How to Use an Audit Invoice Template for Accurate Financial Reporting

Managing financial transactions efficiently requires clear and professional billing documents. These documents serve as a critical tool in maintaining transparency between service providers and clients, ensuring all payments are properly recorded and tracked. With the right structure, you can simplify the entire process and avoid potential errors in calculations and details.

Structured financial documents are designed to not only reflect the agreed-upon fees but also to provide a streamlined way of managing records. They include essential details like service descriptions, dates, and amounts, helping both parties understand what is being billed and why. Whether you are a freelancer, contractor, or part of a larger business, having an organized approach to your financial reporting is key.

By using a professional approach to creating these documents, you enhance credibility and foster trust with your clients. With the right setup, the billing process becomes smoother, more efficient, and ensures that nothing important is overlooked. The following sections will guide you through how to create these essential financial tools and use them to your advantage.

Audit Invoice Template Overview

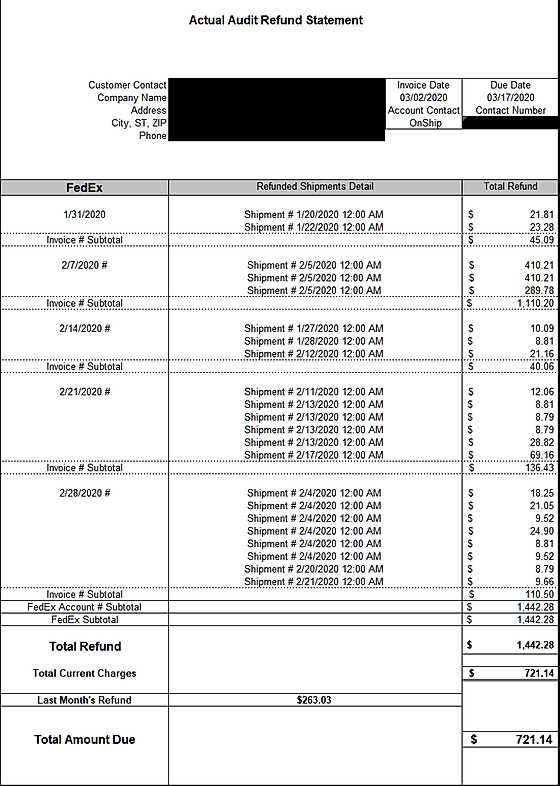

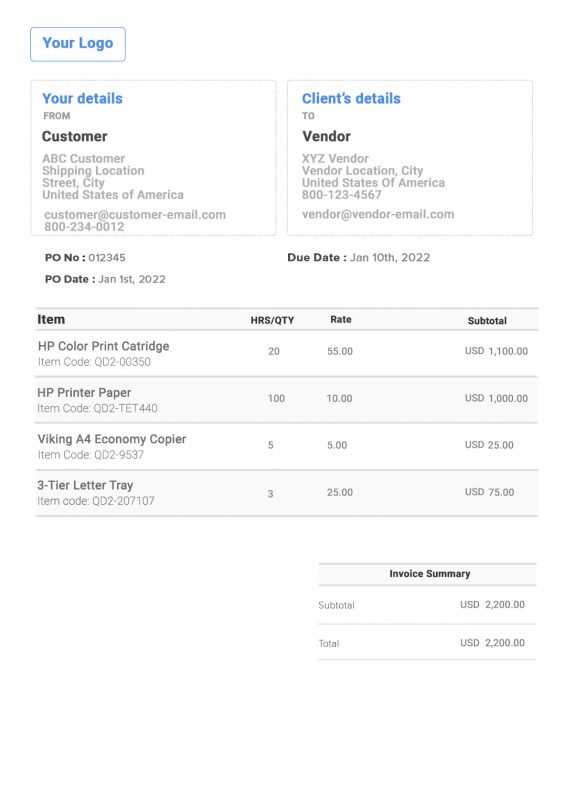

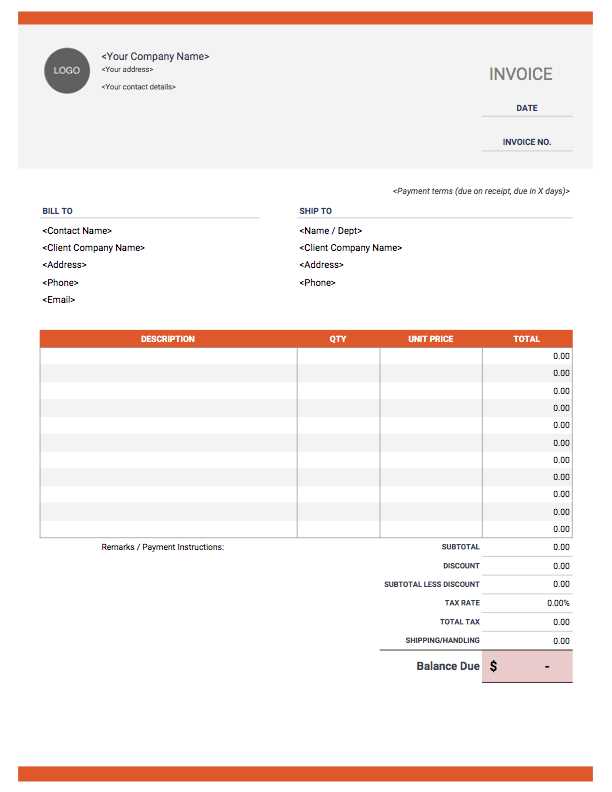

When handling financial documents for services rendered, having a clear and consistent format is essential. A well-organized billing document not only ensures accurate tracking of payments but also maintains professionalism in client communications. The right structure can help you clearly outline charges, dates, and services, ensuring that all parties involved are on the same page.

This document format typically includes several key sections to provide a comprehensive overview of the transaction. By breaking down charges, highlighting important details, and maintaining consistency, it can be used across various client interactions, making the entire process more efficient. Below is an example of the common structure you might encounter in a well-designed financial statement.

| Section | Description |

|---|---|

| Header | Includes the name of the service provider, client, and relevant contact information. |

| Service Details | A clear list of services provided, including dates and hours worked. |

| Payment Terms | Information regarding payment due dates, late fees, and accepted payment methods. |

| Total Amount | The sum total for the services rendered, including any applicable taxes or discounts. |

| Footer | Additional information such as company policies or legal disclaimers. |

By incorporating these sections, the document becomes a tool for both record-keeping and clear communication, helping to avoid any misunderstandings during financial transactions. The layout and organization should always be simple, ensuring that all relevant information is easy to locate and review.

Benefits of Using a Billing Document Format

Utilizing a structured format for financial records offers numerous advantages, making the process more efficient and organized. By standardizing the way you present charges, you ensure clarity, accuracy, and professionalism in every transaction. Whether you’re managing multiple clients or simply keeping track of services rendered, this approach minimizes errors and saves time.

Improved Organization and Consistency

One of the primary benefits of using a standardized billing document is the ability to maintain organization. With a clear structure, every essential detail–such as dates, amounts, and service descriptions–can be easily located. This consistency not only makes it easier for you to manage your records but also allows your clients to quickly understand the charges being applied, fostering trust and reducing confusion.

Time-Saving Efficiency

Efficiency is another significant benefit. By using a pre-designed structure, you eliminate the need to manually create documents from scratch each time. This saves valuable time, especially when dealing with multiple clients or projects. It also reduces the risk of overlooking important details, ensuring that your records are always accurate and up-to-date.

Ultimately, adopting a streamlined financial document format enhances both the professional presentation of your business and the efficiency of your workflow, allowing you to focus more on delivering quality services.

Key Elements in a Billing Document

Creating a clear and comprehensive financial statement requires including specific details that ensure both parties understand the terms of the transaction. A well-organized record helps to avoid misunderstandings and ensures that the amount due is accurate. The following elements are essential in any professional billing document, regardless of the service provided.

Client and Provider Information are foundational components. Clearly stating the names, addresses, and contact details of both the service provider and the client ensures transparency and establishes a point of reference for communication. This section allows for easy identification of the parties involved, should any questions arise about the transaction.

Service Breakdown should include a detailed list of the services rendered. Each item should be accompanied by a description, the number of hours worked (if applicable), and the agreed-upon rate. This section helps avoid confusion and justifies the charges applied, giving both parties clarity on the exact nature of the work performed.

Payment Terms define when the payment is due, what methods are accepted, and any potential late fees. These terms help to set clear expectations and avoid any delays in payment processing. Additionally, including this information helps prevent disputes regarding payment timing or conditions.

Total Amount is perhaps the most important element. This section should clearly display the final amount owed, including any taxes, discounts, or additional fees. Ensuring this figure is easily recognizable allows for quicker processing and approval from the client.

These key components ensure that your financial records are not only professional but also comprehensive, reducing the potential for errors or confusion. Properly structured documents lead to smoother transactions and improved client relationships.

How to Customize Your Billing Document

Customizing your financial documents allows you to create a personalized, professional presentation that aligns with your business and client needs. A well-tailored record not only helps improve your branding but also makes it easier to adapt to different clients or services. Here’s how you can modify a standard document format to suit your requirements.

Step 1: Modify the Header

The header is the first thing your clients will see, so it’s important to make it stand out. You can customize the header to reflect your branding by adding your company logo, slogan, or custom fonts. Here’s what to include:

- Company name and logo

- Your contact information (phone number, email, address)

- Client’s name and address

- Unique document number or reference code

Step 2: Adjust Service Details

Tailoring the service section is crucial to accurately reflect the work you have done. Make sure the description of services is specific and clear, including:

- Detailed description of each service or product

- Time spent or units used for the service

- Rate applied to each service or unit

Customizing this section ensures that your client fully understands what they are being charged for, reducing potential confusion.

Step 3: Update Payment Terms

Modify the payment section to fit your business model and terms of agreement. This can include:

- Due date for payment

- Accepted payment methods (bank transfer, credit card, PayPal, etc.)

- Late payment fees or discounts for early payments

Having these terms tailored to your business not only ensures clarity but also sets clear expectations for both parties involved.

Step 4: Finalize the Footer

The footer is a great place to include any legal disclaimers, additional terms, or company policies that apply. You can also add:

- Tax identification number

- Company registration information

- Links to your website or social media profiles

Customizing these elements ensures that your document not only looks professional but also aligns with your legal and branding needs.

By following these steps, you can customize your financial records to reflect your brand identity while ensuring clarity and professionalism in your transactions.

Common Mistakes to Avoid

When creating financial documents for services rendered, it’s important to avoid certain errors that can lead to confusion or disputes. Even small mistakes in formatting or content can affect your professional image and delay payment. Below are some of the most common mistakes people make when preparing these documents and how to avoid them.

| Mistake | How to Avoid It |

|---|---|

| Incomplete or Incorrect Client Information | Double-check client details, such as name, address, and contact information, to ensure accuracy. |

| Unclear Service Descriptions | Provide a detailed breakdown of the services rendered, including dates, hours worked, and the agreed-upon rate. |

| Missing or Incorrect Payment Terms | Clearly state payment deadlines, accepted payment methods, and any late fees in the document. |

| Failure to Include Taxes or Additional Charges | Make sure to include any applicable taxes, discounts, or additional fees to avoid surprises. |

| Inconsistent Formatting | Maintain a clean and uniform format throughout the document for easy readability and professionalism. |

Avoiding these common mistakes ensures that your financial documents are accurate, professional, and easy to understand, helping to streamline the payment process and strengthen your relationships with clients.

Why Accurate Billing Matters

Accurate financial documentation is crucial for maintaining smooth business operations and fostering trust between service providers and clients. Ensuring that all charges, terms, and services are clearly and correctly outlined can prevent misunderstandings, delays in payment, and potential disputes. A well-prepared document not only reflects professionalism but also builds credibility with your clients.

Financial accuracy helps maintain the integrity of your business transactions. When all details are precise, there is less chance of errors that could lead to overcharging or undercharging. This minimizes the need for corrections, saving both time and resources while improving overall client satisfaction.

Consistency in billing also enhances client relationships. Clients who receive accurate and transparent records are more likely to trust your business and continue working with you. Additionally, clear documentation ensures timely payments, which is vital for maintaining healthy cash flow and avoiding unnecessary delays in revenue collection.

Ultimately, accurate records are the foundation for a well-managed business. By investing time in creating precise, professional financial documents, you set your business up for long-term success and avoid potential challenges down the road.

How to Track Expenses Effectively

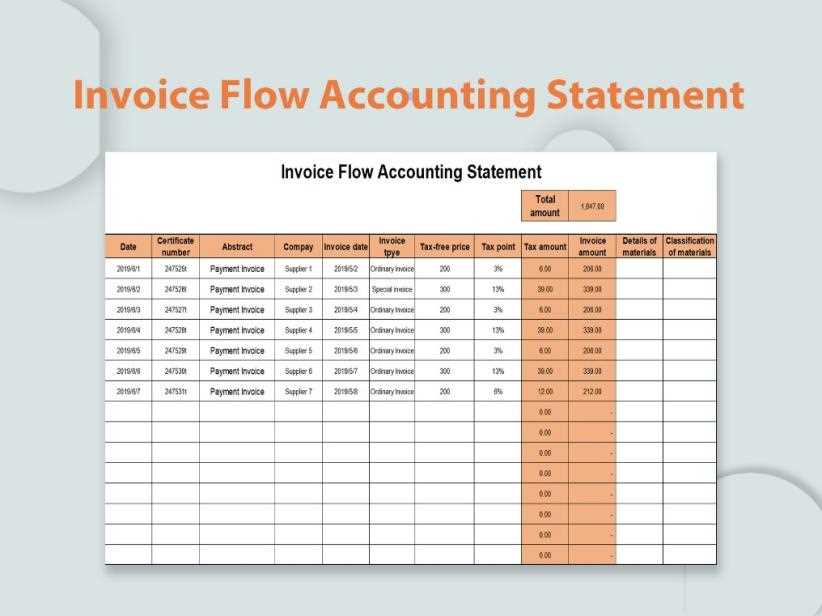

Tracking expenses is a vital part of managing business finances, ensuring that all costs are accounted for and categorized properly. By maintaining a detailed record of expenditures, you can monitor your spending patterns, avoid overages, and ensure that your financial statements are accurate. Below are some strategies to help you efficiently track your expenses.

Step 1: Categorize Your Expenses

Organizing your expenditures into categories allows you to better understand where your money is going. Common categories may include labor, materials, overhead costs, and miscellaneous fees. Keeping track of these expenses separately provides insight into areas where you can potentially cut costs or allocate resources more effectively.

| Expense Category | Description |

|---|---|

| Labor Costs | Salaries, hourly wages, and other compensation for workers involved in the project. |

| Materials and Supplies | Costs related to the physical goods or resources used in the project. |

| Operational Expenses | Day-to-day costs for running the business, such as utilities, rent, and administrative expenses. |

| Miscellaneous | Other costs that don’t fit into the main categories, such as travel or unforeseen expenses. |

Step 2: Use Tools for Accurate Tracking

Using tools like expense tracking software or spreadsheets can help you stay organized. These tools allow you to input your expenses in real-time, track receipts, and generate detailed reports for easy reference. Automated systems help reduce errors and make it easier to compile accurate financial data for your business.

By staying organized and utilizing proper tracking methods, you can ensure that your financial records are thorough, accurate, and useful for decision-making. Tracking expenses not only improves budgeting but also provides clarity during tax season or when evaluating project costs.

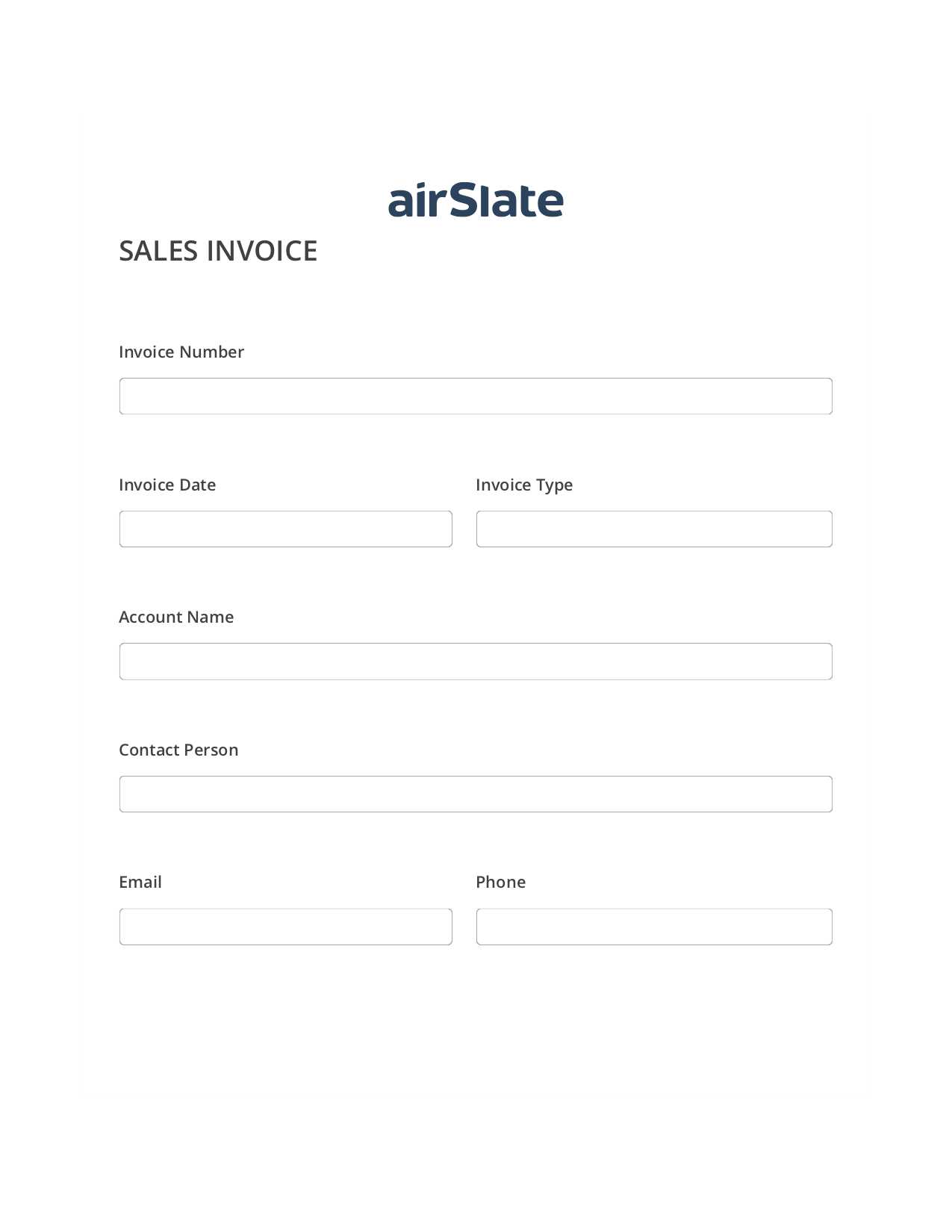

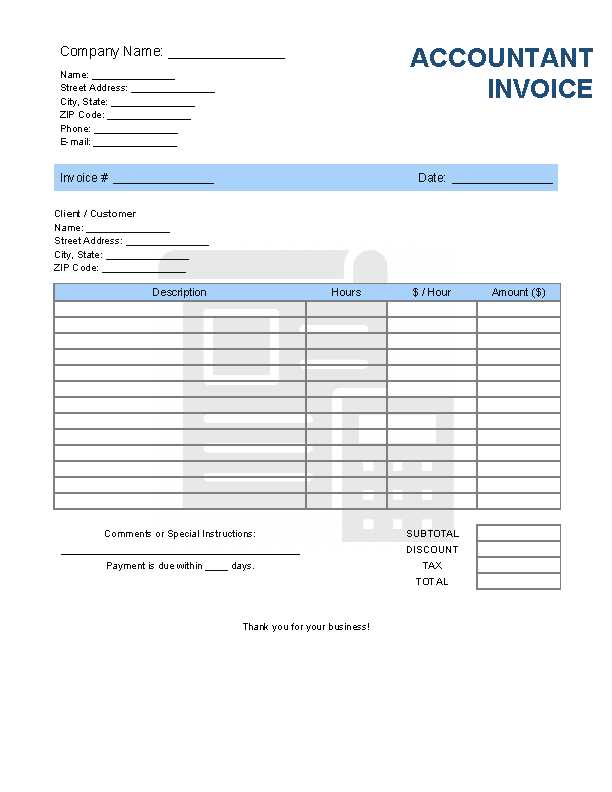

Setting Up Your Billing Format

Establishing a clear and consistent format for your financial documents is crucial for ensuring professionalism and clarity. A well-structured layout helps both you and your clients easily understand the charges, terms, and details related to the transaction. Here’s how you can set up a format that is both practical and visually appealing.

Step 1: Choose the Right Layout

Choosing an appropriate layout is the first step in setting up a clear document. The layout should be clean and easy to navigate. Consider the following components when choosing your design:

- Use headings and subheadings to organize sections.

- Ensure sufficient white space between sections for clarity.

- Group similar information, such as client details and service descriptions, together.

Step 2: Key Sections to Include

Your document should contain specific sections that outline the essential information. Below are the key areas that should be included:

- Contact Information: Ensure both your details and your client’s are clearly stated, including address, phone number, and email.

- Service Description: Provide a detailed breakdown of the services or products provided, including quantities, prices, and dates.

- Payment Terms: Specify payment due dates, late fees, and accepted methods of payment.

- Total Amount: Clearly state the total amount due, ensuring any taxes, discounts, or extra charges are included.

Step 3: Formatting and Design Tips

Incorporating simple yet effective design principles can greatly enhance the readability of your document. Here are a few tips:

- Use a professional font and size (e.g., Arial, Times New Roman, 12 pt).

- Ensure all numbers, dates, and amounts are aligned for easy reading.

- Include your business logo and branding elements to give the document a professional touch.

Setting up a consistent and clear format for your financial documents helps foster professionalism and trust with your clients, while also making the process of billing and payments more efficient.

Best Practices for Document Clarity

Clear communication is key to ensuring smooth transactions and avoiding misunderstandings. By adhering to best practices for formatting and presenting your financial records, you can make the details easy to read, understand, and process. This helps foster trust with clients and ensures that payments are made on time without confusion.

Step 1: Use Simple and Precise Language

To avoid any ambiguity, it is important to use straightforward language. Avoid jargon or overly complex terms that might confuse your clients. Clearly describe the services provided, the agreed-upon costs, and any additional terms in plain language. Here are some tips to follow:

- Be specific about services or products–avoid vague descriptions.

- List quantities, prices, and dates in a structured way to ensure clarity.

- Avoid using abbreviations that could be misunderstood.

Step 2: Organize Information Logically

Proper organization is essential to presenting information in a way that is easy to follow. A well-organized document ensures that the client can quickly find what they need without sifting through unnecessary details. Here are the best practices for organization:

- Use headings and subheadings to break the document into sections.

- Group related information together, such as contact details, services rendered, and payment terms.

- Align text and numbers properly to make reading and scanning easier.

Step 3: Include All Necessary Details

Leaving out important information can lead to confusion and delays. Ensure that every relevant detail is included, such as:

- Your business details (name, address, phone number, and email).

- The client’s information (name, address, and contact details).

- A breakdown of the charges, including rates, quantities, and any additional fees.

- Payment due date, terms, and instructions on how to pay.

By following these best practices, you can create documents that are clear, professional, and easy to understand, ensuring that both you and your clients are on the same page and minimizing the risk of disputes or delayed payments.

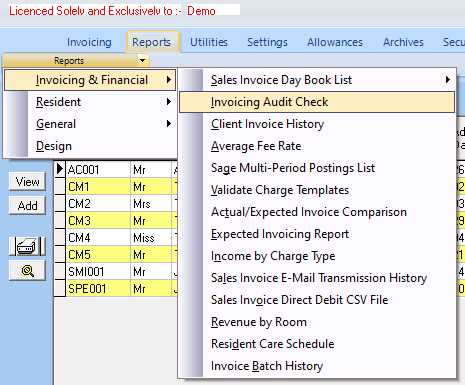

Integrating Documents with Accounting Software

Streamlining financial processes is crucial for efficiency, especially when managing multiple transactions and client accounts. One of the most effective ways to automate and simplify the process is by integrating financial documentation with accounting software. This integration helps eliminate manual data entry, reduces errors, and ensures consistency across all records.

Step 1: Choose Compatible Software

Before you can integrate your financial documents, it’s important to select accounting software that supports this feature. Many modern tools allow for easy importation of data, including financial records and payment details. When choosing software, consider:

- Compatibility with your existing financial systems.

- Customizability to fit your business’s unique needs.

- Integration with other platforms you may already be using (e.g., CRM or inventory management software).

Step 2: Automate Data Flow

Once the accounting software is set up, you can automate the flow of information between your records and the software. This step reduces the need for manual entry and ensures that all relevant details are captured accurately. Benefits of automation include:

- Real-time updates on payments and balances.

- Fewer chances of human error in calculations and data entry.

- Faster processing times for financial reporting and reconciliation.

Integrating your financial documents with accounting software not only saves time but also ensures that your records remain accurate and up-to-date, improving your overall business efficiency.

Managing Multiple Clients with Documents

Handling multiple clients can be a complex task, especially when it comes to managing individual accounts and financial records. However, by using well-structured formats, you can streamline the process and maintain organization. Customizing your documentation to suit different client needs ensures that each transaction is clear and easy to manage, saving you time and effort in the long run.

Step 1: Personalize Documents for Each Client

When working with several clients, it’s important to tailor your financial documents to reflect the specifics of each relationship. This means adjusting details such as:

- Client names and contact information.

- Service descriptions and pricing that fit the individual agreement.

- Payment terms and conditions relevant to each client’s needs.

Step 2: Organize Client Records Efficiently

Keeping track of multiple client records is easier when you organize the documents in a systematic way. Use consistent naming conventions, and ensure that each document is properly labeled and categorized. Here are a few tips:

- Create separate folders for each client, grouping documents by month or service type.

- Label each record with client-specific identifiers for easy searching.

- Track important dates such as payment deadlines or contract renewal dates.

By managing multiple client documents effectively, you can ensure smoother interactions and quicker processing, reducing the risk of errors and missed deadlines.

Legal Considerations in Billing

When managing financial transactions with clients, it’s important to be aware of the legal aspects surrounding billing and payment processes. Failing to follow legal guidelines can lead to disputes, financial penalties, or even litigation. Understanding the legal requirements helps ensure that all billing activities are compliant and transparent, ultimately protecting both your business and your clients.

Step 1: Adhere to Contractual Agreements

Each client relationship should be governed by a clear contract outlining payment terms, services rendered, and other financial obligations. It’s crucial to ensure that all billing is consistent with the agreed-upon terms. Some key points to consider include:

- Clearly defined payment schedules, including due dates and late fees.

- Agreed-upon rates or fees for services, and any changes in these rates.

- Terms for refunding or adjusting charges in case of disputes or errors.

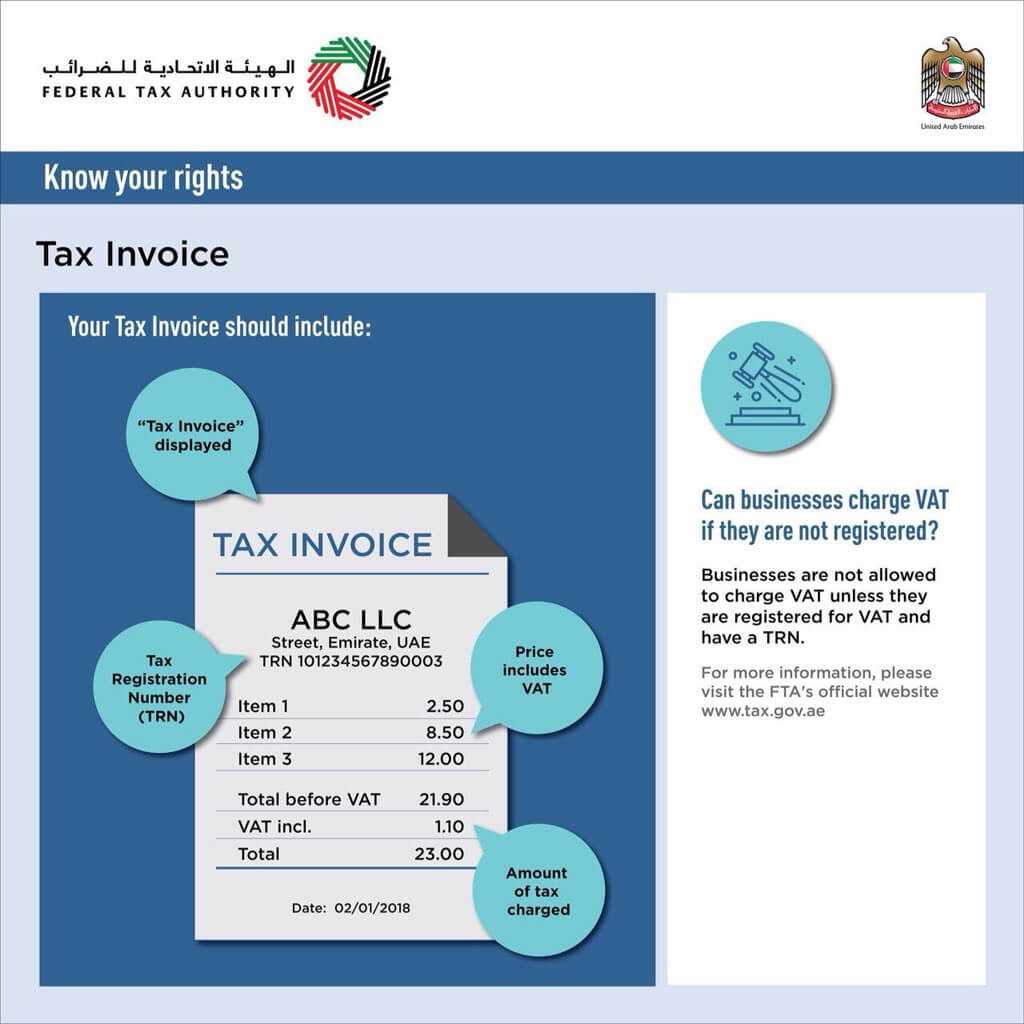

Step 2: Comply with Tax Regulations

In many jurisdictions, there are specific tax rules related to financial documents. Ensuring compliance with tax regulations is vital to avoid fines and legal issues. Make sure to:

- Clearly state applicable tax rates and amounts on your documents.

- Maintain proper records of all transactions for tax reporting purposes.

- Stay updated on local, state, or national tax laws that may impact your billing practices.

By addressing these legal considerations, you can ensure that your billing practices are both transparent and legally sound, minimizing the risk of disputes and maintaining a trustworthy reputation with your clients.

How to Ensure Timely Payments

Ensuring timely payments is critical to maintaining healthy cash flow and building strong relationships with clients. Effective strategies can minimize delays and reduce the chances of overdue balances. By setting clear expectations and staying organized, you can ensure that clients pay on time, helping your business run smoothly.

Step 1: Set Clear Payment Terms

One of the most important steps in securing on-time payments is establishing clear and transparent payment terms from the beginning. Clearly communicated expectations help clients understand their responsibilities and minimize misunderstandings. Consider the following:

- Define specific due dates for each payment.

- Outline acceptable payment methods (e.g., bank transfer, credit card, online payment platforms).

- Specify any late fees or penalties for overdue payments.

Step 2: Send Reminders and Follow-Up

Sending reminders is an effective way to encourage timely payments. Set up a reminder schedule to notify clients of upcoming or overdue payments. Best practices include:

- Send a polite reminder a few days before the payment is due.

- Follow up promptly if a payment is missed, while maintaining professionalism.

- Offer clients multiple payment options for convenience.

By establishing clear terms and following up consistently, you can significantly reduce delays and ensure that payments are processed promptly, keeping your financial operations on track.

Improving Financial Accuracy with Documents

Maintaining precise financial records is essential for any business, and using well-structured documentation formats can significantly reduce errors. By automating and standardizing the way financial data is recorded, businesses can ensure that their figures are accurate and reliable. A clear and consistent system allows for easier tracking, fewer discrepancies, and a more efficient accounting process.

By using standardized formats, businesses can reduce the risk of miscalculations, missed items, or overlooked details. These systems can streamline the process of documenting transactions and ensure that all required data is included in every entry. Here are some benefits:

- Consistency: A uniform format eliminates guesswork, ensuring that all entries follow the same structure and contain all the necessary details.

- Efficiency: Automation of repetitive tasks can reduce the time spent on manual data entry, freeing up resources for other important tasks.

- Accuracy: Templates help to minimize human error, such as misplacing decimal points or forgetting key information.

Ultimately, improving the accuracy of financial documentation will not only save time but also enhance the integrity of your financial reports, leading to better decision-making and more reliable business operations.

Streamlining the Billing Process

Efficient management of financial transactions is crucial for any business. Streamlining the billing process not only saves time but also reduces the likelihood of errors, leading to quicker payments and better client satisfaction. Simplifying the way bills are created, sent, and tracked can greatly enhance the overall efficiency of your financial operations.

Automating Repetitive Tasks

Automation plays a key role in speeding up the billing cycle. By using automated tools, businesses can eliminate the manual effort involved in preparing and sending bills. Automation ensures consistency and reduces the risk of human error. Here are some ways to automate:

- Set up recurring billing for regular clients.

- Integrate payment systems with accounting software for automatic updates.

- Use digital billing platforms to send and track documents instantly.

Organizing and Centralizing Data

Keeping all billing information in one place is vital for an efficient process. Centralized systems allow for easy access to past records, track payments, and monitor overdue balances. A well-organized system ensures that all data is readily available for quick reference, reducing delays and confusion.

By implementing these strategies, businesses can simplify the billing process, allowing for smoother cash flow and more accurate financial tracking.

Tips for Efficient Invoice Review

Reviewing financial documents efficiently is crucial for maintaining accuracy and ensuring that payments are processed correctly. A well-structured approach to reviewing records can help avoid mistakes, improve processing time, and ensure that all necessary details are accounted for. Implementing best practices can streamline the entire review process and reduce administrative overhead.

Here are some tips for conducting a more efficient and thorough review:

- Establish a Standard Review Checklist: Create a consistent list of items to check every time you review a document. This can include verifying amounts, dates, services rendered, and payment terms.

- Use Digital Tools: Leverage accounting software that automatically detects discrepancies and highlights potential errors, saving time and effort in the review process.

- Check for Completeness: Ensure that all necessary information, such as the client’s details, payment terms, and itemized charges, is clearly included and accurate.

Using a Template for Consistency

Utilizing a standard document format can help maintain consistency across all transactions. It ensures that no critical details are missed and that each document is easy to review. A structured layout reduces confusion and increases processing speed.

Double-Check for Errors

Before finalizing the review, double-check all calculations and ensure there are no discrepancies in the amounts. Pay particular attention to numbers, tax rates, and total sums. Small errors can add up over time, so thorough checks are essential.

By following these guidelines, you can streamline the process, minimize errors, and ensure that all records are accurate and complete, resulting in faster payment cycles and a smoother overall workflow.