Essential Private Tutoring Invoice Template for Seamless Billing

When providing educational support, clear and accurate billing is crucial for maintaining a professional relationship with clients. Creating a well-organized document that outlines services rendered, fees, and payment details ensures both the provider and the student or parent are on the same page. A streamlined process not only saves time but also builds trust and credibility.

Managing finances effectively is an essential skill for educators. Whether you’re an independent instructor or part of a larger network, having a structured approach to record payments helps you stay organized and avoid confusion. A properly formatted bill can also serve as a helpful reference for both parties when addressing any questions or discrepancies.

By using a customizable document, instructors can easily adjust details to match their specific services, ensuring that each transaction is handled professionally. Whether you’re offering hourly lessons or package deals, having a reliable format can make the billing process seamless and stress-free.

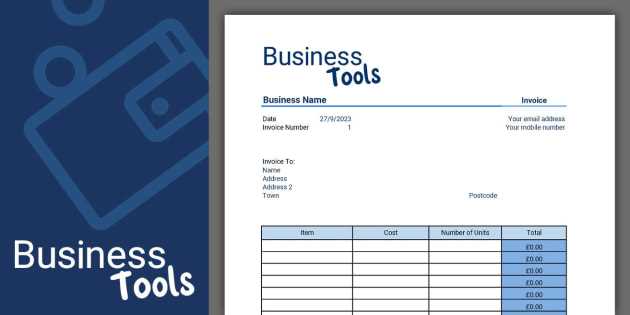

Private Tutoring Invoice Template Overview

When providing educational services, maintaining clear financial records is essential. A structured document helps both educators and clients ensure that all sessions, fees, and payments are properly tracked. This tool not only streamlines billing but also enhances professionalism by clearly presenting the agreed-upon terms. Whether you’re working with a single student or a group, this document serves as a detailed summary of services rendered.

A well-crafted bill serves multiple purposes, from helping educators keep track of their income to ensuring transparency for clients. By using an organized format, you reduce the chance of errors and misunderstandings, making the process more efficient for everyone involved.

Key features often included in such documents are:

- Provider’s contact information and payment details

- Client’s name and address

- Session dates and hours worked

- Cost per hour or session and total amount due

- Payment terms and due date

These details can be easily adjusted to fit various teaching models, from hourly rates to bulk lesson packages. The format is typically customizable, allowing you to add or remove sections based on your needs. Having a standardized document for every billing cycle ensures consistency and reduces the time spent on administrative tasks.

In this section, we’ll explore the advantages of using a structured document, how to customize it to fit your services, and why it’s a vital tool for educators looking to maintain a professional and organized approach to financial transactions.

Why You Need an Invoice Template

Having a standardized document for financial transactions is essential for maintaining professionalism and clarity. Whether you’re offering lessons on a one-time basis or on an ongoing schedule, a clear billing system ensures both you and your clients are on the same page. A well-structured document saves time, reduces errors, and builds trust between parties.

Here are the key reasons why using a predefined format is beneficial:

Consistency and Professionalism

By using a fixed layout for every transaction, you create a consistent and professional experience for your clients. This shows that you take your work seriously and care about the details, which can lead to more referrals and repeat business.

Time Savings and Organization

Customizing and creating a new bill for every client or session can be time-consuming. By using a ready-to-go document, you save time and ensure that all necessary details are included. This allows you to focus more on your educational work, rather than administrative tasks.

Additional benefits of using a standardized document include:

- Reduced risk of missing important information

- Clear payment terms for both parties

- Ability to quickly track and follow up on unpaid fees

- Improved record-keeping for tax purposes

In summary, having a structured approach to billing helps keep everything organized, reduces misunderstandings, and enhances the overall professionalism of your service.

Key Elements of a Tutoring Invoice

Creating a comprehensive document for billing is essential for both clarity and professionalism. A well-organized record helps ensure all relevant details are included, making it easier for clients to understand the charges and for instructors to maintain accurate financial records. There are several critical components that should be included to ensure transparency and efficiency.

Basic Information

Every document should start with essential contact details to identify both parties involved. This includes:

- Educator’s name, address, and contact information

- Client’s name and address

- Date of the service

- Unique reference number or invoice ID

Service Breakdown

A clear breakdown of the services rendered ensures both parties understand what was provided and the associated costs. This section should typically include:

- Hours or sessions completed

- Hourly rate or package price

- Total amount due

- Any discounts or additional charges (if applicable)

Including these elements not only helps to avoid confusion but also makes it easier for clients to track their payments and for educators to maintain accurate records of their income. Ensuring that each document is complete and transparent is key to building a strong and professional relationship with clients.

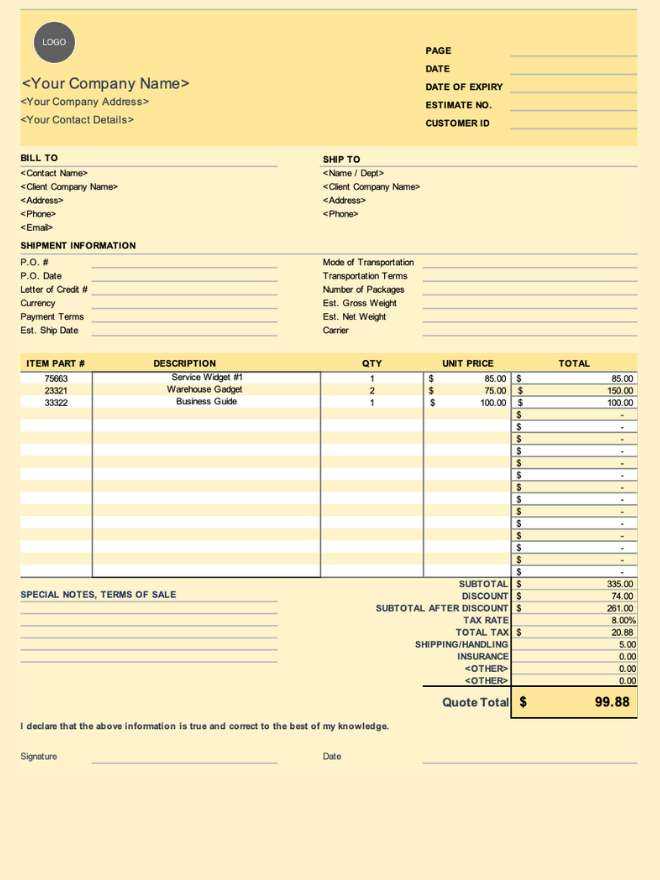

Customizing Your Invoice Template

Personalizing your billing document is essential to reflect the unique aspects of your services and to maintain a professional image. A customizable structure allows you to adjust the format to suit specific client needs or different pricing models. Customization ensures that every detail is relevant and tailored to each transaction.

Here are key elements you can modify to align with your preferences:

- Branding: Add your logo, business name, or slogan to make your document look more professional and reinforce your brand identity.

- Payment Terms: Clearly specify your payment expectations, such as due dates, late fees, or accepted payment methods (bank transfer, PayPal, etc.).

- Service Descriptions: Provide detailed descriptions of the lessons or services offered, helping clients understand exactly what they’re paying for.

- Discounts and Promotions: Include any special offers or discounts applied to the current billing cycle, ensuring clients see the adjusted total.

- Tax Information: If applicable, make sure your tax rates are clearly stated, whether you include sales tax, VAT, or other relevant charges.

Customizing your document helps create a more personalized experience for clients and reinforces your professionalism. By adjusting these elements, you can ensure the document reflects your teaching style, pricing structure, and business model effectively.

How to Create a Professional Invoice

Creating a polished and professional billing document is essential for ensuring clarity and promoting trust with your clients. A well-structured record not only simplifies the payment process but also reflects your commitment to professionalism and attention to detail. By following a few straightforward steps, you can easily craft a document that meets both your and your clients’ expectations.

Here are some key steps to follow when creating a professional billing document:

- Start with clear identification: Include your name, business name, and contact information at the top of the document. Similarly, ensure the client’s name and address are listed accurately.

- Assign a unique reference number: This helps keep your records organized and makes it easier to track payments, especially for future reference or accounting purposes.

- List all services provided: Break down each lesson, session, or package offered, including the hours worked or number of sessions completed. Be specific and clear about what the client is paying for.

- Specify the cost and total due: Clearly state the rate per session or package and calculate the total amount due. If discounts or adjustments are applied, make sure to include them to avoid confusion.

- Set payment terms: Specify the due date, any late fees for overdue payments, and the accepted methods of payment, such as bank transfer or online payment platforms.

- Double-check for accuracy: Review the document for any errors in the information provided, including dates, rates, and contact details. A mistake could delay the payment process or lead to misunderstandings.

By following these steps, you ensure that your document looks polished and is easy to understand. A well-crafted billing record not only enhances your professional image but also contributes to smoother, more efficient transactions with your clients.

Free vs Paid Invoice Templates

When it comes to creating a structured billing document, there are two main options: free formats and paid solutions. Both have their advantages and drawbacks, depending on your specific needs. Free options are often simple and accessible, while paid services may offer more features, customization, and professional designs. Choosing the right option depends on your business requirements and the level of professionalism you want to convey.

Let’s compare the key differences between free and paid solutions:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited templates and options for customization | Highly customizable with a wide range of designs |

| Ease of Use | Basic formats, may require additional editing | More user-friendly with drag-and-drop features |

| Design Quality | Simple designs, may lack polish | Professional, polished designs that align with branding |

| Additional Features | Limited features, such as basic math calculations | Advanced features, like automated calculations, tracking, and reminders |

| Support | Minimal or no customer support | Dedicated customer service and troubleshooting assistance |

While free formats are suitable for individuals or small businesses with basic billing needs, paid solutions offer more advanced features that may be necessary as your business grows. Consider the complexity of your billing process, your budget, and how important design and branding are for your service when making a decision.

Best Practices for Invoice Formatting

Properly formatting your billing document is crucial for clarity and professionalism. A well-structured record ensures that both you and your client can easily understand the charges and payment terms, avoiding confusion and errors. Adhering to best practices not only enhances the appearance of the document but also contributes to smoother transactions and better record-keeping.

Key Formatting Tips

To ensure that your document is both functional and professional, consider the following formatting guidelines:

| Formatting Aspect | Best Practice |

|---|---|

| Font and Text | Use clear, legible fonts such as Arial or Times New Roman, with appropriate font size (usually 10-12 pt). |

| Layout | Organize information in a clean, logical order with clear sections for contact details, service breakdown, and total cost. |

| Spacing | Ensure sufficient white space between sections to make the document easy to read and navigate. |

| Headers and Subheaders | Use bold text for headings and subheadings to distinguish sections clearly. |

| Alignment | Align the text consistently (e.g., left-aligned for text, right-aligned for amounts) to ensure readability. |

| Color | Limit the use of color to maintain professionalism. If used, make sure it is subtle and aligns with your branding. |

Additional Considerations

In addition to formatting, paying attention to the overall structure and presentation of your document is essential. Make sure all required information is included, such as the payment due date, yo

Setting Rates and Payment Terms

Establishing clear rates and payment conditions is vital for managing financial transactions effectively. Whether you’re charging per hour or offering a package deal, making sure both parties understand the costs and payment expectations from the beginning can prevent misunderstandings. Clear and fair pricing, combined with well-defined payment terms, sets the foundation for a professional relationship.

Here are some key elements to consider when setting your pricing structure and payment terms:

| Aspect | Best Practices |

|---|---|

| Pricing Structure | Decide whether to charge an hourly rate, a fixed fee per session, or offer discounts for bulk lessons. |

| Clear Breakdown | Provide an itemized list of services and costs to make it easier for clients to understand the charges. |

| Payment Frequency | Clarify whether you expect payment before services are rendered, after each session, or on a monthly basis. |

| Late Payment Policy | Include any late fees or interest charges for overdue payments to encourage prompt settlement. |

| Accepted Payment Methods | Specify how payments should be made (bank transfer, PayPal, cash, etc.) to avoid confusion. |

| Discounts and Special Offers | Detail any discounts for long-term packages, multiple sessions, or referrals. |

By clearly stating your rates and payment expectations, you help set professional boundaries and ensure smooth transactions. Establishing these terms upfront also makes it easier to handle any payment-related issues in the future. A well-organized and transparent approach not only benefits you but also helps maintain a positive relationship with your clients.

Incorporating Client Details in the Invoice

Including accurate client information in your billing document is essential for clarity and proper record-keeping. By ensuring that the client’s contact details, along with any specific agreements or instructions, are clearly stated, you not only avoid confusion but also establish a professional and transparent relationship. This also makes it easier to track payments and follow up on any issues that may arise.

Here are the key client details that should always be included in your billing record:

- Client’s Full Name: Ensure you use the client’s legal name to avoid any confusion, especially if you need to reference the payment in future correspondence.

- Address: Including the client’s address can be helpful for billing records, especially if you need to send physical copies of documents.

- Contact Information: Always include a phone number or email address for easy follow-up or communication regarding payments.

- Client’s ID or Reference Number: If applicable, include any unique client identification numbers to help track their records across your system.

- Special Agreements: If there are any particular payment arrangements or terms agreed upon, these should be clearly noted to avoid future disputes.

By incorporating these client details into your documents, you ensure that both you and the client have a clear understanding of the transaction. This also helps create a professional image and fosters trust, making future dealings smoother and more efficient.

Tracking Payments with Invoice Templates

Effectively managing payments is essential for maintaining a smooth cash flow in any service-based business. By using a well-organized document to track outstanding amounts, paid fees, and payment due dates, you can stay on top of your financial records. A clear payment tracking system not only helps you avoid missed payments but also makes it easier to follow up with clients if necessary.

One of the best ways to keep track of payments is to include a dedicated section in your billing records where you can mark the status of each payment. This section can include the following elements:

- Payment Status: Indicate whether the payment is pending, completed, or overdue.

- Payment Date: Record the date when the payment was made, or the agreed due date.

- Amount Paid: Clearly note the amount the client has paid so far, and any outstanding balance.

- Method of Payment: Document the payment method (e.g., bank transfer, cash, or online payment platform) for reference.

- Notes: Leave space for any additional comments, such as partial payments or special payment arrangements.

Using a document that allows you to easily track each transaction ensures that you can quickly identify any overdue payments and follow up with clients accordingly. By keeping detailed records, you avoid confusion and ensure that all financial dealings are transparent and properly documented. This also saves you time in the long run by reducing the need for constant manual tracking or reminders.

Ensuring Accuracy in Billing

Accuracy in financial documentation is crucial for maintaining trust and professionalism in any business. When preparing a record of services rendered, it’s essential to double-check all details to prevent errors that could lead to misunderstandings or payment delays. An accurate document not only helps you get paid on time but also prevents confusion for your clients.

Here are some tips to ensure that your billing record is always accurate:

- Double-check Service Details: Ensure that each service provided is listed correctly, with clear descriptions and the correct number of hours or sessions. This helps avoid confusion over what was charged.

- Verify Rates and Amounts: Double-check that the rates applied are correct and that calculations (e.g., hourly rates or package prices) are accurate.

- Review Client Information: Ensure that all client details, such as their name, contact information, and any special terms or discounts, are correct.

- Check Payment Terms: Confirm that the payment due date and terms are clearly stated, including any applicable late fees or early payment discounts.

- Proofread for Typos: Small mistakes in spelling, grammar, or figures can undermine the professionalism of your document and may cause confusion.

By following these steps, you can ensure that your billing records are clear, accurate, and free of errors. This attention to detail helps build trust with your clients and ensures that payments are processed smoothly and on time.

Automating Your Invoice Process

Automating your billing process can save you time, reduce errors, and improve efficiency. By using automated systems, you can ensure that your financial records are generated consistently and promptly without needing to manually create each document. This is especially helpful for businesses that deal with a high volume of clients or recurring services.

There are several ways to automate your billing process:

- Use Accounting Software: Tools like QuickBooks, Xero, or FreshBooks can automatically generate and send billing records, track payments, and send reminders for overdue payments.

- Recurring Billing Options: For clients with ongoing services, set up recurring billing to automatically charge them on a regular schedule (weekly, monthly, etc.).

- Template Libraries: Many accounting platforms provide pre-built billing formats that you can customize. Once set up, these templates can be reused for multiple clients with minimal changes.

- Payment Integration: Use payment processors (such as PayPal or Stripe) that integrate with your billing system, allowing clients to pay directly from the document, speeding up the payment cycle.

- Automated Reminders: Set up automated email reminders to notify clients of upcoming due dates or overdue payments, reducing the need for manual follow-ups.

By automating these aspects of your billing, you free up time to focus on your core services and ensure that your financial processes are streamlined and consistent. Automation not only increases efficiency but also reduces the risk of human error, making the overall payment experience smoother for both you and your clients.

Common Mistakes to Avoid

When managing your billing records, even small mistakes can lead to confusion, delays in payment, or damaged client relationships. Avoiding common errors is key to maintaining professionalism and ensuring that your financial transactions run smoothly. Here are some of the most frequent mistakes to watch out for and tips on how to avoid them.

1. Missing or Inaccurate Client Information

One of the most common errors is not including or incorrectly entering client details, such as their name, address, or contact information. This can lead to confusion or delayed payments, especially if the client needs to reference the document later.

- Always verify that the client’s name and contact details are correct.

- Check that any special agreements or references are clearly noted.

2. Incorrect Service Descriptions or Charges

Misunderstanding the services provided or incorrectly listing charges can create mistrust or lead to disputes. Ensure that every service is clearly described, and the amounts are calculated correctly.

- Break down each service or session clearly, including the date, time, and number of hours worked.

- Double-check your rates and the total amount due to prevent any errors in calculation.

By avoiding these common mistakes, you can ensure your financial documents remain professional, clear, and accurate. This helps maintain good client relationships and ensures smoother transactions.

Legal Considerations for Tutoring Invoices

When creating and managing billing documents, it is important to ensure that they are legally compliant. A well-structured financial record not only helps you maintain professionalism but also protects you and your clients in case of disputes. Being aware of legal requirements for documenting services, handling payments, and providing clear terms can help avoid potential legal issues down the road.

1. Compliance with Tax Laws

One of the most important legal considerations is understanding tax obligations. Depending on your location, you may be required to collect and remit sales tax or other types of taxes on the services you provide. It’s essential to check local regulations to determine if tax needs to be added to your charges, and to ensure that your financial records reflect this.

- Include any applicable taxes on the final amount due.

- Ensure that you keep detailed records of taxes collected for reporting purposes.

2. Clear Payment Terms and Conditions

Including clear payment terms in your billing document can prevent future misunderstandings. This includes specifying the payment due date, accepted methods of payment, and any late fees or penalties for overdue payments. By outlining these terms upfront, you protect both yourself and your client and help ensure that the financial transaction is handled smoothly.

- Clearly state the payment deadline and methods accepted (e.g., bank transfer, credit card, or online payment systems).

- Outline any penalties for late payments to discourage delays.

By following these legal considerations, you not only comply with local regulations but also promote transparency and professionalism, which can help foster positive client relationships and reduce the risk of disputes.

Tips for Maintaining Professionalism

Maintaining professionalism in your business dealings is crucial for building trust and ensuring long-term success. Whether you’re dealing with clients, managing payments, or handling any documentation, presenting yourself in a professional manner can significantly enhance your reputation and client satisfaction. Below are key tips to help you maintain a high standard of professionalism in your business operations.

| Aspect | Best Practices |

|---|---|

| Clear Communication | Always communicate expectations, pricing, and terms upfront to avoid misunderstandings. |

| Timely Responses | Respond to client inquiries and requests promptly to show respect for their time and maintain trust. |

| Accurate Records | Ensure all your documentation is accurate, including payment records and service details, to avoid confusion. |

| Polished Appearance | Use clean, clear, and professional formats for all business communications, from contracts to receipts. |

| Respect Deadlines | Always adhere to agreed deadlines, whether for providing services or sending bills, to reinforce reliability. |

By following these practices, you can ensure that your interactions with clients remain professional and that your business operations run smoothly. Consistency in professionalism not only fosters trust but also leads to positive client experiences and better retention rates.

How to Send Invoices Effectively

Sending billing documents promptly and correctly is an essential part of ensuring smooth financial transactions with clients. The process of delivering your payment requests should be clear, professional, and efficient to avoid delays and confusion. Effective communication regarding payment expectations plays a key role in maintaining a positive business relationship.

Here are some best practices to help you send billing records effectively:

- Choose the Right Delivery Method: Opt for digital delivery, such as email, to ensure that your client receives the document quickly and securely. If necessary, you can also use postal services for formal or larger transactions.

- Include Clear Instructions: Ensure that your billing document includes clear payment instructions, including due dates, accepted payment methods, and any necessary details like bank account numbers or links to online payment platforms.

- Send Reminders Promptly: If a payment is overdue, follow up in a professional manner. Set up automated reminders or send gentle email notifications to remind clients of outstanding amounts.

- Use Professional Email Communication: When sending your billing document via email, make sure your email body is polite and professional. Include the necessary context, such as the service provided and the amount due, and attach the document in a clear, accessible format (e.g., PDF).

- Confirm Receipt: Ask clients to confirm that they have received the payment request, especially if it contains important details. This ensures that the client is aware of the due amount and avoids confusion later.

By following these guidelines, you can ensure that your billing process runs smoothly, payments are received on time, and your clients have a positive experience working with you. Prompt, clear, and professional communication will help you maintain trust and encourage timely payments, leading to better financial management for your business.