Sales Return Invoice Template for Streamlined Return Management

Managing product returns and refunds efficiently is essential for maintaining smooth business operations. With the right documentation, businesses can handle these processes with accuracy and ease, ensuring both customer satisfaction and compliance with financial practices. Properly structured records are vital for tracking products sent back and ensuring that the corresponding refunds are processed correctly.

Creating an organized system for dealing with these transactions can save time, reduce errors, and help businesses maintain clear financial records. An effective approach includes using a standardized document to capture all necessary details related to returned items, the reason for their return, and the refund or credit issued. This method not only benefits businesses in managing their inventory but also provides customers with transparency and reassurance during the return process.

Sales Return Invoice Template Overview

When managing product exchanges and refunds, businesses need a structured document to record key details of the transaction. This document serves as an official record for both the company and the customer, ensuring that all aspects of the return process are clearly noted. A well-designed form is crucial for maintaining accurate records and minimizing disputes.

Such a document typically includes several essential components that help track the exchange process, streamline communications with customers, and ensure compliance with internal policies. By organizing all necessary information in one place, businesses can handle these transactions smoothly and professionally.

- Product Information: Details about the item being returned, including its description, quantity, and condition.

- Customer Details: Information about the customer making the return, such as their contact information and order reference number.

- Reason for Return: A section where the customer can provide a reason for returning the product, whether due to defects, dissatisfaction, or other factors.

- Refund or Exchange Process: Clear instructions on how the business will proceed with the refund or exchange, including any policies on restocking fees or partial refunds.

- Financial Details: Information on amounts owed, credits issued, or adjustments made to the original payment.

Using a standardized document not only helps ensure accuracy and consistency but also speeds up the administrative process. It serves as a point of reference for resolving any future queries or concerns regarding the return and refund process, keeping all parties informed and protected.

What is a Sales Return Invoice

A return document is a formal record issued when a customer returns a purchased item. It outlines the specifics of the transaction, including the products being sent back, the reason for the return, and the financial adjustments made, such as refunds or credits. This document serves as proof of the return and ensures that both the business and the customer are aligned on the terms of the exchange.

Such a document is an essential tool for managing the reverse flow of goods, offering clear communication between both parties. It details the necessary adjustments in the accounting system and facilitates smooth processing of returns. This record helps maintain accurate financial tracking and supports transparency in the business-customer relationship.

Additionally, a return document plays a critical role in inventory management. By noting which items have been returned, businesses can update stock levels and address any discrepancies between recorded and physical inventory. This is vital for maintaining proper stock control and avoiding errors in future orders.

Why Use a Return Invoice Template

Having a structured form for processing returned products and exchanges simplifies the entire process for both businesses and customers. A standardized document ensures that all relevant information is captured efficiently, reducing the chances of errors and misunderstandings. By using a consistent format, businesses can streamline their operations and ensure that every return is handled in a clear and organized manner.

Consistency and Accuracy

One of the main benefits of using a predefined form is consistency. Each return transaction will follow the same process, ensuring that all required details are recorded accurately. This minimizes the risk of missing important information, which could lead to delays or complications in the refund or exchange process. Accurate documentation also helps with internal record-keeping and financial tracking.

Time and Resource Efficiency

Using a pre-designed document saves valuable time by eliminating the need to create new records from scratch for each return. Employees can quickly fill in the necessary fields, reducing administrative work and freeing up resources for other tasks. This efficiency contributes to better overall workflow and improved customer service, as returns can be processed faster.

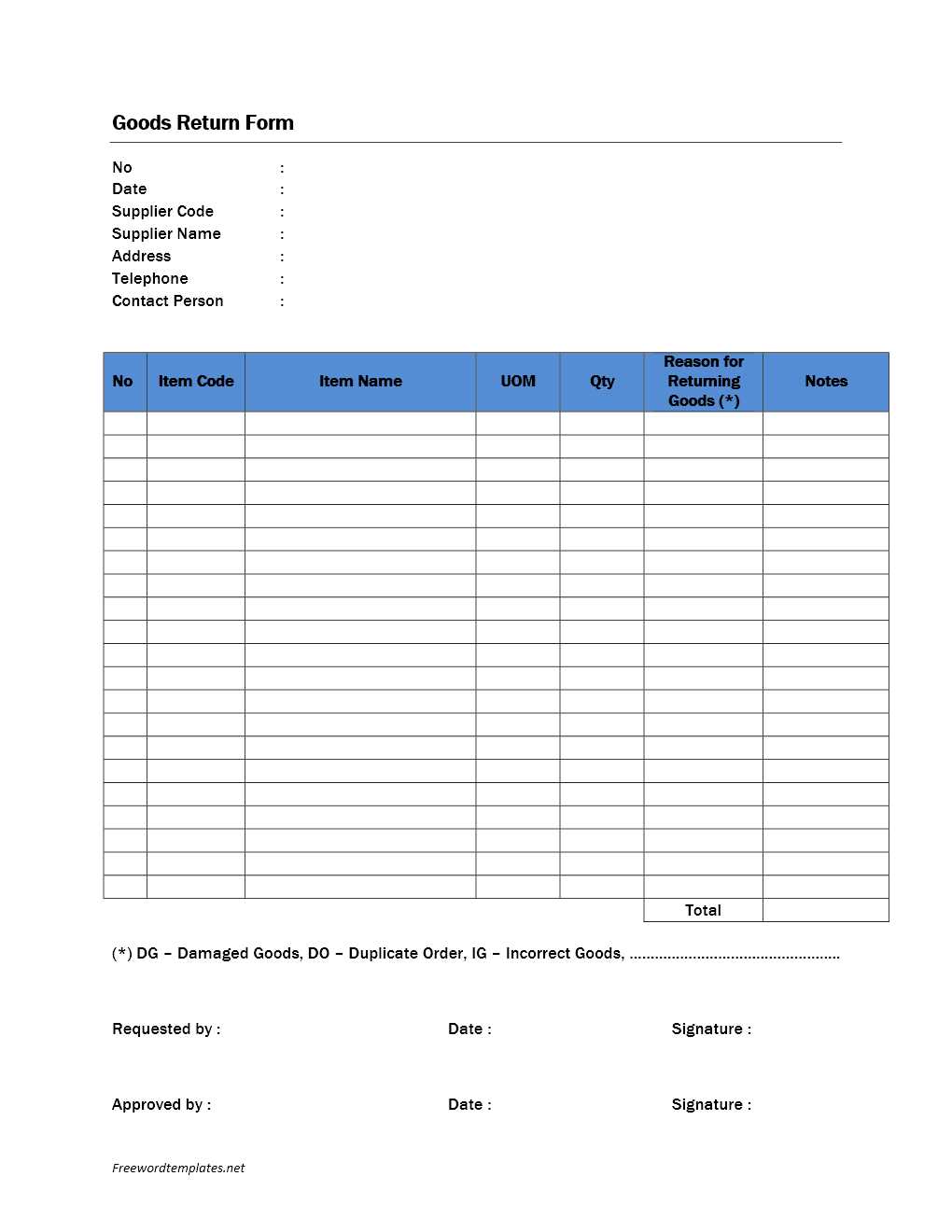

Key Elements of a Return Invoice

To effectively manage product exchanges and refunds, certain essential details must be included in any document used for processing these transactions. A well-structured form captures all necessary information, ensuring that the process is transparent and both parties are on the same page. The following elements are crucial for ensuring a smooth and accurate transaction.

Essential Information for Tracking Returns

- Transaction Reference: A unique identifier for each exchange, typically linked to the original purchase or order number.

- Customer Details: Information such as the customer’s name, contact details, and billing address, which is essential for verification and communication.

- Product Details: A detailed description of the returned items, including quantity, SKU, or serial number if applicable.

- Reason for Return: A field where customers can specify why the product is being returned, whether due to defects, dissatisfaction, or other reasons.

- Refund or Credit Information: Clear instructions on how the business will process the refund or offer credit, along with the amount or adjustments to be made.

Additional Information for Proper Documentation

- Return Date: The date the products were received back, which helps in tracking the return period for compliance with company policies.

- Payment Adjustments: Any changes to the original payment amount, including deductions or additional charges such as restocking fees.

- Authorized Signatures: Signatures from both the customer and the company representative, which serve as proof of the transaction’s validity and agreement.

Including these elements helps businesses maintain clear, accurate records and ensures both parties understand the terms of the exchange. This clarity is key for resolving any potential issues and maintaining c

How to Create a Return Invoice

Creating a well-organized document for processing product exchanges or refunds requires careful attention to detail. The process involves capturing all relevant information related to the returned items, the customer’s request, and the necessary financial adjustments. A clear and professional record not only helps ensure a smooth transaction but also aids in inventory management and financial tracking.

Step-by-Step Process

To create an effective form for managing returns, follow these key steps:

- Gather Product and Customer Information: Collect details such as the customer’s name, order number, product description, and reason for the return.

- Detail Financial Adjustments: Clearly state any refund or credit amount, and if applicable, any fees or deductions.

- Include Date and Signatures: Note the return date and include authorized signatures to validate the transaction.

- Review and Confirm: Double-check all information for accuracy to prevent mistakes or misunderstandings.

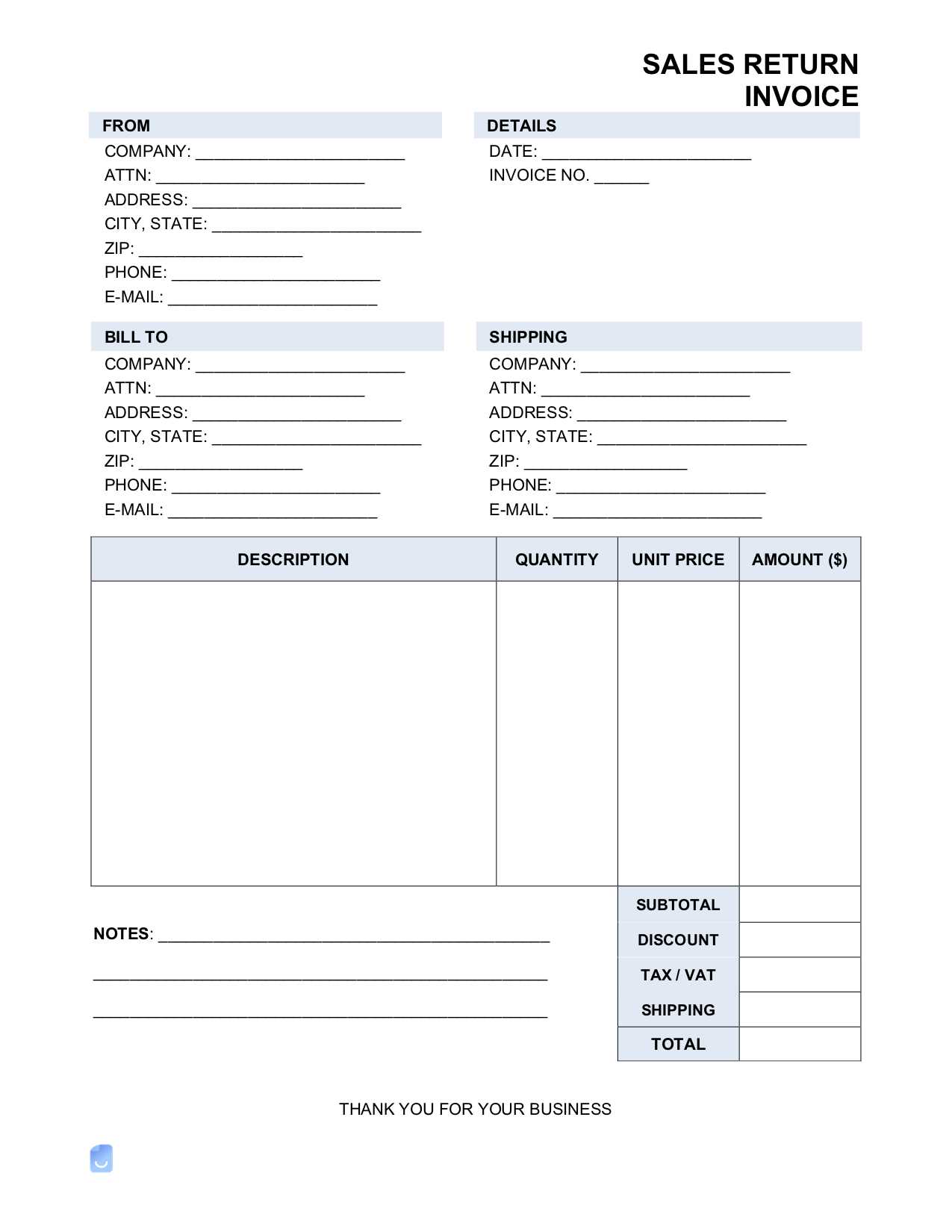

Example Structure

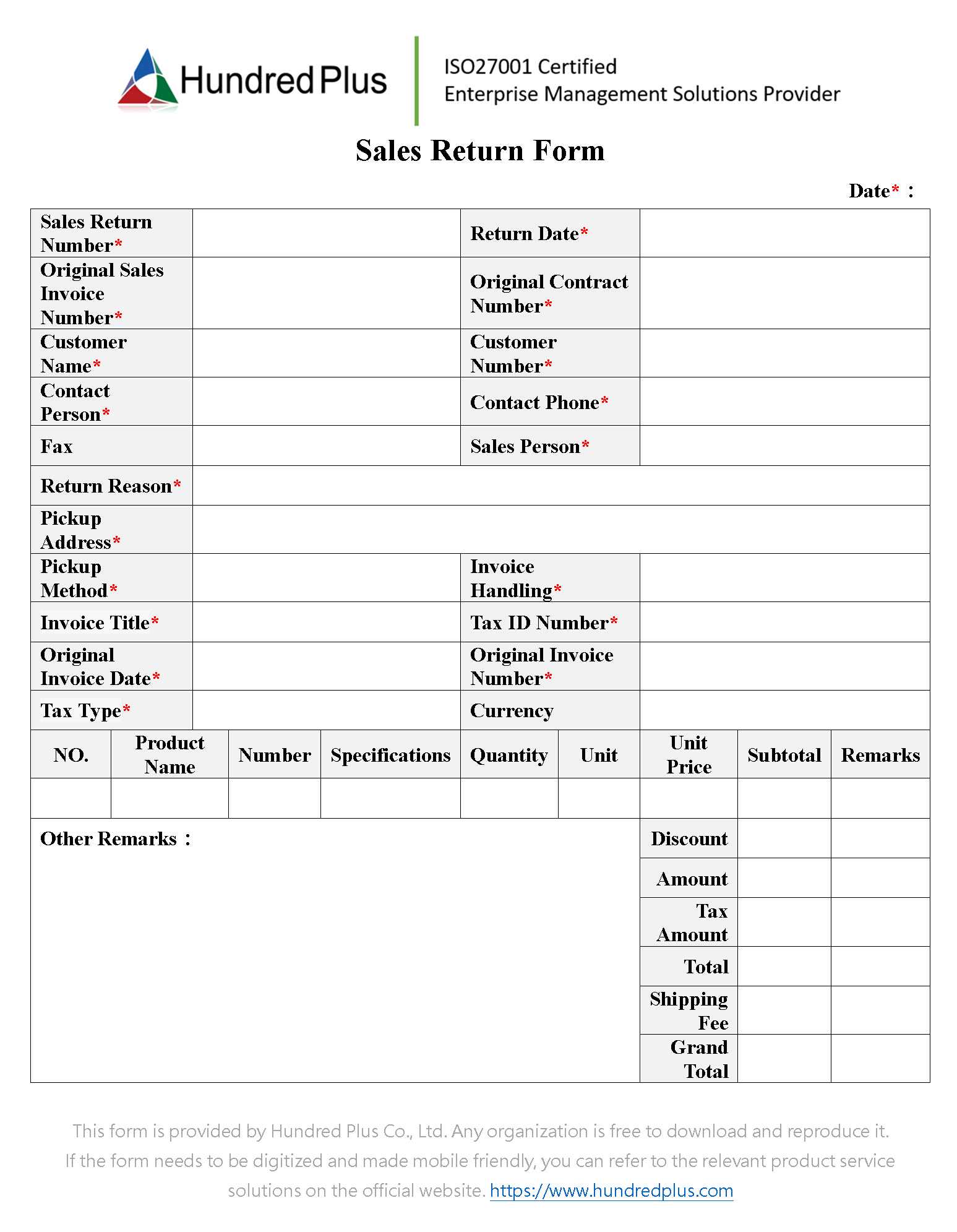

Below is an example layout for a return form:

| Field | Description |

|---|---|

| Transaction Reference | A unique number associated with the exchange. |

| Customer Information | Name, contact details, and billing address. |

| Product Information | Details of the returned items, such as SKU or product name. |

| Reason for Return | The explanation provided by the customer for returning the item. |

| Refund or Credit | Amount to be refunded or credited back to the customer. |

| Authorized Signatures | Signatures from both the customer and the company representative. |

By following this structure, businesses can ensure that every exchange or refund is properly documented and easily accessible for future reference.

Benefits of Using an Invoice Template

Utilizing a predefined form to manage exchanges and refunds brings numerous advantages to both businesses and customers. A standardized document ensures consistency, reduces errors, and speeds up the overall process. By organizing essential information in one place, businesses can handle returns more efficiently, leading to smoother operations and better customer satisfaction.

Improved Accuracy and Consistency

One of the main benefits of using a predefined format is the reduction of human error. A structured form eliminates the need to manually write down all details for each transaction, ensuring that important information is not overlooked. Whether it’s tracking product information or calculating refund amounts, a standardized document guarantees that all aspects are captured accurately every time.

Time-Saving and Efficiency

Having a consistent format readily available significantly reduces the time needed to process each transaction. Employees can quickly fill in the necessary fields rather than creating a new document from scratch. This leads to faster processing times, which ultimately enhances customer experience and allows staff to focus on other essential tasks.

Common Mistakes in Return Invoices

Despite the importance of accuracy in processing product exchanges, several common errors can occur when handling these transactions. These mistakes can lead to confusion, delays, or even disputes between businesses and customers. Understanding and avoiding these issues is crucial for maintaining smooth operations and ensuring that all returns are properly documented and resolved.

One common mistake is failing to include all necessary details, such as the correct product description, quantity, or customer information. Missing or incomplete data can lead to miscommunication and make it difficult to process refunds or exchanges. Additionally, not clearly stating the reason for the exchange can create misunderstandings, particularly if the product is returned due to damage or a defect.

Another frequent issue is improper handling of financial adjustments. This includes errors in calculating refund amounts or neglecting to note any fees associated with the return. In some cases, businesses might not adjust inventory levels accordingly, which can lead to discrepancies in stock counts and affect future orders. Ensuring that all financial details, including credits or deductions, are clearly outlined is essential to avoid these types of problems.

Finally, not having proper authorizations on the document–such as signatures from both the customer and the business representative–can lead to disputes over the legitimacy of the transaction. This is particularly important for keeping accurate records and maintaining a clear audit trail in case of future inquiries or issues.

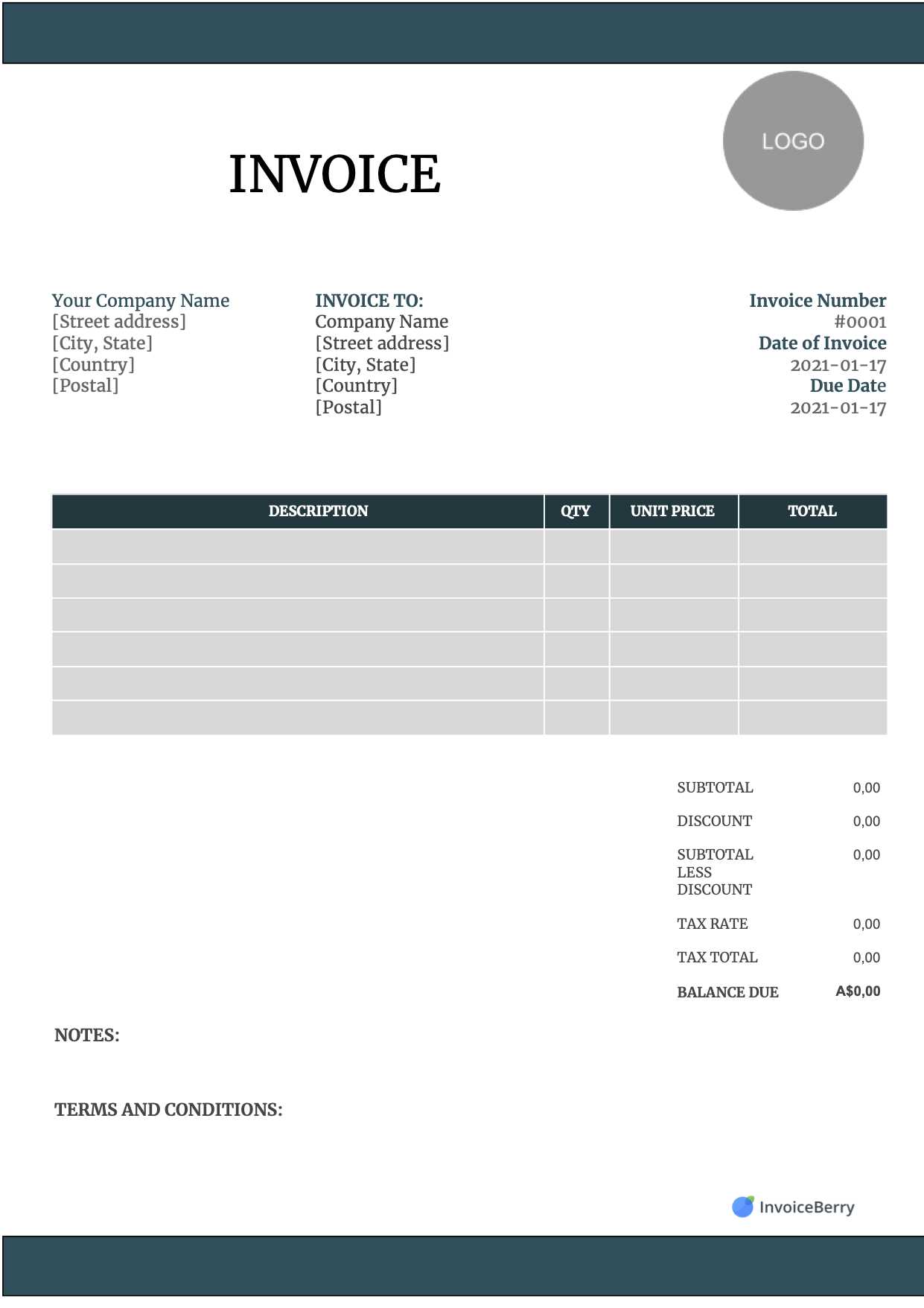

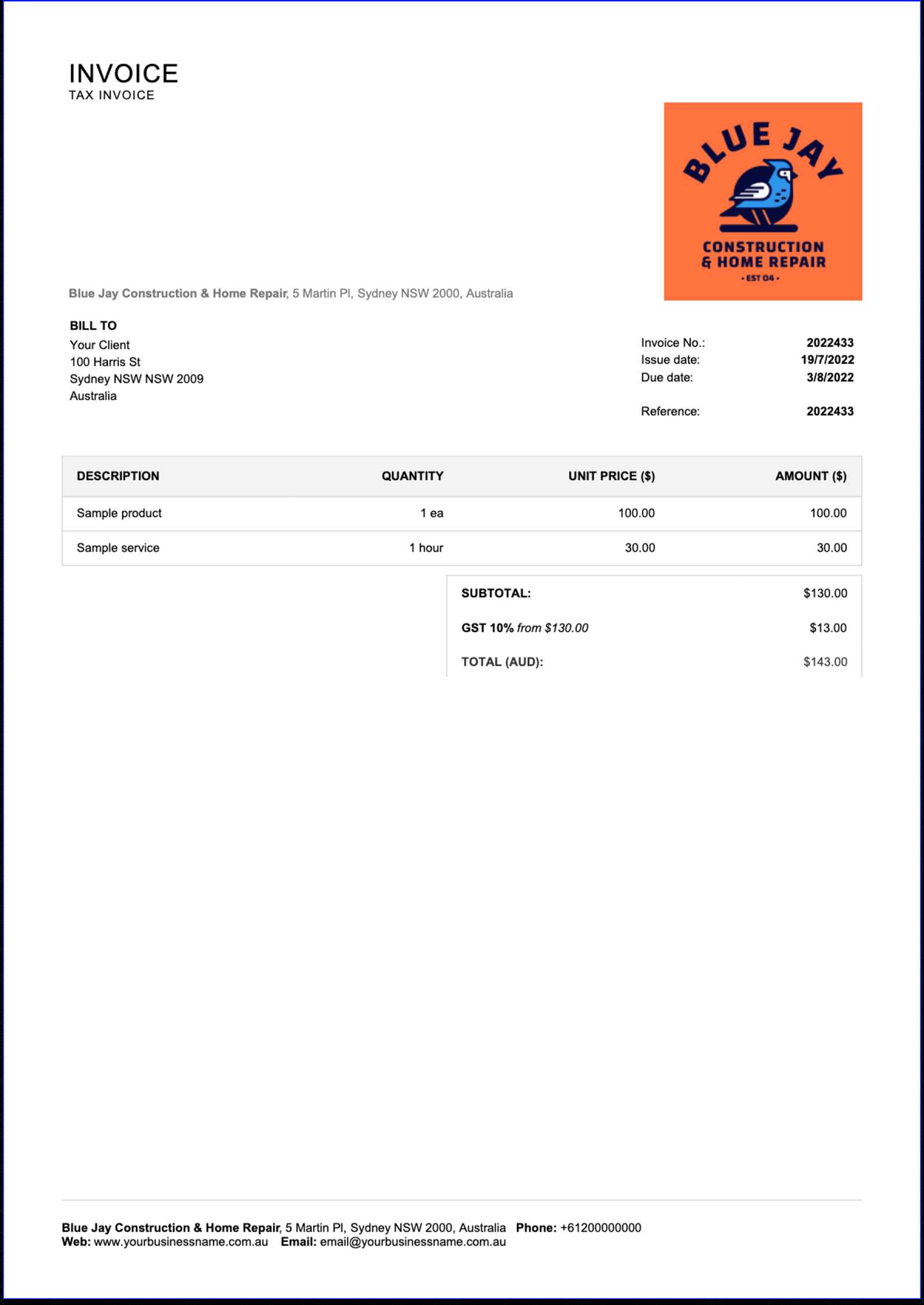

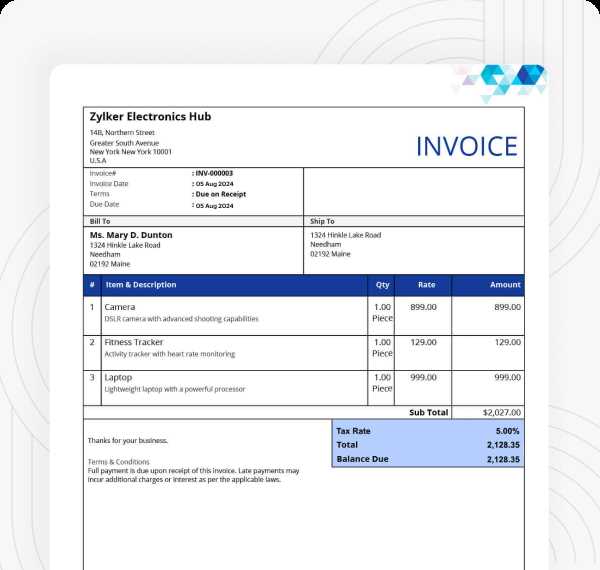

Free Sales Return Invoice Templates

Accessing free forms for processing product exchanges and refunds can significantly simplify the administrative tasks for businesses. These downloadable documents provide a ready-made structure, which can be customized to fit specific business needs. By using free templates, companies can save both time and money, avoiding the need to create new forms from scratch for every transaction.

Many online platforms offer these forms at no cost, allowing businesses to easily download and modify them. These pre-designed records often include the most common fields required for processing exchanges, such as customer details, product information, and refund amounts. Additionally, some providers allow for basic customization, enabling businesses to add their branding or specific terms and conditions.

Utilizing free forms is especially beneficial for small businesses or startups that may not have the resources to invest in specialized software or complex systems. These ready-to-use documents ensure that companies can quickly and accurately process refunds, while also keeping their operations organized and compliant with internal policies.

Benefits of Free Forms:

- Cost-effective: No need to invest in expensive software or hire professional designers.

- Easy customization: Modify the document to reflect your business’s specific needs and branding.

- Time-saving: Pre-made structure allows for quick adoption and use.

- Accurate record-keeping: Ensures important details are captured, helping maintain proper documentation.

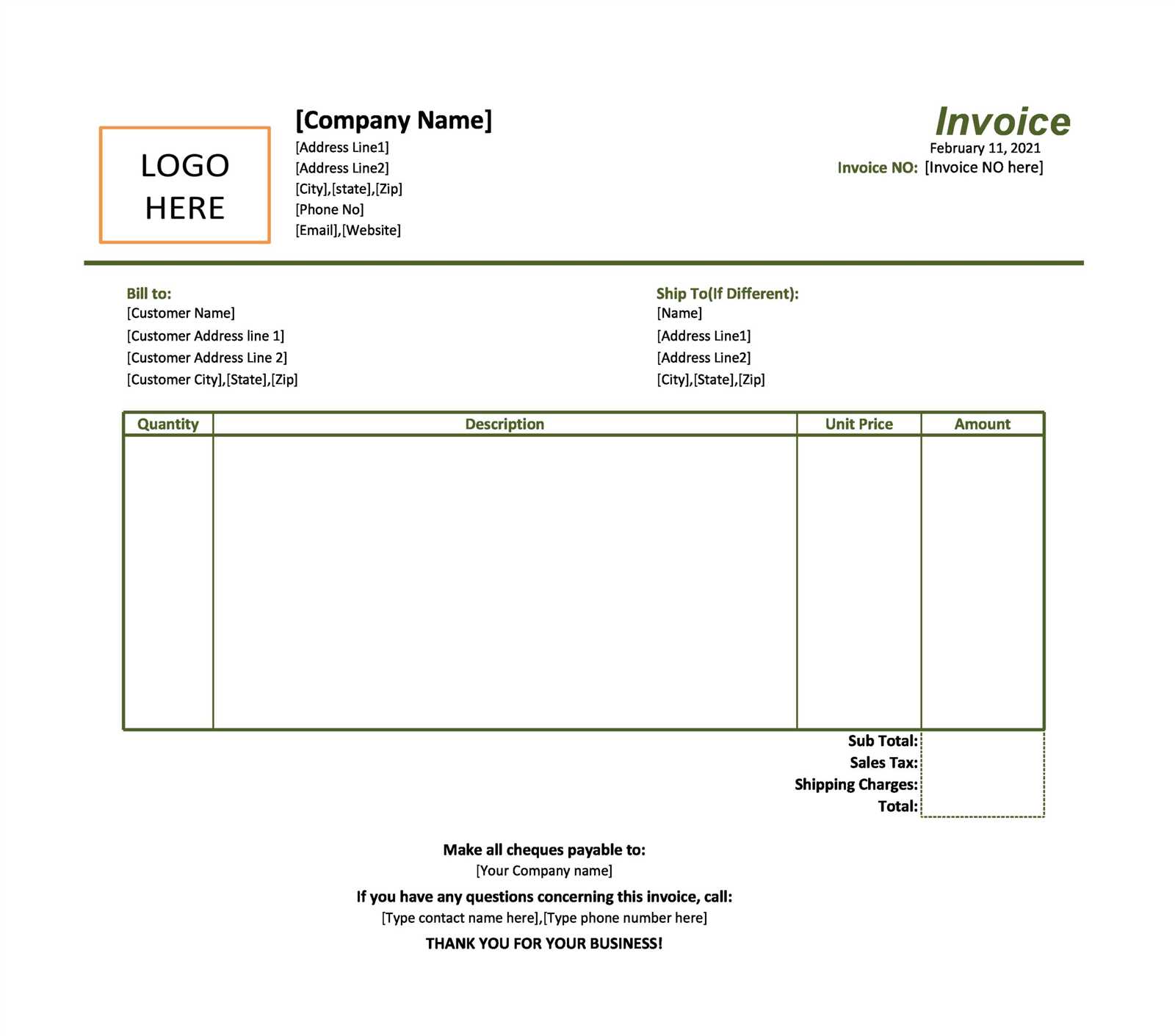

Customizing Your Return Invoice Template

Personalizing your form for processing exchanges and refunds is an essential step in aligning it with your business’s unique needs and branding. Customization allows businesses to include specific fields, add company logos, and tailor the layout to fit their operational requirements. A well-adjusted document not only enhances the professional appearance but also helps streamline internal processes by ensuring that all necessary details are captured clearly.

When adjusting your document, it’s important to consider both functionality and design. By modifying certain elements, you can ensure that the form reflects your company’s policies, while also maintaining ease of use for employees and customers alike. Below are some common adjustments that can be made:

| Customization Area | Description |

|---|---|

| Logo and Branding | Adding your company logo and colors to maintain a professional and branded appearance. |

| Field Adjustments | Including specific fields such as purchase order numbers, customer feedback, or condition of the returned item. |

| Payment Details | Incorporating details like payment methods or specific refund processes tailored to your business model. |

| Legal and Policy Information | Adding relevant terms and conditions regarding exchanges, warranty periods, or restocking fees. |

By customizing your document in these ways, you ensure that the form not only meets legal requirements but also aligns with your company’s specific workflows and customer expectations. A tailored approach helps improve efficiency and clarity in every exchange or refund transaction.

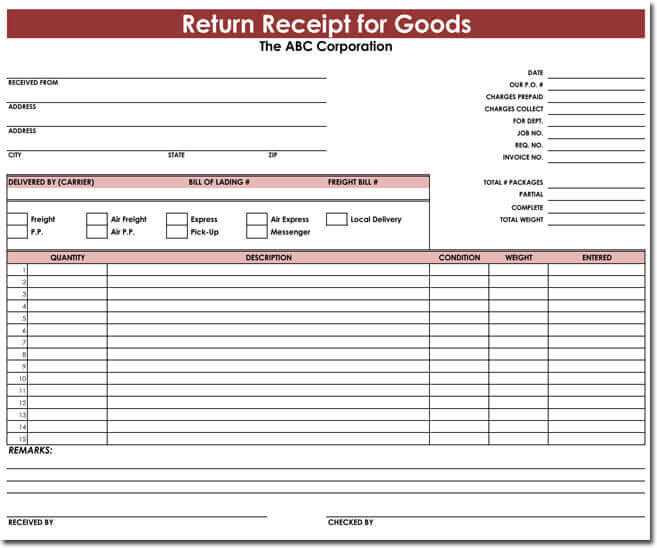

How to Track Returns with Invoices

Effectively tracking exchanges and refunds is crucial for businesses to maintain accurate inventory levels, ensure proper financial accounting, and monitor customer satisfaction. A structured form can serve as a powerful tool for recording and following up on these transactions. By incorporating detailed tracking features into your forms, you can streamline the process and keep all parties informed at every stage.

Key Elements for Tracking

To successfully track returned items, the document should include specific fields that allow for clear monitoring of the entire exchange process. These details help ensure that each transaction is processed in a timely and organized manner. Here are some key elements to include:

| Tracking Element | Description |

|---|---|

| Transaction Reference Number | A unique code that links the returned item to the original purchase for easy tracking. |

| Return Status | Indicates whether the return is pending, processed, or completed, helping track the progress of the transaction. |

| Product Condition | Helps identify if the item was returned in a resellable condition or if any damage occurred during the return process. |

| Refund or Credit Status | Tracks whether the refund or credit has been issued, ensuring timely financial adjustments. |

| Authorized Signatures | Signatures from both the customer and company representative confirm the validity and approval of the return. |

Benefits of Proper Tracking

By accurately tracking each returned item and associated transaction, businesses can quickly resolve issues related to inventory discrepancies, customer complaints, and financial adjustments. This organized approach not only reduces errors but also provides valuable insights into return trends, which can help inform future business decisions.

Automating Sales Return Invoices

Automating the process of managing product exchanges and refunds can significantly enhance efficiency, reduce errors, and improve overall customer satisfaction. By integrating automation into your workflow, you can streamline the creation, processing, and tracking of transactions, allowing your business to focus on more critical tasks while ensuring accuracy and consistency in documentation.

Automation tools can generate forms automatically when a return request is made, pulling relevant details from your order management system. This eliminates the need for manual data entry, reducing the chances of mistakes. Once a transaction is processed, the system can also update inventory levels and financial records, ensuring that your stock and accounting systems remain synchronized without any additional effort.

Key Benefits of Automating the Process:

- Speed: Automated systems can instantly generate necessary documents, speeding up the entire exchange process.

- Consistency: Every form follows a uniform structure, ensuring that all required details are included and reducing the likelihood of errors.

- Accuracy: By pulling information directly from your database, automation minimizes the chances of human error and ensures correct data entry.

- Cost-Effective: Automation reduces the need for manual labor, allowing employees to focus on more value-added activities.

Integrating automation for managing product exchanges not only saves time and resources but also improves the experience for customers, ensuring that their returns are processed promptly and without complication.

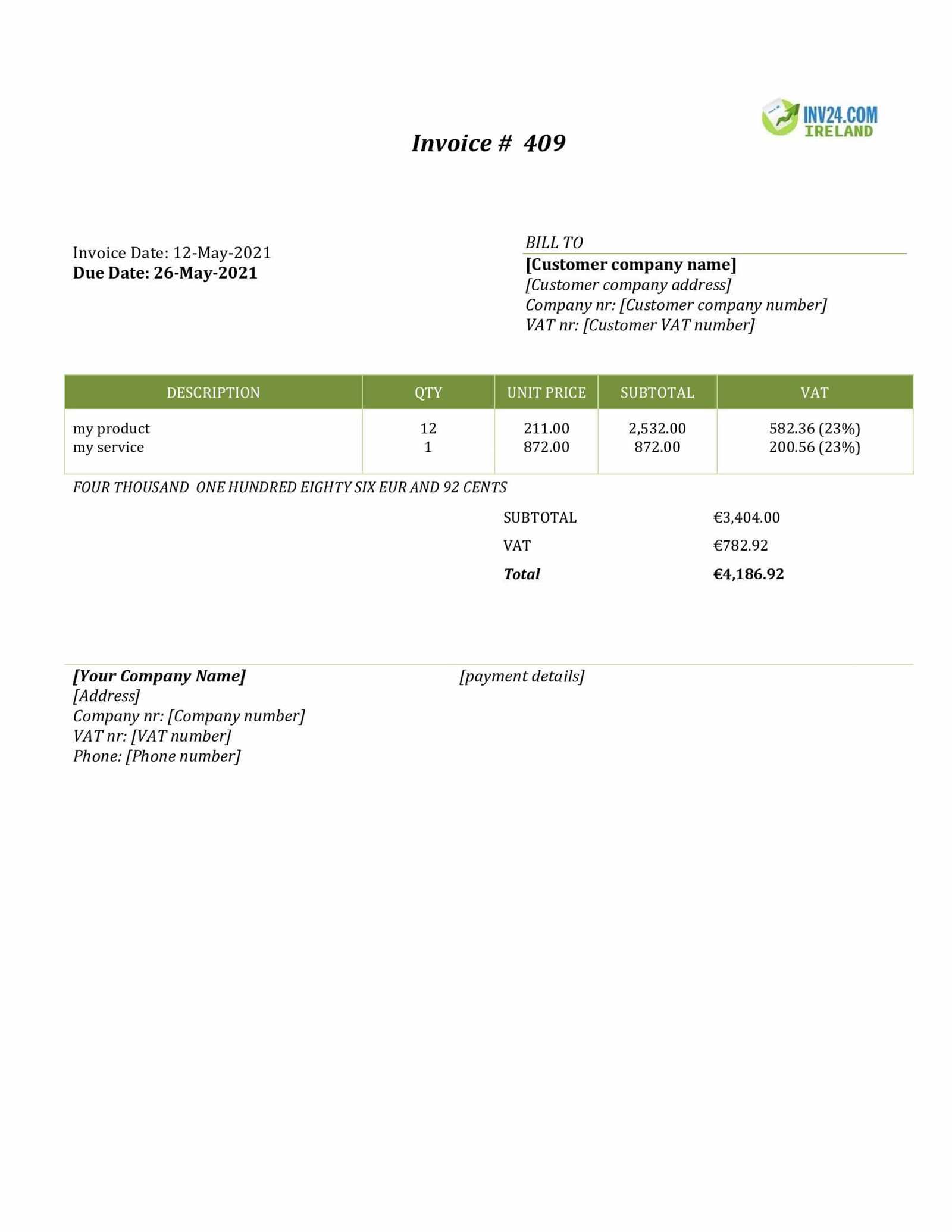

Sales Return Invoice vs Credit Note

Understanding the difference between a document used for processing product exchanges and a credit note is essential for businesses to handle refunds and adjustments correctly. While both documents deal with financial adjustments related to returned goods, they serve distinct purposes and are used at different stages of the transaction process. Knowing when to use each can help prevent confusion and ensure smooth financial operations.

A document used for handling exchanges typically provides a detailed record of the returned item, the reason for the return, and any corresponding financial transactions, such as refunds or adjustments. It is issued when a product is physically returned to the business. On the other hand, a credit note is often issued after the return has been accepted and processed, serving as a formal acknowledgment of the amount credited back to the customer, either in cash or as store credit.

While both documents can involve similar financial figures, the key difference lies in the timing and the specific nature of each record. The former is more transaction-focused, detailing the return process, while the latter is an accounting document confirming the adjustment in the customer’s account.

Legal Requirements for Return Invoices

When handling exchanges and refunds, it is crucial to ensure that the necessary documentation complies with legal standards. Proper records not only protect your business but also provide clarity for customers and help maintain trust. Legal requirements for processing returns vary by jurisdiction, but certain elements must always be included to ensure the transaction is valid and compliant.

Essential Elements for Compliance

There are several key elements that must be included in any document used to process returns to meet legal requirements. These include:

- Transaction Details: A clear reference to the original purchase, including the order number, date of purchase, and product details. This ensures the return is connected to a specific transaction.

- Customer Information: The full name, contact details, and address of the customer involved in the return. This helps ensure that both parties can be identified in case of any disputes or future references.

- Refund or Credit Amount: A detailed explanation of the amount refunded or credited to the customer, and whether this is in cash, credit, or a different form. Legal standards often require clarity on the financial adjustments made during the return process.

- Reason for the Return: A description of why the product is being returned (e.g., defective item, dissatisfaction, etc.) may be required to ensure that the return is valid under the applicable laws.

- Authorized Signatures: The signatures of both the customer and a company representative may be necessary to validate the return and demonstrate agreement on both sides.

Regional Variations and Regulations

It’s important to recognize that legal requirements for processing returns can vary depending on the country or region in which your business operates. Some jurisdictions have specific consumer protection laws that mandate c

How to Handle Refunds in Invoices

Managing refunds correctly is an important part of the exchange process, ensuring that both your business and the customer are treated fairly. Proper documentation and clear procedures help maintain accurate financial records and prevent misunderstandings. Whether the refund is issued as a credit, cash, or another form, it’s essential to follow specific steps to ensure everything is processed smoothly and in compliance with company policies.

When processing refunds, it’s important to include certain details in the documentation. These details not only confirm the amount being refunded but also explain the reasoning behind the refund, the method of reimbursement, and any relevant transaction information. Below are key steps to follow when handling refunds:

- Identify the Original Transaction: Clearly link the refund to the original purchase by including the order number, date of purchase, and product details.

- Refund Amount: Specify the exact amount being refunded. If partial refunds are being issued, make sure to indicate which items or services are being refunded and the corresponding amounts.

- Reason for Refund: Provide a brief explanation of why the refund is being issued (e.g., product defect, customer dissatisfaction, etc.). This helps avoid future disputes and maintains transparency.

- Refund Method: Clearly state how the refund will be issued–whether it’s through a credit to the customer’s account, a direct payment, or another method.

- Adjustments to Taxes and Fees: If applicable, adjust any taxes or fees based on the refund amount. This ensures that your financial records remain accurate and reflect the change in the total transaction value.

By ensuring that these steps are followed, businesses can handle refunds efficiently, keep accurate records, and ensure

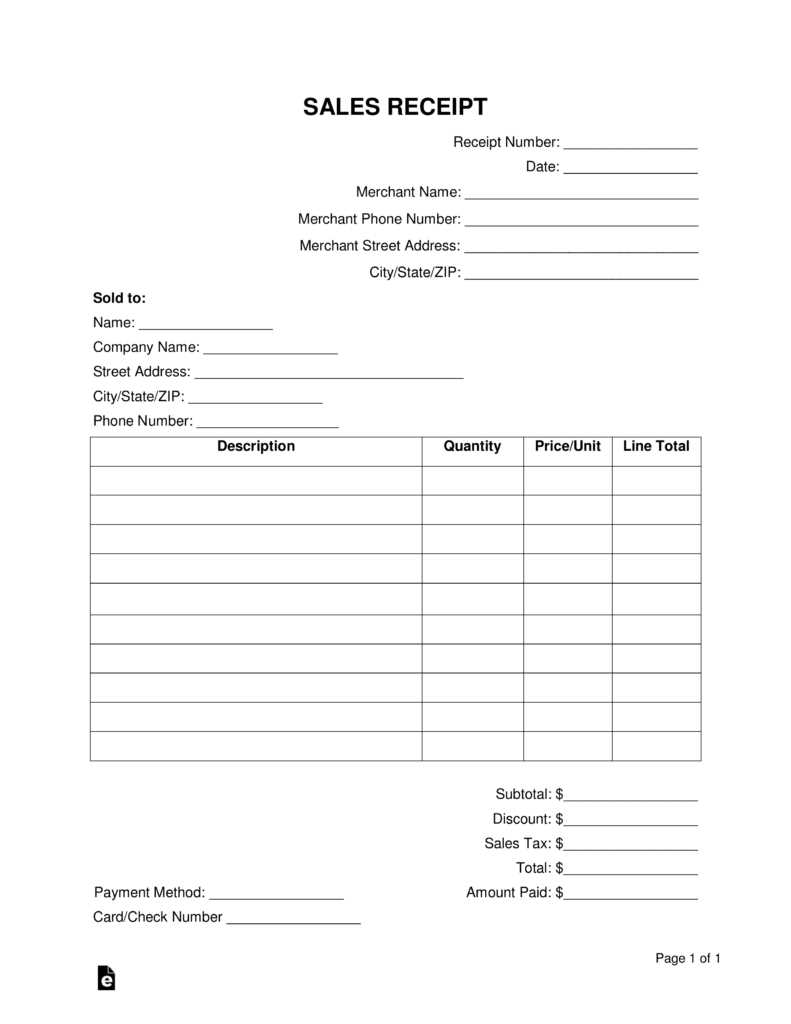

Sales Return Invoices for Small Businesses

For small businesses, handling exchanges and refunds can present unique challenges, especially when it comes to maintaining accurate records and managing financial transactions. Having a streamlined process for documenting these transactions is essential for staying organized and ensuring both legal compliance and customer satisfaction. Proper forms for managing exchanges help small businesses maintain order and improve operational efficiency.

Small businesses may not have the resources to invest in expensive software or complex systems, but they can still benefit from having a well-organized approach to managing product returns and refunds. Whether manually created or automated, the document should be clear, concise, and customizable to meet the needs of the business. Here are some important considerations for small businesses when managing exchanges:

- Clarity and Simplicity: Keep the form simple and easy to understand. Avoid complex language or unnecessary fields, focusing on the core details such as product information, customer details, and refund amounts.

- Customization: Customize your document to reflect your brand. Add your company logo, include specific policies, and ensure that it aligns with your business’s return and exchange guidelines.

- Accurate Record-Keeping: Ensure that the document is stored correctly and can be easily accessed if needed for accounting purposes or customer inquiries. Proper records help in tracking inventory and managing finances efficiently.

- Legal Compliance: Be aware of local laws regarding exchanges and refunds. Some jurisdictions have specific requirements for processing refunds, such as mandatory timeframes or requirements for issuing credits.

By using a straightforward and organized approach, small businesses can manage exchanges more effectively and maintain a strong relationship with their customers. Having clear documentation not only simplifies the return process but also helps small businesses keep accurate financial records, which are crucial for tax reporting and business growth.

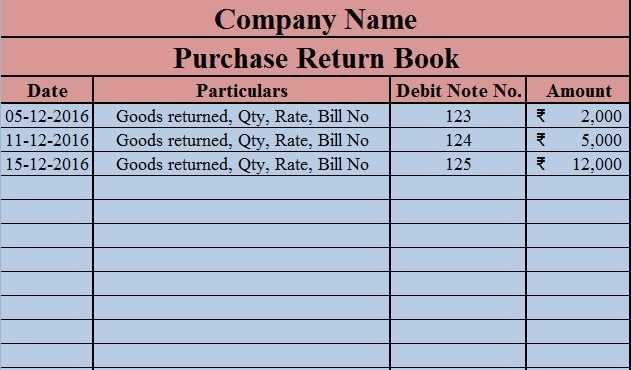

Integrating Return Invoices with Accounting Software

Integrating documents used for processing exchanges with accounting software is a crucial step for businesses looking to automate and streamline their financial operations. By connecting your records of returned goods to your accounting system, you can reduce manual data entry, improve accuracy, and ensure that financial statements are always up to date. This integration simplifies tracking refunds, managing inventory adjustments, and reconciling financial transactions.

Benefits of Integration

Integrating these forms with accounting software provides several key benefits that can save time and reduce errors:

- Automatic Updates: When a return transaction is recorded, the system automatically adjusts the inventory and financial records, reducing the need for manual input and preventing discrepancies.

- Real-Time Tracking: With integration, businesses can track the status of returns and their corresponding financial adjustments in real time, making it easier to manage cash flow and stock levels.

- Reduced Errors: By eliminating the need for double data entry, the risk of errors decreases, ensuring that both accounting and inventory records are accurate.

- Time Savings: Automated processes free up valuable time, allowing employees to focus on more important tasks, such as customer service and strategic decision-making.

Key Considerations for Integration

While integrating these forms with accounting software offers numerous benefits, there are several factors to consider to ensure the process runs smoothly:

- Compatibility: Ensure that the software you use for managing returns can be integrated with your existing accounting platform. Many modern accounting tools offer integrations with common business systems, but it’s important to verify compatibility before proceeding.

- Customization: Customize the integration to reflect your specific busines

Best Practices for Return Invoice Management

Effectively managing documents related to product exchanges and refunds is essential for maintaining financial accuracy and customer satisfaction. By following best practices, businesses can streamline their processes, reduce errors, and ensure compliance with relevant regulations. Whether it’s improving workflow efficiency or enhancing communication with customers, managing these documents in an organized manner is crucial for long-term success.

Here are some best practices for managing refund-related documentation:

- Maintain Clear and Consistent Documentation: Ensure that all records related to exchanges are detailed and consistent. Include key information such as order numbers, dates, customer details, and product descriptions. This will help in tracking transactions accurately and reduce the risk of misunderstandings.

- Standardize Your Process: Develop a standard procedure for processing and documenting returns. This includes clear guidelines on what qualifies for a return, how to document the exchange, and how to process refunds. Consistency helps to prevent errors and ensures that each transaction is handled fairly.

- Integrate with Your Accounting System: Automate the update process by integrating these documents with your accounting and inventory systems. This ensures real-time adjustments to your financial and stock records, minimizing human error and saving valuable time.

- Stay Compliant with Local Laws: Be aware of consumer protection laws in your region. Some jurisdictions have strict guidelines regarding refund policies, return timeframes, and restocking fees. Make sure your process complies with these laws to avoid legal issues.

- Keep Communication Transparent: Keep customers informed throughout the exchange process. Clear communication regarding timelines, refund methods, and status updates fosters trust and ensures customer satisfaction.

- Store and Retrieve Documents Efficiently: Implement a reliable system for storing and retrieving all related documents. Digital systems can streamline this process by allowing easy access to historical records and quick searches for specific transactions when needed.

By following these best practices, businesses can ensure smooth management of exchanges and refunds, leading to improved customer experiences and better op

How to Avoid Return Invoice Issues

Managing the documentation for product exchanges can sometimes lead to confusion and errors, which can impact both customer satisfaction and business operations. To avoid common pitfalls, businesses need to ensure that the entire process–from the creation of the document to its final resolution–is handled accurately and efficiently. By following best practices, businesses can prevent issues such as incorrect refunds, incomplete records, or compliance problems.

Here are several strategies for avoiding issues related to refund-related documents:

- Clear Policies and Communication: Ensure that customers are fully aware of your policies regarding exchanges and refunds. Clear guidelines about time limits, conditions for returns, and any potential fees can help reduce confusion and disputes.

- Accurate Record Keeping: Double-check all information entered in the document to ensure that it matches the original transaction. This includes order numbers, customer details, product descriptions, and refund amounts. Inaccuracies can lead to delays and customer dissatisfaction.

- Consistency Across Systems: If you use different platforms or tools to handle sales, returns, and accounting, ensure they are well-integrated. Discrepancies between your sales and financial records can lead to issues when processing refunds or tracking stock levels.

- Timely Processing: Process all exchanges and refunds promptly. Delays in handling these documents can frustrate customers and lead to negative feedback. Make sure your team is trained to handle these requests quickly and efficiently.

- Stay Up to Date with Legal Requirements: Different regions have specific laws regarding consumer rights, especially concerning product exchanges and refunds. Stay informed about these regulations to ensure compliance and avoid legal issues.

- Double-Check Refund Amounts: Ensure that the correct amount is refunded based on the original purchase. Over-refunding or under-refunding can lead to financial discrepancies or customer complaints.

By following these strategies, businesses can avoid common issues related to exchanges and ensure a smoother process for both customers and employees. Proper management of these documents not only fosters customer loyalty but also supports the accuracy of financial and inventory records.