Free Invoice Template Numbers for Mac

Managing financial transactions and ensuring smooth operations is a crucial part of any business. One of the essential tasks in maintaining an organized workflow is generating structured documents to record services or products provided. Having a reliable and easily accessible tool for creating these documents can save time and reduce the risk of errors.

For those using Apple’s operating system, there are multiple options to streamline this process. With the right tools, creating professional, organized records becomes a simple task. Whether you’re a freelancer, small business owner, or entrepreneur, using digital resources designed to assist in record-keeping can greatly improve efficiency and accuracy.

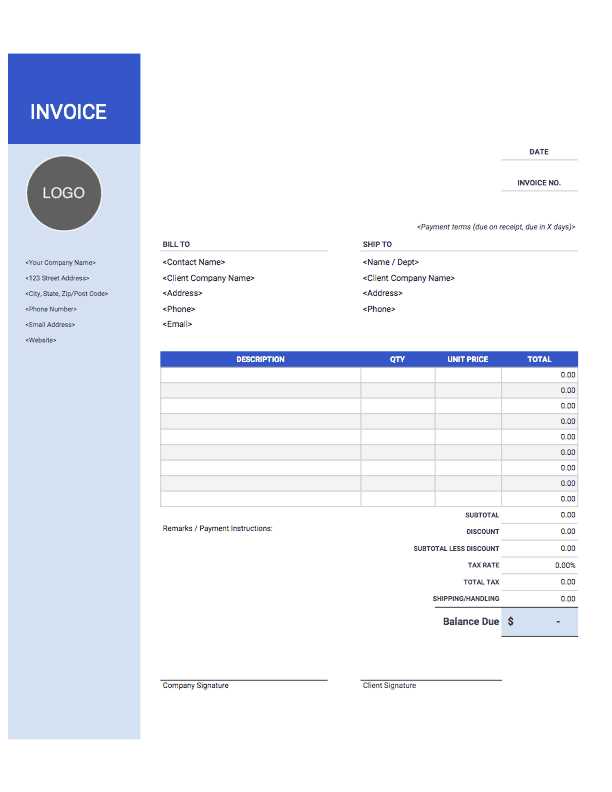

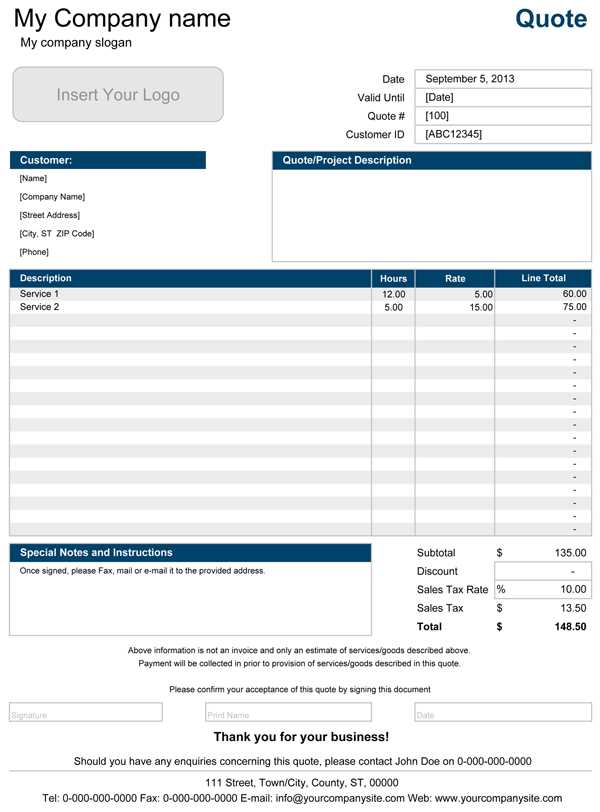

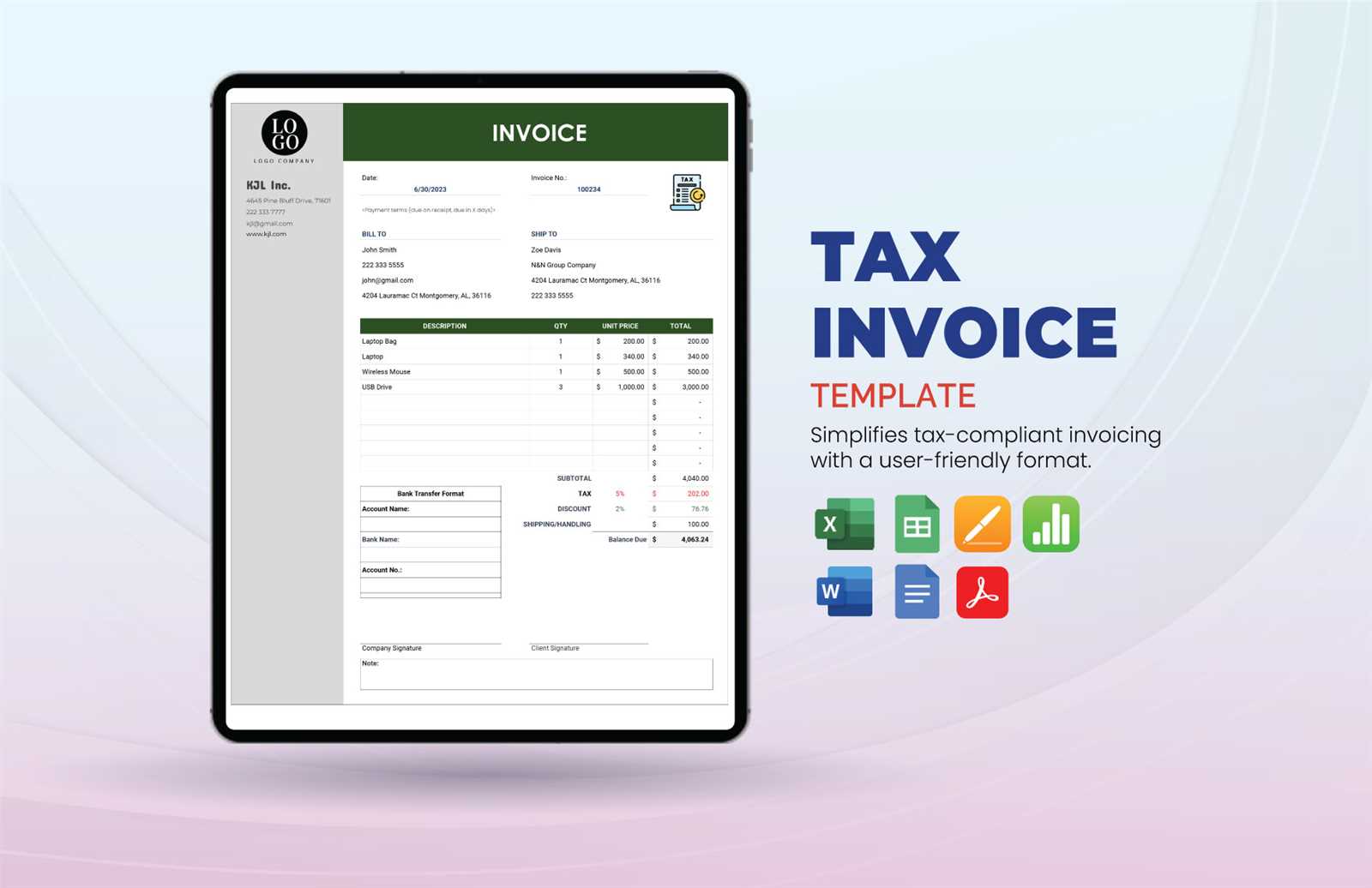

Customization is key when selecting a solution for your financial documents. Many tools offer flexibility to tailor the format and appearance according to your specific needs, helping you maintain consistency and professionalism in your financial communications. These tools are designed to support various methods of organization, ensuring that every transaction is tracked seamlessly.

In this article, we explore accessible options that enable users to manage their billing requirements with ease, regardless of budget. Whether you’re new to business or a seasoned professional, these solutions provide the resources needed for an efficient, organized approach to financial documentation.

Free Invoice Templates for Mac Users

For anyone looking to organize their financial records with ease, finding the right resources is essential. Using pre-designed tools allows for quick setup and eliminates the need for manual creation of each document. These solutions are designed to simplify the process, offering a range of features to suit different business needs and personal preferences.

Many tools are available for Apple users that can assist in generating well-structured and professional documents for transactions. These resources allow users to efficiently input key details and track payments without having to start from scratch each time. The best part is that a number of these options are available at no cost, making them highly accessible for small businesses and freelancers.

Customization is one of the most important features of these tools. Users can modify fields, adjust the layout, and personalize documents to align with their brand or preferences. Whether you’re handling simple services or more complex projects, the right tool can help you stay organized and ensure consistency in your financial communications.

Thanks to the variety of available options, anyone with an Apple device can easily access these tools and benefit from their functionality. From basic designs to more advanced solutions, there is something available to meet every need, all while maintaining a professional appearance and improving overall efficiency.

How to Create Invoice Numbers on Mac

When managing client transactions, assigning a unique identifier to each record is crucial for organization and tracking purposes. The ability to generate and assign these identifiers efficiently ensures that all records remain distinct and can be easily referenced when necessary. Fortunately, Apple users have a variety of tools at their disposal to create and organize these identifiers quickly and without hassle.

Using Spreadsheet Software

One of the simplest methods to generate identifiers is through spreadsheet applications like Numbers or Excel. These programs offer built-in features to automatically sequence and generate unique values for each document. By using simple formulas, you can set up a system that auto-increments with each new entry, ensuring that every transaction gets its own distinct reference number.

Automation Tools for Customization

For more advanced needs, there are automation tools available that can help streamline the process even further. These programs allow users to customize the format of each reference number, including adding specific prefixes, suffixes, or dates. This can be especially useful for businesses that want to keep track of their records over time or distinguish between different types of transactions.

Whether using basic spreadsheet functions or more advanced automation, generating unique identifiers for each document is an easy and efficient way to maintain order and ensure clarity in financial management. The right tools make this process straightforward, allowing you to focus on the core aspects of your business operations.

Top Free Invoice Templates for Mac

For those looking to streamline their financial documentation, there are a number of pre-designed solutions available to help create professional records with ease. These tools can save time and eliminate the need for manual formatting, allowing users to quickly generate clear, consistent documents for their transactions. Whether you are a freelancer, small business owner, or running a larger operation, these resources can simplify the process and enhance overall productivity.

Best Options for Quick Setup

Many applications offer ready-to-use structures, providing various layouts that suit different business needs. These options can be easily customized to add specific details, modify the layout, and adjust the style according to your branding preferences. Below is a comparison of some of the best available solutions for users looking to generate professional records quickly and effectively.

| Tool | Features | Customization Options |

|---|---|---|

| Numbers | Simple to use, integrates with other Apple apps | Easy formula integration, adjustable fields |

| Google Sheets | Cloud-based, accessible anywhere | Customizable layouts, template library |

| Zoho Invoice | Cloud platform, automated features | Customizable design, branding options |

Additional Tools and Apps

Aside from the well-known options, there are also specialized programs designed specifically for organizing financial records. These often include features like automatic numbering, payment tracking, and even integration with accounting softwar

Benefits of Using Invoice Templates

Utilizing pre-designed solutions for generating financial documents offers a range of advantages that can significantly improve your business operations. By automating the process and reducing the need for manual creation, these tools help save time and ensure consistency across all your records. With the right system in place, you can focus on your core business activities while maintaining a professional and organized approach to client transactions.

One of the primary benefits of using these ready-made structures is increased efficiency. Rather than starting from scratch with each new record, you can simply fill in the necessary details, allowing you to complete your work faster. This efficiency is particularly valuable for small businesses and freelancers who may be managing a high volume of transactions and need to stay on top of every detail.

Another key advantage is accuracy. By using a predefined structure, you minimize the risk of making mistakes when formatting or including important information. This consistency ensures that every document adheres to the same standards, helping you avoid errors that could lead to misunderstandings or payment delays.

Additionally, these tools often come with built-in features like automatic sequencing, customizable fields, and options for personal branding, allowing you to tailor your documents to suit your business needs. With these features, your documents look professional and polished, helping you maintain a trustworthy image in the eyes of your clients.

Finally, using pre-made resources makes tracking and organizing past records much easier. With everything stored in an orderly manner, you can quickly reference previous transactions, check payment statuses, and generate reports as needed–helping you stay organized and on top of your financials at all times.

Customizing Your Mac Invoice Templates

Personalizing your financial documents allows you to better reflect your business’s unique identity and meet specific needs. Whether you are adjusting the layout, adding your logo, or modifying the content structure, customization makes your documents both professional and tailored to your brand. With the right tools, you can easily make changes to ensure your records are clear, organized, and aligned with your company’s style.

Most available tools on Apple devices provide a range of customization options, giving you the flexibility to modify essential details. For instance, you can adjust fields to capture the exact information you need, such as payment terms or service descriptions. You may also choose to highlight specific sections, making key information stand out for your clients. Changing colors, fonts, and formatting can also help create a more personalized look that resonates with your brand’s image.

Adding logos or other branding elements is another important feature. Incorporating your business logo into your records helps reinforce your brand’s presence and ensures consistency across all client-facing materials. Whether placed in the header or footer, your logo can add a professional touch that boosts credibility.

Furthermore, with the ability to integrate automated fields or calculations, you can improve the efficiency of creating new records. By setting up formulas for tax calculations, discount applications, or total amounts, you reduce the chance of manual errors and make the process smoother. Customization ensures that the final product not only serves its purpose but also supports your operational needs seamlessly.

Overall, customizing your financial documents is an essential step in maintaining a professional, branded, and efficient business operation. The ability to adjust and refine your documents ensures that they always reflect the highest standards, making them not only functional but also an effective marketing tool for your business.

Best Software for Invoices on Mac

For businesses looking to streamline their financial document creation, selecting the right software can make a world of difference. The best tools not only allow for easy creation and management of records but also offer customization options and automation features to simplify the entire process. Whether you’re handling client transactions or tracking expenses, having the right platform can help you stay organized and professional.

There are several high-quality programs available for Apple users that provide everything needed to generate professional documents efficiently. These platforms typically offer templates, customizable fields, and automatic number sequencing to ensure accuracy and consistency in every document. Additionally, some tools come with cloud integration, allowing you to access your records from anywhere, making them ideal for businesses that require mobility and flexibility.

QuickBooks is one of the most popular options, known for its comprehensive accounting features, which include simple document generation and payment tracking. With its wide range of features, it is suitable for both freelancers and larger businesses looking for an all-in-one solution. Similarly, Zoho Invoice offers a user-friendly interface with strong automation capabilities and customizable designs, perfect for businesses that want more control over their documents.

Bill.com is another excellent choice, providing an intuitive platform with powerful tools for invoicing, payment management, and client communication. Its integration with other financial software makes it an attractive option for companies looking to simplify their financial operations.

Finally, for those seeking a straightforward, no-frills option, Wave offers an accessible solution that includes invoicing, accounting, and receipt scanning features. Its ease of use and no-cost entry point make it ideal for small businesses and individuals who need basic but effective tools for managing their records.

Choosing the right software will depend on your specific needs, but these options provide a range of features to ensure that your business runs smoothly, allowing you to focus more on growth and less on administrative tasks.

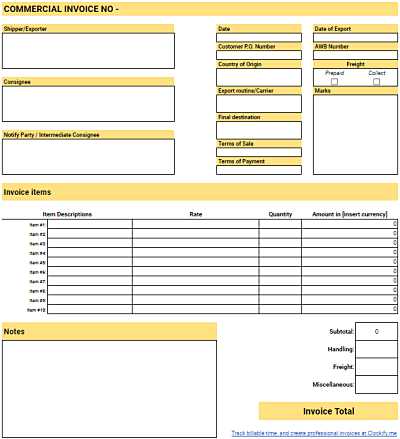

Where to Find Free Invoice Templates

If you’re looking to create professional financial records without spending money on software, there are plenty of resources available that offer ready-to-use designs at no cost. These resources can help you quickly generate well-structured documents, saving time and effort while maintaining a polished appearance for your business. Below are some of the best places to find such tools online.

- Google Docs – Offers a variety of customizable designs that you can access and modify through your Google account. Templates are cloud-based, so you can access and edit them from anywhere.

- Microsoft Office Templates – Through the Office website, users can download a wide selection of professionally designed documents compatible with Microsoft Word or Excel. These templates are easy to modify and free to use for personal or commercial purposes.

- Canva – Known for its user-friendly design tools, Canva provides numerous customizable options for generating professional documents. With its drag-and-drop interface, even beginners can quickly adjust templates to meet their specific needs.

- Zoho Invoice – While primarily a paid service, Zoho offers free access to basic templates that you can customize and use for managing client records. The platform also includes useful features like auto-calculation and cloud storage for easy access.

- Invoice Generator – This online tool allows users to create a record in minutes without needing to register. You can customize essential fields, including payment terms and amounts, and download your documents directly in PDF format.

These options provide a wide range of designs, from simple to more complex layouts, and are perfect for individuals or small businesses that need a quick, efficient way to create their financial records. Whether you prefer using cloud-based tools or desktop applications, there is a solution available that will help you stay organized without spending any money.

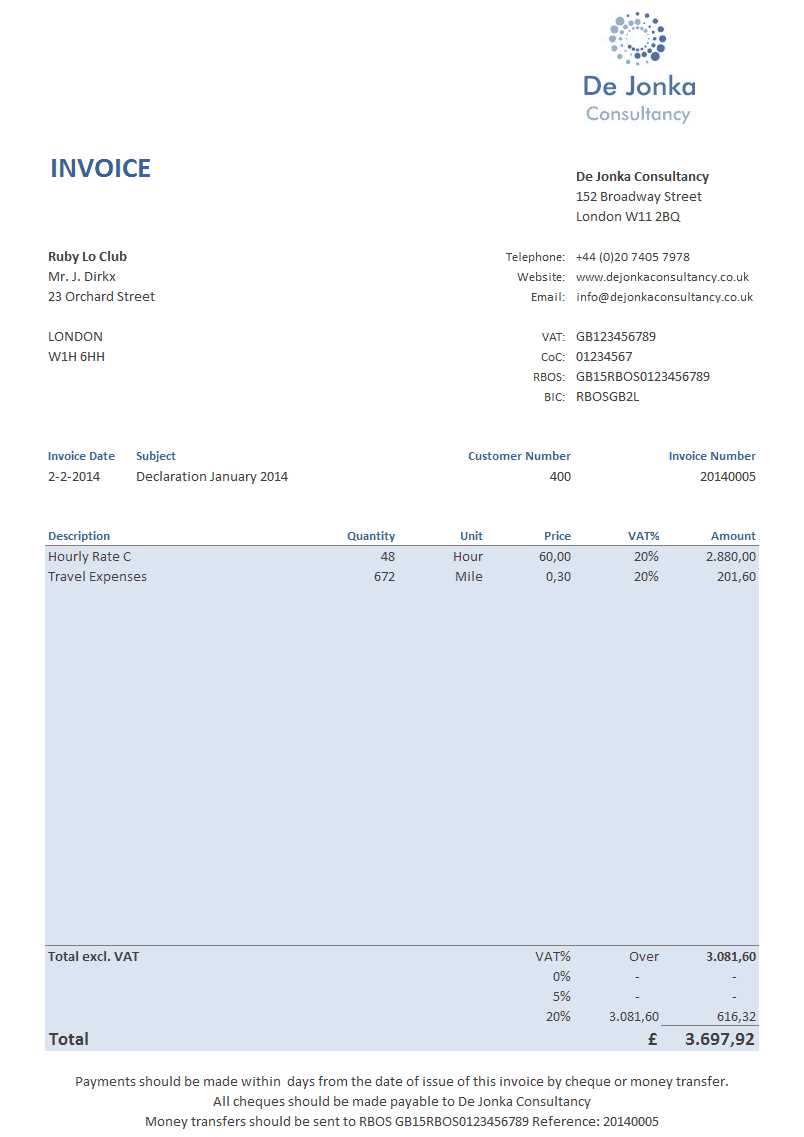

How to Organize Invoice Numbers Efficiently

Managing and tracking your financial records requires a systematic approach to ensure that each transaction is clearly identified and easily referenced. Organizing identifiers effectively not only helps with record-keeping but also facilitates smoother audits and quicker access to past documents. An efficient numbering system can save time, reduce errors, and enhance your overall workflow.

Implementing a Sequential System

One of the most common methods for organizing identifiers is to use a simple sequential system. This method ensures that each record is assigned a unique value in the order it is created. For example, the first record might be labeled as “001,” the next as “002,” and so on. This system is easy to set up and maintain, especially with the use of spreadsheet software or dedicated accounting platforms that allow automatic sequencing of values. The key to success with this approach is to avoid gaps in the sequence, as every new document should follow the last one in numerical order.

Adding Prefixes or Suffixes for Clarity

For businesses handling multiple types of transactions, adding prefixes or suffixes to your identifiers can improve organization. For example, you could use a prefix such as “SVC” for service-related transactions and “PROD” for product sales. This helps quickly distinguish between different types of documents. Similarly, you could include date indicators or client initials to make each identifier even more descriptive and meaningful. This additional level of detail can be especially helpful when sorting and retrieving records from different periods or categories.

By incorporating these strategies, you can create a clear, efficient system for managing your documents. Whether you are a freelancer or a larger company, staying organized with a structured approach to identifiers will help ensure your financial records are accurate, accessible, and easy to navigate when needed.

Using Excel for Invoice Creation on Mac

Excel is a versatile tool that can be incredibly useful for generating professional records. Its customizable features allow you to create detailed documents that can be adjusted to fit any business’s specific needs. Whether you are managing a small freelance operation or handling a larger volume of transactions, Excel can help simplify the process of documenting sales and services efficiently.

Setting Up a Basic Structure

Creating your first record in Excel starts with establishing a clean, easy-to-navigate structure. Begin by organizing the key sections such as client information, item descriptions, quantities, rates, and total amounts. Excel’s grid format is ideal for this, allowing you to separate these details into clear columns and rows. You can also adjust column widths and row heights to accommodate different data points, ensuring that everything fits neatly and is easy to read.

Automating Calculations

One of Excel’s biggest advantages is its ability to automate complex calculations. By using simple formulas, you can automatically calculate totals, taxes, discounts, and other amounts. For instance, multiplying quantities by rates or adding up the total for several line items can be done instantly. This automation not only saves time but also reduces the risk of human error, ensuring that your documents are always accurate.

Additionally, Excel allows you to customize the appearance of your documents. You can add logos, adjust fonts, and apply color schemes to match your business’s branding. With the right setup, Excel becomes a powerful tool for creating documents that are both functional and professional, without the need for advanced software.

By taking advantage of Excel’s features, you can quickly generate well-organized and accurate records that help keep your business running smoothly. Whether you’re a seasoned entrepreneur or just starting out, Excel offers a cost-effective and efficient solution for managing your business documentation.

Mac Apps for Invoice Management

Managing financial documents on a Mac is made easier with a variety of applications designed to streamline the process. These tools allow users to create, track, and organize their transaction records efficiently, reducing the time spent on manual data entry and ensuring that every record is accurate and easily accessible. Whether you’re a freelancer, a small business owner, or running a larger operation, having the right app can simplify your workflow and improve productivity.

QuickBooks is one of the most popular choices, offering a comprehensive suite of tools for managing finances, including the ability to generate professional documents. With features like automatic calculations, client tracking, and customizable formats, QuickBooks makes it easy to create and manage all your financial records in one place. It’s ideal for those who need an all-in-one solution for accounting and documentation.

FreshBooks is another excellent option for business owners who need a simple yet effective way to handle their financial transactions. This app is known for its user-friendly interface and powerful automation features, including automatic reminders for overdue payments and recurring transactions. FreshBooks also integrates seamlessly with other tools, making it a great choice for businesses looking to centralize their financial processes.

Zoho Books is a cloud-based application that offers a range of features for financial management, including the ability to create and manage client records, generate reports, and track expenses. With its intuitive design and powerful automation tools, Zoho Books helps users stay organized and save time. The app is perfect for those looking for a straightforward, no-fuss way to manage their financial documents.

Wave is another great app that provides all the basic tools needed for managing your financial records, and it does so at no cost. Wave offers features such as automatic transaction syncing, expense tracking, and customizable documents, making it an excellent option for small businesses and freelancers on a budget.

With these apps, you can simplify the process of tracking and organizing your financial records, all while maintaining a high level of professionalism. By selecting the right app for your business needs, you can save time, reduce errors, and ensure that your financial documentation remains organized and accessible at all times.

How to Avoid Common Invoice Errors

Creating accurate and clear financial documents is essential for maintaining good relationships with clients and ensuring timely payments. Even minor mistakes can lead to confusion, delays, and sometimes even lost revenue. By being aware of common errors and taking proactive steps, you can avoid these pitfalls and streamline your billing process.

Key Mistakes to Watch Out For

There are several common issues that businesses often face when creating financial records. These errors, if left unchecked, can lead to misunderstandings and slow down payment processing. Below are some of the most frequent mistakes, along with tips on how to prevent them:

| Common Error | How to Avoid It |

|---|---|

| Incorrect Amounts | Always double-check totals and calculations before finalizing documents. Use automated calculations when possible to reduce human error. |

| Missing Information | Ensure that all necessary details, including client information, payment terms, and item descriptions, are included and clearly written. |

| Wrong Dates | Verify that all dates (issue date, due date, and service date) are accurate to avoid confusion and potential delays. |

| Unclear Payment Terms | Specify payment due dates, late fees, and accepted methods of payment in clear and simple language. |

Steps to Ensure Accuracy

To avoid these errors, it’s essential to establish a routine that ensures every detail is reviewed before submission. Using digital tools with automated features can also help eliminate many common mistakes. Many accounting or record-keeping applications include built-in validation tools that alert you when something is missing or incorrect. Setting up a checklist before you finalize your record

Free Online Invoice Templates for Mac

If you’re looking for an easy and cost-effective way to generate professional financial documents, online platforms offer a variety of ready-made options that are accessible from any device. These resources allow you to quickly customize records to suit your business needs without the hassle of designing them from scratch. For users of Apple devices, these tools offer seamless integration with cloud storage, ensuring you can access your documents from anywhere and at any time.

Where to Find Online Resources

There are numerous websites that offer templates designed specifically to streamline the creation of business documents. Below are some of the top platforms where you can find customizable and easy-to-use options:

- Google Docs – A cloud-based solution that provides a variety of document designs that can be modified to suit your business’s unique needs. These documents are easily accessible and shareable across devices.

- Canva – A graphic design tool that offers pre-made, customizable layouts for business documents. With its simple drag-and-drop interface, even beginners can create polished documents quickly.

- Microsoft Office Online – The online version of Office offers a collection of templates, including professional designs for creating detailed financial records. These can be used directly within your browser.

- Zoho Invoice – While primarily a paid service, Zoho offers free templates that allow users to create clean, well-structured records. It also integrates with other tools for easy tracking of payments.

- Wave – Known for being a comprehensive financial management tool, Wave provides easy-to-use templates that you can customize to generate invoices and other financial documents.

Advantages of Using Online Platforms

Using online resources for creating business documents offers several benefits. First, the templates are usually designed by professionals, ensuring they are visually appealing and functional. Additionally, many platforms offer cloud storage integration, so your records are always accessible and backed up. Most importantly, these tools are often free to use, making them an ideal choice for small businesses, freelancers, or those just starting out.

Whether you’re handling a few transactions or managing a larger operation, these online platforms provide the flexibility and tools necessary to keep your financial documentation organized and professional. With easy customization options and no upfront cost, these resources are a great way to simplify the process of creating essential business records.

Design Tips for Professional Invoices

Creating well-organized and visually appealing financial documents is essential for making a positive impression on clients. A clean, professional design not only makes your documents easier to understand but also reinforces your brand’s image. Here are some design tips to help you create documents that stand out while ensuring clarity and ease of use.

Maintain a Clean and Structured Layout

A well-organized layout is the key to making your records easy to navigate. Start by dividing the document into clearly defined sections, such as your business’s contact information, client details, itemized charges, and totals. Keep the structure simple, and ensure that each section is easy to identify at a glance. Use headings, bold text, and spacing to visually separate these sections, making the document look less cluttered and more professional.

Use Consistent Branding and Colors

Incorporating your company’s logo, color scheme, and fonts helps maintain brand consistency across all your communications. Choose colors that align with your brand identity but avoid using too many colors that can make the document look chaotic. A clean, minimalist design with one or two accent colors will help keep the document professional and polished. Additionally, ensure that the fonts are easy to read–use standard, clear fonts like Arial or Helvetica for the main text and reserve decorative fonts for headings if needed.

Pro Tip: If you’re unsure about colors or fonts, many online platforms provide pre-designed professional layouts that already adhere to best practices, so you don’t have to worry about making design decisions from scratch.

Incorporate Essential Details Clearly

It’s essential that all key details–such as payment terms, due dates, and item descriptions–are displayed clearly and in a consistent format. Avoid using overly complex language and keep the descriptions straightforward. Be sure to include all necessary details to prevent confusion or delays in payment processing.

In summary, a professional and visually appealing design can significantly enhance the effectiveness of your financia

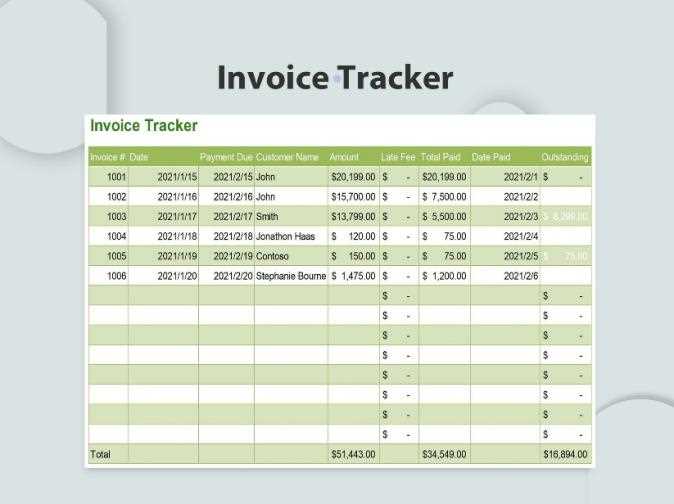

How to Track Payments with Invoices

Tracking payments efficiently is a crucial aspect of managing your business’s cash flow. Keeping accurate records of when and how payments are made ensures you can follow up on outstanding balances and avoid potential financial confusion. A clear system for tracking payments helps you stay organized, maintain client relationships, and prevent any discrepancies from affecting your finances.

Set Up a Payment Tracking System

To track payments effectively, it’s important to establish a consistent system. One of the simplest ways is to assign a unique reference number to each record. This number serves as a quick identifier for both you and your clients, making it easier to match payments with the corresponding transaction. Additionally, include key payment details such as the date received, payment method (bank transfer, credit card, etc.), and the amount paid. By ensuring this information is recorded consistently, you can quickly verify whether payments are received on time and in full.

Use Digital Tools for Automatic Updates

Modern financial management tools often include automatic payment tracking features. These platforms can sync with your payment processor or bank account to automatically update records when payments are received. For example, many accounting software options offer integrations with PayPal, credit card processors, or direct bank transfers, allowing them to update your records in real-time. This reduces the manual effort required to track payments and minimizes the risk of errors.

Pro Tip: Make use of automated reminders or payment statuses to notify clients about due or overdue amounts, which helps reduce late payments and streamline the collection process.

Monitor Outstanding Balances

In addition to tracking payments, it’s equally important to keep an eye on unpaid balances. Regularly review your records to ensure that any overdue amounts are flagged and followed up on promptly. Many financial management tools allow you to generate reports that show outstanding payments, so you can prioritize follow-ups and ensure no payment is forgotten.

By setting up a reliable tracking system and leveraging digital tools, you can maintain control over your cash flow, avoid missed payments, and keep your business finances organized and efficient. A systematic approach to payment tracking will give you peace of mind and enable you to focus on growing your business.

Legal Considerations for Invoice Numbering

When managing business transactions, it is essential to follow specific legal requirements regarding the organization and sequence of financial documents. Properly numbering your transaction records is not just a matter of convenience, but a legal obligation in many jurisdictions. Maintaining a clear and systematic approach to document sequencing helps ensure compliance with tax regulations and minimizes the risk of disputes with clients or tax authorities.

Why Sequential Numbering Matters

Sequential numbering is a standard practice for tracking and recording transactions. It provides a transparent and traceable system that can help prove the legitimacy of business activities in case of an audit or legal review. A proper sequence prevents confusion by making it clear that each document is distinct and issued in chronological order. Many countries require businesses to use a continuous, unbroken sequence of reference numbers, and failure to comply can result in penalties or difficulties with tax filings.

Legal Requirements and Compliance

While the specific rules regarding document numbering vary by region, most jurisdictions have specific guidelines that businesses must adhere to. For example, in many countries, tax authorities require that businesses use unique identification codes for each document, and that these identifiers be assigned in a specific order. The goal is to avoid any possibility of duplication, omission, or manipulation of records. Additionally, businesses should keep a clear audit trail by maintaining records of issued and voided documents.

Tip: Check with local regulations or a legal professional to ensure you are meeting all requirements related to financial record-keeping in your area.

Handling Missing or Incorrect Sequences

It is also important to address the handling of missing or skipped numbers in your system. Many countries require that businesses document any gaps in their numbering sequence and provide explanations if necessary. This is particularly relevant for larger organizations that may issue hundreds or thousands of records regularly. By maintaining careful logs and providing justifiable reasons for any irregularities, businesses can avoid complications and demonstrate compliance with the law.

By adhering to legal requirements for document sequencing and maintaining a transparent system, businesses can protect themselves from potential legal issues and streamline their record-keeping practices. Proper numbering ensures that you remain compliant, organized, and prepared for any necessary audits or legal scrutiny.