Free Billing Invoice Template Download for Quick and Easy Invoicing

Managing business transactions efficiently is crucial for smooth operations. One key aspect of this is having a reliable system in place to track payments, send receipts, and ensure clients are invoiced correctly. Using an organized structure helps avoid confusion and ensures timely payments, making the whole process faster and more professional.

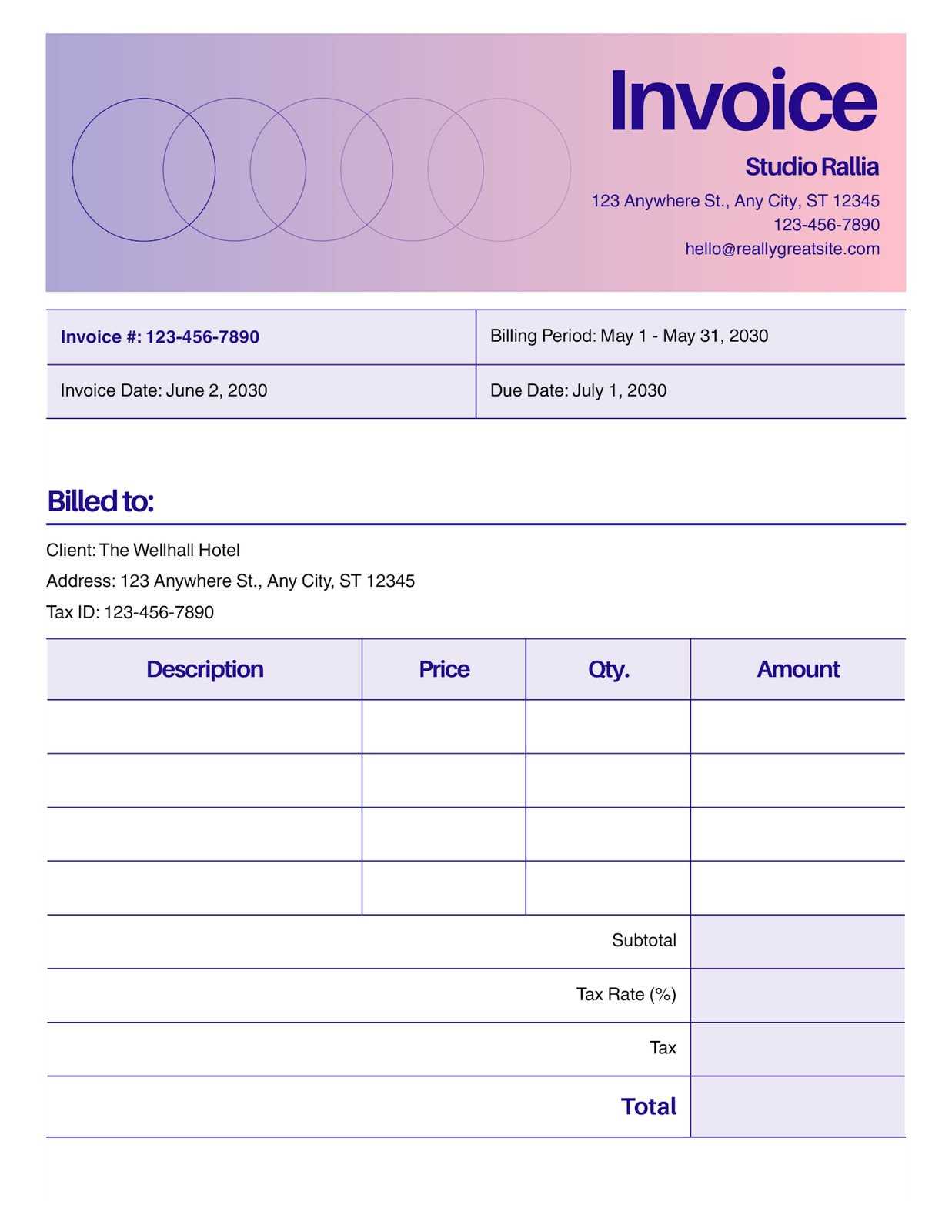

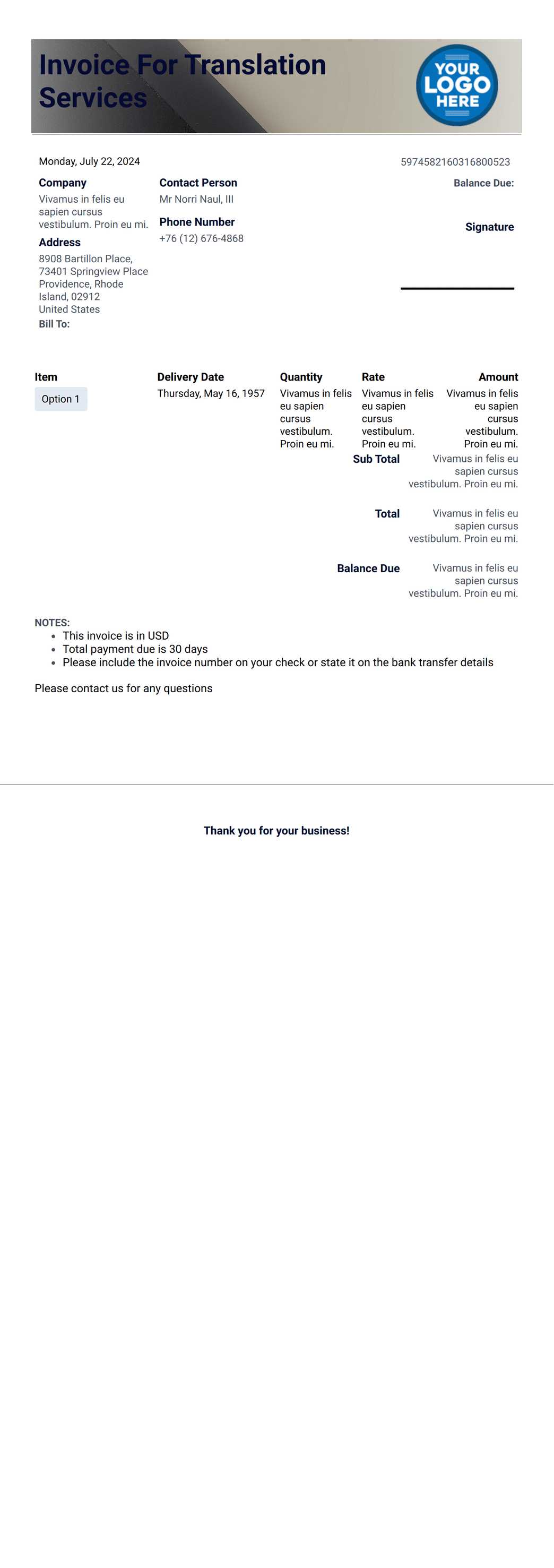

Instead of starting from scratch every time, many businesses turn to pre-designed documents that simplify the task. These ready-to-use solutions allow for quick adaptation to individual needs and help maintain consistency across all transactions. With the right tools, creating a professional-looking record is straightforward and can save valuable time for small business owners and freelancers alike.

Efficient management of financial details is essential for building trust with clients and maintaining a solid reputation. By implementing a structured approach, you can avoid costly errors and streamline the entire procedure. Whether you’re sending an estimate, tracking expenses, or requesting payment, using a well-designed form is a smart way to stay organized and professional.

Free Billing Invoice Templates for Business

In any business, maintaining a consistent and organized approach to managing payments is essential. A simple yet effective way to handle transactions is by using pre-designed documents that can be easily customized to suit different needs. These ready-made forms help save time and ensure accuracy, allowing you to maintain a professional image while simplifying the payment process.

Benefits of Using Pre-Designed Documents

By relying on well-crafted forms, businesses can streamline their operations and reduce the risk of errors. These documents often come with all the necessary fields to track transaction details, including amounts, dates, and recipient information. As a result, you can focus on your core work rather than worrying about formatting or forgetting essential details.

How to Use These Tools Effectively

To get the most out of these tools, it’s important to customize them to match your business’s specific requirements. Add your logo, adjust the layout, and make sure the information provided is accurate. Once personalized, these forms can be used repeatedly, making your accounting process quicker and more efficient. With just a few clicks, you can send out well-structured records that help maintain transparency with your clients.

How to Download a Billing Invoice Template

Getting access to pre-made forms for managing your transactions is a quick and efficient way to streamline your business processes. The procedure for obtaining these ready-to-use documents is simple and can be done with just a few steps. Once you have the appropriate form, you can easily customize it to fit your needs and ensure accurate financial records.

Steps to Obtain the Document

Most resources for these forms are available through websites that specialize in business tools. Simply visit a trusted site, select the desired format, and click on the link to access the document. Depending on the platform, you may be required to provide some basic information, such as your business name or email address, before gaining access to the material.

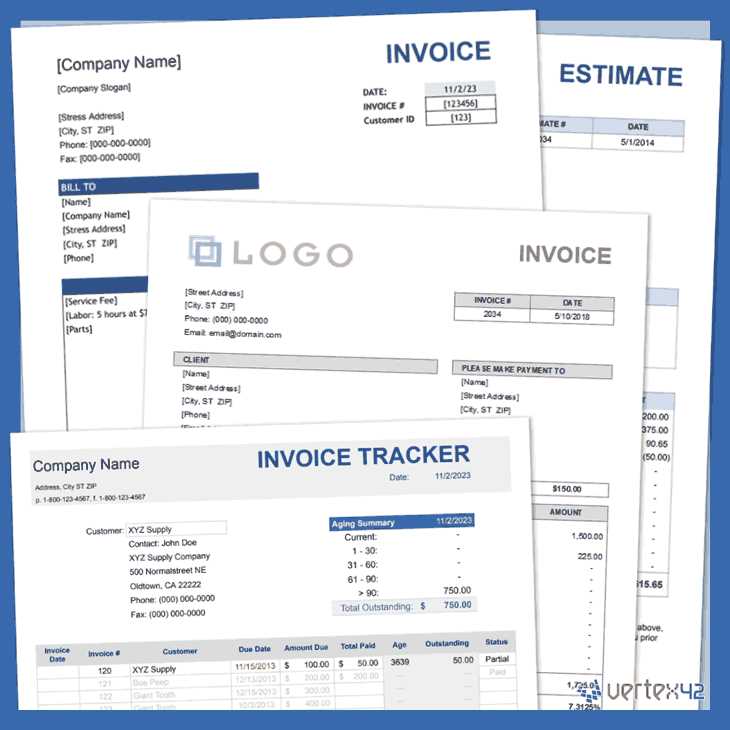

Understanding Different Formats

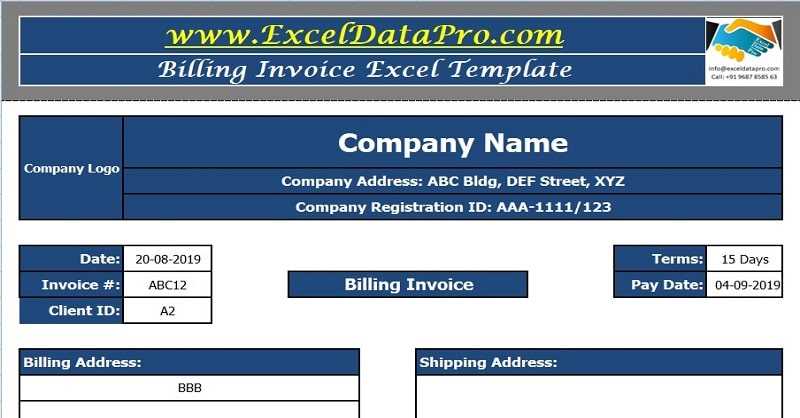

These ready-made documents are usually offered in various formats, such as Word, Excel, or PDF. Each format has its own advantages depending on how you intend to use it. For example, Excel formats allow for easier calculation of totals, while PDF documents ensure a consistent and professional layout that is easy to print.

| Format | Advantages |

|---|---|

| Excel | Easy to modify, automate calculations, customizable layout |

| Consistent formatting, easy to print or send electronically | |

| Word | Simple to edit and customize, good for basic use |

Once you’ve selected the right format, simply save the document to your computer and start customizing it with your business details. With the right tools in hand, you’ll be able to create professional, accurat

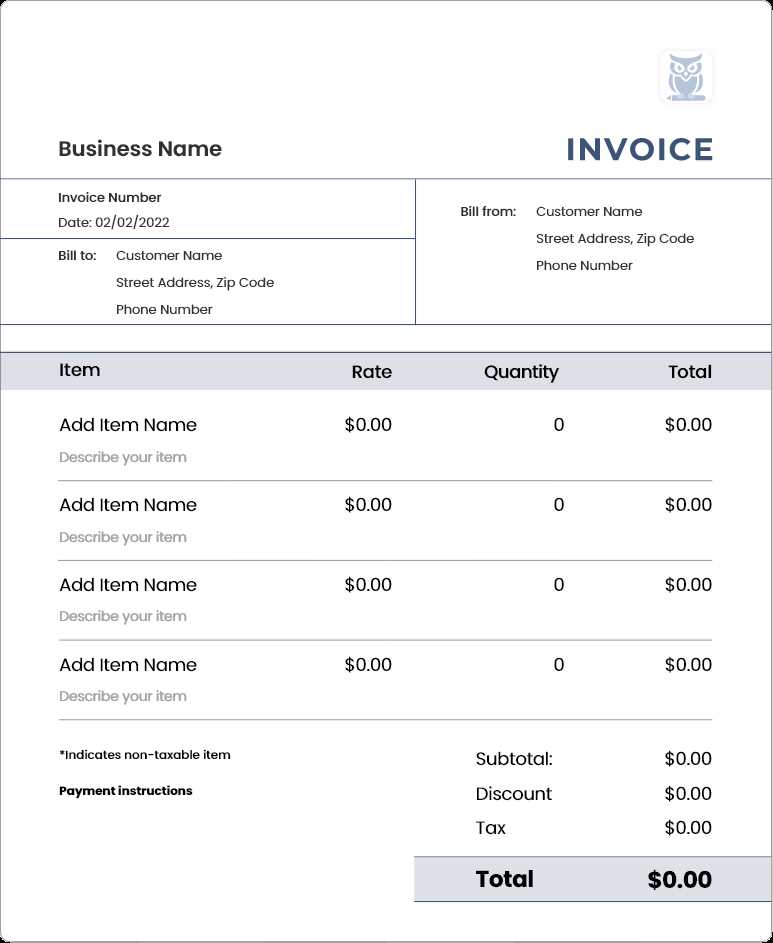

Top Benefits of Using an Invoice Template

Using pre-designed documents to handle financial transactions provides numerous advantages for businesses of all sizes. These ready-made solutions help ensure consistency, save time, and reduce the risk of errors. By adopting such tools, companies can create clear, professional records that enhance both internal organization and client relations.

Efficiency and Time Savings

One of the primary benefits of using pre-designed documents is the significant time saved in generating records. Instead of manually creating each document from scratch, you can fill in the necessary details and have an accurate, professional-looking record in minutes. This increased efficiency allows you to focus on other important aspects of your business.

Consistency and Professionalism

Pre-made forms ensure that every document you issue follows the same structure and style, which fosters a sense of professionalism. Clients will appreciate receiving consistent, well-organized records, which can also help to build trust. A uniform approach to transactions can reinforce your brand image and make your business appear more polished and reliable.

| Benefit | Details |

|---|---|

| Time Savings | Quickly fill out details, reducing time spent on paperwork. |

| Accuracy | Minimize errors with pre-structured fields and automatic calculations. |

| Consistency | Ensure all records have the same format and design, enhancing professionalism. |

Whether you’re a freelancer, a small business owner, or part of a larger organization, these pre-designed documents provide an easy way to handle financial records efficiently while maintaining a high standard of professionalism.

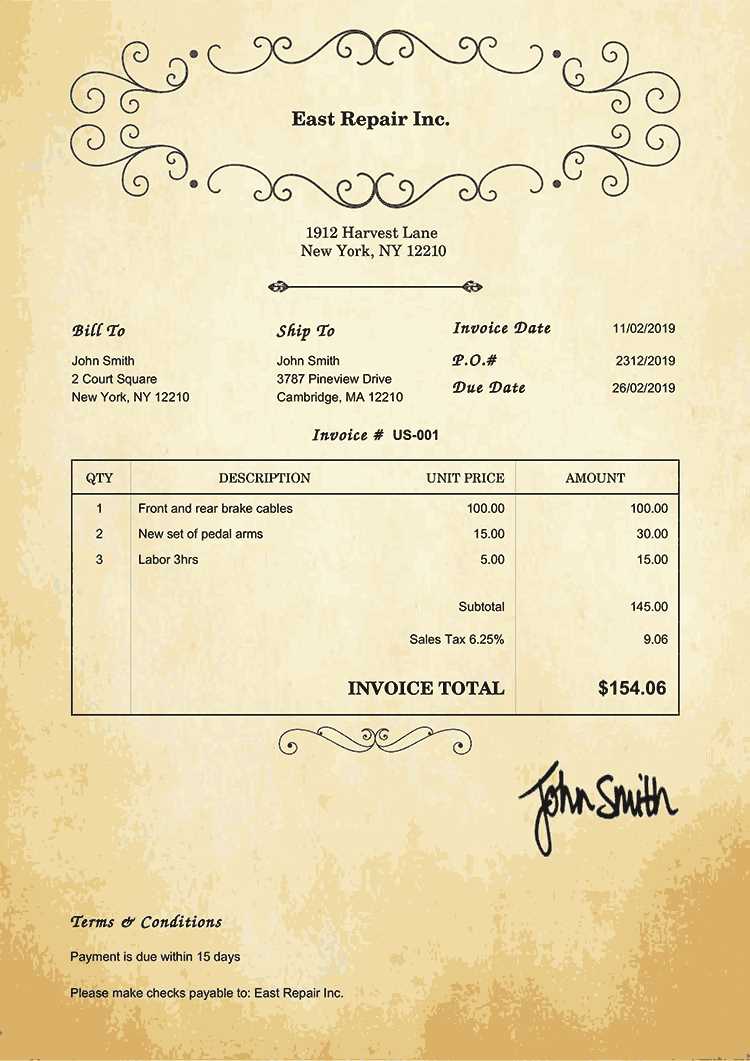

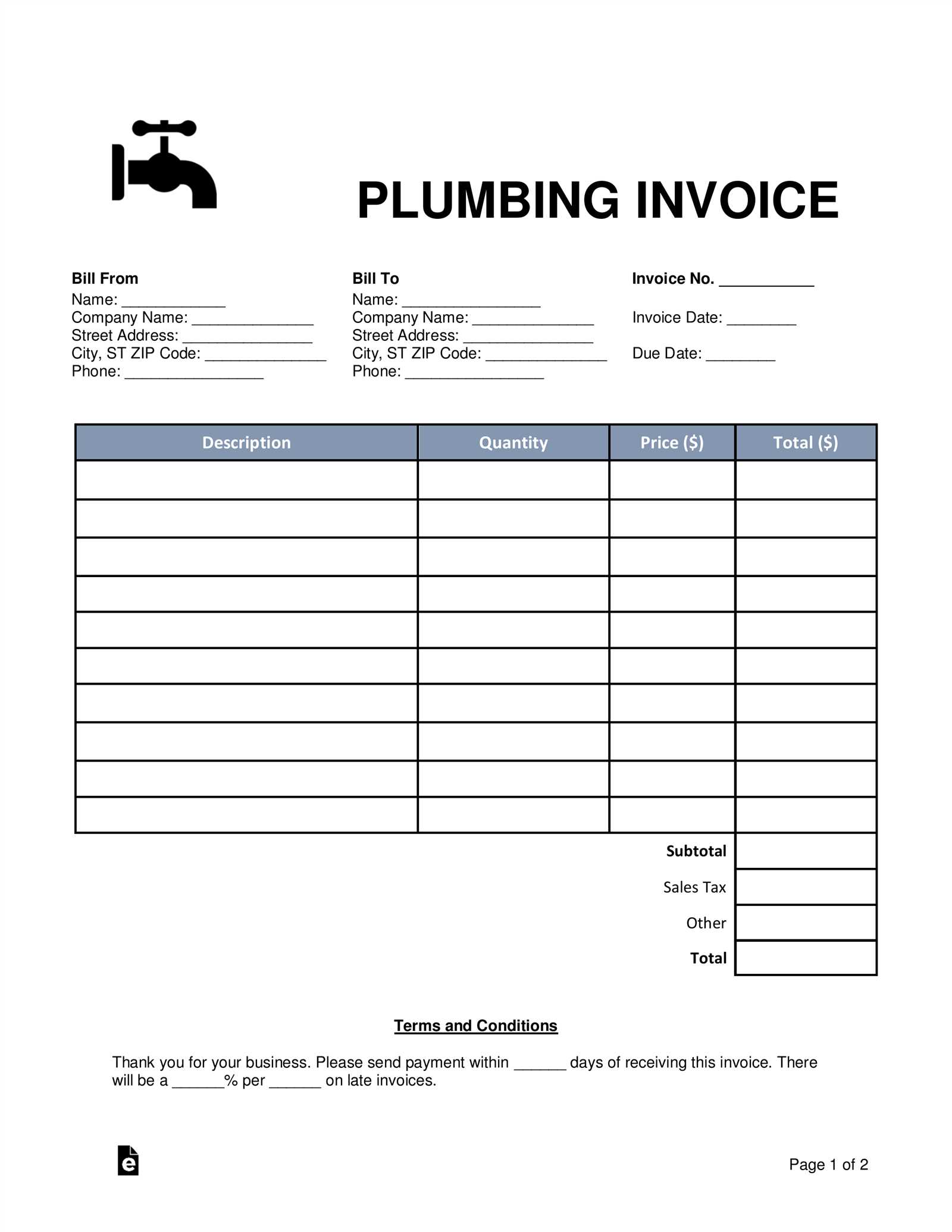

What to Include in Your Invoice

When creating a document to request payment from clients, it’s essential to include all necessary details to avoid confusion and ensure smooth transactions. The more thorough and accurate the information, the better the chances of timely payments and a professional relationship. There are several key elements that should always be present in any payment request document to ensure clarity and prevent misunderstandings.

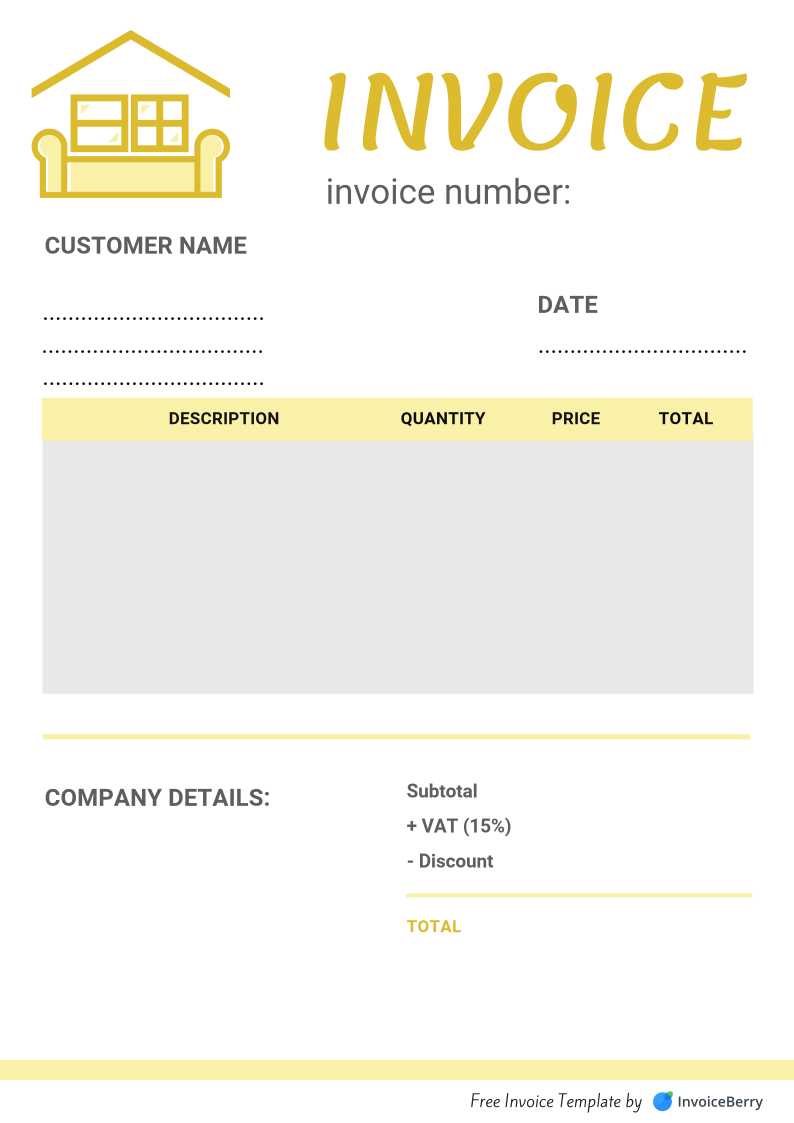

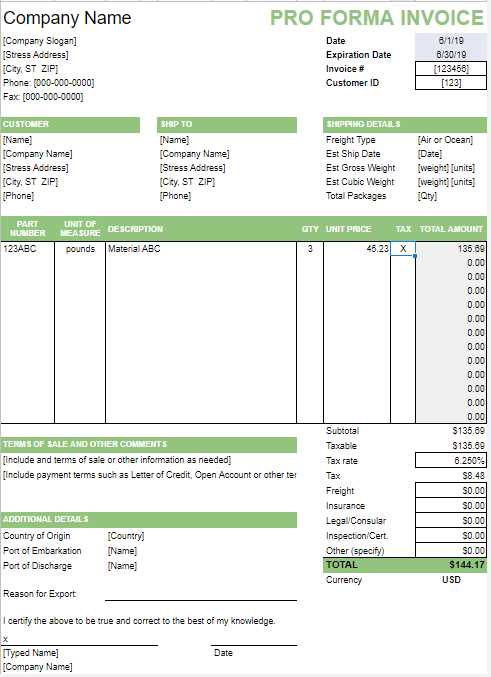

Essential Information for Clarity

To make sure your request is understood and processed efficiently, always include essential information such as the date of issue, payment due date, and detailed descriptions of the goods or services provided. It’s important to specify the agreed-upon terms to ensure both parties are aligned on expectations. Additionally, always include clear identification of both the sender and recipient, along with their contact information for future reference.

Understanding Pricing and Taxes

Clearly listing the prices of goods or services, including any applicable taxes or discounts, is crucial. This transparency helps your clients understand the total amount owed and how it was calculated. A breakdown of costs allows them to verify the charges and avoid disputes later on. If you offer multiple products or services, make sure each one is clearly listed with corresponding costs.

| Information | Details | ||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date of Issue | Indicate when the document was created. | ||||||||||||||||||||||||||||||||||||||||||||||

| Due Date |

| Error | Solution | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Missing Client Contact Information | Verify all contact details before finalizing the document. | |||||||||||||||||||||||||||||||||||||||||

| Unclear Descriptions | Provide detailed, itemized descriptions of each service or product pr

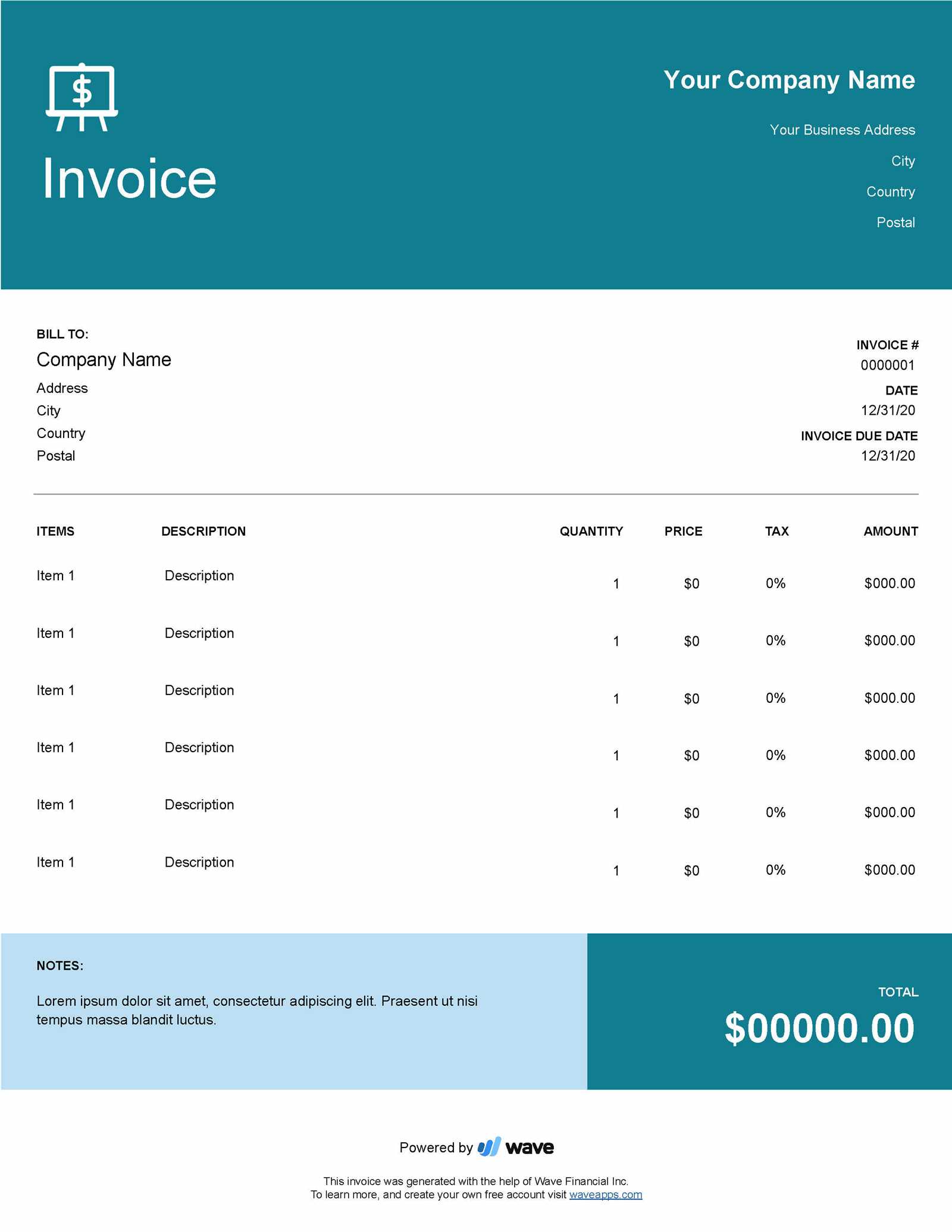

Why Free Invoice Templates Are IdealFor small businesses, freelancers, or anyone just starting out, having access to high-quality, ready-to-use documents can be a game changer. These pre-designed resources eliminate the need for complicated software or hiring an accountant, allowing you to focus on what really matters: your work. They are cost-effective, efficient, and versatile, providing a quick solution to managing payment requests without additional financial burden. Benefits of Using No-Cost OptionsThere are several advantages to using free tools for managing financial records. Here are the key reasons why they are an ideal choice:

Why Choose These Tools Over Paid Solutions?

While paid software offers more advanced features, for many small businesses or independent workers, the basics are all they need. Free resources provide sufficient functionality without the overhead costs, making them perfect for those just starting out or operating on a tight budget.

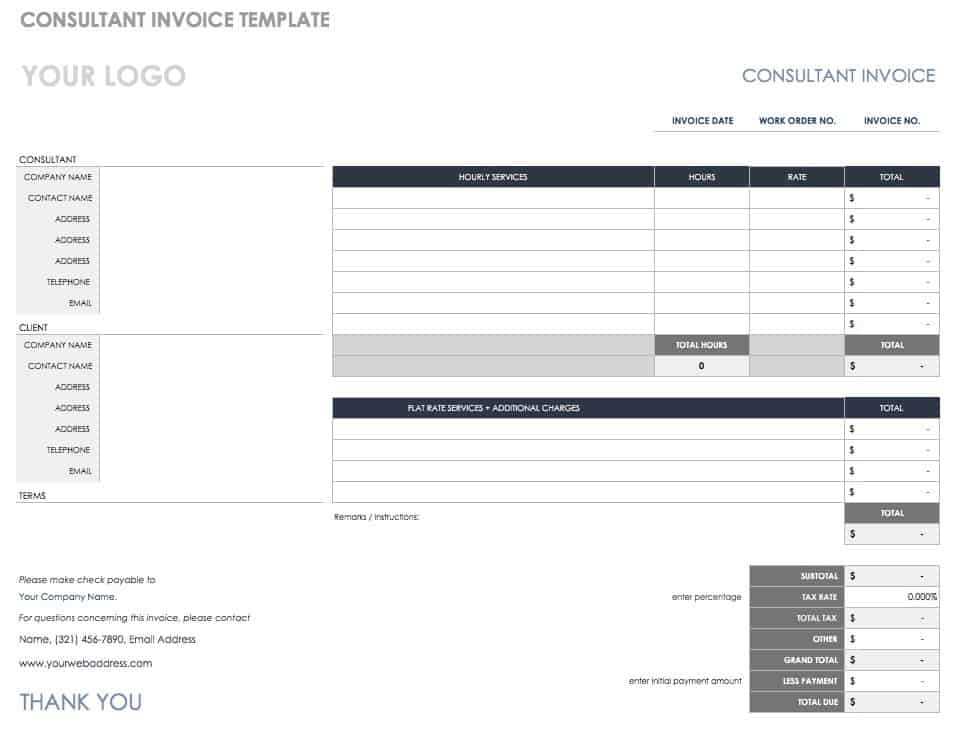

For many entrepreneurs, using no-cost resources provides a practical, efficient, and hassle-free way to manage transactions. These tools are ideal for those who need reliable, easy-to-use options without the extra expenses of more complex systems. Best Formats for Invoice Templates

When selecting the best format for your payment request documents, it’s important to consider the nature of your business and how you plan to use the records. Different formats offer varying levels of flexibility and ease of use, so choosing the right one can make a significant impact on how quickly and efficiently you handle transactions. Below are some of the most common formats, each suited for different needs. Popular Formats for Easy Use

Different formats offer distinct advantages, from ease of customization to compatibility with other software. Here are the most common options and how they can benefit you:

Choosing the Right Format for Your BusinessThe best choice of format depends on how you plan to use the document and how much customization is needed. Here are a few things to consider when choosing the format:

|