How to Use an Invoice Sheet Template for Efficient Billing

Managing financial transactions efficiently is a key aspect of running any business. Properly formatted billing documents ensure that payments are processed smoothly and records are kept in order. By using structured templates, you can simplify the process of generating these important records and focus more on growing your business.

These ready-to-use documents allow for easy customization, helping to maintain professionalism and consistency. Whether you’re a freelancer, small business owner, or part of a larger organization, having a standardized approach to invoicing can save time and reduce errors. The right tools provide clarity for both you and your clients, creating transparency and trust in your financial dealings.

Using pre-designed forms means you don’t have to worry about the layout or details that should be included. Instead, you can focus on personalizing the essential information, ensuring accuracy with every transaction. Additionally, such systems help you stay organized, making it easy to track past payments and follow up on outstanding amounts.

What is an Invoice Sheet Template

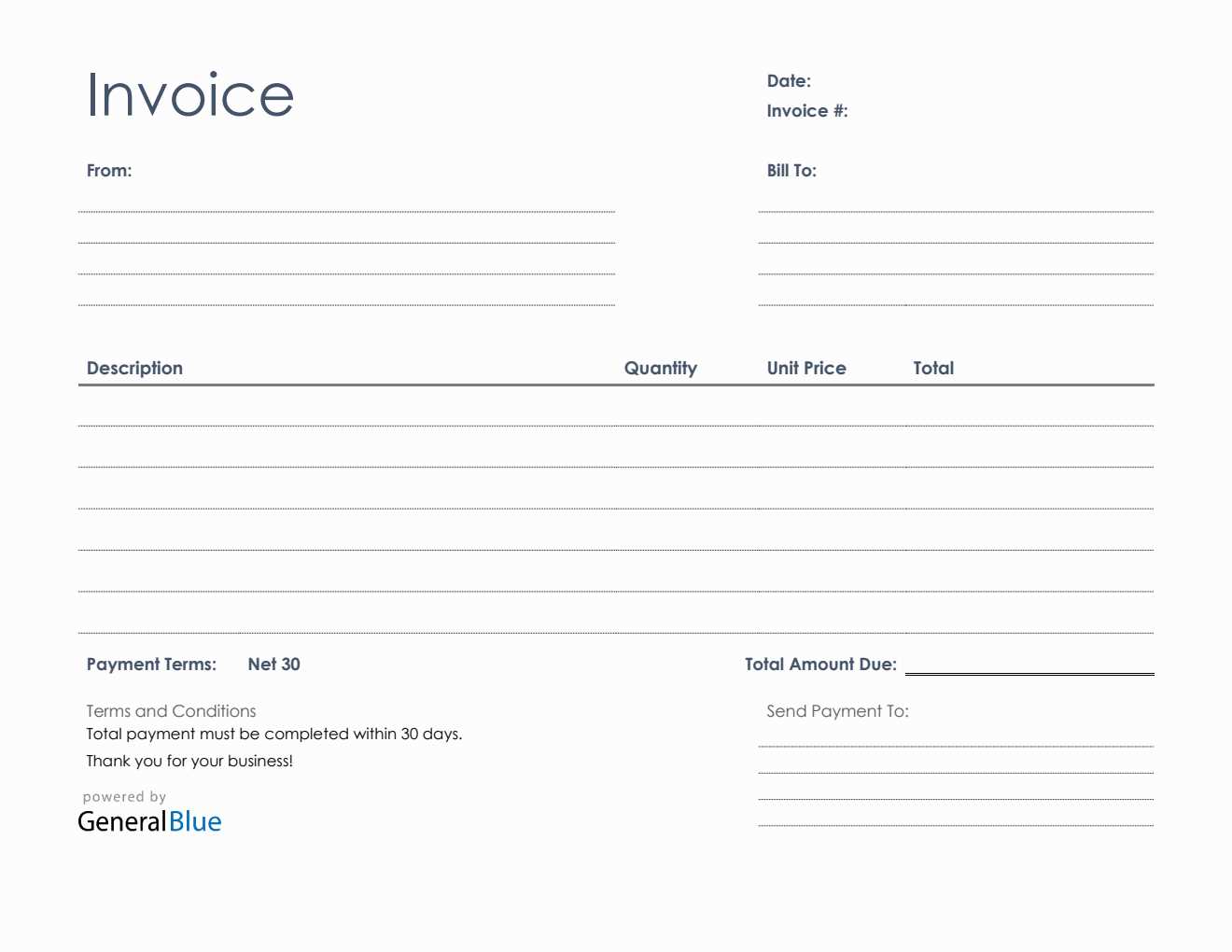

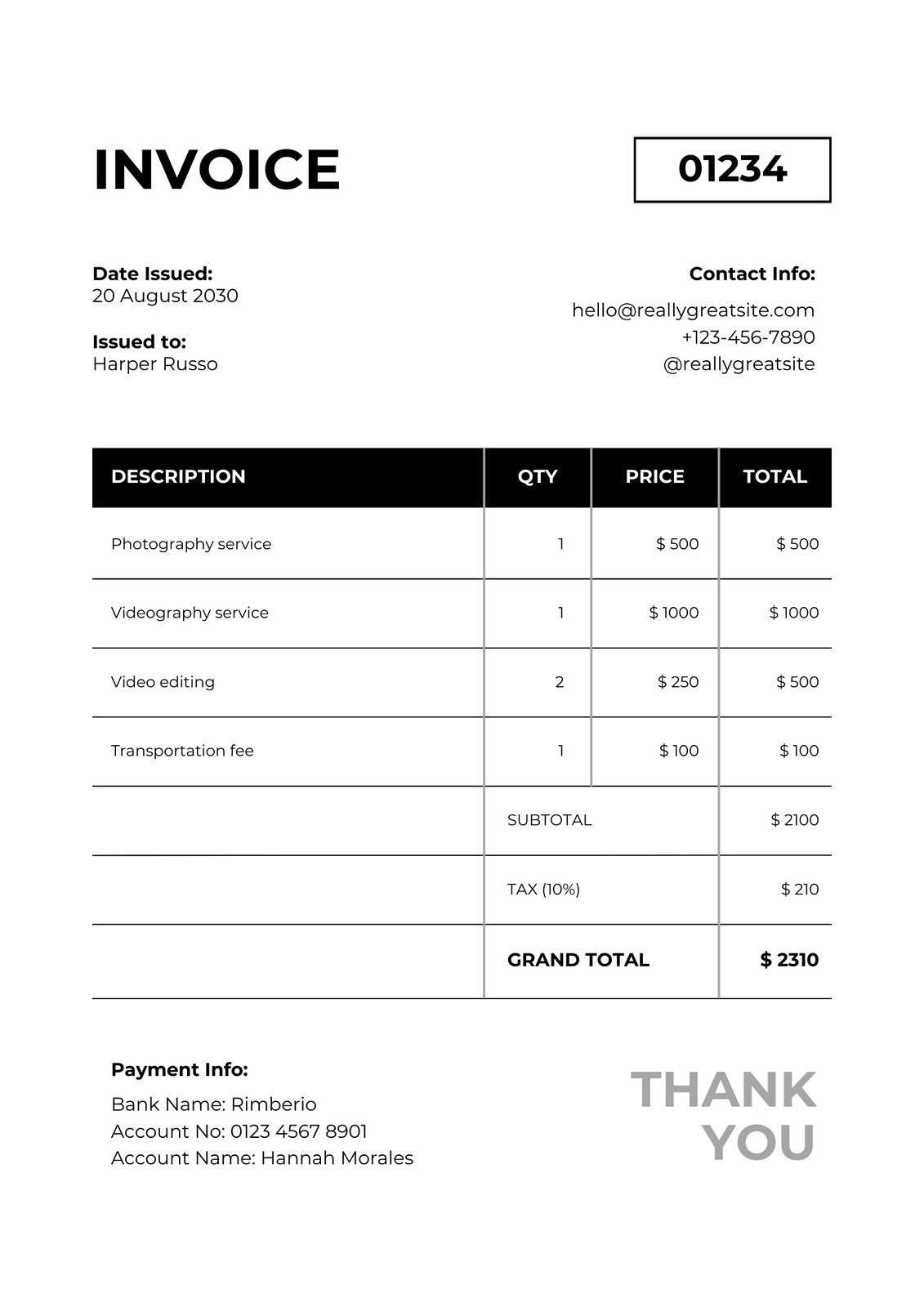

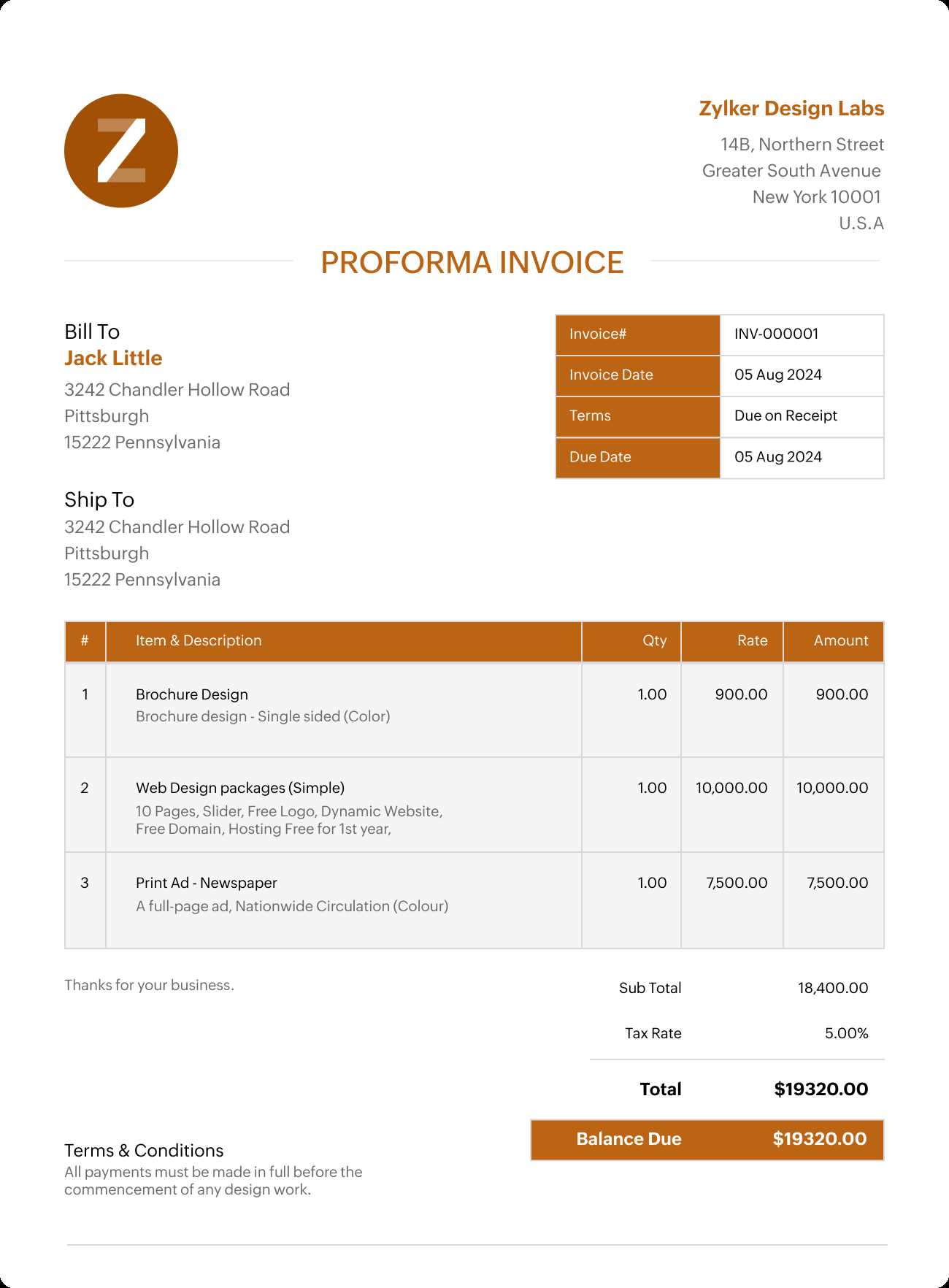

At its core, a structured document used for recording payments is an essential tool for businesses of all sizes. It helps to keep track of transactions, ensuring that both parties involved have a clear understanding of amounts due, payment terms, and services or products provided. By using a pre-designed format, this process becomes much more efficient, reducing the chances of errors and ensuring consistency across financial records.

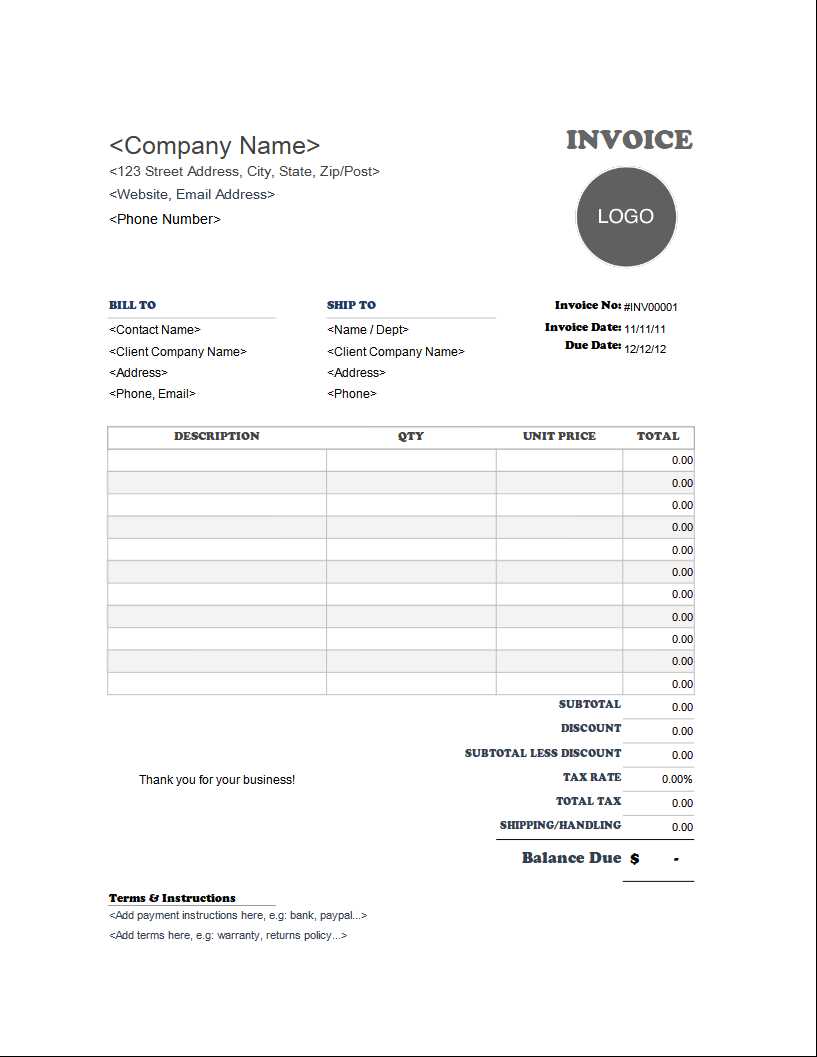

Such a document typically includes fields for key information such as the recipient’s details, transaction dates, item descriptions, and amounts. The beauty of these pre-made designs lies in their ability to be customized quickly, making them suitable for a wide range of business needs. With the right structure, generating these documents becomes a straightforward task, allowing you to focus on other aspects of your business.

Using a standard structure not only saves time but also presents a professional image to clients. The clarity and uniformity offered by these tools help avoid confusion and foster trust between businesses and their customers. In short, it’s an essential resource for keeping financial matters organized and ensuring that payments are processed without unnecessary complications.

Benefits of Using an Invoice Sheet

Using a well-organized document for tracking financial transactions offers numerous advantages for businesses, regardless of their size or industry. By relying on a standardized format, companies can ensure that all essential details are included, reducing the likelihood of errors and misunderstandings. This not only speeds up the billing process but also enhances clarity for both the business and its clients.

One of the key benefits is time efficiency. Pre-designed structures eliminate the need to manually create documents from scratch, allowing businesses to generate them quickly and consistently. This is especially valuable for companies that process a high volume of transactions or work with tight deadlines. Additionally, using such systems helps reduce the chances of making costly mistakes that could lead to payment delays or disputes.

Another important advantage is improved professionalism. A clean, organized layout reflects well on a business and helps build trust with clients. It shows attention to detail and ensures that every transaction is documented accurately. Furthermore, having a clear record of transactions helps businesses stay on top of their finances, making it easier to monitor cash flow and track outstanding payments.

Finally, utilizing a structured tool also simplifies record-keeping and financial reporting. These documents can be stored digitally, making it easy to access past records when needed. With everything in one place, businesses can streamline their accounting processes and stay organized without much effort.

How to Customize an Invoice Template

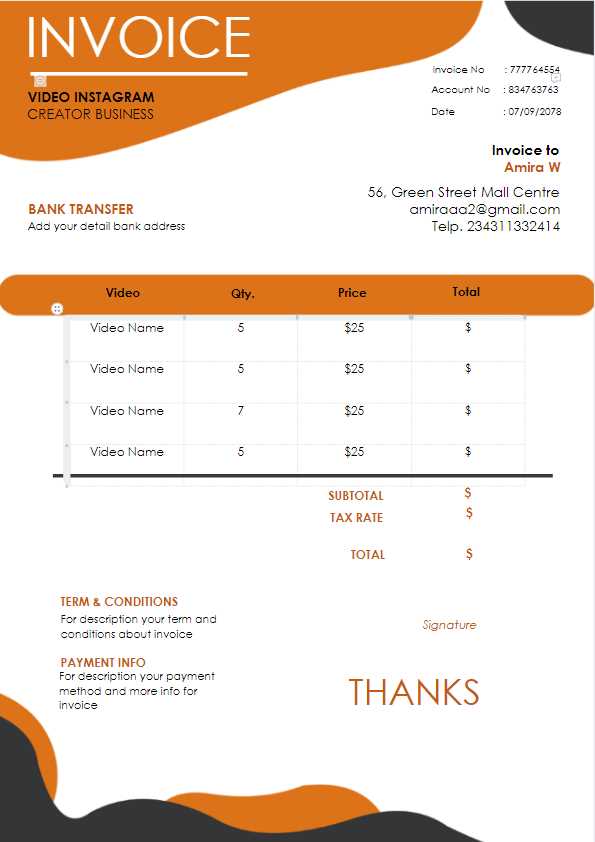

Customizing a pre-designed document for billing purposes is a straightforward process that allows businesses to adapt it to their specific needs. By personalizing the layout, content, and details, you can ensure the document reflects your brand, includes all necessary information, and meets legal or operational requirements.

Here are the main steps to customize a billing document:

- Update Your Business Information

Add your company name, logo, address, and contact details at the top of the document. This ensures clients can easily reach you if they have questions or need assistance. - Include Customer Details

Input the name, address, and contact information of the client. This makes the document personalized and ensures it is directed to the right recipient. - Adjust Payment Terms

Clearly state the payment due date, any late fees, and accepted payment methods. This section sets expectations for when and how the client should pay. - Customize Item Descriptions

List the products or services provided, along with any relevant details such as quantities, unit prices, and discounts. This helps clients understand what they are being charged for. - Choose a Layout Style

Adjust the layout according to your preferences. You can modify the font, color scheme, and arrangement of sections to match your branding and create a professional look. - Include Additional Notes or Terms

If necessary, add special instructions, warranties, or other terms to the bottom of the document. This section can also be used for a thank-you note or any other custom message.

Once all fields are customized, review the document for accuracy and consistency. By following these steps, you can create a polished and personalized billing document that meets

Top Features of a Good Invoice Template

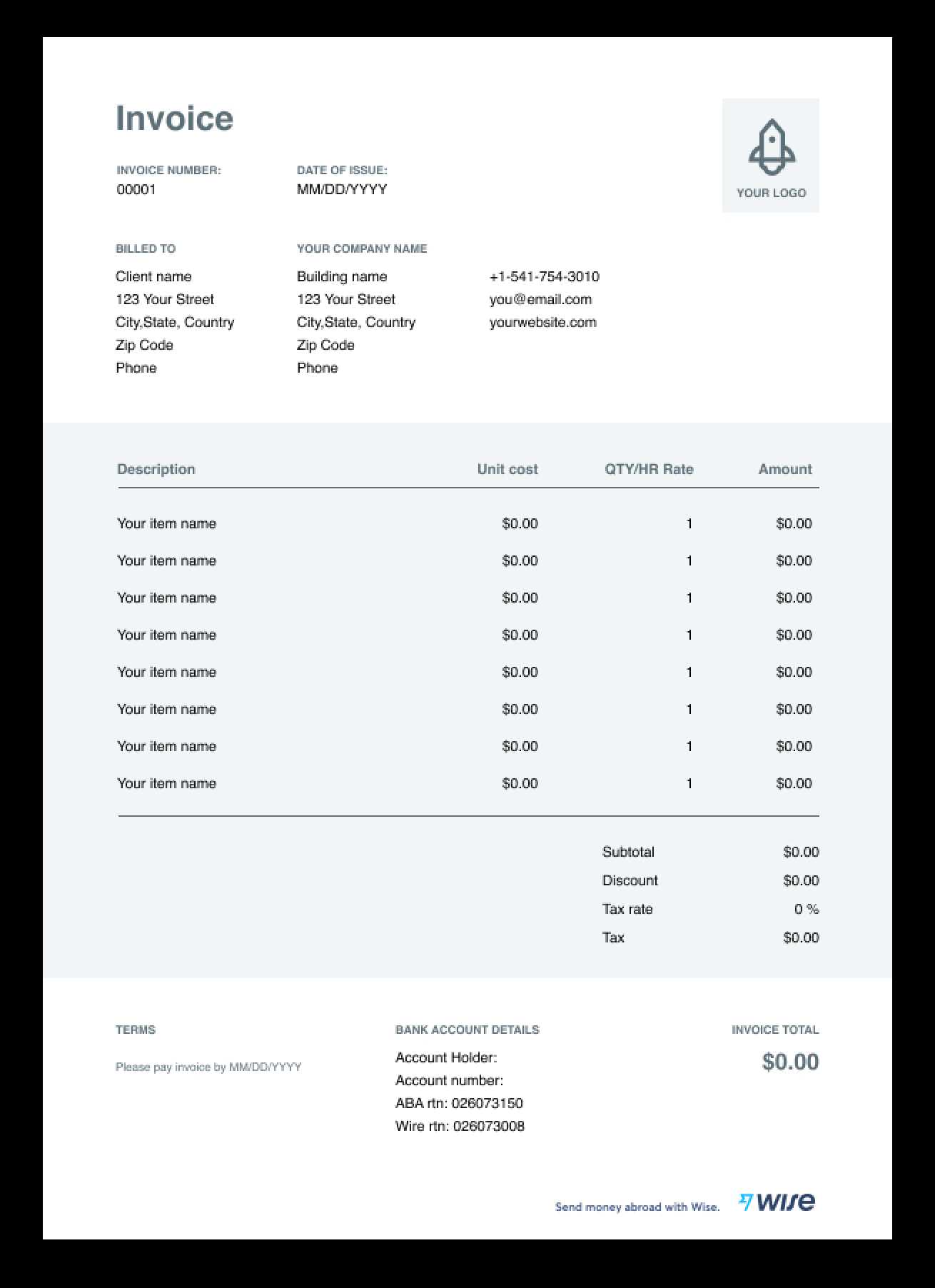

A well-designed billing document serves as both a professional tool and a clear record of transactions. The best formats combine functionality with simplicity, ensuring that all critical information is included in an organized and easy-to-read manner. A good document layout not only speeds up the payment process but also helps maintain accuracy and transparency between businesses and clients.

Here are the key features that make a billing document effective:

- Clear Branding

Including your business name, logo, and contact information prominently at the top ensures that the document reflects your brand and makes it easier for clients to recognize. - Comprehensive Client Information

A well-structured document should include the recipient’s full name, address, and contact details, ensuring that the bill is directed to the correct party and providing easy access to contact information if needed. - Detailed Itemization

A good document should break down products or services provided, with clear descriptions, quantities, unit prices, and applicable discounts. This transparency ensures both parties understand what is being charged and why. - Payment Terms and Due Date

It is crucial to clearly outline the payment due date, any late fees, and accepted methods of payment. This section sets expectations and helps avoid payment delays or confusion. - Professional Layout

A clean, well-organized design is essential for readability. Clear section headings, sufficient white space, and an easy-to-follow flow make it simple for clients to quickly locate key information. - Tax Calculations and Totals

The document should include sections for tax rates and total amounts due, calculated automatically if possible. This makes the billing process more efficient and reduces the risk of errors. - Additional Customizable Fields

The ability to add personalized notes or terms at the end of the

How to Download Invoice Sheet Templates

Accessing and downloading a pre-designed billing document is a simple process that can save businesses a significant amount of time. Many online resources provide free and paid options, allowing you to choose a layout that fits your needs and preferences. Whether you’re looking for a basic structure or a more detailed and customized design, there are multiple platforms where these documents are available.

To download a structured document for billing, follow these steps:

- Search for Reliable Sources

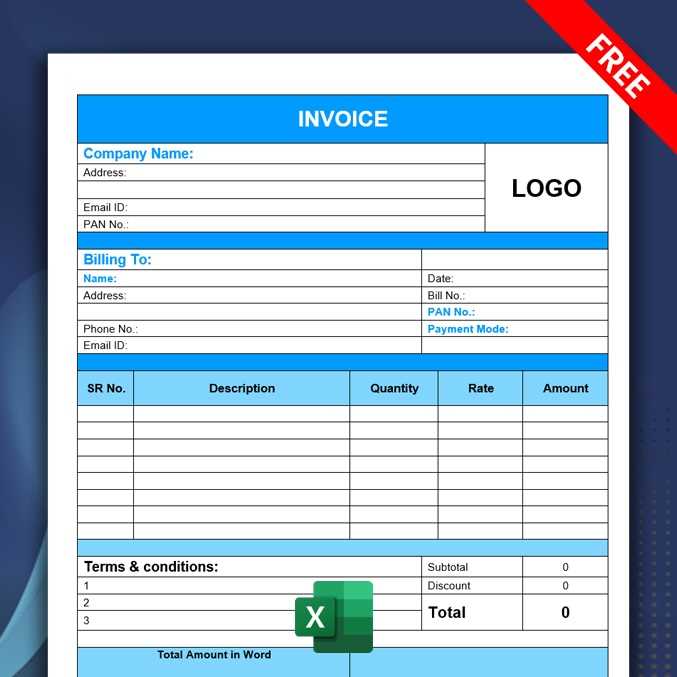

Begin by looking for trusted websites or platforms that specialize in business documents. Many websites offer free downloadable versions of billing forms, while others provide advanced features for a fee. - Choose a Format

Most sources offer documents in various formats, such as Excel, Word, or PDF. Choose the format that is most compatible with your needs and editing preferences. - Browse Available Options

Explore different styles and layouts available on the platform. Select a design that aligns with your business’s branding and the level of detail you require. - Download the Document

Once you’ve chosen your preferred layout, click the download button or link. Some websites may require you to sign up or provide an email address before downloading. - Customize the Document

After downloading, open the document in your preferred software. Add your business details, client information, and any other relevant data to personalize it for your transactions.

Many platforms also offer additional features, such as automated calculations, customizable fields, and integrations with accounting software. By selecting the right resource, you can enhance your billing process and ensure it meets both your business needs and client expectations.

Choosing the Right Template for Your Business

Selecting the right document format for billing is an important decision that can impact the efficiency of your financial processes. The right structure ensures that all relevant information is clearly presented, reduces errors, and creates a professional image for your business. Different types of businesses have different needs, so it’s essential to choose a format that aligns with both your operational requirements and the expectations of your clients.

Here are some factors to consider when choosing a billing document layout for your business:

- Business Size and Complexity

If you’re a freelancer or a small business, a simple and straightforward design might be sufficient. However, larger organizations or those with more complex offerings may need a more detailed layout with additional sections like taxes, multiple payment methods, or purchase orders. - Branding and Professionalism

Choose a design that reflects your brand. A well-designed document with your logo, business colors, and clear font styles helps project a professional image and makes your business appear more established and reliable. - Customization Flexibility

Select a layout that allows for easy customization. This is especially important if your business needs to add or modify specific fields, such as custom terms, discounts, or payment options. - Ease of Use

The template should be easy to navigate and edit, even for those with limited technical skills. Look for formats that are compatible with programs you already use, such as Microsoft Excel, Word, or Google Docs, to streamline the process. - Industry-Specific Features

Some industries may have specific requirements for their documents, such as detailed service descriptions, hourly rates, or compliance with certain tax laws

Creating Professional Invoices with Templates

When it comes to managing payments, presenting a polished and professional document is crucial. Using a pre-designed format for billing makes it easier to create consistent and accurate records. These layouts help streamline the process, ensure that no essential details are left out, and establish trust with clients by reflecting your business’s attention to detail.

Key Elements of a Professional Document

To create a professional billing record, ensure that the following elements are included:

- Clear Identification

Your business name, logo, and contact information should be clearly displayed at the top of the document. This ensures clients can easily identify the source and contact you with any questions. - Accurate Client Information

Include the client’s full name, address, and any relevant details so they know exactly which transaction is being billed. - Itemized List of Services or Products

Provide a detailed list of what you’re charging for, including descriptions, quantities, prices, and any applicable taxes or discounts. This transparency builds trust and reduces confusion. - Payment Terms

Be clear about when the payment is due and any late fees or penalties. Including this information in the layout ensures both parties are on the same page regarding payment expectations.

Customizing Your Document for Branding

A key advantage of using a pre-designed structure is the ability to customize it to reflect your brand. Modify the colors, fonts, and style to match your business’s identity. Adding your logo and adjusting the layout will help you create a visually appealing document that aligns with your company’s overall image.

How to Add Details to an Invoice Sheet

Filling in a billing document with all the necessary details ensures accuracy and transparency, which helps prevent misunderstandings with clients. By adding the correct information in a clear and organized manner, you make it easier for both parties to track payments and fulfill obligations. Here’s a guide on how to effectively include essential details in your billing document.

Follow these steps to add the right information:

- Business Information

Begin by entering your company name, logo, and contact information at the top of the document. This provides clarity and allows your client to easily reach out to you if needed. - Client Information

Include the client’s name, address, and contact details. This ensures that the document is correctly directed to the recipient and helps with record-keeping. - Transaction Date

Clearly state the date the goods or services were provided. This date is essential for setting payment expectations and tracking payment timelines. - List of Products or Services

Include a detailed, itemized list of the services or products provided. For each item, specify the quantity, unit price, and any discounts or special terms. This breakdown helps the client understand exactly what they are being billed for. - Tax and Discount Details

If applicable, calculate and include the tax amounts and any discounts given. This ensures that the client knows exactly how the final amount was determined. - Payment Terms

Clearly define when the payment is due and what payment methods are acceptable. Include any penalties or late fees for overdue payments to avoid confusion later. - Total Amount Due

Provide a clear, easy-to-read total at the bottom of the document, including all applicable taxes and discounts. This is the final amount the client needs to pay.

Once you have added all these details, double-check everything for accuracy. A well-detailed billing document not only facilitates smooth transactions but also enhances your professional i

Common Mistakes to Avoid in Invoice Sheets

When creating billing documents, accuracy is essential for ensuring smooth transactions and avoiding misunderstandings with clients. Small errors or omissions can lead to payment delays, disputes, or confusion. By being aware of common mistakes and taking the necessary steps to avoid them, businesses can ensure their financial records remain clear and professional.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include or incorrectly entering contact information. This can lead to confusion, especially if the client cannot reach you for clarification or questions. Make sure to include your business name, address, phone number, and email address. Similarly, always verify that the client’s details are accurate before finalizing the document.

2. Lack of Detailed Descriptions

Another mistake is not providing sufficient detail about the goods or services provided. Vague descriptions or missing information can leave clients uncertain about what they are being charged for. Be sure to list each item or service clearly, including quantities, unit prices, and any discounts or special terms that may apply. This helps avoid disputes and ensures transparency.

Additional mistakes to avoid include:

- Not Including Payment Terms

Always specify when the payment is due and outline any late fees or penalties. Failing to include these terms can result in missed payments or confusion about deadlines. - Incorrect Calculations

Double-check all figures, including item totals, taxes, and discounts. A small mathematical error can lead to billing discrepancies and impact cash flow. - Unclear or Inconsistent Layout

A cluttered or inconsistent design can make the document hard to read. Use a clean, organized layout with clearly labeled sections to enhance readability. - Missing a Unique Invoice Number

Always include a unique reference number for each transaction. This makes it easier to track payments and manage your records efficiently.

Avoiding these mistakes will help create clear, professional, and accurate billing documents that foster trust and maintain strong client relationships.

Why Automating Invoices Saves Time

Automating the process of generating and sending billing documents can significantly reduce the time spent on manual tasks. Instead of creating each document from scratch, automation tools can quickly populate necessary fields, apply consistent formatting, and ensure all required details are included. This streamlined approach frees up valuable time that can be better spent on other important aspects of running a business.

Here are the key reasons why automation can save you time:

- Speed and Efficiency

Automated systems can generate multiple documents in just a few clicks, eliminating the need to input data manually each time. This efficiency makes it possible to process more transactions in less time. - Consistency and Accuracy

Automation reduces the risk of human error, ensuring that all details, such as client information, amounts, and payment terms, are consistently applied. This eliminates mistakes that can lead to delays or confusion. - Quick Updates and Customization

If your business needs to update payment terms, prices, or service descriptions, automated systems can apply these changes to all relevant documents without requiring you to adjust each one individually. - Reduced Manual Input

By integrating your billing system with other tools, such as accounting or CRM software, automation can pull data directly from those platforms, further reducing the need for manual input. - Automated Reminders

Many automation systems can send payment reminders or follow-ups automatically, ensuring that clients receive timely notifications without any additional effort on your part.

Incorporating automation into your billing process not only saves time but also helps improve the accuracy and reliability of your financial operations, ultimately leading to smoother workflows and faster payments.

Free vs Paid Invoice Templates

When it comes to choosing a format for creating billing documents, businesses often face the decision of whether to use free or paid options. Both have their pros and cons, and the right choice depends on your business needs, budget, and the level of customization you’re seeking. Understanding the differences between these two types of resources can help you make an informed decision that aligns with your objectives.

Benefits of Free Billing Documents

Free resources offer a simple solution for businesses just starting out or those with limited budgets. These options are often easily accessible, with no cost involved, making them an attractive choice for small businesses or freelancers. Some key advantages include:

- No Cost

Free options are obviously cost-effective, making them ideal for businesses that are looking to save money without sacrificing essential features. - Basic Functionality

Many free formats include basic fields like business and client information, product descriptions, and payment terms. This can be sufficient for businesses with straightforward billing needs. - Quick Setup

Free resources are typically easy to use and require little to no setup. You can often download a ready-to-use document and start filling in the details right away.

Benefits of Paid Billing Documents

Paid options, on the other hand, offer additional features and a higher degree of customization, making them a great investment for businesses that require more complex or professional documents. Some benefits of paid formats include:

- Advanced Features

Paid formats often include more advanced features such as automatic tax calculations, built-in payment tracking,

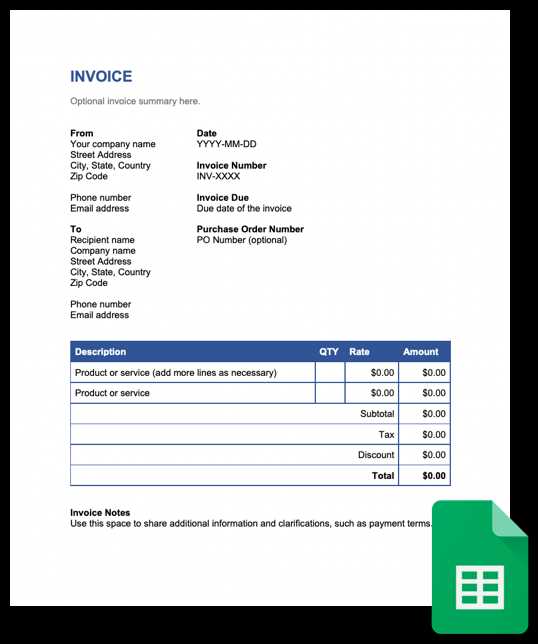

How to Use Templates in Excel

Using pre-designed layouts in Excel can save a significant amount of time and effort when creating business documents. These ready-made designs allow you to easily enter data without having to worry about formatting or structure. Excel offers a variety of templates that are perfect for handling various types of business tasks, including billing records, financial reports, and tracking documents. By utilizing these templates, you can streamline your workflow and ensure consistency across all your documents.

Follow these simple steps to use a pre-designed layout in Excel:

- Open Excel

Start by launching the Excel application on your computer. If you’re using Office 365, you can also use Excel online. - Search for a Template

In the main screen, you’ll see a search bar at the top where you can type keywords such as “billing” or “accounting” to find suitable templates. You can also browse through the available categories to find a layout that fits your needs. - Select a Template

Once you’ve found a design that suits your requirements, click on it to open a preview. If it meets your needs, select “Create” to open the template in a new workbook. - Enter Your Information

With the template open, simply begin filling in the necessary details. Excel will automatically handle the formatting, so you don’t need to worry about adjusting the layout. Customize fields such as the date, client name, items, and amounts to suit your specific situation. - Customize the Template

If you need to make any adjustments to the design or data calculations, you can do so easily. Excel allows you to modify formulas, add or remove rows, and change colors to better fit your brand or style. - Save and Export

Once you’ve entered all your information and made any necessary adjustments, save your document in your preferred file format. You can also export it to PDF if you need to share it with clients or colleagues.

Using a pre-designed layout in Excel not only saves you time but also helps maintain a consistent and professional look for your business documents. The customizable features of Excel templates allow you to adapt them for any situation, from simple transactions to more complex business dealings.

Feature Benefit Pre-designed Layout Eliminates the need for manual formatting, ensuring a polished appearance. Built-in Formulas Automatic calculations for totals, taxes, and discounts save time and reduce errors. Customization Options Allows you to modify fields and design elements to fit your specific business needs. Ease of Use Simple to use, even for users with limited experience in Excel. By following these steps, you can quickly and easily generate professional documents in Excel, helping you stay organized and efficient in your business operations.

Why Invoice Templates Improve Cash Flow

Maintaining a steady cash flow is critical for the success and sustainability of any business. One of the key factors in ensuring timely payments is sending accurate and professional documents to clients. By using pre-designed formats for billing, businesses can streamline the invoicing process, reduce errors, and promote faster payment collection. These ready-to-use layouts help establish clarity and consistency, which ultimately results in better cash flow management.

Faster Processing and Payment

Using structured layouts ensures that all necessary details are included and properly formatted, which makes the document easier to understand. Clear and accurate billing records help clients process payments more quickly, reducing delays. When businesses use automated or pre-designed structures, the time spent on creating and sending bills is minimized, leading to faster client response times.

Minimized Errors and Disputes

When all the details are already set in a consistent structure, the chances of making errors such as incorrect amounts or missing information are greatly reduced. Mistakes in billing often lead to disputes, which can delay payments and disrupt cash flow. A clear, professional document eliminates confusion and fosters trust, encouraging clients to settle their payments on time.

Here are some additional ways pre-designed billing formats help improve cash flow:

Benefit Impact on Cash Flow Consistency Regular and clear billing formats ensure that payments are expected and timely, reducing the time spent chasing overdue payments. Automated Reminders Pre-designed documents can be set up to automatically send reminders, prompting clients to pay faster and reducing delays in receiving funds. Professional Appearance Well-organized and polished billing records make a business appear more professional, increasing the likelihood of timely payments from clients. Clear Payment Terms Clearly stated payment terms, such as due dates and late fees, encourage clients to adhere to deadlines, ensuring that payments are received without delay. By using structured billing documents, businesses can not only reduce administrative time but also encourage timely payments and improve overall financial stability. The efficiency and professionalism offered by pre-designed formats play a significant role in promoting sm

Tips for Organizing Invoice Records

Efficiently organizing billing records is crucial for managing your business’s financial health. Proper organization helps you keep track of payments, monitor outstanding balances, and ensure that your accounting is accurate. By maintaining a systematic approach to your records, you can easily access important information when needed, avoid late payments, and simplify your financial reporting. Here are some tips to help you stay organized and on top of your financial documentation.

1. Use Clear Naming Conventions

Adopt a consistent naming convention for all your financial documents. This might include the client name, date, and a unique reference number. For example, “ClientName_2024-10-15_Invoice123” helps you quickly identify the document, and reduces the chances of confusion when searching through files.

2. Categorize Your Records

Separate your documents into categories such as “Paid”, “Pending”, and “Overdue”. This will allow you to quickly identify which invoices need follow-up and which have been settled. It’s also helpful to create folders for different clients or projects to keep everything organized and easily accessible.

3. Implement Digital Systems

Digital records are easier to search, sort, and store than physical ones. Use accounting software or cloud storage to keep your billing documents organized. These tools also offer features like automatic backups, which ensures your records are safely stored and accessible whenever you need them.

4. Set Up a Filing System

Whether physical or digital, establish a clear filing system. For paper records, use labeled folders or binders. For digital records, create subfolders by client or project. Within each folder, organize documents by date to make it easier to track payment history and identify outstanding balances.

5. Regularly Review Your Records

Set aside time each month to review your financial records. This ensures that all payments are accounted for, and you can follow up on any overdue balances promptly. Regular reviews also help prevent discrepancies and ensure that your records are up to date and accurate.

6. Keep Backup Copies

Always keep a backup copy of your billing documents. This is particularly important for businesses that handle sensitive or high-value transactions. Cloud storage, external hard drives, and automated backup systems can protect your data from loss due to accidental deletion or hardware failure.

By following these organizational tips, you can streamline your billing process, reduce stress, and stay on top of your financial management. A well-organized record-k

How to Handle Invoice Disputes

Disputes over payment documents are a common challenge in business, and resolving them swiftly is crucial for maintaining healthy client relationships and ensuring steady cash flow. Whether the disagreement involves incorrect amounts, missing information, or misunderstandings about terms, knowing how to address the issue professionally and efficiently can prevent unnecessary delays and conflicts. Here’s how to handle disputes effectively when they arise.

1. Review the Document Carefully

When a dispute occurs, the first step is to review the document in question thoroughly. Check for any errors or discrepancies in the details, such as amounts, client information, services provided, or payment terms. Sometimes, the dispute can be resolved quickly by correcting minor mistakes. Ensuring that your records are accurate from the start is vital for avoiding misunderstandings later on.

2. Communicate Clearly with the Client

Once you’ve reviewed the document, reach out to the client as soon as possible to discuss the dispute. Open, clear communication is key to resolving the issue quickly. Always approach the conversation with a calm and professional tone, focusing on finding a solution rather than assigning blame. If necessary, provide supporting documentation to clarify the charges or terms in question. Be prepared to listen to the client’s perspective and remain flexible to find a mutually agreeable resolution.

Here are some additional tips to effectively handle disputes:

- Stay Professional: Keep all correspondence polite and professional. Avoid confrontational language or making assumptions about the client’s intentions.

- Document Everything: Keep a record of all communications related to the dispute. This can be useful if the issue escalates and may be needed for legal or accounting purposes.

- Offer Compromises When Appropriate: In some cases, offering a compromise, such as a small discount or extended payment deadline, can help resolve the issue and maintain good client relations.

- Set a Resolution Deadline: Establish a clear timeline for resolving the issue. This helps prevent the dispute from dragging on and keeps the payment process moving forward.

By addressing disputes promptly and professionally, businesses can resolve conflicts efficiently, maintain client trust, and ensure that their financial processes continue smoothly. Handling disputes with transparency and respect ultimately leads to better long-term relationships and more timely payments.

Legal Considerations for Invoice Templates

When creating billing documents for your business, it’s essential to ensure that they meet legal requirements. These documents serve not only as a record of transactions but also as a tool for protecting both parties involved in a transaction. By understanding the legal aspects of these documents, businesses can avoid disputes, ensure compliance, and safeguard their interests. Below are some key legal considerations to keep in mind when designing or using pre-designed billing formats.

1. Include All Required Information

One of the most important legal aspects is ensuring that all required details are included. Depending on the country and type of business, this can vary, but common elements include the following:

- Business Identification: Your company name, address, and tax identification number (TIN) or VAT number.

- Client Information: The client’s full name or business name and address.

- Clear Description of Goods or Services: A detailed breakdown of the products or services provided, including quantities, prices, and any applicable taxes.

- Payment Terms: Clear payment deadlines, penalties for late payment, and any discounts for early payments.

- Issue Date and Due Date: The date the document was created and the date by which payment is due.

Failing to include any of these required elements may result in legal complications or disputes over the terms of the transaction.

2. Adhere to Local Laws and Tax Regulations

Different jurisdictions have specific rules regarding the content and structure of billing documents. For example, certain regions require businesses to include specific tax-related information, such as the breakdown of sales tax or VAT on each item. Additionally, businesses must ensure they comply w

How to Track Payments with Invoice Templates

Tracking payments is essential for maintaining a steady cash flow and ensuring your business remains financially healthy. By using structured billing formats, you can easily monitor which payments have been received and which are still outstanding. Properly tracking payments helps you stay on top of your financial records, avoid overdue accounts, and simplify your accounting process. Here are some effective methods for keeping track of payments using predefined document layouts.

1. Use a Payment Status Column

Adding a dedicated column to track payment status is one of the simplest ways to stay organized. This column can include options such as “Paid”, “Pending”, or “Overdue”. By updating this status after each transaction, you can quickly identify which payments have been made and which require follow-up.

- Paid: Mark when a payment has been received and processed.

- Pending: Mark when a payment is due but has not yet been received.

- Overdue: Mark payments that have passed the due date and require immediate action.

2. Maintain a Payment Record Log

In addition to the status column, maintaining a separate log of payment transactions is helpful for keeping an accurate record. This log should include the following details:

- Client Name: The name of the customer or business making the payment.

- Amount Paid: The exact amount received from the client.

- Date of Payment: The date the payment was processed or received.

- Payment Method: Whether the paymen

- Open Excel

- Clear Identification

- Search for Reliable Sources