Free Invoice Template Maker Generate Professional Invoices in Minutes

Generating accurate and well-structured billing documents is essential for any business, whether you’re a freelancer or running a large organization. Having the right tools can significantly reduce the time and effort spent on creating and managing financial paperwork. With the right resources, crafting professional invoices can be a straightforward task.

By using a simple and intuitive tool, you can easily produce polished billing statements without needing advanced technical skills. These tools are designed to help users create documents that meet legal and professional standards, while also allowing customization for your specific needs.

Efficiency is key when managing client transactions, and automated systems ensure that you stay organized and accurate. Whether you need to adjust the layout, include specific payment terms, or track your finances, these solutions streamline the process, saving valuable time. With minimal input, you can generate comprehensive records that reflect your business’s professionalism and attention to detail.

Free Invoice Template Maker Overview

Managing financial transactions efficiently is a crucial aspect of running a business, and having the right tools can make this process much easier. There are various platforms available that simplify the creation of professional documents used for billing clients. These tools are designed to help you quickly generate polished, accurate records that meet industry standards and are tailored to your business needs.

Using an automated tool to create billing statements allows you to avoid manual errors and time-consuming tasks. Instead of starting from scratch every time, you can choose from a variety of pre-designed formats and adjust them to fit your specific requirements. This ensures that you maintain consistency and professionalism with each document.

Customization is a key feature of these resources. With just a few clicks, you can adjust the layout, add specific payment terms, or include your company logo. The goal is to create a seamless experience for both you and your clients, making the entire billing process as smooth and straightforward as possible.

Additionally, these platforms often come with useful features like automatic tax calculations, payment tracking, and export options, so you can easily store and manage your financial records. By choosing the right tool, you can save time and focus more on growing your business, rather than getting bogged down by administrative tasks.

Why Use an Invoice Template Generator

Creating financial documents manually can be time-consuming and prone to errors, especially when dealing with multiple clients or complex transactions. An automated tool can greatly simplify this process, helping you generate well-structured and accurate records in a fraction of the time. These platforms are designed to save you effort, allowing you to focus more on your business while ensuring that your paperwork remains professional and consistent.

One of the key advantages of using such a tool is the ease of use. You no longer need to worry about formatting issues, adding necessary fields, or ensuring compliance with industry standards. With just a few clicks, you can generate a document that looks polished and meets the required criteria, all without needing advanced design or accounting skills.

Efficiency is another significant benefit. By streamlining the process of document creation, you can handle more clients and transactions without increasing the time spent on administrative tasks. Additionally, many tools offer features like auto-calculation for taxes, discounts, and totals, reducing the risk of human error.

Moreover, these platforms provide a level of customization that allows you to tailor each record to reflect your branding, payment terms, and specific requirements. This flexibility ensures that your business maintains a professional image, while also offering the convenience of creating tailored documents in minutes.

Benefits of Free Invoice Templates

Using pre-designed solutions for creating billing documents offers a variety of advantages for businesses of all sizes. These resources can help streamline the process, improve accuracy, and reduce the amount of time spent on administrative tasks. With simple tools at your disposal, you can easily generate professional, well-structured financial records that reflect your brand and ensure smooth transactions with clients.

Time and Cost Efficiency

One of the most significant benefits of using these resources is the amount of time and money they save. Instead of designing a document from scratch or hiring a designer, you can simply use an available option and customize it to suit your needs. This allows you to focus your efforts on growing your business rather than spending time on paperwork.

- Quick setup: Generate a document in minutes, without any complicated processes.

- No design skills required: Pre-made structures ensure a professional appearance even if you’re not a designer.

- Zero cost: Most platforms offer accessible solutions at no charge, which means you can get started immediately.

Professional Look and Consistency

These tools provide polished, standardized formats that can help establish a strong professional image for your business. Whether you’re sending documents to clients or partners, having a consistent format can increase trust and credibility.

- Customizable features: Add your logo, company details, and payment terms to create a personalized look.

- Consistency: Ensure that all your billing statements follow the same layout, maintaining a uniform appearance across all transactions.

- Industry compliance: Many solutions are designed to meet the necessary requirements, ensuring your documents are legally sound.

How to Create Invoices Quickly

Creating billing statements in a timely manner is essential for maintaining smooth cash flow and professional relationships with clients. With the right tools, the process can be completed in just a few steps, allowing you to focus on other important tasks. By following a few simple guidelines, you can streamline the creation of your financial documents and ensure accuracy every time.

Step-by-Step Process

Using an automated tool makes generating these records both fast and easy. Here’s a quick guide to help you create your documents efficiently:

- Select a Format: Choose a pre-designed layout that suits your business needs. Most platforms offer a variety of options to choose from.

- Enter Client Information: Add the necessary details such as client name, address, and contact information.

- List Services or Products: Clearly outline the items or services provided, including quantities and rates.

- Apply Payment Terms: Specify payment deadlines, discounts, or any relevant terms.

- Finalize and Export: Review the document for accuracy and export it in your desired format for easy sharing.

Key Tips for Speed

- Save Defaults: Many tools allow you to save client information or your business details for future use, saving time on repeat entries.

- Auto-calculation: Use features that automatically calculate totals, taxes, and discounts to avoid manual errors

Customizing Your Invoice Design

Personalizing your financial documents not only helps to maintain a professional image but also allows you to tailor them to the specific needs of your business. Customization options give you the flexibility to align your documents with your brand identity, ensuring that each statement reflects your unique style and enhances client trust.

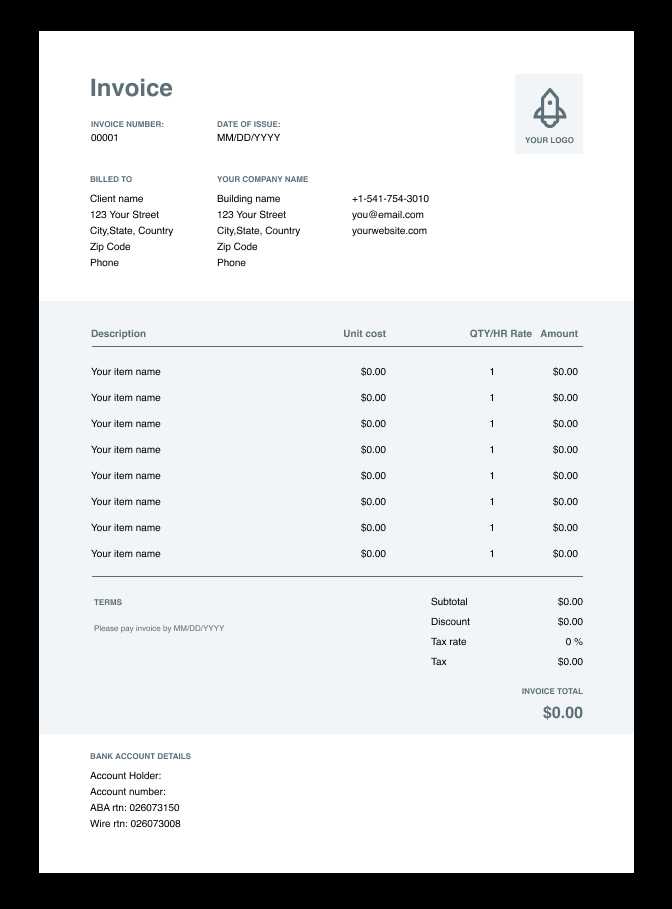

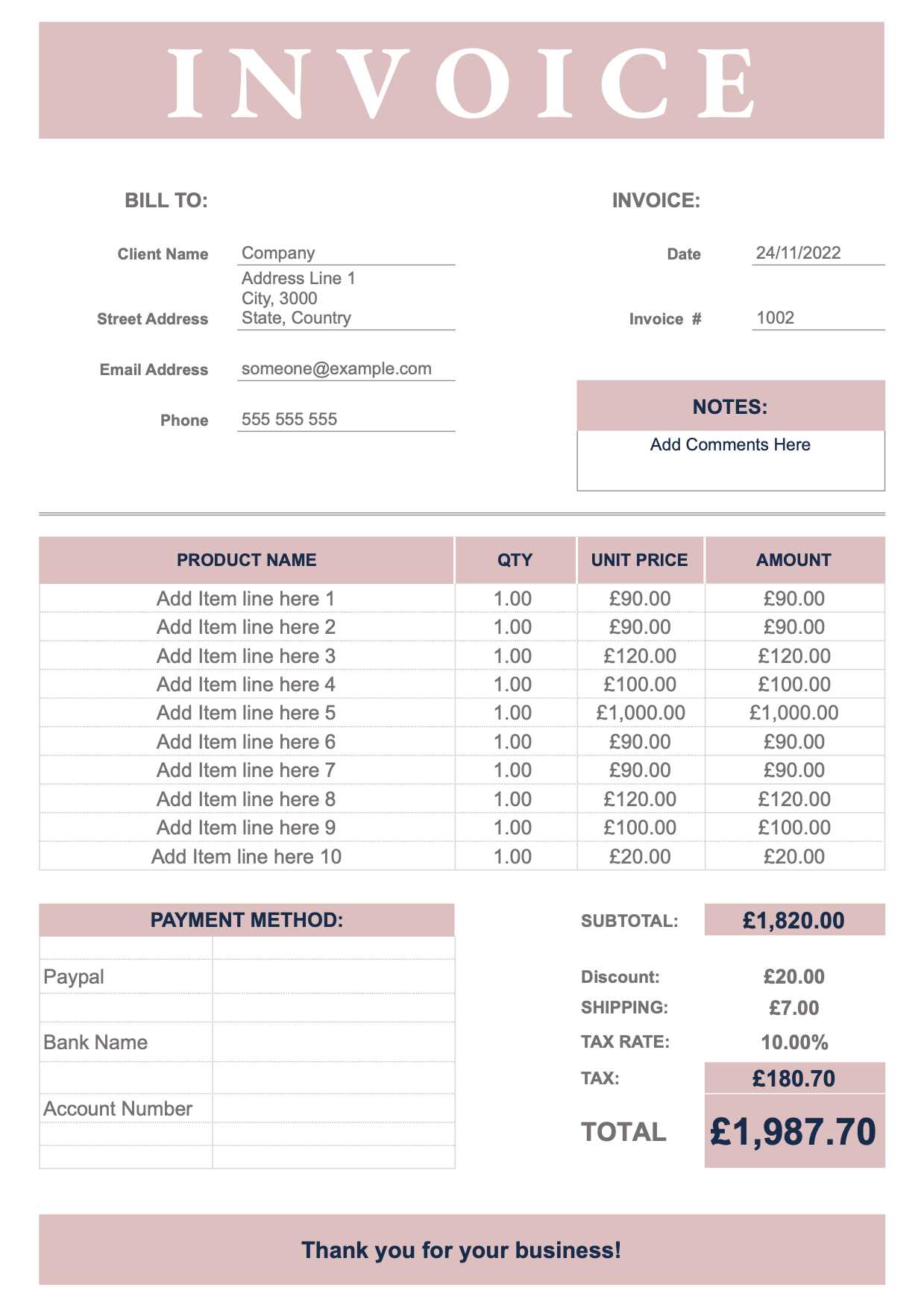

Design flexibility is a key benefit, allowing you to adjust various elements of your documents. You can modify the layout, choose color schemes, and add your logo to create a consistent and recognizable look. By making small adjustments, you ensure your documents look polished and on-brand every time.

Key Design Elements to Customize

- Logo and Branding: Upload your company logo and use your brand colors for a cohesive appearance.

- Header and Footer: Customize the header with your company name and contact details, while adjusting the footer for payment instructions or legal disclaimers.

- Fonts and Styles: Choose fonts that align with your company’s image and ensure readability.

- Layout: Adjust the layout to highlight key information, such as payment terms and services rendered, making the document clear and easy to read.

How Customization Enhances Efficiency

Tailoring your documents to fit your business not only helps maintain a consistent image but also improves efficiency. By standardizing the design, you reduce the time spent formatting each document, allowing you to focus more on delivering your services and less on administrative tasks.

Choosing the Right Invoice Format

Selecting the correct structure for your billing documents is essential for ensuring clarity and professionalism. Different formats serve different purposes, so it’s important to choose one that suits your business needs while ensuring all necessary information is presented in an organized way. The format you select can affect how clients perceive your business and can influence the ease with which payments are processed.

The right design depends on factors such as the nature of your services or products, the frequency of transactions, and any specific client preferences. By understanding the different options available, you can choose the format that will best serve both your business and your clients.

Common Formats for Billing Documents

Format Type Best For Key Features Basic Freelancers or small businesses Simple layout with basic fields for services, totals, and payment terms Itemized Businesses with multiple products or services Breakdown of individual items with descriptions, quantities, and unit prices Recurring Subscription-based services Pre-set details for recurring charges and payment terms, often with automated date generation Proforma Estimating costs or providing advance billing N How to Save Time with Templates

Using pre-designed formats can significantly reduce the time spent on administrative tasks, allowing you to focus on the core aspects of your business. Instead of creating new documents from scratch each time, you can rely on ready-made structures that are easy to customize. These solutions streamline the entire process, making it faster and more efficient.

Key Ways Templates Save Time

- Quick Customization: Instead of entering details from scratch, simply adjust key fields like client names, services, or amounts.

- Pre-set Structure: With predefined sections for important information, you eliminate the need for manual formatting and layout adjustments.

- Reusable Content: Once you have a standardized layout, you can reuse it for multiple clients, saving time on repetitive tasks.

- Auto-calculation: Many tools automatically calculate totals, taxes, and discounts, reducing manual errors and speeding up the process.

How Automation Enhances Efficiency

- Automated Client Information: Save client details to reuse across documents, avoiding the need to re-enter data each time.

- Default Settings: Set default payment terms or billing options, so you don’t need to adjust these on every new document.

- Exporting and Sharing: Generate and export documents in various formats instantly, making it easy to send them to clients without delay.

By implementing these time-saving strategies, you can handle more clients and manage transactions faster, all while maintaining a high level of accuracy and professionalism in your business operations.

Top Features of Invoice Makers

When choosing a tool for generating billing documents, it’s important to look for features that can simplify your workflow, ensure accuracy, and improve efficiency. The best platforms provide a range of functions that allow you to create professional and error-free records with minimal effort. Here are some of the top features you should look for when selecting a tool for generating financial statements.

Essential Features for Maximum Efficiency

- Customization Options: Ability to adjust the layout, colors, and fonts to match your brand identity, ensuring every document reflects your business style.

- Automatic Calculations: Tools that calculate totals, taxes, and discounts for you, reducing the risk of human error and speeding up the process.

- Recurring Billing: The option to create templates for repeat transactions, making it easy to send consistent billing statements for subscription services or ongoing contracts.

- Client Management: Save and manage client information, making it easy to autofill contact details and other relevant data for repeat transactions.

Additional Features for Enhanced Functionality

- Multi-currency Support: Ideal for businesses that deal with clients from different countries, allowing you to create documents in various currencies.

- Mobile Access: Access to tools on mobile devices, so you can create and send billing records on-the-go, from anywhere.

- Export and Sharing Options: Export your documents in multiple formats (PDF, Excel, etc.) and share them directly via email or cloud storage.

- Tax Compliance: Built-in features that ensure your records comply with local tax regulations, including tax rates and VAT calculations.

By leveraging these features, you can streamline your billing process, reduce administrative overhead, and maintain a high level of professionalism in all your busines

Understanding Invoice Template Elements

When creating professional billing documents, it’s essential to understand the key components that make up these records. Each section plays a specific role in ensuring clarity, accuracy, and professionalism. Knowing the purpose of each element will help you create effective and legally sound documents that can be easily understood by clients and business partners alike.

There are several critical parts of a billing statement, each serving a different purpose. From client information to payment terms, these elements come together to form a comprehensive and organized document. Let’s break down the key components you should be familiar with when generating your records.

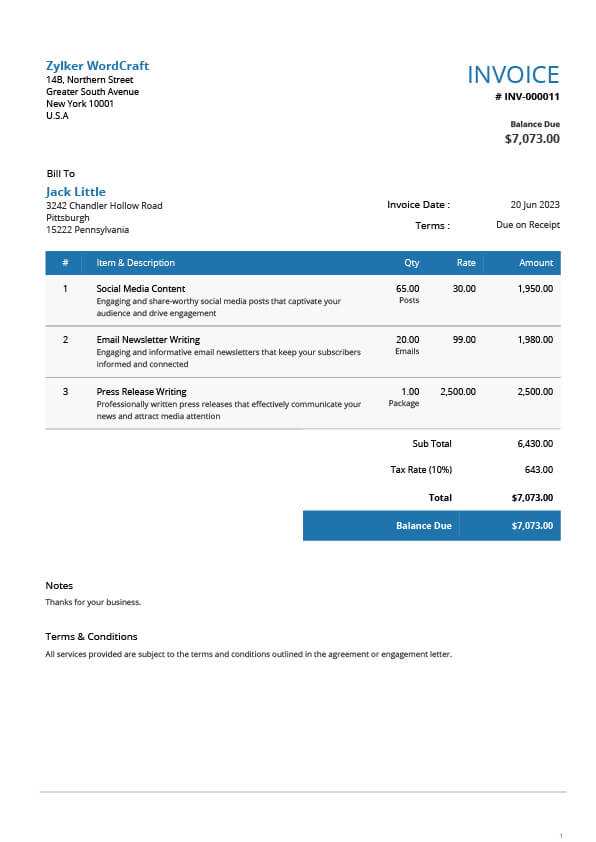

Key Elements of a Billing Document

- Header: This section typically includes your company name, logo, and contact information. It sets the tone for your document and makes it easy for clients to identify who the bill is from.

- Client Information: The details of the client being billed, including their name, address, phone number, and email. This ensures accurate delivery and clear communication.

- Document Number: A unique identifier for each document, allowing for easy tracking and reference. This is especially useful for record-keeping and managing multiple transactions.

- Dates: Including the issue date and due date helps clarify the timeline of the transaction and ensures clients are aware of payment deadlines.

- Itemized List: A detailed breakdown of the goods or services provided, including descriptions, quantities, individual prices, and total costs. This section ensures transparency and helps clients understand exactly what they are paying for.

- Subtotal: The sum of all items or services before taxes, discounts, and additional fees are applied. It gives clients a clear view of the base cost of the transaction.

- Taxes and Additional Fees: This secti

How to Add Tax and Discounts

Incorporating taxes and discounts into your financial records is an important part of creating accurate and transparent billing documents. Whether you need to apply a tax rate based on location or offer a discount to incentivize early payment, knowing how to add these elements properly ensures that the final amount is correct and clearly communicated to your client.

Adding taxes involves calculating the appropriate amount based on the applicable tax rate, which can vary depending on your location or the type of service or product. It’s important to specify the tax rate applied and provide a clear breakdown, so clients understand how the final amount is derived.

Steps to Add Tax

- Identify Tax Rate: Check the local tax regulations to determine the applicable rate for your product or service.

- Calculate Tax Amount: Multiply the subtotal of the goods or services by the tax rate to determine the tax due.

- Display Clearly: Ensure that the tax amount is clearly separated from the subtotal and is shown as a distinct line item on the document.

Applying discounts helps make your offer more attractive to clients and can be a useful tool in encouraging faster payments or larger orders. Whether it’s a fixed percentage or a flat amount, clearly indicating the discount will help clients understand their savings and build trust in your pricing strategy.

Steps to Add Discounts

- Choose Discount Type: Decide whether the discount will be a fixed amount or a percentage off the total.

- Calculate Discount: If using a percentage, simply multiply the total by the discount rate. If a fixed amount, subtract the set amount from the total.

- Display Discount: Clearly show the discount applied, so your client can easily see the reduction in price before taxes are added.

By care

Tracking Payments with Templates

Effectively managing and tracking payments is crucial for maintaining cash flow and ensuring timely settlements with clients. Using pre-designed formats for your billing documents can make it much easier to monitor which payments have been received and which are still pending. With the right tools, you can keep track of outstanding balances and avoid unnecessary delays in getting paid.

By incorporating payment tracking features into your financial documents, you can quickly identify overdue payments and take appropriate action. This will help you stay organized, improve your financial visibility, and ultimately streamline your business operations.

Steps to Track Payments

- Include Payment Status: Always mark the status of the payment (e.g., Paid, Pending, Overdue) directly on the document to keep track of each client’s balance.

- Record Payment Dates: Clearly note the date of payment receipt or the due date for each transaction, helping you monitor the payment timeline.

- Track Amount Paid: Deduct payments from the total amount due and show the remaining balance, making it easy to see what is still owed.

Useful Features for Tracking Payments

- Automated Reminders: Set up automatic reminders or due date alerts, which notify clients when payments are due or overdue.

- Payment History: Keep a record of all past transactions, so you can easily check whether a payment has been made for a previous document.

- Multiple Payment Methods: Include multiple payment options (bank transfer, credit card, PayPal, etc.) to make it easier for clients to pay promptly.

- Late Fee Calculation

Best Free Invoice Makers Available

When it comes to creating professional billing documents, having access to reliable tools is essential for businesses of all sizes. Many platforms offer the ability to generate customized and accurate records without requiring a financial investment. These tools typically come with a variety of features that help simplify the process, from automated calculations to customizable layouts, ensuring you can produce polished documents quickly and efficiently.

Below, we explore some of the best options available for creating professional records at no cost. These platforms are ideal for freelancers, small business owners, or anyone who needs to generate billing documents without the complexity of expensive software.

Top Tools for Generating Documents

- Wave: A popular option for small businesses, offering free document creation with easy-to-use features such as recurring billing and tax management.

- Zoho Invoice: Known for its flexibility, this platform allows for unlimited document creation, customizable designs, and integration with other Zoho tools.

- Invoice Generator: A straightforward and user-friendly platform that lets you create and download records in minutes, perfect for quick and simple transactions.

- PayPal Invoicing: For businesses that use PayPal, this option is seamless and integrates payment processing directly into your billing process, making it convenient for both the user and the client.

Why Choose These Platforms

- Ease of Use: All of these tools are designed to be intuitive, requiring little to no experience in creating professional documents.

- Customizable Features: Adjust layouts, fonts, and branding to ensure that your records reflect your business’s style.

- Time-Saving: With automated calculations, easy client manage

Exporting and Printing Invoices Easily

Once your billing document is finalized, the next step is to share it with your clients or print it for your records. The ability to easily export and print financial statements is crucial for streamlining your administrative tasks. With the right tools, you can quickly convert your records into downloadable files or hard copies, ensuring smooth communication with clients and efficient internal documentation management.

Most platforms that allow you to generate business documents come with export and print features that simplify the entire process. These options help you maintain professional standards and ensure that your clients receive accurate, high-quality records every time.

Exporting Options

- PDF Export: This is the most common format for sharing documents, as it preserves the layout and formatting across all devices. It’s ideal for emailing to clients or saving for future reference.

- Excel or CSV Export: If you need to track or manage multiple records, exporting to Excel or CSV format allows you to organize data, run calculations, and keep everything in a spreadsheet for easy access.

- Cloud Integration: Many platforms offer cloud storage options, enabling you to store and access documents from anywhere and easily share them through links or email.

Printing Your Documents

- High-Quality Printing: Ensure that your records are formatted properly for printing, with clear fonts, properly aligned text, and space for signatures or stamps.

- Print Preview: Use the print preview function to check how your document will appear on paper before sending it to the printer. This helps avoid formatting issues or unwanted blank pages.

How to Handle Multiple Clients

Managing multiple clients can be a challenging task, especially when it comes to organizing billing records and ensuring each client’s financial details are accurate and up-to-date. Properly tracking payments, maintaining clear communication, and staying organized are essential for running a smooth business when working with several clients simultaneously. Using the right tools and strategies can help you manage these tasks effectively, saving time and reducing the risk of errors.

With the right approach, you can easily handle various client relationships, ensuring that each transaction is correctly recorded and processed. This will not only improve your efficiency but also strengthen your professional reputation by demonstrating your attention to detail and commitment to service.

Strategies for Managing Multiple Clients

- Client Profiles: Create separate records or profiles for each client. Store all necessary details such as contact information, payment history, and specific terms or agreements to stay organized.

- Custom Billing Documents: Use customizable tools to generate documents that meet each client’s specific needs, such as varying payment terms, service details, or custom pricing.

- Set Clear Deadlines: Establish clear due dates for payments and set reminders to follow up with clients as deadlines approach. This helps avoid overdue payments and keeps your cash flow on track.

- Use Client Management Tools: Leverage software or online tools that help you track multiple clients at once, keeping all records organized in one place. This can streamline everything from payment tracking to project progress.

Tips for Efficient Client Communication

- Regular Updates: Keep clients informed about the status of their transactions and any changes to pricing or terms. Proactive communication builds trust and reduces confusion.

- Personalized Communication: Tailor your messages to each client, addressing their specific needs and concerns. Personalized attention helps foster strong, lasting relationships.

Common Mistakes to Avoid in Invoices Creating accurate and professional financial documents is crucial for maintaining smooth business operations. However, even experienced individuals can make mistakes when preparing these documents, leading to confusion, delayed payments, or even lost clients. Being aware of common errors and knowing how to avoid them can ensure that your documents are clear, professional, and effective.

By avoiding the most frequent mistakes, you can build trust with your clients, improve payment turnaround times, and maintain organized records for future reference. Below are some of the most common pitfalls to watch out for and how to ensure your documents remain error-free.

Top Mistakes to Avoid

- Missing or Incorrect Contact Information: Always double-check that both your details and your client’s are accurate. Incorrect or missing contact info can cause confusion or delays in communication.

- Failure to Include a Due Date: A missing or unclear due date can lead to delayed payments. Always ensure that the due date is clearly stated, making it easy for clients to know when payments are expected.

- Not Itemizing Charges: Clients should be able to easily understand what they are being charged for. Always break down services, products, or hours worked so there is no ambiguity in the amounts.

- Incorrect Calculations: Double-check your math to avoid overcharging or undercharging clients. Even small errors in totals or tax rates can create unnecessary complications.

- Omitting Payment Terms: Clearly state your payment terms (e.g., net 30, deposit required, etc.). Failing to do so can result in misunderstandings about when and how payments should be made.

How to Ensure Accuracy

- Use Automated Tools: Consider using digital tools to help generate your records. Automated features often include calculations and preset fields to ensure accuracy.

- Review Before Sending: Always rev

When to Upgrade to Premium Invoice Tools

As your business grows, so does the need for more advanced tools to manage transactions effectively. While basic tools may be sufficient for small businesses or startups, there comes a time when upgrading to a premium solution can provide significant benefits. Premium tools often offer enhanced features, more customization options, and better support, which can streamline your processes and save you valuable time.

Knowing when to make the switch is important. Upgrading should be a decision based on your growing business needs, rather than simply a desire for more features. Below, we explore the key indicators that signal when it might be time to move to a more advanced system.

Indicators for Upgrading

- Growing Client Base: As you take on more clients, manually handling each transaction becomes cumbersome. Premium tools often offer client management features that allow you to organize, track, and manage multiple accounts more efficiently.

- Increased Complexity: If your billing process involves multiple services, tax rates, or currencies, upgrading to a premium tool can help automate and simplify these complex tasks.

- Customization Needs: Basic tools may not offer the level of customization you need for your documents. With premium solutions, you can tailor your designs, workflows, and even automate certain features to match your specific business requirements.

- Integration with Other Systems: As your business grows