion.

- Ensure Correct Formatting: Clearly label the tax amount, such as “Sales Tax” or “VAT,” and include the percentage rate used. Make sure the total price reflects both the product or service cost and the tax amount.

By following these guidelines, you can ensure that your clients understand the breakdown of costs and that your transactions are fully compliant with tax regulations.

Handling Payment Terms in Invoices

Clear payment terms are essential for maintaining smooth financial transactions with clients. Outlining when and how payment should be made helps prevent misunderstandings and ensures that both parties are on the same page. By specifying payment deadlines, accepted methods, and any penalties for late payments, you create an agreement that encourages prompt payment while protecting your business interests.

Key Elements to Include in Payment Terms

When setting payment terms, it’s important to clearly define the following elements:

- Payment Due Date: Specify the exact date by which payment should be made. Common options include “Net 30,” “Net 15,” or “Due on receipt.”

- Accepted Payment Methods: List the payment options you accept, such as bank transfers, credit cards, or online payment systems like PayPal.

- Late Payment Penalties: Indicate any fees or interest charges that will apply if payment is not received by the due date.

How to Communicate Payment Terms Effectively

It’s important to make your payment terms easy to understand. Consider the following tips:

- Be Specific: Avoid vague language. Clearly state your expectations for payment deadlines, methods, and penalties.

- Highlight Key Details: Use bold or underlined text to emphasize the due date, late fees, and payment methods to ensure these terms stand out.

- Provide Multiple Payment Options: Offering flexibility in how clients can pay makes it easier for them to settle their balance on time.

By handling payment terms clearly and professionally, you help establish a strong business relationship built on trust and transparency.

Legal Requirements for Automotive Invoices

Ensuring that your billing documents comply with legal standards is crucial for maintaining proper business practices and avoiding potential disputes with clients or authorities. Various regions have specific regulations regarding what must be included in such documents to ensure transparency, accuracy, and compliance with tax laws. Understanding these requirements helps protect your business and ensures that all transactions are legally sound.

Mandatory Information to Include

There are several key details that must be present in all billing documents to meet legal requirements. These include:

- Business Information: Your company name, address, and contact details, including your business registration number or tax ID if applicable.

- Customer Information: The recipient’s full name or business name, address, and contact details.

- Transaction Details: A clear description of the products or services provided, including quantities, prices, and any applicable discounts.

- Tax Information: The correct tax rates applied to the transaction and the total amount of tax charged. This is especially important for VAT or sales tax reporting.

- Payment Terms: The agreed-upon payment due date and the methods of payment that are accepted.

Regional Considerations and Compliance

It’s important to note that legal requirements can vary depending on your country or region. Some specific regulations to consider include:

- VAT/Sales Tax Regulations: In certain countries, taxes must be separately itemized, with clear reference to the applicable rates.

- Retention of Records: You may be required by law to retain records of transactions for a specified period (e.g., 5-7 years) for tax or audit purposes.

- Electronic vs. Paper Documents: Some jurisdictions have specific rules regarding the format of billing documents (whether they must be paper or can be issued electronically).

By adhering to these legal requirements, you not only ensure compliance wit

How to Track Outstanding Invoices

Keeping track of unpaid bills is essential to maintain cash flow and avoid financial issues. A systematic approach to monitoring outstanding amounts ensures that you can follow up with clients in a timely manner, reduce late payments, and improve your business’s financial stability. Implementing effective tracking methods helps you stay organized and proactive when managing overdue accounts.

Methods for Tracking Unpaid Bills

There are several tools and techniques you can use to effectively track unpaid balances:

- Use Accounting Software: Many software options provide automated tracking, allowing you to set reminders for overdue payments and generate reports on outstanding amounts.

- Manual Tracking with Spreadsheets: If you prefer a more hands-on approach, creating a spreadsheet with columns for due dates, payment status, and amounts owed can help you stay on top of pending payments.

- Implement a Reminder System: Set up automated email reminders or phone calls to notify clients of upcoming or overdue payments.

Best Practices for Managing Outstanding Balances

Following these best practices can improve your success rate in collecting payments on time:

- Set Clear Payment Terms: Clearly outline payment expectations upfront and ensure clients understand the due date and any penalties for late payments.

- Send Regular Follow-ups: Don’t hesitate to follow up regularly with clients whose payments are overdue. Be polite but firm in requesting the outstanding balance.

- Offer Payment Plans: For clients facing financial difficulties, consider offering flexible payment arrangements to encourage timely settlements.

By tracking unpaid balances efficiently and taking proactive steps, you can reduce the risk of bad debt and maintain a healthier cash flow for your business.

Design Tips for Professional Invoices

The design of your billing documents plays a crucial role in how your business is perceived by clients. A well-structured, visually appealing layout not only enhances professionalism but also ensures clarity and ease of understanding. Effective design helps clients quickly find essential details, reduces confusion, and builds trust in your business.

Key Elements of a Well-Designed Document

To create a polished and professional document, focus on these design principles:

- Clear Structure: Organize the content into clearly defined sections, such as contact information, transaction details, taxes, and payment terms. Use headers, bullet points, and consistent spacing to improve readability.

- Readable Fonts: Choose easy-to-read fonts that reflect your brand’s tone. Avoid overly decorative fonts, and ensure that the font size is large enough for easy reading.

- Brand Consistency: Incorporate your company logo, brand colors, and consistent fonts to maintain a professional and cohesive look across all your business documents.

- White Space: Don’t overcrowd the document with text. Ample white space around sections helps focus attention on the most important details and makes the document visually appealing.

Enhancing Client Experience with Design

Beyond aesthetics, good design contributes to a smooth client experience. Consider these additional tips:

- Highlight Key Information: Emphasize important details such as due dates, payment methods, and total amounts with bold text or color to ensure they stand out.

- Provide Visual Cues: Use icons or lines to separate sections and guide the reader’s eye through the document, making it easier for clients to navigate the information.

- Responsive Design: Ensu

Integrating Invoices with Accounting Software

Integrating billing documents with accounting software can significantly streamline your financial management. This connection reduces the need for manual data entry, minimizes errors, and helps keep your records up to date. By automating the process, you can focus more on growing your business while ensuring that financial reports are accurate and compliant with tax regulations.

Benefits of Integration

When you integrate billing systems with accounting software, you unlock several advantages:

- Time Savings: Automation speeds up the process, eliminating the need to manually enter payment details into accounting systems.

- Reduced Errors: Data entered automatically from billing records reduces human error, ensuring accuracy in financial reporting.

- Real-Time Updates: Your records are updated in real-time, which helps you maintain an accurate overview of your financial status at any given moment.

- Improved Cash Flow Management: Automated tracking of outstanding payments and due dates helps you follow up more effectively and maintain steady cash flow.

How to Set Up the Integration

Integrating your billing system with accounting software is typically straightforward, but there are a few steps to follow:

- Choose Compatible Software: Ensure the software you choose supports integration with your current billing system. Many modern platforms offer built-in features for seamless connections.

- Link Both Systems: Follow the software provider’s instructions to connect your billing platform to your accounting software. This might involve syncing customer information, transaction details, and payment history.

- Automate Data Transfer: Set up rules or triggers to automatically transfer payment information and billing details to your accounting system. This step helps reduce the need for manual updates.

- Regularly Review Integration: Periodically check that the integration is working properly and that all data is syncing as expected. Update software versions to keep eve

Automotive Invoice Template for Auto Repairs

When running an auto repair business, clear and detailed documentation is essential for both the service provider and the customer. A well-organized billing document helps ensure transparency, builds trust, and avoids misunderstandings. This document serves as an official record of the work performed, the parts used, and the overall cost, ensuring that all parties are on the same page about the services provided.

Key Elements of a Repair Bill

A professional bill should include all the necessary details, such as a clear description of the repairs done, labor charges, and any parts replaced. It’s important to provide itemized information so that customers can understand what they are being charged for. Accuracy and transparency are key to fostering positive relationships and encouraging repeat business.

Customizing Your Document

Each repair shop may have unique services and pricing structures, so the document should be customizable. Including your shop’s logo, contact details, and terms of payment helps reinforce your brand and set expectations clearly. Offering different payment methods or discounts for repeat customers can also be included to improve customer satisfaction.

In conclusion, a detailed and structured repair bill not only simplifies financial transactions but also ensures professionalism and customer trust.

Creating Consistency Across Invoices

Maintaining uniformity in financial documents is crucial for any business. A consistent approach to billing ensures clarity, reduces errors, and creates a professional image. When all records follow the same structure and format, it becomes easier to manage, track, and compare transactions over time, fostering trust with customers and simplifying internal processes.

Consistency can be achieved by using the same layout, language, and design across all documents. This includes consistent placement of information such as service descriptions, costs, and payment terms. By establishing a standardized format, businesses not only improve their operational efficiency but also make it easier for clients to read and understand their charges.

Additionally, adopting a unified style helps in building a recognizable brand identity. Whether it’s the use of logos, specific fonts, or color schemes, a cohesive look across all financial records strengthens the company’s professional appearance and reinforces credibility.

How Invoices Improve Cash Flow Management

Efficient cash flow management is vital for the health of any business, especially when it comes to receiving timely payments for services rendered. A well-structured billing document plays a crucial role in ensuring that payments are collected on time, helping businesses maintain liquidity and avoid financial strain. By setting clear expectations around amounts owed and payment deadlines, businesses can better track outstanding balances and improve their overall cash flow cycle.

Tracking and Monitoring Payments

Having a detailed record of all transactions allows businesses to effectively monitor outstanding payments. With clear documentation, it becomes easier to track which clients have paid and which still owe money, reducing the risk of delayed payments and improving the business’s ability to plan its expenses.

Facilitating Timely Payments

By clearly outlining payment terms and deadlines, businesses can encourage clients to pay promptly. Sending a timely and accurate billing document after services are provided reminds customers of their financial obligations, reducing delays and enhancing cash flow. Offering incentives for early payments or introducing late fees for overdue amounts are additional strategies that can be incorporated to improve payment timelines.

Payment Terms Action Impact on Cash Flow Net 30 Payment due within 30 days Improves cash flow by setting clear expectations and deadlines Early Payment Discount Discount for payments made before due date Encourages quicker payments and boosts cash reserves Late Payment Fee Additional charge for overdue payments Where to Find Free Invoice Templates

For businesses looking to streamline their billing process, finding a reliable and free solution for creating detailed payment documents is essential. Fortunately, there are numerous resources available online that offer customizable forms without any cost. These platforms provide ready-made designs that can be tailored to fit the needs of different industries, ensuring quick and easy generation of accurate billing statements.

Several websites specialize in offering free downloadable or editable files that can be used to create professional-looking documents. These platforms often allow users to customize the layout, add their business logo, and adjust payment terms to reflect their specific requirements. Whether you need a basic format or a more complex structure, there are options that can accommodate various needs and preferences.

Additionally, popular productivity tools like Microsoft Word, Google Docs, and Excel often feature pre-designed templates. These programs offer flexibility for users who prefer working offline or integrating the document creation process into their everyday workflow. They also allow for easy export options to other formats, making sharing and storing completed forms simple.